0000099780DEF 14AFALSE00000997802022-01-012022-12-31iso4217:USD0000099780trn:SavageMember2022-01-012022-12-310000099780trn:SavageMember2021-01-012021-12-3100000997802021-01-012021-12-310000099780trn:SavageMember2020-01-012020-12-3100000997802020-01-012020-12-3100000997802020-02-172020-12-310000099780trn:LovettMember2020-01-012020-02-160000099780trn:MarchettoMember2020-01-012020-02-160000099780trn:TeachoutMember2020-01-012020-02-16000009978012022-01-012022-12-310000099780trn:MarchettoMember2020-01-012020-12-310000099780trn:LovettMember2020-01-012020-12-310000099780trn:TeachoutMember2020-01-012020-12-310000099780trn:StockAwardsAndStockOptionsReportedValueMemberecd:PeoMembertrn:SavageMember2022-01-012022-12-310000099780ecd:NonPeoNeoMembertrn:StockAwardsAndStockOptionsReportedValueMember2022-01-012022-12-310000099780trn:StockAwardsAndStockOptionsReportedValueMemberecd:PeoMembertrn:SavageMember2021-01-012021-12-310000099780ecd:NonPeoNeoMembertrn:StockAwardsAndStockOptionsReportedValueMember2021-01-012021-12-310000099780trn:StockAwardsAndStockOptionsReportedValueMemberecd:PeoMembertrn:SavageMember2020-01-012020-12-310000099780ecd:NonPeoNeoMembertrn:StockAwardsAndStockOptionsReportedValueMember2020-01-012020-12-310000099780ecd:PeoMembertrn:SavageMembertrn:EquityAwardsUnvestedMember2022-01-012022-12-310000099780ecd:NonPeoNeoMembertrn:EquityAwardsUnvestedMember2022-01-012022-12-310000099780ecd:PeoMembertrn:SavageMembertrn:EquityAwardsUnvestedMember2021-01-012021-12-310000099780ecd:NonPeoNeoMembertrn:EquityAwardsUnvestedMember2021-01-012021-12-310000099780ecd:PeoMembertrn:SavageMembertrn:EquityAwardsUnvestedMember2020-01-012020-12-310000099780ecd:NonPeoNeoMembertrn:EquityAwardsUnvestedMember2020-01-012020-12-310000099780trn:EquityAwardsVestedDuringTheYearMemberecd:PeoMembertrn:SavageMember2022-01-012022-12-310000099780trn:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2022-01-012022-12-310000099780trn:EquityAwardsVestedDuringTheYearMemberecd:PeoMembertrn:SavageMember2021-01-012021-12-310000099780trn:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2021-01-012021-12-310000099780trn:EquityAwardsVestedDuringTheYearMemberecd:PeoMembertrn:SavageMember2020-01-012020-12-310000099780trn:EquityAwardsVestedDuringTheYearMemberecd:NonPeoNeoMember2020-01-012020-12-310000099780trn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMemberecd:PeoMembertrn:SavageMember2022-01-012022-12-310000099780ecd:NonPeoNeoMembertrn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMember2022-01-012022-12-310000099780trn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMemberecd:PeoMembertrn:SavageMember2021-01-012021-12-310000099780ecd:NonPeoNeoMembertrn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMember2021-01-012021-12-310000099780trn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMemberecd:PeoMembertrn:SavageMember2020-01-012020-12-310000099780ecd:NonPeoNeoMembertrn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMember2020-01-012020-12-310000099780trn:MarchettoMembertrn:StockAwardsAndStockOptionsReportedValueMemberecd:PeoMember2020-01-012020-12-310000099780trn:LovettMembertrn:StockAwardsAndStockOptionsReportedValueMemberecd:PeoMember2020-01-012020-12-310000099780trn:TeachoutMembertrn:StockAwardsAndStockOptionsReportedValueMemberecd:PeoMember2020-01-012020-12-310000099780trn:MarchettoMemberecd:PeoMembertrn:EquityAwardsUnvestedMember2020-01-012020-12-310000099780trn:LovettMemberecd:PeoMembertrn:EquityAwardsUnvestedMember2020-01-012020-12-310000099780trn:TeachoutMemberecd:PeoMembertrn:EquityAwardsUnvestedMember2020-01-012020-12-310000099780trn:EquityAwardsVestedDuringTheYearMembertrn:MarchettoMemberecd:PeoMember2020-01-012020-12-310000099780trn:EquityAwardsVestedDuringTheYearMembertrn:LovettMemberecd:PeoMember2020-01-012020-12-310000099780trn:EquityAwardsVestedDuringTheYearMembertrn:TeachoutMemberecd:PeoMember2020-01-012020-12-310000099780trn:MarchettoMembertrn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMemberecd:PeoMember2020-01-012020-12-310000099780trn:LovettMembertrn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMemberecd:PeoMember2020-01-012020-12-310000099780trn:TeachoutMembertrn:EquityAwardsValueOfDividendsOrDividendEquivalentsPaidAdjustmentMemberecd:PeoMember2020-01-012020-12-31000009978022022-01-012022-12-31000009978032022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No.)

| | | | | |

Filed by the Registrant ☑ | Filed by a party other than the Registrant |

| | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

Trinity Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

| | | | | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ☑ | No fee required. |

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

☐ | Fee paid previously with preliminary materials. |

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | | | |

| 14221 N. Dallas Parkway, Suite 1100 Dallas, Texas 75254 www.trin.net |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| DATE & TIME | | | | | PLACE | | | | | RECORD DATE | | |

| | | | | | | | | | | | | |

| Monday, May 8, 2023, at 8:30 a.m., Central Daylight Time | | | | Will be held at 30283 220th Street Shell Rock, Iowa 50670 | | | | All stockholders of record at the close of business on March 14, 2023, are entitled to vote | |

| | | | | | | | | | | | | |

Items of Business

| | | | | |

| At the meeting, the stockholders will act on the following matters: |

| 01 | Election of the eight nominees named in the attached proxy statement as directors; |

| 02 | Approval of the Fifth Amended and Restated Trinity Industries, Inc. Stock Option and Incentive Plan; |

| 03 | Advisory vote on named executive officer compensation; |

| 04 | Advisory vote on the frequency of advisory votes on executive compensation; |

| 05 | Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2023; and |

| 06 | Any other matters that may properly come before the meeting. |

All stockholders of record at the close of business on March 14, 2023, are entitled to vote at the meeting or any postponement or adjournment of the meeting. A list of the stockholders is available at the Company’s offices in Dallas, Texas.

Your vote is important! Please vote as promptly as possible by using the internet, by telephone or, if you have requested a printed version of these materials, by signing, dating, and returning the printed proxy card to the address listed on the card.

By Order of the Board of Directors,

Jared S. Richardson

Vice President and Secretary

March 28, 2023

| | | | | | | | |

| | |

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be Held on May 8, 2023: This Proxy Statement and the Annual Report to Stockholders for the fiscal year ended December 31, 2022, are available for viewing, printing, and downloading at www.proxyvote.com. "Delivering Goods for the Good of All" | |

| | |

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| Proxy Statement Summary | | |

| Proxy Statement | | |

| Corporate Governance | | |

| Independence of Directors | | |

| Board Leadership Structure | | |

| Board Committees | | |

| Board’s Role in Risk Oversight | | |

| Risk Assessment of Compensation Policies and Practices | | |

| Compensation Committee Interlocks and Insider Participation | | |

| Communications with Directors | | |

| Commitment to Sustainability | | |

| Proposal 1 - Election of Directors | | |

| Nominees | | |

| Proposal 2 - Approval of the Fifth Amended and Restated Stock Option and Incentive Plan | | |

| Proposal 3 - Advisory Vote to Approve Named Executive Officer Compensation | | |

| Proposal 4 - Advisory Vote on the Frequency of Advisory Votes on Executive Compensation | | |

| Proposal 5 - Ratification of the Appointment of Ernst & Young LLP | | |

| Fees of Independent Registered Public Accounting Firm for Fiscal Years 2022 and 2021 | | |

| Report of the Audit Committee | | |

| Executive Compensation | | |

| Compensation Discussion and Analysis | | |

| Human Resources Committee Report | | |

| Compensation of Executives | | |

| Summary Compensation Table | | |

| Grants of Plan-Based Awards | | |

| Discussion Regarding Summary Compensation Table and Grants of Plan-Based Awards Table | | |

| Outstanding Equity Awards at Year-End | | |

| | | | | | | | |

| | Page |

| Option Exercises and Stock Vested in 2022 | | |

| Nonqualified Deferred Compensation | | |

| Deferred Compensation Discussion | | |

| Potential Payments Upon Termination or Change in Control | | |

| Director Compensation | | |

| Director Compensation Discussion | | |

| CEO Pay Ratio | | |

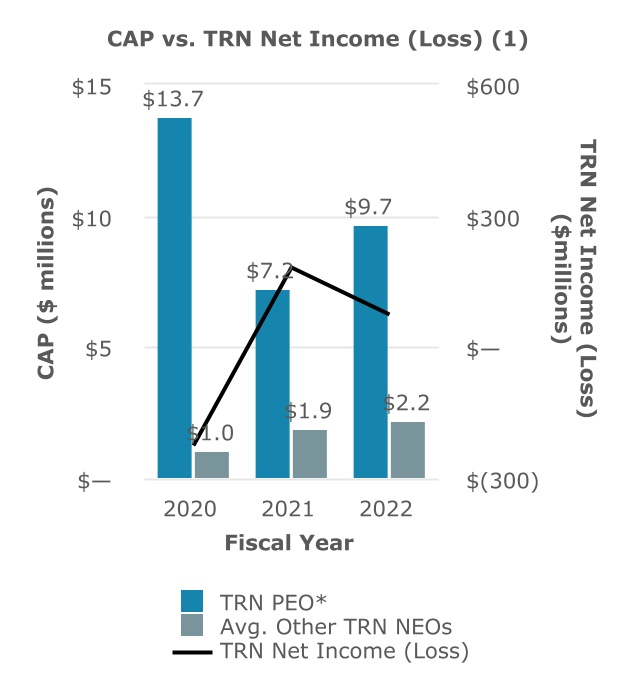

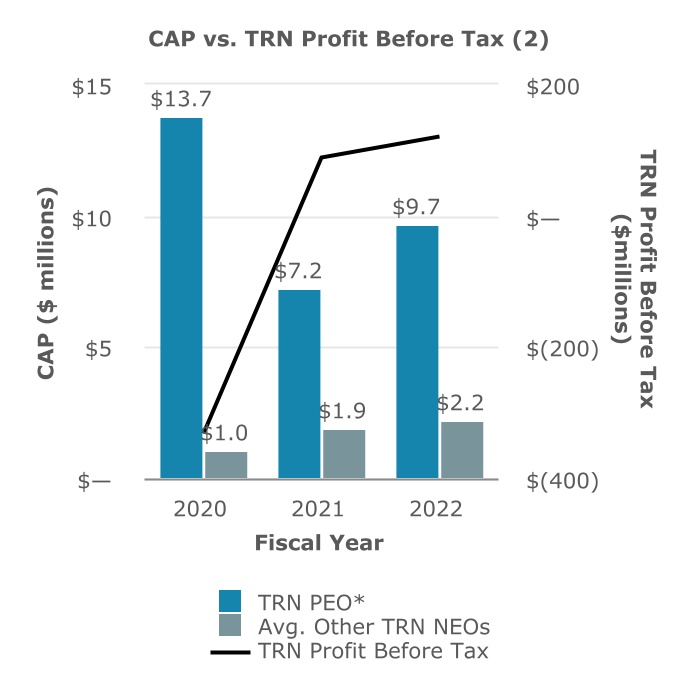

| Pay vs. Performance | | |

| Transactions with Related Persons | | |

| Security Ownership | | |

| Security Ownership of Certain Beneficial Owners and Management | | |

| Additional Information | | |

| Stockholder Proposals for the 2024 Proxy Statement | | |

| Director Nominations or Other Business for Presentation at the 2024 Annual Meeting | | |

| Report on Form 10-K | | |

| Other Business | | |

| Appendix A - Fifth Amended and Restated Trinity Industries, Inc. Stock Option and Incentive Plan | | |

| Appendix B - Reconciliations of Non-GAAP Measures | | |

PROXY STATEMENT SUMMARY

This summary highlights information contained in this Proxy Statement. It does not contain all information you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting of Stockholders

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| DATE & TIME May 8, 2023 8:30 a.m. Central Daylight Time PLACE 30283 220th Street Shell Rock, Iowa 50670 RECORD DATE March 14, 2023 | | | | | | | | | | | |

| | | | ONLINE | | | | | BY MAIL | | |

| | | | | | | | | | | |

| | | | You can vote online at www.proxyvote.com. | | | | Mark, sign and date your proxy card and return to 51 Mercedes Way, Edgewood, NY 11717 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | BY PHONE | | | | | IN PERSON | | |

| | | | | | | | | | | | | |

| Stockholders as of the record date are entitled to vote | | | | You can vote by phone at 1-800-690-6903. | | | | You can vote in person at 30283 220th Street Shell Rock, Iowa 50670 | |

| | | | | | | | | | | | | |

Agenda and Voting Recommendations

| | | | | | | | | | | |

| Item | Description | Board

Recommendation | Page |

| | | |

| 01 | Election of Directors | FOR each nominee | |

| 02 | Approval of the Fifth Amended and Restated Trinity Industries Stock Option and Incentive Plan | FOR | |

| 03 | Advisory vote to approve named executive officer compensation | FOR | |

| 04 | Advisory vote on the frequency of advisory votes on executive compensation | ONE YEAR | |

| 05 | Ratification of Ernst & Young LLP as independent auditors for 2023 | FOR | |

| | | | | | | | |

Trinity Industries, Inc. | 1 | 2023 Proxy Statement |

2022 Business Highlights

| | | | | | | | | | | | | | |

| | | | |

| $1.02 | | $154M | | M&A |

Reported earnings per share of $1.02; adjusted earnings per share of $0.94(1) | | Returned to stockholders in share repurchases and dividends | | Completed acquisitions of Quasar Platform, Inc. and Holden America |

| | | | |

| | | | |

| | | | |

$3.9B | | $2.0B | | 50.5% |

New railcar backlog as of December 31, 2022 | | Full year total company revenues | | Total stockholder return for 2020-2022 |

| | | | |

(1) excludes $0.08 per share of adjustments made to better reflect the Company's core operating performance; see Appendix B for reconciliation of non-GAAP measures

Director Nominees

The following table provides summary information about each nominee for director. Each director is elected annually by a majority of votes cast.

| | | | | | | | | | | | | | |

| Nominee | Age | Director Since | Principal Occupation | Committees |

| | | | |

| E. Jean Savage | 59 | 2018 | Chief Executive Officer and President,

Trinity Industries, Inc. | None |

| William P. Ainsworth | 66 | 2021 | Retired Group President of Energy and Transportation, Caterpillar, Inc. | Finance and Governance |

| Robert C. Biesterfeld Jr. | 47 | 2022 | Former Chief Executive Officer and President,

C. H. Robinson Worldwide, Inc. | Finance and HR |

| John J. Diez | 52 | 2018 | Executive Vice President and Chief Financial Officer,

Ryder System, Inc. | Audit, Governance, and HR |

| Leldon E. Echols | 67 | 2007 | Non-Executive Chairman, Trinity Industries, Inc. | Audit, Finance, Governance, and HR |

| Veena M. Lakkundi | 54 | 2022 | Senior Vice President, Strategy & Corporate Development, Rockwell Automation, Inc. | Audit and Governance |

| S. Todd Maclin | 66 | 2020 | Retired Chairman, Chase Commercial and Consumer Banking, JPMorgan Chase & Co. | Finance and HR |

| Dunia A. Shive | 62 | 2014 | Former Chief Executive Officer and President, Belo Corp. | Audit, Governance, and Finance |

| | | | | | | | |

Trinity Industries, Inc. | 2 | 2023 Proxy Statement |

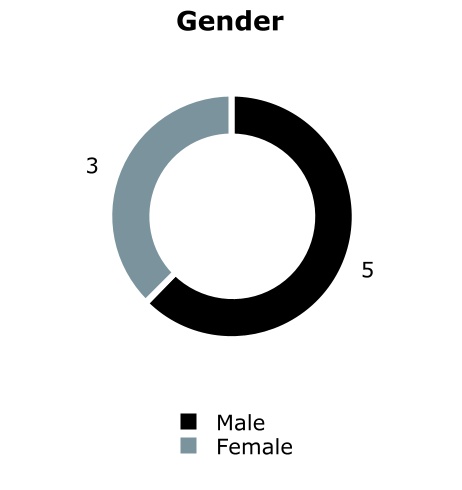

Diversity of Director Nominees

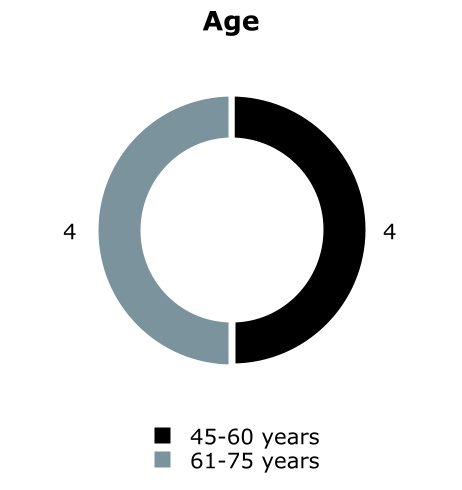

The following graphics and table provide information regarding the diversity of the members of the Board standing for election at the Annual Meeting.

| | | | | | | | | | | | | | | | | | | | |

| Ethnicity/Race | | Gender |

| Director | Caucasian/White | Hispanic/Latino | Other | | Female | Male |

| | | | | | |

| William P. Ainsworth | * | | | | | * |

| Robert C. Biesterfeld Jr. | * | | | | | * |

| John J. Diez | | * | | | | * |

| Leldon E. Echols | * | | | | | * |

| Veena M. Lakkundi | | | * | | * | |

| S. Todd Maclin | * | | | | | * |

| E. Jean Savage | * | | | | * | |

| Dunia A. Shive | | | * | | * | |

| | | | | | | | |

Trinity Industries, Inc. | 3 | 2023 Proxy Statement |

| | | | | |

| 14221 N. Dallas Parkway, Suite 1100 Dallas, Texas 75254 www.trin.net |

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 8, 2023

This Proxy Statement is being provided to the stockholders of Trinity Industries, Inc. (the “Company”) in connection with the solicitation of proxies by the Company's Board of Directors to be voted at the Annual Meeting of Stockholders to be held at 30283 220th Street, Shell Rock, Iowa, on Monday, May 8, 2023, at 8:30 a.m., Central Daylight Time (the “Annual Meeting”), or at any postponement or adjournment thereof, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Company’s mailing address is 14221 N. Dallas Parkway, Suite 1100, Dallas, Texas 75254.

To both save money and protect the environment, the Company has elected to provide access to its proxy materials and Annual Report to Stockholders for the fiscal year ended December 31, 2022 (“2022 Annual Report”) on the internet, instead of mailing the full set of printed proxy materials, in accordance with the rules of the Securities and Exchange Commission (“SEC”) for the electronic distribution of proxy materials. Proxy materials or a Notice of Internet Availability of Proxy Materials (the “Notice”) are being first released or mailed to stockholders on or about March 28, 2023. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request it. Instead, the Notice instructs you how to obtain and review all of the important information contained in the Proxy Statement and 2022 Annual Report. The Notice also instructs you how to submit your proxy over the internet. If you received a Notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions for requesting such materials included in the Notice.

All stockholders of record can vote by telephone using the toll-free telephone number on the Notice or proxy card, or via the internet at www.proxyvote.com, and using the procedures and instructions described on the Notice or proxy card. You will need the 16-digit control number provided in your proxy materials. If you are a stockholder of record and receive a Notice card, you may request a written proxy card by following the instructions included in the Notice. To vote your proxy by mail using a written proxy card, mark your vote on the proxy card, then follow the instructions on the card. You may vote in person by attending the meeting.

The named proxies will vote your shares according to your directions. If you sign and return your proxy but do not make any of the selections, the named proxies will vote your shares: (i) FOR election of the eight nominees for directors as set forth in this Proxy Statement, (ii) FOR approval of the Fifth Amended and Restated Trinity Industries, Inc. Stock Option and Incentive Plan, (iii) FOR approval, on an advisory basis, of the compensation of the Company’s named executive officers as disclosed in these materials, (iv) for approval, on an advisory basis, of the ONE YEAR frequency of advisory votes on executive compensation, and (v) FOR ratification of Ernst & Young LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31,

| | | | | | | | |

Trinity Industries, Inc. | 4 | 2023 Proxy Statement |

| | | | | |

| Proxy Statement for Annual Meeting of Stockholders | |

2023. The proxy may be revoked at any time before it is exercised by filing with the Company a written revocation addressed to the Corporate Secretary, by executing a proxy bearing a later date, or by attending the Annual Meeting and voting in person.

The cost of soliciting proxies will be borne by the Company. In addition to the use of postal services or the internet, proxies may be solicited by directors, officers, and regular employees of the Company (none of whom will receive any additional compensation for any assistance they may provide in the solicitation of proxies) in person or by telephone. The Company has hired Georgeson, Inc. to assist in the solicitation of proxies at an estimated cost of $14,500 plus expenses.

The outstanding voting securities of the Company consist of shares of common stock, $0.01 par value per share (“Common Stock”). The record date for the determination of the stockholders entitled to notice of and to vote at the Annual Meeting, or any postponement or adjournment thereof, has been established by the Board of Directors as the close of business on March 14, 2023. At that date, there were outstanding and entitled to vote 81,149,139 shares of Common Stock.

The presence, in person or by proxy, of the holders of record of a majority of the outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting, but if a quorum should not be present, the meeting may be adjourned from time to time until a quorum is obtained. A holder of Common Stock will be entitled to one vote per share on each matter properly brought before the meeting. Cumulative voting is not permitted in the election of directors.

| | | | | | | | |

Trinity Industries, Inc. | 5 | 2023 Proxy Statement |

| | | | | |

| Proxy Statement for Annual Meeting of Stockholders | |

| | | | | | | | | | | |

| Item | Description | Votes Required for Approval | Effect of Abstention |

| | | |

| | | |

| 01 | Election of Directors | Affirmative vote of a majority of the votes cast for the election of directors at the Annual Meeting | An incumbent director nominee who receives a greater number of votes “against” than “for” is required to tender his or her resignation, which will be accepted or rejected by the Board as more fully described in “Election of Directors.” An abstention will not count as a vote cast and therefore will not affect the outcome of the vote. |

| | | |

| | | |

| 02 | Approval of the Fifth Amended and Restated Trinity Industries, Inc. Stock Option and Incentive Plan | Affirmative vote of a majority of votes cast on the proposal | An abstention will not count as a vote cast and therefore will not affect the outcome of the vote. |

| | | |

| | | |

| 03 | Advisory vote to approve named executive officer compensation | Affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the subject matter | An abstention will effectively count as a vote cast against this proposal. |

| | | |

| | | |

| 04 | Advisory vote to approve the frequency of advisory votes on executive compensation | Plurality of the shares present in person or represented by proxy and entitled to vote at the meeting selecting one, two, or three years | An abstention will have no effect on the vote since the vote is the plurality of shares present in person or represented by proxy and entitled to vote at the meeting selecting one, two, or three years. |

| | | |

| | | |

| 05 | Ratification of Ernst & Young LLP as independent auditors for 2023 | Affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote on the subject matter | An abstention will effectively count as a vote cast against this proposal. |

Votes may be cast for or against all of the director nominees, or any of them individually. Shares of a stockholder who abstains from voting on any or all proposals will be included for the purpose of determining the presence of a quorum. Broker non-votes on any matter, as to which the broker has indicated on the proxy that it does not have discretionary authority to vote, will be treated as votes not cast or as shares not entitled to vote with respect to that matter and will not affect the outcome of the vote. However, such shares will be considered present and entitled to vote for quorum purposes so long as they are entitled to vote on at least one matter.

| | | | | | | | |

Trinity Industries, Inc. | 6 | 2023 Proxy Statement |

CORPORATE GOVERNANCE

The business affairs of the Company are managed under the direction of the Board of Directors (also referred to in this proxy statement as the “Board”) in accordance with the General Corporation Law of the State of Delaware and the Company’s Certificate of Incorporation and Bylaws. The role of the Board of Directors is to oversee the management of the Company for the benefit of the stockholders. This responsibility includes monitoring senior management’s conduct of the Company’s business operations and affairs; reviewing and approving the Company’s financial objectives, strategies, and plans; risk management oversight; evaluating the performance of the Chief Executive Officer and other executive officers; and overseeing the Company’s policies and procedures regarding corporate governance, legal compliance, ethical conduct, and maintenance of financial and accounting controls. The Board of Directors includes an independent Chairman and diverse and independent Board members who help ensure the Company's business strategies and programs are aligned with stakeholder interests.

The Board first adopted Corporate Governance Principles in 1998, which are reviewed annually by the Corporate Governance and Directors Nominating Committee and were last amended in December 2020. The Company has a long-standing Code of Business Conduct and Ethics, which is applicable to all employees of the Company, including the Chief Executive Officer, Chief Financial Officer, principal accounting officer, and controller, as well as the Board. The Company intends to post any amendments or waivers for its Code of Business Conduct and Ethics to the Company's website at www.trin.net to the extent applicable to an executive officer, principal accounting officer, controller, or director of the Company. The Corporate Governance Principles and the Code of Business Conduct and Ethics are available on the Company’s web site at www.trin.net under the heading “Investor Relations — Governance — Governance Documents.”

The directors hold regular and special meetings and spend such time on the affairs of the Company as their duties require. During 2022, the Board of Directors held six meetings. The Board meets regularly in non-management executive sessions. The Board has elected Leldon E. Echols as non-executive Chairman of the Board. In this role, Mr. Echols chairs the non-management executive sessions. In 2022, all directors of the Company attended at least 75% of the meetings of the Board of Directors and the committees on which they served. It is Company policy that each director is expected to attend the Annual Meeting. Seven of the eight directors then serving were in attendance at the 2022 Annual Meeting.

Independence of Directors

The Board of Directors makes all determinations with respect to director independence in accordance with the New York Stock Exchange (“NYSE”) listing standards and the rules and regulations promulgated by the SEC. In addition, the Board of Directors established certain guidelines to assist it in making any such determinations regarding director independence (the “Independence Guidelines”), which are available on the Company’s website at www.trin.net under the heading “Investor Relations — Governance — Governance Documents — Categorical Standards of Director Independence.” The Independence Guidelines set forth commercial and charitable relationships that may not rise to the level of material relationships that would impair a director’s independence as set forth in the NYSE listing standards and SEC rules and regulations. The determination of whether such relationships as described in the Independence Guidelines actually impair a director’s independence is made by the Board on a case-by-case basis.

| | | | | | | | |

Trinity Industries, Inc. | 7 | 2023 Proxy Statement |

The Board undertook its annual review of director independence and considered transactions and relationships between each director, or any member of his or her immediate family, and the Company and its subsidiaries and affiliates. In making its determination, the Board applied the NYSE listing standards and SEC rules and regulations together with the Independence Guidelines. In making such determinations, the Board, among other things, considered the transactions described below.

As a result of its review, the Board affirmatively determined that the following directors are independent of the Company and its management under the standards set forth in the listing standards of the NYSE and the SEC rules and regulations: William P. Ainsworth, Robert C. Biesterfeld Jr., John J. Diez, Leldon E. Echols, Tyrone M. Jordan, Veena M. Lakkundi, S. Todd Maclin, and Dunia A. Shive. Mr. Jordan is not standing for re-election at the Annual Meeting. Prior to his departure from the Board in May 2022, the Board had determined that Jason G. Anderson was independent. The Board determined that E. Jean Savage is not independent because of her employment by the Company.

Board Leadership Structure

Mr. Echols serves as the independent, non-executive Chairman of the Board. As stated in the Corporate Governance Principles, the Board believes the decision as to whether the offices of Chairman and Chief Executive Officer should be combined or separated is the responsibility of the Board. The members of the Board possess experience and unique knowledge of the challenges and opportunities the Company faces. They are, therefore, in the best position to evaluate the current and future needs of the Company and to judge how the capabilities of the directors and senior managers can be most effectively organized to meet those needs. The separation of the roles of Chairman and Chief Executive Officer allows Ms. Savage to focus on leading the Company’s business strategies, operations, and other corporate activities, while Mr. Echols provides independent oversight and direction and presides at meetings of the Board of Directors. For these reasons, the Board believes this leadership structure is effective for the Company.

Board Committees

The standing committees of the Board of Directors are the Audit Committee, Corporate Governance and Directors Nominating Committee, Finance and Risk Committee, and Human Resources Committee. Each of the committees is governed by a charter, current copies of which are available on the Company’s website at www.trin.net under the heading “Investor Relations — Governance — Governance Documents.” Ms. Savage, Chief Executive Officer and President (collectively referred to as the “CEO”) of the Company, does not serve on any Board committee. Director membership of the committees is identified below.

| | | | | | | | |

Trinity Industries, Inc. | 8 | 2023 Proxy Statement |

| | | | | | | | | | | | | | |

| Director | Audit Committee | Corporate Governance and Directors Nominating Committee | Finance and Risk Committee | Human Resources Committee |

| | | | |

| William P. Ainsworth | | * | * | |

| Robert C. Biesterfeld Jr. | | | * | * |

| John J. Diez | * | C | | * |

| Leldon E. Echols | * | * | * | C |

| Tyrone M. Jordan | * | | | * |

| Veena M. Lakkundi | * | * | | |

| S. Todd Maclin | | | C | * |

| Dunia A. Shive | C | * | * | |

* - Member

C - Chair

| | | | | | | | |

Trinity Industries, Inc. | 9 | 2023 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| | | | | The Audit Committee’s function is to oversee, on behalf of the Board, (i) the integrity of the Company’s financial statements and related disclosures; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the qualifications, independence, and performance of the Company’s independent auditing firm; (iv) the performance of the Company’s internal audit function; (v) the Company’s internal accounting and disclosure control systems and practices; (vi) the Company’s procedures for monitoring compliance with its Code of Business Conduct and Ethics; and (vii) the Company’s policies and procedures with respect to risk assessment, management, and mitigation. In carrying out its function, the Audit Committee (a) reviews with management, the chief audit executive, and the independent auditors, the Company’s financial statements, the accounting principles applied in their preparation, the scope of the audit, any comments made by the independent auditors on the financial condition of the Company and its accounting controls and procedures; (b) reviews with management its processes and policies related to risk assessment, management, and mitigation, compliance with corporate policies, compliance programs, and internal controls; and (c) performs such other duties as the Audit Committee deems appropriate. The Audit Committee also has oversight of information technology and cybersecurity, and received reports from senior management on these topics twice in 2022. In addition, the Board received two reports on these topics from senior management during 2022.

The Audit Committee pre-approves all auditing and all allowable non-audit services provided to the Company by the independent auditors. The Audit Committee selects and retains the independent auditors for the Company and approves audit fees. The Audit Committee met seven times during 2022. The Board of Directors has determined that all members of the Audit Committee are “independent” as defined by the rules of the SEC and the listing standards of the NYSE. The Board has determined that Mr. Diez, Mr. Echols, Mr. Jordan, and Ms. Shive each qualify as an audit committee financial expert within the meaning of SEC regulations. |

| Audit Committee | |

| | | |

| Chair: Dunia A. Shive | |

| Members: John J. Diez, Leldon E. Echols, Tyrone M. Jordan, Veena M. Lakkundi | |

| Number of Meetings in 2022: 7 | |

| | | |

| | | | | | | | | | | | | | | | | |

| | | | | The functions of the Corporate Governance and Directors Nominating Committee (the “Governance Committee”) are to identify and recommend to the Board individuals qualified to be nominated for election to the Board; review the qualifications of the members of each committee (including the independence of directors) to ensure that each committee’s membership meets applicable criteria established by the SEC and NYSE; recommend to the Board the members and Chairperson for each Board committee; periodically review and assess the Company’s Corporate Governance Principles and the Company’s Code of Business Conduct and Ethics and make recommendations for changes to the Board; periodically review the Company’s orientation program for new directors and the Company’s practices for continuing education of existing directors; annually review director compensation and benefits and make recommendations to the Board regarding director compensation and benefits; review, approve, and ratify all transactions with related persons that are required to be disclosed under the rules of the SEC; annually conduct an individual director performance review of each incumbent director; and oversee the annual self-evaluation of the performance of the Board. The Governance Committee also reviews and oversees the Company's Corporate Social Responsibility Report and the actions and steps taken towards the Company's environmental, social, and governance goals. Each member of the Governance Committee is an independent director under the NYSE listing standards. The Governance Committee met three times during 2022. |

| Corporate Governance

and Directors Nominating Committee | |

| | | |

| Chair: John J. Diez | |

| Members: William P. Ainsworth, Leldon E. Echols, Veena M. Lakkundi, Dunia A. Shive | |

| Number of Meetings in 2022: 3 | |

| | | | |

| | | | | | | | |

Trinity Industries, Inc. | 10 | 2023 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| | | | | In performing its annual review of director compensation, the Governance Committee utilizes independent compensation consultants from time to time to assist in making its recommendations to the Board. The Governance Committee reviewed the director compensation for 2022, considered benchmarking information provided by Meridian Compensation Partners, LLC (the “Compensation Consultant”), and the Board established director compensation as discussed in “Director Compensation.”

The Governance Committee will consider director candidates recommended to it by stockholders. In considering candidates submitted by stockholders, the Governance Committee will consider the needs of the Board and the qualifications of the candidate. To have a candidate considered by the Governance Committee, a stockholder must submit the recommendation in writing and must include the following information:

•the name of the stockholder, evidence of the person’s ownership of Company stock, including the number of shares owned and the length of time of ownership, and a description of all arrangements or understandings regarding the submittal between the stockholder and the recommended candidate; and •the name, age, business and residence addresses of the candidate, the candidate’s résumé or a listing of his or her qualifications to be a director of the Company, and the person’s consent to be a director if selected by the Governance Committee, nominated by the Board, and elected by the stockholders.

The stockholder recommendation and information described above must be sent to the Corporate Secretary at 14221 N. Dallas Parkway, Suite 1100, Dallas, Texas 75254 and must be received by the Corporate Secretary not less than 120 days prior to the anniversary date of the date the Company’s proxy statement was released in connection with the previous year’s Annual Meeting of Stockholders.

The Governance Committee believes the qualifications for serving as a director of the Company are that a nominee demonstrate depth of experience at the policy-making level in business, government, or education; possess the ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and a willingness to exercise independent judgment; and have an impeccable reputation for honest and ethical conduct in both professional and personal activities. In addition, the Governance Committee examines a candidate’s time availability, the candidate’s ability to make analytical and probing inquiries, and financial independence to ensure he or she will not be financially dependent on director compensation.

The Governance Committee periodically identifies potential nominees by asking current directors and executive officers for their recommendations of persons meeting the criteria described above who might be available to serve on the Board. The Governance Committee may also engage firms that specialize in identifying director candidates, which it did in 2022. As described above, the Governance Committee will also consider candidates recommended by stockholders. |

| | | | | | | | |

Trinity Industries, Inc. | 11 | 2023 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| | | | | Once a person has been identified as a potential candidate, the Governance Committee makes an initial determination regarding the need for additional Board members to fill vacancies or expand the size of the Board. If the Governance Committee determines additional consideration is warranted, the Governance Committee will review such information and conduct interviews as it deems necessary to fully evaluate each director candidate. In addition to the qualifications of a candidate, the Governance Committee will consider such relevant factors as it deems appropriate, including the current composition of the Board, the evaluations of other prospective nominees, and the need for any required expertise on the Board or one of its committees. The Governance Committee considers potential candidates in light of the skills, experience, and attributes (i) possessed by current directors and (ii) that the Board has identified as important for new directors to possess. The Governance Committee also contemplates multiple dynamics that promote and advance diversity among its members. Although the Governance Committee does not have a formal diversity policy, the Governance Committee considers a number of factors regarding diversity of personal and professional backgrounds (both domestic and international), gender, national origins, specialized skills and acumen, and breadth of experience in industry, manufacturing, financing transactions, and business combinations. The Governance Committee’s evaluation process will not vary based on whether or not a candidate is recommended by a stockholder. |

| | | | | | | | | | | | | | | | | |

| | | | | The duties of the Finance and Risk Committee (the “Finance Committee”) include reviewing significant acquisitions and dispositions of businesses or assets and authorizing such transactions within limits prescribed by the Board; periodically reviewing the Company’s financial status and compliance with debt instruments; reviewing and making recommendations to the Board regarding financings and refinancings; authorizing financings and refinancings within limits prescribed by the Board; reviewing and assessing risk and litigation exposure related to the Company’s operations; monitoring and oversight responsibility for the Company's qualified retirement plans and certain related non-qualified plans; reviewing the Company's liquidity; reviewing stockholder returns including the Company's dividend and share repurchase program; and reviewing the Company’s insurance coverages. In addition, the Finance Committee periodically identifies, assesses, and reviews the business, commercial, operational, financial, and other risks associated with the Company's products and services. The Finance Committee also receives regular reports on legal, environmental, and safety matters. The Finance Committee met four times in 2022. |

| Finance and Risk Committee | |

| | | |

| Chair: S. Todd Maclin | |

| Members: William P. Ainsworth, Robert C. Biesterfeld Jr., Leldon E. Echols, Dunia A. Shive | |

| Number of Meetings in 2022: 4 | |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 12 | 2023 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| | | | | The Human Resources Committee (the “HR Committee”) makes recommendations to the independent members of the Board of Directors in its responsibilities relating to the fair and competitive compensation of the Company’s CEO. The HR Committee has been delegated authority by the Board to make compensation decisions with respect to the other named executive officers (as defined below). Each member of the HR Committee is an independent director under the NYSE listing standards, including those standards applicable specifically to members of compensation committees. The HR Committee met four times during 2022.

The HR Committee reviews management succession planning and approves awards under the Company’s incentive compensation and equity-based plans. The HR Committee annually evaluates the leadership and performance of the Company’s CEO, and recommends the CEO's compensation to the Company’s independent directors. The independent directors are responsible for approving the CEO’s compensation. The CEO provides to the HR Committee an assessment of the performance of the other named executive officers. The HR Committee also has direct access to the Company’s key leaders. The HR Committee reviews and approves compensation for the Chief Financial Officer (the “CFO”) and the other executive officers named in the “Summary Compensation Table.” The CEO, the CFO, and the other executive officers named in the “Summary Compensation Table” are referred to in this proxy statement as the “named executive officers.” |

| Human Resources Committee | |

| | | |

| Chair: Leldon E. Echols | |

| Members: Robert C. Biesterfeld Jr., John J. Diez, Tyrone M. Jordan, S. Todd Maclin | |

| Number of Meetings in 2022: 4 | |

| | | |

The Role of the Compensation Consultant

The HR Committee retains an independent executive compensation consultant to provide an assessment of the Company’s executive compensation programs and to perform five key tasks. The consultant (i) reviews and assists in the design of the Company’s compensation programs, (ii) provides insight into executive compensation practices used by other companies, (iii) benchmarks the Company’s executive compensation pay levels with relevant peer survey data, (iv) provides proxy disclosure information for comparator companies, and (v) provides input to the HR Committee on the risk assessment, structure, and overall competitiveness of the Company’s executive compensation programs.

The HR Committee retained the services of the Compensation Consultant to assist in providing an independent assessment of the executive compensation programs. Meridian Compensation Partners, LLC was the HR Committee’s sole compensation consultant in 2022 and was chosen given its (i) depth of resources, (ii) content expertise, and (iii) extensive experience. The Compensation Consultant reported directly to the HR Committee for the purposes of advising it on matters relating to 2022 executive compensation. The services of the Compensation Consultant were used only in conjunction with executive compensation matters and to provide benchmarking information regarding director compensation and compensation trends for similar companies. The Compensation Consultant was not retained by the Company for any purpose. The Compensation Consultant’s ownership structure, limited service lines, and policies and procedures are designed to ensure that the Compensation Consultant’s work for the HR Committee does not raise any conflicts of interest. The amount of fees paid in 2022 to the Compensation Consultant by the Company represented less than 1% of the Compensation Consultant’s

| | | | | | | | |

Trinity Industries, Inc. | 13 | 2023 Proxy Statement |

total annual revenues for the year. The internal policies of the Compensation Consultant prohibit its partners, consultants, and employees from engaging in conduct that could give rise to conflicts of interest and from buying, selling, and trading in the securities of client companies when that partner, consultant, or employee is providing consulting services to the client. The employees of the Compensation Consultant providing consulting services to the HR Committee have no other business or personal relationship with any member of the HR Committee or any executive officer of the Company. After a review of these factors and the considerations outlined in applicable SEC and NYSE rules, the HR Committee has concluded that the work of the Compensation Consultant has not raised any conflicts of interest and that the Compensation Consultant is independent from the Company and from management.

The HR Committee instructed the Compensation Consultant to provide analyses, insight, and benchmarking information for 2022 on the named executive officers and other key executives to determine whether the compensation packages for these executives were competitive with the market and met the Company’s objectives. The Compensation Consultant was instructed to:

•review the total direct compensation (base salary, annual incentive, and long-term incentive);

•help identify and confirm that the comparator companies selected by the HR Committee were appropriate; and

•gather publicly-traded comparator company proxies and peer survey data to ascertain market competitive rates for the named executive officers.

The Compensation Consultant benchmarked all cash and equity components of compensation for 2022, excluding deferred compensation, and, for each position, determined certain percentile benchmarks.

The Role of Management

The CEO, the CFO, and the Chief Human Resources Officer work with the HR Committee and the Compensation Consultant to develop the framework and design the plans for all compensation components. The CEO and CFO recommend the financial performance measurements for the annual incentive awards and the long-term performance-based equity awards, subject to HR Committee approval. The CFO certifies the achievement of these financial performance measures. The HR Committee recommends the CEO's compensation to the independent directors for their approval. The CEO makes recommendations to the HR Committee on compensation for each of the other named executive officers.

The Role of the HR Committee

Throughout the year, the CEO provides the HR Committee with an ongoing assessment of the performance of the other named executive officers. These assessments provide background information for any adjustment to base salary, annual incentive, or long-term incentive. Both annual incentives and long-term incentives are established with threshold, target, and maximum payout levels.

The HR Committee realizes that benchmarking and comparing peer group proxy disclosure data require certain levels of interpretation due to the complexities associated with executive compensation plans. The HR Committee uses the benchmarking information and the peer group proxy disclosure data provided by the Compensation Consultant as general guidelines and adjusts compensation levels based on what the HR Committee believes is in the best interests of the Company’s stockholders. The HR Committee uses its judgment and bases its consideration of each executive’s compensation on performance in respect to the value of the executive’s

| | | | | | | | |

Trinity Industries, Inc. | 14 | 2023 Proxy Statement |

contributions to the Company, the executive’s tenure, and peer survey data that establishes the ranges against which compensation is benchmarked.

Board’s Role in Risk Oversight

The Audit Committee has the responsibility to oversee the Company’s policies and procedures relating to risk assessment, management, and mitigation. The Finance Committee has the responsibility to review and assess risk exposure related to the Company’s operations, including safety, environmental, financial, contingent liabilities, and other risks that may be material to the Company, as well as the activities of management in identifying, assessing, and mitigating against business, commercial, operational, financial, and personal risks associated with the Company’s products and services. The Finance Committee accomplishes this responsibility as described at www.trin.net under the heading “Investor Relations - Governance - Governance Documents - Finance and Risk Committee Charter.” In addition, the Audit Committee, in its discretion, reviews the Company’s major risks and exposures, including (i) risks related to data privacy, cybersecurity, business continuity, information technology operational resilience, and regulatory matters, (ii) any special-purpose entities, complex financing transactions, and related off-balance sheet accounting matters, and (iii) legal matters that may significantly impact the Company’s financial statements or risk management. The Audit Committee periodically reviews and assesses the adequacy of the security for the Company's information systems and the Company's contingency plans in the event of a systems breakdown or security breach. The Board has also received specific cybersecurity training from third-party experts.

Risk Assessment of Compensation Policies and Practices

The Company conducts a detailed risk assessment of its compensation policies and practices (the “Compensation Policies”) for its employees, including its executive officers. Participants in the Compensation Policies risk assessment include the Company’s management, human resources group, internal audit group, Compliance and Risk Committee (which consists of senior corporate and business segment executives who meet regularly to identify and review risks and assess exposures), the Compensation Consultant, and the HR Committee.

At the request of the HR Committee, the Compensation Consultant performs a risk assessment with respect to the Compensation Policies applicable to executive officers. The Compensation Consultant did not find any excessive risk in its review of the Compensation Policies applicable to executive officers.

Also, representatives of the Company’s management, human resources group, and internal audit group review the Compensation Policies and meet to discuss and assess the likelihood and potential impact of the risk presented by the Compensation Policies and present findings to the Company’s internal Compliance and Risk Committee. The Compliance and Risk Committee considers these findings and assessments and reviews the Compensation Policies and the Compensation Consultant’s risk assessment. The Compliance and Risk Committee has concluded that the Compensation Policies are not reasonably likely to have a material adverse effect on the Company.

Compensation Committee Interlocks and Insider Participation

Messrs. Biesterfeld, Diez, Echols, Jordan, and Maclin served on the HR Committee during the last completed fiscal year. In addition, Mr. Anderson, a former director of the Company, served on the HR Committee during the last completed fiscal year. None of the members of the HR Committee had ever served as an executive officer or employee of the Company or any of its subsidiaries at the time of such member's service on the HR Committee. There were no compensation committee interlocks during 2022.

| | | | | | | | |

Trinity Industries, Inc. | 15 | 2023 Proxy Statement |

Communications with Directors

The Board has established a process to receive communications by mail from stockholders and other interested parties. Stockholders and other interested parties may contact any member of the Board, including the Chairman, Mr. Echols, or the non-management directors as a group, any Board committee or any chair of any such committee. To communicate with the Board of Directors, any individual director, or any group or committee of directors, correspondence should be addressed to the Board of Directors or any such individual director or group or committee of directors by either name or title. All such correspondence should be sent “c/o Corporate Secretary” at 14221 N. Dallas Parkway, Suite 1100, Dallas, Texas 75254.

All communications received as set forth in the preceding paragraph will be opened by the office of the Corporate Secretary for the sole purpose of determining whether the contents represent a message to directors. Any contents that are not in the nature of advertising, promotions of a product or service, or offensive material will be forwarded promptly to the addressee. In the case of communications to the Board or any group or committee of directors, the Corporate Secretary will make sufficient copies of the contents to send to each director who is a member of the group or committee to which the envelope is addressed.

Commitment to Sustainability

The Company recognizes that further integrating the key principles of sustainability, including environmental stewardship, safety and quality assurance, corporate social responsibility, governance, and diversity, equity, and inclusion, are important to enhancing long-term value. The Company strives to employ its resources in ways that make positive contributions to its stakeholders and the communities in which it operates. As the Company pursues improvements to its products and services, it keeps in mind the environmental and societal impacts of its decisions and works to protect natural resources and the environment for the benefit of current and future generations. The Company continuously looks for ways to improve its governance practices with the goal of promoting the long-term interests of stakeholders, strengthening accountability, and inspiring trust.

| | | | | |

| Environmental Stewardship |

|

| The Company takes its commitment to reducing its own environmental impact seriously, as it recognizes climate change is a challenge facing its business, industry, and communities today. The Company is committed to contributing to a more resource-efficient economy and embedding climate change mitigation into its business strategy to help confront challenges such as energy management, fuel economy and efficiency, and materials sourcing. The Company aims to operate its business in a manner that minimizes the impact on natural resources and the environment, and has certified all of its railcar manufacturing facilities, as well as the corporate headquarters, to the ISO 14001 (environmental management) standard. The Company believes railcars are a more environmentally-friendly way to fuel the North American supply chain. U.S. freight railroads produce far fewer greenhouse gas emissions than certain other modes of commercial transportation, such as trucks. The Company strives to responsibly support customers' products at each stage of the product lifecycle, including recycling the railcar through scrap and salvage at the end of its useful life. Additionally, the Company's sustainable railcar conversion program repurposes and reuses railcar materials and components to sustainably bring renewed life to existing assets. |

| | | | | | | | |

Trinity Industries, Inc. | 16 | 2023 Proxy Statement |

| | | | | |

| Social Responsibility |

|

| The Company actively engages stakeholders across its environmental, health, and safety initiatives to continually improve processes and performance as it operates its businesses with a goal of zero injuries and incidents. The Company's goal is to add value to the communities in which its employees live and work, strengthening relationships and leveraging partnerships to amplify its impact. The Company strives to attract and retain a diverse and empowered workforce. Its priorities include fostering an inclusive and collaborative workplace, promoting opportunities for professional development, improving the well-being of its employees and other stakeholders, and contributing to the communities in which the Company operates. |

| | | | | |

| Workforce Talent and Diversity |

|

The Company is committed to attracting and retaining highly skilled and diverse employees and is proud that its workforce is made up of talented people from a variety of backgrounds. This commitment to diversity, equity, and inclusion as a driver of long-term success is one the Company strives to uphold throughout the organization, including through all stages of the human resources process, from recruitment and hiring to talent retention.

The Company encourages and supports employee resource and networking groups, its diversity, equity, and inclusion committee, and other employee groups, which offer educational, professional development, and community service opportunities. The Company also provides focused training, mentoring, and employee development for specialized positions, such as plant managers, engineers, accountants, and more.

Through strategies such as its employee experience survey, the employee recognition program, and a comprehensive commitment to its core values, the Company is dedicated to building a healthy, engaging workplace where employees can thrive and do their best work. The Company takes pride in maintaining an active dialogue with employees. The Company benchmarks overall employee engagement with an annual cross-organization survey targeting metrics such as safety, job satisfaction, and more, and uses the results of this survey to guide its efforts to improve the employee experience. |

| | | | | | | | |

Trinity Industries, Inc. | 17 | 2023 Proxy Statement |

PROPOSAL 01

ELECTION OF DIRECTORS

| | | | | | | | | | | | | | | | | |

The Board of Directors currently consists of nine members, eight of which are standing for election at the Annual Meeting. Following a recommendation from the Governance Committee: Leldon E. Echols, Chairman of the Board William P. Ainsworth Robert C. Biesterfeld Jr. John J. Diez Veena M. Lakkundi S. Todd Maclin E. Jean Savage Dunia A. Shive have been nominated by the Board for election at the Annual Meeting to hold office until the next Annual Meeting or the election of their respective successors. Each of them is a current member of the Board. Mr. Jordan is not standing for re-election at the Annual Meeting and his service as a director will end at the time of the Annual Meeting. The Board of Directors has determined that all of the director nominees other than Ms. Savage, the Company's CEO, are “independent directors.” Therefore, the Board has concluded that Ms. Savage is not independent. An incumbent director nominee who receives a greater number of votes “against” than “for” in an uncontested election is required to tender his or her resignation for consideration by the Governance Committee and the Board (with the affected director recusing himself or herself from the deliberations). The Board will be free to accept or reject the resignation and will make its decision known publicly within 90 days of certification of the vote results. If a director’s resignation is accepted by the Board, the Board may fill the resulting vacancy. The information provided below is biographical information about each of the nominees, as well as a description of the experience, qualifications, attributes, or skills that led the Board to nominate the individual for election as a director of the Company. | | | | |

| | THE BOARD BELIEVES that each of the director nominees possesses the qualifications described at www.trin.net under the heading “Investor Relations - Governance - Governance Documents - Corporate Governance and Directors Nominating Committee Charter.” That is, the Board believes each nominee possesses: (i)deep experience at the policy making level in business, government, or education; (ii)the ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company; (iii)a willingness to exercise independent judgment; and (iv)an impeccable reputation for honest and ethical conduct in both professional and personal activities. | |

| | | | |

The Board of Directors recommends that you vote "FOR" all of the Nominees. | | | |

| | | | | | | | |

Trinity Industries, Inc. | 18 | 2023 Proxy Statement |

| | | | | |

| Proposal 1 - Election of Directors | |

Nominees

| | | | | | | | | | | |

Leldon E. Echols Leldon E. Echols | | MR. ECHOLS serves as non-executive Chairman of the Board, Chair of the HR Committee, and a member of the Audit Committee, the Governance Committee, and the Finance Committee. He served as Executive Vice President and Chief Financial Officer of Centex Corporation, a residential construction company, from 2000 to 2006, when he retired. Prior to joining Centex, he spent 22 years with Arthur Andersen LLP and served as Managing Partner, Audit Practice for the North Texas, Colorado, and Oklahoma Region from 1997 to 2000. Mr. Echols is a member of the American Institute of Certified Public Accountants and the Texas Society of CPAs. Mr. Echols has been engaged in private investments since 2006. He is a member of the board of directors and Chair of the audit committee of EnLink Midstream Manager, LLC, a company that owns interests in EnLink Midstream, LLC, which is engaged in the gathering, transmission, treating, processing, and marketing of natural gas, natural gas liquids, and crude oil. He is also a member of the board of directors and the audit committee of HF Sinclair Corporation, an independent energy company. He served as a member of the board of directors of HollyFrontier Corporation, an independent petroleum refiner, from 2009 until the establishment of HF Sinclair Corporation as its parent company in 2022. From 2008 to 2014, Mr. Echols served on the boards of directors of Crosstex Energy, L.P. and Crosstex Energy, Inc., which are predecessors to certain of the EnLink entities. From 2014 to 2019, he was a member of the board of directors of EnLink Midstream GP, LLC, a company that owned interests in EnLink Midstream Partners, LP. |

| | |

Age: 67 Director Since: 2007 | |

| |

| In addition to having gained substantial managerial experience as an executive officer of Centex, Mr. Echols possesses important skills and experience gained through his service in public accounting. His service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations. |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 19 | 2023 Proxy Statement |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | |

William P. Ainsworth William P. Ainsworth | | MR. AINSWORTH is a member of the Finance Committee and the Governance Committee. From 2019 until his retirement in 2020, Mr. Ainsworth served as Group President of the Energy & Transportation segment for Caterpillar, Inc. (“Caterpillar”), a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. From 2017 until his appointment as Group President in 2019, Mr. Ainsworth was Senior Vice President and Strategic Advisor to Caterpillar’s executive committee and was responsible for Caterpillar’s Rail Division. From 1993 until 2019, he served as President and Chief Executive Officer of Progress Rail Services, an integrated and diversified supplier of railroad and transit products and services as well as railcar leasing. Progress Rail Services was acquired by Caterpillar in 2006, and Mr. Ainsworth was appointed a Vice President of Caterpillar at that time. |

| |

| Mr. Ainsworth has extensive experience in the railcar industry, providing the Board with key skills relevant to the Company’s operations. In addition, he has extensive experience in managing a significant industrial enterprise. |

| | |

Age: 66 Director Since: 2021 | |

| | | |

| | | | | | | | | | | |

Robert C. Biesterfeld Jr. Robert C. Biesterfeld Jr. | | MR. BIESTERFELD is a member of the Finance Committee and the HR Committee. From 2019 to 2022, he served as the President and Chief Executive Officer of C.H. Robinson Worldwide, Inc. (“C.H. Robinson”), a global logistics company. Prior to his most recent role at C.H. Robinson, he held the positions of Chief Operating Officer from 2018 to 2019, President of North American Surface Transportation from 2016 to 2018, Vice President of Truckload from 2014 to 2015, and Vice President of Temperature Controlled Transportation and Sourcing Services in 2013. He began his career with C.H. Robinson in 1999. Mr. Biesterfeld served as a member of the board of directors of C.H. Robinson from 2019 to 2022. He previously served as a trustee of the Winona State University Foundation. He served on the board of directors for the Transportation Intermediaries Association from 2015 to 2020. |

| |

| Mr. Biesterfeld has broad experience in managing and leading a significant publicly-traded company. His experience in transportation and logistics provides the Board with key skills relevant to the Company’s operations. His service on the board of another significant public company provides the Board with additional perspective on the Company's operations. |

| | |

Age: 47 Director Since: 2022 | |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 20 | 2023 Proxy Statement |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | |

John J. John J.Diez | | MR. DIEZ is Chair of the Governance Committee and a member of the Audit Committee and the HR Committee. Since 2021, Mr. Diez has served as Executive Vice President and Chief Financial Officer of Ryder System, Inc. ("Ryder"), a commercial fleet management and supply chain solutions company. From 2019 to 2021, Mr. Diez served as the President of Fleet Management Solutions for Ryder. From 2015 to 2019, he was President of Dedicated Transportation Solutions for Ryder. Mr. Diez joined Ryder in 2002 and held various other roles of increasing responsibility and seniority in finance and operations. Mr. Diez spent eight years in the audit practice of KPMG LLP prior to joining Ryder. He is a Certified Public Accountant in the state of Florida and a member of the American Institute of CPAs. |

| |

| Mr. Diez has extensive experience in managing a significant industrial enterprise. In addition, he possesses important skills and experience gained through his service in public accounting and as a chief financial officer. His experience in equipment leasing, logistics, and supply chain matters provides the Board with key skills relevant to the Company’s operations. |

| | |

Age: 52 Director Since: 2018 | |

| | | |

| | | | | | | | | | | |

Veena M. Lakkundi Veena M. Lakkundi | | MS. LAKKUNDI is a member of the Audit Committee and the Governance Committee. She has served as Senior Vice President, Strategy & Corporate Development, of Rockwell Automation, Inc., an industrial automation and digital transformation company (“Rockwell”), since 2021. She joined Rockwell following a 28-year career with 3M Company, a consumer goods, health care, and worker safety company (“3M”). From 2020 to 2021, Ms. Lakkundi served as 3M’s Senior Vice President, Strategy & Business Development. From 2019 to 2020, she served as Global Vice President and General Manager, Industries Adhesives and Tapes Division. From 2017 to 2019, she served as Vice President, Chief Ethics & Compliance Officer. During her time with 3M, she held various other roles of increasing responsibility and seniority in profit and loss leadership, business development in emerging markets, and research and development. She currently serves on the board of Claroty, which empowers organizations to secure cyber-physical systems across industrial (OT), healthcare (IoMT), and enterprise (IoT) environments: the Extended Internet of Things (XIoT). She also serves on the board of MINNDEPENDENT, a non-profit organization that strengthens the state’s independent schools by focusing on STEM K-12 programming. She previously served on the board of the 3M Foundation. |

| | |

Age: 54 Director Since: 2022 | |

| |

| Ms. Lakkundi has substantial experience in strategy and business development with significant industrial enterprises. In addition, her service as an ethics and compliance officer strengthens the Board's expertise in these areas. |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 21 | 2023 Proxy Statement |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | |

S. Todd S. ToddMaclin | | MR. MACLIN is Chair of the Finance Committee and a member of the HR Committee. Mr. Maclin retired in 2016 from a 37-year career at JPMorgan Chase & Co. and its predecessor banks, where he rose to Chairman, Chase Commercial and Consumer Banking in 2013, and served on the company's operating committee. Prior to that, he held a variety of leadership roles, including Regional Executive for Texas and the Southwest U.S., and Global Executive for Energy Investment Banking. Mr. Maclin serves as a director of The University of Texas Development Board, as a member of the advisory council for McCombs Graduate School of Business, on the executive committee of The University of Texas Chancellor's Council, on the board of visitors of UT Southwestern Health System, on the steering committee for the O'Donnell Brain Institute for UT Southwestern, and on the board of Southwestern Medical Foundation and a member of its investment committee. Mr. Maclin serves on the board of directors of Kimberly-Clark Corporation, a global manufacturer of branded tissue and personal care products. He also serves on the board of directors of RRH Corporation, the parent company of Hunt Consolidated, Inc., a company involved in oil and gas exploration and production, refining, liquified natural gas, power, real estate, investments, ranching, and infrastructure; is a board advisor for Cyber Defense Labs; and is an advisory director of Susser Banc Holdings Corporation. |

| | |

Age: 66 Director Since: 2020 | |

| |

| Mr. Maclin has substantial experience as a senior executive in the banking industry, which provides the Board with financial transaction expertise. His service on the boards of other significant companies provides the Board with additional perspective on the Company's operations. |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 22 | 2023 Proxy Statement |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | |

E. Jean E. JeanSavage | | MS. SAVAGE has served as Chief Executive Officer and President of the Company since 2020. From 2017 until her retirement in 2020, Ms. Savage served as Vice President of Caterpillar, where she had responsibility for the Surface Mining & Technology Division. From 2014 to 2017, she was Chief Technology Officer and Vice President of Caterpillar’s Innovation and Technology Development Division. From 2009 to 2014, she served as Senior Vice President and Chief Operating Officer of the Locomotive and Railcar Services business unit for Caterpillar subsidiary Progress Rail Services. Ms. Savage joined Progress Rail Services in 2002 as Vice President for Quality and Continuous Improvement. She also served as Vice President of Progress Rail’s Freight Car Repair, Parts and Quality Divisions. Prior to joining Progress Rail, she worked in a variety of manufacturing and engineering positions in her 14 years at Parker Hannifin Corporation, a leader in motion and control technologies and systems. Ms. Savage is a member of the board of trustees of the Manufacturers Alliance for Productivity and Innovation and a member of the board of directors of the National Association of Manufacturers. Ms. Savage also served for nine years in the U.S. Army Reserves as a military intelligence officer. Ms. Savage is a member of the board of directors of WestRock Company, a provider of differentiated paper and packaging solutions, where she serves on the audit committee. She is also a member of the board of directors of the Dallas Regional United Way. Ms. Savage was named 2022 Railway Woman of the Year by the League of Railway Women. |

| | |

Age: 59 Director Since: 2018 | |

| |

| During her tenure with the Company, Ms. Savage has provided excellent leadership, exhibiting sound judgment and business acumen. With her experience in leading and transforming significant industrial enterprises during her time at Caterpillar, including optimizing business operations and corporate infrastructure, Ms. Savage brings substantial expertise to the Company. In addition, her experience in the railcar industry, as well as her knowledge of the complex public company reporting requirements to consolidate an operating company and a financial company, provide the Board with key skills relevant to the Company’s operations. |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 23 | 2023 Proxy Statement |

| | | | | |

| Proposal 1 - Election of Directors | |

| | | | | | | | | | | |

Dunia A. Dunia A.Shive | | MS. SHIVE is Chair of the Audit Committee and a member of the Governance Committee and the Finance Committee. From 2008 to 2013, she served as Chief Executive Officer and President of Belo Corp., a media company that owned several television stations, until its acquisition by Gannett Co., Inc. After the acquisition, Ms. Shive served as Senior Vice President of TEGNA Inc., formerly Gannett Co., Inc., a publishing, broadcast and digital media company, until her retirement in 2017. She joined Belo Corp. in 1993 and served in a variety of leadership positions during her tenure, including Chief Financial Officer. Ms. Shive is a member of the board of directors of Kimberly-Clark Corporation, a global manufacturer of branded tissue and personal care products, where she serves as Chair of the audit committee. Ms. Shive is also a member of the board of directors of Main Street Capital Corporation, a principal investment firm that provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies, and DallasNews Corporation, a local news and information publishing company in Texas. From 2014 to 2018, Ms. Shive was a director of Dr Pepper Snapple Group, Inc. From 2009 to 2015, she served on the board of directors of the Associated Press, where she served as Chair of the audit committee from 2011 to 2015. From 2008 to 2013, she served on the board of directors of Belo Corp. |

| | |

Age: 62 Director Since: 2014 | |

| |

| Ms. Shive has broad experience in managing and leading a significant publicly-traded company. In addition, she possesses important skills and experience gained through her position as a chief financial officer and service in public accounting prior to joining Belo Corp. Her service on the boards of other significant companies provides the Board with additional perspective on the Company’s operations. |

| | | |

| | | | | | | | |

Trinity Industries, Inc. | 24 | 2023 Proxy Statement |

PROPOSAL 02

APPROVAL OF THE FIFTH AMENDED AND RESTATED TRINITY INDUSTRIES, INC. STOCK OPTION AND INCENTIVE PLAN

Upon recommendation of the HR Committee, the Board adopted, subject to stockholder approval, the Fifth Amended and Restated Trinity Industries, Inc. Stock Option and Incentive Plan (the “Fifth Amended Plan”) on March 7, 2023. The Fifth Amended Plan amends and restates the Fourth Amended and Restated Trinity Industries, Inc. 2004 Stock Option and Incentive Plan, which was approved by stockholders in 2017 (the “2017 Plan”), and includes, among other amendments as described below, an increase in the number of shares of Common Stock reserved and available for issuance pursuant to awards under the 2017 Plan from 20,150,000 to 22,050,000 shares (an increase of 1,900,000 shares).

The Board of Directors recommends that you vote FOR the approval of the Fifth Amended Plan and the material terms of the performance goals thereunder.

Rationale