Grandview Gold Inc. - Exhibit 99.91 - Filed by newsfilecorp.com

Exhibit 99.91

GRANDVIEW GOLD INC.

Notice of Meeting

and

Management Information Circular

in respect of the

Annual and Special Meeting of Shareholders

to be held on November 28, 2011

OCTOBER 28, 2011

GRANDVIEW GOLD INC.

330 Bay Street, Suite 820, Toronto, ON M5H 2S8

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

to be held on November 28, 2011

TO THE SHAREHOLDERS OF GRANDVIEW GOLD INC.

NOTICE IS HEREBY GIVEN that an annual and special meeting (the

"Meeting") of shareholders ("Shareholders") of common shares

("Common Shares") of Grandview Gold Inc. ("Grandview", or the

"Corporation") will be held at 130 King Street West, Suite 1600, Toronto,

ON M5X 1J5 at 10:00 a.m. (Toronto time) on Monday, November 28, 2011 for the

following purposes:

| 1. |

to receive the financial statements of the Corporation

for the year ended May 31, 2011, together with the auditors' report

thereon; |

| |

|

| 2. |

to elect the directors of the Corporation for the ensuing

year; |

| |

|

| 3. |

to appoint the auditors of the Corporation for the

ensuing year and authorize the directors to fix their

remuneration; |

| |

|

| 4. |

to consider and, if deemed advisable, to pass (with or

without variation) an ordinary resolution of the disinterested

shareholders approving and confirming an extension of the term of Common

Share purchase warrants previously issued by the Corporation as set out in

the proposed resolution set forth in the management information circular

dated October 28, 2011 (the "Circular") of the Corporation, the

text of which is incorporated herein by reference; |

| |

|

| 5. |

to consider and, if deemed advisable, to pass an ordinary

resolution to repeal the existing By-Laws of the Corporation and to adopt

new By-Laws, as more particularly described in the accompanying Circular;

and |

| |

|

| 6. |

to transact such other business as may properly be

brought before the Meeting or any adjournment or adjournments

thereof. |

The specific details of the matters to be put before the

Meeting as identified above are set forth in the Circular of the Corporation

accompanying and forming part of this notice. Shareholders should refer to the

Circular for more detailed information with respect to the matters to be

considered at the Meeting.

If you are a registered shareholder of the Corporation

and are unable to attend the Meeting in person, please date and execute the

accompanying form of proxy and return it in the envelope provided to Equity

Financial Trust Company, the registrar and transfer agent of the Corporation, at

200 University Avenue, Suite 400, Toronto, Ontario M5H 4H1 by no later than 5:00

p.m. (Toronto time) on November 25, 2011, or in the case of any adjournment of

the Meeting, not less than 48 hours prior to the time of such meeting.

If you are not a registered shareholder of the

Corporation and receive these materials through your broker or through another

intermediary, please complete and return the form of proxy in accordance with

the instructions provided to you by your broker or by the other intermediary.

The directors of the Corporation have fixed the close of

business on October 28, 2011 as the record date for the determination of the

shareholders of the Corporation entitled to receive notice of the Meeting.

By order of the Board of Directors

“Paul Sarjeant”

__________________________________

PAUL SARJEANT, P. Geo

Director, President and Chief Executive Officer

October 28, 2011

GRANDVIEW GOLD INC.

330 Bay Street, Suite 820,

Toronto, ON M5H 2S8

MANAGEMENT INFORMATION CIRCULAR

FOR THE ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

TO BE

HELD ON NOVEMBER 28, 2011

SOLICITATION OF PROXIES

This Information Circular is furnished in connection with

the solicitation of proxies by the management ("Management") of Grandview Gold

Inc. ("Grandview" or the "Corporation") for use at the annual and special

meeting (the "Meeting") of the shareholders ("Shareholders") of common shares

("Common Shares") of the Corporation.

The Meeting will be held at 130 King Street West, Suite 1600,

Toronto, ON M5X 1J5 at 10:00 a.m. (Toronto time) on November 28, 2011, and at

any adjournments thereof for the purposes set forth in the Notice of Annual and

Special Meeting of Shareholders accompanying this Information Circular.

Information contained herein is given as of October 28, 2011 unless otherwise

specifically stated.

Solicitation of proxies will be primarily by mail but may be

supplemented by solicitation personally by directors, officers and employees of

the Corporation without special compensation. The cost of solicitation by

Management will be borne by the Corporation.

APPOINTMENT AND REVOCATION OF PROXIES

Enclosed herewith is a form of proxy for use at the Meeting.

The persons named in the form of proxy are directors and officers of the

Corporation. A Shareholder submitting a proxy has the right to appoint a

nominee (who need not be a Shareholder) to represent him at the Meeting other

than the persons designated in the enclosed proxy form by inserting the name of

his chosen nominee in the space provided for that purpose on the form and by

striking out the printed names.

A form of proxy will not be valid for the Meeting or any

adjournment thereof unless it is signed by the Shareholder or by the

Shareholder's attorney authorized in writing or, if the Shareholder is a

corporation, it must be executed by a duly authorized officer or attorney

thereof. The proxy, to be acted upon, must be deposited with the registrar and

transfer agent of the Corporation, Equity Financial Trust Company at 200

University Avenue, Suite 400, Toronto, Ontario M5H 4H1 by 5:00 p.m. (Toronto

time) on November 25, 2011, or in the case of any adjournment of the Meeting,

not less than 48 hours prior to the time of such meeting, or delivering it to

the Chairman of the Meeting, on the day of the meeting or any adjournment

thereof prior to the time of the voting.

A Shareholder who has given a proxy may revoke it prior to its

use, in any manner permitted by law, including by instrument in writing executed

by the Shareholder or by his attorney authorized in writing or, if the

Shareholder is a corporation, executed by a duly authorized officer or attorney

thereof and deposited at the office of the Equity Financial Trust Company at any

time up to and including the last business day preceding the day of the Meeting,

or any adjournment thereof, at which the proxy is to be used, or with the

chairman of the Meeting on the day of the Meeting or any adjournment thereof.

ADVICE TO BENEFICIAL HOLDERS OF COMMON SHARES

The information set forth in this section is of significant

importance to many Shareholders as a substantial number of Shareholders do not

hold Common Shares in their own name. Shareholders who do not hold their Common

Shares in their own name (referred to in this Information Circular as

"Beneficial Shareholders") should note that only proxies deposited by

Shareholders whose names appear on the records of Grandview as the registered

holders of Common Shares can be recognized and acted upon at the Meeting. If

Common Shares are listed in an account statement provided to a Shareholder by a

broker, then in almost all cases those Common Shares will not be registered in the Shareholder's name on the records of

Grandview. Such Common Shares will more likely be registered under the names of

the Shareholder's broker or an agent of that broker. In Canada, the vast

majority of such Common Shares are registered under the names of CDS & Co.

(the registration name for CDS Depository and Clearing Services Inc., which acts

as nominee for many Canadian brokerage firms). Common Shares held by brokers or

their agents or nominees can only be voted (for or against resolutions) upon the

instructions of the Beneficial Shareholder. Without specific instructions,

brokers and their agents and nominees are prohibited from voting Common Shares

for the broker's clients. Therefore, Beneficial Shareholders should ensure

that instructions respecting the voting of their Common Shares are communicated

to the appropriate person.

Applicable regulatory policy requires intermediaries/brokers to

seek voting instructions from Beneficial Shareholders in advance of

shareholders' meetings. Every intermediary/broker has its own mailing procedures

and provides its own return instructions which should be carefully followed by

Beneficial Shareholders in order to ensure that their Common Shares are voted at

the Meeting. Often, the form of proxy supplied to a Beneficial Shareholder by

its broker is identical to the form of proxy provided to registered

shareholders; however, its purpose is limited to instructing the registered

shareholder how to vote on behalf of the Beneficial Shareholder. The majority of

brokers now delegate responsibility for obtaining instructions from clients to

Broadridge Financial Services, Inc. ("Broadridge"). Broadridge typically

mails a scanable voting instruction form in lieu of the form of proxy. The

Beneficial Shareholder is requested to complete and return the voting

instruction form to them by mail or facsimile. Alternatively, the Beneficial

Shareholder can call a toll-free telephone number to vote the Common Shares held

by the Beneficial Shareholder. Broadridge then tabulates the results of all

instructions received and provides appropriate instructions respecting the

voting of Common Shares to be represented at the Meeting. A Beneficial

Shareholder receiving a voting instruction form cannot use that voting

instruction form to vote Common Shares directly at the Meeting as the voting

instruction form must be returned as directed by Broadridge well in advance of

the Meeting in order to have the Common Shares voted.

Although a Beneficial Shareholder may not be recognized

directly at the Meeting for the purposes of voting Common Shares registered in

the name of his broker (or agent of the broker), a Beneficial Shareholder may

attend at the Meeting as proxyholder for a registered shareholder and vote the

Common Shares in that capacity. Beneficial Shareholders who wish to attend at

the Meeting and indirectly vote their Common Shares as proxyholder for a

registered shareholder should enter their own names in the blank space on the

instrument of proxy provided to them and return the same to their broker (or the

broker's agent) in accordance with the instructions provided by such broker (or

agent), well in advance of the Meeting.

VOTING OF PROXIES

All Common Shares represented at the Meeting by properly

executed proxies will be voted on any ballot that may be called for and, where a

choice with respect to any matter to be acted upon has been specified in the

accompanying form of proxy, the Common Shares represented by the proxy will be

voted in accordance with such instructions. In the absence of any such

instruction, the persons whose names appear on the printed form of proxy will

vote in favour of all the matters set out thereon. The enclosed form of proxy

confers discretionary authority upon the persons named therein. If any other

business or amendments or variations to matters identified in the Notice of

Meeting properly comes before the Meeting then discretionary authority is

conferred upon the person appointed in the proxy to vote in the manner they see

fit, in accordance with their best judgment. At the time of the printing of

this Information Circular, Management knows of no such amendment, variation or

other matter to come before the Meeting other than the matters referred to in

the Notice of Meeting.

SUPPLEMENTAL MAILING LIST

Under National Instrument 51-102 - Continuous Disclosure

Obligations, a person or corporation who in the future wishes to receive

financial statements and the related management's discussion and analysis from

the Corporation must deliver a written request for such material to the

Corporation, together with a signed statement that the person or corporation is

the owner of securities (other than debt instruments) of the Corporation.

Shareholders who wish to receive financial statements and the related

management's discussion and analysis are encouraged to send the enclosed mail

card, together with the completed form of proxy to Equity Financial Trust

Company, at 200 University Avenue, Suite 400, Toronto, Ontario M5H 4H1. Copies

of the Corporation's annual and interim financial statements are also available

on SEDAR at www.sedar.com.

- 2 -

APPROVAL OF MATTERS

Unless otherwise noted, approval of matters to be placed before

the Meeting is by an "ordinary resolution", which is a resolution passed

by a simple majority (50% plus 1) of the votes cast by Shareholders of the

Corporation present and entitled to vote in person or by proxy.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The authorized capital of the Corporation consists of an

unlimited number of Common Shares and an unlimited number of convertible,

redeemable, voting, non-participating shares (the "Preference Shares") of

which, on the date of this Circular, 81,163,032 Common Shares and no Preference

Shares were issued and outstanding.

Common Shares

The holders of Common Shares are entitled to receive notice of

and to attend any meeting of the Shareholders (except meetings at which only the

holders of another class of shares are entitled to vote) and are entitled to one

vote for each Common Share held. Subject to the prior rights of the holders of

the Preference Shares or any other shares ranking senior to the Common Shares,

the holders of the Common Shares are entitled to: (a) receive any dividends as

and when declared by the board of directors of the Corporation (the

"Board") out of the assets of the Corporation properly applicable to the

payment of dividends, in such amount and in such form as the Board may from time

to time determine; and (b) receive the remaining property of the Corporation in

the event of any liquidation, dissolution of winding-up of the Corporation.

Each Shareholder is entitled to one vote for each Common Share

shown as registered in his or her name on the list of Shareholders. The list of

Shareholders will be prepared as of October 28, 2011, the record date fixed for

determining shareholders entitled to the notice of the Meeting.

Other than as set out below, to the knowledge of the directors

and executive officers of the Corporation, as of the date hereof, no person or

company beneficially owns, or controls or directs, directly or indirectly,

voting securities carrying ten percent (10%) or more of the voting rights

attached to any class of voting securities of the Corporation.

Shareholder |

Number of

Securities Held |

% of Issued and

Outstanding Voting

Securities Held |

| Centerpoint Resources Inc. |

20,000,000 Common Shares |

24.64%

|

DIVIDEND POLICY

The Corporation has not paid any dividends on the Common Shares

to date and does not expect to pay dividends on such shares in the foreseeable

future. It is anticipated that all available funds will be used to finance the

future development of the Corporation.

INTEREST OF CERTAIN PERSONS OR COMPANIES IN MATTERS TO BE

ACTED ON

Management is not aware of any material interest, direct or

indirect, by way of beneficial ownership of securities or otherwise, of any

director or executive officer or any associate or affiliate of any of the

foregoing in any matter to be acted on at the Meeting other than the election of

directors or the appointment of auditors.

STOCK OPTION PLAN

The Corporation has established a stock option plan, ratified

and adopted by the Shareholders on March 26, 2004, amended on October 30, 2006

and October 30, 2009 and ratified and re-confirmed by the Shareholders on

November 30, 2009 (the "Option Plan"), for the granting for the granting

of incentive stock options ("Options") to directors, officers and employees of the Corporation or to a

consultant (the "Participants"). The Option Plan is intended to afford

persons who provide services to the Corporation, whether as directors, officers,

employees or consultants, an opportunity to obtain a proprietary interest in

Grandview by permitting them to purchase Common Shares, thereby more closely

aligning the personal interests of such directors, officers, employees and

consultants to those of Shareholders, and to aid in attracting as well as

retaining and encouraging the continued involvement of such persons with the

Corporation.

- 3 -

Description of the Option Plan

Under the Option Plan:

Options may be granted in such numbers and with such vesting

provisions as the Board may determine;

| (a) |

the exercise price of Options shall not be less than the

"discounted market price" of the Common Shares at the date of granting

such option. For purposes of the Option Plan, "discounted market price"

means the greater of the closing market price of the underlying Common

Shares on (a) the closing price of the Common Shares on the TSX on the

last business day prior to the date on which the Option is granted, and

(b) the date of the grant of the Option; |

| |

|

| (b) |

the term and expiry date of the Options granted shall be

determined in the discretion of the Board at the time of granting of the

Options; |

| |

|

| (c) |

the maximum term for Options is five years; |

| |

|

| (d) |

the Options are not assignable or transferable, with the

exception of an assignment made to a personal representative of a deceased

Participant; |

| |

|

| (e) |

the aggregate number of Common Shares reserved for

issuance pursuant to Options granted to any one person, when combined with

any other share compensation arrangement, may not exceed 5% of the

outstanding Common Shares (on a non-diluted basis); |

| |

|

| (f) |

the number of Common Shares, together with Grandview’s

other previously established or proposed share compensation arrangements,

(i) issuable (or reserved for issuance) to "insiders" of the Corporation

may not exceed 10% of the outstanding Common Shares, or (ii) issued to

"insiders" of Grandview within a one year period may not exceed 10% of the

outstanding Common Shares; |

| |

|

| (g) |

the issuance of Common Shares to any one individual

within a one-year period may not exceed 5% of the issued and outstanding

Common Shares; |

| |

|

| (h) |

the issuance of Common Shares to any one "consultant" of

the Corporation, within a one-year period, may not exceed 2% of the issued

and outstanding Common Shares; |

| |

|

| (i) |

the issuance of Common Shares to any one "consultant" of

the Corporation engaged to provide investor relation activities for the

Corporation, within a one-year period, may not exceed 1% of the issued and

outstanding Common Shares; |

| |

|

| (j) |

the vesting period or periods within the ten year maximum

term during which an Option or a portion thereof may be exercised by a

Participant shall be determined by the Board. Further, the Board may, in

its sole discretion at any time or in the Option agreement in respect of

any Options granted, accelerate or provide for the acceleration of,

vesting of Options previously granted; |

| |

|

| (k) |

in the event of the resignation or retirement of a

Participant, or the termination of the employment of a Participant,

whether with or without cause or reasonable notice, prior to the expiry

time of an Option, such Option shall cease and terminate on the ninetieth

day following the effective date of such resignation, retirement or

termination, and in the event of the death of a holder of Options, such

Options shall be exercisable until the earlier of one year following the

death of the holder, or the expiry time of such Option, whichever occurs

first, and thereafter shall be of no further force or effect whatsoever as

to the Common Shares in respect of which such Option has not previously

been exercised; |

- 4 -

| (l) |

in the event of a sale of Grandview or all or

substantially all of its property and assets or a change of control of

Grandview, holders of Options, whether such Options have vested or not in

accordance with their terms, may exercise such options until the earlier

of the expiry of the Options and the thirtieth day following the sale of

Grandview or all or substantially all of its property and assets or a

change of control of Grandview; |

| |

|

| (m) |

the aggregate number of Common Shares that may be

reserved for issuance under the Option Plan, together with any Common

Shares reserved for issuance under any other share compensation

arrangement must not exceed 20% of the number of Common Shares, on a

non-diluted basis, outstanding at the time; and |

| |

|

| (n) |

the Board retains the right to suspend, terminate, or

discontinue the terms and conditions of the Option Plan by resolution of

the Board. |

Recent Changes Made to the Stock Option Plans

Effective October 27, 2011, the Board adopted certain changes

to the Corporation's stock option plan in order to comply with the recent tax

amendments to the Income Tax Act (Canada) concerning stock options

awarded to employees, which came into force on January 1, 2011. The changes have

the sole purpose of allowing the Corporation to establish the necessary measures

to comply with the new income tax remittance obligations set out in the

Income Tax Act (Canada). The approval of the Shareholders to the

amendment was not required under the amendment provisions of the Option Plan or

by the TSX and, accordingly, was not sought.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION

PLANS

The following table sets forth the number of Common Shares to

be issued upon exercise of outstanding options ("Options") issued

pursuant to compensation plans under which equity securities of the Corporation

are authorized for issuance, the weighted average exercise price of such

outstanding Options and the number of Common Shares remaining available for

future issuance under such compensation plans as at May 31, 2011.

Plan Category |

Number of securities

to be

issued upon exercise of

outstanding

Options(1) |

Weighted-average

exercise

price of outstanding Options |

Number of securities remaining

available for future issuance

under equity

compensation plans

(excluding securities reflected in

the first column)(1) |

| Equity compensation plans approved by

security holders(1) |

5,250,000 |

$0.33 |

10,982,606 |

| Equity compensation plans not approved by

security holders |

N/A |

N/A |

N/A |

| TOTAL |

5,250,000 |

$0.33 |

10,982,606

|

__________________________

Note:

| (1) |

The Corporation currently has a rolling 20% stock option

plan. As at May 31, 2011, 81,163,032 Common Shares were issued and

outstanding. |

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

None of the directors or executive officers of the Corporation

were indebted to the Corporation as at May 31, 2011.

- 5 -

MANAGEMENT CONTRACTS

Management functions of the Corporation and its subsidiaries

are not to any substantial degree performed by persons other than the directors

or executive officers of the Corporation or subsidiary of the Corporation.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

The directors and officers of the Corporation are not aware of

any transaction since the beginning of the Corporation's last completed

financial year or any proposed transaction that has materially affected or will

materially affect the Corporation in which any director or senior officer of the

Corporation, any proposed Management nominee for election as a director, any

person beneficially owning or exercising control or direction over more than 10%

of the Common Shares of the Corporation or any associate or affiliate of any of

the foregoing has or had a material interest, direct or indirect.

ORDINARY BUSINESS

FINANCIAL STATEMENTS AND AUDITORS' REPORT

At the Meeting, Shareholders will consider the financial

statements of the Corporation for the year ended May 31, 2011 and the auditors'

report thereon, but no vote by the Shareholders with respect thereto is required

or proposed to be taken.

APPOINTMENT OF AUDITORS

Shareholders of the Corporation will be asked at the Meeting to

appoint PricewaterhouseCoopers LLP ("PWC") as the Corporation's auditors

to hold office until the close of the next annual meeting of shareholders of the

Corporation, and to authorize the directors of the Corporation to fix the

auditors' remuneration.

UNLESS OTHERWISE SPECIFIED, THE PERSONS NAMED IN THE

ACCOMPANYING PROXY INTEND TO VOTE FOR THE APPOINTMENT OF PRICEWATERHOUSECOOPERS

LLP, CHATERED ACCOUNTANTS AS AUDITORS OF THE CORPORATION UNTIL THE CLOSE OF THE

NEXT ANNUAL MEETING OF SHAREHOLDERS AND FOR THE AUTHORIZATION OF THE DIRECTORS

TO FIX THEIR REMUNERATION.

ELECTION OF DIRECTORS

The articles of the Corporation provide for a minimum of three

(3) and a maximum of ten (10) directors. The Corporation has determined that six

(6) directors will be elected at the Meeting.

UNLESS A CHOICE IS OTHERWISE SPECIFIED, IT IS INTENDED THAT

THE SHARES REPRESENTED BY THE PROXIES HEREBY SOLICITED WILL BE VOTED BY THE

PERSONS NAMED THEREIN FOR THE ELECTION OF THE NOMINEES WHOSE NAMES ARE SET FORTH

BELOW, ALL OF WHOM ARE NOW MEMBERS OF THE BOARD OF DIRECTORS AND HAVE BEEN SINCE

THE DATES INDICATED.

Management does not contemplate that any nominee will be

unwilling or unable to serve as director but, if that should occur for any

reason prior to the Meeting, it is intended that the persons named in the

enclosed form of proxy shall reserve the right to vote for another nominee in

his discretion. Each of the following persons is nominated to hold office as a

director until the next annual meeting or until his successor is duly elected,

unless his office is earlier vacated in accordance with the by-laws of the

Corporation.

- 6 -

Name and Municipality of

Residence

|

Office held with

Grandview |

Director Since |

Principal

Occupation |

Common Shares

Beneficially

Owned

Directly or Indirectly(1) |

Paul Sarjeant

Burlington,

Ontario, Canada |

President, Chief Executive

Officer and Director |

November 7, 2006 |

From 1999 until November, 2006

operated a securities business focused on strategic planning and

investment analysis. Since his appointment, Mr. Sarjeant's full time

employment has been with the Corporation. |

133,333(2) |

D. Richard Brown(3)

Toronto, Ontario, Canada |

Director |

March 26, 2004 |

Partner at Osprey Capital

Partners. |

105,000(4) |

Peter Born (3)

Ottawa, Ontario, Canada |

Director |

June, 2007 |

Ph.D., professional registered

geologist (ON) and President of 1727856 Ontario Ltd. |

133,333(6) |

Ken Hight(5)

Toronto,

Ontario, Canada |

Director |

May 12, 2008 |

From 2000-2005 served as CEO of

ITG Canada and from 2005 – 2008 served as CEO of E*Trade Canada and

concurrently EVP, E*Trade Financial New York, CEO of Liquidnet Cnada until

September 2009. Currently Chair and CEO of Portage Mining Corp. and

director of two other TSX-V companies. |

133,333(7) |

Jack Austin(3)

Vancouver, British

Columbia, Canada |

Director |

December 3, 2009 |

Currently Senior Advisor-

International to Stern Partners Inc., President of Centerpoint Resources

Inc., Chairman and director of New Pacific Minerals Corp. and Director of

Yalian Steel Corporation. |

600,000(8) |

Ted Nunn(5)

Vancouver, British

Columbia, Canada |

Director |

December 3, 2009 |

President of Centershield Gold

Mines Inc and VP Technical Services for Centerpoint Resources Inc. |

Nil(9)

|

__________________________

Notes:

| (1) |

The information as to shares beneficially owned, directly

or indirectly, not being within the knowledge of the Corporation, has been

furnished by the respective directors and executive officers

individually. |

| (2) |

Paul Sarjeant holds options to purchase up to a total of

1,250,000 common shares of the Corporation, 600,000 being exercisable at

the price of $0.68 per common share expiring on September 27, 2012, and

the remaining 650,000 exercisable at $0.15 per common share expiring June

23, 2014. These options were granted to Mr. Sarjeant under the Option

Plan. Mr. Sarjeant also holds 133,333 warrants exercisable at the price of

$0.12 and expiring on December 3, 2011. |

| (3) |

Chairman of the Audit Committee of the Board of

Directors. The members of the Audit Committee are D. Richard Brown

(Chairman), Jack Austin and Peter Born. |

| (4) |

D. Richard Brown holds options to purchase up to a total

of 650,000 common shares of the Corporation, 200,000 being exercisable at

the price of $0.68 per common share expiring on September 27, 2012, and

the remaining 450,000 exercisable at $0.15 per common share expiring June

23, 2014. These options were granted to Mr. Brown under the Option

Plan. |

| (5) |

Member of the Compensation Committee of the Board of

Directors. The members of the Compensation Committee are Ken Hight

(Chairman), Ted Nunn and Michael Hitch. Mr. Hitch is not standing for

re-election to the Board. |

| (6) |

Dr. Peter Born holds options to purchase up to a total of

600,000 common shares of the Corporation, 150,000 of which are exercisable

at the price of $0.68 per common share expiring on September 27, 2012, and

the remaining 450,000 exercisable at the price of $0.15 per common share

expiring June 23, 2014. Dr. Born also holds 133,333 warrants exercisable

at the price of $0.12 and expiring on December 3, 2011. |

| (7) |

Ken Hight holds options to purchase up to a total of

450,000 common shares of the Corporation which are exercisable at the

price of $0.15 per common share expiring June 23, 2014. Mr. Hight also

holds 133,333 warrants exercisable at the price of $0.12 and expiring on

December 3, 2011. |

- 7 -

| (8) |

Jack Austin holds options to purchase up to a total of

450,000 common shares of the Corporation which are exercisable at the

price of $0.15 per common share expiring December 9, 2014. Mr. Austin also

holds 600,000 warrants exercisable at the price of $0.12 and expiring on

December 3, 2011. |

| (9) |

Ted Nunn holds options to purchase up to a total of

450,000 common shares of the Corporation which are exercisable at the

price of $0.15 per common share expiring December 9,

2014. |

Corporate Cease Trade Orders, Bankruptcies, Penalties or

Sanctions

To the best knowledge of the Corporation, no director or

officer or principal shareholder of the Corporation is, as at the date hereof or

has been within the last ten years prior to the date hereof, (a) subject to a

cease trade order, an order similar to a cease trade order or an order that

denied a company access to any exemption under securities legislation that was

in effect for a period of more than 30 consecutive days that was issued while

the director or officer of the Corporation was acting in the capacity as

director, chief executive officer or chief financial officer of that company;

(b) subject to a cease trade order, an order similar to a cease trade order or

an order that denied a company access to any exemption under securities

legislation that was in effect for a period of more than 30 consecutive days

that was issued after the director or officer ceased to be a director, chief

executive officer or chief financial officer of that company and which resulted

from an event that occurred while that person was acting in such capacity; (c) a

director or executive officer of any company that, while that person was acting

in that capacity, or within a year of that person ceasing to act in that

capacity, became bankrupt, made a proposal under any legislation relating to

bankruptcy or insolvency or was subject to or instituted any proceedings,

arrangement or compromise with creditors or had a receiver, receiver manager or

trustee appointed to hold its assets; or (d) became bankrupt, made a proposal

under any legislation relating to bankruptcy or insolvency, or became subject to

or instituted any proceedings, arrangement or compromise with creditors, or had

a receiver, receiver manager or trustee appointed to hold his assets.

To the knowledge of the Corporation, no director or executive

officer of the Corporation, (a) has been subject to any penalties or sanctions

imposed by a court relating to securities or by a securities regulatory

authority or has entered into a settlement agreement with a securities

regulatory or (b) has been subject to any other penalties or sanctions imposed

by a court or regulatory body that would likely be considered important to a

reasonable investor in making an investment decision.

Individual Bankruptcies

To the knowledge of the Corporation, no director of the

Corporation is, or has within the ten years prior to the date hereof, become

bankrupt, made a proposal under any legislation relating to bankruptcy or

insolvency, or become subject to or instituted any proceedings, arrangement or

compromise with creditors or had a receiver, receiver manager or trustee

appointed to hold the assets of that individual.

SPECIAL BUSINESS

EXTENSION OF WARRANTS

The Shareholders of the Corporation will be asked at the

Meeting to consider, and if thought advisable, to approve an extension of the

expiry date of 26,666,665 common share purchase warrants of Grandview issued on

December 3, 2009 (the "Warrants"). The Warrants were originally issued as

part of a private placement financing on December 3, 2009. The Warrants are

exercisable into Common Shares of the Corporation at an exercise price of $0.12

per Common Share and will expire on December 3, 2011, subject to receipt of the

approval of the Shareholders to extend the expiry date by one year to December

3, 2012. Of the 26,666,665 Warrants issued, none of the Warrants have been

exercised as of October 28, 2011.

Of the 26,666,665 Warrants, 21,066,665 are held by insiders of

the Corporation as follows: 20,000,000 Warrants are held by Centerpoint

Resources Inc., 133,333 Warrants are held by Peter Born, 66,666 Warrants are

held by Michael Hitch, 133,333 Warrants are held by Paul Sarjeant, 133,333

Warrants are held by Ken Hight and 600,000 Warrants are held by Jack Austin. As

a result, "disinterested" Shareholder approval is required to extend the expiry

date of the Warrants.

- 8 -

The Warrants are currently significantly out-of-the-money and

are not reflective of the economic interest that was contemplated when the

Warrants were granted, and the Board decided to give the Warrant holders more

time to consider and make a further investment in the Corporation through the

exercise of their Warrants. Consequently, on October 6, 2011, the Board adopted

a resolution, subject to regulatory approval, authorizing the extension of the

expiry date of the Warrants. The Board has unanimously approved the extension of

the expiry of the warrants to December 3, 2012, and on October 18, 2011 the

Corporation received TSX approval, subject to customary conditions of the TSX,

to extend the expiry date of the Warrants. The exercise price of the Warrants

will remain the same. To satisfy the conditions of the TSX approval, the

Corporation is required to seek "disinterested" Shareholder approval for the

extension of the expiry date of the Warrants held by insiders of the

Corporation.

The Board is requesting the shareholders of the Corporation to

pass, with or without variation, the following resolution:

"BE IT RESOLVED THAT, as an ordinary

resolution of disinterested Shareholders of Grandview Gold Inc. (the

"Corporation"):

| |

1. |

The extension of the expiry date of the Warrants to

December 3, 2012, as more particularly described in the information

circular of the Corporation dated October 28, 2011, is hereby approved;

and |

| |

|

|

| |

2. |

Any one director or officer of the Corporation be and is

hereby authorized to make all such arrangements and do all acts and

things, and to sign and execute all documents and instruments in writing,

whether under the corporate seal of the Corporation or otherwise, as may

be considered necessary or advisable to give full force and effect to the

foregoing." |

In order to be effective, the resolution must be passed by a

simple majority of the votes cast by Shareholders at the Meeting, excluding the

votes held directly or indirectly by the holders or Warrants. The Corporation

estimates that votes attached to 26,666,665 Common Shares will be withheld from

voting on this matter as they represent Common Shares beneficially owned by the

holders of Warrants.

REPEAL AND ADOPTION OF GENERAL BY-LAWS

At the Meeting, the Shareholders will be asked to consider, and

if deemed advisable, to repeal and replace the Corporation's current By-Law

Number 1 and By-Law No. 4 (the "Old By-Laws") with By-Law No. 1 (the

"New By-Laws") in order to reflect the current circumstances and

practices of Grandview and certain amendments to the Business Corporations

Act (Ontario) (the "OBCA"), which came into force on August 1, 2007.

The Corporation's By-Laws have not been updated since 1987, and the New By-Laws

are typical of by-laws of public companies incorporated under the OBCA. A copy

of the New By-Laws is attached hereto as Schedule "B". The

material changes may be summarized as follows:

| (a) |

The quorum necessary for board meetings has changed from

requiring the nearest whole number of directors which is equal to or

greater than two-fifths of the number of current directors to a majority

of the number of directors or minimum number of directors required by the

articles, and if the Corporation has fewer than three directors, all of

the directors must be present at any meeting of directors to constitute a

quorum for the transaction of business; |

| |

|

| (b) |

Conflict of interest provisions have been added to

reflect amendments to the OBCA prohibiting conflicted directors from

attending any part of a meeting during which the contract or transaction

creating the conflict is discussed; |

| |

|

| (c) |

Indemnity provisions have been added to reflect OBCA

amendments which have broadened the language of indemnity coverage to

include "investigative or other proceedings in which the indemnitee is

involved because of association with the corporation" and which also now

permit Grandview to advance monies to an indemnified individual for costs,

charges and expenses associated with such

proceedings; |

- 9 -

| (d) |

The record date for notice of meetings of shareholders

has been added to reflect OBCA amendments (as a result of this amendment,

the record date shall not precede by more than sixty days nor by less than

thirty days the date on which the meeting is to be held); and |

| |

|

| (e) |

The notice and waiver provisions have been amended to

reflect OBCA amendments that allow for persons to send notices and

consents to waive by electronic means in accordance with the Electronic

Commerce Act, 2000. |

Pursuant to the OBCA, in order to be effective, the

Shareholders are required by ordinary resolution (the "By-law

Resolution"), to confirm the repeal of By-law Number One and the adoption of

the New By-Laws. The form of ordinary resolution to approve the By-law

Resolution to be considered by the Shareholders at the Meeting is as follows:

"BE IT RESOLVED THAT, as an ordinary

resolution of the Shareholders of Grandview Gold Inc. (the

"Corporation"):

| |

1. |

Pursuant to the Business Corporations Act

(Ontario) (the "OBCA"), the repeal of By-Law Number 1 and

By-Law No. 4 and their replacement with By-law No. 1 in the form attached

as Schedule "B" to the Corporation's Information Circular dated October

28, 2011, prepared for the purpose of the annual and special meeting of

shareholders to be held November 28, 2011, is hereby approved, ratified

and confirmed; and |

| |

|

|

| |

2. |

Any one director or officer of the Corporation be and is

hereby authorized to make all such arrangements and do all acts and

things, and to sign and execute all documents and instruments in writing,

whether under the corporate seal of the Corporation or otherwise, as may

be considered necessary or advisable to give full force and effect to the

foregoing." |

To be approved, the above resolution must be passed by a

majority of the votes cast by Shareholders at the Meeting in respect of this

resolution.

STATEMENT OF EXECUTIVE COMPENSATION

The Corporation's Statement of Executive Compensation, in

accordance with the requirements of Form 51-102F6 – Statement of Executive

Compensation, is set forth below, which contains information about the

compensation paid to, or earned by, the Corporation's Chief Executive Officer

and Chief Financial Officer and each of the other three most highly compensated

executive officers of the Corporation earning more than CDN$150,000.00 in total

compensation as at May 31, 2011 (the "Named Executive Officers" or

"NEO's") during the Corporation's last three most recently completed

financial years. Based on the foregoing, Paul Sarjeant, President, CEO and a

director of the Corporation, and Ernest Cleave, Chief Financial Officer of the

Corporation, are the Corporation's only Named Executive Officers as at May 31,

2011.

Compensation Discussion and Analysis

Compensation Review Process

The Corporation has a Compensation Committee (the

"Compensation Committee") but does not retain a compensation consultant.

The Compensation Committee oversees an annual review of director and executive

compensation to ensure development of a compensation strategy that properly

aligns the interests of directors and executives with the long-term interests of

the Corporation and its Shareholders. The Compensation Committee is comprised of

Ken Hight, Ted Nunn and Dr. Michael Hitch.

The Compensation Committee reviews on an annual basis the cash

compensation, performance and overall compensation package for each NEO. It then

submits to the Board recommendations with respect to the basic salary, bonus and

participation in share compensation arrangements for each NEO. After discussing

various factors with both Management and peers in the industry, and receiving

recommendations for bonuses and 2011 salaries for executive officers, the Compensation Committee made its

recommendations to the Board for approval. In conducting its review of

Management’s recommendations, the Compensation Committee was satisfied that all

recommendations complied with the Compensation Committee’s philosophy and

guidelines set forth above.

- 10 -

Objectives of the Compensation Program

The objectives of the Corporation's compensation program are to

attract, hold and inspire performance of members of Management of a quality and

nature that will enhance the sustainable growth of the Corporation.

To determine compensation payable, the Compensation Committee

reviews compensation paid for directors and officers of companies of similar

business, size and stage of development and determine an appropriate

compensation reflecting the need to provide incentive and compensation for the

time and effort expended by the directors and NEO's while taking into account

the financial and other resources of the Corporation.

The annual salaries for NEOs are designed to be comparable to

executive compensation packages for similar positions at companies with similar

financial, operating and industrial characteristics. The NEOs will be paid an

annual salary that also takes into account his or her existing professional

qualifications and experience. The NEOs' performances and salaries are to be

reviewed periodically on the anniversary of their appointment to their

respective officer-ships with the Corporation. Increases in salary are to be

evaluated on an individual basis and are performance and market-based.

The Board is given discretion to determine and adjust, year to

year, the relative weighting of each form of compensation discussed above in a

manner which best measures the success of the Corporation and its NEO's.

Elements of Executive Compensation

The Corporation's executive compensation program is based on

the objectives of: (a) recruiting and retaining the executives critical to the

success of the Corporation; (b) providing fair and competitive compensation; (c)

balancing the interests of Management and Shareholders; and (d) rewarding

performance, on the basis of both individual and corporate performance.

For the financial year ended May 31, 2011, the Corporation's

executive compensation program consisted of the following elements:

| |

(a) |

a base salary, incentive cash bonuses and other

compensation (together, a "Short-Term Incentive"); and |

| |

|

|

| |

(b) |

a long-term equity compensation consisting of stock

options granted under the Corporation's stock incentive plan (each, a

"Long-Term Incentive"). |

The specific rationale and design of each of these elements are

outlined in detail below.

| Element of Compensation

|

Summary and Purpose of Element |

| |

|

| Short-Term Incentive Plan |

|

| |

|

| Base Salary |

Executive annual base salaries are set at a level that is

competitive with compensation for executive officers of peer group oil and

gas companies and having regard to the potential longer term compensation

provided by the Option Plan. Salaries form an essential element of the

Corporation's compensation mix as they are the first base measure to

compare and remain competitive relative to peer groups. Base salaries are

fixed and therefore not subject to uncertainty and are used as the base to

determine other elements of compensation and benefits. The Compensation

Committee and the Board review NEO salaries at least annually. Typically,

the Board, upon recommendation of the Compensation Committee, makes annual

salary adjustments no later than April 15th of each year for the 12 month

period from June 1st to May 31st.

|

- 11 -

| Annual Performance-Based Cash Incentives |

Any bonus paid to the NEO's is entirely within the

discretion of the Board, following consideration by the Compensation

Committee. In making bonus determinations, the Board reviews corporate and

individual performance. |

|

Annual performance-based cash bonuses are a variable

component of compensation designed to reward the Corporation’s executive

officers for maximizing annual operating performance. |

| |

|

| Other Compensation (Perquisites) |

There are currently no other forms of compensation.

|

| |

|

| Long-Term Incentive Plan |

|

| |

|

| Stock Options |

The granting of stock options is a variable component of

compensation intended to reward the NEO's for their success in achieving

sustained, long-term profitability and increases in stock value.

|

|

The executive officers are entitled to participate in the

Option Plan which forms an important element of the Corporations

compensation policies. Options grants are periodically made to recognize

exemplary performance (including in connection with a promotion within the

Corporation) and provide for long-term reward and incentive for increasing

shareholder value and align the interests of the executive officers with

the long- term interests of shareholders. Options may also be granted to

executive officers upon their commencement of service.

|

Base Salary

In determining the base salary of an NEO, the Board's practice

in recent years has been to consider the recommendations made by the

Compensation Committee and then review and summarize these recommendations as

well as the previous year’s remuneration paid to executives with similar titles

at a comparative group of companies in the marketplace. In determining the base

salary to be paid to a particular executive officer, the Board also considers

the particular responsibilities related to the position, the experience level of

the NEO, and his or her past performance at the Corporation.

The Board believes that it is appropriate to establish

compensation levels based in large part on a general consideration against

similar companies, both in terms of compensation practices as well as levels of

compensation. In this way, the Corporation can gauge if its compensation is

competitive in the marketplace for its talent, as well as ensure that the

Corporation's compensation is reasonable. Accordingly, the Board reviews

compensation levels for the Named Executive Officers against compensation levels

of the comparison companies which are identified by the Board.

Annual Performance-Based Cash Incentives

NEO's are eligible for annual cash bonuses, and the Board

considers both corporate and the individual performance of each NEO. There is no

policy currently in place for determining bonuses, and the Board reviews

generally the individual’s impact on maximizing operating performance. In

general the Corporation will consider the following factors, depending on the

relevance of these factors to the particular NEO, when determining potential

bonuses:

| |

(a) |

performance against budget; |

| |

|

|

| |

(b) |

expense control; |

| |

|

|

| |

(c) |

performance factors; and |

| |

|

|

| |

(d) |

other exceptional or unexpected

factors. |

In taking into account the financial performance aspect, it is

recognized that NEO's cannot control certain factors, such as overall market

conditions. When applying the financial performance criteria, the Board

considers factors over which the NEO's can exercise control, such as meeting

budget targets established by the Board at the beginning of each year,

controlling costs, taking successful advantage of business opportunities and

enhancing the competitive and business prospects of the Corporation.

- 12 -

With respect to the financial year ended May 31, 2011, no

bonuses were awarded to any Named Executive Officers.

Other Compensation – Perquisites

With respect to the financial year ended May 31, 2011, no

perquisites were paid for by the Corporation in respect of the NEO’s.

Stock Options

To determine the granting of stock options to its NEO's, the

Committee reviews the matter and makes a recommendation to the Board. The Board

reviews each recommendation and decides whether to accept, reject or alter such

recommendation. The Board considers prior grants, the role of the individual in

the operating performance of the company, and salary and cash bonuses being

paid.

During the financial year ended May 31, 2011, no stock options

were granted to the Named Executive Officers.

Other Long-Term Incentive Plans

The Corporation does not have any other long-term incentive

plans and does not provide retirement benefits to its employees.

Overview of How the Compensation Program Fits with

Compensation Goals

1. Attract, Hold

and Inspire Key Talent

The compensation package meets the goal of attracting, holding

and motivating key talent in a highly competitive mineral exploration

environment through the following elements:

| |

(a) |

A competitive cash compensation program, consisting of

base salary and bonus opportunity, which is generally above similar

opportunities. |

| |

|

|

| |

(b) |

Providing an opportunity to participate in the

Corporation's growth through options. |

2. Alignment of

Interests of NEO's with Interests of the Shareholders

The compensation package meets the goal of aligning the

interests of the NEO's with the interests of Shareholders through the following

elements:

| |

(a) |

Through the grant of stock options, if the price of the

Corporation shares increases over time, both NEO's and Shareholders will

benefit. |

| |

|

|

| |

(b) |

By providing a vesting period on stock awards, NEO's have

an interest in increasing the price of the Corporation's shares over time,

rather than focusing on short-term increases. |

- 13 -

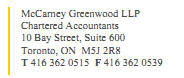

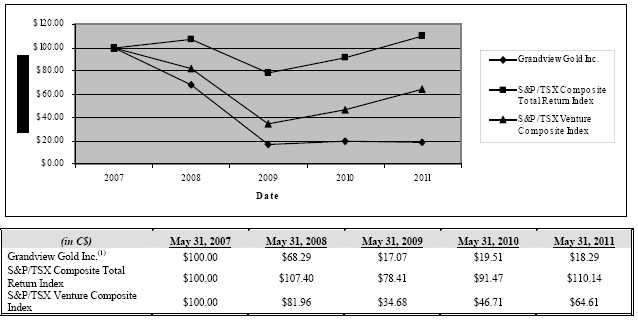

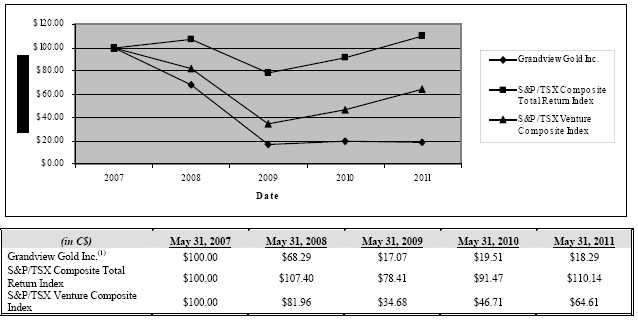

Performance Graph

The following graph compares the yearly percentage change in

the cumulative total shareholder return, assuming an initial investment of $100

in Common Shares on May 31, 2006 against the cumulative total shareholder return

of the S&P/TSX Composite Index for all of the Corporation's most recently

completed financial years since it became a reporting issuer, assuming the

reinvestment of all dividends.

__________________________

Note:

| (1) |

Listed as "GVX" on the Toronto Stock Exchange.

|

Summary Compensation Table

The following tables provide information for the three most

recently completed financial years ended May 31, 2011, 2010 and 2009 regarding

compensation earned by each of the following Named Executive Officers of the

Corporation: (a) Paul Sarjeant, President, CEO and a director of the

Corporation; and (b) Ernest Cleave, Chief Financial Officer of the

Corporation.

The first table outlines the information for the financial

years ended May 31, 2011 and 2010 in accordance with the new Form 51-102F6 and

the second table outlines the information for the financial years ended May 31,

2009 in accordance with Form 51-102F6 which came into force on March 30, 2004,

as amended.

Unless otherwise noted, salaries for the Named Executive

Officers are paid in Canadian dollars.

Financial Years Ended May 31, 2011 and May 31, 2010

Name and

principal

position |

Year |

Salary

($) |

Share-

based

awards

($) |

Option-

based

awards

($) |

Non-equity incentive plan

compensation

($)

|

Pension

Value ($) |

All other

compensati

on

($) |

Total

compensati

on

($) |

Annual

incentive

plans |

Long-term

incentive

plans |

Paul Sarjeant

President, CEO and a Director |

2011

2010 |

150,000

150,000 |

Nil

Nil |

Nil

71,500 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

10,000 |

150,000

231,500 |

Ernest Cleave

Chief Financial Officer |

2011

2010 |

36,000

36,000 |

Nil

Nil |

Nil

24,750 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

Nil

Nil |

36,000

60,750 |

- 14 -

Financial Year Ended May 31, 2009

| Name and Principal

Position |

Annual Compensation

|

Long-Term Compensation

|

All Other

Compensation

($) |

| Awards

|

Payouts

|

Year |

Salary

($) |

Bonus

($) |

Other

Annual

Compensation

($) |

Securities

Under

Options

Granted

(#)

|

Shares or

Units Subject

to Resale

Restrictions

($) |

LTIP

Payouts

($) |

Paul Sarjeant

President, CEO and a

Director |

2009 |

150,010.00 |

Nil |

Nil |

Nil |

Nil |

N/A |

94,000 |

Ernest Cleave

Chief Financial

Officer |

2009 |

51,794.00 |

Nil |

Nil |

Nil |

Nil |

N/A |

Nil |

Summary Compensation – Narrative Discussion

The Corporation has entered into executive employment

agreements with each of its Named Executive Officers, as described below.

Paul Sarjeant

The Corporation entered into a consulting agreement made

effective as of the 31st day of October, 2006 (the "Sarjeant

Agreement") with Paul Sarjeant and his duly registered sole proprietorship

(the "Consultant"), engaging Mr. Sarjeant to act as President and Chief

Executive Officer of the Corporation. The compensation payable for such services

is a base salary of CDN$150,000.00 per year, payable in monthly payments of

CDN$12,500.00, subject to review by the Board, the payment of business expenses,

the provision of consultant benefits and the awarding of bonuses at the option

and discretion of the Board, to be payable in either cash or Common Shares. The

initial term of the Sarjeant Agreement was three (3) years, subject to

additional one (1) year extensions, and was renewed on October 31, 2009 for a

further two (2) year term.

Ernest Cleave

The Corporation entered into a consulting contract agreement

made as of the 10th day of November, 2005 with Ernest Cleave (the

"Cleave Agreement"), engaging Mr. Cleave to act as Chief Financial

Officer of the Corporation. The compensation payable for such services is a

contract fee of CDN$36,000.00, payable in monthly payments of CDN$3,000.00,

subject to review by the board, and compensation of expenses. The initial term

of the Cleave Agreement was from November 10, 2005 to May 31, 2006, which term

is automatically extended for additional two (2) year terms until otherwise

terminated.

Incentive Plan Awards

The following table provides information regarding the

incentive plan awards for each Named Executive Officer outstanding as of May 31,

2011.

- 15 -

Outstanding Share-Based Awards and Option-Based Awards

Name

and principal

position |

Option-based Awards |

Share-based Awards |

Number

of

securities

underlying

unexercised

options (#) |

Option

exercise price

(C$) |

Option

expiration date |

Value

of

unexercised

in-the-money

options

($) (1) |

Number

of shares

or units of shares

that have not vested

(#) |

Market

or

payout value of

share-based

awards

that have

not vested ($) |

Paul Sarjeant

President, CEO and a Director |

600,000

650,000 |

0.68

0.15 |

September 27, 2012

June 23, 2014 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

Ernest Cleave

Chief Financial Officer |

250,000

225,000 |

0.68

0.15 |

September 27, 2012

June 23, 2014 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

The following table provides information regarding the value

vested or earned of incentive plan awards for the financial year ended May 31,

2011.

Value Vested or Earned During the Financial Year Ended May

31, 2011

Name and principal

position

|

Option-based awards – Value

vested during the year ($)

|

Share-based awards – Value

vested during the year ($)

|

Non-equity incentive plan

compensation – Value earned during

the year ($)

|

Paul Sarjeant

President, CEO and a

Director

|

Nil |

Nil |

Nil |

Ernest Cleave

Chief Financial Officer |

Nil |

Nil |

Nil |

Pension Plan Benefits

The Corporation does not currently provide pension plan

benefits to its Named Executive Officers.

Termination and Change of Control Benefits

The termination and change of control benefits set forth in the

executive employment agreements entered into between the Corporation and each of

its Named Executive Officers are described below.

Paul Sarjeant

The Sarjeant Agreement, described in "Summary Compensation –

Narrative Discussion", above, does not contain any change of control

provisions. The termination provisions are as follows:

| |

(a) |

If the Corporation terminates the Sarjeant Agreement at

will, without cause, the Corporation shall pay to the Consultant within

sixty (60) days of the date of termination a settlement amount equal to

nine (9) months' of the base salary at the rate in effect immediately

prior to the effective date of termination and, to the extent earned, pay

to the Consultant within ten (10) business days of such termination, all

accrued amounts due and owing under the Sarjeant

Agreement; |

- 16 -

| |

(b) |

If the Corporation terminates the Sarjeant Agreement for

cause or if, during the term of the Sarjeant Agreement, Mr. Sarjeant, in

the reasonable judgment of the Board, acting in good faith, becomes

unable, by reason of physical or mental disability, with or without

reasonable accommodation, to adequately perform the duties and obligations

under the Sarjeant Agreement, the Corporation shall pay to the Consultant,

to the extent earned, within ten (10) business days of such termination,

all accrued amounts due and owing under the Sarjeant Agreement; |

| |

|

|

| |

(c) |

If the Consultant terminates the Sarjeant Agreement at

will by giving three (3) months' prior written notice to the Board, the

Corporation shall pay to the Consultant within ten (10) business days of

such termination, all accrued amounts due and owing under the Sarjeant

Agreement |

| |

|

|

| |

(d) |

In the event of dissolution of the Consultant or the

death of Mr. Sarjeant, the Corporation shall pay all accrued amounts due

and owing under the Sarjeant Agreement and such other death benefits that

Mr. Sarjeant's survivors may be entitled to under such plans, programs and

policies maintained by the Corporation; |

| |

|

|

| |

(e) |

In the event of termination of the Sarjeant Agreement

pursuant to paragraphs (b) and (c), above, any stock options held by the

Consultant that have not vested as of the date of such termination shall

be deemed to be terminated and any stock options held by the Consultant

that have vested as of the date of such termination shall remain

exercisable subject to the terms of the stock option plan and/or agreement

pursuant to which said stock options were originally granted; |

| |

|

|

| |

(f) |

In the event of termination of the Sarjeant Agreement

pursuant to paragraphs (a) or (d), above, all unvested stock options held

by the Consultant shall be deemed to have vested as of the effective date

of termination or deemed termination to allow the Consultant (or his

personal representatives) to exercise the options to purchase shares

granted thereby with regard to that number of shares that the Consultant

would have been entitled to purchase had his employment continued for a

period of three (3) months from the effective date of such termination or

deemed termination; and |

| |

|

|

| |

(g) |

In the event that any of the terms of such options set

forth in paragraphs (e) and (f), above, are not ascertainable or in the

event that applicable securities legislation precludes the acceleration of

the vesting dates in the manner described herein, the Corporation agrees

to compensate the Consultant by way of a cash payment, paid within one

hundred twenty (120) days of the effective date of termination of the

Consultant, of that amount of money which the Consultant would have been

entitled to if it had exercised any such options on the effective date of

termination or deemed termination at the applicable exercise price and

sold the securities on the exchange or market where the majority of the

Corporation’s shares are then traded, at a price equal to the average

trading price for the last ten (10) business days preceding the effective

date of termination on which the subject securities were

traded. |

Ernest Cleave

The Cleave Agreement, described in "Summary Compensation –

Narrative Discussion", above, does not contain any change of control

provisions. The termination provisions are as follows:

| |

(a) |

If the Corporation terminates the Cleave Agreement at

will, the Corporation shall pay to Mr. Cleave an amount equal to three (3)

months of the contract fee at the rate in effect at the time of such

termination, payable in one lump sum on the date of termination;

and |

| |

|

|

| |

(b) |

If Mr. Cleave terminates the Cleave Agreement for "good

reason", the Corporation shall pay to Mr. Cleave an amount equal to one

(1) month of the contract fee at the rate in effect at the time of such

termination, payable in one lump sum on the date of termination, where the

term "good reason" means, if, without Mr.

Cleave's consent, there is a material reduction in his duties and

responsibilities, there is a material reduction of the contract fee or the

Corporation breaches any material provision of the Cleave Agreement and such

breach is not remedied within thirty (30) days' notice. |

- 17 -

Estimated Incremental Payment on Change of Control or

Termination

The following table provides details regarding the estimated

incremental payments from the Corporation to each of Paul Sarjeant and Ernest

Cleave upon a change of control or on termination by the Corporation without

cause, assuming a triggering event occurred on May 31, 2011.

NEO and Agreement |

Severance Period

(# of

months) |

Base Salary

(CDN$) |

Total Incremental Payment

(CDN$) |

| Paul Sarjeant – Sarjeant Agreement |

9 |

150,000.00 |

112,500.00 |

| Ernest Cleave – Cleave Agreement |

3 |

36,000.00 |

9,000.00 |

| TOTALS: |

12 |

186,000.00 |

121,500.00 |

Director Compensation

The Corporation has no standard arrangement pursuant to which

directors are compensated for their services as directors, except for the

granting from time to time of incentive stock options in accordance with the

Corporation's 2004 stock option plan. Currently, the directors of the

Corporation do not receive any compensation for attending meetings of the board

of directors or a committee of the board of directors.

Director Compensation Table

The following table provides information regarding compensation

paid to the Corporation's non-executive directors during the financial year

ended May 31, 2011. Information regarding the compensation paid to Paul Sarjeant

during the financial year ended May 31, 2011 (including as a director) is

disclosed in the sections above relating to executive compensation.

Name |

Fees

earned ($) |

Share-based

awards

($) (1) |

Option-based

awards

($) |

Non-equity incentive

plan

compensation

($) |

All other

compensation

($) |

Total

($) |

| D. Richard Brown |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| Michael Hitch |

Nil |

Nil |

Nil |

Nil |

10,000 |

Nil |

| Peter Born |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| Ken Hight |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| Jack Austin |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| Ted Nunn |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

| TOTALS |

Nil |

Nil |

Nil |

Nil |

Nil |

Nil |

Director Compensation – Narrative Discussion

Incentive Plan Awards

The following table provides information regarding the

incentive plan awards for each non-executive director outstanding as of May 31,

2011. Information regarding the incentive plan awards for Paul Sarjeant during

the financial year ended May 31, 2011 is disclosed in the sections above

relating to executive compensation.

- 18 -

Outstanding Share-Based Awards and Option-Based Awards

Name |

Option-based

Awards |

Share-based

Awards |

Number

of

securities

underlying

unexercised

options (#) |

Option

exercise price

(C$) |

Option

expiration date |

Value

of

unexercised in-

the-money

options

($) |

Number

of shares

or units of shares

that have not vested

(#) |

Market

or

payout value of

share-based

awards

that have

not vested ($) |

D. Richard Brown

|

200,000

450,000 |

0.68

0.15 |

September 27, 2012

June 23, 2014 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

Michael Hitch

|

225,000

450,000 |

0.68

0.15 |

September 27, 2012

June 23, 2014 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

Peter Born

|

150,000

450,000 |

0.68

0.15 |

September 27, 2012

June 23, 2014 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

| Ken Hight |

450,000 |

0.15 |

June 23, 2014 |

Nil |

Nil |

Nil |

| Jack Austin |

450,000 |

0.15 |

June 23, 2014 |

Nil |

Nil |

Nil |

| Ted Nunn |

450,000 |

0.15 |

June 23, 2014 |

Nil |

Nil |

Nil |

Michael Hitch

|

225,000

450,000 |

0.68

0.15 |

September 27, 2012

June 23, 2014 |

Nil

Nil |

Nil

Nil |

Nil

Nil |

The following table provides information regarding the value

vested or earned of incentive plan awards for each non-executive director for

the financial year ended May 31, 2011. Information regarding the value vested or

earned of incentive plan awards for each of Dr. Michael Hitch and Paul Sarjeant

for the financial year ended May 31, 2011 is disclosed in the sections above

relating to executive compensation.

Value Vested or Earned During the Financial Year Ended May

31, 2011

Name |

Option-based awards – Value

vested during the year ($) |

Share-based awards – Value

vested during the year ($) |

Non-equity incentive plan

compensation – Value earned during

the year ($)

|

| D. Richard Brown |

Nil |

Nil |

Nil |

| Michael Hitch |

Nil |

Nil |

Nil |

| Peter Born |

Nil |

Nil |

Nil |

| Ken Hight |

Nil |

Nil |

Nil |

| Jack Austin |

Nil |

Nil |

Nil |

| Ted Nunn |

Nil |

Nil |

Nil |

Retirement Policy for Directors

The Corporation does not have a retirement policy for its

directors.

Directors’ and Officers’ Liability Insurance

The Corporation procured and funded a directors' and officers'

insurance policy with a limit of $2,000,000 liability and carrying $25,000

deductible for an annual premium of $13,000 for the year ended December 21,

2011.

- 19 -

CORPORATE GOVERNANCE

Statement of Corporate Governance

Effective June 30, 2005 National Instrument 58-101 –

Disclosure of Corporate Governance Practices ("NI 58-101") of the

Canadian Securities Administrators was adopted. Pursuant to NI 58-101 an issuer

whose common shares are traded on the TSX and which issuer is seeking proxies

from its security holders for the purposes of electing directors must include in

its management information circular the corporate governance practices which

have been adopted by the issuer as more fully set out in NI 58-101.

Corporate governance refers to the manner in which a board of

directors oversees the management and direction of a corporation. Governance is

not a static issue, and must be judged from time-to-time based on the evolution

of a corporation with respect to its size and the nature or its business, and

upon the changing standards of the community. Not all corporate governance

systems are alike. The Corporation's approach has been developed with respect to

the Corporation's growth and current status. The composition of the Board is

reviewed on an annual basis by the full Board and Management.

In reviewing the issue of corporate governance, the Board has

determined to perform the function as an entire Board. The Board's mandate was

to consider corporate governance matters and make recommendations consistent

with the Corporation's position and size as a junior mining corporation. The

resulting approach to corporate governance adopted by the Board reflects these

recommendations and recognizes the responsibility of the Board for the

stewardship of the Corporation.

The Corporation's approach to corporate governance is set out

in Schedule "A" attached to this Circular. Through regular review

at quarterly meetings, the Board will continue to examine these issues in light

of the Corporation's development in the mineral exploration business. In