Exhibit

CURO GROUP HOLDINGS CORP. AND SUBSIDIARIES

YEAR ENDED DECEMBER 31, 2018

INDEX

ITEM 1. BUSINESS

Company Overview and History

We are a growth-oriented, technology-enabled, highly-diversified, multi-channel and multi-product consumer finance company serving a wide range of underbanked consumers in the United States ("U.S.") and Canada. We believe that we have the only true omni-channel customer acquisition, onboarding and servicing platform that is integrated across store, online, mobile and contact center touchpoints. Our IT platform, which we refer to as the “Curo Platform,” seamlessly integrates customer acquisition loan underwriting, scoring, servicing, collections, regulatory compliance and reporting activities into a single, centralized system. We use advanced risk analytics powered by proprietary algorithms and over 15 years of loan performance data to efficiently and effectively score our customers’ loan applications. From January 1, 2010 to December 31, 2018, we extended over $16.4 billion in total credit across approximately 41.7 million total loans.

CURO was founded in 1997 to meet the growing needs of underbanked consumers looking for access to credit. With more than 20 years of experience, we seek to offer a variety of convenient, easily-accessible financial and loan services across all of our markets.

CURO Financial Technologies Corp. ("CFTC"), previously known as Speedy Cash Holdings Corp., was incorporated in Delaware in July 2008. CURO Group Holdings Corp. ("CGHC"), previously known as Speedy Group Holdings Corp., was incorporated in Delaware in 2013 as the parent company of CFTC. The terms “CURO," "we,” “our,” “us” and the “Company” refer to CGHC and its directly and indirectly owned subsidiaries as a combined entity, except where otherwise stated. CFTC, our wholly-owned subsidiary, includes it's directly and indirectly owned subsidiaries as a consolidated entity, except where otherwise stated.

We operate in the U.S. under two principal brands, “Speedy Cash” and “Rapid Cash,” as well as under the “Avio Credit” brand, which is currently available in 11 states. We operate in Canada under two principal brands, “Cash Money” and “LendDirect,” which offers Installment loans online and at certain stores.

On February 25, 2019, we placed our U.K. operations into administration, as described further in Note 24 of Item 8 of this report, which resulted in treatment of the U.K. segment as discontinued operations for all periods presented. Throughout this report, current and prior period financial information is presented as if the U.K. segment was excluded from continuing operations.

As of December 31, 2018, our store network consisted of 413 locations across 14 U.S. states and seven Canadian provinces and we offered our online services in 27 U.S. states and five Canadian provinces.

We offer a broad range of consumer finance products, including Unsecured Installment loans, Secured Installment loans, Open-End loans and Single-Pay loans. We have tailored our products to fit our customers’ particular needs as they access and build credit. We believe that our product suite allows us to serve a broader group of potential borrowers than most of our competitors. The flexibility of our products, particularly our Installment and Open-End products, allow us to continue serving customers as their credit needs evolve and mature. Our broad product suite creates a diversified revenue stream and our omni-channel platform seamlessly delivers our products across all contact points–we refer to it as “Call, Click or Come In.” We believe these complementary channels drive brand awareness, increase approval rates, lower customer acquisition costs and improve customer satisfaction levels and customer retention.

We serve the large and growing market of individuals who have limited access to traditional sources of consumer credit and financial services. We define our addressable market as underbanked consumers in the U.S. and Canada. According to a study by the Center for Financial Services Innovation ("CFSI") conducted in 2017, there are as many as 121 million Americans who are underserved by financial services companies. According to studies by ACORN Canada and PricewaterhouseCoopers LLP, an estimated 15% of Canadian residents (approximately five million individuals) classified as underbanked. With an addressable market of 126 million individuals, we believe that our scalable omni-channel platform and diverse product offerings are better positioned than our competitors to gain market share.

In April 2018, we announced that we expect to begin offering U.S. consumers a new line of credit product through a relationship with MetaBank® ("Meta"), a wholly-owned subsidiary of Meta Financial Group, Inc. CURO and Meta are currently developing the pilot launch. We do not expect the Meta relationship to contribute to financial results until 2020.

Initial Public Offering

On December 7, 2017, our common stock began trading on the New York Stock Exchange ("NYSE") under the symbol "CURO." We completed our initial public offering ("IPO") of 6,666,667 shares of common stock on December 11, 2017, at a price of $14.00 per share, which provided net proceeds to us of $81.1 million. On January 5, 2018, the underwriters exercised their option to purchase additional shares at the IPO price, less the underwriting discount, which provided additional proceeds to us of $13.1 million.

On December 6, 2017 we effected a 36-for-1 split of our common stock and on December 11, 2017 we increased the authorized number of shares of our common stock to 250,000,000, consisting of 225,000,000 shares of common stock, with a par value of $0.001 per share and 25,000,000 shares of preferred stock, with a par value of $0.001 per share. All share and per share data in this recast of our Annual Report on Form 10-K ("Report") have been retroactively adjusted for all periods presented to reflect the stock split as if the stock split had occurred at the beginning of the earliest period presented.

On March 7, 2018, we used a portion of the IPO net proceeds to redeem $77.5 million of the 12.00% Senior Secured Notes due 2022 and to pay related fees, expenses, premiums and accrued interest.

Transition From Emerging Growth Company Status

At the time of our IPO, we qualified as an “emerging growth company”("EGC") under the Jumpstart Our Business Startups Act of 2012 ("JOBS Act"). This permitted us to take advantage of reduced disclosure requirements and other benefits not available to other non-EGC companies. On August 27, 2018, we completed the issuance of our 8.25% Senior Secured Notes due 2025. This issuance, along with prior issuances of Senior Secured Notes during 2017, caused us to exceed $1.0 billion in nonconvertible debt securities issued in the previous three‑year period. As a result, we no longer qualified for EGC status and thus were no longer entitled to the reporting and other advantages offered under that status.

As a result of transitioning out of EGC status, we could no longer take advantage of reduced reporting and disclosure obligations and we were required to engage an independent registered public accounting audit firm to report on the effectiveness of our internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act for the fiscal year ended December 31, 2018. In addition, we adopted certain recently-issued accounting pronouncements as of their effective date, for which we were previously allowed to delay adoption. The impacts on our accounting policy adoption practices are further described in Note 1, "Summary of Significant Accounting Policies and Nature of Operations" of the Notes to Consolidated Financial Statements in this Report (the "Notes to Consolidated Financial Statements").

Industry Overview

We operate in a segment of the financial services industry that provides lending products to underbanked consumers in need of convenient and flexible access to credit and other financial products. In the U.S. alone, according to a study by the CFSI, these underserved consumers in our target market spent an estimated $173.2 billion on fees and interest in 2016 related to credit products similar to those we offer.

We believe our target consumers have a need for tailored financing products to cover essential expenses. According to a study in 2017 by the U.S. Federal Reserve, 44% of American adults could not cover an emergency expense costing $400 or would cover it by selling an asset or borrowing money. Additionally, a study published in 2015 by JP Morgan Chase & Co., which analyzed the transaction information of 2.5 million of its account holders in the U.S., found that 41% of those sampled experienced month-to-month income fluctuations of more than 30%.

We compete against a wide variety of consumer finance providers including online and branch-based consumer lenders, credit card companies, pawn shops, rent-to-own and other financial institutions that offer similar financial services. A study by CFSI published in November 2016 estimated that spending on credit products offered by our industry in the U.S. exhibited a compound annual growth rate of 10% from 2010 to 2015. This growth has been accompanied by shrinking access to credit for our customer base as evidenced by an estimated $142 billion reduction in the availability of non-prime consumer credit in the U.S. between the 2008/2009 credit crisis to 2015 (based on analysis of master pool trust data of securitizations for major credit card issuers).

In addition to the broad trends impacting the consumer finance landscape, we believe we are well positioned to grow our market share as a result of several changes we have observed related to consumer preferences within alternative financial services. As described below, we believe that a combination of evolving consumer preferences, increasing use of mobile devices and overall adoption rates for technology are driving significant change in our industry.

| |

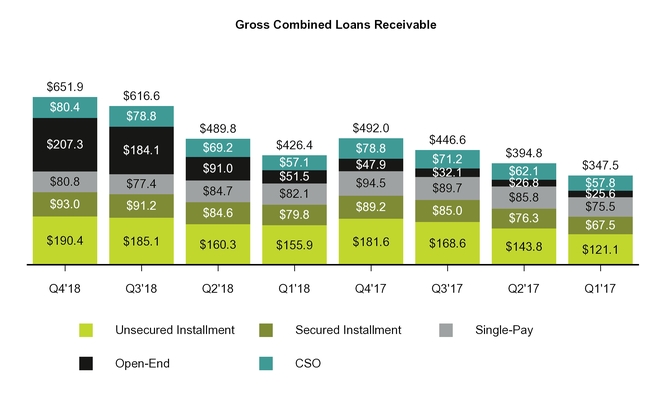

• | Shifting preference towards installment loans—Given our experience in offering Installment and Open-End loan products since 2008, we believe that Single-Pay loans are becoming less popular or less suitable for a growing portion of our customers. Our customers generally have shown a preference for Installment and Open-End loan products, which typically have longer terms, lower periodic payments and a lower relative cost than Single-Pay products. Offering more flexible terms and lower payments also significantly expands our addressable market by broadening our products’ appeal to a larger proportion of consumers in the market. For example, in the U.S. our Installment and Open-End loans increased from 58.8% of total Company-Owned loans at the beginning of 2015 to 86.2% at December 31, 2018. Additionally, in Canada our aggregate Installment and Open-End loan products grew from $50.0 million in the third quarter of 2017 to $173.5 million in the fourth quarter of 2018. |

| |

• | Increasing adoption of online channels—Our experience is that customers prefer service across multiple channels or touch points. Approximately 63% of respondents in a study by CFI Group published in 2016 said they conducted more than half of their banking activities electronically and they reported an overall level of satisfaction that met or exceeded the average. For the year ended December 31, 2018 our consolidated total revenue generated through our online channels totaled $444.1 million and represented 42% of our total revenues for the year, compared to $333.5 million and 36%, respectively, for the year ended December 31, 2017. |

| |

• | Increasing adoption of mobile apps and devices—With the proliferation of pay-as-you-go and other smartphone plans, many of our underbanked customers have moved directly to mobile devices for loan origination and servicing. According to a 2016 study by the Pew Research Center covering the U.S. and Canada, smartphone penetration was 72% and 67%, respectively. Additionally, 43% of respondents in a study by CFI Group said they conduct financial transactions using a mobile banking app. In 2012, less than 44% of our U.S. customers reached us via a mobile device, whereas in the fourth quarter of 2018, that percentage had grown to over 80%. |

Our Strengths

We believe the following competitive strengths differentiate us and serve as barriers to others seeking to enter our market.

| |

• | Unique omni-channel platform / site-to-store capability—We believe we have the only fully-integrated store, online, mobile and contact center platform to support omni-channel customer engagement. We offer a seamless “Call, Click or Come In” capability for customers to apply for loans, receive loan proceeds, make loan payments and otherwise manage their accounts, whether in store, online or over the phone. Customers can utilize any of our three channels at any time and in any combination to obtain a loan, make a loan payment or manage their account. In addition, we have our “Site-to-Store” capability, for which customers that do not qualify for a loan online are directed to a store to complete a loan transaction with one of our associates. Our "Site-to-Store" program resulted in approximately 241,000 loans in the year ended December 31, 2018. These aspects of our platform enable us to source a larger number of customers, serve a broader range of customers and continue serving these customers for longer periods of time. |

| |

• | Industry leading product and geographic diversification—In addition to channel diversification, we have increased our diversification by product and geography allowing us to serve a broader range of customers with a flexible product offering. As part of this effort, we have also developed and launched new brands and will continue to develop new brands with differentiated marketing messages. These initiatives have helped diversify our revenue streams by enabling us to appeal to a wider array of borrowers. |

| |

• | Leading analytics and information technology drives strong credit risk management—We have developed a bespoke, proprietary IT platform (the "Curo Platform"), which is a unified, centralized platform that seamlessly integrates activities related to customer acquisition, underwriting, scoring, servicing, collections, compliance and reporting. Our IT platform is underpinned by over 15 years of continually updated customer data comprising over 78 million loan records (as of December 31, 2018) used to formulate our robust, proprietary underwriting algorithms. This platform then automatically applies multi-algorithmic analysis to a customer’s loan application to produce a “Curo Score” which drives our underwriting decision. As of December 31, 2018, we had approximately 167 employees who write code and manage our networks and infrastructure for our IT platform. This fully-integrated IT platform enables us to make real-time, data-driven changes to our customer acquisition and risk models, which yield significant benefits in terms of customer acquisition costs and credit performance. |

| |

• | Multi-faceted marketing strategy drives low customer acquisition costs—Our marketing strategy includes a combination of strategic direct mail, television advertisements and online and mobile-based digital campaigns, as well as strategic partnerships and other commonly used modes of marketing. Our Marketing, Risk and Credit Analytics team, consisting of approximately 57 professionals as of December 31, 2018, uses our integrated CURO Platform to cross reference marketing spend, new customer account data and granular credit metrics to optimize our marketing budget across these channels in real time and to produce higher quality new loans. In addition to these diversified marketing programs, our stores play a critical role in creating brand awareness and driving new customer acquisition. From January 2015 through December 2018, we acquired nearly 2.7 million new customers in North America. |

| |

• | Focus on customer experience—We focus on customer service and experience and have designed our stores, website and mobile application interfaces to appeal to our customers’ needs. We continue to augment our web and mobile app interfaces to enhance our “Call, Click or Come In” strategy, with a focus on adding functionality across all our channels. Our stores are branded with distinct and recognizable signage, are conveniently located and typically are open seven days a week. Furthermore, we employ highly experienced store managers, which we believe is a critical component to |

driving customer retention, lowering acquisition costs and maximizing store-level margins. For example as of December 31, 2018 in the U.S. the average tenure for our store managers was over eight years, for district managers it was approximately 12 years, and for regional directors it was approximately 14 years.

| |

• | Strong compliance culture with centralized collections operations—We seek to consistently engage in proactive and constructive dialogue with regulators in each of our jurisdictions and have made significant investments in best-practice automated tools for monitoring, training and compliance management. As of December 31, 2018, our compliance group consisted of 25 individuals based in the U.S. and Canada, and our compliance management systems are integrated into our proprietary IT platform. In addition to conducting semi-annual compliance audits, our in-house centralized collections strategy, supported by our proprietary back-end customer database and analytics team, drives an effective, compliant and highly-scalable model. |

| |

• | Demonstrated access to capital markets and diversified funding sources—We have raised nearly $2.1 billion of debt financing across eight separate offerings and various credit facilities since 2008, with our most recent offering completed in August 2018. This aggregate amount includes $690.0 million of 8.25% Senior Secured Notes due 2025 and a C$175.0 million nonrecourse revolving facility due 2022 to support growth of multi‑pay products in Canada, both of which we closed in August 2018. We also have U.S. and Canadian bank revolving credit facilities to supplement intra‑period liquidity. Additionally, we raised over $90.0 million in our IPO. We believe this is an important significant differentiator if competitors have trouble accessing capital to fund their business models if credit markets tighten. For more information, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” |

| |

• | Experienced and innovative management team—Our management team is among the most experienced in the industry with over a century of collective experience and an average tenure of nearly eight years. We also have deep bench strength across key functional areas including accounting, compliance, IT and legal. |

| |

• | History of growth and profitability—Throughout our operating history we have maintained strong profitability and growth. Between 2010 and 2018 we grew revenue, Adjusted EBITDA and Adjusted Net Income at a compound annual growth rate of 22.7%, 20.7% and 19.4%, respectively. For more information on non-GAAP measures, see “Supplemental Non-GAAP Financial Information” within Item 6. "Selected Financial Data." At the same time, we have significantly expanded our product offerings to better serve our growing and expanding customer base. |

Growth Strategy

Leverage our capabilities to continue growing Installment and Open-End products—Installment and Open-End products accounted for 74% of our consolidated revenue for the year ended December 31, 2018, up from 19% in 2010. We believe that the revenue growth for these products reflects our customers' preferences for these products. We anticipate that these products will continue to account for a greater share of our revenue and provide us a competitive advantage versus other consumer lenders with narrower product focus. We believe that our ability to continue to be successful in developing and managing new products is based upon our capabilities in three key areas:

| |

• | Underwriting: Installment and Open-End products generally have lower yields than Single-Pay products, which necessitates stringent credit criteria supported by sophisticated credit analytics. Our industry leading analytics platform combines data from over 78 million records (as of December 31, 2018) associated with loan information from third-party reporting agencies. |

| |

• | Collections and Customer Service: Installment and Open-End products have longer terms than Single-Pay loans, in some cases up to a total of 60 months. These longer terms drive the need for a more comprehensive collection and a credit-default servicing strategy that emphasizes curing a default and putting the customer back on a track to repaying the loan. We utilize a centralized collection model that eliminates the need for our store management personnel from ever having to contact customers to resolve a delinquency. We have also invested in building new contact centers in the countries in which we operate, each of which utilizes sophisticated dialer technologies to help us contact our customers in a scalable, efficient manner. |

| |

• | Funding: The shift to larger balance Installment loans with extended terms and Open-End loans with revolving terms requires more substantial and more diversified funding sources. Given our deep and successful track record in accessing diverse sources of capital, we believe that we are well-positioned to support future new product transitions. |

Serve additional types of borrowers—In addition to growing our existing suite of Installment and Open-End lending products, we are focused on expanding the total number of customers that we are able to serve through product, geographic and channel expansion. These efforts include expansion of our online channel, as well as continued targeted additions to our store footprint. We continue to introduce additional products to address our customers’ preference for longer term products that allow for greater flexibility in managing their monthly payments.

In the second quarter of 2017, we launched Avio Credit, a U.S. online product targeting individuals in the 600-675 FICO band. This product is structured as an Unsecured Installment loan with varying principal amounts and loan terms up to 48 months. As of April 2017, 10% of U.S. consumers had FICO scores between 600 and 649. A further 13.2% of U.S. consumers had FICO scores between 650 and 699, a portion of whom would fall into the credit profile targeted by our Avio Credit product.

We are expanding Installment and Open-End loan products under our LendDirect brand in Canada to include additional provinces and increase customer acquisition efforts in existing markets. To supplement the online channel, we opened three LendDirect stores in Canada during the fourth quarter of 2017 and seven during the year ended December 31, 2018. We have also accelerated our offering of Open-End products under our Canadian CashMoney brand. Seven million Canadians have a FICO score below 700 according to FactorTrust. We estimate that the consumer credit opportunity for this customer segment exceeds C$165 billion. We also believe these customers represent a highly-fragmented market with low penetration by our industry which represents a growth opportunity for us.

In April 2018, we announced a relationship with Meta to offer consumers in the U.S. a flexible and innovative line of credit product. CURO and Meta are currently developing the pilot launch. We do not expect the Meta relationship to contribute to our financial results until 2020.

Continue to bolster our core business through enhancement of our proprietary risk scoring models— We continuously refine and update our credit models to drive additional improvements in our performance metrics. By regularly updating our credit underwriting algorithms we can continue to enhance the value of each of our customer relationships through improved credit performance. By combining these underwriting improvements with data-driven marketing spend, we believe our optimization efforts will produce margin expansion and earnings growth.

Expand credit for our borrowers—Through extensive testing and our proprietary underwriting, we have successfully increased credit limits for customers, enabling us to offer “the right loan to the right customer.” The favorable take rates and credit performance have improved overall loan-vintage and portfolio performance. For the year ended December 31, 2018, our average loan amount for Unsecured and Secured Installment loans grew to $664 and $1,405, respectively, from $643 and $1,303, respectively, for the year ended December 31, 2017.

Continue to improve the customer journey and experience—We have projects in our development pipeline to enhance our “Call, Click or Come In” customer experience and execution, ranging from the redesign of our web and app interfaces to enhanced service features to payments optimization.

Enhance our network of strategic partnerships—Our strategic partnership network generates customer applicants that we can close using our diverse array of marketing channels. By further leveraging these existing networks and expanding the reach of our partnership platform to include new relationships, we can increase the number of overall leads we receive.

Customers

Our customers require essential financial services and place a value on timely, transparent, affordable and convenient alternatives to banks, credit card companies and other traditional financial services companies. According to a May 2017 study by FactorTrust, underbanked customers in the U.S. have the following characteristics:

| |

• | average age of 39 for applicants and 41 for borrowers; |

| |

• | applicants are 47% male and 53% female; |

| |

• | 45% have a bachelor’s degree or higher; and |

| |

• | the top five employment segments are Retail, Food Service, Government, Banking/Finance and Business Services. |

In the U.S., our customers generally earn between $25,000 and $75,000 annually. In Canada, our customers generally earn between C$25,000 and C$60,000 annually. Our customers utilize the services provided by our industry for a variety of reasons, including that they often:

| |

• | have immediate need for cash between paychecks; |

| |

• | have been rejected for traditional banking services; |

| |

• | maintain sufficient account balances to make a bank account economically efficient; |

| |

• | prefer and trust the simplicity, transparency and convenience of our products; |

| |

• | need access to financial services outside of normal banking hours; and |

| |

• | reject complicated fee structures in bank products (e.g., credit cards and overdrafts). |

Products and Services

We provide Unsecured Installment loans, Secured Installment loans, Open-End loans, Single-Pay loans and a number of ancillary financial products, including check cashing, proprietary reloadable prepaid debit cards (Opt+), credit protection insurance in the Canadian market, gold buying, retail installment sales and money transfer services. We have designed our products and customer experience to be consumer-friendly, accessible and easy to understand. Our platform and product suite enable us to provide a number of key benefits that appeal to our customers:

| |

• | transparent approval process; |

| |

• | flexible loan structure, providing greater ability to manage monthly payments; |

| |

• | simple, clearly communicated pricing structure; and |

| |

• | full customer account management online and via mobile devices. |

Our centralized underwriting platform and its proprietary algorithms are used for every aspect of underwriting and scoring of our loan products. The customer application, approval, origination and funding processes differ by state, country and by channel. Our customers typically have an active phone number, open checking account, recurring income and a valid government-issued form of identification. For in-store loans, the customer presents required documentation, including a recent pay stub or support for underlying bank account activity for in-person verification. For online loans, application data is verified with third-party data vendors, our proprietary algorithms and/or tech-enabled account verification. Our proprietary, highly scalable, scoring system employs a champion/challenger process whereby models compete to produce the most successful customer outcomes and profitable cohorts. Our algorithms use data relevancy and machine learning techniques to identify approximately 60 variables from a universe of approximately 11,600 that are the most predictive in terms of credit outcomes. The algorithms are continuously reviewed and refreshed and are focused on a number of factors related to disposable income, expense trends and cash flows, among other factors, for a given loan applicant. The predictability of our scoring models is driven by the combination of application data, purchased third-party data and our robust internal database of over 78 million records (as of December 31, 2018) associated with loan information. These variables are then analyzed using a series of algorithms to create a score that allows us to optimize lending decisions in a scalable manner.

Geography and Channel Mix

For the years ended December 31, 2018, 2017 and 2016, approximately 81.6%, 79.8% and 76.3%, respectively, of our consolidated revenues were generated from services provided within the U.S. and approximately 18.4%, 20.2% and 23.7%, respectively, of our consolidated revenues were generated from services provided within Canada. For each of the years ended December 31, 2018 and 2017, approximately 62.4% and 61.5%, respectively, of our long-lived assets were located within the U.S., and approximately 37.6% and 38.5%, respectively, of our long-lived assets were located within Canada. See Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations" in this Report for additional information on our geographic segments.

Stores: As of December 31, 2018, we had 413 stores across 14 U.S. states and seven provinces in Canada, which included the following:

| |

• | 213 U.S. locations: Texas (90 stores), California (36), Nevada (18), Arizona (13), Tennessee (11), Kansas (10), Illinois (8), Alabama (7), Missouri (5), Louisiana (5), Colorado (3), Oregon (3), Washington (2) and Mississippi (2); |

| |

• | 200 Canadian locations: Ontario (131), Alberta (27), British Columbia (26), Saskatchewan (6), Nova Scotia (5), Manitoba (4) and New Brunswick (1). |

Online: We lend online in 27 states in the U.S. and five provinces in Canada.

Overview of Loan Products

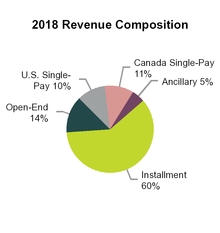

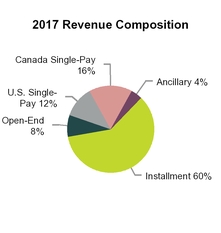

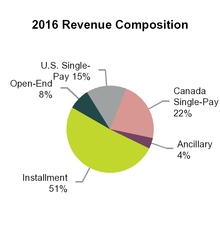

The following charts depict the revenue contribution, including credit services organization ("CSO") fees, of the products and services that we currently offer:

For the years ended December 31, 2018, 2017 and 2016, revenue generated through our online channel represented 42%, 36% and 31%, respectively, of consolidated revenue.

Below is an outline of the primary products we offered as of December 31, 2018:

|

| | | | |

| Unsecured Installment | Secured Installment | Open-End | Single-Pay |

Channel | Online and in-store: 15 U.S. states and Canada | Online and in-store: 7 U.S. states | Online: KS, TN, ID, UT, RI, VA, DE and Canada. In-Store: KS, TN and Canada. | Online and in-store: 12 U.S. states and Canada |

Approximate Average Loan Size (1) | $664 | $1,405 | $814 | $319 |

Duration | Up to 60 months | Up to 42 months | Revolving/Open-Ended | Up to 62 days |

Pricing | 15.7% average monthly interest rate (2) | 11.6% average monthly interest rate (2) | Daily interest rates ranging from 0.13% to 0.99% | Fees ranging from $13 to $25 per $100 borrowed |

(1) Includes CSO loans |

(2) Weighted average of the contractual interest rates for the portfolio as of December 31, 2018. Excludes CSO fees |

Unsecured Installment Loans

Unsecured Installment loans are fixed-term, fully amortizing loans with a fixed payment amount due each period during the term of the loan. Loans are originated and owned by us or third-party lenders pursuant to CSO and credit access business statutes, which we collectively refer to as our CSO programs. For CSO programs, we arrange and guarantee the loans. Payments are due bi-weekly or monthly to best match the customer's pay cycle. Customers may prepay without penalty or fees. Unsecured Installment loan terms are governed by enabling state legislation in the U.S. and federal regulations in Canada. Unsecured Installment loans comprised 50.1%, 49.2% and 40.2% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively. We believe that the flexible terms and lower payments associated with Installment loans significantly expand our addressable market by allowing us to serve a broader range of customers with a variety of credit needs.

Secured Installment Loans

Secured Installment loans are similar to Unsecured Installment loans except that they are secured by a vehicle title. These loans are originated and owned by us or by third-party lenders through our CSO programs. For these loans the customer provides a clear title or security interest in his or her vehicle as collateral. The customer receives the benefit of immediate cash and retains possession of the vehicle while the loan is outstanding. The loan requires periodic payments of principal and interest with a fixed payment amount due each period during the term of the loan. Payments are due bi-weekly or monthly to match the customer's pay cycle. Customers may prepay without penalty or fees. Secured Installment loan terms are governed by enabling state legislation in the U.S. Secured Installment loans comprised 10.6%, 10.9%, and 10.2% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively.

Open-End Loans

Open-End loans are a line of credit without a specified maturity date. Customers may draw against their line of credit, repay with minimum, partial or full payment and redraw as needed. We report and earn interest on the outstanding loan balances drawn by the customer against their approved credit limit. Customers may prepay without penalty or fees. Typically, customers do not initially draw the full amount of their credit limit. Loan terms are governed by enabling state legislation in the U.S. and federal regulations in Canada. Open-End loans comprised 13.6%, 8.0% and 8.4% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively.

Single-Pay Loans

Single-Pay loans are generally unsecured short-term, small-denomination loans whereby a customer receives cash in exchange for a post-dated personal check or a pre-authorized debit from the customer’s bank account. We agree to defer deposit of the check or debiting of the customer’s bank account until the loan's due date, which typically falls on the customer’s next pay date. Single-Pay loans are governed by enabling state legislation in the U.S. and provincial legislation in Canada. Single-Pay loans comprised 21.0%, 27.6% and 36.7% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively. Single-Pay loans originated in the U.S. comprised 10.3%, 11.6% and 14.8% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively.

Ancillary Products

We provide a number of ancillary financial products including check cashing, proprietary reloadable prepaid debit cards (Opt+), credit protection insurance in the Canadian market, gold buying, retail installment sales and money transfer services. We had over 76,000 active Opt+ cards as of December 31, 2018, which includes any card with a positive balance or transaction in the past 90 days. Opt+ customers have loaded over $2.0 billion to their cards since we started offering this product in 2011. Ancillary products comprised 4.8%, 4.3% and 4.5% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively.

CSO Programs

Through our CSO programs, we act as a credit services organization/credit access business on behalf of customers in accordance with applicable state laws. We currently offer loans through CSO programs in stores and online in the state of Texas and online in the state of Ohio. As a CSO we earn revenue by charging the customer a fee (the "CSO fee") for arranging an unrelated third-party to make a loan to that customer. In Texas, we offer Unsecured Installment loans and Secured Installment loans with a maximum term of 180 days.

In Ohio, we currently operate as a registered CSO and provide CSO services to borrowers who apply for and obtain Unsecured Installment loans from a third-party lender. However, Ohio House Bill 123 was introduced in March 2017 to effectively eliminate the viability of the CSO model. In late July 2018, the Ohio legislature passed House Bill 123 and the Governor signed the bill into law. The principal sections of the new law are scheduled to become effective on or about April 27, 2019. As a result, we will no longer operate as a registered CSO in Ohio after April 27, 2019. Our revenue attributable to Ohio was $19.3 million in 2018, or 1.8% of our consolidated revenue, on an Unsecured Installment loan receivable balance of $5.2 million as of December 31, 2018 (average Unsecured Installment loan receivable balance of $6.5 million for the year ended December 31, 2018). After loss provisions and direct costs, our EBITDA contribution from Ohio was immaterial. The Ohio Department of Commerce granted us a short-term lender's license on February 15, 2019. Under this license, we will offer an Installment loan product for a term of 120 days. Ohio customers may originate and manage their loans online via the internet or mobile application.

We currently have relationships with four unaffiliated third-party lenders for our CSO programs. We periodically evaluate the competitive terms of our unaffiliated third-party lender contracts and such evaluation may result in the transfer of volume and loan balances between lenders. The process does not require significant effort or resources outside the normal course of business and we believe the incremental cost of changing or acquiring new unaffiliated third-party lender relationships to be immaterial.

Under our CSO programs, we agree to provide certain services to a customer in exchange for a CSO fee payable to us by the customer. One of the services is to guarantee the customer’s obligation to repay the loan the customer receives from the third-party lender. CSO fees are calculated based on the amount of the customer’s outstanding loan. For CSO loans, each lender is responsible for providing the criteria by which the customer’s application is underwritten and, if approved, determining the amount of the customer loan. We in turn are responsible for assessing whether or not we will guarantee the loan. This guarantee represents an obligation to purchase specific loans if they go in to default.

The maximum amount payable under all such CSO guarantees provided by us was $66.9 million at December 31, 2018, compared to $65.2 million at December 31, 2017. This liability is not included in our Consolidated Balance Sheets. Should we be required to pay any portion of the total amount of the loans we have guaranteed, we will attempt to recover some or all of the entire amount from the applicable customer(s). We hold no collateral in respect of the guarantees.

We estimate a liability for losses associated with the guaranty provided to the CSO lenders using assumptions and methodologies similar to the allowance for loan losses, which we recognize for our consumer loans.

Our liability for incurred losses on CSO loans guaranteed by the Company was $12.0 million and $17.8 million at December 31, 2018 and 2017, respectively.

CSO fees are calculated based on the amount of the customer’s outstanding loan in compliance with each state's applicable statute. These laws generally define the services that we can provide to consumers and require us to provide a contract to the customer outlining our services and the costs of those services to the customer. For services we provide under our CSO programs, we receive payments from customers on their scheduled loan repayment due dates. The CSO fee is earned ratably over the term of the loan as the customers make payments. If a loan is paid off early, no additional CSO fees are due or collected. The maximum CSO loan term is 180 days and 18 months in Texas and Ohio, respectively. During the years ended December 31, 2018 and 2017, 57.3% and 53.6%, respectively, of Unsecured Installment loans, and 54.5% and 53.6%, respectively, of Secured Installment loans originated under CSO programs were paid off prior to the original maturity date.

Since CSO loans are made by a third-party lender, we do not include them in our Consolidated Balance Sheets as loans receivable. CSO fees receivable are included in “Prepaid expense and other” in our Consolidated Balance Sheets. We receive payments from customers for these fees on their scheduled loan repayment due dates.

The majority of revenue generated through our CSO programs was for Unsecured Installment loans, which comprised 97.6%, 96.4% and 91.6% of our total CSO revenue for the years ended December 31, 2018, 2017 and 2016, respectively.

Total revenue generated through our CSO programs comprised 27.1%, 27.7%, and 27.2% of our consolidated revenue during the years ended December 31, 2018, 2017 and 2016, respectively.

Sales and Marketing

We are focused in part on attracting new customers as demonstrated by the 2.2 million new customers we acquired between January 2015 and December 2018 in the U.S. For the years ended December 31, 2018, 2017 and 2016, U.S. advertising as a percentage of U.S. revenue was 5.7%, 4.9% and 5.0%, respectively.

United States

In the U.S., our marketing efforts focus on a variety of targeted, direct response strategies. We use various forms of media to build brand awareness and drive customer traffic in stores, online and to our contact centers. These strategies include direct response spot television in each operating market, radio campaigns, point-of-purchase materials, a multi-listing and directory program for print and online yellow pages, local store marketing activities, prescreen direct mail campaigns, robust online marketing strategies and “send a friend” and word-of-mouth referrals from satisfied customers. We also utilize our unique capability to drive customers originated online to our store locations–a program we call “Site-to-Store.”

Canada

We believe Cash Money has built strong brand awareness as a leading provider of alternative financial solutions in Canada. Cash Money’s marketing efforts have historically included high frequency television buys, print media and targeted publications, as well as local advertising in the communities we serve.

Information Systems

The Curo Platform is our proprietary IT platform, which is a unified, centralized platform that seamlessly integrates activities related to customer acquisition, underwriting, scoring, servicing, collections, compliance and reporting. The Curo Platform is scalable and has been successfully implemented in the U.S. and Canada. The Curo Platform is designed to enable us to support and monitor compliance with regulatory and other legal requirements applicable to the financial products we offer. Our platform captures transactional history by store and by customer, which allows us to track loan originations, payments, defaults and payoffs, as well as historical collection activities on past-due accounts. In addition, our stores perform automated daily cash reconciliation

at each store and every bank account in the system. This fully-integrated IT platform enables us to make real-time, data-driven changes to our acquisition and risk models, which yield significant benefits in terms of customer acquisition costs and credit performance. Each of our stores has secure, real-time access to corporate servers and the most up-to-date information to maintain consistent underwriting standards. All loan applications are scanned and electronic copies are centrally stored for convenient access and retrieval. Our IT platform contains over 15 years of continually updated customer data comprising over 78 million loan records (as of December 31, 2018) to formulate our robust, proprietary underwriting algorithms. This platform then automatically applies multi-algorithmic analysis to a customer’s loan application to produce a “Curo Score,” which drives our underwriting decision. As of December 31, 2018, we have over 167 employees who write code and manage our networks and infrastructure for our IT platform.

Collections

To enable store-level employees to focus on customer service and to improve effectiveness and compliance management, we operate centralized collection facilities in the U.S. and Canada. Our collections personnel are trained to optimize regulatory-compliant loan repayment while treating our customers fairly. Our collections personnel contact customers after a missed payment, primarily via phone calls, letters and emails, and attempt to help the customer understand available payment arrangements or alternatives to satisfy the deficiency. We use a variety of collection strategies, including payment plans, settlements and adjustments to due dates. Collections teams are trained to apply different strategies and tools for the various stages of delinquency and also vary methodologies by product type.

Our collections centers in Wichita, Kansas and Toronto, Ontario employed a total of 181 collection professionals as of December 31, 2018.

We assign all our delinquent loan accounts in the U.S. to an affiliated third-party collection agency typically after 91 days without a scheduled payment. Under our policy, the precise number of days past-due to trigger a collection-agency referral varies by state and product and requires, among other things, that proper notice be delivered to the customer. Once a loan meets the criteria set forth in the policy, it is automatically referred for collection. We make changes to our policy periodically in response to various factors, including regulatory developments and market conditions. Our policy is overseen and directed by our Chief Operating Officer, Senior Vice President in charge of collections and our Chief Executive Officer. As delinquent accounts are paid, the Curo Platform updates these accounts in real time. This ensures that collection activity will cease the moment a customer’s account is brought current or paid in full and considered in “good standing.” See Note 19, “Related Party Transactions" of the Notes to Consolidated Financial Statements for a description of our relationship with our third-party collection agency.

Competition

We believe that the primary factors upon which we compete are:

| |

• | flexibility of product offering; |

Our underbanked customers tend to value service that is quick and convenient, lenders that can provide the most appropriate structure, and loan terms and payments that are affordable. We face competition in all of our markets from other alternative financial services providers, banks, savings and loan institutions, short-term consumer lenders and other financial services entities. Generally, the landscape is characterized by a small number of large, national participants with a significant presence in markets across the country and a significant number of smaller localized operators. Our competitors in the alternative financial services industry include monoline operators (both public and private) specializing in short-term cash advances, multiline providers offering cash advance services in addition to check cashing and other services and subprime specialty finance and consumer finance companies, as well as businesses conducting operations online and by phone.

Employees

As of December 31, 2018, we had approximately 4,100 employees worldwide, approximately 3,000 of whom work in our stores. We have a state-of-the-art financial technology office in Chicago which allows us to attract and retain talented IT development and data science professionals. None of our employees are unionized or covered by a collective bargaining agreement and we consider our employee relations to be good.

We believe that customer service is critical to our continued success and growth. As such, we have staffed each of our stores with a full-time Store Manager, Branch Manager or Manager, who runs the day-to-day operations of the store. The Manager is typically supported by two to three Senior Assistant Managers and/or Assistant Managers and three to eight full-time Customer Advocates. A new store will typically start with a Manager, a Senior Assistant Manager, two Assistant Managers and two Customer Advocates. Customer Advocates conduct the point-of-sale activities and greet and interact with customers from a secured area behind expansive windows. We believe staff continuity is critical to our business. We believe that our pay rates are equal to or better than all of our major competitors and we constantly evaluate our benefit plans to maintain their competitiveness.

Regulatory Environment and Compliance

The alternative financial services industry is regulated at the federal, state and local levels in the U.S. and at the federal and provincial levels in Canada. In general, these regulations are designed to protect consumers and the public, while providing standard guidelines for business operations. Laws and regulations typically impose restrictions and requirements, such as governing interest rates and fees, maximum loan amounts, the number of simultaneous or consecutive loans, required waiting periods between loans, loan extensions and refinancings, payment schedules (including maximum and minimum loan durations), required repayment plans for borrowers claiming inability to repay loans, disclosures, security for loans and payment mechanisms, licensing, and in certain jurisdictions, database reporting and loan utilization information. We are also subject to federal, state, provincial and local laws and regulations relating to our other financial products, including laws and regulations governing recording and reporting certain financial transactions, identifying and reporting suspicious activities and safeguarding the privacy of customers’ non-public personal information. For more information regarding the regulations applicable to our business and the risks to which they subject us, see the section entitled “Risk Factors” in this Report.

The legal environment is constantly changing as new laws and regulations are introduced and adopted, and existing laws and regulations are repealed, amended, modified or reinterpreted. We regularly work with authorities, both directly and through our active memberships in industry trade associations, to support our industry and to promote the development of laws and regulations that are equitable to businesses and consumers alike.

Regulatory authorities at various levels of government and voters have enacted, and are likely to continue to propose, new rules and regulations impacting our industry. Due to the evolving nature of laws and regulations, further rulemaking could result in new or expanded regulations, particularly at the state level, that may adversely impact our current product offerings or alter the economic performance of our existing products and services. For example, laws were recently enacted in Ohio by legislation and in Colorado by voter initiative that impaired our lending businesses in those states. Additionally, a rule adopted by the Consumer Financial Protection Bureau (“CFPB”) in 2017 (the “2017 Final CFPB Rule”) will likely increase costs and lessen the effectiveness of our loan servicing and collections. If a recent CFPB proposal to rescind part of the 2017 Final CFPB Rule does not go into effect, the 2017 Final CFPB Rule could have a more significant negative impact on our business. In addition, the CFPB is expected to propose a rule that will impact debt collector communications with consumers and provide additional guidance on how to engage in such communications. Although the rule is not expected to apply directly to our activities, such a rule might impact third-party debt collection on our behalf through such proposals, and the CFPB might use its supervisory authority to impose similar restrictions on us. We cannot provide any assurances that additional federal, state, provincial or local statutes or regulations will not be enacted in the future in any of the jurisdictions in which we operate. It is possible that future changes to statutes or regulations will have a material adverse effect on our results of operations and financial condition.

U.S. Regulations

U.S. Federal Regulations

The U.S. federal government and its agencies possess significant regulatory authority over consumer financial services. The body of laws to which we are subject has a significant impact on our operations.

Dodd-Frank: In 2010, the U.S. Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act ("Dodd-Frank"). Title X of this legislation created the CFPB, which became operational in July 2011. Title X provides the CFPB with broad rule-making, supervisory and enforcement powers with regard to consumer financial services. Title X of Dodd-Frank also contains so-called “UDAAP” provisions declaring unlawful “unfair,” “deceptive” and “abusive” acts and practices in connection with the delivery of consumer financial services and giving the CFPB the power to enforce UDAAP prohibitions and to adopt UDAAP rules defining, within constraints, unlawful acts and practices. Additionally, the Federal Trade Commission Act prohibits “unfair” and “deceptive” acts and practices in connection with a trade or business and gives the Federal Trade Commission enforcement authority to prevent and redress violations of this prohibition.

CFPB Rules: Pursuant to its authority to adopt UDAAP rules, the CFPB published the 2017 Final CFPB Rule in the Federal

Register on November 17, 2017. The provisions of the 2017 Final CFPB Rule directly applicable to us were scheduled to become effective in August 2019. However, the effectiveness of these provisions has been stayed, at least for now, by a federal district court hearing and an industry challenge to the 2017 Final CFPB Rule. While the lawsuit has also been stayed, the plaintiffs challenging the 2017 Final CFPB Rule are seeking a preliminary injunction against the 2017 Final CFPB Rule on the basis that the 2017 Final CFPB Rule is arbitrary and capricious and also on the basis that rulemaking by a single CFPB director who is not subject to discharge without cause is unconstitutional.

In February 2019, the CFPB issued two notices of proposed rulemaking proposing (i) to delay the August 19, 2019 compliance date for the so-called "Mandatory Underwriting Provisions" of the 2017 Final CFPB Rule to November 19, 2020 and (ii) to rescind such Mandatory Underwriting Provisions (the “2019 Proposed Rule”). The Mandatory Underwriting Provisions which the 2019 Proposed Rule would rescind: (i) provide that it is an unfair and abusive practice for a lender to make a covered short-term or longer-term balloon-payment loan, including our payday and vehicle title loans with a term of 45 days or less, without reasonably determining that consumers have the ability to repay those loans according to their terms; (ii) prescribe mandatory underwriting requirements for making this ability-to-repay determination; (iii) exempt certain loans from the mandatory underwriting requirements; and (iv) establish related definitions, reporting, and recordkeeping requirements.

In light of the industry challenge to the 2017 Final CFPB Rule, the CFPB's proposals to delay the effective date of the Mandatory Underwriting Provisions and ultimately rescind them, and the possibility of legal challenges to the 2019 Proposed Rule if it is adopted, we cannot predict whether or when the 2017 Final CFPB Rule will go into effect and, if so, whether and how it might be further modified; nor can we quantify the potential effect on our results of operations and financial condition.

In its issued form, the 2017 Final CFPB Rule sets forth the Mandatory Underwriting Provisions that establish ability-to-repay, ("ATR") requirements for “covered short-term loans” and “covered longer-term balloon-payment loans,” as well as payment limitations on these loans and “covered longer-term loans.” Covered short-term loans are consumer loans with a term of 45 days or less. Covered longer-term balloon payment loans include consumer loans with a term of more than 45 days where (i) the loan is payable in a single payment, (ii) any payment is more than twice any other payment, or (iii) the loan is a multiple advance loan that may not fully amortize by a specified date and the final payment could be more than twice the amount of other minimum payments. Covered longer-term loans are consumer loans with a term of more than 45 days where (i) the total cost of credit exceeds an annual rate of 36%, and (ii) the lender obtains a form of “leveraged payment mechanism” giving the lender a right to initiate transfers from the consumer’s deposit or other asset account. Post-dated checks, authorizations to initiate ACH payments and authorizations to initiate prepaid or debit card payments are all leveraged payment mechanisms under the CFPB Rule.

The 2017 Final CFPB Rule excluded from coverage, among other loans: (i) purchase-money credit secured by the vehicle or other goods financed (but not unsecured purchase-money credit or credit that finances services as opposed to goods); (ii) real property or dwelling-secured credit if the lien is recorded or perfected; (iii) credit cards; (iv) student loans; (v) non-recourse pawn loans; and (vi) overdraft services and overdraft lines of credit. These exclusions would not apply to our current loans.

Under the provisions of the 2017 Final CFPB Rule applicable to covered short-term loans and covered longer-term balloon payment loans, a lender would need to choose between:

| |

• | A “full payment test,” under which the lender must make a reasonable determination of the consumer’s ability to repay the loan and cover major financial obligations and living expenses over the term of the loan and the succeeding 30 days. Under this test, the lender must take account of the consumer’s basic living expenses and obtain and generally verify evidence of the consumer’s income and major financial obligations. However, in circumstances where a lender determines that a reliable income record is not reasonably available, such as when a consumer receives and spends income in cash, the lender may reasonably rely on the consumer’s statements alone as evidence of income. Further, unless a housing debt obligation appears on a national consumer report, the lender may reasonably rely on the consumer's written statement. As part of the ATR determination, the 2017 Final CFPB Rule permits lenders and consumers to rely on income from third parties, such as spouses, to which the consumer has a reasonable expectation of access and permits lenders in certain circumstances to consider whether another person is regularly contributing to the payment of major financial obligations or basic living expenses. A 30-day cooling off period applies after a sequence of three covered short-term or longer-term balloon payment loans. |

| |

• | A “principal-payoff option,” under which the lender may make up to three sequential loans, ("Section 1041.6 Loans") without engaging in an ATR analysis. The first Section 1041.6 Loan in any sequence of Section 1041.6 Loans without a 30-day cooling off period between loans is limited to $500, the second is limited to a principal amount that is at least one-third smaller than the principal amount of the first, and the third is limited to a principal amount that is at least two-thirds smaller than the principal amount of the first. A lender may not use this option if (i) the consumer had in the past 30 days an outstanding covered short-term loan or an outstanding longer-term balloon payment loan that is not a Section 1041.6 Loan, or (ii) the new Section 1041.6 Loan would result in the consumer having more than six covered short- |

term loans (including Section 1041.6 Loans) during a consecutive 12-month period or being in debt for more than 90 days on such loans during a consecutive 12-month period. For Section 1041.6 Loans, the lender cannot take vehicle security or structure the loan as open-end credit.

These provisions from the 2017 Final CFPB Rule are included in the 2019 Proposed Rule's identification of “Mandatory Underwriting Provisions.” In proposing the 2019 Proposed Rule, the CFPB expressed the view that the Mandatory Underwriting Provisions “would have the effect of restricting access to credit and reducing competition for these products” and “would have the effect of reducing credit access and competition in the States which have determined it is in their citizens’ interest to be able to use such products, subject to State-law limitations.” The CFPB therefore reached a preliminarily conclusion that “neither the evidence cited nor legal reasons provided in the 2017 Final CFPB Rule support its determination that the identified practice is unfair and abusive, thereby eliminating the basis for the 2017 Final CFPB Rule’s Mandatory Underwriting Provisions to address that conduct.” In the 2019 Proposed Rule, the CFPB concluded that it is appropriate to propose rescinding the Mandatory Underwriting Provisions of the 2017 Final CFPB Rule.

Covered longer-term loans that are not balloon loans are not subject to the Mandatory Underwriting Provisions of the 2017 Final CFPB Rule. However, such loans are subject to the 2017 Final CFPB Rule's “penalty fee prevention” provisions ("Payment Provisions"), which apply to all covered loans. Under these provisions:

| |

• | If two consecutive attempts to collect money from a particular account of the borrower, made through any channel (e.g., paper check, ACH, prepaid card) are returned for insufficient funds, the lender cannot make any further attempts to collect from such account unless the borrower has provided a new and specific authorization for additional payment transfers. The 2017 Final CFPB Rule contains specific requirements and conditions for the authorization. While the CFPB has explained that these provisions are designed to limit bank penalty fees to which consumers may be subject, and while banks do not charge penalty fees on card authorization requests, the 2017 Final CFPB Rule nevertheless treats card authorization requests as payment attempts subject to these limitations. |

| |

• | A lender generally must give the consumer at least three business days advance notice before attempting to collect payment by accessing a consumer’s checking, savings, or prepaid account. The notice must include information such as the date of the payment request, payment channel and payment amount (broken down by principal, interest, fees, and other charges), as well as additional information for “unusual attempts,” such as when the payment is for a different amount than the regular payment, initiated on a date other than the date of a regularly scheduled payment or initiated in a different channel that the immediately preceding payment attempt. A lender must also provide the borrower with a "consumer rights notice" in a prescribed form after two consecutive failed payment attempts. |

The Payment Provisions are outside the scope of the 2019 Proposed Rule although the CFPB indicated it has received a formal request to revisit the treatment of debt cards under the Payment Provisions and it intends to examine the Payment Provisions further. If the CFPB determines that further action is warranted, it may commence a separate rulemaking initiative.

The 2017 Final CFPB Rule also requires the CFPB’s registration of consumer reporting agencies as “registered information systems” to whom lenders must furnish information about covered short-term and longer-term balloon loans and from whom lenders must obtain consumer reports for use in extending such credit. If there is no registered information system or if no registered information system has been registered for at least 180 days, lenders will be unable to make Section 1041.6 Loans. The 2019 Proposed Rule also proposes to rescind the registered information system reporting requirements and related recordkeeping requirements.

For a discussion of the potential impact of the 2017 Final CFPB Rule and 2019 Proposed Rule on us, see “Risk Factors--Risks Relating to the Regulation of Our Industry--The CFPB promulgated new rules applicable to our loans that could have a material adverse effect on our business and results of operations." The CFPB promulgated new rules applicable to our loans that could have a material adverse effect on our business and results of operations” in "Risk Factors" of this Report.

CFPB Enforcement. In addition to Dodd-Frank's grant of rule-making authority, which resulted in the CFPB Rule, Dodd-Frank gives the CFPB authority to pursue administrative proceedings or litigation for violations of federal consumer financial laws (including Dodd-Frank’s UDAAP provisions and the CFPB’s own rules). In these proceedings, the CFPB can obtain cease and desist orders (which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief) and monetary penalties ranging from $5,000 per day for ordinary violations of federal consumer financial laws to $25,000 per day for reckless violations and $1 million per day for knowing violations. Also, where a company has violated Title X of Dodd-Frank or CFPB regulations promulgated thereunder, Dodd-Frank empowers state attorneys general and state regulators to bring civil actions for the kind of cease and desist orders available to the CFPB (but not for civil penalties). Potentially, if the CFPB, the FTC

or one or more state officials believe we have violated the foregoing laws, they could exercise their enforcement powers in ways that would have a material adverse effect on us.

CFPB Supervision and Examination. Additionally, the CFPB has supervisory powers over many providers of consumer financial products and services, including explicit authority to examine (and require registration) of payday lenders. The CFPB released its Supervision and Examination Manual, which includes a section on Short-Term, Small-Dollar Lending Procedures, and began field examinations of industry participants in 2012. The CFPB commenced its first supervisory examination of us in October 2014. The scope of the CFPB’s examination included a review of our Compliance Management System, our Short-Term Small Dollar lending procedures and our compliance with federal consumer financial protection laws. The 2014 examination did not materially affect our financial condition or results of operations, and we received the final CFPB Examination Report in September 2015.

The CFPB commenced its second examination of us in February 2017 and completed the related field work in June 2017. The scope of the 2017 examination included a review of our Compliance Management System, our substantive compliance with applicable federal laws and other matters requiring attention. The 2017 examination did not materially affect our financial condition or results of operations, and we received the final CFPB Examination Report in February 2018.

Reimbursement Offer. Possible Changes in Payment Practices. During 2017, it was determined that a limited universe of our borrowers may have incurred bank overdraft or non-sufficient funds fees because of possible confusion about certain electronic payments we initiated on their loans. As a result, we decided to reimburse such fees through payments or credits against outstanding loan balances, subject to per-customer dollar limitations, upon receipt of (i) claims from potentially affected borrowers stating that they were in fact confused by our practices and (ii) bank statements from such borrowers showing that fees for which reimbursement was sought were incurred at a time that such borrowers might reasonably have been confused about our practices. As of September 30, 2018, net of payments made, we no longer have a liability for this matter.

Additionally, in June 2018 we discontinued the use of secondary payment cards for affected borrowers referenced above who did not explicitly reauthorize the use of secondary payment cards. For those borrowers, in the event we cannot obtain payment through the bank account or payment card listed on the borrower’s application, we will need to rely exclusively on other collection methods such as delinquency notices and/or collection calls. Our discontinuance of using secondary cards for affected borrowers will increase collections costs and reduce the effectiveness of our collection efforts.

While we do not expect that matters arising from our past CFPB examinations will have a material impact on us, we have made in recent years and are continuing to make, at least in part to meet the CFPB's expectations, certain enhancements to our compliance procedures and consumer disclosures. For example, we are in the process of evaluating our payment practices. Even if the Payment Provisions do not become effective, we may make changes to these practices in a manner that will increase our costs and/or reduce our consolidated revenues.

Anti-Arbitration Rule. Under its authority to regulate pre-dispute arbitration provisions pursuant to Section 1028 of Dodd-Frank, in July 2017 the CFPB issued a final rule prohibiting the use of mandatory arbitration clauses with class action waivers in agreements for certain consumer financial products and services, including those applicable to us. Subsequently, Congress overturned the rule and the President signed a joint resolution on November 1, 2017 to repeal the Anti-Arbitration Rule. As a result, the rule will not become effective, and, pursuant to the Congressional Review Act, substantially similar rules may only be reissued with specific legislative authorization.

MLA. The Military Lending Act (the "MLA"), enacted in 2006 and implemented by the Department of Defense (the "DoD"), imposes a 36% cap on the “all-in” annual percentage rates charged on certain loans to active-duty members of the U.S. military, reserves and National Guard and their dependents. As initially adopted, the MLA and related DoD rules applied to our loans with terms up to 90 days but not our longer-term loans. However, effective in October 2016, the DoD expanded its MLA regulations to encompass some of our longer-term Installment and Open-End Loans that were not previously covered. As a result, we ceased offering short-term consumer loans to these applicants in 2007 and all loans to these applicants in 2016.

Enumerated Consumer Financial Services Laws, TCPA and CAN-SPAM. Federal law imposes additional requirements on us with respect to our consumer lending. These requirements include disclosure requirements under the Truth in Lending Act ("TILA"), and Regulation Z. TILA and Regulation Z require creditors to deliver disclosures to borrowers prior to consummation of both closed-end and open-end loans and, additionally for open-end credit products, periodic statements and change in terms notices. For closed-end loans, the annual percentage rate, the finance charge, the amount financed, the total of payments, the number and amount of payments and payment due dates, late fees and security interests must all be disclosed. For open end credit, the borrower must be provided with key information that includes annual percentage rates and balance computation methods, various fees and charges, and security interests.

Under the Equal Credit Opportunity Act ("ECOA"), and Regulation B, we may not discriminate on various prohibited bases, including race, gender, national origin, marital status and the receipt of government benefits, or retirement or part-time income, and we must also deliver notices specifying the basis for credit denials, as well as certain other notices.

The Fair Credit Reporting Act ("FCRA") regulates the use of consumer reports and reporting of information to credit reporting agencies. FCRA limits the permissible uses of credit reports and requires us to provide notices to customers when we take adverse action or increase interest rates based on information obtained from third parties, including credit bureaus.

We are also subject to additional federal requirements with respect to electronic signatures and disclosures under the Electronic Signatures In Global And National Commerce Act ("ESIGN") and requirements with respect to electronic payments under the Electronic Funds Transfer Act ("EFTA)" and Regulation E. EFTA and Regulation E requirements also have an important impact on our prepaid debit card services business. The EFTA and Regulation E protect consumers engaging in electronic fund transfers and contain restrictions, require disclosures and provide consumers certain rights relating to electronic fund transfers, including electronic fund transfers authorized in advance to recur at substantially equal intervals.

Additionally, we are subject to the Telephone Consumer Protection Act (the "TCPA"), the CAN-SPAM Act and the regulations of the Federal Communications Commission, which include limitations on telemarketing calls, auto-dialed calls, pre-recorded calls, text messages and unsolicited faxes. While we believe that our practices comply with the TCPA, the TCPA has given rise to a spate of litigation nationwide.

We apply the rules under the Fair Debt Collection Practices Act ("FDCPA") as a guide to conducting our collections activities for delinquent loan accounts, and we are subject to applicable state collections laws as well.

Bank Secrecy Act and Anti-Money Laundering Laws. Under regulations of the U.S. Department of the Treasury (the "Treasury Department") adopted under the Bank Secrecy Act of 1970 ("BSA"), we must report currency transactions in an amount greater than $10,000 by filing a Currency Transaction Report ("CTR"), and we must retain records for five years for purchases of monetary instruments for cash in amounts from $3,000 to $10,000. Multiple currency transactions must be treated as a single transaction if we have knowledge that the transactions are by, or on behalf of, the same person and result in either cash in or cash out totaling more than $10,000 during any one business day. We will file a CTR for any transaction which appears to be structured to avoid the required filing and the individual transaction or the aggregate of multiple transactions would otherwise meet the threshold and require the filing of a CTR.

The BSA also requires us to register as a money services business with the Financial Crimes Enforcement Network of the Treasury Department ("FinCEN"). This registration is intended to enable governmental authorities to better enforce laws prohibiting money laundering and other illegal activities. We are registered as a money services business with FinCEN and must re-register with FinCEN by December 31 every other year. We must also maintain a list of names and addresses of, and other information about, our stores and must make that list available to FinCEN and any requesting law enforcement or supervisory agency. That store list must be updated at least annually.

Federal anti-money-laundering laws make it a criminal offense to own or operate a money transmittal business without the appropriate state licenses, which we maintain. In addition, the USA PATRIOT Act of 2001 and its corresponding federal regulations require us, as a “financial institution,” to establish and maintain an anti-money-laundering program. Such a program must include: (i) internal policies, procedures and controls designed to identify and report money laundering; (ii) a designated compliance officer; (iii) an ongoing employee-training program; and (iv) an independent audit function to test the program. In addition, federal regulations require us to report suspicious transactions involving at least $2,000 to FinCEN. The regulations generally describe four classes of reportable suspicious transactions: one or more related transactions that the money services business knows, suspects or has reason to suspect (i) involve funds derived from illegal activity or are intended to hide or disguise such funds, (ii) are designed to evade the requirements of the BSA (iii) appear to serve no business or lawful purpose or (iv) involve the use of the money service business to facilitate criminal activity.

The Office of Foreign Assets Control ("OFAC") publishes a list of individuals and companies owned or controlled by, or acting for or on behalf of, targeted or sanctioned countries. It also lists individuals, groups and entities, such as terrorists and narcotics traffickers, designated under programs that are not country-specific. Collectively, such individuals and companies are called “Specially Designated Nationals.” Their assets are blocked and we are generally prohibited from dealing with them.

Privacy Laws. The Gramm-Leach-Bliley Act of 1999 and its implementing federal regulations require us generally to protect the confidentiality of our customers’ nonpublic personal information and to disclose to our customers our privacy policy and practices, including those regarding sharing the customers’ nonpublic personal information with third-parties. That disclosure must be made to customers at the time the customer relationship is established and at least annually thereafter, unless posted on our website.