Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x |

Preliminary Proxy Statement | |||||

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||

| ¨ |

Definitive Proxy Statement | |||||

| ¨ |

Definitive Additional Materials | |||||

| ¨ |

Soliciting Material Pursuant to § 240.14a-12 | |||||

C. R. Bard, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

C. R. BARD, INC.

730 Central Avenue

Murray Hill, New Jersey 07974

March 16, 2012

Dear Shareholder:

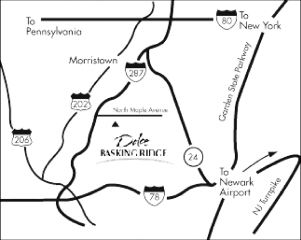

Your Board of Directors joins me in extending an invitation to attend the 2012 Annual Meeting of Shareholders, which will be held on Wednesday, April 18, 2012, at Dolce Basking Ridge, 300 North Maple Avenue, Basking Ridge, New Jersey 07920. The meeting will start promptly at 10:00 a.m.

We sincerely hope you will be able to attend and participate in the meeting. We will be acting on the items set forth in the accompanying Notice and Proxy Statement.

If you plan to attend the meeting and are a shareholder of record, please mark your proxy card in the space provided for that purpose. An admission ticket is included with the proxy card for each shareholder of record. If your shares are not registered in your name, please advise the shareholder(s) of record (your bank, broker or other nominee) that you wish to attend. That firm must provide you with evidence of your ownership, which will enable you to gain admission to the meeting.

Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. As a shareholder of record, you can vote your shares by telephone or over the Internet in accordance with the instructions set forth on the enclosed proxy card, or mark your vote on the proxy card, sign and date it and mail it in the envelope provided. As a result of changes in applicable law, banks, brokers, etc. can no longer exercise discretionary voting on most matters, including uncontested elections of directors and certain executive compensation proposals. If you are not a shareholder of record, please follow the instructions provided by the shareholder of record (your bank, broker or other nominee) so that your shares are voted at the meeting on all matters, including the election of directors.

Sincerely,

TIMOTHY M. RING

Chairman and

Chief Executive Officer

Table of Contents

C. R. BARD, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

April 18, 2012

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of C. R. Bard, Inc. will be held on Wednesday, April 18, 2012, at Dolce Basking Ridge, 300 North Maple Avenue, Basking Ridge, New Jersey 07920, at 10:00 a.m. for the following purposes:

| 1. | To elect four Class I director nominees for a term of three years and one Class II director nominee for a term of one year; |

| 2. | To ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2012; |

| 3. | To approve the 2012 Long Term Incentive Plan of C. R. Bard, Inc., as amended and restated (formerly the 2003 Long Term Incentive Plan of C. R. Bard, Inc., as amended and restated); |

| 4. | To approve the Employee Stock Purchase Plan of C. R. Bard, Inc. as amended and restated (formerly the 1998 Employee Stock Purchase Plan of C. R. Bard, Inc., as amended and restated); |

| 5. | To hold a “Say-on-Pay” advisory vote to approve the compensation of our named executive officers; |

| 6. | To consider and vote upon Management’s proposal to amend the Company’s Restated Certificate of Incorporation to declassify the Board of Directors; |

| 7. | To consider and vote upon a shareholder proposal relating to sustainability reporting; and |

| 8. | To transact such other business as may properly come before the meeting and any adjournments thereof. |

Only shareholders of record at the close of business on February 27, 2012 are entitled to notice of and to vote at the meeting and any adjournments or postponements thereof.

Copies of the 2011 Annual Report to Shareholders and Form 10-K of C. R. Bard, Inc. for 2011 are enclosed with this Notice, the attached Proxy Statement and the accompanying proxy card or voting instruction form.

All shareholders are urged to attend the meeting in person or by proxy. Shareholders who do not expect to attend the meeting in person are requested to vote either: (i) by telephone as directed on the enclosed proxy card or voting instruction form; (ii) over the Internet as directed on the enclosed proxy card or voting instruction form; or (iii) by completing, signing and dating the enclosed proxy card or voting instruction form and returning it promptly in the self-addressed envelope provided, which needs no postage if mailed in the United States.

By order of the Board of Directors

JEAN F. HOLLOWAY

Vice President, General Counsel and Secretary

March 16, 2012

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Shareholders to Be Held on April 18, 2012:

The Proxy Statement, the 2011 Annual Report to Shareholders and the Form 10-K of C. R. Bard, Inc.

for 2011 are available at www.edocumentview.com/bcr.

NO MATTER HOW MANY SHARES YOU OWNED

ON THE RECORD DATE, YOUR VOTE IS IMPORTANT.

PLEASE INDICATE YOUR VOTING INSTRUCTIONS EITHER: (i) BY TELEPHONE AS DIRECTED ON THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM; (ii) OVER THE INTERNET AS DIRECTED ON THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM; OR (iii) BY COMPLETING, SIGNING AND DATING THE ENCLOSED PROXY CARD OR VOTING INSTRUCTION FORM AND RETURNING IT PROMPTLY IN THE SELF-ADDRESSED ENVELOPE PROVIDED, WHICH NEEDS NO POSTAGE IF MAILED IN THE UNITED STATES. IN ORDER TO AVOID THE ADDITIONAL EXPENSE TO THE COMPANY OF FURTHER SOLICITATION, WE ASK YOUR COOPERATION IN PHONING IN YOUR VOTE, VOTING OVER THE INTERNET OR MAILING YOUR PROXY CARD OR VOTING INSTRUCTION FORM PROMPTLY.

Table of Contents

| 2 | ||||

| 7 | ||||

| 9 | ||||

| 10 | ||||

| 10 | ||||

| 19 | ||||

| 19 | ||||

| 19 | ||||

| 27 | ||||

| 27 | ||||

| 40 | ||||

| 41 | ||||

| 47 | ||||

| 48 | ||||

| 50 | ||||

| 52 | ||||

| 54 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 64 | ||||

| 65 | ||||

| 65 | ||||

| Policies and Procedures for Transactions with Related Persons |

66 | |||

| 66 | ||||

| 67 | ||||

| 68 | ||||

| 69 | ||||

| 74 | ||||

| 77 | ||||

| 78 | ||||

| PROPOSAL NO. 7 — SHAREHOLDER PROPOSAL RELATING TO SUSTAINABILITY REPORTING |

79 | |||

| 83 | ||||

| 83 | ||||

| 83 | ||||

| Exhibits |

||||

| A-1 | ||||

| B-1 | ||||

| Exhibit C — PROPOSED AMENDMENT TO THE RESTATED CERTIFICATE OF INCORPORATION |

C-1 |

1

Table of Contents

C. R. BARD, INC.

730 Central Avenue

Murray Hill, New Jersey 07974

PROXY STATEMENT

We are furnishing this proxy statement to the shareholders of C. R. Bard, Inc. in connection with the solicitation by our Board of Directors of proxies to be voted at the 2012 Annual Meeting of Shareholders (the “Annual Meeting”) referred to in the attached notice and at any adjournments of that meeting. The Annual Meeting will be held on Wednesday, April 18, 2012, at Dolce Basking Ridge, 300 North Maple Avenue, Basking Ridge, New Jersey 07920, at 10:00 a.m. We expect to mail this proxy statement and the accompanying proxy card or voting instruction form beginning on March 16, 2012 to each shareholder entitled to vote.

When used in this proxy statement, the terms “we,” “us,” “our,” “the Company” and “C. R. Bard” refer to C. R. Bard, Inc. The terms “Board of Directors” and “Board” refer to the Board of Directors of C. R. Bard, Inc.

WHO IS ENTITLED TO VOTE?

All record holders of our common stock as of the close of business on February 27, 2012, which is the record date, are entitled to vote. You are a “record holder” if your shares are held in your name. If your shares are held through a bank, broker or other nominee, your shares are held in “street name.” See the information below on instructing your bank, broker or other nominee to vote your shares.

HOW DO I VOTE, IF I AM A RECORD HOLDER?

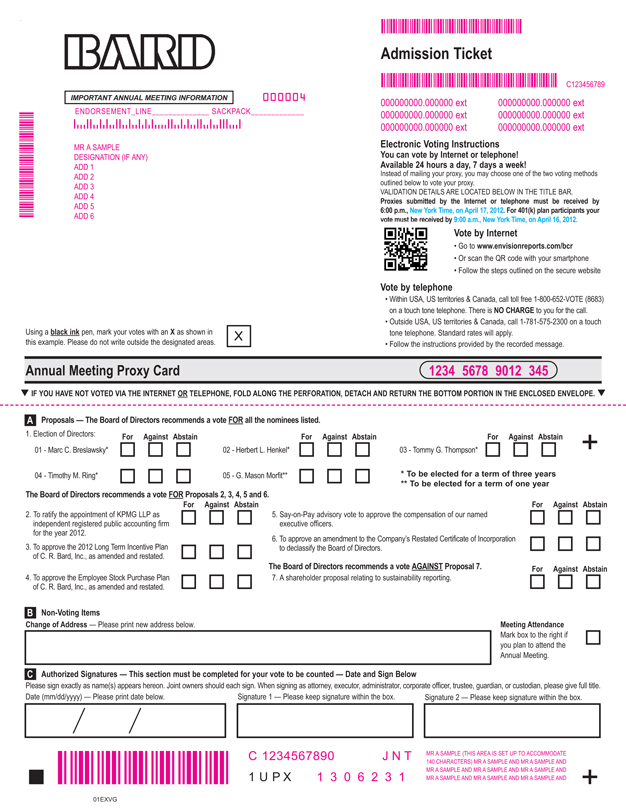

If you are a record holder, you may vote using any one of the following methods:

| • | By mail: You may vote by completing, signing and dating the enclosed proxy card and returning it in the self-addressed envelope provided. You must sign your name exactly as it appears on the proxy card. If you are signing in a representative capacity (for example, as an officer of a corporation, executor or trustee), you must indicate your name and title; |

| • | By telephone or over the Internet: Follow the telephone or Internet voting instructions on your proxy card or voting instruction form. If you vote by telephone or over the Internet, you need not return your proxy card; or |

| • | In Person: Attend the Annual Meeting to vote by ballot. |

HOW DO I HAVE MY SHARES VOTED IF THEY ARE HELD IN STREET NAME?

If your shares are held in street name, please refer to the voting instructions provided by your bank, broker or other nominee in order to have your shares voted.

If you hold your shares in street name and you wish to vote your shares in person at the Annual Meeting, you must obtain a valid proxy issued in your name from your bank, broker or other nominee.

CAN I ACCESS THE PROXY MATERIALS ON THE INTERNET INSTEAD OF RECEIVING PAPER COPIES?

This proxy statement (along with a letter and notice to shareholders), the 2011 Annual Report to Shareholders and the Form 10-K of C. R. Bard for 2011 (the “Proxy Materials”) are available for viewing at www.edocumentview.com/bcr.

If you are a record holder, you can vote this proxy on the Internet at www.envisionreports.com/bcr. You may also enroll in the electronic proxy delivery service at any time by going directly to www.computershare-na.com/green and following the instructions.

2

Table of Contents

If you hold your shares in street name, please refer to the information provided by your bank, broker or other nominee for instructions on how to elect to access future proxy materials on the Internet.

WHAT PROPOSALS WILL BE VOTED ON AT THE ANNUAL MEETING?

Record holders are entitled to vote on the following proposals:

| • | Election of four Class I director nominees for a term of three years and one Class II director nominee for a term of one year; |

| • | Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2012; |

| • | Approval of the 2012 Long Term Incentive Plan of C. R. Bard, Inc., as amended and restated (formerly the 2003 Long Term Incentive Plan of C. R. Bard, Inc., as amended and restated) (the “2012 Long Term Incentive Plan”); |

| • | Approval of the Employee Stock Purchase Plan of C. R. Bard, Inc., as amended and restated (formerly the 1998 Employee Stock Purchase Plan of C. R. Bard, Inc., as amended and restated) (the “Employee Stock Purchase Plan”); |

| • | A “Say-on-Pay” advisory vote to approve the compensation of our named executive officers; |

| • | A Management proposal to amend the Company’s Restated Certificate of Incorporation to declassify the Board of Directors; and |

| • | A shareholder proposal relating to sustainability reporting. |

If any other matters properly come before the Annual Meeting, the persons named as proxies will vote upon those matters according to their discretion.

You should specify your choices with regard to each of the proposals by telephone, over the Internet or on the enclosed proxy card or voting instruction form. The persons named as proxies will vote all properly executed proxy cards or voting instruction forms that are delivered by shareholders to us in time to be voted at the Annual Meeting (and that are not revoked as described below) in accordance with the directions noted on the proxy card or voting instruction form. In the absence of such instructions from you, the persons named as proxies will vote the shares represented by a signed and dated proxy card in the manner recommended by the Board.

WHAT ARE THE BOARD OF DIRECTORS’ VOTING RECOMMENDATIONS?

Our Board of Directors recommends that you vote your shares as follows:

| • | FOR all director nominees for election as set forth under Proposal No. 1; |

| • | FOR the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2012 as set forth under Proposal No. 2; |

| • | FOR the approval of the 2012 Long Term Incentive Plan as set forth under Proposal No. 3; |

| • | FOR the approval of the Employee Stock Purchase Plan as set forth under Proposal No. 4; |

| • | FOR the approval, on an advisory basis, of the compensation of our named executive officers, as set forth under Proposal No. 5; |

| • | FOR the amendment of the Company’s Restated Certificate of Incorporation to declassify the Board of Directors as set forth under Proposal No. 6; and |

| • | AGAINST the shareholder proposal relating to sustainability reporting as set forth under Proposal No. 7. |

3

Table of Contents

WHAT IS THE VOTING REQUIREMENT TO ELECT THE DIRECTORS AND TO APPROVE EACH OF THE PROPOSALS?

Our Restated Certificate of Incorporation provides for majority voting in uncontested elections of directors. As a result, directors must be elected by the affirmative vote of a majority of the votes cast in an uncontested election, counting as cast those shares for which votes are “Against.” A majority of the votes cast means that the number of votes cast in favor of a director nominee must exceed the number of votes cast against that director nominee. For purposes of determining the number of votes cast at the Annual Meeting, only those votes cast “For” or “Against” are included in the calculation of votes cast. In the event that an incumbent director nominee fails to receive the vote required for election to the Board of Directors, that director nominee is required to promptly tender his or her resignation pursuant to the director resignation policy adopted as part of our Corporate Governance Guidelines. See “Proposal No. 1 – Election of Directors” below for further discussion regarding such a tendered resignation.

In a contested election, which is any election in which the number of nominees exceeds the number of directors to be elected, our directors must be elected by a plurality of the votes cast.

Your bank, broker or other nominee may not vote your shares for the election of directors at the Annual Meeting, unless you inform such person how you want your shares voted. In addition, pursuant to rules passed in accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act, your bank, broker or other nominee may not vote your shares with respect to the “Say-on-Pay” advisory vote, unless you inform them how to vote.

The approval of Proposal Nos. 2, 3, 4 and 7 requires the affirmative vote of a majority of the votes cast on each proposal. For purposes of determining the number of votes cast at the Annual Meeting with respect to Proposal Nos. 2, 3, 4 and 7, only those votes cast “For” or “Against” are included in the calculation of votes cast. On Proposal No. 5, the “Say-on-Pay” advisory vote, a majority of the votes cast will reflect the advice of the shareholders. Proposal No. 6, the amendment of the Company’s Restated Certificate of Incorporation, requires the affirmative vote of seventy-five percent of the outstanding shares entitled to vote thereon.

Our transfer agent will tabulate the votes cast at the Annual Meeting. Abstentions and/or broker non-votes are counted as shares present at the Annual Meeting for purposes of determining a quorum. Abstentions and/or broker non-votes are not included in the determination of the shares voted on Proposal Nos. 1, 2, 3, 4, 5, 6 or 7.

Participants in our 401(k) plan may direct the plan trustee how to vote the shares allocated to their accounts. The 401(k) plan provides that the trustee will vote any shares for which the trustee does not receive voting instructions in the same proportion as the shares voted by the plan’s participants. To allow sufficient time for the trustee to vote your shares under your 401(k) plan, your voting instructions must be received by 9:00 a.m. New York time on April 16, 2012.

WHAT HAPPENS IF I DO NOT GIVE SPECIFIC VOTING INSTRUCTIONS?

Shareholders of Record. If you are a shareholder of record and you:

| • | Indicate when voting over the Internet or by telephone that you wish to vote as recommended by the Board; or |

| • | Sign and return a proxy card without giving specific voting instructions, |

then the persons named as proxies will vote your shares in the manner recommended by the Board on all matters presented in this proxy statement and as the persons named as proxies may determine in their discretion with respect to any other matters properly presented for a vote at the Annual Meeting.

Street Name Holders. If you hold your shares in street name (through a bank, broker or other nominee) and do not provide specific voting instructions, then, under the rules of the New York Stock Exchange, the bank, broker or other nominee may generally vote on routine matters but cannot vote on non-routine matters. If you do not provide voting instructions on non-routine matters, your shares will not be voted by your bank, broker or other nominee. This is referred to as a “broker non-vote.”

4

Table of Contents

WHICH BALLOT MEASURES ARE CONSIDERED “ROUTINE” OR “NON-ROUTINE”?

The ratification of the appointment of KPMG LLP as our independent registered public accounting firm for 2012 (Proposal No. 2) is considered a routine matter. A bank, broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal No. 2.

The election of directors (Proposal No. 1), the vote to approve the 2012 Long Term Incentive Plan (Proposal No. 3), the vote to approve the Employee Stock Purchase Plan (Proposal No. 4), the approval, on an advisory basis, of the compensation of our named executive officers (Proposal No. 5), Management’s proposal to amend the Company’s Restated Certificate of Incorporation (Proposal No. 6) and the shareholder proposal on sustainability reporting (Proposal No. 7) are matters considered non-routine. A bank, broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on Proposal Nos. 1, 3, 4, 5, 6 and 7.

HOW CAN I CHANGE MY VOTE OR REVOKE MY PROXY?

Any record holder delivering a proxy has the power to change his or her vote and/or revoke his or her proxy at any time before it is voted by:

| • | giving notice of revocation in writing to our Secretary, at C. R. Bard, Inc., 730 Central Avenue, Murray Hill, New Jersey 07974 (by mail or overnight delivery); |

| • | executing and delivering to our Secretary or our transfer agent, Computershare Trust Company, a proxy card relating to the same shares bearing a later date than the original proxy card; or |

| • | voting in person at the Annual Meeting. |

Please note, however, that under the rules of the national stock exchanges, any holder of our common stock whose shares are held in street name by a member brokerage firm may revoke his or her proxy and vote his or her shares in person at the Annual Meeting only in accordance with applicable rules and procedures of those exchanges, as employed by the street name holder’s brokerage firm. In addition, if you hold your shares in street name, you must have a valid proxy from the record holder of the shares to vote in person at the Annual Meeting.

WHAT CONSTITUTES A QUORUM?

Under New Jersey law and our by-laws, the presence in person or by proxy of the holders of a majority of the shares of our common stock issued and outstanding and entitled to vote at the Annual Meeting constitutes a quorum. On February 27, 2012, the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting, our outstanding voting securities consisted of 84,806,055 shares of common stock. Each share is entitled to one vote.

WHO CAN ATTEND THE ANNUAL MEETING?

If you are a record holder as of the record date, you may attend the Annual Meeting and must present the Admission Ticket attached to your proxy card. If you hold your shares in street name, you will need to provide proof of ownership from your bank, broker or other nominee.

HOW CAN I FIND VOTING RESULTS OF THE ANNUAL MEETING?

We will announce preliminary voting results at the Annual Meeting and file a Form 8-K with the Securities and Exchange Commission indicating final results.

HOW CAN I GET A COPY OF THE DOCUMENTS REFERRED TO IN THIS PROXY STATEMENT?

This proxy statement refers to certain documents that are available on our website located at www.crbard.com. A copy of these documents is also available, free of charge, upon written request sent to C. R. Bard, Inc., 730 Central Avenue, Murray Hill, New Jersey 07974, Attention: Secretary.

5

Table of Contents

WHO BEARS THE COST OF SOLICITING PROXIES?

We have retained Georgeson Shareholder Communications, Inc. to solicit proxies for a fee of $9,000, plus reasonable out-of-pocket expenses. Our officers and other employees may also solicit proxies. The cost of solicitation will be borne by the Company.

HOW DO I COMMUNICATE WITH OUR BOARD OF DIRECTORS?

Shareholders may communicate directly with our Board of Directors, the independent members of our Board of Directors or our Audit Committee. The process for doing so is described on our website at www.crbard.com on the “Contacts” page.

6

Table of Contents

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The table below indicates all persons who, to our knowledge, beneficially owned more than 5% of our outstanding common stock as of February 27, 2012:

| Name and Address of Beneficial Owner |

Number of

Shares of Common Stock Beneficially Owned |

Percent of Class |

||||||

| Donald A. Yacktman 6300 Bridgepoint Parkway, Bldg. 1, Suite 320 Austin, TX 78730 |

5,880,926 | (1) | 6.9 | % | ||||

| ValueAct Capital 435 Pacific Avenue, 4th Floor San Francisco, CA 94133 |

5,872,939 | (2) | 6.9 | % | ||||

| The Bank of New York Mellon Corporation One Wall Street, 31st Floor New York, New York 10286 |

5,726,218 | (3) | 6.7 | % | ||||

| The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, PA 19355 |

5,129,906 | (4) | 6.0 | % | ||||

| BlackRock, Inc. 40 East 52nd Street New York, New York 10022 |

4,428,873 | (5) | 5.2 | % | ||||

| (1) | Reflects Mr. Yacktman’s beneficial ownership of (i) 30,000 shares of common stock beneficially owned by the Yacktman Family Trust, whereby Mr. Yacktman’s wife serves as a co-trustee; (ii) 2,400 shares of common stock held by the Yacktman Family Revocable Trust, whereby Mr. Yacktman and his wife serve as co-trustees; (iii) 2,500 shares of common stock held by the Donald A. Yacktman GRAT, whereby Mr. Yacktman’s wife serves as a trustee; (iv) 4,750,000 shares of common stock beneficially owned by The Yacktman Funds, Inc., an investment company registered under the Investment Company Act of 1940; and (v) 1,096,026 shares of common stock beneficially owned by Yacktman Asset Management Co., an investment advisor registered under Section 203 of the Investment Advisors Act of 1940. Mr. Yacktman holds 100% of the outstanding shares of capital stock of Yacktman Asset Management Co. Reflects for Mr. Yacktman, sole voting power with respect to 5,875,726 shares, shared voting power with respect to 1,090,826 shares, sole dispositive power with respect to 5,875,726 shares and shared dispositive power with respect to 5,200 shares. Reflects for The Yacktman Funds, Inc. beneficial ownership of 4,750,000 shares consisting of sole voting power with respect to 4,750,000 shares, and shared voting, sole dispositive and shared dispositive power with respect to 0 shares. Reflects for Yacktman Asset Management Co. beneficial ownership of 1,096,026 shares consisting of sole voting power with respect to 1,090,826 shares, sole dispositive power with respect to 5,200 shares, and shared voting and shared dispositive power with respect to 0 shares. The foregoing information is based solely on a Schedule 13G filed by Mr. Yacktman, The Yacktman Funds, Inc. and Yacktman Asset Management Co. with the SEC on February 2, 2012 that reported beneficial ownership as of December 31, 2011. |

| (2) | Reflects shared voting and dispositive power with respect to 5,872,939 shares (and sole voting and dispositive power with respect to 0 shares) for each of (a) ValueAct Capital Master Fund, L.P. (“ValueAct Master Fund”), (b) VA Partners I, LLC (“VA Partners I”), (c) ValueAct Capital Management, L.P. (“ValueAct Management L.P.”), (d) ValueAct Capital Management, LLC (“ValueAct Management LLC”), (e) ValueAct Holdings, L.P. (“ValueAct Holdings”) and (f) ValueAct Holdings GP, LLC (“ValueAct Holdings GP”) (collectively, “ValueAct”). ValueAct Master Fund is a limited partnership organized under the laws of the British Virgin Islands. VA Partners I is a Delaware limited liability company, the principal business of which is to serve as the General Partner to ValueAct Master Fund. ValueAct Management L.P. is a Delaware limited partnership which renders management services to ValueAct Master Fund. ValueAct Management LLC is a Delaware limited liability company, the principal business of which is to serve as the General Partner to ValueAct Management L.P. ValueAct Holdings is a Delaware limited partnership and is the sole owner of the limited partnership interests of ValueAct Management L.P. and the membership interests of VA Partners I. ValueAct Holdings GP is a Delaware limited liability company, the principal business of which is to serve as the General Partner to ValueAct Holdings. Shares reported as beneficially owned by ValueAct Master Fund are also reported as beneficially owned by (i) ValueAct Management L.P. as the manager of each such investment partnership; (ii) ValueAct Management LLC, as General Partner of ValueAct Management L.P.; (iii) ValueAct Holdings, as the sole owner of the limited partnership interests of ValueAct Management L.P. and the membership interests of ValueAct Management LLC and as the majority owner of the membership interests of VA Partners I; and (iv) ValueAct Holdings GP, as General Partner of ValueAct Holdings. Shares reported as beneficially owned by ValueAct Master Fund are also reported as beneficially owned by VA Partners I, as General Partner of ValueAct Master Fund. VA Partners I, ValueAct Management L.P., ValueAct Management LLC, ValueAct Holdings and ValueAct Holdings GP also, directly or indirectly, may own interests in one or more than one of the partnerships from time to time. By reason of such relationship ValueAct Master Fund is reported as having shared power to vote or to direct the vote, and shared power to dispose or direct the disposition of, such shares of common stock, with VA Partners I (only with |

7

Table of Contents

| respect to ValueAct Master Fund), ValueAct Management L.P., ValueAct Management LLC, ValueAct Holdings and ValueAct Holdings GP. The foregoing information is based solely on Amendment No. 2 to Schedule 13D jointly filed by the ValueAct entities with the SEC on January 25, 2012 that reported beneficial ownership as of January 20, 2012. |

| (3) | Reflects the beneficial ownership of The Bank of New York Mellon Corporation and various related entities as follows: (a) for The Bank of New York Mellon Corporation reflects beneficial ownership of 5,726,218 shares consisting of sole voting power with respect to 4,707,556 shares, shared voting power with respect to 395 shares, sole dispositive power with respect to 5,533,189 shares, and shared dispositive power with respect to 10,179 shares, (b) for MBC Investments Corporation reflects beneficial ownership of 5,089,047 shares consisting of sole voting power with respect to 3,944,228 shares, sole dispositive power with respect to 5,089,047 shares, and shared voting and dispositive power with respect to 0 shares, (c) for each of Mellon International Holdings S.A.R.L. and BNY Mellon International Asset Management Group Limited reflects beneficial ownership of 4,436,097 shares consisting of sole voting power with respect to 3,571,413 shares, sole dispositive power with respect to 4,436,097 shares, and shared voting and dispositive power with respect to 0 shares, and (d) for Walter Scott & Partners Limited reflects beneficial ownership of 4,406,181 shares consisting of sole voting power with respect to 3,571,413 shares, sole dispositive power with respect to 4,406,181 shares, and shared voting and dispositive power with respect to 0 shares. The shares reported are beneficially owned by the following direct or indirect subsidiaries of The Bank of New York Mellon Corporation: The Bank of New York Mellon; BNY Mellon, National Association; BNY Mellon Trust of Delaware; The Dreyfus Corporation (parent holding company of MBSC Securities Corporation); Lockwood Advisors, Inc.; Mellon Capital Management Corporation; Newton Capital Management Limited; Walter Scott & Partners Limited; MBSC Securities Corporation; Pershing LLC; B.N.Y. Holdings (Delaware) Corporation (parent holding company of BNY Mellon Trust of Delaware); MBC Investments Corporation (parent holding company of Mellon Capital Management Corporation); Mellon International Holdings S.A.R.L. (parent holding company of BNY Mellon International Asset Management Group Limited); BNY Mellon International Asset Management Group Limited (parent holding company of Newton Management Limited; Walter Scott & Partners Limited); Newton Management Limited (parent holding company of Newton Capital Management Limited and Newton Investment Management Limited); Pershing Group LLC (parent holding company of Lockwood Advisors, Inc. and Pershing LLC); and The Bank of New York Mellon SA/NV (parent holding company of BNY Mellon Service Kapitalanlage-Gesellschaft mbH). The foregoing information is based solely on Amendment No. 2 to the Schedule 13G filed by The Bank of New York Mellon Corporation and related entities on January 30, 2012 reporting beneficial ownership as of December 31, 2011. |

| (4) | Reflects sole voting and shared dispositive power with respect to 121,303 shares, and sole dispositive power with respect to 5,008,603 shares. The foregoing information is based solely on a Schedule 13G filed by Vanguard Group Inc. with the SEC on February 8, 2012 that reported beneficial ownership as of December 31, 2011. |

| (5) | Reflects sole voting and dispositive power with respect to 4,428,873 shares, and shared voting and dispositive power with respect to 0 shares. The foregoing information is based solely on a Schedule 13G filed by BlackRock, Inc. with the SEC on February 9, 2012 that reported beneficial ownership as of December 31, 2011. |

8

Table of Contents

SECURITY OWNERSHIP OF MANAGEMENT

The table below contains information as of February 27, 2012 with respect to the beneficial ownership of our common stock by each of the following individuals, in each case, based on information provided by these individuals:

| • | directors and director nominees; |

| • | our Chief Executive Officer, Chief Financial Officer and the three other most highly compensated executive officers during the last fiscal year, whom we collectively refer to as the “named executive officers”; and |

| • | all directors and executive officers as a group. |

Unless otherwise noted in the footnotes following the table, the persons as to whom the information is given had sole voting and investment power over the shares of our common stock shown as beneficially owned.

| Shares of Common Stock Beneficially Owned |

||||||||||||

| Name |

Held as of February 27, 2012(1)(2) |

Right to Acquire Within 60 Days of February 27, 2012 Under Options |

Percent of Class |

|||||||||

| Sharon M. Alterio |

54,789 | 61,066 | * | |||||||||

| David M. Barrett |

7,441 | 800 | * | |||||||||

| Marc C. Breslawsky |

61,045 | 11,600 | * | |||||||||

| Timothy P. Collins |

55,589 | 60,036 | * | |||||||||

| Herbert L. Henkel |

31,449 | 11,600 | * | |||||||||

| John C. Kelly |

11,864 | 800 | * | |||||||||

| Theodore E. Martin |

26,886 | 0 | * | |||||||||

| G. Mason Morfit (3) |

0 | 0 | * | |||||||||

| Gail K. Naughton |

10,450 | 1,600 | * | |||||||||

| Timothy M. Ring |

275,850 | (4) | 643,401 | 1.07 | % | |||||||

| Todd C. Schermerhorn |

92,012 | 68,350 | * | |||||||||

| Tommy G. Thompson |

18,046 | 5,600 | * | |||||||||

| John H. Weiland |

200,963 | 371,241 | * | |||||||||

| Anthony Welters |

36,372 | 11,600 | * | |||||||||

| Tony L. White |

52,350 | 11,600 | * | |||||||||

| All Directors and Executive Officers as a group (22 people) |

1,173,150 | 1,556,664 | 3.2 | % | ||||||||

| * | Represents less than 1% of our outstanding common stock. |

| (1) | Includes phantom stock shares credited to the accounts of non-employee directors under our Deferred Compensation Contract, Deferral of Directors’ Fees for non-employee directors, as follows: David M. Barrett, 1,406; Marc C. Breslawsky, 27,982; Herbert L. Henkel, 13,672; John C. Kelly, 822; Theodore E. Martin, 9,732; Tommy G. Thompson, 6,044; Anthony Welters, 16,503; and Tony L. White, 19,373. See “Director Compensation – Fees and Deferred Compensation.” Also includes share equivalent units credited to the accounts of non-employee directors under the Stock Equivalent Plan for Outside Directors, as follows: David M. Barrett, 2,472; Marc C. Breslawsky, 22,300; Herbert L. Henkel, 9,964; John C. Kelly, 2,472; Theodore E. Martin, 8,218; Gail K. Naughton, 6,814; Tommy G. Thompson, 5,839; Anthony Welters, 15,106; and Tony L. White, 22,300. See “Director Compensation – Stock Equivalent Plan for Outside Directors.” Non-employee directors do not have the right to vote phantom stock shares or share equivalent units. |

| (2) | Includes restricted stock units purchased under our Management Stock Purchase Program, as follows: Sharon M. Alterio, 23,565; Timothy P. Collins, 28,305; Timothy M. Ring, 68,844; Todd C. Schermerhorn, 20,131; John H. Weiland, 62,850; and all executive officers (other than the named executive officers) as a group, 105,742. See “Executive Officer Compensation – Nonqualified Deferred Compensation – MSPP.” Participants in the Management Stock Purchase Program do not have the right to vote restricted stock units. |

| (3) | G. Mason Morfit was elected by the Board of Directors in January 2012. A total of 5,872,939 shares are owned directly by ValueAct Capital Master Fund, L.P. and may be deemed to be beneficially owned by (i) VA Partners I, LLC as General Partner of ValueAct Capital Master Fund, L.P., (ii) ValueAct Capital Management, L.P. as the manager of ValueAct Capital Master Fund, L.P., (iii) ValueAct Capital Management, LLC as General Partner of ValueAct Capital Management, L.P., (iv) ValueAct Holdings, L.P. as the |

9

Table of Contents

| sole owner of the limited partnership interests of ValueAct Capital Management, L.P. and the membership interests of ValueAct Capital Management, LLC and as the majority owner of the membership interests of VA Partners I, LLC and (v) ValueAct Holdings GP, LLC as General Partner of ValueAct Holdings, L.P. G. Mason Morfit is a member of the Management Board of ValueAct Holdings GP, LLC and disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein. See footnote 2 to “Security Ownership of Certain Beneficial Owners” above. |

| (4) | Includes 612 shares owned by family members and as to which beneficial ownership is disclaimed by Mr. Ring. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Under the federal securities laws, our directors, certain of our officers and our ten percent shareholders are required to report to the Securities and Exchange Commission, or the “SEC,” and the New York Stock Exchange, or the “NYSE,” by specific dates, transactions and holdings in our common stock. Based on our review of these reports and other information provided by those persons, we believe that during fiscal year 2011 all of these filing requirements were timely satisfied.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

There are currently twelve members on our Board of Directors, which is divided into three classes. Class I consists of Marc C. Breslawsky, Herbert L. Henkel, Timothy M. Ring and Tommy G. Thompson, whose terms expire at the Annual Meeting and who have been nominated for re-election at the Annual Meeting. Class II consists of David M. Barrett, Theodore E. Martin, Anthony Welters and Tony L. White, whose terms expire in 2013, and G. Mason Morfit who was elected by the Board of Directors in January 2012 and is being nominated for election by the shareholders at the Annual Meeting. Class III consists of John C. Kelly, Gail K. Naughton and John H. Weiland whose terms expire in 2014. Even if Proposal No. 6, to approve an amendment to the Company’s Restated Certificate of Incorporation to declassify the Board of Directors is approved by the requisite vote of shareholders, the Class I Directors will continue in office until their term expires in 2015. We have no reason to believe that any nominee will be unable to serve.

Upon election by the shareholders, directors serve for a three-year term and until their successors are elected and qualified. The five nominees must receive a majority of the votes cast to be elected. A majority of the votes cast means that the number of votes cast in favor of a director nominee must exceed the number of votes cast against that director nominee. For purposes of determining the number of votes cast at the Annual Meeting, only those votes cast “For” or “Against” are included in the calculation of votes cast.

Under New Jersey law, a director’s term extends until his or her successor is elected and qualified. This is referred to as the “director holdover rule.” As a result, an incumbent director who is not re-elected because he or she does not receive a majority of the votes cast would nonetheless continue in office because no successor has been elected. To address this situation, we adopted a policy, which is included in our Corporate Governance Guidelines, that requires any incumbent director nominee who receives less than a majority of the votes cast in an uncontested election to tender his or her resignation promptly. Our Governance Committee will consider the resignation offer and recommend to the Board of Directors whether to accept it. The Board of Directors will then act on the Governance Committee’s recommendation within 90 days following certification of the shareholders’ vote. In the event that the Board of Directors accepts the resignation, the Board of Directors may decrease the number of directors, fill the vacancy or take other appropriate action. See “Corporate Governance – The Board of Directors and Committees of the Board – Governance Committee – Director Resignation Policy.”

If the enclosed proxy card or voting instruction form is properly executed and received in time for the Annual Meeting, it is the intention of the persons named as proxies to vote the shares represented thereby for the persons nominated for election as directors, unless authority to vote shall have been withheld. If your shares are not registered in your name, please follow the directions you receive from the shareholder(s) of record (your bank, broker or other nominee), so that your shares are voted in accordance with your intent. The ability of brokers to exercise discretionary voting in uncontested director elections has been eliminated, which means that your broker may not vote your shares for the election of directors at the Annual Meeting unless you inform the

10

Table of Contents

broker how you want your shares voted. In the event that any nominee is unable to serve as a director, the accompanying proxy card will be voted for such other person or persons as may be nominated by our Board of Directors.

Set forth below are the names, principal occupations and directorships with public companies, in each case, for the past five years, ages of the directors and information relating to other positions held by them with us and other companies. Additionally, there is a brief discussion of each director’s experience, qualifications, attributes and/or skills that led to the conclusion that such person should serve as a director. There are no family relationships between or among any of the directors, executive officers and nominees for director.

11

Table of Contents

Nominees for Re-election as Class I Directors

(Terms to Expire in 2015)

|

Marc C. Breslawsky Age 69 Director since 1996 | |

| Retired Chairman and Chief Executive Officer of Imagistics International Inc. (formerly Pitney Bowes Office Systems) (document imaging solutions). Mr. Breslawsky served as Chairman and Chief Executive Officer of Imagistics International Inc. from December 2001 to December 2005, having been President and Chief Operating Officer of Pitney Bowes Inc. from 1996 to 2001, Vice Chairman from 1994 to 1996 and President of Pitney Bowes Office Systems from 1990 to 1994. He is also a director of The Brink’s Company. Mr. Breslawsky was formerly a director of Océ-USA Holding, Inc. and UIL Holdings Corporation. Mr. Breslawsky is a member of the Audit Committee, the Finance Committee, and the Science and Technology Committee.

Mr. Breslawsky has been nominated to serve an additional term as a director as a result of his significant leadership experience in management, sales, finance and accounting for public companies, including his experience as Chairman and Chief Executive Officer of Imagistics International Inc., as well as his prior service on C. R. Bard’s Board, and experience on both the executive and finance committees of other large public companies. He is a member of the American Institute of Certified Public Accountants. Mr. Breslawsky received his B.A. from New York University and is a Certified Public Accountant. | ||

|

Herbert L. Henkel Age 63 Director since 2002 | |

| Retired Chairman and Chief Executive Officer of Ingersoll-Rand Company. Mr. Henkel served as Chairman from February 2010 to June 2010, having been Chairman and Chief Executive Officer from May 2000 to February 2010, President and Chief Executive Officer from October 1999 to May 2000 and President and Chief Operating Officer from April to October 1999. Prior to that, Mr. Henkel served as President and Chief Operating Officer of Textron, Inc. from 1998 to 1999, having been President of Textron Industrial Products from 1995 to 1998. He is also a director of 3M Company and Visteon Corporation. Mr. Henkel was formerly a director of AT&T Corporation. Mr. Henkel is lead director and is also a member of the Compensation Committee, the Executive Committee, the Finance Committee and the Governance Committee.

Mr. Henkel has been nominated to serve an additional term as a director as a result of the breadth and significance of his experience in management, sales and marketing, as well as research and technical operations for global companies in a variety of industries. This experience includes his service as the Chairman and Chief Executive Officer of Ingersoll-Rand Company, a global diversified industrial company, as well as his prior service on our Board and experience on the audit, governance and nominating committees of other large public companies. He holds both a B.S. and an M.S. in engineering from Polytechnic University of New York, as well as an M.B.A. from Pace University, New York. | ||

12

Table of Contents

|

Tommy G. Thompson Age 70 Director since 2005 | |

| Former U.S. Department of Health and Human Services Secretary. Mr. Thompson served as Secretary of the U.S. Department of Health and Human Services from January 2001 to January 2005, having been Governor of Wisconsin from November 1986 to January 2001. Mr. Thompson was a partner in the Akin Gump Strauss Hauer & Feld LLP law firm from March 2005 to January 2012, and he served as Independent Chairman of the Deloitte Center for Health Solutions from March 2005 to May 2009. Mr. Thompson was Chairman of the Board of Logistics Health, Inc. from January 2011 to June 2011, having been President of Logistics Health, Inc. from February 2005 to January 2011. He is also a director of CareView Communications, Inc., Centene Corporation, Cytori Therapeutics, Inc. and United Therapeutics Corporation. Mr. Thompson was formerly a director of AGA Medical Corporation, CNS Response, Inc., PURE Bioscience, SpectraScience, Inc., VeriChip Corporation and Voyager Pharmaceutical Corporation. He is a member of the Governance Committee, the Regulatory Compliance Committee, and the Science and Technology Committee.

Mr. Thompson has been nominated to serve an additional term as a director as a result of his significant experience in the healthcare industry both as a public official and in the private sector. As Secretary of the U.S. Department of Health and Human Services, he oversaw the principal public agency for protecting the health of Americans and providing essential human services through its eleven divisions, including the U.S. Food and Drug Administration, the Office of Inspector General, the Center for Medicare and Medicaid Services, and the Center for Disease Control and Prevention. His experience also includes his prior service as Chairman of the Board and President of Logistics Health, Inc., which provides third party administrative support to public and private employers requiring occupational medical services. Mr. Thompson is a recipient of the prestigious Horatio Alger Award. He is also a member of the District of Columbia and Wisconsin bars. Mr. Thompson received both his B.S. and his J.D. from the University of Wisconsin-Madison. | ||

| Timothy M. Ring Age 54 Director since 2003 | ||

|

Chairman and Chief Executive Officer of C. R. Bard. Mr. Ring has served as Chairman and Chief Executive Officer of the Company since August 2003, having been Group President from April 1997 to August 2003, Group Vice President from December 1993 to April 1997 and Vice President-Human Resources from June 1992 to December 1993. He is also a director of Quest Diagnostics Incorporated. Mr. Ring was formerly a director of CIT Group Inc. Mr. Ring is a member of the Executive Committee.

Mr. Ring has been nominated to serve an additional term as a director due to his prior service on our Board and nearly 20 years of experience in various leadership capacities at C. R. Bard, including as the Company’s Chairman and Chief Executive Officer. He was previously responsible for the Company’s global Vascular and Specialty Access businesses. Mr. Ring has been instrumental in developing and implementing C. R. Bard’s current strategic direction. Prior to joining the Company, he gained valuable experience in leadership roles at Abbott Laboratories in both human resources and general management. Mr. Ring is a Trustee of the Foundation of The University of Medicine & Dentistry of New Jersey. He holds a B.S. in Industrial and Labor Relations from Cornell University. | |

13

Table of Contents

Nominee for Election as Class II Director

(Term to Expire in 2013)

| G. Mason Morfit Age 36 Director since 2012 | ||

|

Partner and member of the Management Committee of ValueAct Capital Management, L. P. (“ValueAct”), one of Bard’s largest shareholders. Mr. Morfit has been a partner of ValueAct since January 2003, having been an associate with ValueAct from January 2001 to December 2002. Prior to joining ValueAct, Mr. Morfit worked in equity research at Credit Suisse First Boston from September 1999 to November 2000. Mr. Morfit is also a director of Valeant Pharmaceuticals International, Inc. He was formerly a director of Advanced Medical Optics, Inc. Mr. Morfit is a member of the Audit Committee and the Finance Committee.

In January 2012, the Company entered into a Cooperation Agreement with ValueAct and Mr. Morfit pursuant to which the Company’s Board of Directors increased the size of the Board, and appointed Mr. Morfit as a director and determined to nominate him for election as a director at the 2012 Annual Meeting of Shareholders. In addition, ValueAct agreed, subject to exceptions, not to engage in certain transactions regarding the Company and its securities until a date specified in the Cooperation Agreement. If elected, Mr. Morfit will serve until the Company’s 2013 Annual Meeting of Shareholders. Mr. Morfit is qualified to serve as a director due to his experience as a seasoned investor involved in the strategic planning for other companies and his experience on the audit, governance and compensation committees of other public companies. Mr. Morfit holds a B.A. from Princeton University and is a CFA Charterholder. | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE ELECTION OF ALL DIRECTOR NOMINEES.

14

Table of Contents

| Other Directors of the Company

Class II Directors (Terms Expire in 2013) | ||

| David M. Barrett, M.D. Age 69 Director since 2009 | ||

|

Emeritus President and Chief Executive Officer of Lahey Clinic (a nonprofit, multispeciality healthcare organization). Dr. Barrett retired from his position as President and CEO of Lahey Clinic having served in this role from September 1999 to November 2010 and as a member of its Board of Trustees and Chair of the Board of Governors from September 1999 to November 2010, having been Chair of the Department of Urology of Mayo Clinic, Vice Chair of the Board of Governors, Trustee of the Mayo Foundation and a member of its Executive Committee since 1975. He is also an Adjunct Professor of Surgery at Dartmouth Medical School. Dr. Barrett is currently an Emeritus Trustee of the Lahey Clinic and the Mayo Clinic. Dr. Barrett is a member of the Audit Committee, the Regulatory Compliance Committee, and the Science and Technology Committee.

Dr. Barrett is qualified to serve as a director as a result of, among other things, the breadth of healthcare experience that he brings to C. R. Bard. As President and Chief Executive Officer of Lahey Clinic, Dr. Barrett oversaw one of the largest healthcare systems in New England. He also currently serves on the audit committee of the CommonFund, an institutional investment firm that works with the nonprofit and pension investment communities. In addition, before joining Lahey Clinic in September 1999, he had a distinguished career as a physician, teacher and administrator at Mayo Clinic. Dr. Barrett is an authority on urologic oncology, urinary incontinence, bladder reconstruction and genitourinary prostheses. Dr. Barrett received his B.A. from Albion College and his M.D. from Wayne State University School of Medicine.

| |

| Theodore E. Martin Age 72 Director since 2003 | ||

|

Retired President and Chief Executive Officer of Barnes Group Inc. Mr. Martin served as President and Chief Executive Officer of Barnes Group Inc. from 1995 through 1998, having been Group Vice President from 1990 to 1995. He is also a director of Ingersoll-Rand Company. Mr. Martin was formerly a director of Applera Corporation and Unisys Corporation. Mr. Martin is a member of the Audit Committee, the Compensation Committee, the Regulatory Compliance Committee, and the Science and Technology Committee.

Mr. Martin is qualified to serve as a director as a result of over 40 years of experience, including as a senior executive officer and a director at other large public companies, and as a member of C. R. Bard’s Board. This experience includes his service as the President and Chief Executive Officer of Barnes Group Inc., a manufacturer of precision metal parts and a distributor of industrial supplies. He holds a B.A. from Syracuse University and an M.B.A. from the University of Hawaii. | |

15

Table of Contents

| Anthony Welters Age 57 Director since 1999 | ||

|

Executive Vice President of UnitedHealth Group, Inc. (a diversified health and well-being company). Mr. Welters has served as Executive Vice President of UnitedHealth Group, Inc. since November 2006 and as a Member of the Office of the Chief Executive Officer since January 2011. He also served as President of the Public and Senior Markets Group from September 2007 to December 2010. Mr. Welters has also served as President and Chief Executive Officer of AmeriChoice Corporation, a UnitedHealth Group Company, and Chairman and Chief Executive Officer of AmeriChoice Corporation and its predecessor companies since 1989. He is also a director of West Pharmaceutical Services, Inc. Mr. Welters was formerly a director of Qwest Communications International, Inc. Mr. Welters is a member of the Compensation Committee, the Governance Committee and the Regulatory Compliance Committee.

Mr. Welters is qualified to serve as a director as a result of over 20 years of experience in the healthcare industry and his prior service on C. R. Bard’s Board. This experience includes his service as Executive Vice President of UnitedHealth Group, which designs products, provides services and applies technologies designed to improve access to health and well-being services. He is a recipient of the prestigious Horatio Alger Award and serves as a director of the Horatio Alger Association. He also serves as Chairman of the Board of Trustees for the Morehouse School of Medicine in Atlanta. Mr. Welters holds a B.A. from Manhattanville College and a J.D. from New York University School of Law. | |

| Tony L. White Age 65 Director since 1996 | ||

|

Retired Chairman, President and Chief Executive Officer of Applied Biosystems, Inc. (formerly Applera Corporation). Mr. White served as Chairman, President and Chief Executive Officer of Applied Biosystems, Inc. from September 1995 through November 2008. He is also a director of CVS Caremark Corporation and Ingersoll-Rand Company. Mr. White was formerly a director of AT&T Corporation. Mr. White is a member of the Compensation Committee, the Executive Committee and the Governance Committee.

Mr. White is qualified to serve as a director as a result of his significant experience in the life sciences industry. His experience includes his service as Chairman, President and Chief Executive Officer of Applied Biosystems, Inc., a life sciences and products company, as well as his prior service on C. R. Bard’s Board and experience on both the executive and compensation committees of other large public companies. He also held a number of management positions both in the United States and internationally during a 26-year career at Baxter International, Inc. Mr. White received his B.A. from Western Carolina University. | |

16

Table of Contents

Class III Directors

(Terms Expire in 2014)

| John C. Kelly Age 69 Director since 2009 | ||

|

Former Senior Vice President, Finance of Pfizer Inc. (pharmaceutical products). Mr. Kelly served as Senior Vice President, Finance of Pfizer Inc. from October 2009 to February 2010, having been Vice President and Controller of Wyeth (pharmaceutical and healthcare products) since March 2008. Mr. Kelly held various other positions, including Vice President, Finance Operations, since joining Wyeth in 2002. He is also a director of The Medicines Company. Mr. Kelly is a member of the Audit Committee and the Finance Committee.

Mr. Kelly is qualified to serve as a director as result of over 40 years of experience in accounting and finance, as well as his background in healthcare. Prior to joining Wyeth (and then Pfizer), where he handled a wide range of assignments in finance, he spent more than 35 years in public accounting at Arthur Andersen in various leadership capacities, including as the partner in charge of audit and business consulting practices in the New York metropolitan area. He is a certified public accountant and was an elected member of the Council of the American Institute of Certified Public Accountants. He earned both his B.S. in business administration and M.B.A. in international finance from Seton Hall University. | |

| Gail K. Naughton, Ph.D. Age 56 Director since 2004 | ||

|

Chairman and Chief Executive Officer of Histogen, Inc. (regenerative medicine). Dr. Naughton has served as the Chairman and Chief Executive Officer of Histogen, Inc. since June 2007, having been Vice Chairman of Advanced Tissue Sciences, Inc. (ATS) (human-based tissue engineering) from March 2002 to October 2002, President from August 2000 to March 2002, President and Chief Operating Officer from 1995 to 2000 and co-founder and director since inception in 1991. Dr. Naughton also served as Dean of the College of Business Administration at San Diego State University from August 2002 to June 2011. In March 2003, ATS liquidated pursuant to an order of the United States Bankruptcy Court for the Southern District of California, following the filing of a voluntary petition under Chapter 11 in October 2002. Dr. Naughton was formerly a director of Celera Corporation and SYS Technologies, Inc. Dr. Naughton is a member of the Governance Committee, the Regulatory Compliance Committee, and the Science and Technology Committee.

Dr. Naughton is qualified to serve as a director because of the breadth of her life sciences industry knowledge and experience, including her experience as Chairman and Chief Executive Officer of Histogen, Inc. Dr. Naughton was the first woman to be awarded the National Inventor of the Year award by The Intellectual Property Owners Association. She has conducted extensive research, authored numerous scientific publications and holds more than 95 U.S. and foreign patents. Dr. Naughton has also built a distinguished academic career, including serving as the Dean of the College of Business Administration, San Diego State University and on the boards of several academic institutions, non-profit organizations and foundations. Dr. Naughton earned a B.S. from St. Francis College, Brooklyn, New York, and both an M.S. in Histology and a Ph.D. in Hematology from New York University Medical Center. She also holds an M.B.A. in Executive Management from the Anderson School at the University of California, Los Angeles. | |

17

Table of Contents

| John H. Weiland Age 56 Director since 2005 | ||

|

President and Chief Operating Officer of C. R. Bard. Mr. Weiland has served as President and Chief Operating Officer of the Company since August 2003, having been Group President from April 1997 to August 2003 and Group Vice President from March 1996 to April 1997. Mr. Weiland joined C. R. Bard from Dentsply International, where he was a Senior Vice President, until March 1996. He is also a director of West Pharmaceutical Services, Inc.

Mr. Weiland is qualified to serve as a director as a result of his extensive knowledge and experience in the medical device industry, his prior service on the Board of C. R. Bard, and 16 years of experience in various leadership capacities at our company. Mr. Weiland joined C. R. Bard in 1996 as Group Vice President and was promoted to Group President in 1997, with responsibility for C. R. Bard’s Surgical, Urological and Endoscopic Technology businesses, and its worldwide manufacturing operations. He was promoted to President and Chief Operating Officer in August 2003. Mr. Weiland also held senior management positions at Dentsply International, American Hospital Supply and Baxter Healthcare. In 1987, he was named a White House Fellow and served as a Special Assistant to two members of President Reagan’s cabinet. Mr. Weiland is a 2012 recipient of the prestigious Horatio Alger Award. Mr. Weiland received a B.S. in Biology from DeSales University and an M.B.A. from New York University. | |

18

Table of Contents

The NYSE listing standards require that a majority of our Board of Directors be independent. No director qualifies as independent unless our Board affirmatively determines that the director has no material relationship with us, either directly or as a partner, shareholder or officer of an organization that has a relationship with us. In accordance with the NYSE listing standards, our Board has adopted Corporate Governance Guidelines. The Corporate Governance Guidelines are available on our website at www.crbard.com. The Corporate Governance Guidelines contain categorical standards for director independence. These standards provide that the following relationships will not be considered a material relationship that would impair a director’s independence:

| • | A director who is a director, an executive officer or an employee, or whose immediate family member is a director, an executive officer or an employee, of a company that makes payments to, or receives payments from, C. R. Bard for goods or services in an amount which, in any single fiscal year, is less than the greater of $1,000,000 or 2% of that other company’s consolidated gross revenues; or |

| • | A director who serves, or whose immediate family member serves, as an executive officer, director, trustee or employee of a charitable organization and our discretionary charitable contributions to the organization are less than the greater of $1,000,000 or 2% of that organization’s consolidated gross revenues. |

The Board of Directors has determined that all of the current members of the Board, other than Messrs. Ring and Weiland, are independent under the NYSE listing standards and satisfy our categorical standards. In making this determination, the Board considered ordinary course, arm’s-length commercial transactions with companies for which Messrs. Breslawsky, Henkel, Welters and White served as a director and/or an executive officer during 2011. In each case, the amount of the transactions with these companies was below the thresholds set forth in the NYSE listing standards and in the categorical standards in our Corporate Governance Guidelines.

In addition, in accordance with the NYSE listing standards, the Board of Directors has determined that the Audit Committee, Compensation Committee and Governance Committee are composed entirely of independent directors. The Board of Directors has also determined that each member of the Audit Committee is independent under the provisions of the Sarbanes-Oxley Act of 2002 and the rules of the SEC thereunder applicable to audit committee independence.

We have also adopted a Business Ethics Policy, which includes our Code of Ethics for Senior Financial Officers, and is available on our website at www.crbard.com.

The Board of Directors and Committees of the Board

The Board of Directors held six meetings in 2011. During 2011, each director attended more than 75% of all meetings of the Board of Directors and Committees on which he or she served.

Director Attendance at Annual Meetings

We encourage all of the directors to attend the annual meeting of shareholders. To that end, and to the extent reasonably practicable, we regularly schedule a meeting of the Board of Directors on the same day as the annual meeting of shareholders. Each member of the Board of Directors attended the 2011 Annual Meeting of Shareholders.

Board Committees

The Board of Directors had the following standing committees in 2011: an Audit Committee, a Compensation Committee, a Governance Committee, a Regulatory Compliance Committee, a Science and Technology Committee, a Finance Committee and an Executive Committee.

19

Table of Contents

The following table names the directors and identifies the Committees on which they presently serve:

| Director | Audit | Compensation | Finance | Governance | Regulatory Compliance |

Science & Technology |

Executive | |||||||

| David M. Barrett |

X | X | X | |||||||||||

| Marc C. Breslawsky |

X | C | X | |||||||||||

| Herbert L. Henkel |

X | X | C | X | ||||||||||

| John C. Kelly |

C | X | ||||||||||||

| Theodore E. Martin |

X | X | X | C | ||||||||||

| G. Mason Morfit |

X | X | ||||||||||||

| Gail K. Naughton, Ph. D. |

X | X | X | |||||||||||

| Timothy M. Ring |

C | |||||||||||||

| Tommy G. Thompson |

X | X | X | |||||||||||

| John H. Weiland |

||||||||||||||

| Anthony Welters |

X | X | C | |||||||||||

| Tony L. White |

C | X | X |

“C” indicates Committee Chair.

Audit Committee

The Audit Committee met six times during 2011. As chair of the Audit Committee in 2011, Mr. Kelly also conducted several interim meetings with management to review our quarterly earnings press releases and filings relating to certain of our benefit plans. The Board of Directors has determined that each of the members of the Audit Committee (other than Mr. Morfit) is an “audit committee financial expert” as defined by the rules and regulations adopted by the SEC. The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). The Audit Committee operates under a written charter that is available on our website at www.crbard.com.

The principal functions of the Audit Committee are to:

| • | appoint, determine the compensation of, terminate and oversee the work of our independent registered public accounting firm; |

| • | approve in advance all audit and non-audit services provided by our independent registered public accounting firm; |

| • | review with management and our independent registered public accounting firm, prior to public dissemination, our earnings press releases and annual and quarterly financial statements, including disclosure contained in Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | review, in consultation with our independent registered public accounting firm, management and our internal auditors, our financial reporting processes, including internal controls; |

| • | produce a report for inclusion in the annual proxy statement in accordance with applicable rules and regulations; and |

| • | report regularly to the full Board of Directors, including with respect to any issues that arise regarding the quality or integrity of our financial statements, the performance and independence of our independent registered public accounting firm or the performance of our internal audit function. |

Compensation Committee

The Compensation Committee met seven times during 2011. Each member of the Compensation Committee must be determined by the Board of Directors to be an independent, non-employee and outside director under the rules of the NYSE and Rule 16b-3 under the Exchange Act and Section 162(m) of the Internal Revenue Code,

20

Table of Contents

respectively. In 2011, the Board of Directors determined that all members of the Compensation Committee met these requirements. Except for the standard compensation received in connection with service on the Board of Directors and its committees, the members of the Compensation Committee are not eligible to participate in any of our compensation plans or programs that they administer. The Compensation Committee operates under a written charter that is available on our website at www.crbard.com.

The principal functions of the Compensation Committee are to:

| • | establish and review our overall compensation philosophy; |

| • | review and approve corporate goals and objectives relevant to the CEO’s and other executive officers’ compensation; |

| • | evaluate the performance of the CEO and, with the assistance of the CEO, the performance of our other executive officers, and determine and approve the annual salary, bonus, equity-based incentives and other benefits and perquisites of the CEO and our other executive officers; |

| • | periodically review compensation programs and policies; |

| • | review, monitor and approve equity-based compensation plans; |

| • | produce a report for inclusion in the annual proxy statement in accordance with applicable rules and regulations; and |

| • | report regularly to the full Board of Directors on compensation matters. |

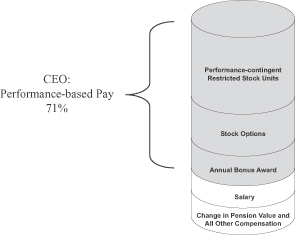

Executive Officer Compensation Process

The Compensation Committee generally fulfills certain of its key responsibilities at periodic meetings throughout the year. At its February meeting, the Committee typically approves the amount of the annual incentive bonus awards, if any, for the prior plan year under our Executive Bonus Plan, evaluates the CEO’s performance for the past year and establishes his goals for the current year, approves increases to base salaries for senior executives for the current year and establishes the performance targets for the current plan year under our Executive Bonus Plan. At its December meeting, the Committee approves annual equity awards under our 2003 Long Term Incentive Plan and reviews the budget for merit-based increases in base salaries that are made early in the following year.

The Compensation Committee has the authority to select and/or retain compensation consultants to assist in the evaluation of executive compensation. To obtain access to independent compensation data, analysis and advice, an independent compensation consultant, Pearl Meyer & Partners, was retained in 2011 by the Compensation Committee. A representative of the consultant attends Compensation Committee meetings as necessary. The principal projects assigned to the consultant include evaluation of the composition of the peer group of companies, evaluation of levels of executive compensation and perquisites as compared to general market compensation data and the peer companies’ compensation data, and evaluation of proposed compensation programs or changes to existing programs. Pearl Meyer & Partners does not provide any other services to the Company and works with the Company’s management only on matters for which the Compensation Committee is responsible.

In making its executive compensation decisions, the Compensation Committee also receives recommendations from the CEO for all executive officers other than himself, as discussed in more detail in the Compensation Discussion and Analysis below. The CEO considers the compensation consultant’s reports in order to make base salary, annual bonus target and long-term incentive recommendations for the other named executive officers. He also regularly attends Compensation Committee meetings, although he is not present when the Committee discusses his compensation.

Although the Compensation Committee believes that input from the consultant and management provides it with a useful perspective, the Committee makes the final decisions as to the compensation programs and levels

21

Table of Contents

for all executive officers. The Compensation Committee has authority under its charter to delegate its responsibilities to a subcommittee of the Committee, but did not do so in 2011.

Compensation Committee Interlocks and Insider Participation

None of the directors on the Compensation Committee is or was formerly an officer or employee of C. R. Bard or had any relationship or related person transaction requiring disclosure under the rules of the SEC. None of our executive officers serves as a member of the board of directors or compensation committee of any entity that has one or more of its executive officers serving as a member of our Compensation Committee. In addition, none of our executive officers serves as a member of the compensation committee of any entity that has one or more of its executive officers serving as a member of our Board of Directors.

Governance Committee

The Governance Committee met five times during 2011. The Governance Committee operates under a written charter that is available on our website at www.crbard.com.

The principal functions of the Governance Committee, which also performs the nominating committee role, are to:

| • | identify individuals qualified to become directors and select, or recommend that the Board of Directors select, the candidates for director to be elected by the Board or by the shareholders at an annual or special meeting; |

| • | advise and make recommendations to the Board on all matters concerning Board procedures and directorship practices; |

| • | take a leadership role in shaping our corporate governance; and |

| • | consider and make recommendations to the Board of Directors regarding directors’ compensation and benefits. |

Director Nomination Process

In considering possible candidates for director, the Governance Committee takes into account all factors it considers appropriate, which may include strength of character, mature judgment, career specialization, relevant technical skills, diversity and the extent to which the candidate would fill a present need on the Board of Directors. In addition, the Governance Committee seeks candidates who contribute knowledge, experience and skills in at least one of the following core competencies in order to promote a Board that, as a whole, possesses a good balance in these core competencies: accounting and finance, business judgment, management, industry knowledge, international markets, leadership and strategy/vision. In considering candidates for the Board, the Governance Committee considers the entirety of each candidate’s credentials and believes that, at a minimum, each nominee should satisfy the following criteria: highest character and integrity; experience and understanding of strategy and policy-setting; reputation for working constructively with others; sufficient time to devote to our Board matters; and no conflict of interest that would interfere with performance as a director. The Governance Committee also takes into account the core competencies of incumbent directors with a particular focus on their individual professional backgrounds, with the goal of ensuring diversity in the skill sets and applicable professional experience of directors, while promoting balanced perspectives of the Board as a whole.

In the case of incumbent directors whose terms of office are set to expire, the Governance Committee considers these directors’ overall service to us during their term, including attendance at meetings, level of participation and quality of performance. In the case of new director candidates, the Governance Committee compiles a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm to assist in identifying potential candidates. The Governance Committee then meets to discuss and consider candidates’ qualifications and independence and solicits input from other directors. One or more of the directors will discuss the position with those prospective candidates who appear likely to be able to fill a significant need

22

Table of Contents

of the Board of Directors and satisfy the criteria described above. If there appears to be sufficient interest, an in-person meeting will be arranged. If the Governance Committee, based on the results of these contacts, believes it has identified a viable candidate, it will discuss the matter with the full Board of Directors.

Shareholders may recommend director candidates for consideration by the Governance Committee. Recommendations should be sent to C. R. Bard, Inc., 730 Central Avenue, Murray Hill, New Jersey 07974, Attention: Secretary. The Governance Committee will evaluate shareholder-recommended director candidates in the same manner as it evaluates director candidates identified by other means. The shareholder making the recommendation should provide to the Governance Committee his or her name and address, that shareholder’s ownership of our common stock, a brief biography of the candidate, the candidate’s share ownership and any other information requested by the Governance Committee. See “Proposals of Shareholders” below for the notice and deadline requirements for shareholder recommendations.

Director Resignation Policy