Management's Discussion and Analysis of

Results of Operations and Financial Condition

For the year ended

December

31, 2017

February 21, 2018

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated February 21, 2018 is intended to supplement Hudbay Minerals Inc.'s audited consolidated financial statements and related notes for the year ended December 31, 2017 (the "consolidated financial statements"). The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS") as issued by the International Accounting Standards Board.

References to “Hudbay”, the “Company”, “we”, “us”, “our” or similar terms refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at December 31, 2017. "Hudbay Peru" refers to HudBay Peru S.A.C., our wholly-owned subsidiary which owns a 100% interest in the Constancia mine, and “Hudbay Arizona” refers to HudBay Arizona Inc., our wholly-owned subsidiary, which indirectly owns a 92.05% interest in the Rosemont project.

Readers should be aware that:

| − |

This MD&A contains certain “forward-looking statements” and “forward-looking information” (collectively, “forward-looking information”) that are subject to risk factors set out in a cautionary note contained in our MD&A. | |

| − |

This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers. | |

| − |

We use a number of non-IFRS financial performance measures in our MD&A. | |

| − |

The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates. |

For a discussion of each of the above matters, readers are urged to review the “Notes to Reader” discussion beginning on page 48 of this MD&A.

Additional information regarding Hudbay, including the risks related to our business and those that are reasonably likely to affect our financial statements in the future, is contained in our continuous disclosure materials, including our most recent Annual Information Form (“AIF”), consolidated financial statements and Management Information Circular available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

All amounts are in US dollars unless otherwise noted.

OUR BUSINESS

We are an integrated mining company primarily producing copper concentrate (containing copper, gold and silver), zinc concentrate and zinc metal. With assets in North and South America, we are focused on the discovery, production and marketing of base and precious metals. Directly and through our subsidiaries, we own four polymetallic mines, four ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan (Canada) and Cusco (Peru), and a copper project in Arizona (United States). Our growth strategy is focused on the exploration and development of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. Our vision is to be a responsible, top-tier operator of long-life, low-cost mines in the Americas. Our mission is to create sustainable value through the acquisition, development and operation of high-quality, long-life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence. We are governed by the Canada Business Corporations Act and our shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima. We also have warrants listed under the symbol “HBM.WT” on the Toronto Stock Exchange and “HBM/WS” on the New York Stock Exchange.

1

STRATEGY

Our mission is to create sustainable value through acquisition, development and operation of high quality, long life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence.

We believe that the greatest opportunities for shareholder value creation in the mining industry are in the discovery of new mineral deposits and the development of new facilities to profitably extract ore from those deposits. We also believe that our successful development, ramp-up and operation of the Constancia mine in Peru, along with our long history of mining and experience in northern Manitoba provide us with a competitive advantage in these respects relative to other mining companies of similar scale.

We intend to grow Hudbay through exploration and development of properties we already control, such as our Rosemont project in Arizona, as well as through the acquisition of other properties that fit our strategic criteria. We also continuously work to optimize the value of our producing assets through efficient and safe operations.

In an attempt to ensure that any acquisitions we undertake create sustainable value for stakeholders, we have established a number of criteria for evaluating mineral property acquisition opportunities. These include the following:

| − |

Geography: Potential acquisitions should be located in jurisdictions that support responsible mining activity and have acceptable levels of political risk. Given our current scale and geographic footprint, our current geographic focus is on select investment grade countries in the Americas, with strong rule of law and respect for human rights; | |

| − |

Geology: We believe we have particular expertise in the exploration and development of porphyry and volcanogenic massive sulphide mineral deposits. While these types of deposits typically contain copper, zinc and precious metals in varying quantities, we have a primary focus on copper; | |

| − |

Commodity: Among the metals we produce, we believe copper has the best long-term supply/demand fundamentals and the greatest opportunities for risk-adjusted returns; | |

| − |

Quality: We are focused on adding long-life, low cost assets to our existing portfolio of high quality assets. Long life assets can capture peak pricing of multiple commodity price cycles and low cost assets can generate free cash flow even through the trough of price cycles; | |

| − |

Potential: We consider the full spectrum of acquisition opportunities from early-stage exploration to producing assets, but they must meet our stringent criteria for growth and value creation. We believe that the market for mineral assets is sophisticated and fully values delineated resources and reserves, especially at properties that are already in production, which makes it difficult to acquire properties for substantially less than their fair value. Therefore, we typically look for mineral assets that we believe offer significant potential for exploration, development and optimization; | |

| − |

Process: Before we make an acquisition, we develop a clear understanding of how we can add value to the acquired property primarily through the application of our technical, social, operational and project execution expertise, as well as through the provision of necessary financial capacity and other operational optimization opportunities; | |

| − |

Operatorship: We believe real value is created through leading efficient project development and operations. Additionally, we believe that large, transformational mergers or acquisitions are risky and potentially value destructive in the mining industry; | |

| − |

Financial: Acquisitions should be accretive to Hudbay on a per share basis. Given that our strategic focus includes the acquisition of non-producing assets at various stages of development, when evaluating accretion we will consider measures such as net asset value per share and the contained value of reserves and resources per share. |

Our key objectives for 2018 are to:

|

− |

Utilize technology and process improvements to drive additional efficiencies in our operations to generate incremental free cash flow and increase net asset value; | |

| − | Complete the Lalor paste plant and ramp up base metal ore throughput from Lalor to 4,500 tonnes per day; | |

| − | Begin initial mining of Lalor gold zone material to enhance Lalor’s economics and better understand the potential for gold processing options; |

2

| − |

Deliver on plans to advance the development of the high grade Pampacancha deposit so that it can start to be mined in late 2018; | |

| − |

Advance permitting and technical work at the Rosemont project; | |

| − |

Utilize free cash flow generation to further reduce net debt; | |

| − |

Test promising exploration targets near Constancia and Lalor, and at greenfield sites in Peru, Chile and Canada; and | |

| − |

Continue to evaluate exploration and acquisition opportunities that meet our criteria described above, and pursue those opportunities that we determine to be in the best interest of the company and our stakeholders. |

3

SUMMARY RESULTS

Summary of Fourth Quarter Results

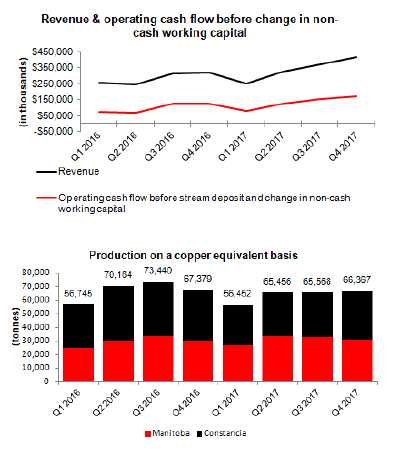

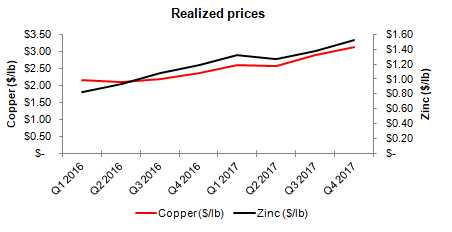

Operating cash flow before change in non-cash working capital increased to $171.9 million in the fourth quarter of 2017 from $122.3 million in the same quarter of 2016. We benefited from 32% and 29% higher realized prices on copper and zinc, respectively, while higher zinc sales and precious metals sales offset lower copper sales.

Net profit and basic and diluted earnings per share in the fourth quarter of 2017 were $99.7 million and $0.38, respectively, compared to a net loss and loss per share of $47.3 million and $0.20, respectively, in the fourth quarter of 2016. The prior period loss was mainly due to a $47.7 million charge taken in relation to the call premium that was paid to bondholders to facilitate the early redemption of our refinanced $920 million notes (the “Redeemed Notes”). The fourth quarter of 2017 benefited from an increase in gross profit of $57.6 million compared to the same period last year, mostly due to the previously mentioned higher realized copper and zinc prices. In addition, non-recurring deferred tax adjustments of $45.4 million were recorded in the fourth quarter of 2017, primarily as a result of changes in U.S. tax legislation (See “Tax Expense (Recovery)”).

Net profit and basic and diluted earnings per share in the fourth quarter of 2017 were affected by, among other things, the following items:

|

(in $ millions, except per share amounts) |

Pre-tax | After-tax | Per share | ||||||

|

|

gain (loss) | gain (loss) | gain (loss) | ||||||

|

Mark-to-market adjustments of various items |

(5.6 | ) | (4.3 | ) | (0.02 | ) | |||

|

Past service pension costs |

(10.4 | ) | (6.9 | ) | (0.03 | ) | |||

|

Gain on contingent consideration from Balmat sale |

6.4 | 6.4 | 0.03 | ||||||

|

Asset impairment |

(11.3 | ) | (7.5 | ) | (0.03 | ) | |||

|

Non-cash deferred tax adjustments |

- | 45.4 | 0.17 |

Compared to the same quarter of 2016, fourth quarter 2017 production of zinc, gold and silver in concentrate increased due to increased Lalor mine throughput and higher zinc grades at 777, while copper production remained consistent.

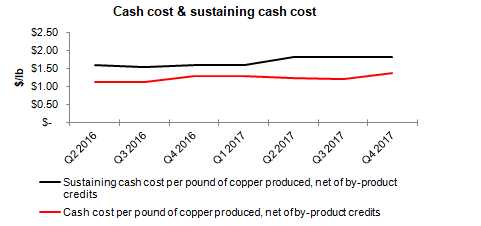

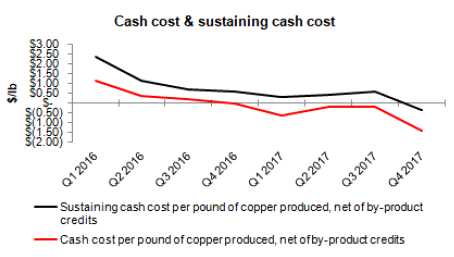

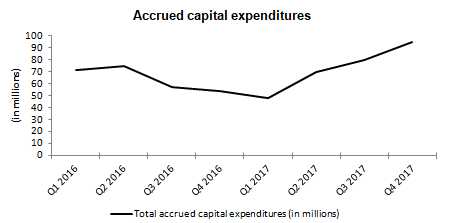

In the fourth quarter of 2017, consolidated cash cost per pound of copper produced, net of by-product credits, was $0.77, a decrease compared to $0.85 in the same period last year1. Incorporating sustaining capital, capitalized exploration, royalties and corporate selling and administrative expenses, consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits, in the fourth quarter of 2017 was $1.49, up from $1.46 in the fourth quarter of 20161. The increase in all-in sustaining cash cost was driven by higher planned sustaining capital expenditures in Manitoba.

Net debt1 declined by $26.5 million from September 30, 2017 to $623.1 million at December 31, 2017, as a result of cash flow from our operations. At December 31, 2017, total liquidity including cash and available credit facilities was $777.9 million, up from $749.9 million at September 30, 2017.

| 1 |

Cash cost and sustaining cash cost per pound of copper produced, net of by-product credits, and net debt are not recognized under IFRS. For more detail on these non-IFRS financial performance measures, please see the discussion under "Non-IFRS Financial Performance Measures" beginning on page 39 of this MD&A. |

4

During the fourth quarter, we recognized a pre-tax expense of $10.4 million for past service pension costs arising from new collective bargaining agreements in our Manitoba business unit. We also recognized an asset impairment charge of $11.3 million related to equipment purchased to build a new concentrator in Snow Lake, Manitoba that we no longer expect to be usable in our operations. We realized a gain of $6.4 million upon receipt of deferred consideration from the sale of the Balmat mine, which followed the completion of certain milestones.

Summary of Full Year Results

Operating cash flow before change in non-cash working capital increased in 2017 to $530.6 million from $387.9 million in 2016. This increase reflects higher copper and zinc prices realized throughout 2017 and higher zinc and gold sales. The increased zinc sales are a function of higher production from the re-sequencing of the 777 mine plan to prioritize higher grade zinc stopes.

Net profit and basic and diluted earnings per share for 2017 were $163.9 million and $0.67, respectively, compared to a net loss and loss per share of $35.2 million and $0.15, respectively, in 2016. The prior year loss was mostly the result of a $49.9 million charge taken in relation to the December 2016 call premium that was paid to bondholders to facilitate the early redemption of our $920 million of Redeemed Notes and the write-down of unamortized transaction costs associated with the Redeemed Notes. In the current year, we benefited from the aforementioned increase in copper and zinc prices and higher sales of zinc and gold. In addition, as indicated, there was a non-cash tax recovery of $45.4 million primarily as a result of changes to US tax legislation (See “Tax Expense (Recovery)”). Lastly, although copper grades were lower and mine operating costs were higher as a result of greater ore production activity, cash cost per pound of copper produced declined from 2016 by 10% to $0.84 as a result of higher byproduct credits from zinc production and prices.

5

On a consolidated basis, Hudbay’s copper production exceeded 2017 guidance and production of zinc and precious metals were within 2017 guidance ranges. Combined unit operating costs at Manitoba and Peru exceeded guidance ranges primarily due to increased operating costs and lower than expected mill throughput, while zinc plant unit operating costs were within the guidance range.

KEY FINANCIAL RESULTS

|

Financial Condition |

||||||

|

(in $ thousands) |

Dec. 31, 2017 | Dec. 31, 2016 | ||||

|

Cash and cash equivalents |

356,499 | 146,864 | ||||

|

Total long-term debt |

979,575 | 1,232,164 | ||||

|

Net debt 1 |

623,076 | 1,085,300 | ||||

|

Working capital |

308,675 | 121,539 | ||||

|

Total assets |

4,648,729 | 4,456,556 | ||||

|

Equity |

2,144,255 | 1,763,212 |

|

|

||||||||||||

|

Financial Performance |

Three months ended | Year ended | ||||||||||

|

(in $ thousands, except per share amounts) |

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | ||||||||

|

|

2017 | 2016 | 2017 | 2016 | ||||||||

|

Revenue |

414,143 | 316,654 | 1,362,553 | 1,128,678 | ||||||||

|

Cost of sales |

278,291 | 238,449 | 988,608 | 905,800 | ||||||||

|

Profit (loss) before tax |

85,540 | (26,065 | ) | 198,728 | 5,605 | |||||||

|

Profit (loss) |

99,676 | (47,273 | ) | 163,899 | (35,193 | ) | ||||||

|

Basic and diluted earnings (loss) per share |

0.38 | (0.20 | ) | 0.67 | (0.15 | ) | ||||||

|

Operating cash flow before change in non-cash working capital |

171,904 | 122,257 | 530,561 | 387,868 | ||||||||

1 Net debt is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under "Non-IFRS Financial Reporting Measures" beginning on page 39 of this MD&A.

6

KEY PRODUCTION RESULTS

|

|

Three months ended | Three months ended | |||||||||||||||||

|

|

Dec. 31, 2017 | Dec. 31, 2016 | |||||||||||||||||

|

|

Peru | Manitoba | Total | Peru | Manitoba | Total | |||||||||||||

|

|

|||||||||||||||||||

|

Contained metal in concentrate produced 1 |

|||||||||||||||||||

|

Copper |

tonnes | 33,837 | 9,338 | 43,175 | 33,986 | 9,797 | 43,783 | ||||||||||||

|

Gold |

oz | 5,139 | 27,389 | 32,528 | 5,033 | 22,449 | 27,482 | ||||||||||||

|

Silver |

oz | 670,219 | 333,272 | 1,003,491 | 723,392 | 269,286 | 992,678 | ||||||||||||

|

Zinc |

tonnes | - | 33,055 | 33,055 | - | 29,144 | 29,144 | ||||||||||||

|

Payable metal in concentrate sold |

|||||||||||||||||||

|

Copper |

tonnes | 34,227 | 7,252 | 41,479 | 35,969 | 8,223 | 44,192 | ||||||||||||

|

Gold |

oz | 4,442 | 26,779 | 31,221 | 6,183 | 19,158 | 25,341 | ||||||||||||

|

Silver |

oz | 543,763 | 291,723 | 835,486 | 701,654 | 209,671 | 911,325 | ||||||||||||

|

Zinc2 |

tonnes | - | 32,318 | 32,318 | - | 28,094 | 28,094 | ||||||||||||

|

|

|||||||||||||||||||

|

Cash cost3 |

$ /lb | 1.38 | (1.42 | ) | 0.77 | 1.11 | (0.06 | ) | 0.85 | ||||||||||

|

Sustaining cash cost3 |

$ /lb | 1.81 | (0.35 | ) | - | 1.54 | 0.58 | - | |||||||||||

|

|

|||||||||||||||||||

|

All-in sustaining cash cost3 |

$ /lb | - | - | 1.49 | - | - | 1.46 | ||||||||||||

|

|

Year ended | Year ended | |||||||||||||||||

|

|

Dec. 31, 2017 | Dec. 31, 2016 | |||||||||||||||||

|

|

Peru | Manitoba | Total | Peru | Manitoba | Total | |||||||||||||

|

|

|||||||||||||||||||

|

Contained metal in concentrate produced 1 |

|||||||||||||||||||

|

Copper |

tonnes | 121,781 | 37,411 | 159,192 | 133,432 | 41,059 | 174,491 | ||||||||||||

|

Gold |

oz | 17,579 | 91,014 | 108,593 | 26,276 | 88,020 | 114,296 | ||||||||||||

|

Silver |

oz | 2,374,008 | 1,113,250 | 3,487,258 | 2,760,332 | 995,564 | 3,755,896 | ||||||||||||

|

Zinc |

tonnes | - | 135,156 | 135,156 | - | 110,582 | 110,582 | ||||||||||||

|

Payable metal in concentrate sold |

|||||||||||||||||||

|

Copper |

tonnes | 111,402 | 37,253 | 148,655 | 132,663 | 38,788 | 171,451 | ||||||||||||

|

Gold |

oz | 12,464 | 97,306 | 109,770 | 24,199 | 71,328 | 95,527 | ||||||||||||

|

Silver |

oz | 1,950,893 | 1,109,376 | 3,060,269 | 2,423,165 | 758,594 | 3,181,759 | ||||||||||||

|

Zinc2 |

tonnes | - | 116,377 | 116,377 | - | 103,453 | 103,453 | ||||||||||||

|

|

|||||||||||||||||||

|

Cash cost3 |

$ /lb | 1.28 | (0.59 | ) | 0.84 | 1.09 | 0.41 | 0.93 | |||||||||||

|

Sustaining cash cost3 |

$ /lb | 1.76 | 0.23 | - | 1.51 | 1.16 | - | ||||||||||||

|

|

|||||||||||||||||||

|

All-in sustaining cash cost3 |

$ /lb | - | - | 1.52 | - | - | 1.52 | ||||||||||||

| 1 |

Metal reported in concentrate is prior to deductions associated with smelter contract terms. |

| 2 |

Includes refined zinc metal sold and payable zinc in concentrate sold. |

| 3 |

Cash cost, sustaining cash cost and all-in sustaining cash cost per pound of copper produced, net of by-product credits are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under "Non-IFRS Financial Reporting Measures" beginning on page 39 of this MD&A. |

7

RECENT DEVELOPMENTS

Rosemont Developments

Work continues with the U.S. Forest Service on the draft Mine Plan of Operations, which is progressing as planned. The remaining key federal permit outstanding is the Section 404 Water Permit from the U.S. Army Corps of Engineers.

On November 27, 2017, opponents of the Rosemont project filed a lawsuit against the U.S. Forest Service challenging, among other things, the issuance of the Final Record of Decision in respect of Rosemont. This is one of two active lawsuits challenging the Final Record of Decision and is one of the many legal challenges that have been advanced against the Rosemont permitting process. Hudbay is confident that Rosemont’s permits will continue to be upheld.

Dividend Declared

We declared a semi-annual dividend of C$0.01 per share on February 21, 2018. The dividend will be paid on March 29, 2018 to shareholders of record as of March 9, 2018.

Collective Bargaining Agreements

Three-year collective bargaining agreements have been entered into with Hudbay’s unionized workforces at each of its Manitoba and Peru operations, providing labour stability.

8

CONSTANCIA OPERATIONS REVIEW

|

|

Three months ended | Year ended | Guidance 1 | ||||||||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual | ||||||||||||||

|

|

2017 | 2016 | 2017 | 2016 | 2017 | 2018 | |||||||||||||

|

|

|||||||||||||||||||

|

Ore mined |

tonnes | 7,241,633 | 6,215,160 | 29,982,808 | 26,519,954 | ||||||||||||||

|

Copper |

% | 0.55 | 0.61 | 0.54 | 0.62 | ||||||||||||||

|

Gold |

g/tonne | 0.10 | 0.05 | 0.06 | 0.07 | ||||||||||||||

|

Silver |

g/tonne | 4.01 | 4.24 | 3.96 | 4.25 | ||||||||||||||

|

|

|||||||||||||||||||

|

Ore milled |

tonnes | 7,666,223 | 7,202,321 | 28,743,952 | 27,032,775 | ||||||||||||||

|

Copper |

% | 0.54 | 0.58 | 0.52 | 0.60 | ||||||||||||||

|

Gold |

g/tonne | 0.04 | 0.05 | 0.04 | 0.06 | ||||||||||||||

|

Silver |

g/tonne | 3.86 | 4.65 | 3.92 | 4.90 | ||||||||||||||

|

Copper concentrate |

tonnes | 131,308 | 132,741 | 479,858 | 527,296 | ||||||||||||||

|

Concentrate grade |

% Cu | 25.77 | 25.60 | 25.38 | 25.31 | ||||||||||||||

|

Copper recovery |

% | 82.1 | 81.6 | 81.1 | 82.4 | ||||||||||||||

|

Gold recovery |

% | 48.0 | 43.9 | 47.4 | 48.4 | ||||||||||||||

|

Silver recovery |

% | 70.5 | 67.1 | 65.5 | 64.9 | ||||||||||||||

|

Combined unit operating costs 1 |

$ /tonne | 9.75 | 7.98 | 8.83 | 8.09 | 7.20 - 8.80 | 7.50 - 9.20 | ||||||||||||

1Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs.

Ore mined at our Constancia mine during the fourth quarter of 2017 increased by 17% compared to the same period in 2016 in line with improved mill availability. As expected, milled copper grades in the fourth quarter were approximately 7% lower than the same period in 2016 as we entered lower grade phases of the mine plan. Mill throughput improved 6% due to increased plant availability as well as plant optimization initiatives during the fourth quarter of 2017.

Recoveries of copper, gold and silver were higher in the fourth quarter of 2017, compared to the same period in 2016. Optimization in process recoveries continues to be implemented and evaluated.

Combined mine, mill and G&A unit operating costs in the fourth quarter of 2017 were 22% higher than the same period in 2016. The higher combined unit costs are mostly related to decreased capitalized stripping, higher utility prices and higher overall operating costs due to increased molybdenum production during the period. Additionally, increased plant maintenance costs were incurred, as there was a major scheduled plant shutdown. Full year 2017 unit operating costs were higher than guidance expectations due to lower than expected mill throughput combined with factors affecting the fourth quarter costs described above.

9

|

|

Three months ended | Year ended | Guidance | ||||||||||||||||

|

Contained metal in |

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual | ||||||||||||||

|

concentrate produced |

2017 | 2016 | 2017 | 2016 | 2017 | 2018 | |||||||||||||

|

|

|||||||||||||||||||

|

Copper |

tonnes | 33,837 | 33,986 | 121,781 | 133,432 | 100,000 - 115,000 | 95,000 - 115,000 | ||||||||||||

|

Gold |

oz | 5,139 | 5,033 | 17,579 | 26,276 | ||||||||||||||

|

Silver |

oz | 670,219 | 723,392 | 2,374,008 | 2,760,332 | ||||||||||||||

|

Precious metals1 |

oz | 14,713 | 15,367 | 51,493 | 65,709 | 55,000 - 65,000 | 65,000 - 85,000 | ||||||||||||

1 Precious metals production includes gold and silver production on a gold equivalent basis. Silver converted to gold at a ratio of 70:1.

In 2017, copper production at Constancia exceeded guidance, while precious metals production was slightly below the lower end of the guidance.

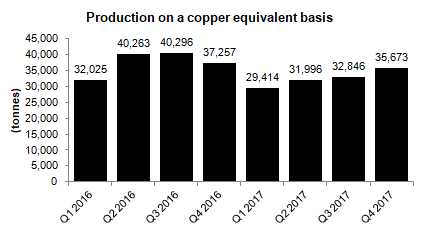

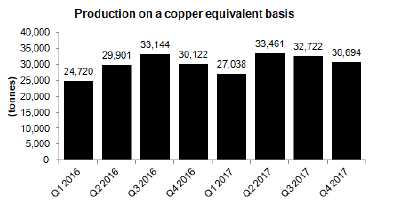

Copper equivalent production improved over the course of 2017 as a result of improved mill throughput, although production was lower than 2016 due to lower grades as we entered lower grade phases of the mine plan.

Peru Cash Cost and Sustaining Cash Cost

|

|

Three months ended | Year ended | |||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

|

|

2017 | 2016 | 2017 | 2016 | |||||||||

|

Cash cost per pound of copper produced, net of by-product credits 1 |

$ /lb | 1.38 | 1.11 | 1.28 | 1.09 | ||||||||

|

Sustaining cash cost per pound of copper produced, net of by-product credits 1 |

$ /lb | 1.81 | 1.54 | 1.76 | 1.51 | ||||||||

1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-IFRS financial performance measures, please see the discussion under "Non-IFRS Financial Performance Measures" beginning on page 39 of this MD&A.

Cash cost per pound of copper produced, net of by-product credits, for the three months ended December 31, 2017 was $1.38, an increase of 24% from the same period in 2016 mainly as a result of lower deferred stripping, increased plant cash costs and profit sharing.

Sustaining cash cost per pound of copper produced, net of by-product credits, for the three months ended December 31, 2017 was $1.81, an increase of 18% from the same period in 2016 as a result of the factors noted above.

10

Metal Sold

|

|

Three months ended | Year ended | |||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

|

|

2017 | 2016 | 2017 | 2016 | |||||||||

|

Payable metal in concentrate |

|||||||||||||

|

Copper |

tonnes | 34,227 | 35,969 | 111,402 | 132,663 | ||||||||

|

Gold |

oz | 4,442 | 6,183 | 12,464 | 24,199 | ||||||||

|

Silver |

oz | 543,763 | 701,654 | 1,950,893 | 2,423,165 | ||||||||

Production and Combined Unit Costs Guidance

In 2018, production of copper contained in concentrate in Peru is forecast to decrease by approximately 14% compared to 2017 production, due to lower copper grades at Constancia as the mine shifts to production of lower-grade hypogene ore in the main pit, in line with the mine plan.

Production of precious metals contained in concentrate in 2018 in Peru is forecast to increase by approximately 46% compared to 2017 production, primarily due to the expected start of mining at the Pampacancha deposit.

Combined unit costs for Peru in 2018 are expected to be approximately 4% higher than 2017 guidance as a result of the addition of a fourth operating shift at Constancia in line with the new three-year collective bargaining agreement, as well as higher diesel and steel prices.

Peru Updates

Negotiations to secure surface rights over the Pampacancha deposit are ongoing. The community has provided Hudbay with access to the land to carry out early-works activities and Hudbay expects to begin ore production later this year. In the event that the commencement of mining at Pampacancha is unexpectedly delayed beyond 2018, Hudbay expects to mine material from the main Constancia pit instead, which would not impact copper production guidance, but would reduce 2018 Peru precious metals production guidance by approximately 25%.

Twin hole drilling in the Constancia pit has indicated that the positive copper grade bias versus resource grades that has been experienced since the start of Constancia’s production is expected to persist through the life of the deposit, although the extent of the bias is expected to be less than what has been experienced to date. 2018 Peru copper guidance partially reflects the anticipated grade bias; work is ongoing to develop a revised mine plan and updated reserves, which are expected to be released by April 2018.

11

MANITOBA OPERATIONS REVIEW

Mines

|

|

Three months ended | Year ended | |||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

|

|

2017 | 2016 | 2017 | 2016 | |||||||||

|

777 |

|||||||||||||

|

Ore |

tonnes | 202,528 | 298,135 | 1,014,369 | 1,297,829 | ||||||||

|

Copper |

% | 1.86 | 1.67 | 1.65 | 1.57 | ||||||||

|

Zinc |

% | 5.40 | 3.81 | 5.17 | 3.47 | ||||||||

|

Gold |

g/tonne | 2.48 | 1.64 | 2.11 | 1.52 | ||||||||

|

Silver |

g/tonne | 34.46 | 24.06 | 27.59 | 21.34 | ||||||||

|

Lalor |

|||||||||||||

|

Ore |

tonnes | 334,229 | 272,156 | 1,293,418 | 1,086,362 | ||||||||

|

Copper |

% | 0.77 | 0.58 | 0.68 | 0.62 | ||||||||

|

Zinc |

% | 7.20 | 7.42 | 7.73 | 7.01 | ||||||||

|

Gold |

g/tonne | 2.25 | 2.07 | 1.93 | 2.24 | ||||||||

|

Silver |

g/tonne | 25.19 | 21.73 | 23.18 | 21.63 | ||||||||

|

Reed 1 |

|||||||||||||

|

Ore |

tonnes | 102,229 | 104,719 | 460,413 | 443,561 | ||||||||

|

Copper |

% | 3.52 | 2.90 | 3.67 | 3.96 | ||||||||

|

Zinc |

% | 0.69 | 0.63 | 0.60 | 0.62 | ||||||||

|

Gold |

g/tonne | 0.51 | 0.44 | 0.47 | 0.50 | ||||||||

|

Silver |

g/tonne | 8.97 | 5.76 | 7.19 | 6.78 | ||||||||

|

Total Mines |

|||||||||||||

|

Ore |

tonnes | 638,986 | 675,010 | 2,768,200 | 2,827,752 | ||||||||

|

Copper |

% | 1.55 | 1.42 | 1.53 | 1.58 | ||||||||

|

Zinc |

% | 5.59 | 4.77 | 5.61 | 4.38 | ||||||||

|

Gold |

g/tonne | 2.04 | 1.63 | 1.75 | 1.64 | ||||||||

|

Silver |

g/tonne | 25.54 | 20.28 | 22.14 | 19.17 | ||||||||

1 Includes 100% of Reed mine production. We purchase 30% of the Reed ore production from our joint venture partner on market-based terms.

|

|

Three months ended | Year ended | |||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

|

Unit Operating Costs |

2017 | 2016 | 2017 | 2016 | |||||||||

|

Mines |

|||||||||||||

|

777 |

C$/tonne | 90.34 | 53.40 | 68.49 | 52.27 | ||||||||

|

Lalor |

C$/tonne | 80.91 | 69.14 | 80.12 | 66.41 | ||||||||

|

Reed |

C$/tonne | 109.02 | 57.39 | 73.70 | 48.29 | ||||||||

|

Total Mines |

C$/tonne | 87.36 | 60.51 | 74.85 | 57.51 | ||||||||

12

Ore mined at our Manitoba mines during the fourth quarter of 2017 decreased by 5% compared to the same period in 2016 primarily as a result of lower production at the 777 mine. Ore mined at the 777 mine declined as ground conditions necessitated the implementation of a more conservative stope sequence in order to adapt to more challenging operating conditions as the mine ages. Lower than planned equipment availability, and delays in the mine sequence resulting from a plugged paste backfill line in the third quarter also impacted fourth quarter production rates. Overall copper, zinc, gold and silver grades were higher in the fourth quarter of 2017 compared to the same period in 2016 by 9%, 17%, 25% and 26%, respectively as a result of higher grades at all mines.

Total mine unit operating costs in the fourth quarter of 2017 were 44% higher compared to the same period in 2016.

We ceased capitalizing Reed development costs in the third quarter of 2017 as a result of the mine’s expected closure in the third quarter of 2018, resulting in higher Reed unit operating costs compared to prior periods. The 777 mine’s unit costs were negatively impacted by lower production as a result of the items noted above. Consistent with our revised mine plan, Lalor’s unit costs reflect increased cement rock filling costs as well as substantial operating and capital development work that was undertaken to increase Lalor’s production rate to 4,500 tonnes per day by the third quarter of 2018. The successful ramp up of ore production from the Lalor mine has resulted in the accumulation of an ore stockpile which exceeds the Stall concentrator’s current milling capacity. With intention to take advantage of higher metal prices and increase our revenues, excess Lalor ore production was trucked to the Flin Flon mill for processing, which contributed to the increased unit costs for Lalor.

Full year ore production at our Manitoba mines in 2017 was 2% lower than in 2016 as a result of decreased production at the 777 mine, which was partially offset by increased production at the Lalor mine. The 777 mine production was lower for the reasons noted above. Zinc grades were 28% higher due to higher Lalor mine output and the prioritization of production from higher-grade zinc zones at the 777 mine. Unit operating costs in 2017 increased by 30% compared to 2016 as a result of Lalor ramp-up activities including increasing drilled inventory and the associated operating development to access the required drill platforms, increased cemented rock filling to avoid leaving high grade ore pillars, and additional ore haulage costs to truck the excess ore feed to the Flin Flon mill to utilize its excess processing capacity.

13

Processing Facilities

|

|

Three months ended | Year ended | |||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

|

|

2017 | 2016 | 2017 | 2016 | |||||||||

|

Flin Flon Concentrator |

|||||||||||||

|

Ore |

tonnes | 402,240 | 464,747 | 1,602,688 | 1,764,725 | ||||||||

|

Copper |

% | 2.06 | 2.04 | 2.12 | 2.18 | ||||||||

|

Zinc |

% | 4.50 | 2.96 | 4.08 | 2.74 | ||||||||

|

Gold |

g/tonne | 1.89 | 1.32 | 1.65 | 1.26 | ||||||||

|

Silver |

g/tonne | 25.78 | 19.23 | 21.69 | 17.63 | ||||||||

|

Copper concentrate |

tonnes | 34,308 | 36,695 | 132,278 | 148,706 | ||||||||

|

Concentrate grade |

% Cu | 22.54 | 23.44 | 23.81 | 23.82 | ||||||||

|

Zinc concentrate |

tonnes | 29,987 | 22,518 | 109,451 | 76,730 | ||||||||

|

Concentrate grade |

% Zn | 50.76 | 51.34 | 51.28 | 51.49 | ||||||||

|

Copper recovery |

% | 93.3 | 90.6 | 92.6 | 92.2 | ||||||||

|

Zinc recovery |

% | 84.1 | 84.2 | 85.9 | 81.6 | ||||||||

|

Gold recovery |

% | 65.3 | 60.6 | 62.2 | 59.7 | ||||||||

|

Silver recovery |

% | 61.9 | 57.7 | 58.9 | 56.7 | ||||||||

|

Contained metal in concentrate produced |

|||||||||||||

|

Copper |

tonnes | 7,734 | 8,602 | 31,488 | 35,422 | ||||||||

|

Zinc |

tonnes | 15,222 | 11,562 | 56,128 | 39,504 | ||||||||

|

Precious metals 1 |

oz | 18,916 | 14,344 | 62,357 | 50,861 | ||||||||

|

Stall Concentrator |

|||||||||||||

|

Ore |

tonnes | 267,636 | 257,759 | 1,102,034 | 1,089,530 | ||||||||

|

Copper |

% | 0.71 | 0.58 | 0.65 | 0.63 | ||||||||

|

Zinc |

% | 7.28 | 7.39 | 7.76 | 7.03 | ||||||||

|

Gold |

g/tonne | 2.26 | 2.10 | 1.91 | 2.25 | ||||||||

|

Silver |

g/tonne | 25.14 | 21.77 | 22.85 | 21.67 | ||||||||

|

Copper concentrate |

tonnes | 8,492 | 5,951 | 29,362 | 27,298 | ||||||||

|

Concentrate grade |

% Cu | 18.89 | 20.08 | 20.18 | 20.65 | ||||||||

|

Zinc concentrate |

tonnes | 34,708 | 33,995 | 152,766 | 138,056 | ||||||||

|

Concentrate grade |

% Zn | 51.38 | 51.72 | 51.73 | 51.48 | ||||||||

|

Copper recovery |

% | 84.5 | 80.0 | 82.4 | 82.1 | ||||||||

|

Zinc recovery |

% | 91.6 | 92.3 | 92.4 | 92.8 | ||||||||

|

Gold recovery |

% | 58.6 | 60.3 | 56.3 | 57.4 | ||||||||

|

Silver recovery |

% | 58.7 | 57.4 | 56.2 | 56.4 | ||||||||

|

Contained metal in concentrate produced |

|||||||||||||

|

Copper |

tonnes | 1,604 | 1,195 | 5,923 | 5,637 | ||||||||

|

Zinc |

tonnes | 17,833 | 17,582 | 79,028 | 71,075 | ||||||||

|

Precious metals 1 |

oz | 13,234 | 11,952 | 44,561 | 51,381 | ||||||||

1 Precious metals production includes gold and silver production on a gold-equivalent basis. Silver is converted to gold at a ratio of 70:1.

14

|

|

Three months | ||||||||||||||||||

|

|

ended | Year ended | Guidance | ||||||||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual | ||||||||||||||

|

Unit Operating Costs |

2017 | 2016 | 2017 | 2016 | 2017 | 2018 | |||||||||||||

|

Concentrators |

|||||||||||||||||||

|

Flin Flon |

C$/tonne | 20.68 | 18.48 | 19.26 | 18.32 | ||||||||||||||

|

Stall |

C$/tonne | 29.09 | 27.58 | 29.63 | 23.62 | ||||||||||||||

|

Combined mine/mill unit operating costs 1 |

|||||||||||||||||||

|

Manitoba |

C$/tonne | 124.67 | 96.38 | 118.04 | 92.77 | 88 -108 | 110 -123 | ||||||||||||

1 Reflects combined mine, mill and G&A costs per tonne of ore milled. Includes the cost of ore purchased from our joint venture partner at the Reed mine.

Ore processed in the Flin Flon concentrator in the fourth quarter of 2017 was 13% lower than the same period in 2016 primarily as a result of lower mine production, and challenges in primary crushing due to frozen blocks of ore feed recovered from stockpiles. Copper and precious metals recoveries were higher in the fourth quarter of 2017 compared to the same period in 2016 as a result of higher head grades and improvements made to the mill. Unit operating costs at the Flin Flon concentrator were 12% higher in the fourth quarter of 2017 compared to the same period in 2016 as a result of higher maintenance expenditures and reduced production. Ore processed at the Stall concentrator in the fourth quarter of 2017 was 4% higher than the same period in 2016. Unit operating costs at the Stall concentrator were 5% higher in the fourth quarter of 2017 compared to the same period in 2016 as a result of higher maintenance expenditures resulting from unplanned repairs.

For the full year, ore processed in Flin Flon was 9% lower than in 2016 as a result of lower production at our 777 mine, partially offset by processing Lalor ore in Flin Flon starting in August. Zinc and precious metals recoveries in 2017 were higher compared to 2016 as a result of higher head grades. Unit operating costs at the Flin Flon concentrator in 2017 were 5% higher than in 2016 as a result of lower production as well as unscheduled maintenance in the first quarter of 2017 and the completion of staged repairs throughout the remainder of the year with the intention of maintaining the asset to match the expected mine life. For the full year, ore processed at the Stall concentrator was consistent with 2016. Unit operating costs at the Stall concentrator in 2017 were 25% higher than in 2016 as a result of higher maintenance throughout 2017 as well as the use of higher cost temporary crushing facilities in the first quarter.

Manitoba combined mine, mill and G&A unit operating costs in the fourth quarter and full year in 2017 were 29% and 27% higher, respectively, than in the same periods in 2016 due to the factors described above as well as higher 777, Reed and Lalor unit costs due to the factors described under “Mines” above. In addition, the stockpiling of Lalor ore described above increased combined mine/mill unit costs as that metric is expressed as total costs during the period (irrespective of inventory changes), divided by the tonnes of ore milled. Processing the additional Lalor production in Flin Flon is expected to drive economies of scale and additional revenues through a faster ramp up. Combined mine/mill unit operating costs in Manitoba exceeded the guidance range for the reasons noted above.

15

|

|

Three months ended | Year ended | Guidance | ||||||||||||||||

|

Manitoba contained metal |

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual | ||||||||||||||

|

in concentrate produced 1,2 |

2017 | 2016 | 2017 | 2016 | 2017 | 2018 | |||||||||||||

|

Copper |

tonnes | 9,338 | 9,797 | 37,411 | 41,059 | 32,500 - 42,500 | 27,500 - 32,500 | ||||||||||||

|

Gold |

oz | 27,389 | 22,449 | 91,014 | 88,020 | - | - | ||||||||||||

|

Silver |

oz | 333,272 | 269,286 | 1,113,250 | 995,564 | - | - | ||||||||||||

|

Zinc |

tonnes | 33,055 | 29,144 | 135,156 | 110,582 | 125,000 - 150,000 | 105,000 - 130,000 | ||||||||||||

|

Precious metals3 |

oz | 32,150 | 26,296 | 106,918 | 102,242 | 90,000 - 110,000 | 120,000 - 145,000 | ||||||||||||

1 Includes 100% of Reed mine production. We own a

70% interest in the Reed mine and purchase 30% of the Reed ore production from

our joint venture partner on market based terms.

2

Metal reported in concentrate is prior to deductions associated with

smelter terms.

3 Precious metals production includes gold and

silver production on a gold-equivalent basis. Silver is converted to gold at a

ratio of 70:1.

In the fourth quarter of 2017, production of copper was 5% lower than the same period in 2016 as a result of lower production at 777, while zinc, gold, and silver production was 13%, 22%, and 24% higher, respectively, compared to the same period of 2016 as a result of higher grades at all mines as well as higher production at Lalor. Production of all metals in Manitoba for full year 2017 was within the guidance ranges.

Zinc Plant

|

|

Three months ended | Year ended | Guidance | ||||||||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual | ||||||||||||||

|

Zinc Production |

2017 | 2016 | 2017 | 2016 | 2017 | 2018 | |||||||||||||

|

Zinc Concentrate Treated |

|||||||||||||||||||

|

Domestic |

tonnes | 59,302 | 60,350 | 223,973 | 216,982 | ||||||||||||||

|

Refined Metal Produced |

|||||||||||||||||||

|

Domestic |

tonnes | 27,794 | 28,899 | 107,946 | 102,594 | 95,000-115,000 | 110,000-115,000 | ||||||||||||

| Three months ended | Year ended | Guidance | |||||||||||||||||

| Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual | |||||||||||||||

| Unit Operating Costs | 2017 | 2016 | 2017 | 2016 | 2017 | 2018 | |||||||||||||

| Zinc Plant 1 | C$/lb | 0.43 | 0.44 | 0.43 | 0.45 | 0.40 - 0.50 | 0.40 - 0.50 | ||||||||||||

1 Zinc unit operating costs include G&A costs.

16

Production of cast zinc and operating cost per pound of zinc metal produced in the fourth quarter was consistent with the same period in 2016 while full year production was 5% higher than 2016 as a result of higher amperages in the zinc plant cell house due to improvements made in the operation of the cooling towers during the hotter summer months. Unit costs were 2% lower in the fourth quarter compared to the same period in 2016 and 4% lower for the 2017 year compared to 2016 as a result of increased production. Zinc plant production and unit costs were within the guidance ranges for 2017.

Manitoba Cash Cost and Sustaining Cash Cost

|

|

Three months ended | Year ended | |||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

|

|

2017 | 2016 | 2017 | 2016 | |||||||||

|

Cost per pound of copper produced |

|||||||||||||

|

Cash cost per pound of copper produced, net of by-product credits 1 |

$ /lb | (1.42 | ) | (0.06 | ) | (0.59 | ) | 0.41 | |||||

|

Sustaining cash cost per pound of copper produced, net of by-product credits 1 |

$ /lb | (0.35 | ) | 0.58 | 0.23 | 1.16 | |||||||

|

|

|||||||||||||

|

Cost per pound of zinc produced |

|||||||||||||

|

Cash cost per pound of zinc produced, net of by-product credits 1 |

$ /lb | 0.29 | 0.36 | 0.20 | 0.32 | ||||||||

|

Sustaining cash cost per pound of zinc produced, net of by-product credits 1 |

$ /lb | 0.59 | 0.57 | 0.43 | 0.61 | ||||||||

1 Cash cost and sustaining cash cost per pound of copper & zinc produced, net of by-product credits, are not recognized under IFRS. For more detail on this non-IFRS financial performance measure, please see the discussion under "Non-IFRS Financial Performance Measures" beginning on page 39 of this MD&A.

In Manitoba, cash cost per pound of copper produced, net of by-product credits, in the fourth quarter of 2017 and full year were negative $1.42 and negative $0.59 per pound of copper produced, respectively. These were lower compared to the same periods in 2016, primarily as a result of significantly increased by-product credits for all metals, which were partially offset by expected higher costs at our 777 and Reed mines during this part of their mine lives.

Sustaining cash cost per pound of copper produced, net of by-product credits, in the fourth quarter of 2017 and full year were negative $0.35 and $0.23 per pound of copper produced, respectively, compared to $0.58 and $1.16 in the prior year as a result of the same factors described above, which were partially offset by planned increased capital spending.

Cash cost and sustaining cash cost per pound of zinc produced, net of by-product credits, were comparable and lower compared to the same period last year as a result of increased zinc production, and higher grades realized with the revised 777 mine plan, partially offset by the higher mining costs associated with the 777 and Reed mines at this stage of their mine lives.

17

Metal Sold

| Three months ended | Year ended | ||||||||||||

| Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | ||||||||||

| 2017 | 2016 | 2017 | 2016 | ||||||||||

| Payable metal in concentrate | |||||||||||||

| Copper | tonnes | 7,252 | 8,223 | 37,253 | 38,788 | ||||||||

| Gold | oz | 26,779 | 19,158 | 97,306 | 71,328 | ||||||||

| Silver | oz | 291,723 | 209,671 | 1,109,376 | 758,594 | ||||||||

| Zinc | tonnes | 7,138 | - | 12,701 | - | ||||||||

| Refined zinc | tonnes | 25,180 | 28,094 | 103,676 | 103,453 | ||||||||

Due to increased Lalor mine throughput and higher zinc grades at 777, zinc concentrate production exceeded the processing capacity of the Flin Flon zinc plant. As a result, sales of excess zinc concentrate inventory began in the second quarter of 2017 and will continue as long as concentrate production exceeds zinc plant processing capacity; which is estimated to continue until the second quarter of 2018.

Production and Combined Unit Costs Guidance

In 2018, production of copper contained in concentrate in Manitoba is forecast to decrease by approximately 20% compared to 2017 production, due to the Reed mine closing.

Production of precious metals contained in concentrate in 2018 in Manitoba is forecast to increase by approximately 24% compared to 2017 production, primarily due to an expected increase in precious metals production from the Lalor mine.

Combined unit costs for Manitoba are forecast to be higher than 2017 guidance of C$88-108/tonne, due mainly to reduced ore production at the 777 mine, the cessation of the capitalization of development costs at Reed as it approaches the end of its mine life and costs for trucking ore from Lalor to the Flin Flon concentrator for processing, in lieu of capital expenditures on expanding the Stall concentrator.

Hudbay’s anticipated zinc concentrate production from the Manitoba Business Unit in 2018 is expected to result in full utilization of the Flin Flon zinc plant’s processing capacity, with some zinc concentrate planned for sale to third parties.

18

OUTLOOK

This outlook includes forward-looking information about our operations and financial expectations based on our expectations and outlook as of February 21, 2018. This outlook, including expected results and targets, is subject to various risks, uncertainties and assumptions, which may impact future performance and our achievement of the results and targets discussed in this section. For additional information on forward-looking information, refer to "Forward-Looking Information" on page 48 of this MD&A. We may update our outlook depending on changes in metals prices and other factors.

In addition to this section, refer to the "Operations Review" and "Financial Review" sections for additional details on our outlook for 2018. For information on our sensitivity to metals prices, refer below to the "Commodity Markets" and "Sensitivity Analysis" sections of this MD&A.

Material Assumptions

Our 2018 operational and financial performance will be influenced by a number of factors. At the macro-level, the general performance of the Chinese, North American and global economies will influence the demand for our products. The realized prices we achieve in the commodity markets significantly affect our performance. Our general expectations regarding metals prices and foreign exchange rates are included below in the “Commodity Markets” and “Sensitivity Analysis” sections of this MD&A.

2018 Mine and Mill Production (Contained Metal in Concentrate)

| Year ended | |||||||

| December 31, 2017 | 2018 Guidance | ||||||

| Copper | tonnes | 159,192 | 122,500 - 147,500 | ||||

| Zinc | tonnes | 135,156 | 105,000 - 130,000 | ||||

| Precious metals1 | oz | 158,411 | 185,000 - 230,000 |

1 Precious metals production includes gold and silver production on a gold-equivalent basis. Silver converted to gold at a ratio of 70:1.

In 2018, consolidated production of copper contained in concentrate is forecast to decrease by approximately 15% compared to 2017 production, due to lower copper grades at Constancia as the mine shifts to production of lower-grade hypogene ore in the main pit, in line with the mine plan, and the Reed mine closure. Production of zinc contained in concentrate in 2018 is forecast to decrease by approximately 13% compared to 2017 production, due to lower zinc grades at the 777 and Lalor mines, in line with the respective mine plans.

Consolidated production of precious metals contained in concentrate in 2018 is forecast to increase by approximately 31% compared to 2017 production, primarily due to an expected increase in precious metals production from the Lalor mine in Manitoba and the expected start of mining at the Pampacancha deposit in Peru. In 2018, precious metals contained in ore production from the Lalor mine, which has no royalty or stream obligations, is expected to account for 67% of Manitoba’s precious metals production, compared to 49% of 2017 actual Manitoba precious metals production. Mine development at Lalor is now adjacent to the gold zones, and a recent batch sample of gold ore sent to the Flin Flon concentrator realized favourable gold recoveries of more than 60%. The mine plan for 2018 includes some mining of the gold zone for processing at Flin Flon, which is included in our precious metals production guidance. This will enable a better understanding of the gold zone characteristics and better inform the evaluation of options for processing Lalor gold.

Production and Cost Outlook

For a discussion of our 2018 expectations for Peru and Manitoba production and costs, refer to the “Production and Combined Unit Costs Guidance” sections of each business units operations review above.

19

Exploration

During the downturn in metals prices over the past few years, Hudbay more than doubled its owned or optioned mineral properties from approximately 380,000 hectares to approximately 860,000 hectares across Canada, Peru, the United States and Chile. Hudbay’s 2018 exploration budget of $50 million, more than twice that of 2017, will be focused on exploration near existing processing infrastructure in Manitoba and Peru, as well as grassroots exploration properties in Chile and British Columbia.

As disclosed on January 8, 2018, Hudbay has acquired a large, contiguous block of mineral rights to explore for mineable deposits within trucking distance of the Constancia processing facility. Hudbay is commencing permitting, community relations and technical activities required to access and conduct drilling activities on these properties and will provide further detail on its exploration plans in due course.

|

Exploration Guidance |

Year ended | |||||

|

(in $ millions) |

December 31, 2017 | 2018 Guidance | ||||

|

Manitoba |

7.1 | 15.0 | ||||

|

Peru |

1.4 | 20.0 | ||||

|

Generative and other |

8.4 | 15.0 | ||||

|

Total exploration expenditures |

16.9 | 50.0 | ||||

|

Capitalized Spending1 |

(1.4 | ) | (10.0 | ) | ||

|

|

||||||

|

Total1 |

15.5 | 40.0 |

1 Assumes $10 million of Manitoba expenditures will be capitalized in 2018.

Commodity Markets

In addition to our production, financial performance is directly affected by a number of factors, including metals prices, foreign exchange rates, and input costs, including energy prices. Average prices for copper and zinc were significantly higher in 2017 compared to 2016, whereas precious metals prices were little changed.

We have developed the following market analysis from various information sources including analyst and industry experts.

Copper

In 2017, the London Metal Exchange (“LME”) copper price averaged $2.80 per pound ("/lb"), with prices ranging between $2.48/lb and $3.27/lb. Copper refined metal markets experienced a small deficit in 2017, as global economic growth improved while copper supply growth was muted.

In 2018, both copper supply and demand are expected to increase moderately, although there is a greater than usual risk of production disruptions due to renegotiations of labour agreements at major copper mines.

Although copper prices have recovered to levels that support the viability of existing operations, we believe current copper prices remain at levels that are too low to incentivize significant investments in new copper production. New copper production will be needed to replace mine depletion and progressively lower mine grades globally. As a result, copper mine supply is expected to peak before the end of the decade which, assuming continued global and Chinese economic growth, is expected to be followed by copper market deficits and significantly higher copper prices.

20

Zinc

In 2017, the LME zinc price averaged $1.31/lb, with prices ranging from $1.10/lb to $1.53/lb. Zinc market deficits that have been in place for several years continued to grow in 2017, with the refined metal deficit estimated to reach 6% of global demand. Zinc demand in China and globally saw moderate growth in 2017, which is expected to continue into 2018, while zinc metal production was constrained by limited concentrate supply. The recent increase in zinc prices to more than $1.50/lb is likely to incentivize new zinc production, thereby reducing the size of the global deficit, although prices could still increase further if available metal inventory reaches critically low levels during 2018.

Sensitivity Analysis

The following table displays the estimated impact of changes in metals prices and foreign exchange rates on our 2018 net profit, earnings per share and operating cash flow, assuming that our operational performance is consistent with our guidance for 2018. The effects of a given change in an assumption are isolated.

|

|

2018 | Change of 10% | Impact on | Impact on | Impact on |

|

|

Base | represented by: | Profit | EPS1 | operating cash flow2 |

|

Metals Prices 3 |

|||||

|

Copper price |

$3.00/lb | +/- $0.30/lb | +/- $50M | +/- 0.19 | +/- $56M |

|

Zinc price |

$1.30/lb | +/- $0.13/lb | +/- $23M | +/- 0.09 | +/- $32M |

|

Gold price4 |

$1,300/oz | +/- $130/oz | +/- $9M | +/- 0.04 | +/- $10M |

|

|

|||||

|

Exchange Rates5 |

|||||

|

C$/US$ |

1.25 | +/- 0.125 | +/- $40M | +/- 0.15 | +/- $38M |

1 Based on 261.3 million common shares outstanding

as at December 31, 2017.

2 Operating cash flow before changes in

non-cash working capital.

3 Copper and zinc prices are based on

quoted LME prices and gold price is based on London Bullion Market Association

prices.

4 Gold price sensitivity also includes the impact of a

+/-10% change in the silver price (2018 assumption: $18/oz of silver).

5 Change in profit from operational performance only, does not

include change in profit arising from translation of balance sheet accounts.

FINANCIAL REVIEW

Financial Results

In the fourth quarter of 2017, our profit was $99.7 million compared to a loss of $47.3 million for the fourth quarter of 2016. For the full year 2017, we recorded a profit of $163.9 million compared to a loss of $35.2 million in 2016.

The following table provides further details of this variance:

21

|

|

Three months ended | Year ended | ||||

|

(in $ millions) |

Dec. 31, 2017 | Dec. 31, 2017 | ||||

|

Increase (decrease) in components of profit or loss: |

||||||

|

Revenues |

97.5 | 233.9 | ||||

|

Cost of sales |

||||||

|

Mine operating costs |

(42.7 | ) | (88.6 | ) | ||

|

Depreciation and amortization |

2.9 | 5.8 | ||||

|

Net finance expense |

61.6 | 45.6 | ||||

|

Other |

(7.7 | ) | (3.6 | ) | ||

|

Tax |

35.3 | 6.0 | ||||

|

|

||||||

|

Increase in profit for the period |

146.9 | 199.1 |

Revenue

Total revenue for the fourth quarter of 2017 was $414.1 million, $97.5 million higher than the same period in 2016. This increase was due to higher copper and zinc prices, while higher zinc and gold sales volumes offset lower copper sales volumes.

For the full year 2017, revenue was $1,362.6 million, $233.9 million higher than in 2016, due primarily to higher copper and zinc prices, along with higher zinc and precious metal sales. These increases were partially offset by lower copper sales volumes, along with lower average precious metals prices for the year.

|

|

Three months ended | Year ended | ||||

|

(in $ millions) |

Dec. 31, 2017 | Dec. 31, 2017 | ||||

|

Metals prices1 |

||||||

|

Higher copper prices |

72.0 | 206.5 | ||||

|

Higher zinc prices |

24.8 | 94.0 | ||||

|

Lower gold prices |

(0.9 | ) | (13.2 | ) | ||

|

Lower silver prices |

(1.1 | ) | (7.0 | ) | ||

|

Sales volumes |

||||||

|

Lower copper sales volumes |

(16.1 | ) | (116.9 | ) | ||

|

Higher zinc sales volumes |

11.0 | 28.9 | ||||

|

Higher gold sales volumes |

7.4 | 24.2 | ||||

|

(Lower) higher silver sales volumes |

(0.8 | ) | 0.7 | |||

|

Other |

||||||

|

Derivative mark-to-market increase (decrease) |

0.7 | (6.9 | ) | |||

|

Other volume and pricing differences |

2.1 | 11.3 | ||||

|

Effect of (higher) lower treatment and refining charges |

(1.6 | ) | 12.3 | |||

|

|

||||||

|

Increase in revenue in 2017 compared to 2016 |

97.5 | 233.9 |

1 See discussion below for further information regarding metals prices.

22

Our revenue by significant product type is summarized below:

|

|

Three months ended | Year ended | ||||||||||

|

|

Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | ||||||||

|

(in $ millions) |

2017 | 2016 | 2017 | 2016 | ||||||||

|

Copper |

286.6 | 230.7 | 925.1 | 835.5 | ||||||||

|

Zinc |

108.1 | 71.6 | 352.9 | 237.0 | ||||||||

|

Gold |

35.2 | 28.8 | 130.8 | 119.8 | ||||||||

|

Silver |

12.4 | 14.3 | 45.8 | 52.1 | ||||||||

|

Other |

2.8 | 0.7 | 14.1 | 2.7 | ||||||||

|

Gross revenue1 |

445.1 | 346.1 | 1,468.7 | 1,247.1 | ||||||||

|

Treatment and refining charges |

(31.0 | ) | (29.4 | ) | (106.1 | ) | (118.4 | ) | ||||

|

Revenue |

414.1 | 316.7 | 1,362.6 | 1,128.7 | ||||||||

1 Copper, gold and silver revenues include unrealized gains and losses related to non-hedge derivative contracts including fixed for floating swaps, that are included in realized prices. Zinc revenues include unrealized gains and losses related to non-hedge derivative contracts that are not included in realized prices.

23

Realized sales prices

This measure is intended to enable management and investors to understand the average realized price of metals sold to third parties in each reporting period. The average realized price per unit sold does not have any standardized meaning prescribed by IFRS, is unlikely to be comparable to similar measures presented by other issuers, and should not be considered in isolation or a substitute for measures of performance prepared in accordance with IFRS.

For sales of copper, gold and silver we may enter into non-hedge derivatives (“QP hedges”) which are intended to manage the provisional pricing risk arising from quotational period terms in concentrate sales agreements. The QP hedges are not removed from the calculation of realized prices. We expect that gains and losses on QP hedges will offset provisional pricing adjustments on concentrate sales contracts.

Our realized prices for the fourth quarter and year-to-date in 2017 and 2016, respectively, are summarized below:

|

|

Realized prices1 for the | Realized prices1 for the | |||||||||||||||||

|

|

Three months ended | Year ended | |||||||||||||||||

|

|

LME QTD | Dec. 31, | Dec. 31, | LME YTD | Dec. 31, | Dec. 31, | |||||||||||||

|

|

20172 | 2017 | 2016 | 20172 | 2017 | 2016 | |||||||||||||

|

Prices |

|||||||||||||||||||

|

Copper |

$ /lb | 3.09 | 3.13 | 2.37 | 2.80 | 2.82 | 2.21 | ||||||||||||

|

Zinc3 |

$ /lb | 1.47 | 1.53 | 1.19 | 1.31 | 1.38 | 1.01 | ||||||||||||

|

Gold4 |

$ /oz | 1,129 | 1,136 | 1,192 | 1,254 | ||||||||||||||

|

Silver4 |

$ /oz | 14.89 | 15.72 | 14.96 | 16.38 | ||||||||||||||

1 Realized prices exclude refining and treatment

charges and are on the sale of finished metal or metal in concentrate. Realized

prices include the effect of provisional pricing adjustments on prior period

sales.

2 London Metal Exchange average for copper and

zinc prices.

3 This amount includes a realized sales

price of $1.55 for cast zinc metal and $1.48 for zinc concentrate sold for the

three months ended December 31, 2017. Zinc realized prices include premiums paid

by customers for delivery of refined zinc metal, but exclude unrealized gains

and losses related to non-hedge derivative contracts that are included in zinc

revenues. For the three months ended December 31, 2017, the unrealized component

of the zinc derivative resulted in a loss of $0.02/lb. For the three months

ended December 31, 2016, the unrealized component of the zinc derivative

resulted in a loss of $0.03/lb.

4 Sales of gold and

silver from our 777 and Constancia mines are subject to our precious metals

stream agreement with Wheaton Precious Metals, pursuant to which we recognize

deferred revenue for precious metals deliveries and also receive cash payments.

Stream sales are included within realized prices and their respective deferred

revenue and cash payment rates can be found on page 26.

24

The following table provides a reconciliation of average realized price per unit sold, by metal, to revenues as shown in the consolidated financial statements:

| Three months ended December 31, 2017 | ||||||||||||||||||

| (in $ millions) 1 | Copper | Zinc | Gold | Silver | Other | Total | ||||||||||||

| Revenue per financial statements | 286.6 | 108.1 | 35.2 | 12.4 | 2.8 | 445.1 | ||||||||||||

| Derivative mark-to-market 2 | - | 1.1 | - | - | - | 1.1 | ||||||||||||

| Revenue, excluding mark-to-market on non-QP hedges | 286.6 | 109.2 | 35.2 | 12.4 | 2.8 | 446.2 | ||||||||||||

| Payable metal in concentrate sold 3 | 41,479 | 32,318 | 31,221 | 835,486 | - | - | ||||||||||||

| Realized price 4 | 6,909 | 3,381 | 1,129 | 14.89 | - | - | ||||||||||||

| Realized price 5 | 3.13 | 1.53 | - | - | - | - | ||||||||||||

| Year ended December 31, 2017 | ||||||||||||||||||

| (in $ millions) 1 | Copper | Zinc | Gold | Silver | Other | Total | ||||||||||||

| Revenue per financial statements | 925.1 | 352.9 | 130.8 | 45.8 | 14.1 | 1,468.7 | ||||||||||||

| Derivative mark-to-market 2 | - | 0.9 | - | - | - | 0.9 | ||||||||||||

| Revenue, excluding mark-to-market on non-QP hedges | 925.1 | 353.8 | 130.8 | 45.8 | 14.1 | 1,469.6 | ||||||||||||

| Payable metal in concentrate sold 3 | 148,655 | 116,377 | 109,770 | 3,060,269 | - | - | ||||||||||||

| Realized price 4 | 6,223 | 3,041 | 1,192 | 14.96 | - | - | ||||||||||||

| Realized price 5 | 2.82 | 1.38 | - | - | - | - | ||||||||||||

| Three months ended December 31, 2016 | ||||||||||||||||||

| (in $ millions) 1 | Copper | Zinc | Gold | Silver | Other | Total | ||||||||||||

| Revenue per financial statements | 230.7 | 71.6 | 28.8 | 14.3 | 0.7 | 346.1 | ||||||||||||

| Derivative mark-to-market 2 | - | 1.8 | - | - | - | 1.8 | ||||||||||||

| Revenue, excluding mark-to-market on non-QP hedges | 230.7 | 73.4 | 28.8 | 14.3 | 0.7 | 347.9 | ||||||||||||

| Payable metal in concentrate sold 3 | 44,192 | 28,094 | 25,341 | 911,325 | - | - | ||||||||||||

| Realized price 4 | 5,221 | 2,614 | 1,136 | 15.72 | - | - | ||||||||||||

| Realized price 5 | 2.37 | 1.19 | - | - | - | - | ||||||||||||

| Year ended December 31, 2016 | ||||||||||||||||||

| (in $ millions) 1 | Copper | Zinc | Gold | Silver | Other | Total | ||||||||||||

| Revenue per financial statements | 835.5 | 237.0 | 119.8 | 52.1 | 2.7 | 1,247.1 | ||||||||||||

| Derivative mark-to-market 2 | - | (6.0 | ) | - | - | - | (6.0 | ) | ||||||||||

| Revenue, excluding mark-to-market on non-QP hedges | 835.5 | 231.0 | 119.8 | 52.1 | 2.7 | 1,241.1 | ||||||||||||

| Payable metal in concentrate sold 3 | 171,451 | 103,453 | 95,527 | 3,181,759 | - | - | ||||||||||||

| Realized price 4 | 4,872 | 2,233 | 1,254 | 16.38 | - | - | ||||||||||||

| Realized price 5 | 2.21 | 1.01 | - | - | - | - | ||||||||||||

| 1 |

Average realized price per unit sold may not calculate based on amounts presented in this table due to rounding. |

| 2 |

Derivative mark-to-market excludes mark-to-market on QP hedges. |

| 3 |

Copper and zinc shown in tonnes and gold and silver shown in ounces. |

| 4 |

Realized price for copper and zinc in $/metric tonne and realized price for gold and silver in $/oz. |

| 5 |

Realized price for copper and zinc in $/lb. |

The price, quantity and mix of metals sold, affect our revenue, operating cash flow and profit. Revenue from metals sales can vary from quarter to quarter due to production levels, shipping volumes and transfer of risk and title to customers.

25

Metals Prices

For details on market metal prices refer to the discussion on “Commodity Markets” section beginning on page 20 of this MD&A.

Stream Sales

The following table shows stream sales included within realized prices and their respective deferred revenue and cash payment rates:

| Three months ended | Year ended | ||||||||||||

| Dec. 31, 2017 | Dec. 31, 2017 | ||||||||||||

| Manitoba | Peru | Manitoba | Peru | ||||||||||

| Gold1 | oz | 6,568 | 2,212 | 24,479 | 8,842 | ||||||||

| Silver1 | oz | 124,484 | 539,135 | 526,648 | 1,924,220 | ||||||||

| Gold deferred revenue drawdown rate2 | $ /oz | 1,079 | 431 | 1,097 | 431 | ||||||||

| Gold cash rate 3 | $ /oz | 412 | 400 | 410 | 400 | ||||||||

| Silver deferred revenue drawdown rate2 | $ /oz | 16.04 | 7.45 | 16.66 | 7.41 | ||||||||

| Silver cash rate 3 | $ /oz | 6.08 | 5.90 | 6.05 | 5.90 | ||||||||

| Three months ended | Year ended | ||||||||||||

| Dec. 31, 2016 | Dec. 31, 2016 | ||||||||||||

| Manitoba | Peru | Manitoba | Peru | ||||||||||

| Gold | oz | 6,314 | 3,343 | 32,051 | 15,280 | ||||||||

| Silver | oz | 83,838 | 701,654 | 395,724 | 2,423,165 | ||||||||

| Gold deferred revenue drawdown rate1 | $ /oz | 977 | 432 | 1,049 | 435 | ||||||||

| Gold cash rate 2 | $ /oz | 408 | 400 | 405 | 400 | ||||||||

| Silver deferred revenue drawdown rate1 | $ /oz | 17.89 | 7.40 | 19.14 | 7.39 | ||||||||

| Silver cash rate 2 | $ /oz | 6.02 | 5.90 | 5.98 | 5.90 | ||||||||

| 1 |

Included in both three months ended and year ended December 31, 2017 amounts above, is 3,611 oz of gold and 46,205 oz of silver that did not result in a drawdown of deferred revenue. |

| 2 |

Deferred revenue amortization is recorded in Manitoba at C$1,368/oz and C$20.33/oz for gold and silver, respectively, (January 1, 2017 to June 30, 2017 - C$1,464/oz and C$22.60/oz; 2016 - C$1,382/oz and C$25.23/oz) and converted to US dollars at the exchange rate in effect at the time of revenue recognition. |

| 3 |

The gold and silver cash rate for Manitoba increased by 1% from $400/oz and $5.90/oz effective August 1, 2015. Subsequently every year, on August 1, the cash rate will increase by 1% compounded. The weighted average cash rate is disclosed. |

26

Cost of Sales

Our detailed cost of sales is summarized as follows:

| Three months ended | Year ended | |||||||||||

| Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | |||||||||

| (in $ thousands) | 2017 | 2016 | 2017 | 2016 | ||||||||

| Peru | ||||||||||||

| Mine | 21,334 | 12,261 | 61,459 | 55,570 | ||||||||

| Concentrator | 39,703 | 32,253 | 138,502 | 118,721 | ||||||||

| Changes in product inventory | 4,725 | 8,538 | (2,960 | ) | 13,544 | |||||||

| Depreciation and amortization | 51,455 | 48,847 | 174,110 | 178,099 | ||||||||

| G&A | 17,528 | 12,957 | 56,205 | 44,401 | ||||||||

| Freight, royalties and other charges | 13,764 | 13,038 | 49,659 | 56,897 | ||||||||

| Total Peru cost of sales | 148,509 | 127,894 | 476,975 | 467,232 | ||||||||

| Manitoba | ||||||||||||

| Mines | 41,794 | 29,193 | 151,994 | 116,973 | ||||||||

| Concentrators | 12,666 | 11,767 | 48,947 | 43,885 | ||||||||

| Zinc plant | 18,458 | 17,113 | 67,966 | 65,587 | ||||||||

| Purchased ore and concentrate (before inventory changes) | 6,156 | 4,501 | 21,881 | 16,705 | ||||||||

| Changes in product inventory | (7,918 | ) | (4,894 | ) | (9,919 | ) | (3,027 | ) | ||||

| Depreciation and amortization | 23,842 | 29,345 | 118,770 | 120,531 | ||||||||

| G&A | 23,267 | 13,291 | 63,645 | 39,970 | ||||||||

| Freight, royalties and other charges | 11,517 | 10,239 | 48,349 | 37,944 | ||||||||

| Total Manitoba cost of sales | 129,782 | 110,555 | 511,633 | 438,568 | ||||||||

| Cost of sales | 278,291 | 238,449 | 988,608 | 905,800 | ||||||||

Total cost of sales for the fourth quarter of 2017 was $278.3 million, reflecting an increase of $39.8 million from the fourth quarter of 2016. Cost of sales related to Peru was $20.6 million higher compared to the fourth quarter of 2016 as a result of higher mining, depreciation and G&A costs. In Manitoba, cost of sales increased by $19.2 million compared to the fourth quarter of 2016 as a result of higher mining and G&A costs. Manitoba G&A costs increased mainly due to a past service pension charge of $10.4 million as a result of the new three year collective bargaining agreements that were reached.

Cost of sales year-to-date in 2017 was $988.6 million, an increase of $82.8 million compared to 2016. The increase is mostly attributable to Manitoba which had higher year-to-date costs of $75.8 million compared to the same period last year due to higher mining costs for the reasons outlined in the Manitoba Operations Review Section, the past service pension charge outlined above, increased profit sharing costs, and additional costs due to utilization of temporary crushing facilities at the Stall mill primarily during the first quarter.

For details on unit operating costs refer to the respective tables in the “Operations Review” section beginning on page 9 of this MD&A.

For the fourth quarter of 2017, other significant variances in expenses, compared to the same period in 2016, include the following:

27

| − |

Selling and administrative expenses increased by $1.6 million, which was mainly the result of increased share based compensation expenses resulting from the revaluation of previously issued share units to higher share prices during the current quarter compared to the same period last year. |

| − |

Exploration and evaluation expenses increased by $3.9 million mainly as a result of increased surveying activities at the Manitoba business unit. |

| − |

Other operating income was higher by $9.3 million mainly as a result of a $6.4 million gain associated with contingent consideration from the Balmat sale as a result of a project milestone being achieved by the buyer. |

| − |

Asset Impairment of $11.3 million is the result of revaluing certain processing equipment that was previously purchased to build a new concentrator in Snow Lake, Manitoba to expected disposition proceeds. We no longer expect these assets to be usable in our operations. |

| − |

Finance expenses decreased by $54.9 million mainly as a result of a $47.7 million call premium paid to facilitate the early redemption of our $920 million of Redeemed Notes in 2016. In addition, interest costs have been lower in 2017 due to overall debt reduction during the year, lower interest rate resulting from the refinancing in 2016 as well as lower borrowings on our revolving credit facilities and improved terms following the amendments to our Credit Facilities in July 2017. |

| − |

Other finance expenses decreased by $6.5 million primarily as a result of: |

| − |

Fair value adjustments pertaining to the embedded derivative on the senior unsecured notes, our gold option liability related to the acquisition of the New Britannia mine and mill (“NBM Mill”) and an embedded derivative pertaining to purchase contracts resulted in a loss of $0.4 million in the fourth quarter of 2017 compared to loss of $5.4 million in the fourth quarter of 2016; | |

| − |

Mark-to-market losses on warrants of $0.7 million compared to a loss of $4.1 million in the same period last year; | |

| − |

Disposals, impairment and mark-to-market adjustments on held for trading and available-for-sale investments resulted in a net loss of $0.2 million during the current period of 2017 compared to a loss of $0.8 million during the same period last year, | |

| − |

Foreign exchange losses of $1.3 million in the fourth quarter of 2017 compared to gains of $1.2 million in the fourth quarter of 2016. |

For the full year, other significant variances in expenses in 2017, compared to 2016 include the following:

| − |

Selling and administrative expenses increased by $4.5 million, which was mainly the result of increased share based compensation expenses resulting from the revaluation of previously issued share units to higher share prices during the current year compared to last year. |

| − |

Exploration and evaluation expenses increased by $10.7 million as a result of higher exploration spending in Manitoba as well as spending pursuant to an option agreement on properties in British Columbia. |

| − |