UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

|

(Mark One) |

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the year ended December 31, 2005 |

|

|

OR |

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 000-51759

H&E EQUIPMENT SERVICES, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

81-0553291 |

|

(State of incorporation) |

|

(I.R.S. employer identification no.) |

|

11100 Mead Road, Suite 200, |

|

|

|

Baton Rouge, Louisiana 70816 |

|

(225) 298-5200 |

|

(Address of principal executive offices, |

|

(Registrant’s telephone number, including area code) |

|

including zip code) |

|

|

Securities

registered pursuant to Section 12(b) of the Act:

NONE

Securities registered

pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by checkmark if the registrant is not required to file report pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Sections 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer,or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer x

Indicate by checkmark whether the Registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes o No x

The aggregate market value of the Registrant’s voting stock held by non-affiliates of the Registrant: Not applicable as of June 30, 2005. The aggregate market value of the voting stock held by non-affiliates of the Registrant as of March 22, 2006 was approximately $385,565,956. Shares of common stock held by each executive officer and director and by each person who owns 10% or more of our outstanding common stock have been excluded since such persons may be deemed affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 22, 2006, there were 38,192,095 shares of common stock, par value $0.01 per share, of the registrant outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the document listed below have been incorporated by reference into the indicated parts of this Form 10-K, as specified in the responses to the item numbers involved.

|

Part III |

|

The Registrant’s definitive proxy statement for use in connection with the Annual Meeting of Stockholders to be filed within 120 days after the Registrant’s fiscal year ended December 31, 2005. |

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about our beliefs and expectations, are forward-looking statements. Forward-looking statements include statements preceded by, followed by or that include the words “may,” “could,” “would,” “should,” “believe,” “expect,” “anticipate,” “plan,” “estimate,” “target,” “project,” “intend” and similar expressions. These statements include, among others, statements regarding our expected business outlook, anticipated financial and operating results, our business strategy and means to implement the strategy, our objectives, the amount and timing of capital expenditures, the likelihood of our success in expanding our business, financing plans, budgets, working capital needs and sources of liquidity.

Forward-looking statements are only predictions and are not guarantees of performance. These statements are based on our management’s beliefs and assumptions, which in turn are based on currently available information. Important assumptions relating to the forward-looking statements include, among others, assumptions regarding demand for our products, the expansion of product offerings geographically or through new applications, the timing and cost of planned capital expenditures, competitive conditions and general economic conditions. These assumptions could prove inaccurate. Forward-looking statements also involve known and unknown risks and uncertainties, which could cause actual results that differ materially from those contained in any forward-looking statement. Many of these factors are beyond our ability to control or predict. Such factors include, but are not limited to, the following:

· general economic conditions and construction activity in the markets where we operate in North America;

· relationships with new equipment suppliers;

· increased maintenance and repair costs;

· our substantial leverage;

· the risks associated with the expansion of our business;

· our possible inability to integrate any businesses we acquire;

· competitive pressures;

· compliance with laws and regulations, including those relating to environmental matters; and

· other factors discussed under “Risk Factors” or elsewhere in this annual report on Form 10-K.

Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the Securities and Exchange Commission (“SEC”), we are under no obligation to publicly update or revise any forward-looking statements after we file this annual report, whether as a result of any new information, future events or otherwise. Investors, potential investors and other readers are urged to consider the above mentioned factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results or performance.

SPECIAL NOTE REGARDING THE REGISTRANT

In connection with our initial public offering of our common stock in February 2006, we converted H&E Equipment Services L.L.C. (“H&E LLC”), a Louisiana limited liability company and the wholly-owned operating subsidiary of H&E Holding L.L.C. (“H&E Holdings”) into H&E Equipment Services, Inc., a Delaware corporation. Prior to our initial public offering, our business was conducted through H&E LLC. In order to have an operating Delaware corporation as the issuer for our initial public offering, H&E Equipment Services, Inc. was formed as a Delaware corporation and a wholly-owned subsidiary of H&E Holdings, and immediately prior to the closing of the initial public offering on February 3, 2006, H&E LLC and H&E Holdings merged with and into us (H&E Equipment Services, Inc.), with us surviving the reincorporation merger as the operating company. In these transactions, holders of preferred limited liability company interests and holders of common limited liability company interests in H&E Holdings received shares of our common stock. We refer to these transactions collectively in this annual

3

report on Form 10-K as the “Reorganization Transactions.” Unless we state otherwise, the information in this annual report on Form 10-K gives effect to these reorganization transactions. Also, except where specifically noted, references in this annual report on Form 10-K to “the Company”, “we” or “us” mean H&E Equipment Services L.L.C. for periods prior to February 3, 2006, and H&E Equipment Services, Inc. for periods on or after February 3, 2006.

We are one of the largest integrated equipment services companies in the United States focused on heavy construction and industrial equipment. We rent, sell and provide parts and service support for four core categories of specialized equipment: (1) hi-lift or aerial platform equipment; (2) cranes; (3) earthmoving equipment; and (4) industrial lift trucks. We engage in five principal business activities in these equipment categories:

· equipment rental;

· new equipment sales;

· used equipment sales;

· parts sales; and

· repair and maintenance services.

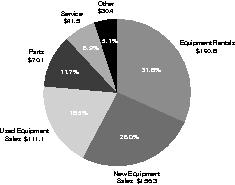

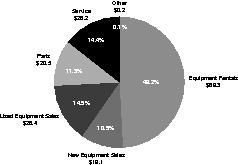

By providing rental, sales, parts, repair and maintenance functions under one roof, we offer our customers a one-stop solution for their equipment needs. This full-service approach provides us with (1) multiple points of customer contact; (2) cross-selling opportunities among our rental, used and new equipment sales, parts sales and services operations; (3) an effective method to manage our rental fleet through efficient maintenance and profitable distribution of used equipment; and (4) a mix of business activities that enables us to operate effectively throughout economic cycles. We believe that the operating experience and extensive infrastructure we have developed throughout our history as an integrated services company provide us with a competitive advantage over rental-focused companies and equipment distributors. In addition, our focus on four core categories of heavy construction and industrial equipment enables us to offer specialized knowledge and support to our customers. For the year ended December 31, 2005, we generated total revenues of approximately $600.2 million. The pie charts below illustrate a breakdown of our revenues and gross profits for the year ended December 31, 2005, respectively, by business segment (see notes to the consolidated financial statements included in Item 8—Consolidated Financial Statements and Supplementary Data):

|

Revenue by Segment |

Gross Profit by Segment |

|

|

|

4

Our rental equipment operation has an extremely well-maintained, optimally aged rental fleet and its own dedicated sales force focused by equipment type. In new equipment sales, we are a leading distributor for nationally-recognized suppliers of equipment and sell through a specialized retail sales force that is distinct from our rental sales force. Our used equipment sales are generated primarily from sales of used equipment from our rental fleet and are an effective and profitable way for us to manage and dispose of equipment in our rental fleet. We also sell used equipment that we acquire through trade-ins from our new equipment customers and through selective purchases of high quality used equipment. Our parts business primarily sells new and used parts for the equipment we sell, maintains an extensive in-house inventory in order to provide timely parts and service support to our customers and is an on-site source of parts for our own rental fleet. Our services operation provides on-site maintenance and repair services for our customers’ equipment and for our own fleet, and has approximately 560 service technicians. These complementary rental, sales and service offerings collectively leverage our specialized knowledge and infrastructure to provide an integrated platform of heavy construction and industrial equipment products and services.

We have operated, through our predecessor companies, as an integrated equipment services company for approximately 45 years and have built an extensive infrastructure that includes 48 full-service facilities located throughout the high growth Intermountain, Southwest, Gulf Coast, West Coast and Southeast regions of the United States. Our management, from the corporate level down to the branch store level, has extensive industry experience. We focus our rental and sales activities on, and organize our personnel principally, by our four equipment categories. We believe this allows us to provide specialized equipment knowledge, improve the effectiveness of our rental and sales forces and strengthen our customer relationships. In addition, we operate our day-to-day business on a branch basis which we believe allows us to more closely service our customers, fosters management accountability at local levels, and strengthens our local and regional relationships.

Equipment Rentals. We rent our heavy construction and industrial equipment to our customers on a daily, weekly and monthly basis. We have a well-maintained rental fleet that, at December 31, 2005, consisted of approximately 14,300 pieces of equipment having an original acquisition cost (which we define as the cost originally paid to manufacturers or the original amount financed under operating leases) of approximately $522 million and an average age of approximately 41 months. Approximately 63% of the fleet consisted of hi-lift or aerial equipment, 15% consisted of cranes, 13% consisted of earthmoving equipment, 6% consisted of industrial lift trucks, and the remainder consisted of miscellaneous other equipment. We actively manage the size, quality, age and composition of our rental fleet, employing a “cradle through grave” approach. During the life of our rental equipment, we:

· aggressively negotiate on purchase price;

· use our customized information technology systems to closely monitor and analyze, among other things, time utilization (equipment usage based on customer demand), rental rate trends and targets and equipment demand;

· maintain fleet quality through regional quality control managers and our on-site parts and services support; and

· dispose of rental equipment through our retail sales force.

During 2005, we increased our overall gross rental fleet, through normal course business activities by approximately $52.6 million as measured by original acquisition cost. Approximately 70% of our fleet was “on-rent,” reflecting the percentage of our rental fleet that was actually rented on average during our 2005 fiscal year. We rent our equipment through a dedicated rental sales force focused by product type that is separate from our retail sales force. We continuously monitor and adjust rental rates, and we currently have a rental rate initiative driven by management to increase rental rates. Our regional focus and active

5

management also allows us to share equipment, where appropriate, among branches within our regions to optimize utilization and rental rates. Our rental business creates cross-selling opportunities for us in sales and services.

New Equipment Sales. We sell new heavy construction and industrial equipment in all four equipment categories, and are a leading distributor for nationally-recognized suppliers including JLG Industries, Gehl, Genie Industries (Terex), Komatsu, Bobcat and Yale Material Handling. In addition, we are the world’s largest distributor of Grove and Manitowoc crane equipment. We believe that this strong distribution network provides us with a higher level of partnering with key suppliers and improves our purchasing power. We sell new equipment through our professional in-house retail sales force focused by product type. By organizing our sales and purchase activities based on specialized equipment knowledge, we believe we are able to improve the effectiveness of our sales force, better serve our customers, and more efficiently manage purchase terms. Our new equipment sales operation is a source of new customers for our parts sales and service support activities, as well as for used equipment sales.

Used Equipment Sales. We sell used equipment primarily from our rental fleet, as well as inventoried equipment that we acquire through trade-ins from our equipment customers and selective purchases of high-quality used equipment. For the year ended December 31, 2005, approximately 78% of our used equipment sales revenues were derived from sales of rental fleet equipment. Selling used equipment is an effective way for us to manage the size and composition of our rental fleet and provides a profitable distribution channel for disposal of rental equipment. We sell used equipment through our retail sales force and we do not rely on auction houses or other wholesale channels for disposition like many of our competitors. We believe this allows us to generally realize higher prices on average for our used rental equipment, which enhances the lifetime profitability of our rental fleet and, consequently, our return on capital. For the year ended December 31, 2005, we sold approximately $87.0 million of used equipment from our rental fleet at an average selling price of approximately 136.6% of book value. Used equipment sales, like new equipment sales, generates parts and service business for us.

Parts Sales. We sell new and used parts to customers and also provide parts to our own rental fleet. We sell a range of maintenance and replacement parts from original equipment manufacturers on equipment we sell, as well as for makes of equipment that we do not sell or rent. We maintain an extensive in-house parts inventory in order to provide timely parts and service support to our customers as well as to our own rental fleet. We generally are able to acquire non-stock or out-of-stock parts directly from manufacturers within one to two business days. Our product support sales representatives are specialists by equipment type. Our parts sales provide us with a relatively stable revenue stream that is less sensitive to economic cycles than our rental and equipment sales operations. In addition, our parts operation enable us to maintain a high quality rental fleet and provide additional support to our end users.

Service Support. We provide maintenance and repair services for our customers’ owned equipment and to our own rental fleet. In addition to repair and maintenance on an as-needed or scheduled basis, we provide ongoing preventative maintenance services and warranty repairs for our customers. We have approximately 560 technicians and over 500 field service and delivery trucks. As part of our commitment to a well-maintained rental fleet and to provide customers with high-quality service and repair options, we devote significant resources to training these technical service employees and over time have built a full-scale services infrastructure that would be difficult for companies without the requisite resources and lead time to replicate. Our after-market service provides a high-margin, relatively stable source of revenue through changing economic cycles.

In addition to our principal business activities mentioned above, we provide ancillary equipment support activities including transportation, hauling, parts shipping and loss damage waivers.

6

Industry Background

The U.S. construction equipment distribution industry is fragmented and consists mainly of a small number of multi-location regional or national operators and a large number of relatively small, independent businesses serving discrete local markets. This industry is driven by a broad range of economic factors including total U.S. non-residential construction trends, construction machinery demand, and demand for rental equipment. Construction equipment is largely distributed to end users through two channels: equipment rental companies and equipment dealers. Examples of rental equipment companies include United Rentals, Hertz Equipment Rental and Rental Service Corporation. Examples of equipment dealers include Finning and Toromont. Unlike many of these companies which principally focus on one channel of distribution, we operate substantially in both channels. As an integrated equipment service company, we rent, sell and provide parts and service support. Although many of the historically pure equipment rental companies have announced plans or have begun to provide parts and service support to customers, their service offerings are typically limited and may prove difficult to expand due to the infrastructure, training and resources necessary to develop the breadth of offerings and depth of specialized equipment knowledge that our service and sales staff provides.

Integrated Platform of Products and Services. We believe that the operating experience and extensive infrastructure we have developed through years of operating as an integrated equipment services company provides us with a competitive advantage over rental-focused companies and equipment distributors. Our integrated platform of products and services provides us with multiple points of customer contact and cross-selling opportunities among our rental, used and new equipment sales, parts sales and services operations. As a result of our integrated approach, our five reporting segments generally derive their revenue from the same customer base. Key strengths of our integrated equipment services platform include:

· Ability to strengthen customer relationships by providing a full-range of products and services;

· Purchasing power gained through purchases for our new equipment sales and rental operations;

· High quality rental fleet supported by our strong product support capabilities;

· Established retail sales network resulting in profitable disposal of our used equipment; and

· Mix of business activities that enable us to effectively operate through economic cycles.

Complementary, High Margin Parts and Service Operations. Our parts and service businesses allow us to maintain our rental fleet in excellent condition and to offer our customers top quality rental equipment. Through our operating history, we have invested a significant amount of capital and management resources in our parts and service operations. Our large staff of trained technicians, wide range of stocked parts, and the significant investment and infrastructure at the branch level required to establish our service operations provide us with an advantage over potential competitors who do not have the requisite resources and lead time to build a full-scale parts and service business. Our after-market parts and service businesses together provide us with a high-margin revenue source that has proven to be stable throughout a range of economic cycles. While large capital expenditures may be reduced by economic downturns, customers generally continue to repair and maintain their existing equipment. Parts sales and service revenues on a combined basis represented approximately 18.6% of our total revenues and 25.7% of our gross profit for the year ended December 31, 2005.

Specialized, High Quality Equipment Fleet. Our focus on four core types of heavy construction and industrial equipment allows us to better provide the specialized knowledge and support that our customers demand when renting and purchasing equipment. These four types of equipment are attractive because they have a long useful life, high residual value and strong industry demand. We offer customers a comprehensive selection of equipment within these categories from leading manufacturers around the

7

world. In addition, our parts and service operations allow us to optimally maintain our rental equipment fleet. We actively manage our rental fleet quality through regional quality control managers and our parts and service support.

Well-Developed Infrastructure. We have built an infrastructure that includes a network of 48 full-service facilities, and a workforce that includes a highly-skilled group of approximately 560 service technicians and an aggregate of approximately 155 sales people in our specialized rental and equipment sales forces. Our integrated platform is the result of many years of strategic development, while many rental-focused equipment companies have only recently begun to devote resources to providing full-service capabilities. In addition, we have strategically expanded our network to solidify our presence in the attractive, contiguous regions where we operate. We believe that our well-developed infrastructure helps us to better serve large multi-regional customers than our historically rental-focused competitors and provides an advantage when competing for lucrative fleet and project management business.

Leading Distributor for Suppliers. We are a leading distributor for nationally-recognized equipment suppliers, including JLG Industries, Gehl, Genie Industries (Terex), Komatsu, Bobcat and Yale Material Handling. In addition, we are the world’s largest distributor of Grove and Manitowoc crane equipment. These relationships improve our ability to negotiate equipment acquisition pricing and allow us to purchase parts at wholesale costs. As an authorized distributor for a wide range of suppliers, we are also able to provide our customers parts and service that in many cases are covered under the manufacturer’s warranty.

Customized Information Technology Systems. Our customized information systems provide management and employees with the data and reports that facilitate our ability to make rapid and informed decisions. These systems allow us to actively manage our business and our rental fleet. Our customer relationship management system, which is currently being implemented, will provide our sales force with real-time access to customer and sales information. We have an in-house team of information technology specialists that support our systems.

Experienced Management Team. Our senior management team is led by John M. Engquist, our President and Chief Executive Officer, who has approximately 31 years of industry experience. Our senior and regional managers have an average of approximately 22 years of industry experience. Our branch managers have extensive knowledge and industry experience as well.

Leverage our Integrated Business Model. We intend to continue to actively leverage our integrated business model to offer a one-stop solution to our customers’ varied needs with respect to the four categories of heavy construction and industrial equipment on which we focus. Our platform of full-service, complementary rental, sales, and on-site parts, repair and maintenance functions provides us with multiple points of customer contact, enables us to offer specialized equipment knowledge and support to our customers, and allows us to foster strong customer relationships. We will continue to cross-sell our services to expand and deepen our customer relationships. We believe that our integrated equipment services model provides us with a strong platform for additional growth.

Managing the Life Cycle of our Rental Equipment. We actively manage the size, quality, age and composition of our rental fleet, employing a “cradle through grave” approach. During the life of our rental equipment, we (1) aggressively negotiate on purchase price; (2) use our customized information technology systems to closely monitor and analyze, among other things, time utilization (equipment usage based on customer demand), rental rate trends and targets and equipment demand; (3) continuously adjust our fleet mix and pricing; (4) maintain fleet quality through regional quality control managers and our on-site parts and services support; and (5) dispose of rental equipment through our retail sales force. This allows us to purchase our rental equipment at competitive prices, optimally utilize our fleet, cost-effectively maintain our equipment quality and maximize the value of our equipment at the end of its useful life.

8

Grow our Parts and Service Operations. Our strong parts and services operations are keystones of our integrated equipment services platform and together provide us with a relatively stable high-margin revenue source. We have built an extensive infrastructure that enables us to provide parts and service support to our end-users as well as our own rental fleet. We intend to grow this product support side of our business and further penetrate our customer base. Our parts and services operation helps us develop strong, on-going customer relationships, attract new customers and maintain a high-quality rental fleet.

Enter Carefully Selected New Markets. We intend to continue to strategically expand our network to solidify our presence in the attractive, contiguous regions where we operate. The regions in which we operate are attractive because they are among the highest growth areas in the United States and are minimally impacted by seasonality. We have a proven track record of successfully entering new markets and currently have 48 full-service facilities located in 18 states. We look to add locations that offer attractive growth opportunities, high demand for construction and heavy equipment, and contiguity to our existing markets.

Make Selective Acquisitions. The equipment industry is fragmented and consists of a large number of relatively small, independent businesses servicing discrete local markets. Some of these businesses may represent attractive acquisition candidates. We intend to evaluate and pursue acquisitions on an opportunistic basis, with an objective of increasing our revenues, improving our profitability, entering additional attractive markets and strengthening our competitive position.

Through our predecessor companies, we have been in the equipment services business for approximately 45 years. H&E Equipment Services L.L.C. was formed in June 2002 through the combination of Head & Engquist Equipment, LLC (“Head & Engquist”), a wholly-owned subsidiary of Gulf Wide Industries, L.L.C. (“Gulf Wide”), and ICM Equipment Company L.L.C (“ICM”). Head & Engquist, founded in 1961, and ICM, founded in 1971, were two leading regional, integrated equipment service companies operating in contiguous geographic markets. In the June 2002 transaction, Head & Engquist and ICM were merged with and into Gulf Wide, which was renamed H&E Equipment Services L.L.C. Prior to the combination, Head & Engquist operated 25 facilities in the Gulf Coast region, and ICM operated 16 facilities in the Intermountain region of the United States.

In connection with our initial public offering in February 2006, we converted H&E LLC into H&E Equipment Services, Inc.. Prior to our initial public offering, our business was conducted through H&E LLC. In order to have an operating Delaware corporation as the issuer for our initial public offering, H&E Equipment Services, Inc. was formed as a Delaware corporation and wholly-owned subsidiary of H&E Holdings, and immediately prior to the closing of our initial public offering, on February 3, 2006, H&E LLC and H&E Holdings merged with and into us (H&E Equipment Services, Inc.), with us surviving the reincorporation merger as the operating company.

We serve more than 23,000 customers in the United States, primarily in the Intermountain, Southwest, Gulf Coast, West Coast and Southeast regions. Our customers include a wide range of industrial and commercial companies, construction contractors, manufacturers, public utilities, municipalities, maintenance contractors and a variety of other large industrial accounts. They vary from small, single machine owners to large contractors and industrial and commercial companies who typically operate under equipment and maintenance budgets. Our branches enable us to closely service local and regional customers, while our well developed full service infrastructure enables us to effectively service multi-regional and national accounts. Our integrated strategy enables us to satisfy customer requirements and increase revenues from customers through cross-selling opportunities presented by the various products and services that we offer. As a result, our five reporting segments generally derive their revenue from the same customer base. In 2005, no single customer accounted for more than 1.0% of our total

9

revenues, and no single customer accounted for more than 10% of our revenue on a segment basis. Our top ten customers combined accounted for less than 6.0% of our total revenues.

We have two distinct, focused sales forces; one specializing in equipment rentals and one focused specifically on new and used equipment sales. We believe maintaining separate sales forces for equipment rental and sales is important to our customer service, allowing us to effectively meet the demands of different types of customers.

Both our rental sales force and equipment sales force, together comprising over 155 sales people, are divided into smaller, product focused teams which enhances the development of in-depth product application and technical expertise. To further develop knowledge and experience, we provide our sales force with extensive training, including frequent factory and in-house training by manufacturer representatives regarding the operational features, operator safety training and maintenance of new equipment. This training is essential, as our sales personnel regularly call on contractors’ job sites often assisting customers in assessing their immediate and ongoing equipment needs. In addition, we have a commission-based compensation program for our sales force.

We recently began to implement a company-wide customer relationship management system. We believe that this comprehensive customer and sales management tool will enhance our territory management program by increasing the productivity and efficiency of our sales representatives and branch managers as they are provided real-time access to sales and customer information.

We have developed strategies to identify target customers for our equipment services in all markets. These strategies allow our sales force to identify frequent rental users, function as advisors and problem solvers for our customers and accelerate the sale process in new operations.

While our specialized, well-trained sales force strengthens our customer relationships and fosters customer loyalty, we also promote our business through marketing and advertising, including industry publications, direct mail campaigns, the Internet and Yellow Pages.

We have implemented a national accounts program in order to develop national relationships and increase awareness of our extensive offering of industrial and construction equipment, ancillary products, parts and services. Under this program, a portion of our sales force is assigned to call on corporate headquarters of our large customers, particularly those with a national or multi-regional presence.

We purchase a significant amount of equipment from the same manufacturers with whom we have distribution agreements. These relationships improve our ability to negotiate equipment acquisition pricing. As an authorized distributor for a wide range of suppliers, we are also able to provide our customers parts and service that in many cases are covered under the manufacturer’s warranty. We are a leading distributor for nationally-recognized equipment suppliers including JLG Industries, Gehl, Genie Industries (Terex), Komatsu, Bobcat, Yale Material Handling, Grove and Manitowoc. While we believe that we have alternative sources of supply for the equipment we purchase in each of our principal product categories, termination of one or more of our relationships with any of our major suppliers of equipment could have a material adverse effect on our business, financial condition or results of operation if we were unable to obtain adequate or timely rental and sales equipment.

10

Information Technology Systems

We have specialized information systems that track (i) rental inventory utilization statistics; (ii) maintenance and repair costs; (iii) returns on investment for specific equipment types; and (iv) detailed operational and financial information for each piece of equipment. These systems enable us to closely monitor our performance and actively manage our business, and include features that were custom designed to support our integrated services platform. The point-of-sale aspect of our systems enables us to link all of our facilities, permitting universal access to real-time data concerning equipment located at the individual facility locations and the rental status and maintenance history for each piece of equipment. In addition, our systems include, among other features, on-line contract generation, automated billing, local sales tax computation and automated rental purchase option calculation. We customized our customer relationship management system to enable us to more effectively manage our business. This customer relationship management system, which is currently being implemented, provides real-time sales and customer information, a quote system, a territory mapping feature and other organizational tools to assist our sales forces. In addition, we maintain an extensive customer database which allows us to monitor the status and maintenance history of our customers’ owned-equipment and enables us to more effectively provide parts and service to meet their needs. All of our critical systems run on servers and other equipment that is less than three years old.

Seasonality

Although our business is not significantly impacted by seasonality, the demand for our rental equipment tends to be lower in the winter months. The level of equipment rental activities are directly related to commercial and industrial construction and maintenance activities. Therefore, equipment rental performance will be correlated to the levels of current construction activities. The severity of weather conditions can have a temporary impact on the level of construction activities.

Equipment sales cycles are also subject to some seasonality with the peak selling period during the spring season and extending through the summer. Parts and service activities are less affected by changes in demand caused by seasonality.

The equipment industry is generally comprised of either pure rental equipment companies or manufacturer dealer/distributorship companies. We are an integrated equipment services company and rent, sell and provide parts and service support. Despite consolidation, the equipment industry is still fragmented and consists mainly of a small number of multi-location regional or national operators and a large number of relatively small, independent businesses serving discrete local markets. Many of the markets in which we operate are served by numerous competitors, ranging from national and multi-regional equipment rental companies (for example, United Rentals, Hertz Equipment Rental, Nations Rent and RSC Equipment Rental) to small, independent businesses with a limited number of locations.

We believe that participants in the equipment rental industry generally compete on the basis of availability, quality, reliability, delivery and price. In general, large operators enjoy substantial competitive advantages over small, independent rental businesses due to a distinct price advantage. Although many rental equipment companies have now announced plans to provide parts and service support to customers, their service offerings are typically limited and may prove difficult to expand due to the training, infrastructure and management resources necessary to develop the breadth of service offerings and depth of knowledge our service technicians are able to provide. Some of our competitors have significantly greater financial, marketing and other resources than we do.

The retail sales and distribution industry continues to be redefined through consolidation and competition. Traditionally, equipment manufacturers distributed their equipment and parts through a

11

network of independent dealers with distribution agreements. As a result of the consolidation and competition, both manufacturers and distributors sought to streamline their operations, improve their costs and gain market share. Our established, integrated infrastructure enables us to compete directly with our competitors on either a local, regional or national basis. We believe customers place greater emphasis on value-added services, teaming with equipment rental and sales companies who can meet all of their equipment, parts and service needs.

Environmental and Safety Regulations

Our facilities and operations are subject to comprehensive and frequently changing federal, state and local environmental and occupational health and safety laws. These laws regulate (i) the handling, storage, use and disposal of hazardous materials and wastes and, if any, the associated cleanup of properties affected by pollutants; (ii) air quality; and (iii) wastewater. We do not currently anticipate any material adverse effect on our business or financial condition or competitive position as a result of our efforts to comply with such requirements. Although we have made and will continue to make capital and other expenditures to comply with environmental requirements, we do not expect to incur material capital expenditures for environmental controls or compliance.

In the future, federal, state or local governments could enact new or more stringent laws or issue new or more stringent regulations concerning environmental and worker health and safety matters, or effect a change in their enforcement of existing laws or regulations, that could affect our operations. Also, in the future, contamination may be found to exist at our facilities or off-site locations where we have sent wastes. There can be no assurance that we will not discover previously unknown environmental non-compliance or contamination. We could be held liable for such newly-discovered non-compliance or contamination. It is possible that changes in environmental and worker health and safety laws or liabilities from newly-discovered non-compliance or contamination could have a material adverse effect on our business, financial condition and results of operations.

As of December 31, 2005, we had approximately 1,448 employees. The total number of employees does not significantly fluctuate throughout the year. Of these employees, 478 are salaried personnel and 970 are hourly personnel. Our employees perform the following functions: sales operations, parts operations, rental operations, technical service and office and administrative support. Collective bargaining agreements relating to three separate locations cover approximately 92 of our employees. We believe our relations with our employees are good, and we have never experienced a work stoppage.

We file electronically with the SEC annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934. The public may read and copy any materials we have filed with or furnished to the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-3330. The SEC maintains an Internet site (www.sec.gov) that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. Copies of our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, ownership reports for insiders and any amendments to these reports filed or furnished with the SEC are available free of charge through our Internet site (www.he-equipment.com) as soon as reasonably practicable after filing with the SEC. Additionally, the Company makes available free of charge on its internet website:

· its Code of Conduct,

12

· the charter of its Nominating and Governing Committee,

· the charter of its Compensation Committee,

· the charter of its Audit Committee.

Investing in our securities involves a high degree of risk. You should consider carefully the following risk factors and the other information in this annual report on Form 10-K, including our consolidated financial statements and related notes, before making any investment decisions regarding our securities. If any of the following risks actually occur, our business, financial condition and operating results could be adversely affected. As a result, the trading price of our securities could decline and you may lose part or all of your investment.

Risks Related to our Company

We have substantial indebtedness and may be unable to service our debt. Our substantial indebtedness could adversely affect our financial position, limit our available cash and our access to additional capital and prevent us from growing our business.

We have a substantial amount of indebtedness. As of December 31, 2005, our total indebtedness (consisting of the aggregate amounts outstanding under our senior secured credit facility, senior secured notes, senior subordinated notes and notes payable) was approximately, $349.9 million, $106.5 million of which was first-priority secured debt and effectively senior to our senior secured notes and senior subordinated notes. As of December 31, 2005, we did not have any outstanding capital lease obligations. Additionally, as of December 31, 2005, the senior secured notes and senior subordinated notes were effectively subordinated to our obligations under $93.7 million of first-priority secured manufacturer floor plan financings to the extent of the value of their collateral, $0.5 million in notes payable and $8.3 million in standby letters of credit.

In February 2006, we used a portion of the proceeds from our initial public offering to repay approximately $96.6 million of our outstanding principal indebtedness under our senior secured credit facility. Accrued interest in the amount of $0.2 million was subsequently paid in March 2006. At March 22, 2006, we had no borrowings under the senior secured credit facility and we had $156.7 million of borrowing availability, net of issued letters of credit.

In addition, subject to restrictions in our senior secured credit facility and the indenture governing the senior secured notes, we may incur additional first-priority borrowings under the senior secured credit facility.

The level of our indebtedness could have important consequences, including:

· a substantial portion of our cash flow from operations will be dedicated to debt service and may not be available for other purposes;

· limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

· limiting our ability to obtain financing in the future for working capital, capital expenditures and general corporate purposes, including acquisitions, and may impede our ability to secure favorable lease terms;

· making us more vulnerable to economic downturns and may limit our ability to withstand competitive pressures; and

· placing us at a competitive disadvantage compared to our competitors with less indebtedness.

13

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control. An inability to service our indebtedness could lead to a default under our senior secured credit facility and our indentures, which may result in an acceleration of our indebtedness.

To service our indebtedness, we will require a significant amount of cash. For the year ended December 31, 2005, we needed approximately $349.9 million to service our indebtedness (not including amounts payable under our operating leases for rental equipment). Our ability to pay interest and principal in the future on our indebtedness (including obligations under the senior secured credit facility, the senior secured notes, the senior subordinated notes and notes payable) and to satisfy our other debt obligations will depend upon our future operating performance and the availability of refinancing indebtedness, which will be affected by prevailing economic conditions and financial, business and other factors, some of which are beyond our control. Based on our current level of operations and anticipated cost savings and operating improvements, we believe our cash flow from operations, available cash and available borrowing under the senior secured credit facility, as amended, will be adequate to meet our future liquidity needs for at least the next twelve months.

Our future cash flow may not be sufficient to meet our obligations and commitments. If we are unable to generate sufficient cash flow from operations in the future to service our indebtedness and to meet our other commitments, we will be required to adopt one or more alternatives, such as refinancing or restructuring our indebtedness, selling material assets or operations or seeking to raise additional debt or equity capital. These actions may not be effected on a timely basis or on satisfactory terms or at all, and these actions may not enable us to continue to satisfy our capital requirements. In addition, our existing or future debt agreements, including the indentures governing the senior secured notes and senior subordinated notes and the senior secured credit facility may contain restrictive covenants prohibiting us from adopting any of these alternatives. Our failure to comply with these covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all of our indebtedness. See Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.

Our senior secured credit facility and the indentures governing our notes impose certain restrictions. A failure to comply with these restrictions could lead to an event of default, resulting in an acceleration of indebtedness, which may affect our ability to finance future operations or capital needs, or to engage in other business activities.

The operating and financial restrictions and covenants in our debt agreements, including the senior secured credit facility, and the indentures governing our senior secured notes and our senior subordinated notes, may adversely affect our ability to finance future operations or capital needs or to engage in other business activities. Our senior secured credit facility requires us to maintain specified financial ratios and tests, including interest coverage and leverage ratios and maximum capital expenditures, which may require that we take action to reduce debt or to act in a manner contrary to our business objectives. In addition, the senior secured credit facility and the senior secured notes and senior subordinated notes restrict our ability to, among other things:

· incur additional indebtedness;

· dispose of assets;

· incur guarantee obligations;

· repay indebtedness or amend debt instruments;

· pay dividends;

· create liens on assets;

· make investments;

· make acquisitions;

14

· engage in mergers or consolidations; or

· engage in certain transactions with subsidiaries and affiliates and otherwise restrict corporate activities.

A failure to comply with the restrictions contained in the senior secured credit facility could lead to an event of default, which could result in an acceleration of our indebtedness. Such an acceleration would constitute an event of default under the indenture governing the senior secured notes. A failure to comply with the restrictions in the senior secured notes indenture or the senior secured subordinated notes indenture could result in an event of default under those indentures. Our future operating results may not be sufficient to enable compliance with the covenants in the senior secured credit facility, the indentures or other indebtedness or to remedy any such default. In addition, in the event of an acceleration, we may not have or be able to obtain sufficient funds to refinance our indebtedness or make any accelerated payments, including those under the senior secured notes and the senior subordinated notes, and the lenders or noteholders could seek to enforce security interests in the collateral securing such indebtedness. Also, we may not be able to obtain new financing. Even if we were able to obtain new financing, we cannot guarantee that the new financing will be on commercially reasonable terms or terms that are acceptable to us. If we default on our indebtedness, our business financial condition and results of operation could be materially and adversely affected.

Concentration of ownership among our existing executives, directors and principal stockholders may prevent new investors from influencing significant corporate decisions.

After giving effect to the completion of the Reorganization Transactions and our initial public offering, Bruckman, Rosser, Sherill & Co. II, L.P. and Bruckman, Rosser, Sherill & Co., L.P. (collectively “BRS”) and their affiliates beneficially own securities representing approximately 41.2% of the voting power of our outstanding common stock and our executives, directors and principal stockholders beneficially own, in the aggregate, securities representing approximately 65.5% of the voting power of our outstanding common stock. Accordingly, these stockholders can exercise significant influence over our business policies and affairs, including the composition of our board of directors and any action requiring the approval of our stockholders, including the adoption of amendments to our certificate of incorporation and the approval of significant corporate transactions, including mergers or sales of substantially all of our assets. This concentration of ownership will limit your ability to influence corporate actions. The concentration of ownership may also delay, defer or even prevent a change in control of our company and may make some transactions more difficult or impossible without the support of these stockholders. We cannot assure you that the interests of these stockholders will not conflict with your interests. In addition, our interests may conflict with these stockholders in a number of areas relating to our past and ongoing relationships, including:

· the timing and manner of any sales or distributions by these stockholders of all or any portion of its ownership interest in us;

· business opportunities that may be presented to BRS and its affiliates and to our directors associated with BRS; and

· competition between BRS and its affiliates and us within the same lines of business.

For additional information regarding the share ownership of, and or relationships with, certain stockholders, you should read the information under Item 12—Security Ownership of Certain Beneficial Owners and Management, and Item 13—Certain Relationships and Related Transactions.

15

Our business could be hurt by a decline in construction and industrial activities, which could decrease the demand for equipment or depress rental rates and sales prices, resulting in a decline in our revenues and profitability.

Our equipment is principally used in connection with construction and industrial activities. Consequently, a downturn in construction or industrial activity may lead to a decrease in the demand for our equipment or depress rental rates and the sales prices for the equipment we sell. We have identified below certain of the factors which may cause such a downturn, either temporarily or long-term:

· a reduction in spending levels by customers;

· a slow-down of the economy over the long-term;

· adverse weather conditions which may affect a particular region;

· an increase in interest rates; or

· terrorism or hostilities involving the United States.

Our revenue and operating results may fluctuate, which could result in a decline in our profitability and make it more difficult for us to grow our business.

Our revenue and operating results have historically varied from quarter to quarter. Periods of decline could result in an overall decline in profitability and make it more difficult for us to make payments on our indebtedness and grow our business. We expect our quarterly results to continue to fluctuate in the future due to a number of factors, including:

· seasonal sales and rental patterns of our construction customers, with sales and rental activity tending to be lower in the winter;

· severe weather and seismic conditions temporarily affecting the regions where we operate;

· cyclical nature of our customers’ business, particularly our construction customers;

· changes in corporate spending for plants and facilities or changes in government spending for infrastructure products;

· general economic conditions in the markets where we operate;

· the effectiveness of integrating acquired businesses and new locations;

· timing of acquisitions and new location openings and related costs.

In addition, we incur various costs when integrating newly acquired businesses or opening locations, and the profitability of a new location is generally expected to be lower in the initial months of operation.

We purchase a significant amount of our equipment from a limited number of manufacturers. Termination of one or more of our relationships with any of those manufacturers could have a material adverse effect on our business, as we may be unable to obtain adequate or timely rental and sales equipment.

Currently, we purchase most of our rental and sales equipment from leading, nationally-known original equipment manufacturers (“OEMs”). For the year ended December 31, 2005, we purchased approximately 83% of our rental and sales equipment from seven manufacturers. Although we believe that we have alternative sources of supply for the rental and sales equipment we purchase in each of our principal product categories, termination of one or more of our relationships with any of these major suppliers could have a material adverse effect on our business, financial condition or results of operation if we were unable to obtain adequate or timely rental and sales equipment.

16

Our new equipment suppliers may appoint additional distributors, sell directly or unilaterally terminate our distribution agreements, which could have a material adverse effect on our business due to a reduction of, or inability to increase, our revenues.

We are a distributor of new equipment and parts supplied by leading, nationally-known OEMs. Under our distribution agreements with these OEMs, manufacturers retain the right to appoint additional dealers and sell directly to national accounts and government agencies. In most instances, they may unilaterally terminate their distribution agreements with us at any time without cause. We have both written and oral distribution agreements with our new equipment suppliers. Under our oral agreements with the OEMs, we operate under our developed course of dealing with the supplier and are subject to the applicable state law regarding such relationship. Any such actions could have a material adverse effect on our business, financial condition and results of operations due to a reduction of, or an inability to increase, revenues.

Our rental fleet is subject to residual value risk upon disposition.

The market value of any given piece of rental equipment could be less than its depreciated value at the time it is sold. The market value of used rental equipment depends on several factors, including:

· the market price for new equipment of a like kind;

· wear and tear on the equipment relative to its age;

· the time of year that it is sold (prices are generally higher during the construction season);

· worldwide and domestic demands for used equipment; and

· general economic conditions.

Although for the year ended December 31, 2005 we sold used equipment from our rental fleet at an average selling price of approximately 136.6% of book value, we cannot assure you that used equipment selling prices will not decline. Any significant decline in the selling prices for used equipment could have a material adverse affect on our business, financial condition or results of operations.

We incur maintenance and repair costs associated with our rental fleet equipment that could have a material adverse effect on our business in the event these costs are greater than anticipated.

Determining the optimal age for our rental fleet equipment is subjective and requires considerable estimates by management. We have made estimates regarding the relationship between the age of our rental fleet equipment, and the maintenance and repair costs, and the market value of used equipment. Our future operating results could be adversely affected because our maintenance and repairs costs may be higher than estimated and market values of used equipment may fluctuate.

We may be unsuccessful in integrating our prior acquisitions and our future acquisitions, which may decrease our profitability and make it more difficult for us to grow our business.

We may not have sufficient management, financial and other resources to integrate and consolidate any future acquisitions, including our recent acquisition of all of the capital stock of Eagle High Reach Equipment, Inc. and all of the equity interests of its subsidiary, Eagle High Reach Equipment, LLC (together, “Eagle”), and we may be unable to operate profitably as a consolidated company. For a discussion of the Eagle acquisition, see Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments. Any significant diversion of management’s attention or any major difficulties encountered in the integration of the businesses could have a material adverse effect on our business, financial condition or results of operation which could decrease our profitability and make it more difficult for us to grow our business.

17

We may not be able to facilitate our growth strategy by identifying or completing transactions with attractive acquisition candidates, which could impede our revenues and profitability.

An important element of our growth strategy is to continue to seek additional businesses to acquire in order to add new customers within our existing markets. We cannot assure you that we will be able to identify attractive acquisition candidates or complete the acquisition of any identified candidates at favorable prices and upon advantageous terms and conditions. Furthermore, competition for attractive acquisition candidates may limit the number of acquisition candidates or increase the overall costs of making acquisitions. The difficulties we may face in identifying or completing acquisitions could impede our revenues and profitability.

We may experience integration and consolidation risks associated with our growth strategy. Future acquisitions may also result in significant transaction expenses and risks associated with entering new markets and we may be unable to profitably operate our consolidated company.

We periodically engage in evaluations of potential acquisitions and start-up facilities. The success of our growth strategy depends, in part, on selecting strategic acquisition candidates at attractive prices and identifying strategic start-up locations. We expect to face competition for acquisition candidates, which may limit the number of acquisition opportunities and lead to higher acquisition costs. We may not have the financial resources necessary to consummate any acquisitions or to successfully open any new facilities in the future or the ability to obtain the necessary funds on satisfactory terms. Any future acquisitions or the opening of new facilities may result in significant transaction expenses and risks associated with entering new markets in addition to the integration and consolidation risks described above. We may not have sufficient management, financial and other resources to integrate any such future acquisitions or to successfully operate new locations and we may be unable to profitably operate our consolidated company.

We may not be able to successfully integrate the recently acquired Eagle business or achieve expected results.

The Eagle acquisition expands our presence into California where we currently do not operate. We may experience difficulties in successfully operating in this new market and in integrating Eagle’s business with our own, which could increase our costs or adversely impact our ability to operate our business.

We are dependent on key personnel. A loss of key personnel could have a material adverse effect on our business, which could result in a decline in our revenues and profitability.

We are dependent on the experience and continued services of our senior management team, including Mr. Engquist, with whom we have an employment agreement which terminates December 31, 2006. Mr. Engquist has approximately 31 years of industry experience and has served as an officer of Head and Engquist since 1990, a director of Gulf Wide since 1995, an officer and director of H&E LLC since its formation in June 2002 and an officer and director of H&E Equipment Services, Inc. since its inception. If we lose the services of any member of our senior management team, particularly Mr. Engquist, and are unable to find a suitable replacement, we may not have the depth of senior management resources required to efficiently manage our business and execute our strategy.

Our business could be hurt if we are unable to obtain additional capital as required, resulting in a decrease in our revenues and profitability.

The cash that we generate from our business, together with cash that we may borrow under our senior secured credit facility, may not be sufficient to fund our capital requirements. As a result, we may require additional financing to obtain capital for, among other purposes, purchasing equipment, completing acquisitions, establishing new locations and refinancing existing indebtedness. Any additional indebtedness that we incur will make us more vulnerable to economic downturns and limit our ability to withstand competitive pressures. Moreover, we may not be able to obtain additional capital on acceptable terms, if at

18

all. If we are unable to obtain sufficient additional financing in the future, our business could be adversely affected by reducing our ability to increase revenues and profitability.

We are subject to competition, which may have a material adverse effect on our business by reducing our ability to increase or maintain revenues or profitability.

The equipment rental and retail distribution industries are highly competitive and the equipment rental industry is highly fragmented. Many of the markets in which we operate are served by numerous competitors, ranging from national and multi-regional equipment rental companies to small, independent businesses with a limited number of locations. We generally compete on the basis of, among other things: (1) quality and breadth of service; (2) expertise; (3) reliability; and (4) price. Some of our competitors have significantly greater financial, marketing and other resources than we do, and may be able to reduce rental rates or sales prices. If competitive pressures were to cause us to reduce our rates, our operating margins may be adversely impacted. If we were to maintain rates in the face of reductions by our competitors, our market share could decline. We may encounter increased competition from existing competitors or new market entrants in the future, which could have a material adverse effect on our business, financial condition and results of operations.

Disruptions in our information technology systems, including our customer relationship management system, could adversely affect our operating results by limiting our capacity to effectively monitor and control our operations.

Our information technology systems facilitate our ability to monitor and control our operations and adjust to changing market conditions. Any disruption in any of these systems, including our customer relationship management system, or the failure of any of these systems to operate as expected could, depending on the magnitude of the problem, could adversely affect our operating results by limiting our capacity to effectively monitor and control our operations and adjust to changing market conditions.

The nature of our business exposes us to various liability claims, which may exceed the level of our insurance and thereby not fully protect us.

Our business exposes us to claims for personal injury, death or property damage resulting from the use of the equipment we rent or sell and from injuries caused in motor vehicle accidents in which our delivery and service personnel are involved. We carry comprehensive insurance, subject to deductibles, at levels we believe are sufficient to cover existing and future claims. However, we may be exposed to multiple claims that do not exceed our deductibles, and, as a result, we could incur significant out-of-pocket costs that could adversely affect our financial condition and results of operations. In addition, the cost of such insurance policies may increase significantly as a result of general rate increases for the type of insurance we carry as well as our historical experience and experience in our industry. Although we have not experienced any material losses that were not covered by insurance, our existing or future claims may exceed the level of our insurance, and such insurance may not continue to be available on economically reasonable terms, or at all. If we are required to pay significantly higher premiums for insurance, are not able to maintain insurance coverage at affordable rates or if we must pay amounts in excess of claims covered by our insurance, we could experience higher costs that could adversely affect our financial condition and results of operations.

We could be adversely affected by environmental and safety requirements, which could force us to increase significant capital and other operational costs and may subject us to unanticipated liabilities.

Our operations, like those of other companies engaged in similar businesses, require the handling, use, storage and disposal of certain regulated materials. As a result, we are subject to the requirements of federal, state and local environmental and occupational health and safety laws and regulations. We may not be at all times in complete compliance with all such requirements. We are subject to potentially

19

significant civil or criminal fines or penalties if we fail to comply with any of these requirements. We have made and will continue to make capital and other expenditures in order to comply with these laws and regulations. However, the requirements of these laws and regulations are complex, change frequently, and could become more stringent in the future. It is possible that these requirements will change or that liabilities will arise in the future in a manner that could have a material adverse effect on our business, financial condition and result of operations.

Environmental laws also impose obligations and liability for the cleanup of properties affected by hazardous substance spills or releases. These liabilities can be imposed on the parties generating or disposing of such substances or operator of affected property, often without regard to whether the owner or operator knew of, or was responsible for, the presence of hazardous substances. Accordingly, we may become liable, either contractually or by operation of law, for remediation costs even if a contaminated property is not presently owned or operated by us, or if the contamination was caused by third parties during or prior to our ownership or operation of the property. Given the nature of our operations (which involve the use of petroleum products, solvents and other hazardous substances for fueling and maintaining our equipment and vehicles), there can be no assurance that prior site assessments or investigations have identified all potential instances of soil or groundwater contamination. Future events, such as changes in existing laws or policies or their enforcement, or the discovery of currently unknown contamination, may give rise to additional remediation liabilities which may be material.

Hurricanes or other adverse weather events could negatively affect our local economies or disrupt our operations, which could have an adverse effect on our business or results of operations.

Our market areas in the southeastern United States are susceptible to hurricanes. Such weather events can disrupt our operations, result in damage to our properties and negatively affect the local economies in which we operate. In late summer 2005, Hurricane Katrina and Hurricane Rita struck the Gulf Coast region of the United States and caused extensive and catastrophic physical damage to those areas. While Hurricane Katrina and Hurricane Rita did not have a material adverse effect on our business or results of operations, future hurricanes could affect our operations or the economies in those market areas and result in damage to certain of our facilities and the equipment located at such facilities, or equipment on rent with customers in those areas. Our business or results of operations may be adversely affected by these and other negative effects of future hurricanes.

We will incur increased costs as a result of having publicly traded common stock.

Although H&E LLC previously filed reports under the Securities and Exchange Act of 1934, as amended (“Exchange Act”), we will incur significant legal, accounting, reporting, insurance and other expenses as a result of having publicly traded common stock that we did not previously incur. We also anticipate that we will incur costs associated with recently adopted corporate governance requirements, including requirements under the Sarbanes-Oxley Act of 2002, as amended, as well as rules implemented by the SEC and The Nasdaq National Market. We expect these rules and regulations to increase our legal and financial compliance costs and to make some activities more time-consuming and costly. We also expect these rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and we may be required to accept reduced policy limits and coverage to incur substantially higher costs to obtain the same or similar coverage. As a result, we may experience more difficulty attracting and retaining qualified individuals to serve on our board of directors or as executive officers. We cannot predict or estimate the amount of additional costs we may incur as a result of these requirements or the timing of such costs.

20

The Company’s disclosure controls and procedures were not effective as of December 31, 2004 to properly record and report the correct accounting treatment of deferred taxes from the Gulf Wide transaction.

Our Chief Executive Officer and Chief Financial Officer evaluated the effectiveness of our disclosure controls and procedures as of December 31, 2005, as required by Section 404 of the Sarbanes-Oxley Act of 2002, as amended. As part of their evaluation, they reviewed the circumstances surrounding the delay in filing their annual report on Form 10-K for the year ended December 31, 2004 and the restatement of our previously issued financial statements for the years ended December 31, 2002 and 2003. We delayed filing our Form 10-K for the year ended December 31, 2004 and our Forms 10-Q for the quarters ended March 31, 2005 and June 30, 2005 pending completion by our accountants, BDO Seidman LLP, of the re-audits of our 2002 and 2003 financial statements that were audited by our prior accountants.

During these re-audits, we discovered that we incorrectly recognized the deferred tax components related to the tax basis of carryover goodwill acquired in our combination with ICM Equipment Company in 2002. After internal review and consultation with our Audit Committee, we determined to restate our 2002 and 2003 financial statements to reflect the proper accounting treatment of deferred income taxes. Our Chief Executive Officer and our Chief Financial Officer concluded that our disclosure controls and procedures were not effective as of December 31, 2004 to properly record and report the correct accounting treatment of deferred taxes from our 2002 transaction. However, after discovery of this issue, we revisited and reassessed, in consultation with our accountants and our tax manager (who joined us in 2003), the tax treatment, including deferred tax components, for the 2002 transaction to ensure that there were no additional corrections necessary in this regard. To the extent we engage in acquisition transactions in the future, our disclosure controls and procedures now include the involvement of our tax manager and other tax professionals, as necessary, in the appropriate tax analysis and related financial disclosure. Our Chief Executive Officer and our Chief Financial Officer have concluded that our current disclosure controls and procedures are effective to provide reasonable assurance that material information required to be included in our periodic SEC reports is recorded, processed, summarized and reported within the time periods specified in the SEC rules and forms.

Our internal controls over financial reporting may not be effective and our independent registered public accounting firm may not be able to certify as to their effectiveness, which could have a significant and adverse effect on our business and reputation.