UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number

(Exact name of Registrant as specified in its charter)

(State or other jurisdiction of | (IRS Employer Identification No.) | |

incorporation or organization) |

(Address of principal executive offices) (Zip Code)

Registrant’s Telephone Number: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol | Name of each exchange |

Securities registered pursuant to Section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit).

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ | Non-accelerated filer ☐ | Smaller reporting company | Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

As of February 21, 2020, there were outstanding

As of June 30, 2019 the aggregate market value of the Common Stock (based upon the closing price of the stock on the New York Stock Exchange on such date) held by non-affiliates was approximately $

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Company’s Definitive Proxy Statement for the Company’s Annual Meeting of Shareholders (the “2020 Proxy Statement”) scheduled to be held on May 4, 2020 are incorporated by reference in Part III of this report.

TABLE OF CONTENTS

2

Forward-Looking Information

From time to time, in the Company’s statements and written reports, including this report, the Company discusses its expectations regarding future performance by making certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by the use of words such as “anticipate,” “believe,” “expect,” “intend,” “estimate,” “project,” and other words of similar meaning in connection with a discussion of future operating or financial performance and are subject to certain factors, risks, trends and uncertainties that could cause actual results and achievements to differ materially from those expressed in the forward-looking statements. These forward-looking statements are based on currently available competitive, financial and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and actual results may differ materially from those expressed or implied herein. Consequently, the Company wishes to caution readers not to place undue reliance on any forward-looking statements. Factors, among others, which could cause the Company’s future results to differ materially from the forward-looking statements, expectations and assumptions expressed or implied herein include general factors, such as economic conditions, political developments, currency exchange rates, interest and inflation rates, accounting standards, taxes, and laws and regulations affecting the Company in markets where it competes and those factors described in Item 1A “Risk Factors” and elsewhere in this Form 10-K and in other Company filings with the Securities and Exchange Commission. The Company does not undertake to update any of these forward-looking statements.

PART I

ITEM 1. Business.

Tootsie Roll Industries, Inc. and its consolidated subsidiaries (the “Company”) have been engaged in the manufacture and sale of confectionery products for over 100 years. This is the only industry segment in which the Company operates and is its only line of business. The majority of the Company’s products are sold under the registered trademarks TOOTSIE ROLL, TOOTSIE POPS, CHILD’S PLAY, CARAMEL APPLE POPS, CHARMS, BLOW-POP, CHARMS MINI POPS, CELLA’S, DOTS, JUNIOR MINTS, CHARLESTON CHEW, SUGAR DADDY, SUGAR BABIES, ANDES, FLUFFY STUFF, DUBBLE BUBBLE, RAZZLES, CRY BABY, NIK-L-NIP, and TUTSI POP (Mexico).

The Company’s products are marketed in a variety of packages designed to be suitable for display and sale in different types of retail outlets. They are sold through approximately 30 candy and grocery brokers and by the Company itself to approximately 2,000 customers throughout the United States. These customers include wholesale distributors of candy and groceries, supermarkets, variety stores, dollar stores, chain grocers, drug chains, discount chains, cooperative grocery associations, mass merchandisers, warehouse and membership club stores, vending machine operators, the U.S. military and fund-raising charitable organizations.

The Company’s principal markets are in the United States, Canada and Mexico. The majority of production from the Company’s Canadian plants is sold in the United States. The majority of production from the Company’s Mexican plant is sold in Mexico.

The domestic confectionery business is highly competitive. The Company competes primarily with other manufacturers of confectionery products sold to the above mentioned customers. Although accurate statistics are not available, the Company believes it is among the ten largest domestic manufacturers in this field. In the markets in which the Company competes, the main forms of competition comprise brand recognition, as well as competition for retail shelf space and a fair price for the Company’s products at various retail price points.

The Company did not have a material backlog of firm orders at the end of the calendar years 2019 or 2018.

The Company has historically hedged certain of its future sugar and corn syrup needs with derivatives at such times that it believes that the forward markets are favorable. The Company’s decision to hedge its major ingredient requirements is dependent on the Company’s evaluation of forward commodity markets and their comparison

3

to vendor quotations, if available, and/or historical costs. The Company has historically hedged some of these major ingredients with derivatives, primarily commodity futures contracts, before the commencement of the next calendar year to better ascertain the need for product pricing changes or product weight decline (indirect price change) adjustments to its product sales portfolio and better manage ingredient costs. The Company will generally purchase forward derivative contracts (i.e., “long” position) in selected future months that correspond to the Company’s estimated procurement and usage needs of the respective commodity in the respective forward periods.

From time to time, the Company also changes the size and weight of certain of its products in response to significant changes in ingredient and other input costs.

The Company does not hold any material patents, licenses, franchises or concessions. The Company’s major trademarks are registered in the United States, Canada, Mexico and in many other countries. Continued trademark protection is of material importance to the Company’s business as a whole.

Although the Company does research and develops new products and product line extensions for existing brands, it also improves the quality of existing products, improves and modernizes production processes, and develops and implements new technologies to enhance the quality and reduce the costs of products. The Company does not expend material amounts of money on research or development activities.

The manufacture and sale of consumer food products is highly regulated. In the United States, the Company’s activities are subject to regulation by various government agencies, including the Food and Drug Administration, the Department of Agriculture, the Federal Trade Commission, the Department of Commerce and the Environmental Protection Agency, as well as various state and local agencies. Similar agencies also regulate the businesses outside of the United States. The Company maintains quality assurance, food safety and other programs to help ensure that all products the Company manufactures and distributes are safe and of high quality and comply with all applicable laws and regulations.

The Company’s compliance with federal, state and local regulations which have been enacted or adopted regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had a material effect on the capital expenditures, earnings or competitive position of the Company nor does the Company anticipate any such material effects from presently enacted or adopted regulations.

The Company employs approximately 2,000 persons.

The Company has found that its sales normally maintain a consistent level throughout the year except for a substantial increase in the third quarter which reflects pre-Halloween and back-to-school sales. In anticipation of this high sales period, the Company generally begins building inventories in the second quarter of each year. The Company historically offers extended credit terms for sales made under seasonal sales programs, including Halloween. Each year, after accounts receivables related to third quarter sales have been collected, the Company invests such funds in various marketable securities.

Sales revenues from Wal-Mart Stores, Inc. aggregated approximately 24.2%, 24.1%, and 24.0% of net product sales during the years ended December 31, 2019, 2018 and 2017, respectively. Sales revenues from Dollar Tree, Inc. (which includes Family Dollar which was acquired by Dollar Tree) aggregated approximately 11.3%, 11.2%, and 10.9% of net product sales during the years ended December 31, 2019, 2018 and 2017, respectively. Some of the aforementioned sales to Wal-Mart and Dollar Tree are sold to McLane Company, a large national grocery wholesaler, which services and delivers certain of the Company’s products to Wal-Mart, Dollar Tree and other retailers in the U.S.A. Net product sales revenues from McLane, which includes these Wal-Mart and Dollar Tree sales as well as sales and deliveries to other Company customers, were 17.7% in 2019 and 17.4% in 2018 and 16.9% in 2017. At December 31, 2019 and 2018, the Company’s three largest customers discussed above accounted for approximately 30% and 31% of total accounts receivable, respectively. Although no customer, other than McLane Company, Inc., Wal-Mart Stores, Inc. and Dollar Tree, accounted for more than 10% of net product sales, the loss of one or more significant customers could have a material adverse effect on the Company’s business.

4

For a summary of sales and long-lived assets of the Company by geographic area see Note 9 of the “Notes to Consolidated Financial Statements” which is incorporated herein by reference.

Information regarding the Company’s Form 10-K, Form 10-Q, current reports on Form 8-K, and any amendments to these reports, will be made available, free of charge, upon written request to Tootsie Roll Industries, Inc., 7401 South Cicero Avenue, Chicago, Illinois 60629, Attention: Barry Bowen, Treasurer and Assistant Secretary. The Company does not make all such reports available on its website at www.tootsie.com because it believes that they are readily available from the Securities Exchange Commission at www.sec.gov, and because the Company provides them free of charge upon request. Interested parties, including shareholders, may communicate to the Board of Directors or any individual director in writing, by regular mail, addressed to the Board of Directors or an individual director, in care of Tootsie Roll Industries, Inc., 7401 South Cicero Avenue, Chicago, Illinois 60629, Attention: Ellen R. Gordon, Chairman and Chief Executive Officer. If an interested party wishes to communicate directly with the Company’s non-employee directors, it should be noted on the cover of the communication.

ITEM 1A. Risk Factors.

Significant factors that could impact the Company’s financial condition or results of operations include, without limitation, the following:

| ● | Risk of changes in the price and availability of raw materials - The principal ingredients used by the Company are subject to price volatility. Although the Company engages in commodity hedging transactions and annual supply agreements as well as leveraging the high volume of its annual purchases, the Company may experience price increases in certain ingredients that it may not be able to offset, which could have an adverse impact on the Company’s results of operations and financial condition. In addition, although the Company has historically been able to procure sufficient supplies of its ingredients, market conditions could change such that adequate supplies might not be available or only become available at substantially higher costs. Adverse weather patterns, including the effects of climate change or supply interruptions, could also significantly affect the cost and availability of ingredients. |

| ● | Risk of changes in product performance and competition - The Company competes with other well-established manufacturers of confectionery products. A failure of new or existing products to be favorably received, a failure to retain preferred shelf space at retail or a failure to sufficiently counter aggressive promotional and price competition could have an adverse impact on the Company’s results of operations and financial condition. |

| ● | Risk of discounting and other competitive actions - Discounting and pricing pressure by the Company’s retail customers, including the effects of import tariffs, and other competitive actions could make it more difficult for the Company to maintain its operating margins. Actions taken by major customers and competitors may make shelf space less available for the confectionery product category or some of the Company’s products. |

| ● | Risk of pricing actions - Inherent risks in the marketplace, including uncertainties about trade and consumer acceptance of pricing actions, including related trade discounts, or product weight changes (indirect price increases), could make it more difficult for the Company to maintain its sales and operating margins. |

| ● | Risk related to seasonality of sales - The Company’s sales are highest during the Halloween season. Circumstances surrounding Halloween, such as, widespread adverse weather or other widespread events that affect consumer behavior and related media coverage at that time of year or general changes in consumer interest in Halloween, could significantly affect the Company’s sales. |

| ● |

| ● | Risk of dependence on large customers - The Company’s largest customers, Wal-Mart Stores, Inc., Dollar Tree, and the McLane Company accounted for approximately 37.1% of net product sales in 2019, and other large national chains are also material to the Company’s sales. The loss of any of these customers, or one or more other large customers, or a material decrease in purchases by one or more large customers, could result in decreased sales and adversely impact the Company’s results of operations and financial condition. |

5

| ● | Risk of changes in consumer preferences and tastes - Failure to adequately anticipate and react to changing demographics, consumer trends, consumer health concerns and product preferences, including product ingredients, could have an adverse impact on the Company’s results of operations and financial condition. |

| ● | Risk of economic conditions on consumer purchases - The Company’s sales are impacted by consumer spending levels and impulse purchases which are affected by general macroeconomic conditions, consumer confidence, employment levels, disposable income, availability of consumer credit and interest rates on that credit, consumer debt levels, energy costs and other factors. Volatility in food and energy costs, rising unemployment and/or underemployment, declines in personal spending, recessionary economic conditions or other adverse market conditions, could adversely impact the Company’s revenues, profitability and financial condition. |

| ● | Risks related to environmental matters - The Company’s operations are not particularly impactful on the environment, but, increased government environmental regulation or legislation, including various “green” initiatives could adversely impact the Company’s profitability. |

| ● | Risks relating to participation in the multi-employer pension plan for certain Company union employees - As outlined in the Notes to the Consolidated Financial Statements and discussed in the Management’s Discussion and Analysis , the Company participates in a multi-employer pension plan (Plan) which is currently in “critical and declining status”, as defined by applicable law. A designation of “critical and declining status” implies that the Plan is expected to become insolvent within the next 20 years. Under terms of a rehabilitation plan, the Company is to be assessed 5% annual compounded surcharges on its contributions to the Plan until such time as the Plan emerges from critical status. Should the Company withdraw from the Plan, it would be subject to a significant withdrawal liability which is discussed in Note 7 of the Company’s Notes to Consolidated Financial Statements and Management’s Discussion and Analysis. The Company is currently unable to determine the ultimate outcome of this matter and therefore, is unable to determine the effects on its consolidated financial statements, but, the ultimate outcome could be material to its consolidated results of operations in one or more future periods. |

| ● | Risk of new governmental laws and regulations - Governmental laws and regulations, including those that affect food advertising and marketing to children, use of certain ingredients in products, new labeling requirements, income and other taxes and tariffs, including the effects of changes to international trade agreements, new taxes targeted toward confectionery products and the environment, both in and outside the U.S.A., are subject to change over time, which could adversely impact the Company’s results of operations and ability to compete in domestic or foreign marketplaces. |

| ● | Risk of labor stoppages - To the extent the Company experiences any significant labor stoppages, strikes or possible labor shortages, could negatively affect overall operations including production or shipments of finished product to customers. The Company’s union labor agreement at its Chicago plant was executed in 2018 and will continue through September 2022. |

| ● | Risk of impairment of goodwill or indefinite-lived intangible assets - In accordance with authoritative guidance, goodwill and indefinite-lived intangible assets are not amortized but are subject to an impairment evaluation annually or more frequently upon the occurrence of a triggering event. Other long-lived assets are likewise tested for impairment upon the occurrence of a triggering event. Such evaluations are based on assumptions and variables including sales growth, profit margins and discount rates. Adverse changes in any of these variables could affect the carrying value of these intangible assets and the Company’s reported profitability. |

| ● | Risk of the cost of energy increasing - Higher energy costs would likely result in higher plant overhead, distribution, freight and delivery, and other operating costs. The Company may not be able to offset these cost increases or pass such cost increases onto customers in the form of price increases, which could have an adverse impact on the Company’s results of operations and financial condition. |

6

| ● | Risk of a product recall - Issues related to the quality and safety of the Company’s products could result in a voluntary or involuntary large-scale product recall. Costs associated with a product recall and related litigation or fines, and marketing costs relating to the re-launch of such products or brands, could negatively affect operating results. In addition, negative publicity associated with this type of event, including a product recall relating to product contamination or product tampering, whether valid or not, could negatively impact future demand for the Company’s products. |

| ● | Risk of operational interruptions relating to computer software or hardware failures, including cyber-attacks - The Company is reliant on computer systems to operate its business and supply chain. Software failure or corruption, including cyber-based attacks or network security breaches, or catastrophic hardware failures or other disasters could disrupt communications, supply chain planning and activities relating to sales demand forecasts, materials procurement, production and inventory planning, customer shipments, and financial and accounting, all of which could negatively impact sales and profits. |

| ● | Risk of releasing sensitive information - Although the Company does not believe that it maintains a large amount of sensitive data, a system breach, whether inadvertent or perpetrated by hackers, could result in identity theft, ransomware and/or a disruption in operations which could expose the Company to financial costs and adversely affect profitability. |

| ● | Risk of production interruptions - The majority of the Company’s products are manufactured in a single production facility on specialized equipment. In the event of a disaster, such as a fire or earthquake, at a specific plant location, it would be difficult to transfer production to other facilities or a new location in a timely manner, which could result in loss of market share for the affected products. In addition, from time to time, the Company upgrades or replaces this specialized equipment. In many cases these are integrated and complex installations. A failure or delay in implementing such an installation could impact the availability of one or more of the Company’s products which would have an adverse impact on sales and profits. |

| ● | Risk related to international operations - To the extent there are political leadership or legislative changes, social and/or political unrest, civil war, pandemics such as the Coronavirus, terrorism or significant economic or social instability in the countries in which the Company operates, the results of the Company’s business in such countries could be adversely impacted. Currency exchange rate fluctuations between the U.S. dollar and foreign currencies could also have an adverse impact on the Company’s results of operations and financial condition. The Company’s principal markets are the U.S.A., Canada, and Mexico. |

| ● | Risk related to investments in marketable securities - The Company invests its surplus cash in a diversified portfolio of highly rated marketable securities, including corporate and tax exempt municipal bonds, with maturities of generally up to three years, and variable rate demand notes with weekly resets of interest rates and “puts’ to redeem the investment each week. Nonetheless, such investments could become impaired in the event of certain adverse economic and/or geopolitical events which, if severe, would adversely affect the Company’s financial condition. |

| ● | Disruption to the Company’s supply chain could impair the Company’s ability to produce or deliver its finished products, resulting in a negative impact on operating results - Disruption to the manufacturing operations or supply chain, some of which are discussed above, could result from, but are not limited to adverse tariffs which could effectively limit supply or make supply more costly, natural disasters, pandemics, weather, fire or explosion, earthquakes, terrorism or other acts of violence, unavailability of ingredients or packaging materials, labor strikes or other labor activities, operational and/or financial instability of key suppliers, and other vendors or service providers. Although precautions are taken to mitigate the impact of possible disruptions, if the Company is unable, or if it is not financially feasible to effectively mitigate the likelihood or potential impact of such disruptive events, the Company’s results of operations and financial condition could be negatively impacted. |

| ● | Risk related to acquisitions - From time to time, the Company has purchased other confectionery companies or brands. These acquisitions generally come at a high multiple of earnings and are justified based on various |

7

| assumptions related to sales growth, and operating margins. Were the Company to make another acquisition and be unable to achieve the assumed sales and operating margins, it could have an adverse impact on future sales and profits. In addition it could become necessary to record an impairment which would have a further adverse impact on reported profits. |

| ● | Risk of further losses in Spain - The Company has restructured its Spanish subsidiary and is exploring a variety of programs to increase sales and profitability. These efforts thus far are resulting in reductions in operating losses, and our efforts are continuing. Nonetheless, if our efforts are not successful, additional losses and impairments may be reported from in the future. See also Management’s Discussion and Analysis. |

| ● | Risk of “slack fill” litigation - The Company, as well as other confectionery and food companies, have experienced a number of plaintiff claims that certain products are sold in boxes that are not completely full, and therefore such “slack filled” products are misleading, and even deceptive, to the consumer. Although the Company believes that these claims are without merit and has generally been successful in litigation and court decrees, the Company could be exposed to significant legal fees to defend its position, and in the event that it is not successful, could be subject to fines and costs of settlement, including class action settlements. |

| ● | The Company is a controlled company due to the common stock holdings of the Gordon family - The Gordon family’s share ownership represents a majority of the combined voting power of all classes of the Company’s common stock as of December 31, 2019. As a result, the Gordon family has the power to elect the Company’s directors and approve actions requiring the approval of the shareholders of the Company. |

The factors identified above are believed to be significant factors, but not necessarily all of the significant factors, that could impact the Company’s business. Unpredictable or unknown factors could also have material effects on the Company.

Additional significant factors that may affect the Company’s operations, performance and business results include the risks and uncertainties listed from time to time in filings with the Securities and Exchange Commission and the risk factors or uncertainties listed herein or listed in any document incorporated by reference herein.

ITEM 1B. Unresolved Staff Comments.

None.

8

ITEM 2. Properties.

The Company owns its principal manufacturing, warehousing and distribution and offices facilities which are located in Chicago, Illinois in a building consisting of approximately 2,354,000 square feet. In addition, the Company leases manufacturing and warehousing facilities at a second location in Chicago which comprises 137,000 square feet. The lease is renewable by the Company every five years through June 2041.

The Company’s other principal manufacturing, warehousing and distribution facilities, all of which are owned, are:

Location |

| Square Feet (a) |

|

Covington, Tennessee |

| 685,000 | |

Cambridge, Massachusetts |

| 142,000 | |

Delavan, Wisconsin |

| 162,000 | |

Concord, Ontario, Canada |

| 280,500 | (b) |

Hazleton, Pennsylvania |

| 240,000 | (c) |

Mexico City, Mexico |

| 90,000 | |

Barcelona, Spain | 93,000 | (d) |

The Company owns substantially all of the production machinery and equipment located in its plants, warehouses and distribution centers. The Company also holds four commercial real estate properties for investment which were acquired with the proceeds from a sale of surplus real estate in 2005.

ITEM 3. Legal Proceedings.

In the ordinary course of business, the Company is, from time to time, subject to a variety of active or threatened legal proceedings and claims. While it is not possible to predict the outcome of such matters with certainty, in the Company’s opinion, both individually and in the aggregate, they are not expected to have a material effect on the Company’s financial condition, results of operations or cash flows.

ADDITIONAL ITEM. Executive Officers of the Registrant.

See the information on Executive Officers set forth in the table in Part III, Item 10.

ITEM 4. Mine Safety Disclosures.

None.

9

PART II

ITEM 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Company’s common stock is traded on the New York Stock Exchange. The Company’s Class B common stock is subject to restrictions on transferability. The Class B common stock is convertible at the option of the holder into shares of common stock on a share-for-share basis. As of February 28, 2020 there were approximately 2,500 and 1,000 registered holders of record of common and Class B common stock, respectively. In addition, the Company estimates that as of February 28, 2020 there were 17,500 and 1,000 beneficial holders of common and Class B common stock, respectively.

The following table sets forth information about the shares of its common stock the Company purchased on the open market during the fiscal quarter ended December 31, 2019:

Issuer Purchases of Equity Securities

|

|

|

|

| Total Number of |

| Maximum Number (or |

| ||

Total | Average | Shares Purchased | Approximate Dollar Value) |

| ||||||

Number | Price | as Part of Publicly | of Shares that May Yet |

| ||||||

of Shares | Paid per | Announced Plans | be Purchased Under the |

| ||||||

Period | Purchased | Share | or Programs | Plans or Programs |

| |||||

Oct 1 to Oct 31 |

| 118,083 | $ | 35.52 |

| Not Applicable |

| Not Applicable | ||

Nov 1 to Nov 30 |

| 78,404 |

| 34.19 |

| Not Applicable |

| Not Applicable | ||

Dec 1 to Dec 31 |

| — |

| — |

| Not Applicable |

| Not Applicable | ||

Total |

| 196,487 | $ | 34.99 | ||||||

While the Company does not have a formal or publicly announced Company common stock purchase program, the Company repurchases its common stock on the open market from time to time as authorized by the Board of Directors.

Quarterly Stock Prices and Dividends

The high and low quarterly prices for the Company’s common stock, as reported on the New York Stock Exchange and quarterly dividends in 2019 and 2018 were:

2019 | 2018 | |||||||||||||||||||||||

4th | 3rd | 2nd | 1st | 4th | 3rd | 2nd | 1st | |||||||||||||||||

| Quarter |

| Quarter |

| Quarter |

| Quarter |

| Quarter |

| Quarter |

| Quarter |

| Quarter | |||||||||

High | $ | 36.93 | $ | 38.44 | $ | 40.43 | $ | 37.80 | $ | 35.71 | $ | 32.35 | $ | 31.45 | $ | 36.20 | ||||||||

Low | 33.33 | 35.24 | 36.48 | 31.57 | 28.41 | 28.55 | 27.75 | 28.75 | ||||||||||||||||

Dividends per share | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | 0.09 | ||||||||||||||||

NOTE: In addition to the above cash dividends, a 3% stock dividend was issued on April 5, 2019 and April 6, 2018.

10

Performance Graph

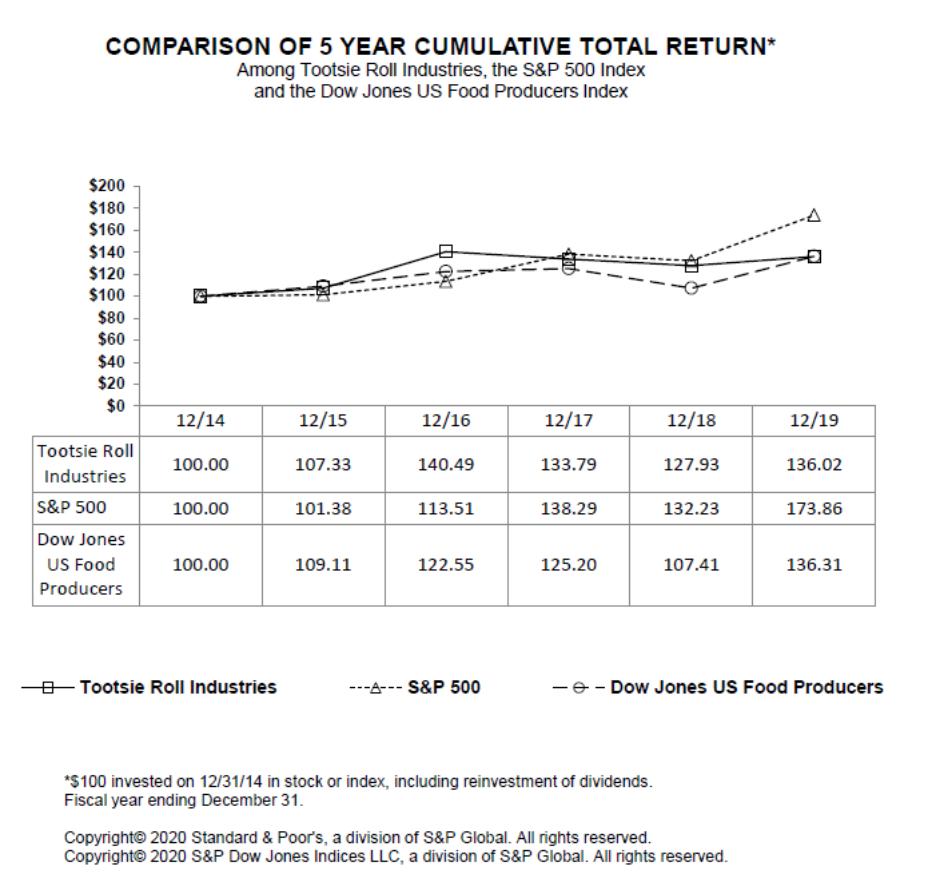

The following performance graph compares the cumulative total shareholder return on the Company’s common stock for a five-year period (December 31, 2014 to December 31, 2019) with the cumulative total return of Standard & Poor’s 500 Stock Index (“S&P 500”) and the Dow Jones Industry Food Index (“Peer Group,” which includes the Company), assuming (i) $100 invested on December 31 of the first year of the chart in each of the Company’s common stock, S&P 500 and the Dow Jones Industry Food Index and (ii) the reinvestment of cash and stock dividends.

11

ITEM 6. Selected Financial Data.

Five Year Summary of Earnings and Financial Highlights

(Thousands of dollars except per share, percentage and ratio figures)

| 2019 |

| 2018 |

| 2017 |

| 2016 |

| 2015 |

| ||||||

Sales and Earnings Data | ||||||||||||||||

Net product sales | $ | 523,616 | $ | 515,251 | $ | 515,674 | $ | 517,373 | $ | 536,692 | ||||||

Product gross margin |

| 194,514 |

| 185,371 |

| 189,263 |

| 196,504 |

| 196,118 | ||||||

Interest expense |

| 220 |

| 181 |

| 144 |

| 105 |

| 76 | ||||||

Provision for income taxes |

| 20,565 |

| 16,401 |

| 3,907 |

| 30,593 |

| 26,451 | ||||||

Net earnings attributable to Tootsie Roll Industries, Inc. |

| 64,920 |

| 56,893 |

| 80,864 | (2) |

| 67,510 |

| 66,089 | |||||

% of net product sales |

| 12.4 | % |

| 11.0 | % |

| 15.7 | % |

| 13.0 | % |

| 12.3 | % | |

% of shareholders’ equity |

| 8.5 | % |

| 7.6 | % |

| 11.0 | % |

| 9.5 | % |

| 9.5 | % | |

Per Common Share Data (1) | ||||||||||||||||

Net earnings attributable to Tootsie Roll Industries, Inc. | $ | 0.99 | $ | 0.86 | $ | 1.21 | (2) | $ | 0.99 | $ | 0.96 | |||||

Cash dividends declared |

| 0.36 |

| 0.36 |

| 0.36 |

| 0.36 |

| 0.35 | ||||||

Stock dividends |

| 3 | % |

| 3 | % |

| 3 | % |

| 3 | % |

| 3 | % | |

Additional Financial Data (1) | ||||||||||||||||

Working capital | $ | 273,786 | $ | 242,655 | $ | 207,132 | $ | 235,739 | $ | 221,744 | ||||||

Net cash provided by operating activities |

| 100,221 |

| 100,929 |

| 42,973 |

| 98,550 |

| 91,073 | ||||||

Net cash provided by (used in) investing activities |

| (15,009) |

| (44,510) |

| (9,320) |

| (51,884) |

| (9,672) | ||||||

Net cash used in financing activities |

| (57,187) |

| (42,353) |

| (56,881) |

| (51,387) |

| (53,912) | ||||||

Property, plant & equipment additions |

| 20,258 |

| 27,612 |

| 16,673 |

| 16,090 |

| 15,534 | ||||||

Net property, plant & equipment |

| 188,455 |

| 186,101 |

| 178,972 |

| 180,905 |

| 184,586 | ||||||

Total assets |

| 977,864 |

| 947,361 |

| 930,946 |

| 920,101 |

| 908,983 | ||||||

Long-term debt |

| 7,500 |

| 7,500 |

| 7,500 |

| 7,500 |

| 7,500 | ||||||

Total Tootsie Roll Industries, Inc. shareholders’ equity |

| 759,854 |

| 750,622 |

| 733,840 |

| 711,364 |

| 698,183 | ||||||

Average shares outstanding |

| 65,474 |

| 66,130 |

| 66,962 |

| 67,869 |

| 68,886 | ||||||

| (1) | Per common share data and average shares outstanding adjusted for annual 3% stock dividends. |

| (2) | The 2017 net earnings and earnings per share includes $20,318 or $0.32 per share relating to a favorable accounting adjustment to revalue the Company’s deferred income tax liabilities resulting from the enactment of the U.S. Tax Cuts and Jobs Act in December 2017. |

12

ITEM 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

(Thousands of dollars except per share, percentage and ratio figures)

The following discussion should be read in conjunction with the other sections of this report, including the consolidated financial statements and related notes contained in Item 8 of this Form 10-K.

FINANCIAL REVIEW

This financial review discusses the Company’s financial condition, results of operations, liquidity and capital resources, significant accounting policies and estimates, new accounting pronouncements, market risks and other matters. It should be read in conjunction with the Consolidated Financial Statements and related Notes that follow this discussion.

FINANCIAL CONDITION

The Company’s overall financial position remains strong given that aggregate cash, cash equivalents and investments is $392,435 at December 31, 2019, including $76,183 in trading securities discussed below. Cash flows from 2019 operating activities totaled $100,221 compared to $100,929 in 2018, and are discussed in the section entitled Liquidity and Capital Resources. During 2019, the Company paid cash dividends of $23,460, purchased and retired $34,116 of its outstanding shares, and made capital expenditures of $20,258.

The Company’s net working capital was $273,786 at December 31, 2019 compared to $242,655 at December 31, 2018 which reflects higher aggregate cash, cash equivalents and short-term investments. As of December 31, 2019, the Company’s total cash, cash equivalents and investments, including all long-term investments in marketable securities, was $392,435 compared to $356,448 at December 31, 2018, an increase of $35,987. The aforementioned includes $76,183 and $62,260 of investments in trading securities as of December 31, 2019 and 2018, respectively. The Company invests in trading securities to provide an economic hedge for its deferred compensation liabilities, as further discussed herein and in Note 7 of the Company’s Notes to Consolidated Financial Statements.

Shareholders’ equity increased from $750,622 at December 31, 2018 to $759,854 as of December 31, 2019, which principally reflects 2019 net earnings of $64,920, less cash dividends of $23,460 and share repurchases of $34,116.

The Company has a relatively straight-forward financial structure and has historically maintained a conservative financial position. The Company has no special financing arrangements or “off-balance sheet” special purpose entities. Cash flows from operations plus maturities of short-term investments are expected to be adequate to meet the Company’s overall financing needs, including capital expenditures, in 2020. Periodically, the Company considers possible acquisitions, and if the Company were to pursue and complete such an acquisition, that could result in bank borrowings or other financing.

RESULTS OF OPERATIONS

2019 vs. 2018

Twelve months 2019 consolidated net sales were $523,616 compared to $515,251 in twelve months 2018, an increase of $8,365 or 1.6%. Fourth quarter 2019 net sales were $134,663 compared to $127,264 in fourth quarter 2018, an increase of $7,399 or 5.8%. Successful marketing and sales programs contributed to the increases in sales for both fourth quarter and twelve months 2019 compared to the corresponding periods in the prior year. Fourth quarter 2019 sales also benefited from the timing of sales between the third and fourth quarters of 2019, however, foreign currency translation had some adverse effects on consolidated sales for the twelve months 2019 period compared to 2018.

Product cost of goods sold were $329,102 in 2019 compared to $329,880 in 2018, a decrease of $778 or 0.2%. Product cost of goods sold includes $408 and $(39) in certain deferred compensation expenses (credits) in 2019 and 2018, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, product cost of goods sold decreased from $329,919 in

13

2018 to $328,694 in 2019, a decrease of $1,225 or 0.4%. As a percent of net product sales, these adjusted costs decreased from 64.0% in 2018 to 62.8% in 2019, a 1.3 favorable percentage point change.

Fourth quarter and twelve months 2019 product cost of goods sold and resulting gross profit margins benefited from increased sales and higher price realization which allowed the Company to recover some margin decline resulting from increases in certain input costs in recent years. Plant efficiencies driven by capital investments and ongoing cost containment programs contributed to the above discussed decreases in adjusted cost of goods sold in 2019. Prior year 2018 gross margin was adversely affected by the implementation and start-up of new manufacturing packaging lines and resulting operational inefficiencies, as well as unfavorable experience from self-insurance programs. The Company is continuing its investments in its plant manufacturing operations to meet new consumer and customer demands, achieve quality improvements, provide genuine value to consumers, and increase operational efficiencies.

Selling, marketing and administrative expenses were $127,802 in 2019 compared to $117,691 in 2018, an increase of $10,111 or 8.6%. Selling, marketing and administrative expenses include $10,884 and $(1,064) in certain deferred compensation expenses (credits) in 2019 and 2018, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, selling, marketing and administrative expenses decreased from $118,755 in 2018 to $116,918 in 2019, a decrease of $1,837 or 1.5%. As a percent of net product sales, these adjusted expenses decreased from 23.0% of net product sales in 2018 to 22.3% of net product sales in 2019, a 0.7 favorable percentage point change. Higher price realization, lower general and administrative expenses, primarily legal and professional fees, and lower freight and delivery unit costs were the principal drivers in these favorable reductions, including reductions as a percentage of sales, in selling, marketing and administrative expenses in fourth quarter and twelve months 2019.

Selling, marketing and administrative expenses include freight, delivery and warehousing expenses. These expenses decreased from $49,527 in 2018 to $49,288 in 2019, a decrease of $239 or 0.5%. As a percent of net product sales, these adjusted expenses decreased from 9.6% in 2018 to 9.4% in 2019, a 0.2 favorable percentage point change. During 2019, the Company implemented additional freight and delivery computer systems and carrier selection processes, including enhanced competitive bidding, which facilitated this favorable unit cost reduction in fourth quarter and twelve months 2019.

The Company has foreign operating businesses in Mexico, Canada and Spain, and exports products to many foreign markets. Such foreign sales were $44,826 and comprised 8.6% of the Company’s consolidated net product sales in 2019. In fourth quarter 2019 and 2018, the Company recorded a pre-tax impairment charge of $377 and $1,125, respectively, relating to its Spanish operations. The Company had a 97% ownership of a Spanish company at both December 31, 2019 and 2018. During 2019 and 2018, this Spanish subsidiary incurred operating losses of $1,102 and $2,840, respectively, and the Company provided approximately $1,399 and $4,484, respectively, of additional cash to finance these losses and certain capital expenditures. Company management expects the competitive and business challenges in Spain to continue but expects continued reduction in operating losses in 2020 compared to 2019. Nonetheless, management believes that operating losses may continue beyond 2019 and that these future losses may require additional cash financing.

The Company believes that the carrying values of its goodwill and trademarks have indefinite lives as they are expected to generate cash flows indefinitely. In accordance with current accounting guidance, these indefinite-lived intangible assets are assessed at least annually for impairment as of December 31 or whenever events or circumstances indicate that the carrying values may not be recoverable from future cash flows. No impairments were recorded in 2019, 2018 or 2017. Current accounting guidance provides entities an option of performing a qualitative assessment (a "step-zero" test) before performing a quantitative analysis. If the entity determines, on the basis of certain qualitative factors, that it is more-likely-than-not that the intangibles (goodwill and certain trademarks) are not impaired, the entity would not need to proceed to the two step impairment testing process (quantitative analysis) as prescribed in the guidance. During fourth quarter 2019 (and fourth quarter 2018), the Company performed a “step zero” test of its goodwill and certain trademarks, and concluded that there was no impairment based on this guidance. For the fair value assessment of certain trademarks where the “step-zero” analysis was not considered appropriate, impairment testing was performed in fourth quarter 2019 (and fourth quarter 2018) using discounted cash flows and estimated royalty rates. For these trademarks, holding all other assumptions constant at the test date, a 100 basis point increase in the discount rate or a 100 basis point decrease in

14

the royalty rate would reduce the fair value of these trademarks by approximately 16% and 10%, respectively. Individually, a 100 basis point increase in the discount rate may result in potential impairment of up to $2 million. A 100 basis point decrease in the royalty rate would not result in a potential impairment as of December 31, 2019.

Earnings from operations were $69,214 in 2019 compared to $70,482 in 2018, a decrease of $1,268. Earnings from operations include $11,292 and $(1,103) in certain deferred compensation expense (credits) in 2019 and 2018, respectively, which are discussed above. Adjusting for these deferred compensation expenses, adjusted earnings from operations increased from $69,379 in 2018 to $80,506 in 2019, an increase of $11,127 or 16.0%. Fourth quarter and twelve months results benefitted from increased sales and higher price realization as well as reductions in certain costs and expenses discussed above.

Management believes the comparisons presented in the preceding paragraphs, after adjusting for changes in deferred compensation, are more reflective of the underlying operations of the Company.

Other income, net was $16,190 in 2019 compared to $2,724 in 2018, an increase of $13,466. Other income, net principally reflects $11,292 and $(1,103) of aggregate net gains (losses) and investment income on trading securities in 2019 and 2018, respectively. These trading securities provide an economic hedge of the Company’s deferred compensation liabilities; and the related net gains (losses) and investment income were offset by a like amount of expense in aggregate product cost of goods sold and selling, marketing, and administrative expenses in the respective years as discussed above. Other income, net includes investment income on available for sale securities of $4,423 and $3,535 in 2019 and 2018, respectively. Other income, net also includes foreign exchange gains (losses) of $(533) and $(659) in 2019 and 2018, respectively.

The Company’s effective income tax rate was 27.9% and 23.5% in fourth quarter 2019 and 2018, respectively, and 24.1% and 22.4% in twelve months 2019 and 2018, respectively. The increase in the effective tax rates for the fourth quarter and twelve months 2019 reflects higher state income taxes, including increases in reserves for uncertain state tax benefits, and increases in valuation allowances for state income tax credit carry-forwards which are not likely to be fully realized in the future. A reconciliation of the differences between the U.S. statutory rate and these effective tax rates is provided in Note 4 of the Company’s Notes to Consolidated Financial Statements.

At December 31, 2019 and 2018, the Company’s deferred tax assets include $617 and $1,844 of income tax benefits relating to its Canadian subsidiary tax loss carry-forwards. The Company expects to fully utilize this deferred tax asset in 2020 (expiration dates are 2029 through 2031). The Company utilized $1,227 and $1,896 of these Canadian tax carry-forward benefits in 2019 and 2018, respectively. The Company has concluded that it is more-likely-than-not that it would realize these deferred tax assets relating to its Canadian tax loss carry-forwards because it is expected that sufficient levels of taxable income will be generated during the carry-forward periods. The Company has provided a full valuation allowance on its Spanish subsidiaries’ tax loss carry-forward benefits of $3,967 and $3,651 as of December 31, 2019 and 2018, respectively, because the Company has concluded that it is not more-likely-than-not that these losses will be utilized before their expiration dates. The Spanish subsidiary has a history of net operating losses and it is not known when and if they will generate taxable income in the future.

U.S. tax reform (US Tax Cuts and Jobs Act enacted in December 2017) included a one-time toll charge resulting from the mandatory deemed repatriation of undistributed foreign earnings and profits. The Company determined that there were no net undistributed foreign earnings and profits subject to this toll charge. U.S. tax reform also changed the United States approach to the taxation of foreign earnings to a territorial system by providing a one hundred percent dividends received deduction for certain qualified dividends received from foreign subsidiaries. These provisions of the U.S. tax reform significantly impact the accounting for the undistributed earnings of foreign subsidiaries, and as a result the Company distributed $8,200 of the earnings held in excess cash by its foreign subsidiaries in 2019. The tax costs associated with a future distribution, including foreign withholding taxes, are not material to the Company’s financial statements. After carefully considering these facts, the Company determined that it would not be asserting permanent reinvestment of its foreign subsidiaries earnings as of December 31, 2017, and the Company continues to make this assertion.

15

Net earnings attributable to Tootsie Roll Industries, Inc. were $14,555 in fourth quarter 2019 compared to $12,175 in fourth quarter 2018, and net earnings per share were $0.22 and $0.18 in fourth quarter 2019 and 2018, respectively. Twelve months 2019 net earnings were $64,920 compared to $56,893 in twelve months 2018, and net earnings per share were $0.99 and $0.86 in twelve months 2018 and 2017, respectively. Earnings per share in 2019 benefited from the reduction in average shares outstanding resulting from purchases of the Company’s common stock in the open market by the Company. Average shares outstanding decreased from 66,130 in 2018 to 65,474 in 2019 which reflects share repurchases of $34,116 during 2019.

Beginning in 2012, the Company received periodic notices from the Bakery, Confectionery, Tobacco Workers and Grain Millers International Union Pension Plan (Plan), a multi-employer defined benefit pension plan for certain Company union employees, that the Plan’s actuary certified the Plan to be in “critical status”, the “Red Zone”, as defined by the Pension Protection Act (PPA) and the Pension Benefit Guaranty Corporation (PBGC); and that a plan of rehabilitation was adopted by the trustees of the Plan in 2012. During 2015, the Company received notices that the Plan’s status was changed to “critical and declining status”, as defined by the PPA and PBGC, for the plan year beginning January 1, 2015, and that the Plan was projected to have an accumulated funding deficiency for the 2017 through 2024 plan years. A designation of “critical and declining status” implies that the Plan is expected to become insolvent in the next 20 years. The Company has continued to receive annual notices each year (2016 to 2019) that this Plan remains in “critical and declining status” and is projected to become insolvent within the next 20 years. These notices have also advised that the Plan trustees were considering the reduction or elimination of certain retirement benefits and may seek assistance from the PBGC. Plans in “critical and declining status” may elect to suspend (temporarily or permanently) some benefits payable to all categories of participants, including retired participants, except retirees that are disabled or over the age of 80. Suspensions must be equally distributed and cannot drop below 110% of what would otherwise be guaranteed by the PBGC.

Based on these updated notices, the Plan’s funded percentage (plan investment assets as a percentage of plan liabilities), as defined, were 51.6%, 54.7%, and 57.0% as of the most recent valuation dates available, January 1, 2018, 2017, and 2016, respectively (these valuation dates are as of the beginning of each Plan year). These funded percentages are based on actuarial values, as defined, and do not reflect the actual market value of Plan investments as of these dates. If the market value of investments had been used as of January 1, 2019 the funded percentage would be 54.2% (not 51.6%). As of the January 1, 2018 valuation date (most recent valuation available), only 18% of Plan participants were current active employees, 52% were retired or separated from service and receiving benefits, and 30% were retired or separated from service and entitled to future benefits. The number of current active employee Plan participants as of January 1, 2018 fell 3% from the previous year and 11% over the past two years. When compared to the Plan valuation date of January 1, 2011 (seven years earlier), current active employee participants have declined 39%, whereas participants who were retired or separated from service and receiving benefits increased 6% and participants who were retired or separated from service and entitled to future benefits increased 9%. The Company understands that the Plan is continuing to explore additional restructuring measures which include incentives to participating employers in exchange for providing additional future cash contributions as well as suspension of certain retirement benefits.

The Company has been advised that its withdrawal liability would have been $99,800, $81,600, and $82,200 if it had withdrawn from the Plan during 2019, 2018 and 2017, respectively. The increase from 2018 to 2019 was mainly attributable to a decrease in the Plan’s assets during 2018, net of market returns, and the withdrawal of a large contributing employer where their actual withdrawal payments (likely over 20 years as discussed below) are not enough to fully fund their actual withdrawal liability. The Company’s relative share of the Plan’s contribution base, driven by employer withdrawals, has increased for the last several years, and management believes that this trend could continue indefinitely which will add upward pressure on the Company’s withdrawal liability. Based on the above, including the Plan’s projected insolvency in the year 2030, management believes that the Company’s withdrawal liability could increase further in future years.

Based on the Company’s updated actuarial study and certain provisions in ERISA and the law relating to withdrawal liability payments, management believes that the Company’s liability would likely be limited to twenty annual payments of $3,045 which have a present value in the range of $35,700 to $46,700 depending on the interest rate used to discount these payments. While the Company’s actuarial consultant does not believe that the Plan will suffer a future mass withdrawal (as defined) of participating employers, in the event of a mass withdrawal, the Company’s annual withdrawal

16

payments would theoretically be payable in perpetuity. Based on the Company’s updated actuarial study, the present value of such perpetuities is in the range of $49,900 to $104,500 and would apply in the unlikely event that substantially all employers withdraw from the Plan. The aforementioned is based on a range of valuations and interest rates which the Company’s actuary has advised is provided under the statute. Should the Company actually withdraw from the Plan at a future date, a withdrawal liability, which could be higher than the above discussed amounts, could be payable to the Plan.

The Company and the union concluded a new labor contract in 2018 which requires the Company’s continued participation in this Plan through September 2022. The amended rehabilitation plan, which also continues, requires that employer contributions include 5% compounded annual surcharge increases each year for an unspecified period of time beginning in 2012 as well as certain plan benefit reductions. The Company’s pension expense for this Plan for 2019, 2018 and 2017 was $2,961, $2,836 and $2,617, respectively. The aforementioned expense includes surcharges of $948, $811 and $656 in 2019, 2018 and 2017, respectively, as required under the amended rehabilitation plan.

The Company understands that the U.S Congress and the U.S Senate have proposed various legislation, including the “Butch Lewis Act,” that would provide varying degrees of assistance to troubled multi-employer plans similar to this Plan, including long-term low interest loans to troubled multi-employer plans. Certain provisions proposed would change the withdrawal liability rules which could increase the Company’s obligation in the event that the Company withdrew form this Plan, resulting in higher annual payment amounts and payments for a longer period of time in excess of the maximum twenty year period discussed above. The Company is currently unable to determine the ultimate outcome of the above discussed multi-employer union pension matter and therefore is unable to determine the effects on its consolidated financial statements, but the ultimate outcome could be material to its consolidated results of operations or cash flows in one or more future periods. See also Note 7 in the Company’s Consolidated Financial Statements on Form 10-K for the year ended December 31, 2019.

17

2018 vs. 2017

Twelve months 2018 consolidated net sales were $515,251 compared to $515,674 in twelve months 2017, a decrease of $423 or 0.1%. Fourth quarter 2018 net sales were $127,264 compared to $125,179 in fourth quarter 2017, an increase of $2,085 or 1.7%. Fourth quarter 2018 sales reflects an increase of 3.4% in U.S. sales in the quarter, however, foreign sales declined in fourth quarter 2018. The timing of certain foreign sales between third and fourth quarter in the comparative 2018 and 2017 periods adversely affected fourth quarter consolidated 2018 sales. Unfavorable translation of foreign sales, primarily Mexico, also contributed to lower sales in fourth quarter and twelve months 2018 compared to the prior year corresponding period. The Company’s unit selling prices and price realization in 2018 was consistent with 2017. Because of increased pricing pressures and cost increases facing the confectionery industry, companies in the confectionery industry are taking pricing actions to recover many of the same input cost increases that we have and continue to experience which are discussed below, including higher freight and delivery expenses. In particular, the Company has taken selective price increases, effective at the beginning of 2019, to recover these same input cost increases.

Product cost of goods sold were $329,880 in 2018 compared to $326,411 in 2017, an increase of $3,469 or 1.1%. Product cost of goods sold includes $(39) and $1,953 in certain deferred compensation expenses (credits) in 2018 and 2017, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, product cost of goods sold increased from $324,458 in 2017 to $329,919 in 2018, an increase of $5,461 or 1.7%. As a percent of net product sales, these adjusted costs increased from 62.9% in 2017 to 64.0% in 2018, a 1.1 unfavorable percentage point change. Although costs for key ingredients were more favorable in 2018 compared to 2017, higher manufacturing costs for wages, salaries and benefits and plant overhead operations contributed to higher product cost of goods sold in 2018 compared to 2017. Increases in employee healthcare and other benefit costs, principally resulting from unfavorable experience under our self-insurance programs, adversely affected gross profit margins in 2018 compared to 2017. Costs relating to quality improvements in product packaging and start-up of new manufacturing packaging lines being phased into service during 2018 also had an unfavorable impact on twelve months 2018 gross profit margins when compared to 2017. The above discussed cost factors also affected fourth quarter 2018 gross profit margins compared to fourth quarter 2017.

Selling, marketing and administrative expenses were $117,691 in 2018 compared to $121,484 in 2017, a decrease of $3,793 or 3.1%. Selling, marketing and administrative expenses include $(1,064) and $8,024 in certain deferred compensation expenses (credits) in 2018 and 2017, respectively. These deferred compensation expenses principally result from changes in the market value of investments and investment income from trading securities relating to compensation deferred in previous years and are not reflective of current operating results. Adjusting for the aforementioned, selling, marketing and administrative expenses increased from $113,460 in 2017 to $118,755 in 2018, an increase of $5,295 or 4.7%. As a percent of net product sales, these adjusted expenses increased from 22.0% of net product sales in 2017 to 23.1% of net product sales in 2018, a 1.1 unfavorable percentage point change.

Selling, marketing and administrative expenses include freight, delivery and warehousing expenses. These expenses increased from $44,082 in 2017 to $49,527 in 2018, an increase of $5,445 or 12.4%. As a percent of net product sales, these adjusted expenses increased from 8.6% in 2017 to 9.6% in 2018, a 1.0 unfavorable percentage point change. These expenses principally reflect higher freight rates driven by the continuing imbalance between supply and demand for over-the-road truck delivery as well as higher fuel costs. Freight and delivery expenses began their significant acceleration in fourth quarter 2017, and therefore, this impact was less significant in the comparative fourth quarters of 2018 and 2017, than for the twelve months 2018 and 2017. Higher legal and professional fees also contributed to this increase in selling, marketing and administrative expenses in both fourth quarter and twelve months 2018.

The Company has foreign operating businesses in Mexico, Canada and Spain, and exports products to many foreign markets. Such foreign sales were $43,690 and comprised 8.5% of the Company’s consolidated net product sales in 2018. In fourth quarter 2018 and 2017, the Company recorded a pre-tax impairment charge of $1,125 and $2,371, respectively, relating to its Spanish operations. The Company had a 97% ownership of a Spanish company at both December 31, 2018 and 2017. During 2018 and 2017, this Spanish subsidiary incurred operating losses of $2,840 and $3,212, respectively,

18

and the Company provided approximately $4,484 and $2,734, respectively, of additional cash to finance these losses and certain capital expenditures.

Earnings from operations were $70,482 in 2018 compared to $70,422 in 2017, an increase of $60. Earnings from operations include $(1,103) and $9,977 in certain deferred compensation expense (credits) in 2018 and 2017, respectively, which are discussed above. Adjusting for these deferred compensation expenses, adjusted earnings from operations decreased from $80,399 in 2017 to $69,379 in 2018, a decrease of $11,020 or 13.7%. Twelve months and fourth quarter results were adversely affected primarily by higher costs and expenses for freight and delivery and manufacturing operations as discussed above.

Management believes the comparisons presented in the preceding paragraphs, after adjusting for changes in deferred compensation, are more reflective of the underlying operations of the Company.

Other income, net was $2,724 in 2018 compared to $14,139 in 2017, a decrease of $11,415. Other income, net principally reflects $(1,103) and $9,977 of aggregate net gains (losses) and investment income on trading securities in 2018 and 2017, respectively. These trading securities provide an economic hedge of the Company’s deferred compensation liabilities; and the related net gains (losses) and investment income were offset by a like amount of expense in aggregate product cost of goods sold and selling, marketing, and administrative expenses in the respective years as discussed above. Other income, net includes investment income on available for sale securities of $3,535 and $2,851 in 2018 and 2017, respectively. Other income, net also includes foreign exchange gains (losses) of $(659) and $259 in 2018 and 2017, respectively.

Fourth quarter and twelve months 2018 net earnings benefited from a lower U.S. federal income tax rate resulting from U.S. tax reform legislation enacted in December 2017. In connection with this tax reform legislation, the Company recorded a net tax benefit of $20,318, or $0.30 per share, during fourth quarter 2017. This benefit reflected the estimated accounting adjustment from the revaluation of the Company’s net deferred income tax liabilities as of December 31, 2017 to reflect the new lower U.S. corporate income tax rate. As a result of this tax legislative change, including the above discussed revaluation of deferred tax liabilities, the Company’s effective income tax rate was 23.5% in fourth quarter 2018 compared to negative 110.9%, a net tax credit, in fourth quarter 2017; and 22.4% in twelve months 2018 compared to 4.6% in twelve months 2017. A reconciliation of the differences between the U.S. statutory rate and these effective tax rates is provided in Note 4 of the Company’s Notes to Consolidated Financial Statements.

At December 31, 2018 and 2017, the Company’s deferred tax assets include $1,844 and $3,740 of income tax benefits relating to its Canadian subsidiary tax loss carry-forwards which the Company expects to realize before their expiration dates (2029 through 2031). The Company utilized $1,896 and $2,606 of these tax carry-forward benefits in 2018 and 2017, respectively. The Company has concluded that it is more-likely-than-not that it would realize these deferred tax assets relating to its Canadian tax loss carry-forwards because it is expected that sufficient levels of taxable income will be generated during the carry-forward periods. The Company has provided a full valuation allowance on its Spanish subsidiaries’ tax loss carry-forward benefits of $3,651 and $3,038 as of December 31, 2018 and 2017, respectively, because the Company has concluded that it is not more-likely-than-not that these losses will be utilized before their expiration dates. The Spanish subsidiary has a history of net operating losses and it is not known when and if they will generate taxable income in the future.

Based on SEC guidance in Staff Accounting Bulletin No. 118, the Company considered its accounting for the effects of U.S. tax reform to be provisional as of December 31, 2017 and through the first three quarters ended September 30, 2018 because the ultimate impact might have differed from these provisional amounts, due to, among other things, additional regulatory guidance from the Internal Revenue Service and state authorities. The accounting for Tax Cuts and Jobs Act was completed as of December 31, 2018 and there were no material adjustment to the previously recorded provisional amounts.

Net earnings attributable to Tootsie Roll Industries, Inc. were $12,175 in fourth quarter 2018 compared to $31,985 in fourth quarter 2017, and net earnings per share were $0.18 and $0.48 in fourth quarter 2018 and 2017, respectively. The prior year fourth quarter 2017 net earnings include a favorable deferred income tax accounting adjustment of $20,318 or $0.30 per share which is discussed above. Adjusting for the effects of this fourth quarter 2017 tax adjustment,

19

comparable net earnings per share were $0.18 in both 2018 and 2017. Twelve months 2018 net earnings were $56,893 compared to $80,864 in twelve months 2017, and net earnings per share were $.86 and $1.21 in twelve months 2018 and 2017, respectively. Adjusting for the effects of the 2017 tax adjustment discussed above, comparable net earnings per share were $0.86 and $0.91, a decrease of $0.05 or 5.5%. Earnings per share in 2018 benefited from the reduction in average shares outstanding resulting from purchases of the Company’s common stock in the open market by the Company. Average shares outstanding decreased from 66,962 in 2017 to 66,130 in 2018.

The Company has included the above non-GAAP discussion regarding the impacts of tax reform. The Company believes this discussion provides meaningful supplemental information to both management and investors that is indicative of the Company's core net results and facilitates comparison of net results across reporting periods. The Company uses this non-GAAP measure when evaluating its financial results as well as for internal evaluation and analysis purposes. This non-GAAP measure should not be viewed as a substitute for the Company's GAAP results.

LIQUIDITY AND CAPITAL RESOURCES

Cash flows from operating activities were $100,221, $100,929 and $42,973 in 2019, 2018 and 2017, respectively. The $708 decrease in cash flows from operating activities from 2018 to 2019 primarily reflects the timing of payments and refunds of income taxes, combined with increases in prepaid expenses and inventories, offset by a decrease in accounts receivable as of December 31, 2019. The $57,956 increase in cash flows from operating activities from 2017 to 2018 primarily reflects the timing of payments and refunds of income taxes, an increase in prepaid expenses as of December 31, 2017, and the decrease in deferred compensation payments in 2018.

The Company manages and controls a VEBA trust, to fund the estimated future costs of certain union employee health, welfare and other benefits. A contribution of $20,024 was made to this trust in 2017; no contribution was made to the trust during 2018 or 2019. The Company uses these funds to pay the actual cost of such benefits over each union contract period. At December 31, 2019 and 2018, the VEBA trust held $12,085 and $15,921, respectively, of aggregate cash and cash equivalents. This asset value is included in prepaid expenses and long-term other assets in the Company’s Consolidated Statement of Financial Position. These assets are categorized as Level 1 within the fair value hierarchy.

Cash flows from investing activities reflect capital expenditures of $20,258, $27,612, and $16,673 in 2019, 2018 and 2017, respectively. The changes in amounts from 2018 to 2019 principally reflect new manufacturing packaging lines in 2018 and the timing of expenditures relating to other plant manufacturing capital projects. Company management has committed approximately $25,000 to a rehabilitation upgrade and expansion of one of its manufacturing plants in the U.S.A. The Company spent approximately $2,000 in 2019, and management’s projected cash outlays for this project are approximately $15,000 in 2020 and $8,000 in 2021. All capital expenditures are to be funded from the Company’s cash flow from operations and internal sources including available for sale securities.

Other than the bank loans and the related restricted cash of the Company’s Spanish subsidiary which are discussed in Note 1 of the Company’s Notes to Consolidated Financial Statements, the Company had no bank borrowings or repayments in 2017, 2018, or 2019, and had no outstanding bank borrowings as of December 31, 2018 or 2019. Nonetheless, the Company would consider bank borrowing or other financing in the event that a business acquisition is completed.

Financing activities include Company common stock purchases and retirements of $34,116, $19,317, and $34,133 in 2019, 2018 and 2017, respectively. Cash dividends of $23,460, $22,978, and $22,621 were paid in 2019, 2018 and 2017, respectively.

SIGNIFICANT ACCOUNTING POLICIES AND ESTIMATES

Preparation of the Company’s financial statements involves judgments and estimates due to uncertainties affecting the application of accounting policies, and the likelihood that different amounts would be reported under different conditions or using different assumptions. The Company bases its estimates on historical experience and other assumptions, as discussed herein, that it believes are reasonable. If actual amounts are ultimately different from previous estimates, the revisions are included in the Company’s results of operations for the period in which the actual amounts become known.

20

The Company’s significant accounting policies are discussed in Note 1 of the Company’s Notes to Consolidated Financial Statements.

Following is a summary and discussion of the more significant accounting policies and estimates which management believes to have a significant impact on the Company’s operating results, financial position, cash flows and footnote disclosure.

Revenue recognition

As more fully discussed in Note 1, the Company adopted the new accounting revenue recognition guidance (ASC 606) effective January 1, 2018. As a result of adoption, the cumulative impact to retained earnings at January 1, 2018 was a net after-tax increase of $3,319 ($4,378 pre-tax). The adoption principally changed the timing of recognition of certain trade promotions and related adjustments thereto which affect net product sales. The comparative prior information has not been restated and continues to be reported under the accounting standards in effect for such period. The adoption of the new standard in 2018 did not have a material effect on 2018 and 2019 results, and management does not believe that it will have a material effect on results in future years. Revenue for net product sales continues to be recognized at a point in time when products are delivered to or picked up by the customer, as designated by customers’ purchase orders, as discussed in Note 1.

Provisions for bad debts are recorded as selling, marketing and administrative expenses. Write-offs of bad debts did not exceed 0.1% of net product sales in each of 2019, 2018 and 2017, and accordingly, have not been significant to the Company’s financial position or results of operations.

Intangible assets

The Company’s intangible assets consist primarily of goodwill and acquired trademarks. In accordance with accounting guidance, goodwill and other indefinite-lived assets, trademarks, are not amortized, but are instead subjected to annual testing for impairment unless certain triggering events or circumstances are noted. The Company performs its annual impairment review and assessment as of December 31. All trademarks have been assessed by management to have indefinite lives because they are expected to generate cash flows indefinitely. The Company reviews and assesses certain trademarks (non-amortizable intangible assets) for impairment by comparing the fair value of each trademark with its carrying value. Current accounting guidance provides entities an option of performing a qualitative assessment (a "step-zero" test) before performing a quantitative analysis. If the entity determines, on the basis of certain qualitative factors, that it is more-likely-than-not that the intangibles (goodwill and certain trademarks) are not impaired, the entity would not need to proceed to the two step impairment testing process (quantitative analysis) as prescribed in the guidance. During fourth quarter 2019, the Company performed a “step zero” test of its goodwill and certain trademarks, and concluded that there was no impairment based on this guidance.

The Company determines the fair value of certain trademarks using discounted cash flows and estimates of royalty rates. If the carrying value exceeds fair value, such trademarks are considered impaired and is reduced to fair value. The Company utilizes third-party professional valuation firms to assist in the determination of valuation of certain trademarks. Impairments have not generally been material to the Company’s historical operating results.