trn-20200630TRINITY INDUSTRIES INC0000099780false2020Q212/3100000997802020-01-012020-06-30xbrli:shares00000997802020-07-17iso4217:USD0000099780trn:ManufacturingMember2020-04-012020-06-300000099780trn:ManufacturingMember2019-04-012019-06-300000099780trn:ManufacturingMember2020-01-012020-06-300000099780trn:ManufacturingMember2019-01-012019-06-300000099780trn:LeasingMember2020-04-012020-06-300000099780trn:LeasingMember2019-04-012019-06-300000099780trn:LeasingMember2020-01-012020-06-300000099780trn:LeasingMember2019-01-012019-06-3000000997802020-04-012020-06-3000000997802019-04-012019-06-3000000997802019-01-012019-06-300000099780trn:OtherMember2020-04-012020-06-300000099780trn:OtherMember2019-04-012019-06-300000099780trn:OtherMember2020-01-012020-06-300000099780trn:OtherMember2019-01-012019-06-30iso4217:USDxbrli:shares00000997802020-06-3000000997802019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMemberus-gaap:OperatingSegmentsMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMemberus-gaap:OperatingSegmentsMember2019-12-310000099780trn:PartiallyOwnedSubsidiariesMember2020-06-300000099780trn:PartiallyOwnedSubsidiariesMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMember2019-12-3100000997802018-12-3100000997802019-06-3000000997802020-03-310000099780us-gaap:CommonStockMember2019-12-310000099780us-gaap:AdditionalPaidInCapitalMember2019-12-310000099780us-gaap:RetainedEarningsMember2019-12-310000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310000099780us-gaap:TreasuryStockMember2019-12-310000099780us-gaap:ParentMember2019-12-310000099780us-gaap:NoncontrollingInterestMember2019-12-310000099780us-gaap:RetainedEarningsMember2020-01-012020-03-310000099780us-gaap:ParentMember2020-01-012020-03-310000099780us-gaap:NoncontrollingInterestMember2020-01-012020-03-3100000997802020-01-012020-03-310000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310000099780us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310000099780us-gaap:TreasuryStockMember2020-01-012020-03-310000099780us-gaap:CommonStockMember2020-03-310000099780us-gaap:AdditionalPaidInCapitalMember2020-03-310000099780us-gaap:RetainedEarningsMember2020-03-310000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310000099780us-gaap:TreasuryStockMember2020-03-310000099780us-gaap:ParentMember2020-03-310000099780us-gaap:NoncontrollingInterestMember2020-03-310000099780us-gaap:RetainedEarningsMember2020-04-012020-06-300000099780us-gaap:ParentMember2020-04-012020-06-300000099780us-gaap:NoncontrollingInterestMember2020-04-012020-06-300000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300000099780us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300000099780us-gaap:CommonStockMember2020-04-012020-06-300000099780us-gaap:TreasuryStockMember2020-04-012020-06-300000099780us-gaap:CommonStockMember2020-06-300000099780us-gaap:AdditionalPaidInCapitalMember2020-06-300000099780us-gaap:RetainedEarningsMember2020-06-300000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300000099780us-gaap:TreasuryStockMember2020-06-300000099780us-gaap:ParentMember2020-06-300000099780us-gaap:NoncontrollingInterestMember2020-06-3000000997802019-03-310000099780us-gaap:CommonStockMember2018-12-310000099780us-gaap:AdditionalPaidInCapitalMember2018-12-310000099780us-gaap:RetainedEarningsMember2018-12-310000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310000099780us-gaap:TreasuryStockMember2018-12-310000099780us-gaap:ParentMember2018-12-310000099780us-gaap:NoncontrollingInterestMember2018-12-310000099780us-gaap:RetainedEarningsMember2019-01-012019-03-310000099780us-gaap:ParentMember2019-01-012019-03-310000099780us-gaap:NoncontrollingInterestMember2019-01-012019-03-3100000997802019-01-012019-03-310000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-03-310000099780us-gaap:AdditionalPaidInCapitalMember2019-01-012019-03-310000099780us-gaap:TreasuryStockMember2019-01-012019-03-310000099780us-gaap:CommonStockMember2019-03-310000099780us-gaap:AdditionalPaidInCapitalMember2019-03-310000099780us-gaap:RetainedEarningsMember2019-03-310000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-03-310000099780us-gaap:TreasuryStockMember2019-03-310000099780us-gaap:ParentMember2019-03-310000099780us-gaap:NoncontrollingInterestMember2019-03-310000099780us-gaap:RetainedEarningsMember2019-04-012019-06-300000099780us-gaap:ParentMember2019-04-012019-06-300000099780us-gaap:NoncontrollingInterestMember2019-04-012019-06-300000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-04-012019-06-300000099780us-gaap:AdditionalPaidInCapitalMember2019-04-012019-06-300000099780us-gaap:TreasuryStockMember2019-04-012019-06-300000099780us-gaap:CommonStockMember2019-04-012019-06-300000099780us-gaap:CommonStockMember2019-06-300000099780us-gaap:AdditionalPaidInCapitalMember2019-06-300000099780us-gaap:RetainedEarningsMember2019-06-300000099780us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-06-300000099780us-gaap:TreasuryStockMember2019-06-300000099780us-gaap:ParentMember2019-06-300000099780us-gaap:NoncontrollingInterestMember2019-06-300000099780trn:RailcarproductsDomaintrn:ExternalCustomersMembertrn:RailProductsGroupMember2020-06-300000099780trn:LeasingMembertrn:RailcarproductsDomaintrn:RailProductsGroupMember2020-06-300000099780trn:RailcarproductsDomaintrn:RailProductsGroupMember2020-06-30xbrli:pure0000099780trn:ComponentsandmaintenanceservicesDomaintrn:RailProductsGroupMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780srt:MinimumMember2020-06-300000099780srt:MaximumMember2020-06-300000099780trn:ConsolidatedSubsidiariesExcludingLeasingMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMembersrt:MinimumMember2020-06-300000099780srt:MaximumMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780srt:MaximumMembertrn:RailcarLeasingAndManagementServicesGroupMember2018-12-310000099780us-gaap:ServiceLifeMember2020-04-012020-06-300000099780us-gaap:ServiceLifeMember2020-01-012020-06-300000099780srt:MinimumMember2020-01-012020-06-300000099780srt:MaximumMember2020-01-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesDomain2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesDomain2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesDomainus-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2020-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMember2020-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestRateSwapMemberus-gaap:AccumulatedNetGainLossFromCashFlowHedgesAttributableToNoncontrollingInterestMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2006SecuredRailcarEquipmentNotesMember2020-04-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2006SecuredRailcarEquipmentNotesMember2019-04-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2006SecuredRailcarEquipmentNotesMember2020-01-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2006SecuredRailcarEquipmentNotesMember2019-01-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2006SecuredRailcarEquipmentNotesMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesMember2020-04-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesMember2019-04-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesMember2020-01-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesMember2019-01-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpired2018SecuredRailcarEquipmentNotesMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2020-04-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2019-04-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2020-01-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2019-01-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMembertrn:InterestRateSwapExpiredTRIPHoldingsWarehouseLoanMember2020-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-04-012020-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2019-04-012019-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-01-012020-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2019-01-012019-06-300000099780trn:InterestRateSwapExpiredTRIPMasterFundingSecuredRailcarEquipmentNotesMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-04-012020-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2019-04-012019-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-01-012020-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2019-01-012019-06-300000099780us-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2020-04-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2019-04-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2020-01-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2019-01-012019-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:InterestExpenseMemberus-gaap:InterestRateSwapMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestExpenseMember2020-04-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestExpenseMember2020-01-012020-06-300000099780us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForeignExchangeContractMemberus-gaap:InterestExpenseMember2020-06-300000099780us-gaap:FairValueInputsLevel1Member2020-01-012020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2019-12-310000099780us-gaap:FairValueInputsLevel2Member2020-01-012020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherAssetsMember2019-12-310000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2019-12-310000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:AccruedLiabilitiesMember2020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InterestRateSwapMemberus-gaap:AccruedLiabilitiesMember2019-12-310000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMember2020-06-300000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AccruedLiabilitiesMember2019-12-310000099780us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2020-06-30trn:segment0000099780trn:RailcarLeasingAndManagementServicesGroupMember2020-04-012020-06-300000099780trn:RailProductsGroupMember2020-04-012020-06-300000099780us-gaap:AllOtherSegmentsMember2020-04-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:IntersegmentEliminationMember2020-04-012020-06-300000099780us-gaap:IntersegmentEliminationMembertrn:RailProductsGroupMember2020-04-012020-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2020-04-012020-06-300000099780trn:ConsolidatedSubsidiariesLeasingMemberus-gaap:IntersegmentEliminationMember2020-04-012020-06-300000099780us-gaap:IntersegmentEliminationMembertrn:ConsolidatedSubsidiariesExcludingLeasingMember2020-04-012020-06-300000099780us-gaap:IntersegmentEliminationMember2020-04-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780us-gaap:OperatingSegmentsMembertrn:RailProductsGroupMember2020-04-012020-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780us-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMember2019-04-012019-06-300000099780trn:RailProductsGroupMember2019-04-012019-06-300000099780us-gaap:AllOtherSegmentsMember2019-04-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:IntersegmentEliminationMember2019-04-012019-06-300000099780us-gaap:IntersegmentEliminationMembertrn:RailProductsGroupMember2019-04-012019-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2019-04-012019-06-300000099780trn:ConsolidatedSubsidiariesLeasingMemberus-gaap:IntersegmentEliminationMember2019-04-012019-06-300000099780us-gaap:IntersegmentEliminationMembertrn:ConsolidatedSubsidiariesExcludingLeasingMember2019-04-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780us-gaap:OperatingSegmentsMembertrn:RailProductsGroupMember2019-04-012019-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780us-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMember2020-01-012020-06-300000099780trn:RailProductsGroupMember2020-01-012020-06-300000099780us-gaap:AllOtherSegmentsMember2020-01-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:IntersegmentEliminationMember2020-01-012020-06-300000099780us-gaap:IntersegmentEliminationMembertrn:RailProductsGroupMember2020-01-012020-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2020-01-012020-06-300000099780trn:ConsolidatedSubsidiariesLeasingMemberus-gaap:IntersegmentEliminationMember2020-01-012020-06-300000099780us-gaap:IntersegmentEliminationMembertrn:ConsolidatedSubsidiariesExcludingLeasingMember2020-01-012020-06-300000099780us-gaap:IntersegmentEliminationMember2020-01-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780us-gaap:OperatingSegmentsMembertrn:RailProductsGroupMember2020-01-012020-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780us-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMember2019-01-012019-06-300000099780trn:RailProductsGroupMember2019-01-012019-06-300000099780us-gaap:AllOtherSegmentsMember2019-01-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:IntersegmentEliminationMember2019-01-012019-06-300000099780us-gaap:IntersegmentEliminationMembertrn:RailProductsGroupMember2019-01-012019-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:IntersegmentEliminationMember2019-01-012019-06-300000099780trn:ConsolidatedSubsidiariesLeasingMemberus-gaap:IntersegmentEliminationMember2019-01-012019-06-300000099780us-gaap:IntersegmentEliminationMembertrn:ConsolidatedSubsidiariesExcludingLeasingMember2019-01-012019-06-300000099780us-gaap:IntersegmentEliminationMember2019-01-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300000099780us-gaap:OperatingSegmentsMembertrn:RailProductsGroupMember2019-01-012019-06-300000099780us-gaap:AllOtherSegmentsMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300000099780us-gaap:OperatingSegmentsMember2019-01-012019-06-300000099780us-gaap:OperatingSegmentsMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780us-gaap:OperatingSegmentsMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780us-gaap:OperatingSegmentsMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780us-gaap:OperatingSegmentsMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300000099780us-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780us-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780us-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780us-gaap:CorporateNonSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-30trn:subsidiary0000099780trn:PartiallyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-01-012020-06-30trn:board_member0000099780trn:PartiallyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMember2020-06-300000099780trn:PartiallyOwnedSubsidiariesMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-06-300000099780trn:ConsolidatedSubsidiariesLeasingMemberus-gaap:IntersegmentEliminationMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-12-310000099780trn:ConsolidatedSubsidiariesLeasingMemberus-gaap:IntersegmentEliminationMember2019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMember2019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:LeasingAndManagementMember2020-04-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:LeasingAndManagementMember2019-04-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:LeasingAndManagementMember2020-01-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:LeasingAndManagementMember2019-01-012019-06-300000099780trn:RailcarOwnedOneYearOrLessMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780trn:RailcarOwnedOneYearOrLessMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780trn:RailcarOwnedOneYearOrLessMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780trn:RailcarOwnedOneYearOrLessMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300000099780trn:RailcarOwnedGreaterThanOneYearMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300000099780trn:RailcarOwnedGreaterThanOneYearMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-04-012019-06-300000099780trn:RailcarOwnedGreaterThanOneYearMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-01-012020-06-300000099780trn:RailcarOwnedGreaterThanOneYearMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-01-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:SalesofLeasedRailcarsDomain2020-04-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:SalesofLeasedRailcarsDomain2019-04-012019-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:SalesofLeasedRailcarsDomain2020-01-012020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMembertrn:SalesofLeasedRailcarsDomain2019-01-012019-06-300000099780us-gaap:RailroadTransportationEquipmentMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780trn:TripMasterFundingSecuredRailcarEquipmentNotesMembertrn:TripHoldingsMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMember2020-06-300000099780trn:TrinityRailLeasing2012Membertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMembertrn:TRL2012SecuredRailcarEquipmentNotesRIV2013Member2020-06-300000099780trn:OtherThirdPartiesMember2020-01-012020-06-300000099780trn:OtherThirdPartiesMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780us-gaap:PropertyLeaseGuaranteeMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780us-gaap:BuildingMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780us-gaap:LandMembertrn:ManufacturingandCorporateMember2020-06-300000099780us-gaap:LandMembertrn:ManufacturingandCorporateMember2019-12-310000099780trn:ManufacturingandCorporateMemberus-gaap:BuildingAndBuildingImprovementsMember2020-06-300000099780trn:ManufacturingandCorporateMemberus-gaap:BuildingAndBuildingImprovementsMember2019-12-310000099780us-gaap:MachineryAndEquipmentMembertrn:ManufacturingandCorporateMember2020-06-300000099780us-gaap:MachineryAndEquipmentMembertrn:ManufacturingandCorporateMember2019-12-310000099780us-gaap:ConstructionInProgressMembertrn:ManufacturingandCorporateMember2020-06-300000099780us-gaap:ConstructionInProgressMembertrn:ManufacturingandCorporateMember2019-12-310000099780trn:ManufacturingandCorporateMember2020-06-300000099780trn:ManufacturingandCorporateMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:MachineryAndEquipmentMemberus-gaap:OperatingSegmentsMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:MachineryAndEquipmentMemberus-gaap:OperatingSegmentsMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMemberus-gaap:EquipmentLeasedToOtherPartyMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMemberus-gaap:EquipmentLeasedToOtherPartyMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:OperatingSegmentsMember2019-12-310000099780us-gaap:EquipmentLeasedToOtherPartyMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMemberus-gaap:OperatingSegmentsMember2020-06-300000099780us-gaap:EquipmentLeasedToOtherPartyMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMemberus-gaap:OperatingSegmentsMember2019-12-310000099780us-gaap:IntersegmentEliminationMember2020-06-300000099780us-gaap:IntersegmentEliminationMember2019-12-310000099780us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:CorporateMember2020-06-300000099780us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:CorporateMember2019-12-310000099780us-gaap:SeniorNotesMemberus-gaap:CorporateMember2020-06-300000099780us-gaap:SeniorNotesMemberus-gaap:CorporateMember2019-12-310000099780us-gaap:CorporateMember2020-06-300000099780us-gaap:CorporateMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:A2006SecuredRailcarEquipmentNotesMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:A2006SecuredRailcarEquipmentNotesMembertrn:RailcarLeasingAndManagementServicesGroupMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2009SecuredRailcarEquipmentNotesMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2009SecuredRailcarEquipmentNotesMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2010SecuredRailcarEquipmentNotesMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2010SecuredRailcarEquipmentNotesMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:A2017SecuredRailcarEquipmentNotesMemberDomaintrn:RailcarLeasingAndManagementServicesGroupMembertrn:PromissoryNotesMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:A2017SecuredRailcarEquipmentNotesMemberDomaintrn:RailcarLeasingAndManagementServicesGroupMembertrn:PromissoryNotesMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2018SecuredRailcarEquipmentNotesDomain2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2018SecuredRailcarEquipmentNotesDomain2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:TRIHC2018SecuredRailcarEquipmentNotesMember2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:TRIHC2018SecuredRailcarEquipmentNotesMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2019SecuredRailcarEquipmentNotesDomainDomain2020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:A2019SecuredRailcarEquipmentNotesDomainDomain2019-12-310000099780us-gaap:LineOfCreditMembertrn:TilcWarehouseFacilityMemberus-gaap:RevolvingCreditFacilityMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:TILCMember2020-06-300000099780us-gaap:LineOfCreditMembertrn:TilcWarehouseFacilityMemberus-gaap:RevolvingCreditFacilityMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:TILCMember2019-12-310000099780trn:WhollyOwnedSubsidiariesMembertrn:RailcarLeasingAndManagementServicesGroupMember2019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMembertrn:TRL2012SecuredRailcarEquipmentNotesRIV2013Member2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMembertrn:TRL2012SecuredRailcarEquipmentNotesRIV2013Member2019-12-310000099780trn:TripMasterFundingSecuredRailcarEquipmentNotesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMember2020-06-300000099780trn:TripMasterFundingSecuredRailcarEquipmentNotesMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMember2019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:PartiallyOwnedSubsidiariesMember2019-12-310000099780trn:RailcarLeasingAndManagementServicesGroupMember2019-12-310000099780trn:A4.55SeniorNotesDueOctober2024Memberus-gaap:SeniorNotesMemberus-gaap:CorporateMember2020-06-300000099780us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:CorporateMember2020-01-012020-06-300000099780us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMemberus-gaap:CorporateMember2020-06-300000099780us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:CorporateMember2020-06-300000099780srt:MaximumMemberus-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:CorporateMember2020-06-300000099780us-gaap:LineOfCreditMembertrn:TilcWarehouseFacilityMemberus-gaap:RevolvingCreditFacilityMembertrn:RailcarLeasingAndManagementServicesGroupMembertrn:TILCMember2020-01-012020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:A2006SecuredRailcarEquipmentNotesMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-01-012020-06-300000099780trn:WhollyOwnedSubsidiariesMembertrn:A2017SecuredRailcarEquipmentNotesMemberDomaintrn:RailcarLeasingAndManagementServicesGroupMembertrn:PromissoryNotesMemberus-gaap:SubsequentEventMember2020-07-172020-07-170000099780trn:WhollyOwnedSubsidiariesMembertrn:A2017SecuredRailcarEquipmentNotesMemberDomaintrn:RailcarLeasingAndManagementServicesGroupMembertrn:PromissoryNotesMemberus-gaap:SubsequentEventMember2020-07-170000099780trn:RailcarLeasingAndManagementServicesGroupMembertrn:A2009SecuredRailcarEquipmentNotesMemberus-gaap:SecuredDebtMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMembertrn:A2010SecuredRailcarEquipmentNotesMember2020-06-300000099780trn:A2017SecuredRailcarEquipmentNotesMemberDomaintrn:RailcarLeasingAndManagementServicesGroupMembertrn:PromissoryNotesMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMembertrn:A2018SecuredRailcarEquipmentNotesDomain2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMembertrn:TRIHC2018SecuredRailcarEquipmentNotesMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMembertrn:A2019SecuredRailcarEquipmentNotesDomainDomain2020-06-300000099780us-gaap:LineOfCreditMembertrn:TilcWarehouseFacilityMemberus-gaap:RevolvingCreditFacilityMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMembertrn:TilcWarehouseFacilityTerminationPaymentsMembertrn:RailcarLeasingAndManagementServicesGroupMember2020-06-300000099780trn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMembertrn:TRL2012SecuredRailcarEquipmentNotesRIV2013Member2020-06-300000099780trn:TripMasterFundingSecuredRailcarEquipmentNotesMembertrn:RailcarLeasingAndManagementServicesGroupMemberus-gaap:SecuredDebtMember2020-06-3000000997802017-01-012017-06-300000099780us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2019-12-310000099780us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2019-12-310000099780us-gaap:EmployeeSeveranceMember2020-06-300000099780us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310000099780us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310000099780us-gaap:AccumulatedTranslationAdjustmentMember2020-01-012020-06-300000099780us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-06-300000099780us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-01-012020-06-300000099780us-gaap:AccumulatedGainLossNetCashFlowHedgeNoncontrollingInterestMember2020-01-012020-06-300000099780us-gaap:NoncontrollingInterestMember2020-01-012020-06-300000099780us-gaap:AccumulatedTranslationAdjustmentMember2020-06-300000099780us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-06-300000099780us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2020-06-300000099780us-gaap:TreasuryStockMember2019-07-012019-09-3000000997802019-09-300000099780us-gaap:TreasuryStockMember2019-10-012019-12-310000099780us-gaap:AdditionalPaidInCapitalMember2019-01-012019-06-300000099780us-gaap:EmployeeStockOptionMember2020-01-012020-06-300000099780us-gaap:RestrictedStockUnitsRSUMembersrt:MinimumMember2020-01-012020-06-300000099780srt:MaximumMemberus-gaap:RestrictedStockUnitsRSUMember2020-01-012020-06-300000099780us-gaap:PerformanceSharesMember2020-01-012020-06-300000099780trn:RestrictedShareAwardsMember2020-01-012020-06-300000099780us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-06-300000099780us-gaap:RestrictedStockMember2020-04-012020-06-300000099780us-gaap:EmployeeStockOptionMember2020-04-012020-06-300000099780us-gaap:RestrictedStockMember2020-01-012020-06-300000099780us-gaap:RestrictedStockMember2019-04-012019-06-300000099780us-gaap:EmployeeStockOptionMember2019-01-012019-06-300000099780us-gaap:RestrictedStockMember2019-01-012019-06-300000099780trn:HighwayProductsLitigationMembertrn:JoshuaHarmanFalseClaimsActMember2015-06-092015-06-090000099780trn:StateCountyandMunicipalActionsMembertrn:HighwayProductsLitigationMember2020-06-300000099780us-gaap:AccruedLiabilitiesMember2020-06-300000099780trn:EnvironmentalAndWorkplaceMattersMember2020-06-30

UNITED STATES SECURITIES AND EXCHANGE CO.

Washington, D.C. 20549

Form 10-Q

| | | | | |

| (Mark One) | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE QUARTERLY PERIOD ENDED JUNE 30, 2020

| | | | | |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________ .

Commission File Number 1-6903

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | | | 75-0225040 |

| (State or Other Jurisdiction of Incorporation or Organization) | | | (I.R.S. Employer Identification No.) |

| 2525 N. Stemmons Freeway | | | |

| Dallas, | Texas | | 75207-2401 |

(Address of principal executive offices) | | | (Zip Code) |

(214) 631-4420

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | TRN | New York Stock Exchange |

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer þ Accelerated filer ¨ Non-accelerated filer ¨

Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

At July 17, 2020, the number of shares of common stock, $0.01 par value, outstanding was 118,661,510.

TRINITY INDUSTRIES, INC.

FORM 10-Q

TABLE OF CONTENTS

PART I

Item 1. Financial Statements

Trinity Industries, Inc. and Subsidiaries

Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| | (in millions, except per share amounts) | | | | | | |

| Revenues: | | | | | | | |

| Manufacturing | $ | 316.6 | | | $ | 459.1 | | | $ | 695.7 | | | $ | 863.7 | |

| Leasing | 192.6 | | | 276.9 | | | 428.7 | | | 477.1 | |

| 509.2 | | | 736.0 | | | 1,124.4 | | | 1,340.8 | |

| Operating costs: | | | | | | | |

| Cost of revenues: | | | | | | | |

| Manufacturing | 293.7 | | | 399.6 | | | 637.1 | | | 751.2 | |

| Leasing | 102.9 | | | 178.9 | | | 241.5 | | | 290.7 | |

| 396.6 | | | 578.5 | | | 878.6 | | | 1,041.9 | |

| Selling, engineering, and administrative expenses: | | | | | | | |

| Manufacturing | 19.6 | | | 26.5 | | | 41.5 | | | 49.7 | |

| Leasing | 13.0 | | | 12.7 | | | 27.3 | | | 25.5 | |

| Other | 24.2 | | | 30.6 | | | 52.3 | | | 54.2 | |

| 56.8 | | | 69.8 | | | 121.1 | | | 129.4 | |

| Gains on dispositions of property: | | | | | | | |

Net gains on railcar lease fleet sales owned more than one year at the time of sale | 5.7 | | | 18.7 | | | 14.4 | | | 26.6 | |

| Other | 0.9 | | | 0.6 | | | 1.8 | | | 2.7 | |

| 6.6 | | | 19.3 | | | 16.2 | | | 29.3 | |

| Impairment of long-lived assets | 369.4 | | | — | | | 369.4 | | | — | |

| Restructuring activities, net | 0.3 | | | — | | | 5.8 | | | — | |

| Total operating profit (loss) | (307.3) | | | 107.0 | | | (234.3) | | | 198.8 | |

| Other (income) expense: | | | | | | | |

| Interest income | — | | | (1.6) | | | (2.4) | | | (2.9) | |

| Interest expense | 53.0 | | | 57.0 | | | 114.3 | | | 109.7 | |

| Other, net | (0.7) | | | (0.1) | | | (1.5) | | | 0.2 | |

| 52.3 | | | 55.3 | | | 110.4 | | | 107.0 | |

| Income (loss) from continuing operations before income taxes | (359.6) | | | 51.7 | | | (344.7) | | | 91.8 | |

| Provision (benefit) for income taxes: | | | | | | | |

| Current | (79.7) | | | 1.0 | | | (452.5) | | | 0.2 | |

| Deferred | 7.9 | | | 13.1 | | | 233.1 | | | 22.8 | |

| (71.8) | | | 14.1 | | | (219.4) | | | 23.0 | |

| Income (loss) from continuing operations | (287.8) | | | 37.6 | | | (125.3) | | | 68.8 | |

Loss from discontinued operations, net of benefit for income taxes of $—, $0.3, $0.1, and $0.5 | — | | | (0.8) | | | (0.2) | | | (1.9) | |

| Net income (loss) | (287.8) | | | 36.8 | | | (125.5) | | | 66.9 | |

Net income (loss) attributable to noncontrolling interest | (80.9) | | | 0.4 | | | (80.3) | | | (0.1) | |

| Net income (loss) attributable to Trinity Industries, Inc. | $ | (206.9) | | | $ | 36.4 | | | $ | (45.2) | | | $ | 67.0 | |

| | | | | | | |

Basic earnings per common share: | | | | | | | |

| Income (loss) from continuing operations | $ | (1.76) | | | $ | 0.29 | | | $ | (0.38) | | | $ | 0.53 | |

| Income (loss) from discontinued operations | — | | | (0.01) | | | — | | | (0.02) | |

| Basic net income (loss) attributable to Trinity Industries, Inc. | $ | (1.76) | | | $ | 0.28 | | | $ | (0.38) | | | $ | 0.51 | |

| Diluted earnings per common share: | | | | | | | |

| Income (loss) from continuing operations | $ | (1.76) | | | $ | 0.29 | | | $ | (0.38) | | | $ | 0.52 | |

| Income (loss) from discontinued operations | — | | | (0.01) | | | — | | | (0.01) | |

| Diluted net income (loss) attributable to Trinity Industries, Inc. | $ | (1.76) | | | $ | 0.28 | | | $ | (0.38) | | | $ | 0.51 | |

| Weighted average number of shares outstanding: | | | | | | | |

| Basic | 117.3 | | | 127.6 | | | 117.6 | | | 129.0 | |

| Diluted | 117.3 | | | 129.2 | | | 117.6 | | | 130.7 | |

See accompanying notes to Consolidated Financial Statements.

Trinity Industries, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income (Loss)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| | 2020 | | 2019 | | 2020 | | 2019 |

| | (in millions) | | | | | | |

| Net income (loss) | $ | (287.8) | | | $ | 36.8 | | | $ | (125.5) | | | $ | 66.9 | |

| Other comprehensive income (loss): | | | | | | | |

| Derivative financial instruments: | | | | | | | |

Unrealized losses arising during the period, net of tax benefit of $0.5, $2.4, $8.2, and $4.1 | (1.7) | | | (8.0) | | | (27.3) | | | (13.5) | |

Reclassification adjustments for losses included in net income, net of tax benefit of $1.2, $—, $1.7, and $0.4 | 4.9 | | | 1.0 | | | 5.9 | | | 1.9 | |

| | | | | | | |

Defined benefit plans: | | | | | | | |

Amortization of prior service cost, net of tax benefit of $0.1, $—, $0.2, and $— | 0.2 | | | — | | | 0.4 | | | — | |

Amortization of net actuarial losses, net of tax benefit of $0.3, $0.3, $0.6, and $0.6 | 1.2 | | | 0.8 | | | 2.4 | | | 1.6 | |

| 4.6 | | | (6.2) | | | (18.6) | | | (10.0) | |

| Comprehensive income (loss) | (283.2) | | | 30.6 | | | (144.1) | | | 56.9 | |

Less: comprehensive income (loss) attributable to noncontrolling interest | (80.6) | | | 0.7 | | | (79.7) | | | 0.5 | |

Comprehensive income (loss) attributable to Trinity Industries, Inc. | $ | (202.6) | | | $ | 29.9 | | | $ | (64.4) | | | $ | 56.4 | |

See accompanying notes to Consolidated Financial Statements.

Trinity Industries, Inc. and Subsidiaries

Consolidated Balance Sheets

| | | | | | | | | | | |

| June 30, 2020 | | December 31, 2019 |

| (unaudited) | | |

| | (in millions) | | |

| ASSETS | | | |

| Cash and cash equivalents | $ | 157.0 | | | $ | 166.2 | |

| | | |

| Receivables, net of allowance | 226.9 | | | 260.1 | |

| Income tax receivable | 463.0 | | | 14.7 | |

| Inventories: | | | |

| Raw materials and supplies | 229.8 | | | 263.4 | |

| Work in process | 89.3 | | | 108.8 | |

| Finished goods | 102.4 | | | 61.2 | |

| 421.5 | | | 433.4 | |

Restricted cash, including partially-owned subsidiaries of $27.7 and $33.0 | 136.9 | | | 111.4 | |

Property, plant, and equipment, at cost, including partially-owned subsidiaries of $1,923.8 and $2,065.3 | 8,939.5 | | | 9,272.5 | |

Less accumulated depreciation, including partially-owned subsidiaries of $499.7 and $527.7 | (2,155.1) | | | (2,161.9) | |

| 6,784.4 | | | 7,110.6 | |

| Goodwill | 208.8 | | | 208.8 | |

| Other assets | 266.9 | | | 396.2 | |

| Total assets | $ | 8,665.4 | | | $ | 8,701.4 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Accounts payable | $ | 188.2 | | | $ | 203.9 | |

| Accrued liabilities | 325.6 | | | 342.1 | |

| Debt: | | | |

| Recourse | 528.0 | | | 522.8 | |

| Non-recourse: | | | |

| Wholly-owned subsidiaries | 3,045.7 | | | 3,080.7 | |

| Partially-owned subsidiaries | 1,251.7 | | | 1,278.4 | |

| 4,825.4 | | | 4,881.9 | |

| Deferred income taxes | 1,026.4 | | | 798.3 | |

| Other liabilities | 139.4 | | | 96.3 | |

| Total liabilities | 6,505.0 | | | 6,322.5 | |

| | | |

Preferred stock – 1.5 shares authorized and unissued | — | | | — | |

Common stock – 400.0 shares authorized | 1.2 | | | 1.2 | |

| Capital in excess of par value | — | | | — | |

| Retained earnings | 2,063.3 | | | 2,182.9 | |

| Accumulated other comprehensive loss | (172.3) | | | (153.1) | |

| Treasury stock | (0.9) | | | (0.9) | |

| 1,891.3 | | | 2,030.1 | |

| Noncontrolling interest | 269.1 | | | 348.8 | |

| Total stockholders' equity | 2,160.4 | | | 2,378.9 | |

| Total liabilities and stockholders' equity | $ | 8,665.4 | | | $ | 8,701.4 | |

See accompanying notes to Consolidated Financial Statements.

Trinity Industries, Inc. and Subsidiaries

Consolidated Statements of Cash Flows

(unaudited)

| | | | | | | | | | | |

| Six Months Ended

June 30, | | |

| | 2020 | | 2019 |

| | (in millions) | | |

| Operating activities: | | | |

| Net income (loss) | $ | (125.5) | | | $ | 66.9 | |

| Loss from discontinued operations, net of income taxes | 0.2 | | | 1.9 | |

Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 134.6 | | | 138.1 | |

| Stock-based compensation expense | 14.9 | | | 13.0 | |

| | | |

| Provision for deferred income taxes | 233.1 | | | 22.8 | |

Net gains on railcar lease fleet sales owned more than one year at the time of sale | (14.4) | | | (26.6) | |

| Gains on dispositions of property and other assets | (5.3) | | | (2.7) | |

| Impairment of long-lived assets | 369.4 | | | — | |

| Restructuring activities | 5.2 | | | — | |

| Non-cash interest expense | 4.5 | | | 7.2 | |

| Loss on early extinguishment of debt | 5.0 | | | — | |

| Other | (5.4) | | | (0.8) | |

| Changes in operating assets and liabilities: | | | |

| (Increase) decrease in receivables | 33.1 | | | (75.1) | |

| (Increase) decrease in income tax receivable | (448.3) | | | 19.4 | |

| (Increase) decrease in inventories | 11.9 | | | (75.8) | |

| (Increase) decrease in other assets | 169.7 | | | (33.0) | |

| Increase (decrease) in accounts payable | (15.7) | | | 5.6 | |

| Increase (decrease) in accrued liabilities | (37.7) | | | (51.7) | |

| Increase (decrease) in other liabilities | (1.5) | | | (5.2) | |

| Net cash provided by operating activities – continuing operations | 327.8 | | | 4.0 | |

| Net cash used in operating activities – discontinued operations | (0.2) | | | (1.1) | |

| Net cash provided by operating activities | 327.6 | | | 2.9 | |

| | | |

| Investing activities: | | | |

| | | |

| Proceeds from dispositions of property and other assets | 14.2 | | | 14.3 | |

Proceeds from railcar lease fleet sales owned more than one year at the time of sale | 132.2 | | | 99.9 | |

| | | |

Capital expenditures – leasing, net of sold lease fleet railcars owned one year or less with a net cost of $54.0 and $91.8 | (259.5) | | | (690.9) | |

| Capital expenditures – manufacturing and other | (41.5) | | | (34.0) | |

| | | |

| | | |

| Other | — | | | (1.2) | |

| | | |

| | | |

| Net cash used in investing activities | (154.6) | | | (611.9) | |

| | | |

| Financing activities: | | | |

| | | |

| | | |

| Payments to retire debt | (618.3) | | | (1,044.9) | |

| Proceeds from issuance of debt | 552.4 | | | 1,626.9 | |

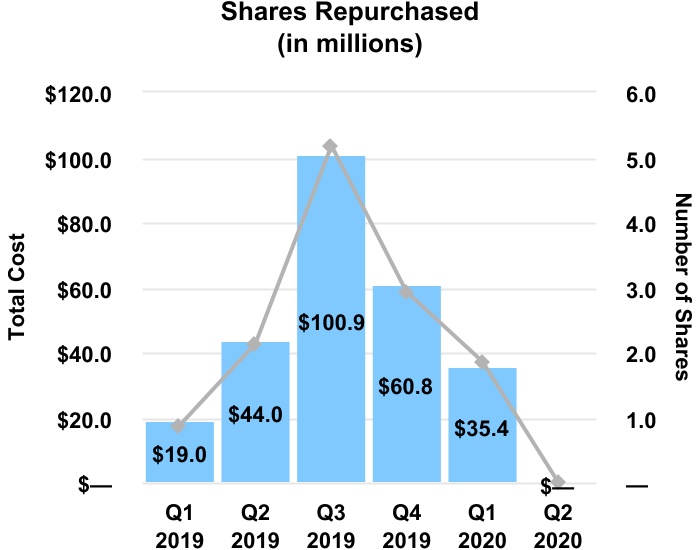

| Shares repurchased | (35.4) | | | (59.0) | |

| Dividends paid to common shareholders | (46.4) | | | (39.5) | |

| Purchase of shares to satisfy employee tax on vested stock | (9.0) | | | (7.9) | |

| | | |

| | | |

| | | |

| Distributions to noncontrolling interest | — | | | (0.9) | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (156.7) | | | 474.7 | |

| Net increase (decrease) in cash, cash equivalents, and restricted cash | 16.3 | | | (134.3) | |

| Cash, cash equivalents, and restricted cash at beginning of period | 277.6 | | | 350.8 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 293.9 | | | $ | 216.5 | |

See accompanying notes to Consolidated Financial Statements.

Trinity Industries, Inc. and Subsidiaries

Consolidated Statements of Stockholders' Equity

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock | | | | Capital in

Excess of

Par Value | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | Treasury

Stock | | | | Trinity

Stockholders’

Equity | | Noncontrolling

Interest | | Total

Stockholders’

Equity |

| | Shares | | $0.01 Par Value | | | | | | | | Shares | | Amount | | | | | | |

| | (in millions, except par value and per common share amounts) | | | | | | | | | | | | | | | | | | |

Balances at

December 31, 2019 | 119.7 | | | $ | 1.2 | | | $ | — | | | $ | 2,182.9 | | | $ | (153.1) | | | (0.1) | | | $ | (0.9) | | | $ | 2,030.1 | | | $ | 348.8 | | | $ | 2,378.9 | |

| Net income | — | | | — | | | — | | | 161.7 | | | — | | | — | | | — | | | 161.7 | | | 0.6 | | | 162.3 | |

Other comprehensive (loss) income | — | | | — | | | — | | | — | | | (23.5) | | | — | | | — | | | (23.5) | | | 0.3 | | | (23.2) | |

Cash dividends declared on common stock (1) | — | | | — | | | — | | | (24.6) | | | — | | | — | | | — | | | (24.6) | | | — | | | (24.6) | |

Stock-based compensation expense | — | | | — | | | 7.3 | | | — | | | — | | | — | | | — | | | 7.3 | | | — | | | 7.3 | |

| Shares repurchased | — | | | — | | | — | | | — | | | — | | | (1.9) | | | (35.4) | | | (35.4) | | | — | | | (35.4) | |

Other restricted share activity | — | | | — | | | 0.7 | | | — | | | — | | | — | | | (0.9) | | | (0.2) | | | — | | | (0.2) | |

| | | | | | | | | | | | | | | | | | | |

Cumulative effect of adopting new accounting standard | — | | | — | | | — | | | 0.5 | | | — | | | — | | | — | | | 0.5 | | | — | | | 0.5 | |

Other | — | | | — | | | — | | | 0.5 | | | — | | | — | | | — | | | 0.5 | | | — | | | 0.5 | |

Balances at

March 31, 2020 | 119.7 | | | $ | 1.2 | | | $ | 8.0 | | | $ | 2,321.0 | | | $ | (176.6) | | | (2.0) | | | $ | (37.2) | | | $ | 2,116.4 | | | $ | 349.7 | | | $ | 2,466.1 | |

| Net income (loss) | — | | | — | | | — | | | (206.9) | | | — | | | — | | | — | | | (206.9) | | | (80.9) | | | (287.8) | |

Other comprehensive income | — | | | — | | | — | | | — | | | 4.3 | | | — | | | — | | | 4.3 | | | 0.3 | | | 4.6 | |

Cash dividends declared on common stock (1) | — | | | — | | | — | | | (20.6) | | | — | | | — | | | — | | | (20.6) | | | — | | | (20.6) | |

Stock-based compensation expense | — | | | — | | | 7.6 | | | — | | | — | | | — | | | — | | | 7.6 | | | — | | | 7.6 | |

| | | | | | | | | | | | | | | | | | | |

Other restricted share activity | 1.5 | | | — | | | 1.9 | | | — | | | — | | | (0.6) | | | (11.4) | | | (9.5) | | | — | | | (9.5) | |

| | | | | | | | | | | | | | | | | | | |

Retirement of treasury stock | (2.5) | | | — | | | (17.5) | | | (30.2) | | | — | | | 2.5 | | | 47.7 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

Balances at

June 30, 2020 | 118.7 | | | $ | 1.2 | | | $ | — | | | $ | 2,063.3 | | | $ | (172.3) | | | (0.1) | | | $ | (0.9) | | | $ | 1,891.3 | | | $ | 269.1 | | | $ | 2,160.4 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

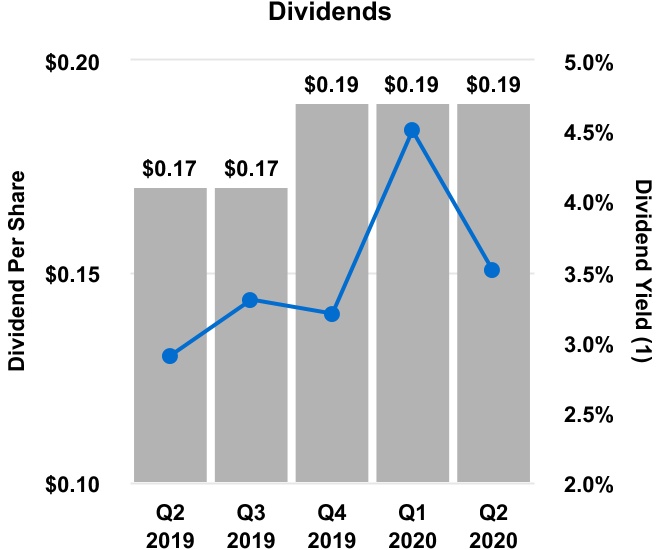

(1) Dividends of $0.19 per common share for all periods presented in 2020.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common

Stock | | | | Capital in

Excess of

Par Value | | Retained

Earnings | | Accumulated

Other

Comprehensive

Loss | | Treasury

Stock | | | | Trinity

Stockholders’

Equity | | Noncontrolling

Interest | | Total

Stockholders’

Equity |

| | Shares | | $0.01 Par Value | | | | | | | | Shares | | Amount | | | | | | |

| | (in millions, except par value and per common share amounts) | | | | | | | | | | | | | | | | | | |

Balances at

December 31, 2018 | 133.3 | | | $ | 1.3 | | | $ | 1.2 | | | $ | 2,326.1 | | | $ | (116.8) | | | (0.1) | | | $ | (1.0) | | | $ | 2,210.8 | | | $ | 351.2 | | | $ | 2,562.0 | |

| Net income (loss) | — | | | — | | | — | | | 30.6 | | | — | | | — | | | — | | | 30.6 | | | (0.5) | | | 30.1 | |

Other comprehensive (loss) income | — | | | — | | | — | | | — | | | (4.1) | | | — | | | — | | | (4.1) | | | 0.3 | | | (3.8) | |

Cash dividends declared on common stock (1) | — | | | — | | | — | | | (22.3) | | | — | | | — | | | — | | | (22.3) | | | — | | | (22.3) | |

Stock-based compensation expense | — | | | — | | | 5.5 | | | — | | | — | | | — | | | — | | | 5.5 | | | — | | | 5.5 | |

| Shares repurchased | — | | | — | | | 70.0 | | | — | | | — | | | (3.5) | | | (89.0) | | | (19.0) | | | — | | | (19.0) | |

| | | | | | | | | | | | | | | | | | | |

Other restricted share activity | — | | | — | | | 0.6 | | | — | | | — | | | — | | | (1.1) | | | (0.5) | | | — | | | (0.5) | |

Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.4) | | | (0.4) | |

Cumulative effect of adopting new accounting standard | — | | | — | | | — | | | 13.7 | | | — | | | — | | | — | | | 13.7 | | | — | | | 13.7 | |

Other | — | | | — | | | — | | | (0.2) | | | — | | | — | | | — | | | (0.2) | | | — | | | (0.2) | |

Balances at

March 31, 2019 | 133.3 | | | $ | 1.3 | | | $ | 77.3 | | | $ | 2,347.9 | | | $ | (120.9) | | | (3.6) | | | $ | (91.1) | | | $ | 2,214.5 | | | $ | 350.6 | | | $ | 2,565.1 | |

| Net income | — | | | — | | | — | | | 36.4 | | | — | | | — | | | — | | | 36.4 | | | 0.4 | | | 36.8 | |

Other comprehensive (loss) income | — | | | — | | | — | | | — | | | (6.5) | | | — | | | — | | | (6.5) | | | 0.3 | | | (6.2) | |

Cash dividends declared on common stock (1) | — | | | — | | | — | | | (21.6) | | | — | | | — | | | — | | | (21.6) | | | — | | | (21.6) | |

Stock-based compensation expense | — | | | — | | | 7.5 | | | — | | | — | | | — | | | — | | | 7.5 | | | — | | | 7.5 | |

| Shares repurchased | — | | | — | | | — | | | — | | | — | | | (2.1) | | | (44.0) | | | (44.0) | | | — | | | (44.0) | |

Other restricted share activity | 0.7 | | | — | | | 1.0 | | | — | | | — | | | (0.5) | | | (8.5) | | | (7.5) | | | — | | | (7.5) | |

Distributions to noncontrolling interest | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | (0.5) | | | (0.5) | |

Retirement of treasury stock | (6.1) | | | — | | | (85.8) | | | (56.9) | | | — | | | 6.1 | | | 142.7 | | | — | | | — | | | — | |

| | | | | | | | | | | | | | | | | | | |

Balances at

June 30, 2019 | 127.9 | | | $ | 1.3 | | | $ | — | | | $ | 2,305.8 | | | $ | (127.4) | | | (0.1) | | | $ | (0.9) | | | $ | 2,178.8 | | | $ | 350.8 | | | $ | 2,529.6 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

(1) Dividends of $0.17 per common share for all periods presented in 2019.

See accompanying notes to Consolidated Financial Statements.

Trinity Industries, Inc. and Subsidiaries

Notes to Consolidated Financial Statements

(Unaudited)

Note 1. Summary of Significant Accounting Policies

Basis of Presentation

The foregoing Consolidated Financial Statements are unaudited and have been prepared from the books and records of Trinity Industries, Inc. and its consolidated subsidiaries (“Trinity,” “Company,” “we,” “our,” or "us") including the accounts of our wholly-owned subsidiaries and partially-owned subsidiaries, TRIP Rail Holdings LLC (“TRIP Holdings”) and RIV 2013 Rail Holdings LLC ("RIV 2013"), in which we have a controlling interest. In our opinion, all normal and recurring adjustments necessary for a fair presentation of our financial position as of June 30, 2020, and the results of operations for the three and six months ended June 30, 2020 and 2019, and cash flows for the six months ended June 30, 2020 and 2019, have been made in conformity with generally accepted accounting principles. All significant intercompany accounts and transactions have been eliminated. Certain prior year balances have been reclassified to conform to the 2020 presentation.

Due to seasonal and other factors, including the potential impacts of the coronavirus pandemic (“COVID-19”) and the related governmental response, the results of operations for the six months ended June 30, 2020 may not be indicative of expected results of operations for the year ending December 31, 2020. These interim financial statements and notes are condensed as permitted by the instructions to Form 10-Q and should be read in conjunction with our audited Consolidated Financial Statements included in our Form 10-K for the year ended December 31, 2019.

Revenue Recognition

Revenue is measured based on the allocation of the transaction price in a contract to satisfied performance obligations. The transaction price does not include any amounts collected on behalf of third parties. We recognize revenue when we satisfy a performance obligation by transferring control over a product or service to a customer. Payments for our products and services are generally due within normal commercial terms. The following is a description of principal activities from which we generate our revenue, separated by reportable segments. See Note 3 for a further discussion regarding our reportable segments.

Railcar Leasing and Management Services Group

In our Railcar Leasing and Management Services Group ("Leasing Group"), revenue from rentals and operating leases, including contracts that contain non-level fixed lease payments, is recognized monthly on a straight-line basis. Leases not classified as operating leases are generally considered sales-type leases as a result of an option to purchase.

We review our operating lease receivables for collectibility on a regular basis, taking into consideration changes in factors such as the lessee’s payment history, the financial condition of the lessee, and business and economic conditions in the industry in which the lessee operates. In the event that the collectibility of a receivable with respect to any lessee is no longer probable, we de-recognize the revenue and related receivable and recognize future revenue only when the lessee makes a rental payment. Contingent rents are recognized when the contingency is resolved.

Selling profit or loss associated with sales-type leases is recognized upon lease commencement, and a net investment in the sales-type lease is recorded on the Consolidated Balance Sheet. Interest income related to sales-type leases is recognized over the lease term using the effective interest method. We had no sales-type leases as of June 30, 2020.

Revenue is recognized from the sales of railcars from the lease fleet on a gross basis in leasing revenues and cost of revenues if the railcar has been owned for one year or less at the time of sale. Sales of railcars from the lease fleet owned for more than one year are recognized as a net gain or loss from the disposal of a long-term asset. Revenue from servicing and management agreements is recognized as each performance period occurs.

We account for shipping and handling costs as activities to fulfill the promise to transfer the goods; as such, these fees are recorded in revenue. The fees and costs of shipping and handling activities are accrued when the related performance obligation has been satisfied.

Rail Products Group

Our railcar manufacturing business recognizes revenue when the customer has submitted its certificate of acceptance and legal title of the railcar has passed to the customer. Certain contracts for the sales of railcars include price adjustments based on steel-price indices; this amount represents variable consideration for which we are unable to estimate the final consideration until the railcar is delivered.

Within our maintenance services business, revenue is recognized over time as repair and maintenance projects are completed, using an input approach based on the costs incurred relative to the total estimated costs of performing the project. We recorded contract assets of $8.9 million and $5.2 million as of June 30, 2020 and December 31, 2019, respectively, related to unbilled revenues recognized on repair and maintenance services that have been performed, but for which the entire project has not yet been completed, and the railcar has not yet been shipped to the customer. These contract assets are included within the Receivables, net of allowance line in our Consolidated Balance Sheets.

All Other

Our highway products business recognizes revenue when shipment has occurred and legal title of the product has passed to the customer.

Unsatisfied Performance Obligations

The following table includes estimated revenue expected to be recognized in future periods related to performance obligations that are unsatisfied or partially satisfied as of June 30, 2020 and the percentage of the outstanding performance obligations as of June 30, 2020 expected to be delivered during the remainder of 2020:

| | | | | | | | | | | |

| Unsatisfied performance obligations at June 30, 2020 | | |

| Total

Amount | | Percent expected to be delivered in 2020 |

| | (in millions) | | |

| Rail Products Group: | | | |

| Products: | | | |

| External Customers | $ | 829.8 | | | |

| Leasing Group | 507.5 | | | |

| $ | 1,337.3 | | | 40.7 | % |

| | | |

| Maintenance Services | $ | 6.7 | | | 75.0 | % |

| | | |

| Railcar Leasing and Management Services Group | $ | 100.5 | | | 9.0 | % |

The remainder of the unsatisfied performance obligations for the Rail Products Group is expected to be delivered through 2023. Unsatisfied performance obligations for the Railcar Leasing and Management Services Group are related to servicing, maintenance, and management agreements and are expected to be performed through 2029.

Lease Accounting

Lessee

We are the lessee of operating leases predominantly for railcars, as well as office buildings, manufacturing equipment, and office equipment. Our operating leases have remaining lease terms ranging from one year to sixteen years, some of which include options to extend for up to five years, and some of which include options to terminate within one year. As of June 30, 2020, we had no finance leases in which we were the lessee. Certain of our operating leases include lease incentives, which reduce the right-of-use asset and are recognized on a straight-line basis over the lease term. As applicable, the lease liability is also reduced by the amount of lease incentives that have not yet been reimbursed by the lessor.

In March 2020, we entered into a lease agreement for a new headquarters facility in Dallas, Texas. The new lease has a contractual term of 16 years from the legal commencement date, which is February 1, 2021. There is an option to extend the lease term; however, we determined that the renewal was not reasonably certain at lease inception. For accounting purposes, the lease commencement date was determined to be in April 2020, which is when we obtained control of the new facility for build-out purposes.

The following table summarizes the impact of our operating leases on our Consolidated Financial Statements (in millions, except lease term and discount rate):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| Consolidated Statement of Operations | | | | | | | |

| Operating lease expense | $ | 4.6 | | | $ | 4.1 | | | $ | 8.5 | | | $ | 9.3 | |

| Short-term lease expense | $ | 1.2 | | | $ | 1.2 | | | $ | 1.4 | | | $ | 2.6 | |

| | | | | | | |

| | | | | June 30, 2020 | | December 31, 2019 |

| Consolidated Balance Sheet | | | | | | | |

Right-of-use assets (1) | | | | | $ | 77.2 | | | $ | 44.2 | |

Lease liabilities (2) | | | | | $ | 89.2 | | | $ | 44.8 | |

| | | | | | | |

| Weighted average remaining lease term | | | | | 11.0 years | | 4.8 years |

| Weighted average discount rate | | | | | 3.4 | % | | 4.1 | % |

| | | | | | | |

| | | | | Six Months Ended

June 30, | | |

| | | | | 2020 | | 2019 |

| Consolidated Statement of Cash Flows | | | | | | | |

| Cash flows from operating activities | | | | | $ | 8.5 | | | $ | 9.3 | |

Right-of-use assets recognized in exchange for new lease liabilities (3) | | | | | $ | 50.7 | | | $ | 4.2 | |

(1) Included in other assets in our Consolidated Balance Sheet. See Note 10 for more information on the impairment of right-of-use assets.

(2) Included in other liabilities in our Consolidated Balance Sheet.

(3) Includes the commencement of the new headquarters facility described above for the six months ended June 30, 2020.

Future contractual minimum operating lease liabilities will mature as follows (in millions):

| | | | | | | | | | | | | | | | | |

| Leasing Group | | Non-Leasing Group | | Total |

| Remaining six months of 2020 | $ | 4.9 | | | $ | 2.0 | | | $ | 6.9 | |

| 2021 | 8.5 | | | 3.1 | | | 11.6 | |

| 2022 | 7.8 | | | 6.9 | | | 14.7 | |

| 2023 | 5.9 | | | 7.0 | | | 12.9 | |

| 2024 | 2.7 | | | 5.9 | | | 8.6 | |

| Thereafter | 1.5 | | | 67.6 | | | 69.1 | |

| Total operating lease payments | $ | 31.3 | | | $ | 92.5 | | | $ | 123.8 | |

| Less: Present value adjustment | | | | | (23.0) | |

| Less: Lease incentives | | | | | (11.6) | |

| Total operating lease liabilities | | | | | $ | 89.2 | |

Lessor

Our Leasing Group enters into railcar operating leases with third parties with terms generally ranging between one year and ten years, although certain leases entered into in prior periods had lease terms of up to twenty years. The majority of our fleet operates on leases that earn fixed monthly lease payments. Generally, lease payments are due at the beginning of the applicable month. A portion of our fleet operates on per diem leases that earn usage-based variable lease payments. Some of our leases include options to extend the leases for up to five years, and a small percentage of our leases include options to terminate within one year with certain notice requirements and early termination penalties.

In the second quarter, due to COVID-19, certain of the Leasing Group's customers requested rent relief, primarily in the form of rent payment extensions. In April 2020, the FASB staff issued a question and answer document (the "Lease Modification Q&A") focused on the application of lease accounting guidance to lease concessions provided as a result of the COVID-19 pandemic. The Lease Modification Q&A provides entities with the option to elect to account for lease concessions resulting from COVID-19 as though the enforceable rights and obligations existed in the original lease in certain circumstances. We have elected this practical expedient in our accounting for any eligible lease concessions provided for our leased railcars. To date, these concessions have not had a significant impact on our Consolidated Financial Statements.

Leases previously classified as sales-type leases included an option for the lessee to purchase the leased railcars with certain notice. During the three months ended March 31, 2020, the lessee exercised its option to purchase the leased railcars. As of June 30, 2020, non-Leasing Group operating leases were not significant, and we had no sales-type leases and no direct finance leases.

We manage risks associated with residual values of leased railcars by investing across a diverse portfolio of railcar types, staggering lease maturities within any given railcar type, avoiding concentration of railcar type and industry, and participating in active secondary markets. Additionally, our lease agreements contain normal wear and tear return condition provisions and high mileage thresholds designed to protect the value of our residual assets. Our lease agreements do not contain any material residual value guarantees or restrictive covenants.

The following table summarizes the impact of our leases on our Consolidated Statement of Operations (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| Operating lease revenues | $ | 165.1 | | | $ | 171.6 | | | $ | 337.3 | | | $ | 339.9 | |

| Variable operating lease revenues | $ | 10.6 | | | $ | 10.8 | | | $ | 23.2 | | | $ | 21.6 | |

| Sales-type lease revenues | $ | — | | | $ | 32.3 | | | $ | — | | | $ | 34.2 | |

| Interest income on sales-type lease receivables | $ | — | | | $ | 0.3 | | | $ | — | | | $ | 0.3 | |

| Profit recognized at sales-type lease commencement | $ | — | | | $ | 3.9 | | | $ | — | | | $ | 4.1 | |

Future contractual minimum revenues for operating leases will mature as follows (in millions)(1):

| | | | | |

| Remaining six months of 2020 | $ | 298.6 | |

| 2021 | 494.0 | |

| 2022 | 387.9 | |

| 2023 | 280.9 | |

| 2024 | 199.8 | |

| Thereafter | 353.8 | |

| Total | $ | 2,015.0 | |

(1) Total contractual minimum rental revenues on operating leases relates to our wholly-owned and partially-owned subsidiaries and sub-lease rental revenues associated with the Leasing Group's operating lease obligations.

Financial Instruments

We consider all highly liquid debt instruments to be either cash and cash equivalents if purchased with a maturity of three months or less, or short-term marketable securities if purchased with a maturity of more than three months and less than one year.

Financial instruments that potentially subject us to a concentration of credit risk are primarily cash investments including restricted cash and receivables. We place our cash investments in bank deposits and investment grade, short-term debt instruments and limit the amount of credit exposure to any one commercial issuer. The carrying values of cash, receivables, and accounts payable are considered to be representative of their respective fair values.

Concentrations of credit risk with respect to receivables are limited due to control procedures that monitor the credit worthiness of customers, the large number of customers in our customer base, and their dispersion across different end markets and geographic areas. Receivables are generally evaluated at a portfolio level based on these characteristics. As receivables are generally unsecured, we maintain an allowance for credit losses using a forward-looking approach based on historical expected losses and consideration of current and expected future economic conditions. Historically, we have observed that the likelihood of loss increases when receivables have aged beyond 180 days. When a receivable is deemed uncollectible, the write-off is recorded as a reduction to allowance for credit losses. During the six months ended June 30, 2020, we recognized approximately $2.4 million of credit loss expense, which included $0.6 million in write-offs, related to our in-scope receivables, bringing the allowance for credit losses balance at June 30, 2020 to $7.9 million. This balance excludes the general reserve for operating lease receivables that is permitted under ASC 450.

Property, Plant, and Equipment

In early 2020, we finalized an assessment of the estimated useful lives and salvage value assumptions for the railcars in our lease fleet. Based upon analysis of historical fleet data, review of industry standards, and consideration of certain economic factors by railcar type, we determined that it was appropriate to revise the useful lives and salvage values of certain railcar types in our lease fleet. The net impact of these changes, which took effect January 1, 2020, resulted in a change in the weighted average useful life from approximately 34 years to approximately 37 years. This change was accounted for as a change in accounting estimate, which is required to be accounted for on a prospective basis. This change in estimate resulted in a decrease in depreciation expense and an increase in income from continuing operations of approximately $7.7 million and $15.4 million, as well as an increase in net income of approximately $5.9 million and $11.8 million for the three and six months ended June 30, 2020, respectively. Further, earnings per share increased $0.05 for the three months ended June 30, 2020 and increased $0.10 per share for the six months ended June 30, 2020. See Note 10 for further information regarding impairment of long-lived assets related to our small cube covered hopper railcars recorded in the three and six months ended June 30, 2020.

Goodwill

As of June 30, 2020 and December 31, 2019, the carrying amount of our goodwill totaled $208.8 million, which is primarily attributable to the Rail Products Group.

Warranties

We provide various express, limited product warranties that generally range from one year to five years depending on the product. The warranty costs are estimated using a two-step approach. First, an engineering estimate is made for the cost of all claims that have been asserted by customers. Second, based on historical claims experience, a cost is accrued for all products still within a warranty period for which no claims have been filed. We provide for the estimated cost of product warranties at the time revenue is recognized related to products covered by warranties and assess the adequacy of the resulting reserves on a quarterly basis. The changes in the accruals for warranties for the three and six months ended June 30, 2020 and 2019 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

June 30, | | | | Six Months Ended

June 30, | | |

| 2020 | | 2019 | | 2020 | | 2019 |

| | (in millions) | | | | | | |

| Beginning balance | $ | 7.7 | | | $ | 7.1 | | | $ | 8.1 | | | $ | 7.4 | |

| Warranty costs incurred | (0.6) | | | (0.6) | | | (1.5) | | | (1.5) | |

| Warranty originations and revisions | 2.4 | | | 1.9 | | | 3.0 | | | 2.6 | |

| Warranty expirations | — | | | (0.1) | | | (0.1) | | | (0.2) | |

| Ending balance | $ | 9.5 | | | $ | 8.3 | | | $ | 9.5 | | | $ | 8.3 | |

Recent Accounting Pronouncements

Adopted in 2020

ASU 2016-13 — In June 2016, FASB issued ASU No. 2016-13, "Measurement of Credit Losses on Financial Instruments," which amends the impairment model by requiring entities to use a forward-looking approach based on expected losses rather than incurred losses to estimate credit losses on certain types of financial instruments, including trade receivables. This approach may result in the earlier recognition of allowances for losses. In November 2018, the FASB issued ASU No. 2018-19, "Codification Improvements to Topic 326, Financial Instruments—Credit Losses," which excludes operating lease receivables from the scope of ASU 2016-13. ASU 2016-13 is effective for public companies during interim and annual reporting periods beginning after December 15, 2019, with early adoption permitted.