Annual Report 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

☐

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE

SECURITIES EXCHANGE ACT OF 1934

OR

☑

EXCHANGE ACT OF 1934

For the fiscal year ended

OR

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

OR

☐

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Commission file number:

(Jurisdiction of incorporation or organization)

,

,

(Address of principal executive office)

,

Telephone: (

)

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of each class

Trading symbol(s)

Name of each exchange on

which registered

Ordinary Shares (par value of USD 0.10 each)

UBS

New York Stock Exchange

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None.

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None.

Annual Report 2023

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of 31 December 2023:

UBS Group AG

Ordinary shares, par value USD 0.10 per share:

(including 253,233,437 treasury shares)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes

☐

☑

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes

☐

☑

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to

file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☑

No

☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted

pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period

that the registrant was required to submit such files).

☑

No

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or an

emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer” and “emerging growth company”

in Rule 12b-2 of the Exchange Act.

☑

Accelerated filer

☐

Non-accelerated filer

☐

☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards

Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the

effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the

registrant included in the filing reflect the correction of an error to previously issued financial statements.

☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-

based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to

§240.10D-1(b).

☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this

filing:

U.S. GAAP

☐

Standards Board

☑

Other

☐

Annual Report 2023

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the

registrant has elected to follow.

Item 17

☐

Item 18

☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the

Exchange Act)

Yes

☐

☑

Annual Report 2023

Cautionary Statement:

Refer to the

Cautionary Statement Regarding Forward -Looking Statements

Report 2023 (page 425).

Cross-reference table

Set forth below are the respective items of SEC Form 20-F, and the locations in this document where the corresponding

information can be found.

●

Annual Report

hereof.

●

Supplement

refers to certain supplemental information contained in this forepart of the Form 20-F, starting on page

11 following the cross-reference table.

●

Financial Statements

refers to the consolidated financial statements of UBS Group AG, contained in the Annual

Report.

In the cross-reference table below, page numbers refer either to the Annual Report or the Supplement, as noted.

Please see page 9 of the Annual Report for definitions of terms used in this Form 20-F relating to UBS.

Form 20-F item

Response or location in this filing

Item 1

. Identity of Directors,

Senior Management and

Advisors.

Not applicable.

Item 2

. Offer Statistics and

Expected Timetable.

Not applicable.

Item 3.

B – Capitalization and

Indebtedness.

Not applicable.

C – Reasons for the Offer and

Use of Proceeds.

Not applicable.

D – Risk Factors.

Annual Report,

(61-73).

Item 4

. Information on the Company.

A

– History and Development of

the Company

1-3: Annual Report,

Corporate information

and

Contacts

(7). The registrants' agent is

David Kelly, 600 Washington Boulevard, Stamford, CT 06901.

4: Annual Report,

Our evolution

(16);

Acquisition and integration of Credit Suisse

19);

Our strategy

(19-20);

Our businesses

(22-31); Note 30 to the Financial Statements

(

Changes in organization and acquisitions and disposals of subsidiaries and businesses

)

(398).

5-6: Annual Report,

Our businesses

(22-31), as applicable, Note 2 to the Financial

Statements (

Accounting for the acquisition of the Credit Suisse Group

) (308-314); Note

12 to the Financial Statements (

Property, equipment and software)

Note 30 to

the Financial Statements (

Changes in organization and acquisitions and disposals of

subsidiaries and businesses

) (398).

7: Annual Report,

Acquisition and integration of Credit Suisse

8: Annual Report,

Information sources

B – Business Overview.

1, 2 and 5: Annual Report,

Our strategy, business model and environment

Note 3a to the Financial Statements (

Segment reporting)

(314-315)

and Note 3b to the

Financial Statements (

Segment reporting by geographic location)

(316). See also

Supplement (11-12).

3: Annual Report,

Seasonal characteristics

(82).

4: Not applicable.

6: None.

7: Information as to the basis for these statements normally accompanies the statements,

except where marked in the report as a statement based upon publicly available

information or internal estimates, as applicable. Annual Report,

Our businesses

(22-31),

as applicable.

8: Annual Report,

Regulation and supervision

(50-55)

and

developments

Supplement (13).

C – Organizational Structure.

Annual Report,

Our evolution

(16) and Note 29 to the Financial Statements (

Interests in

subsidiaries and other entities

) (394-398).

Annual Report 2023

D – Property, Plant and

Equipment.

Annual Report,

Property, plant and equipment

(410)

,

Note 1a, 8) to the Financial

Statements (

Summary of material accounting policies: Property, equipment and

software

) (305), Note 12 to the Financial Statements (

Property, equipment and software)

(328).

Information required by SEC

Regulation S-K Part 1400

Annual Report,

Information required by Subpart 1400 of Regulation S-K

(411-416),

Loss

history statistics

(124), and Note 10 to the Financial Statements (

Financial assets at

amortized cost and other positions in scope of expected credit loss measurement)

Item 4A

. Unresolved Staff

Comments.

None.

Item 5

. Operating and Financial Review and Prospects.

A

– Operating Results.

1: Annual Report,

Our key figures

(9),

(21),

Our

businesses

(22-31),

Financial and operating performance

Income statement

(282), Note 1b to the Financial Statements (

Changes in accounting policies,

comparability and other adjustments

) (307), Note 3 to the Financial Statements (

Segment

reporting)

(314-316), and

(409-410). The supporting disclosure

notes to the Financial Statements provide further details around the components of

revenue and expenses.

2: Not applicable

3: Annual Report,

Risk factors

(61-73),

Capital management

(159-169),

Currency

Management

(180) and Note 26 to the Financial Statements (

Hedge Accounting)

282).

4:

Annual Report,

Our environment

(32-35),

Regulation and supervision

(50-55)

and

Regulatory and legal developments

Accounting and financial reporting

Note 1b to the Financial Statements (

Changes in accounting policies, comparability and

other adjustments

) (307).

A discussion on the results for the year 2022 compared with 2021 can be found on UBS

annual report 2022 filed with the SEC in Form 20-F on March 6, 2023, under

Financial

and operating performance

and under

Financial statements

B – Liquidity and Capital

Resources.

1: Annual Report,

Risk factors

(61-73)

,

Financial and operating performance

Seasonal characteristics

Interest rate risk in the banking book

Capital,

liquidity and funding, and balance sheet

(159-182)

, Asset encumbrance

(174),

Note 23 to

the Financial Statements (

Restricted and transferred financial assets)

(373-376), Note 24

to the Financial Statements (

Maturity analysis of assets and liabilities

) (376-378) and

Note 29 to the Financial Statements (

Interests in subsidiaries and other entities

) (394-

398).

Liquidity and capital management is undertaken at UBS as an integrated asset and

liability management function. While we believe our 'working capital' is sufficient for the

company's present requirements, it is our opinion that, as a bank, our liquidity coverage

ratio (LCR) is the more relevant measure. For more information see, Annual Report,

Liquidity coverage ratio

2: Annual Report,

Capital,

liquidity and funding, and balance sheet

(159-182),

Management

(180), Note 11 to the Financial Statements (

Derivative instruments)

(326-

328), Note 16 to the Financial Statements (

Debt issued designated at fair value)

(331),

Note 17 to the Financial Statements (

Debt issued measured at amortized cost

) (332),

Note 19 to the Financial Statements (

Other liabilities

) (345), and Note 26 to the Financial

Statements (

Hedge Accounting

) (379-282).

3: Annual Report,

Material cash requirements

Liquidity and funding management

(150-152), Note 24 to the Financial Statements (

Maturity analysis of assets and

liabilities

) (376-378), and Note 12 to the Financial Statements (

Property, equipment and

software)

C—Research and Development,

Patents and Licenses, etc.

Not applicable.

D—Trend Information.

Annual Report,

Our businesses

Our environment

Regulatory and legal

developments

Risk factors

Financial and operating performance

95),

Top and emerging risks

(

Accounting for the acquisition of the Credit Suisse Group

) (308-314).

E—Critical Accounting

Estimates

Not applicable.

Annual Report 2023

Item 6.

A

– Directors and Senior

Management.

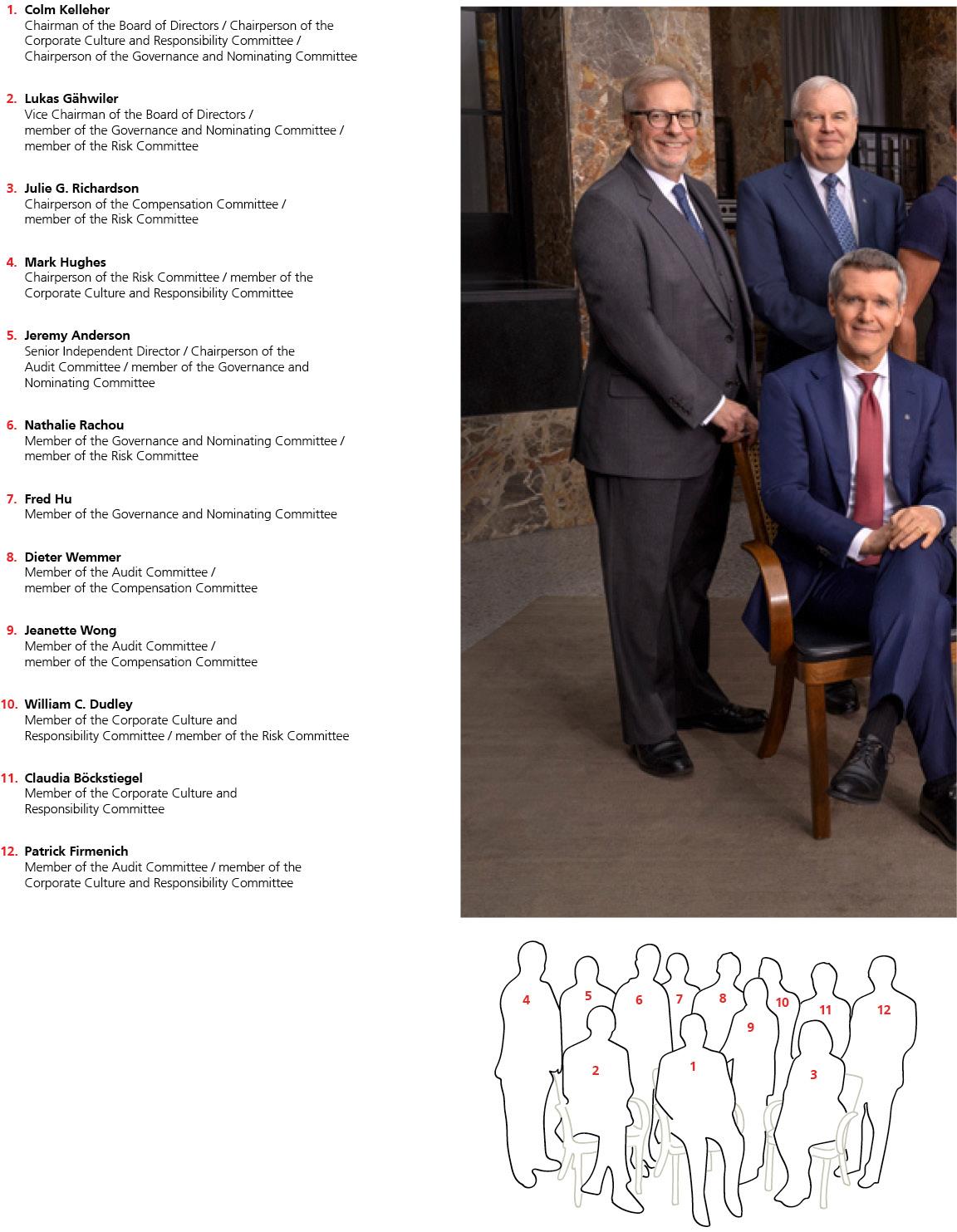

1, 2 and 3: Annual Report,

Board of Directors

(193-208) and

Group Executive Board

(209-217).

4, 5: None.

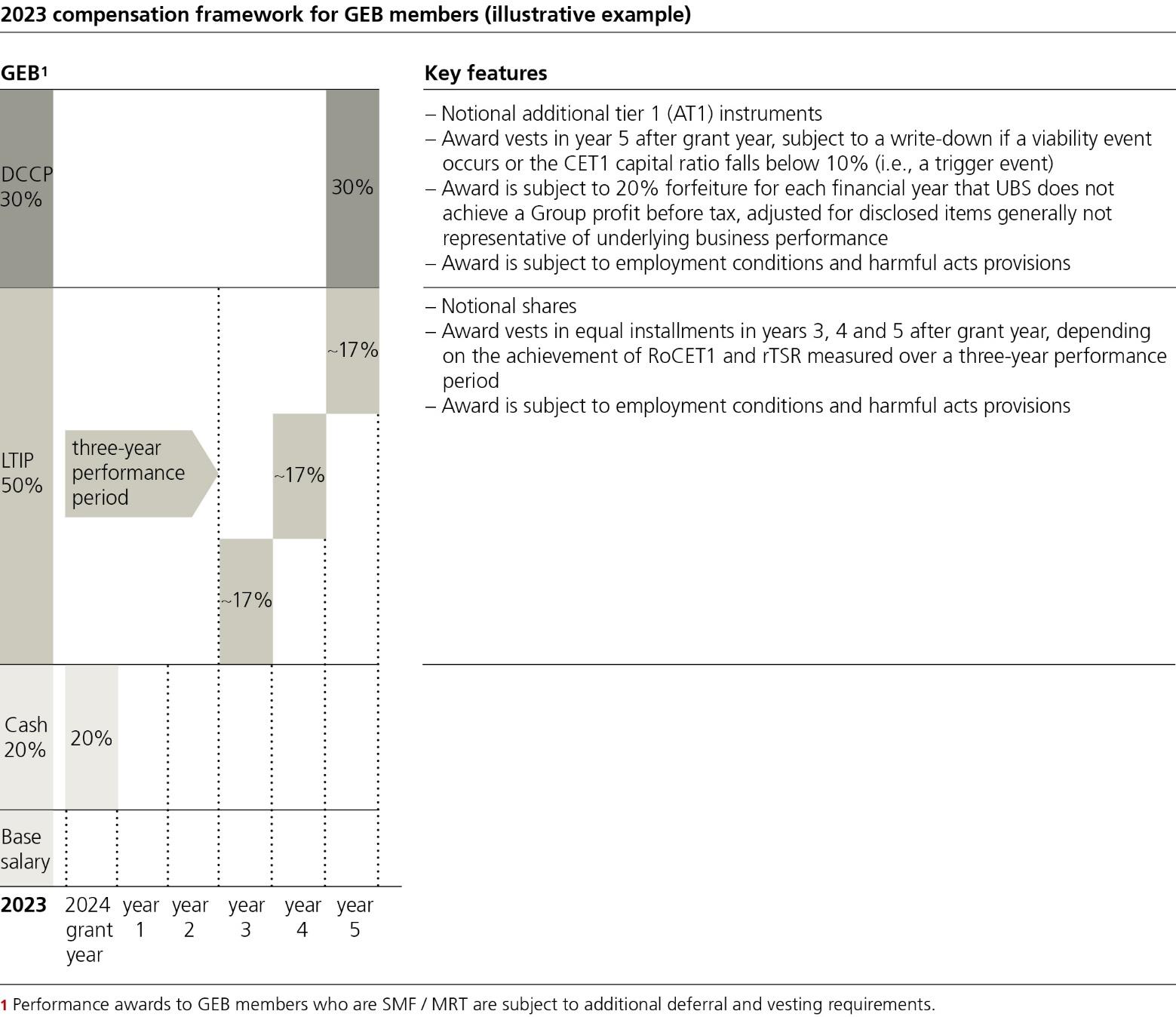

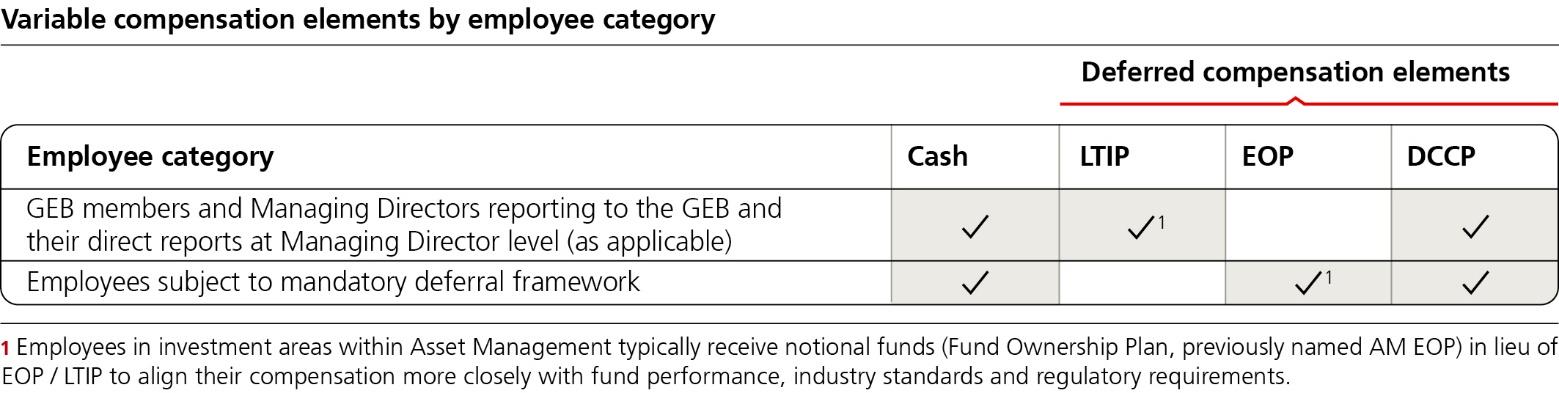

B – Compensation.

1: Annual Report,

Compensation

(223-270), Note 1a, 4) to the Financial Statements

(

Share-based and other deferred compensation plans

) (303-304), Note 28 to the Financial

Statements (

Employee benefits: variable compensation)

Financial Statements (

Related parties)

(399-400).

2: Annual Report,

Compensation

(223-270), Note 27 to the Financial Statements (

Post-

employment benefit plans)

(382-390).

C – Board practices.

1: Annual Report,

Board of Directors

(193-208). The term of office for members of the

Board of Directors and its Chairman expires after completion of the next Annual General

Meeting. The next UBS Group AG Annual General Meeting is scheduled on 24 April

2024.

2: Annual Report,

Board of Directors

(193-208),

Compensation

(223-270),

Clauses on

change of control

Related parties

) (399-

400).

3: Annual Report,

Audit Committee

Compensation Committee

(203) and

Auditors

(218-220).

D—Employees.

Annual Report,

(38-41).

In addition to seeking out employee feedback, we maintain an open dialogue with our

formal employee representation groups. We have European works councils representing

17 countries and consider topics related to our performance and operations. Local works

councils (such as the UBS Employee Representation Committee and the Credit Suisse

Staff Council in Switzerland) discuss benefits, workplace conditions and redundancies,

among other topics. Collectively, these groups represent approximately 51.5% of our

global workforce.

Where applicable, our operations are subject to collective bargaining agreements (CBA).

Benefits are aligned with local markets and often go beyond legal requirements or market

practice.

UBS Group AG (consolidated) personnel by business division and Group functions:

As of

Full-time equivalents

31.12.23

31.12.22

31.12.21

Personnel (full-time equivalents)

112,842

72,597

71,385

Global Wealth Management

29,633

24,351

24,093

Personal & Corporate Banking

11,333

5,725

5,791

Asset Management

3,714

2,848

2,693

Investment Bank

11,251

9,177

8,667

Non-Core and Legacy

2,578

Group functions

54,334

30,497

30,142

Non-core and Legacy was created in 2023, and includes positions and businesses not

aligned with our strategy and policies. Those consist of the assets and liabilities of the

Capital Release Unit (Credit Suisse) and certain assets and liabilities of the Investment

Bank (Credit Suisse), Wealth Management (Credit Suisse), Swiss Universal Bank (Credit

Suisse) and Asset Management (Credit Suisse). Non-core and Legacy also includes the

remaining assets and liabilities of UBS’s Non-core and Legacy portfolio and smaller

amounts of assets and liabilities of UBS business divisions that we have assessed as not

strategic in light of the acquisition of the Credit Suisse Group.

E—Share Ownership.

1 and 2: Annual Report,

Compensation

(223-270), Note 28 to the Financial Statements

(

Employee benefits: variable compensation

) (390-394) and Note 31b to the Financial

Statements (

Equity holdings of key management personnel

)

(399).

F—Disclosure of a registrant’s

action to recover erroneously

awarded compensation.

Not applicable.

Annual Report 2023

Item 7.

A—Major Shareholders.

Annual Report,

Group structure and shareholders

(186),

191) and

(191).

According to the mandatory FMIA disclosure notifications filed with UBS Group AG and

SIX, the following entities disclosed holding of more than 3% of the total share capital of

UBS Group AG, with the following number of shares:

Shareholder

Number of shares held

Norges Bank, Oslo, on 4 December 2023

165,792,053

BlackRock Inc., New York, on 30 November

2023

173,509,685

Artisan Partners Limited Partnership,

Milwaukee, on 29 March 2023

106,896,637

Shareholder

Percentage of shares held (according to last

notification received up to end of given year)

2023

2022

2021

Norges Bank, Oslo

4.79

3.01

3.01

BlackRock Inc., New York

5.01

5.23

4.70

Artisan Partners Limited Partnership,

Milwaukee

3.03

3.15

3.15

B—Related Party Transactions.

Annual Report,

Loans granted to GEB members

(265)

, Loans granted to BoD members

(266)

and

Note 31 to the Financial Statements (

Related parties

)

(399-400).

C—Interests of Experts and

Counsel.

Not applicable.

Item 8

. Financial Information.

A—Consolidated Statements

and Other Financial

Information.

1, 2, 3, 4, 6: Please see Item 18 of this Form 20-F.

5: Not applicable.

7: Information on material legal and regulatory proceedings is in Note 18 to the Financial

Statements (

Provisions and contingent liabilities

) (332-344).

For developments during the year, please see also the note

Provisions and contingent

liabilities

reports for the First, Second and Third Quarters 2023, filed on Forms 6-K dated April 25,

2023 , August 31, 2023 and November 7, 2023 (, respectively; as well as the

Provisions

and contingent liabilities

dated February 6, 2024. The disclosures in each such Quarterly Report speak only as of

their respective dates.

8: Annual Report,

Dividend distribution

(180)

, Distributions to

shareholders

(190-191).

B—Significant Changes.

None.

Item 9

. The Offer and Listing.

A

– Offer and Listing Details.

1, 2, 3, 5, 6, 7: Not applicable.

4: Annual Report,

Listing of UBS Group AG shares

(182).

B—Plan of Distribution.

Not applicable.

C—Markets.

Cover page (3).

Annual Report,

Listing of UBS Group AG shares

D—Selling Shareholders.

Not applicable.

E—Dilution.

Not applicable.

F—Expenses of the Issue.

Not applicable.

Annual Report 2023

Item 10

. Additional Information.

A—Share Capital.

Not applicable.

B—Memorandum and Articles

of Association.

1: Supplement (14-17).

2: Annual Report,

Compensation governance

(234-235),

Compensation for the

Board of

Directors

(255-257).

Supplement (14-17).

3: Annual Report,

Share

capital structure

(187-191),

Shareholders' participation rights

(191-193),

Elections and terms of office

Change of control and defense measures

(218). Supplement (14-17).

4: Supplement (14-17).

5: Annual Report,

Shareholders' participation rights

6: Annual Report,

Transferability, voting rights and nominee registration

Shareholders' participation rights

7: Annual Report,

Change of control and defense measures

8: Annual Report,

Significant Shareholders

(186).

9: Supplement (14-17) and Annual Report, D

ifferences from corporate

governance standards relevant to US-listed companies

(185),

Compensation governance

(234-235),

Compensation for the

Board of Directors

(255-257),

Share

capital structure

(187-191),

Shareholders' participation rights

Elections and terms of office

(201),

Transferability, voting rights and nominee registration

Change of control

and defense measures

Significant Shareholders

(186).

10:

Supplement (14-17).

C—Material Contracts.

The Terms & Conditions of the several series of capital instruments issued to date, and to

be issued pursuant to Deferred Capital Contingent Plans, are exhibits 4.1 through 4.20 to

this Form 20-F. These notes are described under

Swiss SRB total loss-absorbing capacity

framework

Our deferred compensation plans

on pages 248-249 of the Annual Report.

The Asset Transfer Agreement by which certain assets and liabilities of UBS AG were

transferred to UBS Switzerland AG is filed as Exhibit 4.21, and is described under

Joint

liability of UBS AG and UBS Switzerland AG

on page 166 of the Annual Report.

The merger agreement between UBS Group AG and Credit Suisse Group AG, as well as

the parent bank merger agreement between UBS AG and Credit Suisse AG dated 7

December 2023 filed as Exhibit 4.22 hereto and the Swiss banks merger agreement

between UBS Switzerland AG and Credit Suisse (Schweiz) AG dated 9 February 2024

filed as Exhibit 4.23 hereto, are described under

Acquisition and integration of Credit

Suisse

on pages 17-19 of the Annual Report.

The mergers described in the parent bank merger agreement and the Swiss banks merger

agreement will be carried out with some procedural simplifications and without any

consideration given that both companies are or – in the case of the merger between UBS

Switzerland AG and Credit Suisse (Schweiz) AG – will be wholly-owned by the same

parent entity. Upon completion, all assets and liabilities of Credit Suisse AG and Credit

Suisse (Schweiz) AG, respectively, will, in principle, transfer automatically to UBS AG

and UBS Switzerland AG, respectively.

D—Exchange Controls.

Other than in relation to economic sanctions, there are no restrictions under the Articles

of Association of UBS Group AG, nor under Swiss law, as presently in force, that limit

the right of non-resident or foreign owners to hold UBS’s securities freely. There are

currently no Swiss foreign exchange controls or other Swiss laws restricting the import or

export of capital by UBS or its subsidiaries, nor restrictions affecting the remittance of

dividends, interest or other payments to non-resident holders of UBS securities. The

Swiss federal government may impose sanctions on particular countries, regimes,

organizations or persons which may create restrictions on exchange of control. A current

list, in German, French and Italian, of such sanctions can be found at www.seco-

admin.ch. UBS may also be subject to sanctions regulations from other jurisdictions

where it operates imposing further restrictions.

E—Taxation.

Supplement (18-20).

F—Dividends and Paying

Agents.

Not applicable.

G—Statement by Experts.

Not applicable.

H—Documents on Display.

UBS files periodic reports and other information with the Securities and Exchange

Commission. You may read and copy any document that we file with the SEC on the

SEC’s website,

www.sec.gov

. Much of this information may also be found on the UBS

website at

www.ubs.com/investors

.

Annual Report 2023

I—Subsidiary Information.

Not applicable.

J—Annual Report to Security

Holders

Not applicable

Item 11

. Quantitative and Qualitative Disclosures About Market Risk.

(a) Quantitative Information

About Market Risk.

Annual Report,

Market risk

(126-134).

(b) Qualitative Information

About Market Risk.

Annual Report,

Market risk

(126-134).

(c) Interim Periods.

Not applicable.

Item 12.

A

– Debt Securities

Not applicable.

B – Warrants and Rights

Not applicable.

C – Other Securities

Not applicable.

D – American Depositary Shares

Not applicable.

Item 13

. Defaults, Dividend

Arrearages and Delinquencies.

There has been no material default in respect of any indebtedness of UBS or any of its

significant subsidiaries or any arrearages of dividends or any other material delinquency

not cured within 30 days relating to any preferred stock of UBS Group AG or any of its

significant subsidiaries.

Item 14.

to the Rights of Security Holders

and Use of Proceeds.

None.

Item 15.

(a)

Disclosure Controls and

Procedures

Annual Report,

US disclosure requirements

(221), and

Exhibit 12 to this Form 20-

F.

(b) Management’s Annual

Report on Internal Control over

Financial Reporting

Annual Report,

Management’s report on internal control over financial reporting

(c) Attestation Report of the

Registered Public Accounting

Firm

Annual Report,

Reports of Independent Registered Public Accounting Firm

(272-274).

(d) Changes in Internal Control

over Financial Reporting

None.

Item 16A.

Audit Committee

Financial Expert.

Annual Report,

Audit Committee

(202) and

Differences from corporate governance

standards relevant to US-listed companies

(185).

All Audit Committee members have accounting or related financial management

expertise and, in compliance with the rules established pursuant to the US Sarbanes-

Oxley Act of 2002, at least one member, the Chairperson Jeremy Anderson, qualifies as a

financial expert.

Item 16B.

Code of Ethics.

Annual Report,

Our Code of Conduct and Ethics

(43) UBS's Code of Conduct and Ethics

("the Code") is published on our website under https://www.ubs.com/code.The Code does

not include a waiver option, and no waiver from any provision of the Code was granted to

any employee in 2023.

Item 16C.

Principal Accountant

Fees and Services.

Annual Report,

Auditors

None of the non-audit services so disclosed were approved by the Audit Committee

pursuant to paragraph (c) (7)(i)(C) of Rule 2-01 of Regulation S-X.

Item 16D.

Exemptions from the

Listing Standards for Audit

Committees.

Not applicable.

Item 16E.

Purchases of Equity

Securities by the Issuer and

Affiliated Purchasers.

Annual Report,

Holding of UBS Group AG shares

Letter to Shareholders

6).

Item 16F.

Changes in

Registrant’s Certifying

Accountant.

Not applicable.

Annual Report 2023

Item 16G.

Corporate

Governance.

Annual Report,

companies

Governance and Nominating Committee

Item 16H.

Mine Safety

Disclosure.

Not applicable.

Item 16I.

Disclosure Regarding

Foreign Jurisdictions that

Prevent Inspections

Not applicable.

Item 16J.

Insider trading

policies.

Not applicable.

Item 16K.

Annual Report,

Operational risks affect our business

Risk management and

control

Board of Directors

Cybersecurity governance

Group Executive Board

Item 17.

Financial Statements.

Not applicable.

Item 18.

Annual Report,

Financial statements

(272),

Significant regulated subsidiary and sub-

group information

(405-407) and

Additional regulatory information

Item 19.

Exhibits

Supplement (21-22).

Annual Report 2023

Supplemental information

Item 4. Information on the Company

B – Business Overview

Item 4.B.2. Geographic breakdown of total revenues of UBS Group AG consolidated

The allocation of total revenues by geographical region for the Credit Suisse subgroup is not available on the same allocation

basis as for UBS Group for 2023 and the cost to develop this information would be excessive. The below information is

disclosed for UBS AG subgroup and for Credit Suisse AG subgroup, in their own accounting standards.

UBS AG consolidated

UBS AG’s Financial Statements are prepared in accordance with IFRS Accounting Standards, as issued by the International

Accounting Standards Board and are stated in USD. The operating regions shown in the table below correspond to the regional

management structure of UBS AG. The allocation of revenues to these regions reflects, and is consistent with, the basis on which

the business is managed and its performance is evaluated. These allocations involve assumptions and judgments that management

considers to be reasonable, and may be refined to reflect changes in estimates or management structure.

The main principles of the allocation methodology are that client revenues are attributed to the domicile of the client, and trading

and portfolio management revenues are attributed to the country where the risk is managed. This revenue attribution is consistent

with the mandate of the regional Presidents. Certain revenues, such as those related to Non-core and Legacy and Group Items,

are managed at a Group level. These revenues are included in the

Global

USD billion

Business Division

FY

Americas

Asia Pacific

EMEA

Switzerland

Global

Total

Global Wealth

Management

2023

10.2

2.5

3.6

2.4

(0.1)

18.6

2022

10.6

2.6

3.9

1.9

0.0

19.0

2021

10.7

2.9

3.9

1.9

0.0

19.4

Personal &

Corporate Banking

2023

0.0

0.0

0.0

5.3

0.0

5.3

2022

0.0

0.0

0.0

4.3

0.0

4.3

2021

0.0

0.0

0.0

4.3

0.0

4.3

Asset Management

2023

0.6

0.3

0.4

0.8

(0.0)

2.1

2022

0.5

0.4

0.4

0.7

0.8

3.0

2021

0.6

0.5

0.5

0.8

0.0

2.6

Investment Bank

2023

2.5

2.3

2.2

0.8

0.0

7.8

2022

2.7

2.7

2.6

0.7

0.0

8.7

2021

3.2

3.0

2.5

0.8

(0.0)

9.5

Non-core and

Legacy

2023

0.0

0.0

0.0

0.0

0.1

0.1

2022

0.0

0.0

0.0

0.0

0.2

0.2

2021

0.0

0.0

0.0

0.0

0.1

0.1

Group Items

2023

0.0

0.0

0.0

0.0

(0.1)

(0.1)

2022

0.0

0.0

0.0

0.0

(0.3)

(0.3)

2021

0.0

0.0

0.0

0.0

0.0

0.0

UBS AG subgroup

2023

13.3

5.2

6.1

9.2

(0.1)

33.7

2022

13.8

5.6

7.0

7.7

0.8

34.9

2021

14.5

6.5

7.0

7.8

0.1

35.8

Annual Report 2023

Credit Suisse AG consolidated

Credit Suisse AG’s consolidated financial statements are prepared in accordance with accounting principles generally accepted

in the US (US GAAP) and are stated in Swiss francs (CHF). Responsibility for each product is allocated to a specific segment,

which records all related revenues and expenses. Revenue-sharing and service level agreements govern the compensation

received by one segment for generating revenue or providing services on behalf of another. Corporate services and business

support in finance, operations, human resources, legal, compliance, risk management and IT are provided by corporate

functions, and the related costs are allocated to the segments and Corporate Center based on their requirements and other

relevant measures.

The designation of net revenues and income/(loss) before taxes is based on the location of the office recording the transactions.

This presentation does not reflect the way the Credit Suisse AG is managed.

Net revenues

CHF million

)

2023

2022

2021

Wealth Management

3,058

4,904

5,549

Swiss Bank

3,515

4,228

4,457

Asset Management

659

1,214

1,352

Non-core and Legacy (including

Investment Bank)

(1,185)

4,635

11,347

Corporate Center

14,586

(61)

(9)

Adjustments

1

(743)

2

293

346

Net revenues

19,890

15,213

23,042

1

not legally owned by the Bank and vice versa, and certain revenues and expenses that were not allocated to the segments.

2

Net revenues

by geographic location

CHF million

)

2023

2022

2021

Switzerland

17,210

7,154

8,382

EMEA

(1,488)

523

2,916

Americas

4,270

6,134

8,896

Asia Pacific

(102)

1,402

2,848

Net revenues

19,890

15,213

23,042

Annual Report 2023

Disclosure Pursuant To Section 219 of the Iran Threat Reduction And Syrian Human Rights Act

Section 219 of the US Iran Threat Reduction and Syria Human Rights Act of 2012 (“ITRA”) added Section 13(r) to the US

Securities Exchange Act of 1934, as amended (the “Exchange Act”) requiring each SEC reporting issuer to disclose in its

annual and, if applicable, quarterly reports whether it or any of its affiliates have knowingly engaged in certain activities,

transactions or dealings relating to Iran or with the Government of Iran or certain designated natural persons or entities

involved in terrorism or the proliferation of weapons of mass destruction during the period covered by the report. The required

disclosure may include reporting of activities not prohibited by US or other law, even if conducted outside the US by non-US

affiliates in compliance with local law. Pursuant to Section 13(r) of the Exchange Act, we note the following for the period

covered by this annual report:

UBS has a Group Sanctions Policy that prohibits transactions involving sanctioned countries, including Iran, and sanctioned

individuals and entities. However, UBS Switzerland AG maintains one account involving the Iranian government under the

auspices of the United Nations in Geneva after agreeing with the Swiss government that it would do so only under certain

conditions. These conditions include that payments involving the account must: (1) be made within Switzerland; (2) be

consistent with paying rent, salaries, telephone and other expenses necessary for its operations in Geneva; and (3) not involve

any Specially Designated Nationals (SDNs) blocked or otherwise restricted under US or Swiss law. In 2023, the gross

revenues for this UN-related account were approximately USD 5,731.46. We do not allocate expenses to specific client

accounts in a way that enables us to calculate net profits with respect to any individual account. UBS AG intends to continue

maintaining this account pursuant to the conditions it has established with the Swiss Government and consistent with its Group

Sanctions Policy.

As previously reported, UBS had certain outstanding legacy trade finance arrangements issued on behalf of Swiss client

exporters in favor of their Iranian counterparties. In February 2012 UBS ceased accepting payments on these outstanding

export trade finance arrangements and worked with the Swiss government who insured these contracts (Swiss Export Risk

Insurance "SERV"). On December 21, 2012, UBS and the SERV entered into certain Transfer and Assignment Agreements

under which SERV purchased all of UBS's remaining receivables under or in connection with Iran-related export finance

transactions. Hence, the SERV is the sole beneficiary of said receivables. There was no financial activity involving Iran in

connection with these trade finance arrangements in 2023, and no gross revenue or net profit.

In connection with these trade finance arrangements, UBS Switzerland AG has maintained one existing account relationship

with an Iranian bank.

This account was established prior to the US designation of this bank and maintained due to the existing

trade finance arrangements. In 2007, following the designation of the bank pursuant to sanctions issued by the US, UN and

Switzerland, the account was blocked under Swiss law and remained subject to blocking requirements until January 2016.

Client assets as of 31 December 2023 were CHF 3,097.40. Gross revenues were USD 3.69 equivalent.

In addition to the above, during 2023, Credit Suisse AG processed a small number of de minimis payments related to the

operation of Iranian diplomatic missions in Switzerland and related to fees for ministerial government functions such as issuing

passports and visas. Processing these payments is permitted under Swiss law, and Credit Suisse AG intends to continue

processing such payments. Revenues and profits from these activities are not calculated but would be negligible.

Annual Report 2023

Item 10. Additional Information.

B—Memorandum and Articles of Association.

Please see the Articles of Association of UBS Group AG (Exhibit 1.1 to this Form 20-F) and the Organization Regulations of

UBS Group AG (Exhibit 1.2 to this Form 20-F).

Set forth below is a summary of the material provisions of the Articles of Association of UBS Group AG (the “Articles”),

Organization Regulations of UBS Group AG (the “Organization Regulations”) and relevant Swiss laws, in particular the Swiss

Code of Obligations, relating to the ordinary shares of UBS Group AG (the “shares”). This description does not purport to be

complete and is qualified in its entirety by references to Swiss law, including Swiss company law, and to the Articles and

Organization Regulations.

The principal legislation under which UBS Group AG operates, and under which the shares are issued, is the Swiss Code of

Obligations.

Shares and Shareholders

Shares

The shares are registered shares

(Namenaktien)

securities (

einfache Wertrechte

) (in the sense of the Swiss Code of Obligations). The shares are fully paid up, and there is no

liability of shareholders to further capital calls by UBS Group AG. The shares rank

pari passu

including voting rights, entitlement to dividends, share of the liquidation proceeds in case of the liquidation of UBS Group AG,

preemptive rights in the event of a share issue (

Bezugsrechte

) and advance subscription rights in the event of the issuance of

equity-linked securities (

Vorwegzeichnungsrechte

).

The Articles provide that we may elect to print and deliver certificates for shares at any time. However, shareholders have no

right to request the printing and delivery of certificates for shares or the conversion of the shares into another form.

Share Register

Swiss law distinguishes between registration with and without voting rights. Shareholders must be registered in our share

register as shareholders with voting rights in order to vote and participate in shareholders’ meetings or to assert or exercise

other rights related to voting rights.

Swiss law and the Articles require UBS Group AG to keep a share register in which the names, addresses and nationality (or

registered office in the case of legal entities) of the owners of the shares are recorded. The main function of the share register is

to register shareholders entitled to vote and participate in shareholders’ meetings, or to assert or exercise other rights related to

voting rights.

A shareholder will be registered in our share register with voting rights upon disclosure of its name, address and nationality (or

registered office in the case of legal entities). However, we may decline a registration with voting rights if the shareholder does

not declare that it has acquired the shares in its own name and for its own account. If the shareholder refuses to make such

declaration, it will be registered in our share register as a shareholder without voting rights.

In order to register shares in our share register, a shareholder must file a share registration form with the share register. Failing

such registration, a shareholder may not vote at or participate in shareholders’ meetings, but will be entitled to receive

dividends and other rights with financial value, such as preemptive rights in the event of a share issue (

Bezugsrechte

) and

advance subscription rights in the event of the issuance of equity-linked securities (

Vorwegzeichnungsrechte

), and its share of

liquidation proceeds. Shareholders registered in our share register may at any time request from us a confirmation of the shares

that they hold according to our share register.

UBS Group AG’s share register is kept by UBS Shareholder Services, P.O. Box, 8098 Zurich, Switzerland. UBS Shareholder

Services is responsible for the registration of the shares. The share register is split into two parts – a Swiss register, which is

maintained by UBS Group AG, acting as Swiss share registrar, and a US register, which is maintained by Computershare Trust

Company NA, c/o Computershare Investor Services, P.O. Box 505000, Louisville, KY 40233-5000, United States, as US

transfer agent.

Transfer of Shares

The transfer of shares constituting intermediated securities (

Bucheffekten

) (within the meaning of the Swiss Federal

Intermediated Securities Act) is effected by entries in securities accounts in accordance with applicable law. The transfer of

shares that do not constitute intermediated securities is effected by way of a written declaration of assignment and requires

notice to UBS Group AG.

Annual Report 2023

Shareholders’ Meetings

A shareholders’ meeting is convened by the Board of Directors (the “BoD”) or, if necessary, by the company’s statutory

auditors upon notification of the shareholders at least 20 days prior to such meeting. An invitation to any shareholders’ meeting

will be sent to all registered shareholders. The Articles do not require a minimum number of shareholders to be present in order

to hold a shareholders’ meeting.

Unless otherwise provided by Swiss law or the Articles (as indicated below), resolutions require the approval of a majority of

the votes represented, excluding blank and invalid ballots, at a shareholders’ meeting in order to be passed.

Under Swiss corporate law (or Swiss banking law, as the case may be), a resolution passed at a shareholders’ meeting with the

approval of at least a two-thirds of the votes, and a majority of the nominal value of shares, in each case represented at such

meeting is required in order to approve:

●

A change in the corporation’s stated purpose in its articles of association;

●

The consolidation of shares, unless the consent of all the shareholders concerned is required;

●

The restriction or exclusion of preemptive rights in the event of a share issue (

Bezugsrechte

);

●

The conversion of participation certificates into shares;

●

The introduction of shares with preferential voting rights;

●

Any restriction on the transferability of registered shares;

●

Any change in the currency of the share capital;

●

The introduction of a casting vote for the person chairing the shareholders’ meeting;

●

A provision of the articles of association on holding the shareholders’ meeting abroad;

●

The delisting of the equity securities of the corporation;

●

The creation of conditional capital, the introduction of a capital band or, in accordance with Swiss banking law, the

introduction of reserve capital;

●

An increase in share capital in consideration of contributions in kind, or by off-set of a claim, or involving the

granting of special privileges, or from the transformation of reserves into share capital;

●

A change of domicile of the corporation;

●

The introduction of an arbitration clause in the articles of association;

●

Dissolution of the corporation.

Under the Articles, a resolution passed at a shareholders’ meeting with the approval of at least two-thirds of the votes

represented at such meeting is required in order to approve:

●

A change to the provisions in the Articles regarding the number of members of the BoD;

●

Removal of one-quarter or more of the members of the BoD; or

●

The deletion or modification of the provision of the Articles establishing these supermajority requirements.

At shareholders’ meetings, a shareholder can be represented by a legal representative or under a written power of attorney by a

proxy who does not need to be a shareholder or, under a written or electronic power of attorney, by the independent proxy.

Votes are taken electronically, by written ballot or by a show of hands. Shareholders representing at least 3% of the votes

represented may always request that a vote or election take place electronically or by a written ballot.

Net Profits and Dividends

Swiss law requires that at least 5% of the annual net profits of a corporation must be retained and booked as statutory retained

earnings until these retained earnings equal, together with the corporation’s statutory capital reserve, no less than 50% of the

corporation’s share capital registered in the commercial register. Holding companies, such as UBS Group AG, must increase

their statutory retained earnings until these equal, together with their statutory capital reserve, no less than 20% of the holding

company’s share capital registered in the commercial register. Any remaining net profit of the corporation may be allocated by

the shareholders represented at the applicable shareholders’ meeting.

Under Swiss law, dividends may be paid by a corporation only if, based on its audited standalone statements prepared in

accordance with Swiss law, the corporation has sufficient distributable profits from the previous financial years or if the

reserves of the corporation are sufficient to allow distribution of a dividend. In either event, dividends may be paid by the

corporation only after approval by the shareholders’ meeting. The BoD may propose to the shareholders that a dividend be

paid, but cannot itself set the dividend. The corporation’s statutory auditors must confirm that any dividend proposal of the

BoD is in accordance with Swiss law and the corporation’s articles of association.

Dividends are usually due and payable after the shareholders’ resolution relating to the allocation of profits has been passed.

Under Swiss law, the statute of limitations in respect of dividend payments is five years.

Annual Report 2023

Preemptive and Advance Subscription Rights

Under Swiss law, any share issue, whether for cash or non-cash consideration or for no consideration, is subject to the prior

approval of the shareholders’ meeting. Existing shareholders of a Swiss corporation have certain preemptive rights in the event

of a share issue (

Bezugsrechte

) and advance subscription rights in the event of the issuance of equity-linked securities

(

Vorwegzeichnungsrechte

) to subscribe for the new shares or equity-linked securities, as the case may be, in proportion to the

nominal amount of shares held. However, the articles of association of the corporation or a resolution approved at a

shareholders’ meeting by at least two-thirds of the votes and a majority of the nominal value of the shares, in each case

represented at the meeting, may limit or exclude such preemptive or advance subscription rights in certain limited

circumstances.

Notices

Notices to shareholders are made by publication in the Swiss Official Gazette of Commerce. The BoD may designate further

means of communication for publishing notices to shareholders.

Mandatory Tender Offer

Under the applicable provisions of the Swiss Financial Market Infrastructure Act, anyone who directly or indirectly or acting in

concert with third parties acquires more than 33 1/3% of the voting rights (whether exercisable or not) of a Swiss-listed

company will have to submit a takeover bid to acquire all other listed equity securities of such company. A waiver from the

mandatory bid rule may be granted by the Swiss Takeover Board or the Swiss Financial Market Supervisory Authority

FINMA. If no waiver is granted, the mandatory takeover bid must be made pursuant to the procedural rules set forth in the

Swiss Financial Market Infrastructure Act and its implementing ordinances .

Board of Directors

Borrowing Power

Neither Swiss law nor the Articles restrict in any way our power to borrow and raise funds, provided that any such borrowing

is entered into on arms’ length terms.

UBS Group AG, as a listed company, may grant loans to members of its BoD based on the Articles. The Articles restrict UBS

Group AG’s ability to grant loans to BoD members as follows: First, loans to the independent members of the BoD shall be

made in accordance with the customary business and market conditions. Second, loans to the non-independent members of the

BoD shall be made in the ordinary course of business on substantially the same terms as those granted to UBS employees.

Third, the total amount of such loans shall not exceed CHF 20m per member.

Conflicts of Interests

Swiss law requires directors and members of senior management to inform the BoD immediately and comprehensively of any

conflicts of interest affecting them. The BoD then has to take the measures required to safeguard the interests of the

corporation. Directors and officers are personally liable to the corporation for any breach of these provisions. In addition,

Swiss law contains a provision under which payments made to a shareholder or a director or any person associated therewith,

other than at arm’s length, must be repaid to the corporation if the shareholder or director was acting in bad faith.

In addition, the Organization Regulations provide that the member of the BoD or senior management with a conflict of interest

shall participate in discussions and a double vote (meaning a vote with and a vote without the conflicted individual) shall take

place. A binding decision on the matter requires the same outcome in both votes. This is subject to exceptional circumstances

in which the best interests of UBS dictate that the member of the BoD or senior management with a conflict of interest shall

not participate in the discussions and decision-making involving the interest at stake.

Retirement of Board Members

There is no age-limit requirement for retirement of the members of the BoD. The term of office for each BoD member is until

the next annual general meeting of shareholders, and no BoD member may serve for more than 10 consecutive terms of office.

In exceptional circumstances the BoD can extend this limit.

Annual Report 2023

The Company

Repurchase of Shares

Swiss law limits a corporation’s ability to hold or repurchase its own shares. We and our subsidiaries may repurchase shares

only if and to the extent that (i) we have freely distributable reserves in the amount of the purchase price and (ii) the aggregate

nominal value of all shares held by us and our subsidiaries does not exceed 10% of our nominal share capital (or 20% of our

nominal share capital in specific circumstances). Repurchases for cancellation purposes approved by the shareholders’ meeting

are not subject to the 10% threshold for own shares within the meaning of article 659 paragraph 2 of the Swiss Code of

Obligations. We must create a special reserve in our standalone financial statements prepared in accordance with Swiss law in

the amount of the purchase price of any repurchased shares. Furthermore, in our consolidated financial statements, own shares

are recorded at cost and reported as treasury shares, resulting in a reduction in total shareholders’ equity. Shares held by us or

any of our subsidiaries do not carry any rights to vote at shareholders’ meetings.

Sinking Fund Provisions

There are no provisions in Swiss law or in the Articles requiring us to put resources aside for the exclusive purpose of

redeeming bonds or repurchasing shares.

Registration and Business Purpose

UBS Group AG was incorporated and registered as a corporation limited by shares (

Aktiengesellschaft

) under the laws of

Switzerland. UBS Group AG was entered into the commercial register of Canton Zurich on June 10, 2014 under the

registration number CHE-395.345.924 and has its registered domicile in Zurich, Switzerland. The business purpose of UBS

Group AG, as set forth in article 2 of the Articles, is the acquisition, holding, management and sale of direct and indirect

participations in enterprises of any kind, in particular in the area of banking, financial, advisory, trading and service activities

in Switzerland and abroad. UBS Group AG may establish enterprises of any kind in Switzerland and abroad, hold equity

interests in these companies, and conduct their management. UBS Group AG is authorized to acquire, mortgage and sell real

estate and building rights in Switzerland and abroad. UBS Group AG may provide loans, guarantees and other types of

financing and security for group companies and borrow and invest capital on the money and capital markets.

Duration and Liquidation

UBS Group AG has an unlimited duration.

Under Swiss law, we may be dissolved at any time by way of liquidation or in the case of a merger in accordance with the

Swiss Federal Act on Merger, Demerger, Transformation of Assets of October 3, 2002, as amended, based on a resolution

passed at a shareholders’ meeting with the approval of at least a two-thirds majority of the votes, and a majority of the nominal

value of shares, in each case represented at such meeting. As UBS Group AG is the Swiss parent of a financial group, the

Swiss Financial Market Supervisory Authority FINMA is the only competent authority to open restructuring or liquidation

(bankruptcy) proceedings with respect to UBS Group AG.

Under Swiss law, any surplus arising out of a liquidation (after the settlement of all claims of all creditors) must be used first to

repay the nominal share capital of UBS Group AG. Thereafter, any balance must be distributed to shareholders in proportion to

the paid-up nominal value of shares held.

Other

, Aeschengraben 9, 4051

, PCAOB number

, have been appointed as statutory

auditors and as auditors of the consolidated accounts of UBS Group AG. The auditors are subject to election each year by the

shareholders at the annual general meeting.

Annual Report 2023

E—Taxation.

This section outlines the material Swiss tax and US federal income tax consequences of the ownership of UBS Group AG's

ordinary shares (defined as "UBS ordinary shares " in this section) by a US holder (as defined below) who holds UBS ordinary

shares as capital assets. This discussion addresses only US federal income taxation and Swiss income and capital taxation and

does not discuss all of the tax consequences that may be relevant to holders in light of their individual circumstances, including

other foreign tax consequences, state or local tax consequences, estate and gift tax consequences, and tax consequences arising

under the Medicare contribution tax on net investment income or the alternative minimum tax. It is designed to explain the

major interactions between Swiss and US taxation for US persons who hold UBS ordinary shares.

The discussion does not address the tax consequences to persons who hold UBS ordinary shares in particular circumstances,

such as tax-exempt entities, banks, financial institutions, life insurance companies, broker-dealers, traders in securities that

elect to use a mark-to-market method of accounting for securities holdings, holders that actually or constructively own 10% or

more of the total combined voting power of the voting stock of UBS Group AG or of the total value of stock of UBS Group

AG, holders that hold UBS ordinary shares as part of a straddle or a hedging or conversion transaction, holders that purchase or

sell UBS ordinary shares as part of a wash sale for tax purposes or holders whose functional currency for US tax purposes is

not the US dollar. This discussion also does not apply to holders who acquired their UBS ordinary shares through a tax-

qualified retirement plan, nor generally to unvested UBS ordinary shares held under deferred compensation arrangements.

If a partnership (or other entity treated as a partnership for US federal income tax purposes) holds UBS ordinary shares, the US

federal income tax treatment of a partner will generally depend on the status of the partner and the tax treatment of the

partnership. A partner in a partnership holding the UBS ordinary shares should consult its tax advisor with regard to the US

federal income tax treatment of an investment in the ordinary shares.

The discussion is based on the tax laws of Switzerland and the United States, including the US Internal Revenue Code of 1986,

as amended, its legislative history, existing and proposed regulations under the Internal Revenue Code, published rulings and

court decisions, as in effect on the date of this document, as well as the Convention between the United States of America and

the Swiss Confederation for the Avoidance of Double Taxation with Respect to Taxes on Income (the “Treaty”), all of which

may be subject to change or change in interpretation, possibly with retroactive effect.

For purposes of this discussion, a “US holder” is any beneficial owner of UBS ordinary shares that is for US federal income

tax purposes:

●

A citizen or resident of the United States;

●

A domestic corporation or other entity taxable as a corporation;

●

An estate, the income of which is subject to US federal income tax without regard to its source; or

●

A trust, if a court within the United States is able to exercise primary supervision over the administration of the trust

and one or more US persons have the authority to control all substantial decisions of the trust.

Holders of UBS ordinary shares are urged to consult their tax advisors regarding the US federal, state and local and the Swiss

and other tax consequences of owning and disposing of these shares in their particular circumstances.

Dividends and Distributions

Dividends paid by UBS Group AG to a holder of UBS ordinary shares (including dividends on liquidation proceeds and stock

dividends) are in principle subject to a Swiss federal withholding tax at a rate of 35%.

Under the Capital Contribution Principle, the repayment of capital contributions, including share premiums made by the

shareholders after December 31, 1996 is in principle no longer subject to Swiss withholding tax if certain requirements

regarding the booking of these capital contributions are met.

Swiss companies listed on a Swiss stock exchange such as UBS Group AG can repay reserves from capital contributions to

their shareholders without deduction of Swiss withholding tax only if they distribute at least the same amount of taxable

dividends. For this reason UBS Group AG pays half of the dividend from capital contribution reserves and half of the dividend

from taxable dividends which is subject to 35% Swiss withholding tax.

Annual Report 2023

A US holder resident in the US that qualifies for Treaty benefits may apply for a refund of the withholding tax withheld in

excess of the 15% Treaty rate (or for a full refund in case of qualifying retirement arrangements). The claim for refund must be

filed with the Swiss Federal Tax Administration, Eigerstrasse 65, CH-3003 Berne, Switzerland no later than December 31 of

the third year following the end of the calendar year in which the income subject to withholding was due. The form used for

obtaining a refund is one of the Swiss Tax Forms 82 (82 C for US companies; 82 E for other US entities; 82 I for individuals;

82 R for regulated investment companies), which may be obtained from the Swiss Federal Tax Administration at the address

above or downloaded from the web page of the Swiss Federal tax Administration. The form must be filled out in triplicate with

each copy duly completed and signed before a notary public in the United States. The form must be accompanied by evidence

of the deduction of withholding tax withheld at the source.

A US holder resident outside the US may be eligible for a withholding tax reclaim. If the US holder is resident in Switzerland,

a full reclaim based on the Swiss withholding tax Act is possible provided all necessary conditions are met. A US holder

resident neither in the US nor in Switzerland may be eligible for a partial reclaim provided that a Treaty between Switzerland

and the country of residence is applicable and that all necessary conditions are met.

Transfers of UBS Ordinary Shares

The purchase or sale of UBS ordinary shares, whether by Swiss resident or non-resident holders (including US holders), may

be subject to a Swiss securities transfer stamp duty of up to 0.15% calculated on the purchase price or sale proceeds if it occurs

through or with a bank or other securities dealer as defined in the Swiss Federal Stamp Tax Act in Switzerland or the

Principality of Liechtenstein. In addition to the stamp duty, the sale of UBS ordinary shares by or through a member of a

recognized stock exchange may be subject to a stock exchange levy.

Capital gains realized by a US holder upon the sale of UBS ordinary shares are not subject to Swiss income or gains taxes,

unless such US holder holds such shares as business assets of a Swiss business operation qualifying as a permanent

establishment. In the latter case, gains are taxed at ordinary Swiss individual or corporate income tax rates, as the case may be,

and losses are deductible for purposes of Swiss income taxes. Furthermore, a US holder who is an individual resident in

Switzerland and holds such shares as business assets (as he qualifies as a professional trader of securities as per Swiss tax law)

may be liable to Swiss income taxes on gains.

(b) Ownership of UBS Ordinary Shares - US Federal Income Taxation

The tax treatment of the UBS ordinary shares will depend in part on whether or not UBS Group AG is classified as a passive

foreign investment company, or PFIC, for US federal income tax purposes. Except as discussed below under “—Passive

Foreign Investment Company (PFIC) Rules”, this discussion assumes that UBS Group AG is not classified as a PFIC for

United States federal income tax purposes.

Dividends and Distributions

A US holder will include in gross income and treat as a dividend the gross amount of any distribution paid, before reduction

for Swiss withholding taxes, by UBS Group AG out of its current or accumulated earnings and profits (as determined for US

federal income tax purposes), other than certain pro-rata distributions of UBS ordinary shares, when the distribution is actually

or constructively received by the US holder. Distributions in excess of current and accumulated earnings and profits (as

determined for US federal income tax purposes) will be treated as a return of capital to the extent of the US holder’s basis in its

UBS ordinary shares and thereafter as capital gain. However, UBS Group AG does not expect to calculate earnings and profits

in accordance with US federal income tax principles. Accordingly, a US holder should expect to generally treat distributions

made on UBS ordinary shares as dividends.

Dividends paid to a noncorporate US holder that constitute qualified dividend income will be taxable to the holder at

preferential rates, provided that the holder has a holding period in the shares of more than 60 days during the 121-day period

beginning 60 days before the ex-dividend date and meets other holding period requirements. Dividends paid by UBS Group

AG with respect to the ordinary shares will generally be qualified dividend income provided that, in the year that the US holder

receives the dividend, the UBS ordinary shares are readily tradable on an established securities market in the United States.

The UBS ordinary shares are listed on the New York Stock Exchange, and UBS Group AG therefore expects that dividends

will be qualified dividend income.

For US federal income tax purposes, a dividend will include a distribution characterized under Swiss law as a repayment of

capital contributions if the distribution is made out of current or accumulated earnings and profits, as described above.

Dividends will generally be income from sources outside the United States for foreign tax credit limitation purposes, and will

generally be "passive" income for purposes of computing the foreign tax credit allowable to the holder. However, if (a) we are

50% or more owned, by vote or value, by US persons and (b) at least 10% of our earnings and profits are attributable to

sources within the United States, then for foreign tax credit purposes, a portion of our dividends would be treated as derived

from sources within the United States. With respect to any dividend paid for any taxable year, the US source ratio of our

dividends for foreign tax credit purposes would be equal to the portion of our earnings and profits from sources within the

United States for such taxable year, divided by the total amount of our earnings and profits for such taxable year. Special rules

apply in determining the foreign tax credit limitation with respect to dividends that are subject to preferential rates. The

dividend will not be eligible for the dividends-received deduction generally allowed to US corporations in respect of dividends

received from other US corporations.

Annual Report 2023

Dividends on the UBS ordinary shares are taxable to a US holder when the US holder receives the dividends, actually or

constructively. In the case of dividends that are paid in Swiss francs, the amount of the dividend distribution included in

income of a US holder will be the US dollar value of the Swiss franc payments made, determined at the spot Swiss franc/US

dollar rate on the date such dividend distribution is includible in the income of the US holder, regardless of whether the

payment is in fact converted into US dollars. Generally, any gain or loss resulting from currency exchange fluctuations during

the period from the date the dividend payment is included in income to the date such dividend payment is converted into US

dollars will be treated as ordinary income or loss and will not be eligible for the special tax rate applicable to qualified

dividend income. Such gain or loss will generally be income or loss from sources within the United States for foreign tax credit

limitation purposes.

Subject to US foreign tax credit limitations, the nonrefundable Swiss tax withheld and paid over to Switzerland will generally

be creditable or deductible against the US holder’s US federal income tax liability. Special rules apply in determining the

foreign tax credit limitation with respect to dividends that are subject to the preferential tax rates. To the extent a reduction or

refund of the tax withheld is available to a US holder under the laws of Switzerland or under the Treaty, the amount of tax

withheld that is refundable will not be eligible for credit against the US holder’s US federal income tax liability, whether or not

the refund is actually obtained. See “(a) Ownership of UBS Ordinary Shares – Swiss Taxation” above, for the procedures for

obtaining a tax refund.

Transfers of UBS Ordinary Shares

A US holder that sells or otherwise disposes of UBS ordinary shares generally will recognize capital gain or loss for US federal

income tax purposes equal to the difference between the US dollar value of the amount realized and its tax basis, determined in

US dollars, in such UBS ordinary shares. Capital gain of a non-corporate US holder is generally taxed at preferential rates if

the UBS ordinary shares were held for more than one year. The gain or loss will generally be income or loss from sources

within the United States for foreign tax credit limitation purposes. A US holder will not be allowed a foreign tax credit in

respect of any stamp duty or stock exchange levy that is imposed upon a transfer of UBS ordinary shares.

Passive Foreign Investment Company (PFIC) Rules

UBS Group AG believes that it should not currently be classified as a PFIC for US federal income tax purposes, and it does not

expect to become a PFIC in the foreseeable future. However, this conclusion is a factual determination made annually and

thus may be subject to change. In addition, UBS Group AG’s current position that it is not currently, and it does not expect to

become, a PFIC is based on the position that UBS Group AG qualifies for a special rule that treats income recognized by a

bank in the active conduct of a banking business as active income for PFIC purposes (the “active bank exception”). It is

possible, however, that UBS Group AG may not satisfy the requirements of the active bank exception in the current or a future

taxable year, or that the U.S. Internal Revenue Service may issue guidance in the future under which UBS Group AG would

not satisfy the requirements of the active bank exception. It is therefore possible that UBS Group AG could become a PFIC in

a future taxable year. In general, UBS Group AG will be a PFIC with respect to a US holder if, for any taxable year in which

the US holder held UBS ordinary shares, either (i) at least 75% of the gross income of UBS Group AG for the taxable year is

passive income or (ii) at least 50% of the value, determined on the basis of a quarterly average, of UBS Group AG’s assets is

attributable to assets that produce or are held for the production of passive income (including cash). “Passive income”

generally includes dividends, interest, gains from the sale or exchange of investment property rents and royalties and certain

other specified categories of income. If a foreign corporation owns at least 25% by value of the stock of another corporation,

the foreign corporation is treated for purposes of the PFIC tests as owning its proportionate share of the assets of the other

corporation, and as receiving directly its proportionate share of the other corporation's income.

If UBS Group AG were to be treated as a PFIC, special rules apply with respect to (i) any gain a US holder realizes on the sale

or other disposition of UBS ordinary shares, and (ii) any excess distribution that UBS Group AG makes to a US holder

(generally, any distributions to the US holder during a single taxable year, other than the taxable year in which the US holder’s

holding period in the UBS ordinary shares begins, that are greater than 125% of the average annual distributions received by

the US holder in respect of the UBS ordinary shares during the three preceding taxable years or, if shorter, the US holder’s

holding period for the UBS ordinary shares that preceded the taxable year in which the US holder receives the distribution).

Under these rules: (i) the gain or excess distribution will be allocated ratably over the US holder’s holding period for the UBS

ordinary shares, (ii) the amount allocated to the taxable year in which the US holder realized the gain or excess distribution or

to prior years before the first year in which UBS Group AG is a PFIC with respect to the US holder will be taxed as ordinary

income, (iii) the amount allocated to each other prior year will be taxed at the highest tax rate in effect for that year, and (iv)

the interest charge generally applicable to underpayments of tax will be imposed in respect of the tax attributable to each such

year.

Special rules apply for calculating the amount of the foreign tax credit with respect to excess distributions by a PFIC. With

certain exceptions, a US holder’s UBS ordinary shares will be treated as stock in a PFIC if UBS Group AG was a PFIC at any

time during the holder’s holding period in the UBS ordinary shares. In addition, dividends received from UBS Group AG

would not be eligible for the preferential tax rate applicable to qualified dividend income if UBS Group AG were to be treated

as a PFIC either in the taxable year of the distribution or the preceding taxable year, but would instead be taxable at rates

applicable to ordinary income. If a US holder owns UBS ordinary shares during any year that UBS Group AG is PFIC with

respect to the US holder, the US holder may be required to file Internal Revenue Service Form 8621.

Annual Report 2023

Item 19. Exhibits.

Exhibit

number

Description

1.1

(Incorporated by reference to Form 6-K of UBS

Group AG filed on April 25, 2023)

1.2

2(b)

Instruments defining the rights of the holders of long-term debt issued by UBS Group AG and its subsidiaries.

We agree to furnish to the SEC upon request, copies of the instruments, including indentures, defining the rights of

the holders of our long-term debt and of our subsidiaries’ long-term debt.

2(d)

4.1

.

(Incorporated by

reference to Exhibit 4.3 to UBS's Annual Report on Form 20-F for the fiscal year ended December 31, 2014)

4.2

.

(Incorporated

by reference to Exhibit 4.4 to UBS's Annual Report on Form 20-F for the fiscal year

ended December 31, 2014)

4.3

(Incorporated by reference to Exhibit 4.8 to UBS's Annual Report on Form 20-F for the fiscal year ended

December 31, 2015)

4.4

ended December 31, 2019)

4.5

(Incorporated by reference to Exhibit 4.18 to UBS's Annual Report on Form 20-F for the fiscal

year ended December 31, 2019)

4.6

(Incorporated by reference to Exhibit 4.19 to UBS's Annual Report on Form 20-F for the fiscal year

ended December 31, 2019)

4.7

. (Incorporated by reference to Exhibit 4.19 to UBS's Annual Report on Form 20-F for the fiscal year

ended December 31, 2020)

4.8

(Incorporated by reference to Exhibit 4.20 to UBS's Annual Report on Form 20-F for the fiscal year

ended December 31, 2020)

4.9

.

(Incorporated by reference to Exhibit 4.21 to UBS's Annual Report on Form 20-F for the fiscal year

ended December 31, 2020)