OVBC

Annual Report

2021

Start your engines...

|

Message from Management

Dear Neighbors and Friends,

Surely 2021, like 2020, will go down in history as the time of the global pandemic. Though this unceasing disease did its best to force our community apart, we noticed something pretty amazing, but not

surprising, our community came TOGETHER like never before.

When we opened a new drive-thru office in the north endof Point Pleasant, you showed us your love by flocking toit. When we shared our joy over breathing new life into OVB on the Square, you congratulated us

and set to workon how to expand on this revitalization of the downtown.When we collected toys for local children in need, moreof you than ever before stood up and said, “How can we help?”

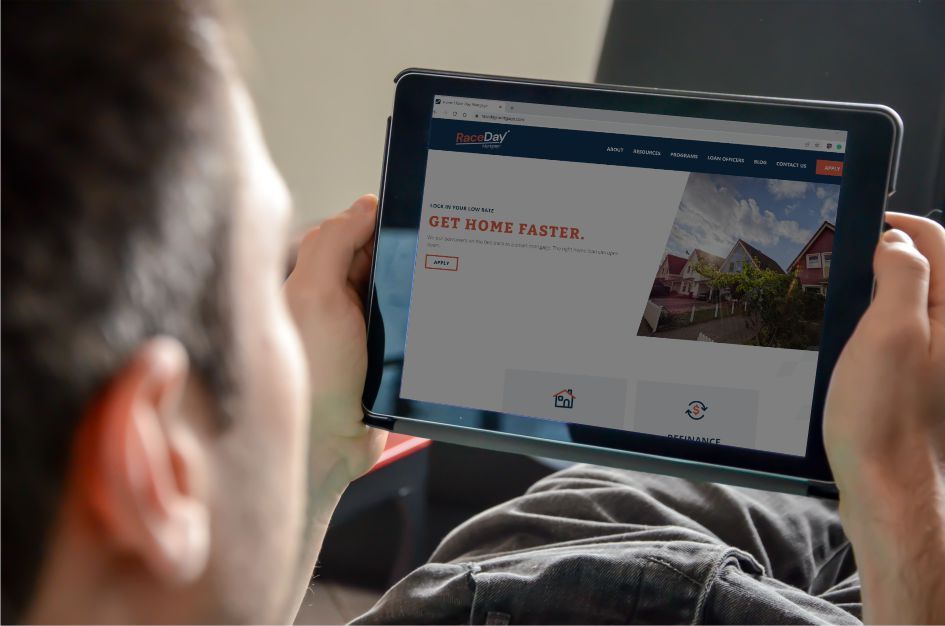

This doesn’t happen in the big city. It happens here at home where your company is constantly working to improve service. One of our most promising new endeavorsof the year was the opening of Race Day

Mortgage, an online-only consumer direct mortgage company. We hope to leave the competition in the dust through speed of service and a seamless online model, backed by OVB’s quality customer service approach.

The giving we do to sustain the community and the steps we take to improve service are connected. In all that wedo, you are the driving force behind this company’s will to put our Community First. You are

keeping us on track for success.

|

|

For several years now, we have invited shareholders, employees, customers, and neighbors to join us in our Community First mission. And you have accepted the challenge, rising to the occasion with a shared

generosity and enthusiasm to make this a better place to live and work. With your support, your company reached the milestone of the 2nd highest record earnings in company history.

Thank you.

Within these pages, please find information regarding your company’s management and operation for the past year. Between the lines, you may even spot a little of our determination to remain an independent

community bank. You can learn more by attending our Annual Shareholders Meeting to be be held Wednesday, May 18, at the brand new Holzer Leadership & Innovation Institute. Get involved. Let’s keep Community First.

Sincerely,

Thomas E. Wiseman

Chairman of the Board & CEO

Ohio Valley Banc Corp.

|

| Larry E. Miller, II |

||

|

President & Chief Operating Officer

Ohio Valley Banc Corp.

|

1

Being a community leader

is about being the one who helps others cross the

finish line

|

Ohio Valley Bank and Loan Central have always been known for providing outstanding service to the community. These financial professionals try every day to do what is expected and then go one step beyond.

In September of 2021, Ohio Valley Bank opened its own subsidiary, a nationwide online-only consumer direct mortgage company.

Yes, our community got a little bigger.

Race Day Mortgage serves customers in not only Ohio, but also Tennessee, North Carolina, South Carolina, Florida,Colorado, Utah, Pennsylvania, Washington, and Nevada.Plans are in place to add more states

over the next few years.

You won’t find a Race Day Mortgage office on a map or with Siri. The loan officers and processing personnel who help these clients work remotely from Columbus, Ohio, to Houston, Texas. These

mortgage professionals, though serving a much larger community than the bank, serve their customers

|

|

with respect, a sense of urgency, and a determination to do whatever it takes. Lessons they have embraced from Ohio Valley Bank.

As of press time, Race Day Mortgage has a perfect 5-Star Rating on Bankrate.com. But don’t take our word for it, see what this Las Vegas customer had to say.

“We recently refinanced our home with Race Day Mortgage. I have gone through the home buying process and refi process numerous times. My experience with Race Day Mortgage was nothing short of amazing! I was

shopping around and checking different rates on Bankrate and could not be happier to have gone with Race Day. Not only was the customer service fantastic, the process was super stress free, quick, and easy! I could not recommend them

enough! In fact, I recommended them to some long time friends who also went through the process and had nothing but positive things to say. Thanks again for everything!”

|

2

2021 notable small numbers

Every year, we tend to report the big numbers. This year, we share the small numbers that make an enormous impact...

106

New pages built as part of the redesign of www.ovbc.com, which debuted in July. The new site features a robust fraud and scam information section, more free financial education resources, integrated blog, and is highlighted with local photography.

New pages built as part of the redesign of www.ovbc.com, which debuted in July. The new site features a robust fraud and scam information section, more free financial education resources, integrated blog, and is highlighted with local photography.

42

The 42nd card in OVB’s Community First Debit Card Program was introduced, meaning that the program now raises much needed funds for 42 local schools and charities on an ongoing basis.

The 42nd card in OVB’s Community First Debit Card Program was introduced, meaning that the program now raises much needed funds for 42 local schools and charities on an ongoing basis.

10

States served by Race Day Mortgage with 8 more states to be added in early 2022 and plans to further expand.

States served by Race Day Mortgage with 8 more states to be added in early 2022 and plans to further expand.

7

Free services offered with every OVB checking account: Digital Banking, Online Bill Pay, Debit Card, Benjamin Tracker money management, eDelivery statements and notices, OVB Line Telephone Banking, and OVB ATM service.

Free services offered with every OVB checking account: Digital Banking, Online Bill Pay, Debit Card, Benjamin Tracker money management, eDelivery statements and notices, OVB Line Telephone Banking, and OVB ATM service.

6

Loan Central offices stayed open extended, holiday, and special weekend hours to help members of their community get their taxes done in record time.

Loan Central offices stayed open extended, holiday, and special weekend hours to help members of their community get their taxes done in record time.

1

Mission to put your “Community First.”

Mission to put your “Community First.”

3

2019 Little Miss Apple Festival Kennedy Knittel proudly shows the 2021 finalists the exhibit created in her honor at OVB Jackson.

Being a community bank

is about being there for our

community

|

Our Community First mission is a new way of thinking about shareholder return. When we give back to the community we serve, the businesses and people in that community are better able to do their work and

in turn give back themselves.

This year, we were thrilled to see our friends and neighbors join us and put their Community First in creative ways.

Right Page Left to Right:

Jackson County OVB 4-H Scholar Elizabeth Fannin slipped into the 4-H building early because she couldn’t wait to see her lifesize photo at the Fair. Every OVB 4-H Scholar receives a total of $3,000 in

scholarship money over four years. As of 2021, the OVB 4-H Scholarship Program has awarded 241 scholarships.

Young gymnasts Ella Grant and Bekah Circle unveiled the Southern Ohio Gymnastics Association (SOGA) debit card design as part of OVB’s Community First Debit Card Program. For every upgrade to the SOGA

design, the boosters receive $5. Over 40 other local schools and charities are getting the funds they need though this groundbreaking program created by OVB.

Ohio Valley Bank’s Point Pleasant North office opened with a ribbon-cutting ceremony right in the drive-thru lane! The convenient new location has been very popular with customers, handling over 13,000 teller

and

|

|

ATM transactions in their first four and a half months of operation.

OVB’s Jenni Swain and Bill Richards put in a little elbow grease during an Impact Day at the Gallipolis Freight and Railroad Museum. Employees are allowed up to three paid days off to volunteer in their

community through the Impact Day program. In addition to cleaning train cars, the bank’s volunteers also put up wall paneling inside.

Right Middle:Employees representing every Ohio Valley Bank and Loan Central location lined up to pass a commemorative flag presented to former Chairman JeffSmith on his

retirement at the OVB on the Square flag raising ceremony. Many members of the community,including the VFW Honor Guard, came out to take part in the special occasion.

Page Bottom:OVB’s Leigh Anne Roten and Maranda Prevatt delivered a donation to the Fisher House made possible by employees serving on the bank’s Veterans Action

Committee. Fisher House serves as a place to stay for the families of veterans who are patients at the Williams Veterans Medical Center in Huntington. OVB Barboursville and other locations also held drives to collect non-perishable food,

toiletry items, and slippers for the house over the year. Pictured with Fisher House Director Jason Wyant.

|

4

5

|

Director & Officer

|

|

OVBC OFFICERS

|

|

| Listing | |||

|

|

|

Thomas E. Wiseman, Chairman & Chief Executive Officer

|

|

|

|

|

Larry E. Miller II, President & Chief Operating Officer

|

|

|

OVBC DIRECTORS

|

|

Tommy R. Shepherd, Senior Vice President & Secretary

|

|

|

|

|

Scott W. Shockey, Senior Vice President & CFO

|

|

| Thomas E. Wiseman |

|

Bryan F. Stepp, Senior Vice President - Lending/Credit

|

|

|

Chairman & Chief Executive Officer,

|

|

Bryna S. Butler, Vice President

|

|

|

Ohio Valley Banc Corp. and Ohio Valley Bank

|

|

Frank W. Davison, Vice President

|

|

|

|

|

Allen W. Elliott, Vice President

|

|

|

Larry E. Miller II

|

|

Cherie A. Elliott, Vice President

|

|

|

President & Chief Operating Officer,

|

|

Brandon O. Huff, Vice President

|

|

|

Ohio Valley Banc Corp. and Ohio Valley Bank

|

|

Ryan J. Jones, Vice President

|

|

|

|

|

Marilyn G. Kearns, Vice President

|

|

|

David W. Thomas, Lead Director

|

|

Mario P. Liberatore, Vice President

|

|

|

Former Chief Examiner, Ohio Division of

|

|

Shawn R. Siders, Vice President

|

|

|

Financial Institutions

|

|

Paula W. Clay, Assistant Secretary

|

|

|

bank supervision and regulation

|

|

Cindy H. Johnston, Assistant Secretary

|

|

|

|

|

|

|

|

Anna P. Barnitz

|

|

OHIO VALLEY BANK DIRECTORS

|

|

| Treasurer & CFO, Bob’s Market & Greenhouses, Inc. | |||

| wholesale horticultural products and retail landscaping |

Thomas E. Wiseman, Chairman |

Edward J. Robbins | |

| stores | David W. Thomas, Lead Director | Edward B. Roberts | |

|

|

|

Anna P. Barnitz

|

Brent A. Saunders |

| Kimberly A. Canady | Kimberly A. Canady | K. Ryan Smith | |

| Owner, Canady Farms, LLC | Brent R. Eastman | ||

| agricultural products and agronomy services | Larry E. Miller II | ||

| Brent R. Eastman | LOAN CENTRAL DIRECTORS | ||

| President & Co-owner, Ohio Valley Supermarkets |

|||

| Partner, Eastman Enterprises | Larry E. Miller II | ||

| grocery | Cherie A. Elliott | ||

| Ryan J. Jones | |||

| Edward J. Robbins | |||

| President & CEO, Ohio Valley Veneer, Inc. | RACE DAY MORTGAGE DIRECTORS | ||

| wood harvesting, processing and manufacturing of dry | |||

| lumber & flooring in Ohio, Kentucky, and Tennessee | Bryan F. Stepp | Scott W. Shockey | |

| Bryna S. Butler | Thomas E. Wiseman | ||

| Edward B. Roberts | Tim J. Scholten | ||

| Co-owner, OakBridge Financial Partners LLC | |||

| Financial Advisor, LPL Financial | WEST VIRGINIA ADVISORY BOARD | ||

| financial services | |||

| Mario P. Liberatore, Chairman | |||

| Brent A. Saunders | E. Allen Bell | ||

| Chairman of the Board, Holzer Health System | Richard L. Handley | ||

| Attorney, Halliday, Sheets & Saunders | Stephen L. Johnson | ||

| healthcare and legal | John A. Myers | ||

| K. Ryan Smith | DIRECTORS EMERITUS | ||

| President, University of Rio Grande, | |||

| Rio Grande Community College | W. Lowell Call | Barney A. Molnar | |

| Former Speaker of the Ohio House of Representatives | Steven B. Chapman |

Jeffrey E. Smith | |

| higher education | Robert E. Daniel | Wendell B. Thomas |

|

| Harold A. Howe | Lannes C. Williamson | ||

| John G. Jones | |||

6

|

OHIO VALLEY BANK OFFICERS

|

|

|

||

|

|

|

|

||

|

EXECUTIVE OFFICERS

|

|

ASSISTANT VICE PRESIDENTS

|

||

|

|

|

|||

|

Thomas E. Wiseman

|

Chairman & Chief Executive Officer |

|

Terri M. Camden

|

Asst. Human Resources Director |

|

Larry E. Miller II

|

President & Chief Operating Officer |

|

Barbara A. Patrick

|

BSA Officer/Loss Prevention |

|

Tommy R. Shepherd

|

Executive Vice President & Secretary |

|

Stephenie L. Peck

|

Regional Branch Administrator |

|

Scott W. Shockey

|

Executive Vice President, |

|

Raymond G. Polcyn

|

Manager of Buying Department |

| Chief Financial Officer | Richard P. Speirs | Facilities Manager /Security Officer | ||

|

Bryan F. Stepp

|

Executive Vice President, |

|

Kimberly R. Williams

|

Systems Officer |

| Lending/Credit | Melissa P. Wooten | Shareholder Relations Manager & | ||

|

Mario P. Liberatore

|

President, OVB West Virginia |

|

Trust Officer | |

|

|

|

Joe J. Wyant

|

Region Manager Jackson County | |

|

SENIOR VICE PRESIDENTS

|

|

|

||

|

|

|

ASSISTANT CASHIERS

|

||

|

Bryna S. Butler

|

Corporate Communications |

|

|

|

|

Frank W. Davison

|

Operations |

|

Glen P. Arrowood II

|

Manager of Indirect Lending |

|

Allen W. Elliott

|

Branch Administration |

|

William F. Richards

|

Advertising Manager |

|

Brandon O. Huff

|

Process Efficiency Officer |

|

Pamela K. Smith

|

Eastern Cabell Region Manager |

|

Ryan J. Jones

|

Chief Risk Officer |

|

Anthony W. Staley

|

Product Development |

|

Marilyn G. Kearns

|

Human Resources |

|

|

Business Sales & Support |

|

Shawn R. Siders

|

Chief Credit Officer |

|

|

|

|

|

|

LOAN CENTRAL OFFICERS |

||

|

VICE PRESIDENTS

|

|

|

||

|

|

|

Larry E. Miller II, Chairman of the Board

|

||

|

John A. Anderson

|

Director of Loan Operations |

|

Cherie A. Elliott, President

|

|

|

Shelly N. Boothe

|

Commerical Business |

|

Timothy R. Brumfield, Vice President & Secretary,

|

|

| Development Officer |

Manager, Gallipolis Office

|

|||

|

Kyla R. Carpenter

|

Director of Marketing |

|

John J. Holtzapfel, Compliance Officer,

|

|

|

Paula W. Clay

|

Assistant Secretary |

|

Manager, Wheelersburg Office

|

|

|

Jody M. DeWees

|

Trust |

|

Melody D. Hammond, Manager, Chillicothe Office

|

|

|

Lori A. Edwards

|

Residential Loan Operations Manager |

|

Joseph I. Jones, Manager, South Point Office

|

|

|

Brian E. Hall

|

Corporate Banking |

|

Steven B. Leach, Manager, Jackson Office

|

|

|

Cindy H. Johnston

|

Assistant Secretary |

|

T. Joe Wilson, Manager, Waverly Office

|

|

|

Angela S. Kinnaird

|

Director of Customer Support |

|

|

|

|

Tamela D. LeMaster

|

Branch Administration/CRM |

|

RACE DAY MORTGAGE OFFICERS

|

|

|

Adam D. Massie

|

Northern Region Manager |

|

|

|

|

Jay D. Miller

|

Business Development Officer |

|

Bryan F. Stepp

|

President |

|

Diana L. Parks

|

Internal Audit Liaison |

|

Scott W. Shockey

|

Secretary - Treasurer |

|

Christopher S. Petro

|

Comptroller |

|

|

|

|

Benjamin F. Pewitt

|

Business Development |

|

|

|

|

Gregory A. Phillips

|

Consumer Lending |

|

|

|

|

Christopher L. Preston

|

Business Development West Virginia |

|

|

|

|

Daniel T. Roush

|

Senior Compliance Officer |

|

|

|

|

Rick A. Swain

|

Western Division Branch Manager |

|

|

|

|

Patrick H. Tackett

|

Corporate Banking |

|

|

|

7

The Swain family has been OVBC shareholders for multiple generations. Little ones Natalie, Sable (between Mom Jenni and Dad BJ), Lyla, and Finlee enjoy the security their shares provide.

Being a responsible shareholder

is about planning for your company’s

future

|

Ohio Valley Banc Corp. shareholders are folks who believe in the power of community and pride in one’s hometown.We believe this is the reason for much of your company’s success.

|

|

|

|

As shares pass from generation to generation, it is vitally important to protect these ideals. Rather than selling shares on the open market, ensure shares are in the hands of shareholders who hold these

values and want to see OVB remain an independent community bank.

It is easy for registered shareholders to transfer ownership of any number of shares at any time without brokerage fees. This is accomplished through the “gifting” of shares.Shares can be gifted to a

child, grandchild, or anyone.Contact the OVBC Shareholder Relations Department at 800-468-6682 or email investorrelations@ovbc.com to get started.

OVBC shareholders received over $4 million in dividends in 2021, and our shareholders returned that loyalty by reinvesting over $1.1 million of those dividends through the Dividend Reinvestment Program

and Employee Stock Ownership Plan. On top of that, over $757,000 was invested through supplemental payments by current shareholders. Growing numbers are realizing the benefit of OVBC ownership. Make sure your family is included in those

numbers, and know that the staff of OVBC’s companies look forward to serving you and your loved ones for many generations to come.

|

|

$4,017,965

in dividends

paid to OVBC shareholders

in 2021

$1,152,143

of those dividends

reinvested in the company

through the Dividend Reinvestment

Program and Employee

Profit Sharing Plan.

|

8

OHIO VALLEY BANC CORP.

ANNUAL REPORT 2021

FINANCIALS

SELECTED FINANCIAL DATA

|

|

Years Ended December 31

|

|||||||||||||||||||

|

|

2021

|

2020

|

2019

|

2018

|

2017

|

|||||||||||||||

|

(dollars in thousands, except share and per share data)

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

SUMMARY OF OPERATIONS:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total interest income

|

$

|

44,712

|

$

|

46,173

|

$

|

50,317

|

$

|

49,197

|

$

|

45,708

|

||||||||||

|

Total interest expense

|

3,699

|

6,191

|

7,265

|

5,471

|

3,975

|

|||||||||||||||

|

Net interest income

|

41,013

|

39,982

|

43,052

|

43,726

|

41,733

|

|||||||||||||||

|

Provision for loan losses

|

(419

|

)

|

2,980

|

1,000

|

1,039

|

2,564

|

||||||||||||||

|

Total other income

|

9,864

|

11,438

|

9,166

|

8,938

|

9,435

|

|||||||||||||||

|

Total other expenses

|

37,280

|

36,133

|

39,498

|

37,426

|

36,609

|

|||||||||||||||

|

Income before income taxes

|

14,016

|

12,307

|

11,720

|

14,199

|

11,995

|

|||||||||||||||

|

Income taxes

|

2,284

|

2,048

|

1,813

|

2,255

|

4,486

|

|||||||||||||||

|

Net income

|

11,732

|

10,259

|

9,907

|

11,944

|

7,509

|

|||||||||||||||

|

|

||||||||||||||||||||

|

PER SHARE DATA:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Earnings per share

|

$

|

2.45

|

$

|

2.14

|

$

|

2.08

|

$

|

2.53

|

$

|

1.60

|

||||||||||

|

Cash dividends declared per share

|

$

|

0.84

|

$

|

0.84

|

$

|

0.84

|

$

|

0.84

|

$

|

0.84

|

||||||||||

|

Book value per share

|

$

|

29.74

|

$

|

28.48

|

$

|

26.77

|

$

|

24.87

|

$

|

23.26

|

||||||||||

|

Weighted average number of common shares outstanding

|

4,780,609

|

4,787,446

|

4,767,279

|

4,725,971

|

4,685,067

|

|||||||||||||||

|

|

||||||||||||||||||||

|

AVERAGE BALANCE SUMMARY:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total loans

|

$

|

841,681

|

$

|

811,434

|

$

|

775,860

|

$

|

773,995

|

$

|

753,204

|

||||||||||

|

All other interest-earning assets(1)

|

307,228

|

205,532

|

189,187

|

223,390

|

193,199

|

|||||||||||||||

|

Deposits

|

1,042,364

|

906,315

|

850,400

|

886,639

|

845,227

|

|||||||||||||||

|

Other borrowed funds(2)

|

34,564

|

40,416

|

45,850

|

48,967

|

47,663

|

|||||||||||||||

|

Shareholders’ equity

|

138,831

|

131,038

|

122,314

|

112,393

|

108,110

|

|||||||||||||||

|

Total assets

|

1,233,801

|

1,096,191

|

1,035,230

|

1,063,256

|

1,014,115

|

|||||||||||||||

|

|

||||||||||||||||||||

|

PERIOD END BALANCES:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Total loans

|

$

|

831,191

|

$

|

848,664

|

$

|

772,774

|

$

|

777,052

|

$

|

769,319

|

||||||||||

|

All other interest-earning assets(1)

|

334,811

|

255,662

|

166,761

|

184,925

|

189,941

|

|||||||||||||||

|

Deposits

|

1,059,908

|

993,739

|

821,471

|

846,704

|

856,724

|

|||||||||||||||

|

Shareholders’ equity

|

141,356

|

136,324

|

128,179

|

117,874

|

109,361

|

|||||||||||||||

|

Total assets

|

1,249,769

|

1,186,932

|

1,013,272

|

1,030,493

|

1,026,290

|

|||||||||||||||

|

|

||||||||||||||||||||

|

KEY RATIOS:

|

||||||||||||||||||||

|

|

||||||||||||||||||||

|

Return on average assets

|

.95

|

%

|

.94

|

%

|

.96

|

%

|

1.12

|

%

|

0.74

|

%

|

||||||||||

|

Return on average equity

|

8.45

|

%

|

7.83

|

%

|

8.10

|

%

|

10.63

|

%

|

6.95

|

%

|

||||||||||

|

Dividend payout ratio

|

34.25

|

%

|

39.20

|

%

|

40.37

|

%

|

33.20

|

%

|

52.36

|

%

|

||||||||||

|

Average equity to average assets

|

11.25

|

%

|

11.95

|

%

|

11.82

|

%

|

10.57

|

%

|

10.66

|

%

|

||||||||||

(1) All other interest-earning assets include securities, interest-bearing deposits with banks and restricted investments in bank stocks.

(2) Other borrowed funds include subordinated debentures.

9

consolidated statements of condition

|

As of December 31

|

||||||||

|

2021

|

2020

|

|||||||

|

(dollars in thousands, except share and per share data)

|

||||||||

|

Assets

|

||||||||

|

Cash and noninterest-bearing deposits with banks

|

$

|

|

$

|

|

||||

|

Interest-bearing deposits with banks

|

|

|

||||||

|

Total cash and cash equivalents

|

|

|

||||||

|

Certificates of deposit in financial institutions

|

|

|

||||||

|

Securities available for sale

|

|

|

||||||

|

Securities held to maturity (estimated fair value: 2021 - $

|

|

|

||||||

|

Restricted investments in bank stocks

|

|

|

||||||

|

Total loans

|

|

|

||||||

|

Less: Allowance for loan losses

|

(

|

)

|

(

|

)

|

||||

|

Net loans

|

|

|

||||||

|

Premises and equipment, net

|

|

|

||||||

|

Premises and equipment held for sale, net

|

|

|

||||||

|

Other real estate owned, net

|

|

|

||||||

|

Accrued interest receivable

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Other intangible assets, net

|

|

|

||||||

|

Bank owned life insurance and annuity assets

|

|

|

||||||

|

Operating lease right-of-use asset, net

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

Liabilities

|

||||||||

|

Noninterest-bearing deposits

|

$

|

|

$

|

|

||||

|

Interest-bearing deposits

|

|

|

||||||

|

Total deposits

|

|

|

||||||

|

Other borrowed funds

|

|

|

||||||

|

Subordinated debentures

|

|

|

||||||

|

Operating lease liability

|

|

|

||||||

|

Other liabilities

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Commitments and Contingent Liabilities (See Note L)

|

|

|

||||||

|

Shareholders’ Equity

|

||||||||

|

Common stock ($

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Accumulated other comprehensive income

|

|

|

||||||

|

Treasury stock, at cost (2021 –

|

(

|

)

|

(

|

)

|

||||

|

Total shareholders’ equity

|

|

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

|

$

|

|

||||

See accompanying notes to consolidated financial statements

10

consolidated statements of income

|

For the years ended December 31

|

2021

|

2020

|

||||||

|

(dollars in thousands, except per share data)

|

||||||||

|

Interest and dividend income:

|

||||||||

|

Loans, including fees

|

$

|

|

$

|

|

||||

|

Securities:

|

||||||||

|

Taxable

|

|

|

||||||

|

Tax exempt

|

|

|

||||||

|

Dividends

|

|

|

||||||

|

Interest-bearing deposits with banks

|

|

|

||||||

|

Other interest

|

|

|

||||||

|

|

|

|||||||

|

Interest expense:

|

||||||||

|

Deposits

|

|

|

||||||

|

Other borrowed funds

|

|

|

||||||

|

Subordinated debentures

|

|

|

||||||

|

|

|

|||||||

|

Net interest income

|

|

|

||||||

|

Provision for loan losses

|

(

|

)

|

|

|||||

|

Net interest income after provision for loan losses

|

|

|

||||||

|

Noninterest income:

|

||||||||

|

Service charges on deposit accounts

|

|

|

||||||

|

Trust fees

|

|

|

||||||

|

Income from bank owned life insurance and annuity assets

|

|

|

||||||

|

Mortgage banking income

|

|

|

||||||

|

Electronic refund check / deposit fees

|

|

|

||||||

|

Debit / credit card interchange income

|

|

|

||||||

|

Gain (loss) on other real estate owned

|

|

(

|

)

|

|||||

|

Loss on sale of securities

|

( |

) | ||||||

|

Tax preparation fees

|

|

|

||||||

|

Litigation settlement

|

|

|

||||||

|

Other

|

|

|

||||||

|

|

|

|||||||

|

Noninterest expense:

|

||||||||

|

Salaries and employee benefits

|

|

|

||||||

|

Occupancy

|

|

|

||||||

|

Furniture and equipment

|

|

|

||||||

|

Professional fees

|

|

|

||||||

|

Marketing expense

|

|

|

||||||

|

FDIC insurance

|

|

|

||||||

|

Data processing

|

|

|

||||||

|

Software

|

|

|

||||||

|

Foreclosed assets

|

|

|

||||||

|

Amortization of intangibles

|

|

|

||||||

|

Other

|

|

|

||||||

|

|

|

|||||||

|

Income before income taxes

|

|

|

||||||

|

Provision for income taxes

|

|

|

||||||

|

NET INCOME

|

$

|

|

$

|

|

||||

|

Earnings per share

|

$

|

|

$

|

|

||||

See accompanying notes to consolidated financial statements

11

consolidated statements of

comprehensive income

|

For the years ended December 31

|

2021

|

2020

|

||||||

|

(dollars in thousands)

|

||||||||

|

NET INCOME

|

$

|

|

$

|

|

||||

|

Other comprehensive income (loss):

|

||||||||

|

Change in unrealized gain (loss) on available for sale securities

|

(

|

)

|

|

|||||

| Reclassification adjustment for realized losses |

||||||||

| ( |

) | |||||||

|

Related tax effect

|

|

(

|

)

|

|||||

|

Total other comprehensive income (loss), net of tax

|

(

|

)

|

|

|||||

|

Total comprehensive income

|

$

|

|

$

|

|

||||

See accompanying notes to consolidated financial statements

12

consolidated statements of changes in

shareholders’ equity

|

For the years ended December 31, 2021, 2020

|

||||||||||||||||||||||||

|

(dollars in thousands, except share and per share data)

|

||||||||||||||||||||||||

|

Common

Stock

|

Additional

Paid-In

Capital

|

Retained

Earnings

|

Accumulated

Other

Comprehensive

Income (Loss)

|

Treasury

Stock

|

Total

Shareholders'

Equity

|

|||||||||||||||||||

|

Balances at January 1, 2020

|

$ |

|

$ |

|

$ |

|

$ |

|

$ |

(

|

)

|

$ |

|

|||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

|

|

|

|

|

|

||||||||||||||||||

|

Cash dividends, $

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||

|

Balances at December 31, 2020

|

|

|

|

|

(

|

)

|

|

|||||||||||||||||

|

Net income

|

|

|

|

|

|

|

||||||||||||||||||

|

Other comprehensive income (loss), net

|

|

|

|

(

|

)

|

|

(

|

)

|

||||||||||||||||

|

Cash dividends, $

|

|

|

(

|

)

|

|

|

(

|

)

|

||||||||||||||||

| Shares acquired for treasury, |

( |

) | ( |

) | ||||||||||||||||||||

|

Balances at December 31, 2021

|

$

|

|

$

|

|

$

|

|

$

|

|

$

|

(

|

)

|

$

|

|

|||||||||||

See accompanying notes to consolidated financial statements

13

consolidated statements of cash flows

|

For the years ended December 31

|

2021

|

2020

|

||||||

|

(dollars in thousands)

|

||||||||

|

Cash flows from operating activities:

|

||||||||

|

Net income

|

$

|

|

$

|

|

||||

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

||||||||

|

Depreciation of premises and equipment

|

|

|

||||||

|

Net amortization (accretion) of purchase accounting adjustments

|

|

(

|

)

|

|||||

|

Net amortization of securities

|

|

|

||||||

|

Net realized loss on sale of securities

|

||||||||

|

Proceeds from sale of loans in secondary market

|

|

|

||||||

|

Loans disbursed for sale in secondary market

|

(

|

)

|

(

|

)

|

||||

|

Amortization of mortgage servicing rights

|

|

|

||||||

|

Impairment (recovery) of mortgage servicing rights

|

(

|

)

|

|

|||||

|

Gain on sale of loans

|

(

|

)

|

(

|

)

|

||||

|

Amortization of intangible assets

|

|

|

||||||

|

Deferred tax (benefit) expense

|

(

|

)

|

|

|||||

|

Provision for loan losses

|

(

|

)

|

|

|||||

|

Earnings on bank owned life insurance and annuity assets

|

(

|

)

|

(

|

)

|

||||

|

Loss on sale of other real estate owned

|

(

|

)

|

|

|||||

|

Change in accrued interest receivable

|

|

(

|

)

|

|||||

|

Change in accrued liabilities

|

(

|

)

|

(

|

)

|

||||

|

Change in other assets

|

(

|

)

|

(

|

)

|

||||

|

Net cash provided by operating activities

|

|

|

||||||

|

Cash flows from investing activities:

|

||||||||

|

Proceeds from sales of securities available for sale

|

||||||||

|

Proceeds from maturities and paydowns of securities available for sale

|

|

|

||||||

|

Purchases of securities available for sale

|

(

|

)

|

(

|

)

|

||||

|

Proceeds from calls and maturities of securities held to maturity

|

|

|

||||||

|

Purchases of securities held to maturity

|

(

|

)

|

(

|

)

|

||||

|

Proceeds from maturities of certificates of deposit in financial institutions

|

|

|

||||||

|

Purchases of certificates of deposit in financial institutions

|

(

|

)

|

(

|

)

|

||||

|

Redemptions of restricted investments in bank stocks

|

||||||||

|

Net change in loans

|

( |

) | ||||||

|

Proceeds from sale of other real estate owned

|

|

|

||||||

|

Purchases of premises and equipment

|

(

|

)

|

(

|

)

|

||||

|

Disposals of premises and equipment

|

|

|

||||||

|

Proceeds from bank owned life insurance

|

||||||||

|

Purchases of bank owned life insurance and annuity assets

|

(

|

)

|

(

|

)

|

||||

|

Net cash (used in) investing activities

|

(

|

)

|

(

|

)

|

||||

|

Cash flows from financing activities:

|

||||||||

|

Change in deposits

|

|

|

||||||

|

Cash dividends

|

(

|

)

|

(

|

)

|

||||

|

Purchases of treasury stock

|

( |

) | ||||||

|

Proceeds from Federal Home Loan Bank borrowings

|

|

|

||||||

|

Repayment of Federal Home Loan Bank borrowings

|

(

|

)

|

(

|

)

|

||||

|

Change in other long-term borrowings

|

|

(

|

)

|

|||||

|

Change in other short-term borrowings

|

(

|

)

|

(

|

)

|

||||

|

Net cash provided by financing activities

|

|

|

||||||

|

Cash and cash equivalents:

|

||||||||

|

Change in cash and cash equivalents

|

|

|

||||||

|

Cash and cash equivalents at beginning of year

|

|

|

||||||

|

Cash and cash equivalents at end of year

|

$

|

|

$

|

|

||||

|

Supplemental disclosure:

|

||||||||

|

Cash paid for interest

|

$

|

|

$

|

|

||||

|

Cash paid for income taxes

|

|

|

||||||

|

Transfers from loans to other real estate owned

|

|

|

||||||

|

Operating lease liability arising from obtaining right-of-use asset

|

|

|

||||||

See accompanying notes to consolidated financial statements

14

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies

Description of Business: Ohio Valley Banc Corp. (“Ohio Valley”) is a financial holding company

registered under the Bank Holding Company Act of 1956. Ohio

Valley has one banking subsidiary, The Ohio Valley Bank Company (the “Bank”), an Ohio state-chartered bank that is a member of

the Federal Reserve Bank (“FRB”) and is regulated primarily by the Ohio Division of Financial Institutions and the Federal Reserve Board. Ohio Valley also has a subsidiary that engages in consumer lending generally to individuals with

higher credit risk history, Loan Central, Inc.; a subsidiary insurance agency that facilitates the receipts of insurance commissions, Ohio Valley Financial Services Agency, LLC; and a limited purpose property and casualty insurance company,

OVBC Captive, Inc. The Bank has two wholly-owned subsidiaries, Race Day Mortgage, Inc., an Ohio corporation that provides online consumer mortgages, and Ohio Valley REO, LLC ("Ohio Valley REO"), an Ohio limited liability company, to which

the Bank transfers certain real estate acquired by the Bank through foreclosure for sale by Ohio Valley REO. Ohio Valley and its subsidiaries are collectively referred to as the “Company.”

The Company provides a

full range of commercial and retail banking services from 22 offices located in southeastern Ohio and western West Virginia. It

accepts deposits in checking, savings, time and money market accounts and makes personal, commercial, floor plan, student, construction and real estate loans. Substantially all loans are secured by specific items of collateral, including

business assets, consumer assets, and commercial and residential real estate. Commercial loans are expected to be repaid from cash flow from business operations. The Company also offers safe deposit boxes, wire transfers and other standard

banking products and services. The Bank’s deposits are insured by the Federal Deposit Insurance Corporation (“FDIC”). In addition to accepting deposits and making loans, the Bank invests in U. S. Government and agency obligations, interest-bearing deposits in other financial institutions and

investments permitted by applicable law.

The Bank’s trust department provides a

wide variety of fiduciary services for trusts, estates and benefit plans and also provides investment and security services as an agent for its customers.

Principles of Consolidation: The consolidated financial statements include the accounts of Ohio Valley

and its wholly-owned subsidiaries, the Bank, Loan Central, Inc., Ohio Valley Financial Services Agency, LLC, and OVBC Captive, Inc. All material intercompany accounts and transactions have been eliminated.

Industry Segment Information:

Internal financial information is primarily reported and aggregated in two lines of business, banking and consumer finance.

Use of Estimates: To prepare financial statements in conformity with accounting principles

generally accepted in the U.S., management makes estimates and assumptions based on available information. These estimates and assumptions affect the amounts reported in the financial statements and the disclosures provided, and actual

results could differ.

Cash and Cash Equivalents: Cash and cash equivalents include cash on hand, noninterest-bearing deposits

with banks, federal funds sold and interest-bearing deposits with banks with maturity terms of less than 90 days. Generally, federal funds are purchased and sold for one-day periods. The Company reports net cash flows for customer loan

transactions, deposit transactions, short-term borrowings and interest-bearing deposits with other financial institutions.

Certificates of deposit in financial

institutions: Certificates of deposit in financial

institutions are carried at cost and have maturity terms of 90 days or greater. The longest maturity date is September 22, 2023.

Securities: The Company classifies securities into held to maturity and available for sale

categories. Held to maturity securities are those which the Company has the positive intent and ability to hold to maturity and are reported at amortized cost. Securities classified as available for sale include securities that could be sold

for liquidity, investment management or similar reasons even if there is not a present intention of such a sale. Available for sale securities are reported at fair value, with unrealized gains or losses included in other comprehensive income,

net of tax.

Premium amortization is deducted from,

and discount accretion is added to, interest income on securities using the level yield method without anticipating prepayments, except for mortgage-backed securities where prepayments are anticipated. Gains and losses are recognized upon the

sale of specific identified securities on the completed trade date.

15

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies (continued)

Other-Than-Temporary Impairments of

Securities: In determining an other-than-temporary impairment (“OTTI”), management considers many factors, including: (1) the length of time and the extent to which the

fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, (3) whether the market decline was affected by macroeconomic conditions, and (4) whether the Company has the intent to sell the debt

security or more likely than not will be required to sell the debt security before its anticipated recovery. The assessment of whether an OTTI decline exists involves a high degree of subjectivity and judgment and is based on the

information available to management at a point in time.

When an OTTI occurs, the amount of the OTTI recognized in earnings depends on whether an entity intends to sell

the security or it is more likely than not it will be required to sell the security before recovery of its amortized cost basis, less any current-period credit loss. If an entity intends to sell or it is more likely than not it will be

required to sell the security before recovery of its amortized cost basis, less any current-period credit loss, the OTTI shall be recognized in earnings equal to the entire difference between the investment’s amortized cost basis and its fair

value at the balance sheet date. If an entity does not intend to sell the security and it is not more likely than not that the entity will be required to sell the security before recovery of its amortized cost basis less any current-period

loss, the OTTI shall be separated into the amount representing the credit loss and the amount related to all other factors. The amount of the total OTTI related to the credit loss is determined based

on the present value of cash flows expected to be collected and is recognized in earnings. The amount of the total OTTI related to other factors is recognized in other comprehensive income, net of applicable taxes. The previous amortized cost

basis less the OTTI recognized in earnings becomes the new amortized cost basis of the investment.

Restricted Investments in Bank Stocks:

As a member of the Federal Home Loan Bank (“FHLB”) system and the FRB system, the Bank is

required to own a certain amount of stock based on its level of borrowings and other factors and may invest in additional amounts. FHLB stock and FRB stock are carried at cost, classified as restricted securities, and periodically evaluated

for impairment based on ultimate recovery of par value. Both cash and stock dividends are reported as income. The Company has additional investments in other restricted bank stocks that are not material to the financial statements.

Loans: Loans that management has the intent and ability to hold for the foreseeable future or until

maturity or payoff are reported at the principal balance outstanding, net of unearned interest, deferred loan fees and costs, and an allowance for loan losses. Interest income is reported on an accrual basis using the interest method and

includes amortization of net deferred loan fees and costs over the loan term using the level yield method without anticipating prepayments. The amount of the Company’s recorded investment is not materially different than the amount of unpaid

principal balance for loans.

Interest income is discontinued and

the loan moved to non-accrual status when full loan repayment is in doubt, typically when the loan is impaired or payments are past due 90 days or over unless the loan is well-secured or in process of collection. Past due status is based on the

contractual terms of the loan. In all cases, loans are placed on nonaccrual or charged-off at an earlier date if collection of principal or interest is considered doubtful. Nonaccrual loans and loans past due 90 days or over and still accruing

include both smaller balance homogeneous loans that are collectively evaluated for impairment and individually classified impaired loans.

All interest accrued but not received

for loans placed on nonaccrual is reversed against interest income. Interest received on such loans is accounted for on the cash-basis method until qualifying for return to accrual. Loans are returned to accrual status when all the principal

and interest amounts contractually due are brought current and future payments are reasonably assured.

The Bank also originates long-term,

fixed-rate mortgage loans, with full intention of being sold to the secondary market. These loans are considered held for sale during the period of time after the principal has been advanced to the borrower by the Bank, but before the Bank has

been reimbursed by the Federal Home Loan Mortgage Corporation or mortgage broker, typically within a few business days. Loans sold to the secondary market are carried at the lower of aggregate cost or fair value. Total loans on the balance

sheet included $1,682 in loans held for sale by the Bank as of December 31, 2021, as compared to $70 loans held for sale at December 31, 2020.

16

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies (continued)

Allowance

for Loan Losses: The allowance for loan losses is a

valuation allowance for probable incurred credit losses. Loan losses are charged against the allowance when management believes the uncollectibility of a loan balance is confirmed. Subsequent recoveries, if any, are credited to the

allowance. Management estimates the allowance balance required using past loan loss experience, the nature and volume of the portfolio, information about specific borrower situations and estimated collateral values, economic conditions, and

other factors. Allocations of the allowance may be made for specific loans, but the entire allowance is available for any loan that, in management’s judgment, should be charged-off.

The allowance consists of specific and general components. The

specific component relates to loans that are individually classified as impaired. A loan is impaired when, based on current information and events, it is probable that the Company will be unable to collect all amounts due according to the

contractual terms of the loan agreement. Loans for which the terms have been modified and for which the borrower is experiencing financial difficulties are considered troubled debt restructurings and classified as impaired.

Factors considered by management in

determining impairment include payment status, collateral value, and the probability of collecting scheduled principal and interest payments when due. Loans that experience insignificant payment delays and payment shortfalls generally are not

classified as impaired. Management determines the significance of payment delays and payment shortfalls on a case-by-case basis, taking into consideration all of the circumstances surrounding the loan and the borrower, including the length and

reasons for the delay, the borrower’s prior payment record, and the amount of shortfall in relation to the principal and interest owed.

Commercial and commercial real estate

loans are individually evaluated for impairment. If a loan is impaired, a portion of the allowance is allocated so that the loan is reported, net, at the present value of estimated future cash flows using the loan’s existing rate or at the

fair value of collateral if repayment is expected solely from the collateral. Smaller balance homogeneous loans, such as consumer and most residential real estate, are collectively evaluated for impairment, and accordingly, they are not

separately identified for impairment disclosure. Troubled debt restructurings are measured at the present value of estimated future cash flows using the loan’s effective rate at inception. If a troubled debt restructuring is considered to be

a collateral dependent loan, the loan is reported, net, at the fair value of the collateral. For troubled debt restructurings that subsequently default, the Company determines the amount of reserve in accordance with the accounting policy for

the allowance for loan losses.

The general component covers

non-impaired loans and impaired loans that are not individually reviewed for impairment and is based on historical loss experience adjusted for current factors. The historical loss experience is determined by portfolio segment and is based on

the actual loss history experienced by the Company over the most recent 3 5 years for the commercial portfolio segment. The total loan portfolio’s actual loss experience is supplemented with

other economic factors based on the risks present for each portfolio segment. These economic factors include consideration of the following: levels of and trends in delinquencies and impaired loans; levels of and trends in charge-offs and

recoveries; trends in volume and terms of loans; effects of any changes in risk selection and underwriting standards; other changes in lending policies, procedures, and practices; experience, ability, and depth of lending management and other

relevant staff; national and local economic trends and conditions; industry conditions; and effects of changes in credit concentrations. The following portfolio segments have been identified: Commercial and Industrial, Commercial Real Estate,

Residential Real Estate, and Consumer.

Commercial and

industrial loans consist of borrowings for commercial purposes to individuals, corporations, partnerships, sole proprietorships, and other business enterprises. Commercial and industrial loans are generally secured by business assets such as

equipment, accounts receivable, inventory, or any other asset excluding real estate and generally made to finance capital expenditures or operations. The Company’s risk exposure is related to deterioration in the value of collateral securing

the loan should foreclosure become necessary. Generally, business assets used or produced in operations do not maintain their value upon foreclosure, which may require the Company to write down the value significantly to sell.

Commercial real estate consists of nonfarm, nonresidential loans secured by owner-occupied and nonowner-occupied commercial real estate as well as commercial construction loans. An owner-occupied loan relates to a

borrower purchased building or space for which the repayment of principal is dependent upon cash flows from the ongoing business operations conducted by the party, or an affiliate of the party, who owns the property. Owner-occupied loans

that are dependent on cash flows from operations can be adversely affected by current market conditions for their product or service. A nonowner-occupied loan is a property loan for which the repayment of principal is dependent upon

rental income associated with the property or the subsequent sale of the property. Nonowner-occupied loans that are dependent upon rental income are primarily impacted by local economic conditions which dictate occupancy rates and the amount

of rent charged. Commercial construction loans consist of borrowings to purchase and develop raw land into 1-4 family residential properties. Construction loans are extended to individuals as well as corporations for the construction of an

individual or multiple properties and are secured by raw land and the subsequent improvements. Repayment of the loans to real estate developers is dependent upon the sale of properties to third parties in a timely fashion upon completion.

Should there be delays in construction or a downturn in the market for those properties, there may be significant erosion in value which may be absorbed by the Company.

17

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies (continued)

Residential real estate loans consist

of loans to individuals for the purchase of 1-4 family primary residences with repayment primarily through wage or other income sources of the individual borrower. The Company’s loss exposure to these loans is dependent on local market

conditions for residential properties as loan amounts are determined, in part, by the fair value of the property at origination.

Consumer loans are

comprised of loans to individuals secured by automobiles, open-end home equity loans and other loans to individuals for household, family, and other personal expenditures, both secured and unsecured. These loans typically have maturities of

6 years or less with repayment dependent on individual wages and income. The risk of loss on consumer loans is elevated as the

collateral securing these loans, if any, rapidly depreciate in value or may be worthless and/or difficult to locate if repossession is necessary. The Company has allocated the highest percentage of its allowance for loan losses as a

percentage of loans to the other identified loan portfolio segments due to the larger dollar balances associated with such portfolios.

At December 31, 2021, there were no

changes to the accounting policies or methodologies within any of the Company’s loan portfolio segments from the prior period.

Concentrations of Credit Risk: The Company grants residential, consumer and commercial loans to customers

located primarily in the southeastern Ohio and western West Virginia areas.

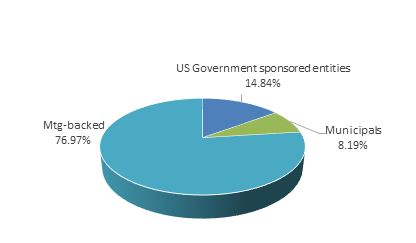

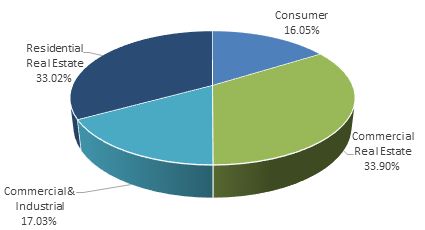

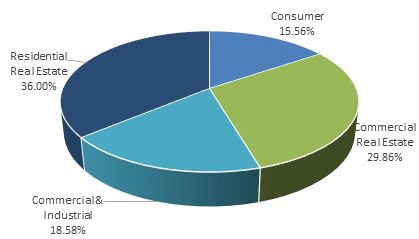

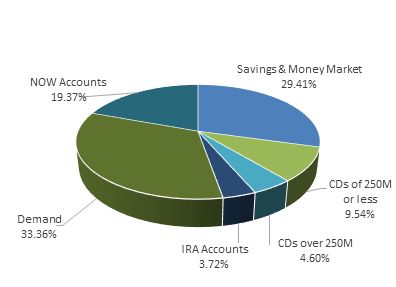

The following represents the composition of the Company’s loan portfolio as of December 31:

|

% of Total Loans

|

||||||||

|

2021

|

2020

|

|||||||

|

Residential real estate loans

|

|

%

|

|

%

|

||||

|

Commercial real estate loans

|

|

%

|

|

%

|

||||

|

Consumer loans

|

|

%

|

|

%

|

||||

|

Commercial and industrial loans

|

|

%

|

|

%

|

||||

|

|

%

|

|

%

|

|||||

The Bank, in the

normal course of its operations, conducts business with correspondent financial institutions. Balances in correspondent accounts, investments in federal funds, certificates of deposit and other short-term securities are closely monitored to

ensure that prudent levels of credit and liquidity risks are maintained. At December 31, 2021, the Bank’s primary correspondent balance was $135,995

on deposit at the FRB, Cleveland, Ohio.

Premises and Equipment: Land is carried at cost. Premises and equipment are stated at cost less

accumulated depreciation, which is computed using the straight-line method over the estimated useful life of the owned asset and, for leasehold improvement, over the remaining term of the leased facility, whichever is shorter. The useful

lives range from 3 to 8 years

for equipment, furniture and fixtures and 7 to 39 years for buildings and improvements.

The Company enters into leases in the normal course of business primarily for branch buildings and office space to conduct business. The Company’s leases have remaining terms ranging from 16 months to 20 years, some of

which include options to extend the leases for up to 15 years .

18

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies (continued)

The Company includes lease extension and termination options in the lease term if, after considering relevant economic factors, it is reasonably certain

the Company will exercise the option. In addition, the Company has elected to account for any non-lease components in its real estate leases as part of the associated lease component. The Company has also elected to not recognize leases

with original lease terms of 12 months or less (short-term leases) on the Company’s balance sheet.

Leases are classified as operating or finance leases at the lease commencement date. Lease expense for operating leases and short-term leases is

recognized on a straight-line basis over the lease term. Right-of-use (“ROU”) assets represent our right to use an underlying asset for the lease term and lease liabilities are recognized at the lease commencement date based on the

estimated present value of lease payments over the lease term. At December 31, 2021, the Company did no t have any finance

leases.

The Company’s operating lease ROU assets and operating lease liabilities are valued based on the present value of future minimum lease payments,

discounted with an incremental borrowing rate for the same term as the underlying lease. The Company has one lease arrangement that contains variable lease payments that are adjusted periodically for an index.

Foreclosed assets: Assets acquired through or instead of loan foreclosure are initially recorded

at fair value less costs to sell when acquired, establishing a new cost basis. Physical possession of residential real estate property collateralizing a consumer mortgage loan occurs when legal title is obtained upon completion of foreclosure

or when the borrower conveys all interest in the property to satisfy the loan through completion of a deed in lieu of foreclosure or through a similar legal agreement. These assets are subsequently accounted for at lower of cost or fair value

less estimated costs to sell. If fair value declines subsequent to foreclosure, a valuation allowance is recorded through expense. Operating costs after acquisition are expensed.

Goodwill: Goodwill arises from business combinations and is generally determined as the

excess of the fair value of the consideration transferred, plus the fair value of any noncontrolling interests in the acquiree, over the fair value of the net assets acquired and liabilities assumed as of the acquisition date. Goodwill

acquired in a purchase business combination and determined to have an indefinite useful life are not amortized, but tested for impairment at least annually. Goodwill is the only intangible asset with an indefinite life on our balance sheet.

The Company has selected December 31 as the date to perform its annual qualitative impairment test. For the year ended December 31, 2021, the Company used a qualitative assessment based on profitability and positive equity to determine that

it was more likely than not that the fair value of goodwill was more than the carrying amount, resulting in no impairment. For

the year ended December 31, 2020, management could not conclude using a qualitative assessment that its fair value of goodwill exceeded the carrying amount due to the Company’s stock price having traded below book value for an extended period

throughout 2020. Therefore, the Company performed a quantitative impairment test to conclude that there was no goodwill impairment

for the year ended December 31, 2020. See Note F for more specific disclosures related to goodwill impairment testing.

Long-term Assets: Premises and equipment and other long-term assets are reviewed for impairment

when events indicate their carrying amount may not be recoverable from future undiscounted cash flows. If impaired, the assets are recorded at fair value.

Mortgage Servicing Rights: A mortgage servicing right (“MSR”) is a contractual agreement where the right

to service a mortgage loan is sold by the original lender to another party. When the Company sells mortgage loans to the secondary market, it retains the servicing rights to these loans. The Company’s MSR is recognized separately when

acquired through sales of loans and is initially recorded at fair value with the income statement effect recorded in mortgage banking income. Subsequently, the MSR is then amortized in proportion to and over the period of estimated future

servicing income of the underlying loan. The MSR is then evaluated for impairment periodically based upon the fair value of the rights as compared to the carrying amount, with any impairment being recognized through a valuation allowance.

Fair value of the MSR is based on market prices for comparable mortgage servicing contracts. Impairment is determined by stratifying rights into groupings based on predominant risk characteristics, such as interest rate, loan type and

investor type. If the Company later determines that all or a portion of the impairment no longer exists for a particular grouping, a reduction of the allowance may be recorded as an increase to income. At December 31, 2021 and 2020, the

Company’s MSR assets were $480 and $458 ,

respectively.

Earnings Per Share: Earnings per share is based on net income divided by the following weighted

average number of common shares outstanding during the periods: 4,780,609 for 2021 and 4,787,446 for 2020. Ohio Valley had no dilutive effect and no potential common shares issuable under stock options or other agreements for any period presented.

19

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies (continued)

Income Taxes: Income tax expense is the sum of the current year income tax due or refundable

and the change in deferred tax assets and liabilities. Deferred tax assets and liabilities are the expected future tax consequences of temporary differences between the carrying amounts and tax bases of assets and liabilities, computed using

enacted tax rates. The effect on deferred tax assets and liabilities of a change in tax rates is recognized at the time of enactment of such change in tax rates. A valuation allowance, if needed, reduces deferred tax assets to the amount

expected to be realized.

A tax position is recognized as a

benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50%

likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The Company recognizes interest and/or penalties related to income tax matters in income tax expense.

Comprehensive Income: Comprehensive income consists of net income and other comprehensive

income (loss). Other comprehensive income (loss) includes unrealized gains and losses on securities available for sale which are also recognized as separate components of equity, net of tax.

Loss Contingencies: Loss contingencies, including claims and legal actions arising in the ordinary course

of business, are recorded as liabilities when the likelihood of loss is probable and an amount or range of loss can be reasonably estimated. Management does not believe there now are such matters that will have a material effect on the financial

statements.

Bank Owned Life Insurance and Annuity

Assets: The Company has purchased life insurance policies on

certain key executives. Bank owned life insurance is recorded at the amount that can be realized under the insurance contract at the balance sheet date, which is the cash surrender value adjusted for other charges or other amounts due that

are probable at settlement. The Company also purchased an annuity investment for a certain key executive that earns interest.

Employee Stock Ownership Plan: Compensation expense is based on the market price of shares as they are

committed to be allocated to participant accounts.

Dividend Reinvestment Plan: The Company maintains a Dividend Reinvestment Plan. The plan enables

shareholders to elect to have their cash dividends on all or a portion of shares held automatically reinvested in additional shares of the Company’s common stock. The stock is issued out of the Company’s authorized shares and credited to

participant accounts at fair market value. Dividends are reinvested on a quarterly basis.

Loan Commitments and Related Financial

Instruments: Financial instruments include off-balance sheet

credit instruments, such as commitments to make loans and commercial letters of credit, issued to meet customer financing needs. The face amount for these items represents the exposure to loss, before considering customer collateral or

ability to repay. These financial instruments are recorded when they are funded. See Note L for more specific disclosure related to loan commitments.

Dividend Restrictions: Banking regulations require maintaining certain capital levels and may limit

the dividends paid by the Bank to Ohio Valley or by Ohio Valley to its shareholders. See Note P for more specific disclosure related to dividend restrictions.

Restrictions

on Cash: Cash on hand or on deposit with a third-party correspondent bank and the FRB totaled $136,379 and $121,432 at year-end 2021 and 2020, respectively, and

were subject to clearing requirements but not subject to any regulatory reserve requirements. The balances on deposit with a third-party correspondent do not earn interest.

Derivatives: At the inception of a derivative contract, the Company designates

the derivative as one of three types based on the Company’s intentions and belief as to likely effectiveness as a hedge. These three types are (1) a hedge of the fair value of a recognized asset or liability or of an unrecognized firm

commitment (“fair value hedge”), (2) a hedge of a forecasted transaction or the variability of cash flows to be received or paid related to a recognized asset or liability (“cash flow hedge”), or (3) an instrument with no hedging

designation (“stand-alone derivative”).

20

notes to the consolidated financial statements

Amounts are in thousands, except share and per share data.

Note A - Summary of Significant Accounting Policies (continued)

Net cash settlements on derivatives

that qualify for hedge accounting are recorded in interest income or interest expense, based on the item being hedged. Net cash settlements on derivatives that do not qualify for hedge accounting are reported in noninterest income. Cash flows

on hedges are classified in the cash flow statement the same as the cash flows of the items being hedged.

At December 31, 2021 and 2020, the

only derivative instruments used by the Company were interest rate swaps, which are classified as stand-alone derivatives. See Note H for more specific disclosures related to interest rate swaps.

Fair Value of Financial Instruments:

Fair values of financial instruments are estimated using relevant market information and other assumptions, as more fully disclosed in Note O. Fair value estimates involve uncertainties and matters of significant judgment regarding interest

rates, credit risk, prepayments, and other factors, especially in the absence of broad markets for particular items. Changes in assumptions or in market conditions could significantly affect the estimates.

Reclassifications: The consolidated financial statements for 2020 have been reclassified

to conform with the presentation for 2021. These reclassifications had no effect on the net results of operations or shareholders’ equity.

Current Events: In March 2020, the

World Health Organization declared the outbreak of the coronavirus (“COVID-19”) as a global pandemic. COVID-19 has continued to negatively impact the global economy, disrupt global supply chains, create significant volatility, disrupt

financial markets, and increase unemployment levels.

The continued financial impact of