| Filer: C. R. Bard, Inc.

Pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Exchange Act of 1934

Subject Company: C. R. Bard, Inc.

Commission File No. 001-6926 |

On April 23, 2017, Becton, Dickinson and Company (“BD”) and C. R. Bard, Inc. (“Bard”) made available a transaction website at http://bdandbard.transactionannouncement.com/ to provide supplemental information about the merger of BD and Bard. Bard also announced the merger of BD and Bard on several social media platforms. Screenshots of the transaction website and the social media communications follow.

FORWARD-LOOKING STATEMENTS

This website contains

certain estimates and other “forward-looking statements” within the meaning of the federal securities laws, including Section 23A of the Securities Act of 1933, as amended, and Section 2lE of the Securities Exchange Act of 1934, as

amended. Forward looking statements generally are accompanied by words such as “will”, “expect”, “outlook” “anticipate,” “intend,” “plan,” “believe,” “seek,”

“see,” “will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different

degrees, uncertain, such as statements regarding the estimated or anticipated future results of BD, and of the combined company following BD’s proposed acquisition of Bard, the anticipated benefits of the proposed combination, including

estimated synergies, the expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and Bard management and are not predictions of actual

performance.

These statements are subject to a number of risks and uncertainties regarding BD and Bard’s respective businesses and the proposed acquisition,

and actual results may differ materially. These risks and uncertainties include, but are not limited to, (i) the ability of the parties to successfully complete the proposed acquisition on anticipated terms and timing, including obtaining

required shareholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future

prospects, business and management strategies for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the acquisition, (ii) risks relating to the integration of

Bard’s operations, products and employees into BD and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe, (iii) the outcome of

any legal proceedings related to the proposed acquisition, (iv) access to available financing including for the refinancing of BD’s or Bard’s debt on a timely basis and reasonable terms, (v) the ability to market and sell

Bard’s products in new markets, including the ability to obtain necessary regulatory product registrations and clearances, (vi) the loss of key senior management or other associates; the anticipated demand for BD’s and Bard’s

products, including the risk of future reductions in government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures, (vii) the impact of

competition in the medical device industry, (viii) the risks of fluctuations in interest or foreign currency exchange rates, (ix) product liability claims, (x) difficulties inherent in product development, including the timing or

outcome of product development efforts, the ability to obtain regulatory approvals and clearances and the timing and market success of product launches, (xi) risks relating to fluctuations in the cost and availability of raw materials and other

sourced products and the ability to maintain favorable supplier arrangements and relationships, (xii) successful compliance with governmental regulations applicable to BD, Bard and the combined company, (xiii) changes in regional, national

or foreign economic conditions, (xiv) uncertainties of litigation, and (xv) other factors discussed in BD’s and Bard’s respective filings with the Securities and Exchange Commission.

The forward-looking statements in this document speak only as of date of this document BD and Bard undertake no obligation to update any to forward-looking statements to reflect

events or circumstances after the date hereof, except as required by applicable laws or regulations.

IMPORTANT INFORMATION FOR INVESTORS

In connection with the proposed transaction, BD will file with the SEC a registration statement on Form S-4 that will constitute a

prospectus of BD and include a proxy statement of Bard. BD and Bard also plan to file other relevant documents with the SEC regarding the proposed transaction. INVESTORS are URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS

FILED with THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL contain IMPORTANT information. You may obtain a free copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and Bard

with the SEC at the SEC’s website at www.sec.gov. In addition, you will be able to obtain free copies of these documents by phone, e-mail or written request by contacting the investor relations department

of BD or Bard at the following:

Becton, Dickinson and Company C.R. Bard, Inc.

1 Becton Drive 730 Central Avenue

Franklin Lakes, New Jersey 07417 Murray

Hill, New Jersey 07974 Attn: Investor Relations Attn: Investor Relations

1-(800)-284-6845 1-(906)-277-8065

PARTICIPANT’S IN THE SOLICITATION

BD and Bard and their respective directors and

executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BD’s directors and executive officers is available in

BD’s proxy statement dated December 15, 2016, for its 2017 Annual Meeting of Shareholders. Information about Bard’s directors and executive officers is available in Bard’s proxy statement dated March 15, 2017, for its 2017

Annual Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus

and other relevant materials to be filed with the SEC regarding the acquisition when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions.

You may obtain free copies of these documents from BD or Bard as indicated above.

NO OFFER OR SOLICITATION

This website shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the U.S. Securities Act of 1933, as amended.

Agree I have read and agree to the terms of this website.

BD

BARD

BD ACQUISITION OF BARD

Welcome

Investor Call

BD and Bard announced on April 23, 2017 that they have entered into a

definitive agreement

Listen to the investor call

under which BD will acquire

Bard for $317.00 per Bard common share in cash and stock, for a total

April 24, 2017

consideration of $24 billion, creating a highly differentiated medical technology company focused

8:00 AM ET

on delivering innovative healthcare solutions to improve clinical and economic

outcomes.

Click for webcast

BD Contact Information

Media

Kristen Cardillo

(201)

847-5657

Investor Relations

Monique N. Dolecki

(201)

847-5378

Bard Contact Information

Media

Scott Lowry

(908)

277-8365

Press Release

Click here to download PDF

Click here to download PDF

Investor Relations

Todd W. Garner

(908)

277-8065

Important Information | © 2017 BD

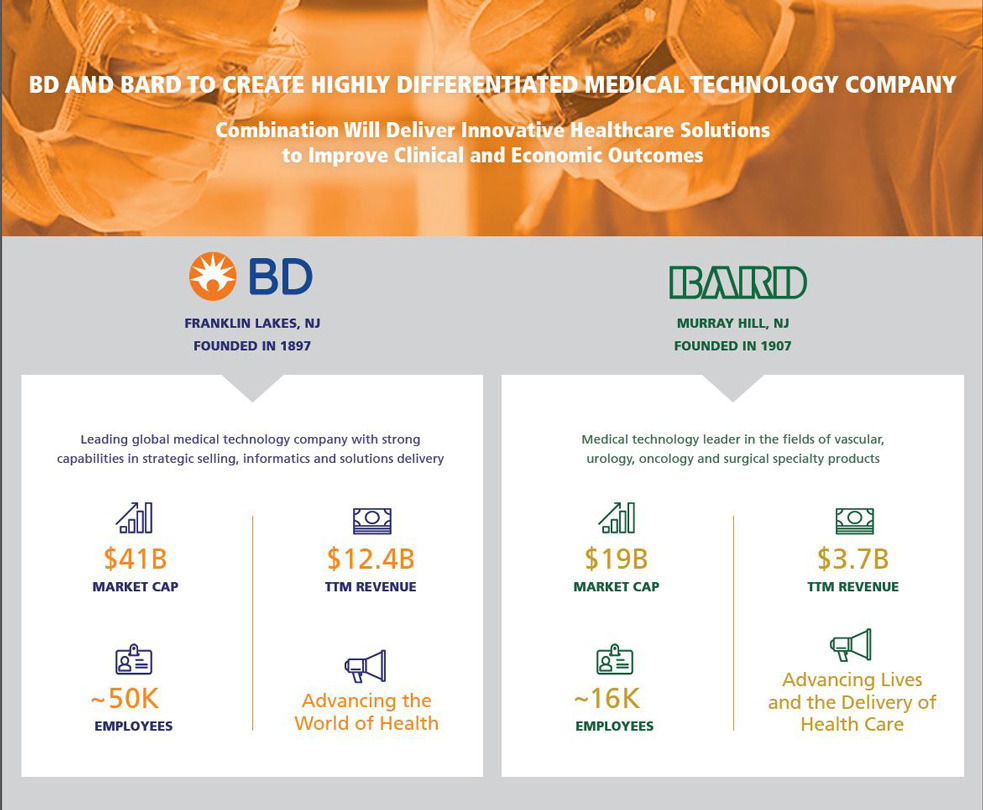

BD AND BARD TO CREATE HIGHLY DIFFERENTIATED MEDICAL TECHNOLOGY COMPANY

Combination Will Deliver Innovative Healthcare Solutions to Improve Clinical and Economic Outcomes

BD

FRANKLIN LAKES, NJ FOUNDED IN 1897

Leading global medical technology company with strong capabilities in strategic selling, informatics and solutions delivery

$41B

MARKET CAP

$12.4B

TTM REVENUE

~50K

EMPLOYEES

Advancing the World of Health

BARD

MURRAY HILL, NJ FOUNDED IN 1907

Medical technology leader in the fields of vascular, urology,

oncology and surgical specialty products

$ 19B

MARKET CAP

$3.7B

TTM REVENUE

~16K

EMPLOYEES

Advancing Lives and the Delivery of Health Care

COMBINATION ACCELERATES BD’S GROWTH STRATEGY BY BRINGING MORE COMPREHENSIVE, CLINICALLY RELEVANT SOLUTIONS TO CUSTOMERS &

PATIENTS AROUND THE GLOBE

STRATEGICALLY WELL-ALIGNED WITH HIGHLY COMPATIBLE CULTURES

Builds on BD’s leadership position in medication management and

infection prevention

Bard’s strong product portfolio and innovation pipeline increases BD’s opportunities in fast growing clinical areas

Accelerated growth outside of the U.S.

Financially compelling combination

with meaningful long-term value for shareholders

> Brings together highly complementary product sets to create unmatched solutions for customers.

> Better positioned to provide end-to-end medication management solutions across the care

continuum.

> Further expands BD’s leadership in infection prevention, with offerings positioned to address 75% of the most costly and frequent healthcare

associated infections (HAIs).

> Bard’s clinically differentiated offerings create more meaningful scale and relevance for BD in high growth categories of

oncology and surgery.

> Expands BD’s focus on the treatment of disease states beyond diabetes to include peripheral vascular disease, urology, hernia and

cancer.

> More opportunities for patients and clinicians around the world to benefit from BD’s and Bard’s product technology.

> Expanded portfolio of clinically relevant products, with clearly identified opportunities to drive near-term revenue synergies outside of the U.S.

> Large and growing presence in emerging markets, including $1 billion in annual revenue in China.

> Accelerates BD’s progress towards long-term target of revenue growth of 5+ percent.

> Approximately $300 million of estimated annual, pre-tax, run-rate cost

synergies are expected in FY 2020.

> Revenue synergies identified beginning in FY 2019.

> Expected to improve BD’s gross margins and increase BD’s EPS growth trajectory.

FORWARD-LOOKING STATEMENTS

This fact sheet contains certain estimates and

other “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward looking

statements generally are accompanied by words such as “will”, ‘‘expect”, “outlook” ‘anticipate,’ “intend,” “plan,” “believe,” “seek,” ‘“see,”

“will,” “would,” “target,” or other similar words, phrases or expressions and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain,

such as statements regarding the estimated or anticipated future results of BD, and of the combined company following BD’s proposed acquisition of Bard, the anticipated benefits of the proposed combination, including estimated synergies, the

expected timing of completion of the transaction and other statements that are not historical facts. These statements are based on the current expectations of BD and Bard management and are not predictions of actual performance.

These statements are subject to a number of risks and uncertainties regarding BD and Bard’s respective businesses and the proposed acquisition, and actual results may differ

materially. These risks and uncertainties include, but are not limited to, (i) the ability of the parties to successfully complete the proposed acquisition on anticipated terms and timing, including obtaining required shareholder and regulatory

approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies

for the management, expansion and growth of the new combined company’s operations and other conditions to the completion of the acquisition, (ii) risks relating to the integration of Bard’s operations, products and employees into BD

and the possibility that the anticipated synergies and other benefits of the proposed acquisition will not be realized or will not be realized within the expected timeframe, (iii) the outcome of any legal proceedings related to the proposed

acquisition, (iv) access to available financing including for the refinancing of BD’s or Bard’s debt on a timely basis and reasonable terms, (v) the ability to market and sell Bard’s products in new markets, including the

ability to obtain necessary regulatory product registrations and clearances, (vi) the loss of key senior management or other associates; the anticipated demand for BD’s and Bard’s products, including the risk of future reductions in

government healthcare funding, changes in reimbursement rates or changes in healthcare practices that could result in lower utilization rates or pricing pressures, (vii) the impact of competition in the medical device industry, (viii) the

risks of fluctuations in interest or foreign currency exchange rates, (ix) product liability claims, (x) difficulties inherent in product development, including the timing or outcome of product development efforts, the ability to obtain

regulatory approvals and clearances and the timing and market success of product launches, (xi) risks relating to fluctuations in the cost and availability of raw materials and other sourced products and the ability to maintain favorable

supplier arrangements and relationships, (xii) successful compliance with governmental regulations applicable to BD, Bard and the combined company, (xiii) changes in regional, national or foreign economic conditions, (xiv) uncertainties of

litigation, and (xv) other factors discussed in BD’s and Bard’s respective filings with the Securities and Exchange Commission.

The forward-looking

statements in this document speak only as of date of this document. BD and Bard undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date hereof, except as required by applicable laws or

regulations.

IMPORTANT INFORMATION FOR INVESTORS

In connection

with the proposed transaction, BD will file with the SEC a registration statement on Form S 4 that will constitute a prospectus of BD and include a proxy statement of Bard. BD and Bard also plan to file other relevant documents with the SEC

regarding the proposed transaction. INVESTORS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. You may obtain a free

copy of the proxy statement/prospectus (if and when it becomes available) and other relevant documents filed by BD and Bard with the SEC at the SEC’s website at www.sec.gov. In addition, you will be able to obtain free copies of these documents

by phone, e mail or written request by contacting the investor relations department of BD or Bard at the following:

Becton, Dickinson and Company

C.R. Bard. Inc.

1 Becton Drive

730 Central Avenue

Franklin Lakes, New Jersey 07417

Murray Hill, New Jersey 07974

Attn: Investor Relations

Attn: Investor Relations

1-(800)-284-6845

1-(908)-277-8065

PARTICIPANTS IN THE SOLICITATION

BD and Bard and their respective directors and executive

officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about BD’s directors and executive officers is available in BD’s

proxy statement dated December 15, 2016, for its 2017 Annual Meeting of Shareholders. Information about Bard’s directors and executive officers is available in Bard’s proxy statement dated March 15, 2017, for its 2017 Annual

Meeting of Stockholders. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and

other relevant materials to be filed with the SEC regarding the acquisition when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You

may obtain free copies of these documents from BD or Bard as indicated above.

NO OFFER OR SOLICITATION

This fact sheet shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of

Section 10 of the U.S. Securities Act of 1933, as amended.

FORWARD-LOOKING STATEMENTS

The information presented herein contains estimates and other forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The words “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “outlook” and similar words, phrases or expressions are intended to identify such forward-looking statements, but other statements that are not historical facts may also be considered forward-looking statements. These forward-looking statements include statements about the benefits of the merger, including anticipated future financial and operating results, synergies, accretion and growth rates, BD’s, Bard’s and the combined company’s plans, objectives, expectations and intentions, and the expected timing of completion of the transaction. There are several factors which could cause actual plans and results to differ materially from those expressed or implied in forward-looking statements. Such factors include, but are not limited to, the failure of the closing conditions to be satisfied, or any unexpected delay in closing the proposed merger, including the failure to obtain the necessary approval by Bard shareholders and the risk that the required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed merger; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the outcome of any legal proceedings related to the proposed merger; risks relating to the integration of BD’s and Bard’s businesses, operations, products and employees, including the risk that this integration will be materially delayed or will be more costly or difficult than expected; the risk that the integration of the cost savings and any revenue synergies from the merger may not be realized or take longer than anticipated to be realized; the risk of higher than anticipated costs, fees, expenses and charges in relation to the proposed merger; access to available financing on a timely basis and reasonable terms; reputational risk and the reaction of BD’s and Bard’s employees, customers, suppliers or other business partners to the proposed merger, including a risk of loss of key senior management or other associates; developments, sales efforts, income tax matters, the outcomes of contingencies such as legal proceedings, and other economic, business, competitive and regulatory factors; as well as other risks, uncertainties and factors discussed in BD’s and Bard’s respective filings with the U.S. Securities and Exchange Commission (the “SEC”), available free of charge at the SEC’s website at www.sec.gov. BD and Bard do not intend, and disclaim any obligation, to update or revise any forward-looking statements contained in this communication to reflect events or circumstances after the date hereof, except as required by applicable laws or regulations.

ADDITIONAL INFORMATION ABOUT THE PROPOSED TRANSACTION AND WHERE TO FIND IT

In connection with the proposed transaction, BD will file a registration statement on Form S-4 with the SEC that will include a proxy statement of Bard that also constitutes a prospectus of BD. BD and Bard also plan to file other documents in connection with the proposed transaction with the SEC. INVESTORS AND SHAREHOLDERS OF BARD ARE URGED TO READ CAREFULLY THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT BD, BARD, THE PROPOSED TRANSACTION AND RELATED MATTERS. The registration statement and proxy statement/prospectus and other documents filed by BD or Bard with the SEC will be available free of charge at the SEC’s website at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of the documents filed with the SEC by BD at BD’s website at www.bd.com, in the “Investors” section by clicking the “Investors” link or by contacting BD Investor Relations at Monique_Dolecki@bd.com or calling 201-847-5378, and will be able to obtain free copies of the documents filed with the SEC by Bard at Bard’s website at www.crbard.com, in the “Investors” section by clicking the “Investors” link or by contacting Bard Investor Relations at Todd.garner@crbard.com or calling 908-277-8065.

PARTICIPANTS IN THE SOLICITATION

BD, Bard, their respective directors and certain of their executive officers and other employees may be deemed to be participants in the solicitation of proxies from Bard’s shareholders in connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the Bard shareholders in connection with the proposed merger, including a description of their direct or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement/prospectus when it is filed with the SEC. Information about BD’s directors and executive officers is available in BD’s proxy statement for its 2017 annual meeting of shareholders, which was filed with the SEC on December 15, 2016, and other documents subsequently filed by BD with the SEC. Information about Bard’s directors and executive officers is available in Bard’s proxy statement for its 2017 annual meeting of shareholders, which was filed with the SEC on March 15, 2017, and other documents subsequently filed by Bard with the SEC.