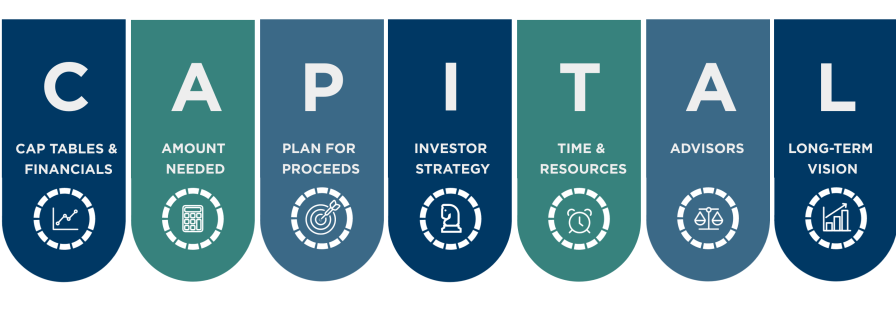

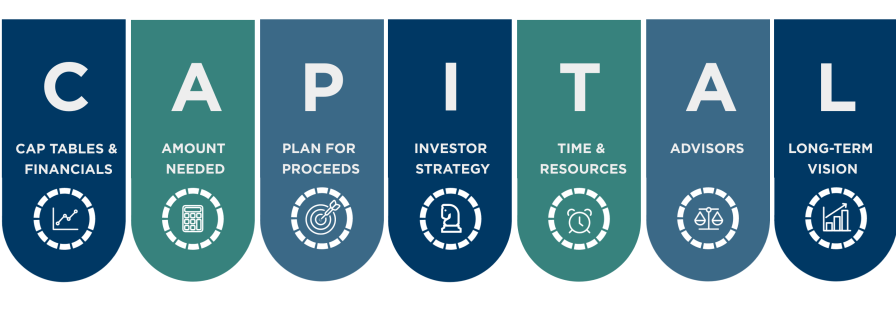

Ready to Raise CAPITAL

A number of factors go into being ready to raise capital from investors. Most sophisticated investors will expect the company to have taken certain steps and prepared certain documents before they enter the room to pitch for funding.

Before you embark on raising capital, we encourage you to consider some key fundamentals of your business, which you can remember using the acronym CAPITAL.

Cap Tables and Financials: Update your financials for disclosure

Investors will expect you to have a cap table that clearly reflects the ownership interests in the company. In addition, companies should have their financial statements ready to convey the financial position of the company.

Amount Needed: Calculate your runway needs

One of the first questions a company will hear is “how much money are you looking to raise?” The answer to that question should reflect a thoughtfully calculated “runway” based on projected expenses.

Plan for Proceeds: Describe how you'll use the money

Investors expect to hear not only how much money you need, but a plan for how that funding will be spent in furtherance of the company’s goals. This plan should include meeting the expenses projected in your “runway.”

Investor Strategy: Focus on experts who bring value

Many investors are focused on particular sectors or stages of a company’s life cycle, and early-stage investors in particular often become involved as advisors to the company. Target investors who know your industry, bring value beyond financing, and have a clear long-term vision for the company that is consistent with your own goals.

Time and Resources: Prepare to invest yourself in the process

Entrepreneurs will tell you that raising capital takes time and resources, often from the senior leadership team. Prepare to spend time and resources throughout the capital-raising process outside of the day-to-day operations of running the business.

Advisors: Line up your attorneys and accountants

Hiring the right professional advisors with experience in raising capital is critical to navigating a smooth financing in compliance with laws. In addition to federal securities laws, attorneys can help companies navigate state law questions and other ownership reporting.

Long-term Vision: Pitch with the investors' exit in mind

Be able to explain your long-term vision for how the company will return capital back to the investors.

Have suggestions on additional educational resources? Email smallbusiness@sec.gov.

Print this Building Block.

Last Reviewed or Updated: Aug. 8, 2025