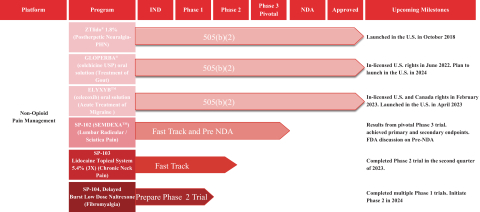

Our Marketed Product and Pipeline

The following chart illustrates our current commercial products and novel product candidates, for which we have worldwide commercialization rights, except with respect to Japan for ZTlido and SP-103.

Our principal executive offices are located at 960 San Antonio Road, Palo Alto, California 94303, and our telephone number is (650) 516-4310. For additional information about us, please see the sections of this prospectus titled “Business” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

See the section of this prospectus titled “Risk Factors” in this prospectus for a discussion of some of the risks related to the execution of our business strategy.

Business Combination

On November 10, 2022 (the “Closing Date”), Vickers consummated the previously announced Business Combination pursuant to the terms of the Merger Agreement, by and among Vickers, Merger Sub and Legacy Scilex.

Pursuant to the Merger Agreement, (i) prior to the Closing, Vickers changed its jurisdiction of incorporation by deregistering as a Cayman Islands exempted company and continuing and domesticating as a corporation incorporated under the laws of the State of Delaware (the “Domestication”) and (ii) at the Closing, and following the Domestication, Merger Sub merged with and into Legacy Scilex (the “Merger”), with Legacy Scilex as the surviving company in the Merger, and, after giving effect to such Merger, Legacy Scilex became a wholly owned subsidiary of Vickers. The Merger was approved by Vickers’s shareholders at a meeting held on November 9, 2022. In connection with the Business Combination, Vickers changed its name to “Scilex Holding Company.”

In accordance with the terms and subject to the conditions of the Merger Agreement, at the Effective Time, (i) each outstanding share of Legacy Scilex Common Stock outstanding immediately prior to the Effective Time was automatically cancelled in exchange for the right to receive 0.673498 shares of our Common Stock, (ii) each share of Legacy Scilex Preferred Stock outstanding immediately prior to the Effective Time was cancelled in exchange for the right to receive (a) one share of Series A Preferred Stock and (b) one-tenth of one share of our Common Stock, and (iii) each option to purchase shares of Legacy Scilex Common Stock outstanding as of immediately prior to the Effective Time was converted into the right to receive a comparable option to purchase shares of our Common Stock.

3