EX-99.38

Exhibit 99.38

Notice to Reader

Re: Akumin Inc.

Please be advised that the audited consolidated financial statements of Akumin Inc. as at and for the year ended December 31, 2018 were corrected for an error relating to the classification of cash flows.

As described in note 13, during 2018 the Company acquired all of the outstanding non-controlling interests in seven of its existing Texas based diagnostic

imaging centres. Previously, the “Acquisition of non-controlling interests” line was incorrectly presented under the Investing activities category instead of the Financing activities category within the consolidated statements of cash

flow for the year ended December 31, 2018.

The

error did not impact the consolidated balance sheets, consolidated statements of operations and comprehensive income (loss) or changes in equity. Operating cash flow and increase in cash during the period were not impacted. Basic and diluted

earnings per share were not impacted.

Akumin Inc.

Consolidated Financial Statements (Restated)

December 31, 2018

(expressed in US dollars unless otherwise stated)

Akumin Inc.

Table of Contents

Independent

auditor’s report

To the Shareholders of Akumin Inc.

Our opinion

In our opinion, the accompanying consolidated financial statements present fairly, in all material respects, the financial position of Akumin Inc.

and its subsidiaries (together, the Company) as at December 31, 2018 and 2017, and its financial performance and its cash flows for the year ended December 31, 2018 and the fifteen-month period ended December 31, 2017 in accordance with

International Financial Reporting Standards as issued by the International Accounting Standards Board (IFRS).

What we

have audited

The Company’s consolidated financial statements comprise:

|

· |

the consolidated balance sheets as at December 31, 2018 and 2017; |

|

· |

the consolidated statements of net income (loss) and comprehensive income (loss) for the year ended December 31, 2018 and the fifteen-month

period ended December 31, 2017; |

|

· |

the consolidated statements of changes in equity for the year ended December 31, 2018 and the fifteen-month period ended December 31,

2017; |

|

· |

the consolidated statements of cash flows for the year ended December 31, 2018 and the fifteen-month period ended December 31, 2017;

and |

|

· |

the notes to the consolidated financial statements, which include a summary of significant accounting policies. |

Basis for opinion

We conducted our audit in accordance with Canadian generally accepted

auditing standards. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the consolidated financial

statements section of our report.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Independence

We are independent of the Company in accordance with the ethical requirements that are relevant to our audit of the consolidated financial

statements in Canada. We have fulfilled our other ethical responsibilities in accordance with these requirements.

Emphasis of matter

We draw attention to Note 2 to the consolidated financial statements, which explains that the consolidated financial statements for the year ended

December 31, 2018 has been restated from those on which we originally reported on March 28, 2019. Our opinion is not modified in respect of this matter.

PricewaterhouseCoopers LLP

PwC Tower, 18 York Street, Suite 2600, Toronto, Ontario, Canada M5J 0B2

T: +1 416 863 1133, F: +1 416 365 8215

“PwC” refers to PricewaterhouseCoopers LLP, an

Ontario limited liability partnership.

Other information

Management is responsible for the other information. The other information comprises the Management’s Discussion and Analysis.

Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of assurance

conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other

information identified above and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially

misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we

are required to report that fact. We have nothing to report in this regard.

Responsibilities of management and those charged with governance for

the consolidated financial statements

Management is responsible for the preparation and fair presentation of the consolidated

financial statements in accordance with IFRS, and for such internal control as management determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or

error.

In preparing the consolidated financial statements, management is responsible for assessing the Company’s ability to

continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless management either intends to liquidate the Company or to cease operations, or has no realistic

alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting

process.

Auditor’s responsibilities for the audit of the consolidated financial

statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free

from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with

Canadian generally accepted auditing standards will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected

to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in

accordance with Canadian generally accepted auditing standards, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

|

· |

Identify and assess the risks of material misstatement of the consolidated financial statements, whether due to fraud or error, design and

perform audit procedures responsive to those risks, and obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement resulting from fraud is higher than for one

resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. |

|

· |

Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the

circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control. |

|

· |

Evaluate the appropriateness of accounting policies used and the reasonableness of accounting estimates and related disclosures made by

management. |

|

· |

Conclude on the appropriateness of management’s use of the going concern basis of accounting and, based on the audit evidence obtained, whether a material

uncertainty exists related to events or conditions that may cast significant doubt on the Company’s ability to continue as a going concern. If we conclude that a material uncertainty exists, we are required to draw attention in our

auditor’s report to the related disclosures in the consolidated financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our auditor’s

report. However, future events or conditions may cause the Company to cease to continue as a going concern. |

|

· |

Evaluate the overall presentation, structure and content of the consolidated financial statements, including the disclosures, and whether the

consolidated financial statements represent the underlying transactions and events in a manner that achieves fair presentation. |

|

· |

Obtain sufficient appropriate audit evidence regarding the financial information of the entities or business activities within the Company to

express an opinion on the consolidated financial statements. We are responsible for the direction, supervision and performance of the group audit. We remain solely responsible for our audit opinion. |

We communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit and significant

audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide those

charged with governance with a statement that we have complied with relevant ethical requirements regarding independence, and to communicate with them all relationships and other matters that may reasonably be thought to bear on our independence,

and where applicable, related safeguards.

The engagement partner on the audit resulting in this independent auditor’s report is

Jennifer Psutka.

(Signed)

“PricewaterhouseCoopers LLP”

Chartered

Professional Accountants, Licensed Public Accountants

Toronto, Ontario

November 13, 2019

Akumin Inc.

Consolidated Balance Sheets

| |

|

|

|

|

|

|

| (expressed in US dollars unless otherwise stated) |

|

|

|

|

|

|

| |

|

December 31,

2018 |

|

|

December 31,

2017 |

|

| |

|

$ |

|

|

$ |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash |

|

|

19,326,412 |

|

|

|

12,145,481 |

|

| Accounts receivable (note 4) |

|

|

29,810,501 |

|

|

|

12,968,010 |

|

| Prepaid expenses and other current assets |

|

|

1,049,285 |

|

|

|

381,144 |

|

| |

|

|

50,186,198 |

|

|

|

25,494,635 |

|

| Security deposits and other assets |

|

|

815,450 |

|

|

|

209,335 |

|

| Property and equipment (note 5) |

|

|

55,567,588 |

|

|

|

42,002,927 |

|

| Goodwill (notes 3 and 7) |

|

|

130,539,869 |

|

|

|

100,777,451 |

|

| Intangible assets (note 6) |

|

|

3,668,596 |

|

|

|

2,264,041 |

|

| |

|

|

240,777,701 |

|

|

|

170,748,389 |

|

| Liabilities |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts payable and accrued liabilities (note 8) |

|

|

16,865,477 |

|

|

|

14,578,538 |

|

| Finance leases (note 9) |

|

|

851,183 |

|

|

|

528,895 |

|

| Senior loans payable (notes 10 and 11) |

|

|

2,867,167 |

|

|

|

3,016,958 |

|

| |

|

|

20,583,827 |

|

|

|

18,124,391 |

|

| Finance leases (note 9) |

|

|

3,325,832 |

|

|

|

2,062,103 |

|

| Senior loans payable (notes 10 and 11) |

|

|

108,801,431 |

|

|

|

70,156,708 |

|

| Subordinated notes payable (note 12) |

|

|

1,492,233 |

|

|

|

— |

|

| Subordinated notes payable – earn-out (note 12) |

|

|

169,642 |

|

|

|

— |

|

| |

|

|

134,372,965 |

|

|

|

90,343,202 |

|

| Shareholders’ Equity |

|

|

|

|

|

|

|

|

| Common shares (note 13) |

|

|

123,746,423 |

|

|

|

83,771,904 |

|

| Warrants (note 13) |

|

|

1,742,910 |

|

|

|

1,310,661 |

|

| Contributed surplus (notes 13 and 16) |

|

|

5,088,376 |

|

|

|

2,205,784 |

|

| Deficit |

|

|

(26,640,173 |

) |

|

|

(13,223,745 |

) |

| Equity attributable to shareholders of Akumin Inc. |

|

|

103,937,536 |

|

|

|

74,064,604 |

|

| Non-controlling interests (note 23) |

|

|

2,467,200 |

|

|

|

6,340,583 |

|

| |

|

|

106,404,736 |

|

|

|

80,405,187 |

|

| |

|

|

240,777,701 |

|

|

|

170,748,389 |

|

Commitments and

contingencies (note 15)

Subsequent events (note 24)

| Approved by the Board of Directors |

|

|

|

| “(signed) Riadh Zine” |

Director |

“(signed) Thomas Davies” |

Director |

| The accompanying notes are an integral part of these consolidated financial statements. |

Akumin Inc.

Consolidated Statements of Net Income (Loss) and Comprehensive Income

(Loss)

| (expressed in US dollars unless otherwise stated) |

|

|

|

|

|

|

| |

|

|

|

|

Fifteen-month |

|

| |

|

Year ended

December 31,

2018

$ |

|

|

period ended

December 31,

2017

$ |

|

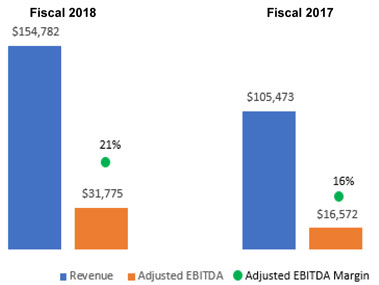

| Revenue |

|

|

|

|

|

|

|

|

| Service fees – net of allowances and discounts |

|

|

152,012,831 |

|

|

|

102,217,457 |

|

| Other revenue |

|

|

2,769,236 |

|

|

|

3,255,971 |

|

| |

|

|

154,782,067 |

|

|

|

105,473,428 |

|

| |

|

|

|

|

|

|

|

|

| Expenses |

|

|

|

|

|

|

|

|

| Employee compensation |

|

|

57,653,048 |

|

|

|

38,467,730 |

|

| Reading fees |

|

|

20,560,092 |

|

|

|

15,582,202 |

|

| Rent and utilities |

|

|

16,435,169 |

|

|

|

12,986,924 |

|

| Third party services and professional fees |

|

|

11,300,654 |

|

|

|

8,831,940 |

|

| Administrative |

|

|

8,767,662 |

|

|

|

5,776,156 |

|

| Medical supplies and other |

|

|

5,716,480 |

|

|

|

5,100,635 |

|

| Depreciation and amortization (notes 5 and 6) |

|

|

9,852,034 |

|

|

|

6,480,341 |

|

| Stock-based compensation (notes 13 and 16) |

|

|

5,702,395 |

|

|

|

3,242,224 |

|

| Interest expense (notes 9, 10, 11 and 12) |

|

|

5,979,035 |

|

|

|

5,375,865 |

|

| Impairment of property and equipment (note 5) |

|

|

642,681 |

|

|

|

600,890 |

|

| Settlement costs (recoveries) |

|

|

43,029 |

|

|

|

(191,500 |

) |

| Provisions |

|

|

— |

|

|

|

725,000 |

|

| Acquisition related costs |

|

|

2,425,577 |

|

|

|

4,256,271 |

|

| Public offering costs |

|

|

813,545 |

|

|

|

1,520,117 |

|

| Financial instruments revaluation, unrealized foreign exchange loss and other (gains) losses (note 22) |

|

|

2,843,262 |

|

|

|

2,943,621 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

148,734,663 |

|

|

|

111,698,416 |

|

| |

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

|

|

6,047,404 |

|

|

|

(6,224,988 |

) |

| |

|

|

|

|

|

|

|

|

| Income tax provision (recovery) (note 14) |

|

|

(1,526,534 |

) |

|

|

123,561 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) and comprehensive income (loss) for the period |

|

|

7,573,938 |

|

|

|

(6,348,549 |

) |

| |

|

|

|

|

|

|

|

|

| Non-controlling interests (note 23) |

|

|

2,574,137 |

|

|

|

2,155,445 |

|

| |

|

|

|

|

|

|

|

|

| Net income (loss) attributable to common shareholders |

|

|

4,999,801 |

|

|

|

(8,503,994 |

) |

| |

|

|

|

|

|

|

|

|

| Net income (loss) per share (note 21) |

|

|

|

|

|

|

|

|

| Basic |

|

|

0.09 |

|

|

|

(0.27 |

) |

| Diluted |

|

|

0.08 |

|

|

|

(0.27 |

) |

| |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial

statements.

Akumin Inc.

Consolidated Statements of Changes in Equity

| (expressed in US dollars unless otherwise stated) |

| |

|

Common

shares

$ |

|

|

Warrants

$ |

|

|

Contributed

surplus

$ |

|

|

Deficit

$ |

|

|

Non-

controlling

interest

$ |

|

|

Total

equity

$ |

|

| Balance as at September 30, 2016 |

|

|

11,004,683 |

|

|

|

475,180 |

|

|

|

713,560 |

|

|

|

(4,719,751 |

) |

|

|

— |

|

|

|

7,473,672 |

|

| Acquisition of non-controlling interests (business combinations) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

7,699,222 |

|

|

|

7,699,222 |

|

| Net loss and comprehensive loss for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(8,503,994 |

) |

|

|

2,155,445 |

|

|

|

(6,348,549 |

) |

| Issuance of common shares – net of issuance costs |

|

|

24,925,041 |

|

|

|

— |

|

|

|

1,750,000 |

|

|

|

— |

|

|

|

— |

|

|

|

26,675,041 |

|

| RSUs and warrants exercised |

|

|

38,441,229 |

|

|

|

(34,261,229 |

) |

|

|

(3,500,000 |

) |

|

|

— |

|

|

|

— |

|

|

|

680,000 |

|

| Issuance of warrants |

|

|

— |

|

|

|

35,096,710 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

35,096,710 |

|

| Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

3,242,224 |

|

|

|

— |

|

|

|

— |

|

|

|

3,242,224 |

|

| Conversion of subordinated notes payable |

|

|

9,400,951 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

9,400,951 |

|

| Payment to non-controlling interests |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,514,084 |

) |

|

|

(3,514,084 |

) |

| Balance as at December 31, 2017 |

|

|

83,771,904 |

|

|

|

1,310,661 |

|

|

|

2,205,784 |

|

|

|

(13,223,745 |

) |

|

|

6,340,583 |

|

|

|

80,405,187 |

|

| Acquisition of non-controlling interests (note 13) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(18,416,229 |

) |

|

|

(3,074,267 |

) |

|

|

(21,490,496 |

) |

| Net income and comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,999,801 |

|

|

|

2,574,137 |

|

|

|

7,573,938 |

|

| Issuance of common shares – net of issuance costs (note 13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisition consideration |

|

|

3,709,588 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,709,588 |

|

| Public offering |

|

|

32,444,362 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

32,444,362 |

|

| RSUs and warrants exercised (note 13) |

|

|

3,820,569 |

|

|

|

(302,130 |

) |

|

|

(2,819,803 |

) |

|

|

— |

|

|

|

— |

|

|

|

698,636 |

|

| Issuance of warrants (note 13) |

|

|

— |

|

|

|

734,379 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

734,379 |

|

| Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

5,702,395 |

|

|

|

— |

|

|

|

— |

|

|

|

5,702,395 |

|

| Payment to non-controlling interests (note 23) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,373,253 |

) |

|

|

(3,373,253 |

) |

| Balance as at December 31, 2018 |

|

|

123,746,423 |

|

|

|

1,742,910 |

|

|

|

5,088,376 |

|

|

|

(26,640,173 |

) |

|

|

2,467,200 |

|

|

|

106,404,736 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated financial statements.

Akumin Inc.

Consolidated Statements of Cash Flows (Restated)

| (expressed in US dollars unless otherwise stated) |

|

|

|

|

|

|

| |

|

Year ended

December 31,

2018

$ |

|

|

Fifteen-month

period ended

December 31,

2017

$ |

|

| |

|

(restated – |

|

|

|

|

| |

|

note 2) |

|

|

|

|

| Cash flows provided by (used in) |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income (loss) for the period |

|

|

7,573,938 |

|

|

|

(6,348,549 |

) |

| Adjustments for |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

9,852,034 |

|

|

|

6,480,341 |

|

| Stock-based compensation (notes 13 and 16) |

|

|

5,702,395 |

|

|

|

3,242,224 |

|

| Impairment of property and equipment |

|

|

642,681 |

|

|

|

600,890 |

|

| Interest expense – accretion of debt |

|

|

591,191 |

|

|

|

1,133,963 |

|

| Deferred income tax recovery |

|

|

(1,755,083 |

) |

|

|

— |

|

| Financial instruments revaluation, unrealized foreign exchange loss and other (gains) losses |

|

|

2,843,262 |

|

|

|

2,943,621 |

|

| Changes in non-cash working capital |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

(15,523,343 |

) |

|

|

(3,422,908 |

) |

| Prepaid expenses, security deposits and other assets |

|

|

(1,048,918 |

) |

|

|

173,245 |

|

| Provisions |

|

|

— |

|

|

|

(1,932,360 |

) |

| Accounts payable and accrued liabilities |

|

|

(2,459,457 |

) |

|

|

2,902,315 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

6,418,700 |

|

|

|

5,772,782 |

|

| |

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Property and equipment and intangible assets |

|

|

(9,739,344 |

) |

|

|

(5,183,928 |

) |

| Business acquisitions – net of cash acquired (note 3) |

|

|

(35,310,993 |

) |

|

|

(76,307,639 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

(45,050,337 |

) |

|

|

(81,491,567 |

) |

| |

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Loan proceeds (note 10) |

|

|

111,900,000 |

|

|

|

46,759,883 |

|

| Loan repayments (notes 10 and 11) |

|

|

(76,043,474 |

) |

|

|

(1,538,510 |

) |

| Issuance costs – loans |

|

|

(2,211,914 |

) |

|

|

(3,033,591 |

) |

| Finance leases – net |

|

|

(555,259 |

) |

|

|

(509,248 |

) |

| Capital stock (note 13) |

|

|

|

|

|

|

|

|

| Special warrants |

|

|

— |

|

|

|

34,797,004 |

|

| Common shares |

|

|

35,698,637 |

|

|

|

11,176,600 |

|

| Equity issuance costs |

|

|

(1,821,260 |

) |

|

|

(3,521,851 |

) |

| Acquisition of non-controlling interests |

|

|

(17,780,909 |

) |

|

|

— |

|

| Payment to non-controlling interests |

|

|

(3,373,253 |

) |

|

|

(3,514,084 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

45,812,568 |

|

|

|

80,616,203 |

|

| |

|

|

|

|

|

|

|

|

| Increase in cash during the period |

|

|

7,180,931 |

|

|

|

4,897,418 |

|

| |

|

|

|

|

|

|

|

|

| Cash – Beginning of period |

|

|

12,145,481 |

|

|

|

7,248,063 |

|

| |

|

|

|

|

|

|

|

|

| Cash – End of period |

|

|

19,326,412 |

|

|

|

12,145,481 |

|

| |

|

|

|

|

|

|

|

|

| Supplementary information |

|

|

|

|

|

|

|

|

| Interest expense paid |

|

|

5,386,688 |

|

|

|

4,249,205 |

|

| Income taxes paid |

|

|

329,562 |

|

|

|

24,481 |

|

| |

|

|

|

|

|

|

|

|

The accompanying notes are an integral part of these consolidated

financial statements.

Akumin Inc.

Notes to Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

|

1 |

Presentation of consolidated financial statements and nature of operations |

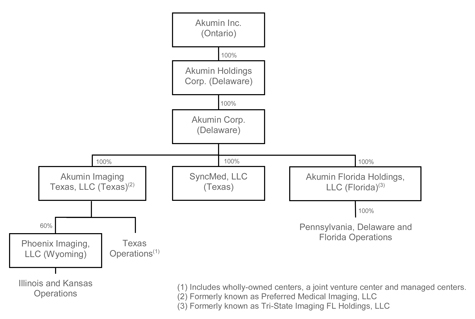

The operations of Akumin Inc. (Akumin or the Company) and its Subsidiaries (defined below) primarily consist of operating outpatient diagnostic

imaging centres located in Florida, Delaware, Pennsylvania, Texas, Illinois and Kansas. Substantially all of the centres operated by Akumin were obtained through acquisition. Related to its imaging centre operations, Akumin also operates a medical

equipment business, SyncMed, LLC, which provides maintenance services to Akumin’s imaging centres in Texas, Illinois and Kansas and a billing and revenue cycle management business, Rev Flo, Inc., whose operations were merged into

Akumin’s wholly owned subsidiary, Akumin Corp. on December 31, 2018.

The services offered by the Company (through the Subsidiaries) include magnetic resonance imaging (MRI), computed tomography (CT), positron

emission tomography (PET), nuclear medicine, mammography, ultrasound, digital radiography (X-ray), fluoroscopy and other related procedures.

The Company has a diverse mix of payers, including private, managed care

capitated and government payers.

The registered and head office of Akumin is located at 151 Bloor Street West, Suite 603, Toronto, Ontario, M5S 1S4. All operating activities are conducted through its wholly owned US subsidiary, Akumin Holdings Corp. and the

wholly owned subsidiaries of Akumin Holdings Corp., namely, Akumin Corp., Akumin Florida Holdings, LLC, formerly known as Tri-State Imaging FL Holdings, LLC (FL Holdings), Akumin Imaging Texas, LLC, formerly known as Preferred Medical Imaging, LLC

(PMI), SyncMed and Akumin FL, LLC (Akumin FL) (collectively, the Subsidiaries), all of which are located in the United States.

|

2 |

Summary of significant accounting policies |

The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (IFRS) as issued by the

International Accounting Standards Board (IASB).

The significant accounting policies described below have been applied

consistently to all periods presented. Certain comparative information has been reclassified to conform with the presentation adopted in the current fiscal period.

During September 2017, the Company changed its reporting year-end from September 30 to December 31. As a result, during the transitional

year, the consolidated financial statements were presented for the fifteen-month period ended December 31, 2017.

These

consolidated financial statements were approved by the Board of Directors (the Board) and authorized for issue by the Board on November 13, 2019.

Basis of presentation

The consolidated financial statements include all

of the accounts of the Company and the Subsidiaries. All intercompany transactions and balances have been eliminated on consolidation.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Functional and reporting currency and foreign currency translation

The

functional and reporting currency of the Company and the Subsidiaries is US dollars. Monetary assets and liabilities denominated in foreign currencies are translated into US dollars at the rates of exchange prevailing at the consolidated balance

sheet dates. Non-monetary assets and liabilities are translated at rates prevailing at the dates of acquisition. Revenues and expenses are translated at the average rate of exchange in effect during the month the transaction occurred. All exchange

gains and losses are recognized in the current year’s earnings.

Cash

Cash includes cash on hand and cash held with banks.

Property and equipment

Property and equipment are recorded at cost and are depreciated over their estimated useful lives using the declining balance method,

unless stated otherwise, as follows:

| Medical equipment and equipment under finance leases |

20% |

| Computer and office equipment |

30% |

| Furniture and fittings |

15% |

| Leasehold improvements |

straight-line over |

| |

term of lease |

Expenditures for maintenance and repairs are charged to operations as incurred. Operating lease buyouts and significant upgrades are

capitalized.

Intangible assets

The Company classifies intangible assets, obtained through acquisitions or developed internally, as definite lived. Intangible assets consist

of software costs, trade name and covenants not to compete; these intangible assets are recorded at cost and are amortized over their estimated useful lives, using the declining balance method, unless stated otherwise, as follows:

| Software costs and trade name |

20% |

| Covenant not to compete |

straight-line over |

| |

term of contract |

| |

|

The

Company reviews the appropriateness of the amortization period related to the definite lived intangible assets annually.

Goodwill

Goodwill is recognized as the fair value of the consideration

transferred, less the fair value of the net identifiable assets acquired and liabilities assumed, as at the acquisition date. Subsequent to initial recognition, goodwill is measured at cost less accumulated impairment losses. Goodwill acquired in

business combinations is allocated to groups of cash generating units (CGUs) that are expected to benefit from the synergies of the combination. The determination of CGUs and the level at which goodwill is monitored requires judgment by management.

The Company’s CGUs generally represent individual business units below the level of the Company’s operating segment. Goodwill is tested annually for impairment as at October 1 by comparing the carrying value of the CGUs against the

recoverable amount (higher of value in use and fair value less costs to sell).

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Impairment of long-lived assets

The Company assesses, at each reporting

date, whether there is an indication that a long-lived asset may be impaired. If any indication exists, the Company estimates the recoverable amount. For the purpose of impairment testing, assets that cannot be tested individually are grouped

together into the smallest group of assets that generates cash inflows from continuing use that are largely independent of the cash inflows of other CGUs. The recoverable amount of an asset or a CGU is the higher of its fair value, less costs to

sell, and its value in use.

Fair value less costs to sell is the amount obtainable from the sale of an asset or CGU in an arm’s

length transaction between knowledgeable, willing parties, less the costs to sell. Costs of disposal are incremental costs directly attributable to the disposal of an asset and income tax expense.

In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that

reflects current market assessments of the time value of money and the risks specific to the asset or CGU.

If the carrying amount of

an asset or CGU exceeds its recoverable amount, an impairment charge is recognized immediately in the consolidated statements of net income (loss) and comprehensive income (loss) by the amount by which the carrying amount of the asset or CGU exceeds

the recoverable amount. Where an impairment loss subsequently reverses, the carrying amount of the asset or CGU is increased to the lesser of the revised estimate of the recoverable amount, and the carrying amount that would have been recorded had

no impairment loss been recognized previously.

Segment reporting

Operating segments are reported in a manner consistent with the internal reporting provided to the chief operating decision maker. The

chief operating decision maker, who is responsible for allocating resources and assessing performance of the operating segments, has been identified as the Chief Executive Officer. The Company has one reportable segment, which is outpatient

diagnostic imaging services.

Revenue recognition

The Company adopted IFRS 15, Revenue from Contracts with Customers (IFRS 15), as at January 1, 2018, with full retrospective application. Service

fee revenue, net of contractual allowances and discounts, consists of net patient fees received from various payers and patients based mainly on established contractual billing rates, less allowances for contractual adjustments and discounts and

allowances. This service fee revenue is primarily comprised of fees for the use of the Company’s diagnostic imaging equipment and provision of medical supplies.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Service fee

revenue is recorded during the period in which the Company’s performance obligations are satisfied, based on the estimated collectible amounts from the patients and third party payers. The Company’s performance obligations are satisfied

when services are rendered to the patient. Third party payers include federal and state agencies (under the Medicare and Medicaid programs), managed care health plans, commercial insurance companies and employers. Estimates of contractual allowances

are based on the payment terms specified in the related contractual agreements. A provision for credit losses is also recorded in accordance with IFRS 9. The Company regularly attempts to estimate its expected reimbursement for patients based on the

applicable contract terms. The Company believes its review process enables it to identify instances on a timely basis where such estimates need to be revised.

Other revenue consists of miscellaneous fees under contractual arrangements, including service fee revenue under capitation arrangements with third party payers, management fees and fees for other services provided to third

parties. Revenue is recorded during the period in which the Company’s performance obligations under the contract are satisfied by the Company. There was no material impact to other revenue as a result of adopting IFRS 15.

IFRS 15 applies a single model for recognizing revenue from contracts with customers. It requires revenue to be recognized in a manner that

depicts the transfer of promised goods or services to a customer and at an amount that reflects the consideration expected to be received in exchange for transferring those goods or services. This is achieved by applying the following five

steps:

|

i) |

identify the contract with a customer; |

|

ii) |

identify the performance obligation in the contract; |

|

iii) |

determine the transaction price; |

|

iv) |

allocate the transaction price to the performance obligations in the contract; and |

|

v) |

recognize revenue when (or as) the entity satisfies a performance obligation. |

The

principal change affecting the Company results from the presentation of variable consideration that under the accounting standard is included in the transaction price up to an amount that is probable that a significant reversal will not occur. The

most common form of variable consideration the Company experiences relates to amounts for services provided that are ultimately not realizable from a payer. Under the previous standard, the Company’s estimate for unrealized amounts was

recorded in expenses as a provision for credit losses. Under IFRS 15, the Company’s estimate for unrealizable amounts is recognized as an adjustment to the transaction price at the inception of the contract. The net impact of adoption of IFRS

15 for the fifteen months ended December 31, 2017 is a reduction in service fee revenue of $5,272,485 and a corresponding reduction in operating expenses of $5,272,485 with no impact to net income. Due to the nature of these adjustments, there was

no impact to the opening retained earnings, consolidated balance sheets, consolidated statements of changes in equity or consolidated statements of cash flows.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

The Company

has elected to use the following practical expedients in adopting IFRS 15:

|

i) |

the amount of consideration over the contract term has not been adjusted for the effects of a significant financing component, since at

contract inception, the period between when the Company transfers a promised service to a customer and when the customer pays for that service will generally be one year or less; and |

|

ii) |

incremental costs associated with obtaining a contract are recognized as an expense when incurred because the amortization period of the asset that the Company would

have otherwise recognized is generally one year or less. |

Earnings per share

Basic earnings per common share (EPS) is calculated by dividing the net earnings available to common shareholders by the weighted average number

of common shares outstanding during the year. Diluted EPS is calculated by adjusting the net earnings available to common shareholders and the weighted average number of common shares outstanding for the effects of all dilutive

instruments.

Income taxes

Income tax expense comprises current and deferred tax. Income tax is recognized in the consolidated statements of net income (loss) and

comprehensive income (loss). Current income tax expense represents the amount of income taxes payable based on tax law that is enacted or substantively enacted at the reporting date, and is adjusted for changes in estimates of tax expense recognized

in prior periods. A current tax liability or asset is recognized for income taxes payable, or paid but recoverable, in respect of all periods to date.

The Company uses the deferred tax method of accounting for income taxes. Accordingly, deferred tax assets and liabilities are recognized for the deferred tax consequences attributable to differences between the consolidated

financial statements’ carrying amounts of assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted or substantively enacted tax rates expected to apply to taxable income in the

periods in which those temporary differences are expected to be recovered or settled. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in the consolidated statements of net income (loss) and comprehensive

income (loss) in the period in which the enactment or substantive enactment occurs. A deferred tax asset is recognized for unused tax losses, tax credits and deductible temporary differences, to the extent that it is more likely than not that future

taxable income will be available to utilize such amounts. Deferred tax assets are reviewed at each reporting date and are adjusted to the extent that it is no longer probable that the related tax benefits will be realized. Deferred tax assets and

liabilities are offset when they relate to income taxes levied by the same tax authority and the Company intends to settle its current tax assets and liabilities on a net basis.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Financial instruments

On January 1, 2018, the

Company adopted IFRS 9, Financial Instruments (IFRS 9), retrospectively and has chosen to not restate comparative information in accordance with the transitional provisions in IFRS 9. IFRS 9 addresses the classification, measurement and recognition

of financial assets and liabilities. It establishes three measurement categories for financial assets: amortized cost, fair value through profit or loss (FVTPL) and fair value through other comprehensive income (FVOCI). The basis of classification

depends on the entity’s business model and the contractual cash flow characteristics of the financial asset. A new expected credit losses model replaces the incurred loss impairment model previously used in IAS 39, Financial Instruments

– Recognition and Measurement (IAS 39).

The classification of financial liabilities under IFRS 9 remains broadly the same

as under IAS 39. Financial liabilities are measured at amortized cost unless they are required to be measured at FVTPL or the Company has opted to measure them at FVTPL.

The Company completed an assessment of its financial assets (cash, accounts receivable and derivative financial instruments) and financial

liabilities (accounts payable and accrued liabilities, loans and finance leases) as at January 1, 2018. All financial assets or liabilities were classified at amortized cost under IAS 39 and IFRS 9, except for derivative financial instruments, which

were classified at FVTPL under IAS 39 and IFRS 9. There has been no significant impact for the Company from the adoption of IFRS 9 on the carrying amounts of financial assets or liabilities as at January 1, 2018. Also, there was no material impact

from the transition to IFRS 9 on the consolidated statements of net income (loss) and comprehensive income (loss).

|

a) |

Measurement of financial assets and liabilities |

Financial assets and liabilities at amortized cost are initially recognized at fair value, and subsequently are carried at amortized cost less any

impairment. Derivative financial instruments and earn-outs are initially recognized and subsequently measured at fair value.

|

b) |

Impairment of financial assets |

IFRS 9 replaces the incurred loss model in IAS 39 with an expected credit loss (ECL) model. The new impairment model applies to financial assets measured at amortized cost, contract assets and debt instruments measured at

FVOCI, but not to investments in equity instruments. Under IFRS 9, credit losses are generally recognized earlier than under IAS 39. On adoption of IFRS 9, the financial assets of the Company measured at amortized cost consisted of cash, accounts

receivable and loans to related parties.

Under IFRS 9, expected credit losses are measured as follows:

|

· |

twelve-month ECL – ECLs that result from possible default events within twelve months after the reporting date;

and |

|

· |

lifetime ECLs – ECLs that result from all possible default events over the expected life of a financial

instrument. |

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

The

Company measures provision for credit losses at an amount equal to lifetime ECLs, except for the following, which are measured based on twelve-month ECLs:

|

· |

cash and loans to related parties for which the risk of default occurring over the expected life of the financial

instrument has not increased significantly since initial recognition. |

In applying the IFRS 9 impairment

requirements, the Company has applied the general approach for cash and loans to related parties, while the Company has elected to measure provision for credit losses for accounts receivable at an amount equal to lifetime ECLs using the simplified

approach.

In order to assess whether the credit risk of a financial asset has increased significantly since initial recognition and

when estimating ECLs, the Company considers reasonable and supportable information that is relevant and available without undue cost or effort. This includes information based on the Company’s historical experience and other forward-looking

information. The maximum period considered when estimating ECLs is the maximum contractual period over which the Company is exposed to credit risk.

ECLs are a probability weighted estimate of provision for credit losses. Provision for credit losses is measured as the present value of the difference between the cash flows due to the Company in accordance with the contract

and the cash flows the Company expects to receive. ECLs are discounted at the effective interest rate of the financial asset; however, due to the short-term nature of most of the Company’s financial assets measured at amortized cost, the time

value of money is not expected to be significant in the calculation of the ECL.

|

d) |

Impact of the new impairment model |

The Company has determined that the application of IFRS 9’s impairment requirements as at January 1, 2018 does not result in a significant

change in the provision for credit losses recognized by the Company. For accounts receivable, the Company uses a provision matrix to determine the ECLs based on actual credit loss experience with consideration of forward-looking information

including changes to economic conditions that would impact its customers.

The Company applied the general approach for loans to

related parties, considering any significant increases in credit risk for such receivables since inception. In determining the ECLs for such receivables, the Company considered actual credit loss experience with consideration of forward-looking

information including changes to economic conditions that would impact the payers.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Leases

A lease is classified at the inception date as a finance lease

or an operating lease. A lease that transfers substantially all of the benefits and risks incidental to the ownership of property is classified as a finance lease.

Finance leases are capitalized at the commencement of the lease at the fair value of the leased property as at the inception date or, if lower,

at the present value of the minimum lease payments. Lease payments are apportioned between finance charges and the reduction of the lease liability so as to achieve a constant rate of interest on the remaining balance of the liability. Finance

charges are recognized in finance costs in the consolidated statements of net income (loss) and comprehensive income (loss).

A

leased asset is depreciated over the useful life of the asset. However, if there is no reasonable certainty that the Company will obtain ownership by the end of the lease term, the asset is depreciated over the shorter of the estimated useful life

of the asset and the lease term.

An operating lease is a lease other than a finance lease. Operating lease payments are

recognized as an operating expense in the consolidated statements of net income (loss) and comprehensive income (loss) on a straight-line basis over the lease term.

Warrants

Financial instruments issued by the Company are classified as equity only to the extent they do not meet the definition of a financial liability or financial asset. The Company has issued warrants that are convertible into

common stock; these warrants are classified as equity instruments.

Restricted share units

Restricted share units (RSUs) are issued in accordance with the Company’s RSU Plan, which entitles a holder of one RSU to receive one

common share of the Company. RSUs are assigned a value based on the market value of the common shares of the Company on the grant date (or the nearest working day prior to the grant date). Such value is classified as stock-based compensation over

the vesting period for all RSUs awarded to employees or the Board (note 13). For RSUs awarded to non-employees for equity issuance services, the value of the RSUs is classified as equity issuance costs on vesting of such RSUs. For RSUs awarded to

non-employees for business services, the RSU expense would be recognized in the consolidated statements of net income (loss) and comprehensive income (loss) on vesting of such RSUs.

Stock-based compensation

The Company’s primary type of stock-based compensation consists of stock options, which are described in note 16. The Company uses the fair value method, which includes a volatility assumption, based on a peer group of

companies. Each tranche of a share option award is considered a separate award with its own vesting period and recorded at fair value on the date of grant. The fair value of each tranche is measured at the date of grant using the Black-Scholes

option pricing model. Compensation expense is recognized over the tranche’s vesting period based on the number of awards expected to vest by increasing contributed surplus. Any consideration paid by employees or directors on the exercise of

stock options is credited to common stock and the related fair value of those stock options is transferred from the contributed surplus to common stock.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Business combinations

The Company accounts for business combinations using

the acquisition accounting method. The total purchase price is allocated to the assets acquired and liabilities assumed based on fair values as at the date of acquisition. Goodwill as at the acquisition date is measured as the excess of the

aggregate of the consideration transferred and the amount of any non-controlling interests in the acquired company over the net of the acquisition date fair values of the identifiable assets acquired and the liabilities assumed. Any non-controlling

interests in the acquired company are measured at the non-controlling interests’ proportionate share of the identifiable assets and liabilities of the acquired business. Best estimates and assumptions are used in the purchase price allocation

process to accurately value assets acquired and liabilities assumed at the business combination date. These estimates and assumptions are inherently uncertain and subject to refinement. As a result, during the measurement period, which may be up to

one year from the business combination date, the Company may record adjustments to the assets acquired and liabilities assumed, with the corresponding offset to goodwill. On conclusion of the measurement period or final determination of the values

of assets acquired or liabilities assumed, whichever comes first, any subsequent adjustments are recorded in the consolidated statements of net income (loss) and comprehensive income (loss) in the period in which the adjustments were

determined.

Changes in non-controlling interests

The Company treats transactions with non-controlling interests that do not result in a loss of control as transactions with equity owners

of the Company. A change in ownership interest results in an adjustment between the carrying amounts of the controlling and non-controlling interests to reflect their relative interests in the subsidiary. Any difference between the amount of the

adjustment to non-controlling interests and any consideration paid or received is recognized in a reserve within equity attributable to owners of Akumin.

Provisions

Provisions are recognized when the Company has a present

legal or constructive obligation as a result of past events, it is more likely than not that an outflow of resources will be required to settle the obligation, and the amount can be reliably estimated. Provisions are measured based on

management’s best estimate of the expenditure required to settle the obligation at the end of the reporting period, and are discounted to their present value where the effect is material.

Contingencies

Contingent liabilities are possible obligations whose existence will be confirmed only on the occurrence or nonoccurrence of uncertain future events outside the Company’s control, or present obligations that are not

recognized because it is not probable that an outflow of economic benefits would be required to settle the obligation or the amount cannot be measured reliably.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Contingent liabilities are not recognized but are disclosed and described in note 15 to the consolidated financial statements, including an

estimate of their potential financial effect and uncertainties relating to the amount or timing of any outflow, unless the possibility of settlement is remote. In assessing loss contingencies related to legal proceedings that are pending against the

Company or unasserted claims that may result in such proceedings, the Company, with assistance from its legal counsel, evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of

relief sought or expected to be sought.

Use of estimates

The preparation of consolidated financial statements in conformity with IFRS requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the date of the consolidated financial statements, and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. As additional

information becomes available or actual amounts are determinable, the recorded estimates are revised and reflected in operating results in the period in which they are determined.

|

i) |

Accounts receivable and allowance for credit losses |

Accounts receivable are recognized initially at fair value and are subsequently measured at amortized cost less loss allowances. During the year

ended December 31, 2018, the Company applied the simplified approach to measure expected credit losses, permitted by IFRS 9, which uses a lifetime expected loss allowance for all accounts receivable. During the fifteen months ended December 31,

2017, the impairment for accounts receivable was recorded when there was an expectation that the Company would not be able to collect all amounts due of the receivable.

Accounts receivable are considered to be in default when customers have failed to make the contractually required payments when due. A provision

for credit losses is recorded as a reduction in revenue with an offsetting amount recorded as an allowance for credit losses, reducing the carrying value of the receivable. When a receivable is considered uncollectible, the receivable is written off

against the allowance for credit losses account.

|

ii) |

Impairment of goodwill and long-lived assets |

Management tests at least annually or more frequently if there are events or changes in circumstances to assess whether goodwill suffered any

impairment. Property and equipment are reviewed for impairment whenever events or changes in circumstances indicate the carrying amount may not be recoverable. An impairment loss is recognized for the amount by which the asset’s carrying

amount exceeds its recoverable amount. The recoverable amount is the higher of an asset’s fair value less costs to sell and value in use. For the purposes of assessing impairment, assets are grouped at the lowest levels for which there are

separately identifiable cash flows.

Management makes key assumptions and estimates in determining the recoverable amount from

CGUs or groups of CGUs, including future cash flows based on historical and budgeted operating results, growth rates, tax rates and appropriate after-tax discount rates.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

The

Company evaluates its long-lived assets (property and equipment) and intangible assets, other than goodwill and intangible assets with indefinite lives, for impairment whenever indicators of impairment exist. The accounting standards require that if

the sum of the undiscounted expected future cash flows from a long-lived asset or definite-lived intangible asset is less than the carrying value of that asset, an asset impairment charge must be recognized. The amount of the impairment charge is

calculated as the excess of the asset’s carrying value over its fair value, which generally represents the discounted future cash flows from that asset.

The Company is subject to government audits and the outcome of such audits may differ from original estimates. Management believes a sufficient amount has been accrued for income taxes. Further, management evaluates the

realizability of the net deferred tax assets and assesses the valuation allowance periodically. If future taxable income or other factors are not consistent with the Company’s expectations, an adjustment to its allowance for net deferred tax

assets may be required. For net deferred tax assets, the Company considers estimates of future taxable income, including tax planning strategies, in determining whether net deferred tax assets are more likely than not to be realized.

|

iv) |

Business combinations |

Significant judgment is required in identifying tangible and intangible assets and liabilities of acquired businesses, as well as determining their fair values. The Company applies the acquisition method to account for

business combinations. The consideration transferred for the acquisition of a subsidiary is the fair value of the assets transferred, the liabilities incurred to the former owners of the acquiree and the equity interests issued by the Company. The

consideration transferred includes the fair value of any asset or liability resulting from a contingent consideration arrangement. Identifiable assets acquired and liabilities and contingent liabilities assumed in a business combination are measured

initially at their fair values at the acquisition date. The Company recognizes any non-controlling interest in the acquiree at fair value of the recognized amounts of the acquiree’s identifiable net assets.

|

v) |

Contractual allowances |

Net patient service revenue is reported at the estimated net realizable amounts from patients, third party payors, and others for services

rendered and recognized in the period in which the services are performed. Net patient service revenue is recorded based on established billing rates, less estimated discounts for contractual allowances, principally for patients covered by managed

care and other health plans, and self-pay patients. Contractual adjustments result from the differences between the established rates charged for services performed and expected reimbursements by government sponsored health-care programs and

insurance companies for such services.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

Correction of error in statement of cash flows

Our consolidated statement of

cash flows for the year ended December 31, 2018 has been restated to classify the cash flows associated with the acquisition of non-controlling interests as a financing cash flow. Previously, management had incorrectly presented such cash flows as

an investing activity. The nature of the transaction which gave rise to these cash flows is described in note 13. Furthermore, this adjustment does not affect our previously reported consolidated balance sheet, statement of net income (loss) and

comprehensive income (loss) or the statement of changes in equity.

The following table summarizes the effects of the restatement

resulting from the correction of this error:

| |

|

2018

$ |

|

|

Change

$ |

|

|

2018

$ |

|

| |

|

(as previously

reported) |

|

|

|

|

|

(restated) |

|

| Acquisition of non-controlling interests |

|

|

(17,780,909 |

) |

|

|

17,780,909 |

|

|

|

— |

|

| Total cash flows used in investing activities |

|

|

(62,831,246 |

) |

|

|

17,780,909 |

|

|

|

(45,050,337 |

) |

| Acquisition of non-controlling interests |

|

|

— |

|

|

|

(17,780,909 |

) |

|

|

(17,780,909 |

) |

| Total cash flows from financing activities |

|

|

63,593,477 |

|

|

|

(17,780,909 |

) |

|

|

45,812,568 |

|

|

a) |

On April 5, 2018, the Company announced that, through a subsidiary, it had entered into a management agreement with the owners of four centres located in one of

Akumin’s core geographic markets (the Managed Centres, and the period from April 5 to May 11, 2018, the Management Period). On May 11, 2018, the Company announced it had acquired, through a subsidiary (Akumin FL), certain assets of the Managed

Centres in Florida (the Tampa Acquisition). The sellers were paid cash consideration of $50,000. The Company also assumed certain priority ranked accounts payable of $1,553,290 (including $727,826 related to working capital loans advanced from the

Company to the Managed Centres during the Management Period) and a 6% third party subordinated note with a principal balance of $1.5 million (face value) and a term of four years. The principal balance of the third party loan is subject to an

earn-out of up to an additional $4.0 million, subject to the satisfaction of certain revenue-based milestones (note 12). The Company has made a preliminary fair value determination of the acquired assets and assumed liabilities as

follows: |

| |

|

$ |

|

| Assets acquired |

|

|

|

| Non-current assets |

|

|

|

| Property and equipment |

|

|

1,719,000 |

|

| |

|

|

|

|

| Liabilities assumed |

|

|

|

|

| Current liabilities |

|

|

|

|

| Accounts payable and accrued liabilities |

|

|

1,553,290 |

|

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

| |

|

$ |

|

| Non-current liabilities Subordinated note |

|

|

1,490,932 |

|

| Subordinated note – earn-out |

|

|

160,790 |

|

| |

|

|

|

|

| |

|

|

3,205,012 |

|

| |

|

|

|

|

| Net liabilities acquired |

|

|

(1,486,012 |

) |

| Goodwill |

|

|

1,536,012 |

|

| |

|

|

|

|

| Purchase price |

|

|

50,000 |

|

| |

|

|

|

|

This acquisition was an opportunity for the Company to increase its economies of scale

across Florida. The goodwill assessed on acquisition, expected to be deductible for income tax purposes, reflects the Company’s expectation of future benefits from the acquired business and workforce, and potential synergies from cost savings.

The results of operations of the Tampa Acquisition have been included in the Company’s consolidated statements of net income (loss) and comprehensive income (loss) from the acquisition date. Since the acquisition date, the Tampa Acquisition

contributed revenue of approximately $5.1 million and net income before tax of approximately $0.8 million to the Company’s consolidated results for the twelve months ended December 31, 2018.

The Company has estimated the contribution to the Company’s consolidated results from this acquisition had the business combination

occurred at the beginning of the year. Had the business combination occurred at the beginning of fiscal 2018, this business combination would have contributed approximately $8.0 million in revenue and $1.2 million in income before tax for the twelve

months ended December 31, 2018, and consolidated pro forma revenue and income before tax for the same period would have been approximately $157.6 million and $6.5 million, respectively. These estimates should not be used as an indicator of past or

future performance of the Company or the acquisition.

|

b) |

On August 15, 2018, the Company announced that, through a subsidiary, it had acquired 11 outpatient diagnostic imaging centres in the Tampa Bay Area (the Rose

Acquisition) for a cash consideration of approximately $24.6 million, which was financed through the Syndicated Term Loan (note 10). The Company has made a preliminary fair value determination of the acquired assets and assumed liabilities as

follows. The intangible assets consist of the trade name and covenants not to compete. The fair value of the accounts receivable is approximately $1.3 million and it is net of expected credit losses of approximately 4%. Subsequent to the completion

of the acquisition the Company, in accordance with the purchase agreement, prepared a working capital statement as of the closing date and determined a working capital asset of $323,983 due to the Company. |

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

| |

|

$ |

|

| Assets acquired |

|

|

|

|

| Current assets |

|

|

|

|

| Cash |

|

|

1,045,574 |

|

| Accounts receivable |

|

|

1,319,148 |

|

| Prepaid expenses |

|

|

74,582 |

|

| |

|

|

|

|

| |

|

|

2,439,304 |

|

| |

|

|

|

|

| Non-current assets |

|

|

|

|

| Property and equipment |

|

|

8,637,953 |

|

| Intangible assets |

|

|

1,330,000 |

|

| |

|

|

|

|

| |

|

|

9,967,953 |

|

| |

|

|

|

|

| |

|

|

12,407,257 |

|

| |

|

|

|

|

| Liabilities assumed |

|

|

|

|

| Current liabilities |

|

|

|

|

| Accounts payable and accrued liabilities |

|

|

2,211,319 |

|

| Non-current liabilities |

|

|

|

|

| Wesley Chapel Loan (note 11) |

|

|

1,908,456 |

|

| Deferred tax liability (note 14) |

|

|

1,755,083 |

|

| |

|

|

|

|

| |

|

|

5,874,858 |

|

| |

|

|

|

|

| Net assets acquired |

|

|

6,532,399 |

|

| Goodwill |

|

|

17,753,601 |

|

| |

|

|

|

|

| Purchase price |

|

|

24,286,000 |

|

This acquisition was an opportunity for the Company to increase its economies of scale across Florida. The goodwill assessed on the Rose

Acquisition, expected to not be deductible for income tax purposes, reflects the Company’s expectation of future benefits from the acquired business and workforce, and potential synergies from cost savings. The results of operations of the

Rose Acquisition have been included in the Company’s consolidated statements of net income (loss) and comprehensive income (loss) from the acquisition date. Since the acquisition date, the Rose Acquisition contributed revenue of approximately

$9.1 million and income before tax of approximately $0.3 million to the Company’s consolidated results for the twelve months ended December 31, 2018.

The Company has estimated the contribution to the Company’s consolidated results from this acquisition as though the business combination occurred at the beginning of fiscal 2018. Had the business combination occurred

at the beginning of fiscal 2018, this business combination would have contributed approximately $23.9 million in revenue and $0.9 million in income before tax for the twelve months ended December 31, 2018, and consolidated pro forma revenue and

income before tax for the same period would have been approximately $169.6 million and $6.6 million, respectively. These estimates should not be used as an indicator of past or future performance of the Company or the business acquired in the Rose

Acquisition.

Akumin Inc.

Notes to

Consolidated Financial Statements

December 31, 2018 and December 31, 2017

(expressed in US dollars unless otherwise

stated)

|

c) |