| HUDBAY MINERALS INC. |

| ANNUAL INFORMATION FORM |

| FOR THE |

| YEAR ENDED DECEMBER 31, 2017 |

| March 29, 2018 |

| TABLE OF CONTENTS |

ANNUAL INFORMATION FORM | 2

| FORWARD-LOOKING INFORMATION |

This annual information form (“AIF”) contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. All information contained in this AIF, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as “plans”, “expects”, “budget”, “guidance”, “scheduled”, “estimates”, “forecasts”, “strategy”, “target”, “intends”, “objective”, “goal”, “understands”, “anticipates” and “believes” (and variations of these or similar words) and statements that certain actions, events or results “may”, “could”, “would”, “should”, “might” “occur” or “be achieved” or “will be taken” (and variations of these or similar expressions). All of the forward-looking information in this AIF is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, production, cost and capital and exploration expenditure guidance, anticipated production at our mines and processing facilities, the anticipated timing, cost and benefits of developing the Rosemont project, Pampacancha deposit and Lalor growth projects, the anticipated impact of any delays to the start of mining the Pampacancha deposit, the anticipated results of litigation challenging the Rosemont permitting process, anticipated exploration plans, anticipated mine plans, anticipated metals prices and the anticipated sensitivity of our financial performance to metals prices, events that may affect our operations and development projects, the permitting, development and financing of the Rosemont project, the potential to optimize the scale of production at Lalor and to efficiently process the excess base metals ore and initial gold zone ore production at the Flin Flon mill, anticipated cash flows from operations and related liquidity requirements, the anticipated effect of external factors on revenue, such as commodity prices, estimation of mineral reserves and resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, and business and acquisition strategies. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by us at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that we identified and were applied by us in drawing conclusions or making forecasts or projections set out in the forward looking information include, but are not limited to:

| • |

the success of mining, processing, exploration and development activities; |

| • |

the scheduled maintenance and availability of our processing facilities; |

| • |

the accuracy of geological, mining and metallurgical estimates; |

| • |

anticipated metals prices and the costs of production; |

| • |

the supply and demand for metals we produce; |

| • |

the supply and availability of all forms of energy and fuels at reasonable prices; |

| • |

no significant unanticipated operational or technical difficulties; |

| • |

the execution of our business and growth strategies, including the success of our strategic investments and initiatives; |

| • |

the availability of additional financing, if needed; |

| • |

the ability to complete project targets on time and on budget and other events that may affect our ability to develop our projects; |

| • |

the timing and receipt of various regulatory, governmental and joint venture partner approvals; |

| • |

the availability of personnel for our exploration, development and operational projects and ongoing employee and union relations; |

| • |

the ability to secure required land rights to develop the Pampacancha deposit; |

| • |

maintaining good relations with the communities in which we operate, including the communities surrounding our Constancia mine and Rosemont project and First Nations communities surrounding our Lalor and Reed mines; |

| • |

no significant unanticipated challenges with stakeholders at our various projects; |

| • |

no significant unanticipated events or changes relating to regulatory, environmental or health and safety matters; |

ANNUAL INFORMATION FORM | 3

| • |

no contests over title to our properties, including as a result of rights or claimed rights of aboriginal peoples; |

| • |

the timing and possible outcome of pending litigation and no significant unanticipated litigation; |

| • |

certain tax matters, including, but not limited to current tax laws and regulations and the refund of certain value added taxes from the Canadian and Peruvian governments; and |

| • |

no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates). |

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of our projects (including risks associated with the permitting, development and economics of the Rosemont project and related legal challenges), risks related to the maturing nature of our 777 mine and the pending closure of our Reed mine and their impact on the related Flin Flon metallurgical complex, dependence on key personnel and employee and union relations, risks related to the schedule for mining the Pampacancha deposit (including the timing and cost of acquiring the required surface rights and the cost and impact of any schedule delays), risks related to the cost, schedule and economics of the capital projects intended to increase processing capacity for Lalor ore, risks related to political or social unrest or change, risks in respect of aboriginal and community relations, rights and title claims, operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, depletion of our reserves, volatile financial markets that may affect our ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, our ability to comply with our pension and other post-retirement obligations, our ability to abide by the covenants in our debt instruments and other material contracts, tax refunds, hedging transactions, as well as the risks discussed under the heading “Risk Factors”.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. We do not assume any obligation to update or revise any forward-looking information after the date of this AIF or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

| NOTE TO UNITED STATES INVESTORS |

This AIF has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to U.S. issuers.

Information concerning our mineral properties has been prepared in accordance with the requirements of Canadian securities laws, which differ in material respects from the requirements of the Securities and Exchange Commission (the “SEC”) set forth in Industry Guide 7. Under the SEC’s Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time of the reserve determination, and the SEC does not recognize the reporting of mineral deposits which do not meet the SEC Industry Guide 7 definition of “Reserve”. In accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Definition Standards for Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014. While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are recognized and required by NI 43-101, the SEC does not recognize them. You are cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence and as to whether they can be economically or legally mined. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource exists, that it can be economically or legally mined, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded into mineral reserves. You should consider closely the disclosure on the mining industry technical terms in Schedule A “Glossary of Mining Terms” of this AIF.

ANNUAL INFORMATION FORM | 4

| CURRENCY AND EXCHANGE RATES |

This AIF contains references to both United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars, and Canadian dollars are referred to as “Canadian dollars” or “C$”. For United States dollars to Canadian dollars, the average exchange rate for 2017 and the closing exchange rate at December 31, 2017, as reported by the Bank of Canada, were one United States dollar per 1.2986 and 1.2545 Canadian dollars, respectively.

On March 28, 2018, the Bank of Canada daily exchange rate was one United States dollar per 1.2902 Canadian dollars.

| OTHER IMPORTANT INFORMATION |

Certain scientific and technical terms and abbreviations used in this AIF are defined in the “Glossary of Mining Terms” attached as Schedule A.

Unless the context suggests otherwise, references to “we”, “us”, “our” and similar terms, as well as references to “Hudbay” and “Company”, refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries.

| CORPORATE STRUCTURE |

INCORPORATION AND REGISTERED OFFICE

We were formed by the amalgamation of Pan American Resources Inc. and Marvas Developments Ltd. on January 16, 1996, pursuant to the Business Corporations Act (Ontario) and changed our name to Pan American Resources Inc. On March 12, 2002, we acquired ONTZINC Corporation, a private Ontario corporation, through a reverse takeover and changed our name to ONTZINC Corporation. On December 21, 2004, we acquired Hudson Bay Mining and Smelting Co., Limited (“HBMS”) and changed our name to HudBay Minerals Inc. In connection with the acquisition of HBMS, on December 21, 2004, we amended our articles to consolidate our common shares on a 30 to 1 basis. On October 25, 2005, we were continued under the Canada Business Corporations Act (“CBCA”). On August 15, 2011, we completed a vertical short-form amalgamation under the CBCA with our subsidiary, HMI Nickel Inc. On January 1, 2017, we completed a vertical short-form amalgamation under the CBCA with two of our subsidiaries, HBMS and Hudson Bay Exploration and Development Company Limited, and changed our name from HudBay Minerals Inc. to Hudbay Minerals Inc.

Our registered office is located at 2200-201 Portage Avenue, Winnipeg, Manitoba R3B 3L3 and our principal executive office is located at 25 York Street, Suite 800, Toronto, Ontario M5J 2V5.

ANNUAL INFORMATION FORM | 5

Our common shares are listed on the Toronto Stock Exchange (“TSX”), New York Stock Exchange (“NYSE”) and Bolsa de Valores de Lima under the symbol “HBM”. Our warrants are listed under the symbol “HBM. WT” on the TSX and “HBM/WS” on the NYSE.

INTERCORPORATE RELATIONSHIPS

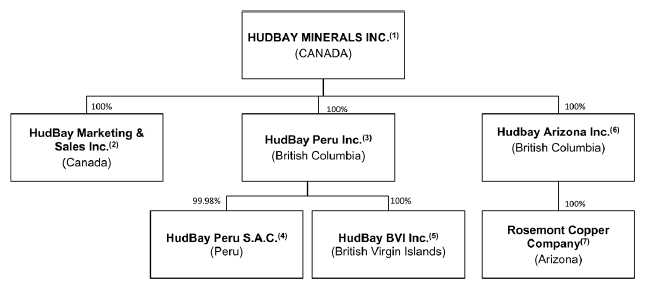

The following chart shows our principal subsidiaries, their jurisdiction of incorporation and the percentage of voting securities we beneficially own or over which we have control or direction.

|

Notes: |

|

| 1. |

Hudbay owns our Canadian mining operations, is the borrower under our Canada Facility, the issuer of our Senior Unsecured Notes and a guarantor of our Peru Facility. |

| 2. |

HudBay Marketing & Sales Inc. markets and sells our copper concentrate and zinc metal produced in Manitoba and is a guarantor of our Credit Facilities and our Senior Unsecured Notes. |

| 3. |

HudBay Peru Inc. owns 99.98% of HudBay Peru S.A.C. (“Hudbay Peru”). The remaining 0.02% is owned by 6502873 Canada Inc., our wholly-owned subsidiary. HudBay Peru Inc. is a guarantor of our Credit Facilities and our Senior Unsecured Notes. |

| 4. |

Hudbay Peru owns the Constancia mine, is the borrower under our Peru Facility and is a guarantor of our Canada Facility and our Senior Unsecured Notes. |

| 5. |

HudBay (BVI) Inc. (“Hudbay BVI”) was incorporated for the sole purpose of entering into and fulfilling our obligations under the precious metals stream agreement in respect of the Constancia mine. |

| 6. |

Hudbay Arizona Inc, through its subsidiaries, indirectly owns 100% of Rosemont Copper Company. |

| 7. |

Rosemont Copper Company currently owns a 92.05% interest in the Rosemont project. |

| DEVELOPMENT OF OUR BUSINESS |

STRATEGY

Our mission is to create sustainable value through acquisition, development and operation of high quality, long life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence.

We believe that the greatest opportunities for shareholder value creation in the mining industry are in the discovery of new mineral deposits and the development of new facilities to profitably extract ore from those deposits. We also believe that our successful development, ramp-up and operation of the Constancia mine in Peru, along with our long history of mining and experience in northern Manitoba provide us with a competitive advantage in these respects relative to other mining companies of similar scale.

ANNUAL INFORMATION FORM | 6

We intend to grow Hudbay through exploration and development of properties we already control, such as our Rosemont project in Arizona, as well as through the acquisition of other properties that fit our strategic criteria. We also continuously work to optimize the value of our producing assets through efficient and safe operations.

In an attempt to ensure that any acquisitions we undertake create sustainable value for stakeholders, we have established a number of criteria for evaluating mineral property acquisition opportunities. These include the following:

| — |

Geography: Potential acquisitions should be located in jurisdictions that support responsible mining activity and have acceptable levels of political risk. Given our current scale and geographic footprint, our current geographic focus is on select investment grade countries in the Americas, with strong rule of law and respect for human rights; | |

| — |

Geology: We believe we have particular expertise in the exploration and development of porphyry and volcanogenic massive sulphide mineral deposits. While these types of deposits typically contain copper, zinc and precious metals in varying quantities, we have a primary focus on copper; | |

| — |

Commodity: Among the metals we produce, we believe copper has the best long-term supply/demand fundamentals and the greatest opportunities for risk-adjusted returns; | |

| — |

Quality: We are focused on adding long-life, low cost assets to our existing portfolio of high quality assets. Long life assets can capture peak pricing of multiple commodity price cycles and low cost assets can generate free cash flow even through the trough of price cycles; | |

| — |

Potential: We consider the full spectrum of acquisition opportunities from early-stage exploration to producing assets, but they must meet our stringent criteria for growth and value creation. We believe that the market for mineral assets is sophisticated and fully values delineated resources and reserves, especially at properties that are already in production, which makes it difficult to acquire properties for substantially less than their fair value. Therefore, we typically look for mineral assets that we believe offer significant potential for exploration, development and optimization; | |

| — |

Process: Before we make an acquisition, we develop a clear understanding of how we can add value to the acquired property primarily through the application of our technical, social, operational and project execution expertise, as well as through the provision of necessary financial capacity and other operational optimization opportunities; | |

| — |

Operatorship: We believe real value is created through leading efficient project development and operations. Additionally, we believe that large, transformational mergers or acquisitions are risky and potentially value destructive in the mining industry; | |

| — |

Financial: Acquisitions should be accretive to Hudbay on a per share basis. Given that our strategic focus includes the acquisition of non-producing assets at various stages of development, when evaluating accretion we will consider measures such as net asset value per share and the contained value of reserves and resources per share. |

THREE YEAR HISTORY

Equity Financing

On September 27, 2017, we completed an equity offering of 24,000,000 common shares of the Company at a price of C$10.10 per share, for gross proceeds of C$242.4 million ($195.3 million). The intended use of proceeds from the offering was to advance Hudbay’s growth projects, enhance our financial flexibility to pursue other growth opportunities, reduce debt and for general corporate purposes.

Credit Facility Extension and Amendments

On July 14, 2017, we amended our $350 million corporate revolving credit facility (the “Canada Facility”) and our $200 million Peru revolving credit facility (the “Peru Facility” and, together with the Canada Facility, the “Credit Facilities”) to secure both facilities with substantially all of the Company's assets, other than assets related to the Rosemont project. This allowed us to amend the financial covenants, extend the maturity dates and reduce the interest rates of the Credit Facilities and enhance our financial flexibility.

The Credit Facilities have substantially similar terms and conditions and mature in July 2021.

ANNUAL INFORMATION FORM | 7

Rosemont

Since the acquisition of the Rosemont project in 2014, Hudbay has completed an extensive work program and, in March 2017, we filed our first National Instrument 43-101 technical report for Rosemont. The technical report projects that Rosemont will have a 19-year mine life and generate an after-tax, unlevered internal rate of return of 15.5%, based upon a long-term copper price of $3.00 per pound. For additional information, see “Rosemont Technical Report”.

On June 7, 2017, the U.S. Forest Service ("USFS") issued the Final Record of Decision ("FROD") related to the Rosemont project. Hudbay is currently in the process of working with the USFS to complete the Mine Plan of Operations ("MPO") for Rosemont, a draft of which was submitted to the USFS in late June 2017. The remaining key federal permit outstanding for Rosemont is the Section 404 Water Permit from the U.S. Army Corps of Engineers.

Our ownership in the Rosemont project is subject to an Earn-In Agreement and a Joint Venture Agreement with United Copper & Moly LLC (“UCM”). Pursuant to the Earn-In Agreement, UCM has earned a 7.95% interest in the project and may earn up to a 20% interest (the “Earn-In Right”). The Earn-In Right is conditional on UCM contributing an additional $106 million to the joint venture (the “Earn-In Investment”), which amount UCM is not obliged to contribute until all material permits in respect of the Rosemont project have been granted.

Amalgamation

On January 1, 2017, the Company amalgamated with two of its wholly-owned subsidiaries, being Hudson Bay Mining and Smelting Co., Limited and Hudson Bay Exploration and Development Company Limited, and changed its name from “HudBay Minerals Inc.” to “Hudbay Minerals Inc.”.

Senior Unsecured Notes Refinancing

On December 12, 2016, we completed an offering of $1.0 billion aggregate principal amount of senior notes in two series: (i) a series of 7.250% senior notes due 2023 in an aggregate principal amount of $400 million (the “2023 Notes”) and (ii) a series of 7.625% senior notes due 2025 in an aggregate principal amount of $600 million (the “2025 Notes and, together with the 2023 Notes, the “Senior Unsecured Notes”).

The proceeds from this offering were used to redeem all $920 million of our previously outstanding 9.50% senior unsecured notes due 2020 (the “Redeemed Notes”) and to pay a call premium, pre-paid interest and other transaction costs associated with the refinancing. The Senior Unsecured Notes have extended maturity dates, significantly reduced interest costs and a more flexible covenant structure as compared to the Redeemed Notes.

The $1.0 billion aggregate principal amount of Senior Unsecured Notes are fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis, by substantially all of our existing and future subsidiaries other than our subsidiaries associated with the Rosemont project. For additional information, see “Description of Capital Structure – Senior Unsecured Notes”.

CEO Transition

Effective January 1, 2016, Alan Hair became our President and Chief Executive Officer, replacing David Garofalo, who announced his resignation in early December 2015. Mr. Hair has twenty years of experience with Hudbay and has worked in the mining industry for more than three decades. He previously served as Hudbay’s Chief Operating Officer from 2012 to 2015, a role that is now held by Cashel Meagher. Mr. Meagher was previously Vice President, South America Business Unit from 2011 to 2015, where he led the successful construction and ramp-up of the Constancia operation.

ANNUAL INFORMATION FORM | 8

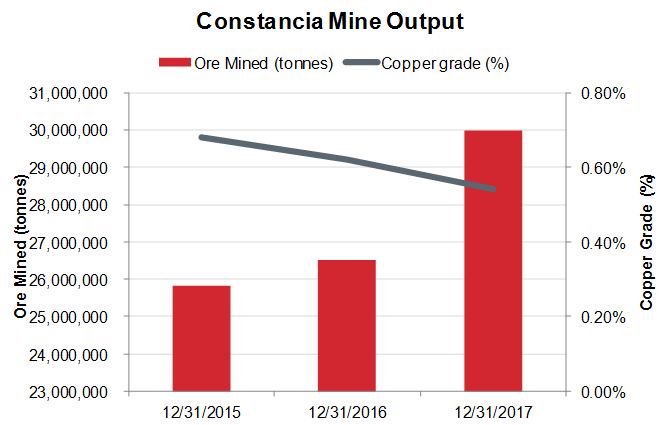

Constancia Mine

We substantially completed construction of the Constancia mine in Peru at the end of 2014 and the mine reached commercial production in the second quarter of 2015. The mine reached full and steady state production in the second half of 2015 and since that time we have been focused on optimization initiatives. We completed a twin hole drill program in the fourth quarter of 2017 that confirmed the extent of the positive grade bias that has existed since the commencement of production and we also constructed a new resource model that formed the basis for a new mine plan and technical report for Constancia. The updated National Instrument 43-101 technical report in respect of Constancia includes an updated mine plan showing an increase to the total metal contained in the estimated mineral reserves. This new mine plan also reflects updated throughput, recoveries and capital and operating cost assumptions for the remainder of the mine life. The new technical report assumes that mining of the high-grade Pampacancha satellite deposit will commence in 2019, which is one year later than contemplated by the previous technical report. For additional information, see “Description of our Business – Material Mineral Projects – Constancia Mine”.

Lalor Mine

Our Lalor mine achieved commercial production in 2014 and base metal production has steadily ramped-up since that time. Production from Lalor is currently being processed at the Stall and Flin Flon mills and, given the excess capacity in Flin Flon, we no longer have plans to expand the processing capacity of the Stall mill. A decline to access the copper-gold zone at Lalor commenced in January 2018 and additional detailed technical work is underway to optimize the mine plan. Test mining of the gold zone began in February 2018, which will enable a better understanding of the gold zone characteristics and better inform the evaluation of options for processing Lalor gold in the future. The gold ore is currently being shipped to Flin Flon for processing.

| DESCRIPTION OF OUR BUSINESS |

GENERAL

We are an integrated mining company producing copper concentrate (containing copper, gold and silver), zinc concentrate and zinc metal. With assets in North and South America, we are focused on the discovery, production and marketing of base and precious metals. Directly and through our subsidiaries, we own four polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and a copper project in Arizona (United States). Our growth strategy is focused on the exploration and development of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. Our vision is to become a top-tier operator of long-life, low cost mines in the Americas. Our mission is to create sustainable value through acquisition, development and operation of high quality, long life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence.

We have four material mineral projects:

| 1. |

our 100% owned Constancia mine, an open pit copper mine in Peru, which achieved commercial production in the second quarter of 2015; |

| 2. |

our 100% owned Lalor mine, an underground zinc, copper and gold mine near Snow Lake, Manitoba, which achieved commercial production in the third quarter of 2014; |

| 3. |

our 100% owned 777 mine, an underground copper, zinc, gold and silver mine in Flin Flon, Manitoba, which has been producing since 2004; and |

ANNUAL INFORMATION FORM | 9

| 4. |

our 92.05% owned Rosemont project, a copper development project in Pima County, Arizona; our ownership in the Rosemont project is subject to an Earn-In Agreement with UCM, pursuant to which UCM has earned a 7.95% interest in the project and may earn up to a 20% interest. |

We also own a 70% interest in the Reed mine near Snow Lake, Manitoba, which commenced commercial production in April 2014 and is scheduled to close in mid 2018, and own or have an interest in exploration properties in close proximity to our material mineral projects as well as elsewhere in North and South America.

In addition, we own and operate a portfolio of processing facilities in northern Manitoba, including our primary Flin Flon ore concentrator, which produces zinc and copper concentrates, our Stall concentrator, which produces zinc and copper concentrates and our Flin Flon zinc plant, which produces high-grade zinc metal. In 2015, we acquired the New Britannia mill, located in Snow Lake, which, if refurbished, has the potential to increase our capacity to process gold ore from Lalor. In Peru, we own and operate a processing facility at Constancia, which produces copper and molybdenum concentrates.

The following map shows where our primary assets and certain exploration properties are located.

MATERIAL MINERAL PROJECTS

Constancia

Constancia is our 100% owned copper mine in Peru. It is located in the Province of Chumbivilcas in southern Peru and consists of the Constancia and Pampacancha deposits.

We completed construction of the Constancia mine in the fourth quarter of 2014 at a capital cost of construction of approximately $1.7 billion and the mine reached commercial production in the second quarter of 2015. The mine reached full and steady state production in the second half of 2015 and we have since been focused on optimizing the operation.

ANNUAL INFORMATION FORM | 10

We completed a twin hole drill program in the fourth quarter of 2017 that confirmed the extent of the positive grade bias that has existed since the commencement of production and we also constructed a new resource model that formed the basis for a new mine plan and technical report for Constancia. The updated National Instrument 43-101 technical report in respect of Constancia includes an updated mine plan showing an increase to the total metal contained in the estimated mineral reserves. This new mine plan also reflects updated throughput, recoveries and capital and operating cost assumptions for the remainder of the mine life. The new technical report assumes that mining of the high-grade Pampacancha satellite deposit will commence in 2019, which is one year later than contemplated by the previous technical report. Although negotiations to secure surface rights over the Pampacancha deposit continue to progress and we’ve been granted permission to carry out some early works, we are no longer assuming ore production from Pampacancha in 2018.

100% of the payable silver and 50% of the payable gold at Constancia is subject to a precious metals stream agreement with Wheaton Precious Metals. We receive cash payments equal to the lesser of (i) the market price and (ii) $400 per ounce (for gold) and $5.90 per ounce (for silver), subject to one percent annual escalation starting in 2019. Gold recovery for purposes of calculating payable gold is fixed at 55% for gold mined from Constancia and 70% for gold mined from Pampacancha.

On March 29, 2018, we filed a technical report titled “NI 43-101 Technical Report, Constancia Mine, Cuzco, Peru”, effective as of December 31, 2017, prepared by Cashel Meagher, P. Geo (our Chief Operating Officer) (the “Constancia Technical Report”), a copy of which is available under our profile on SEDAR at www.sedar.com and will be filed on EDGAR at www.sec.gov. For additional details on our Constancia mine, refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the Constancia mine.

| Constancia Mineral Reserves – January 1, 2018(1)(2) | |||||

| Tonnes | Cu (%) | Mo (g/t) | Au (g/t) | Ag (g/t) | |

| Constancia | |||||

| Proven | 455,900,000 | 0.30 | 96 | 0.035 | 2.93 |

| Probable | 72,800,000 | 0.23 | 72 | 0.035 | 3.09 |

| Total Proven and Probable | 528,700,000 | 0.29 | 93 | 0.035 | 2.95 |

| Pampacancha | |||||

| Proven | 32,400,000 | 0.59 | 178 | 0.368 | 4.48 |

| Probable | 7,500,000 | 0.62 | 173 | 0.325 | 5.75 |

| Total Proven and Probable | 39,900,000 | 0.60 | 177 | 0.360 | 4.72 |

| Total Mineral Reserve | 568,600,000 | 0.32 | 99 | 0.058 | 3.07 |

| 1. |

The mineral reserve estimates for Constancia are based on a long range mine plan with economic value calculation per block (NSR in $/t), mining, processing and detailed engineering parameters. |

| 2. |

The Constancia reserve pits (Constancia and Pampacancha) consist of operational pits of proven and probable reserves and are based on the following long-term metals prices: $3.00 per pound of copper; $11.00 per pound of molybdenum; $18.00 per ounce of silver; and $1,260 per ounce of gold; metallurgical recoveries applied by ore type (between 84.4% to 90.5%); and processing cost of $4.54 per tonne, general and administrative costs of $1.60 per tonne and mining costs of $1.30 and $1.35 per tonne (waste and ore, respectively). |

ANNUAL INFORMATION FORM | 11

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the Constancia mine.

| Constancia Mineral Resources – January 1, 2018 | |||||

| Tonnes | Cu (%) | Mo (g/t) | Au (g/t) | Ag (g/t) | |

| Constancia | |||||

| Measured | 175,000,000 | 0.20 | 51 | 0.028 | 2.19 |

| Indicated | 180,900,000 | 0.20 | 56 | 0.033 | 2.09 |

| Inferred | 54,100,000 | 0.24 | 43 | 0.018 | 1.71 |

| Pampacancha | |||||

| Measured | 11,400,000 | 0.41 | 101 | 0.245 | 4.95 |

| Indicated | 6,000,000 | 0.35 | 84 | 0.285 | 5.16 |

| Inferred | 10,100,000 | 0.14 | 143 | 0.233 | 3.86 |

| Total Measured & Indicated | 373,300,000 | 0.21 | 56 | 0.041 | 2.28 |

| Total Inferred | 64,100,000 | 0.22 | 59 | 0.052 | 2.05 |

| 1. |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Schedule A “Glossary of Mining Terms”. |

| 2. |

Mineral resources are constrained within a computer generated pit using the Lerchs-Grossman algorithm. Estimates of mineral resources are based on the following long-term metals prices: $3.00 per pound of copper; $11.00 per pound of molybdenum; $18.00 per ounce of silver; and $1,260 per ounce of gold. Metallurgical recoveries of 90.5% copper, 55% molybdenum, 72% silver and 60% gold were applied to sulfide material. Metallurgical recoveries of 88.4% copper, 55% molybdenum, 90% silver and 60% gold were applied to mixed and supergene material. A metallurgical recovery of 84% copper, 52% silver and 60% gold for copper was applied to skarn and high zinc material. NSR was calculated for every model block and is an estimate of recovered economic value of copper, molybdenum, silver and gold combined. |

The following chart shows Constancia production (tonnes and grade) for the last three years:

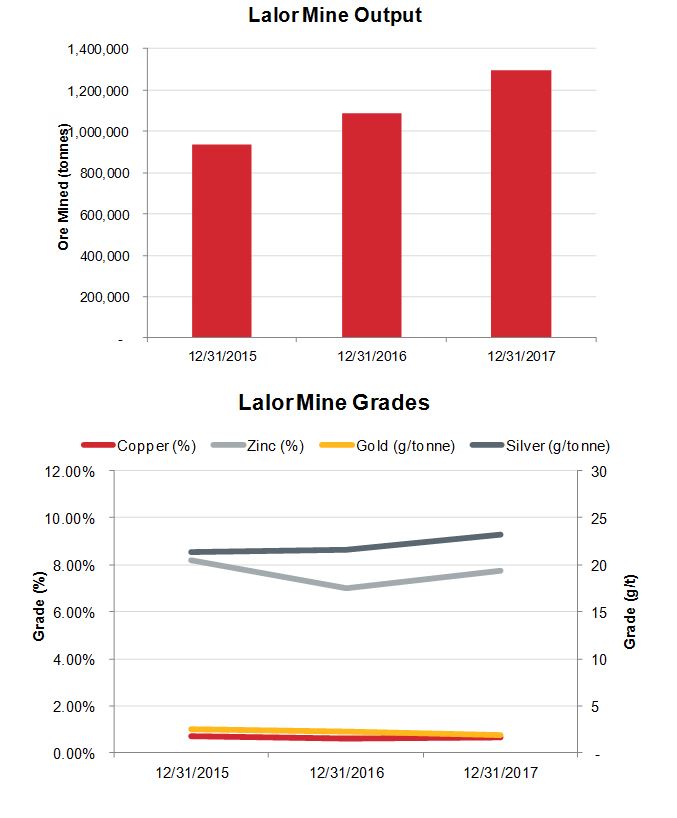

Lalor

Our 100% owned Lalor mine is a zinc, copper and gold mine near the Town of Snow Lake in the province of Manitoba. Lalor is located approximately 208 kilometres by road east of Flin Flon, Manitoba.

The Lalor mine achieved commercial production in 2014 and base metal production has steadily ramped-up since that time. We expect Lalor to reach a production rate of 4,500 tonnes per day by the third quarter of 2018.

ANNUAL INFORMATION FORM | 12

Given existing processing capacity at the Flin Flon mill, we have been trucking excess production from Lalor to the Flin Flon mill since August 2017 and no longer have plans to expand the processing capacity of the Stall concentrator. Ore processed at the Stall and Flin Flon mills is produced into zinc and copper concentrates.

A decline to access the copper-gold zone at Lalor commenced in January 2018 and additional detailed technical work is underway to optimize the mine plan. Test mining of the gold zone began in February 2018, which will enable a better understanding of the gold zone characteristics and better inform the evaluation of options for processing Lalor gold in the future. The gold ore is currently being shipped to Flin Flon for processing.

On March 30, 2017, we filed a NI 43-101 technical report titled “NI 43-101 Technical Report, Lalor Mine, Snow Lake, Manitoba, Canada”, prepared by Robert Carter, P. Eng. (our General Manager Mining Operations, Manitoba Business Unit), dated effective March 30, 2017 (the “Lalor Technical Report”), a copy of which is available under our profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For additional details on our Lalor mine, refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the Lalor mine.

| Lalor Mineral Reserves – January 1, 2018 (1)(2)(3) | |||||

| Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) | |

| Lalor Mine | |||||

| Proven | 3,511,000 | 0.73 | 6.21 | 2.37 | 27.18 |

| Probable | 9,484,000 | 0.65 | 4.31 | 2.72 | 26.03 |

| Total Mineral Reserve | 12,995,000 | 0.67 | 4.83 | 2.62 | 26.33 |

| 1. |

Mineral reserves are estimated at an NSR cut-off of $88 per tonne for longhole open stope mining method and $111 per tonne for cut and fill mining method. |

| 2. |

A zinc price of $1.07 per pound (includes premium), copper price of $3.00 per pound, gold price of $1,260 per ounce and silver price of $18.00 per ounce and an exchange rate of 1.10 C$/US$ was used to estimate mineral reserves. |

| 3. |

For additional details relating to the estimates of mineral reserves at our Lalor mine, including data verification and quality assurance / quality control processes, refer to Schedule B and the Lalor Technical Report. |

The following tables set forth our estimates of the mineral resources (exclusive of mineral reserves) at the Lalor mine.

| Lalor Base Metal Mineral Resources – January 1, 2018 (1)(2) | |||||

| Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) | |

| Lalor – Indicated Base Metal | |||||

| Indicated | 2,100,000 | 0.49 | 5.34 | 1.69 | 28.10 |

| Lalor – Inferred Base Metal | |||||

| Inferred | 545,000 | 0.32 | 8.15 | 1.45 | 22.28 |

| 1. |

A zinc metal price of $1.19 per pound, a copper price of $2.67 per pound, gold price of $1,300 per ounce and a siliver price of $18.00 per ounce were used to calculate a zinc equivalence (Zn Eq) cut-off of 4.1%, where Zn Eq = Zn% + (1.98 x Cu%) + (1.11 x Au g/t) + (0.01 x Ag g/t) – (0.01 x Pb%). An exchange rate of 1.25 C$/US$ was used to estimate mineral resources. The Zn Eq considers the ratio of milling recovery, payability and value of metals after application of downstream processing costs. The Zn Eq cut-off of 4.1% covers administration overhead, mining removal, milling and general and administration costs. |

| 2. |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Schedule A “Glossary of Mining Terms”. |

ANNUAL INFORMATION FORM | 13

| Lalor Gold Mineral Resources – January 1, 2018 (1)(2) | |||||

| Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) | |

| Lalor – Indicated Gold Zone | |||||

| Indicated | 1,750,000 | 0.34 | 0.40 | 5.18 | 30.61 |

| Lalor – Inferred Gold Zone | |||||

| Inferred | 4,121,000 | 0.90 | 0.31 | 5.02 | 27.61 |

| 1. |

A gold metal price of $1.300 per ounce, a copper price of $2.67 per pound and a silver price of $18.00 per ounce were used to calculate a gold equivalence (Au Eq) cut-off of 2.4 g/t Au Eq, where Au Eq = Au g/t + (1.34 x Cu %) + (0.01 x Ag g/t). An exchange rate of 1.25 C$/US$ was used to estimate mineral resources. The Au Eq considers the ratio of milling recovery, payability and value of metals after application of downstream processing costs. Au Eq cut-off of 2.4 g/t covers administration overhead, mining removal, milling and general and administration costs. |

| 2. |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Schedule A “Glossary of Mining Terms”. |

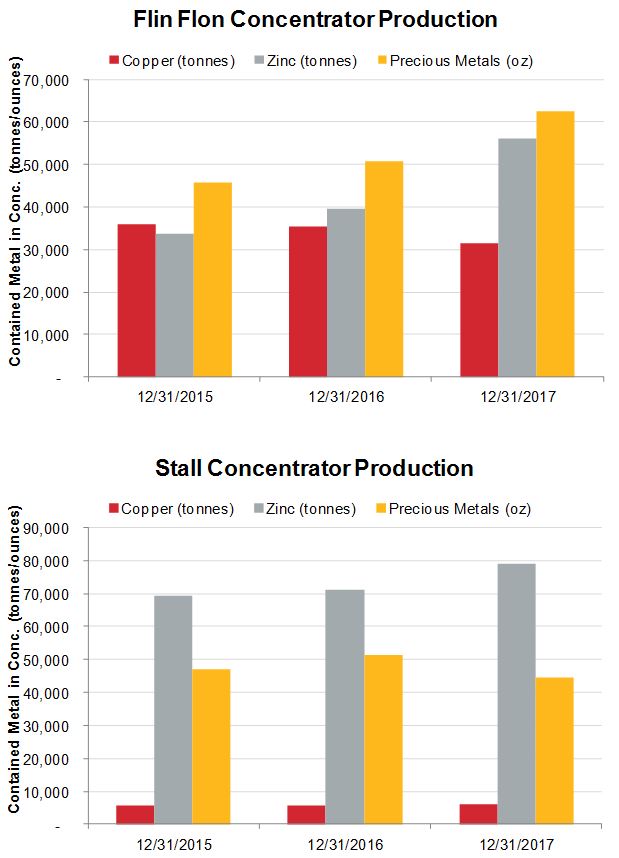

Production

The following charts show Lalor production (tonnes and grade) for the last three years:

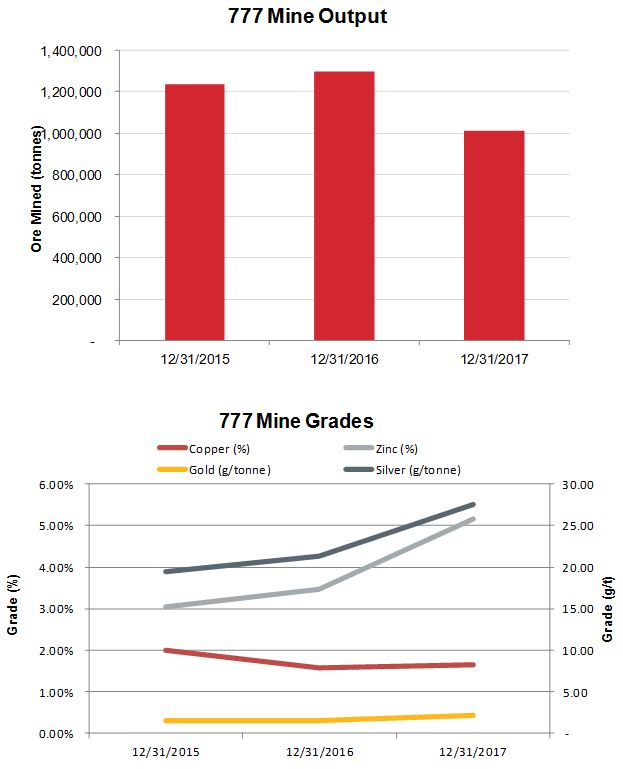

777

Our 100% owned 777 mine is an underground copper, zinc, gold and silver mine located within the Flin Flon Greenstone Belt, immediately adjacent to our principal concentrator and zinc pressure leach plant in Flin Flon, Manitoba. Development of the 777 mine commenced in 1999 and commercial production began in 2004. The mine life is expected to be until 2021.

ANNUAL INFORMATION FORM | 14

Ore produced at the 777 mine is transported to our Flin Flon concentrator for processing into copper and zinc concentrates.

Pursuant to the precious metals stream agreement we entered into with Wheaton Precious Metals in respect of the 777 mine, we are required to deliver 50% of the payable gold and 100% of the payable silver from the 777 mine and receive fixed payments equal to the lesser of (i) the market price and (ii) $400 per ounce (for gold) and $5.90 per ounce (for silver), subject to one percent annual escalation that started in 2015.

On November 6, 2012, we filed a NI 43-101 technical report titled “Technical Report, 777 mine, Flin Flon, Manitoba, Canada”, prepared by Brett Pearson, P. Geo., Darren Lyhkun, P. Eng., Cassandra Spence, P. Eng., Stephen West, P. Eng. and Robert Carter, P. Eng. and dated effective October 15, 2012 (the “777 Technical Report”), a copy of which is available under our profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov. For additional details on our 777 mine refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the 777 mine.

| 777 Mineral Reserves – January 1, 2018(1)(2) | |||||

| 777 Mine | Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) |

| Proven | 2,625,000 | 1.78 | 4.20 | 1.70 | 25.97 |

| Probable | 1,251,000 | 1.11 | 4.33 | 1.82 | 25.41 |

| Total Mineral Reserve | 3,876,000 | 1.56 | 4.24 | 1.73 | 25.79 |

| 1. |

A zinc price of $1.24 per pound (includes premium), copper price of $2.67 per pound, a gold price of $1,300 per ounce and silver price of $18.00 per ounce using an exchange rate of 1.25 C$/US$ were used to estimate mineral reserves and mineral resources. |

| 2. |

For additional details relating to the estimates of mineral reserves and resources at our 777 mine, including data verification and quality assurance / quality control processes, refer to Schedule B and the 777 Technical Report. |

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the 777 mine.

| 777 Mineral Resources – January 1, 2018 (1)(2)(3) | |||||

| 777 Mine | Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) |

| Indicated | 736,000 | 0.99 | 3.53 | 1.82 | 26.24 |

| Inferred | 673,000 | 1.01 | 4.26 | 1.72 | 30.95 |

| 1. |

A zinc price of $1.24 per pound (includes premium), copper price of $2.67 per pound, a gold price of $1,300 per ounce and silver price of $18.00 per ounce using an exchange rate of 1.25 C$/US$ were used to estimate mineral reserves and mineral resources. |

| 2. |

For additional details relating to the estimates of mineral reserves and resources at our 777 mine, including data verification and quality assurance / quality control processes, refer to Schedule B and the 777 Technical Report. |

| 3. |

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Please refer to Schedule A “Glossary of Mining Terms”. |

ANNUAL INFORMATION FORM | 15

Production

The following charts show 777 production (tonnes and grade) for the last three years:

Rosemont

Rosemont is a copper development project, located in Pima County, Arizona, approximately 50 kilometres southeast of Tucson. Our ownership in the Rosemont project is subject to an Earn-In Agreement with UCM, pursuant to which UCM has earned a 7.95% interest in the project and may earn up to a 20% interest.

Since the acquisition of the Rosemont project in 2014, we have completed an extensive work program, including in-fill drilling, detailed metallurgical test work, and a bottom-up approach to cost estimation, along with other feasibility-level work. The Rosemont project will be an open pit, shovel and truck operation and has an expected 19-year mine life. Rosemont is expected to generate an after-tax, unlevered internal rate of return of 15.5%, using a long-term copper price of $3.00 per pound of copper, and has a capital cost estimate of $1,921 million (on a 100% basis).

On June 7, 2017, the U.S. Forest Service ("USFS") issued the Final Record of Decision ("FROD") related to the Rosemont project. Hudbay is currently in the process of working with the USFS to complete the Mine Plan of Operations ("MPO") for Rosemont, a draft of which was submitted to the USFS in late June 2017. The remaining key federal permit outstanding for Rosemont is the Section 404 Water Permit from the U.S. Army Corps of Engineers.

ANNUAL INFORMATION FORM | 16

Opponents of the Rosemont project filed two lawsuits in 2017 against the USFS and the U.S. Fish and Wildlife Service challenging, among other things, the issuance of the FROD in respect of Rosemont. These lawsuits are two of the many legal challenges that have been advanced against the Rosemont permitting process over the past number of years and Hudbay is confident that Rosemont’s permits will continue to be upheld.

Pursuant to our precious metals stream agreement with Wheaton Precious Metals in respect of the Rosemont project, we will receive deposit payments of $230 million against delivery of 100% of the payable silver and gold from the Rosemont project. The deposit will be payable upon the satisfaction of certain conditions precedent, including the receipt of permits for the Rosemont project and the commencement of construction. In addition to the deposit payments, as gold and silver is delivered to Wheaton Precious Metals, we will receive cash payments equal to lesser of (i) the market price and (ii) $450 per ounce (for gold) and $3.90 per ounce (for silver), subject to one percent annual escalation after three years.

On March 30, 2017, we filed a technical report titled “NI 43-101, Feasibility Study, Updated Mineral Resource, Mineral Reserve and Financial Estimates, Rosemont Project, Pima County, Arizona, USA”, effective as of March 30, 2017, prepared by Cashel Meagher, P. Geo (our Chief Operating Officer) (the “Rosemont Technical Report”), a copy of which is available under our profile on SEDAR at www.sedar. com and on EDGAR at www.sec.gov. For additional details on our Rosemont project, refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves at the Rosemont project.

| Rosemont Mineral Reserves – March 30, 2017(1)(2)(3) | ||||

| Tonnes | Cu (%) | Mo (%) | Ag (g/t) | |

| Proven | 426,100,000 | 0.48 | 0.012 | 4.96 |

| Probable | 111,000,000 | 0.31 | 0.010 | 3.09 |

| Total Proven and Probable | 537,100,000 | 0.45 | 0.012 | 4.58 |

| 1. |

Blocks were classified as Proven or Probable in accordance with CIM Definition Standards 2014. |

| 2. |

Mineral resources are constrained within a computer generated pit using the Lerchs-Grossman algorithm. Metal prices of US$3.15/lb copper, US$11.00/lb molybdenum and US$18.00/troy oz silver were used. Metallurgical recoveries of 90% copper, 63% molybdenum and 75.5% silver were applied. No metallurgical recovery of molybdenum and silver from oxide ore is projected. |

| 3. |

Based on 100% ownership of the Rosemont project. |

The following table sets forth our estimates of the mineral resources (exclusive of mineral reserves) at the Rosemont project.

| Rosemont Mineral Resources – March 30, 2017(1)(2)(3) | ||||

| Tonnes | Cu (%) | Mo (%) | Ag (g/t) | |

| Measured | 161,300,000 | 0.38 | 0.009 | 2.72 |

| Indicated | 374,900,000 | 0.25 | 0.011 | 2.60 |

| Total Measured & Indicated | 536,200,000 | 0.29 | 0.011 | 2.64 |

| Total Inferred | 62,300,000 | 0.30 | 0.010 | 1.58 |

| 1. | Mineral resources that are not mineral reserves do not have

demonstrated economic viability. Please refer to Schedule A “Glossary of Mining

Terms”. |

| 2. | Mineral resources are constrained within a computer

generated pit using the Lerchs-Grossman algorithm. Estimates of mineral

resources are based on the following long-term metals prices: $3.15 per pound of

copper; $11.00 per pound of molybdenum; and $18.00 per ounce of silver. Metallurgical recoveries

of 85% copper, 60% molybdenum and 75% silver were applied to sulfide

material. Metallurgical recoveries of 40% copper, 30% molybdenum and 40%

silver were applied to mixed material. A metallurgical recovery of 65% for

copper was applied to oxide material. NSR was calculated for every model

block and is an estimate of recovered economic value of copper,

molybdenum, and silver combined. Cut-off grades were set in terms of NSR

based on current estimates of process recoveries, total process and

general and administrative operating costs of $5.70 per ton for oxide,

mixed and sulfide material. |

| 3. | Based on 100% ownership of the Rosemont project. |

ANNUAL INFORMATION FORM | 17

OTHER ASSETS

Reed

Our 70% owned Reed mine near Flin Flon, Manitoba began commercial production on April 1, 2014 and is scheduled to close in mid 2018. Reed ore is transported by truck for processing at the Flin Flon concentrator.

Our estimates of mineral reserves for Reed are set out below.

| Reed Mineral Reserves – January 1, 2018 (1)(2) | |||||

| Reed Mine | Tonnes | Cu (%) | Zn (%) | Au (g/t) | Ag (g/t) |

| Proven | 67,000 | 2.91 | 1.16 | 0.47 | 7.78 |

| Probable | 209,000 | 3.31 | 0.40 | 0.74 | 6.72 |

| Total Mineral Reserve | 276,000 | 3.21 | 0.58 | 0.67 | 6.98 |

| 1. |

A zinc price of $1.22 per pound (includes premium), copper price of $2.50 per pound, gold price of $1,300 per ounce and silver price of $18.00 per ounce using an exchange rate of 1.28 C$/US$ was used to estimate mineral reserves. A zinc price of $1.24 per pound (includes premium), copper price of $2.67 per pound, gold price of $1,300 per ounce and silver price of $18.00 per ounce using an exchange rate of 1.25 C$/US$ was used to estimate mineral resources. |

| 2. |

For additional details relating to the estimates of mineral reserves and resources at the Reed mine, including data verification and quality assurance/quality control processes refer to the pre-feasibility study filed on SEDAR on May 14, 2012 by VMS Ventures Inc. titled “Pre-Feasibility Study Technical Report on the Reed Copper Deposit, Central Manitoba, Canada” prepared by Trevor Allen, P. Geo., Cassandra Spence, P. Eng., Mark Hatton, P. Eng. and Brent Christensen, P. Eng. and dated effective April 2, 2012. |

Processing Facilities

Manitoba Business Unit

Our primary ore concentrator in Manitoba is located in Flin Flon. The concentrator, which is directly adjacent to our metallurgical zinc plant, produces zinc and copper concentrates primarily from ore mined at our 777 mine. Its capacity is approximately 6,000 tonnes of ore per day. The concentrator can handle ore from more than one mine separately, and blending is done at the grinding stage. As a result, ore mined from our Reed mine, and a portion of the ore mined from our Lalor mine, is transported to the Flin Flon concentrator for processing. The Flin Flon concentrator facility includes a paste backfill plant and associated infrastructure such as maintenance shops and laboratories. Tailings from the concentrator are pumped to the Flin Flon tailings impoundment immediately adjacent to the concentrator.

Our zinc plant in Flin Flon, Manitoba produces special high-grade zinc metal in three cast shapes from zinc concentrate. We produced 107,946 tonnes of cast zinc in 2017 and the capacity of the zinc plant is approximately 115,000 tonnes of cast zinc per year. Included in the zinc plant are an oxygen plant, a concentrate handling and storage facility, a zinc pressure leach plant, a solution purification plant, a modern electro-winning cellhouse, a casting plant, and a zinc storage area with the ability to load trucks or rail cars. The zinc plant has a dedicated leach residue disposal facility. The bulk of the waste material is tailings cake residues containing gypsum, iron, and sulphur. Wastewater is treated and recycled through the zinc plant.

ANNUAL INFORMATION FORM | 18

Our Stall concentrator in Snow Lake, Manitoba was re-started in late 2009 and a new copper recovery circuit was installed in the third quarter of 2012 to facilitate processing of Lalor ore. In 2014, we refurbished equipment and facilities at the Stall concentrator, and the concentrator now processes approximately 3,000 tonnes per day of ore production from the Lalor mine and produces zinc and copper concentrates. The majority of the zinc concentrate is shipped by truck for further processing at our zinc plant in Flin Flon, with the excess zinc concentrate sold to market. Tailings generated by the Stall concentrator are deposited subaqueously in our Anderson Lake tailings facility. A paste plant is currently under construction at the Lalor mine, and once completed the majority of the tailings produced from the Stall mill will be pumped to the paste plant, dewatered, mixed with cement and sent underground as pastefill.

In 2015, Hudbay acquired a 100% interest in the New Britannia mine and mill, located in Snow Lake, Manitoba. The New Britannia mill is currently on care and maintenance. If refurbished, it has the potential to process up to 1,500 tonnes per day of gold zone and copper-gold zone ore from the Lalor mine and may provide a more attractive alternative to transporting Lalor ore to Flin Flon for processing. The New Britannia mill includes an existing Carbon-in-Pulp circuit that has historically produced gold doré on site.

Peru Business Unit

Our processing plant at Constancia has a nominal throughput capacity of 90,000 tonnes per day of ore and averaged throughput of approximately 79,000 tonnes per day in 2017. The principal product of the concentrator is copper concentrate, although it also produces molybdenum concentrate. The primary crusher, belt conveyors, thickeners, tanks, flotation cells, mills and various other types of equipment are designed and constructed to be open to the environment. The concentrate filtration and storage building is enclosed. The tailings are pumped to the tailings management facility for storage and water is returned via parallel piping to the process plant for reuse.

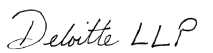

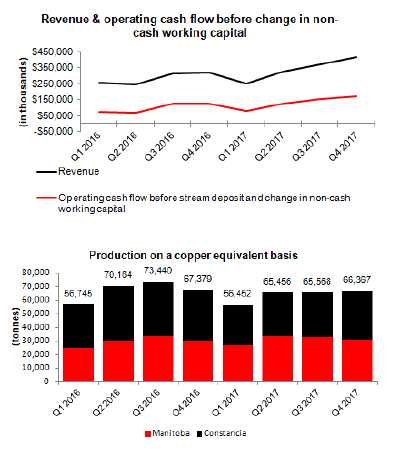

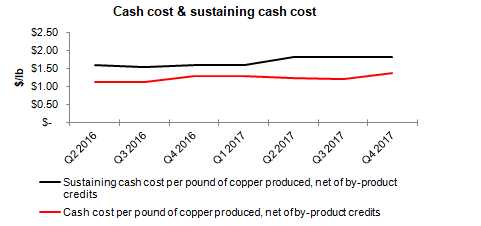

Production

The following charts show concentrator production (tonnes/ounces) for our Constancia, Flin Flon and Stall concentrators for the last three years:

ANNUAL INFORMATION FORM | 19

Exploration

During the downturn in metals prices over the past few years, Hudbay has almost tripled its owned or optioned mineral properties from approximately 380,000 hectares by the end of 2015 to approximately 1,100,000 hectares by end of 2017 across Canada, Peru, the United States and Chile. Hudbay’s 2018 exploration budget of $50 million, more than twice that of 2017, will be focused on exploration near existing processing infrastructure in Manitoba and Peru, as well as on grassroots exploration properties in Peru, Chile and British Columbia.

In Peru, we recently acquired a large, contiguous block of mineral rights to explore for mineable deposits within trucking distance of the Constancia processing facility and we have commenced permitting, community relations and technical activities required to access and conduct drilling activities on these properties.

Strategic Investments

As at December 31, 2017, we held minority equity positions in 15 junior exploration companies, representing investments with a fair market value of approximately C$30 million, as part of our strategy to populate a pipeline of projects with the potential for exploration and development. Our early stage opportunity pipeline consists of minority interests in junior exploration companies with projects in Canada, the United States, Chile and Peru. We are continuing to evaluate new projects and potential investments to add to our portfolio and will seek to dispose of investments when the underlying projects are no longer consistent with our strategy.

ANNUAL INFORMATION FORM | 20

Cash and Cash Equivalents

Our cash and cash equivalents as of December 31, 2017 were $356.5 million, and are held in low risk liquid investments and deposit accounts pursuant to our investment policy.

OTHER INFORMATION

Products and Marketing

Our principal products are copper concentrate, which contains payable copper, gold and silver, zinc concentrate, refined zinc metal and molybdenum concentrate. In 2017, we produced 641,498 tonnes of copper concentrate (479,858 tonnes from Constancia and 161,638 tonnes from our operations in Manitoba), 262,218 tonnes of zinc concentrate, the majority of which was processed in our Flin Flon zinc plant facility to produce 107,948 tonnes of cast zinc, and 914 tonnes of molybdenum concentrate.

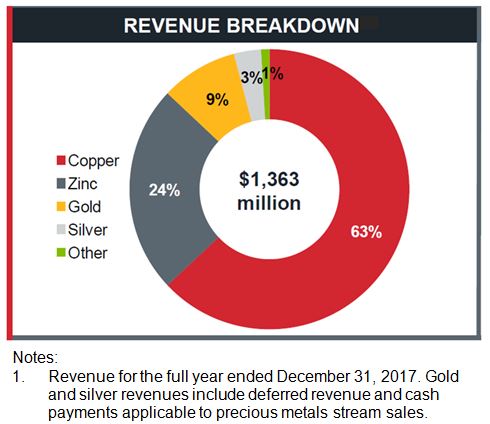

In 2017, copper concentrate sales represented approximately 75% (2016 - 81%), zinc metal sales represented approximately 21% (2016 – 19%), zinc concentrate sales represented approximately 3% (2016 - nil), and molybdenum sales represented approximately 1% (2016 – nil), of our total gross consolidated revenue (which includes the unrealized gains and losses on derivatives associated with sales of copper and zinc).

Our 2017 revenue breakdown by commodity type is illustrated in the chart below:

In 2017, approximately 78% (69% in 2016) of our copper concentrate sales were to third party purchasers at benchmark terms and for 2018 this is expected to decline to approximately 73%. The balance of our copper concentrate production is sold pursuant to shorter-term contracts as opportunities arise. Manitoba copper concentrate production is primarily sold for delivery to smelters in Canada and Europe, while Peru copper concentrate production is primarily sold for delivery to smelters in Asia, with the balance delivered within South America, and to Europe and India.

In 2017, zinc concentrate that was not processed internally in our Flin Flon zinc plant was delivered to smelters in Canada, Europe and Asia. All 30,047 tonnes of zinc concentrate delivered in 2017 was sold at spot terms.

ANNUAL INFORMATION FORM | 21

All molybdenum concentrate production in 2017 was sold to third party purchasers on spot terms and was delivered to roasters in South America, Asia and North America.

We sell gold and silver (contained in concentrate) from our 777 and Constancia mines to Wheaton Precious Metals pursuant to the terms of the precious metals stream agreements in respect of our 777 and Constancia mines.

We ship cast zinc metal produced at our Flin Flon zinc plant by rail and truck to third party customers in North America.

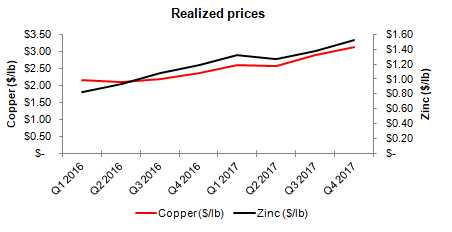

Commodity Markets

In addition to our production, financial performance is directly affected by a number of factors, including metals prices, foreign exchange rates, and input costs, including energy prices. Average prices for copper and zinc were significantly higher in 2017 compared to 2016, whereas precious metals prices were little changed.

For additional information refer to our market analysis of copper, zinc, gold and silver prices during this period on pages 20 and 21 of our management’s discussion and analysis for the year ended December 31, 2017, a copy of which has been filed on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Specialized Skill and Knowledge

The success of our operations depends in part on our ability to attract and retain geologists, engineers, metallurgists and other personnel with specialized skill and knowledge about the mining and mineral processing industries in the geographic areas in which we operate. For additional information, see “Risk Factors – Human Resources”.

Competitive Conditions

The mining industry is intensely competitive and we compete with many companies in the search for and acquisition of attractive mineral properties. In addition, we also compete for the technical expertise to find, develop, and operate such properties, the labour to operate the properties, and the capital for the purpose of funding such properties. For additional information, see “Risk Factors – Competition”.

Economic Dependence

We do not have any contracts upon which our business is substantially dependent, as our principal products, copper concentrate, zinc concentrate and refined zinc metal are widely traded commodities and we may enter into contracts for the sale of such products with a variety of potential purchasers.

Environmental Protection

Our activities are subject to environmental laws and regulations. Environmental laws and regulations are evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. For additional information, see “Risk Factors – Governmental and Environmental Regulation”.

Our goal is to continue to improve our environmental performance. We have established an environmental management program directed at environmental protection and compliance to achieve our goal and address these regulatory changes. For additional information, see “Corporate Social Responsibility”.

ANNUAL INFORMATION FORM | 22

Employees

As at December 31, 2017, we had 61 employees at our Toronto head office, 1,371 employees in Manitoba, 748 employees in Peru and 39 employees in Arizona.

We have entered into separate three-year collective bargaining agreements that expire at the end of 2020 with the unionized workforces at our Manitoba and Peru operations. Unionized workers represented approximately 76% of our employees in Manitoba and 36% of our employees in Peru as at December 31, 2017.

Hudbay maintains a profit sharing plan pursuant to which 10% of the after-tax profit of the Manitoba Business Unit (excluding provisions or recoveries for deferred income and mining tax) for any given year is distributed among eligible employees in the Flin Flon/Snow Lake operations, with the exception of executive officers and key management personnel.

As mandated by Peruvian law, Hudbay distributes 8% of the after-tax profit of the Peru Business Unit amongst all employees in Peru, including executive officers and key management personnel.

| CORPORATE SOCIAL RESPONSIBILITY |

At Hudbay, we view our responsible corporate behaviour as integral to the successful execution of our business strategy, particularly in maintaining a good reputation with our regulators and communities and being able to bring that good reputation to new communities and jurisdictions when we embark on new projects. We therefore commit to our stakeholders to work to create benefits and opportunities that contribute to their economic and social sustainability, and to protect our natural environment. We also commit to our employees to maintain a safe and healthy work environment. As described below, we have adopted a number of voluntary codes and other external instruments that we consider particularly relevant to our business, including Environmental Management System Standard ISO 14001, Occupational Health and Safety Assessment Series (“OHSAS”) 18001, the Voluntary Principles on Security and Human Rights, and our commitment to follow the Towards Sustainable Mining (“TSM”) program of the Mining Association of Canada at all of our operating locations.

HEALTH, SAFETY AND ENVIRONMENTAL POLICIES

Among our core values are protecting the health and welfare of our employees and contractors and reducing the impact of our operations on the environment. All of our producing operations have management systems certified to OHSAS 18001 and Environmental Management System Standard ISO 14001. In addition, the production and supply of our cast zinc products are registered to the ISO 9001 quality standard.

We believe that ongoing improvement in the safety of our workplace assists in maintaining healthy labour relations and that our ability to minimize recordable injuries (Medical Aid, Restricted Work and Lost Time injuries) and environmental regulatory violations is a significant factor in maintaining and realizing opportunities to improve overall operational efficiency. Our safety management systems also focus on identifying and mitigating fatal risks, including both critical controls addressing fatal risks and also on thoroughly investigating any incidents that represent a potential fatality regardless of the actual outcome of the incident. In 2017, our recordable injury frequency per 200,000 hours worked was 11.5, a slight improvement over our 2016 performance of 13. While we are focusing on total recordable injuries, Hudbay’s Constancia operation achieved a noteworthy performance of zero lost time injuries in 2017.

Our environmental management program consists of a corporate environmental policy, and at each site codes of practice, regular audits, the integration of environmental procedures with operating procedures, employee training and emergency prevention and response procedures. Appropriate water stewardship plays an important role in the development and operation of our projects, particularly the Rosemont project. We did not have any material environmental non-compliances in 2017.

ANNUAL INFORMATION FORM | 23

We maintain a company wide information system for recording, managing and tracking environmental, health, safety and community incidents.

HUMAN RIGHTS POLICY

Our Human Rights Policy articulates our commitments to human rights and addresses topics such as business and labour practices, community participation and security measures. Our Corporate Standards for Community Giving and Investment and Local Procurement and Employment provide our business units with additional corporate direction on minimum standards with respect to meeting the commitments we set out in our Human Rights Policy.

The Voluntary Principles on Security and Human Rights provide important guidance for our security and community relations practices in locations with higher potential for social conflict and, in Peru, we regularly audit security policies and practices and conduct gap analyses against the Voluntary Principles.

SUSTAINABILITY REPORTING

We publish an annual corporate social responsibility report that presents and discusses our environmental, social, health and safety performance. This report is prepared pursuant to the Global Reporting Initiative guidelines, which is the world’s most widely used sustainability framework. Our 2016 Annual / Corporate Social Responsibility Combined Report has been prepared largely in accordance with the “Core” option of the G4 guidelines and is available on our website at http://www.hudbayminerals.com/English/Responsibility/Reports. Our 2017 report is expected to be released in the second quarter of 2018.

| RISK FACTORS |

An investment in our securities is speculative and involves significant risks that should be carefully considered by investors and prospective investors. In addition to the risk factors described elsewhere in this AIF, the risk factors that impact us and our business include, but are not limited to, those set out below. Any one or more of these risks could have a material adverse effect on our business, results of operations, financial condition and the value of our securities.

METALS PRICES AND FOREIGN EXCHANGE

Our profit or loss and financial condition depend upon the market prices of the metals we produce, which are cyclical and which can fluctuate widely with demand. The profitability of our current operations is directly related and sensitive to changes in the market price of copper and zinc and, to a lesser extent, that of gold and silver. Market prices of metals can be affected by numerous factors beyond our control, including the overall state of the economy, general levels of supply and demand for a broad range of industrial products, substitution of new or different products in critical applications for existing products, level of industrial production, expectations with respect to the rate of inflation, foreign exchange rates and investment demand for commodities, interest rates and speculative activities. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments. The Chinese market has become a significant source of global demand for commodities, including copper and zinc. Chinese demand has been a major driver in global commodities markets for a number of years. A slowing in China’s economic growth could result in lower prices and demand for our products and negatively impact our results. We could also experience these negative effects if demand in China slowed for other reasons, such as increased self-sufficiency or increased reliance on other suppliers to meet demand. Prices are also affected by the overall supply of the metals we produce, which can be affected by the start-up of major new mines, production disruptions and closures of existing mines. Future price declines may, depending on hedging practices, materially reduce our profitability and could cause us to reduce output at our operations (including, possibly, closing one or more of our mines or plants). If such price declines were significant, there could be a material and adverse effect on our cash flow from operations and our ability to satisfy our debt service obligations (see “Access to Capital and Indebtedness” below).

ANNUAL INFORMATION FORM | 24

In addition to adversely affecting the reserve estimates and the financial condition of the Company, declining metals prices can impact operations by requiring an assessment or reassessment of the feasibility of a particular project. If metals prices should decline below our cash costs of production and remain at such levels for any sustained period, we could determine that it is not economically feasible to continue production at any or all of our mines. We may also curtail or suspend some or all of our exploration and development activities, with the result that our depleted reserves are not replaced.

In addition, since our core operations are located in Canada and Peru, many of our costs are incurred in Canadian dollars and Peruvian soles. However, our revenue is tied to market prices for copper, zinc and other metals we produce, which are typically denominated in United States dollars. If the Canadian dollar or Peruvian sol appreciate in value against the United States dollar, our results of operations and financial condition could be materially adversely affected. Although we may use hedging strategies to limit exposure to currency fluctuations, there can be no assurance that such hedging strategies will be successful or that they will mitigate the risk of such fluctuations.

DEVELOPMENT OF NEW PROJECTS

Our ability to successfully develop the Rosemont project (and, to a lesser extent, our current brownfield growth projects in Manitoba and Peru) is subject to many risks and uncertainties, including: the ability to generate sufficient free cash flows and secure adequate financing to fund the projects; obtaining and maintaining key permits and approvals from governmental authorities; successful resolution of administrative and legal challenges against permits that have been issued to us (including two challenges that were launched against the U.S. Forest Service and the U.S. Fish and Wildlife Service in 2017 in relation to the issuance of the Final Record of Decision (“FROD”) for the Rosemont Project) and those permits that may be issued in the future; construction, commissioning and ramp-up risks; scheduling and cost-overrun risks; developing and maintaining good relationships with the community, local government and other stakeholders and interested parties; and political and social risk.

Significant amounts of capital will be required to construct and operate Rosemont. Our capital and operating costs may be affected by a variety of factors, including project scope changes, local currency appreciation and general cost escalation common to mining projects globally. Factors such as changes to technical specifications, failure to enter into agreements with contractors or suppliers in a timely manner, including contracts in respect of project infrastructure, and shortages of capital, may also delay or prevent the completion of construction or commencement of production or require the expenditure of additional funds. Many major mining projects constructed in the last five to ten years have experienced cost overruns that substantially exceeded the capital cost estimated during the basic engineering phase of those projects, sometimes by as much as 50% or more. There can be no certainty that after Rosemont is fully permitted there will be sufficient financing or other transactions available on acceptable terms to fund the construction of Rosemont.

The development of the Rosemont project may not occur as planned. While we expect that the Rosemont project’s successful completion will result in increased copper and precious metals production and enhanced growth opportunities for us, these anticipated benefits will primarily depend on whether and when the Rosemont project receives the permits required to commence construction and operate the mine. While we believe the permits will be granted, there can be no assurance that this will be the case and that any administrative and legal challenges to Rosemont’s existing (including those with respect to the FROD) permits will be successfully resolved. Moreover, there may be a delay in the issuance of the remaining permits and further delay caused by administrative and legal challenges to such permits. The Rosemont project is also subject to a joint venture agreement with UCM, which requires UCM’s consent for a number of important project decisions. Any failure to agree with UCM on one of these decisions or any other disagreement or dispute with UCM could hinder our ability to successfully finance and develop the project.

ANNUAL INFORMATION FORM | 25

The capital expenditures, timeline and other risks involved with developing a new mine, such as Rosemont, or mining a new deposit such as Pampacancha at our Constancia mine in Peru, are considerable. In the case of Pampacancha, there is a risk that we may not be able to secure the surface rights required to develop the deposit according to our schedule or at all. If we do not achieve certain production milestones from Pampacancha, we will be obliged to deliver additional ounces of gold to Wheaton Precious Metals; however, we do not consider any such delivery obligations to be material. Any inability to secure the required surface rights for Pampacancha or take possession of areas for which we hold surface rights could render us unable to carry out planned exploration, development and mining activities and expose us to financial risks. There can be no assurance that our current development projects or other projects we intend to develop will be able to be developed successfully or economically or that they will not be subject to the other risks described in this section.

DEPLETION OF RESERVES

Subject to any future expansion or other development, production from existing operations at our mines will typically decline over the life of the mine and, in the case of a maturing mine nearing the end of its life such as our 777 mine, the risk of the extraction of mineral reserves becoming uneconomic increases. As a result, our ability to maintain our current production or increase our annual production of base and precious metals and generate revenues therefrom will depend significantly upon our ability to discover or acquire new deposits, to successfully bring new mines into production and to expand mineral reserves at existing mines. Exploration and development of mineral properties involve significant financial risk. Very few properties that are explored are later developed into operating mines. Whether a mineral deposit will be commercially viable depends on a number of factors, including: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which are highly cyclical; political and social stability; and government regulation, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. Even if we identify and acquire an economically viable ore body, several years may elapse from the initial stages of development. We may incur significant expenses to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities. As a result, we cannot provide assurance that our exploration or development efforts will result in any new commercial mining operations or yield new mineral reserves to replace or expand current mineral reserves.

POLITICAL AND SOCIAL RISKS