Exhibit 99.1

CrossAmerica Partners LP Reports Third Quarter 2023 Results

Allentown, PA November 7, 2023 – CrossAmerica Partners LP (NYSE: CAPL) (“CrossAmerica” or the “Partnership”), a leading wholesale fuels distributor, convenience store operator, and owner and lessor of real estate used in the retail distribution of motor fuels, today reported financial results for the third quarter ended September 30, 2023.

“CrossAmerica had another excellent quarter with continued strong operating results in fuel margins, fuel volume and store merchandise sales and margin,” said Charles Nifong, President and CEO of CrossAmerica. “While retail fuel margins were down from the extraordinary quarter last year, the overall business still performed well for the current quarter. With our strong balance sheet and solid distribution coverage, the business is well positioned for the future.”

Non-GAAP Measures and Same Store Metrics

Non-GAAP measures used in this release include EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. These Non-GAAP measures are further described and reconciled to their most directly comparable GAAP measures in the Supplemental Disclosure Regarding Non-GAAP Financial Measures section of this release.

1

Same store fuel volume and same store merchandise sales include aggregated individual store results for all stores that had fuel volume or merchandise sales in all months for both periods within the same segment. Same store merchandise sales excludes branded food sales and other revenues such as lottery commissions and car wash sales.

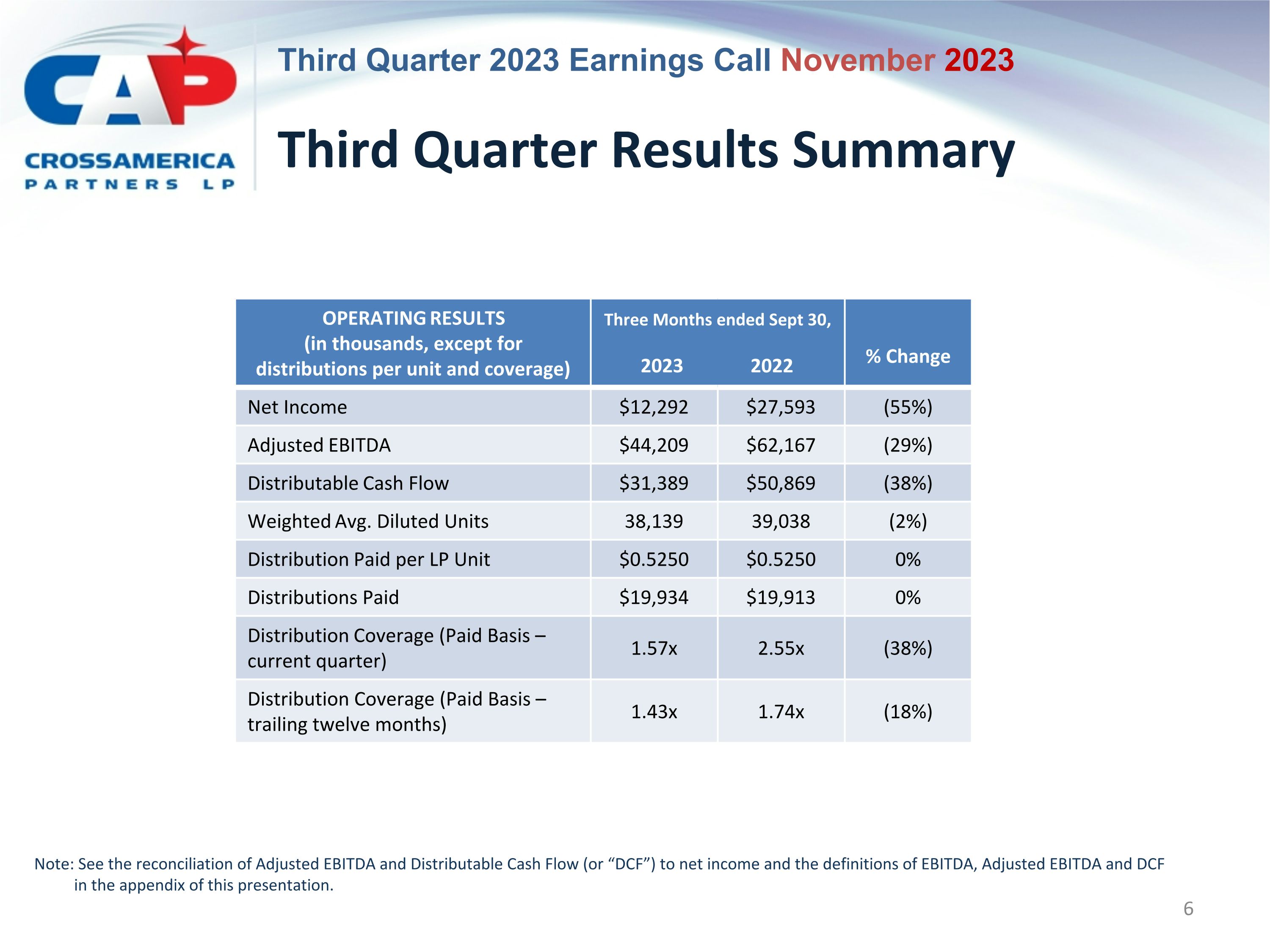

Third Quarter Results

Consolidated Results

Key Operating Metrics |

Q3 2023 |

Q3 2022 |

Net Income |

$12.3M |

$27.6M |

Adjusted EBITDA |

$44.2M |

$62.2M |

Distributable Cash Flow |

$31.4M |

$50.9M |

Distribution Coverage Ratio: Current Quarter |

1.57x |

2.55x |

Distribution Coverage Ratio: Trailing Twelve Months |

1.43x |

1.74x |

CrossAmerica reported declines in Net Income and Adjusted EBITDA for the third quarter 2023 compared to the exceptionally strong results of the third quarter 2022. For the third quarter 2023, the decrease in Net Income and Adjusted EBITDA was primarily driven by declines in gross profit in both the wholesale and retail segments, as the partnership experienced extraordinary motor fuel margins in the third quarter 2022. The year-over-year decline in Distributable Cash Flow was primarily driven by the decline in Adjusted EBITDA noted above in addition to a $2.2 million increase in interest expense for the quarter when compared to the third quarter of 2022.

Wholesale Segment

Key Operating Metrics |

Q3 2023 |

Q3 2022 |

Wholesale segment gross profit |

$32.9M |

$34.1M |

Wholesale motor fuel gallons distributed |

217.3M |

212.7M |

Average wholesale gross profit per gallon |

$0.086 |

$0.092 |

During the third quarter 2023, CrossAmerica’s wholesale segment gross profit declined 4% compared to the third quarter 2022. This was primarily driven by a decrease in motor fuel gross profit, which was driven by a 7% decrease in fuel margin per gallon, partially offset by a 2% increase in wholesale volume distributed. The decrease in fuel margin per gallon was primarily attributable to lower fuel margin on variably priced wholesale contracts during the quarter relative to last year and to the lower cost of fuel and a corresponding decline in CrossAmerica's fuel purchase terms discounts on certain gallons during the third quarter of 2023 compared to the prior year. This was partially offset by better sourcing costs as a result of brand consolidation and other initiatives. The fuel margin per gallon of $0.086 for the third quarter 2023 compared favorably to both the first and second quarters 2023 ($0.083 and $0.082 per gallon, respectively). The increase in wholesale fuel volume was driven primarily by the Community Service Stations, Inc. assets acquired during the fourth quarter 2022, partially offset by the net loss of independent dealer contracts and the conversion of certain lessee dealer sites to company operated sites.

Retail Segment

Key Operating Metrics |

Q3 2023 |

Q3 2022 |

Retail segment gross profit |

$67.6M |

$80.6M |

|

|

|

Retail segment motor fuel gallons distributed |

132.2M |

126.7M |

Same store motor fuel gallons distributed |

121.8M |

119.6M |

Retail segment motor fuel gross profit |

$36.2M |

$54.5M |

Retail segment margin per gallon, before deducting credit card fees and commissions |

$0.372 |

$0.534 |

|

|

|

Same store merchandise sales excluding cigarettes* |

$53.3M |

$49.1M |

2

Merchandise gross profit* |

$25.4M |

$20.6M |

Merchandise gross profit percentage* |

28.7% |

27.1% |

*Includes only company operated retail sites

For the third quarter 2023, the retail segment generated a 16% decrease in gross profit compared to the third quarter 2022. The decline for the third quarter 2023 was due to a decrease in motor fuel gross profit, partially offset by an increase in merchandise gross profit.

The retail segment sold 132.2 million retail fuel gallons during the third quarter 2023, which was an increase of 4% when compared to the third quarter 2022. Retail segment fuel gallons increased during the third quarter of 2023 compared to the prior year due to the conversion of certain lessee dealer sites to company operated sites and higher same store gallon performance relative to the prior year. Same store retail segment fuel volume for the third quarter 2023 increased 2% from 119.6 million gallons during the third quarter 2022 to 121.8 million gallons. While the fuel margin per gallon of $0.372 for the third quarter 2023 declined year-over-year due to the steep drop in crude oil prices during the third quarter 2022, it compared favorably to both the first and second quarters 2023 ($0.318 and $0.370 per gallon, respectively).

For the third quarter 2023, CrossAmerica’s merchandise gross profit and other revenue increased 24% when compared to the third quarter 2022, due to an increase in overall store sales as a result of an increase in the company operated site count due to the conversion of certain lessee dealer and commission agent sites to company operated sites and an increase in both merchandise gross profit percentage and same store sales. Same store merchandise sales, excluding cigarettes, increased 9% for the third quarter 2023 when compared to the third quarter 2022. The merchandise gross profit percentage increased to 28.7% for the third quarter 2023 from 27.1% for the third quarter 2022, primarily due to improved merchandise gross margins and merchandise sales shifting towards higher margin products.

Divestment Activity

During the three months ended September 30, 2023, CrossAmerica sold one property for $0.1 million in proceeds, resulting in a net gain of an insignificant amount. For the nine months ended September 30, 2023, CrossAmerica sold eight properties for $8.3 million in proceeds, resulting in a net gain of $6.3 million.

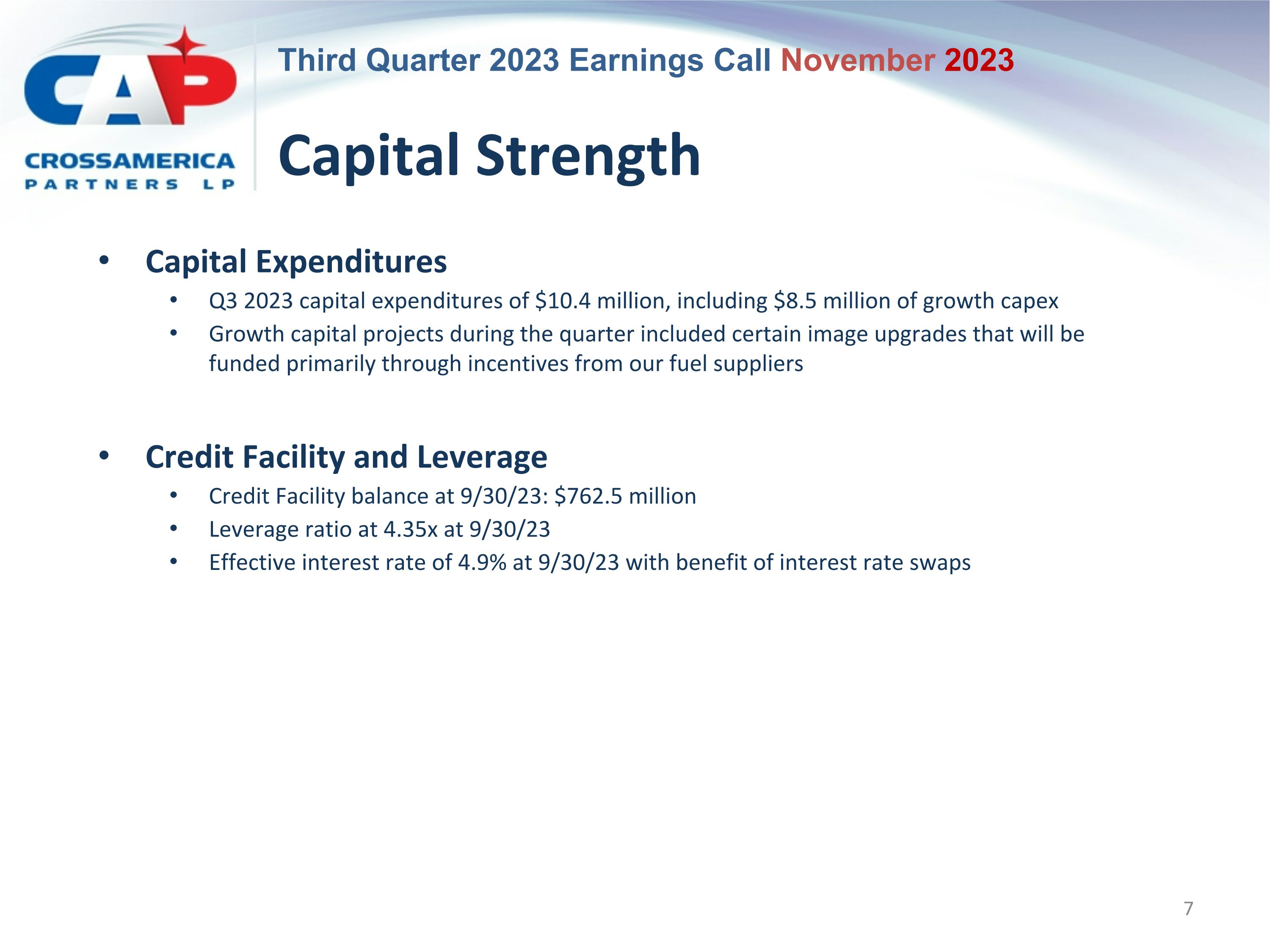

Liquidity and Capital Resources

As of September 30, 2023, CrossAmerica had $762.5 million outstanding under its CAPL Credit Facility. As of November 2, 2023, after taking into consideration debt covenant restrictions, approximately $170.6 million was available for future borrowings under the CAPL Credit Facility. Taking the interest rate swap contracts the Partnership currently has in place into account, CrossAmerica’s effective interest rate on the CAPL Credit Facility at September 30, 2023 was 4.9%. Leverage, as defined in the CAPL Credit Facility, was 4.35 times as of September 30, 2023. As of September 30, 2023, CrossAmerica was in compliance with its financial covenants under the credit facility.

Distributions

On October 23, 2023, the Board of the Directors of CrossAmerica’s General Partner (“Board”) declared a quarterly distribution of $0.5250 per limited partner unit attributable to the third quarter 2023. As previously announced, the distribution will be paid on November 10, 2023 to all unitholders of record as of November 3, 2023. The amount and timing of any future distributions is subject to the discretion of the Board as provided in CrossAmerica’s Partnership Agreement.

3

Conference Call

The Partnership will host a conference call on November 8, 2023 at 9:00 a.m. Eastern Time to discuss third quarter 2023 earnings results. The conference call numbers are 888-886-7786 or 416-764-8658 and the passcode for both is 83482565. A live audio webcast of the conference call and the related earnings materials, including reconciliations of any non-GAAP financial measures to GAAP financial measures and any other applicable disclosures, will be available on that same day on the investor section of the CrossAmerica website (www.crossamericapartners.com). To listen to the audio webcast, go to https://caplp.gcs-web.com/webcasts-presentations. After the live conference call, an archive of the webcast will be available on the investor section of the CrossAmerica site at https://caplp.gcs-web.com/webcasts-presentations within 24 hours after the call for a period of sixty days.

4

CROSSAMERICA PARTNERS LP

CONSOLIDATED BALANCE SHEETS

(Thousands of Dollars, except unit data)

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2023 |

|

|

2022 |

|

||

ASSETS |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

5,790 |

|

|

$ |

16,054 |

|

Accounts receivable, net of allowances of $718 and $686, respectively |

|

|

38,735 |

|

|

|

30,825 |

|

Accounts receivable from related parties |

|

|

445 |

|

|

|

743 |

|

Inventory |

|

|

53,609 |

|

|

|

47,307 |

|

Assets held for sale |

|

|

1,135 |

|

|

|

983 |

|

Current portion of interest rate swap contracts |

|

|

12,691 |

|

|

|

13,827 |

|

Other current assets |

|

|

10,856 |

|

|

|

8,667 |

|

Total current assets |

|

|

123,261 |

|

|

|

118,406 |

|

Property and equipment, net |

|

|

706,409 |

|

|

|

728,379 |

|

Right-of-use assets, net |

|

|

153,246 |

|

|

|

164,942 |

|

Intangible assets, net |

|

|

98,618 |

|

|

|

113,919 |

|

Goodwill |

|

|

99,409 |

|

|

|

99,409 |

|

Interest rate swap contracts, less current portion |

|

|

9,301 |

|

|

|

3,401 |

|

Other assets |

|

|

26,983 |

|

|

|

26,142 |

|

Total assets |

|

$ |

1,217,227 |

|

|

$ |

1,254,598 |

|

|

|

|

|

|

|

|

||

LIABILITIES AND EQUITY |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Current portion of debt and finance lease obligations |

|

$ |

3,034 |

|

|

$ |

11,151 |

|

Current portion of operating lease obligations |

|

|

35,085 |

|

|

|

35,345 |

|

Accounts payable |

|

|

80,216 |

|

|

|

77,048 |

|

Accounts payable to related parties |

|

|

10,098 |

|

|

|

7,798 |

|

Accrued expenses and other current liabilities |

|

|

27,577 |

|

|

|

23,144 |

|

Motor fuel and sales taxes payable |

|

|

21,187 |

|

|

|

20,813 |

|

Total current liabilities |

|

|

177,197 |

|

|

|

175,299 |

|

Debt and finance lease obligations, less current portion |

|

|

760,688 |

|

|

|

761,638 |

|

Operating lease obligations, less current portion |

|

|

123,491 |

|

|

|

135,220 |

|

Deferred tax liabilities, net |

|

|

11,733 |

|

|

|

10,588 |

|

Asset retirement obligations |

|

|

47,506 |

|

|

|

46,431 |

|

Other long-term liabilities |

|

|

47,299 |

|

|

|

46,289 |

|

Total liabilities |

|

|

1,167,914 |

|

|

|

1,175,465 |

|

|

|

|

|

|

|

|

||

Commitments and contingencies |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Preferred membership interests |

|

|

27,101 |

|

|

|

26,156 |

|

|

|

|

|

|

|

|

||

Equity: |

|

|

|

|

|

|

||

Common units— 37,970,720 and 37,937,604 units issued and |

|

|

1,233 |

|

|

|

36,508 |

|

Accumulated other comprehensive income |

|

|

20,979 |

|

|

|

16,469 |

|

Total equity |

|

|

22,212 |

|

|

|

52,977 |

|

Total liabilities and equity |

|

$ |

1,217,227 |

|

|

$ |

1,254,598 |

|

5

CROSSAMERICA PARTNERS LP

CONSOLIDATED STATEMENTS OF OPERATIONS

(Thousands of Dollars, Except Unit and Per Unit Amounts)

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Operating revenues (a) |

|

$ |

1,210,023 |

|

|

$ |

1,274,407 |

|

|

$ |

3,371,578 |

|

|

$ |

3,842,651 |

|

Costs of sales (b) |

|

|

1,109,583 |

|

|

|

1,159,677 |

|

|

|

3,091,355 |

|

|

|

3,560,146 |

|

Gross profit |

|

|

100,440 |

|

|

|

114,730 |

|

|

|

280,223 |

|

|

|

282,505 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses (c) |

|

|

50,609 |

|

|

|

46,845 |

|

|

|

146,030 |

|

|

|

131,170 |

|

General and administrative expenses |

|

|

6,877 |

|

|

|

6,599 |

|

|

|

20,091 |

|

|

|

18,762 |

|

Depreciation, amortization and accretion expense |

|

|

19,096 |

|

|

|

21,329 |

|

|

|

58,214 |

|

|

|

61,523 |

|

Total operating expenses |

|

|

76,582 |

|

|

|

74,773 |

|

|

|

224,335 |

|

|

|

211,455 |

|

Gain (loss) on dispositions and lease terminations, net |

|

|

287 |

|

|

|

(318 |

) |

|

|

5,220 |

|

|

|

(620 |

) |

Operating income |

|

|

24,145 |

|

|

|

39,639 |

|

|

|

61,108 |

|

|

|

70,430 |

|

Other income, net |

|

|

174 |

|

|

|

120 |

|

|

|

598 |

|

|

|

352 |

|

Interest expense |

|

|

(10,559 |

) |

|

|

(8,351 |

) |

|

|

(33,254 |

) |

|

|

(22,333 |

) |

Income before income taxes |

|

|

13,760 |

|

|

|

31,408 |

|

|

|

28,452 |

|

|

|

48,449 |

|

Income tax expense |

|

|

1,468 |

|

|

|

3,815 |

|

|

|

2,603 |

|

|

|

1,843 |

|

Net income |

|

|

12,292 |

|

|

|

27,593 |

|

|

|

25,849 |

|

|

|

46,606 |

|

Accretion of preferred membership interests |

|

|

629 |

|

|

|

575 |

|

|

|

1,845 |

|

|

|

1,138 |

|

Net income available to limited partners |

|

$ |

11,663 |

|

|

$ |

27,018 |

|

|

$ |

24,004 |

|

|

$ |

45,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Earnings per common unit |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

0.31 |

|

|

$ |

0.71 |

|

|

$ |

0.63 |

|

|

$ |

1.20 |

|

Diluted |

|

$ |

0.31 |

|

|

$ |

0.71 |

|

|

$ |

0.63 |

|

|

$ |

1.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted-average common units: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

37,966,474 |

|

|

|

37,925,082 |

|

|

|

37,953,348 |

|

|

|

37,912,737 |

|

Diluted |

|

|

38,139,258 |

|

|

|

39,037,660 |

|

|

|

38,126,392 |

|

|

|

37,950,362 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Supplemental information: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(a) includes excise taxes of: |

|

$ |

76,991 |

|

|

$ |

66,129 |

|

|

$ |

223,066 |

|

|

$ |

204,588 |

|

(a) includes rent income of: |

|

|

20,137 |

|

|

|

21,260 |

|

|

|

61,980 |

|

|

|

62,736 |

|

(b) excludes depreciation, amortization and accretion |

|

|

|

|

|

|

|

|

|

|

|

|

||||

(b) includes rent expense of: |

|

|

5,679 |

|

|

|

5,906 |

|

|

|

16,891 |

|

|

|

17,692 |

|

(c) includes rent expense of: |

|

|

3,957 |

|

|

|

4,012 |

|

|

|

11,666 |

|

|

|

11,521 |

|

6

CROSSAMERICA PARTNERS LP

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Thousands of Dollars)

|

|

Nine Months Ended September 30, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net income |

|

$ |

25,849 |

|

|

$ |

46,606 |

|

Adjustments to reconcile net income (loss) to net cash provided by |

|

|

|

|

|

|

||

Depreciation, amortization and accretion expense |

|

|

58,214 |

|

|

|

61,523 |

|

Amortization of deferred financing costs |

|

|

2,806 |

|

|

|

2,053 |

|

Credit loss expense |

|

|

37 |

|

|

|

139 |

|

Deferred income tax expense (benefit) |

|

|

1,145 |

|

|

|

(677 |

) |

Equity-based employee and director compensation expense |

|

|

2,084 |

|

|

|

1,608 |

|

(Gain) loss on dispositions and lease terminations, net |

|

|

(5,220 |

) |

|

|

620 |

|

Changes in operating assets and liabilities, net of acquisitions |

|

|

(5,926 |

) |

|

|

14,588 |

|

Net cash provided by operating activities |

|

|

78,989 |

|

|

|

126,460 |

|

|

|

|

|

|

|

|

||

Cash flows from investing activities: |

|

|

|

|

|

|

||

Principal payments received on notes receivable |

|

|

162 |

|

|

|

102 |

|

Proceeds from sale of assets |

|

|

4,983 |

|

|

|

4,398 |

|

Capital expenditures |

|

|

(21,680 |

) |

|

|

(26,784 |

) |

Cash paid in connection with acquisitions, net of cash acquired |

|

|

— |

|

|

|

(1,885 |

) |

Net cash used in investing activities |

|

|

(16,535 |

) |

|

|

(24,169 |

) |

|

|

|

|

|

|

|

||

Cash flows from financing activities: |

|

|

|

|

|

|

||

Borrowings under revolving credit facilities |

|

|

221,900 |

|

|

|

64,600 |

|

Repayments on revolving credit facilities |

|

|

(65,537 |

) |

|

|

(101,815 |

) |

Borrowings under the Term Loan Facility |

|

|

— |

|

|

|

1,120 |

|

Repayments on the Term Loan Facility |

|

|

(158,980 |

) |

|

|

(24,600 |

) |

Net proceeds from issuance of preferred membership interests |

|

|

— |

|

|

|

24,430 |

|

Payments of finance lease obligations |

|

|

(2,150 |

) |

|

|

(2,030 |

) |

Payments of deferred financing costs |

|

|

(7,106 |

) |

|

|

(6 |

) |

Distributions paid on distribution equivalent rights |

|

|

(168 |

) |

|

|

(137 |

) |

Income tax distributions paid on preferred membership interests |

|

|

(900 |

) |

|

|

— |

|

Distributions paid on common units |

|

|

(59,777 |

) |

|

|

(59,713 |

) |

Net cash used in financing activities |

|

|

(72,718 |

) |

|

|

(98,151 |

) |

Net (decrease) increase in cash and cash equivalents |

|

|

(10,264 |

) |

|

|

4,140 |

|

|

|

|

|

|

|

|

||

Cash and cash equivalents at beginning of period |

|

|

16,054 |

|

|

|

7,648 |

|

Cash and cash equivalents at end of period |

|

$ |

5,790 |

|

|

$ |

11,788 |

|

7

Segment Results

Wholesale

The following table highlights the results of operations and certain operating metrics of the Wholesale segment (thousands of dollars, except for the number of distribution sites and per gallon amounts):

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Motor fuel gross profit |

|

$ |

18,786 |

|

|

$ |

19,501 |

|

|

$ |

53,427 |

|

|

$ |

54,719 |

|

Rent gross profit |

|

|

12,424 |

|

|

|

12,959 |

|

|

|

38,281 |

|

|

|

37,944 |

|

Other revenues |

|

|

1,642 |

|

|

|

1,657 |

|

|

|

4,053 |

|

|

|

5,250 |

|

Total gross profit |

|

|

32,852 |

|

|

|

34,117 |

|

|

|

95,761 |

|

|

|

97,913 |

|

Operating expenses |

|

|

(9,471 |

) |

|

|

(10,071 |

) |

|

|

(28,936 |

) |

|

|

(28,116 |

) |

Operating income |

|

$ |

23,381 |

|

|

$ |

24,046 |

|

|

$ |

66,825 |

|

|

$ |

69,797 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Motor fuel distribution sites (end of period): (a) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Independent dealers (b) |

|

|

636 |

|

|

|

623 |

|

|

|

636 |

|

|

|

623 |

|

Lessee dealers (c) |

|

|

582 |

|

|

|

641 |

|

|

|

582 |

|

|

|

641 |

|

Total motor fuel distribution sites |

|

|

1,218 |

|

|

|

1,264 |

|

|

|

1,218 |

|

|

|

1,264 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Average motor fuel distribution sites |

|

|

1,222 |

|

|

|

1,273 |

|

|

|

1,243 |

|

|

|

1,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Volume of gallons distributed |

|

|

217,348 |

|

|

|

212,657 |

|

|

|

637,340 |

|

|

|

630,985 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Margin per gallon |

|

$ |

0.086 |

|

|

$ |

0.092 |

|

|

$ |

0.084 |

|

|

$ |

0.087 |

|

(a) In addition, CrossAmerica distributed motor fuel to sub-wholesalers who distributed to additional sites.

(b) The increase in the independent dealer site count was primarily attributable to the acquisition of assets from Community Service Stations, Inc. and the ongoing real estate rationalization effort, partially offset by the net loss of contracts.

(c) The decrease in the lessee dealer site count was primarily attributable to the conversion of certain lessee dealer sites to company operated sites, largely in the second quarter of 2023, and CrossAmerica's real estate rationalization effort.

8

Retail

The following table highlights the results of operations and certain operating metrics of the Retail segment (in thousands, except for the number of retail sites):

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Gross profit: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Motor fuel |

|

$ |

36,226 |

|

|

$ |

54,476 |

|

|

$ |

98,723 |

|

|

$ |

110,621 |

|

Merchandise |

|

|

25,427 |

|

|

|

20,649 |

|

|

|

67,782 |

|

|

|

57,496 |

|

Rent |

|

|

2,034 |

|

|

|

2,395 |

|

|

|

6,808 |

|

|

|

7,100 |

|

Other revenue |

|

|

3,901 |

|

|

|

3,093 |

|

|

|

11,149 |

|

|

|

9,375 |

|

Total gross profit |

|

|

67,588 |

|

|

|

80,613 |

|

|

|

184,462 |

|

|

|

184,592 |

|

Operating expenses |

|

|

(41,138 |

) |

|

|

(36,774 |

) |

|

|

(117,094 |

) |

|

|

(103,054 |

) |

Operating income |

|

$ |

26,450 |

|

|

$ |

43,839 |

|

|

$ |

67,368 |

|

|

$ |

81,538 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Retail sites (end of period): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Company operated retail sites (a) |

|

|

293 |

|

|

|

252 |

|

|

|

293 |

|

|

|

252 |

|

Commission agents (b) |

|

|

189 |

|

|

|

198 |

|

|

|

189 |

|

|

|

198 |

|

Total system sites at the end of the period |

|

|

482 |

|

|

|

450 |

|

|

|

482 |

|

|

|

450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Total retail segment statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Volume of gallons sold |

|

|

132,160 |

|

|

|

126,669 |

|

|

|

382,049 |

|

|

|

371,524 |

|

Same store total system gallons sold(c) |

|

|

121,782 |

|

|

|

119,559 |

|

|

|

347,800 |

|

|

|

342,758 |

|

Average retail fuel sites |

|

|

482 |

|

|

|

451 |

|

|

|

472 |

|

|

|

452 |

|

Margin per gallon, before deducting credit card fees and |

|

$ |

0.372 |

|

|

$ |

0.534 |

|

|

$ |

0.354 |

|

|

$ |

0.400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Company operated site statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Average retail fuel sites |

|

|

293 |

|

|

|

253 |

|

|

|

279 |

|

|

|

253 |

|

Same store fuel volume(c) |

|

|

81,042 |

|

|

|

80,387 |

|

|

|

227,985 |

|

|

|

227,964 |

|

Margin per gallon, before deducting credit card fees |

|

$ |

0.394 |

|

|

$ |

0.596 |

|

|

$ |

0.378 |

|

|

$ |

0.427 |

|

Same store merchandise sales(c) |

|

$ |

76,333 |

|

|

$ |

73,060 |

|

|

$ |

207,210 |

|

|

$ |

199,264 |

|

Same store merchandise sales excluding cigarettes(c) |

|

$ |

53,305 |

|

|

$ |

49,093 |

|

|

$ |

143,275 |

|

|

$ |

131,881 |

|

Merchandise gross profit percentage |

|

|

28.7 |

% |

|

|

27.1 |

% |

|

|

28.5 |

% |

|

|

27.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Commission site statistics: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Average retail fuel sites |

|

|

189 |

|

|

|

198 |

|

|

|

193 |

|

|

|

199 |

|

Margin per gallon, before deducting credit card fees and |

|

$ |

0.325 |

|

|

$ |

0.410 |

|

|

$ |

0.306 |

|

|

$ |

0.345 |

|

(a) The increase in the company operated site count was primarily attributable to the conversion of certain lessee dealer and commission sites to company operated sites, largely during the second quarter of 2023.

(b) The decrease in the commission agent site count was primarily attributable to the conversion of certain commission agent sites to company operated sites, largely during the first quarter of 2023.

(c) Same store fuel volume and same store merchandise sales include aggregated individual store results for all stores that had fuel volume or merchandise sales in all months for both periods. Same store merchandise sales excludes branded food sales and other revenues such as lottery commissions and car wash sales.

9

Supplemental Disclosure Regarding Non-GAAP Financial Measures

CrossAmerica uses the non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income before deducting interest expense, income taxes and depreciation, amortization and accretion (which includes certain impairment charges). Adjusted EBITDA represents EBITDA as further adjusted to exclude equity-based compensation expense, gains or losses on dispositions and lease terminations, net and certain discrete acquisition related costs, such as legal and other professional fees, separation benefit costs and certain other discrete non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax expense. The Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by distributions paid on common units.

EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess CrossAmerica’s financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess the operating performance of the Partnership’s business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of CrossAmerica’s retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess the ability to generate cash sufficient to make distributions to CrossAmerica’s unitholders.

CrossAmerica believes the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing the financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in the industry, CrossAmerica’s definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

10

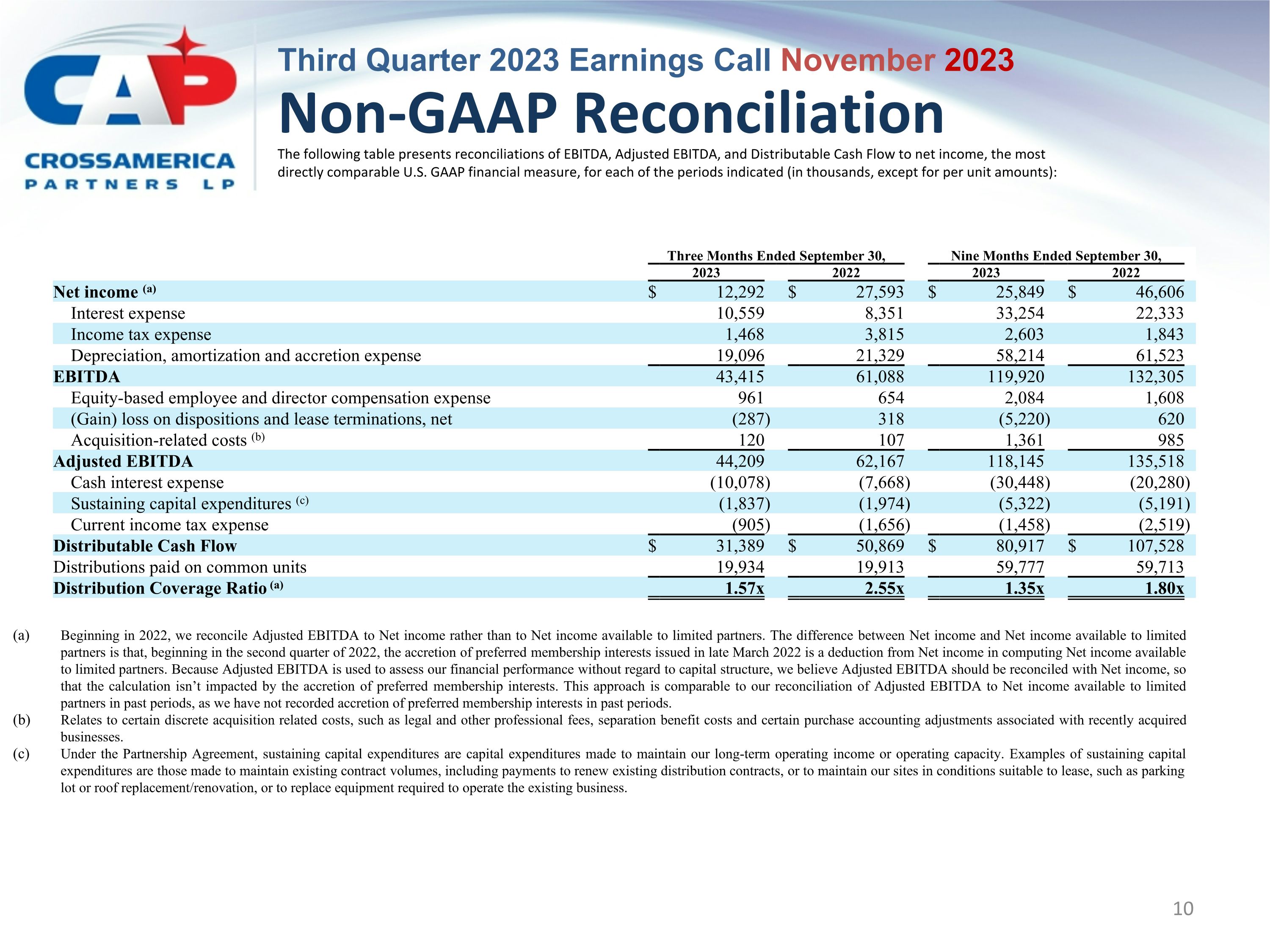

The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts):

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Net income (a) |

|

$ |

12,292 |

|

|

$ |

27,593 |

|

|

$ |

25,849 |

|

|

$ |

46,606 |

|

Interest expense |

|

|

10,559 |

|

|

|

8,351 |

|

|

|

33,254 |

|

|

|

22,333 |

|

Income tax expense |

|

|

1,468 |

|

|

|

3,815 |

|

|

|

2,603 |

|

|

|

1,843 |

|

Depreciation, amortization and accretion expense |

|

|

19,096 |

|

|

|

21,329 |

|

|

|

58,214 |

|

|

|

61,523 |

|

EBITDA |

|

|

43,415 |

|

|

|

61,088 |

|

|

|

119,920 |

|

|

|

132,305 |

|

Equity-based employee and director compensation expense |

|

|

961 |

|

|

|

654 |

|

|

|

2,084 |

|

|

|

1,608 |

|

(Gain) loss on dispositions and lease terminations, net |

|

|

(287 |

) |

|

|

318 |

|

|

|

(5,220 |

) |

|

|

620 |

|

Acquisition-related costs (b) |

|

|

120 |

|

|

|

107 |

|

|

|

1,361 |

|

|

|

985 |

|

Adjusted EBITDA |

|

|

44,209 |

|

|

|

62,167 |

|

|

|

118,145 |

|

|

|

135,518 |

|

Cash interest expense |

|

|

(10,078 |

) |

|

|

(7,668 |

) |

|

|

(30,448 |

) |

|

|

(20,280 |

) |

Sustaining capital expenditures (c) |

|

|

(1,837 |

) |

|

|

(1,974 |

) |

|

|

(5,322 |

) |

|

|

(5,191 |

) |

Current income tax expense |

|

|

(905 |

) |

|

|

(1,656 |

) |

|

|

(1,458 |

) |

|

|

(2,519 |

) |

Distributable Cash Flow |

|

$ |

31,389 |

|

|

$ |

50,869 |

|

|

$ |

80,917 |

|

|

$ |

107,528 |

|

Distributions paid on common units |

|

|

19,934 |

|

|

|

19,913 |

|

|

|

59,777 |

|

|

|

59,713 |

|

Distribution Coverage Ratio (a) |

|

1.57x |

|

|

2.55x |

|

|

1.35x |

|

|

1.80x |

|

||||

(a) Beginning in 2022, CrossAmerica reconciles Adjusted EBITDA to Net income rather than to Net income available to limited partners. The difference between Net income and Net income available to limited partners is that, beginning in the second quarter of 2022, the accretion of preferred membership interests issued in late March 2022 is a deduction from Net income in computing Net income available to limited partners. Because Adjusted EBITDA is used to assess CrossAmerica’s financial performance without regard to capital structure, the partnership believes Adjusted EBITDA should be reconciled with Net income, so that the calculation isn’t impacted by the accretion of preferred membership interests. This approach is comparable to the reconciliation of Adjusted EBITDA to Net income available to limited partners in past periods, as CrossAmerica has not recorded accretion of preferred membership interests in past periods.

(b) Relates to certain discrete acquisition-related costs, such as legal and other professional fees, separation benefit costs and certain purchase accounting adjustments associated with recently acquired businesses.

(c) Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain CrossAmerica's long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes, including payments to renew existing distribution contracts, or to maintain the sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business.

About CrossAmerica Partners LP

CrossAmerica Partners LP is a leading wholesale distributor of motor fuels, convenience store operator, and owner and lessee of real estate used in the retail distribution of motor fuels. Its general partner, CrossAmerica GP LLC, is indirectly owned and controlled by entities affiliated with Joseph V. Topper, Jr., the founder of CrossAmerica Partners and a member of the board of the general partner since 2012. Formed in 2012, CrossAmerica Partners LP is a distributor of branded and unbranded petroleum for motor vehicles in the United States and distributes fuel to approximately 1,700 locations and owns or leases approximately 1,100 sites. With a geographic footprint covering 34 states, the Partnership has well-established relationships with several major oil brands, including ExxonMobil, BP, Shell, Sunoco, Valero, Gulf, Citgo, Marathon and Phillips 66. CrossAmerica Partners LP ranks as one of ExxonMobil’s largest distributors by fuel volume in the United States and in the top 10 for additional brands. For additional information, please visit www.crossamericapartners.com.

Contact

Investor Relations: Randy Palmer, rpalmer@caplp.com or 610-625-8000

11

Cautionary Statement Regarding Forward-Looking Statements

Statements contained in this release that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s Form 10-K or Forms 10-Q filed with the Securities and Exchange Commission, and available on CrossAmerica’s website at www.crossamericapartners.com. The Partnership undertakes no obligation to publicly update or revise any statements in this release, whether as a result of new information, future events or otherwise.

12