ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED

OCTOBER 31, 2011

Suite 2300 – 1177 West Hastings Street

Vancouver, British

Columbia

V6E 2K3

January 26, 2012

ITEM 2 - TABLE OF CONTENTS

i

TABLE OF CONTENTS

(continued)

| Page | ||

| ITEM 15: | NAMES AND INTERESTS OF EXPERTS | 63 |

| Names and Interests of Experts | 63 | |

| ITEM 16: | ADDITIONAL INFORMATION | 64 |

| Audit Committee Information | 64 | |

| Additional Information | 64 | |

| SCHEDULE “A” – AUDIT COMMITTEE INFORMATION | ||

ii

PRELIMINARY NOTES

Documents Incorporated by Reference

Incorporated by reference into this Annual Information Form (“AIF”) are the following documents:

| (a) |

Consolidated Audited Financial Statements of the Company for the year ended October 31, 2011; | |

| (b) |

Management Discussion and Analysis of the Company for the year ended October 31, 2011 dated January 26, 2012 (“MD&A”); | |

| (c) |

Management Information Circular dated August 11, 2011 in respect of the 2011 Annual General Meeting (“Information Circular”); | |

| (d) |

Technical report dated December 6, 2011 entitled “Technical Report, Carbon Creek Coal Property, British Columbia, Canada” prepared by Norwest Corporation (the “Carbon Creek Report”); | |

| (e) |

Technical report dated January 18, 2012 entitled “Technical Report, Sheini Hills Iron Project, Ghana, Africa” prepared by Keith J. Henderson, EurGeol (the “Sheini Report”); | |

| (f) |

Technical report dated January 27, 2012, effective January 19, 2012, entitled “Technical Report on the Longnose Ilmenite Project, Minnesota, USA” prepared by SRK Consulting (Canada) Inc. (the “Longnose Report”); and | |

| (g) |

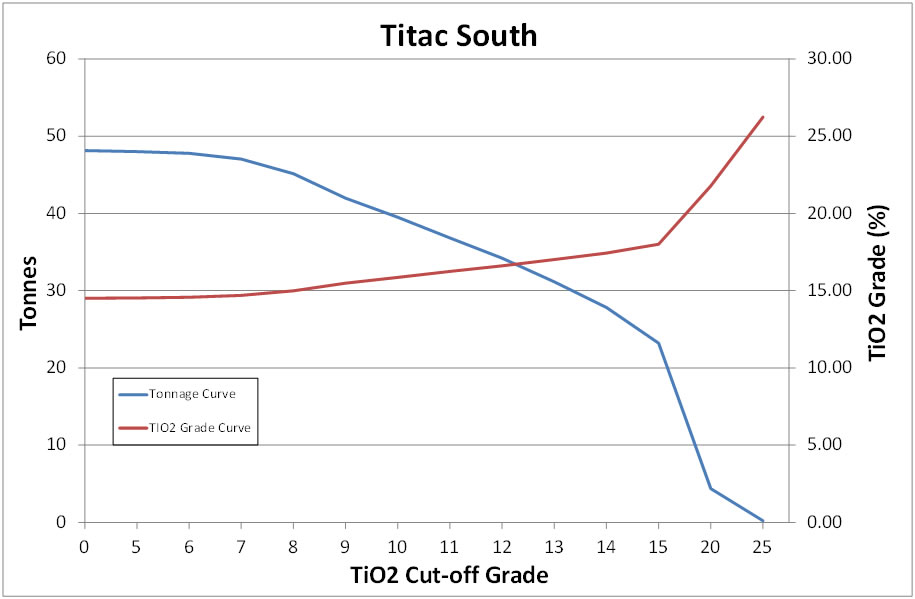

Technical report dated January 27, 2012, effective January 19, 2012, entitled “Technical Report on the Titac Ilmenite Exploration Project, Minnesota, USA” prepared by SRK Consulting (Canada) Inc. (the “Titac Report”); |

copies of which may be obtained online from SEDAR at www.sedar.com.

All financial information in this AIF is prepared in accordance with generally accepted accounting principles in Canada.

Date of Information

All information in this AIF is as of October 31, 2011 unless otherwise indicated.

Currency and Exchange Rates

All dollar amounts in this AIF are expressed in Canadian dollars unless otherwise indicated. The Company’s accounts are maintained in Canadian dollars and the Company’s financial statements are prepared in accordance with generally accepted accounting principles in Canada. All references to “U.S. dollars”, “USD” or to “US$” are to U.S. dollars, to “MXP” are to Mexican pesos, to “ARS” are to Argentinean pesos and to “PEN” are to Peruvian nuevo soles.

The following table sets forth the rate of exchange for the Canadian dollar, expressed in United States dollars in effect at the end of the periods indicated, the average of exchange rates in effect on the last day of each month during such periods, and the high and low exchange rates during such periods based on the noon rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars.

- 4 -

| Year Ended October 31 | |||

| Canadian Dollars to U.S. Dollars | 2011 | 2010 | 2009 |

| Rate at end of period | USD 1.0065 | USD 0.9784 | USD 0.9282 |

| Average rate for period | USD 1.0139 | USD 0.9636 | USD 0.8552 |

| High for period | USD 1.0583 | USD 1.0039 | USD 0.9716 |

| Low for period | USD 0.9430 | USD 0.9278 | USD 0.7692 |

Metric Equivalents

For ease of reference, the following factors for converting Imperial measurements into metric equivalents are provided:

| To convert from Imperial | To metric | Multiply by |

| Acres | Hectares | 0.404686 |

| Feet | Metres | 0.30480 |

| Miles | Kilometres | 1.609344 |

| Tons | Tonnes | 0.907185 |

| Ounces (troy)/ton | Grams/Tonne | 34.2857 |

| 1 mile = 1.609 kilometres | 2000 pounds (1 short ton) = 0.907 tonnes |

| 1 acre = 0.405 hectares | 1 ounce (troy) = 31.103 grams |

| 2,204.62 pounds = 1 metric ton = 1 tonne | 1 ounce (troy)/ton = 34.2857 grams/tonne |

Terms used and not defined in this AIF that are defined in National Instrument 51-102 “Continuous Disclosure Obligations” shall bear that definition. Other definitions are set out in National Instrument 14-101 “Definitions”.

Forward-Looking Statements

This AIF contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”) within the meaning of applicable Canadian and US securities legislation. These statements relate to future events or the future activities or performance of the Company. All statements, other than statements of historical fact, are forward-looking statements. Information concerning mineral resource estimates also may be deemed to be forward-looking statements in that it reflects a prediction of the mineralization that would be encountered if a mineral deposit were developed and mined. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, plans and similar expressions, or which by their nature refer to future events. These forward-looking statements include, but are not limited to, statements concerning:

-

the Company’s strategies and objectives, both generally and specifically in respect of the Carbon Creek property, the Sheini iron ore properties, and the Minnesota Iron/Titanium properties;

-

the ability of the Company to convert portions of the existing resource at the Carbon Creek property into the Measured & Indicated categories;

-

the ability of the Company to increase the global resource at the Carbon Creek property by including additional coal seams in the resource estimation;

- 5 -

-

the timing of decisions regarding the timing and costs of exploration programs with respect to, and the issuance of the necessary permits and authorizations required for, the Company’s ongoing exploration programs on its properties;

-

the Company’s estimates of the quality and quantity of the resources at its mineral properties;

-

the timing and cost of the planned future exploration programs at the Minnesota Iron/Titanium and Carbon Creek properties, and the timing of the receipt of results therefrom;

-

the Company’s future cash requirements;

-

general business and economic conditions;

-

the Company’s ability to meet its financial obligations as they come due, and to be able to raise the necessary funds to continue operations; and

-

the Company’s ability to negotiate acceptable option/joint venture agreements for some or all of its “non-core” properties.

Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Inherent in forward-looking statements are risks and uncertainties beyond the Company’s ability to predict or control, including, but not limited to, risks related to the Company’s inability to identify one or more economic deposits on its properties, variations in the nature, quality and quantity of any mineral deposits that may be located, variations in the market price of any mineral products the Company may produce or plan to produce, the Company’s inability to obtain any necessary permits, consents or authorizations required for its activities, to produce minerals from its properties successfully or profitably, to continue its projected growth, to raise the necessary capital or to be fully able to implement its business strategies, and other risks identified herein under “Risk Factors”. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future performance, and that actual results are likely to differ, and may differ materially, from those expressed or implied by forward-looking statements contained in this AIF. Such statements are based on a number of assumptions which may prove incorrect, including, but not limited to, assumptions about:

-

the level and volatility of the price of commodities, and iron ore, coal, vanadium and titanium in particular;

-

general business and economic conditions;

-

the timing of the receipt of regulatory and governmental approvals, permits and authorizations necessary to implement and carry on the Company’s planned exploration programs, particularly at the Minnesota Iron/Titanium and Carbon Creek property;

-

conditions in the financial markets generally;

-

the Company’s ability to secure the necessary consulting, drilling and related services and supplies on favourable terms in connection with its ongoing and planned exploration programs;

-

the Company’s ability to attract and retain key staff;

-

the accuracy of the Company’s resource estimates (including with respect to size and grade) and the geological, operational and price assumptions on which these are based;

-

the timing of the ability to commence and complete the planned work at the Carbon Creek property;

- 6 -

-

the anticipated terms of the consents, permits and authorizations necessary to carry out the planned exploration programs at the Company’s properties and the Company’s ability to comply with such terms on a safe and cost-effective basis;

-

the ongoing relations of the Company with its underlying optionors/lessors and the applicable regulatory agencies;

-

that the metallurgy and recovery characteristics of samples from certain of the Company’s mineral properties are reflective of the deposit as a whole;

-

the Company’s ability to negotiate and enter into appropriate off-take agreements for the potential products from Carbon Creek; and

-

the Company’s ability to overcome any potential difficulties in adapting pilot scale operations and testing to commercial scale operations.

In addition, in carrying out the resource estimation with respect to the Carbon Creek project, as described under “Narrative Description of the Business - Material Mineral Projects – Carbon Creek Metallurgical Coal Deposit, British Columbia, Canada”, a number of assumptions have been made, which are more particularly described in that section.

These forward-looking statements are made as of the date hereof and the Company does not intend and does not assume any obligation to update these forward-looking statements, except as required by applicable law. For the reasons set forth above, investors should not attribute undue certainty to or place undue reliance on forward-looking statements.

Caution Regarding Adjacent or Similar Mineral Properties

This AIF contains information with respect to adjacent or similar mineral properties in respect of which the Company has no interest or rights to explore or mine. The Company advises US investors that the mining guidelines of the US Securities and Exchange Commission (the “SEC”) set forth in the SEC’s Industry Guide 7 (“SEC Industry Guide 7”) strictly prohibit information of this type in documents filed with the SEC. Because Cardero meets the definition of a “foreign private issuer” under applicable SEC rules and is preparing this AIF pursuant to Canadian disclosure requirements under the Canada-U.S. Multi-Jurisdictional Disclosure System, this AIF is not subject to the requirements of SEC Industry Guide 7. Readers are cautioned that the Company has no interest in or right to acquire any interest in any such properties, and that mineral deposits on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties.

Caution Regarding Reference to Resources and Reserves

National Instrument 43-101 Standards of Disclosure of Mineral Projects (“NI 43-101”) is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all reserve and resource estimates contained in or incorporated by reference in this AIF have been prepared in accordance with NI 43-101 and the guidelines set out in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Standards on Mineral Resource and Mineral Reserves, adopted by the CIM Council on November 14, 2004 (the “CIM Standards”) as they may be amended from time to time by the CIM.

United States investors are cautioned that the requirements and terminology of NI 43-101 and the CIM Standards differ significantly from the requirements and terminology set forth in SEC Industry Guide 7. Accordingly, the Company’s disclosures regarding mineralization may not be comparable to similar information disclosed by companies subject to SEC Industry Guide 7. Without limiting the foregoing, while the terms “mineral resources”, “inferred mineral resources”, “indicated mineral resources” and “measured mineral resources” are recognized and required by NI 43-101 and the CIM Standards, they are not recognized by the SEC and are not permitted to be used in documents filed with the SEC by companies subject to SEC Industry Guide 7. Mineral resources which are not mineral reserves do not have demonstrated economic viability, and US investors are cautioned not to assume that all or any part of a mineral resource will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher resource category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of a feasibility study or prefeasibility study, except in rare cases. The SEC normally only permits issuers to report mineralization that does not constitute SEC Industry Guide 7 compliant “reserves” as in-place tonnage and grade without reference to unit amounts. The term “contained ounces” is not permitted under the rules of SEC Industry Guide 7. In addition, the NI 43-101 and CIM Standards definition of a “reserve” differs from the definition in SEC Industry Guide 7. In SEC Industry Guide 7, a mineral reserve is defined as a part of a mineral deposit which could be economically and legally extracted or produced at the time the mineral reserve determination is made. The SEC has taken the position that mineral reserves for a mineral property may not be designated unless: (i) competent professional engineers conduct a detailed engineering and economic study, and the “bankable” or “final” feasibility study demonstrates that a mineral deposit can be mined profitably at a commercial rate; (ii) a historic three-year average commodity price is used in any reserve or cash flow analysis used to designate reserves; and (iii) the company has demonstrated that the mineral property will receive its governmental permits, and the primary environmental document has been filed with the appropriate governmental authorities. See “Glossary of Terms”.

- 7 -

Caution Regarding Historical Results

Historical results of operations and trends that may be inferred from the discussion and analysis in this AIF may not necessarily indicate future results from operations. In particular, the current state of the global securities markets may cause significant reductions in the price of the Company’s securities and render it difficult or impossible for the Company to raise the funds necessary to continue operations. See “Risk Factors – Share Price Volatility”.

Glossary of Terms

The following is a glossary of certain mining and other terms used in this AIF:

| “aeolian” |

Caused or carried by the wind |

| “Ag” |

Silver |

| “alteration” |

Changes in the chemical or mineralogical composition of a rock, generally produced by weathering or hydrothermal solutions |

| “anomalous” |

Departing from the expected or normal |

| “anomaly” |

A geological feature, especially in the subsurface, distinguished by geological, geophysical or geochemical means, which is different from the general surroundings and is often of potential economic value |

| “As” |

Arsenic |

| “Au” |

Gold |

| “breccia” |

Angular broken rock fragments held together by a mineral cement or a fine- grained matrix |

- 8 -

| “Cardero Argentina” |

Cardero Argentina, S.A., a wholly owned Argentinean subsidiary of Cardero |

|

| |

| “Cardero Chile” |

Compania Minera Cardero Chile Limitada, a wholly owned Chilean subsidiary of Cardero |

|

| |

| “Cardero Coal” |

Cardero Coal Ltd., a wholly owned British Columbia subsidiary of Cardero |

|

| |

| “Cardero Ghana” |

Cardero Ghana Ltd., a wholly owned Ghana subisidary of Cardero Iron Ghana BVI |

|

| |

| “Cardero Hierro BVI” |

Cardero Hierro Peru (BVI) Ltd., a wholly owned British Virgin Islands subsidiary of Cardero Iron BVI |

|

| |

| “Cardero Hierro Peru” |

Cardero Hierro del Peru, S.A.C., a wholly owned Peruvian subsidiary of Cardero Hierro BVI |

|

| |

| “Cardero Iron” |

Cardero Iron Ore Company Ltd., a wholly owned British Columbia subsidiary of Cardero |

|

| |

| “Cardero Iron BVI” |

Cardero Iron Ore Company (BVI) Ltd., a wholly owned British Virgin Islands subsidiary of Cardero Iron |

|

| |

| “Cardero Iron Ghana” |

Cardero Iron Ore Ghana (BVI) Ltd., a wholly owned British Virgin Islands subsidiary of Cardero Iron BVI |

|

| |

| “Cardero Iron USA” |

Cardero Iron Ore (USA) Inc., a wholly owned Delaware subsidiary of Cardero Iron |

|

| |

| “Cardero Management USA” |

Cardero Iron Ore Management (USA) Inc., a wholly owned Delaware subsidiary of Cardero Iron |

|

| |

| “Cardero Peru” |

Cardero Peru, S.A.C., a wholly owned Peruvian subsidiary of Cardero |

|

| |

| “cateo” |

A cateo is an exploration concession, granted under Argentine mining law, which does not permit mining but gives the owner a preferential right to apply for a mining concession (mina) for the some or all of the area of the cateo following a discovery. Cateos are measured in 500 hectare unit areas, and a single cateo cannot exceed 20 units (10,000 hectares) |

|

| |

| “CCDL” |

Cerro Colorado Development Ltd., a wholly owned British Columbia subsidiary of Cardero |

|

| |

| “clastic” |

Pertaining to a rock or sediment composed principally of fragments derived from pre-existing rocks or minerals and transported some distance from their places of origin; also said of the texture of such a rock |

|

| |

| “cm” |

Centimetres |

|

| |

| “Co” |

Cobalt |

- 9 -

| “Common Shares” |

The common shares without par value in the capital stock of Cardero as the same are constituted on the date hereof |

|

| |

| “conglomerate” |

A coarse grained clastic sedimentary rock, composed of rounded to sub-angular fragments larger than 2mm in diameter set in a fine-grained matrix of sand or silt, and commonly cemented by calcium carbonate, iron oxide, silica or hardened clay |

|

| |

| “Cu” |

Copper |

|

| |

| “deposit” |

A mineralized body which has been physically delineated by sufficient drilling, trenching, and/or underground work, and found to contain a sufficient average grade of metal or metals to warrant further exploration and/or development expenditures. Such a deposit does not qualify as a commercially mineable ore body or as containing reserves or ore, unless final legal, technical and economic factors are resolved |

|

| |

| “diamond drill” |

A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of the long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock which is recovered in long cylindrical sections, an inch or more in diameter |

|

| |

| “dike” |

A tabular body of igneous rock that cuts across the structure of adjacent rocks or cuts massive rocks (cf: “Sill”) |

|

| |

| “dip” |

The angle that a stratum or any planar feature makes with the horizontal, measured perpendicular to the strike and in the vertical plane |

|

| |

| “direct reduction” |

In a direct reduction process, lump iron oxide pellets and/or lump iron ore are reduced (oxygen removed) by a reducing gas, producing direct reduced iron (DRI). If the cooling stage is omitted, the DRI can be immediately briquetted into hot briquetted iron (HBI) |

|

| |

| “Director” |

A member of the Board of Directors of Cardero |

|

| |

| “disseminated” |

Fine particles of mineral dispersed throughout the enclosing rock |

|

| |

| “distal” |

Said of an ore deposit formed at a considerable distance (e.g. tens of kilometres) from the volcanic source from which its constituents have been derived |

|

| |

| “DRI” |

Direct reduced iron is a virgin iron source that is relatively uniform in composition, and virtually free from tramp or deleterious elements. It is used increasingly in electric furnace steelmaking to dilute the contaminants present in the scrap used in these processes. It has an associated energy value in the form of combined carbon, which has a tendency to increase furnace efficiency |

|

| |

| “dune” |

A mound, ridge or hill of wind-blown sand, either bare or covered with vegetation |

- 10 -

| “epithermal” |

Said of a hydrothermal mineral deposit formed within about 1 kilometre of the earth’s surface and in the temperature range of 50-200° C, occurring mainly as veins |

|

| |

| “executive officer” |

When used in relation to any issuer (including Cardero) means an individual who is: |

| (a) |

a chair, vice chair or president; | |

| (b) |

a vice-president in charge of a principal business unit, division or function, including sales, finance or production; | |

| (c) |

an officer of the issuer or any of its subsidiaries that performs a policy-making function in respect of the issuer; or | |

| (d) |

performing a policy-making function in respect of the issuer |

| “exsolved” |

Said of a substance that has undergone “exsolution”, being the process of the separation of an initially homogenous solution into at least two different crystalline minerals without the addition or removal of any materials – usually occurs upon cooling |

| “Fe” |

Iron |

| “felsic” |

An igneous rock having abundant light coloured minerals, also, applied to those minerals (quartz, feldspars, feldspathoids, muscovite) as a group |

| “footwall” |

The mass of rock beneath a fault, orebody or mine working; especially the wall rock beneath an inclined vein or fault |

| “gangue” |

The valueless rock or mineral aggregates in an ore; that part of the ore that is not economically desirable but cannot be avoided in mining. It is separated from the ore minerals during concentration |

| “gneiss” |

A foliated rock formed by regional metamorphism, in which bands or lenticles of granular minerals alternate with bands or lenticles of minerals with flaky or elongate prismatic habit. Mineral composition is not an essential factor in its definition |

| “g/t” |

Grams per metric tonne |

| “grab sample” |

A sample composed of one or more pieces of rock, collected from a mineralized zone that, when analyzed, do not represent a particular width of mineralization nor necessarily the true mineral concentration of any larger portion of a mineralized zone |

| “grade” |

To contain a particular quantity of ore or mineral, relative to other constituents, in a specified quantity of rock |

| “hematite” |

A common iron mineral found in igneous, sedimentary and metamorphic rocks – a principal ore of iron |

- 11 -

| “hydrothermal” |

A term pertaining to hot aqueous solutions of magmatic origin which may transport metals and minerals in solution |

|

| |

| “hypabyssal” |

A general adjective applied to minor intrusions such as sills and dikes, and to the rocks that compose them, which have crystallized under conditions intermediate between plutonic and extrusive |

|

| |

| “ilmenite” |

An iron black opaque rhombohedral mineral (FeTiO3 ) – the principal ore of titanium |

|

| |

| “intrusion” |

The process of the emplacement of magma in pre-existing rock, magmatic activity. Also, the igneous rock mass so formed |

|

| |

| “intrusive” |

Of or pertaining to intrusion, both the process and the rock so formed |

|

| |

| “IOCG” |

iron oxide copper-gold |

|

| |

| “Iron Sands Project” |

The Pampa el Toro iron sands project in Peru |

|

| |

| “km” |

Kilometres |

|

| |

| “lens” |

A body of ore or rock that is thick in the middle and thin at the edges, like a doubly convex lens (adj: “lenticular”) |

|

| |

| “m” |

Metres |

|

| |

| “mm” |

Millimetres |

|

| |

| “mafic” |

Said of an igneous rock composed chiefly of dark, ferromagnesian minerals, also, said of those minerals |

|

| |

| “magmatic” |

Of, or pertaining to, or derived from, magma |

|

| |

| “magnetic separation” |

A process in which a magnetically susceptible mineral is separated from gangue minerals by applying a strong magnetic field; ores of iron are commonly treated in this way. It can be either “dry”(the matter to undergo separation does not have any added fluids, such as water) or “wet” (the matter to undergo separation has a fluid, such as water, added prior to undergoing separation) |

|

| |

| “magnetite” |

A black, isometric, strongly magnetic, opaque mineral of the spinel group which constitutes an important ore of iron and is a very common and widely distributed accessory mineral in rock of all kinds |

|

| |

| “massive” |

Said of a mineral deposit, especially of sulphides, characterized by a great concentration of ore in one place, as opposed to a disseminated or veinlike deposit |

|

| |

| “metallogeny” |

The study of the genesis of mineral deposits, with emphasis on their relationship in space and time to regional petrographic and tectonic features of the earth’s crust |

- 12 -

| “metasomatism” |

The process of practically simultaneous capillary solution and deposition by which a new mineral may grow in the body of an old mineral or mineral aggregate (syn: “replacement”) |

|

| |

| “migmatites” |

A rock composed of igneous or of igneous appearing and/or metamorphic materials, which are generally distinguishable megascopically |

|

| |

| “mina” |

A mina is a mining concession, granted under Argentine mining law, which permits mining within the area of the concession on a commercial basis. The area of a mina is measured in “pertenencias”. A mina may be applied for following a formal declaration of a discovery within the area of the mina. Each mina may consist of two or more pertenencias. “Common pertenencias” are six hectares and “disseminated pertenencias” are 100 hectares (relating to disseminated deposits of metals rather than discrete veins). The applicable mining authority may determine the number of pertenencias required to cover the geologic extent of the mineral deposit in question. Once granted, minas have an indefinite term assuming exploration development or mining is in progress |

|

| |

| “mineral reserve” |

The economically mineable part of a measured or indicated mineral resource demonstrated by at least a preliminary feasibility study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A mineral reserve includes diluting materials and allowances for losses that may occur when the material is mined and processed |

|

| |

| “mineral resource” |

A concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a mineral resource are known, estimated or interpreted from specific geological evidence and knowledge. The term “mineral resource” covers mineralization and natural material of intrinsic economic interest which has been identified and estimated through exploration and sampling and within which mineral reserves may subsequently be defined by the consideration and application of technical, economic, legal, environmental, socio-economic and governmental factors. The phrase “reasonable prospects for economic extraction” implies a judgement by a qualified person (as that term is defined in NI 43-101) in respect of the technical and economic factors likely to influence the prospect of economic extraction. A mineral resource is an inventory of mineralization that, under realistically assumed and justifiable technical and economic conditions, might become economically extractable |

|

| |

| “mineralization” |

The concentration of metals and their chemical compounds within a body of rock |

|

| |

| “MMC” |

Minerales Y Metales California, S.A. de C.V., a wholly owned Mexican subsidiary of Cardero |

- 13 -

| “National Instrument

43-101”/ “NI 43-101” |

National Instrument 43-101 of the Canadian Securities Administrators entitled “Standards of Disclosure for Mineral Projects” |

|

| |

| “NSR” |

Net smelter return |

|

| |

| “NYSE-A” |

NYSE - Amex LLC |

|

| |

| “open pit” |

A surface mine, open to daylight, such as a quarry. Also referred to as open-cut or open-cast mine |

|

| |

| “pelite” |

A mudstone or lutite |

|

| |

| “pelitic” |

Pertaining to or derived from pelite; esp. said of a sedimentary rock composed of a clay or a metamorphic rock derived from a pelite |

|

| |

| “pig iron” |

Semi-finished metal produced from iron ore in blast furnace, containing 92 percent iron, high amounts of carbon (typically up to 3.5 percent), and balance largely manganese and silicone plus small amounts of phosphorus, sulphur, and other impurities. Pig iron is further refined in a furnace for conversion into steel. The term was derived from the 19th century method of casting the bars of the pig iron in depressions or moulds formed in the sand floor adjacent to the furnace. These were connected to a runner (known as a sow) and when filled with metal the runner and the numerous smaller moulds were supposed to resemble a litter of suckling pigs, hence the term pig iron |

|

| |

| “porphyry” |

An igneous rock of any composition that contains conspicuous phenocrysts (relatively large crystals) in a fine-grained groundmass |

|

| |

| “PPB” or “ppb” |

Parts per billion |

|

| |

| “PPM or “ppm” |

Parts per million |

|

| |

| “pseudomorph” |

A mineral whose outward crystal form is that of another mineral; it is described as being” after” the mineral whose outward form it has. Adj: “pseudomorphous” |

|

| |

| “SHV” |

Sediment Hosted Vein, a reference to a family of gold deposits that consist of gold in quartz veins hosted by shale and siltstone sedimentary rocks |

|

| |

| “sill” |

A tabular igneous intrusion that parallels the planar structure of the surrounding rock (cf: dike) |

|

| |

| “slag” |

A product of smelting, containing, mostly as silicates, the substances not sought to be produced as matte or metal, and having a lower specific gravity than the latter; - called also, esp. in iron smelting, cinder. The slag of iron blast furnaces is essentially silicate of calcium, magnesium, and aluminum; that of lead and copper smelting furnaces contains iron |

|

| |

| “strike” |

The direction taken by a structural surface |

- 14 -

| “sulfide” |

A mineral compound characterized by the linkage of sulphur with a metal, such as galena (lead sulphide) or pyrite (iron sulphide) |

|

| |

| “TiO2 ” |

Titanium dioxide, also known as “titanium oxide” or “titania”, a naturally occurring oxide of titanium |

|

| |

| “tailings” |

The material that remains after all metals considered economic have been removed from ore during milling |

|

| |

| “TSE” |

Toronto Stock Exchange |

|

| |

| “V2 O5 ” |

Vanadium pentoxide, an important compound of vanadium, used primarily for the production of sulphuric acid and ferrovanadium |

- 15 -

ITEM 3: CORPORATE STRUCTURE

Name, Address and Incorporation

Cardero Resource Corp. (“Cardero”) was incorporated under the Company Act (British Columbia) on December 31, 1985 under the name “Halley Resources Ltd.”. The name was subsequently changed to “Rugby Resources Limited” on September 6, 1991, to “Euro-Ad Systems Inc.” on April 30, 1993, to “Sun Devil Gold Corp.” on July 3, 1997, and to “Cardero Resource Corp.” on May 18, 1999. Cardero was transitioned under the Business Corporations Act (British Columbia) (“BCBCA”) on January 13, 2005, and is now governed by that statute. On April 22, 2005, Cardero filed a new Notice of Articles, reflecting the adoption by the shareholders, on April 15, 2005, of a new form of Articles to govern the affairs of the Company in substitution for the original articles adopted under the old Company Act (B.C.) and reflecting the increased flexibility available to companies under the BCBCA. A copy of the new Articles is available on SEDAR at www.sedar.com.

The head office and principal business address of Cardero is located at Suite 2300 – 1177 West Hastings Street, Vancouver, British Columbia, Canada V6E 2K3, and its registered and records office is located at 550 Burrard Street, Suite 2300, P.O. Box 30, Bentall 5, Vancouver, British Columbia, Canada V6C 2B5.

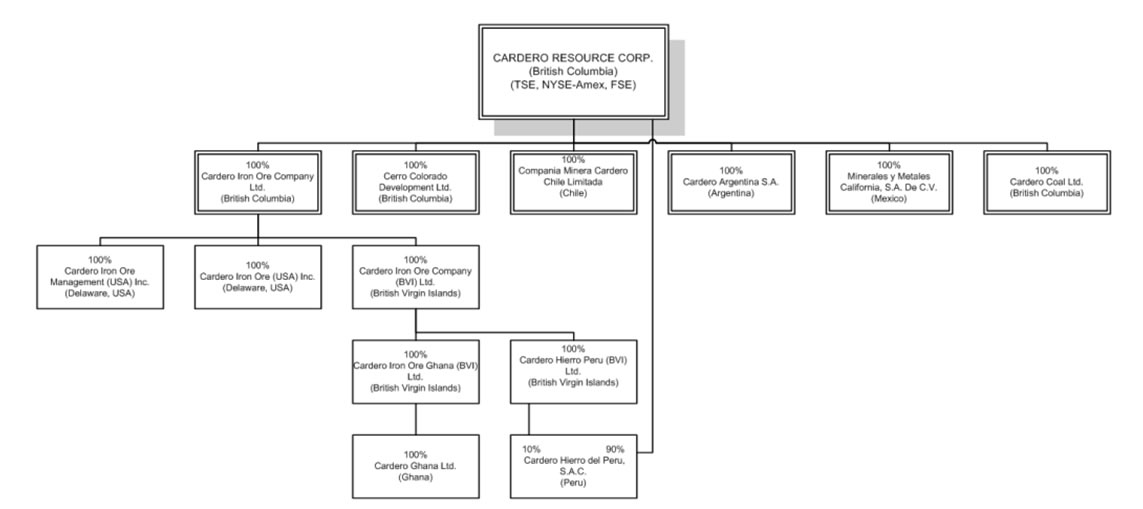

Intercorporate Relationships

The following corporate chart sets forth all of Cardero’s subsidiaries and their respective jurisdictions of incorporation. Each of these subsidiaries is wholly owned, directly or indirectly, by Cardero:

Throughout this document references made to the “Company” refer to Cardero and its consolidated subsidiaries, Cardero Coal, Cardero Iron, Cardero Argentina, Cardero Peru, Cardero Chile, CCDL, MMC, Cardero Iron USA, Cardero Management USA, Cardero Iron BVI, Cardero Hierro BVI, Cardero Hierro Peru, Cardero Iron Ghana and Cardero Ghana, while reference to “Cardero” refer to the Canadian parent company only.

- 16 -

ITEM 4: GENERAL DEVELOPMENT OF THE BUSINESS

Three Year History

The Company is a mineral exploration company engaged in the acquisition, exploration and development of mineral properties. The Company currently holds or has the right to acquire interests in a number of mineral properties in Argentina, Mexico, Peru, the United States of America, Ghana and Canada. The Company is in the exploration stage as its properties have not yet reached commercial production and none of its properties is beyond the preliminary exploration stage. All work presently planned by the Company is directed at defining mineralization and increasing understanding of the characteristics of, and economics of, that mineralization. There are currently no identified mineral reserves and, other than on the Carbon Creek property and the Longnose and Titac properties, there are currently no identified mineral resources, on any of the Company’s mineral properties.

Over the past three financial years, the Company has focused on the acquisition and exploration of mineral properties primarily in Argentina, Mexico, Peru, the United States and, more recently, Ghana and Canada. During the 2009, 2010 and 2011 financial years, the Company entered into a number of option agreements to acquire properties in these countries that it believes have the potential to host large gold, silver, copper-gold, iron ore/titanium/vanadium and/or coal deposits. Some of these, such as the Huachi, Cerro Juncal, Cerro Atajo, La Poma and Mina Azules properties in Argentina, the La Zorra and Ludivina properties in Mexico, the Amable Maria and Bocana properties in Peru, the Pedernales property in Chile and the properties acquired as part of its SHV Project in Argentina, have since been returned to the respective vendors or abandoned, and the associated costs written off, in light of disappointing exploration results. In this regard, during the 2010 fiscal year, the Company wrote off $8,498,083 in acquisition and exploration costs due to disappointing exploration results; during the 2011 fiscal year the Company wrote off $12,206,614 in acquisition and exploration costs. However, the Company has retained the most strategic concessions and continues to look for a joint venture partner to carry out additional exploration. The Organullo property in Argentina was the subject of an extensive work program in the fall of 2010, and in September 2011, the Company entered into an option/joint venture agreement with Artha Resources Corporation (“Artha”), whereby an Argentinean subsidiary of Artha can earn a 55% working interest in the Organullo property, and thereafter form a joint venture with Cardero Argentina S.A. The Company continued active discussions towards a joint venture or outright sale of the Iron Sands Project with a number of companies which continued to express an interest in this project. The Titac and Longnose properties in Minnesota were the subject of an initial drill program in 2010 and the Company completed follow-up work programs in 2011. Final drill results were received on these properties (see “Narrative Description of the Business - Material Mineral Projects - Longnose Titanium Project, Minnesota, USA” and “Titac Titanium Project, Minnesota, USA”).

During fiscal 2010, the Company optioned out its Corrales and Santa Teresa properties in Mexico and its Pirquitas property in Argentina, and will continue to seek joint venture partners for its Los Manantiales (Mina Angela) property in Argentina.

Pursuant to a Memorandum of Understanding dated August 8, 2008 (but effective as and from April 25, 2008) between the Company and International Minerals and Mines Ltd., a private Gibraltar company (“IMM”), the Company had the right to acquire up to a 30% interest in IMM Gold Limited (“IMMG”), a subsidiary of IMM which is engaged in reconnaissance exploration programs in the Caucasian Region. The Company is the manager of the exploration programs on behalf of IMMG. A director of Cardero is a director and significant shareholder of a private company which is the major shareholder (67%) of IMM. The Company acquired an initial 15% interest in IMMG by issuing to IMM an initial 500,000 Common Shares in November 2008, at which time the Company received 123,530 ordinary shares of IMMG, representing a 15% interest. While prospective areas were identified, no properties had been acquired by IMMG. Accordingly the Company determined not to acquire the additional 15% interest in IMMG before December 31, 2009. However, the Company has continued to work with IMMG in reviewing potential acquisitions.

- 17 -

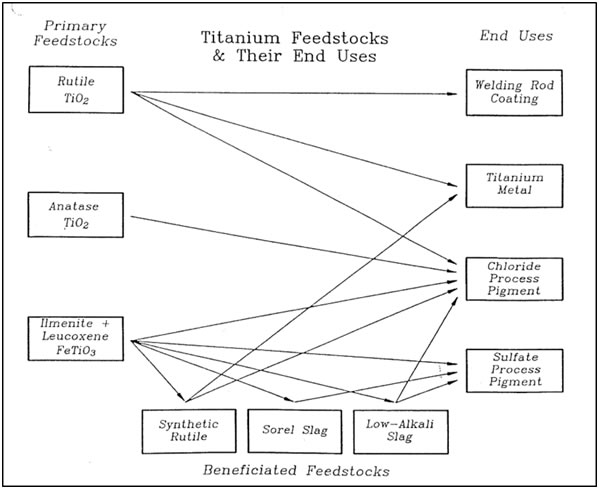

Having identified iron ore as a commodity for which there was a significant demand, the Company has, on an ongoing basis, continued to evaluate a number of prospective iron ore properties, some of which have been acquired. The Pampa de Pongo Iron property (which sold for USD 100 million in January, 2010) and the Iron Sands Project, both in Peru, are examples of this. The Company has also focused on iron ore properties that contain significant titanium and vanadium, both of which are important industrial metals, and is pursuing ongoing metallurgical testwork to determine the optimum way to separate out the titanium and/or vanadium from the slag produced by treating the iron ore in a melter to produce titanium/vanadium rich slag.

The primary focus of the Company’s activities in fiscal 2008 and 2009 was the completion of a preliminary economic assessment at the Iron Sands Project in Peru, as well as ongoing metallurgical work relevant to the production of iron ore and pig iron from Pampa de Pongo material. Due to the significant costs associated with moving the project forward to commercial production, management determined that the sale of the Pampa de Pongo project was appropriate and, to this end, on October 24, 2008, the Company entered into an agreement with Nanjinzhao Group Co., Ltd., (“Nanjinzhao”), a private Chinese enterprise located in Zibo City, Shandong Province, People’s Republic of China, for the sale of the property. The sale was ultimately completed in January, 2010 and the total sale price of USD 100 million was received by the Company. The Company paid a finder’s fee to an arm’s length private company in consideration of the finder introducing Cardero to Nanjinzhao and providing ongoing advice in the negotiations.

During fiscal 2008 and fiscal 2009, the Company also carried out a pilot plant separation test at the Iron Sands Project, with a view to producing an iron concentrate and carrying out metallurgical testing of such concentrate, allowing for the Company to optimize the separation parameters and determine potential production parameters. The Company successfully produced a 40 tonne magnetic concentrate, significantly increased the pilot plant through-put (from 2.8 to 18 tonnes/hour) and increased the anticipated magnetic concentrate grade (to 55.5% iron). The concentrate was shipped to the United States, where extensive commercial scale melting tests, targeting the production of a premium-quality pig iron were carried out. In addition, bench scale testing of the concentrate indicates that a simple screening process resulted in an upgrade to 62.8% iron, and additional work is underway, targeting an increase to 64% iron through additional screening and other mineral separation techniques. The Company commissioned SRK Consulting (Johannesburg) to prepare a resource estimate for the Iron Sands Project utilizing the information from the 120 existing resource definition drillholes, and the resource estimate was delivered on, and effective as at, July 21, 2009.

In keeping with bulk-commodity focus, in June, 2010, Cardero acquired an initial interest of 49.9% in Coalhunter Mining Corporation (“Coalhunter”). Pursuant to private placements completed on September 27, 2010 and December 21, 2010, Cardero’s interest in Coalhunter increased to 45.5% . On June 1, 2011, Cardero acquired all of the issued and outstanding common shares of Coalhunter and Coalhunter subsequently changed its name to “Cardero Coal Ltd.” (see “Significant Acquisitions”). Upon completion of the acquisition, Michael Hunter was appointed President of Cardero and, subsequent to fiscal 2011, also assumed the position of Chief Executive Officer with Hendrik Van Alphen stepping down as CEO and assuming the position of Managing Director.

During fiscal 2011, Cardero acquired an aggregate of 8,634,007 common shares, representing 16.32%, of Abzu Gold Ltd. ("Abzu"), together with warrants to purchase an additional 3,782,000 common shares of Abzu. Abzu operates as a gold exploration and discovery company in Ghana, West Africa.

Cardero also completed an additional $1,175,000 investment in Kria Resources Ltd. ("Kria") through the exercise of warrants acquired by way of private placement. The investment resulted in Cardero holding an aggregate of 20,875,000 common shares of Kria, representing approximately 19.97% of the issued and outstanding common shares of Kria.

- 18 -

The Company optioned its Organullo Gold Project, Northwest Argentina, to Artha Resources Corporation ("Artha"), whereby Artha can earn an undivided fifty-five (55%) percent working interest in the Organullo Project, and thereafter form a Joint Venture with Cardero Argentina. Joint venturing of the Organullo Project is part of Cardero's strategy to option-out all non-core assets, allowing the Company to focus on development of its coal and iron ore projects.

The 2011 field program was completed at the Carbon Creek Metallurgical Coal deposit ("Carbon Creek") located in the Peace River Coal Field of northeastern British Columbia. Additionally, the Company received a Preliminary Economic Assessment (see “Narrative Description of the Business -Material Mineral Projects – Carbon Creek Metallurgical Coal Deposit, British Columbia, Canada”).

Subsequent to fiscal 2011, Cardero entered into a Letter of Intent ("LOI") with Anglo Pacific Group PLC ("Anglo Pacific") to acquire 100% of Trefi Coal Corporation ("Trefi"), a wholly owned subsidiary of Anglo Pacific which owns the Trefi Metallurgical Coal deposit in the Peace River Coalfield, northeast British Columbia, Canada. The Trefi Metallurgical Coal deposit comprises 15 coal licenses and 3 license application areas, totaling 9,437 hectares, located approximately 30 kilometres southeast of the town of Chetwynd in northeastern BC. The deposit has been explored previously by Gulf Canada (27 drillholes for 6,332 metres) and by Anglo Pacific (5 drillholes for 1,006 metres). The deposit is located within 60 kilometres of the Company's flagship metallurgical coal deposit at Carbon Creek.

Cardero closed its non-brokered private placement (the "Offering") announced on November 2, 2011 and increased on November 7, 2011. A total of 8,029,750 units ("Cardero Units") was sold at a price of CAD 0.95 per Cardero Unit for aggregate gross proceeds of CAD 7,628,262.50. Each Cardero Unit consisted of one Common Share and one-half of one common share purchase warrant (each whole warrant, a "Cardero Warrant"). Each Cardero Warrant is exercisable into one additional Common Share for a period of 12 months from the closing of the Offering at an exercise price of CAD 1.25. If, at any time from 4 months after the closing of the Offering until the expiry of the Cardero Warrants, the daily volume-weighted average trading price of the Common Shares on the TSX exceeds CAD 1.75 for at least 10 consecutive trading days, the Company may, within 30 days, give an expiry acceleration notice to the holders of Cardero Warrants and, if it does so, the Cardero Warrants will, unless exercised, expire on the 30th day after the expiry acceleration notice is given.

Cardero received repayment of the USD 8 million loan originally made to Kria Resources Inc. ("Kria") (now a wholly owned subsidiary of Trevali Mining Corporation ("Trevali")). The Company, Kria and Trevali agreed that the loan, plus interest of USD 645,260, was to be repaid as follows: (i) Kria has paid Cardero USD 5,000,000 in cash; and (ii) the balance of USD 3,645,260 (equivalent to CAD 3,734,569) has been satisfied by Trevali issuing to Cardero 4,149,521 units ("Trevali Units"), with each Trevali Unit being comprised of one common share of Trevali ("Trevali Common Share") and one-half of one transferrable common share purchase warrant (a "Trevali Warrant"), at a deemed price of CAD 0.90 per Trevali Unit. Each whole Trevali Warrant will entitle the holder thereof to purchase one Trevali Common Share ("Trevali Warrant Share") at a price of CAD 1.10 per share until January 16, 2014. The Trevali Common Shares, Trevali Warrants and any Trevali Warrant Shares issued are subject to a hold period in Canada expiring on May 17, 2012.

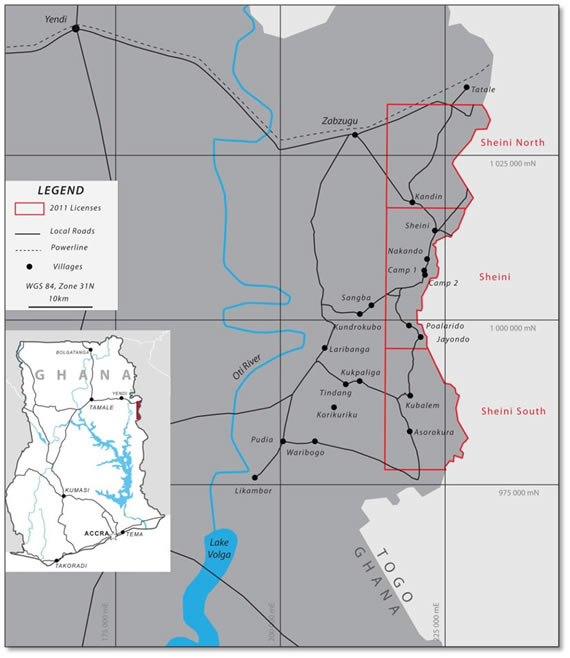

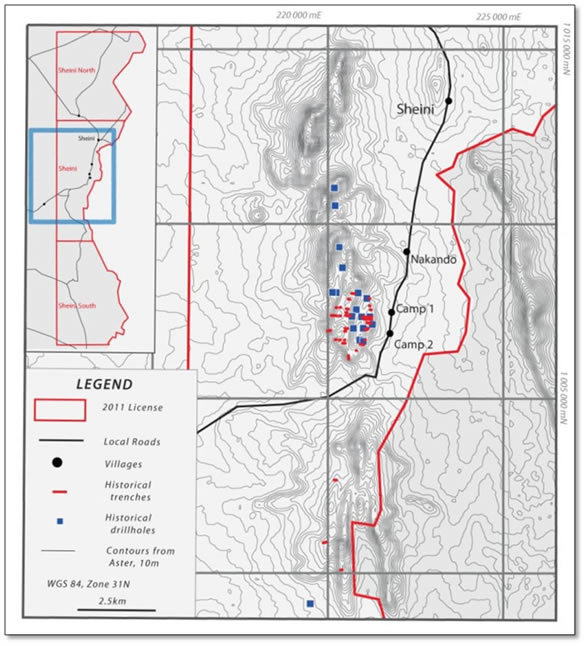

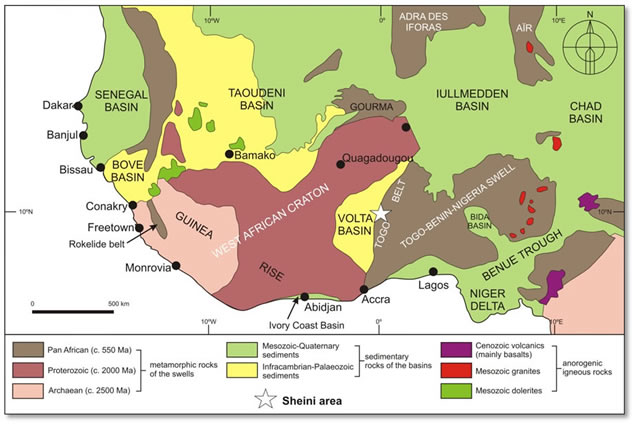

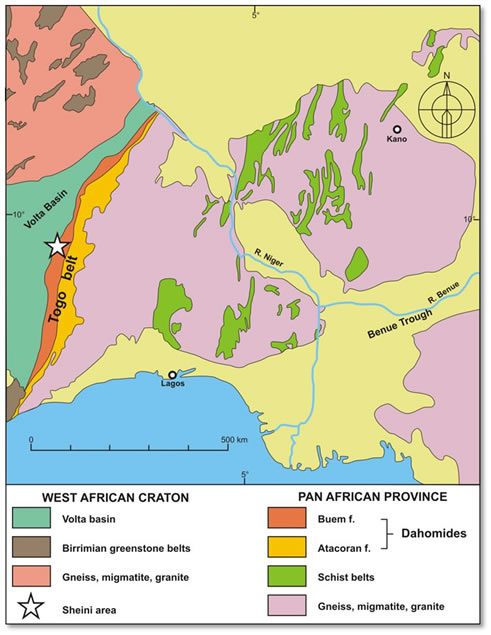

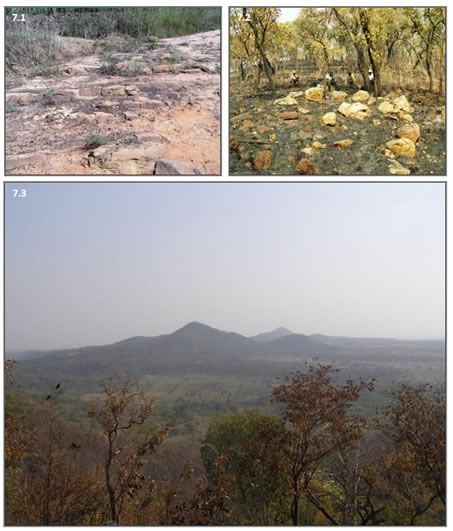

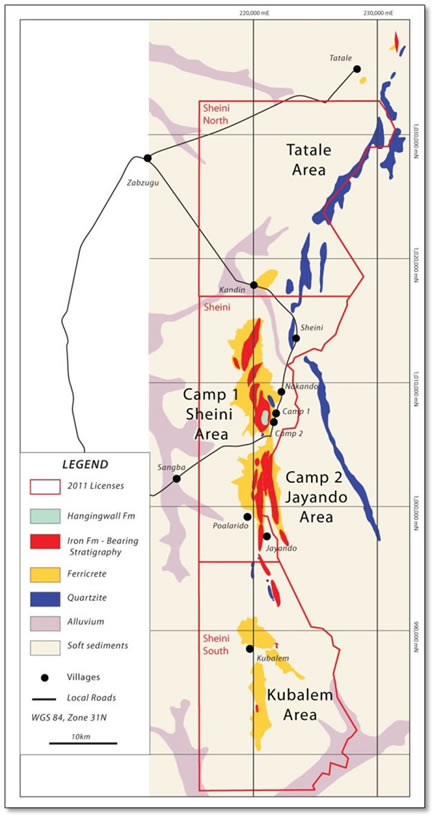

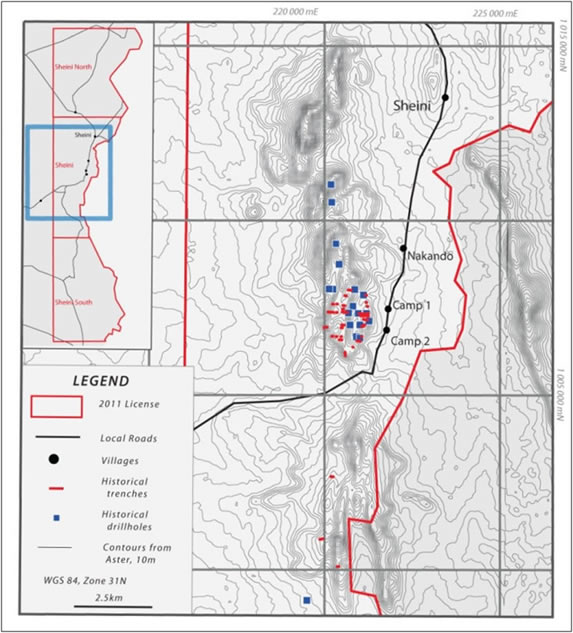

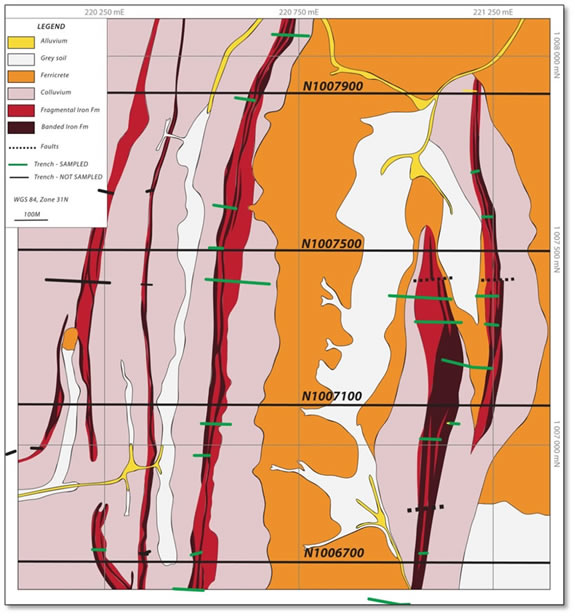

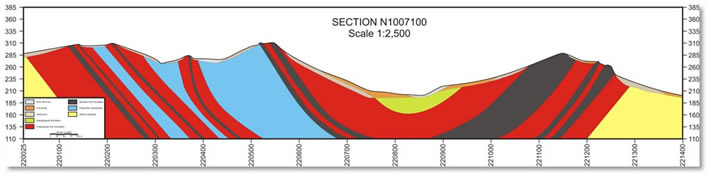

Cardero’s Ghanaian joint venture partner, Emmaland Resources Limited ("Emmaland"), received from the Government of the Republic of Ghana, through The Minister for Lands and Natural Resources (Ghana) ("Minister"), three prospecting licenses covering lands located in the Zabzugu-Tatale District in the Northern Region of the Republic of Ghana and referred to as the Sheini Hills Iron Project (approximately 400 square kilometres in aggregate). Cardero Ghana has signed joint venture agreements with Emmaland pursuant to which Cardero Ghana can acquire a 100% joint venture interest in each of the three licenses. Exploration has been initiated over Sheini Hills Iron Deposits, Ghana (see “Narrative Description of the Business - Material Mineral Projects – Sheini Hills Iron Project, Ghana”).

- 19 -

Significant Acquisitions

Since November 1, 2010, being the commencement of the Company’s last completed fiscal year, Cardero completed the acquisition of Coalhunter by acquiring all of the issued and outstanding shares of Coalhunter that it did not own, as set out in the Form 51-102F4 filed by the Company. Immediately prior to the acquisition, Cardero held 17,808,143 common shares of Coalhunter (representing approximately 47.48% of Coalhunter’s issued and outstanding shares).

Pursuant to an Arrangement Agreement dated April 18, 2011 between Cardero and Coalhunter, on June 1, 2011 each Coalhunter shareholder (other than Cardero) received 0.8 of a common share of Cardero for each common share of Coalhunter held, resulting in the issuance of 23,397,002 Common Shares. A further 5,885,543 Common Shares are reserved upon the exercise of options held by former Coalhunter optionees, the exercise of Coalhunter warrants and pursuant to Coalhunter property acquisition agreements.

Coalhunter is a private British Columbia company that has entered into various agreements to explore and, if warranted, develop, certain coal deposits in the Peace River Coal Field located in the northeast region of British Columbia. The property consists of a lease of freehold coal and certain coal licenses issued, or to be issued, by the British Columbia government. Coalhunter will hold a 75% interest in the joint venture and its co-venturer will hold a 25% carried interest. Coalhunter will be required to fund all exploration, development and mining costs, and the co-venturer will receive 25% of the net proceeds (after recovery by Coalhunter of its capital expenditures and ongoing operating costs). See “Narrative Description of the Business - Material Mineral Projects – Carbon Creek Metallurgical Coal Deposit, British Columbia, Canada”.

Coalhunter changed its name to “Cardero Coal Ltd.” on September 14, 2011.

ITEM 5: NARRATIVE DESCRIPTION OF THE BUSINESS

General

Summary

The Company currently holds, or has rights to acquire, interests (ranging from 75% to 100%) in several mineral properties (subject, in certain cases, to net smelter return royalties payable to the original property vendors) in Argentina, Mexico, Peru, the United States, Ghana and Canada. The Company is in the process of evaluating such properties through exploration programs or, in some cases, mineralogical and metallurgical studies and materials processing tests. In all cases, the objective is to evaluate the potential of the subject property and to determine if spending additional funds is warranted (in which case, an appropriate program to advance the property to the next decision point will be formulated and, depending upon available funds, implemented) or not (in which case the property may be offered for option/joint venture or returned to the vendor or abandoned, as applicable). At the present time, the Company is primarily interested in properties that are prospective for precious metals, copper, iron ore, titanium, vanadium and coal.

With the completion of the sale of the Pampa de Pongo Iron Project in January, 2010, the Company considers that the Carbon Creek property in British Columbia, Canada, the Longnose and Titac Iron Titanium properties in Minnesota, USA and the Sheini Hills property in Ghana, Africa, are its material mineral properties at the present time. However, ongoing work on other properties may produce results that would cause the Company to consider them as material mineral properties in the future. Information with respect to the Company’s material mineral properties is set out in the Material Mineral Projects section of this AIF.

- 20 -

The Company is in the exploration stage and does not mine, produce or sell any mineral products at this time, nor do any of its current properties have any known or identified mineral resources (with the exception of the Carbon Creek property and the Longnose and Titac properties), or mineral reserves. The Company does not propose any method of production at this time, although it is conducting extensive work on the Carbon Creek property in order to ascertain the appropriate production methods to employ should the property go into commercial production.

All aspects of the Company’s business require specialized skills and knowledge. Such skills and knowledge include the areas of geology, drilling, logistical planning, geophysics, metallurgy and mineral processing, implementation of exploration programs and accounting. While recent increased activity in the resource mining industry has made it more difficult to locate competent employees and consultants in such fields, the Company has found that it can locate and retain such employees and consultants and believes it will continue to be able to do so.

All of the raw materials the Company requires to carry on its business are readily available through normal supply or business contracting channels in Canada, Ghana, Argentina, Mexico, Peru and the United States. The Company has secured, or reasonably believes that it will be able to secure, personnel to conduct its contemplated programs.

The mining business is subject to mineral price cycles. The marketability of minerals and mineral concentrates is also affected by worldwide economic cycles. In recent years, the significant demand for minerals in some countries (notably China and India) has driven increased commodity prices to historic highs. While the downturn in the world economy in 2008 and 2009 significantly moderated the record high prices, and temporarily reduced the upward price pressures, for many commodities (including several that the Company is in the business of exploring for), the upward price movements have recently become re-established, primarily as a result of Chinese demand for commodities such as copper, coal and iron ore. It is difficult to assess if the apparent upward momentum in several commodity prices are long-term trends, and there is great uncertainty as to the recovery, or otherwise, of the world, and particularly, the Chinese, economy. If the economic recovery stalls and commodity prices decline as a consequence, a continuing period of lower prices could significantly affect the economic potential of many of the Company’s current properties and result in the Company determining to cease work on, or drop its interest in, some or all of such properties. The one exception to this is gold. Fear of potential inflation as a consequence of the stimulus packages implemented by many countries (notably the United States) and the potential negative influence on the US dollar (among other currencies), have led to significant increases in the price of gold to record highs.

The Company’s business is not substantially dependent on any contract such as a contract to sell the major part of its products or services or to purchase the major part of its requirements for goods, services or raw materials, or on any franchise or licence or other agreement to use a patent, formula, trade secret, process or trade name upon which its business depends.

It is not expected that the Company’s business will be affected in the current financial year by the renegotiation or termination of contracts or sub-contracts.

As of October 31, 2011, Cardero had 16 full-time employees, Cardero Coal had 14 full-time employees and Cardero Management USA had three full-time employees. The Company relies to a large degree upon consultants and contractors to carry on many of its activities and, in particular, to supervise and carry out the work programs on its mineral properties. However, should the Company expand its activities, it is likely that it will choose to hire additional employees.

Bankruptcy and Similar Procedures

There are no bankruptcy, receivership or similar proceedings against Cardero, nor is Cardero aware of any such pending or threatened proceedings. There have not been any voluntary bankruptcy, receivership or similar proceedings by Cardero within the three most recently completed financial years or completed or currently proposed for the current financial year.

- 21 -

Reorganizations

There have been no reorganizations of or involving Cardero within the three most recently completed financial years and no reorganizations are currently proposed for the current financial year.

Social or Environmental Policies

Cardero has created a Sustainable Development Committee (“SDC”), which has adopted a formal charter. The overall purpose of the SDC is to assist the Board in fulfilling its oversight responsibilities with respect to the Board’s and the Company’s continuing commitment to improving the environment and ensuring that the Company’s activities are carried out, and that its facilities are operated and maintained, in a safe, sustainable and environmentally sound manner. The primary function of the SDC is to monitor, review and provide oversight with respect to the Company’s policies, standards, accountabilities and programs relative to health, safety, community relations and environmental-related matters. Further, the SDC is to advise the Board and make recommendations for the Board’s consideration regarding health, safety, community relations and environmental-related issues. In particular, the SDC is to consider and advise the Board with respect to current standards of sustainable development for projects and activities such as those of the Company, particularly with a view to ensuring that the Company’s business is run in a manner, and its projects are operated and developed, so as to achieve the ideals and reflect the following principles of sustainable development:

| (a) |

living within environmental limits, | |

| (b) |

ensuring a strong, healthy and just society, | |

| (c) |

achieving a sustainable economy, | |

| (d) |

using sound science responsibly, and | |

| (e) |

promoting good governance. |

The SDC is also responsible for monitoring the activities of the Company in connection with the initial and ongoing interaction between the Company’s activities, operations and personnel and the communities in which the Company’s projects and related activities are located, with a view to ensuring that management develops and follows appropriate policies and activities to enhance the relationship between the Company and its personnel and the communities in which it operates and reflect the principles of sustainable development in that regard.

Although not set out in a specific policy, the Company strives to be a positive influence in the local communities where its mineral projects are located, not only by contributing to the welfare of such communities through donations of money and supplies, as appropriate, but also through hiring, when appropriate, local workers to assist in ongoing exploration programs as well as contributing to and improving local infrastructure. The Company considers that building and maintaining strong relationships with such communities is fundamental to its ability to continue to operate in such regions and to assist in the eventual development (if any) of mining operations in such regions, and it attaches considerable importance to commencing and fostering them from the beginning of its involvement in any particular area.

Cardero has also adopted a Code of Business Conduct and Ethics, which provides, among other things, that the Company is committed to complying with all laws and governmental regulations applicable to its activities and, specifically, to maintaining a safe and healthy work environment and conducting its activities in full compliance with all applicable environmental laws.

- 22 -

Risk Factors

In addition to those risk factors discussed elsewhere in this AIF, the Company is subject to the following risk factors:

Resource Exploration and Development is Generally a Speculative Business: Resource exploration and development is a speculative business and involves a high degree of risk, including, among other things, unprofitable efforts resulting both from the failure to discover mineral deposits and from finding mineral deposits which, though present, are insufficient in size and grade at the then prevailing market conditions to return a profit from production. The marketability of natural resources which may be acquired or discovered by the Company will be affected by numerous factors beyond the control of the Company. These factors include market fluctuations, the proximity and capacity of natural resource markets, government regulations, including regulations relating to prices, taxes, royalties, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital.

There are no known reserves and, other than on the Carbon Creek property and the Longnose and Titac properties, there are no known resources, on any of the Company’s properties. The majority of exploration projects do not result in the discovery of commercially mineable deposits of ore. Substantial expenditures are required to establish ore reserves through drilling and metallurgical and other testing techniques, determine metal content and metallurgical recovery processes to extract metal from the ore, and construct, renovate or expand mining and processing facilities. No assurance can be given that any level of recovery of ore reserves will be realized or that any identified mineral deposit, even it is established to contain an estimated resource, will ever qualify as a commercial mineable ore body which can be legally and economically exploited. Mineral resources are not mineral reserves and there is no assurance that any mineral resources will ultimately be reclassified as proven or probable reserves. Mineral resources which are not mineral reserves do not have demonstrated economic viability.

Fluctuation of Commodity Prices: Even if commercial quantities of mineral deposits are discovered by the Company, there is no guarantee that a profitable market will exist for the sale of the minerals produced. The Company’s long-term viability and profitability depend, in large part, upon the market price of minerals which have experienced significant movement over short periods of time, and are affected by numerous factors beyond the control of the Company, including international economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates and global or regional consumption patterns, speculative activities and increased production due to improved mining and production methods. The recent price fluctuations in the price of all commodities for which the Company is presently exploring is an example of a situation over which the Company has no control and may materially adversely affect the Company in a manner that it may not be able to compensate for. The supply of and demand for minerals are affected by various factors, including political events, economic conditions and production costs in major producing regions. There can be no assurance that the price of any minerals produced from the Company’s properties will be such that any such deposits can be mined at a profit.

Recent market events and conditions: Since 2008, the U.S. credit markets have experienced serious disruption due to a deterioration in residential property values, defaults and delinquencies in the residential mortgage market (particularly, sub-prime and non-prime mortgages) and a decline in the credit quality of mortgage backed securities. These problems have led to a slow-down in residential housing market transactions, declining housing prices, delinquencies in non-mortgage consumer credit and a general decline in consumer confidence. These conditions caused a loss of confidence in the broader U.S. and global credit and financial markets and resulting in the collapse of, and government intervention in, major banks, financial institutions and insurers and creating a climate of greater volatility, less liquidity, widening of credit spreads, a lack of price transparency, increased credit losses and tighter credit conditions. Notwithstanding various actions by the U.S. and foreign governments, concerns about the general condition of the capital markets, financial instruments, banks, investment banks, insurers and other financial institutions caused the broader credit markets to further deteriorate and stock markets to decline substantially. In addition, general economic indicators have deteriorated, including declining consumer sentiment, increased unemployment and declining economic growth and uncertainty about corporate earnings.

- 23 -

While these conditions appear to have improved slightly in 2010/11, unprecedented disruptions in the credit and financial markets have had a significant material adverse impact on a number of financial institutions and have limited access to capital and credit for many companies. These disruptions could, among other things, make it more difficult for the Company to obtain, or increase its cost of obtaining, capital and financing for its operations. The Company’s access to additional capital may not be available on terms acceptable to it or at all.

General Economic Conditions: The recent unprecedented events in global financial markets have had a profound impact on the global economy. Many industries, including the gold and base metal mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations and high volatility in global equity, commodity, foreign exchange and precious metal markets, and a lack of market liquidity. A continued or worsened slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates, and tax rates may adversely affect the Company’s growth and profitability. Specifically:

-

The global credit/liquidity crisis could impact the cost and availability of financing and the Company’s overall liquidity

-

the volatility of gold and other base metal prices may impact the Company’s future revenues, profits and cash flow

-

volatile energy prices, commodity and consumables prices and currency exchange rates impact potential production costs

-

the devaluation and volatility of global stock markets impacts the valuation of the Common Shares, which may impact the Company’s ability to raise funds through the issuance of Common Shares

These factors could have a material adverse effect on the Company’s financial condition and results of operations.

Share Price Volatility: In 2010/11, worldwide securities markets, particularly those in the United States and Canada, have experienced a high level of price and volume volatility, and the market price of securities of many companies, particularly those considered exploration or development stage companies, have experienced unprecedented fluctuations in price which have not necessarily been related to the operating performance, underlying asset values or prospects of such companies. Most significantly, the share prices of junior natural resource companies have experienced an unprecedented decline in value and there has been a significant decline in the number of buyers willing to purchase such securities. In addition, significantly higher redemptions by holders of mutual funds has forced many of such funds (including those holding the Company’s securities) to sell such securities at any price. As a consequence, despite the Company’s past success in securing significant equity financing, market forces may render it difficult or impossible for the Company to secure placees to purchase new share issues at a price which will not lead to severe dilution to existing shareholders, or at all. Therefore, there can be no assurance that significant fluctuations in the Common Shares will not occur, or that such fluctuations will not materially adversely impact on the Company’s ability to raise equity funding without significant dilution to its existing shareholders, or at all.

- 24 -

Permits and Licenses: The operations of the Company will require licenses and permits from various governmental authorities. There can be no assurance that the Company will be able to obtain all necessary licenses and permits that may be required to carry out exploration, development and mining operations at its projects, on reasonable terms or at all. Delays or a failure to obtain such licenses and permits, or a failure to comply with the terms of any such licenses and permits that the Company does obtain, could have a material adverse effect on the Company.

Acquisition of Mineral Properties under Agreements: The agreements pursuant to which the Company has the right to acquire a number of its properties provide that the Company must make a series of cash payments and/or share issuances over certain time periods, expend certain minimum amounts on the exploration of the properties or contribute its share of ongoing expenditures. Failure by the Company to make such payments, issue such shares or make such expenditures in a timely fashion may result in the Company losing its interest in such properties. There can be no assurance that the Company will have, or be able to obtain, the necessary financial resources to be able to maintain all of its property agreements in good standing, or to be able to comply with all of its obligations thereunder, with the result that the Company could forfeit its interest in one or more of its mineral properties.

Title Matters: The acquisition of title to mineral properties in Mexico, Peru, Argentina and Ghana is a very detailed and time-consuming process. Title to, and the area of, mineral concessions may be disputed. While the Company has diligently investigated title to all mineral properties in which it has an interest and, to the best of its knowledge, title to all such properties is in good standing or, where not yet granted, the application process appears to be proceeding normally in all the circumstances, this should not be construed as a guarantee of title or that any such applications for concessions will be granted. Title to mineral properties may be affected by undetected defects such as aboriginal or indigenous peoples’ land claims, or unregistered agreements or transfers. The Company has not obtained title opinions for the majority of its mineral properties. Not all the mineral properties in which the Company has an interest have been surveyed, and their actual extent and location may be in doubt.

Surface Rights and Access: Although the Company acquires the rights to some or all of the minerals in the ground subject to the mineral tenures that it acquires, or has a right to acquire, in most cases it does not thereby acquire any rights to, or ownership of, the surface to the areas covered by its mineral tenures. In such cases, applicable mining laws usually provide for rights of access to the surface for the purpose of carrying on mining activities, however, the enforcement of such rights through the courts can be costly and time consuming. It is necessary to negotiate surface access or to purchase the surface rights if long-term access is required. There can be no guarantee that, despite having the right at law to access the surface and carry on mining activities, the Company will be able to negotiate satisfactory agreements with any such existing landowners/occupiers for such access or purchase of such surface rights, and therefore it may be unable to carry out planned mining activities. In addition, in circumstances where such access is denied, or no agreement can be reached, the Company may need to rely on the assistance of local officials or the courts in the applicable jurisdiction, the outcomes of which cannot be predicted with any certainty. The inability of the Company to secure surface access or purchase required surface rights could materially and adversely affect the timing, cost or overall ability of the Company to develop any mineral deposits it may locate. This is a particular problem in many areas of Mexico, Argentina, Peru and Ghana, where blockades of access to the Company’s properties, hostile actions by local communities and the potential unwillingness of local police or governmental officials to assist a foreign company against its own citizens can result in the Company being unable to carry out any exploration activities despite being legally authorized to do so and having complied with all applicable local laws and requirements.

- 25 -

No Assurance of Profitability: The Company has no history of production or earnings and due to the nature of its business there can be no assurance that the Company will be profitable. The Company has not paid dividends on its shares since incorporation and does not anticipate doing so in the foreseeable future. All of the Company’s properties are in the exploration stage and the Company has not defined or delineated any proven or probable reserves on any of its properties. None of the Company’s properties are currently under development. Continued exploration of its existing properties and the future development of any properties found to be economically feasible, will require significant funds. The only present source of funds available to the Company is through the sale of its equity securities or the sale or optioning of a portion of its interest in its mineral properties. Even if the results of exploration are encouraging, the Company may not have sufficient funds to conduct the further exploration that may be necessary to determine whether or not a commercially mineable deposit exists. While the Company may generate additional working capital through further equity offerings or through the sale or possible syndication of its properties, there is no assurance that any such funds will be available on favourable terms, or at all. At present, it is impossible to determine what amounts of additional funds, if any, may be required. Failure to raise such additional capital could put the continued viability of the Company at risk.

Uninsured or Uninsurable Risks: Exploration, development and mining operations involve various hazards, including environmental hazards, industrial accidents, metallurgical and other processing problems, unusual or unexpected rock formations, structural cave-ins or slides, flooding, fires, metal losses and periodic interruptions due to inclement or hazardous weather conditions. These risks could result in damage to or destruction of mineral properties, facilities or other property, personal injury, environmental damage, delays in operations, increased cost of operations, monetary losses and possible legal liability. The Company may not be able to obtain insurance to cover these risks at economically feasible premiums or at all. The Company may elect not to insure where premium costs are disproportionate to the Company’s perception of the relevant risks. The payment of such insurance premiums and of such liabilities would reduce the funds available for exploration and production activities.

Government Regulation: Any exploration, development or mining operations carried on by the Company will be subject to government legislation, policies and controls relating to prospecting, development, production, environmental protection, mining taxes and labour standards. The Company cannot predict whether or not such legislation, policies or controls, as presently in effect, will remain so, and any changes therein (for example, significant new royalties or taxes), which are completely outside the control of the Company, may materially adversely affect to ability of the Company to continue its planned business within any such jurisdictions.

Foreign Countries and Political Risk: The Company has mineral properties located in Peru, Argentina, Mexico, the United States and Ghana. In such countries, mineral exploration and mining activities may be affected in varying degrees by political or economic instability, expropriation of property and changes in government regulations such as tax laws, business laws, environmental laws and mining laws. Any changes in regulations or shifts in political conditions are beyond the control of the Company and may materially adversely affect it business, or if significant enough, may make it impossible to continue to operate in certain countries. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, foreign exchange restrictions, export controls, income taxes, expropriation of property, environmental legislation and mine safety.

Dependence Upon Others and Key Personnel: The success of the Company’s operations will depend upon numerous factors, many of which are beyond the Company’s control, including (i) the ability of the Company to enter into strategic alliances through a combination of one or more joint ventures, mergers or acquisition transactions; and (ii) the ability to attract and retain additional key personnel in exploration, mine development, sales, marketing, technical support and finance. These and other factors will require the use of outside suppliers as well as the talents and efforts of the Company.

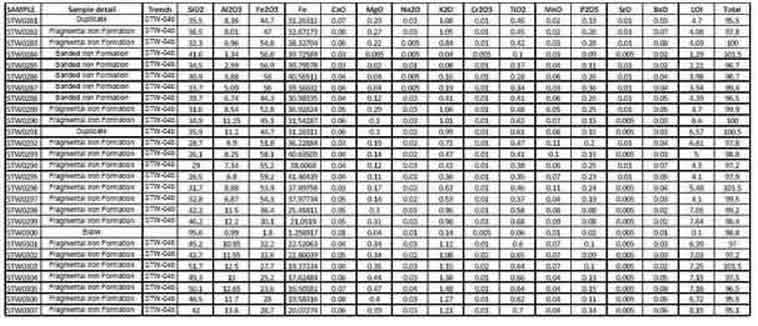

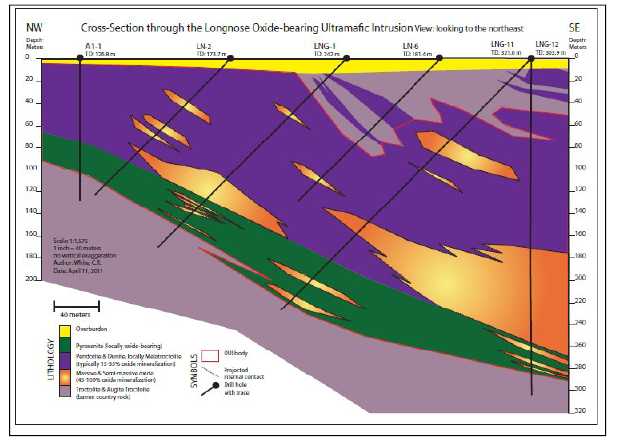

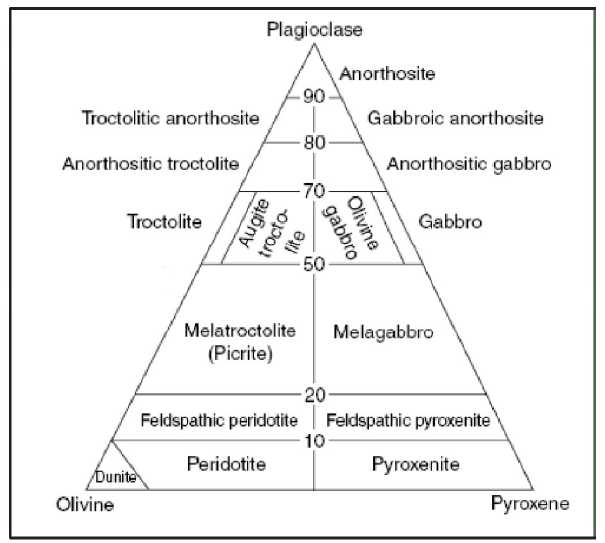

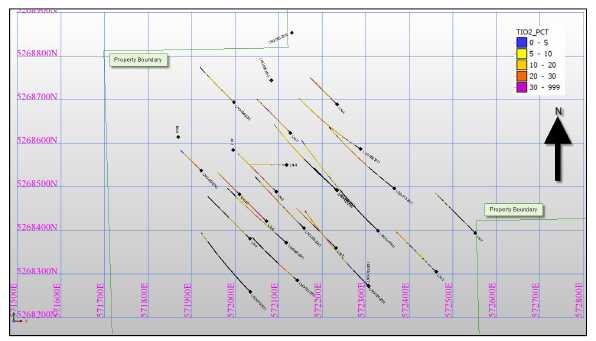

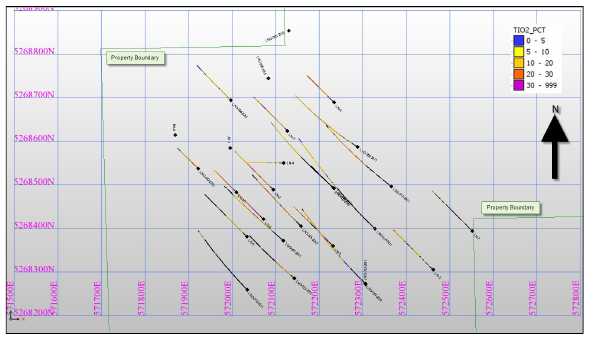

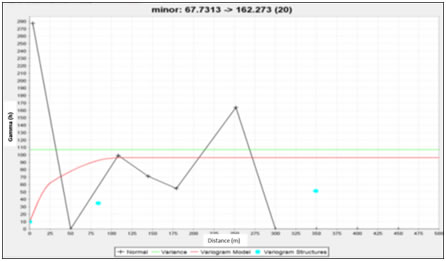

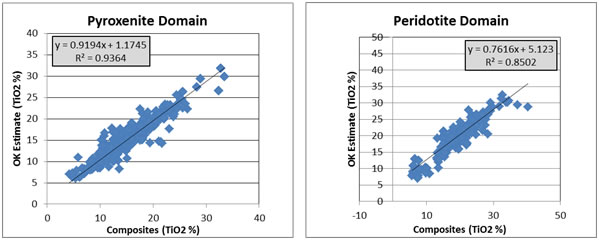

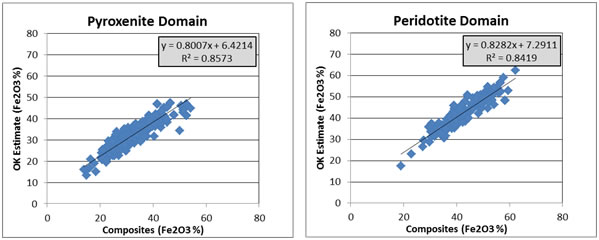

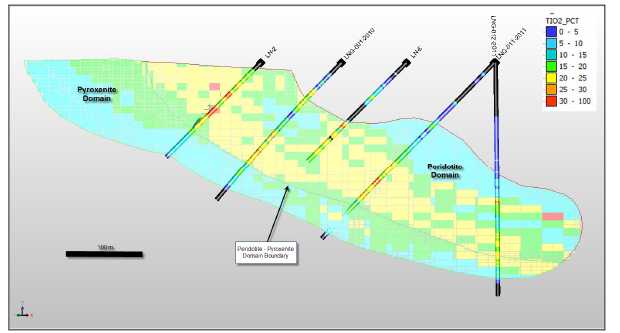

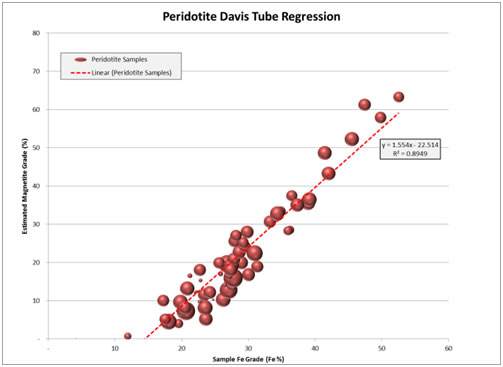

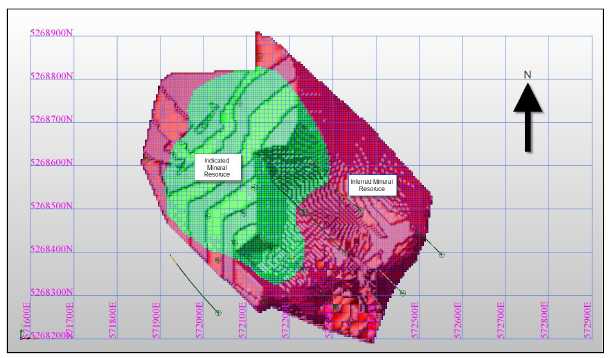

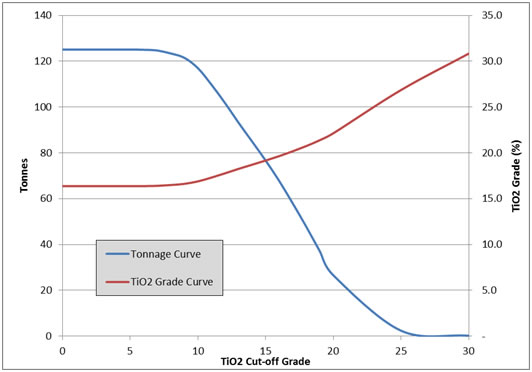

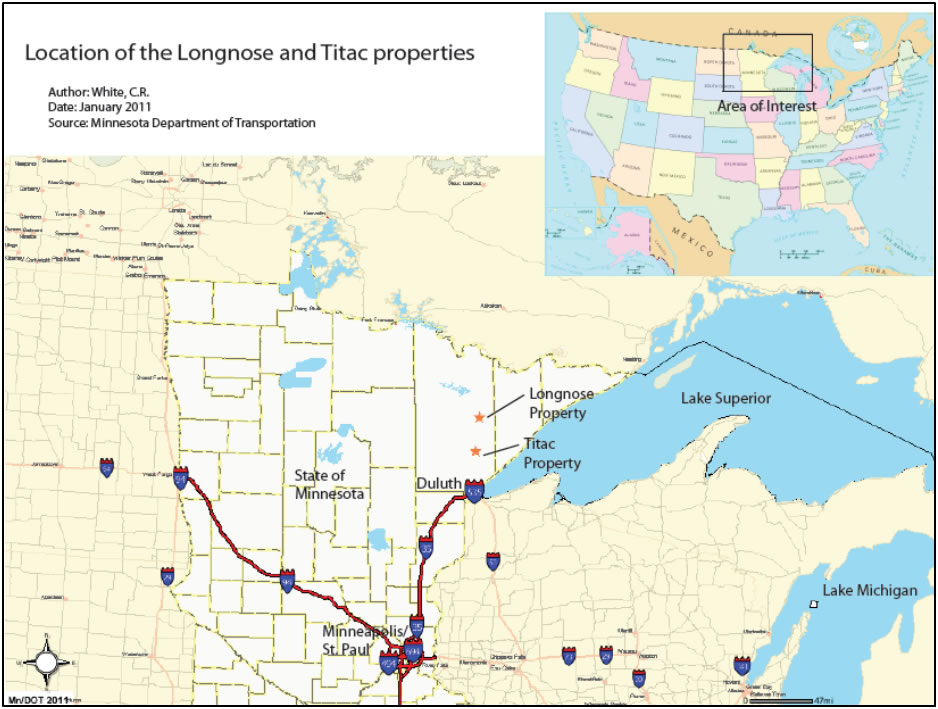

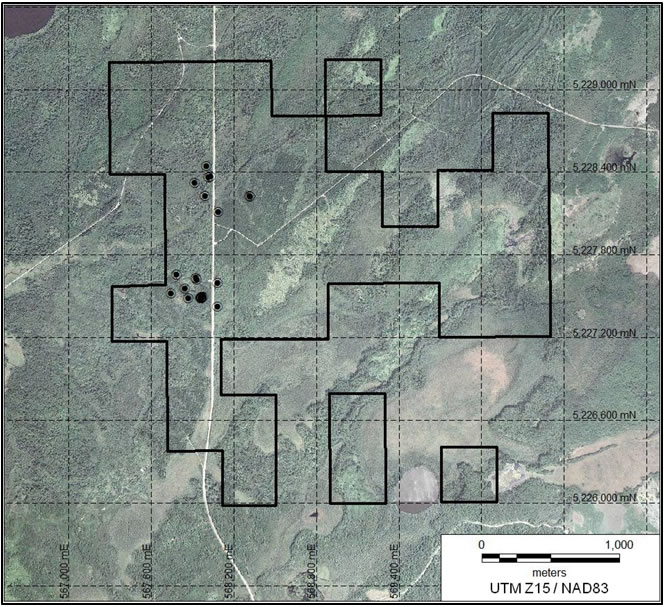

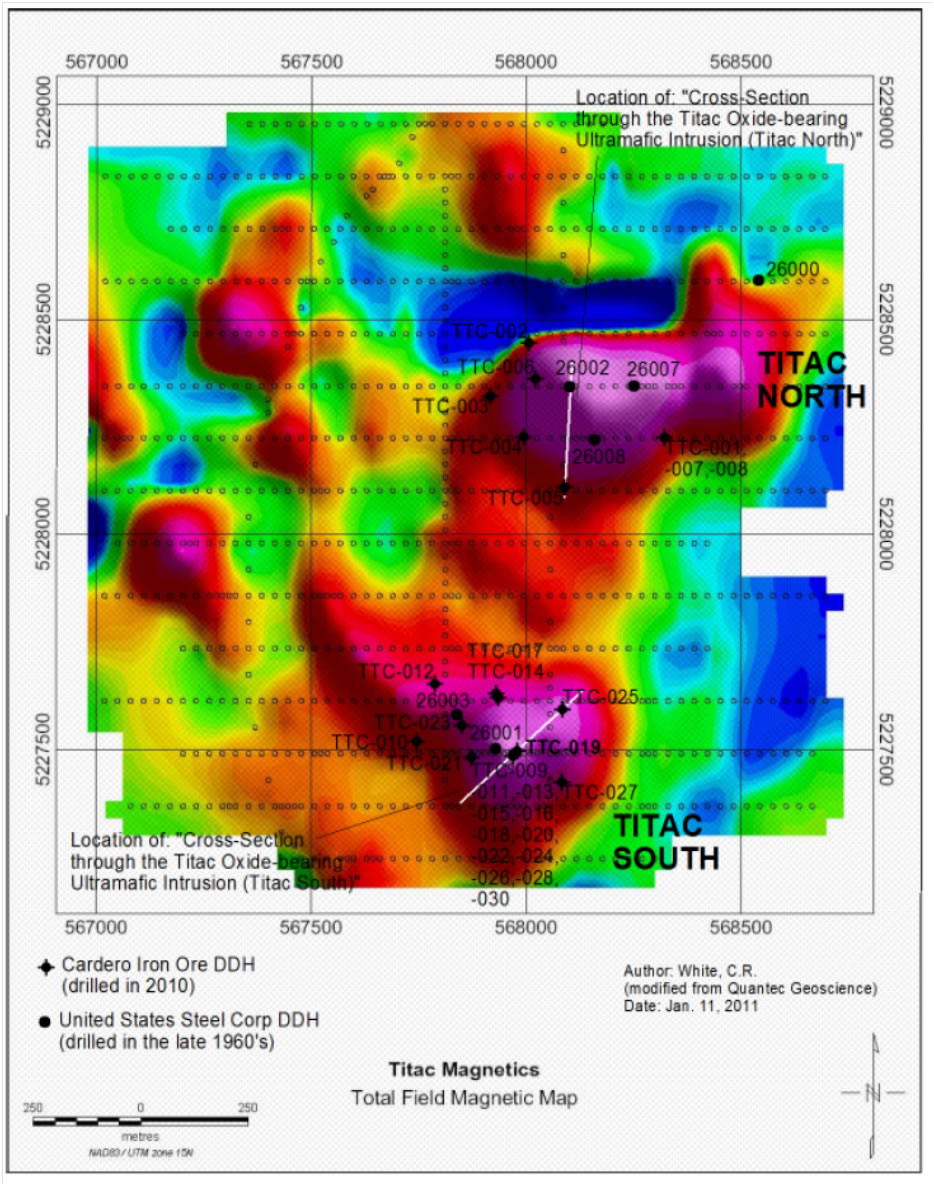

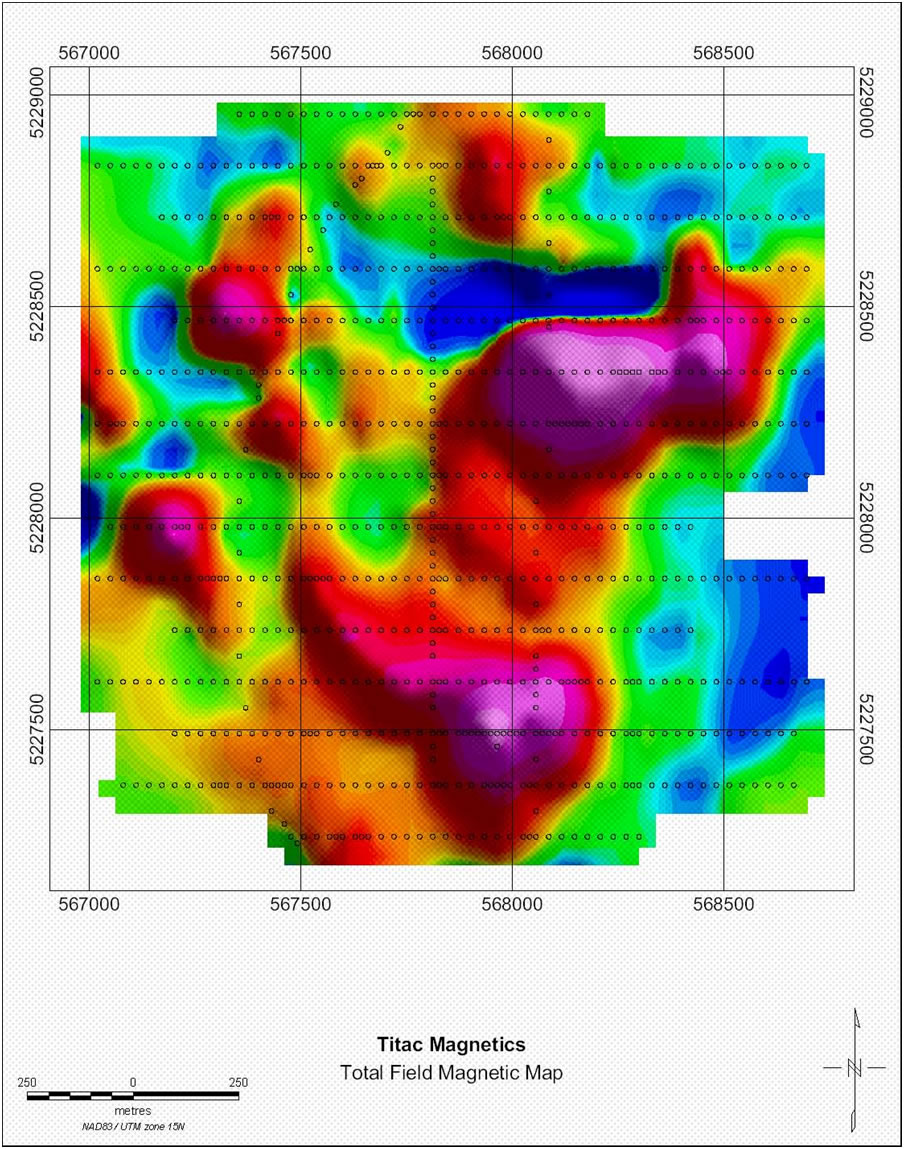

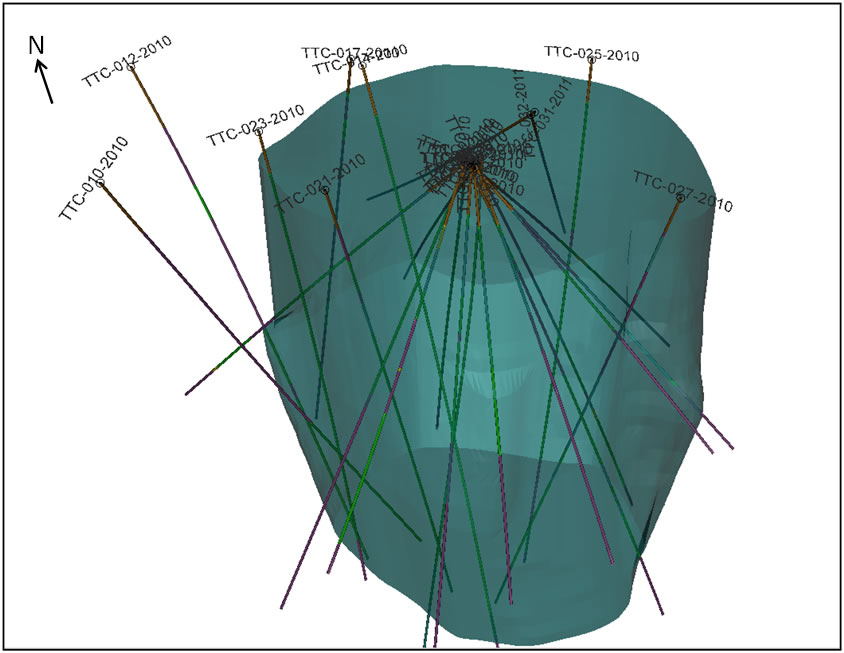

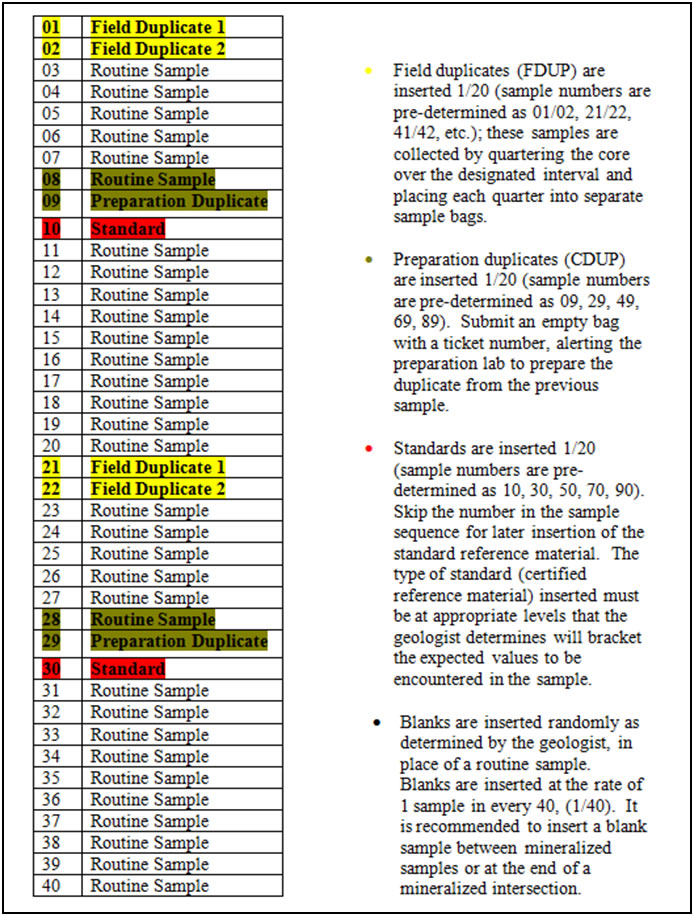

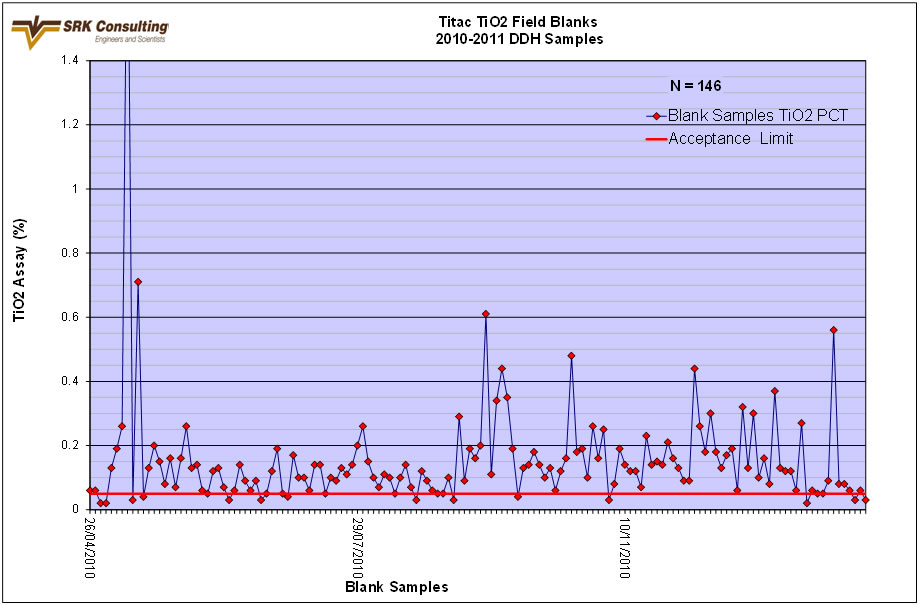

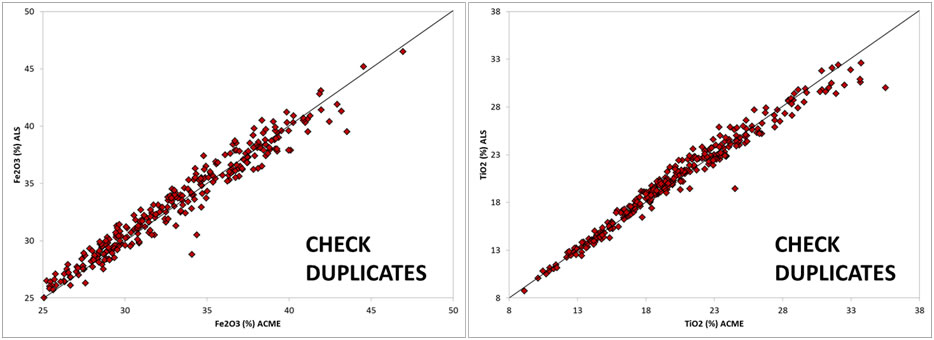

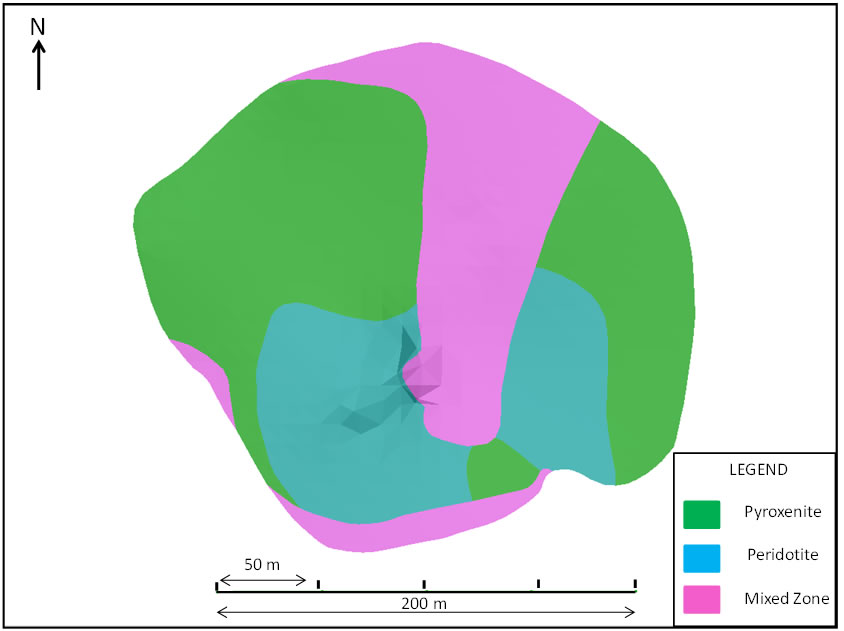

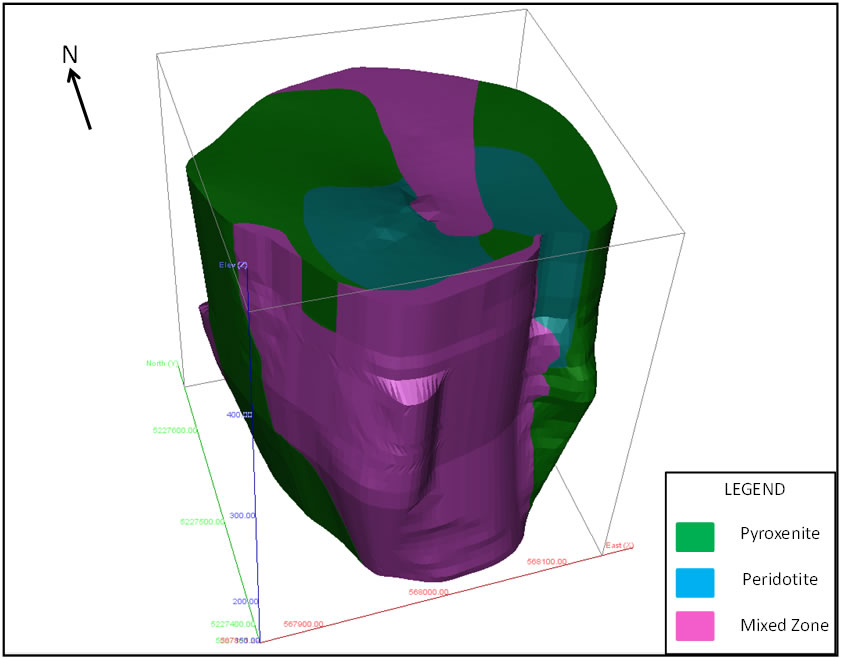

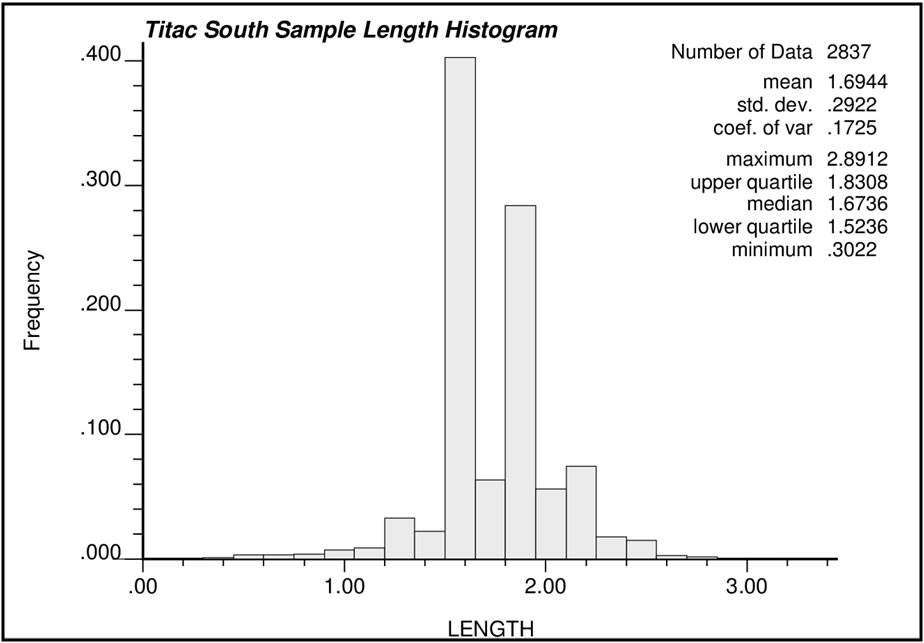

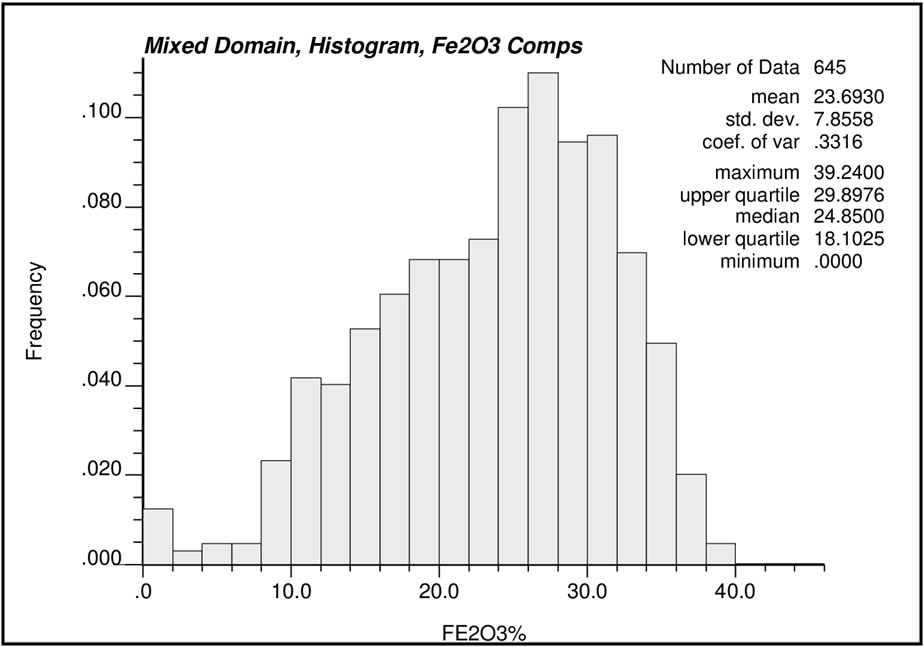

- 26 -