811-05954

REGISTRATION STATEMENT

THE SECURITIES ACT OF 1933

THE INVESTMENT COMPANY ACT OF 1940

Amendment No. 121

San Francisco, California 94105

211 Main Street

San Francisco, California 94105

| |

Douglas P. Dick, Esq.

Dechert LLP 1900 K Street, N.W. Washington, DC 20006 |

| |

John M. Loder, Esq.

Ropes & Gray LLP 800 Boylston Street Boston, MA 02199‑3600 |

|

![[MISSING IMAGE: log-csamctr299c.jpg]](log-csamctr299c.jpg)

| |

Sweep Shares

|

| |

SWGXX

|

|

| | Fund Summary | | | | | | | |

| | | | | | 1 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 4 | | | |

| | | | | | 5 | | | |

| | | | | | 6 | | | |

| | | | | | 7 | | | |

| | | | | | 9 | | |

| | Ticker Symbol: | | | Sweep Shares: | |

| | | |||

| | | | Sweep Shares | |

| | | | | |

| of the value of your investment) | | |||

| Management fees | | | | |

| Distribution (12b-1) fees | | | | |

| Other expenses | | | | |

| Total annual fund operating expenses | | | | |

| Less expense reduction | | | ( | |

| Total annual fund operating expenses after expense reduction(1) | | | | |

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Sweep Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: h85nfbg59ljlrgqgbo49jmitd655.jpg]](h85nfbg59ljlrgqgbo49jmitd655.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | 10 Years | | |||||||||

| | | | | | | | | | | | | | | | | | |||

|

Sweep Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17 |

| |||||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(1)

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.02 | | | | | | 0.01 | | | | | | 0.00(2) | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | — | | | | | | 0.00(2) | | | | | | 0.00(2) | | |

|

Total from investment operations

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.02 | | | | | | 0.01 | | | | | | 0.00(2) | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(2)(3) | | | | | | (0.00)(2) | | | | | | (0.02) | | | | | | (0.01) | | | | | | (0.00)(2) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | — | | | | | | (0.00)(2) | | | | | | (0.00)(2) | | |

|

Total distributions

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | (0.02) | | | | | | (0.01) | | | | | | (0.00)(2) | | |

| Net asset value at end of period | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

| Total return | | | | | 0.02%(3) | | | | | | 0.23% | | | | | | 1.65% | | | | | | 1.23% | | | | | | 0.26% | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.06%(4) | | | | | | 0.30%(4)(5) | | | | | | 0.59% | | | | | | 0.62% | | | | | | 0.63%(4)(6) | | |

|

Gross operating expenses

|

| | | | 0.45% | | | | | | 0.52% | | | | | | 0.59% | | | | | | 0.62% | | | | | | 0.68% | | |

|

Net investment income (loss)

|

| | | | 0.02% | | | | | | 0.18% | | | | | | 1.64% | | | | | | 1.12% | | | | | | 0.25% | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 24,159 | | | | | $ | 20,119 | | | | | $ | 12,450 | | | | | $ | 11,325 | | | | | $ | 25,324 | | |

| | SEC File Number | | | | |

| |

The Charles Schwab Family of Funds 811‑05954

|

| | REG13850-27 | |

![[MISSING IMAGE: log-csamctr299c.jpg]](log-csamctr299c.jpg)

| | Schwab Value Advantage Money Fund® | | | | |

| |

Investor Shares

|

| |

SWVXX

|

|

| |

Ultra Shares

|

| |

SNAXX

|

|

| | Schwab® Government Money Fund | | | | |

| |

Investor Shares

|

| |

SNVXX

|

|

| |

Ultra Shares

|

| |

SGUXX

|

|

| | Schwab® Treasury Obligations Money Fund | | | | |

| |

Investor Shares

|

| |

SNOXX

|

|

| |

Ultra Shares

|

| |

SCOXX

|

|

| |

Schwab® Retirement Government Money Fund

|

| | SNRXX | |

| | Schwab® U.S. Treasury Money Fund | | | | |

| |

Investor Shares

|

| |

SNSXX

|

|

| |

Ultra Shares

|

| |

SUTXX

|

|

| | Fund Summaries | | | | | | | |

| | | | | | 1 | | | |

| | | | | | 5 | | | |

| | | | | | 8 | | | |

| | | | | | 11 | | | |

| | | | | | 14 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 18 | | | |

| | | | | | 24 | | | |

| | | | | | 25 | | | |

| | | | | | 25 | | | |

| | | | | | 26 | | | |

| | | | | | 26 | | | |

| | | | | | 26 | | | |

| | | | | | 29 | | |

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | ||||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | ||||||

| Total annual fund operating expenses | | | | | | | | ||||||

| Less expense reduction | | | | | ( | ) | | | | ( | ) | ||

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | ||||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: eteungsanddenapo9o5lavhevllt.jpg]](eteungsanddenapo9o5lavhevllt.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | 10 Years | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | |

$1

|

| |||

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | | | ||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | | | ||||

| Total annual fund operating expenses | | | | | | | | | | ||||

| Less expense reduction | | | | | ( | ) | | | | ( | | | |

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | | | ||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: ruv2jeblc0cb1onph2if86ggdbar.jpg]](ruv2jeblc0cb1onph2if86ggdbar.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | Since Inception ( | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | — | | |||||||||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | |

$1

|

| |||

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | | | ||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | | | ||||

| Total annual fund operating expenses | | | | | | | | | | ||||

| Less expense reduction | | | | | ( | ) | | | | ( | | | |

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | | | ||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: adbt4v53cs0h0vc3m5eaji0gjdb3.jpg]](adbt4v53cs0h0vc3m5eaji0gjdb3.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | Since Inception ( | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | — | | |||||||||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | |

$1

|

| |||

| | Ticker Symbol: | | | | |

| | | |||

| | | | | |

| of the value of your investment) | | |||

| Management fees | | | | |

| Distribution (12b-1) fees | | | | |

| Other expenses | | | | |

| Total annual fund operating expenses | | | | |

| Less expense reduction | | | ( | |

| Total annual fund operating expenses after expense reduction(1) | | | | |

| | | | |||||||||||||||||||||

| | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

future performance may differ from past performance.

For current performance information, please see

![[MISSING IMAGE: cocc2q0prrrdhpk34lp245l97u9i.jpg]](cocc2q0prrrdhpk34lp245l97u9i.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | Since Inception ( | | |||||||||

| | | | | | | | | | | | | | | | | | |||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Schwab Retirement Government Money Fund | | | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | | | ||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | | | ||||

| Total annual fund operating expenses | | | | | | | | | | ||||

| Less expense reduction | | | | | ( | ) | | | | ( | | | |

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | | | ||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: qua5m7bt0k4bmg5dlsvq9unjk925.jpg]](qua5m7bt0k4bmg5dlsvq9unjk925.jpg)

| | | ||||||||||||

| | | | 1 Year | | | Since Inception ( | | ||||||

| | | | | | | | | | | | | | |

| | | | | | | — | | ||||||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | |

$1

|

| |||

|

Investor Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17 |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(1)

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.00(2) | | | | | | (0.00)(2) | | | | | | — | | |

|

Total from investment operations

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(2)(3) | | | | | | (0.00)(2) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.01) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | — | | | | | | — | | |

|

Total distributions

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.01) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Total return

|

| | | | 0.04%(3) | | | | | | 0.44% | | | | | | 2.07% | | | | | | 1.79% | | | | | | 0.81% | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.11%(4) | | | | | | 0.28%(4)(5) | | | | | | 0.34% | | | | | | 0.34% | | | | | | 0.39%(6) | | |

|

Gross operating expenses

|

| | | | 0.35% | | | | | | 0.41% | | | | | | 0.42% | | | | | | 0.44% | | | | | | 0.54% | | |

|

Net investment income (loss)

|

| | | | 0.04% | | | | | | 0.47% | | | | | | 2.02% | | | | | | 1.87% | | | | | | 0.84% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 42,245 | | | | | $ | 56,419 | | | | | $ | 74,972 | | | | | $ | 47,721 | | | | | $ |

14,955 |

| |

|

Ultra Shares

|

| |

1/1/21

12/31/21 |

| |

1/1/20

12/31/20 |

| |

1/1/19

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(7) |

| |||||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(1)

|

| | | | 0.00 | (2) | | | | 0.01 | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00 | (2) | | | | 0.00(2) | | | | | | 0.00(2) | | | | | | (0.00)(2) | | | | | | — | | | |

|

Total from investment operations

|

| | | | 0.00 | (2) | | | | 0.01 | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | | | (0.00 | )(2)(3) | | | | (0.01) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.01) | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(2) | | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | — | | | | | | — | | | |

|

Total distributions

|

| | | | (0.00 | )(2) | | | | (0.01) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.01) | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | ||

| Total return | | | | | 0.04 | %(3) | | | | 0.53% | | | | | | 2.22% | | | | | | 1.94% | | | | | | 1.00% | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | | | 0.11 | %(4) | | | | 0.18%(4)(5) | | | | | | 0.19% | | | | | | 0.19% | | | | | | 0.20%(6) | | | |

|

Gross operating expenses

|

| | | | 0.20 | % | | | | 0.26% | | | | | | 0.27% | | | | | | 0.29% | | | | | | 0.33% | | | |

|

Net investment income (loss)

|

| | | | 0.04 | % | | | | 0.56% | | | | | | 2.17% | | | | | | 2.00% | | | | | | 1.08% | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 33,078 | | | $ | 37,882 | | | | | $ | 47,497 | | | | | $ | 29,554 | | | | | $ | 12,612 | | | ||

|

Investor Shares

|

| |

1/1/21

12/31/21 |

| |

1/1/20 –

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(1) |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.00(3) | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | — | | | | | | 0.00(3) | | | | | | 0.00(3) | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.00(3) | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3)(4) | | | | | | (0.00)(3) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.00)(3) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | — | | | | | | (0.00)(3) | | | | | | (0.00)(3) | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.00)(3) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Total return

|

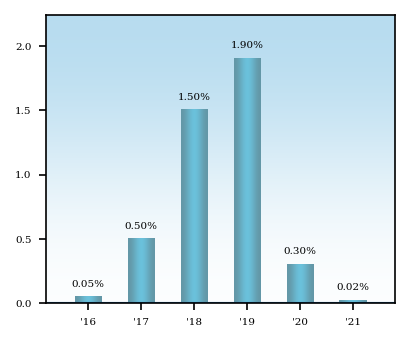

| | | | 0.02%(4) | | | | | | 0.30% | | | | | | 1.90% | | | | | | 1.51% | | | | | | 0.50% | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.06%(5) | | | | | | 0.27%(5)(6) | | | | | | 0.35% | | | | | | 0.35% | | | | | | 0.40%(5)(7) | | |

|

Gross operating expenses

|

| | | | 0.35% | | | | | | 0.43% | | | | | | 0.47% | | | | | | 0.48% | | | | | | 0.53% | | |

|

Net investment income (loss)

|

| | | | 0.02% | | | | | | 0.28% | | | | | | 1.84% | | | | | | 1.66% | | | | | | 0.51% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 6,782 | | | | | $ | 11,980 | | | | | $ | 13,436 | | | | | $ | 7,871 | | | | | $ |

1,362 |

| |

|

Ultra Shares

|

| |

1/1/21

12/31/21 |

| |

9/24/20(11) –

12/31/20 |

| | | | | | | | | | | | | ||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total from investment operations

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | |

|

(0.00

|

)(3)(4)

|

| |

|

(0.00)(3)

|

| | | | | | | | | | | | | | | | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Total return | | | | | 0.02 | %(4) | | | | 0.00%(8)(9) | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | |

|

0.06

|

%(5)

|

| |

|

0.13%(5)(10)

|

| | | | | | | | | | | | | | | | | | | | |

|

Gross operating expenses

|

| | | | 0.20 | % | | | | 0.20%(10) | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)

|

| | | | 0.03 | % | | | | 0.01%(10) | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 4,726 | | | $ | 1,647 | | | | | | | | | | | | | | | | | | | | | ||

|

Investor Shares

|

| |

1/1/21

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(1) |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | (0.01)(4) | | | | | | 0.00(3) | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.02 | | | | | | 0.01 | | | | | | 0.01 | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.02) | | | | | | (0.01) | | | | | | (0.01) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | — | | | | | | (0.00)(3) | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.02) | | | | | | (0.01) | | | | | | (0.01) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Total return

|

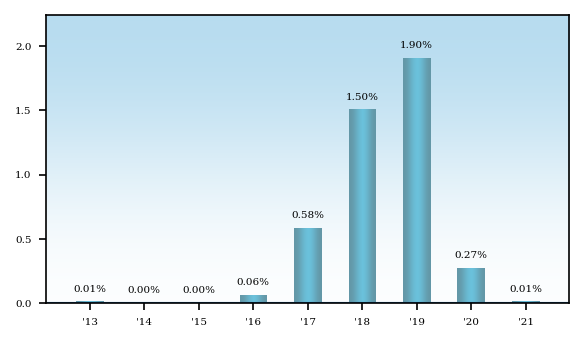

| | | | 0.01% | | | | | | 0.27% | | | | | | 1.89% | | | | | | 1.51% | | | | | | 0.58% | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.06%(5) | | | | | | 0.30%(5)(6) | | | | | | 0.35% | | | | | | 0.35% | | | | | | 0.33%(5)(7) | | |

|

Gross operating expenses

|

| | | | 0.35% | | | | | | 0.46% | | | | | | 0.48% | | | | | | 0.49% | | | | | | 0.54% | | |

|

Net investment income (loss)

|

| | | | 0.01% | | | | | | 0.27% | | | | | | 1.86% | | | | | | 1.57% | | | | | | 0.65% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 5,632 | | | | | $ | 7,573 | | | | | $ | 10,820 | | | | | $ | 7,545 | | | | | $ |

3,125 |

| |

|

Ultra Shares

|

| |

1/1/21

12/31/21 |

| |

9/24/20(8) –

12/31/20 |

| | | | | | | | | | | | | ||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total from investment operations

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Total return | | | | | 0.01 | % | | | | 0.00%(9)(11) | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | |

|

0.06

|

%(5)

|

| |

|

0.16%(5)(10)

|

| | | | | | | | | | | | | | | | | | | | |

|

Gross operating expenses

|

| | | | 0.20 | % | | | | 0.21%(10) | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)

|

| | | | 0.01 | % | | | | 0.01%(10) | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 2,244 | | | $ | 1,754 | | | | | | | | | | | | | | | | | | | | | ||

| | | |

1/1/21

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17 |

| |||||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(1)

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | — | | | | | | 0.00(2) | | | | | | 0.00(2) | | |

|

Total from investment operations

|

| | | | 0.00(2) | | | | | | 0.00(2) | | | | | | 0.02 | | | | | | 0.02 | | | | | | 0.01 | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.01) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | — | | | | | | (0.00)(2) | | | | | | — | | |

|

Total distributions

|

| | | | (0.00)(2) | | | | | | (0.00)(2) | | | | | | (0.02) | | | | | | (0.02) | | | | | | (0.01) | | |

| Net asset value at end of period | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

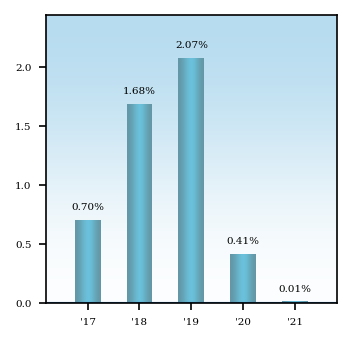

| Total return | | | | | 0.01% | | | | | | 0.40% | | | | | | 2.07% | | | | | | 1.69% | | | | | | 0.70% | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.07%(3) | | | | | | 0.18%(3) | | | | | | 0.19% | | | | | | 0.19% | | | | | | 0.20%(4) | | |

|

Gross operating expenses

|

| | | | 0.21% | | | | | | 0.31% | | | | | | 0.35% | | | | | | 0.38% | | | | | | 0.37% | | |

|

Net investment income (loss)

|

| | | | 0.01% | | | | | | 0.38% | | | | | | 2.01% | | | | | | 1.68% | | | | | | 0.72% | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 1,610 | | | | | $ | 1,804 | | | | | $ | 2,072 | | | | | $ | 1,019 | | | | | $ | 876 | | |

|

Investor Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/17/18(1) –

12/31/18 |

| | | |||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.02 | | | | | | 0.02 | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | (0.01)(4) | | | | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.02 | | | | | | 0.01 | | | | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3)(5) | | | | | | (0.00)(3) | | | | | | (0.02) | | | | | | (0.01) | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.02) | | | | | | (0.01) | | | | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | |

|

Total return

|

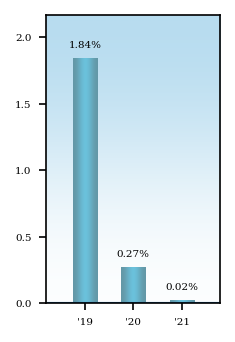

| | | | 0.02%(5) | | | | | | 0.27% | | | | | | 1.84% | | | | | | 1.40%(6) | | | | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.05%(7) | | | | | | 0.23%(7)(8) | | | | | | 0.35% | | | | | | 0.35%(9) | | | | | |

|

Gross operating expenses

|

| | | | 0.35% | | | | | | 0.45% | | | | | | 0.49% | | | | | | 0.49%(9) | | | | | |

|

Net investment income (loss)

|

| | | | 0.02% | | | | | | 0.15% | | | | | | 1.77% | | | | | | 1.64%(9) | | | | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 7,468 | | | | | $ | 11,297 | | | | | $ | 7,517 | | | | | $ | 3,414 | | | | | |

|

Ultra Shares

|

| |

1/1/21–

12/31/21 |

| |

9/24/20(1)–

12/31/20 |

| | | | | | | | | | | | ||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | |

|

Total from investment operations

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | |

|

(0.00

|

)(3)(5)

|

| |

|

(0.00)(3)

|

| | | | | | | | | | | | | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | ||

| Total return | | | | | 0.02 | %(5) | | | | 0.00%(6)(10) | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | |

|

0.05

|

%(7)

|

| |

|

0.12%(7)(9)

|

| | | | | | | | | | | | | | | | | |

|

Gross operating expenses

|

| | | | 0.20 | % | | | | 0.21%(9) | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)

|

| | | | 0.02 | % | | | | 0.01%(9) | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 3,850 | | | $ | 2,260 | | | | | | | | | | | | | | | | | | ||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investments |

| ||||||

| | Schwab Value Advantage Money Fund | | | | | | | | | | | | | |

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab Government Money Fund | | | | | | | | | | | | | |

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab Treasury Obligations Money Fund | | | | | | | | | | | | | |

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab Retirement Government Money Fund | | | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab U.S. Treasury Money Fund | | | | | | | | | | | | | |

| |

Investor Shares

|

| | | | None | | | | | | None | | |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

|

Fund

|

| |

Shareholder Servicing Fee

|

| |||

| Schwab Value Advantage Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab Value Advantage Money Fund – Ultra Shares | | | | | 0.00% | | |

| Schwab Government Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab Government Money Fund – Ultra Shares | | | | | 0.00% | | |

| Schwab Treasury Obligations Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab Treasury Obligations Money Fund – Ultra Shares | | | | | 0.00% | | |

| Schwab Retirement Government Money Fund | | | | | 0.00% | | |

| Schwab U.S. Treasury Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab U.S. Treasury Money Fund – Ultra Shares | | | | | 0.00% | | |

| | SEC File Number | | | | |

| |

The Charles Schwab Family of Funds 811‑05954

|

| | REG13852-26 | |

![[MISSING IMAGE: log-csamctr299c.jpg]](log-csamctr299c.jpg)

| | Schwab® AMT Tax-Free Money Fund | | | | |

| |

Investor Shares

|

| |

SWWXX

|

|

| |

Ultra Shares

|

| |

SCTXX

|

|

| | Schwab® Municipal Money Fund | | | | |

| |

Investor Shares

|

| |

SWTXX

|

|

| |

Ultra Shares

|

| |

SWOXX

|

|

| |

Schwab® California Municipal Money Fund

|

| | | |

| |

Investor Shares

|

| |

SWKXX

|

|

| |

Ultra Shares

|

| |

SCAXX

|

|

| |

Schwab® New York Municipal Money Fund

|

| | | |

| |

Investor Shares

|

| |

SWYXX

|

|

| |

Ultra Shares

|

| |

SNYXX

|

|

| | Fund Summaries | | | | | | | |

| | | | | | 1 | | | |

| | | | | | 5 | | | |

| | | | | | 9 | | | |

| | | | | | 13 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 17 | | | |

| | | | | | 18 | | | |

| | | | | | 23 | | | |

| | | | | | 24 | | | |

| | | | | | 24 | | | |

| | | | | | 25 | | | |

| | | | | | 25 | | | |

| | | | | | 25 | | | |

| | | | | | 28 | | |

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | ||||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | ||||||

| Total annual fund operating expenses | | | | | | | | ||||||

| Less expense reduction | | | | | ( | ) | | | | ( | ) | ||

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | ||||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: aeb6ipu4blghdva1u1te4h5tss5s.jpg]](aeb6ipu4blghdva1u1te4h5tss5s.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | 10 Years | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | — | | |||||||||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | ||||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | ||||||

| Total annual fund operating expenses | | | | | | | | ||||||

| Less expense reduction | | | | | ( | ) | | | | ( | ) | ||

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | ||||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: ebfqupu64jf8d3lbj8eicmkg6grd.jpg]](ebfqupu64jf8d3lbj8eicmkg6grd.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | 10 Years | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | |

$1

|

| |||

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | ||||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | ||||||

| Total annual fund operating expenses | | | | | | | | ||||||

| Less expense reduction | | | | | ( | ) | | | | ( | ) | ||

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | ||||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: a089vfamfjgqfmrrr5nndf0m4qr2.jpg]](a089vfamfjgqfmrrr5nndf0m4qr2.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | 10 Years | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | — | | |||||||||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Ticker Symbols: | | | Investor Shares: | | | Ultra Shares: | |

| | | ||||||||||||

| | | | Investor Shares | | | Ultra Shares | | ||||||

| | | | | | | | | | | | | ||

| of the value of your investment) | | ||||||||||||

| Management fees | | | | | | | | ||||||

| Distribution (12b-1) fees | | | | | | | | ||||||

| Other expenses | | | | | | | | ||||||

| Total annual fund operating expenses | | | | | | | | ||||||

| Less expense reduction | | | | | ( | ) | | | | ( | ) | ||

| Total annual fund operating expenses after expense reduction(1) | | | | | | | | ||||||

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Investor Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: el7ffb21e9gr0bi64v3eqi81jt56.jpg]](el7ffb21e9gr0bi64v3eqi81jt56.jpg)

| | | ||||||||||||||||||

| | | | 1 Year | | | 5 Years | | | 10 Years | | |||||||||

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | — | | | — | | |||||||||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Investor Shares | | | | | None | | | | | | None | | |

| | Ultra Shares | | | | $ | 1,000,000 | | | | | $ | 1 | | |

|

Investor Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(1) |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | (0.00)(3) | | | | | | 0.00(3) | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01)(4) | | | | | | (0.00)(3) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | — | | | | | | — | | | | | | — | | | | | | (0.00)(3) | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.00)(3) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

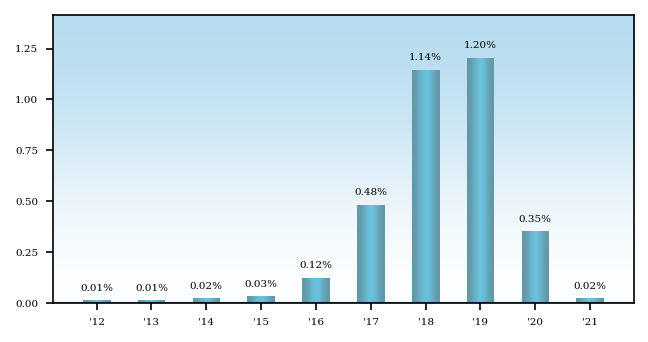

Total return

|

| | | | 0.02% | | | | | | 0.34% | | | | | | 1.19% | | | | | | 1.20%(4) | | | | | | 0.48% | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.11%(5) | | | | | | 0.31%(5)(6) | | | | | | 0.35% | | | | | | 0.35% | | | | | | 0.42%(7) | | |

|

Gross operating expenses

|

| | | | 0.37% | | | | | | 0.49% | | | | | | 0.52% | | | | | | 0.51% | | | | | | 0.55% | | |

|

Net investment income (loss)

|

| | | | 0.01% | | | | | | 0.38% | | | | | | 1.17% | | | | | | 1.14% | | | | | | 0.48% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 644 | | | | | $ | 835 | | | | | $ | 1,273 | | | | | $ | 1,128 | | | | | $ |

632 |

| |

|

Ultra Shares

|

| |

1/1/21–

12/31/21 |

| |

9/24/20(8) –

12/31/20 |

| | | | | | | | | | | | | ||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total from investment operations

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | — | | | | | | | | | | | | | | | | | | | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Total return | | | | | 0.02 | % | | | | 0.01%(9) | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | |

|

0.11

|

%(5)

|

| |

|

0.19%(5)(10)

|

| | | | | | | | | | | | | | | | | | | | |

|

Gross operating expenses

|

| | | | 0.22 | % | | | | 0.22%(10) | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)

|

| | | | 0.01 | % | | | | 0.02%(10) | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 161 | | | $ | 229 | | | | | | | | | | | | | | | | | | | | | ||

|

Investor Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(1) |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | (0.00)(3) | | | | | | 0.00(3) | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.00)(3) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | — | | | | | | — | | | | | | — | | | | | | — | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.00)(3) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Total return

|

| | | | 0.02% | | | | | | 0.35% | | | | | | 1.20% | | | | | | 1.15% | | | | | | 0.48% | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.11%(4) | | | | | | 0.29%(4)(5) | | | | | | 0.34% | | | | | | 0.34% | | | | | | 0.42%(6) | | |

|

Gross operating expenses

|

| | | | 0.35% | | | | | | 0.45% | | | | | | 0.48% | | | | | | 0.48% | | | | | | 0.53% | | |

|

Net investment income (loss)

|

| | | | 0.01% | | | | | | 0.35% | | | | | | 1.19% | | | | | | 1.17% | | | | | | 0.50% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 1,597 | | | | | $ | 2,041 | | | | | $ | 2,674 | | | | | $ | 2,735 | | | | | $ |

822

|

| |

|

Ultra Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(7)(8) |

| |||||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.01 | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | (0.00)(3) | | | | | | 0.00(3) | | | |

|

Total from investment operations

|

| | | | 0.00 | (3) | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.01 | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.01) | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | — | | | | | | — | | | | | | — | | | | | | — | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.01) | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | ||

| Total return | | | | | 0.02 | % | | | | 0.44% | | | | | | 1.35% | | | | | | 1.30% | | | | | | 0.67% | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | | | 0.11 | %(5) | | | | 0.19%(4)(5) | | | | | | 0.19% | | | | | | 0.19% | | | | | | 0.22%(6) | | | |

|

Gross operating expenses

|

| | | | 0.20 | % | | | | 0.30% | | | | | | 0.33% | | | | | | 0.33% | | | | | | 0.47% | | | |

|

Net investment income (loss)

|

| | | | 0.01 | % | | | | 0.45% | | | | | | 1.33% | | | | | | 1.31% | | | | | | 0.71% | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 6,405 | | | $ | 9,948 | | | | | $ | 13,010 | | | | | $ | 12,748 | | | | | $ | 5,832 | | | ||

|

Investor Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(1) |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01)(4) | | | | | | (0.00)(3) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | — | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.00)(3) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Total return

|

| | | | 0.03% | | | | | | 0.32% | | | | | | 1.10% | | | | | | 1.10%(4) | | | | | | 0.45% | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.10%(5) | | | | | | 0.28%(5)(6) | | | | | | 0.35% | | | | | | 0.35% | | | | | | 0.42%(7) | | |

|

Gross operating expenses

|

| | | | 0.35% | | | | | | 0.46% | | | | | | 0.49% | | | | | | 0.49% | | | | | | 0.53% | | |

|

Net investment income (loss)

|

| | | | 0.01% | | | | | | 0.37% | | | | | | 1.08% | | | | | | 1.12% | | | | | | 0.48% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 2,224 | | | | | $ | 3,405 | | | | | $ | 6,168 | | | | | $ | 5,526 | | | | | $ |

1,453 |

| |

|

Ultra Shares

|

| |

1/1/21–

12/31/21 |

| |

9/24/20(8) –

12/31/20 |

| | | | | | | | | | | | | ||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00(3 | ) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3 | ) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total from investment operations

|

| | | | 0.00(3 | ) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Total return | | | | | 0.03 | % | | | | 0.01%(9) | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | |

|

0.09

|

%(5)

|

| |

|

0.16%(5)(10)

|

| | | | | | | | | | | | | | | | | | | | |

|

Gross operating expenses

|

| | | | 0.20 | % | | | | 0.20%(10) | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)

|

| | | | 0.01 | % | | | | 0.01%(10) | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 778 | | | $ | 375 | | | | | | | | | | | | | | | | | | | | | ||

|

Investor Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17(1) |

| |||||||||||||||

|

Per-Share Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net asset value at beginning of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Income (loss) from investment operations:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(2)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.00(3) | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.00(3) | | | | | | (0.00)(3) | | | | | | 0.01 | | |

|

Total from investment operations

|

| | | | 0.00(3) | | | | | | 0.00(3) | | | | | | 0.01 | | | | | | 0.01 | | | | | | 0.01 | | |

|

Less distributions:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01)(4) | | | | | | (0.01)(4) | | |

|

Distributions from net realized gains

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | — | | | | | | — | | | | | | (0.00)(3) | | |

|

Total distributions

|

| | | | (0.00)(3) | | | | | | (0.00)(3) | | | | | | (0.01) | | | | | | (0.01) | | | | | | (0.01) | | |

|

Net asset value at end of period

|

| | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | | | | $ | 1.00 | | |

|

Total return

|

| | | | 0.06% | | | | | | 0.34% | | | | | | 1.18% | | | | | | 1.16%(4) | | | | | | 0.56%(4) | | |

|

Ratios/Supplemental Data

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ratios to average net assets:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.12%(5) | | | | | | 0.30%(5)(6) | | | | | | 0.35% | | | | | | 0.35% | | | | | | 0.42%(7) | | |

|

Gross operating expenses

|

| | | | 0.38% | | | | | | 0.49% | | | | | | 0.51% | | | | | | 0.52% | | | | | | 0.56% | | |

|

Net investment income (loss)

|

| | | | 0.01% | | | | | | 0.43% | | | | | | 1.16% | | | | | | 1.16% | | | | | | 0.48% | | |

|

Net assets, end of period (x 1,000,000)

|

| | | $ | 470 | | | | | $ | 668 | | | | | $ | 1,466 | | | | | $ | 1,126 | | | | | $ |

322 |

| |

|

Ultra Shares

|

| |

1/1/21–

12/31/21 |

| |

9/24/20(8) –

12/31/20 |

| | | | | | | | | | | | | ||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Net asset value at beginning of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net investment income (loss)(2)

|

| | | | 0.00(3 | ) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Net realized and unrealized gains (losses)

|

| | | | 0.00(3 | ) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total from investment operations

|

| | | | 0.00(3 | ) | | | | 0.00(3) | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Distributions from net investment income

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net realized gains

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

|

Total distributions

|

| | | | (0.00 | )(3) | | | | (0.00)(3) | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | | | $ | 1.00 | | | $ | 1.00 | | | | | | | | | | | | | | | | | | | | | ||

| Total return | | | | | 0.06 | % | | | | 0.02%(9) | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | ||

|

Net operating expenses

|

| | | | 0.12 | %(5) | | | | 0.19%(10) | | | | | | | | | | | | | | | | | | | | | |

|

Gross operating expenses

|

| | | | 0.23 | % | | | | 0.22%(10) | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)

|

| | | | 0.01 | % | | | | 0.03%(10) | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 98 | | | $ | 119 | | | | | | | | | | | | | | | | | | | | | ||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Schwab AMT Tax-Free Money Fund | | ||||||||||||

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab Municipal Money Fund | | ||||||||||||

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab California Municipal Money Fund | | ||||||||||||

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

| | Schwab New York Municipal Money Fund | | ||||||||||||

| |

Investor Shares

|

| | |

|

None

|

| | | |

|

None

|

| |

| |

Ultra Shares

|

| | | $ | 1,000,000 | | | | | $ | 1 | | |

|

Fund

|

| |

Shareholder Servicing Fee

|

| |||

| Schwab AMT Tax-Free Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab AMT Tax-Free Money Fund – Ultra Shares | | | | | 0.00% | | |

| Schwab Municipal Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab Municipal Money Fund – Ultra Shares | | | | | 0.00% | | |

| Schwab California Municipal Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab California Municipal Money Fund – Ultra Shares | | | | | 0.00% | | |

| Schwab New York Municipal Money Fund – Investor Shares | | | | | 0.15% | | |

| Schwab New York Municipal Money Fund – Ultra Shares | | | | | 0.00% | | |

| | SEC File Number | | | | |

| |

The Charles Schwab Family of Funds 811‑05954

|

| | REG13854-27 | |

![[MISSING IMAGE: log-csamctr299c.jpg]](log-csamctr299c.jpg)

| |

Ultra Shares

|

| |

SVUXX

|

|

| | Fund Summary | | | | | | | |

| | | | | | 1 | | | |

| | | | | | 5 | | | |

| | | | | | 5 | | | |

| | | | | | 5 | | | |

| | | | | | 6 | | | |

| | | | | | 7 | | | |

| | | | | | 8 | | | |

| | | | | | 8 | | | |

| | | | | | 9 | | | |

| | | | | | 9 | | | |

| | | | | | 9 | | | |

| | | | | | 11 | | |

| | Ticker Symbol: | | | Ultra Shares: | |

| | | |||

| | | | Ultra Shares | |

| | | | | |

| of the value of your investment) | | |||

| Management fees | | | | |

| Distribution (12b-1) fees | | | | |

| Other expenses | | | | |

| Total annual fund operating expenses | | | | |

| Less expense reduction | | | ( | |

| Total annual fund operating expenses after expense reduction(1) | | | | |

| | | ||||||||||||||||||||||||

| | | | 1 Year | | | 3 Years | | | 5 Years | | | 10 Years | | ||||||||||||

| Ultra Shares | | | | $ | | | | | $ | | | | | $ | | | | | $ | | | ||||

![[MISSING IMAGE: aiou9jnu1fr4g2ndshg43trrebct.jpg]](aiou9jnu1fr4g2ndshg43trrebct.jpg)

| | | ||||||||||||||||||

| | | 1 Year | | | 5 Years | | | Since Inception ( | | ||||||||||

| | | | | | | | | | | | | | | | | | |||

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Ultra Shares | | | | $ | 1,000,000 | | | | | $ | 1 | | |

|

Ultra Shares

|

| |

1/1/21–

12/31/21 |

| |

1/1/20–

12/31/20 |

| |

1/1/19–

12/31/19 |

| |

1/1/18–

12/31/18 |

| |

1/1/17–

12/31/17 |

| |||||||||||||||

| Per-Share Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | | | $ | 1.0003 | | | | | $ | 1.0004 | | | | | $ | 1.0002 | | | | | $ | 1.0001 | | | | | $ | 1.0003 | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net investment income (loss)(1)

|

| | | | 0.0003 | | | | | | 0.0057 | | | | | | 0.0217 | | | | | | 0.0201 | | | | | | 0.0103 | | |

|

Net realized and unrealized gains (losses)

|

| | | | (0.0000)(2) | | | | | | (0.0008) | | | | | | 0.0005 | | | | | | (0.0009) | | | | | | (0.0006) | | |

|

Total from investment operations

|

| | | | 0.0003 | | | | | | 0.0049 | | | | | | 0.0222 | | | | | | 0.0192 | | | | | | 0.0097 | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Distributions from net investment income

|

| | | | (0.0003) | | | | | | (0.0050) | | | | | | (0.0220) | | | | | | (0.0191) | | | | | | (0.0099) | | |

|

Distributions from net realized gains

|

| | | | — | | | | | | — | | | | | | (0.0000)(2) | | | | | | — | | | | | | — | | |

|

Total distributions

|

| | | | (0.0003) | | | | | | (0.0050) | | | | | | (0.0220) | | | | | | (0.0191) | | | | | | (0.0099) | | |

| Net asset value at end of period | | | | $ | 1.0003 | | | | | $ | 1.0003 | | | | | $ | 1.0004 | | | | | $ | 1.0002 | | | | | $ | 1.0001 | | |

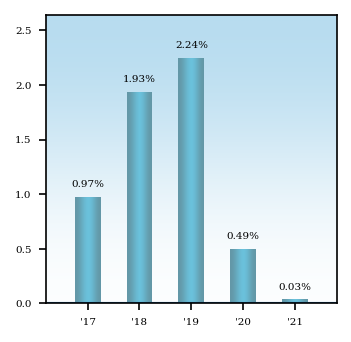

| Total return | | | | | 0.03% | | | | | | 0.49% | | | | | | 2.24% | | | | | | 1.94% | | | | | | 0.97% | | |

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios to average net assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

Net operating expenses

|

| | | | 0.11%(3) | | | | | | 0.18%(3) | | | | | | 0.19% | | | | | | 0.19% | | | | | | 0.20%(4) | | |

|

Gross operating expenses

|

| | | | 0.21% | | | | | | 0.31% | | | | | | 0.34% | | | | | | 0.35% | | | | | | 0.40% | | |

|

Net investment income (loss)

|

| | | | 0.03% | | | | | | 0.57% | | | | | | 2.17% | | | | | | 2.01% | | | | | | 1.03% | | |

| Net assets, end of period (x 1,000,000) | | | | $ | 2,693 | | | | | $ | 3,414 | | | | | $ | 5,388 | | | | | $ | 3,796 | | | | | $ | 1,327 | | |

| | | | |

Minimum

Initial Investment |

| |

Minimum

Additional Investment |

| ||||||

| | Ultra Shares | | | | $ | 1,000,000 | | | | | $ | 1 | | |

| | SEC File Number | | | | |

| |

The Charles Schwab Family of Funds 811‑05954

|

| | REG90260-06 | |

![[MISSING IMAGE: log-csam-ctr-299c.jpg]](log-csamctr299c.jpg)

| | Schwab Value Advantage Money Fund® | | | | |

| |

Investor Shares

|

| |

SWVXX

|

|

| |

Ultra Shares

|

| |

SNAXX

|

|

| | Schwab® Government Money Fund | | | | |

| |

Sweep Shares

|

| |

SWGXX

|

|

| |

Investor Shares

|

| |

SNVXX

|

|

| |

Ultra Shares

|

| |

SGUXX

|

|

| | Schwab® Treasury Obligations Money Fund | | | | |

| |

Investor Shares

|

| |

SNOXX

|

|

| |

Ultra Shares

|

| |

SCOXX

|

|

| |

Schwab® Retirement Government Money Fund

|

| | SNRXX | |

| | Schwab® U.S. Treasury Money Fund | | | | |

| |

Investor Shares

|

| |

SNSXX

|

|

| |

Ultra Shares

|

| |

SUTXX

|

|

| | | |

Page

|

| |||

| | | | | 1 | | | |

| | | | | 1 | | | |

| | | | | 1 | | | |

| | | | | 11 | | | |

| | | | | 13 | | | |

| | | | | 20 | | | |

| | | | | 21 | | | |

| | | | | 25 | | | |

| | | | | 27 | | | |

| | | | | 27 | | | |

| | | | | 28 | | | |

| | | | | 29 | | | |

| | | | | 31 | | | |

| APPENDIX — RATINGS OF INVESTMENT SECURITIES | | | | | | | |

| APPENDIX — PROXY VOTING POLICY | | | | | | | |

| |

Name, Year of Birth, and Position(s) with the Trust

(Term of Office and Length of Time Served(1)) |

| |

Principal Occupations

During the Past Five Years |

| |

Number of Portfolios

in Fund Complex Overseen by the Trustee |

| |

Other Directorships During

the Past Five Years |

|

| |

INDEPENDENT TRUSTEES

|

| |||||||||

| |

Robert W. Burns

1959 Trustee (Trustee of Schwab Strategic Trust since 2009; The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2016) |

| | Retired/Private Investor. | | |

103

|

| | None | |

| |

Nancy F. Heller

1956 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2018) |

| | Retired. | | |

103

|

| | None | |

| |

David L. Mahoney

1954 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios and Laudus Trust since 2011; Schwab Strategic Trust since 2016) |

| | Private Investor. | | |

103

|

| |

Director (2004‑present),

Corcept Therapeutics Incorporated

Director (2009‑2021),

Adamas Pharmaceuticals, Inc.

Director (2003‑2019),

Symantec Corporation |

|

| |

Jane P. Moncreiff

1961 Trustee (Trustee of The Charles Schwab Family of Funds, Schwab Investments, Schwab Capital Trust, Schwab Annuity Portfolios, Schwab Strategic Trust and Laudus Trust since 2019) |

| | Consultant (2018-present), Fulham Advisers LLC (management consulting); Chief Investment Officer (2009-2017), CareGroup Healthcare System, Inc. (healthcare). | | |

103

|

| | None | |

| |

Kiran M. Patel