rmti-202112310001041024false2021FYP3Yhttp://rockwellmed.com/20211231#FinanceAndOperatingLeaseLiabilityCurrent http://rockwellmed.com/20211231#FinanceAndOperatingLeaseLiabilityNoncurrenthttp://rockwellmed.com/20211231#FinanceAndOperatingLeaseLiabilityCurrent http://rockwellmed.com/20211231#FinanceAndOperatingLeaseLiabilityNoncurrent00010410242021-01-012021-12-3100010410242021-06-30iso4217:USD00010410242022-04-06xbrli:shares00010410242021-12-3100010410242020-12-31iso4217:USDxbrli:shares00010410242020-01-012020-12-310001041024us-gaap:CommonStockMember2019-12-310001041024us-gaap:AdditionalPaidInCapitalMember2019-12-310001041024us-gaap:RetainedEarningsMember2019-12-310001041024us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-3100010410242019-12-310001041024us-gaap:RetainedEarningsMember2020-01-012020-12-310001041024us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001041024us-gaap:CommonStockMember2020-01-012020-12-310001041024us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001041024rmti:PublicOfferingMemberus-gaap:CommonStockMember2020-01-012020-12-310001041024us-gaap:AdditionalPaidInCapitalMemberrmti:PublicOfferingMember2020-01-012020-12-310001041024rmti:PublicOfferingMember2020-01-012020-12-310001041024rmti:AtTheMarketMemberus-gaap:CommonStockMember2020-01-012020-12-310001041024rmti:AtTheMarketMemberus-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001041024rmti:AtTheMarketMember2020-01-012020-12-310001041024us-gaap:CommonStockMember2020-12-310001041024us-gaap:AdditionalPaidInCapitalMember2020-12-310001041024us-gaap:RetainedEarningsMember2020-12-310001041024us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001041024us-gaap:RetainedEarningsMember2021-01-012021-12-310001041024us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001041024us-gaap:CommonStockMember2021-01-012021-12-310001041024us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001041024us-gaap:CommonStockMember2021-12-310001041024us-gaap:AdditionalPaidInCapitalMember2021-12-310001041024us-gaap:RetainedEarningsMember2021-12-310001041024us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001041024rmti:PublicOfferingMember2021-01-012021-12-310001041024rmti:AtTheMarketMember2021-01-012021-12-31rmti:employeermti:agreement0001041024us-gaap:PrivatePlacementMemberus-gaap:SubsequentEventMemberrmti:SeriesXConvertiblePreferredStockMemberrmti:DaVitaHealthcarePartnersIncMembersrt:ScenarioForecastMember2022-04-012022-06-300001041024us-gaap:SubsequentEventMemberrmti:ShareIssuanceTrancheOneMemberrmti:DaVitaHealthcarePartnersIncMember2022-04-062022-04-060001041024us-gaap:SubsequentEventMemberrmti:ShareIssuanceTrancheTwoMemberrmti:DaVitaHealthcarePartnersIncMembersrt:ScenarioForecastMember2022-04-012022-06-300001041024us-gaap:SubsequentEventMember2022-04-060001041024us-gaap:SubsequentEventMember2022-04-062022-04-060001041024us-gaap:TransferredAtPointInTimeMemberrmti:DrugProductSalesMember2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:DrugProductSalesMembercountry:US2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberus-gaap:NonUsMemberrmti:DrugProductSalesMember2021-01-012021-12-310001041024rmti:DrugLicenseFeeMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001041024rmti:DrugLicenseFeeMemberus-gaap:TransferredOverTimeMembercountry:US2021-01-012021-12-310001041024rmti:DrugLicenseFeeMemberus-gaap:NonUsMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310001041024rmti:DrugRevenueMember2021-01-012021-12-310001041024rmti:DrugRevenueMembercountry:US2021-01-012021-12-310001041024us-gaap:NonUsMemberrmti:DrugRevenueMember2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductSalesMember2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductSalesMembercountry:US2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberus-gaap:NonUsMemberrmti:ConcentrateProductSalesMember2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductLicenseFeeMember2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductLicenseFeeMembercountry:US2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberus-gaap:NonUsMemberrmti:ConcentrateProductLicenseFeeMember2021-01-012021-12-310001041024rmti:ConcentrateProductsMember2021-01-012021-12-310001041024rmti:ConcentrateProductsMembercountry:US2021-01-012021-12-310001041024us-gaap:NonUsMemberrmti:ConcentrateProductsMember2021-01-012021-12-310001041024country:US2021-01-012021-12-310001041024us-gaap:NonUsMember2021-01-012021-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:DrugProductSalesMember2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:DrugProductSalesMembercountry:US2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberus-gaap:NonUsMemberrmti:DrugProductSalesMember2020-01-012020-12-310001041024rmti:DrugLicenseFeeMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310001041024rmti:DrugLicenseFeeMemberus-gaap:TransferredOverTimeMembercountry:US2020-01-012020-12-310001041024rmti:DrugLicenseFeeMemberus-gaap:NonUsMemberus-gaap:TransferredOverTimeMember2020-01-012020-12-310001041024rmti:DrugRevenueMember2020-01-012020-12-310001041024rmti:DrugRevenueMembercountry:US2020-01-012020-12-310001041024us-gaap:NonUsMemberrmti:DrugRevenueMember2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductSalesMember2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductSalesMembercountry:US2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberus-gaap:NonUsMemberrmti:ConcentrateProductSalesMember2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductLicenseFeeMember2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberrmti:ConcentrateProductLicenseFeeMembercountry:US2020-01-012020-12-310001041024us-gaap:TransferredAtPointInTimeMemberus-gaap:NonUsMemberrmti:ConcentrateProductLicenseFeeMember2020-01-012020-12-310001041024rmti:ConcentrateProductsMember2020-01-012020-12-310001041024rmti:ConcentrateProductsMembercountry:US2020-01-012020-12-310001041024us-gaap:NonUsMemberrmti:ConcentrateProductsMember2020-01-012020-12-310001041024country:US2020-01-012020-12-310001041024us-gaap:NonUsMember2020-01-012020-12-310001041024us-gaap:LicenseMember2021-01-012021-12-310001041024us-gaap:LicenseMember2020-01-012020-12-310001041024us-gaap:ProductMember2021-01-012021-12-310001041024us-gaap:ProductMember2020-01-012020-12-310001041024rmti:ConcentrateProductsMember2020-12-310001041024rmti:ConcentrateProductsMember2021-12-310001041024rmti:BaxterHealthcareOrganizationMember2021-12-310001041024srt:MinimumMember2021-01-012021-12-310001041024srt:MaximumMember2021-01-012021-12-310001041024rmti:BaxterHealthcareOrganizationMember2014-10-012014-10-310001041024rmti:BaxterHealthcareOrganizationMember2020-12-310001041024rmti:WanbangBiopharmaceuticalMember2017-01-012017-12-310001041024rmti:WanbangBiopharmaceuticalMember2020-01-012020-12-310001041024rmti:WanbangBiopharmaceuticalMember2021-01-012021-12-310001041024rmti:WanbangBiopharmaceuticalMember2021-12-310001041024rmti:WanbangBiopharmaceuticalMember2020-12-310001041024rmti:SunPharmaAgreementsMember2020-01-012020-01-310001041024rmti:SunPharmaAgreementsMember2020-01-012020-12-310001041024rmti:SunPharmaAgreementsMember2021-01-012021-12-310001041024rmti:SunPharmaAgreementsMember2021-12-310001041024rmti:SunPharmaAgreementsMember2020-12-310001041024rmti:JeilPharmaAgreementsMember2020-09-012020-09-300001041024rmti:JeilPharmaAgreementsMember2021-01-012021-12-310001041024rmti:JeilPharmaAgreementsMember2020-01-012020-12-310001041024rmti:JeilPharmaAgreementsMember2021-12-310001041024rmti:JeilPharmaAgreementsMember2020-12-310001041024rmti:DrogsanPharmaAgreementsMember2021-06-300001041024rmti:DrogsanPharmaAgreementsMember2021-01-012021-12-310001041024rmti:DrogsanPharmaAgreementsMember2021-12-310001041024us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001041024us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001041024us-gaap:RestrictedStockMember2021-01-012021-12-310001041024us-gaap:RestrictedStockMember2020-01-012020-12-310001041024us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001041024us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001041024us-gaap:WarrantMember2021-01-012021-12-310001041024us-gaap:WarrantMember2020-01-012020-12-310001041024us-gaap:CustomerConcentrationRiskMemberrmti:DaVitaHealthcarePartnersIncMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-31xbrli:pure0001041024us-gaap:CustomerConcentrationRiskMemberrmti:DaVitaHealthcarePartnersIncMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001041024rmti:DaVitaHealthcarePartnersIncMemberus-gaap:AccountsReceivableMember2021-12-310001041024rmti:DaVitaHealthcarePartnersIncMemberus-gaap:AccountsReceivableMember2020-12-310001041024us-gaap:CustomerConcentrationRiskMemberrmti:BaxterHealthcareOrganizationMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001041024us-gaap:CustomerConcentrationRiskMemberrmti:BaxterHealthcareOrganizationMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001041024rmti:BaxterHealthcareOrganizationMemberus-gaap:AccountsReceivableMember2021-12-310001041024rmti:BaxterHealthcareOrganizationMemberus-gaap:AccountsReceivableMember2020-12-310001041024us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-01-012021-12-310001041024us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001041024us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMemberrmti:NiproMedicalCorporationMember2021-01-012021-12-310001041024us-gaap:NonUsMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMemberrmti:NiproMedicalCorporationMember2020-01-012020-12-310001041024rmti:BaxterHealthcareOrganizationMember2021-01-012021-12-310001041024rmti:BaxterHealthcareOrganizationMember2014-10-310001041024rmti:BaxterHealthcareOrganizationMemberrmti:UpfrontFeeMember2021-01-012021-12-310001041024rmti:BaxterHealthcareOrganizationMemberrmti:UpfrontFeeMember2020-01-012020-12-310001041024rmti:TrifericInventoryMember2021-12-310001041024rmti:TrifericInventoryMember2020-12-310001041024rmti:TrifericDialysateMember2021-12-310001041024rmti:TrifericAPIMember2021-12-310001041024rmti:TrifericInventoryMember2021-01-012021-12-310001041024us-gaap:LeaseholdImprovementsMember2021-12-310001041024us-gaap:LeaseholdImprovementsMember2020-12-310001041024us-gaap:MachineryAndEquipmentMember2021-12-310001041024us-gaap:MachineryAndEquipmentMember2020-12-310001041024us-gaap:OfficeEquipmentMember2021-12-310001041024us-gaap:OfficeEquipmentMember2020-12-310001041024us-gaap:OtherMachineryAndEquipmentMember2021-12-310001041024us-gaap:OtherMachineryAndEquipmentMember2020-12-310001041024rmti:A3925NotePayableMemberus-gaap:NotesPayableToBanksMember2021-07-030001041024rmti:A3925NotePayableMemberus-gaap:NotesPayableToBanksMember2021-07-032021-07-030001041024srt:MaximumMemberrmti:AtthemarketOfferingMember2019-03-222019-03-220001041024rmti:LongTermIncentivePlan2007Member2017-04-122020-12-310001041024rmti:LongTermIncentivePlan2007Member2017-04-110001041024rmti:LongTermIncentivePlan2018Member2018-01-290001041024rmti:LongTermIncentivePlan2018Member2020-05-182020-05-180001041024rmti:LongTermIncentivePlan2018Member2020-05-180001041024us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMemberServiceBasedRestrictedStockUnitsMember2021-01-012021-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMemberServiceBasedRestrictedStockUnitsMember2020-01-012020-12-310001041024rmti:ServiceBasedStockOptionAwardsMember2021-01-012021-12-310001041024rmti:ServiceBasedStockOptionAwardsMember2020-01-012020-12-310001041024rmti:ServiceBasedAwardsMember2021-01-012021-12-310001041024rmti:ServiceBasedAwardsMember2020-01-012020-12-310001041024rmti:PerformanceBasedRestrictedStockAwardsMember2021-01-012021-12-310001041024rmti:PerformanceBasedRestrictedStockAwardsMember2020-01-012020-12-310001041024rmti:PerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-310001041024rmti:PerformanceBasedRestrictedStockUnitsMember2020-01-012020-12-310001041024rmti:PerformanceBasedStockOptionAwardsMember2021-01-012021-12-310001041024rmti:PerformanceBasedStockOptionAwardsMember2020-01-012020-12-310001041024rmti:PerformanceBasedAwardsMember2021-01-012021-12-310001041024rmti:PerformanceBasedAwardsMember2020-01-012020-12-310001041024us-gaap:RestrictedStockMember2021-01-012021-12-310001041024us-gaap:RestrictedStockMember2019-12-310001041024us-gaap:RestrictedStockMember2020-12-310001041024us-gaap:RestrictedStockMember2021-12-310001041024rmti:PerformanceBasedRestrictedStockAwardsMember2021-12-310001041024us-gaap:RestrictedStockMember2020-01-012020-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMember2021-01-012021-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMember2019-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMember2020-01-012020-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMember2020-12-310001041024rmti:ServiceBasedRestrictedStockUnitsMember2021-12-310001041024srt:MinimumMemberrmti:ServiceBasedRestrictedStockUnitsMember2021-01-012021-12-310001041024srt:MaximumMemberrmti:ServiceBasedRestrictedStockUnitsMember2021-01-012021-12-310001041024rmti:PerformanceBasedRestrictedStockUnitsMember2021-12-310001041024rmti:PerformanceBasedRestrictedStockUnitsMember2019-12-310001041024rmti:PerformanceBasedRestrictedStockUnitsMember2020-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MinimumMember2021-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MaximumMember2021-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MinimumMember2020-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MaximumMember2020-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MinimumMember2021-01-012021-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MaximumMember2021-01-012021-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MinimumMember2020-01-012020-12-310001041024rmti:ServiceBasedStockOptionAwardsMembersrt:MaximumMember2020-01-012020-12-310001041024rmti:ServiceBasedStockOptionAwardsMember2019-12-310001041024rmti:ServiceBasedStockOptionAwardsMember2019-01-012019-12-310001041024rmti:ServiceBasedStockOptionAwardsMember2020-12-310001041024rmti:ServiceBasedStockOptionAwardsMember2021-12-310001041024rmti:PerformanceBasedStockOptionAwardsMember2019-12-310001041024rmti:PerformanceBasedStockOptionAwardsMember2020-12-310001041024rmti:PerformanceBasedStockOptionAwardsMember2021-12-310001041024rmti:PresidentandChiefExecutiveOfficerMemberrmti:PerformanceBasedStockOptionAwardsMember2020-04-172020-04-1700010410242018-10-072018-10-070001041024rmti:MasterServicesAndIpAgreementMember2021-12-310001041024rmti:MasterServicesAndIpAgreementMember2020-12-310001041024srt:MaximumMember2021-12-310001041024rmti:WixomMichiganPropertyOneMemberstpr:MI2021-12-31utr:sqft0001041024stpr:MIrmti:WixomMichiganPropertyTwoMember2021-12-310001041024stpr:TX2021-12-310001041024stpr:SC2021-12-310001041024stpr:NJ2021-12-310001041024rmti:ConcentrateManufacturingPurchaseObligationMember2021-12-310001041024rmti:AncillarySuppliesPurchaseObligationMember2021-12-310001041024rmti:TermLoanMemberus-gaap:MediumTermNotesMember2020-03-160001041024rmti:TermLoanTrancheOneMemberus-gaap:MediumTermNotesMember2020-03-160001041024rmti:TermLoanTrancheTwoMemberus-gaap:MediumTermNotesMember2020-03-160001041024rmti:TermLoanTrancheThreeMemberus-gaap:MediumTermNotesMember2020-03-160001041024rmti:TermLoanTrancheOneMemberus-gaap:MediumTermNotesMember2020-03-162020-03-160001041024rmti:TermLoanMembersrt:MinimumMemberus-gaap:MediumTermNotesMember2020-03-162020-03-160001041024rmti:TermLoanMembersrt:MaximumMemberus-gaap:MediumTermNotesMember2020-03-162020-03-160001041024rmti:TermLoanMemberus-gaap:MediumTermNotesMember2020-03-162020-03-160001041024rmti:TermLoanMemberus-gaap:MediumTermNotesMember2021-01-012021-12-31rmti:tradingDay0001041024srt:MaximumMemberrmti:TermLoanTrancheTwoAndTrancheThreeMemberus-gaap:MediumTermNotesMember2020-03-160001041024rmti:TermLoanTrancheTwoAndTrancheThreeMemberus-gaap:MediumTermNotesMember2020-03-162020-03-160001041024rmti:TermLoanMemberus-gaap:MediumTermNotesMember2021-09-300001041024rmti:TermLoanMemberus-gaap:MediumTermNotesMember2021-09-012021-09-30rmti:installment0001041024rmti:TermLoanMemberus-gaap:MediumTermNotesMember2021-12-31rmti:customer0001041024us-gaap:PrivatePlacementMemberus-gaap:SubsequentEventMemberrmti:SeriesXConvertiblePreferredStockMemberrmti:ShareIssuanceTrancheOneMemberrmti:DaVitaHealthcarePartnersIncMember2022-04-062022-04-060001041024us-gaap:PrivatePlacementMemberus-gaap:SubsequentEventMemberrmti:SeriesXConvertiblePreferredStockMemberrmti:ShareIssuanceTrancheTwoMemberrmti:DaVitaHealthcarePartnersIncMembersrt:ScenarioForecastMember2022-04-012022-06-300001041024us-gaap:PrivatePlacementMemberus-gaap:SubsequentEventMemberrmti:SeriesXConvertiblePreferredStockMemberrmti:DaVitaHealthcarePartnersIncMember2022-04-060001041024us-gaap:SubsequentEventMemberrmti:SeriesXConvertiblePreferredStockMember2022-04-062022-04-060001041024us-gaap:SubsequentEventMemberrmti:SeriesXConvertiblePreferredStockMember2022-04-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-23661

ROCKWELL MEDICAL, INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 38-3317208 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer

Identification No.) |

30142 S. Wixom Road, Wixom, Michigan | 48393 |

| (Address of principal executive offices) | (Zip Code) |

(248) 960‑9009

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| Common Stock, par value $.0001 | | RMTI | | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act:

(None)

Indicate by check mark if the registrant is a well‑known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S‑T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☒ | Smaller reporting company | ☒ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b‑2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the registrant’s voting and non‑voting common equity held by non‑affiliates of the registrant on June 30, 2021 (computed by reference to the closing sales price of the registrant’s Common Stock as reported on The Nasdaq Capital Market on such date) was $29,007,276.

Number of shares outstanding of the registrant’s Common Stock, par value $0.0001, as of April 6, 2022: 93,986,470 shares.

Documents Incorporated by Reference

Portions of the registrant’s definitive Proxy Statement pertaining to the 2022 Annual Meeting of Stockholders, which the Registrant intends to file pursuant to Regulation 14A with the Securities and Exchange Commission not later than 120 days after the Registrant’s fiscal year ended December 31, 2021, are herein incorporated by reference in Part III of this Annual Report on Form 10‑K.

Table Of Contents

Triferic®, CitraPure®, RenalPure® and SteriLyte® are registered trademarks of Rockwell.

Forward Looking Statements

We make, or incorporate by reference, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, in this Annual Report on Form 10-K. Our forward-looking statements are subject to risks and uncertainties and include information about our current expectations and possible or assumed future results of our operations. When we use words such as “may,” “might,” “will,” “should,” “believe,” “expect,” “anticipate,” “estimate,” “continue,” “could,” “plan,” “potential,” “predict”, “forecast”, “projected,” “intend” or similar expressions, or make statements regarding our intent, belief, or current expectations, we are making forward-looking statements. Our forward looking statements also include, without limitation, statements about our liquidity and capital resources; our ability to continue as a going concern; our ability to develop Ferric Pyrophosphate Citrate ("FPC") for other indications; our ability to successfully execute on our business strategy and development of new indications; and statements regarding our anticipated future financial condition, operating results, cash flows and business plans. Because these forward-looking statements are based on estimates and assumptions that are subject to significant business, economic and competitive uncertainties, many of which are beyond our control or are subject to change, actual results could be materially different from the anticipated future results, performance or achievements expressed or implied by any forward-looking statements. Such business, economic and competitive uncertainties include:

•any further increases in raw material, labor, fuel or other input costs, particularly if we are unable to pass these cost increases along to our customers;

•the duration over which our cash balances will fund our operations;

•our ability to continue as a going concern;

•our ability to obtain additional financing and raise capital as necessary to fund operations or pursue business opportunities;

•our expectations regarding our ability to enter into marketing and other partnership agreements, including amendments to our existing agreements;

•our ability to comply with affirmative and negative covenants under our secured loan with Innovatus;

•the effects of the COVID-19 pandemic on patients, our customers and distributors, and our business, including manufacturing operations and suppliers, as well as the actions by governments, businesses and individuals in response to the pandemic;

•the acceptance of our products by doctors, patients or payors;

•the availability of adequate reimbursement for our products from insurance companies and the government;

•our ability to use existing inventory before shelf life expiration;

•the safety and efficacy of our products;

•our expectations regarding the timing of submissions to, and decisions made by, the FDA, and other regulatory agencies, including foreign regulatory agencies;

•our ability to secure adequate protection for, and licensure of, our intellectual property;

•our estimates regarding the capacity of manufacturing and other facilities to support our products;

•our ability to successfully commercialize our products;

•the rate and degree of market acceptance and clinical utility of our products;

•our ability to obtain and/or retain major customers and distributors;

•our ability to compete against other companies and research institutions;

•our ability to attract and retain key personnel;

•our expectations for increases or decreases in expenses;

•our expectations for incurring capital expenditures to expand our research and development and manufacturing capabilities;

•our expectations for generating revenue or becoming profitable on a sustained basis;

•our expectations regarding the effect of changes in accounting guidance or standards on our operating results;

•the impact of healthcare reform laws and other government laws and regulations;

•the impact of potential shareholder activism;

•our ability to comply with the covenants included in the Products Purchase Agreement, as amended; and

•those factors identified in this Annual Report on Form 10-K under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other filings we periodically make with the SEC.

You should evaluate all forward-looking statements made in this Annual Report on Form 10-K, including the documents we incorporate by reference, in the context of these risks, uncertainties and other factors. Other factors not currently anticipated may also materially and adversely affect our results of operations, cash flows, business, prospects and financial position.

Readers should not place undue reliance on any such forward-looking statements, which are based on information available to us on the date of this report or, if made elsewhere, as of the date made. We do not undertake, and expressly disclaim, any intention to update or alter any statements whether as a result of new information, future events or otherwise except as required by law.

PART I

Item 1. Business.

Our website is included as an inactive textual reference only and nothing on the website is incorporated by reference into this Annual Report on Form 10-K.

Unless otherwise indicated in this Annual Report on Form 10-K “we,” “our,” “us,” “the Company,” "Rockwell," “Rockwell Medical” and other similar terms refer to Rockwell Medical, Inc., together with its consolidated subsidiaries. You are advised to read this Annual Report on Form 10-K in conjunction with other reports and documents that we file from time to time with the Securities and Exchange Commission (“SEC”). In particular, please read our definitive proxy statement, which will be filed with the SEC in connection with our 2022 annual meeting of stockholders, our quarterly reports on Form 10-Q and any current reports on Form 8-K that we may file from time to time. You can access free of charge on our website copies of these reports as soon as practicable after they are electronically filed with the SEC. The SEC also maintains a website on the internet that contains reports, proxy and information statements and other information regarding issuers, such as us, that file electronically with the SEC. The address of the SEC’s website is http://www.sec.gov.

General Information

We were incorporated in the state of Michigan in 1996, and re-domiciled to the state of Delaware in 2019. Our headquarters is located at 30142 Wixom Road, Wixom Michigan 48393. Our telephone number is (248) 960-9009 and our website is http://www.rockwellmed.com. The information contained on, or that can be accessed through, our website is not part of this Annual Report on Form 10-K. We have included our website in this Annual Report on Form 10-K solely as an inactive textual reference.

Triferic®, CitraPure®, RenalPure® and SteriLyte® are registered trademarks of Rockwell. This Annual Report on Form 10-K contains references to our trademarks and trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other company.

OVERVIEW OF BUSINESS

Rockwell Medical is a commercial-stage, biopharmaceutical company developing and commercializing our next-generation parenteral iron technology platform, Ferric Pyrophosphate Citrate ("FPC"), which we believe has the potential to lead to transformative treatments for iron deficiency in multiple disease states, reduce healthcare costs and improve patients’ lives. We are also one of the two major suppliers of life-saving hemodialysis concentrate products to kidney dialysis clinics in the United States.

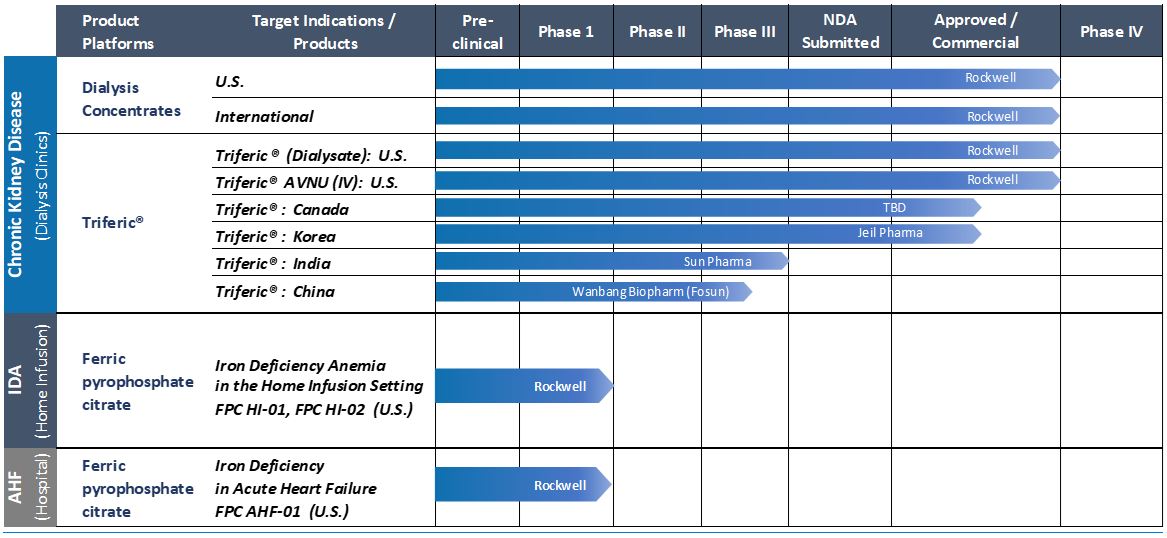

We have two novel, FDA approved therapies, Triferic and Triferic AVNU, which are the first two products developed from our FPC platform. We market both products to kidney dialysis centers for their patients receiving dialysis. In late 2021, we filed an IND with the United Stated Food and Drug Administration ("FDA") with the goal to advance our FPC platform strategy by conducting a Phase II trial for the treatment of iron deficiency anemia in patients outside of dialysis, who are receiving intravenous ("IV") medications in the home infusion setting. The trend toward providing medical care, including the delivery of infused medications at home, make the home infusion market a rapidly growing area of healthcare. We believe that the home infusion setting is a natural path for expansion of our platform as many of the patients suffer from diseases that are associated with iron deficiency and anemia. In our R&D pipeline, we are also investigating FPC’s impact in the treatment of hospitalized patients with acute heart failure.

At Rockwell Medical, we are dedicated to enhancing the currently sub-optimal standard of care for treatment of iron deficiency in acute and chronic disease by leveraging our proprietary FPC platform technology. Our proprietary drug platform, FPC, is a next-generation parenteral iron therapeutic. We believe our FPC platform has several advantages over other parenteral iron therapies. Importantly, it provides iron that is immediately bioavailable for critical body processes once it is administered. It has been demonstrated to be safe and well-tolerated, with a safety profile similar to placebo in clinical trials.

Iron deficiency can develop into a serious medical condition that is often overlooked and undertreated in several illnesses. It is a common comorbidity in many disease states, such as end-stage kidney disease, chronic kidney disease, acute

heart failure, cancer and multiple chronic gastrointestinal conditions. Iron deficiency impacts patients’ health in many ways, including anemia, organ dysfunction, slower recovery, diminished energy and reduced quality of life.

We are the second largest supplier of hemodialysis concentrates in the United States, with a reputation for excellent service, quality, and reliability. We believe this reputation, which is based on over 25 years of service to kidney dialysis centers, combined with approximately $60 million in annual revenue, approximately 300 dedicated employees, expertise in manufacturing and logistics and the added expertise in pharmaceutical development and commercialization brought to the Company by recent additions to our management team, gives us a solid foundation on which to grow.

STRATEGY

Dialysis Business:

We are one of the two major suppliers of hemodialysis concentrates in the United States. Over the past 25 years we developed a core expertise in manufacturing and delivering hemodialysis concentrates. Because these concentrates are used to maintain human life by removing toxins and balancing electrolytes in the dialysis patient’s bloodstream, we manufacture them under cGMP regulations as described below. Our concentrates are manufactured in three facilities, totaling 159,000 square feet, located in Michigan, Texas and South Carolina, from which we deliver these products to dialysis clinics throughout most of the United States. We utilize our own delivery fleet as well as third parties. We employ approximately 300 people in the concentrates unit of our dialysis business.

We believe that the Company has earned a reputation for dependability, quality and service within our customer base. This reputation was further strengthened during the recent challenges presented, not only by the COVID-19 pandemic, but also by supply chain disruptions due to recent natural disasters, in which our team has been challenged by hurricanes, flooding and freezing, while still meeting production demands. During the recent shortage in dialysis concentrates, the Company was able to fill the supply gaps for many clinics because they had not received deliveries of certain products from other suppliers.

We believe that our dialysis business in concentrates and our opportunities with FPC technology are synergistic. We scaled back our commercial organization in 2021, but we are working to maintain our current customer base in the United States while we seek a commercialization partner. We are also seeking to partner with established local and regional pharmaceutical companies for regulatory approval and commercialization in markets outside of the United States.

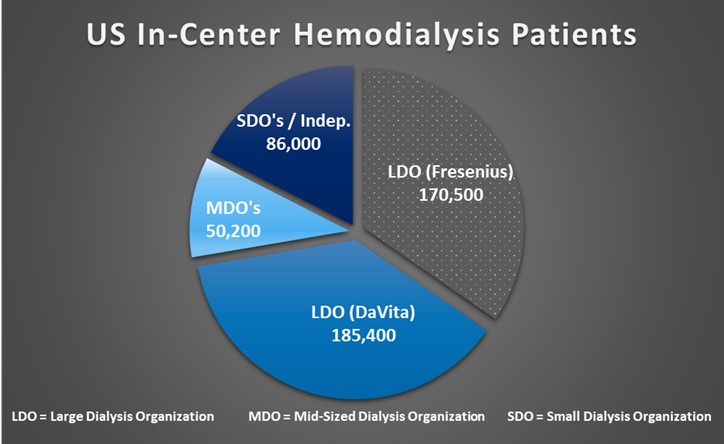

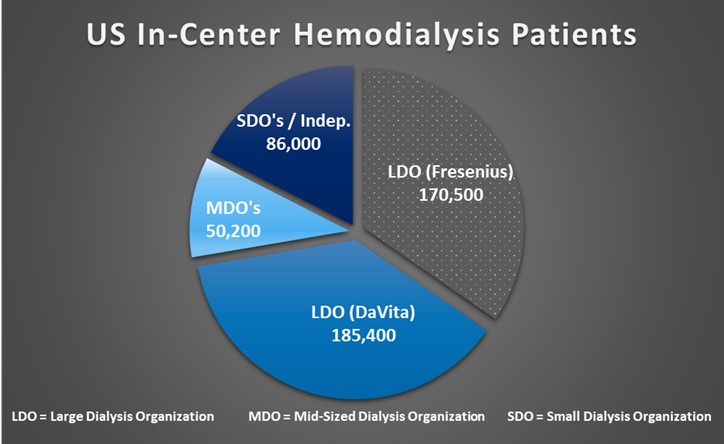

Despite our market position, we believe that our growth opportunities for our concentrates business and Triferic in the US dialysis market are challenged by the consolidated ownership of dialysis clinics, a capitated reimbursement model and the demographics of the dialysis patient population. The two largest dialysis organizations treat approximately 72% of the patients in the United States. One manufactures its own concentrates and IV iron, and we have an existing agreement to supply concentrates to the other. Through our partnership with Baxter Healthcare Corporation, a subsidiary of Baxter International, Inc. ("Baxter"),we currently supply concentrates to a significant percentage of the small and medium sized independent dialysis organizations. In a sector like kidney dialysis, with capitated reimbursement for the dialysis procedure and all included inputs, new product success depends on compelling data demonstrating improved patient outcomes and/or pharmacoeconomics versus the current standard of care in practice in the clinics. Once Medicare determined that Triferic and Triferic AVNU would be reimbursed under the fixed bundled rate for dialysis treatment, market adoption became more dependent on the generation of these data, which were not required for the drug's approval by the FDA.

Notwithstanding the growth limitations mentioned above, we continue to believe that Triferic has the potential to be an important option for the maintenance of hemoglobin in dialysis patients. To this end, we have continued our efforts in generating real world data in clinics with current protocols, which we believe will help with the adoption of Triferic and Triferic AVNU as these results are developed and disseminated over time. In addition, we are seeking a partner to help us further commercialize Triferic.

A key element of our dialysis business strategy is to also improve the strength of our concentrates business by creating efficiencies and enhancing our manufacturing and transportation operations and to fully recoup manufacturing and shipping expenses so that this business has the potential to be profitable. To date, our concentrates business has operated at a loss, with the loss accelerating recently as inflationary pressures have increased our manufacturing and operating costs, while we have limited ability to pass these costs along to certain customers. We have undertaken discussions with our largest customers to renegotiate our existing supply contracts in an effort to improve the profitability of this business line. On April 6, 2022, we entered into a strategic arrangement with our long-time partner, DaVita, Inc. ("DaVita"), a leading provider of kidney care, to

allow the Company to stabilize its concentrates business. The strategic intent of this agreement is to make sure Rockwell Medical is on stable financial footing because it is one of the two major suppliers of dialysis concentrates in the U.S. The amended agreement provides a stronger financial arrangement, encompassing pricing, cost sharing and joint efforts in supply chain improvement and cost cutting, with the goal of having the Company’s concentrates business operate profitably in the future. In addition to the amended agreement, DaVita entered into an agreement pursuant to which it will invest up to $15 million in preferred stock in two equal tranches. The first tranche of $7.5 million was funded on April 7, 2022. The second $7.5 million tranche is to be funded subject to the Company raising $15 million additional capital by June 30, 2022. We are also in discussions with our other major customer to renegotiate certain terms of that agreement. In addition, we are reviewing our entire supply chain to identify opportunities for improvement, prioritizing initiatives that will have the largest impact on long-term efficiency, profitability and growth.

Home Infusion:

Our strategy is to go beyond our foundational business in dialysis by leveraging the efficacy and safety data from Triferic in new therapeutic settings. Subject to having sufficient capital resources, we are planning to develop an FPC-based therapeutic for iron deficiency to be delivered in the home infusion setting. The number of patients served by home infusion therapy grew from approximately 800,000 in 2010 to over 3,000,000 in 2019. The home infusion setting is expected to continue this rapid expansion, which has been accelerated by the COVID-19 environment. Many patient groups requiring home infusion therapies suffer from diseases that are associated with an incidence of iron deficiency and anemia. For example, it is estimated that 40%-55% of all home parenteral nutrition patients are iron deficient. We believe, based on our data from hemodialysis patients, FPC as a home infusion therapy for iron deficiency anemia may have distinct advantages over currently available iron replacement therapy options (see Platform Technology below).

Based on further feedback received in December 2021 from the FDA, we have made plans to initiate a Phase 2 clinical study in home infusion patients with iron deficient anemia to confirm the dose and duration of FPC treatment. We expect to commence this study in 2022, subject to having sufficient working capital to fund this study, and would expect to have top-line data from the trial approximately 12-18 months following commencement of the study (see Clinical Pipeline below).

Pipeline Development

In our R&D pipeline, we are also exploring FPC’s impact in the treatment of hospitalized heart failure patients. More than one million people in the United States are hospitalized each year for acute heart failure. Clinical improvement in heart failure has already been demonstrated with older first-generation forms of IV iron in clinical trials in the outpatient setting. We believe that FPC may deliver rapidly bioavailable iron to the heart and improve cardiac energetics during hospitalization. This effect could help patients recover faster resulting in shorter hospital stays and fewer 30-day re-admissions. If so, these outcomes would translate into a meaningful reduction in healthcare costs and human suffering.

Platform Technology - Ferric Pyrophosphate Citrate

Ferric Pyrophosphate Citrate (“FPC”) is a next-generation parenteral iron that is an important advance in the treatment of iron deficiency anemia, with the potential to be developed for numerous indications. FPC is structurally and functionally different from traditional macromolecular IV iron, or parenteral iron carbohydrate complexes. It is unique in molecular structure and mode-of-action. All components of FPC are normal constituents in the blood. Importantly, FPC has already been shown to be efficacious in clinical trials and is well-tolerated with over 1.6 million doses administered to date. The first two formulations based upon the FPC platform received approval for the replacement of iron to maintain hemoglobin in adult patients with hemodialysis-dependent chronic kidney disease ("HDD-CKD"). Other formulations of our FPC platform, in other disease states, are currently being researched and developed.

FPC is a novel complex iron salt, developed to replace iron losses in patients with anemia in an entirely new way. This unique and differentiated molecule consists of an iron atom complexed to one pyrophosphate and two citrate anions. FPC is a form of protected iron in which citrate and pyrophosphate are tightly complexed to the iron. The molecule is water soluble, making the iron completely bioavailable, and has the ability to deliver iron directly and completely to transferrin, the body's iron transport protein. This transferrin-bound iron is immediately delivered to the bone marrow to be incorporated into hemoglobin, as well as to other tissues such as skeletal muscle and smooth muscle (e.g. the heart). As a result, this novel approach to iron management has the potential for application in the treatment of iron disorders and iron deficiency anemia in multiple disease states. This mechanism uses the body’s own means to transport iron safely to tissues that need iron (e.g. red blood cells and muscle).

The structure of FPC minimizes the potential for the iron to be taken up into the body’s storage cells, such as those present in the liver and other tissues, which is a problem with traditional macromolecular IV iron. Iron release from body storage cells can be slowed or blocked when inflammation is present. Because of its mechanism of action, FPC increases bioavailable iron unimpeded by inflammation without excessively increasing body iron stores or causing inflammation, iron toxicity, or oxidative stress.

FPC iron is delivered to the bone marrow regardless of other underlying conditions that might otherwise block the release of iron. Some of the challenges of managing iron in sick patients, including inflammation, hepcidin block, and functional iron deficiency, can be overcome with FPC due to its ability to provide immediately bioavailable iron.

Our first FPC-based product, Triferic, is used proactively in hemodialysis patients to maintain iron homeostasis, such that the amount of iron delivered to the patient and to the bone marrow for erythropoiesis closely approximates the amount lost during hemodialysis. FPC bypasses the hepcidin induced block caused by inflammation, of iron-release from the macrophages and liver (see “Our Triferic Portfolio” below). Consequently, tissue iron overload is avoided, unlike when traditional macromolecular IV iron are administered proactively. FPC delivers iron and maintains hemoglobin without increasing iron stores (ferritin) and thus addresses an unmet need in hemodialysis patients.

FPC has demonstrated an excellent safety profile. No reported instances of anaphylaxis or hypersensitivity events have been received during more than 1.2 million doses administered. Triferic may be administered even to patients with history of allergic reactions to IV iron.

We are actively evaluating additional indications for potential development (see "Pipeline" below).

PRODUCTS

Pipeline

We currently sell Triferic, Triferic AVNU and our dialysis concentrates portfolio of products. We partner with Baxter for commercialization of our concentrates products in the United States and certain other countries. We partner with Nipro Medical Corporation for our concentrate products in certain countries not included in our Baxter agreement, as described below. Our clinical development programs are all based on FPC, our proprietary platform technology. We are directly executing on clinical development programs in the United States, while our international development efforts in dialysis for local regulatory approval are conducted by our partners.

Our Dialysis Concentrate Products

We are an established leader in manufacturing and delivering high-quality hemodialysis concentrates and dialysates, along with certain ancillary products, to dialysis providers and distributors in the United States and abroad. We manufacture, sell and distribute hemodialysis concentrates and other medical products and supplies used in the treatment of patients with End-Stage Kidney Disease (“ESKD”). As one of the two major suppliers in the United States, our dialysis concentrate products are used to maintain human life by removing toxins and replacing critical nutrients in the dialysis patient’s bloodstream. In 2021, we estimate that we supplied approximately 27% of the United States domestic market with dialysis concentrates, with the majority of our sales in the United States. We also supply dialysis concentrates to distributors serving a number of foreign countries, primarily in the Americas and the Pacific Rim.

All of our concentrate products are manufactured according to Association for the Advancement of Medical Instrumentation guidelines and the FDA's Current Good Manufacturing Practice ("cGMP"). Our concentrate products are diluted with purified water on-site at the clinic in the dialysis machine, creating dialysate, which works to clean the patient’s blood.

CitraPure Citric Acid Concentrate

Our CitraPure Concentrate is citric acid-based, and 100% acetate-free, in contrast to the acetate-based products used for many years. CitraPure does not promote inflammation associated with acetate-based products and the reduction in inflammation is beneficial to improving patient outcomes. Citrate acts as an anticoagulant and has been shown in clinical studies to reduce the need for heparin during dialysis treatment (CitraPure is not indicated for heparin sparing). CitraPure is packaged as a liquid and as a dry powder acid concentrate for use with our Dry Acid Concentrate Mixer. CitraPure is packaged as dry acid concentrate in 25 gallon cases and liquid acid concentrate in 55 gallon drums and four one gallon jugs to a case.

Dri-Sate Dry Acid Concentrate

Our Dri-Sate Concentrate is our original acetic acid-based product. Dri-Sate is packaged as a dry powder acid concentrate for use with our Dry Acid Concentrate Mixer. Dri-Sate is packaged as dry acid concentrate in 25 gallon cases.

RenalPure Liquid Acid Concentrate

Our RenalPure Liquid Concentrate is our original acetic acid-based product and is packaged in 55 gallon drums and four one gallon jugs to a case.

Dry Acid Concentrate Mixer

Our Dry Acid Concentrate Mixer is designed for our CitraPure and Dri-Sate Dry Acid products and enables the clinic to mix acid concentrate on-site. Clinics using our Dry Acid Concentrate products realize numerous advantages, including lower cost per treatment, reduced storage space requirements, reduced number of deliveries and more flexibility in scheduling deliveries, while enabling us to reduce distribution and warehousing costs.

RenalPure and SteriLyte Bicarbonate Concentrate

RenalPure bicarbonate is a dry powder mixed on-site at the clinic and is packaged for bulk and individual treatment and SteriLyte bicarbonate is a liquid packaged in four one gallon jugs to a case and is used mainly in acute care settings.

Ancillary Products

We offer certain ancillary products to selected customers including cleaning agents, 6% bleach for disinfection, citric acid descale, filtration salts and other supplies used by hemodialysis providers.

Our Triferic Portfolio

Triferic

Triferic (dialysate) and Triferic AVNU (IV) are currently the only FDA-approved therapies indicated to replace iron and maintain hemoglobin in adult hemodialysis patients. These were our first products based on our FPC platform technology. Triferic (dialysate) in a liquid form was approved in 2015. In 2016, the powder version of Triferic (dialysate) was also approved. These two formulations provide a convenient means to administer Triferic (dialysate) in a clinical setting. Triferic AVNU, approved in 2020, has the same indication for use as Triferic (dialysate), but it is formulated for delivery as an IV infusion.

Each hemodialysis treatment results in a small amount of blood loss due to trapping of red blood cells in the extracorporeal blood circuit and blood loss from the vascular access. This blood loss, when combined with repeated blood draws, increased blood loss from the gastrointestinal (“GI”) tract and stimulation of erythropoiesis by use of erythropoiesis stimulating agents (“ESAs”), frequently results in iron deficiency in hemodialysis patients. Hemodialysis-related blood loss averages about 1g to 1.5g of elemental iron annually, not taking into consideration possible blood losses from dialyzer clotting or bleeding from surgical procedures related to vascular access.

We believe Triferic addresses an important medical need in the treatment of ongoing iron losses and anemia in ESKD patients. Triferic’s unique mode-of-action (see “Platform Technology” above) distinguishes it from traditional macromolecular IV iron because Triferic donates iron to transferrin, immediately, and completely, as soon as it enters the blood, providing immediately bioavailable iron to the body. The iron bound to transferrin is transported to the bone marrow to facilitate the body’s manufacture of hemoglobin. Triferic delivers approximately 5 mg to 7 mg of iron to the bone marrow with every hemodialysis treatment and maintains hemoglobin without increasing iron stores (ferritin).

Triferic (dialysate)

Triferic (dialysate) and Triferic AVNU are currently the only FDA-approved therapy indicated to replace iron to maintain hemoglobin in adult hemodialysis patients. We believe that Triferic, due to its unique mechanism of action, facilitates both potential clinical and cost-saving benefits. Triferic is an innovative iron therapy that replaces the ongoing iron losses routinely occurring in the vast majority of hemodialysis patients. Our first formulation of the drug is delivered via the dialysate, which is an innovative mode of delivery we believe that adds a convenience factor for the dialysis units.

The first presentation of Triferic (dialysate) is a liquid, single-patient dose, which was approved by the FDA in 2015. The second presentation is a powder packet, multiple-use formulation of Triferic (dialysate), which was approved by the FDA in 2016. We built a commercial organization for our Triferic products and launched both Triferic products in the United States in May 2019. We scaled back our commercial organization in 2021, but we are working to maintain our current customer base in the United States while we seek a commercialization partner.

Reimbursement

Triferic (dialysate) received a reimbursement J-code on January 1, 2016 from the Centers for Medicare & Medicaid Services (“CMS”), providing that it would be reimbursed for administration to dialysis patients within the existing fixed-price “bundle” of payments that CMS provides to dialysis providers. In June 2018, the Company determined, based on feedback

provided from CMS’s Innovation Center (“CMMI”), that Triferic (dialysate) was unlikely to obtain add-on reimbursement in the near term. As a result, the Company changed its commercialization strategy to plan for the commercial launch of Triferic (dialysate) with reimbursement within the bundle of payments to dialysis providers, while continuing to develop Triferic AVNU (IV). On April 26, 2019, we were notified of a preliminary recommendation by CMS to grant our powder packet formulation of Triferic (dialysate) a separate J-Code, which became effective on July 1, 2019.We commercially launched Triferic (dialysate) in May 2019.

Triferic AVNU (IV)

We also developed Triferic AVNU, an IV formulation of Triferic, for use by hemodialysis patients in the United States as well as international markets. Triferic AVNU was approved by the FDA on March 27, 2020. Triferic AVNU can be administered to any hemodialysis patient regardless of the type of bicarbonate technology, or machine technology including hemodiafiltration, used. Use of Triferic (dialysate) is limited to clinics that use a central loop or liquid jugs to deliver bicarbonate. However, Triferic AVNU must be delivered at every dialysis session via slow IV infusion, over 3-4 hours, which may be logistically challenging for some clinics. Triferic AVNU is not eligible for add-on reimbursement and is reimbursed within the “bundle,” as with Triferic (dialysate).

MARKETING, SALES AND INTERNATIONAL

Market Opportunity

Hemodialysis

The United States dialysis market is currently the largest market in the world for dialysis products. As of the end of 2019, there were an estimated 566,600 patients treated with some form of dialysis.

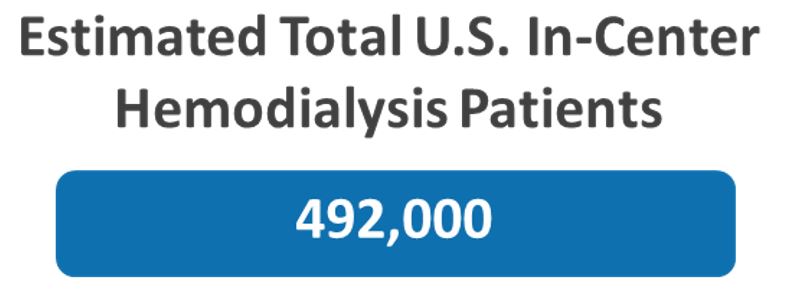

Hemodialysis is the primary treatment modality for ESKD employed in the United States, with approximately 87% of all dialysis patients receiving in-center hemodialysis. There were an estimated 492,000 in-center hemodialysis patients in the United States in 2019, representing approximately 74 million treatments annually. We do not currently compete in the other two segments, peritoneal dialysis, representing approximately 11% of the total patients, or home dialysis, representing approximately 2% of the total patients. Hemodialysis treatments are primarily performed in freestanding clinics and in some hospitals.

According to international data collected by the United States Renal Data System ("USRDS"), the global ESKD population receiving some form of treatment was estimated to be approximately 2.7 million patients at the end of 2019 with an average yearly growth rate over the previous 10 years of 7.4%. Data from USRDS and the European Renal Association indicates that there are more than two million patients undergoing hemodialysis globally. According to the National Kidney Foundation, 10% of the worldwide population is affected by chronic kidney disease and millions die each year because they do not have access to affordable treatments. We have observed that the prevalent ESKD patient population in the United States has grown steadily over the past several decades, with an average yearly growth rate of >3% from 2009 - 2019. Growth rates slowed in 2020 and 2021 due to an increase in deaths associated with the COVID-19 pandemic, however we expect a more typical growth rate of approximately 3% per year to resume in 2022 and persist over the next several years. The Asia-Pacific region is projected to experience rapid growth in both the incidence of kidney disease and total treatment in the ESKD population over the next decade. One common side-effect of dialysis treatments is iron deficiency anemia.

The majority of hemodialysis patients receive dialysis treatment three times per week, or approximately 153 times per year. Most patients who have their dialysis treatment performed at a free-standing clinic have permanent loss of kidney function. These are commonly referred to as “chronic” dialysis patients. Patients that undergo dialysis in hospitals for temporary loss of kidney function are typically referred to as “acute” dialysis patients. The small percentage of chronic dialysis patients that receives their treatment at home are referred to as “home” dialysis patients. In each setting, a dialysis machine dilutes concentrated solution, such as Rockwell’s concentrate products, with purified water. The resulting solution is called dialysate. Dialysate is pumped through an artificial kidney or filter (called a dialyzer) while the patient’s blood is pumped through a semi-permeable membrane inside the dialyzer in the opposite direction the dialysate is flowing. The dialysate can exchange bicarbonate, sodium, calcium, magnesium and potassium into the patient’s blood, while removing fluid and waste. Dialysate generally contains dextrose, sodium chloride, calcium, potassium, magnesium, sodium bicarbonate and citric acid or acetic acid. The patient’s physician chooses the proper concentrations required for each patient based on each particular patient’s needs.

In addition to using concentrate products during every in-center treatment, a dialysis provider also uses other products such as blood tubing, fistula needles, dialyzers, drugs, specialized component kits, dressings, cleaning agents, filtration salts and other supplies, some of which we sell.

Limitations of Existing Anemia Therapies for HDD-CKD Patients

The primary causes of anemia in dialysis patients are loss of renal erythropoietin (“EPO”) production and iron deficiency due to chronic inflammation and increased blood losses related to uremia and hemodialysis. The result is an iron loss of∼5–7mg per dialysis session. The current standard of care for treating anemia in HDD-CKD patients are injectable ESAs and traditional macromolecular IV iron. ESAs and traditional macromolecular IV iron are often used together.

HDD-CKD patients have abnormalities in iron metabolism caused by ongoing blood loss during the hemodialysis treatment, repeated blood draws to follow laboratory parameters and a limited diet. Furthermore, absorption of iron from the

diet and mobilization from body stores is reduced due to increases in a peptide called hepcidin. Hepcidin is the master regulator of iron uptake and distribution and is elevated in patients with inflammation, such as ESKD patients on dialysis. Since iron is a critical component of hemoglobin production, reduced levels of iron can cause iron deficiency anemia.

EPO is a hormone that is produced by the kidneys and stimulates red blood cell production in the bone marrow. In patients with HDD-CKD, the kidneys do not make enough EPO and as a result the bone marrow makes fewer red blood cells, causing anemia. ESAs are synthetic recombinant versions of human EPO that are administered to HDD-CKD patients to stimulate red blood cell production. Administration of ESAs creates a significant demand for iron in the bone marrow, since iron is a critical building block for hemoglobin that is contained in red blood cells.

IV iron is used to support anemia management in dialysis patients to achieve or maintain an iron replete state prior to, during and following initiation of ESA therapy. Traditional IV iron carbohydrate products are macromolecular carbohydrate complexes which are taken up by macrophages which transfer to the liver where iron gets stored. Iron complexes are metabolized within the macrophages to release iron so that it can bind to transferrin in plasma - the iron carrier in the circulation. Transferrin carries the iron to the bone marrow for hemoglobin generation during red cell production. Due to the inflammation present in hemodialysis patients, hepcidin, the master molecule responsible for regulation of iron absorption from the GI tract and export of recycled iron from the macrophages is elevated, thereby blocking the release of iron from macrophages, which is referred to as iron sequestration. This reduces the efficiency of iron delivery to the bone marrow for erythropoiesis, leading to a state of functional iron deficiency. Since macromolecular IV iron finds a depot in macrophages, it is administered in large doses and is, therefore, suited as a replacement therapy in iron depleted patients. Consistent with this mechanism of action, traditional macromolecular IV iron was approved as large dose injection/infusion to replenish and restore iron stores in iron-depleted patients (serum ferritin level < 200 ng/mL) with iron deficiency anemia.

Since macromolecular IV iron has been the only therapy available for hemodialysis patients for over 30 years, it has been commonly used off-label in hemodialysis patients in a proactive manner for maintaining iron balance and preventing the development of iron deficient state. When iron-carbohydrate complexes are administered intravenously to hemodialysis patients, a significant portion of the iron is sequestered, therefore, the dose needed to deliver sufficient iron to the bone marrow far exceeds the amount of iron lost, causing progressive and cumulative tissue iron overload with concomitant elevation of serum ferritin levels.

In summary, we believe that cumulative iron overload in tissues caused by high doses of macromolecular IV iron over time may lead to complications and introduce risk to a dialysis patient's long-term health. Furthermore, the carbohydrate moiety in IV iron complexes is thought to be responsible for anaphylactic reactions occasionally seen with clinical use.

Home Infusion

General

Home infusion therapy includes specialized services that allow patients to receive intravenous medications at home. Providers are specialized, closed-door pharmacies with expertise in sterile compounding and clinical management of IV therapies. The therapy is supported by multi-disciplinary clinical teams (pharmacists, nurses, dietitians and doctors).

Many patient groups requiring home infusion therapies suffer from chronic diseases that are associated with a risk of iron deficiency and anemia. As an example, one group in particular at high risk for developing iron deficiency anemia (“IDA”) is patients who require parenteral nutrition (food or supplements delivered through a “feeding tube” or via intravenous delivery). It is estimated that 40-55% of all patients on parenteral nutrition are iron deficient. Patients with IDA can exhibit symptoms of fatigue, shortness of breath, rapid or irregular heartbeats and glossitis - all which affect quality of life. The majority of these patients are undertreated, due in part to limitations with currently available IV iron products. Home infusion represents a large and rapidly growing segment of healthcare where we believe FPC may have distinct advantages over currently available iron replacement therapy options.

Diseases Often Treated With Infusion Therapy At Home

Diseases commonly requiring infusion therapy include infections that are unresponsive to oral antibiotics, cancer and cancer-related pain, dehydration, gastrointestinal diseases or disorders which prevent normal functioning of the gastrointestinal system, and more. A recent National Home Infusion Foundation ("NHIF") report found that in 2019 home infusion and specialty providers cared for more than 3 million patients in the United States, representing a 300% increase since the last industry study in 2008.

Until the 1980s, patients receiving infusion therapy had to remain in the inpatient setting for the duration of their therapy, which often lasted for several hours. Heightened emphasis on cost-containment in health care, as well as developments in the clinical administration of the therapy, led to strategies to administer infusion therapy in alternate settings. For individuals requiring long-term therapy, inpatient care is not only tremendously expensive but also prevents the individual from resuming normal lifestyle and work activities.

The technological advances that enabled safe and effective administration of infusion therapies in the home, the desire of patients to resume normal lifestyles and work activities while recovering from illness, and the cost-effectiveness of home care are important. Consequently, home infusion therapy has evolved into a comprehensive medical therapy that is a much less costly alternative to inpatient treatment in a hospital or skilled nursing facility.

Home infusion has been proven to be a safe and effective alternative to inpatient care for many disease states and therapies. For many patients, receiving treatment at home or in an outpatient infusion suite setting is preferable to inpatient care. A thorough patient assessment and home assessment are performed before initiating infusion therapy at home to ensure the patient is an appropriate candidate for home care (Source: www.nhia.org).

Home infusion therapy allows patients that require multiple on-going infusions of medications to receive them in the comfort of their own home. The benefits include, increased quality of life, shorter hospital/skilled nursing facility length of stay, lower rates of depression and fatigue, less opioid use and reduced risk of hospital/facility acquired infections.

Growth In Home Infusion

The home and specialty infusion marketplace is experiencing rapid growth and provides a favorable reimbursement opportunity for suitable drugs because of the benefits listed above. In addition to these factors, COVID-19 and its impact has accelerated existing trends.

We believe the home infusion sector will continue to grow in the future, driven by: (1) high rates of patient demand, and satisfaction with services, (2) site of care optimization programs driven by commercial payers, (3) legislation to expand coverage for Medicare beneficiaries and (4) a robust pipeline of specialty IV treatments.

Iron Deficiency Anemia In Home Infusion

IDA is a common comorbidity for many different types of patients with diseases that are treated with home infusion therapy.

The following home infusion therapies are provided to patients for the treatment of diseases that may be associated with a risk of iron deficiency anemia. Applicability of FPC will depend on length of therapy, prevalence of iron deficiency, and acceptability of alternative therapies such as traditional IV iron loading or oral iron.

1.NHIA Infusion Industry Trends Report 2020.

2.Hwa YL, Rashtak S, Kelly DG, and Murray JA. Iron deficiency in long-term parenteral nutrition therapy. JPEN 2015.

3.Busti E, et al. Anemia and iron deficiency in cancer patients. Role of iron replacement therapy. Pharmaceuticals 2018, 11, 94

4.Beale A, et al. Iron Deficiency in Acute Decompensated Heart Failure. J. Clin. Med. 2019, 8, 1569.

5.Kaitha S, et al. Iron deficiency anemia in inflammatory bowel disease. World J Gastrointest Pathophysiol. 2015. 6(3):62-72.

6.von Haehling S, et al. Iron Deficiency in Heart Failure. JACC. 2019. 7(1):36-46.

It is recommended that patients receiving home parenteral nutrition be screened regularly for anemia. Treatment with parenteral iron for these patients with iron deficiency is recommended. Inadequate response to treatment may be related to continued blood loss, inflammation, ineffective absorption or poor adherence to therapy. Treatment patterns are inadequate for patients on home infusion therapy with IDA. IV iron supplementation is more effective than oral formulations, however, concern for adverse events is a deterrent. Home infusion of traditional macromolecular IV iron is limited due to the risk of hypersensitivity and need for medical supervision of the injection, and concerns about incompatibility with other infused drugs (e.g., stability of parenteral nutrition lipids when delivered with carbohydrate-based IV iron preparations). An office visit for infusion of IV iron is costly, inconvenient, and often does not fit the physician practice care model. Limitations with the current approach can lead to a vicious cycle of late diagnosis and treatment, inconsistent follow-up, and increased risk of office visits or hospitalizations.

For home parenteral nutrition (“HPN”) patients specifically, there is a significant opportunity for FPC for home infusion and an unmet need for effective proactive iron maintenance therapy. The NHIF estimates there are approximately 113,000 HPN patients annually, of which 83,000 patients require short-term care (averaging 45 days) and 30,000 patients require long-term care. An estimated 36% to 55% of such patients are iron deficient and the majority of patients have a negative iron balance due to low/no dietary iron absorption and inflammation. The current treatment for these patients is daily infusions of parenteral nutrition supplements, which last for 8 to 12 hours per day. Traditional parenteral iron is infrequently used due to risk of hypersensitivity and concerns regarding incompatibility with lipids. Oral iron is also considered to be inadequate due to patient inability to absorb or unwanted side effects. We believe that the inadequacy and burden of current treatments presents an opportunity for our FPC pipeline.

We believe FPC may be suited for use as a home infusion therapy:

•Home infusion clinicians are hesitant to recommend macromolecular IV iron supplementation at home due to the potential for severe hypersensitivity risk - however rare. FPC has been demonstrated to have a safety profile similar to placebo in prospective randomized clinical trials in hemodialysis patients.

•Treatment with loading doses of traditional IV iron therapy can temporarily address iron deficiency, but iron deficiency may persist due to inflammation. FPC provides 100% immediately bioavailable iron, bypassing storage in the liver. Iron from FPC is bioavailable even in the presence of inflammation and elevated hepcidin.

•Managing iron with loading doses of macromolecular IV iron is inconsistent for home infusion patients. FPC can be dosed consistently in low doses as a physiologic maintenance dose to address an on-going negative iron balance and prevent iron deficiency anemia.

Sales and Marketing

Domestic Dialysis

Concentrates

We use Baxter as our exclusive commercial partner responsible for marketing our Dialysis Concentrate Products within the United States and in select foreign markets pursuant to an exclusive Distribution Agreement, as amended (collectively, the “Distribution Agreement”). In June 2017, we entered into the First Amendment to Exclusive Distribution Agreement with Baxter which, among other things, enabled us to negotiate directly with DaVita, Inc. ("DaVita") on a long-term contract for the supply of our concentrate products. In August 2019, we signed a new Products Purchase Agreement (the "Products Purchase Agreement") with DaVita. In March 2020, we entered into a Second Amendment to the Exclusive Distribution Agreement with Baxter (the “Second Amendment”). The Second Amendment provides for, among other things, a commitment by Rockwell to maintain a specified manufacturing capacity for Baxter, a cap upon the net amount of reimbursable transportation expenses and modified extension terms.

The Products Purchase Agreement with DaVita provided for an increase in the product sale prices relative to the prices charged for products under the previous agreement with DaVita. On April 6, 2022, we entered into an amendment to the Products Purchase Agreement under which we agreed to a price increase, effective May 1, 2022, as well as the pass-through of certain costs, determined on a quarterly basis. Certain costs are subject to a cap. The Amendment will provide us with the potential to operate the concentrates business profitably in the future, subject to cost containment activities to be undertaken by the Company.

We also supply dialysis concentrates to distributors serving a number of foreign countries, primarily in the Americas and the Pacific Rim. Nipro Medical Corporation is our primary distributor of our dialysis concentrates in certain countries in Latin America that are not covered under the Distribution Agreement.

Dialysate concentrates accounted for approximately 98.3% of our 2021 revenue. Approximately 89.4% of our 2021 sales were to distributors and customers for use in the United States.

Triferic In The United States

Our primary customers in the United States for sales of Triferic (dialysate), Triferic AVNU and our dialysis concentrates are dialysis provider organizations. The dialysis provider market is considerably consolidated, with the top 10 provider organizations treating approximately 90% of in-center hemodialysis patients. We market and sell Triferic (dialysate),

Triferic AVNU directly to these medium-sized, and independent dialysis chains and are currently searching for a commercial partner within the United States to continue the commercialization these products into the market.

Triferic (dialysate). We significantly scaled back our field-based sales team that supported the commercialization of Triferic (dialysate) in the United States in August 2021.

Our initial target customers included selected medium and small sized dialysis chains and independent dialysis centers. The launch of Triferic (dialysate) enabled us to engage with key customers in the dialysis industry regarding the potential clinical and pharmacoeconomic benefits of Triferic and is providing us with valuable experience to support our future commercial and medical initiatives.

Triferic AVNU (IV). Triferic AVNU (IV) was FDA approved on March 27, 2020. We initiated a limited evaluation program with sample product in the fourth quarter of 2020 and we began commercial sales of Triferic AVNU in the first quarter of 2021.

Research to Support the Triferic Value Proposition. The kidney dialysis market in the U.S. is a concentrated market, where two companies service approximately 74% of the patients. The dialysis procedure, including all inputs, is reimbursed under capitated reimbursement model at a fixed rate. This means any new product success depends on compelling data demonstrating improved patient outcomes and/or pharmacoeconomics versus the current standard of care in practice in the clinics. Once it was determined by Medicare that Triferic would be reimbursed under the fixed bundled rate, market adoption became dependent on the generation of these data, which were not required for approval from the FDA.

We have made progress and continue to be confident that Triferic has the potential to be an important option for the maintenance of hemoglobin in dialysis patients. To this end, we have increased our efforts in generating real world data in clinics with current protocols, which we believe can help with the adoption of Triferic as these results are created and disseminated over time. We are also seeking a commercialization partner that can help us market Triferic on a larger scale.

International Dialysis.

Our strategy for growth includes the expansion of Triferic sales outside the United States by licensing it to key partners for development and/or commercialization. Partnering in these regions allows us to better leverage the development, regulatory, commercial presence and expertise of business partners to increase sales of our products throughout the world. To date, we have established partnerships in China, India, Korea, Turkey, Peru and Chile. We continue to pursue international licensing opportunities in other countries and regions.

China:

In 2016, we licensed the commercialization rights for Triferic (dialysate) and Triferic AVNU for the Chinese market to Wanbang Biopharmaceutical ("Wanbang"), a subsidiary of Shanghai Fosun Pharmaceutical (Group) Co., Ltd.. Wanbang estimates there are almost 600,000 patients receiving hemodialysis in the People’s Republic of China and it is expected to become the largest ESRD market in the world over the next several years. Wanbang is currently enrolled patients in a Phase III trial. If approved, Wanbang will commence commercialization of Triferic following the regulatory approval (for more information see Clinical Development below).

India:

We have licensed the commercialization rights for Triferic (dialysate) in India to a wholly-owned subsidiary of Sun Pharmaceutical Industries Ltd. (together, “Sun Pharma”). It is estimated there are approximately 120,000 patients receiving hemodialysis in India.

Sun Pharma has submitted the NDA for Triferic in India and is currently working with the Indian Central Drugs Standard Control Organization for the optimal regulatory path for approval of Triferic (dialysate) in India. A Joint Alliance Committee, comprised of members from the Company and Sun Pharma, continues to guide the development and execution for Triferic (dialysate) in India. Sun Pharma will be responsible for all clinical, regulatory and commercialization activities.

Korea:

We have licensed the commercialization rights for Triferic (dialysate) and Triferic AVNU for the Korean market to Jeil Pharmaceuticals (“Jeil”). It is estimated there are approximately 78,000 hemodialysis patients in Korea. Jeil has recently submitted the NDA for both Triferic (dialysate) and Triferic AVNU with the goal of being able to commercially launch Triferic (AVNU) in 2022. In January 2022, Jeil received approval by the Ministry of Food and Drug Safety (MFDS) of the Republic of Korea for formulations: Triferic Injection (AVNU) and Triferic Dialysate with the goal of being able to commercially launch Triferic AVNU in 2022.

Turkey:

In 2021 Drogsan Pharmaceuticals, a leading pharmaceutical company in Turkey, entered into an exclusive license agreement with Rockwell Medical for the rights to commercialize Triferic AVNU in Turkey. The agreement also allows for Drogsan to negotiate further geographic expansion into the surrounding region. Drogsan submitted their application for Triferic AVNU in January 2022.

Canada:

We filed for regulatory approval of Triferic AVNU (IV) in May of 2020, and if approved and granted favorable placement on both national and providence formularies, we would be entitled to receive a transfer price based on our partner’s sales price in Canada. It is estimated that approximately 17,000 patients are receiving hemodialysis in Canada. In 2021 we terminated our distribution agreement with our commercial partner in Canada. We are now seeking a new commercialization partner in that market.

Peru: