0000066382DEF 14AFALSEiso4217:USD00000663822023-06-042024-06-0100000663822022-05-292023-06-0300000663822021-05-302022-05-2800000663822020-05-312021-05-290000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-06-042024-06-010000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2023-06-042024-06-010000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-05-292023-06-030000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2022-05-292023-06-030000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-05-302022-05-280000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2021-05-302022-05-280000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-05-312021-05-290000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:PeoMember2020-05-312021-05-290000066382ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:EqtyAwrdsAdjsExclgValRprtdInSummryCompstnTblMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-06-042024-06-010000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-06-042024-06-010000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-06-042024-06-010000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-06-042024-06-010000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-06-042024-06-010000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-06-042024-06-010000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-06-042024-06-010000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-05-292023-06-030000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-05-292023-06-030000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-05-292023-06-030000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-05-292023-06-030000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-05-292023-06-030000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-05-292023-06-030000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-05-292023-06-030000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-05-302022-05-280000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-05-302022-05-280000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-05-302022-05-280000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-05-302022-05-280000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-05-302022-05-280000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-05-302022-05-280000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-05-302022-05-280000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-05-312021-05-290000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-05-312021-05-290000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-05-312021-05-290000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-05-312021-05-290000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-05-312021-05-290000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-05-312021-05-290000066382ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-05-312021-05-290000066382ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-05-312021-05-29000006638212023-06-042024-06-01000006638222023-06-042024-06-01000006638232023-06-042024-06-01000006638242023-06-042024-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

MillerKnoll, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | |

| ☒ | No fee required. |

| | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

To our shareholders: MillerKnoll wrapped up fiscal year 2024 with a strong finish. Anticipating demand improvement toward the end of the year, we took action to navigate the environment and drive meaningful profitability improvement. We leveraged our global operations network and diversified channels, invested in innovative solutions for customers, strengthened our product offerings and enhanced our physical and digital experiences. While our retail business and the industry continue to navigate tough conditions in the short-term, we are focused on long-term growth. We are optimistic entering the new year with momentum and positive levels of activity across our business.

Growing Globally With our collective of brands, we believe there is substantial opportunity to grow internationally.

The strength of our dealer network plays a crucial role in our International Contract strategy. This year, we accelerated our international MillerKnoll dealer network, adding 29 dealers in 13 new cities and 3 new countries. Through our dealers’ | | | showrooms we are expanding our presence in high-performing regions, and throughout the year dealers opened new MillerKnoll showrooms in India, Singapore, and Indonesia. We also added sales leadership and resources in these regions to better connect our international dealers with MillerKnoll. These strategies are yielding positive results and customer engagement.

We have been acting on aggressive plans to bring Knoll to new markets throughout Europe. Our network around the globe is ready to deliver designs for these regions as demand continues to grow.

Designing with Impact Conversations about the modern workplace are shifting to focus on creating spaces that promote wellbeing and connection. As a leader in transforming modern design, we have an opportunity to shape the dialogue on the modern office through our “Design with Impact” program, aimed at redefining the workplace and bringing design into its next chapter. Launched this year, our approach addresses employees’ need for community and connection, focuses on improving wellbeing, and helps organizations | | | navigate and design for change. These efforts have improved our product offerings and deepened engagement with clients, allowing us to deliver solutions that extend past theoretical return-to-office ideas and meet the unique needs companies face today.

Innovating Customer Experiences Our showrooms and storefronts are a key destination for our customers as they explore our collective of design brands. We have enhanced our physical locations and digital experiences.

Based on feedback from our design partners and dealers, we know that in cities where we have multiple showrooms for separate brands, they often chose to visit only one location for convenience. During the year, we began the process of co-locating brand showrooms to create a more powerful customer experience. |

“Conversations about the modern workplace are shifting to focus on creating spaces that promote wellbeing and connection.” |

| | | | | | |

|

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

For example, we opened a new MillerKnoll contract showroom in Dallas bringing the Herman Miller and Knoll brands together. In San Francisco, we consolidated our showroom space creating one beautiful location with dedicated space for Herman Miller, Knoll, and Geiger DatesWeiser. In New York we’re expanding our 251 Park Avenue South showroom with dedicated space for Herman Miller, Knoll, Geiger, DatesWeiser, Muuto, and others. Spaces like this, which integrate our portfolio of solutions under one roof, will continue to strengthen our position within the contract furniture industry.

We also continued to optimize our retail presence, prioritizing customer experience and operational efficiency. Strategic decisions, such as converting HAY stores to Design Within Reach (DWR) locations and offering HAY and Muuto through DWR e-commerce sites streamlined operations while offering customers a way to experience more brands in one place. Adding tools such as design configurators, which allow customers to create renderings of their home space and strengthening the trade offerings pages on our site which allow designers to place orders at any time, allowed us to strengthen our e-commerce business. In addition, we debuted a new DWR format in San Francisco with rotating galleries and interactive exhibits, and Muuto opened its flagship store in Tokyo, further strengthening our presence in Asia. We’ll apply learnings from these physical experiences to future stores.

Our retail teams also focused on enhancing and expanding our product assortment. To capture more sales and productivity with less foot traffic, we densified our store space to show more of | | | our collections. Expanded design services and tools allowed us to work more closely with clients to improve their experience, deepen relationships, and generate larger orders.

Despite lingering macroeconomic challenges facing our industry at-large, our strategic approach to optimizing our retail engine and enriching our customers’ experience has put us in a strong position to seize pent-up retail demand, particularly as conditions in the housing market indicate a shift in the right direction.

Focusing on High Impact Verticals We are constantly seeking new opportunities to direct our expertise and industry experience towards spaces beyond the home and office, including high-impact verticals such as healthcare and education.

Our scale, agile manufacturing capabilities, distribution network, and design leadership make us uniquely competitive in capturing these high impact verticals as well as the market resilient sectors, such as financial services and legal. We remain focused on these bright spots, as we forge new client relationships and deepen our presence in designing spaces beyond the traditional workspace.

Building on our Design DNA Our company has spent over a century defining the design industry. This year marked several significant anniversaries.

| | | “Our scale, agile manufacturing capabilities, distribution network, and design leadership, make us uniquely competitive in capturing these market resilient sectors.” |

— Herman Miller organized a 100th anniversary exhibition tour starting in Milan and concluding at Fulton Market Design Days, offering limited-edition prints of the John Massey-designed Eames Soft Pad Group poster, and releasing a special edition of the monograph “Herman Miller: A Way of Living.”

— Knoll introduced a special series of Saarinen Tables in exclusive natural stones at its showroom in Paris, to honor the brand’s 85th anniversary. Additionally, Knoll recognized the 75th anniversary of the iconic womb chair and debuted a refreshed design for Knoll overall.

— Holly Hunt celebrated its 40th anniversary with a special edition HH40 collection that included fresh design concepts with a nod to its rich history.

We also launched more than 40 new products or enhancements across the collective this year, including the Herman Miller Gaming and G2 Esports limited-edition Embody Chair, the NaughtOne Pippin flexible lounge chair and Morse Table System, Florence Knoll’s reintroduced Model 31 and 33 seating, Herman Miller’s Fuld Nesting Chair, Muuto’s Fine Suspension Lamp, and the HAY Type Chair. |

|

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

“We’ve made progress toward our sustainability initiatives through enhancements in renewable energy, reducing the single-use plastics in both our packaging and production, and increasing recycled content in products.”

| | | Our focus on sustainability and innovation is reflected in the new products launched and awards we received. Notably, the NaughtOne Pippin Chair has been recognized for its sustainability achievements, exemplifying our focus on sustainability in the design of products. Our efforts have also been acknowledged by prestigious organizations such as EcoVadis and SEAL Awards, highlighting our leadership in sustainability and corporate responsibility.

Internally, we continue to focus on employee engagement initiatives which build a supportive work environment and promote our teams’ wellbeing. Our global team is an asset and the Business Resource Groups (BRGs), led by associates, remind us that our differences encourage vibrancy, innovation, and better solutions. BRGs are voluntary and open to all employees interested in fostering an inclusive workplace, while also aligning with our Company’s mission and objectives.

Our annual company-wide Day of Purpose provides our employees a day away from the office to contribute to their communities and ensures U.S. team members can participate in regional elections. In November, associates organized | | | nearly 250 global Day of Purpose events. We reaffirmed that when we come together as one MillerKnoll collective, we are better together and can achieve more.

In conclusion, this year has been one of significant achievements and evolution, all designed to strengthen our position in the market. MillerKnoll’s commitment to design excellence and international expansion will drive growth and success. We’re confident in the strength of our business, even as demand pressures linger. We’ve navigated the economic environment to meet rebounding demand and are optimistic about the future as conditions become even more favorable. As we move forward, we are grateful for your continued support and confidence in MillerKnoll. |

MillerKnoll brands earned a number of design awards including the Fast Company Innovation by Design award for the Knoll Newson Task Chair and Interior Design’s Best of Year Award in the Contract Task Seating category for the Herman Miller Asari Chair.

Creating a Better World In 2023, we launched the first Better World Report as MillerKnoll highlighting our collective progress toward protecting the planet and fostering an inclusive work environment for our associates.

We’ve made progress toward our sustainability initiatives through enhancements in renewable energy, reducing the single-use plastics in both our packaging and production, and increasing recycled content in products. | | | |

| |

| Andi R. Owen President and Chief Executive Officer |

| | | | | | |

| | | | | | |

| | | | | | |

BOARD OF DIRECTORS1

| | | | | | | | | | | | | | |

Michael A. Volkema Chairman since 2000 and Director since 1995 | | | John Maeda Director since 2024 | |

| | | | |

Tina Edekar Edmundson Director since 2024 | | | Heidi J. Manheimer Director since 2014 | |

| | | | |

Douglas D. French Director since 2002 | | | Candace S. Matthews Director since 2020 | |

| | | | |

Jeanne K. Gang Director since 2024 | | | Andi R. Owen President and CEO, and Director since 2018 | |

| | | | |

John R. Hoke III Director since 2005 | | | Michael C. Smith Director since 2019 | |

| | | | |

Lisa A. Kro Director since 2012 | | | Michael R. Smith Director since 2021 | |

| | | | |

| | | | |

BOARD COMMITTEES2

| | | | | | | | | | | | | | |

| Audit | | Compensation | | Governance and Corporate Responsibility |

| | | | |

| Lisa A. Kro (Chair) | | Michael C. Smith (Chair) | | John R. Hoke III (Chair) |

| Douglas D. French | | Douglas D. French | | Heidi J. Manheimer |

| Michael R. Smith | | Heidi J. Manheimer | | Candace S. Matthews |

| | Candace S. Matthews | | Michael R. Smith |

|

EXECUTIVE OFFICERS

| | | | | | | | |

Andi R. Owen President and Chief Executive Officer Elected as an executive officer in 2018 | | Jeffrey M. Stutz Chief Financial Officer Elected as an executive officer in 2009 |

| | |

Christopher M. Baldwin Group President, MillerKnoll Elected as an executive officer in 2021 | | Megan C. Lyon Chief Strategy and Technology Officer Elected as an executive officer in 2019 |

| | |

John P. Michael President, Americas Contract Elected as an executive officer in 2020 | | Debbie F. Propst President, Global Retail Elected as an executive officer in 2020 |

| | |

Jacqueline H. Rice General Counsel and Corporate Secretary Elected as an executive officer in 2019 | | B. Ben Watson Chief Creative and Product Officer Elected as an executive officer in 2010 |

| | |

| | |

1 As of Proxy Record Date, August 16, 2024.

2 Andi R. Owen is an ex officio member of all committees. Ad hoc committees may be commissioned from time to time. Directors appointed to Board in 2024 will be appointed to Committees at the October 2024 meeting.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

October 14, 2024

10:30 am Eastern Daylight Time (“EDT”)

MillerKnoll, Inc. will hold a virtual annual shareholders meeting at www.virtualshareholdermeeting.com/MLKN2024

Items of Business

MillerKnoll, Inc. (“we,” “us,” “our,” the “Company,” or “MillerKnoll”) will ask shareholders to vote on the proposals listed in the table below and consider any other matters as may properly come before the meeting or any adjournment or postponement thereof:

| | | | | |

Proposal | Board Recommendation |

1.Elect six directors, one for a term of one year, one for a term of two years, and four for a term of three years; | FOR |

2.Approve, on an advisory basis, the Company’s Named Executive Officer compensation; and | FOR |

3.Ratify the Audit Committee’s selection of KPMG LLP as MillerKnoll, Inc.’s independent registered public accounting firm for fiscal 2025. | FOR |

| | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON OCTOBER 14, 2024: Our Proxy Statement and Annual Report on Form 10-K are available at www.proxyvote.com.

|

How to Vote

Shareholders of record at the close of business on August 16, 2024 (the “Record Date”), will be eligible to vote at this year’s Annual Meeting. Voting in advance of the Annual Meeting is encouraged, even if you plan to attend. Shareholders can vote shares by any of the following methods:

| | | | | | | | | | | | | | | | | | | | |

INTERNET Visit www.proxyvote.com until 11:59 pm ET on October 13, 2024(1) | | TELEPHONE Call 1 800 690 6903 until 11:59 pm ET on October 13, 2024(1)

| | MAIL Mark, sign, date, and mail proxy card. Must be received by October 11, 2024 | | ONLINE AT THE MEETING Shareholders of record may vote during the meeting as indicated below |

(1) For shares held directly, vote by October 13, 2024. For shares held in a plan, such as the MillerKnoll Retirement Plan, vote by October 9, 2024, 10:00 am ET.

As a shareholder, you are cordially invited to attend the virtual meeting on Monday, October 14, 2024, beginning promptly at 10:30 am EDT. Fifteen minutes prior to start time, you should log on at www.virtualshareholdermeeting.com/MLKN2024 to complete online check-in procedures. You will be required to enter your 16-digit control number included in your Notice of Internet Availability of the Proxy Materials (the “Notice of Internet Availability”), on your proxy card, or on the instructions that accompanied your proxy materials. During the virtual meeting, you will be able to listen, vote shares electronically, and submit questions. There will be no physical location for shareholders to attend.

By Order of the Board of Directors of MillerKnoll, Inc.

Jacqueline H. Rice

General Counsel and Corporate Secretary

August 30, 2024

TABLE OF CONTENTS | | | | | | | | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Corporate Governance |

P | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Executive Compensation |

P | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Audit Matters |

P | | |

| | |

| | |

| | |

| Other Corporate Governance |

| | |

| | |

| | |

| | |

| | |

| General Information |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Appendix |

| | |

| | |

| | |

|

| | |

BUSINESS OVERVIEW AND STRATEGY

As a global leader of design, MillerKnoll and our collective of dynamic brands have led conversations on design for over 100 years, and we continue to drive our industry forward with visionary thinking and a purposeful approach. From the spaces we make that help us live and work better, to how we manufacture our products, to the ways we solve challenges facing our customers and global community, design is our tool for creating positive impact. Our optimism leads us as we redefine modern for the 21st century, and design a future that is more sustainable, caring, and beautiful for all people and our planet.

Areas of Strategic Focus

Our strategy is designed to harness the full potential of MillerKnoll while driving growth across all business segments, geographies, and customer groups and creating value for all our stakeholders. We will capitalize on global trends including hybrid and flexible work, consumers’ focus on investing in their homes, a focus on health and well-being, and an expectation of corporate social responsibility. Our strategy includes three key focus areas:

•Drive Customer Demand and Order Growth

•Foster a Culture of Highly Engaged Associates

•Deliver Value for our Associates and Shareholders

Drive Customer Demand and Order Growth

We are prioritizing programs to deliver world-class experiences with every client interaction. We have a global, go-to-market framework for contract sellers, Design With Impact, that is organized around well-being, connection and change, and we are investing in MillerKnoll showrooms that bring our brands closer together to show the breadth of our offerings. As part of this work, we are enhancing and opening MillerKnoll showrooms in select markets including Atlanta, Chicago, Dallas, London, Los Angeles, New York, Toronto and San Francisco. In addition, we will continue to leverage the wide reach of our dealers’ showrooms around the globe.

In retail, we are working to evolve and enhance the Design Within Reach experience. We are testing new store formats, expanding our product assortment and offering design services both in store and online to enhance the customer experience, attract new customers, and grow existing customers. In addition, we continue to launch new online tools to support our trade customers making it easier for them to incorporate our products in their client projects.

Foster a Culture of Highly Engaged Associates

As MillerKnoll, we have created one of the most talented teams in the industry. We are committed to nurturing this distinct competitive advantage by fostering a culture of highly engaged associates and inspiring belief in our shared future. We empower our associates to be agile and hold our teams accountable for living our actions and delivering high performance.

Our priorities include offering a seamless MillerKnoll employee experience via a global Human Resources technology platform; providing a competitive and internally equitable compensation and benefits program; growing internal capabilities through development opportunities for all career levels; and investing to make MillerKnoll an employer of choice around the world.

Deliver Value to Our Associates and Shareholders

We believe there is opportunity for meaningful long-term growth in each of our business segments. MillerKnoll is uniquely positioned to capitalize on these opportunities given the breadth of our Contract and Global Retail businesses and product portfolios, global reach, and omni-channel distribution and fulfillment capabilities.

FINANCIAL HIGHLIGHTS FROM FISCAL 2024

During fiscal year 2024 MillerKnoll demonstrated an ability to navigate challenging macroeconomic conditions, with meaningful improvement in profitability amongst lower levels of net sales as compared to the prior year. In 2024 MillerKnoll net sales decreased 11.2% and 8.1%(1) on a reported and organic basis, respectively. Diluted earnings per share improved by 101.8% and 12.4%(1) on a reported and adjusted basis, respectively.

Net sales within the Americas Contract segment declined by 10.0% on a reported basis and 8.3%(1) on an organic basis. Our Global Retail segment saw a 16.4% reported and 8.6%(1) organic net sales decline over the prior year. The International Contract and Specialty segment net sales declined by 8.4% on a reported basis and 7.2%(1) organically.

Gross margin of 39.1% represented an increase over the prior year of 410 basis points. On an adjusted basis gross margin improved 370 basis points.(1) Gross margin improvement in the year was driven primarily by favorable freight, logistics and commodity costs, the benefit of price increase actions taken over the past few years and benefits from the realization of synergies associated with the acquisition of Knoll.

Reported operating expenses of $1.25 billion were $55.4 million below the prior year. On an adjusted basis, operating expenses of $1.16 billion(1) were $31.5 million below the prior year period.

On a reported basis, operating earnings of $167.2 and operating margin of 4.6% were higher compared to the prior year’s figures of $122.3 million and 3.0%. On an adjusted basis, we achieved operating earnings of $262.2 million(1) and a 7.2%(1) adjusted operating margin for fiscal 2024 compared to adjusted operating earnings of $256.5 million(1) and a 6.3%(1) adjusted operating margin in the prior year.

Diluted earnings per share for the full year totaled $1.11 compared to a earnings per share of $0.55 last year. On an adjusted basis, diluted earnings per share totaled $2.08(1) in the current fiscal year compared to $1.85(1) in fiscal 2023.

We reported a net operating cash inflow of $352.3 million in fiscal 2024. This is an increase in operating cash inflows of $189.4 million from the prior year, driven by a combination of increased earnings and a reduction in working capital. Capital expenditures for the year totaled $78.4 million, and the Company paid $55.6 million in dividends. The Company ended the fiscal year with a cash position of $230.4 million.

(1) Non-GAAP measurements; see Appendix A for reconciliations and explanations.

PROXY STATEMENT SUMMARY

This section highlights certain important information presented in this Proxy Statement and is intended to assist you in evaluating the matters to be voted on at our Annual Shareholder Meeting to be held on Monday, October 14, 2024. We encourage you to read this Proxy Statement in its entirety before you cast your vote. For more information regarding MillerKnoll’s fiscal 2024 performance, please review our Annual Report on Form 10-K for the fiscal year ended June 1, 2024.

Proposals and Voting Recommendations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

PROPOSAL 1 | | | ELECTION OF DIRECTORS | | | P The Board of Directors recommends a vote “FOR” the election of each of the nominees to serve as directors. | |

| | | | |

| | | | |

| | | | | | | | |

| The Board of Directors of the Company has nominated the following three directors, previously elected by our shareholders for re-election to the Board: Douglas D. French, John R. Hoke III, and Heidi J. Manheimer. In addition, our Board of Directors has nominated the following three directors recently appointed to the Board for election to the Board by shareholders: Tina Edekar Edmundson, Jeanne K. Gang, and John Maeda. The Board approved each of the nominees following the recommendation of our Governance and Corporate Responsibility Committee. | | | |

| | | |

| | | |

| | | |

| | | |

|

| | | | | | | | | |

PROPOSAL 2 | | | ADVISORY VOTE TO APPROVE NAMED EXECUTIVE OFFICER COMPENSATION | | | P The Board of Directors recommends a vote “FOR” the advisory vote to approve the Company’s Named Executive Officer compensation. | |

| | | | |

| | | | |

| | |

| Our shareholders have the opportunity to participate in an advisory vote on the compensation of the executive officers named in this Proxy Statement (our “Named Executive Officers” or “NEOs”) on an advisory and annual basis, the “say-on-pay” proposal. | | | |

| | | |

| | | |

| | For details, see page 18. | |

| | | |

|

| | | | | | | | | |

PROPOSAL 3 | | | RATIFICATION OF AUDIT COMMITTEE’S SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | P The Board of Directors recommends a vote “FOR” this proposal to ratify the appointment of KPMG LLP as our Company’s independent registered accounting firm for 2025. | |

| | | | |

| | | | |

| | | | | | | | |

Our Audit Committee has appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending May 31, 2025. Representatives of KPMG LLP will participate in the Annual Meeting of Shareholders and will be available to respond to appropriate questions. Shareholders may submit questions online at www.virtualshareholdermeeting.com/MLKN2024. The KPMG LLP representatives will have the opportunity to make a statement if they so desire. | | | |

| | | |

| | | |

| | For details, see page 47. | |

| | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| PROPOSAL 1 | | | ELECTION OF DIRECTORS | |

| | | | | |

| | | | | |

The Board of Directors of the Company has nominated the following three directors, previously elected by our shareholders for re-election to the Board: Douglas D. French, John R. Hoke III, and Heidi J. Manheimer. In addition, our Board of Directors has nominated three directors recently appointed to the Board for election to the Board by shareholders: John Maeda is nominated to serve a one-year term expiring at the 2025 Annual Meeting. Jeanne K. Gang is nominated to serve a two-year term expiring at the 2026 Annual Meeting. Tina Edekar Edmundson is nominated to serve a three-year term expiring at the 2027 Annual Meeting. All other nominees are nominated to serve three-year terms expiring at the 2027 Annual Meeting. Tina Edekar Edmundson, Jeanne K. Gang, and John Maeda were appointed to the Board on July 24, 2024. The Board approved each of the nominees following the recommendation of our Governance and Corporate Responsibility Committee.

More information about the nominees, as well as directors who will continue in office following the Annual Meeting, is provided below. Unless otherwise directed by a shareholder’s proxy, the persons named as proxy holders in the accompanying proxy will vote for the nominees named above. If any of the nominees becomes unavailable, which we do not anticipate, then the Board of Directors may designate substitute nominees at its discretion, in which event your proxy will be voted for such substituted nominees unless you have withheld authority to vote for directors. Shares cannot be voted for a greater number of people than the number of nominees named.

Our Bylaws provide that each director will be elected by the majority of the votes cast with respect to that director’s election at any meeting of shareholders for the election of directors, other than a contested election. A majority of the votes cast means that the number of votes cast “for” a director’s election exceeds the number of votes “withheld” with respect to that director’s election. In a contested election, each director will be elected by a plurality of the votes cast with respect to that director’s election at the meeting. An election is considered contested if the number of persons properly nominated to serve as directors exceeds the number of directors to be elected at that meeting.

In an uncontested election of directors, any nominee for director who is already serving as a director and receives a greater number of votes “withheld” from his or her election than votes “for” his or her election (a “majority against vote”) is required to promptly tender his or her offer of resignation. Abstentions and broker non-votes are not counted as votes cast either “for” or “withheld” with respect to that director’s election. The Governance and Corporate Responsibility Committee of the Board will then promptly consider the offer of resignation submitted by a director receiving a majority against vote, and that Committee will recommend to the Board whether to accept or reject the tendered offer of resignation or whether other action is recommended.

The Board must act on the tendered offer of resignation no later than 90 days following the certification of the shareholder vote for the meeting at which the election occurred. In considering the Committee’s recommendation, the Board will consider the factors presented by the Committee and such additional information and factors the Board believes to be relevant. The Company will promptly publicly disclose the Board’s decision on whether to accept the resignation as tendered, including a full explanation of the process by which the decision was reached and the reasons for the Board’s decision. Any director who tenders a resignation pursuant to those procedures may not participate in the Committee recommendation or the Board consideration regarding whether to accept the tendered resignation.

The Board of Directors currently consists of 12 directors, 11 of whom are independent. The maximum number of directors for the Board is 13. Our Bylaws require that directors be divided into three classes, each class to be as nearly equal in number as possible. Members of each class hold office until the third succeeding annual meeting following their election (other than new directors elected to a class in the middle of the three-year term for that class) and until their successors are duly elected and qualified or until their removal or resignation.

| | |

The Board of Directors recommends a vote “FOR” the election of each of the nominees to serve as directors. |

Our Nominees and Directors

Certain information with respect to the nominees for election at the Annual Meeting, as well as for each of the other directors, is included on the following pages, including their names, ages, a brief description of their recent business experience (including present employment), certain directorships that each person held during the last five years, and the year in which each person became a director of the Company. We have also included additional information about each director describing some of the specific experiences, qualifications, attributes, or skills that each one possesses that the Board believes has prepared them to be effective directors.

| | | | | | | | | | | | | | |

Nominees for Election Whose Terms Expire in 2027 |

|

| | | | | | | | | | | | | | |

Douglas D. French |

| | | Principal Occupation(s) During Past Five Years: | |

| Managing Director, Santé Health Ventures, Since 2007 | |

| | |

| Other Public Directorships: None | |

| | |

| Mr. French has served as a founding partner of Santé Health Ventures, an early-stage healthcare venture fund, since 2007. Prior to co-founding Santé Health Ventures, he served as the President and Chief Executive Officer of Ascension Health, the largest not-for-profit health system in the U.S. Mr. French has also served as CEO for St. Mary’s Medical Center and St. Vincent Health System, both of Midwest Indiana. He has more than three decades of health management experience, including serving as a director for numerous public and private companies. Mr. French’s governance experience, as well as his leadership roles and expertise in the health management industry, provides a valuable resource to management and the Board of Directors.

|

|

| |

Age 70 Director since 2002 Committees: •Audit •Compensation | |

| |

| | |

| | | | | | | | | | | | | | |

John R. Hoke III |

| | | Principal Occupation(s) During Past Five Years: | |

Chief Innovation Officer, Nike, Inc., Since 2023 Chief Design Officer, Nike, Inc., From 2017 – 2023 | |

| |

Other Public Directorships: None | |

| |

Since joining Nike, Inc., a marketer of athletic footwear, apparel, equipment, accessories, and services, in 1993, Mr. Hoke has led the communication of Nike’s culture of creativity and innovation internally and externally. He is currently the Chief Innovation Officer, leading the company’s design team which includes more than 1,000 product and industrial designers, graphic designers, and fashion designers, as well as architects, interface, and digital content designers to strategically amplify and accelerate innovation for Nike’s next chapter of growth. He previously served as Chief Design Officer from 2017 to 2023, and Vice President of Global Design from 2010 to 2017. Mr. Hoke has also served as a director to several not-for-profit organizations relating to art and design.

Mr. Hoke’s design expertise, both domestically and internationally, including his leadership role in a major global enterprise, brings an additional, insightful perspective to the Company’s Board of Directors.

|

|

|

Age 59 Director since 2005 Committees: •Governance and Corporate Responsibility (Chair) |

|

| | | |

| | | | | | | | | | | | | | |

Heidi J. Manheimer |

| | | Principal Occupation(s) During Past Five Years: | |

| Executive Chairman, Surratt Cosmetics LLC, Since 2017 | |

| | |

| Other Public Directorships: None | |

| | |

| Ms. Manheimer is the Executive Chairperson of Surratt Cosmetics LLC, a customizable beauty products and cosmetics company. Ms. Manheimer was an independent consultant from 2015 to 2017. She served as the Chief Executive Officer of Shiseido Cosmetics America, a global leader in skincare and cosmetics, from 2006 to 2015, as President of US Operations from 2002 to 2006, and as Executive Vice President and General Manager from 2000 to 2002. Prior to that, she spent seven years at Barney’s New York and seven years at Bloomingdale’s in the beauty care divisions, rising to senior leadership positions within each company. Ms. Manheimer currently sits on the Board of Directors of Burton Snowboards, having been appointed in 2006. For many years, she has served on nonprofit and trade association boards, and she was elected Chairwoman of the Cosmetic Executive Women Foundation in 2014.

Ms. Manheimer’s extensive experience as a senior executive in the retail industry, experience with both eCommerce and international business practices, and service as a board member for both for-profit and nonprofit businesses provide a valuable resource to management and the Board of Directors.

|

|

| |

Age 61 Director since 2014 Committees: •Compensation •Governance and Corporate Responsibility | |

|

| | |

| | | | | | | | | | | | | | |

| Tina Edekar Edmundson |

| | | Principal Occupation(s) During Past Five Years: | |

President, Luxury, Marriott International, Inc., Since 2023 Global Brand Officer, Marriott International, Inc., From 2013 – 2023 | |

| |

Other Public Directorships: None | |

| |

Ms. Edmundson has set a new standard for creativity and innovation across luxury and lifestyle hospitality. In her current role as the inaugural President, Luxury at Marriott International, she oversees the company’s global brand and operations strategy for their luxury portfolio, which includes more than 500 hotels in 38 countries across eight coveted brands, including The Ritz-Carlton, Ritz-Carlton Reserve, St. Regis, EDITION, Bvlgari Hotels & Resorts, W Hotels, The Luxury Collection, and JW Marriott. She brings over 25 years of experience transforming brands that inspire travel for customers, including her 16-plus year career at Marriott International and previous hospitality experience working with Starwood Hotels and Resorts.

Ms. Edmundson’s proven ability to successfully launch and transform brands, craft exceptional customer experiences, and capitalize on strategic business opportunities within the global and luxury market spaces complements the Company’s strategic priorities and will make her a valuable contributor to the Board. |

|

|

Age 58 Director since 2024 Committees — Pending appointment at October 2024 Board meeting. |

|

| | | |

| | | | | | | | | | | | | | |

Nominees for Election Whose Terms Expire in 2025 |

|

| | | | | | | | | | | | | | | | | |

John Maeda |

| | | Principal Occupation(s) During Past Five Years: |

Vice President of Engineering, Head of Computational Design / AI Platform, Microsoft, Since 2022 Chief Technology Officer, Everbridge, 2020 – 2022 Executive Vice President and Chief Experience Officer, Publicis Sapient, 2019 – 2020 Head of Computational Design and Inclusion, Automattic, 2016 – 2019 |

|

|

| Other Public Directorships: |

Sonos, Inc., 2012 – 2020 |

|

Mr. Maeda is a well-known technologist, educator, and investor. As Vice President of Engineering, Head of Computational Design for Microsoft’s AI Platform, he designs how software developers use AI models to their fullest. Prior to Microsoft, John dedicated his career to advancing design and innovative technologies in risk management at Everbridge, early-stage startups at KleinerPerkins, and cloud publishing at Automattic. He also served as the 16th President of the Rhode Island School of Design and led research at the MIT Media Lab. John is the author of five books on simplicity and leadership and has exhibited his contemporary art worldwide. He brings board experience having served on the Board of Directors for Sonos, Inc.

Mr. Maeda brings insightful thought leadership on using design to improve processes and outcomes in businesses, products, and user experiences. His board experience and executive roles in publicly traded multinational technology companies position him to be a key thought partner on issues at the intersection of design and technology. |

|

|

Age 57 Director since 2024 Committees — Pending appointment at October 2024 Board meeting.

|

|

| | | |

| | | | | | | | | | | | | | |

Nominees for Election Whose Terms Expire in 2026 |

|

| | | | | | | | | | | | | | | | | |

| Jeanne K. Gang |

| | | Principal Occupation(s) During Past Five Years: | | |

| Founding and Principal Partner, Studio Gang Architects, Ltd, Since 1997 |

| | | |

| Other Public Directorships: None |

| | | |

| Ms. Gang is an internationally renowned architect known for designing striking places that strengthen connections between people, communities, and the natural world. She is the founding partner of the architecture and urban design practice Studio Gang, whose award-winning portfolio includes the Gilder Center at the American Museum of Natural History; a new United States Embassy in Brazil; and an expansion of the Clinton Presidential Center. A MacArthur Fellow and a Professor in Practice at the Harvard Graduate School of Design, Jeanne has been named one of TIME Magazine’s most influential people in the world. She has authored four books on architecture, and her work has been exhibited widely.

Ms. Gang’s appointment to the Board underscores MillerKnoll’s commitment to designing a better world. Her deep expertise in architecture, design, and ability to create innovative architectural and urban development solutions will positively influence and challenge the Company’s sustainability initiatives. |

|

| |

Age 60 Director since 2024 Committees — Pending appointment at October 2024 Board meeting.

| |

|

| | | |

| | | | | | | | | | | | | | |

Directors Whose Terms Expire in 2025 |

|

| | | | | | | | | | | | | | |

| Lisa A. Kro |

| | | Principal Occupation(s) During Past Five Years: | |

Chief Financial and Administrative Officer, Ryan Companies, Since 2019 | |

| |

Other Public Directorships: | |

| First Solar, Inc. | |

| |

Ms. Kro is the Chief Financial and Administrative Officer at Ryan Companies, a national real estate services company. From 2010 to 2018 she co-founded and was Managing Director at the private equity firm Mill City Capital. From 2004 to 2010, Ms. Kro was the Chief Financial Officer and a Managing Director of Goldner Hawn Johnson & Morrison, also a private equity firm. Prior to joining Goldner Hawn, she was a partner at KPMG LLP, an international public accounting firm.

Ms. Kro’s service in auditing, as well as her experience in the finance and capital environments, enable her to contribute to a number of financial and strategic areas of the Company. Her experience on other boards, including serving as the financial expert on the Audit Committee of another publicly traded company, First Solar, Inc., contributes to the oversight of the Company’s financial accounting controls and reporting. |

|

|

Age 59 Director since 2012 Board Committees •Audit (Chair) |

|

| | | |

| | | | | | | | | | | | | | |

| Michael C. Smith |

| | | Principal Occupation(s) During Past Five Years: | |

Co-founder and General Partner, Footwork, Since 2021 President and Chief Operating Officer, Stitch Fix, Inc., 2019 – 2021 | |

| |

| Other Public Directorships: | |

| Ulta Beauty, Inc. | |

| |

Mr. Smith is the Co-Founder and General Partner of Footwork Venture Capital, an early-stage venture capital firm. He previously served as President, Chief Operating Officer (COO), and interim Chief Financial Officer of Stitch Fix, an online personal styling platform with more than 2.9 million clients. Prior to Stitch Fix, he was COO at Walmart.com, overseeing all operations for a $5 billion division, including one of the most successful multichannel offerings in the industry. Mr. Smith has been an innovative leader in the digital and fast-paced online consumer sectors for more than 15 years, with leadership positions in eCommerce, operations, customer experience, and finance. He joined Stitch Fix in 2012 and was instrumental in helping to scale the business from a small start-up to the innovative public company it is today.

Mr. Smith’s expertise and passion for building smart, efficient, and customer-centric online experiences helps the Company improve its customer experience initiatives and the growth of global businesses.

|

|

|

Age 54 Director since 2019 Board Committees •Compensation (Chair) |

|

| | | |

| | | | | | | | | | | | | | |

| Michael A. Volkema |

| | | Principal Occupation(s) During Past Five Years: | |

Chairman of the Board, MillerKnoll, Inc., Since 2000 | |

| |

| Other Public Directorships: | |

Wolverine Worldwide, Inc., 2005 – 2021 | |

| |

Mr. Volkema has been Chairman of the Board of Directors of MillerKnoll, Inc. since 2000, serving as non-executive Chairman since 2004. He also served as CEO and President of the Company from 1995 to 2004. Mr. Volkema has more than 30 years of experience as a senior executive in the home and office furnishings industry. This experience includes corporate leadership, branded marketing, international operations, and public company finance and accounting through audit committee service.

Mr. Volkema is a key contributor to the Board based upon his knowledge of the Company’s history and culture, operational experience, board governance knowledge, service on boards of other publicly held companies, and industry experience.

|

|

|

Age 68 Director since 1995 Board Chairman since 2000 |

|

| | | |

| | | | | | | | | | | | | | |

Directors Whose Terms Expire in 2026 |

|

| | | | | | | | | | | | | | |

Candace S. Matthews |

| | | Principal Occupation(s) During Past Five Years: | |

| Chief Reputation Officer, Amway, 2019 – May 2021 Regional President Americas, Amway, 2014 – 2020 | |

| | |

| Other Public Directorships: | |

| Société Bic S.A. | |

| AptarGroup, Inc. | |

| | |

| Ms. Matthews is the former Chief Reputation Officer of Amway Corporation, a leading health and wellness company and the world’s largest direct selling channel. Her tenure at Amway includes serving as Regional President Americas from 2014 to 2020 and Chief Marketing Officer from 2007 to 2014. Ms. Matthews has over 20 years of leadership experience across a variety of highly competitive consumer-product industries, including L’Oréal S.A., the Coca-Cola Company, CIBA Vision Corporation, Bausch + Lomb, Procter & Gamble, and General Mills. She currently serves on the Board of Directors of Société Bic S.A., having been appointed in 2017 where she currently sits on the Audit Committee and is the Chair of the Nominations, Governance and Corporate Social Responsibility Committee. Ms. Matthews was appointed to the Board of Directors of AptarGroup, Inc. in June 2021; as of May 2023 she is now Chair of the Board and she sits on the Corporate Governance Committee.

Ms. Matthews’ extensive experience in corporate social responsibility, consumer marketing, and brand management brings significant expertise as the Company continues to accelerate its focus on strategic growth and culture-building objectives.

|

|

| |

Age 65 Director since 2020 Board Committees: •Compensation •Governance and Corporate Responsibility | |

| |

| | | |

| | | | | | | | | | | | | | |

Andi R. Owen |

| | | Principal Occupation(s) During Past Five Years: | |

| President and CEO, MillerKnoll, Inc., Since 2018 | |

| | |

| Other Public Directorships: | |

| Taylor Morrison Home Corp | |

| | |

| Ms. Owen serves as the Company’s President and Chief Executive Officer, a role she has held since August 2018. Prior to joining the Company, she served a 25-year career at Gap Inc., where she most recently acted as Global President of Banana Republic, from 2014 to 2017, leading 11,000 employees in over 600 stores across 27 countries.

Ms. Owen is the only member of Company management on the Board of Directors. She has a diversified skill set that aligns with the strategic direction of MillerKnoll today, ranging from digital and omni-channel transformation to design, development, and supply chain management, making her an important contributor to the Board

|

|

| |

Age 59 President and CEO, and Director since 2018 Ex-officio member of all Board Committees. | |

| | |

| | | |

| | | | | | | | | | | | | | |

Michael R. Smith |

| | | Principal Occupation(s) During Past Five Years: | |

| Executive Vice President and Chief Financial Officer, McCormick & Company, Inc., Since 2016 | |

| | |

| Other Public Directorships: | |

| Church & Dwight Co, Inc. | |

| | |

| Mr. Smith is Executive Vice President and Chief Financial Officer for McCormick & Company, Inc., a publicly-held consumer packaged goods company. Since 2023, Mr. Smith is also responsible for McCormick's Transformation and Technology function with oversight in related areas such as cybersecurity. He is also a member of McCormick’s Management Committee. In July 2024, he was elected as independent director to the Board of Directors of Church & Dwight Co., Inc. and was appointed to serve on their Audit Committee.

Over his 30-year career with McCormick he has served in a variety of financial leadership roles including Senior Vice President Capital Markets and Chief Financial Officer for North America, Chief Financial Officer for EMEA, Vice President Treasury and Investor Relations, and Vice President Finance and Administration for U.S. Consumer Products. Mr. Smith is a certified public accountant and prior to joining McCormick, he began his career at Coopers & Lybrand.

Mr. Smith’s financial leadership in areas including strategic planning, cost management, shared services, and acquisitions provide a critical perspective to management and the Board of Directors. |

|

| |

Age 60 Director since 2021 Board Committees •Audit •Governance and Corporate Responsibility | |

| |

| | | |

| | | | | | | | | | | | | | |

Director Nominations by Shareholders |

|

The Governance and Corporate Responsibility Committee has not received nominations from any of our shareholders in connection with our 2024 Annual Meeting.

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Governance Guidelines

Our Board of Directors is committed to sound and effective corporate governance practices, ethical conduct, and strong oversight of key topics such as enterprise risk management, executive compensation, and cybersecurity, among others. These practices reflect the Board’s long-standing philosophy that a proper structure, appropriate policies and procedures, and reflective cultural factors provide the cornerstone to good governance. The Board documented those practices by adopting our Board Governance Guidelines (the “Guidelines”). These Guidelines address governance philosophy, director responsibilities, the composition of the Board, required Board meetings and materials, and other corporate governance matters. Under the Guidelines, a majority of the members of our Board must qualify as “independent” under the Nasdaq listing rules. Our Guidelines also require the Board to have an Audit Committee, a Compensation Committee, and a Governance and Corporate Responsibility Committee, and that each member of those committees qualifies as an independent director under the Nasdaq listing standards. Our Guidelines are available for review on our website at www.millerknoll.com/investor-relations/corporate-governance/governance-guidelines.

Leadership Structure

The Board believes the roles of Chief Executive Officer (“CEO”) and Chairperson of the Board should normally be separated. However, the Guidelines state that, if the positions are combined, the Board is to closely monitor the performance and working relationship between the CEO/Chairperson and the Board. In addition, if the positions are combined, the Board will establish a Lead Director who is an independent director, has appropriate authority and duties to act as a liaison between directors and the CEO/Chairperson, and chairs meetings of the independent directors. Consistent with our Guidelines, the roles of CEO and Chairperson are currently separate. Mr. Volkema currently serves as Chairman of the Board. As Mr. Volkema is not an employee of the Company, he serves as a non-executive Chairman.

Director Independence

As required by our Guidelines, our Board has determined that each of our directors, other than Ms. Owen, qualifies as an “independent director,” as defined in the Nasdaq listing rules, and that none of those independent directors has a material relationship with the Company outside of their directorship. The Board’s determination was made as a result of its review of a summary of completed individual questionnaires addressing the nature and extent of each member’s relationship with the Company and taking into consideration the definition of “independent director” under the Nasdaq rules. Our Board also determined that each member of the Audit Committee, Compensation Committee, and Governance and Corporate Responsibility Committee meets the independence requirements applicable to those committees as prescribed by the Nasdaq listing rules and, as to the Audit Committee, the applicable rules of the SEC.

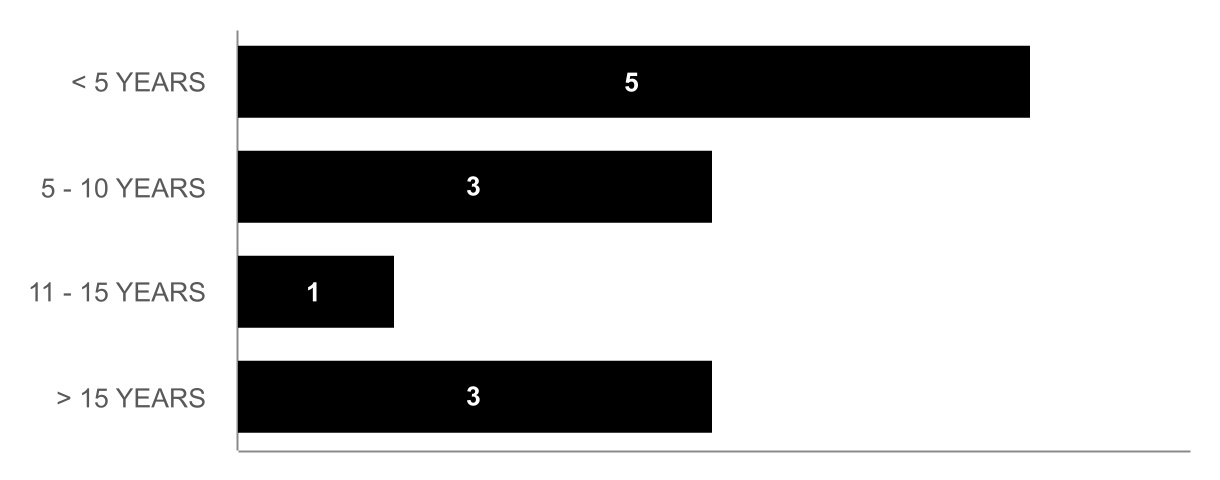

Board Tenure

Including the three directors who were appointed to the Board in July 2024, our directors have an average 9.2 years of tenure on the Board.

Board Diversity

| | | | | | | | | | | | | | | | | | | | |

| Board Diversity Matrix as of August 16, 2024(1) | |

| Board Size | |

| Total Number of Directors | 12 | |

| | Female | Male | Non-Binary | Did Not Disclose | |

| Part I - Gender Identity | |

| Directors | 6 | 6 | — | — | |

| Part II - Demographics Background | |

| African American or Black | 1 | 1 | — | — | |

| Alaskan Native or Native American | — | — | — | — | |

| Asian | 1 | 1 | — | — | |

| Hispanic or Latinx | — | — | — | — | |

| Native Hawaiian or Pacific Islander | — | — | — | — | |

| White | 4 | 4 | — | — | |

| Two or More Races or Ethnicities | — | — | — | — | |

| LGBTQ+ | 0 | |

| Did not disclose demographic background | — | — | — | — | |

(1) To see our Board Diversity Matrix as of August 18, 2023, please see our proxy statement filed with the SEC on September 1, 2023.

The Board’s Role in Risk Oversight

Under the Guidelines, the Board of Directors is responsible for evaluating CEO performance, monitoring succession planning, reviewing the Company’s major financial objectives, evaluating whether the business is being properly managed, and overseeing the processes for maintaining the integrity of the Company with respect to our financial statements, public disclosures, and compliance with laws. The Board has delegated the primary oversight for managing the risk with respect to some of these responsibilities to various Board committees as described in the committee charters.

The following chart outlines our risk management structure and responsibilities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| BOARD OF DIRECTORS Oversees Major Risks | |

| •Business Strategy •Operational | •Financial •Cybersecurity | •Reputation and Brand •Legal and Compliance | •CEO Succession and Compensation | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

|

Audit Committee Primary Risk Oversight

| |

Compensation Committee Primary Risk Oversight

| |

Governance and Corporate Responsibility Committee Primary Risk Oversight

| |

|

•Accounting and Financial Reporting •Internal Controls •Enterprise Risk Management Program •Data Privacy, Information Security and Cybersecurity •Legal and Compliance

| |

•Executive Officer Compensation •Incentive Compensation Programs •Workforce Human Capital Management | |

•Governance Structure and Practices •Board Succession •Shareholder Concerns •Most Environmental, Social, and Governance (“ESG”) Matters

| |

| | | | | | | | | | | | | | | | | |

| MANAGEMENT Key Risk Responsibilities | |

|

•Operations: Identify and Manage Business Risks |

•Corporate Functions: Help Create Risk Framework, Including Defining Boundaries and Monitoring Risk

|

•Internal Audit: Provides Assurance on Internal Controls and Governance Processes | |

| | | | | | | | | | | | | | | | | |

As part of the enterprise risk management process, the Company’s management annually engages in an enterprise risk management process, the key output of which is a series of risk matrices intended to identify and categorize strategic risks. The matrices also identify (1) those members of senior management who are responsible for monitoring each major risk, and (2) whether that risk is reviewed by the Board or a committee of the Board. The development of the matrices is facilitated by our Business Risk Group (the internal audit function of the Company), through discussions with senior management. Management and the Business Risk Group annually review and discuss the risk assessment process, top enterprise risks, and mitigation plans to address the top enterprise risks with the Audit Committee and full Board, as appropriate.

During the past fiscal year, our independent compensation consultant, Pay Governance, reviewed our compensation policies and practices to determine if those policies or practices are reasonably likely to have a material adverse impact on the Company. The Business Risk Group reviewed and agreed with Pay Governance’s report and confirmed the results with the Audit Committee in April 2024. In conducting its review of the compensation plans, the Audit Committee considered both the structure of the compensation plans and the presence of risk-mitigating features such as multi-year earning requirements, vesting provisions, and clawback provisions. Based on the evaluation, the Audit Committee agreed with management’s determination that our compensation policies and practices are not reasonably likely to have a material adverse effect on the Company.

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics that applies to all our employees, officers, and directors. This code is posted on our website at www.millerknoll.com/legal/code-of-business-conduct-and-ethics. Any changes to or waivers of the code involving any financial officer, executive officer, or member of our Board must be approved by the Board of Directors or the Governance and Corporate Responsibility Committee of the Board. If we are required by SEC rules to publicly disclose any such changes or waivers, we intend to do so on our website, millerknoll.com/investor-relations. The code was last materially modified in July 2021. The code is reviewed annually; there were no modifications to, or waivers of, the code in fiscal 2024. The code meets the requirements of the Nasdaq listing rules.

Insider Trading Policy

The Company has adopted an insider trading policy governing the purchase, sale, and/or other disposition of its securities by its directors, officers, employees, and other covered persons. The Company believes this policy is reasonably designed to promote compliance with insider trading laws, rules, and regulations, and the exchange listing standards applicable to the Company. A copy of this policy is filed as an exhibit to our Annual Report on Form 10-K for fiscal 2024.

Meeting Attendance

Each of our directors is expected to attend all meetings of the Board and applicable Committee meetings. Directors are encouraged to join the webcast for the Annual Meeting of Shareholders and all of our then-current directors did so for our 2023 Annual Meeting. During fiscal 2024, the Board held four meetings, and each director attended more than 80% of the aggregate number of meetings of our Board and the Board Committees on which they served. Consistent with the requirements of our Guidelines, the independent members of our Board met in executive sessions without the presence of management after each regularly scheduled Board meeting.

Communications with the Board

Shareholders and other parties interested in communicating directly with one or more of our directors may do so by writing to Corporate Secretary of the Company, MillerKnoll, Inc., 855 East Main Avenue, PO Box 302, Zeeland, Michigan 49464-0302. The Corporate Secretary will forward all relevant correspondence to the director or directors to whom the communication is directed.

Director Nominations

Our Bylaws contain certain procedural requirements applicable to shareholder nominations of directors. A summary of those requirements is set forth below, but shareholders should review our Bylaws for additional details.

Shareholders may nominate a person to serve as a director if they provide written notice to us not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the first anniversary of the preceding year’s Annual Meeting of Shareholders. However, if the date of the Annual Meeting of Shareholders is more than 30 days before or more than 60 days after such anniversary date, notice by the shareholder must be received not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the date of such Annual Meeting of Shareholders or, if the first public announcement of the date of such Annual Meeting of Shareholders is less than 100 days prior to the date of such meeting, the 10th day following the day on which public announcement of the date of such meeting is first made by the Company. With respect to an election to be held at a special meeting of shareholders called for that purpose, written notice must be provided not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the date of such special meeting or, if the first public announcement of the date of such special meeting is less than 100 days prior to the date of such special meeting, the 10th day following the day on which public announcement of the date of such meeting is first made by the Company.

The notice must include certain detailed information regarding the shareholder giving the notice as well as the proposed nominee. Please refer to our Bylaws for the detailed information that must be included in the notice. The shareholder must also deliver to the Company reasonable evidence that the shareholder has complied with the requirements of Rule 14a-19 of the Securities Exchange Act of 1934 (the “Exchange Act”) and such other information as may be reasonably required by the Company or the Board of Directors to, among other things, determine the eligibility of such nominee to serve as a director of the Company.

Our Governance and Corporate Responsibility Committee is responsible for reviewing the qualifications and independence of the members of the Board. To meet the needs of the Company in a rapidly changing environment, the Guidelines explain that the Company requires a high-performing Board of Directors whose members meet the specific resource needs of the business and possess the necessary skills and expertise determined to support our business. To that end, the Governance and Corporate Responsibility Committee considers a number of factors it deems appropriate when considering candidates for the Board. Such factors may include experience and knowledge of the Company’s history and culture; technical experience and backgrounds such as manufacturing, design, marketing, technology, finance, management structure, and philosophy; experience as a senior executive of a public company; and diversity, which may include but not be limited to diversity of gender, ethnicity, age, neurodiversity, geographic origin, and diversity reflecting our employees, the communities we serve, and our customers. The Governance and Corporate Responsibility Committee may also consider experience in a variety of industries in annually assessing and reviewing the current slate of directors and potential director candidates as the need arises. The Governance and Corporate Responsibility Committee is responsible for assessing the appropriate skills and characteristics required of Board members. These factors, and others as considered useful by the Governance and Corporate Responsibility Committee or the Board, are reviewed in the context of an assessment of the perceived needs of the Board at a particular point in time.

A shareholder may also make a recommendation to the Governance and Corporate Responsibility Committee regarding any individual that the shareholder desires the Committee to consider for possible nomination as a candidate for election to the Board. The Board evaluates all candidates, including those that shareholders recommend, in the same manner and under the same standards.

Under our Bylaws and Guidelines, no person may be elected as a director after he or she attains age 72, and a director who attains age 72 while in office is required to tender his or her written resignation, which resignation shall be effective as of (or no later than) the Annual Meeting of Shareholders at or immediately after such person attains age 72.

Non-Employee Director Compensation

The Director Compensation for Fiscal 2024 table presented below provides information on the compensation of each director for fiscal 2024. The standard annual compensation of each director is $230,000. The Audit Committee Chair receives an additional $20,000, and the Chairs of the Compensation Committee and the Governance and Corporate Responsibility Committee each receive an additional $15,000. The Chairperson of the Board of Directors receives additional annual compensation of $120,000 and is eligible to participate in the Company’s health insurance plan. Ms. Owen, the Company’s President and CEO, does not receive any additional compensation for serving on the Board of Directors.

In 2024, the annual compensation and any chairperson fees or additional fees (collectively, the “Annual Fee”) was payable by one or more of the following forms, as selected by each director: (1) in cash, (2) in Company shares valued as of January 15, (3) in stock options valued as of January 15 under the Black-Scholes model, (4) in deferred cash or deferred restricted stock units under the Amended and Restated MillerKnoll, Inc. Director Deferred Compensation Plan (the “Director Deferred Compensation Plan”) described below, (5) as a contribution to the MillerKnoll Educational Scholarship Fund, or (6) as a contribution to the MillerKnoll Global Associate Relief Fund. Each director’s selection is subject to the requirement described under “Annual Fees - Minimum Equity Component” below.

Annual Fees - Minimum Equity Component

At least 50% of each director’s Annual Fee must be elected in one or more of the permissible forms of equity, which includes direct issuance of shares, deferred stock units issued under the Deferred Compensation Plan described below, or stock options to purchase shares of our stock. Subject to certain exceptions, options are fully vested upon grant and expire 10 years after the date of the grant. The option price is payable upon exercise in cash or, subject to certain limitations, in shares of our stock already owned by the optionee or in a combination of shares and cash.

Deferred Compensation

The Director Deferred Compensation Plan allows non-employee directors of the Company to defer a portion of their annual director fees in either a deferred cash account or in deferred restricted stock units.

In the deferred cash account, each account is credited with a number of units equal to a number of shares of the investment selected by the director in certain investment options which do not include Company stock. The initial value of the deferral is equal to the dollar amount of the deferral, divided by the per share fair market value of the selected investment at the time of the deferral. The units are credited with any dividends paid on the investment. The Company maintains a Rabbi Trust to fund its obligations under this plan.

If elected, deferred restricted stock units are credited to the director in a separate deferred stock account with each unit representing one equivalent share of the Company’s common stock to be issued after the deferral period. The deferred restricted stock units are valued at the market price of the Company’s common stock on the date of grant, and the value of the units credited are expensed on the date of grant. Each time a dividend is paid on the Company’s common stock, the director is credited with additional deferred restricted stock units in proportion to the amount of the dividend. At the time(s) specified by the director for receipt of this deferred compensation, these deferred amounts will be paid to the director in shares of the Company’s common stock. The units do not entitle the directors to the rights of holders of common stock, such as voting rights, until shares are issued.

Stock Ownership Guidelines

Director stock ownership guidelines have been in effect since 1997. These guidelines, like those applicable to management, are intended to reinforce the importance of linking shareholder and director interests. It is the policy of the Board that all directors, consistent with their responsibilities to our shareholders, hold an equity interest in the Company. Toward this end, the Board requires that each director have an equity interest after one year on the Board, and the Board encourages each director within five years after joining the Board to have shares of common stock or options for common stock of the Company with a value of at least five times the amount of the annual cash retainer paid to each director.

Other

Directors are reimbursed for travel and other necessary business expenses incurred in the performance of their services for the Company, and they are covered under our business travel insurance policies and the Director and Officer Liability Insurance Policy.

Perquisites

Some directors’ spouses or partners accompany them to attend Board meetings. The Company pays for their expenses, as well as some amenities for the directors and their spouses or partners, including some meals and social events. The total of these perquisites is less than $10,000 per director per year. Directors are approved to purchase Company

products under employee discount pricing. Except where noted in the table footnotes below, the value of this perquisite was less than $10,000 for all directors.

Director Compensation for Fiscal 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash ($)(1) | | Stock Awards ($)(2) | | All Other Compensation ($)(3) | | Total ($) |

| Douglas D. French | | 115,000 | | | 115,000 | | | 0 | | | 230,000 | |

| | | | | | | | |

| John R. Hoke III | | 110,250 | | | 134,750 | | | 0 | | | 245,000 | |

| Lisa A. Kro | | 125,000 | | | 125,000 | | | 0 | | | 250,000 | |

| Heidi J. Manheimer | | 112,700 | | | 117,300 | | | 0 | | | 230,000 | |

| Candace S. Matthews | | 57,500 | | | 172,500 | | | 0 | | | 230,000 | |

| Michael C. Smith | | 110,250 | | | 134,750 | | | 0 | | | 245,000 | |