UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21846

(exact name of Registrant as specified in charter)

1700

Broadway, Suite 1850

Denver, Colorado 80290

(Address of principal executive offices) (Zip code)

Chris Moore, Secretary

Clough Global Opportunities Fund

1700 Broadway, Suite 1850

Denver, Colorado 80290

(Name and address of agent for service)

Registrant’s telephone number, including area code: 855-425-6844

Date of fiscal year end: October 31

Date of reporting period: November 1, 2023 –

Item 1. Reports to Stockholders.

(a)

CLOUGH GLOBAL DIVIDEND AND INCOME FUND

CLOUGH GLOBAL EQUITY FUND

CLOUGH GLOBAL OPPORTUNITIES FUND

Semi-Annual Report

April 30, 2024

Clough Global Funds

SECTION 19(B) DISCLOSURE

April 30, 2024 (Unaudited)

Clough Global Dividend and Income Fund, Clough Global Equity Fund, and Clough Global Opportunities Fund (each a “Fund” and collectively, the “Funds”), acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Fund’s Board of Trustees (the “Board”), have adopted a plan, consistent with each Fund’s investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Funds’ managed distribution policy sets the monthly distribution rate at an amount equal to one twelfth of 10% of each Fund’s adjusted year-ending net asset value (“NAV”), which is the average of the NAVs as of the last five business days of the prior calendar year.

Under the Plan, each Fund will distribute all available investment income to its shareholders, consistent with each Fund’s primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient investment income is not available on a monthly basis, each Fund will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution.

Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases to enable each Fund to comply with the distribution requirements imposed by the Code.

Shareholders should not draw any conclusions about each Fund’s investment performance from the amount of these distributions or from the terms of the Plan. Each Fund’s total return performance on net asset value is presented in its financial highlights table.

Each Board may amend, suspend or terminate each Fund’s Plan without prior notice. The suspension or termination of the Plan could have the effect of creating a trading discount (if a Fund’s stock is trading at or above net asset value) or widening an existing trading discount. Each Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to the Notes to Financial Statements in the Annual Report to Shareholders for a more complete description of its risks.

Please refer to Additional Information for a cumulative summary of the Section 19(a) notices for each Fund’s current fiscal period. Section 19(a) notices for each Fund, as applicable, are available on the Clough Global Closed-End Funds website www.cloughcefs.com.

2

TABLE OF CONTENTS

Clough Global Funds

SHAREHOLDER LETTER

April 30, 2024 (Unaudited)

To Our Investors:

Clough Global Dividend and Income Fund

For the semi-annual period ending April 30, 2024, the Clough Global Dividend and Income Fund (“GLV”) gained +17.3% on net asset value (“NAV”) and +16.5% on market price. GLV’s benchmark, the Morningstar Global Allocation Total Return Index, gained +13.9% over the same period.

Equity investments were the primary contributor to performance, driven by holdings in the information technology, industrials, and healthcare sectors. The Fund’s fixed income positions also generated positive gains.

Among the GLV’s top five performers for the semi-annual period, SK Hynix Inc, a South Korean semiconductor company, gained due to elevated demand for its high bandwidth memory (“HBM”) chips used in artificial intelligence (“AI”). Bank of America Corp estimated sales of HBM will more than triple from $4b in 2023 to $15b in 2025 and SK Hynix has the number one position in that market. Lam Research Corp, a semiconductor company, increased in part due to improving visibility in its backlog. The company is an AI beneficiary and should benefit from an improving memory cycle. Airbus SE, the European aerospace company, rose on expectations for further market share gains as Boeing Co continued to struggle with quality and manufacturing issues. Microsoft Corp, the large software company, reported earnings results that exceeded analysts’ expectations. Its Azure segment also benefited from an AI spending tailwind. Ferguson PLC, an industrial distributor with exposure to housing and infrastructure, rounded out the contributors.

Among the GLV’s bottom five performers for the semi-annual period, a short in a European bank detracted from performance as financial equities rallied during the period. A short in a retailer chain detracted from performance as the company exceeded Wall Street same store sales expectations. A short position in a large manufacturer of motorcycles detracted from performance. The company provided guidance below 2024 estimates, but we believe the stock gained in part due to a new product launch for which we think expectations are too optimistic. A short position in an IT services company detracted from performance. We believe the market is ascribing too much valuation to a potential AI business opportunity and added to the short during the period. Finally, a short position in an auto retailer rounded out the detractors.

Clough Global Equity Fund

For the semi-annual period ending April 30, 2024, the Clough Global Equity Fund (“GLQ”) gained +24.9% on NAV and +26.7% on market price. GLQ’s benchmark, the MSCI World Index, the Bloomberg Developed Markets Large & Mid Cap Total Return Index, gained +20.6% and the MSCI World Index, gained +20.6% over the same period.

Equity holdings in the information technology, industrials, healthcare, and consumer discretionary sectors were the primary driver of performance.

Among GLQ’s top five performers for the semi-annual period, NVIDIA Corp, the large semiconductor company focused on AI, gained when the company’s quarterly results and annual guidance exceeded high Wall Street expectations. Alphabet Inc, the parent company of Google, reported Q1 2024 earnings results that exceeded Wall Street expectations on better-than-expected search and cloud results, and the company also announced an incremental $70 billion share repurchase. Lam Research Corp, a semiconductor company, increased in part due to improving visibility in its backlog. The company is an AI beneficiary and should benefit from an improving memory cycle. Amazon.com Inc, the large online retailer and cloud computing platform, reported quarterly results that exceeded estimates. Growth of the company’s cloud offering, Amazon Web Services (AWS), reaccelerated in part due to AI demand. TransDigm Group Inc, an aerospace manufacturing company, gained as the company’s results exceeded Wall Street estimates on higher-than-expected margins and increased guidance.

Among GLQ’s bottom five performers for the semi-annual period, a short in a European bank detracted from performance as financial equities rallied during the period. Transocean Ltd, the offshore drilling company, reported quarterly results and beat estimates on earnings before interest, tax, depreciation and amortization (“EBITDA”) due to cost management, but the company’s outlook trailed Wall Street estimates. A short in a retailer chain detracted from performance as the company exceeded Wall Street same store sales expectations. Argenx SE, a European biotechnology company, declined after one of its clinical trials generated data below expectations. We reduced the position during the period. A short position in a large manufacturer of motorcycles detracted from performance. The company provided guidance below 2024 estimates, but we believe the stock gained in part due to a new product launch for which we think expectations are too optimistic.

Clough Global Opportunities Fund

For the semi-annual period ending April 30, 2024, the Clough Global Opportunities Fund (“GLO”) gained +22.2% on NAV and +23.0% on market price. GLO’s benchmark, the Morningstar Global Allocation Total Return Index, gained +13.9% over the same period.

Equity investments were the primary contributor to performance, driven by holdings in the information technology, industrials, healthcare, and consumer discretionary sectors. The Fund’s fixed income positions also generated positive gains.

Among GLO’s top five performers for the semi-annual period, Alphabet Inc, the parent company of Google, reported Q1 2024 earnings results that exceeded Wall Street expectations on better-than-expected search and cloud results, and the company also announced an incremental $70 billion share repurchase. NVIDIA Corp, the large semiconductor company focused on AI, gained when the company’s quarterly results and annual guidance exceeded high Wall Street expectations. Lam Research Corp, a semiconductor company, increased in part due to improving visibility in its backlog. The company is an AI beneficiary and should benefit from an improving memory cycle. TransDigm Group Inc, an aerospace manufacturing company, gained as the company’s results exceeded Wall Street estimates on higher-than-expected margins and increased guidance. Amazon.com Inc, the large online retailer and cloud computing platform, reported quarterly results that exceeded estimates. Growth of the company’s cloud offering, Amazon Web Services (AWS), reaccelerated in part due to AI demand.

Among GLO’s bottom five performers for the semi-annual period, a short in a European bank detracted from performance as financial equities rallied during the period. Transocean Ltd, the offshore drilling company, reported quarterly results and beat estimates on EBITDA due to cost management, but the company’s outlook trailed Wall Street estimates. A short in a retailer chain detracted from performance as the company exceeded Wall Street same store sales expectations. Argenx SE, a European biotechnology company, declined after one of its clinical trials generated data below expectations. We reduced the position during the

4

Clough Global Funds

SHAREHOLDER LETTER

April 30, 2024 (Continued) (Unaudited)

period. A short position in a large manufacturer of motorcycles detracted from performance. The company provided guidance below 2024 estimates, but we believe the stock gained in part due to a new product launch for which we think expectations are too optimistic.

MARKET COMMENTARY

To our view, two important economic trends will likely create a positive backdrop for equities:

1. Disinflation is likely to continue in the quarters ahead

2. Productivity should drive profits higher

So, we think trying to pick the month the U.S. Federal Reserve (the “Fed”) will first reduce interest rates is a pointless and frustrating exercise.

Equities did well in 2023 and into early 2024 in the face of a 525-basis point rise in interest rates and a $1.6 trillion reduction in assets held by the U.S. Federal Reserve (the “Fed”) on its balance sheet since 2022. Quality spreads have also narrowed, suggesting that both financial conditions and profits are good. If the Fed is that tight, where is the liquidity so vital to healthy financial markets coming from? There might be some residual quantitative easing left, but we think a more important factor is that the private economy is throwing off cash. That substantially reduces financial market dependence on the Fed.

We think inflation is likely to burn itself out. Much of the index price gains of recent months appear to be residual effects of COVID-related supply side issues. But capital is widely available, manufacturing is booming everywhere, and we think many remaining shortages will turn to gluts in time. Barron’s recently reported on a surge in chemical plant construction that will “create a serious glut that could last years”. The periodical noted that even though polyethylene capacity utilization is falling, large new plants are being built in North America, China and the Middle East. Import prices from China are falling and since the dollar has remained stable, disinflation in the rest of the world should help send the price index for manufactured goods down. The rally in commodities is narrow, based largely on supply restrictions for crude oil and copper, and geopolitical issues for gold as central banks attempt to neuter the dollar. And the sharp rise in insurance rates which drove the March Consumer Price Index (“CPI”) report is likely a one-shot effort to catch up with higher auto-related costs while used car prices are declining and automobile manufacturers are ramping up production and discounting more heavily. Leading indicators of apartment rental pricing suggest a downturn in a category that makes up a very large portion of U.S. price indices.

We believe tight monetary policy only intensifies this disinflationary process.

Job growth remains strong, but an expanding labor force explains why. The U.S. is the only developed world economy which measurably benefits from immigration. From November 2023 to March 2024, full-time workers fell by 1.8 million workers while part-time workers rose by 1.6 million. This should eventually translate into lower unit labor costs.

As populations age, they increase savings, particularly in a world where life expectancy is increasing. Japan is the best example. The one inflationary time in the postwar period which persisted occurred in the 1970s when the baby boomers, the most aggressive borrowers and spenders in history, entered their working and family formation years. The baby boomers practically built the housing stock, and private debt as a percentage of GDP nearly tripled. Today they are entering retirement, a time when people spend less and work down debt.

When private sector debt loads are 151% of GDP, as they are today, the ability to borrow and spend dissipates. Medium and lower income folks do most of the spending and their ability to use installment credit at 22%+ interest rates to maintain that spending will likely run out. Credit card delinquencies are rising as are 90-day delinquencies on Federal Housing Administration (“FHA”) insured mortgages. In the corporate sector, leveraged loan defaults are occurring. This, at least, implies we are late in a credit cycle. Most businesses are trying to reduce debt. Many banks will have to deal with commercial real estate loan issues in the coming year.

The failure of the money stock to grow argues in favor of this analysis. M2, the money aggregate which includes bank deposits, has been declining for two years. The rates paid on traditional demand deposits run ten basis points or less, suggesting banks are not willing to bid up for deposits unless they have to. U.S. banking system deposits have declined from $18 billion two years ago to $17.5 billion today. That suggests there are not enough good loans to leverage the stock of deposits they currently hold. To grow, banks may have to make bad loans.

In summary, we believe that the secular disinflationary forces which preceded the COVID-related inflation will reassert themselves. We think they are driven by a combination of demographics, the large amount of private sector debt outstanding and technologically driven productivity gains. All are likely to intensify in coming years.

The portfolios are positioned to balance large-capitalization technology holdings with value cyclicals we believe are likely to generate high levels of free cash flow. We believe the case for large-capitalization technology remains strong. The free cash flows generated by these companies is at a scale never seen before and we think they will maintain their dominance by building the AI infrastructure. This offers an unprecedented long-term runway for growth. These companies are among the few which moved from Internet dominance to equal dominance in cloud and now, AI.

The old economy offers opportunities as well. For example, we think copper will benefit from a perfect storm consisting of growing demand for clean energy, the need to expand the electric grid for AI needs, and the growth of electric vehicles, while an absence of investment will restrict supplies. We also hold stocks which should benefit from a natural gas price recovery owing to a continuing decline in coal availability as a liquefied natural gas (“LNG”) boom emerges. And the aerospace-defense sector faces a decade of increasing demand and rising profitability as new technologies require advanced defense systems.

5

Clough Global Funds

SHAREHOLDER LETTER

April 30, 2024 (Continued) (Unaudited)

As always, please don’t hesitate to reach out to us with any questions or comments.

Sincerely,

Charles I Clough, Jr.

William Whelan

This letter is provided for informational purposes only and is not an offer to purchase or sell shares. Clough Global Dividend and Income Fund, Clough Global Equity Fund, and Clough Global Opportunities Fund (the “Funds”) are closed-end funds, which are traded on the NYSE American LLC, and do not continuously issue shares for sale as open-end mutual funds do. The market price of a closed-end fund is based on the market’s value. The net asset value (“NAV”) of a closed-end fund is the market price of the underlying investments (i.e., stocks and bonds) in the Funds’ portfolios, minus liabilities, divided by the total number of Fund shares outstanding. However, the Funds also have a market price; the value of which it trades on an exchange. This market price can be more or less than its NAV.

Although not generally stated throughout, the information in this letter reflects the opinions of the individual portfolio managers, which opinion is subject to change, and is not intended to be a forecast of future events, a guarantee of future results or investment advice.

The Morningstar Global Allocation Total Return Index represents a multi-asset class portfolio of 60% global equities and 40% global bonds. The asset allocation within each class is driven by Morningstar asset allocation methodology. To maintain broad global exposure and diversification, the index consists of equities & fixed income and utilizes global, float-weighted index methodology to determine allocation to U.S. and non-U.S.

The Bloomberg Developed Markets Large & Mid Cap Total Return Index is a float market capitalization-weighted equity benchmark that covers 85% market capitalization of the measured market.

The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of 23 developed markets countries. Effective July 31, 2010, the MSCI World Index returns prior to January 1, 2002 were revised to reflect the total returns, with dividends reinvested, reported by MSCI. The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an. indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages (www.msci.com).

Both indices referenced herein reflect the reinvestment of dividends. The performance of the indices referenced herein is used for informational purposes only. One cannot invest directly in an index. Indices are not subject to any of the fees or expenses to which the Funds are subject, and there are significant differences between the Funds’ investments and the components of the indices referenced.

RISKS

An investor should consider investment objectives, risks, charges and expenses carefully before investing. To obtain an annual report or semiannual report which contains this and other information visit www.cloughcefs.com or call 1-855-425-6844. Read them carefully before investing.

The Funds’ distribution policies will, under certain circumstances, have certain adverse consequences to the Funds and their shareholders because it may result in a return of capital resulting in less of a shareholder’s assets being invested in the Funds and, over time, increase the Funds’ expense ratios.

Distributions may be paid from sources of income other than ordinary income, such as net realized short-term capital gains, net realized long-term capital gains and return of capital. Based on current estimates, we anticipate the most recent distribution has been paid from short-term and long-term capital gains. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Funds’ investment experiences during the remainder of its fiscal year and may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Funds provide a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms after the end of the year.

The Funds’ investments in securities of foreign issuers are subject to risks not usually associated with owning securities of U.S. issuers. These risks can include fluctuations in foreign currencies, foreign currency exchange controls, social, political and economic instability, differences in securities regulation and trading, expropriation or nationalization of assets, and foreign taxation issues.

6

Clough Global Funds

SHAREHOLDER LETTER

April 30, 2024 (Continued) (Unaudited)

The Funds’ investments in preferred stocks and bonds of below investment grade quality (commonly referred to as “high yield” or “junk bonds”), if any, are predominately speculative because of the credit risk of their issuers.

An investment by the Funds in real estate investment trusts (“REITs”) will subject it to various risks. The first, real estate industry risk, is the risk that the REIT share prices will decline because of adverse developments affecting the real estate industry and real property values. In general, real estate values can be affected by a variety of factors, including supply and demand for properties, the economic health of the country or of different regions, and the strength of specific industries that rent properties. The second, investment style risk, is the risk that returns from REITs—which typically are small or medium capitalization stocks—will trail returns from the overall stock market. The third, interest rate risk, is the risk that changes in interest rates may hurt real estate values or make REIT shares less attractive than other income-producing investments. Credit risk is the risk that an issuer of a preferred or debt security will become unable to meet its obligation to make dividend, interest and principal payments.

Interest rate risk is the risk that preferred stocks paying fixed dividend rates and fixed-rate debt securities will decline in value because of changes in market interest rates. When interest rates rise the value of such securities generally will fall. Derivative transactions (such as futures contracts and options thereon, options, swaps, and short sales) subject the Funds to increased risk of principal loss due to imperfect correlation or unexpected price or interest rate movements. Compared to investment companies that focus only on large companies, the Funds’ share price may be more volatile because it also invests in small and medium capitalization companies. Past performance is neither a guarantee, nor necessarily indicative, of future results, which may be significantly affected by changes in economic and other conditions.

7

Clough Global Dividend and Income Fund

PORTFOLIO ALLOCATION

April 30, 2024 (Unaudited)

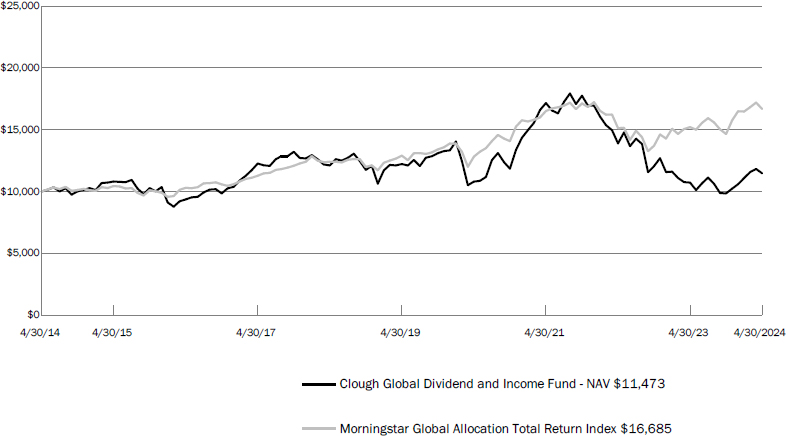

Growth of $10,000 Investment

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares

Total Return as of April 30, 2024(a)

| 6 months | 1 Year | 3 Year(b) | 5 Year(b) | 10 Year(b) | Since

Inception (7/28/2004)(b) |

|

| Clough Global Dividend and Income Fund - NAV(c) | 17.31% | 6.25% | -6.30% | 0.26% | 2.01% | 4.94% |

| Clough Global Dividend and Income Fund - Market Price(d) | 16.49% | 7.03% | -12.49% | -1.48% | 1.27% | 3.64% |

| Morningstar Global Allocation Total Return Index | 13.85% | 9.69% | 0.34% | 5.28% | 5.25% | 6.52% |

| (a) | Total returns assume reinvestment of all distributions. |

| (b) | Annualized. |

| (c) | Performance returns are net of management fees and other Fund expenses. |

| (d) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

Distributions to Common Shareholders

The Fund intends to make monthly distributions to common shareholders according to its managed distribution policy. The Fund’s managed distribution policy is to set the monthly distribution rate at an amount equal to one twelfth of 10% of the Fund’s adjusted year-ending net asset value per share (“NAV”), which will be the average of the NAVs as of the last five business days of the prior calendar year. The Board of Directors approve the distribution and may adjust it from time to time. The monthly distribution amount paid from November 1, 2023 to December 31, 2023 was $0.0597 per share and the Fund paid $0.0526 per share monthly between January 1, 2024 and April 30, 2024. At times, to maintain a stable level of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return of capital, in addition to current net investment income.

8

Clough Global Dividend and Income Fund

PORTFOLIO ALLOCATION

April 30, 2024 (Continued) (Unaudited)

| Global Securities Holdings | %

of Total Portfolio(a) |

| United States of America | 50.80% |

| U.S. Multinationals(b) | 26.35% |

| South Korea | 7.43% |

| France | 4.01% |

| Netherlands | 3.42% |

| Sweden | 2.23% |

| India | 2.00% |

| China | 1.31% |

| Switzerland | 1.11% |

| Ireland | 1.03% |

| Brazil | 0.89% |

| Hong Kong | 0.30% |

| Germany | -0.88% |

| TOTAL INVESTMENTS | 100.00% |

| Asset Allocation | % of Total Portfolio(a) |

| Common Stock - Foreign | 47.59% |

| Common Stock - US | 41.61% |

| Preferred Stock | 1.33% |

| Exchange Traded Funds | -1.01% |

| Total Equities | 89.52% |

| Corporate Bonds | 8.56% |

| Asset-Backed Securities | 0.02% |

| Total Fixed Income | 8.58% |

| Money Market Funds | 1.88% |

| Cash | 0.02% |

| TOTAL INVESTMENTS | 100.00% |

| (a) | Percentages calculated based on total portfolio, including securities sold short and cash balances. |

| (b) | U.S. Multinationals include companies organized or located in the United States that have more than 50% of revenues derived outside of the United States. |

9

Clough Global Equity Fund

PORTFOLIO ALLOCATION

April 30, 2024 (Unaudited)

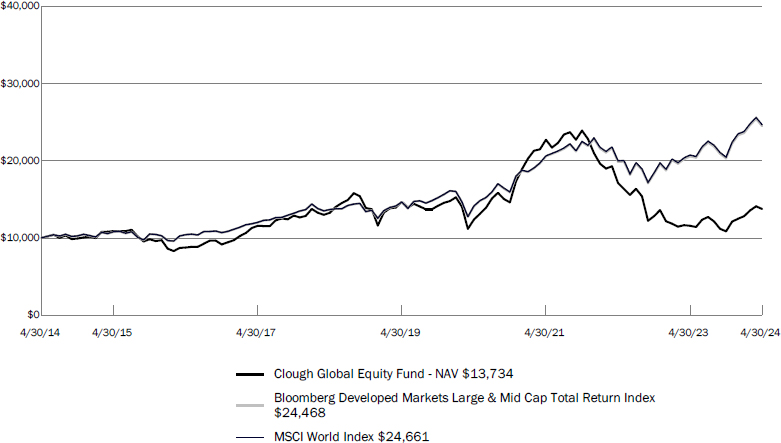

Growth of $10,000 Investment

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares

Total Return as of April 30, 2024(a)

| 6 months | 1 Year | 3 Year(b) | 5 Year(b) | 10 Year(b) | Since

Inception (4/27/2005)(b) | |

| Clough Global Equity Fund - NAV(c) | 24.86% | 18.02% | -11.41% | 1.54% | 4.02% | 5.76% |

| Clough Global Equity Fund - Market Price(d) | 26.72% | 18.82% | -15.37% | -1.61% | 3.06% | 4.38% |

| Bloomberg Developed Markets Large & Mid Cap Total Return Index(e) | 20.57% | 19.04% | 5.96% | 10.85% | 9.36% | 8.33% |

| MSCI World Index | 20.59% | 18.96% | 6.14% | 11.00% | 9.45% | 8.47% |

| (a) | Total returns assume reinvestment of all distributions. |

| (b) | Annualized. |

| (c) | Performance returns are net of management fees and other Fund expenses. |

| (d) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

| (e) | Effective March 31, 2024, the Bloomberg Developed Markets Large & Mid Cap Total Return Index replaced the MSCI World Index as the Fund’s primary index. |

Distributions to Common Shareholders

The Fund intends to make monthly distributions to common shareholders according to its managed distribution policy. The Fund’s managed distribution policy is to set the monthly distribution rate at an amount equal to one twelfth of 10% of the Fund’s adjusted year-ending net asset value per share (“NAV”), which will be the average of the NAVs as of the last five business days of the prior calendar year. The Board of Directors approve the distribution and may adjust it from time to time. The monthly distribution amount paid from November 1, 2023 to December 31, 2023 was $0.0599 per share and the Fund paid $0.0603 per share monthly between January 1, 2024 and April 30, 2024. At times, to maintain a stable level of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return of capital, in addition to current net investment income.

10

Clough Global Equity Fund

PORTFOLIO ALLOCATION

April 30, 2024 (Continued) (Unaudited)

| Global Securities Holdings | %

of Total Portfolio(a) |

| United States of America | 47.03% |

| U.S. Multinationals(b) | 32.49% |

| South Korea | 7.03% |

| India | 3.94% |

| Netherlands | 3.33% |

| China | 3.03% |

| France | 2.95% |

| Switzerland | 1.07% |

| Germany | -1.44% |

| TOTAL INVESTMENTS | 100.00% |

| Asset Allocation | %

of Total Portfolio(a) |

| Common Stock – Foreign | 52.97% |

| Common Stock – US | 46.09% |

| Total Equities | 99.06% |

| Convertible Corporate Bonds | 0.02% |

| Total Fixed Income | 0.02% |

| Money Market Funds | 0.91% |

| Cash | 0.01% |

| TOTAL INVESTMENTS | 100.00% |

| (a) | Percentages calculated based on total portfolio, including securities sold short and cash balances. |

| (b) | U.S. Multinationals includes companies organized or located in the United States that have more than 50% of revenues derived outside of the United States. |

11

Clough Global Opportunities Fund

PORTFOLIO ALLOCATION

April 30, 2024 (Unaudited)

Growth of $10,000 Investment

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Fund over the past ten years. Past performance does not guarantee future results. All returns reflect reinvested dividends, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares

Total Return as of April 30, 2024(a)

| 6 months | 1 Year | 3 Year(b) | 5 Year(b) | 10 Year(b) | Since

Inception (4/25/2006)(b) | |

| Clough Global Opportunities Fund - NAV(c) | 22.19% | 16.20% | -12.25% | 0.89% | 2.97% | 4.01% |

| Clough Global Opportunities Fund - Market Price(d) | 23.00% | 14.35% | -17.04% | -0.98% | 2.40% | 2.60% |

| Morningstar Global Allocation Total Return Index | 13.85% | 9.69% | 0.34% | 5.28% | 5.25% | 5.59% |

| (a) | Total returns assume reinvestment of all distributions. |

| (b) | Annualized. |

| (c) | Performance returns are net of management fees and other Fund expenses. |

| (d) | Market price is the value at which the Fund trades on an exchange. This market price can be more or less than its NAV. |

Distributions to Common Shareholders

The Fund intends to make monthly distributions to common shareholders according to its managed distribution policy. The Fund’s managed distribution policy is to set the monthly distribution rate at an amount equal to one twelfth of 10% of the Fund’s adjusted year-ending net asset value per share (“NAV”), which will be the average of the NAVs as of the last five business days of the prior calendar year. The Board of Directors approve the distribution and may adjust it from time to time. The monthly distribution amount paid from November 1, 2023 to December 31, 2023 was $0.0483 per share and the Fund paid $0.0480 per share monthly between January 1, 2024 and April 30, 2024. At times, to maintain a stable level of distributions, the Fund may pay out less than all of its net investment income or pay out accumulated undistributed income, or return of capital, in addition to current net investment income.

12

Clough Global Opportunities Fund

PORTFOLIO ALLOCATION

April 30, 2024 (Continued) (Unaudited)

| Global Securities Holdings | %

of Total Portfolio(a) |

| United States of America | 49.81% |

| US Multinationals(b) | 30.23% |

| South Korea | 5.67% |

| India | 3.85% |

| Netherlands | 3.34% |

| France | 2.95% |

| China | 2.95% |

| Switzerland | 1.07% |

| Ireland | 1.00% |

| Germany | -1.45% |

| TOTAL INVESTMENTS | 100.00% |

| Asset Allocation | % of Total Portfolio(a) |

| Common Stock – Foreign | 48.80% |

| Common Stock – US | 42.69% |

| Total Equities | 91.49% |

| Corporate Bonds | 6.96% |

| Convertible Corporate Bonds | 0.02% |

| Total Fixed Income | 6.98% |

| Money Market Funds | 1.52% |

| Cash | 0.01% |

| TOTAL INVESTMENTS | 100.00% |

| (a) | Percentages calculated based on total portfolio, including securities sold short and cash balances. |

| (b) | U.S. Multinationals includes companies organized or located in the United States that have more than 50% of revenues derived outside of the United States. |

13

Clough Global Dividend and Income Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 106.64% | ||||||||

| Communication Services - 4.43% | ||||||||

| AT&T, Inc.(a) | 52,400 | $ | 885,036 | |||||

| Comcast Corp., Class A(a)(b) | 42,200 | 1,608,242 | ||||||

| Meta Platforms, Inc. | 1,550 | 666,764 | ||||||

| Verizon Communications, Inc.(a) | 11,000 | 434,390 | ||||||

| 3,594,432 | ||||||||

| Consumer Discretionary - 11.05% | ||||||||

| Autoliv, Inc.(a) | 14,250 | 1,707,007 | ||||||

| BYD Co. Ltd. | 36,500 | 1,005,970 | ||||||

| D.R. Horton, Inc. | 6,270 | 893,412 | ||||||

| Home Depot, Inc.(a)(b) | 5,648 | 1,887,675 | ||||||

| McDonald's Corp.(a) | 4,567 | 1,246,974 | ||||||

| PulteGroup, Inc.(a) | 9,380 | 1,045,120 | ||||||

| Starbucks Corp.(a) | 13,200 | 1,168,068 | ||||||

| 8,954,226 | ||||||||

| Consumer Staples - 5.71% | ||||||||

| Coca-Cola Co.(a) | 24,850 | 1,534,985 | ||||||

| PepsiCo, Inc.(a) | 5,540 | 974,541 | ||||||

| Procter & Gamble Co.(a) | 13,000 | 2,121,600 | ||||||

| 4,631,126 | ||||||||

| Energy - 4.55% | ||||||||

| Chesapeake Energy Corp.(a) | 13,160 | 1,182,821 | ||||||

| Chevron Corp.(a) | 6,600 | 1,064,382 | ||||||

| Exxon Mobil Corp.(a) | 12,210 | 1,444,077 | ||||||

| 3,691,280 | ||||||||

| Financials - 13.47% | ||||||||

| Bank of America Corp.(a) | 24,000 | 888,240 | ||||||

| Charles Schwab Corp.(a) | 24,310 | 1,797,724 | ||||||

| Everest Group Ltd. | 4,245 | 1,555,410 | ||||||

| HDFC Bank Ltd. - ADR(a)(b) | 10,400 | 599,040 | ||||||

| ICICI Bank Ltd. - Sponsored ADR(a)(b) | 33,900 | 933,267 | ||||||

| JPMorgan Chase & Co.(a) | 13,300 | 2,550,142 | ||||||

| Morgan Stanley(a) | 18,550 | 1,685,082 | ||||||

| Prudential Financial, Inc.(a) | 3,300 | 364,584 | ||||||

| Starwood Property Trust, Inc.(a)(b) | 28,600 | 542,542 | ||||||

| 10,916,031 | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS - 106.64% (continued) | ||||||||

| Health Care - 14.94% | ||||||||

| AbbVie, Inc.(a) | 2,850 | $ | 463,524 | |||||

| Eli Lilly & Co. | 1,889 | 1,475,498 | ||||||

| Encompass Health Corp.(a) | 15,300 | 1,275,714 | ||||||

| Gilead Sciences, Inc.(a) | 6,300 | 410,760 | ||||||

| HCA Healthcare, Inc.(a) | 4,830 | 1,496,431 | ||||||

| Humana, Inc. | 1,820 | 549,804 | ||||||

| Johnson & Johnson(a) | 3,107 | 449,241 | ||||||

| Lonza Group AG | 1,584 | 879,493 | ||||||

| Medtronic PLC(a) | 15,600 | 1,251,744 | ||||||

| Merck & Co., Inc.(a) | 16,020 | 2,070,104 | ||||||

| Select Medical Holdings Corp.(a) | 33,500 | 950,395 | ||||||

| Universal Health Services, Inc. | 4,990 | 850,446 | ||||||

| 12,123,154 | ||||||||

| Industrials - 13.48% | ||||||||

| Airbus SE | 18,656 | 3,079,635 | ||||||

| Ferguson PLC(a) | 10,125 | 2,125,238 | ||||||

| General Dynamics Corp.(a) | 9,245 | 2,654,147 | ||||||

| Illinois Tool Works, Inc.(a)(b) | 1,793 | 437,689 | ||||||

| Lockheed Martin Corp.(a) | 815 | 378,918 | ||||||

| Northrop Grumman Corp.(a) | 1,087 | 527,228 | ||||||

| RTX Corp.(a)(b) | 16,995 | 1,725,332 | ||||||

| 10,928,187 | ||||||||

| Information Technology - 28.36% | ||||||||

| Amphenol Corp., Class A | 4,000 | 483,080 | ||||||

| Apple, Inc.(a)(b) | 15,980 | 2,721,873 | ||||||

| ASML Holding N.V. | 3,007 | 2,623,517 | ||||||

| Broadcom, Inc.(a)(b) | 1,475 | 1,917,898 | ||||||

| Cisco Systems, Inc.(a) | 11,500 | 540,270 | ||||||

| Lam Research Corp.(a) | 2,795 | 2,499,876 | ||||||

| Microsoft Corp.(a) | 13,795 | 5,370,807 | ||||||

| NVIDIA Corp. | 1,300 | 1,123,226 | ||||||

| Samsung Electronics Co., Ltd. | 26,583 | 1,490,618 | ||||||

| Samsung Electronics Co., Ltd., Preference | 8,548 | 403,248 | ||||||

| SK Hynix, Inc. | 30,219 | 3,808,805 | ||||||

| 22,983,218 | ||||||||

| Materials - 6.61% | ||||||||

| Dow, Inc.(a) | 17,100 | 972,990 | ||||||

| Ecolab, Inc. | 3,030 | 685,234 | ||||||

| Freeport-McMoRan, Inc., Class B(a) | 39,450 | 1,970,133 | ||||||

| Glencore PLC | 69,270 | 404,823 | ||||||

| International Paper Co.(a)(b) | 18,600 | 649,884 | ||||||

| Vale SA - Sponsored ADR, Class B(a) | 56,300 | 685,171 | ||||||

| 5,368,235 | ||||||||

| Real Estate - 1.41% | ||||||||

| Simon Property Group, Inc.(a)(b) | 4,800 | 674,544 | ||||||

| VICI Properties, Inc.(a) | 16,500 | 471,075 | ||||||

| 1,145,619 | ||||||||

See Notes to Financial Statements.

14

Clough Global Dividend and Income Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Continued) (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 106.64% (continued) | ||||||||

| Utilities - 2.63% | ||||||||

| Duke Energy Corp.(a) | 10,400 | $ | 1,021,904 | |||||

| Exelon Corp.(a)(b) | 29,500 | 1,108,610 | ||||||

| 2,130,514 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $71,694,809) | 86,466,022 | |||||||

| Description/Maturity Date/Rate | Shares | Value | ||||||

| PREFERRED STOCKS - 1.26% | ||||||||

| Gabelli Equity Trust, Inc., Series K, Perpetual Maturity, 5.000%(a)(c) | 21,200 | 455,694 | ||||||

| Trinity Capital, Inc., 1/16/2025, 7.000%(a) | 22,400 | 568,064 | ||||||

| 1,023,758 | ||||||||

| TOTAL PREFERRED STOCKS | ||||||||

| (Cost $1,090,000) | 1,023,758 | |||||||

| Description/Maturity Date/Rate | Principal Amount | Value | ||||||

| CORPORATE BONDS - 8.10% | ||||||||

| Consumer Discretionary - 0.90% | ||||||||

| Melco Resorts Finance Ltd., 7/21/2028, 5.750%(a)(d)(e) | $ | 250,000 | 232,059 | |||||

| PulteGroup, Inc., 1/15/2027, 5.000%(a)(b) | 500,000 | 492,578 | ||||||

| 724,637 | ||||||||

| Energy - 1.83% | ||||||||

| Transocean, Inc., 2/1/2027, 8.000%(d)(e) | 1,476,000 | 1,480,831 | ||||||

| Financials - 0.57% | ||||||||

| Trinity Capital, Inc., 8/24/2026, 4.375%(a) | 500,000 | 463,836 | ||||||

| Health Care - 1.10% | ||||||||

| Tenet Healthcare Corp., 10/1/2028, 6.125% | 900,000 | 889,545 | ||||||

| Industrials - 2.47% | ||||||||

| AerCap Holdings N.V., 10/10/2079, 5.875% | 800,000 | 791,381 | ||||||

| American Airlines 2013-1 Class A Pass Through Trust, 7/15/2025, 4.000% | 368,438 | 358,772 | ||||||

| United Airlines 2020-1 Class B Pass Through Trust, 1/15/2026, 4.875% | 292,320 | 285,596 | ||||||

| Description/Maturity Date/Rate | Principal Amount | Value | ||||||

| CORPORATE BONDS - 8.10% (continued) | ||||||||

| Industrials - 2.47% (continued) | ||||||||

| US Airways 2012-2 Class A Pass Through Trust, 6/3/2025, 4.625%(a) | $ | 579,479 | $ | 572,045 | ||||

| 2,007,794 | ||||||||

| Information Technology - 1.23% | ||||||||

| Apple, Inc., 5/6/2024, 3.450%(a) | 1,000,000 | 999,803 | ||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $6,602,240) | 6,566,446 | |||||||

| Description/Maturity Date/Rate | Principal Amount | Value | ||||||

| ASSET-BACKED SECURITIES - 0.02% | ||||||||

| United States Small Business Administration, 12/1/2028, 6.220%(a) | 19,345 | 19,169 | ||||||

| TOTAL ASSET-BACKED SECURITIES | ||||||||

| (Cost $19,345) | 19,169 | |||||||

| Shares | Value | |||||||

| MONEY MARKET FUNDS - 1.78% | ||||||||

| BlackRock Liquidity Funds, T-Fund Portfolio, Institutional Class, 5.180% (7-day yield) | 1,439,399 | 1,439,399 | ||||||

| TOTAL MONEY MARKET FUNDS | ||||||||

| (Cost $1,439,399) | 1,439,399 | |||||||

| TOTAL INVESTMENTS - 117.80% | ||||||||

| (Cost $80,845,793) | 95,514,794 | |||||||

| Liabilities in Excess of Other Assets - (17.80)%(f) | (14,430,355 | ) | ||||||

| NET ASSETS - 100.00% | $ | 81,084,439 | ||||||

See Notes to Financial Statements.

15

Clough Global Dividend and Income Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Continued) (Unaudited)

| SCHEDULE OF SECURITIES SOLD SHORT | Shares | Value | ||||||

| COMMON STOCKS - (22.23)% | ||||||||

| Consumer Discretionary - (9.85)% | ||||||||

| Asbury Automotive Group, Inc.(g) | (1,800 | ) | $ | (378,432 | ) | |||

| BRP, Inc. | (5,670 | ) | (381,473 | ) | ||||

| Brunswick Corp. | (17,500 | ) | (1,411,200 | ) | ||||

| Ford Motor Co. | (14,870 | ) | (180,671 | ) | ||||

| General Motors Co. | (4,980 | ) | (221,759 | ) | ||||

| Harley-Davidson, Inc. | (24,410 | ) | (839,460 | ) | ||||

| Lithia Motors, Inc., Class A | (1,270 | ) | (323,063 | ) | ||||

| Lowe's Cos., Inc. | (1,800 | ) | (410,382 | ) | ||||

| On Holding AG(g) | (13,700 | ) | (434,975 | ) | ||||

| Pool Corp. | (2,800 | ) | (1,015,084 | ) | ||||

| Signet Jewelers Ltd. | (4,600 | ) | (450,938 | ) | ||||

| Tractor Supply Co. | (4,550 | ) | (1,242,514 | ) | ||||

| YETI Holdings, Inc.(g) | (19,400 | ) | (692,968 | ) | ||||

| (7,982,919 | ) | |||||||

| Consumer Staples - (0.83)% | ||||||||

| Energizer Holdings, Inc. | (23,400 | ) | (672,048 | ) | ||||

| Financials - (2.70)% | ||||||||

| Apollo Global Management, Inc. | (3,700 | ) | (401,006 | ) | ||||

| Blackstone, Inc. | (3,400 | ) | (396,474 | ) | ||||

| Deutsche Bank AG | (42,200 | ) | (677,310 | ) | ||||

| KKR & Co., Inc. | (4,300 | ) | (400,201 | ) | ||||

| SoFi Technologies, Inc.(g) | (46,637 | ) | (316,199 | ) | ||||

| (2,191,190 | ) | |||||||

| Health Care - (1.99)% | ||||||||

| Bio-Techne Corp. | (11,900 | ) | (752,199 | ) | ||||

| United Therapeutics Corp.(g) | (3,670 | ) | (859,991 | ) | ||||

| (1,612,190 | ) | |||||||

| Industrials - (3.48)% | ||||||||

| American Airlines Group, Inc.(g) | (13,900 | ) | (187,789 | ) | ||||

| AMETEK, Inc. | (1,600 | ) | (279,456 | ) | ||||

| Honeywell International, Inc. | (1,300 | ) | (250,549 | ) | ||||

| Jacobs Solutions, Inc. | (2,000 | ) | (287,060 | ) | ||||

| The Middleby Corp.(g) | (3,200 | ) | (444,704 | ) | ||||

| Paychex, Inc. | (6,900 | ) | (819,789 | ) | ||||

| Rockwell Automation, Inc. | (900 | ) | (243,864 | ) | ||||

| Shoals

Technologies Group, Inc., Class A(g) | (37,400 | ) | (316,030 | ) | ||||

| (2,829,241 | ) | |||||||

| Information Technology - (1.77)% | ||||||||

| Clearwater Analytics Holdings(g) | (27,600 | ) | (435,528 | ) | ||||

| International Business Machines Corp. | (6,015 | ) | (999,693 | ) | ||||

| (1,435,221 | ) | |||||||

| Shares | Value | |||||||

| Materials - (1.61)% | ||||||||

| Avery Dennison Corp. | (4,000 | ) | $ | (869,120 | ) | |||

| Corteva, Inc. | (8,100 | ) | (438,453 | ) | ||||

| (1,307,573 | ) | |||||||

| TOTAL COMMON STOCKS | ||||||||

| (Proceeds $18,741,657) | (18,030,382 | ) | ||||||

| EXCHANGE-TRADED FUNDS - (0.96)% | ||||||||

| Consumer Staples Select Sector SPDR Fund | (10,300 | ) | (777,650 | ) | ||||

| TOTAL EXCHANGE-TRADED FUNDS | ||||||||

| (Proceeds $732,375) | (777,650 | ) | ||||||

| TOTAL SECURITIES SOLD SHORT | ||||||||

| (Proceeds $19,474,032) | (18,808,032 | ) | ||||||

| Investment Abbreviations: | ||||||||

| ADR – American Depository Receipt | ||||||||

| PLC – Public Limited Company | ||||||||

| (a) | Pledged security; a portion or all of the security is pledged as collateral for securities sold short or borrowings. As of April 30, 2024, the aggregate value of those securities was $63,227,832, representing 77.98% of net assets. |

| (b) | Loaned security; a portion or all of the security is on loan as of April 30, 2024. |

| (c) | This security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

| (d) | Restricted security. |

| (e) | All or a portion of the security is exempt from registration of the Securities Act of 1933. These securities may be resold in transactions exempt from registration under Rule 144A, normally to qualified institutional buyers. As of April 30, 2024, these securities had an aggregate value of $1,712,890 or 2.11% of net assets. |

| (f) | Includes cash which is being held as collateral for securities sold short. |

| (g) | Non-income producing security. |

For Fund compliance purposes, the Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to Financial Statements.

16

Clough Global Equity Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 117.45% | ||||||||

| Communication Services - 8.89% | ||||||||

| Alphabet, Inc.(a)(b)(c) | 51,310 | $ | 8,447,678 | |||||

| Liberty Media Corp. - Liberty Formula One, Class C(a) | 15,100 | 1,056,547 | ||||||

| Meta Platforms, Inc. | 2,730 | 1,174,364 | ||||||

| Verizon Communications, Inc. | 51,500 | 2,033,735 | ||||||

| 12,712,324 | ||||||||

| Consumer Discretionary - 19.84% | ||||||||

| Amazon.com, Inc.(a)(c) | 45,760 | 8,008,000 | ||||||

| Booking Holdings, Inc.(c) | 350 | 1,208,210 | ||||||

| BYD Co. Ltd. | 103,000 | 2,838,764 | ||||||

| Carnival Corp.(a)(b)(c) | 246,600 | 3,654,612 | ||||||

| D.R. Horton, Inc.(c) | 10,260 | 1,461,947 | ||||||

| DraftKings, Inc.(a)(c) | 59,760 | 2,483,626 | ||||||

| MakeMyTrip Ltd.(a) | 19,700 | 1,304,337 | ||||||

| PulteGroup, Inc.(c) | 8,110 | 903,616 | ||||||

| Royal Caribbean Cruises Ltd.(a)(b)(c) | 20,210 | 2,821,922 | ||||||

| SharkNinja, Inc. | 36,350 | 2,336,578 | ||||||

| Trip.com Group Ltd. - ADR(a)(c) | 27,600 | 1,331,976 | ||||||

| 28,353,588 | ||||||||

| Consumer Staples - 2.89% | ||||||||

| Coca-Cola Co.(c) | 10,400 | 642,408 | ||||||

| General Mills, Inc.(b)(c) | 13,900 | 979,394 | ||||||

| Procter & Gamble Co.(b)(c) | 15,300 | 2,496,960 | ||||||

| 4,118,762 | ||||||||

| Energy - 6.53% | ||||||||

| Chesapeake Energy Corp.(b)(c) | 18,209 | 1,636,625 | ||||||

| Diamondback Energy, Inc.(c) | 2,405 | 483,718 | ||||||

| Exxon Mobil Corp.(c) | 11,919 | 1,409,660 | ||||||

| Noble Corp PLC | 16,057 | 712,610 | ||||||

| Schlumberger N.V.(c) | 14,061 | 667,616 | ||||||

| Southwestern Energy Co.(a)(c) | 250,973 | 1,879,788 | ||||||

| Transocean Ltd.(a)(c) | 481,477 | 2,513,310 | ||||||

| 9,303,327 | ||||||||

| Financials - 9.83% | ||||||||

| Berkshire Hathaway, Inc., Class A(a)(c) | 3 | 1,798,500 | ||||||

| Berkshire Hathaway, Inc., Class B(a) | 1,086 | 430,849 | ||||||

| Charles Schwab Corp. | 25,890 | 1,914,565 | ||||||

| Everest Group Ltd. | 7,470 | 2,737,083 | ||||||

| HDFC Bank Ltd. - ADR(b)(c) | 17,700 | 1,019,520 | ||||||

| ICICI Bank Ltd. - Sponsored ADR(b)(c) | 112,500 | 3,097,125 | ||||||

| JPMorgan Chase & Co.(c) | 15,800 | 3,029,492 | ||||||

| 14,027,134 | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS - 117.45% (continued) | ||||||||

| Health Care - 17.47% | ||||||||

| Amphivena Therapeutics, Inc. Series C(a) (d)(e)(f)(g)(h) | 334,425 | $ | 125,376 | |||||

| Biogen, Inc.(a) | 6,700 | 1,439,294 | ||||||

| Centrexion Therapeutics Corp.(a)(d)(e)(f)(g)(h) | 4,336 | 5,819 | ||||||

| Centrexion Therapeutics Corp. Series D Preferred(a)(d)(e)(f)(g)(h) | 66,719 | 89,537 | ||||||

| DexCom, Inc.(a)(c) | 18,400 | 2,343,976 | ||||||

| Elevance Health, Inc.(c) | 4,345 | 2,296,680 | ||||||

| Eli Lilly & Co. | 4,827 | 3,770,370 | ||||||

| Encompass Health Corp.(c) | 16,000 | 1,334,080 | ||||||

| HCA Healthcare, Inc.(c) | 5,580 | 1,728,796 | ||||||

| Humana, Inc. | 4,410 | 1,332,217 | ||||||

| Intra-Cellular Therapies Inc(a) | 10,100 | 725,281 | ||||||

| Lonza Group AG | 2,752 | 1,528,008 | ||||||

| Merck & Co., Inc.(b)(c) | 16,680 | 2,155,390 | ||||||

| Roivant Sciences Ltd.(a) | 115,900 | 1,263,310 | ||||||

| Select Medical Holdings Corp.(b)(c) | 55,500 | 1,574,535 | ||||||

| UnitedHealth Group, Inc. | 2,900 | 1,402,730 | ||||||

| Universal Health Services, Inc. | 8,540 | 1,455,472 | ||||||

| Viking Therapeutics, Inc.(a) | 5,100 | 405,858 | ||||||

| 24,976,729 | ||||||||

| Industrials - 12.51% | ||||||||

| Airbus SE | 24,617 | 4,063,645 | ||||||

| Boeing Co.(a)(c) | 12,395 | 2,080,377 | ||||||

| Ferguson PLC(c) | 16,530 | 3,469,647 | ||||||

| General Dynamics Corp.(b)(c) | 8,640 | 2,480,458 | ||||||

| Northrop Grumman Corp.(b)(c) | 1,853 | 898,760 | ||||||

| TransDigm Group, Inc.(c) | 3,909 | 4,878,549 | ||||||

| 17,871,436 | ||||||||

| Information Technology - 33.07% | ||||||||

| Amphenol Corp., Class A(c) | 23,400 | 2,826,018 | ||||||

| Apple, Inc.(c) | 25,120 | 4,278,690 | ||||||

| ASML Holding N.V. | 5,264 | 4,592,682 | ||||||

| Broadcom, Inc.(b)(c) | 2,581 | 3,355,997 | ||||||

| Lam Research Corp.(b)(c) | 5,511 | 4,929,093 | ||||||

| Microsoft Corp.(c) | 25,400 | 9,888,982 | ||||||

| NVIDIA Corp.(c) | 5,065 | 4,376,261 | ||||||

| Palo Alto Networks, Inc.(a) | 11,390 | 3,313,237 | ||||||

| Samsung Electronics Co., Ltd. | 45,046 | 2,525,913 | ||||||

| Samsung Electronics Co., Ltd., Preference | 14,668 | 691,957 | ||||||

| SK Hynix, Inc. | 51,339 | 6,470,772 | ||||||

| 47,249,602 | ||||||||

| Materials - 4.26% | ||||||||

| Freeport-McMoRan, Inc., Class B(c) | 69,800 | 3,485,812 | ||||||

| Glencore PLC | 122,583 | 716,391 | ||||||

| Linde PLC(c) | 4,287 | 1,890,396 | ||||||

| 6,092,599 | ||||||||

See Notes to Financial Statements.

17

Clough Global Equity Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Continued) (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 117.45% (continued) | ||||||||

| Real Estate - 0.54% | ||||||||

| Prologis, Inc.(c) | 3,200 | $ | 326,560 | |||||

| Simon Property Group, Inc.(c) | 3,200 | 449,696 | ||||||

| 776,256 | ||||||||

| Utilities - 1.62% | ||||||||

| Duke Energy Corp.(b)(c) | 10,800 | 1,061,208 | ||||||

| Exelon Corp.(c) | 33,600 | 1,262,688 | ||||||

| 2,323,896 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $134,531,916) | 167,805,653 | |||||||

| Principal | ||||||||

| Description/Maturity Date | Amount | Value | ||||||

| CONVERTIBLE CORPORATE BONDS - 0.02% | ||||||||

| Health Care - 0.02% | ||||||||

| Amphivena Convertible Note PP, 12/31/2049(a)(d)(e)(f)(g)(h) | 108,750 | 21,859 | ||||||

| TOTAL CONVERTIBLE CORPORATE BONDS | ||||||||

| (Cost $108,750) | 21,859 | |||||||

| Shares | Value | |||||||

| MONEY MARKET FUNDS - 0.87% | ||||||||

| BlackRock Liquidity Funds, T-Fund Portfolio, Institutional Class, 5.180% (7-day yield) | 1,247,728 | 1,247,728 | ||||||

| TOTAL MONEY MARKET FUNDS | ||||||||

| (Cost $1,247,728) | 1,247,728 | |||||||

| TOTAL INVESTMENTS - 118.34% | ||||||||

| (Cost $135,888,394) | 169,075,240 | |||||||

| Liabilities in Excess of Other Assets - (18.34)%(i) | (26,201,143 | ) | ||||||

| NET ASSETS - 100.00% | ||||||||

| $ | 142,874,097 | |||||||

| SCHEDULE OF SECURITIES SOLD SHORT | Shares | Value | ||||||

| COMMON STOCKS - (21.95)% | ||||||||

| Consumer Discretionary - (9.65)% | ||||||||

| Asbury Automotive Group, Inc.(a) | (3,175 | ) | $ | (667,512 | ) | |||

| BRP, Inc. | (9,970 | ) | (670,774 | ) | ||||

| Brunswick Corp. | (28,600 | ) | (2,306,304 | ) | ||||

| Ford Motor Co. | (26,070 | ) | (316,750 | ) | ||||

| General Motors Co. | (8,560 | ) | (381,177 | ) | ||||

| Harley-Davidson, Inc. | (42,890 | ) | (1,474,987 | ) | ||||

| Lithia Motors, Inc., Class A | (2,280 | ) | (579,986 | ) | ||||

| Lowe’s Cos., Inc. | (3,100 | ) | (706,769 | ) | ||||

| On Holding AG(a) | (24,300 | ) | (771,525 | ) | ||||

| Pool Corp. | (4,920 | ) | (1,783,648 | ) | ||||

| Signet Jewelers Ltd. | (8,100 | ) | (794,043 | ) | ||||

| Tractor Supply Co. | (8,070 | ) | (2,203,756 | ) | ||||

| YETI Holdings, Inc.(a) | (31,500 | ) | (1,125,180 | ) | ||||

| (13,782,411 | ) | |||||||

| Consumer Staples - (0.80)% | ||||||||

| Energizer Holdings, Inc. | (39,900 | ) | (1,145,928 | ) | ||||

| Financials - (2.73)% | ||||||||

| Apollo Global Management, Inc. | (6,600 | ) | (715,308 | ) | ||||

| Blackstone, Inc. | (6,100 | ) | (711,321 | ) | ||||

| Deutsche Bank AG | (74,500 | ) | (1,195,725 | ) | ||||

| KKR & Co., Inc. | (7,700 | ) | (716,639 | ) | ||||

| SoFi Technologies, Inc.(a) | (81,862 | ) | (555,024 | ) | ||||

| (3,894,017 | ) | |||||||

| Health Care - (1.98)% | ||||||||

| Bio-Techne Corp. | (20,900 | ) | (1,321,089 | ) | ||||

| United Therapeutics Corp.(a) | (6,460 | ) | (1,513,772 | ) | ||||

| (2,834,861 | ) | |||||||

| Industrials - (3.41)% | ||||||||

| American Airlines Group, Inc.(a) | (23,900 | ) | (322,889 | ) | ||||

| AMETEK, Inc. | (2,800 | ) | (489,048 | ) | ||||

| Honeywell International, Inc. | (2,100 | ) | (404,733 | ) | ||||

| Jacobs Solutions, Inc. | (3,600 | ) | (516,708 | ) | ||||

| The Middleby Corp.(a) | (5,600 | ) | (778,232 | ) | ||||

| Paychex, Inc. | (12,180 | ) | (1,447,106 | ) | ||||

| Rockwell Automation, Inc. | (1,400 | ) | (379,344 | ) | ||||

| Shoals Technologies Group, Inc., Class A(a) | (63,700 | ) | (538,265 | ) | ||||

| (4,876,325 | ) | |||||||

| Information Technology - (1.77)% | ||||||||

| Clearwater Analytics Holdings(a) | (49,100 | ) | (774,798 | ) | ||||

| International Business Machines Corp. | (10,560 | ) | (1,755,072 | ) | ||||

| (2,529,870 | ) | |||||||

See Notes to Financial Statements.

18

Clough Global Equity Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Continued) (Unaudited)

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | Shares | Value | ||||||

| Materials - (1.61)% | ||||||||

| Avery Dennison Corp. | (7,000 | ) | $ | (1,520,960 | ) | |||

| Corteva, Inc. | (14,400 | ) | (779,472 | ) | ||||

| (2,300,432 | ) | |||||||

| TOTAL COMMON STOCKS | ||||||||

| (Proceeds $32,572,126) | (31,363,844 | ) | ||||||

| TOTAL SECURITIES SOLD SHORT | ||||||||

| (Proceeds $32,572,126) | (31,363,844 | ) | ||||||

Investment Abbreviations:

ADR – American Depository Receipt

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | Loaned security; a portion or all of the security is on loan as of April 30, 2024. |

| (c) | Pledged security; a portion or all of the security is pledged as collateral for securities sold short or borrowings. As of April 30, 2024, the aggregate value of those securities was $99,863,493, representing 69.90% of net assets. |

| (d) | All or a portion of the security is exempt from registration of the Securities Act of 1933. These securities may be resold in transactions exempt from registration under Rule 144A, normally to qualified institutional buyers. As of April 30, 2024, these securities had an aggregate value of $242,591 or 0.17% of net assets. |

| (e) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. |

| (f) | Restricted security. |

| (g) | Fair valued security; valued in accordance with procedures approved by the Board. As of April 30, 2024, these securities had an aggregate value of $242,591 or 0.17% of total net assets. |

| (h) | Private Placement; these securities may only be resold in transactions exempt from registration under the Securities Act of 1933. As of April 30, 2024, these securities had an aggregate value of $242,591 or 0.17% of net assets. |

| (i) | Includes cash which is being held as collateral for securities sold short. |

For Fund compliance purposes, the Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to Financial Statements.

19

Clough Global Opportunities Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 110.06% | ||||||||

| Communication Services - 8.56% | ||||||||

| Alphabet, Inc.(a)(b) | 86,530 | $ | 14,246,299 | |||||

| Liberty Media Corp. - Liberty Formula One, Class C(a) | 27,200 | 1,903,184 | ||||||

| Meta Platforms, Inc. | 4,900 | 2,107,833 | ||||||

| Verizon Communications, Inc.(b) | 93,300 | 3,684,417 | ||||||

| 21,941,733 | ||||||||

| Consumer Discretionary - 18.53% | ||||||||

| Amazon.com, Inc.(a)(b) | 71,650 | 12,538,750 | ||||||

| Booking Holdings, Inc.(b) | 574 | 1,981,465 | ||||||

| BYD Co. Ltd. | 177,500 | 4,892,045 | ||||||

| Carnival Corp.(a)(b)(c) | 435,600 | 6,455,592 | ||||||

| D.R. Horton, Inc.(b) | 17,810 | 2,537,747 | ||||||

| DraftKings, Inc.(a)(b) | 102,440 | 4,257,406 | ||||||

| MakeMyTrip Ltd.(a) | 35,500 | 2,350,455 | ||||||

| PulteGroup, Inc. | 13,890 | 1,547,624 | ||||||

| Royal Caribbean Cruises Ltd.(a)(b)(c) | 31,337 | 4,375,585 | ||||||

| SharkNinja, Inc. | 65,200 | 4,191,056 | ||||||

| Trip.com Group Ltd. - ADR(a) | 49,600 | 2,393,696 | ||||||

| 47,521,421 | ||||||||

| Consumer Staples - 2.70% | ||||||||

| Coca-Cola Co.(b)(c) | 17,900 | 1,105,683 | ||||||

| General Mills, Inc.(b) | 21,700 | 1,528,982 | ||||||

| Procter & Gamble Co.(b) | 26,300 | 4,292,160 | ||||||

| 6,926,825 | ||||||||

| Energy - 5.93% | ||||||||

| Chesapeake Energy Corp.(b) | 29,432 | 2,645,348 | ||||||

| Diamondback Energy, Inc. | 3,912 | 786,821 | ||||||

| Exxon Mobil Corp.(b)(c) | 19,160 | 2,266,053 | ||||||

| Noble Corp PLC(b)(c) | 26,152 | 1,160,626 | ||||||

| Schlumberger N.V.(b) | 16,875 | 801,225 | ||||||

| Southwestern Energy Co.(a)(b) | 406,994 | 3,048,385 | ||||||

| Transocean Ltd.(a)(b)(c) | 862,095 | 4,500,136 | ||||||

| 15,208,594 | ||||||||

| Financials - 9.86% | ||||||||

| Berkshire Hathaway, Inc., Class A(a)(b) | 5 | 2,997,500 | ||||||

| Berkshire Hathaway, Inc., Class B(a) | 1,963 | 778,781 | ||||||

| Charles Schwab Corp. | 46,680 | 3,451,986 | ||||||

| Everest Group Ltd. | 13,390 | 4,906,230 | ||||||

| HDFC Bank Ltd. - ADR(b)(c) | 32,075 | 1,847,520 | ||||||

| ICICI Bank Ltd. - Sponsored ADR(b)(c) | 192,800 | 5,307,784 | ||||||

| JPMorgan Chase & Co.(b) | 27,100 | 5,196,154 | ||||||

| Starwood Property Trust, Inc.(b)(c) | 41,673 | 790,537 | ||||||

| 25,276,492 | ||||||||

| Shares | Value | |||||||

| COMMON STOCKS - 110.06% (continued) | ||||||||

| Health Care - 16.64% | ||||||||

| Amphivena Therapeutics, Inc. Series C(a) (d)(e)(f)(g)(h) | 780,326 | $ | 292,544 | |||||

| Biogen, Inc.(a) | 12,000 | 2,577,840 | ||||||

| Centrexion Therapeutics Corp.(a)(d)(e)(f)(g)(h) | 14,166 | 19,011 | ||||||

| Centrexion Therapeutics Corp. Series D Preferred(a)(d)(e)(f)(g)(h) | 217,952 | 292,492 | ||||||

| DexCom, Inc.(a)(b) | 31,360 | 3,994,950 | ||||||

| Elevance Health, Inc.(b) | 7,644 | 4,040,466 | ||||||

| Eli Lilly & Co. | 7,651 | 5,976,196 | ||||||

| Encompass Health Corp.(b) | 27,400 | 2,284,612 | ||||||

| HCA Healthcare, Inc.(b) | 9,560 | 2,961,879 | ||||||

| Humana, Inc. | 7,750 | 2,341,197 | ||||||

| Intra-Cellular Therapies Inc(a) | 18,100 | 1,299,761 | ||||||

| Lonza Group AG | 4,963 | 2,755,633 | ||||||

| Merck & Co., Inc.(b)(c) | 28,450 | 3,676,309 | ||||||

| Roivant Sciences Ltd.(a) | 198,600 | 2,164,740 | ||||||

| Select Medical Holdings Corp.(b) | 77,200 | 2,190,164 | ||||||

| UnitedHealth Group, Inc. | 5,150 | 2,491,055 | ||||||

| Universal Health Services, Inc. | 15,460 | 2,634,848 | ||||||

| Viking Therapeutics, Inc.(a) | 9,100 | 724,178 | ||||||

| 42,717,875 | ||||||||

| Industrials - 12.14% | ||||||||

| Airbus SE | 44,067 | 7,274,349 | ||||||

| Boeing Co.(a)(b)(c) | 22,305 | 3,743,671 | ||||||

| Ferguson PLC(b) | 30,275 | 6,354,722 | ||||||

| General Dynamics Corp.(b) | 13,940 | 4,002,035 | ||||||

| Northrop Grumman Corp.(b) | 2,909 | 1,410,952 | ||||||

| TransDigm Group, Inc.(b) | 6,681 | 8,338,088 | ||||||

| 31,123,817 | ||||||||

| Information Technology - 29.41% | ||||||||

| Amphenol Corp., Class A | 31,600 | 3,816,332 | ||||||

| Apple, Inc.(b) | 37,300 | 6,353,309 | ||||||

| ASML Holding N.V. | 9,447 | 8,242,224 | ||||||

| Broadcom, Inc.(b)(c) | 4,436 | 5,767,998 | ||||||

| Lam Research Corp.(b)(c) | 10,377 | 9,281,292 | ||||||

| Microsoft Corp.(b)(c) | 40,320 | 15,697,786 | ||||||

| NVIDIA Corp.(b) | 7,293 | 6,301,298 | ||||||

| Palo Alto Networks, Inc.(a) | 20,430 | 5,942,883 | ||||||

| Samsung Electronics Co., Ltd. | 78,075 | 4,377,985 | ||||||

| Samsung Electronics Co., Ltd., Preference | 26,679 | 1,258,571 | ||||||

| SK Hynix, Inc. | 66,464 | 8,377,128 | ||||||

| 75,416,806 | ||||||||

| Materials - 4.20% | ||||||||

| Freeport-McMoRan, Inc., Class B | 124,950 | 6,240,003 | ||||||

| Glencore PLC | 219,538 | 1,283,009 | ||||||

| Linde PLC(b) | 7,380 | 3,254,285 | ||||||

| 10,777,297 | ||||||||

See Notes to Financial Statements.

20

Clough Global Opportunities Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Continued) (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS - 110.06% (continued) | ||||||||

| Real Estate - 0.53% | ||||||||

| Prologis, Inc.(b) | 5,600 | $ | 571,480 | |||||

| Simon Property Group, Inc.(b)(c) | 5,600 | 786,968 | ||||||

| 1,358,448 | ||||||||

| Utilities - 1.56% | ||||||||

| Duke Energy Corp.(b) | 18,700 | 1,837,462 | ||||||

| Exelon Corp.(b)(c) | 57,600 | 2,164,608 | ||||||

| 4,002,070 | ||||||||

| TOTAL COMMON STOCKS | ||||||||

| (Cost $229,382,784) | 282,271,378 | |||||||

| Description/Maturity Date/Rate | Principal Amount | Value | ||||||

| CORPORATE BONDS - 6.70% | ||||||||

| Energy - 1.73% | ||||||||

| Transocean, Inc., 2/1/2027, 8.000%(d)(f) | $ | 4,419,000 | 4,433,463 | |||||

| Financials - 0.76% | ||||||||

| Bank of Americal Corp., Perpetual Maturity, 5.875%(i) | 2,040,000 | 1,959,145 | ||||||

| Health Care - 0.99% | ||||||||

| Tenet Healthcare Corp., 10/1/2028, 6.125%(b)(c) | 2,560,000 | 2,530,261 | ||||||

| Industrials - 3.22% | ||||||||

| AerCap Holdings N.V., 10/10/2079, 5.875% | 2,500,000 | 2,473,065 | ||||||

| American Airlines 2013-1 Class A Pass Through Trust, 7/15/2025, 4.000% | 1,068,469 | 1,040,438 | ||||||

| American Airlines 2019-1 Class A Pass Through Trust, 2/15/2032, 3.500%(b)(c) | 3,445,193 | 2,968,860 | ||||||

| Hexcel Corp., 8/15/2025, 4.950%(b) | 1,000,000 | 991,761 | ||||||

| United Airlines 2020-1 Class B Pass Through Trust, 1/15/2026, 4.875% | 806,400 | 787,852 | ||||||

| 8,261,976 | ||||||||

| TOTAL CORPORATE BONDS | ||||||||

| (Cost $17,154,524) | 17,184,845 | |||||||

| Principal | ||||||||

| Description/Maturity Date | Amount | Value | ||||||

| CONVERTIBLE CORPORATE BONDS - 0.02% | ||||||||

| Health Care - 0.02% | ||||||||

| Amphivena Convertible Note PP, 12/31/2049(a)(d)(e)(f)(g)(h) | 253,750 | $ | 51,004 | |||||

| TOTAL CONVERTIBLE CORPORATE BONDS | ||||||||

| (Cost $253,750) | 51,004 | |||||||

| Shares | Value | |||||||

| MONEY MARKET FUNDS - 1.47% | ||||||||

| BlackRock Liquidity Funds, T-Fund Portfolio, Institutional Class, 5.180% (7-day yield) | 3,759,238 | 3,759,238 | ||||||

| TOTAL MONEY MARKET FUNDS | ||||||||

| (Cost $3,759,238) | 3,759,238 | |||||||

| TOTAL INVESTMENTS - 118.25% | ||||||||

| (Cost $250,550,296) | 303,266,465 | |||||||

| Liabilities in Excess of Other Assets - (18.25)%(j) | (46,809,285 | ) | ||||||

| NET ASSETS - 100.00% | $ | 256,457,180 | ||||||

| SCHEDULE OF SECURITIES SOLD SHORT | Shares | Value | ||||||

| COMMON STOCKS - (21.95)% | ||||||||

| Consumer Discretionary - (9.66)% | ||||||||

| Asbury Automotive Group, Inc.(a) | (5,690 | ) | (1,196,266 | ) | ||||

| BRP, Inc. | (17,860 | ) | (1,201,608 | ) | ||||

| Brunswick Corp. | (51,350 | ) | (4,140,864 | ) | ||||

| Ford Motor Co. | (46,790 | ) | (568,499 | ) | ||||

| General Motors Co. | (15,500 | ) | (690,215 | ) | ||||

| Harley-Davidson, Inc. | (77,010 | ) | (2,648,374 | ) | ||||

| Lithia Motors, Inc., Class A | (4,090 | ) | (1,040,414 | ) | ||||

| Lowe’s Cos., Inc. | (5,600 | ) | (1,276,744 | ) | ||||

| On Holding AG(a) | (43,600 | ) | (1,384,300 | ) | ||||

| Pool Corp. | (8,810 | ) | (3,193,889 | ) | ||||

| Signet Jewelers Ltd. | (14,600 | ) | (1,431,238 | ) | ||||

| Tractor Supply Co. | (14,455 | ) | (3,947,371 | ) | ||||

| YETI Holdings, Inc.(a) | (57,200 | ) | (2,043,184 | ) | ||||

| (24,762,966 | ) | |||||||

| Consumer Staples - (0.81)% | ||||||||

| Energizer Holdings, Inc. | (72,400 | ) | (2,079,328 | ) | ||||

See Notes to Financial Statements.

21

Clough Global Opportunities Fund

SCHEDULE OF INVESTMENTS

April 30, 2024 (Continued) (Unaudited)

| SCHEDULE OF SECURITIES SOLD SHORT (continued) | Shares | Value | ||||||

| Financials - (2.71)% | ||||||||

| Apollo Global Management, Inc. | (11,800 | ) | $ | (1,278,884 | ) | |||

| Blackstone, Inc. | (10,900 | ) | (1,271,049 | ) | ||||

| Deutsche Bank AG | (133,500 | ) | (2,142,675 | ) | ||||

| KKR & Co., Inc. | (13,700 | ) | (1,275,059 | ) | ||||

| SoFi Technologies, Inc.(a) | (146,643 | ) | (994,240 | ) | ||||

| (6,961,907 | ) | |||||||

| Health Care - (1.98)% | ||||||||

| Bio-Techne Corp. | (37,400 | ) | (2,364,054 | ) | ||||

| United Therapeutics Corp.(a) | (11,565 | ) | (2,710,026 | ) | ||||

| (5,074,080 | ) | |||||||

| Industrials - (3.41)% | ||||||||

| American Airlines Group, Inc.(a) | (43,300 | ) | (584,983 | ) | ||||

| AMETEK, Inc. | (5,000 | ) | (873,300 | ) | ||||

| Honeywell International, Inc. | (3,800 | ) | (732,374 | ) | ||||

| Jacobs Solutions, Inc. | (6,400 | ) | (918,592 | ) | ||||

| The Middleby Corp.(a) | (10,100 | ) | (1,403,597 | ) | ||||

| Paychex, Inc. | (21,820 | ) | (2,592,434 | ) | ||||

| Rockwell Automation, Inc. | (2,500 | ) | (677,400 | ) | ||||

| Shoals Technologies Group, Inc., Class A(a) | (115,800 | ) | (978,510 | ) | ||||

| (8,761,190 | ) | |||||||

| Information Technology - (1.77)% | ||||||||

| Clearwater Analytics Holdings(a) | (88,000 | ) | (1,388,640 | ) | ||||

| International Business Machines Corp. | (18,940 | ) | (3,147,828 | ) | ||||

| (4,536,468 | ) | |||||||

| Materials - (1.61)% | ||||||||

| Avery Dennison Corp. | (12,500 | ) | (2,716,000 | ) | ||||

| Corteva, Inc. | (25,900 | ) | (1,401,967 | ) | ||||

| (4,117,967 | ) | |||||||

| TOTAL COMMON STOCKS | ||||||||

| (Proceeds $58,484,838) | (56,293,906 | ) | ||||||

| TOTAL SECURITIES SOLD SHORT | ||||||||

| (Proceeds $58,484,838) | (56,293,906 | ) | ||||||

Investment Abbreviations:

ADR – American Depository Receipt

PLC – Public Limited Company

| (a) | Non-income producing security. |

| (b) | Pledged security; a portion or all of the security is pledged as collateral for securities sold short or borrowings. As of April 30, 2024, the aggregate value of those securities was $168,012,220, representing 65.51% of net assets. |

| (c) | Loaned security; a portion or all of the security is on loan as of April 30, 2024. |

| (d) | All or a portion of the security is exempt from registration of the Securities Act of 1933. These securities may be resold in transactions exempt from registration under Rule 144A, normally to qualified institutional buyers. As of April 30, 2024, these securities had an aggregate value of $5,088,514 or 1.98% of net assets. |

| (e) | As a result of the use of significant unobservable inputs to determine fair value, these investments have been classified as Level 3 assets. |

| (f) | Restricted security. |

| (g) | Fair valued security; valued in accordance with procedures approved by the Board. As of April 30, 2024, these securities had an aggregate value of $655,051 or 0.26% of total net assets. |

| (h) | Private Placement; these securities may only be resold in transactions exempt from registration under the Securities Act of 1933. As of April 30, 2024, these securities had an aggregate value of $655,051 or 0.26% of net assets. |

| (i) | This security has no contractual maturity date, is not redeemable and contractually pays an indefinite stream of interest. |

| (j) | Includes cash which is being held as collateral for securities sold short. |

For Fund compliance purposes, the Fund’s sector classifications refer to any one of the sector sub-classifications used by one or more widely recognized market indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine sector sub-classifications for reporting ease. Sectors are shown as a percent of net assets. These sector classifications are unaudited.

See Notes to Financial Statements.

22

Clough Global Funds

STATEMENTS OF ASSETS AND LIABILITIES

April 30, 2024 (Unaudited)

| Clough Global Dividend and Income Fund | Clough Global Equity Fund | Clough Global

Opportunities Funds |

| |||||||||

| ASSETS: | ||||||||||||

| Investments, at value* | $ | 95,514,794 | $ | 169,075,240 | $ | 303,266,465 | ||||||

| Cash | 29,987 | 18,170 | 35,317 | |||||||||

| Foreign currencies, at value | 6 | – | 5 | |||||||||

| Deposit with broker for securities sold short | 18,231,230 | 30,094,990 | 54,128,351 | |||||||||

| Dividends receivable | 107,148 | 137,255 | 237,500 | |||||||||

| Interest receivable | 94,333 | 12,343 | 198,739 | |||||||||

| Interest receivable on deposits with broker | 70,095 | 116,510 | 208,788 | |||||||||

| Receivable for investments sold | 2,011,102 | 6,695,466 | 11,922,713 | |||||||||

| Prepaid expenses and other assets | 11,190 | 3,138 | 3,138 | |||||||||

| Total Assets | 116,069,885 | 206,153,112 | 370,001,016 | |||||||||

| LIABILITIES: | ||||||||||||

| Loan payable | 16,000,000 | 29,000,000 | 52,000,000 | |||||||||

| Interest on loan payable | 81,516 | 147,747 | 264,925 | |||||||||

| Securities sold short, at value | 18,808,032 | 31,363,844 | 56,293,906 | |||||||||

| Payable for investments purchased | – | 2,565,941 | 4,593,813 | |||||||||

| Dividends payable - short sales | 2,851 | 4,947 | 8,915 | |||||||||

| Accrued investment advisory fee | 66,125 | 149,268 | 297,492 | |||||||||

| Accrued administration fee | 26,922 | 47,268 | 84,785 | |||||||||

| Total Liabilities | 34,985,446 | 63,279,015 | 113,543,836 | |||||||||

| NET ASSETS | $ | 81,084,439 | $ | 142,874,097 | $ | 256,457,180 | ||||||

| COMPOSITION OF NET ASSETS: | ||||||||||||

| Paid in capital | $ | 98,172,260 | $ | 194,322,281 | $ | 366,040,514 | ||||||

| Distributable earnings/(Accumulated loss) | (17,087,821 | ) | (51,448,184 | ) | (109,583,334 | ) | ||||||

| NET ASSETS | $ | 81,084,439 | $ | 142,874,097 | $ | 256,457,180 | ||||||

| Shares outstanding, unlimited shares authorized | 12,472,683 | 18,805,321 | ||||||||||

| Net Asset Value, per share | $ | 6.50 | $ | 7.60 | $ | |||||||

| Investments, at cost | $ | 80,845,793 | $ | 135,888,394 | $ | 250,550,296 | ||||||

| Foreign Currencies, at cost | 6 | – | 5 | |||||||||

| Proceeds of Securities Sold Short | 19,474,032 | 32,572,126 | 58,484,838 | |||||||||

| * Securities Loaned, at value | $ | 13,817,407 | $ | 25,663,464 | $ | 47,502,835 | ||||||

See Notes to Financial Statements.

23

Clough Global Funds

STATEMENTS OF OPERATIONS

For the period ended April 30, 2024 (Unaudited)

| Clough Global Dividend and Income Fund | Clough Global Equity Fund | Clough Global

Opportunities Funds |

| |||||||||

| INVESTMENT INCOME: | ||||||||||||

| Dividends* | $ | 1,028,891 | $ | 1,180,909 | $ | 1,965,002 | ||||||

| Interest | 303,418 | 75,147 | 996,353 | |||||||||

| Interest on deposits with broker | 414,340 | 683,694 | 1,239,302 | |||||||||

| Total Income | 1,746,649 | 1,939,750 | 4,200,657 | |||||||||

| EXPENSES: | ||||||||||||

| Investment advisory fee | 388,834 | 865,719 | 1,736,210 | |||||||||

| Administration fee | 158,311 | 274,145 | 494,820 | |||||||||

| Interest on loan | 494,908 | 897,017 | 1,608,441 | |||||||||

| Trustees' fees | 86,549 | 86,549 | 86,549 | |||||||||

| Dividend expense - short sales | 50,888 | 88,005 | 161,656 | |||||||||

| Total Expenses | 1,179,490 | 2,211,435 | 4,087,676 | |||||||||

| NET INVESTMENT INCOME/(LOSS) | 567,159 | (271,685 | ) | 112,981 | ||||||||

| Net realized gain/(loss) on: | ||||||||||||

| Investment securities | (842,719 | ) | 3,943,059 | 6,319,656 | ||||||||

| Securities sold short | (2,914,316 | ) | (4,571,488 | ) | (8,351,893 | ) | ||||||

| Total return swap contracts | (116,642 | ) | (210,580 | ) | (388,403 | ) | ||||||