UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

(Mark One) | |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended | |

OR | |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the transition period from to | |

Commission file number:

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of | (I.R.S. Employer |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: |

| Trading Symbol |

| Name of each exchange on which registered: |

The |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by checkmark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act ◻ Yes ⌧

Indicate by checkmark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ◻ Yes ⌧

Indicate by checkmark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ⌧

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ⌧

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ◻ | Accelerated filer ◻ | Smaller reporting company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by checkmark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

The aggregate market value of the voting stock held by non-affiliates of the registrant, based upon the closing sale price of $10.98 for the common stock on June 30, 2021 as reported on the Nasdaq Global Select Market, was approximately $

As of March 1, 2022,

TABLE OF CONTENTS

1

PART I

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements relating to our expectations regarding results of operations, market and customer demand for our products, customer qualifications of our products, our ability to expand our markets or increase sales, emerging applications using chips or devices fabricated on our substrates, the development and adoption of new products, applications, enhancements or technologies, the life cycles of our products and applications, product yields and gross margins, expense levels, the impact of the adoption of certain accounting pronouncements, our investments in capital projects, ramping production at our new sites, potential severance costs with respect to the relocation of our gallium arsenide production lines, our ability to have customers re-qualify substrates from our new manufacturing location in Dingxing, China, our ability to utilize or increase our manufacturing capacity, and our belief that we have adequate cash and investments to meet our needs over the next 12 months are forward-looking statements. Additionally, statements regarding completing steps in connection with the proposed listing of shares of our wafer manufacturing company, Beijing Tongmei Xtal Technology Co., Ltd. (“Tongmei”), on the Shanghai Stock Exchange’s Sci-Tech innovAtion boaRd (the “STAR Market”), being accepted to list shares of Tongmei on the STAR Market, the timing and completion of such listing of shares of Tongmei on the STAR Market are forward looking statements. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “goals,” “should,” “continues,” “would,” “could” and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this annual report. Additionally, statements concerning future matters such as our strategy and plans, industry trends and the impact of trends, tariffs and trade wars, the potential or expected impact of the COVID-19 pandemic on our business, results of operations and financial condition, mandatory factory shutdowns in China, changes in policies and regulations in China and economic cycles on our business are forward-looking statements.

Our forward-looking statements are based upon assumptions that are subject to uncertainties and factors relating to the company’s operations and business environment, which could cause actual results to differ materially from those expressed or implied in the forward-looking statements contained in this report. These uncertainties and factors include, but are not limited to: the withdrawal, cancellations or requests for redemptions by private equity funds in China of their investments in Tongmei, the administrative challenges in satisfying the requirements of various government agencies in China in connection with the investments in Tongmei and the listing of shares of Tongmei on the STAR Market, continued open access to companies to list shares on the STAR Market, investor enthusiasm for new listings of shares on the STAR Market and geopolitical tensions between China and the United States. Additional uncertainties and factors include, but are not limited to: the timing and receipt of significant orders; the cancellation of orders and return of product; emerging applications using chips or devices fabricated on our substrates; end-user acceptance of products containing chips or devices fabricated on our substrates; our ability to bring new products to market; product announcements by our competitors; the ability to control costs and improve efficiency; the ability to utilize our manufacturing capacity; product yields and their impact on gross margins; the relocation of manufacturing lines and ramping of production; possible factory shutdowns as a result of air pollution in China; COVID-19 or other outbreaks of a contagious disease; the availability of COVID-19 vaccines; tariffs and other trade war issues; the financial performance of our partially owned supply chain companies; policies and regulations in China; and other factors as set forth in this Annual Report on Form 10-K, including those set forth under the section entitled “Risk Factors” in Item 1A below. All forward-looking statements are based upon management’s views as of the date of this annual report and are subject to risks and uncertainties that could cause actual results to differ materially from historical results or those anticipated in such forward-looking statements. Such risks and uncertainties include those set forth under the section entitled “Risk Factors” in Item 1A below, as well as those discussed elsewhere in this annual report, and identify important factors that could disrupt or injure our business or cause actual results to differ materially from those predicted in any such forward-looking statements.

These forward-looking statements are not guarantees of future performance. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Readers are urged to carefully review and consider the various disclosures made in this report, which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operations and prospects. We undertake no obligation to revise or update any forward-looking statements in order to reflect any development, event or circumstance that may arise after the date of this report.

2

Item 1. Business

AXT, Inc. (“AXT”, “the Company”, “we,” “us,” and “our” refer to AXT, Inc. and its consolidated subsidiaries) is a materials science company that develops and produces high-performance compound and single element semiconductor substrates, also known as wafers. Two of our consolidated subsidiaries produce and sell certain raw materials some of which are used in our substrate manufacturing process and some of which are sold to other companies.

Our substrate wafers are used when a typical silicon substrate wafer cannot meet the performance requirements of a semiconductor or optoelectronic device. The dominant substrates used in producing semiconductor chips and other electronic circuits are made from silicon. However, certain chips may become too hot or perform their function too slowly if silicon is used as the base material. In addition, optoelectronic applications, such as LED lighting and chip-based lasers, do not use silicon substrates because they require a wave form frequency that cannot be achieved using silicon. Alternative or specialty materials are used to replace silicon as the preferred base in these situations. Our wafers provide such alternative or specialty materials. We do not design or manufacture the chips. We add value by researching, developing and producing the specialty material wafers. We have two product lines: specialty material substrates and raw materials integral to these substrates. Our compound substrates combine indium with phosphorous (indium phosphide: InP) or gallium with arsenic (gallium arsenide: GaAs). Our single element substrates are made from germanium (Ge).

InP is a high-performance semiconductor substrate used in broadband and fiber optic applications, 5G infrastructure and data center connectivity. InP substrates are also used in biometric wearables and other health monitoring applications. In recent years, InP demand has increased. Semi-insulating GaAs substrates are used to create various high-speed microwave components, including power amplifier chips used in cell phones, satellite communications and broadcast television applications. Semi-conducting GaAs substrates are used to create opto-electronic products, including high brightness light emitting diodes (HBLEDs) that are often used to backlight wireless handsets and liquid crystal display (LCD) TVs and also used for automotive panels, signage, display and lighting applications. GaAs wafers could also be used for making vertical cavity surface emitting lasers (VCSELs) and micro-LEDs targeting improved screen technology. Ge substrates are used in applications such as solar cells for space and terrestrial photovoltaic applications.

Our supply chain strategy includes partial ownership of raw material companies. Two of these companies are consolidated. One of these consolidated companies produces pyrolytic boron nitride (pBN) crucibles used in the high temperature (typically in the range 500 C to 1,500 C) growth process of single crystal ingots, effusion rings when growing OLED (Organic Light Emitting Diode) tools, epitaxial layer growth in MOCVD (Metal-Organic Chemical Vapor Deposition) reactors and MBE (Molecular Beam Epitaxy) reactors. We use these pBN crucibles in our own ingot growth processes and they are also sold in the open market to other companies. The second consolidated company converts raw gallium to purified gallium. We use purified gallium in producing our GaAs substrates and it is also sold in the open market to other companies for use in producing magnetic materials, high temperature thermometers, single crystal ingots, including gallium arsenide, gallium nitride, gallium antimonite and gallium phosphide ingots, and other materials and alloys. In addition to purified gallium, the second consolidated company also produces InP base material which we then use to grow single crystal ingots. In prior years, a third company was consolidated, but, in the first quarter of 2019, we sold a portion of our ownership to our investment partner and, as of March 11, 2019, we ceased to consolidate this company. Our substrate product group generated 75%, 79% and 81% of our consolidated revenue and our raw materials product group generated 25%, 21% and 19% for 2021, 2020 and 2019, respectively.

3

The following chart shows our substrate products and their materials, diameters and illustrative applications and shows our raw materials group primary products and their illustrative uses and applications.

Products |

| |

Substrate Group and Wafer Diameter | Sample of Applications | |

Indium Phosphide | • Data center connectivity using light/lasers | |

(InP) | • 5G communications | |

2”, 3”, 4” | • Fiber optic lasers and detectors | |

• Passive Optical Networks (PONs) | ||

• Silicon photonics | ||

• Photonic Integrated circuits (PICs) | ||

• High efficiency terrestrial solar cells (CPV) | ||

• RF amplifier and switching (military wireless & 5G) | ||

• Infrared light-emitting diode (LEDs) motion control | ||

• Lidar for robotics and autonomous vehicles | ||

• Infrared thermal imaging | ||

Gallium Arsenide | • Wi-Fi devices | |

(GaAs - semi-insulating) | • IoT devices | |

1”, 2”, 3”, 4”, 5”, 6” | • High-performance transistors | |

• Direct broadcast television | ||

• Power amplifiers for wireless devices | ||

• Satellite communications | ||

• High efficiency solar cells for drones and automobiles | ||

• Solar cells | ||

Gallium Arsenide | • High brightness LEDs | |

(GaAs - semi-conducting) | • Screen displays using micro-LEDs | |

1”, 2”, 3”, 4”, 5", 6” | • Printer head lasers and LEDs | |

• 3-D sensing using VCSELs | ||

• Data center communication using VCSELs | ||

• Sensors for industrial robotics/Near-infrared sensors | ||

• Laser machining, cutting and drilling | ||

• Optical couplers | ||

• High efficiency solar cells for drones and automobiles | ||

• Other lasers | ||

• Night vision goggles | ||

• Lidar for robotics and autonomous vehicles | ||

• Solar cells | ||

Germanium | • Multi-junction solar cells for satellites | |

(Ge) | • Optical sensors and detectors | |

2”, 4”, 6” | • Terrestrial concentrated photo voltaic (CPV) cells | |

• Infrared detectors | ||

• Carrier wafer for LED | ||

Raw Materials Group | ||

6N+ and 7N+ purified gallium | • Key material in single crystal ingots such as: | |

- Gallium Arsenide (GaAs) | ||

- Gallium Nitride (GaN) | ||

- Gallium Antimonite (GaSb) | ||

- Gallium Phosphide (GaP) | ||

Boron trioxide (B2O3) | • Encapsulant in the ingot growth of III-V compound semiconductors | |

Gallium-Magnesium alloy | • Used for the synthesis of organo-gallium compounds in epitaxial growth on semiconductor wafers | |

pyrolytic boron nitride (pBN) crucibles | • Used when growing single-crystal compound semiconductor ingots | |

• Used as effusion rings growing OLED tools | ||

pBN insulating parts | • Used in MOCVD reactors | |

• Used when growing epitaxial layers in Molecular Beam Epitaxy (MBE) reactors |

4

All of our products are manufactured in the People’s Republic of China (PRC or China) by our PRC subsidiaries and PRC joint ventures. The PRC generally has favorable costs for facilities and labor compared with comparable facilities in the United States, Europe or Japan. Our supply chain includes partial ownership of raw material companies in China (subsidiaries/joint ventures). We believe this supply chain arrangement provides us with pricing advantages, reliable supply, market trend visibility and better sourcing lead-times for key raw materials central to manufacturing our substrates. Our raw material companies produce materials, including raw gallium (4N Ga), high purity gallium (6N and 7N Ga), starting material for InP, arsenic, germanium, germanium dioxide, pyrolytic boron nitride (pBN) crucibles and boron oxide (B2O3). We have board representation in all of these raw material companies. We consolidate the companies in which we have either a controlling financial interest, or majority financial interest combined with the ability to exercise substantive control over the operations, or financial decisions, of such companies. We use the equity method to account for companies in which we have smaller financial interest and have the ability to exercise significant influence, but not control, over such companies. We purchase portions of the materials produced by these companies for our own use and they sell the remainder of their production to third parties.

The Beijing city government is moving its offices into the district where our original manufacturing facility is currently located and is in the process of moving thousands of government employees into this district. The government has constructed showcase tower buildings and overseen the establishment of new apartment complexes, retail stores and restaurants. A large park, named Green Heart City Park, was built across the street from our facility and Universal Studios has developed an amusement park within a few miles of our facility. To create room and upgrade the district, the city instructed virtually all existing manufacturing companies, including AXT, to relocate all or some of their manufacturing lines. We were instructed to relocate our gallium arsenide manufacturing lines. For reasons of manufacturing efficiency, we elected to also move part of our germanium manufacturing line. Our indium phosphide manufacturing line, as well as various administrative and sales functions, will remain primarily at our original site.

Begun in 2017, the relocation of our gallium arsenide production lines is now completed. We entered into volume production in 2020. To mitigate our risks and maintain our production schedule, we moved our gallium arsenide equipment in stages. By December 31, 2019, we had ceased all crystal growth for gallium arsenide in our original manufacturing facility in Beijing and transferred 100% of our ingot production to our new manufacturing facility in Kazuo, a city approximately 250 miles from Beijing. We transferred our wafer processing equipment for gallium arsenide to our new manufacturing facility in Dingxing, a city approximately 75 miles from Beijing. Some of our larger, more sophisticated customers qualified gallium arsenide wafers from the new sites in 2020. A few customers, as well as prospective customers, are still in that process. Our new facilities enabled us to expand capacity and upgrade some of our equipment. The new buildings are large enough that we can install additional equipment if market demand increases or if we gain market share. We also acquired sufficient land to enable us to add facilities, if needed in the future. We believe our ability to add capacity gives us a competitive advantage. In addition, a new level of technological sophistication in our manufacturing capabilities will enable us to support the major trends that we believe are likely to drive demand for our products in the years ahead.

Customer qualifications and expanding capacity as needed require us to continue to diligently address the many details that arise at both of the new sites. A failure to properly accomplish this could result in disruption to our production and have a material adverse impact on our revenue, our results of operations and our financial condition. If we fail to meet the product qualification and volume requirements of a customer, we may lose sales to that customer. Our reputation may also be damaged. Any loss of sales could have a material adverse effect on our revenue, our results of operations and our financial condition.

On November 16, 2020, we announced a strategic initiative to access China’s capital markets by beginning a process to list shares of Tongmei in an initial public offering (the “IPO”) on the STAR Market, an exchange intended to support innovative companies in China. We formed and founded Tongmei in 1998 and believe Tongmei has grown into a company that will be an attractive offering on the STAR Market. To qualify for a STAR Market listing, the first major step in the process was to engage private equity firms in China (“Investors”) to invest funds in Tongmei. By December 31, 2020, Investors, which consist of 10 private equity funds, had engaged with Tongmei for a total investment of approximately $48.1 million. (The currency used in the investment transactions was the Chinese renminbi, which has been converted to approximate U.S. dollars for this report.) The remaining investment of approximately $1.5 million of new capital was funded in January 2021. Under China regulations, these investments must be formally approved by the

5

appropriate government agency and are not deemed to be dilutive until such approval is granted. The government approved the approximately $49 million investment in its entirety on January 25, 2021. In exchange for an investment of approximately $49 million, the Investors received a 7.28% noncontrolling interest in Tongmei.

Pursuant to the Capital Investment Agreements with the Investors, each Investor has the right to require AXT to redeem any or all Tongmei shares held by such Investor at the original purchase price paid by such Investor, without interest, in the event of a material adverse change or if Tongmei does not achieve its IPO on or before December 31, 2022. This right is suspended when Tongmei submits its formal application to the Shanghai Stock Exchange and is accepted for review. Tongmei submitted the application in December 2021 and it was formally accepted for review on January 10, 2022. If the Shanghai Stock Exchange approves the formal application, then the Shanghai Stock Exchange will forward it to the Chinese Securities Regulatory Commission (“CSRC”) for further review. The process of going public on the STAR Market includes several periods of review and is therefore a lengthy process. Tongmei does not expect to complete the IPO until the second half of 2022. If, on December 31, 2022, the IPO application remains under review, then the date when such Investor is entitled to exercise such redemption right shall be deferred to a date when such submission is rejected by the CSRC or stock exchange, or the date when Tongmei withdraws its IPO application. If the application is approved and Tongmei completes the IPO then the redemption right is canceled. The listing of Tongmei on the STAR Market will not change the status of AXT as a U.S. public company.

An additional step in the STAR Market IPO process involves certain entity reorganizations and alignment of assets under Tongmei. In this regard our two consolidated raw material companies, Nanjing JinMei Gallium Co., Ltd. (“JinMei”) and Beijing BoYu Semiconductor Vessel Craftwork Technology Co., Ltd. (“BoYu”) and its subsidiaries were assigned to Tongmei in December 2020. As of June 30, 2021, AXT-Tongmei, Inc., a wholly owned subsidiary of AXT (“AXT-Tongmei”), was assigned to Tongmei. The assignment to Tongmei of JinMei, BoYu and its subsidiaries, and AXT-Tongmei will increase the number of customers and employees attributable to Tongmei as well as increase Tongmei’s consolidated revenue.

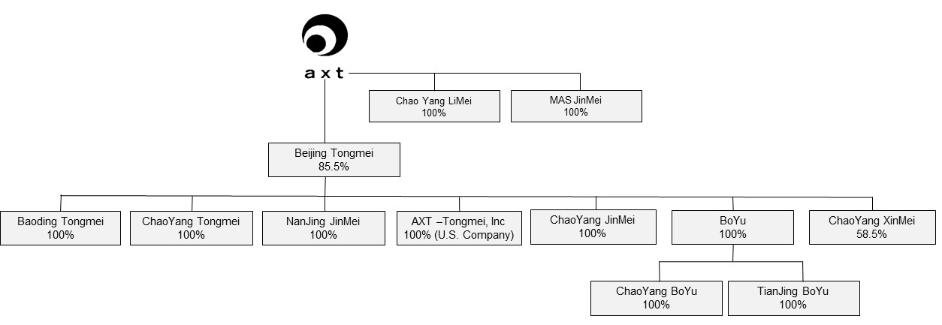

We are neither a PRC operating company nor do we conduct our operations in China through the use of variable interest entities (“VIEs”). The following organization chart depicts the consolidated structure as of December 31, 2021;

In September 2018, the Trump Administration announced a list of thousands of categories of goods that became subject to tariffs when imported into the United States. This pronouncement imposed tariffs on the wafer substrates we imported into the United States. The initial tariff rate was 10% and subsequently was increased to 25%. Approximately 10% of our revenue derives from importing our wafers into the United States and we expect the volume to increase. In 2021, 2020 and 2019, we paid approximately $1.3 million, $1.3 million and $0.7 million, respectively, in tariffs. The future impact of tariffs and trade wars is uncertain.

6

We were incorporated in California in December 1986 and reincorporated in Delaware in May 1998. The Company went public in 1998. We changed our name from American Xtal Technology, Inc. to AXT, Inc. in July 2000. Our principal corporate office is located at 4281 Technology Drive, Fremont, California 94538, and our telephone number at this address is (510) 438-4700.

Industry Background

Certain electronic and opto-electronic applications have performance requirements that exceed the capabilities of conventional silicon substrates, also known as wafers, and often require high-performance compound wafers (mixture of two materials) or single element wafer substrates. Examples of higher performance non-silicon based wafer substrates include GaAs, InP, gallium nitride (GaN), silicon carbide (SiC) and Ge. One of the earliest broadly used alternative wafer substrates was GaAs and GaAs wafer substrates were the earliest wafer substrates we produced.

Silicon substrates dominate the semiconductor substrate market. Silicon wafers are larger in diameter and significantly lower in cost. AXT and our competitors exist because the laws of physics prevent certain functions from performing properly, or at all, if silicon material is used as the wafer substrate. Our substrate wafers are used when a typical silicon substrate wafer cannot meet the performance requirements of a semiconductor chip or optoelectronic device. Demand for higher performance non-silicon-based wafer substrates, such as the substrates in which AXT specializes, is expected to increase as new applications are adopted. In contrast to the ever-more complex electronic circuit designs and the skill sets required to accomplish such designs, the knowledge base and skill sets required for AXT and our competitors are material science-based. We do not design or manufacture the semiconductor chips and other electronic circuits. Instead we apply our deep knowledge in material science to grow single crystal ingots that are then sliced into individual wafer substrates. We add value by researching, developing and producing the specialty material wafers. This places us at the beginning of the semiconductor “food chain”.

InP is a high-performance semiconductor substrate used in broadband and fiber optic applications and data center connectivity. InP substrates can also be used in 5G and health and well-being biometric applications. In recent years, InP demand has increased. Semi-insulating GaAs substrates are used to create various high-speed microwave components, including power amplifier chips used in cell phones, satellite communications and broadcast television applications. Semi-conducting GaAs substrates are used to create opto-electronic products, including HBLEDs that are often used to backlight wireless handsets and LCD TVs and also used for automotive panels, signage, display and lighting applications. GaAs wafers could also be used for making VCSELs and micro-LEDs targeting improved screen technology. Ge substrates are used in applications such as solar cells for space and terrestrial photovoltaic applications.

The AXT Advantages

We believe that we benefit from the following advantages:

| ● | New facilities, equipment and added capacity. We believe we are the only company in our industry to have recently added significant new facilities, equipment and capacity. Although current customers and prospective customers previously viewed our relocation process as a risk, we believe our success in managing this process now positions us as the “go to” supplier with a state of the art manufacturing line, a proven ability to add capacity and a commitment to continuous improvement. |

| ● | Funds from the recent private equity investments in Tongmei and the anticipated future IPO of Tongmei are viewed favorably by our customers, prospective customers and government agencies in China. New applications using InP and GaAs wafer substrates could require significant capital investments to add capacity, purchase and install advanced process and test equipment or construct additional facilities. We believe customers view the funds raised in December 2020 and January 2021, and intended to be raised in the IPO, as a sign of our commitment to meet their needs and to deploy this capital to increase capacity as needed. Further, we believe Tongmei is viewed more favorably by local government agencies in light of its intention to go public on the STAR Market. |

7

| ● | Key leadership in InP technology and revenue growth. We believe our InP wafers have the lowest defect densities, stress and slip lines on the market, enabling our customers to achieve the highest wafer fab and device yields. We have developed a strong base of proprietary InP technology that we continue to expand. There are significant barriers to entry in the InP substrate market and currently, there are only three primary suppliers, including AXT. We believe that this market will continue to expand and grow. We intend to promote our track record of successfully adding capacity as the market expands. |

| ● | Key provider of low defect density GaAs wafer substrates. In recent years customer demand for low etch pit density (“EPD”) GaAs wafer substrates has increased, particularly for LED lighting, the deployment of 3-D sensing for facial recognition in cell phones and world facing camera technology in cell phones. The requirement of low EPD is a barrier to entry and we believe there are a limited number of potential substrate providers that can meet this requirement, including AXT. As we qualify low EPD wafers from our new location, we believe the quality of our low EPD wafers and our ability to expand manufacturing capacity quickly will enable us to support new applications and generate additional revenue. |

| ● | Proprietary process technology drives manufacturing. In our industry, the single crystal growth process and the wafer manufacturing process incorporate proprietary process technology. We have a substantial body of proprietary process technology and we believe this gives us a competitive advantage, especially in InP. This also creates a barrier to entry. |

| ● | Low-cost manufacturing operation in China. Since 2004, we have manufactured all of our products in China, which generally has favorable costs for facilities and labor compared to costs of comparable facilities and labor in the United States, Japan or Europe. As of December 31, 2021, 1,358 of our 1,387 employees (including employees at our Beijing, Kazuo and Dingxing facilities as well as our consolidated raw material companies) were located in China. Our primary competitors have their major manufacturing operations in Germany or Japan. Our presence in China also enables us to closely manage our raw materials supply chain. |

| ● | We believe that we are the only compound semiconductor substrate supplier to have a position in raw materials. We have partial ownership of raw material companies in China that form an integral part of our supply chain. We believe our subsidiaries and raw material companies in China provide us with a more reliable supply of, and shorter lead-times for, the raw materials central to our final manufactured products compared to third-party providers. We believe that this dedicated supply chain will enable us to meet increases in demand from our customers by providing an increased volume of raw materials quickly, efficiently and cost effectively. |

| ● | Our diverse product offering results in a broader range of customers and applications. We offer a diverse range of products and are able to provide custom-defined products that meet our customers’ specifications. We have a strong technical sales support team that engages with our customers and understands their product requirements. A significant percentage of the members of our team that engage with customers have PhDs in physics or materials science. This combination of technical sales strength and our willingness to accept our customers’ unique product specifications results in a broad range of customers and applications. As demand for our wafer substrates expands it could strain the supply of raw materials making our business model even more important. |

| ● | Enhanced revenue diversity through the sale of raw materials. Our strategy allows our consolidated subsidiaries to also sell raw materials in the open market to third parties. Revenue from non-substrate products provides further diversity in our customer base and business model. |

| ● | Business model unique among current competitors. We believe we are the only publicly traded company producing InP, GaAs and Ge wafer substrates. Our direct competitors are either privately owned companies or divisions within very large companies that are publicly listed in Japan. We believe the combination of access to U.S. and China capital markets, China-based manufacturing and a unique strategy for the supply |

8

| of many of the raw materials we need is a competitive advantage as well as an attractive business model to our customers. |

Strategy

Our goal is to become the leading worldwide supplier of high-performance compound and single element semiconductor substrates. Key elements of our strategy include:

Promote our strengths in InP. As cloud-based data centers continue to combine integrated circuits and InP-based lasers to transfer data through light, we believe there will be increased demand for InP substrates. More recently InP is being used in 5G infrastructure. Future applications could include driverless cars, 5G in cell phones and health and well-being biometric wearables.

Add InP capacity and continue InP R&D. We are continuing to add manufacturing capacity for InP to support the growth for this product line. End market applications using our wafer substrate products often have long product life cycles. We believe the end market applications using InP could have product life cycles that are similar to the long product life cycles of end market applications using GaAs. In addition to adding manufacturing capacity, we are continuing to invest in InP crystal growth technology and wafer processing technology. For example, we are developing six-inch diameter ingots and improving the relative flatness of the wafer surface to improve performance.

Target GaAs based 3-D and Time of Flight sensing array applications in mobile devices. Although 3-D sensing has not yet been widely adopted and embraced, we believe its use in world-facing cameras will accelerate adoption and generate a significant impact for high-quality GaAs suppliers. We believe 3-D sensing technology will also be used as sensors in driverless automobiles. The GaAs substrate requirements for 3-D sensing applications include very low defect densities or etch pitch densities. We intend to capture opportunities in these markets by promoting our strengths and capabilities.

Analyze and monitor the potential market for GaAs-based micro-LEDs. There is growing interest in developing micro-LEDs for advanced screen technology. If such technology is adopted successfully for use in smart phones, then the total available market could be significant and we would endeavor to serve that market.

Create customer awareness that the new facilities are designed to allow us to add equipment and capacity rapidly. The construction of new facilities and infrastructure takes much longer to complete in comparison to the installation of furnaces and other manufacturing equipment. We have proven our ability to do both and we believe this ability makes us an attractive supplier for customers.

Offer diverse products, including custom products. We believe AXT has a reputation in the market for providing a broad range of products, including custom products that are supported by a team of technical sales support professionals, the majority of whom hold advanced graduate degrees in physics or materials science. We plan to further promote this brand image as a way to differentiate ourselves in the market. We believe this strategy will lead to a more diverse customer base and higher volumes.

Sustain manufacturing efficiencies. We seek to continue to leverage our China-based manufacturing advantage by increasing efficiencies in our manufacturing methods, systems and processes. We promote the concept and practice of continuous improvement within our company culture.

Increase productivity and seek profitability in our subsidiaries/consolidated raw material companies. The supply and demand equation for specialty materials can be complex and volatile. Over the years, we have established or invested in raw material companies in China that are an integral part of our supply chain. We will continue to provide strategic support to these companies and they, in turn, will continue to be the backbone of our supply chain. We plan to work closely with these companies to increase their productivity and improve their financial performance as they continue to support our supply chain.

9

Materials of the future. The specialty materials substrate market is dynamic and subject to continued changes and cycles. We plan to use our deep knowledge and experience in specialty materials and wafer substrates to seek new applications for existing substrates in our portfolio and explore additional materials that may be synergistic with our knowledge base, customer needs and manufacturing lines.

Technology

Wafer substrates on which integrated circuits and optical devices are fabricated serve as a foundation for semiconductor device fabrication. Wafers are derived from ingots that are grown in a cylindrical form. The diameter and length of an ingot will vary depending on the type of material and the growth process used. An ingot can be single-crystalline (a single crystal) or multi-crystalline (polycrystalline). A single crystal is a continuous lattice of atoms with no boundaries within the structure. The ingot must be a single crystal in order for it to be useful in making wafers for device fabrication. A single crystal ingot can be made from a single element such as germanium or silicon, or it can be made from two or more elements such as gallium arsenide (with gallium and arsenic) or indium phosphide (with indium and phosphorous). Depending on physical properties of the materials in a wafer, the performance of devices and circuits can be remarkably different.

AXT uses its proprietary vertical gradient freeze (VGF) technology for growing single crystal Indium Phosphide (InP), Gallium Arsenide (GaAs) and Germanium (Ge) ingots. After growing the crystalline ingot, the ingot is then sliced into individual substrates or wafers. Before specialty material wafers can be used, a thin layer of structured chemicals is grown on the surface of the substrate. This is called an epitaxial layer. We do not grow the epitaxial layer as it is a complicated and highly technical process. We sell the majority of our substrates to companies that specialize in applying the epitaxial layer. The wafers are then used to produce state-of-the-art electronic and opto-electronic devices and circuit applications.

InP and GaAs compounds are formed by combining elements from Groups III and V in the periodic table of elements, whereas Ge is a Group IV elemental material. Each of these materials has unique properties that determine the best device and/or circuit applications. As a result of their special high electron mobility combined with their direct ban-gap properties, both InP and GaAs wafers have enjoyed dominant roles in the production of light-emitting diodes (LEDs), solid-state lasers and power amplifiers for mobile phones, to name a few applications. Ge wafers, on the other hand, have played a key role in the manufacturing of special solar cells known as triple junction solar cells (TJSCs) for space and terrestrial power generation.

With the recent evolution in several applications, InP lasers are projected to play a dominant role in the optoelectronics arena, e.g. silicon photonics (where InP lasers are a key component), autonomous cars (where special wavelength InP-based lasers are used for object sensing and collision avoidance) and health and well-being biometric wearables. Crystal growth process technology frequently contains steps and procedures that are considered proprietary secrets held by the producer, often including methods to control the temperature within the crucible. InP crystal growth relies on extreme pressure within the crucible. As such it requires not only temperature control methodologies, but also pressure control and stabilization process methodologies, many of which AXT considers proprietary trade secrets. It is this combination of variables and the required methods to control them that create a barrier to entry. We believe our long-term investment in InP research and development has resulted in a substantive body of proprietary knowledge.

After growing the crystalline ingot, the material is then sliced into individual substrates or wafers. We have continued to invest in wafer processing technology covering each step in the process from sawing to edge smoothing to final cleaning and we believe we have technology and trade secrets addressing the scope of wafer processing. One focus in our recent development programs has been on automation, particularly in cleaning the wafers.

Ideally, all the atoms in a wafer or substrate are arrayed in a specific periodic order. However, sensitivities in the ingot growth process will cause some atoms to be improperly aligned and these are referred to as dislocations. The aggregate number of dislocations in a wafer is referred to as the dislocation density. Dislocation densities can be seen as a group of tiny marks or pits under a microscope by etching the wafer with acid and each wafer has an etch pit density or EPD. Certain micro devices, such as the array used for 3-D sensing, require wafers with very low EPD. AXT considers

10

the process technology we use to achieve low EPD as proprietary process technology and we believe we are one of only a few substrate manufacturing companies that can produce low EPD wafers.

Products

We have two product lines: specialty material substrates and raw materials integral to these substrates. We design, develop, manufacture and distribute high-performance semiconductor substrates, also known as wafers. Through the two consolidated subsidiaries in our supply chain, we also sell certain raw materials. InP is a high-performance semiconductor substrate used in fiber optic lasers and detectors, passive optical networks (PONs), telecommunication, 5G infrastructure, metro and data center connectivity, silicon photonics (data centers), photonic ICs (PICs), terrestrial solar cell (CPV), lasers, RF amplifiers (military wireless), infrared motion control and infrared thermal imaging. We make semi-insulating GaAs substrates used in making semiconductor chips in applications such as power amplifiers for wireless devices, high-performance transistors and high efficiency solar cells for drones. Our semi-conducting GaAs substrates are used to create opto-electronic products, which include High Brightness LEDs that are often used to backlight wireless handsets and LCD TVs and for automotive, signage, display and lighting applications, as well as high power industrial lasers for material processing (welding, cutting, drilling, soldering, marking and surface modification). Our semi-conducting GaAs substrates can be used to make micro-LEDs for advanced screen technologies and to create opto-electronic products for 3-D sensing using VCSELs. Ge substrates are used in emerging applications, such as triple junction solar cells for space and terrestrial photovoltaic applications and for optical applications.

Substrates. We currently sell compound substrates manufactured from InP and GaAs, as well as single-element substrates manufactured from Ge. We supply InP substrates in two-, three- and four-inch diameters, and Ge substrates in two-, four- and six-inch diameters. We supply both semi-insulating and semi-conducting GaAs substrates in one-, two-, three-, four-, five- and six-inch diameters. Many of our customers require customized specifications, such as special levels of iron or sulfur dopants or a special wafer thickness. We are developing 6-inch InP wafers and 8-inch GaAs wafers.

Raw Materials. Our two consolidated raw material subsidiaries produce and sell certain raw materials, some of which are used in our substrate manufacturing process and some of which are sold to other companies. One of these consolidated companies produces pBN crucibles and the other consolidated company converts raw gallium to purified gallium and produces InP base material.

We promote our product diversity as a way to differentiate ourselves in the market. Some competitors provide only gallium arsenide substrates. We provide gallium arsenide and also indium phosphide and germanium substrates. Some competitors limit their wafer diameters to only a few sizes. Our wafers range from one inch to up to six inches in diameter. We also produce substrates with customer defined specifications, which may range in thickness, smoothness or flatness and may include adding special additional materials, such as iron or sulfur. In addition to our wafers or substrates, we also generate revenue from our two consolidated subsidiaries that sell raw materials. Product diversity can mitigate some of the down cycles in our market because we are not dependent on a single product or application for revenue.

Customers

Before specialty material wafers can be processed in a typical wafer manufacturing facility that constructs the electronic circuit, laser or optical device on a chip, a thin layer of structured chemicals is grown on the surface of the substrate. This is called an epitaxial layer. We do not grow the epitaxial layer. We sell our substrates to companies that apply the epitaxial layer, who then in turn sell the modified wafers to the wafer fabs, chip design companies, LED manufacturers and others. Some customers do both the epitaxial layer and wafer fabrication.

Epitaxial layer companies that form our customer base are located in Asia, the United States and Europe. We also sell our products to universities and other research organizations that use specialty materials for experimentation in various aspects of semi-conducting and semi-insulating applications. Our customers that purchase raw materials are located in Asia, the United States and Europe.

11

We have at times sold a significant portion of our products in any particular period to a limited number of customers. No customer represented more than 10% of our revenue for the year ended December 31, 2021 and one customer, Landmark, represented 11% and 15% of our revenue for the years ended December 31, 2020 and 2019, respectively. Our top five customers, although not the same five customers for each period, represented 26% of our revenue for the year 2021, 32% of our revenue for 2020 and 40% of our revenue for 2019.

For the year ended December 31, 2021, three customers of our consolidated subsidiaries, in aggregate, accounted for 28% of raw material sales. For the year ended December 31, 2020, three customers of our consolidated subsidiaries, in aggregate, accounted for 31% of raw material sales and for the year ended December 31, 2019, three customers accounted for 48% of raw material sales. Our subsidiaries and consolidated raw material companies are a key strategic benefit for us as they further diversify our sources of revenue.

Manufacturing, Raw Materials and Supplies

We manufacture all of our products in China. We believe this location generally has favorable costs for facilities and labor compared to the United States or compared to the location of some of our competitors in Japan and Germany.

We use a two-stage wafer manufacturing process. The first stage deploys our VGF technology for the crystal growth of single element or compound element ingots in diameters currently ranging from one inch to six inches. The growth process occurs in high temperature furnaces built using our proprietary designs. Growing the crystalline elements into cylindrical ingots takes a number of days, depending on the diameter and length of the ingot produced. The crystal growth stage utilizes AXT proprietary process technology. The second stage includes slicing or sawing the ingot into wafers or substrates, then processing each substrate to strict specifications, including grinding to reduce the thickness, beveling the edges, and then polishing and cleaning each substrate. Many of the wafer processing steps use chemical baths and properly cleaning the wafer is a critical process. The wafer processing stage also utilizes AXT proprietary process technology.

Wafers from each ingot will include some material that does not meet specifications or quality standards. Defects may occur as a result of inherent factors in the materials used in the crystalline growth process. They may also result from variances in the manufacturing process. We have many steps in our line that are partially or fully automated but other manufacturing steps are performed manually. We intend to increase the level of automation, particularly in cleaning the wafers. In 2015, we purchased wafer processing equipment from Hitachi Metals to help us increase automation in our production line and, therefore, reduce variability and defects. In addition, we secured a manufacturing license from Hitachi Metals. This license includes detailed work instructions for using the equipment purchased and allows us to apply the licensed proprietary wafer processing technology at any step and on any form of equipment in our line. Due to potential defects, yield is a key factor in our manufacturing cost. Other key elements are the initial cost of the raw material elements, manufacturing equipment, factory loading, facilities and labor.

Together with certain subsidiaries we have partial ownership of 10 raw material companies in China that form the backbone of our supply chain model. These companies generally provide us with reliable supply, market trend visibility, and shorter lead-times for raw materials central to our manufactured products, including gallium, gallium alloys, indium phosphide poly-crystal, arsenic, germanium, germanium dioxide, high purity arsenic, pBN and boron oxide. We believe that these raw material companies have been and will continue to be advantageous in allowing us to procure materials to support our planned growth. In addition, we purchase supply parts, components and raw materials from several other domestic and international suppliers. We depend on a single or limited number of suppliers for certain critical materials used in the production of our substrates, such as quartz tubing, arsenic, phosphorus and polishing solutions. We generally purchase our materials through standard purchase orders and not pursuant to long-term supply contracts.

Sales and Marketing

We sell our substrate products directly to customers through our direct salesforce in the United States, China and Europe. We also use independent sales representatives and distributors in Japan, Taiwan, Korea and other areas. Our

12

direct salesforce is knowledgeable in the use of compound and single-element substrates. Specialty material wafers are scientifically complicated. Our application engineers must work closely with customers during all stages of our wafer substrate manufacturing process, from developing the precise composition of the wafer substrate through manufacturing and processing the wafer substrate to the customer’s specifications. We believe that maintaining a close relationship with customers and providing them with engineering support improves customer satisfaction and provides us with a competitive advantage in selling. A significant percentage of the members of our technical sales support team who frequently engage with customers have PhDs in physics or materials science.

International Sales. International sales are a substantial part of our business. Sales to customers outside North America (primarily the United States) accounted for approximately 90% of our revenue during each of 2021, 2020 and 2019. The primary markets for sales of our substrate products outside of North America are to customers located in Asia and Western Europe. We occasionally receive small orders from customers located in Israel and Russia.

Our raw material companies sell specialty raw materials including 4N, 5N, 6N, 7N and 8N gallium, boron oxide, germanium, arsenic, germanium dioxide, pyrolytic boron nitride crucibles used in crystal growth, parts for MBE and parts used in manufacturing OLED rings. Each raw material company has its own separate sales force and sells directly to its own customers in addition to selling raw materials to us.

Research and Development

To maintain and improve our competitive position, we focus our research and development efforts on designing new proprietary processes and products, improving the performance of existing products, achieving new lows in EPD, increasing yields and reducing manufacturing costs. We also conduct research and development focusing on larger diameter wafers and, in our history, we have consistently developed new products based on larger wafer diameters. Crystal growth of specialty earth materials becomes significantly more difficult as the ingot diameter increases because a consistent temperature, and in the case of InP, consistent control of pressure, must be applied over a larger surface area. In 2015, we acquired certain proprietary InP crystal growth technology and equipment from Crystacomm.

Certain micro devices, such as the array used for 3-D sensing, require GaAs wafers with very low etch pit density. In anticipation of a growth in demand for low EPD six-inch wafers, we have focused our development efforts on increasing our yield of such wafers.

Our current substrate research and development activities focus on continued development and enhancement of GaAs, InP and Ge substrates, including improved yield, enhanced surface and electrical characteristics and uniformity, greater substrate strength and increased crystal length. In 2015, we acquired proprietary wafer processing equipment from Hitachi Metals. The Hitachi Metals purchase includes a license covering the use of the proprietary equipment and Hitachi Metals’ proprietary wafer processing technology. A particular focus of the equipment and process technology is on cleaning the wafers. It is important to remove any residual cleaning agents from each wafer to ensure that the epitaxial growth process is not encumbered by residual chemicals on the wafer.

Our consolidated subsidiaries conduct research and development, focusing on gallium alloys, gallium refinement and pyrolytic boron nitride crucibles used in high temperature crystal growth.

We have assembled a multi-disciplinary team of skilled scientists, engineers and technicians to meet our research and development objectives. Research and development expenses were $10.3 million in 2021, compared with $7.1 million in 2020 and $5.8 million in 2019. Development work focusing on yield, continuous improvement and other matters related to our research and development efforts also occurs within regular manufacturing processes. These costs are included in our cost of revenue because it is difficult to isolate them as research and development.

Competition

The semiconductor substrate industry is characterized by narrow technological boundaries, price erosion and generally intense competition. Certain wafer substrates, such as low-quality wafer substrates for consumer products using LED lighting, compete almost entirely on price. Other products, such as InP and low EPD GaAs wafers, have

13

fewer competitors and quality is a key competitive factor in addition to price. We face actual and potential competition from a number of established companies who have the advantages of greater name recognition and more established relationships in the industry. In some cases, our competitors have substantially greater financial, technical and marketing resources as they are divisions of much larger companies. They may utilize these advantages to expand their product offerings more quickly, adapt to new or emerging technologies and changes in customer requirements more quickly, and devote greater resources to the marketing and sale of their products. We believe a critical factor in our business is the level of technical support we provide to the customer or prospective customer and we attempt to counter possible advantages of name recognition or size with superior technical support through our team of technical sales support professionals, the majority of whom hold PhDs in physics or materials science.

We believe that the primary competitive factors in the markets in which our substrate products compete are:

| ● | quality; |

| ● | price; |

| ● | customer technical support; |

| ● | performance; |

| ● | meeting customer specifications; and |

| ● | manufacturing capacity. |

Our ability to compete in target markets also depends on factors such as:

| ● | the timing and success of the development and introduction of new products, including larger diameter wafers, and product features by us and our competitors; |

| ● | the availability of adequate sources of raw materials; |

| ● | protection of our proprietary methods, systems and processes; |

| ● | protection of our products and processes by effective use of intellectual property laws; and |

| ● | general economic conditions, which impact end markets using substrates. |

A majority of our customers specialize in epitaxial growth, a complex series of chemical layers grown on top of our wafers. Our wafers cannot be used to make chips until the epitaxial layers are grown. Typically, our customer or prospective customer has at least two qualified substrate suppliers. Qualified suppliers must meet industry-standard specifications for quality, on-time delivery and customer support. Once a substrate supplier has qualified with a customer, price, consistent quality and current and future product delivery lead times become the most important competitive factors. A supplier that cannot meet a customer’s current lead times or that a customer perceives will not be able to meet future demand and provide consistent quality can lose market share. Our primary competition in the market for compound and single element semiconductor substrates includes Sumitomo Electric Industries (“Sumitomo”), Japan Energy (“JX”), Freiberger Compound Materials (“Freiberger”), Umicore, China Crystal Technology Corp. (“CCTC”) and Vital Materials. We believe that at least two of our competitors are shipping high volumes of GaAs substrates manufactured using a process similar to our VGF technology. In addition, we also face competition from semiconductor device manufacturers that may use other specialty material substrates that are not GaAs, InP or Ge based materials and that are actively exploring alternative materials. For example, silicon-on-insulator (“SOI”) technology, a silicon wafer technology that produces satisfactory devices at lower cost, has been proven in the market. From 2012 to 2015, SOI technology displaced GaAs chips in key sectors, primarily the radio frequency (“RF”) switching function in cell phones.

14

Because of our vertically integrated, sophisticated supply chain, we believe we are the only compound semiconductor substrate supplier to offer a broad suite of raw materials. We believe this gives us a unique competitive advantage because we have greater control and stability over many of our needed materials. Further, we believe we have some advantage in manufacturing costs. In the event of a significant increase in demand we believe our raw materials supply chain strategy and our ability to rapidly increase capacity can provide us some advantage.

Intellectual Property

Our success and the competitive position of our VGF technology depend on our ability to maintain our proprietary process technology secrets and other intellectual property protections. We rely on a combination of patents, trademark and trade secret laws, non-disclosure agreements and other intellectual property protection methods to protect our proprietary technology. We believe that, due to the rapid pace of technological innovation in the markets for our products, our ability to establish and maintain a position of technology leadership depends as much on the skills of our research and development personnel as upon the legal protections afforded our existing technologies. To protect our trade secrets, we take certain measures to ensure their secrecy, such as executing non-disclosure agreements with our employees, customers and suppliers. However, reliance on trade secrets is only an effective business practice insofar as trade secrets remain undisclosed and a proprietary product or process is not reverse engineered or independently developed.

In addition to proprietary process trade secrets, we also file patents. To date, we have been issued 75 patents related to our VGF products and processes; 50 in China, 11 in the United States, seven in Japan, two in Taiwan, three in the European Union, one in Canada and one in South Korea. Patents normally have a protected life of 20 years from their filing dates. Our patents have expiration dates ranging from 2022 to 2038. In some cases we may consider filing divisional, continuation or continuation-in-part of the existing patents for additional claims. We currently have 23 patent applications pending, including five in China, three in the United States, three in Japan, four in Taiwan, four in Europe and four in rest of the world. Furthermore, in aggregate, our consolidated raw material companies have been issued 59 patents in China, including 44 patents issued to BoYu and 15 patents issued to JinMei.

In the normal course of business, we periodically receive and make inquiries regarding possible patent infringement. In dealing with such inquiries, it may become necessary or useful for us to obtain or grant licenses or other rights. However, there can be no assurance that such licenses or rights will be available to us on commercially reasonable terms. If we are not able to resolve or settle claims, obtain necessary licenses on commercially reasonable terms and/or successfully prosecute or defend our position, our business, financial condition and results of operations could be materially and adversely affected.

Environmental Regulations

We are subject to federal, state and local environmental and safety laws and regulations in all of our operating locations, including laws and regulations of China, such as laws and regulations related to the development, manufacture and use of our products, the use of hazardous materials, the operation of our facilities, and the use of the real property. These laws and regulations govern the use, storage, discharge and disposal of hazardous materials during manufacturing, research and development and sales demonstrations. We maintain a number of environmental, health and safety programs that are primarily preventive in nature. As part of these programs, we regularly monitor ongoing compliance. If we fail to comply with applicable regulations, we could be subject to substantial liability for clean-up efforts, personal injury, fines or suspension or be forced to cease our operations, and/or suspend or terminate the development, manufacture or use of certain of our products, the use of our facilities, or the use of our real property, each of which could have a material adverse effect on our business, financial condition and results of operations. The regulatory landscape shifts and changes in China as that country attempts to address its environmental pollution. Because we manufacture all of our products in China, we are subject to an evolving set of regulations that could require changes in our equipment and processes and require us to obtain new permits. In 2017, China increased its focus on environmental concerns which increased pressure on manufacturing companies. During periods of severe air pollution in Beijing, manufacturing companies, including AXT, may be ordered by the local government to stop production for several days. For example, in the first quarter of 2018, over 300 manufacturing companies, including AXT, were intermittently shut down by the local government for a total of ten days from February 27 to March 31, due to severe air pollution.

15

Human Capital

As of December 31, 2021, AXT and Tongmei had 1,008 employees, which consisted of 28 employees in our headquarters in Fremont, California, one sales professional in France and 979 employees in our factories in China. In addition, our consolidated raw material companies had, in total, 391 employees. In aggregate, we and our consolidated raw material companies had 1,399 employees, of whom 1,023 were principally engaged in manufacturing, 189 in sales and administration and 187 in research and development. Of these 1,399 employees, 28 were located in the United States, one in France and 1,370 in China. Our employees in China are citizens of China, have families and pay taxes in China. We believe these factors are viewed favorably by government agencies in China.

We believe that our future success largely depends upon our continued ability to attract and retain highly skilled employees. We provide our employees with competitive salaries and bonuses, opportunities for equity ownership, development programs that enable continued learning and growth and a robust employment package that promotes well-being across all aspects of their lives, including health care and paid time off. Most of our employees in China are represented by unions. As of December 31, 2021, 1,151 employees in China, including employees of our consolidated raw material companies, were represented by unions. We have never experienced a work stoppage and we consider our relations with our employees to be good.

Geographical Information

Please see Note 14 of our Notes to Consolidated Financial Statements for information regarding our foreign operations, and see “Risks related to international aspects of our business” under Item 1A. Risk Factors for further information on risks attendant to our foreign operations and dependence.

Available Information

Our principal executive offices are located at 4281 Technology Drive, Fremont, CA 94538, and our main telephone number at this address is (510) 438-4700. Our Internet website address is www.axt.com. Our website address is given solely for informational purposes; we do not intend, by this reference, that our website should be deemed to be part of this Annual Report on Form 10-K or to incorporate the information available at our website address into this Annual Report on Form 10-K.

We file electronically with the Securities and Exchange Commission, or SEC, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. We make these reports available free of charge through our Internet website as soon as reasonably practicable after we have electronically filed such material with the SEC. These reports can also be obtained from the SEC’s Internet website at www.sec.gov.

Item 1A. Risk Factors

For ease of reference, we have divided these risks and uncertainties into the following general categories:

| I. | Summary Risk Factors; |

| II. | General Risk Factors; |

| III. | Risks Related to International Aspects of Our Business; |

| IV. | Risks Related to Our Financial Results and Capital Structure; |

| V. | Risks Related to Our Intellectual Property; and |

| VI. | Risks Related to Compliance, Environmental Regulations and Other Legal Matters. |

16

| I. | Summary Risk Factors |

| ● | We are subject to a number of unique legal and operational risks associated with our corporate structure. |

| ● | The PRC central government may intervene in or influence our PRC operations at any time and the rules and regulations in China can change quickly with little advance notice. |

| ● | Although the audit report included in this Annual Report is prepared by an independent registered public accounting firm who is currently inspected fully by the Public Company Accounting Oversight Board (the “PCAOB”), there is no guarantee that future audit reports will be prepared by an independent registered public accounting firm that is completely inspected by the PCAOB. |

| ● | Our NASDAQ stock price is volatile and our stock price could decline. Unpredictable fluctuations in our operating results, changes and events in our end markets and global trends cause volatility in our stock price. |

| ● | COVID-19 or other contagious diseases may affect our business operations and financial performance. Lack of supply of vaccines and resistance by some to be vaccinated could prolong COVID-19. |

| ● | Global economic and political conditions, including trade tariffs and restrictions from China, may have a negative impact on our business and financial results. |

| ● | Changes in China’s political, social, regulatory or economic environments may affect our financial performance. |

| ● | The Chinese central government is increasingly aware of air pollution and other forms of environmental pollution and their reform efforts can impact our manufacturing, including intermittent mandatory shutdowns. Shutdowns or underutilizing our manufacturing facilities may result in declines in our gross margins. |

| ● | Enhanced trade tariffs, import restrictions, export restrictions, Chinese regulations or other trade barriers may materially harm our business. |

| ● | If China places restrictions on freight and transportation routes and on ports of entry and departure this could result in shipping delays or increased costs for shipping. |

| ● | Our international operations are exposed to potential adverse tax consequence in China. |

| ● | Our gross margin has fluctuated historically and may decline or increase due to several factors. Factors such as product mix, unit volume, yields and other manufacturing efficiencies can cause our gross margin to decrease or increase from quarter to quarter. |

| ● | The proposed Tongmei IPO on the STAR Market in China could fail to be completed. This could result in investor disappointment and in failure to secure sufficient capital needed to take advantage of market opportunities for our products. Our stock price could decline. |

| ● | The terms of the private equity raised by Tongmei in China grant each investor a right of redemption if Tongmei fails to achieve the IPO on or before December 31, 2022. This could result in disgorging the cash that we raised from the investors. |

| ● | Defects in our products could diminish demand for our products. Our ability to receive orders from tier one customers is contingent on producing wafer substrates of very high quality and deploying best practices in manufacturing. We may not always be able to meet these requirements and we could then lose revenue. |

| ● | Difficulties in accurately estimating market demand could result in over-investing in equipment and capacity expansion or losing market share if we do not invest sufficiently. |

| ● | Attracting and retaining tier one customers requires that we succeed in our research and development programs. Customers establish difficult to meet product specifications regarding defect densities, surface flatness diameter size and other specifications pushing the boundaries of material science. We may not achieve these specifications. |

| ● | We are subject to foreign exchange gains and losses that materially impact our income statement. Because we are a global company we are exposed to changes and swings in foreign exchange, particularly when currencies experience periods of volatility. |

| ● | Joint venture raw material companies in China bring certain risks. |

| ● | Risks exist in utilizing our new gallium arsenide manufacturing sites efficiently. |

| ● | We derive a significant portion of our revenue from international sales, and our ability to sustain and increase our international sales involves significant risks. |

17

| II. | General Risk Factors |

Silicon substrates (wafers) are significantly lower in cost compared to substrates made from specialty materials, such as those that we produce, and new silicon-based technologies could enable silicon-based substrates to replace specialty material-based substrates for certain applications.

Historically silicon wafers or substrates are less expensive than specialty material substrates, such as those that we produce. Electronic circuit designers will generally consider silicon first and only turn to alternative materials if silicon cannot provide the required functionality in terms of power consumption, speed, wave lengths or other specifications. Beginning in 2011, certain applications that had previously used GaAs substrates, specifically the RF chip in mobile phones, adopted a new silicon-based technology called silicon on insulator, or SOI. SOI technology uses a silicon-insulator-silicon layered substrate in place of conventional silicon substrates in semiconductor manufacturing. SOI substrates cost less than GaAs substrates and, although their performance is not as robust as GaAs substrates in terms of power consumption, heat generation and speed, they became acceptable in mobile phones and other applications that were previously dominated by GaAs substrates. The adoption of SOI resulted in decreased GaAs wafer demand, and decreased revenue. If SOI or new silicon-based technologies gain more widespread market acceptance, or are used in more applications, our sales of specialty material-based substrates could be reduced and our business and operating results could be significantly and adversely affected.

COVID-19 or other contagious diseases may affect our business operations and financial performance.

The spread of COVID-19 has impacted our operations and financial performance. This outbreak has triggered references to the SARS outbreak, which occurred in 2003 and affected our business operations. Any severe occurrence of an outbreak of a contagious disease such as COVID-19, SARS, Avian Flu or Ebola may cause us or the government to temporarily close our manufacturing operations in China. In January 2020, virtually all companies in China were ordered to remain closed after the traditional Lunar New Year holiday ended, including our subsidiaries in China. If there is a renewed surge of the COVID-19 pandemic in China, the Chinese government may require companies to close again. If one or more of our key suppliers is required to close for an extended period, we might not have enough raw material inventories to continue manufacturing operations. In addition, travel restrictions between China and the U.S. have disrupted our normal movement to and from China and this has impacted our efficiency. If COVID-19 vaccines are not widely available or people choose not to be vaccinated, our business operations may be affected negatively. The outbreak has affected transportation and reduced the availability of air transport, caused port closures, and increased border controls and closures. If our manufacturing operations were closed for a significant period or we experience difficulty in shipping our products, we could lose revenue and market share, which would depress our financial performance and could be difficult to recapture. If one of our key customers is required to close for an extended period, this may delay the placement of new orders. As a result, our revenue would decline. Further, customers might default on their obligations to us. In the first quarter of 2020 we observed an increase in our accounts receivable and believe this was the result of businesses slowing down and a general cautiousness due to the COVID-19 pandemic. Such events would negatively impact our financial performance.

Our gross margin has fluctuated historically and may decline due to several factors.

Our gross margin has fluctuated from period to period as a result of increases or decreases in total revenue, unit volume, shifts in product mix, shifts in the cost of raw materials, costs related to the relocation of our gallium arsenide and germanium production lines, including costs related to hiring additional manufacturing employees at our new locations, tariffs imposed by the U.S. government, the introduction of new products, decreases in average selling prices for products, utilization of our manufacturing capacity, fluctuations in manufacturing yields and our ability to reduce product costs. These factors and other variables change from period to period and these fluctuations are expected to continue in the future. A recent example is that in the second quarter of 2019 our gross margin was 34.3% but it dropped to 21.0% in the fourth quarter of 2019 as a result of several of these factors.

18