Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2018 | ||

| or | ||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to

Commission file number 1-13879

INNOSPEC INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 98-0181725 | |

| State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |

| 8310 South Valley Highway Suite 350 Englewood Colorado |

80112 | |

| (Address of principal executive offices) |

(Zip Code) | |

Registrant’s telephone number, including area code: (303) 792 5554

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| N/A |

N/A |

Securities registered pursuant to Section 12(g) of the Act: Common stock, par value $0.01 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |||

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |||

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of the most recently completed second fiscal quarter (June 30, 2018) was approximately $972 million, based on the closing price of the common shares on the NASDAQ on June 30, 2018. Shares of common stock held by each officer and director and by each beneficial owner who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of February 12, 2019, 24,433,701 shares of the registrant’s common stock were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Innospec Inc.’s Proxy Statement for the Annual Meeting of Stockholders to be held on May 8, 2019 are incorporated by reference into Part III of this Form 10-K.

Table of Contents

1

Table of Contents

CAUTIONARY STATEMENT RELATIVE TO FORWARD-LOOKING STATEMENTS

FORWARD-LOOKING STATEMENTS

This Form 10-K contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included or incorporated herein may constitute forward-looking statements. Such forward-looking statements include statements (covered by words like “expects,” “estimates,” “anticipates,” “may,” “believes,” “feels” or similar words or expressions, for example,) which relate to earnings, growth potential, operating performance, events or developments that we expect or anticipate will or may occur in the future. Although forward-looking statements are believed by management to be reasonable when made, they are subject to certain risks, uncertainties and assumptions, and our actual performance or results may differ materially from these forward-looking statements. You are urged to review our discussion of risks and uncertainties that could cause actual results to differ from forward-looking statements under the heading “Risk Factors.” Innospec undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

2

Table of Contents

| Item 1 | Business |

When we use the terms “Innospec,” “the Corporation,” “the Company,” “Registrant,” “we,” “us” and “our,” we are referring to Innospec Inc. and its consolidated subsidiaries unless otherwise indicated or the context otherwise requires.

General

Innospec develops, manufactures, blends, markets and supplies specialty chemicals for use as fuel additives, ingredients for personal care, home care, agrochemical, metal extraction and other applications and oilfield chemicals. Our products are sold primarily to oil and gas exploration and production companies, oil refiners, fuel manufacturers and users, formulators of personal care, home care, agrochemical and metal extraction formulations, and other chemical and industrial companies throughout the world. Our Fuel Specialties business helps improve fuel efficiency, boost engine performance and reduce harmful emissions. Our Oilfield Services business supplies drilling, completion and production chemicals which make exploration and production more effective, cost-efficient and environmentally friendly. Our performance chemicals provide effective technology-based solutions for our customers’ processes or products focused in the personal care, home care, agrochemical and metal extraction markets. Our Octane Additives business manufactures a fuel additive for use in automotive gasoline.

Segment Information

The Company reports its financial performance based on the four reportable segments described as follows:

| • | Fuel Specialties |

| • | Performance Chemicals |

| • | Oilfield Services |

| • | Octane Additives |

The Fuel Specialties, Performance Chemicals and Oilfield Services segments operate in markets where we actively seek growth opportunities although their ultimate customers are different. The Octane Additives segment is expected to further decline in the next twelve months as our one remaining refinery customer transitions to unleaded fuel.

For financial information about each of our segments, see Note 3 of the Notes to the Consolidated Financial Statements.

Fuel Specialties

Our Fuel Specialties segment develops, manufactures, blends, markets and supplies a range of specialty chemical products used as additives to a wide range of fuels. These fuel additive

3

Table of Contents

products help improve fuel efficiency, boost engine performance and reduce harmful emissions; and are used in the efficient operation of automotive, marine and aviation engines, power station generators, and heating oil.

The segment has grown organically through our development of new products to address what we believe are the key drivers in demand for fuel additives. These drivers include increased demand for fuel, focus on fuel economy, changing engine technology and legislative developments. We have also devoted substantial resources towards the development of new and improved products that may be used to improve combustion efficiency.

Our customers in this segment include national oil companies, multinational oil companies and fuel retailers.

Performance Chemicals

Our Performance Chemicals segment provides effective technology-based solutions for our customers’ processes or products focused in the Personal Care, Home Care, Agrochemical and Metal Extraction markets.

This segment has grown through acquisitions, and the development and marketing of innovative products. The focus for our Performance Chemicals segment is to develop high performance products from its technology base in a number of targeted markets.

Our customers in this segment include large multinational companies, manufacturers of personal care and household products and specialty chemical manufacturers operating in agrochemical, metal extraction and other industrial applications.

Oilfield Services

Our Oilfield Services segment develops and markets products to prevent loss of mud in drilling operations, chemical solutions for fracturing, stimulation and completion operations and products for oil and gas production which aid flow assurance and maintain asset integrity.

This segment has recently been growing strongly, driven by increased customer activity, as the industry recovers from the significant declines of the last two years.

Our customers in this segment include multinational public and independent companies operating currently principally in the Americas.

Octane Additives

Our Octane Additives segment, which we believe is the world’s only producer of tetra ethyl lead (“TEL”), comprises sales of TEL for use in automotive gasoline and provides services in respect of environmental remediation. We are continuing to responsibly manage the decline in the demand for TEL for use in automotive gasoline in line with the transition plans to unleaded gasoline for our one remaining refinery customer. Cost improvement measures continue to be taken to respond to declining market demand.

4

Table of Contents

Sales of TEL for use in automotive gasoline are principally made to state-owned refineries located in North Africa. Our environmental remediation business manages the cleanup of redundant TEL facilities as refineries complete the transition to unleaded gasoline.

Strategy

Our strategy is to develop new and improved products and technologies to continue to strengthen and increase our market positions within our Fuel Specialties, Performance Chemicals and Oilfield Services segments. We also actively continue to assess potential strategic acquisitions, partnerships and other opportunities that would enhance and expand our customer offering. We focus on opportunities that would extend our technology base, geographical coverage or product portfolio. We believe that focusing on the Fuel Specialties, Performance Chemicals and Oilfield Services segments, in which the Company has existing experience, expertise and knowledge, provides opportunities for positive returns on investment with reduced operating risk. We also continue to develop our geographical footprint, consistent with the development of global markets.

Geographical Area Information

Financial information with respect to our domestic and foreign operations is contained in Note 3 of the Notes to the Consolidated Financial Statements.

Working Capital

The nature of our customers’ businesses generally requires us to hold appropriate amounts of inventory in order to be able to respond quickly to customers’ needs. We therefore require corresponding amounts of working capital for normal operations. We do not believe that this is materially different to what our competitors do, with the exception of cetane number improvers, in which case we maintain high enough levels of inventory, as required, to retain our position as market leader in sales of these products.

The purchase of large amounts of certain raw materials across all our segments can create some variations in working capital requirements, but these are planned and managed by the business.

We do not believe that our terms of sale, or purchase, differ markedly from those of our competitors.

Raw Materials and Product Supply

We use a variety of raw materials and chemicals in our manufacturing and blending processes and believe that sources for these are adequate for our current operations. Our major purchases are cetane number improvers, ethylene, various solvents, amines, alcohols, olefin and polyacrylamides.

5

Table of Contents

These purchases account for a substantial portion of the Company’s variable manufacturing costs. These materials are, with the exception of ethylene for one of our operations in Germany, readily available from more than one source. Although ethylene is, in theory, available from several sources, it is not permissible to transport ethylene by road in Germany. As a result, we source ethylene via a direct pipeline from a neighboring site, making it effectively a single source. Ethylene is used as a primary raw material in products representing approximately 5% of Innospec’s sales.

We use long-term contracts (generally with fixed or formula-based costs) and advance bulk purchases to help ensure availability and continuity of supply, and to manage the risk of cost increases. From time to time, for some raw materials, the risk of cost increases is managed with commodity swaps.

We continue to monitor the situation and adjust our procurement strategies as we deem appropriate. The Company forecasts its raw material requirements substantially in advance, and seeks to build long-term relationships and contractual positions with supply partners to safeguard its raw material positions. In addition, the Company operates an extensive risk management program which seeks to source key raw materials from multiple sources and to develop suitable contingency plans.

Intellectual Property

Our intellectual property, including trademarks, patents and licenses, forms a significant part of the Company’s competitive advantage, particularly in the Fuel Specialties, Oilfield Specialties and Performance Chemicals segments. The Company does not, however, consider its business as a whole to be dependent on any one trademark, patent or license.

The Company has a portfolio of trademarks and patents, both granted and in the application stage, covering products and processes in several jurisdictions. The majority of these patents were developed by the Company and, subject to maintenance obligations including the payment of renewal fees, have at least 10 years life remaining.

The trademark “Innospec and the Innospec device” in Classes 1, 2 and 4 of the “International Classification of Goods and Services for the Purposes of the Registration of Marks” are registered in all jurisdictions in which the Company has a significant market presence. The Company also has trademark registrations for certain product names in all jurisdictions in which it has a significant market presence.

We actively protect our inventions, new technologies, and product developments by filing patent applications and maintaining trade secrets. In addition, we vigorously participate in patent opposition proceedings around the world where necessary to secure a technology base free from infringement of our intellectual property.

We have sales contracts with customers in some markets using fixed or formula-based prices, as appropriate, to maintain our gross profits.

6

Table of Contents

Competition

Certain markets in which the Company operates are subject to significant competition. The Company competes on the basis of a number of factors including, but not limited to, product quality and performance, specialized product lines, customer relationships and service, and regulatory expertize.

Fuel Specialties: Within the Fuel Specialties segment, the market is generally characterized by a small number of competitors, none of which hold a dominant position. We consider our competitive edge to be our proven technical development capacity, independence from major oil companies and strong long-term customer relationships.

Performance Chemicals: Within the Performance Chemicals segment we operate in the Personal Care, Home Care, Agrochemical and Metal Extraction markets which are highly fragmented, and the Company experiences substantial competition from a large number of multinational and specialty chemical suppliers in each geographical market. Our competitive position in these markets is based on us supplying a superior, diverse product portfolio which solves particular customer problems or enhances the performance of new or existing products. In a number of specialty chemicals markets, we also supply niche product lines, where we enjoy market-leading positions.

Oilfield Services: Our Oilfield Services segment is very fragmented and although there are a small number of very large competitors, there are also a large number of smaller players focused on specific technologies or regions. Our competitive strength is our proven technology, broad regional coverage and strong customer relationships.

Octane Additives: We believe our Octane Additives segment is the world’s only producer of TEL and accordingly is the only supplier of TEL for use in automotive gasoline. The segment therefore competes with marketers of products and processes that provide alternative ways of enhancing octane performance in automotive gasoline.

Research, Development, Testing and Technical Support

Research, product/application development and technical support (“R&D”) provide the basis for the growth of our Fuel Specialties, Performance Chemicals and Oilfield Services segments. Accordingly, the Company’s R&D activity has been, and will continue to be, focused on the development of new products and formulations. Our R&D department provides technical support for all of our reporting segments. Expenditures to support R&D services were $33.4 million, $31.4 million and $25.4 million in 2018, 2017 and 2016, respectively.

We believe that our proven technical capabilities provide us with a significant competitive advantage. In the last five years, the Fuel Specialties segment has developed new detergents, cold flow improvers, stabilizers, lubricity and combustion improver products, in addition to the introduction of many new cost effective fuel additive packages. This proven technical capability has also been instrumental in enabling us to produce innovative products including Iselux™ and Statsafe®.

7

Table of Contents

Health, Safety and Environmental Matters

We are subject to environmental laws in the countries in which we operate and conduct business. Management believes that the Company is in material compliance with applicable environmental laws and has made the necessary provisions for the continued costs of compliance with environmental laws.

Our principal site giving rise to environmental remediation liabilities is the Octane Additives manufacturing site at Ellesmere Port in the United Kingdom. There are also environmental remediation liabilities on a much smaller scale in respect of our other manufacturing sites in the U.S. and Europe. At Ellesmere Port there is a continuing asset retirement program related to certain manufacturing units that have been closed.

We recognize environmental remediation liabilities when they are probable and costs can be reasonably estimated, and asset retirement obligations when there is a legal obligation and costs can be reasonably estimated. This involves anticipating the program of work and the associated future expected costs, and so involves the exercise of judgment by management. We regularly review the future expected costs of remediation and the current estimate is reflected in Note 12 of the Notes to the Consolidated Financial Statements.

The European Union legislation known as the Registration, Evaluation and Authorization of Chemical Substances Regulations (“REACH”) requires most of the Company’s products to be registered with the European Chemicals Agency. Under this legislation the Company has to demonstrate that its products are appropriate for their intended purposes. During this registration process, the Company incurs expense to test and register its products. The Company estimates that the cost of complying with REACH will be approximately $3 million over the next three years based on the current regulatory environment. However, should the United Kingdom exit the European Union under certain terms, these costs may increase.

Employees

The Company had approximately 2000 employees in 23 countries as at December 31, 2018.

Available Information

Our corporate web site is www.innospecinc.com. We make available, free of charge, on or through this web site our annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after electronically filing such material with, or furnishing it to, the U.S. Securities and Exchange Commission (“SEC”).

The Company routinely posts important information for investors on its web site (under Investor Relations). The Company uses this web site as a means of disclosing material, non-public information and for complying with its disclosure obligations under SEC Regulation FD (“Fair Disclosure”). Accordingly, investors should monitor the Investor Relations portion of the Company’s web site, in addition to following the Company’s press releases, SEC filings, public conference calls, presentations and webcasts.

8

Table of Contents

| Item 1A | Risk Factors |

The factors described below represent the principal risks associated with our business.

Trends in oil and gas prices affect the level of exploration, development and production activity of our customers, and the demand for our services and products, which could have a material adverse impact on our business.

Demand for our services and products in our Oilfield Services business is particularly sensitive to the level of exploration, development and production activity of, and the corresponding capital spending by, oil and gas companies. The level of exploration, development and production activity is directly affected by trends in oil and gas prices, which historically have been volatile and are likely to continue to be volatile. Prices for oil and gas are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and gas, market uncertainty, and a variety of other economic and political factors that are beyond our control. Even the perception of longer-term lower oil and gas prices by oil and gas companies can similarly reduce or defer major expenditures given the long-term nature of many large-scale development projects. Factors affecting the prices of oil and gas include the level of supply and demand for oil and gas, governmental regulations, including the policies of governments regarding the exploration for and production and development of their oil and gas reserves, weather conditions and natural disasters, worldwide political, military, and economic conditions, the level of oil and gas production by non-OPEC countries and the available excess production capacity within OPEC, the cost of producing and delivering oil and gas and potential acceleration of the development of alternative fuels and engine technologies. Any prolonged reduction in oil and gas prices will depress the immediate levels of exploration, development, and production activity which could have a material adverse impact on our results of operations, financial position and cash flows.

We face risks related to our foreign operations that may adversely affect our business.

We serve global markets and operate in certain countries with political and economic instability, including the Middle East, Northern Africa, Asia-Pacific, Eastern Europe and South American regions. Our international operations are subject to numerous international business risks including, but not limited to, geopolitical and economic conditions, risk of expropriation, import and export restrictions, trade wars, exchange controls, national and regional labor strikes, high or unexpected taxes, government royalties and restrictions on repatriation of earnings or proceeds from liquidated assets of overseas subsidiaries. Any of these could have a material adverse impact on our results of operations, financial position and cash flows.

We are subject to extensive regulation of our international operations that could adversely affect our business and results of operations.

Due to our global operations, we are subject to many laws governing international commercial activity, conduct and relations, including those that prohibit improper payments to government officials, restrict where and with whom we can do business, and limit the products, software

9

Table of Contents

and technology that we can supply to certain countries and customers. These laws include but are not limited to, the U.S. Foreign Corrupt Practices Act and United Kingdom Bribery Act, sanctions and assets control programs administered by the U.S. Department of the Treasury and/or the European Union from time to time, and the U.S. export control laws such as the regulations under the U.S. Export Administration Act, as well as similar laws and regulations in other countries relevant to our business operations. Violations of any of these laws or regulations, which are often complex in their application, may result in criminal or civil penalties that could have a material adverse effect on our results of operations, financial position and cash flows.

We may not be able to consummate, finance or successfully integrate future acquisitions, partnerships or other opportunities into our business, which could hinder our strategy or result in unanticipated expenses and losses.

Part of our strategy is to pursue strategic acquisitions, partnerships and other opportunities to complement and expand our existing business. The success of these transactions depends on our ability to efficiently complete transactions, integrate assets and personnel acquired in these transactions and apply our internal control processes to these acquired businesses. Consummating acquisitions, partnerships or other opportunities and integrating acquisitions involves considerable expense, resources and management time commitments, and our failure to manage these as intended could result in unanticipated expenses and losses. Post-acquisition integration may result in unforeseen difficulties and may deplete significant financial and management resources that could otherwise be available for the ongoing development or expansion of existing operations. Furthermore, we may not realize the benefits of an acquisition in the way we anticipated when we first entered the transaction. Any of these risks could adversely impact our results of operations, financial position and cash flows.

Competition and market conditions may adversely affect our operating results.

In certain markets, our competitors are larger than us and may have greater access to financial, technological and other resources. As a result, competitors may be better able to adapt to changes in conditions in our industries, fluctuations in the costs of raw materials or changes in global economic conditions. Competitors may also be able to introduce new products with enhanced features that may cause a decline in the demand and sales of our products. Consolidation of customers or competitors, or economic problems of customers in our markets could cause a loss of market share for our products, place downward pressure on prices, result in payment delays or non-payment, or declining plant utilization rates. These risks could adversely impact our results of operations, financial position and cash flows.

Political developments may adversely affect our business

On June 23, 2016, the United Kingdom (U.K.) held a referendum in which voters approved an exit from the European Union (E.U.), commonly referred to as “Brexit”. Subsequently, the U.K. parliament passed the European Union (Notification of Withdrawal) Act 2017, which conferred power on the U.K. government to give notice to the European Council, under

10

Table of Contents

Article 50(2) of the Treaty on European Union, of the U.K.’s intention to withdraw from the E.U.. The U.K. submitted this notice to the European Council on March 29, 2017. On November 14, 2018, the U.K. agreed the draft text of a withdrawal agreement with the E.U. and the other E.U. member states have indicated that the E.U. is not open to any renegotiation of this agreement. Though a draft withdrawal agreement has been agreed, this may not be approved by the U.K. Parliament. If this is not agreed and ratified by March 29, 2019 (or such later date as may be agreed between the U.K. and the European Council), the U.K. may be required to withdraw from the E.U. without a withdrawal agreement being in force, (commonly referred to as the “No Deal” scenario). It is currently expected that the U.K. will leave the E.U. on March 29, 2019, although this deadline could be extended if the U.K. Parliament has not approved the draft withdrawal agreement by that time, subject to agreement by all E.U. member states. If the E.U. member states refuse to agree to an extension, it is also possible that the U.K. could revoke and reserve the notice of its intention to withdraw from the E.U. in order to restart another two year period of negotiations rather than withdraw in a No Deal scenario. If the U.K. withdraws from the E.U. and the draft withdrawal agreement is ratified before March 29, 2019, then a transition period will exist until December 31 2020, during which businesses in the U.K. will trade on essentially very similar if not the same terms as before and E.U. law will continue to apply in the U.K. while the detailed legal agreement on the future relationship between the U.K. and the E.U. is being negotiated. If a future trading relationship is not agreed between the U.K. and the E.U. before the end of the transition period, or if the U.K. leaves in a No Deal scenario, then there are likely to be greater restrictions on imports and exports between the U.K. and E.U. member states and increased regulatory complexities for businesses trading goods and services between those jurisdictions. For example, during the proposed transition period, goods first lawfully put on the market in the E.U. or in the U.K. prior to the end of the transition period can circulate between the two markets before they reach the end user, but following the end of the transition period or in a No Deal scenario, they may not be able to do so without complying with additional requirements first.

These political developments may adversely impact our results of operations, financial position and cash flows.

We could be adversely affected by technological changes in our industry.

Our ability to maintain or enhance our technological capabilities, develop and market products and applications that meet changing customer requirements, and successfully anticipate or respond to technological changes in a cost effective and timely manner will likely impact our future business success. We compete on a number of fronts including, but not limited to, product quality and performance. In the case of some of our products, our competitors are larger than us and may have greater access to financial, technological and other resources. Technological changes include, but are not limited to, the development of electric and hybrid vehicles, and the subsequent impact on the demand for gasoline and diesel. Our inability to maintain a technological edge, innovate and improve our products could cause a decline in the demand and sales of our products, and adversely impact our results of operations, financial position and cash flows.

11

Table of Contents

Having a small number of significant customers may have a material adverse impact on our results of operations.

Our principal customers are oil and gas exploration and production companies, oil refineries, personal care companies, and other chemical and industrial companies. These industries are characterized by a concentration of a few large participants. The loss of a significant customer, a material reduction in demand by a significant customer or termination or non-renewal of a significant customer contract could adversely impact our results of operations, financial position and cash flows.

Our United Kingdom defined benefit pension plan could adversely impact our financial condition, results of operations and cash flows.

Movements in the underlying plan asset value and Projected Benefit Obligation (“PBO”) of our United Kingdom defined benefit pension plan are dependent on actual return on investments as well as our assumptions in respect of the discount rate, annual member mortality rates, future return on assets and future inflation. A change in any one of these assumptions could impact the plan asset value, PBO and pension credit recognized in the income statement. If future plan investment returns prove insufficient to meet future obligations, or should future obligations increase due to actuarial factors or changes in pension legislation, then we may be required to make additional cash contributions. These events could adversely impact our results of operations, financial position and cash flows.

We may have additional tax liabilities.

We are subject to income and other taxes in the U.S. and other jurisdictions. Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied. Significant judgment is required in estimating our worldwide provision for income taxes. In the ordinary course of our business, there are many transactions and calculations where the ultimate tax determination is uncertain. Although we believe our tax estimates are reasonable, any final determination pursuant to tax audits and any related litigation could be materially different to what is reflected in our consolidated financial statements. Should any tax authority disagree with our estimates and determine any additional tax liabilities, including interest and penalties for us, this could adversely impact our results of operations, financial position and cashflows.

Our success depends on our management team and other key personnel, the loss of any of whom could disrupt our business operations.

Our future success will depend in substantial part on the continued services of our senior management. The loss of the services of one or more of our key executive personnel could affect implementation of our business plan and result in reduced profitability. Our future success also depends on the continued ability to attract, develop, retain and motivate highly-qualified technical, sales and support staff. We cannot guarantee that we will be able to retain our key personnel or attract or retain qualified personnel in the future. If we are unsuccessful in our efforts in this regard, this could adversely impact our results of operations, financial position and cash flows.

12

Table of Contents

Continuing adverse global economic conditions could materially affect our current and future businesses.

Global economic factors affecting our business include, but are not limited to, geopolitical instability in some markets, miles driven by passenger and commercial vehicles, legislation to control fuel quality, impact of alternative propulsion systems, consumer demand for premium personal care and cosmetic products, and oil and gas drilling and production rates. The availability, cost and terms of credit have been, and may continue to be, adversely affected by the foregoing factors and these circumstances have produced, and may in the future result in, illiquid markets and wider credit spreads, which may make it difficult or more expensive for us to obtain credit. Continuing uncertainties in the U.S. and international markets and economies leading to a decline in business and consumer spending could adversely impact our results of operations, financial position and cash flows.

An information technology system failure may adversely affect our business.

We rely on information technology systems to transact our business. Like other global companies, we have, from time to time, experienced threats to our data and systems. Although we have implemented administrative and technical controls and take protective actions to reduce the risk of cyber incidents and protect our information technology, and we endeavor to modify such procedures as circumstances warrant, such measures may be insufficient to prevent physical and electronic break-ins, cyber-attacks or other security breaches to our computer systems. While to date we have not experienced a material cyber security breach, our systems, processes, software and network still may be vulnerable to internal or external security breaches, computer viruses, malware or other malicious code or cyber-attack, catastrophic events, power interruptions, hardware failures, fire, natural disasters, human error, system failures and disruptions, and other events that could have security consequences. Such an information technology failure or disruption could prevent us from being able to process transactions with our customers, operate our manufacturing facilities, and properly report those transactions in a timely manner. A significant, protracted information technology system failure may result in a material adverse effect on our results of operations, financial position and cash flows.

Decline in our TEL business

The remaining sales of the Octane Additives business are now concentrated on one remaining refinery customer. When this customer chooses to cease using TEL as an octane enhancer then the Company’s future operating income and cash flows from operating activities will be materially impacted. While we cannot be certain, it is possible that sales will not continue beyond 2019.

The sales of the AvTel product line are recorded within our Fuel Specialties business. The piston aviation industry has been, and is currently, researching a safe replacement fuel to replace leaded fuel. While we expect that at some point in the future a replacement fuel will be identified, trialed and supplied to the industry, there is no currently agreed replacement. In

13

Table of Contents

addition, there is no clear timescale on the legislation of a replacement product. If a suitable product is identified and the use of leaded fuel is prohibited in piston aviation the Company’s future operating income and cash flows from operating activities would be adversely impacted.

We are exposed to fluctuations in foreign currency exchange rates, which may adversely affect our results of operations.

We generate a portion of our revenues and incur some operating costs in currencies other than the U.S. dollar. In addition, the financial position and results of operations of some of our overseas subsidiaries are reported in the relevant local currency and then translated to U.S. dollars at the applicable currency exchange rates for inclusion in our consolidated financial statements. Fluctuations in these currency exchange rates affect the recorded levels of our assets and liabilities, results of operations and cash flows.

The primary exchange rate fluctuation exposures we have are with the European Union euro, British pound sterling and Brazilian real. Exchange rates between these currencies and the U.S. dollar have fluctuated in recent years and may continue to do so. We cannot accurately predict future exchange rate variability among these currencies or relative to the U.S. dollar. While we take steps to manage currency exchange rate exposure, including entering into hedging transactions, we cannot eliminate all exposure to future exchange rate variability. These exchange risks could adversely impact our results of operations, financial position and cash flows.

Sharp and unexpected fluctuations in the cost of our raw materials and energy could adversely affect our profit margins.

We use a variety of raw materials, chemicals and energy in our manufacturing and blending processes. Many of these raw materials are derived from petrochemical-based and vegetable-based feedstocks which can be subject to periods of rapid and significant cost instability. These fluctuations in cost can be caused by political instability in oil producing nations and elsewhere, or other factors influencing global supply and demand of these materials, over which we have little or no control. We use long-term contracts (generally with fixed or formula-based costs) and advance bulk purchases to help ensure availability and continuity of supply, and to manage the risk of cost increases. From time to time, we have entered into hedging arrangements for certain utilities and raw materials, but do not typically enter into hedging arrangements for all raw materials, chemicals or energy costs. If the costs of raw materials, chemicals or energy increase, and we are not able to pass on these cost increases to our customers, then profit margins and cash flows from operating activities would be adversely impacted. If raw material costs increase significantly, then our need for working capital could increase. Any of these risks could adversely impact our results of operations, financial position and cash flows.

14

Table of Contents

A disruption in the supply of raw materials or transportation services would have a material adverse impact on our results of operations.

Although we try to anticipate problems with supplies of raw materials or transportation services by building certain inventories of strategic importance, transport operations are exposed to various risks such as extreme weather conditions, natural disasters, technological problems, work stoppages as well as transportation regulations. If the Company experiences transportation problems, or if there are significant changes in the cost of these services, the Company may not be able to arrange efficient alternatives and timely means to obtain raw materials or ship finished products, which could adversely impact our results of operations, financial position and cash flows.

A high concentration of significant stockholders may have a material adverse impact on our stock price.

Approximately 46% of our common stock is held by four stockholders. A decision by any of these stockholders to sell all or a significant part of its holding, or a sudden or unexpected disposition of our stock, could result in a significant decline in our stock price which could in turn adversely impact our ability to access equity markets which in turn could adversely impact our results of operations, financial position and cash flows.

Failure to protect our intellectual property rights could adversely affect our future performance and cash flows.

Failure to maintain or protect our intellectual property rights may result in the loss of valuable technologies, or us having to pay other companies for infringing on their intellectual property rights. Measures taken by us to protect our intellectual property may be challenged, invalidated, circumvented or rendered unenforceable. We may also face patent infringement claims from our competitors which may result in substantial litigation costs, claims for damages or a tarnishing of our reputation even if we are successful in defending against these claims, which may cause our customers to switch to our competitors. Any of these events could adversely impact our results of operations, financial position and cash flows.

Our products are subject to extensive government scrutiny and regulation.

We are subject to regulation by federal, state, local and foreign government authorities. In some cases, we need government approval of our products, manufacturing processes and facilities before we may sell certain products. Many products are required to be registered with the U.S. Environmental Protection Agency (EPA), with the European Chemicals Agency (ECHA) and with comparable government agencies elsewhere. We are also subject to ongoing reviews of our products, manufacturing processes and facilities by government authorities, and must also produce product data and comply with detailed regulatory requirements.

In order to obtain regulatory approval of certain new products we must, among other things, demonstrate that the product is appropriate and effective for its intended uses, and that we are capable of manufacturing the product in accordance with applicable regulations. This approval process can be costly, time consuming, and subject to unanticipated and significant delays. We

15

Table of Contents

cannot be sure that necessary approvals will be granted on a timely basis or at all. Any delay in obtaining, or any failure to obtain or maintain, these approvals would adversely affect our ability to introduce new products and to generate income from those products. New or stricter laws and regulations may be introduced that could result in additional compliance costs and prevent or inhibit the development, manufacture, distribution and sale of our products. Such outcomes could adversely impact our results of operations, financial position and cash flows.

Legal proceedings and other claims could impose substantial costs on us.

We are from time to time involved in legal proceedings that result from, and are incidental to, the conduct of our business, including employee and product liability claims. Although we maintain insurance to protect us against a variety of claims, if our insurance coverage is not adequate to cover such claims, then we may be required to pay directly for such liabilities. Such outcomes could adversely impact our results of operations, financial position and cash flows.

Environmental liabilities and compliance costs could have a substantial adverse impact on our results of operations.

We operate a number of manufacturing sites and are subject to extensive federal, state, local and foreign environmental, health and safety laws and regulations, including those relating to emissions to the air, discharges to land and water, and the generation, handling, treatment and disposal of hazardous waste and other materials on these sites. We operate under numerous environmental permits and licenses, many of which require periodic notification and renewal, which is not automatic. New or stricter laws and regulations could increase our compliance burden or costs and adversely affect our ability to develop, manufacture, blend, market and supply products.

Our operations, and the operations of prior owners of our sites, pose the risk of environmental contamination which may result in fines or criminal sanctions being imposed or require significant amounts in remediation payments.

We anticipate that certain manufacturing sites may cease production over time and on closure, will require safely decommissioning and some environmental remediation. The extent of our obligations will depend on the future use of the sites that are affected and the environmental laws in effect at the time. We currently have made a decommissioning and remediation provision in our consolidated financial statements based on current known obligations, anticipated plans for sites and existing environmental laws. If there were to be unexpected or unknown contamination at these sites, or future plans for the sites or environmental laws change, then current provisions may prove inadequate, which could adversely impact our results of operations, financial position and cash flows.

The inability of counterparties to meet their contractual obligations could have a substantial adverse impact on our results of operations.

We sell products to oil companies, oil and gas exploration and production companies and chemical companies throughout the world. Credit limits, ongoing credit evaluation and

16

Table of Contents

account monitoring procedures are used to minimize bad debt risk. Collateral is not generally required. We have in place a credit facility with a syndicate of banks. From time to time, we use derivatives, including interest rate swaps, commodity swaps and foreign currency forward exchange contracts, in the normal course of business to manage market risks. We enter into derivative instruments with a diversified group of major financial institutions in order to manage the exposure to non-performance of such instruments.

We remain subject to market and credit risks including the ability of counterparties to meet their contractual obligations and the potential non-performance of counterparties to deliver contracted commodities or services at the contracted price. The inability of counterparties to meet their contractual obligations could have an adverse impact on our results of operations, financial position and cash flows.

The provisions of our term loan and revolving credit facility may restrict our ability to incur additional indebtedness or to otherwise expand our business.

Our term loan and revolving credit facility contains restrictive clauses which may limit our activities, and operational and financial flexibility. We may not be able to borrow under the credit facility if an event of default under the terms of the facility occurs. An event of default under the term loan and credit facility includes a material adverse change to our assets, operations or financial condition, and certain other events. The term loan and revolving credit facility also contains a number of restrictions that limit our ability, among other things, and subject to certain limited exceptions, to incur additional indebtedness, pledge our assets as security, guarantee obligations of third parties, make investments, undergo a merger or consolidation, dispose of assets or materially change our line of business.

In addition, the term loan and revolving credit facility requires us to meet certain financial ratios, including ratios based on net debt to earnings before income tax, depreciation and amortization (“EBITDA”) and net interest expense to EBITDA. Net debt, net interest expense and EBITDA are non-GAAP measures of liquidity defined in the credit facility. Our ability to meet these financial covenants depends upon the future successful operating performance of the business. If we fail to comply with financial covenants, we would be in default under the term loan and revolving credit facility and the maturity of our outstanding debt could be accelerated unless we were able to obtain waivers from our lenders. If we were found to be in default under the term loan and revolving credit facility, it could adversely impact our results of operations, financial position and cash flows.

Our business is subject to the risk of manufacturing disruptions, the occurrence of which would adversely affect our results of operations.

We are subject to hazards which are common to chemical manufacturing, blending, storage, handling and transportation. These hazards include fires, explosions, remediation, chemical spills and the release or discharge of toxic or hazardous substances together with the more generic risks of labor strikes or slowdowns, mechanical failure in scheduled downtime, extreme weather or transportation interruptions. These hazards could result in loss of life,

17

Table of Contents

severe injury, property damage, environmental contamination and temporary or permanent manufacturing cessation. Any of these factors could adversely impact our results of operations, financial position and cash flows.

Domestic or international natural disasters or terrorist attacks may disrupt our operations, decrease the demand for our products or otherwise have an adverse impact on our business.

Chemical related assets, and U.S. corporations such as us, may be at greater risk of future terrorist attacks than other possible targets in the U.S., the United Kingdom and throughout the world. Extraordinary events such as natural disasters may negatively affect local economies, including those of our customers or suppliers. The occurrence and consequences of such events cannot be predicted, but they can adversely impact economic conditions in general and in our specific markets. The resulting damage from such events could include loss of life, severe injury and property damage or site closure. Any of these matters could adversely impact our results of operations, financial position and cash flows.

While Innospec maintains business continuity plans that are intended to allow it to continue operations or mitigate the effects of events that could disrupt its business, Innospec cannot provide assurances that its plans would fully protect it from all such events. In addition, insurance maintained by Innospec to protect against property damage, loss of business and other related consequences resulting from catastrophic events is subject to coverage limitations, depending on the nature of the risk insured. This insurance may not be sufficient to cover all of Innospec’s damages or damages to others in the event of a catastrophe. In addition, insurance related to these types of risks may not be available now or, if available, may not be available in the future at commercially reasonable rates.

We may be exposed to certain regulatory and financial risks related to climate change

The outcome of new or potential legislation or regulation in the U.S. and other jurisdictions in which we operate may result in new or additional requirements, additional charges to fund energy efficiency activities, fees or restrictions on certain activities. Compliance with these initiatives may also result in additional costs to us, including, among other things, increased production costs, additional taxes, reduced emission allowances or additional restrictions on production or operations. Any adopted future climate change regulations could also negatively impact our ability to compete with companies situated in areas not subject to such limitations. Even without such regulation, increased public awareness and adverse publicity about potential impacts on climate change emanating from us or our industry could harm us. We may not be able to recover the cost of compliance with new or more stringent laws and regulations, which could adversely affect our business and negatively impact our growth. Furthermore, the potential impacts of climate change and related regulation on our customers are highly uncertain and may adversely affect us.

| Item 1B | Unresolved Staff Comments |

None.

18

Table of Contents

| Item 2 | Properties |

A summary of the Company’s principal properties is shown in the following table. Each of these properties is owned by the Company except where otherwise noted:

| Location | Reporting Segment | Operations | ||

| Englewood, Colorado (1) | Fuel Specialties and Performance Chemicals | Corporate Headquarters Business Teams Sales/Administration | ||

| Newark, Delaware (1) | Fuel Specialties | Research & Development | ||

| Herne, Germany (1) | Fuel Specialties | Sales/Manufacturing/Administration Research & Development | ||

| Vernon, France | Fuel Specialties | Sales/Manufacturing/Administration Research & Development | ||

| Moscow, Russia (1) | Fuel Specialties | Sales/Administration | ||

| Leuna, Germany | Fuel Specialties | Sales/Manufacturing/Administration Research & Development | ||

| Ellesmere Port, United Kingdom | Fuel Specialties, Performance Chemicals and Octane Additives | European Headquarters Business Teams Sales/Manufacturing/Administration Research & Development Fuel Technology Center | ||

| Beijing, China (1) | Fuel Specialties and Performance Chemicals | Sales/Administration | ||

| Singapore (1) | Fuel Specialties and Performance Chemicals | Asia-Pacific Headquarters Business Teams Sales/Administration | ||

| Milan, Italy (1) | Fuel Specialties and Performance Chemicals | Sales/Administration | ||

| Rio de Janeiro, Brazil (1) | Fuel Specialties and Performance Chemicals | Sales/Administration | ||

| High Point, North Carolina | Performance Chemicals | Manufacturing/Administration Research & Development | ||

| Salisbury, North Carolina | Performance Chemicals | Manufacturing/Administration Research & Development | ||

| Chatsworth, California (1) | Performance Chemicals | Sales/Manufacturing/Administration | ||

| Everberg, Belgium (1) | Performance Chemicals | Sales/Administration/Research & Development | ||

| Saint Mihiel, France | Performance Chemicals | Manufacturing/Administration/Research & Development | ||

| Castiglione, Italy | Performance Chemicals | Manufacturing/Administration/Research & Development | ||

| Barcelona, Spain (1) | Performance Chemicals | Manufacturing/Administration/Research & Development | ||

19

Table of Contents

| Location | Reporting Segment | Operations | ||

| Oklahoma City, Oklahoma | Oilfield Services | Sales/Manufacturing/Administration | ||

| Midland, Texas | Oilfield Services | Sales/Manufacturing/Administration | ||

| Pleasanton, Texas | Oilfield Services | Sales/Manufacturing/Administration | ||

| Sugar Land, Texas (1) | Oilfield Services | Sales/Administration/Research & Development | ||

| The Woodlands, Houston, Texas (1) | Oilfield Services | Sales/Administration/Research & Development | ||

| Williston, North Dakota | Oilfield Services | Sales/Warehouse | ||

| Casper, Wyoming (1) | Oilfield Services | Warehouse | ||

| Zug, Switzerland (1) | Octane Additives | Sales/Administration | ||

| (1) | Leased property |

Manufacturing Capacity

We believe that our plants and supply agreements are sufficient to meet current sales levels. Operating rates of the plants are generally flexible and varied with product mix and normal sales demand swings. We believe that all of our facilities are maintained to appropriate levels and in sufficient operating condition though there remains an ongoing need for maintenance and capital investment.

| Item 3 | Legal Proceedings |

Legal matters

While we are involved from time to time in claims and legal proceedings that result from, and are incidental to, the conduct of our business including business and commercial litigation, employee and product liability claims, there are no material pending legal proceedings to which the Company or any of its subsidiaries is a party, or of which any of their property is subject. It is possible, however, that an adverse resolution of an unexpectedly large number of such individual claims or proceedings could in the aggregate have a material adverse effect on results of operations for a particular year or quarter.

| Item 4 | Mine Safety Disclosures |

Not applicable.

20

Table of Contents

| Item 5 | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market Information and Holders

The Company’s common stock is listed on the NASDAQ under the symbol “IOSP.” As of February 12, 2019 there were 875 registered holders of the common stock.

Unregistered Sales of Equity Securities

There were no unregistered sales of equity securities during the fourth quarter of 2018.

Issuer Purchases of Equity Securities

During 2018 the Company made no repurchases of our common stock.

On November 3, 2015 the Company announced that its board of directors has authorized a share repurchase program which targets to repurchase up to $90 million of common stock over a three year period which has now ended. During the year ended December 31, 2018, no shares of our common stock were repurchased by the Company under this share repurchase program.

On November 6, 2018 the Company announced that its board of directors had approved a new share repurchase program for the repurchase of up to $100 million of Innospec’s common stock over the following three years. During the year ended December 31, 2018, no shares of our common stock were repurchased by the Company under this share repurchase program.

During the quarter ended December 31, 2018 the company has purchased its common stock in connection with the exercising of stock options by employees to satisfy tax withholding obligations. The following table provides information about our repurchases of equity securities in the period.

Issuer Purchases of Equity Securities

| Period |

Total number of shares purchased |

Average price paid per share |

||||||

| November 1, 2018 through November 30, 2018 |

2,820 | $ | 74.57 | |||||

| Total |

2,820 | $ | 74.57 | |||||

21

Table of Contents

Stock Price Performance Graph

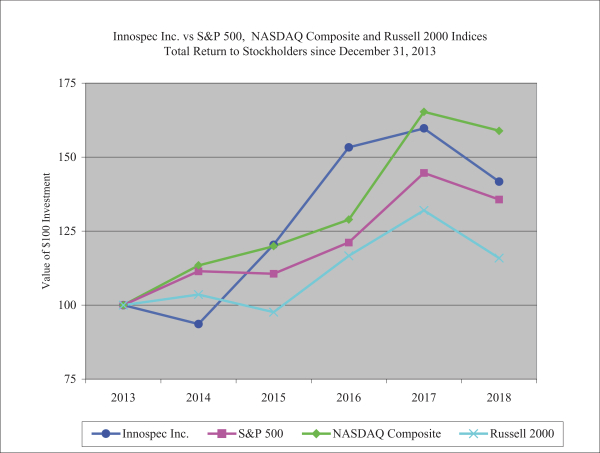

The graph below compares the cumulative total return to stockholders on the common stock of the Corporation, S&P 500 Index, NASDAQ Composite Index and Russell 2000 Index since December 31, 2013, assuming a $100 investment and the re-investment of any dividends thereafter.

Value of $100 Investment made December 31, 2013*

| 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |||||||||||||||||||

| Innospec Inc. |

$ | 100.00 | $ | 93.57 | $ | 120.35 | $ | 153.28 | $ | 159.71 | $ | 141.72 | ||||||||||||

| S&P 500 Index |

100.00 | 111.39 | 110.58 | 121.13 | 144.65 | 135.63 | ||||||||||||||||||

| NASDAQ Composite Index |

100.00 | 113.40 | 119.89 | 128.89 | 165.29 | 158.87 | ||||||||||||||||||

| Russell 2000 Index |

$ | 100.00 | $ | 103.53 | $ | 97.62 | $ | 116.63 | $ | 131.96 | $ | 115.89 | ||||||||||||

* Excludes purchase commissions.

22

Table of Contents

| Item 6 | Selected Financial Data |

FINANCIAL HIGHLIGHTS

| (in millions, except financial ratios, share and |

2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

| Summary of performance: |

||||||||||||||||||||

| Net sales |

$ | 1,476.9 | $ | 1,306.8 | $ | 883.4 | $ | 1,012.3 | $ | 960.9 | ||||||||||

| Operating income |

133.5 | 125.0 | 98.2 | 156.3 | 112.5 | |||||||||||||||

| Income before income taxes |

131.6 | 128.1 | 103.1 | 152.3 | 110.9 | |||||||||||||||

| Income taxes |

(46.6 | ) | (66.3 | ) | (21.8 | ) | (32.8 | ) | (26.8 | ) | ||||||||||

| Net income |

85.0 | 61.8 | 81.3 | 119.5 | 84.1 | |||||||||||||||

| Net income attributable to Innospec Inc. |

85.0 | 61.8 | 81.3 | 119.5 | 84.1 | |||||||||||||||

| Net cash provided by operating activities |

$ | 104.9 | $ | 82.7 | $ | 105.5 | $ | 118.2 | $ | 106.3 | ||||||||||

| Financial position at year end: |

||||||||||||||||||||

| Total assets |

$ | 1,473.4 | $ | 1,410.2 | $ | 1,181.4 | $ | 1,028.6 | $ | 999.9 | ||||||||||

| Long-term debt including finance leases |

210.9 | 224.3 | 273.3 | 134.7 | 140.5 | |||||||||||||||

| Cash, cash equivalents, and short-term investments |

123.1 | 90.2 | 101.9 | 141.7 | 46.3 | |||||||||||||||

| Total equity |

$ | 825.5 | $ | 794.3 | $ | 653.8 | $ | 605.3 | $ | 515.9 | ||||||||||

| Financial ratios: |

||||||||||||||||||||

| Net income attributable to Innospec Inc. as a percentage of net sales |

5.8 | 4.7 | 9.2 | 11.8 | 8.8 | |||||||||||||||

| Effective tax rate as a percentage (1) |

35.4 | 51.8 | 21.1 | 21.5 | 24.2 | |||||||||||||||

| Current ratio (2) |

2.2 | 2.1 | 2.4 | 2.2 | 1.9 | |||||||||||||||

| Share data: |

||||||||||||||||||||

| Earnings per share attributable to Innospec Inc. |

||||||||||||||||||||

| – Basic |

$ | 3.48 | $ | 2.56 | $ | 3.39 | $ | 4.96 | $ | 3.45 | ||||||||||

| – Diluted |

$ | 3.45 | $ | 2.52 | $ | 3.33 | $ | 4.86 | $ | 3.38 | ||||||||||

| Dividend paid per share |

$ | 0.89 | $ | 0.77 | $ | 0.67 | $ | 0.61 | $ | 0.55 | ||||||||||

| Shares outstanding (basic, thousands) |

||||||||||||||||||||

| – At year end |

24,434 | 24,350 | 24,071 | 24,101 | 24,291 | |||||||||||||||

| – Average during year |

24,401 | 24,148 | 23,998 | 24,107 | 24,391 | |||||||||||||||

| Closing stock price |

||||||||||||||||||||

| – High |

$ | 82.70 | $ | 73.25 | $ | 72.75 | $ | 58.70 | $ | 46.03 | ||||||||||

| – Low |

$ | 57.78 | $ | 54.25 | $ | 42.45 | $ | 39.47 | $ | 35.55 | ||||||||||

| – At year end |

$ | 61.76 | $ | 70.60 | $ | 68.50 | $ | 54.31 | $ | 42.70 | ||||||||||

| (1) | The effective tax rate is calculated as income taxes as a percentage of income before income taxes. Income taxes are impacted in 2017 by the provisional estimates recorded in respect of the Tax Act, and in 2018 by the finalization and recording of additional taxes due as a consequence of the Tax Act. |

| (2) | Current ratio is defined as current assets divided by current liabilities. |

23

Table of Contents

QUARTERLY SUMMARY

| (in millions, except per share data) |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| 2018 |

||||||||||||||||

| Net sales |

$ | 360.7 | $ | 358.1 | $ | 363.1 | $ | 395.0 | ||||||||

| Gross profit |

104.5 | 102.8 | 111.0 | 116.7 | ||||||||||||

| Operating income |

28.9 | 28.3 | 33.4 | 42.9 | ||||||||||||

| Net income (1) |

22.2 | 21.8 | 20.6 | 20.4 | ||||||||||||

| Net cash (used in)/provided by operating activities |

$ | (2.0 | ) | $ | 0.3 | $ | 35.1 | $ | 71.5 | |||||||

| Per common share: |

||||||||||||||||

| Earnings – basic |

$ | 0.91 | $ | 0.89 | $ | 0.84 | $ | 0.84 | ||||||||

| – diluted |

$ | 0.90 | $ | 0.89 | $ | 0.84 | $ | 0.83 | ||||||||

| 2017 |

||||||||||||||||

| Net sales |

$ | 294.3 | $ | 326.3 | $ | 332.4 | $ | 353.8 | ||||||||

| Gross profit |

90.9 | 105.1 | 98.8 | 108.5 | ||||||||||||

| Operating income |

25.3 | 33.5 | 29.0 | 37.2 | ||||||||||||

| Net income/(loss) (2) |

17.2 | 26.1 | 23.3 | (4.8 | ) | |||||||||||

| Net cash (used in)/provided by operating activities |

$ | (19.9 | ) | $ | (10.9 | ) | $ | 35.2 | $ | 78.3 | ||||||

| Per common share: |

||||||||||||||||

| Earnings – basic |

$ | 0.71 | $ | 1.08 | $ | 0.97 | $ | (0.20 | ) | |||||||

| – diluted |

$ | 0.70 | $ | 1.06 | $ | 0.95 | $ | (0.20 | ) | |||||||

NOTES

| (1) | Net income includes the following special items, before tax except for the adjustment of unrecognized tax benefits, during the year ended December 31, 2018: |

| (in millions) |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| 2018 |

||||||||||||||||

| US Tax Cuts and Jobs Act 2017 |

$ | 0.0 | $ | 0.0 | $ | 0.0 | $ | 12.3 | ||||||||

| Restructuring charge |

0.0 | 0.0 | 4.8 | 2.3 | ||||||||||||

| Amortization of acquired intangible assets |

4.6 | 4.8 | 4.7 | 4.7 | ||||||||||||

| Adjustment of unrecognized tax benefits |

0.0 | 0.0 | (0.6 | ) | 1.1 | |||||||||||

| Foreign currency exchange (gains)/losses |

(1.0 | ) | (1.6 | ) | 2.5 | 0.7 | ||||||||||

| Acquisition related costs |

$ | 0.0 | $ | 0.0 | $ | 0.0 | $ | 0.7 | ||||||||

| (2) | Net income includes the following special items, before tax except for the adjustment of unrecognized tax benefits, during the year ended December 31, 2017 |

| (in millions) |

First Quarter |

Second Quarter |

Third Quarter |

Fourth Quarter |

||||||||||||

| 2017 |

||||||||||||||||

| US Tax Cuts and Jobs Act 2017 |

$ | 0.0 | $ | 0.0 | $ | 0.0 | $ | 40.6 | ||||||||

| Amortization of acquired intangible assets |

5.1 | 5.0 | 5.0 | 5.5 | ||||||||||||

| Adjustment of unrecognized tax benefits |

0.0 | 0.0 | (0.5 | ) | 0.0 | |||||||||||

| Loss/(gain) on disposal of subsidiary |

0.0 | 1.0 | 0.0 | (0.1 | ) | |||||||||||

| Foreign currency exchange losses/(gains) |

1.0 | (2.1 | ) | (1.8 | ) | (3.7 | ) | |||||||||

| Foreign exchange loss on liquidation of subsidiary |

1.8 | 0.0 | 0.0 | 0.0 | ||||||||||||

| Fair value acquisition accounting |

$ | 1.7 | $ | 0.0 | $ | 0.0 | $ | 0.0 | ||||||||

24

Table of Contents

| Item 7 | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This discussion should be read in conjunction with our consolidated financial statements and the notes thereto.

EXECUTIVE OVERVIEW

In 2018, the strategy to focus on the organic growth of our portfolio and build on the integration of our major acquisition delivered in line with our expectations. Sales revenue grew in all strategic business units. New product development and customer adoption of a strong product portfolio helped to drive this revenue growth in both Fuel Specialties and Performance Chemicals.

In Oilfield Services, the business grew as it acquired more customers and improved profitability, reflecting the strength of the market, augmented by the acquisition of BioSuite LLC in May 2018.

Octane Additives continued to supply the one remaining customer in motor gasoline, albeit at reduced levels, consistent with the customer’s transition to unleaded fuel.

CRITICAL ACCOUNTING ESTIMATES

Note 2 of the Notes to the Consolidated Financial Statements includes a summary of the significant accounting policies and methods used in the preparation of the consolidated financial statements.

Business combinations

The acquisition method of accounting requires that we recognize the assets acquired and liabilities assumed at their acquisition date fair values. Goodwill is measured as the excess of consideration transferred over the acquisition date net fair values of the assets acquired and the liabilities assumed.

The measurement of the fair values of assets acquired and liabilities assumed requires considerable judgment. Although independent appraisals may be used to assist in the determination of the fair values of certain assets and liabilities, those determinations are usually based on significant estimates provided by management, such as forecast revenue or profit. In determining the fair value of intangible assets, an income approach is generally used and may incorporate the use of a discounted cash flow method. In applying the discounted cash flow method, the estimated future cash flows and residual values for each intangible asset are discounted to a present value using a discount rate appropriate to the business being acquired. These cash flow projections are based on management’s estimates of economic and market conditions including revenue growth rates, operating margins, capital expenditures and working capital requirements.

25

Table of Contents

While we use our best estimates and assumptions as part of the process to value assets acquired and liabilities assumed at the acquisition date and contingent consideration at each balance sheet reporting date, our estimates are inherently uncertain and subject to refinement. During the measurement period, which occurs before finalization of the purchase price allocation, changes in assumptions and estimates based on new information that was not previously available, that result in adjustments to the fair values of assets acquired and liabilities assumed will have a corresponding offset to goodwill. Subsequent adjustments will impact our consolidated statements of income.

Environmental Liabilities

We are subject to environmental laws in the countries in which we conduct business. Our principal site giving rise to environmental remediation liabilities is the Octane Additives manufacturing site at Ellesmere Port in the United Kingdom. There are also environmental remediation liabilities on a much smaller scale in respect of our other manufacturing sites in the U.S. and Europe. At Ellesmere Port there is a continuing asset retirement program related to certain manufacturing units that have been closed.

Remediation provisions at December 31, 2018 amounted to $49.5 million and relate principally to our Ellesmere Port site in the United Kingdom. We recognize environmental liabilities when they are probable and costs can be reasonably estimated, and asset retirement obligations when there is a legal obligation and costs can be reasonably estimated. The Company has to anticipate the program of work required and the associated future expected costs, and comply with environmental legislation in the countries in which it operates or has operated in. The Company views the costs of vacating our Ellesmere Port site as contingent upon if and when it vacates the site because there is no present intention to do so.

Income Taxes

We are subject to income and other taxes in the U.S. and other jurisdictions. Tax laws are dynamic and subject to change as new laws are passed and new interpretations of the law are issued or applied.

The calculation of our tax liabilities involves evaluating uncertainties in the application of accounting principles and complex tax regulations. We recognize liabilities for anticipated tax audit issues based on our estimate of whether, and the extent to which, additional taxes will be required. If we ultimately determine that payment of these amounts is unnecessary, we reverse the liability and recognize a tax benefit during the period in which we determine that the liability is no longer necessary.

We also recognize tax benefits to the extent that it is more likely than not that our positions will be sustained, based on technical merits of the position, when challenged by the taxing authorities. To the extent that we prevail in matters for which liabilities have been established, or are required to pay amounts in excess of our liabilities, our effective tax rate in a given period may be materially affected. An unfavourable tax settlement may require cash payments and result in an increase in our effective tax rate in the year of resolution. We report interest

26

Table of Contents

and penalties related to uncertain tax positions as income taxes. For additional information regarding uncertain income tax positions, see Note 10 of the Notes to the Consolidated Financial Statements.

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”). The Tax Act makes broad and complex changes to the U.S. tax code, including, but not limited to, (1) reducing the U.S. federal corporate tax rate from 35 per cent to 21 per cent; (2) requiring companies to pay a one-time transition tax on certain unrepatriated earnings of foreign subsidiaries; (3) generally eliminating U.S. federal income taxes on dividends from foreign subsidiaries; (4) requiring a current inclusion in U.S. federal taxable income of certain earnings of controlled foreign corporations; (5) creating a new limitation on deductible interest expense; and (6) changing rules related to uses and limitations of NOL carry forwards created in tax years beginning after December 31, 2017.

On December 22, 2017, the SEC staff issued Staff Accounting Bulletin No. 118 (“SAB 118”), which provides guidance on accounting for the tax effects of the Tax Act. SAB 118 provided a measurement period that was not to extend beyond one year from the Tax Act enactment date for companies to complete their accounting under ASC 740, Income Taxes. As a result of the Tax Act, we recorded provisional amounts in relation to the accounting of the transition tax in 2017. At December 31, 2018, we consider the accounting of the transition tax and other items as further disclosed in Note 10 to now be complete.

Pensions

The Company maintains a defined benefit pension plan covering a number of its current and former employees in the United Kingdom. The Company also has other much smaller pension arrangements in the U.S. and overseas, but the obligations under those plans are not material. The United Kingdom plan is closed to future service accrual, but has a large number of deferred and current pensioners.

Movements in the underlying plan asset value and Projected Benefit Obligation (“PBO”) are dependent on actual return on investments as well as our assumptions in respect of the discount rate, annual member mortality rates, future return on assets and future inflation. A change in any one of these assumptions could impact the plan asset value, PBO and pension charge recognized in the income statement. Such changes could adversely impact our results of operations and financial position. For example, a 0.25% change in the discount rate assumption would change the PBO by approximately $21 million while the net pension credit for 2019 would change by approximately $0.5 million. A 0.25% change in the level of price inflation assumption would change the PBO by approximately $14 million and the net pension credit for 2019 would change by approximately $0.6 million.

Further information is provided in Note 9 of the Notes to the Consolidated Financial Statements.

27

Table of Contents

Goodwill

The Company’s reporting units, the level at which goodwill is assessed for potential impairment, are consistent with the reportable segments. The components in each segment (including products, markets and competitors) have similar economic characteristics and the segments, therefore, reflect the lowest level at which operations and cash flows can be sufficiently distinguished, operationally and for financial reporting purposes, from the rest of the Company.