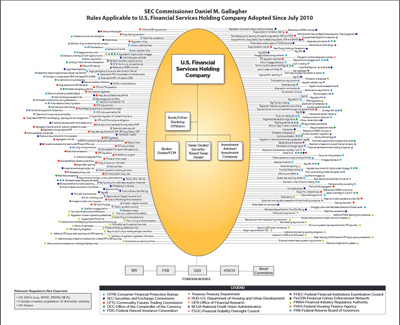

Crazy Quilt Chart of Regulation

Commissioner Daniel M. Gallagher

On March 2, 2015, I published a chart depicting the aggregation of U.S. financial services firm regulation since the enactment of the Dodd Frank Act in 2010. My office has updated the chart to reflect significant FINRA rules and amendments implemented since July 2010.[1]

As mentioned in my earlier statement, I do not plan to continue to update the chart, but I hope that academics, the financial services industry, and other interested parties will undertake similar, more detailed analyses. [2]

[1] I would like to thank the staff of FINRA for their assistance in identifying new rules and rule amendments implemented since July 2010.

[2] In addition to the input we’ve received on the chart, we’ve also received some input as to potential methods for estimating the cost of these regulations. For example, Hal Schroeder (current FASB board member, former equity analyst focused on the financial services industry) using a relative-value method ballparks the cost at over $1 trillion based on pre- and post-crisis changes in bank price-to-book ratios. This type of approach to valuing the aggregate cost of post-financial crisis regulation and regulatory risk seems promising, and I hope it could be refined further by the broader community.

Mr. Schroeder points out that, from 2001 to 2005, bank stocks in the Standard & Poor’s 500 typically traded on a price-to-book basis at a roughly one-multiple discount. For example, a market price of two-times book value per share for banks, compared to three-times for all non-financials in the S&P 500. This valuation gap or discount began to notably expand 18 months before the financial crisis, and had doubled by its beginning. (This doubling is itself notable, as it seems to indicate that at least some investors in the financial sector were not at all surprised by the financial crisis.) After a brief return in 2010 to the pre-crisis valuation norm, the discount that market participants have put on banks had again doubled by the end of 2014 to the same levels as during the crisis.

The return to crisis-level valuations is revelatory: while the broader market has recovered to pre-crisis levels, the banking sector seems to have lost market value of approximately 1x book value, relative to the broader market. To put this in monetary terms, bank book value in the U.S. is approximately $1.6 trillion per the FDIC, so even if you back out the value of the smaller banks that are not components of the S&P 500, a reasonable ballpark estimate of 1x book value seems to be somewhat over $1 trillion. We were unable to think of factors apart from regulation and regulatory risk that could account for this marked difference, but that might be a particular area for additional research.

Last Reviewed or Updated: June 3, 2015