Exhibit 99.1

Annual Consolidated Financial Statements

For the years ended December 31, 2020, 2019 and 2018

(Expressed

in Canadian Dollars)

TABLE OF CONTENTS

|

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL

REPORTING

|

3

|

|

|

Report of Independent Registered Public Accounting

Firm

|

4

|

|

|

Consolidated Statements of Financial Position

|

6

|

|

|

Consolidated Statements of Operations and Comprehensive Gain

(Loss)

|

7

|

|

|

Consolidated Statements of Changes in Equity

|

8

|

|

|

Consolidated Statements of Cash Flows

|

9

|

|

|

|

|

|

|

1

|

DESCRIPTION OF BUSINESS AND NATURE OF OPERATIONS

|

10

|

|

2

|

BASIS OF PRESENTATION

|

10

|

|

3

|

BASIS OF CONSOLIDATION

|

11

|

|

4

|

CHANGES IN ACCOUNTING POLICIES

|

11

|

|

5

|

SIGNIFICANT JUDGMENTS, ESTIMATES AND ASSUMPTIONS

|

12

|

|

6

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

|

16

|

|

7

|

SEGMENTED INFORMATION

|

21

|

|

8

|

CASH AND CASH EQUIVALENTS

|

21

|

|

9

|

RECEIVABLES

|

22

|

|

10

|

PREPAID EXPENSES

|

22

|

|

11

|

MARKETABLE SECURITIES

|

22

|

|

12

|

RIGHT-OF-USE ASSET

|

22

|

|

13

|

EQUIPMENT

|

23

|

|

14

|

MINERAL PROPERTIES

|

25

|

|

15

|

ACCOUNTS PAYABLE AND ACCRUED LIABILITIES

|

30

|

|

16

|

LEASE LIABILITY

|

31

|

|

17

|

PROVISION FOR CLOSURE AND RECLAMATION

|

31

|

|

18

|

TAX PROVISION

|

32

|

|

19

|

SHARE CAPITAL

|

33

|

|

20

|

CAPITAL RISK MANAGEMENT

|

38

|

|

21

|

FAIR VALUE MEASUREMENTS AND FINANCIAL INSTRUMENTS

|

38

|

|

22

|

FINANCIAL RISK MANAGEMENT DISCLOSURES

|

39

|

|

23

|

RELATED PARTY DISCLOSURES

|

40

|

|

24

|

KEY MANAGEMENT PERSONNEL COMPENSATION

|

41

|

|

25

|

SUPPLEMENTAL CASH FLOW INFORMATION

|

42

|

|

26

|

CONTINGENCIES

|

42

|

|

27

|

EVENTS AFTER THE REPORTING DATE

|

43

|

2

The annual audited consolidated financial statements (the

“Annual Financial

Statements”), the notes

thereto, and other financial information contained in the

accompanying Management’s Discussion and Analysis

(“MD&A”) have been prepared in accordance with

International Financial Reporting Standards as issued by the

International Accounting Standards Board and are the responsibility

of the management of Silver Elephant Mining Corp. The financial

information presented elsewhere in the MD&A is consistent with

the data that is contained in the Annual Financial Statements. The

Annual Financial Statements, where necessary, include amounts which

are based on the best estimates and judgment of

management.

In order to discharge management’s responsibility for the

integrity of the Annual Financial Statements, the Company maintains

a system of internal accounting controls. These controls are

designed to provide reasonable assurance that the Company’s

assets are safeguarded, transactions are executed and recorded in

accordance with management’s authorization, proper records

are maintained, and relevant and reliable financial information is

produced. These controls include maintaining quality standards in

hiring and training of employees, policies and procedures manuals,

a corporate code of conduct and ethics and ensuring that there is

proper accountability for performance within appropriate and

well-defined areas of responsibility. The system of internal

controls is further supported by a compliance function, which is

designed to ensure that we and our employees comply with securities

legislation and conflict of interest rules.

The Board of Directors is responsible for overseeing

management’s performance of its responsibilities for

financial reporting and internal control. The Audit Committee,

which is composed of non-executive directors, meets with management

as well as the external auditors to ensure that management is

properly fulfilling its financial reporting responsibilities to the

Board who approve the Annual Financial Statements. The external

auditors have full and unrestricted access to the Audit Committee

to discuss the scope of their audits and the adequacy of the system

of internal controls,

and to review financial reporting

issues.

The

external auditors, Davidson & Company LLP, have been appointed

by the Company’s shareholders to render their opinion on the

Annual Financial Statements and their report is included

herein.

|

“John Lee”

|

“Irina

Plavutska”

|

|

----------------------------------------------------

|

---------------------------------------------------

|

|

John

Lee, Chief Executive Officer

|

Irina

Plavutska, Chief Financial Officer

|

Vancouver,

British Columbia

March

12, 2021

3

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

To the

Shareholders and Directors of

Silver

Elephant Mining Corp.

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statements of

financial position of Silver Elephant Mining Corp.

(the “Company”), as of December 31, 2020, 2019 and

2018, and the related consolidated statements of operations and

comprehensive gain (loss), changes in equity (deficiency), and cash

flows for the years ended December 31, 2020, 2019 and 2018, and the

related notes (collectively referred to as the “financial

statements”). In our opinion, the consolidated financial

statements present fairly, in all material respects, the financial

position of Silver Elephant Mining Corp. as of December 31, 2020,

2019 and 2018, and the results of its operations and its cash flows

for the years ended December 31, 2020, 2019 and 2018 in accordance

with those requirements of International Financial Reporting

Standards (IFRS) as issued by the International Accounting

Standards Board.

Going Concern

The

accompanying consolidated financial statements have been prepared

assuming that the Company will continue as a going concern. As

discussed in Note 1 to the consolidated financial statements, the

Company has suffered recurring losses from operations that raise

substantial doubt about its ability to continue as a going concern.

Management's plans in regard to these matters are also described in

Note 1. The consolidated financial statements do not include any

adjustments that might result from the outcome of this

uncertainty.

Basis for Opinion

These

consolidated financial statements are the responsibility of the

Company’s management. Our responsibility is to express an

opinion on the Company’s consolidated financial statements

based on our audits. We are a public accounting firm registered

with the Public Company Accounting Oversight Board (United States)

(“PCAOB”) and are required to be independent with

respect to the Company in accordance with the U.S. federal

securities laws and the applicable rules and regulations of the

Securities and Exchange Commission and the PCAOB.

We

conducted our audits in accordance with the standards of the PCAOB.

Those standards require that we plan and perform the audit to

obtain reasonable assurance about whether the consolidated

financial statements are free of material misstatement, whether due

to error or fraud. The Company is not required to have, nor were we

engaged to perform, an audit of its internal control over financial

reporting. As part of our audits we are required to obtain an

understanding of internal control over financial reporting but not

for the purpose of expressing an opinion on the effectiveness of

the Company’s internal control over financial reporting.

Accordingly, we express no such opinion.

4

Our

audits included performing procedures to assess the risks of

material misstatements of the financial statements, whether due to

error or fraud, and performing procedures that respond to those

risks. Such procedures included examining, on a test basis,

evidence regarding the amounts and disclosures in the consolidated

financial statements. Our audits also included evaluating the

accounting principles used and significant estimates made by

management, as well as evaluating the overall presentation of the

consolidated financial statements. We believe that our audits

provide a reasonable basis for our opinion.

We have

served as the Company’s auditor since 2013.

|

|

|

|

Vancouver,

Canada

|

Chartered

Professional Accountants

|

March

12, 2021

5

SILVER ELEPHANT MINING CORP.

Consolidated Statements of Financial Position

(Expressed

in Canadian Dollars)

|

As at

|

|

December

31,

|

December

31,

|

December

31,

|

|

|

Notes

|

2020

|

2019

|

2018

|

|

Assets

|

|

|

|

|

|

Current

assets

|

|

|

|

|

|

Cash

|

8

|

$7,608,149

|

$3,017,704

|

$5,304,097

|

|

Receivables

|

9

|

75,765

|

246,671

|

36,399

|

|

Prepaid

expenses

|

10

|

114,717

|

135,767

|

123,272

|

|

|

|

7,798,631

|

3,400,142

|

5,463,768

|

|

Non-current

assets

|

|

|

|

|

|

Restricted cash

equivalents

|

8

|

34,500

|

34,500

|

34,500

|

|

Reclamation

deposits

|

|

21,055

|

21,055

|

21,055

|

|

Right-of-use

asset

|

12

|

18,430

|

50,023

|

-

|

|

Equipment

|

13

|

153,800

|

159,484

|

101,162

|

|

Mineral

properties

|

14

|

31,806,594

|

23,782,884

|

3,643,720

|

|

|

|

$39,833,010

|

$27,448,088

|

$9,264,205

|

|

Liabilities

and Equity (Deficiency)

|

|

|

|

|

|

Current

liabilities

|

|

|

|

|

|

Accounts payable

and accrued liabilities

|

15

|

$1,759,163

|

$2,420,392

|

$1,636,786

|

|

Lease

liability

|

16

|

20,533

|

32,285

|

-

|

|

|

|

1,779,696

|

2,452,677

|

1,636,786

|

|

Non-current

liabilities

|

|

|

|

|

|

Lease

liability

|

16

|

-

|

20,533

|

-

|

|

Provision for

closure and reclamation

|

17

|

695,257

|

266,790

|

265,239

|

|

Tax

provision

|

18

|

-

|

-

|

8,121,918

|

|

|

|

2,474,953

|

2,740,000

|

10,023,943

|

|

Equity

(Deficiency)

|

|

|

|

|

|

Share

capital

|

19

|

197,612,182

|

181,129,012

|

173,819,546

|

|

Reserves

|

19

|

24,852,022

|

24,058,336

|

23,413,830

|

|

Deficit

|

|

(185,106,147)

|

(180,479,260)

|

(197,993,114)

|

|

|

|

37,358,057

|

24,708,088

|

(759,738)

|

|

|

|

$39,833,010

|

$27,448,088

|

$9,264,205

|

|

Approved

on behalf of the Board:

|

|||||

|

"John Lee"

|

|

|

|

|

"Greg Hall"

|

|

John

Lee, Director

|

|

|

|

|

Greg

Hall, Director

|

Contingencies

(Note 26)

Events

after the reporting date (Note 27)

The

accompanying notes form an integral part of these consolidated

financial statements.

6

SILVER ELEPHANT MINING CORP.

Consolidated Statements of Operations and Comprehensive Gain

(Loss)

(Expressed

in Canadian Dollars)

|

|

|

Years

Ended December 31,

|

||

|

|

Notes

|

2020

|

2019

|

2018

|

|

General

and Administrative Expenses

|

|

|

|

|

|

Advertising and

promotion

|

|

$541,029

|

$794,182

|

$471,230

|

|

Consulting and

management fees

|

22

|

570,356

|

251,552

|

255,610

|

|

Depreciation and

accretion

|

|

41,116

|

65,157

|

28,024

|

|

Director

fees

|

22

|

108,600

|

103,805

|

70,378

|

|

Insurance

|

|

100,948

|

93,661

|

55,546

|

|

Office and

administration

|

|

136,274

|

123,904

|

137,289

|

|

Professional

fees

|

|

321,355

|

228,594

|

428,884

|

|

Salaries and

benefits

|

23

|

530,065

|

760,182

|

827,168

|

|

Share-based

payments

|

19

|

770,617

|

707,802

|

553,430

|

|

Stock exchange and

shareholder services

|

|

180,433

|

139,908

|

239,319

|

|

Travel and

accommodation

|

|

93,323

|

236,815

|

231,505

|

|

|

|

(3,394,116)

|

(3,505,562)

|

(3,298,383)

|

|

Other

Items

|

|

|

|

|

|

Costs in excess of

recovered coal

|

13

|

(590,204)

|

(120,354)

|

(94,335)

|

|

Foreign exchange

loss

|

|

(64,841)

|

(443,203)

|

(412,663)

|

|

(Impairment)/recovery

of mineral property

|

14

|

-

|

13,708,200

|

(13,994,970)

|

|

Impairment of

prepaid expenses

|

10

|

(121,125)

|

(51,828)

|

(26,234)

|

|

Impairment of

equipment

|

13

|

-

|

-

|

(425,925)

|

|

Impairment of

receivables

|

9

|

(470,278)

|

(16,304)

|

(21,004)

|

|

Loss on sale of

marketable securities

|

|

-

|

-

|

(91,890)

|

|

(Loss)/gain on sale

of equipment

|

|

13,677

|

(9,795)

|

-

|

|

Gain on debt

settlement

|

23, 26

|

-

|

7,952,700

|

50,000

|

|

Other

income

|

|

-

|

-

|

130,936.00

|

|

|

|

(1,232,771)

|

21,019,416

|

(14,886,085)

|

|

Gain/(Loss)

for Year

|

|

(4,626,887)

|

17,513,854

|

(18,184,468)

|

|

Fair value loss on

marketable securities

|

|

-

|

-

|

(81,000)

|

|

Reclassification

adjustment for realized loss

|

|

|

|

|

|

marketable

securities

|

|

-

|

-

|

68,840

|

|

Comprehensive

Gain/(Loss) for Year

|

|

$(4,626,887)

|

$17,513,854

|

$(18,196,628)

|

|

Gain/(Loss)

Per Common Share,

|

|

|

|

|

|

basic

|

|

$(0.03)

|

$0.17

|

$(0.23)

|

|

diluted

|

|

$(0.03)

|

$0.17

|

$(0.23)

|

|

Weighted

Average Number of Common Shares Outstanding,

|

|

|

|

|

|

basic

|

|

137,901,802

|

102,208,111

|

78,445,396

|

|

diluted

|

|

137,901,802

|

102,398,145

|

78,443,396

|

The

accompanying notes form an integral part of these consolidated

financial statements.

7

SILVER ELEPHANT MINING CORP.

Consolidated Statements of Changes in Equity

(Deficiency)

(Expressed

in Canadian Dollars)

|

|

Number of

Shares

|

Share

Capital

|

Reserves

|

Accumulated Other

Comprehensive Income (loss)

|

Deficit

|

Total Equity

(Deficiency)

|

|

Balance,

December 31, 2017

|

74,721,790

|

$165,862,805

|

$22,621,202

|

$12,160

|

$(179,808,646)

|

$8,687,521

|

|

Private placements,

net of share issue costs

|

16,061,417

|

6,096,621

|

-

|

-

|

-

|

6,096,621

|

|

Warrants issued for

mineral property

|

-

|

-

|

181,944

|

-

|

-

|

181,944

|

|

Exercise of stock

options

|

87,500

|

39,500

|

(15,350)

|

-

|

-

|

24,150

|

|

Exercise of

warrants

|

3,445,420

|

1,470,620

|

(132,453)

|

-

|

-

|

1,338,167

|

|

Bonus

shares

|

1,000,000

|

350,000

|

-

|

-

|

-

|

350,000

|

|

Share-based

payments

|

-

|

-

|

758,487

|

-

|

-

|

758,487

|

|

Loss for the

year

|

-

|

-

|

-

|

-

|

(18,184,468)

|

(18,184,468)

|

|

Unrealized loss on

marketable securities

|

-

|

-

|

-

|

(12,160)

|

-

|

(12,160)

|

|

Balance,

December 31, 2018

|

95,316,127

|

$173,819,546

|

$23,413,830

|

-

|

$(197,993,114)

|

$(759,738)

|

|

Private placements,

net of share issue costs

|

22,750,000

|

6,117,991

|

-

|

-

|

-

|

6,117,991

|

|

Finders

shares

|

1,179,500

|

366,800

|

-

|

-

|

-

|

366,800

|

|

Debt

Settlements

|

104,951

|

43,030

|

-

|

-

|

|

43,030

|

|

Exercise of stock

options

|

622,500

|

328,095

|

(153,845)

|

-

|

-

|

174,250

|

|

Exercise of

warrants

|

651,430

|

279,050

|

(28,478)

|

-

|

-

|

250,572

|

|

Bonus

shares

|

500,000

|

115,000

|

-

|

-

|

-

|

115,000

|

|

Share compensation

for services

|

175,000

|

59,500

|

-

|

-

|

-

|

59,500

|

|

Share-based

payments

|

-

|

-

|

826,829

|

-

|

-

|

826,829

|

|

Gain for the

year

|

-

|

-

|

-

|

-

|

17,513,854

|

17,513,854

|

|

Balance,

December 31, 2019

|

121,299,508

|

$181,129,012

|

$24,058,336

|

-

|

$(180,479,260)

|

$24,708,088

|

|

Private placements,

net of share issue costs

|

38,200,000

|

10,247,206

|

-

|

-

|

-

|

10,247,206

|

|

Finders

units

|

156,900

|

(24,000)

|

24,000

|

-

|

-

|

-

|

|

Broker

warrants

|

-

|

(226,917)

|

226,917

|

-

|

-

|

-

|

|

Shares issued for

property acquisition

|

4,000,000

|

2,000,000

|

-

|

-

|

-

|

2,000,000

|

|

Exercise of stock

options

|

1,233,750

|

572,659

|

(272,847)

|

-

|

-

|

299,812

|

|

Exercise of

warrants

|

14,027,670

|

3,273,822

|

(166,628)

|

-

|

-

|

3,107,194

|

|

Bonus

shares

|

1,601,000

|

640,400

|

-

|

-

|

-

|

640,400

|

|

Share-based

payments

|

-

|

-

|

982,244

|

-

|

-

|

982,244

|

|

Loss for the

year

|

-

|

-

|

-

|

-

|

(4,626,887)

|

(4,626,887)

|

|

Balance,

December 31, 2020

|

180,518,828

|

$197,612,182

|

$24,852,022

|

-

|

$(185,106,147)

|

$37,358,057

|

The

accompanying notes form an integral part of these consolidated

financial statements.

8

SILVER ELEPHANT MINING CORP.

Consolidated Statements of Cash Flows

(Expressed

in Canadian Dollars)

|

|

Years

Ended December 31,

|

||

|

|

2020

|

2019

|

2018

|

|

|

|

|

|

|

Operating

Activities

|

|

|

|

|

Net gain/(loss) for

year

|

$(4,626,887)

|

$17,513,854

|

$(18,184,468)

|

|

Adjustments to

reconcile net loss to net cash flows:

|

|

|

|

|

Depreciation and

accretion

|

64,387

|

65,157

|

28,024

|

|

Share-based

payments

|

770,617

|

707,802

|

553,430

|

|

Unrealized foreign

exchange (gain)/loss

|

-

|

(169,218)

|

580,902

|

|

Share compensation

for services

|

720,900

|

356,003

|

350,000

|

|

(Impairment)/recovery

of mineral property

|

-

|

(13,708,200)

|

13,994,970

|

|

Impairment of

prepaid expenses

|

121,125

|

51,828

|

26,234

|

|

Impairment of

equipment

|

-

|

-

|

425,925

|

|

Impairment of

receivables

|

470,278

|

16,304

|

21,004

|

|

Loss on sale of

marketable securities

|

-

|

-

|

91,890

|

|

(Loss)/gain on sale

of equipment

|

13,677

|

9,795

|

-

|

|

Change in estimate

reclamation provision

|

405,196

|

-

|

-

|

|

Gain on debt

settlement

|

-

|

(7,952,700)

|

-

|

|

|

(2,060,707)

|

(3,109,375)

|

(2,112,089)

|

|

Changes to working

capital items

|

|

|

|

|

Receivables

|

(299,372)

|

(196,079)

|

(22,750)

|

|

Prepaid expenses

and reclamation deposits

|

(100,075)

|

(29,323)

|

(8,896)

|

|

Accounts payable

and accrued liabilities

|

(88,888)

|

659,264

|

(482,952)

|

|

|

(488,335)

|

433,862

|

(514,598)

|

|

Cash

Used in Operating Activities

|

(2,549,042)

|

(2,675,513)

|

(2,626,687)

|

|

|

|

|

|

|

Investing

Activities

|

|

|

|

|

Net

(purchases)/proceeds from marketable securities

|

-

|

-

|

101,550

|

|

Proceeds

on sale of equipment

|

50,695

|

-

|

-

|

|

Purchase of

equipment

|

(111,592)

|

(113,564)

|

(120,416)

|

|

Mineral property

expenditures

|

(6,336,166)

|

(6,123,401)

|

(3,609,896)

|

|

Cash

Used in Investing Activities

|

(6,397,063)

|

(6,236,965)

|

(3,628,762)

|

|

|

|

|

|

|

Financing

Activities

|

|

|

|

|

Proceeds from share

issuance, net of share issue costs

|

10,201,706

|

6,237,791

|

6,096,621

|

|

Proceeds from

exercise of stock options

|

299,812

|

174,250

|

24,150

|

|

Proceeds from

exercise of warrants

|

3,072,194

|

250,572

|

1,338,167

|

|

Lease

payments

|

(37,162)

|

(36,528)

|

-

|

|

Cash

Provided by Financing Activities

|

13,536,550

|

6,626,085

|

7,458,938

|

|

Net Decrease in

Cash

|

4,590,445

|

(2,286,393)

|

1,203,489

|

|

Cash - beginning of

year

|

3,017,704

|

5,304,097

|

4,100,608

|

|

Cash - end of

year

|

$7,608,149

|

$3,017,704

|

$5,304,097

|

Supplemental

cash flow information (Note 25)

The

accompanying notes form an integral part of these consolidated

financial statements.

9

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

1.

DESCRIPTION

OF BUSINESS AND NATURE OF OPERATIONS

Silver

Elephant Mining Corp. (the “Company”) is incorporated under

the laws of the province of British Columbia, Canada. The

common shares without par value

in the capital of the Company (the

“Common

Shares”) are listed for

trading on the Toronto Stock Exchange (the

“TSX”) under the symbol “ELEF” and

on the Frankfurt Stock Exchange under the symbol

“1P2N” and are quoted on the OTCQX® Best Market under the

symbol “SILEF”.

The

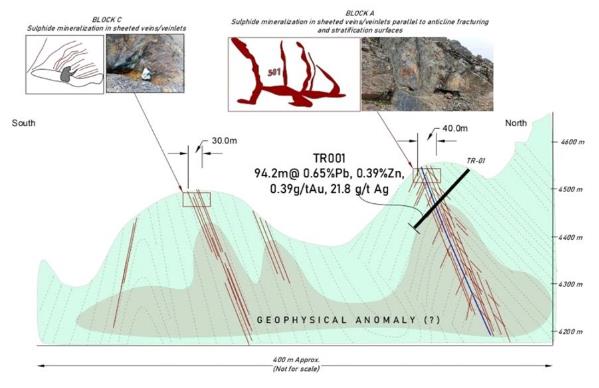

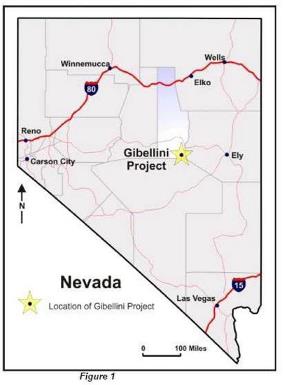

Company is an exploration stage company. The Company holds an interest in the Pulacayo

Paca silver-zinc-lead property located in Bolivia and an

100% interest in two vanadium projects in North America, being the

Gibellini vanadium project, which is comprised of the

Gibellini, Louie

Hill and Bisoni vanadium deposits and associated claims located in

the State of Nevada, USA, and the Titan vanadium-titanium-iron

property located in the Province of Ontario, Canada. In 2020, the

Company acquired the Sunawayo silver-zinc-lead and El Triunfo

gold-silver-zinc properties in Bolivia. The Company also has a 100% interest

in the Ulaan Ovoo coal property located in Selenge province,

Mongolia and a 100% interest in the Chandgana Tal coal property and

Khavtgai Uul coal property located in Khentii province,

Mongolia.

The

Company maintains its registered and records office at Suite 1610

– 409 Granville Street, Vancouver, British Columbia, Canada,

V6C 1T2.

These consolidated audited annual

financial statements have been prepared under the assumption that

the Company is a going concern, which contemplates the

realization of assets and the payment of liabilities in the

ordinary course of business. As at December 31, 2020, Company has a

deficit of $185.1 million.

The

business of mineral exploration involves a high degree of risk and

there can be no assurance that the Company’s current

operations, including exploration programs, will result in

profitable mining operations. The recoverability of the carrying

value of mineral properties, and property and equipment interests

and the Company’s continued existence is dependent upon the

preservation of its interest in the underlying properties, the

discovery of economically recoverable reserves, the achievement of

profitable operations, the ability of the Company to raise

additional sources of funding, and/or, alternatively, upon the

Company’s ability to dispose of some or all of its interests

on an advantageous basis. These conditions may cast significant

doubt upon the Company’s ability to continue as a going

concern.

In

assessing whether the going concern assumption is appropriate,

management takes into account all available information about the

future, which is at least, but not limited to, twelve months from

the end of the reporting period. Management is aware, in making its

assessment, of uncertainties related to events or conditions that

may cast significant doubt upon the entity’s ability to

continue as a going concern that these uncertainties are material

and, therefore, that it may be unable to realize its assets and

discharge its liabilities in the normal course of business.

Accordingly, they do not give effect to adjustments that would be

necessary should the Company be unable to continue as a going

concern and therefore to realize its assets and discharge its

liabilities and commitments in other than the normal course of

business and at amounts different from those in the accompanying

financial statements. These adjustments could be

material.

2.

BASIS

OF PRESENTATION

These

Annual Financial Statements have been prepared in accordance with

International Financial Reporting Standards, (“IFRS”) as issued by the

International Accounting Standards Board (“IASB”).

The

preparation of financial statements in compliance with IFRS

requires the use of certain critical accounting estimates. It also

requires the Company’s management to exercise judgment in

applying the Company’s accounting policies. The areas where

significant judgments and estimates have been made in preparing

these Annual Financial Statements and their effect are disclosed in

Note 5.

These

Annual Financial Statements have been prepared on a historical cost

basis, except for financial instruments classified as fair value

through profit or loss (“FVTPL”), which are stated at their

fair values. These Annual Financial Statements have been prepared

using the accrual basis of accounting except for

10

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

2.

BASIS OF PRESENTATION

(cont’d…)

cash

flow information. These Annual Financial Statements are presented

in Canadian Dollars, except where otherwise noted.

The

accounting policies set out in Note 6 have been applied

consistently by the Company and its subsidiaries to all periods

presented.

The

Annual Consolidated Financial Statements were reviewed by the Audit

Committee and approved and authorized for issue by the Board of

Directors on March 8, 2021.

3.

BASIS

OF CONSOLIDATION

The Annual Financial Statements comprise the financial statements

of the Company and its wholly owned and partially owned

subsidiaries as at December 31, 2020. Subsidiaries are consolidated

from the date of acquisition, being the date on which the Company

obtains control, and continue to be consolidated until the date

when such control ceases. Effects of transactions between

subsidiaries are eliminated on consolidation. The financial

statements of the subsidiaries are prepared for the same reporting

period as the parent company.

Accounting policies of the

subsidiaries have been changed where necessary to ensure

consistency with the policies adopted by the

Company.

The

Company’s significant subsidiaries at December 31, 2020 are

presented in the following table:

4.

CHANGES

IN ACCOUNTING POLICIES

Amendment to IFRS 16, COVID‐19‐Related Rent

Concessions

In May

2020, the International Accounting Standards Board

(“IASB”) issued an amendment to permit lessees, as a

practical expedient, not to assess whether particular rent

concessions that reduce lease payments occurring as a direct

consequence of the COVID‐19 pandemic are lease

modifications and instead to account for those rent concessions as

if they are not lease modifications. The amendment is

effective for annual reporting periods beginning on or after June

1, 2020, with earlier application permitted. The adoption of this

amendment is not expected to have an impact on the financial

statements.

Amendments to IAS 1 and IAS 8: Definition of

Material

In

October 2018, the IASB issued amendments to IAS 1, Presentation of

Financial Statements, and IAS 8, Accounting Policies, Changes in

Accounting Estimates and Errors, to align the definition of

“material” across the standards and to clarify certain

aspects of the definition. The new definition states that,

“Information is material if omitting, misstating or obscuring

it could reasonably be expected to influence decisions that the

primary users of general purpose financial statements make on the

basis of those financial statements, which provide financial

information about a specific reporting entity.”

These amendments are effective for annual periods beginning on or

after January 1, 2020. The amendments to the definition of material

did not have a significant impact on the Annual Financial

Statements.

11

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

4.

CHANGES IN ACCOUNTING POLICIES

(cont’d…)

Future Accounting Pronouncements

The

Company has not early adopted any standard, interpretation or

amendment that has been issued but is not yet

effective.

Amendments to IAS 16: Property, Plant and Equipment: Proceeds

before Intended Use. In May 2020, the IASB issued amendments

to IAS 16, Property, Plant

and Equipment (IAS 16). The amendments prohibit a company from

deducting from the cost of property, plant and equipment amounts

received from selling items produced while the company is

preparing the asset for its intended use. Instead, a company will

recognize such sales proceeds and related costs in profit (loss).

An entity is required to apply these amendments for annual

reporting periods beginning on or after January 1, 2022. The

amendments are applied retrospectively only to items of property,

plant and equipment that are available for use after the beginning

of the earliest period presented in the financial statements in

which the entity first applies the amendments. We are currently

assessing the effect of this amendment on our financial

statements.

Amendments

to IAS 1: Classification of Liabilities as Current or

Non‐Current

and Deferral of Effective Date. In January 2020, the IASB

issued amendments to IAS 1, Presentation of Financial Statements,

to provide a more general approach to the presentation of

liabilities as current or non‐current based on

contractual arrangements in place at the reporting

date.

These

amendments:

−

specify that the rights and conditions existing at the end of the

reporting period are relevant in determining whether the Company

has a right to defer settlement of a liability by at least twelve

months;

−

provide that management’s expectations are not a relevant

consideration as to whether the Company will exercise its rights to

defer settlement of a liability; and

−

clarify when a liability is considered settled.

On July

15, 2020, the IASB issued a deferral of the effective date for the

new guidance by one year to annual reporting periods beginning on

or after January 1, 2023 and is to be applied retrospectively. The

Company has not yet determined the impact of these amendments on

its financial statements.

5.

SIGNIFICANT

JUDGMENTS, ESTIMATES AND ASSUMPTIONS

The

preparation of a company’s financial statements in conformity

with IFRS requires management to make judgments, estimates and

assumptions that affect the reported amounts of assets and

liabilities and disclosures of contingent assets and liabilities at

the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Estimates and

assumptions are continually evaluated and are based on

management’s experience and other factors, including

expectations of future events that are believed to be reasonable

under the circumstances. Actual results could differ from these

estimates.

5.1.

Significant

Judgments

The

significant judgments that the Company’s management has made

in the process of applying the Company’s accounting policies,

apart from those involving estimation uncertainties (Annual

financial statements 5.2), that have the most significant effect on

the amounts recognized in the Annual Financial Statements include,

but are not limited to:

(a)

Functional currency

determination

The

functional currency for each of the Company’s subsidiaries is

the currency of the primary economic environment and the Company

reconsiders the functional currency of its entities if there is a

change in events and conditions which determined the primary

economic environment. Management has determined the functional

currency of all entities to be the Canadian dollar.

12

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

5.

SIGNIFICANT JUDGMENTS, ESTIMATES AND

ASSUMPTIONS (cont’d…)

5.1 Significant Judgments (cont’d…)

(b)

Economic

recoverability and probability of future economic benefits of

exploration, evaluation and development costs

Management

has determined that exploratory drilling, evaluation, development

and related costs incurred which have been capitalized are

economically recoverable. Management uses several criteria in its

assessments of economic recoverability and probability of future

economic benefit including geologic and metallurgic information,

history of conversion of mineral deposits to proven and probable

reserves, scoping, prefeasibility and feasibility studies,

assessable facilities, existing permits and life of mine

plans.

Management

has determined that during the year ended December 31, 2020, none

of the Company’s silver and vanadium projects have reached

technical feasibility and commercial viability and therefore remain

within Mineral Properties on the Statement of Financial

Position.

(c)

Impairment (recovery) assessment of deferred exploration

interests

The

Company considers both external and internal sources of information

in assessing whether there are any indications that mineral

property interests are impaired. External sources of information

the Company considers include changes in the market, economic and

legal environment in which the Company operates that are not within

its control and affect the recoverable amount of mineral property

interest. Internal sources of information the Company considers

include the manner in which mineral properties and plant and

equipment are being used or are expected to be used and indications

of economic performance of the assets.

During

the year ended December 31, 2018, the Company wrote-off $13,994,970

of capitalized mineral property costs. During the year ended

December 31, 2019, the Company reversed $13,708,200 of impairment

(Note 14).

(d)

Deferred Tax Assets

and Liabilities

The

measurement of the deferred tax provision is subject to uncertainty

associated with the timing of future events and changes in

legislation, tax rates and interpretations by tax authorities. The

estimation of deferred taxes includes evaluating the recoverability

of deferred tax assets based on an assessment of the

Company’s ability to utilize the underlying future tax

deductions against future taxable income prior to expiry of those

deductions. For deferred tax calculation purposes, Management

assesses whether it is probable that some or all of the deferred

income tax assets will not be realized. The ultimate realization of

deferred tax assets is dependent upon the generation of future

taxable income, which in turn is dependent upon the successful

discovery, extraction, development and commercialization of mineral

reserves. To the extent that management’s assessment of the

Company’s ability to utilize future tax deductions changes,

the Company would be required to recognize more or fewer deferred

tax assets, and future tax provisions or recoveries could be

affected.

5.2 Estimates and Assumptions

The

Company bases its estimates and assumptions on current and various

other factors that it believes to be reasonable under the

circumstances. Management believes the estimates are reasonable;

however, actual results could differ from those estimates and could

impact future results of operations and cash flows. The areas which

require management to make significant estimates and assumptions in

determining carrying values include, but are not limited

to:

(a)

Mineral

reserves

The recoverability of the carrying value of the mineral properties

is dependent on successful development and commercial exploitation,

or alternatively, sale of the respective areas of

interest.

13

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

5.

SIGNIFICANT JUDGMENTS, ESTIMATES AND

ASSUMPTIONS (cont’d…)

5.2 Estimates and Assumptions

(cont’d…)

(b)

Depreciation

Significant

judgment is involved in the determination of useful life and

residual values for the computation of depreciation, depletion and

amortization and no assurance can be given that actual useful lives

and residual values will not differ significantly from current

assumptions.

(c)

Impairment

The carrying value of long-lived assets are reviewed each reporting

period to determine whether there is any indication of impairment.

If the carrying amount of an asset exceeds its recoverable amount,

the asset is impaired, and an impairment loss is recognized in the

consolidated statement of operations. The assessment of fair

values, including those of the cash generating units (the smallest

identifiable group of assets that generates cash inflows that are

largely independent of the cash inflow from other assets or groups

of assets) (“CGUs”) for purposes of testing impairment,

require the use of estimates and assumptions for recoverable

production, long-term commodity prices, discount rates, foreign

exchange rates, future capital requirements and operating

performance. Changes in any of the assumptions or estimates used in

determining the fair value of long-lived assets could impact the

impairment analysis.

(d)

Allowance for

doubtful accounts, and the recoverability of receivables and

prepaid expense amounts.

Significant

estimates are involved in the determination of recoverability of

receivables and no assurance can be given that actual proceeds will

not differ significantly from current estimations. Similarly,

significant estimates are involved in the determination of the

recoverability of services and/or goods related to the prepaid

expense amounts, and actual results could differ significantly from

current estimations.

Management

has made significant assumptions about the recoverability of

receivables and prepaid expense amounts. During the year ended

December 31, 2020 the Company wrote-off $470,278 (2019 -

$16,304;2018 -

$21,004) of trade receivables which are no longer expected to be

recovered and $121,125 (2019 - $51,828;2018 - $26,234) of prepaid

expenses for which not future benefit is expected to be

received.

(e)

Provision for

closure and reclamation

The

Company assesses its mineral properties’ rehabilitation

provision at each reporting date or when new material information

becomes available. Exploration, development and mining activities

are subject to various laws and regulations governing the

protection of the environment. In general, these laws and

regulations are continually changing, and the Company has made, and

intends to make in the future, expenditures to comply with such

laws and regulations. Accounting for reclamation obligations

requires management to make estimates of the future costs that the

Company will incur to complete the reclamation work required to

comply with existing laws and regulations at each location. Actual

costs incurred may differ from those amounts

estimated.

Also,

future changes to environmental laws and regulations could increase

the extent of reclamation and remediation work required to be

performed by the Company. Increases in future costs could

materially impact the

amounts

charged to operations for reclamation and remediation. The

provision represents management’s best estimate of the

present value of the future reclamation and remediation obligation.

The actual future expenditures may differ from the amounts

currently provided.

(f)

Share-based

payments

Management

uses valuation techniques in measuring the fair value of share

purchase options granted. The fair value is determined using the

Black Scholes option pricing model which requires management to

make certain estimates, judgement, and assumptions in relation to

the expected life of the share purchase options and share purchase

warrants, expected volatility, expected risk-free rate, and

expected forfeiture rate. Changes to these assumptions could have a

material impact on the Annual Financial Statements.

14

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

5.

SIGNIFICANT JUDGMENTS, ESTIMATES AND

ASSUMPTIONS (cont’d…)

5.2 Estimates and Assumptions

(cont’d…)

(g)

Contingencies

The

assessment of contingencies involves the exercise of significant

judgment and estimates of the outcome of future events. In

assessing loss contingencies related to legal proceedings that are

pending against the Company and that may result in regulatory or

government actions that may negatively impact the Company’s

business or operations, the Company and its legal counsel evaluate

the perceived merits of the legal proceeding or unasserted claim or

action as well as the perceived merits of the nature and amount of

relief sought or expected to be sought, when determining the

amount, if any, to recognize as a contingent liability or when

assessing the impact on the carrying value of the Company’s

assets. Contingent assets are not recognized in the Annual

Financial Statements.

(h)

Fair value measurement

The

Company measures financial instruments at fair value at each

reporting date. The fair values of financial instruments measured

at amortized cost are disclosed in Note 21. Also, from time to time,

the fair values of non-financial assets and liabilities are

required to be determined, e.g., when the entity acquires a

business, completes

an

asset acquisition or where an entity measures the recoverable

amount of an asset or cash-generating unit at fair value less costs

of disposal. Fair value is the price that would be received to sell

an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date.

The

fair value of an asset or a liability is measured using the

assumptions that market participants would use when pricing the

asset or liability, assuming that market participants act in their

economic best interest. A fair value measurement of a non-financial

asset takes into account a market participant’s ability to

generate economic benefits by using the asset in its highest and

best use or by selling it to another market participant that would

use the asset in its highest and best use. The Company uses

valuation techniques that are appropriate in the circumstances and

for which sufficient data are available to measure fair value,

maximising the use of relevant observable inputs and minimising the

use of unobservable inputs. Changes in estimates and assumptions

about these inputs could affect the reported fair

value.

COVID-19

An

emerging risk is a risk not well understood at the current time and

for which the impacts on strategy and financial results are

difficult to assess or are in the process of being assessed. Since

December 31, 2019, the outbreak of COVID-19 has resulted in

governments worldwide enacting emergency measures to combat the

spread of the virus. These measures, which include the

implementation of travel bans, self-imposed quarantine periods and

social distancing, have caused material disruption to businesses

globally, resulting in an economic slowdown. Global equity markets

have experienced significant volatility and weakness. Governments

and central banks have reacted with significant monetary and fiscal

interventions designed to stabilize economic conditions. The

duration and impact of the COVID-19 outbreak is unknown at this

time, as is the efficacy of the government and central bank

interventions. It is not possible to reliably estimate the length

and severity of these developments and the impact on the financial

results and condition of the Company and its operating subsidiaries

in future periods.

COVID-19

may impact Company operations, and consequently, the nature and

amounts and disclosures in the financial statements. Some of the

specific areas impacted by COVID-19 include, but are not limited

to:

●

Going concern

assessments;

●

Evaluation of

subsequent events;

●

Impairment and

recovery of mineral properties;

●

Fair value

measurements;

●

Lease

modifications;

●

Employee

termination benefits; and

●

Financial statement

and Management Discussion & Analysis disclosures.

As at

December 31, 2020, the COVID-19 pandemic has not affected the

Company’s critical accounting policies.

15

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

6.

SUMMARY

OF SIGNIFICANT ACCOUNTING POLICIES

(a)

Restricted

cash equivalents

Restricted

cash equivalents consist of highly liquid investments pledged as

collateral for the Company’s credit card and are readily

convertible to known amounts of cash.

(b)

Mineral

properties

Mineral

property assets consist of exploration and evaluation costs. Costs

directly related to the exploration and evaluation of resource

properties are capitalized to mineral properties once the legal

rights to explore the resource properties are acquired or obtained.

These costs include acquisition of rights to explore, license and

application fees, topographical, geological, geochemical and

geophysical studies, exploratory drilling, trenching,

sampling, and activities in relation to evaluating the technical

feasibility and commercial viability of extracting a mineral

resource.

If it

is determined that capitalized acquisition, exploration and

evaluation costs are not recoverable, or the property is abandoned

or management has determined an impairment in value, the property

is written down to its recoverable amount. Mineral properties are

reviewed at least annually for indicators of impairment and are

tested for impairment when facts and circumstances suggest that the

carrying amount may exceed its recoverable amount.

From

time to time, the Company acquires or disposes of properties

pursuant to the terms of option agreements. Options are exercisable

entirely at the discretion of the optionee and, accordingly, are

recorded as mineral property costs or recoveries when the payments

are made or received. After costs are recovered, the balances of

the payments received are recorded as a gain on option or

disposition of mineral property.

(i)

Title to mineral

properties

Although the

Company has taken steps to verify title to the properties on which

it is conducting exploration and in which it has an interest, in

accordance with industry standards for the current stage of

exploration of such properties, these procedures do not guarantee

the Company’s title, nor has the Company insured title.

Property title may be subject to unregistered prior agreements and

non-compliance with regulatory requirements.

(ii)

Realization of

mineral property assets

The

investment in and expenditures on mineral property interests

comprise a significant portion of the Company’s assets.

Realization of the Company’s investment in these assets is

dependent upon the establishment of legal ownership, and the

attainment of successful production from properties or from the

proceeds of their disposal. Resource exploration and development is

highly speculative and involves inherent risks. While the rewards

if an ore body is discovered can be substantial, few properties

that are explored are ultimately developed into profitable

producing mines. There can be no assurance that current exploration

programs will result in the discovery of economically viable

quantities of ore.

The

amounts shown for acquisition costs and deferred exploration

expenditures represent costs incurred to date and do not

necessarily reflect present or future values.

(iii)

Environmental

The

Company is subject to the laws and regulations relating to

environmental matters in all jurisdictions in which it operates,

including provisions relating to property reclamation, discharge of

hazardous material and other matters. The Company may also be held

liable should environmental problems be discovered that were caused

by former owners and operators of its properties and properties in

which it has previously had an interest.

The

Company conducts its mineral exploration activities in compliance

with applicable environmental protection legislation. Other than as

disclosed in Note 17, the Company is not aware of any existing

environmental issues related to any of its current or former

properties that may result in material liability to the Company.

Environmental legislation is becoming increasingly stringent and

costs and expenses of regulatory compliance are increasing. The

impact of new and future environmental legislation on the

Company’s operations may cause additional

expenses

16

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

6.

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (cont’d…)

(b)

Mineral properties

(cont’d…)

(iii)

Environmental

(cont’d…)

and

restrictions. If the restrictions adversely affect the scope of

exploration and development on the mineral properties, the

potential for production on the property may be diminished or

negated.

(c)

Equipment

Equipment

is stated at cost less accumulated depreciation and accumulated

impairment losses, if any. The cost of an item of property and

equipment consists of the purchase price, any costs directly

attributable to bringing the asset to the location and condition

necessary for its intended use, and an initial estimate of the

costs of dismantling and removing the item and restoring the site

on which it is located.

Depreciation

of equipment is recorded on a declining-balance basis at the

following annual rates:

|

Computer

equipment

|

45%

|

|

Furniture

and equipment

|

20%

|

|

Leasehold

improvement

|

Straight

line / 5 years

|

|

Mining

equipment

|

20%

|

|

Vehicles

|

30%

|

|

Right-of-use

asset

|

Straight

line / term of lease

|

When

parts of major components of equipment have different useful lives,

they are accounted for as a separate item of

equipment.

The

cost of major overhauls of parts of equipment is recognized in the

carrying amount of the item if is probable that the future economic

benefits embodied within the part will flow to the Company, and its

cost can be measured reliably. The carrying amount of the replaced

part is derecognized. The costs of the day-to-day servicing of

equipment are recognized in profit or loss as

incurred.

(d)

Impairment of

non-current assets and Cash Generating Units (“CGU”)

At the

end of each reporting period, the Company reviews the carrying

amounts of its tangible and intangible assets to determine whether

there is an indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any).

Where

it is not possible to estimate the recoverable amount of an

individual asset, the Company estimates the recoverable amount of

the CGU, where the recoverable amount of the CGU is the greater of

the CGU’s fair value less costs to sell and its value in use

to which the assets belong. In assessing value in use, estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the

asset.

If the

recoverable amount of an asset (or CGU) is estimated to be less

than its carrying amount, the carrying amount of the asset (or CGU)

is reduced to its recoverable amount. An impairment loss is

recognized immediately in the statement of comprehensive loss,

unless the relevant asset is carried at a revalued amount, in which

case the impairment loss is treated as a revaluation decrease. Each

project or group of claims or licenses is treated as a CGU.

Discounted cash flow techniques often require management to make

estimates and assumptions concerning reserves and expected future

production revenues and expenses, which can vary from actual. Where

an impairment loss subsequently reverses, the carrying amount of

the asset (or CGU) is increased to the revised estimate of its

recoverable amount, such that the increased carrying amount does

not exceed the carrying amount that would have been determined had

no impairment loss been recognized for the asset (or CGU) in prior

years.

17

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

6.

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (cont’d…)

(e)

Foreign currency

translation

Transactions

in currencies other than the functional currency are recorded at

the prevailing exchange rates on the dates of the transactions. At

each financial position reporting date, monetary assets and

liabilities denominated in foreign currencies are translated at the

prevailing exchange rates at the date of the consolidated statement

of financial position. Non-monetary items measured in terms of

historical cost in a foreign currency are not retranslated. Gains

and losses arising from this translation are included in the

determination of net gain or loss for the year.

(f)

Costs in

excess of recovered coal

Exploration

expenditures are re-classified from Exploration and evaluation

assets to deferred development costs within the property and

equipment category once the work completed to date supports the

future development of the property and such development receives

appropriate approvals.

After

reclassification, all subsequent expenditure on the construction,

installation or completion of infrastructure facilities is

capitalized within deferred development cost. Development

expenditure is net of proceeds from the sale of coal extracted

during the development phase to the extent that it is considered

integral to the development of the mine. Any costs incurred in

testing the assets to determine if they are functioning as

intended, are capitalized, net of any proceeds received from

selling any product produced while testing. Where these proceeds

exceed the cost of testing, any excess is recognized in the

statement of profit or loss and other comprehensive

income.

As the

Company’s Ulaan Ovoo mine has been impaired to a value of

$nil (2019 - $nil, 2018 - $nil), all property costs incurred are

presented net of incidental income earned from the property in all

years presented.

(g)

Unit

offerings

Proceeds

received on the issuance of units, consisting of common shares and

warrants, are allocated first to common shares based on the market

trading price of the common shares at the time the units are

priced, and any excess is allocated to warrants.

(h)

Share-based

payments

The

Company has a share purchase option plan that is described in Note

19. The Company accounts for share-based payments using a fair

value-based method with respect to all share-based payments to

directors, officers, employees, and service providers. Share-based

payments to employees are measured at the fair value of the

instruments issued and amortized over the vesting periods.

Share-based payments to non-employees are measured at the fair value of the

goods or services received or if such fair value is not reliably

measurable, at the fair value of the equity instruments issued. The

fair value is recognized as an expense or capitalized to mineral

properties or property and equipment with a corresponding increase

in option reserve. This includes a forfeiture estimate, which is

revised for actual forfeitures in subsequent periods.

Where

the terms and conditions of options are modified before they vest,

the increase in the fair value of the options, measured immediately

before and after the modification, is also charged to the

consolidated statement of operations over the remaining vesting

period.

Upon

the exercise of the share purchase option, the consideration

received, and the related amount transferred from option reserve

are recorded as share capital.

(i)

Loss per

share

Basic

loss per share is calculated using the weighted average number of

common shares outstanding during the period. The Company uses the

treasury stock method to compute the dilutive effect of options and

warrants. Under this method the dilutive effect on earnings per

share is calculated presuming the exercise of outstanding

options

18

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

6.

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (cont’d…)

(i)

Loss per

share

and

warrants. It assumes that the proceeds of such exercise would be

used to repurchase common shares at the average market price during

the period. However, the calculation of diluted loss per share

excludes the effects of various conversions and exercise of options

and warrants that would be anti-dilutive.

(j)

Income

taxes

Income

tax expense comprises current and deferred tax. Current tax is the

expected tax payable or receivable on the taxable income or loss

for the year using tax rates enacted or substantively enacted at

the reporting date.

Deferred

tax is recognized in respect of temporary differences between the

carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for taxation purposes. Deferred tax

is measured at the tax rates that are expected to be applied to

temporary differences when they reverse, based on the tax laws that

have been enacted or substantively enacted by the reporting date.

Deferred tax assets and liabilities are offset if there is a

legally enforceable right to offset current tax liabilities and

assets, and they relate to income taxes levied by the same tax

authority on the same taxable entity.

A

deferred tax asset is recognized for unused tax losses, tax credits

and deductible temporary differences, to the extent that it is

probable that future taxable profits will be available against

which they can be utilized. Deferred tax assets are reviewed at

each reporting date and are reduced to the extent that it is no

longer probable that the related tax benefit will be

realized.

(k)

Provision for

closure and reclamation

The

Company assesses its equipment and mineral property rehabilitation

provision at each reporting date. Changes to estimated future costs

are recognized in the statement of financial position by either

increasing or decreasing the rehabilitation liability and asset to

which it relates if the initial estimate was originally recognized

as part of an asset measured in accordance with IAS 16 Property, Plant and

Equipment.

The

Company records the present value of estimated costs of legal and

constructive obligations required to restore operations in the

period in which the obligation is incurred. The nature of these

restoration activities includes dismantling and removing

structures; rehabilitating mineral properties; dismantling

operating facilities; closure of plant and waste sites; and

restoration, reclamation and vegetation of affected areas. Present

value is used where the effect of the time value of money is

material. The related liability is adjusted each period for the

unwinding of the discount rate and for changes in estimates,

changes to the current market-based discount rate, and the amount

or timing of the underlying cash flows needed to settle the

obligation.

(l)

Financial

instruments

Classification

Financial assets

are classified at initial recognition as either: measured at

amortized cost, FVTPL or fair value through other comprehensive

income ("FVOCI"). The classification depends on the Company’s

business model for managing the financial assets and the

contractual cash flow characteristics. For assets measured at fair

value, gains and losses will either be recorded in profit or loss

or OCI. Derivatives embedded in contracts where the host is a

financial asset in the scope of the standard are never separated.

Instead, the hybrid financial instrument as a whole is assessed for

classification. Financial liabilities are measured at amortized

cost, unless they are required to be measured at FVTPL or the

Company has opted to measure at FVTPL.

Measurement

Financial assets

and liabilities at FVTPL are initially recognized at fair value and

transaction costs are expensed in the consolidated statement of

loss and comprehensive loss. Realized and unrealized gains and

losses arising from changes in the fair value of the financial

assets or liabilities held at FVTPL are included in the

consolidated

19

SILVER ELEPHANT MINING CORP.

Notes

to Annual Consolidated Financial Statements

For the

years ended December 31, 2020, 2019 and 2018

(Expressed in

Canadian Dollars)

6.

SUMMARY OF SIGNIFICANT ACCOUNTING

POLICIES (cont’d…)

(l)

Financial

instruments (cont’d…)

Measurement

(cont’d…)

statement of

operations and comprehensive loss in the period in which they

arise. Where the Company has opted to designate a financial

liability at FVTPL, any changes associated with the Company's

credit risk will be recognized

in OCI.

Financial assets and liabilities at amortized cost are initially

recognized at fair value, and subsequently carried at amortized

cost less any impairment.

Impairment

The

Company assesses on a forward-looking basis the expected credit

loss (“ECL”) associated with financial assets measured

at amortized cost, contract assets and debt instruments carried at

FVOCI. The impairment methodology applied depends on whether there

has been a significant increase in credit risk. Please refer to

Note 21 for relevant fair value measurement

disclosures.

(m)

Leases

At

inception of a contract, we assess whether a contract is, or

contains, a lease. A contract is, or contains, a lease if the

contract conveys the right to control the use of an identified

asset for a period of time in exchange for consideration. We assess

whether the contract involves the use of an identified asset,

whether we have the right to obtain substantially all of the

economic benefits from use of the asset during the term of the

arrangement and if we have the right to direct the use of the

asset. At inception or on assessment of a contract that contains a

lease component, we allocate the consideration in the contract to

each lease component on the basis of their relative stand-alone

prices.

As a

lessee, we recognize a right-of-use asset, which is included in