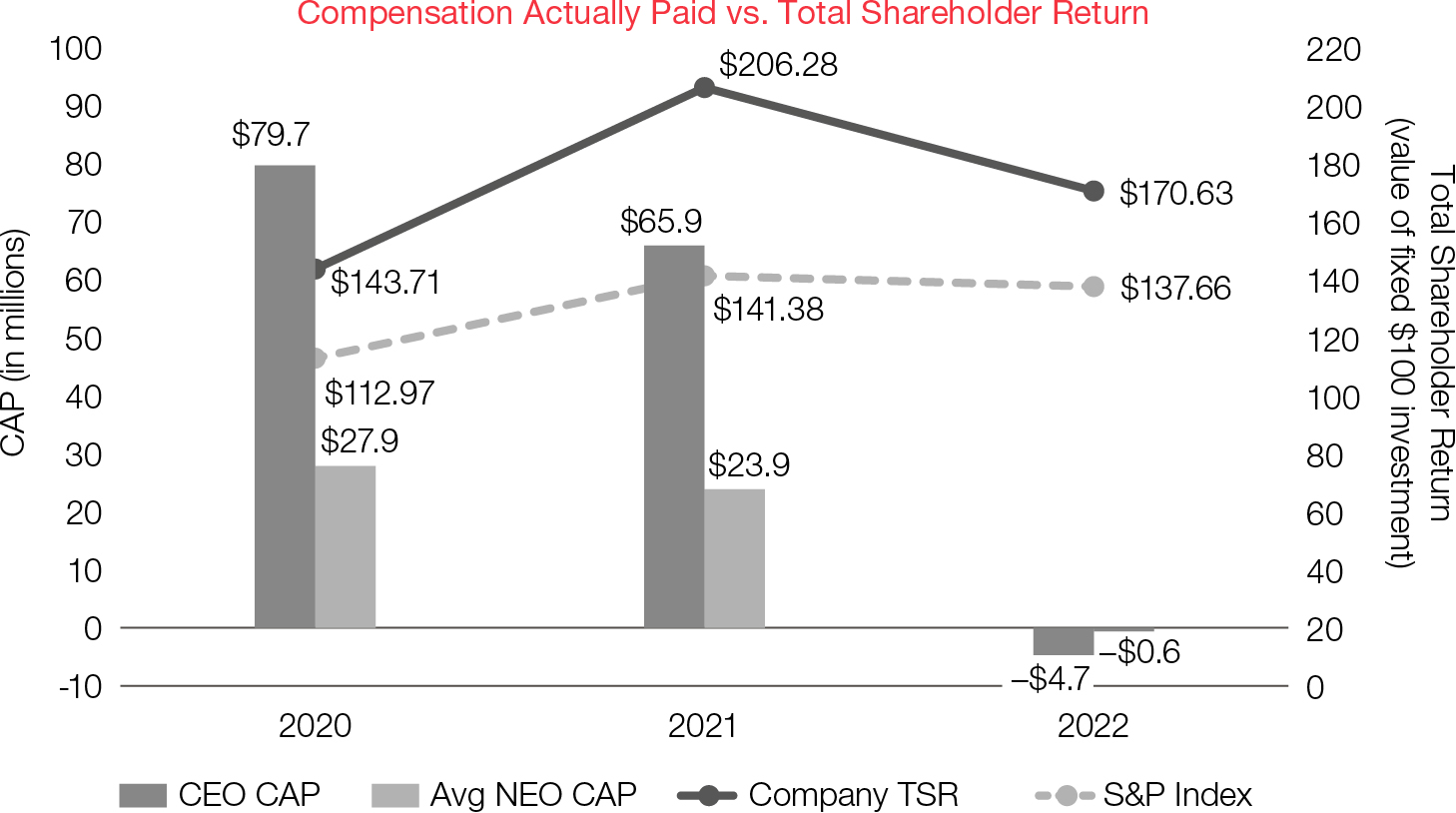

DEF 14AFALSE000009774500000977452022-01-012022-12-3100000977452020-01-012022-12-31iso4217:USDiso4217:USDxbrli:shares00000977452021-01-012021-12-3100000977452020-01-012020-12-310000097745tmo:DefinedBenefitAndPensionPlanAmountsDeductedFromSCTMemberecd:PeoMember2022-01-012022-12-310000097745ecd:NonPeoNeoMembertmo:DefinedBenefitAndPensionPlanAmountsDeductedFromSCTMember2022-01-012022-12-310000097745tmo:DefinedBenefitAndPensionPlanAmountsDeductedFromSCTMemberecd:PeoMember2021-01-012021-12-310000097745ecd:NonPeoNeoMembertmo:DefinedBenefitAndPensionPlanAmountsDeductedFromSCTMember2021-01-012021-12-310000097745tmo:DefinedBenefitAndPensionPlanAmountsDeductedFromSCTMemberecd:PeoMember2020-01-012020-12-310000097745ecd:NonPeoNeoMembertmo:DefinedBenefitAndPensionPlanAmountsDeductedFromSCTMember2020-01-012020-12-310000097745ecd:PeoMembertmo:StockAwardsDeductedFromSCTMember2022-01-012022-12-310000097745ecd:NonPeoNeoMembertmo:StockAwardsDeductedFromSCTMember2022-01-012022-12-310000097745ecd:PeoMembertmo:StockAwardsDeductedFromSCTMember2021-01-012021-12-310000097745ecd:NonPeoNeoMembertmo:StockAwardsDeductedFromSCTMember2021-01-012021-12-310000097745ecd:PeoMembertmo:StockAwardsDeductedFromSCTMember2020-01-012020-12-310000097745ecd:NonPeoNeoMembertmo:StockAwardsDeductedFromSCTMember2020-01-012020-12-310000097745ecd:PeoMembertmo:FVOfEquityAwardsGrantedInPeriodOutstandingUnvestedMember2022-01-012022-12-310000097745ecd:NonPeoNeoMembertmo:FVOfEquityAwardsGrantedInPeriodOutstandingUnvestedMember2022-01-012022-12-310000097745ecd:PeoMembertmo:FVOfEquityAwardsGrantedInPeriodOutstandingUnvestedMember2021-01-012021-12-310000097745ecd:NonPeoNeoMembertmo:FVOfEquityAwardsGrantedInPeriodOutstandingUnvestedMember2021-01-012021-12-310000097745ecd:PeoMembertmo:FVOfEquityAwardsGrantedInPeriodOutstandingUnvestedMember2020-01-012020-12-310000097745ecd:NonPeoNeoMembertmo:FVOfEquityAwardsGrantedInPeriodOutstandingUnvestedMember2020-01-012020-12-310000097745tmo:ChangeInFVOfEquityAwardsAdjMemberecd:PeoMember2022-01-012022-12-310000097745tmo:ChangeInFVOfEquityAwardsAdjMemberecd:NonPeoNeoMember2022-01-012022-12-310000097745tmo:ChangeInFVOfEquityAwardsAdjMemberecd:PeoMember2021-01-012021-12-310000097745tmo:ChangeInFVOfEquityAwardsAdjMemberecd:NonPeoNeoMember2021-01-012021-12-310000097745tmo:ChangeInFVOfEquityAwardsAdjMemberecd:PeoMember2020-01-012020-12-310000097745tmo:ChangeInFVOfEquityAwardsAdjMemberecd:NonPeoNeoMember2020-01-012020-12-310000097745ecd:PeoMembertmo:EquityAwardsGrantedAndVestedInPeriodMember2022-01-012022-12-310000097745ecd:NonPeoNeoMembertmo:EquityAwardsGrantedAndVestedInPeriodMember2022-01-012022-12-310000097745ecd:PeoMembertmo:EquityAwardsGrantedAndVestedInPeriodMember2021-01-012021-12-310000097745ecd:NonPeoNeoMembertmo:EquityAwardsGrantedAndVestedInPeriodMember2021-01-012021-12-310000097745ecd:PeoMembertmo:EquityAwardsGrantedAndVestedInPeriodMember2020-01-012020-12-310000097745ecd:NonPeoNeoMembertmo:EquityAwardsGrantedAndVestedInPeriodMember2020-01-012020-12-310000097745tmo:ChangeInFVOfPriorPeriodAwardsVestedInPeriodMemberecd:PeoMember2022-01-012022-12-310000097745ecd:NonPeoNeoMembertmo:ChangeInFVOfPriorPeriodAwardsVestedInPeriodMember2022-01-012022-12-310000097745tmo:ChangeInFVOfPriorPeriodAwardsVestedInPeriodMemberecd:PeoMember2021-01-012021-12-310000097745ecd:NonPeoNeoMembertmo:ChangeInFVOfPriorPeriodAwardsVestedInPeriodMember2021-01-012021-12-310000097745tmo:ChangeInFVOfPriorPeriodAwardsVestedInPeriodMemberecd:PeoMember2020-01-012020-12-310000097745ecd:NonPeoNeoMembertmo:ChangeInFVOfPriorPeriodAwardsVestedInPeriodMember2020-01-012020-12-31000009774532020-01-012022-12-31000009774512020-01-012022-12-31000009774522020-01-012022-12-31000009774542020-01-012022-12-31000009774552020-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.__ )

| | | | | | | | | | | |

| þ | Filed by the Registrant | ¨ | Filed by a Party other than the Registrant |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Section 240.14a-12 |

Thermo Fisher Scientific Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| þ | | No fee required. |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

From our Chairman, President and CEO

| | | | | |

| Dear Shareholder, Thank you for the confidence you have placed in Thermo Fisher Scientific. Our company’s success is propelled by a profound Mission – to enable our customers to make the world healthier, cleaner and safer. This inspires our 125,000 colleagues to bring their best each day because we know the work we do is helping our customers address some of the world’s greatest challenges. I’m very proud of what we achieved in 2022, as we continued to fulfill our Mission and delivered for all of our stakeholders. Our financial results in 2022 are a testament to the power of our Mission and the passion of our extraordinary team. During the year, we grew our revenue by 15 percent to $44.92 billion. We also delivered strong earnings results, consisting of GAAP diluted earnings per share (“EPS”) of $17.63 and adjusted EPS* of $23.24, and we generated very strong free cash flow* of $6.94 billion. We also returned significant capital to our shareholders through $3.5 billion of stock buybacks and dividends. Our continued success is propelled by our proven growth strategy, which consists of three pillars: •Developing high-impact, innovative new products •Leveraging our scale in high-growth and emerging markets •Delivering a unique value proposition to our customers In 2022, we invested $1.5 billion in research and development, we executed on the capacity and capability investments we’ve made over the past three years, and we successfully integrated PPD to create even more value for our pharmaceutical and biotechnology customers. All of this will create an even brighter future for Thermo Fisher. As a Mission-driven company, we are also committed to creating a brighter future for society overall, and I’m proud of the progress we made during the year on our sustainability priorities: •We reduced our carbon footprint and finalized power purchasing agreements to accelerate our transition to 100% renewable energy for our U.S. operations •We increased our greenhouse gas emissions reduction target to achieve a 50% reduction by 2030 for our operations •Our Foundation for Science supported students around the world with STEM education programs, and we became the title sponsor of the premier middle school STEM competition in the U.S. •Our colleagues collectively volunteered more than 120,000 hours to advance STEM education and support their communities Doing business the right way includes doing right by our colleagues. Based on our strong performance in 2022, we reinvested in our team and made two special payments to non-executive colleagues to help offset the impact of inflation. We were also recognized throughout the year for our industry leadership and inclusive culture. So, once again, it was a great year for Thermo Fisher. On behalf of our global team, thank you for your support of Thermo Fisher Scientific. We look forward to your attendance at our 2023 Annual Meeting of Shareholders on May 24, 2023 at 1:00 p.m. (ET). Sincerely,

|

|

|

Our financial results in 2022 are a testament to the power of our Mission and the passion of our extraordinary team.” |

|

|

| |

| Marc N. Casper Chairman, President and Chief

Executive Officer April 7, 2023 |

| * Adjusted EPS and free cash flow are financial measures that are not prepared in accordance with generally accepted accounting principles (“GAAP”). Appendix A to this Proxy Statement defines these and other non-GAAP financial measures and reconciles them to the most directly comparable historical GAAP financial measures. |

Notice of 2023 annual meeting of shareholders

| | | | | | | | | | | | | | | | | |

| | | | | |

| DATE & TIME Wednesday, May 24, 2023 1:00 p.m. (ET) | | LOCATION www.virtualshareholdermeeting.com/TMO2023 | | RECORD DATE March 27, 2023 |

Items of business

| | | | | | | | | | | | | | | | | |

| | |

Election of directors | Approval of an advisory vote on executive compensation | Approval of an advisory vote on the frequency of future executive compensation advisory votes |

Page 8 Page 8 | | |

FOR each nominee FOR each nominee |  FOR FOR |  EVERY YEAR EVERY YEAR |

| | | | | |

| | | | | |

| | |

Ratification of the selection of the independent auditors | Approval of the Amended and Restated 2013 Stock Incentive Plan | Approval of the 2023 Global Employee Stock Purchase Plan |

| | |

FOR FOR |  FOR FOR |  FOR FOR |

Shareholders will also consider any other business properly brought before the meeting.

By Order of the Board of Directors,

Julia L. Chen

Vice President and Secretary

April 7, 2023

Review your Proxy Statement and vote in one of the following ways:

| | | | | | | | | | | | | | | | | |

| | | | | |

| INTERNET Visit the website listed on your Notice of Internet Availability, proxy card or voting instruction form | | TELEPHONE Call the telephone number on your proxy card or voting instruction form | | MAIL Sign, date and return your proxy card or voting instruction form in the enclosed envelope |

Please refer to the proxy materials or the information forwarded by your bank, broker, trustee or other intermediary to see which voting methods are available to you.

| | |

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on May 24, 2023 |

The Proxy Statement and 2022 Annual Report are available at www.proxyvote.com.

This notice and the accompanying Proxy Statement, 2022 Annual Report, and proxy card or voting instruction form were first made available to shareholders on April 7, 2023. You may vote if you owned shares of our common stock at the close of business on March 27, 2023, the record date for notice of, and voting at, our annual meeting.

Table of contents

| | | | | | | | |

| |

| |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| | |

| |

| |

| |

| |

| |

| |

| | |

| Review and engagement | |

| |

| |

| |

| Equity plan proposals | 60 |

| | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

Appendix A: Reconciliation of GAAP to non-GAAP financial measures | |

Appendix B: Amended and Restated 2013 Stock Incentive Plan | |

| |

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | | | |

| | Frequently Requested Information | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | Clawback Policy | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | Named Executive Officers | | | |

| | | | | |

| | Oversight of Cybersecurity and Information Technology | | | |

| | | | | |

| | | | | |

| | | | | |

| | Oversight of Risk and Strategy | | | |

| | | | | |

| | Peer Group | | | |

| | | | | |

| | Policy on Hedging and Pledging | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Thermo Fisher Scientific Inc. 168 Third Avenue, Waltham, MA 02451 USA thermofisher.com |

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 3 |

Company overview

Who we are

| | | | | | | | |

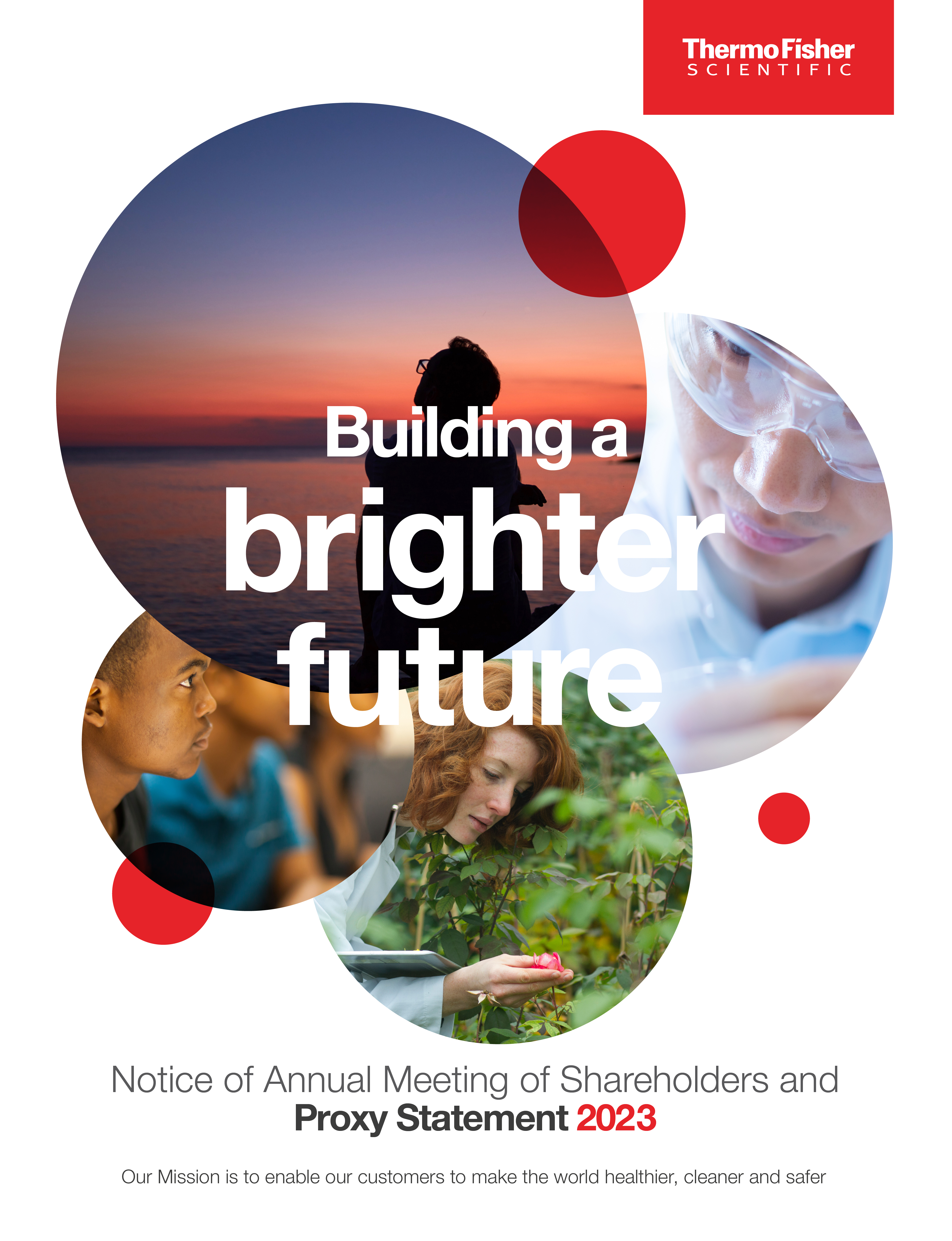

| Thermo Fisher Scientific Inc. (also referred to in this document as “Thermo Fisher,” “we,” “us,” “our,” and the “Company”) is the world leader in serving science. Our Mission is to enable our customers to make the world healthier, cleaner and safer. Whether our customers are accelerating life sciences research, solving complex analytical challenges, increasing productivity in their laboratories, improving patient health through diagnostics or the development and manufacture of life-changing therapies, we are here to support them. Our global team delivers an unrivaled combination of innovative technologies, purchasing convenience and pharmaceutical services through our industry-leading brands, including Thermo Scientific, Applied Biosystems, Invitrogen, Fisher Scientific, Unity Lab Services, Patheon and PPD. | Industry-leading scale •Exceptional commercial reach •Unique customer access •Extensive global footprint •Diversified revenue base •Very strong recurring revenue mix Unmatched depth of capabilities •Leading innovative technologies •Deep applications expertise •Premier productivity partner •Comprehensive pharma services offering | >$40B revenue >125,000 colleagues $1.5B R&D investment |

| | |

Our Mission is our purpose, to enable our customers to make the world healthier, cleaner, and safer. Our teams around the world strive to achieve this Mission every day, and our actions ultimately create an even brighter future for Thermo Fisher and all our stakeholders. Our formula for success starts with our aspirations for the decade ahead, which were established by management, with oversight by our Board, and articulated in our 2030 Vision. To achieve our vision, the Company sets and executes on a rolling 5-year strategic plan in order to identify key opportunities in the markets we serve and develop a roadmap to capture those opportunities, both through organic initiatives and through mergers and acquisitions. Focused execution is key to our success. Our annual goal tree represents our priorities for the year ahead, which are translated into the key objectives that we need to accomplish to ensure that our businesses and functions have clear goals that are aligned to our short- and long-term success. Our work is powered by our PPI Business System, a deeply ingrained philosophy of operational excellence, as well as our 4i Values and our environmental, social, and governance (“ESG”) strategy. We continue to build on our Mission-driven culture through the exceptional talent we attract and develop, that brings its best to work each day and focuses on the priorities we have established.

| | | | | | | | | | | | | | |

4 | 2023 Proxy Statement | | thermofisher.com | |

| | | | | |

| |

| |

Our Mission At Thermo Fisher, everything we do begins with our Mission – to enable our customers to make the world healthier, cleaner and safer. We have a remarkable team of colleagues around the globe who are passionate about helping our customers address some of the world’s greatest challenges. Whether they are developing new treatments for disease, protecting the environment or ensuring public safety, our customers count on us to help them achieve their goals. |

| Healthier |

Advancing promising new drugs |

| Cleaner |

Uncovering clues about our changing climate |

| Safer |

Ensuring safe drinking water |

| |

| |

| | | | | |

| |

Our Values Thermo Fisher’s 4i Values of Integrity, Intensity, Innovation and Involvement are the foundation of our culture. They guide our colleagues’ interactions — with our customers, suppliers and partners, with each other and with our communities. We continue to create a bright future for our Company by doing business the right way. |

| Integrity |

Honor commitments, communicate openly and demonstrate the highest ethical standards |

| Intensity |

Be determined to deliver results with speed, excellence and a passion to succeed |

| Innovation |

Create value by transforming knowledge and ideas into differentiated products and services for our customers |

| Involvement |

Make connections to work as one global team, embracing unique perspectives and treating others with dignity and respect |

| |

| | | | | | | | |

| | |

| | |

| Corporate social responsibility As the world leader in serving science, we bring our Mission to life in the work we do to make a difference for our customers and for society. We are uniquely positioned to contribute to a sustainable future with a global team of more than 125,000 dedicated colleagues that helps our customers discover new therapies and medicines, protect the environment, make sure our food is safe and advance science through thousands of other bold projects that improve millions of lives. Our approach to sustainability is built on a framework of four key pillars – Operations, Colleagues, Communities and Environment – that reinforce our Mission, are foundational to our business strategy and reflect our commitment to all stakeholders. By taking deliberate actions today that address ESG risks, impacts and opportunities, we are strengthening our business for tomorrow’s customers, colleagues and communities. |

| | Operations |

| The products, technologies and services we provide to our customers help them tackle some of the world’s greatest societal and environmental challenges. Our unwavering commitment to the highest ethical, quality, safety and sourcing standards drives the operational integrity to support their success, deliver greater value and build a brighter future. |

| | Colleagues |

| Our colleagues bring outstanding talent and passion every day. To reach our full potential as one global team, we are continuing to build a workforce that reflects the rich diversity of the world around us, fostering a vibrant and inclusive culture and creating the growth opportunities and pathways that allow colleagues to build meaningful careers at Thermo Fisher. |

| | Communities |

| We are deeply committed to delivering local impact on a global scale in support of the communities where we live and work. Enabled by our Foundation for Science, we leverage the aspects of our business that uniquely position us to advance STEM education and health equity as drivers of economic and social opportunity that are key to building a brighter future. |

| | Environment |

| As we innovate to serve our customers, we actively work to minimize environmental impacts across our operations and value chain. Our approach to climate, nature and sustainable design engages customers and suppliers to amplify collective progress. Our climate strategy aligns with the Paris Agreement, the 1.5°C pathway and the Science Based Targets initiative’s Net-Zero Standard. We have set a goal to achieve net zero greenhouse gas (“GHG”) emissions across our value chain by 2050 with two interim targets that drive near-term progress: by 2030, we will reduce Scope 1 and Scope 2 GHG emissions by more than 50% from a 2018 base year, and by 2027, we will engage 90% of suppliers, by spend, to set their own science-based targets. |

| For more information regarding the Board’s oversight of corporate social responsibility matters, see “Oversight of ESG” on page 22. |

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 5 |

2022 performance

| | | | | | | | |

| Proven Growth Strategy |

|

Revenue

15% Growth | |

|

| Commitment to high impact innovation •Innovation is a significant element of our proven growth strategy and central to enabling our customers in the development and scaling of major scientific advancements •In 2022 we launched many outstanding new products across our businesses that strengthen our industry leadership and drive strong returns on investment Scale in high growth emerging markets •Leveraging our scale and leading commercial infrastructure in high growth emerging markets is a key competitive differentiator •We offer outstanding supply chain capabilities and localized research and development and manufacturing to key markets as well as provide a unique customer experience and industry leading e-commerce platform Unique customer value proposition •We help our customers accelerate innovation and enhance their productivity with a unique product and service portfolio •Our unparalleled customer access and trusted partner status differentiates us from peers, allowing us to increase share of wallet with existing customers and win new business •We are continuously enhancing our offering through organic investments and strategic acquisitions |

| |

| | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Operating Income

19% CAGR | | | Adjusted EPS*

17% CAGR | | | Free Cash Flow*

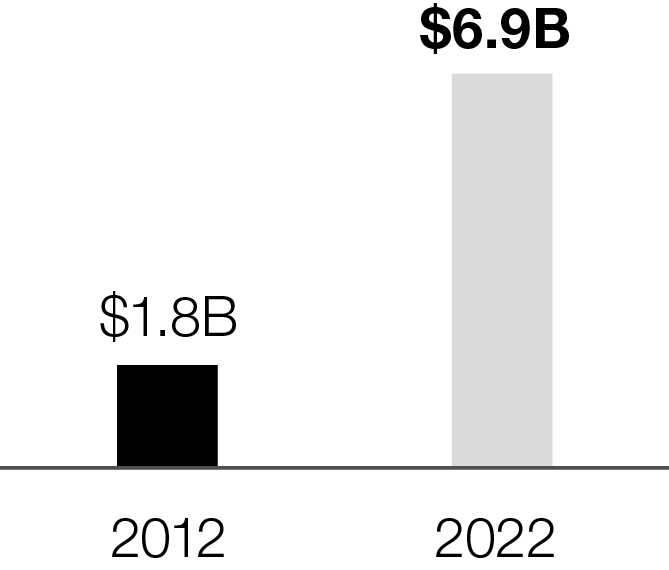

15% CAGR |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return to Shareholders |

| | | | | | |

Quarterly Dividends £15% Compared to 2021 | | Three-Year TSR 71% | | Five-Year TSR 194% | | 2022 Share Repurchases $3.0B |

| | | | | | |

* Adjusted EPS and free cash flow are financial measures that are not prepared in accordance with GAAP. Appendix A to this Proxy Statement defines these and other non-GAAP financial measures and reconciles them to the most directly comparable historical GAAP financial measures.

| | | | | | | | | | | | | | |

6 | 2023 Proxy Statement | | thermofisher.com | |

| | | | | |

| 2022 shareholder engagement | |

Our Board and management team are committed to engaging with and listening to our shareholders. During 2022, we contacted shareholders representing approximately 50% of our outstanding shares to solicit their feedback. During these meetings, we discussed a number of topics, including corporate governance practices, executive compensation and environmental and social issues. We asked our shareholders for their feedback to ensure that we had firsthand knowledge of their perspectives and any concerns related to our current practices. This dialogue has informed our Board and led to enhancements that help us address the issues that matter most to our shareholders. | |

Key topics discussed with shareholders

In the engagements with our shareholders during 2022, we gained valuable feedback on several issues and topics of mutual interest, including those listed below.

| | | | | | | | | | | | | | |

| Topic | | What we heard from our shareholders | | Governance and compensation enhancements informed by

shareholder input |

Board diversity, refreshment,

and tenure | | •Interest in seeing additional information around our priorities for Board diversity, refreshment, and tenure | | •This year we enhanced our disclosures regarding the skills, diversity and background of our Board. We also improved the presentation of our disclosure around the process for identifying and evaluating potential director candidates, including our commitment to seeking out diverse candidates, the composition of our current Board, the different forms of diversity on our Board, and director tenure and refreshment |

| Board oversight of risk, strategy and corporate social responsibility (“CSR”) | | •Interest in understanding the Board’s role in overseeing enterprise risk management, strategy, and our ESG practices | | •We enhanced our disclosure of Board oversight and updated the Board’s governance documents to explicitly include oversight of CSR-related matters |

| Board leadership approach | | •Interest in seeing additional information regarding our Board leadership structure and independent oversight of management | | •We expanded disclosure on our Board leadership structure to further explain why the Board believes that its current leadership structure is appropriate and supports effective risk oversight, given the specific characteristics and circumstances of the Company |

| Align pay with performance | | •Interest in seeing a greater proportion of pay dependent on strategic and operational performance, with motivating metrics to drive long-term shareholder value | | •For 2022, we updated the mix of long-term incentive awards to increase the percentage of performance-based restricted stock unit awards and enhanced the structure of our annual incentive program to further emphasize our CSR priorities |

| Environmental and social goals | | •Interest in understanding our commitment to measurable environmental goals and further transparency of diversity and inclusion (“D&I”) metrics | | •In 2022, we announced a new 2030 greenhouse gas emissions reduction target to reduce our Scope 1 and 2 emissions from operations by more than 50% from a 2018 baseline and we have committed to increase our transparency of D&I metrics over the next few years |

| | | | |

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 7 |

Corporate governance

Governance highlights | | | | | | | | | | | | | | |

| | | | |

| Robust, Independent Oversight | Board Refreshment | |

| •Supermajority of independent directors •100% independent exchange-mandated Board committees •Annual review of Board leadership structure and disclosure of the Board’s reasoning underlying its leadership structure •Strong independent Lead Director with robust authority and responsibility that is disclosed to shareholders •Regular executive sessions of independent directors •Annual Board and committee self-evaluations •“Overboarding” limits for directors •Board-level oversight of ESG matters | | •Regular Board refreshment and mix of tenure of directors (5 new directors joined since 2017) •Corporate Governance Guidelines confirm the Board’s commitment to actively seeking out diverse candidates by including women and minority candidates in the pool from which the Board nominees are chosen | |

| Good Governance Practices | |

| | •Proactive year-round shareholder engagement program with feedback provided to the Board •Clawback policy and clawback provisions in equity award agreements •Prohibition on hedging or pledging shares of the Company’s stock by officers and directors •Strong stock ownership requirements and, for CEO, stock holding requirement | |

Shareholder Rights | | |

| •Annual election of all directors by majority voting •One share, one vote •Shareholder right to call a special meeting (15% threshold) •Proxy access right for shareholders | | |

| | | | |

| | | | | | | | | | | | | | |

8 | 2023 Proxy Statement | | thermofisher.com | |

Director nominee skills and experience

The Board regularly reviews the skills, experience, and background that it believes are desirable to be represented on the Board.

The following identifies some of these key qualifications and skills, describes their relevance to our strategic vision, business and operations, and includes which directors possess these skills:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Skills, Qualifications and Background | | | | | | | | | | | | |

| STRATEGIC LEADERSHIP Experience driving strategic direction and growth of an organization. We seek to have directors that can provide strategic insight to the dynamic and fast-moving markets in which we operate globally. | | n | n | n | n | n | n | n | n | n | n | n |

| CEO OR SENIOR MANAGEMENT LEADERSHIP Experience serving as the Chief Executive Officer or other senior leadership role (e.g. Chief Financial Officer or Division Head) of a major organization. We seek to have directors with hands-on leadership experience in core management areas, such as strategic and operational planning, financial reporting, risk management, CSR and leadership development. | | n | n | n | n | n | n | n | n | n | n | n |

| INDUSTRY BACKGROUND Knowledge of or experience in the Company’s specific industry. We seek to have directors with significant experience in the life sciences industry or other related industries, experience in the end markets we serve, and growth areas that bring valuable perspectives on issues specific to our business. | | n | | n | n | n | | n | n | | n | |

| PUBLIC COMPANY BOARD SERVICE Experience as a board member of another publicly traded company. We seek to have directors with broad knowledge of corporate governance practices, trends and insights into board management, relations between a board and senior management, agenda setting, and succession planning. | | n | | n | n | n | | n | n | n | n | n |

| FINANCIAL ACUMEN AND EXPERTISE Experience or expertise in financial accounting and reporting or the financial management of a major organization. We seek to have directors with an understanding of finance and financial reporting processes to monitor and assess our operating and strategic performance and ensure robust controls and accurate financial reporting. | | n | n | n | | | n | n | n | n | n | n |

| INTERNATIONAL EXPERIENCE Experience doing business internationally. Growing our business outside the United States is a key part of our long-term strategy for growth. We seek to have directors with international experience that provide valued perspectives on our global operations and support key strategic decision-making in international markets. | | n | n | n | n | | n | n | n | n | n | n |

| CORPORATE FINANCE AND M&A EXPERIENCE Experience in corporate lending or borrowing, capital market transactions, significant mergers or acquisitions (“M&A”), private equity, or investment banking. We seek to have directors with transactional experience to oversee the assessment of opportunities consistent with our strategic priorities and long-term plans. | | n | n | n | | | | n | n | n | n | n |

| DIGITAL / TECHNOLOGY Experience or expertise in technology, cybersecurity, cloud computing, or scalable data analytics. We seek to have directors with experience in information technology to enhance the Board’s understanding of the information technology aspects of our business, and help us achieve our business objectives, including with respect to innovation, and to mitigate risks associated with our technological capabilities. | | n | n | | n | | | | | | | n |

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 9 |

Nominee biographies

| | | | | |

| |

| Marc N. Casper | Chairman, President and CEO |

| |

| |

Age: 55 Director since: 2009 Committees: Strategy and Finance, Science and

Technology | PROFESSIONAL HIGHLIGHTS •Thermo Fisher Scientific Inc. •Chairman, President and CEO (2020 - Present) •President and CEO (2009 - 2020) •Executive VP and COO (2008 - 2009) •Executive VP (2006 - 2008) OTHER CURRENT DIRECTORSHIPS: •Synopsys, Inc. PREVIOUSLY HELD DIRECTORSHIPS: •U.S. Bancorp |

DIRECTOR QUALIFICATIONS As the only member of the Company’s management to serve on the Board, Mr. Casper contributes a deep and valuable understanding of Thermo Fisher’s history and day-to-day operations. This contribution is stemmed further from Mr. Casper’s 20-plus years in the life sciences and healthcare equipment industry, and his long-standing employment with the Company. Additionally, Mr. Casper’s experience as the Chief Executive Officer of the Company, and previously serving in various senior level management roles, enables him to provide strategic leadership skills and financial acumen and expertise that are invaluable to the Board. |

| | | | | |

| |

| Nelson J. Chai | Independent |

| |

| |

Age: 57 Director since: 2010 Committees: Audit (Chair), Nominating and Corporate Governance | PROFESSIONAL HIGHLIGHTS •CFO, Uber Technologies Inc. (2018 - Present) •President and CEO, The Warranty Group (2017 - 2018) OTHER CURRENT DIRECTORSHIPS: •None |

DIRECTOR QUALIFICATIONS Mr. Chai’s broad background and experience makes him a suitable and valued member of our Board. Mr. Chai has held executive management positions in a variety of industries and organizations, including his current role as Chief Financial Officer of Uber Technologies Inc., a ridesharing technology platform, and prior roles as President and CEO of The Warranty Group, a provider of specialty insurance products, and President of CIT Group, a financial institution. As a result of his vast background, Mr. Chai brings valuable CEO and strategic leadership, financial acumen and expertise, and accounting experience to our Board. |

|

| | | | | |

| |

| Ruby R. Chandy | Independent |

| |

| |

Age: 61 Director since: 2022 Committees: Audit | PROFESSIONAL HIGHLIGHTS •President, Pall Industrial, Pall Corporation (2012 - 2015) •Previously held various roles at Thermo Fisher (2001 - 2007) OTHER CURRENT DIRECTORSHIPS: •DuPont de Nemours Inc. and Flowserve Corporation PREVIOUSLY HELD DIRECTORSHIPS: •Ametek, Inc. |

DIRECTOR QUALIFICATIONS Ms. Chandy’s broad background and experience makes her a valuable member of the Board. She is a proven executive with experience in global life sciences and multi-industrial companies, including her roles as President of the Industrial Division of Pall Corporation, and as Chief Marketing Officer of Rohm and Haas, a manufacturer of specialty chemicals that was acquired by Dow Chemical Company in 2009. She brings experience in executive management, marketing, strategy, international growth, innovation, and M&A, and has experience in relevant market segments, technologies, geographies, and business functions. Ms. Chandy brings valuable board-level experience from her many years serving on public company boards. |

| | | | | | | | | | | | | | |

10 | 2023 Proxy Statement | | thermofisher.com | |

| | | | | |

| |

| C. Martin Harris | Independent |

| |

| |

Age: 66 Director since: 2012 Committees: Nominating

and Corporate Governance,

Science and Technology | PROFESSIONAL HIGHLIGHTS •University of Texas Austin, Dell Medical School (2016 - Present) •Associate Vice President of the Health Enterprise •Chief Business Officer •Professor, Department of Internal Medicine •Interim Vice President for Medical Affairs (2021 - Present) OTHER CURRENT DIRECTORSHIPS: •Agiliti, Inc., Colgate-Palmolive Company and MultiPlan Corporation PREVIOUSLY HELD DIRECTORSHIPS: •HealthStream Inc., Invacare Corporation |

DIRECTOR QUALIFICATIONS Dr. Harris provides valuable insight and perspective on the healthcare industry stemming from his current role as Chief Business Officer of Dell Medical School of the University of Texas, Austin, and his previous long-standing career as a physician and Chief Information Officer of Cleveland Clinic Hospital, and Chief Strategy Officer of the Cleveland Clinic Foundation. Dr. Harris has been a strategic leader in healthcare organizations, and also brings valuable board-level experience from his many years served on public company boards in the healthcare industry. |

| | | | | |

| |

| Tyler Jacks |

| |

| |

Age: 62 Director since: 2009 Committees: Strategy

and Finance, Science and

Technology (Chair) | PROFESSIONAL HIGHLIGHTS •President, Break Through Cancer (2021 - Present) •Massachusetts Institute of Technology, Koch Institute •Professor, Department of Biology and Center for Cancer Research (1992 - Present) •Founding Director, Integrative Cancer Research (2001 - 2021) •Investigator, Howard Hughes Medical Institute (1994 - 2021) OTHER CURRENT DIRECTORSHIPS: •Amgen, Inc. |

DIRECTOR QUALIFICATIONS Dr. Jacks brings to the Board the benefits of his significant experience of many years in the cancer research industry. He currently serves as President of Break Through Cancer, an organization focusing on collaborative approaches to cancer research, and has worked for over 29 years at Massachusetts Institute of Technology as a professor in the Department of Biology, and formerly as Founding Director of the Koch Institute, a cancer research center. Dr. Jacks brings valuable board-level and industry specific experience from his years serving on public company boards in the biotechnology industry and as a member of multiple scientific advisory boards of biotechnology companies, pharmaceutical companies and academic institutions. |

| | | | | |

| |

R. Alexandra Keith Independent |

| |

| |

Age: 55 Director since: 2020 Committees: Compensation,

Nominating and Corporate

Governance | PROFESSIONAL HIGHLIGHTS •Procter & Gamble Company •Chief Executive Officer, P&G Beauty (2019 - Present), and Executive Sponsor, Corporate Sustainability (2021 - Present) •President, Global Hair Care and Beauty Sector (2017 - 2019) •President, Global Skin and Personal Care (2014 - 2017) OTHER CURRENT DIRECTORSHIPS: •None |

DIRECTOR QUALIFICATIONS Ms. Keith brings a unique and valuable perspective to the Board. She has spent her 30-plus year career at Procter & Gamble, a global consumer products company. Her career started in manufacturing, logistics, innovation planning, and marketing, then continued into various management and senior leadership roles prior to becoming CEO, P&G Beauty in 2019. In 2021, Ms. Keith was appointed Executive Sponsor for Corporate Sustainability, where she works alongside P&G’s Chief Sustainability Officer to guide the company’s sustainability progress. Ms. Keith also brings to the Board executive management and strategic leadership skills, financial expertise and M&A experience. |

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 11 |

| | | | | |

| |

| James C. Mullen |

| |

| |

Age: 64 Director since: 2018 Committees: Strategy and Finance | PROFESSIONAL HIGHLIGHTS •Editas Medicine, Inc. •Executive Chair of the Board (2022 - Present) •Chairman, President and Chief Executive Officer (2021 - 2022) •Chief Executive Officer, Patheon N.V. (2011 - 2017) OTHER CURRENT DIRECTORSHIPS: •Editas Medicine, Inc. PREVIOUSLY HELD DIRECTORSHIPS: •Insulet Inc. and Patheon N.V. |

DIRECTOR QUALIFICATIONS Mr. Mullen brings valuable industry knowledge to the Board, due to his 35-plus years of extensive management experience and his senior leadership background in the pharmaceutical and biotechnology industries. Mr. Mullen currently serves as Executive Chair of the Board of Directors of Editas Medicine, a clinical-stage biotechnology company, and previously served as Chief Executive Officer of Patheon N.V., a contract development and manufacturing organization which was acquired by the Company in 2017, and as Chief Executive Officer of Biogen Inc. We believe this experience provides our Board with specific expertise and insight into our business. Mr. Mullen also brings valuable board-level experience from his service on the boards of public companies in the pharmaceutical industry. |

| | | | | |

| |

| Lars R. Sørensen | Independent |

| |

| |

Age: 68 Director since: 2016 Previously served as a director: 2011 - 2015 Committees: Nominating and Corporate Governance (Chair), Strategy and Finance | PROFESSIONAL HIGHLIGHTS •Ferring Pharmaceuticals SA •Executive Chairman (2022 - Present) •Chairman (2021 - 2022) •President and CEO, Novo Nordisk A/S (2000 - 2016) OTHER CURRENT DIRECTORSHIPS: •Essity Aktiebolag PREVIOUSLY HELD DIRECTORSHIPS: •Carlsberg AS |

DIRECTOR QUALIFICATIONS Mr. Sørensen brings to the Board valuable strategic leadership skills, financial expertise, industry background, and international experience as a result of his current role as Executive Chairman of Ferring Pharmaceuticals, a multinational biopharmaceutical company, and his previous long-standing tenure as Chief Executive Officer at Novo Nordisk A/S, a global healthcare company. Mr. Sørensen also brings valuable board-level experience from his years of serving on public company boards in the life sciences industry. |

|

| | | | | | | | | | | | | | |

12 | 2023 Proxy Statement | | thermofisher.com | |

| | | | | |

| |

| Debora L. Spar | Independent |

| |

| |

Age: 59 Director since: 2019 Committees: Audit, Strategy

and Finance (Chair) | PROFESSIONAL HIGHLIGHTS •Harvard Business School •Professor, Harvard Business School (2018 - Present) and Senior Associate Dean, Business and Global Society (2021 - Present) •Senior Associate Dean, Harvard Business School Online (2019 - 2021) •President and CEO, Lincoln Center for the Performing Arts (2017 - 2018) OTHER CURRENT DIRECTORSHIPS: •None PREVIOUSLY HELD DIRECTORSHIPS: •Goldman Sachs and Northern Star Acquisition Corp. |

DIRECTOR QUALIFICATIONS Dr. Spar brings to the Board valuable executive management and strategic leadership skills, financial expertise, and a unique perspective on technology’s role in shaping society and the global economy. Dr. Spar has served as President and CEO of the Lincoln Center for the Performing Arts and as President of Barnard College. Dr. Spar also brings valuable experience serving on public company boards. |

| | | | | | | | |

| |

| Scott M. Sperling, Lead Director | Independent |

| |

| | |

Age: 65 Director since: 2006 Committees: Compensation | PROFESSIONAL HIGHLIGHTS •Co-Chief Executive Officer, Thomas H. Lee Partners, LP (1994 - Present) OTHER CURRENT DIRECTORSHIPS: •Agiliti, Inc. PREVIOUSLY HELD DIRECTORSHIPS: •iHeart Media, Inc. and The Madison Square Garden Company |

DIRECTOR QUALIFICATIONS Mr. Sperling brings to the Board valuable strategic leadership skills, and corporate finance and acquisition experience due to his current role serving as Co-Chief Executive Officer of Thomas H. Lee Partners LP, a private equity firm. Mr. Sperling also brings valuable board-level experience from serving on public company boards. |

| |

| | | | | |

| |

| Dion J. Weisler | Independent |

| |

| |

Age: 55 Director since: 2017 Committee: Audit, Compensation (Chair) | PROFESSIONAL HIGHLIGHTS •President and CEO, HP Inc. (2015 - 2019) OTHER CURRENT DIRECTORSHIPS: •BHP and Intel Corporation PREVIOUSLY HELD DIRECTORSHIPS: •HP Inc. |

DIRECTOR QUALIFICATIONS Mr. Weisler brings to the Board valuable strategic and senior management leadership skills, financial expertise, international experience, and M&A experience due to his former role serving as Chief Executive Officer at HP Inc., an information technology company. Mr. Weisler also brings valuable board-level experience from his service on other public company boards. |

|

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 13 |

Board composition

The Board takes a thoughtful approach to its composition and regularly reviews the skills, experience, and background that it believes are desirable to be represented on the Board in order to align with the Company’s strategic vision, business and operations, as further discussed below.

Director selection

Sources of nominations

The Nominating and Corporate Governance Committee (“N&CG Committee”) considers recommendations for director nominees suggested by its members, other directors, management and other interested parties. It will consider shareholder recommendations for director nominees that are sent to the N&CG Committee to the attention of the Company’s Secretary at the principal executive office of the Company and will evaluate them in the same manner as candidates suggested by other sources. For more information, see “Submitting 2024 proposals” on page 72. Director criteria

The N&CG Committee, along with the full Board, is responsible for establishing the general criteria and priorities for the selection of director candidates. The Board’s criteria for selecting directors are set forth in the Company’s Corporate Governance Guidelines, which can be found on the Company’s website at www.thermofisher.com, and include demonstrated business acumen, sound business judgment, and a reputation for integrity, honesty, and adherence to high ethical standards.

Selection process

The following describes the director selection process:

| | | | | | | | | | | |

| | | |

| | ESTABLISH NOMINEE CRITERIA •The N&CG Committee, together with the full Board, prioritizes experiences and attributes that will support the Company’s business and strategy, and complement the Board’s current composition, including with respect to diversity, skills and experience, taking into consideration the Company’s general criteria for director nominees set forth in the Company’s Corporate Governance Guidelines. The N&CG Committee believes that the backgrounds and qualifications of the directors considered as a group should provide a significant breadth of experience, knowledge and abilities that assist the Board in fulfilling its responsibilities | |

| | |

| | | |

| | SEARCH FOR NOMINEE •The N&CG Committee engages in a search process to identify qualified candidates, which process may include the use of an independent search firm, and assesses candidates’ skills, experience and alignment with the Company’s business and strategy | |

| | |

| | | |

| | REVIEW CANDIDATE’S HISTORY •The activities and associations of candidates are reviewed for any legal impediment, conflict of interest or other consideration that might prevent or interfere with service on our Board | |

| | |

| | | |

| | EVALUATE CANDIDATE •Director candidates are interviewed by members of the N&CG Committee and other members of the Board | |

| | |

| | | |

| | RECOMMEND CANDIDATE FOR ELECTION •After completing its evaluation, the N&CG Committee makes a recommendation to the full Board as to the persons who should be nominated by the Board, and the Board determines the nominees | |

| | |

| | | |

| | ELECT NOMINEE •The shareholders of the Company consider the nominees and elect directors by a majority vote to serve one-year terms | |

| | |

| | | |

| | | | | | | | | | | | | | |

14 | 2023 Proxy Statement | | thermofisher.com | |

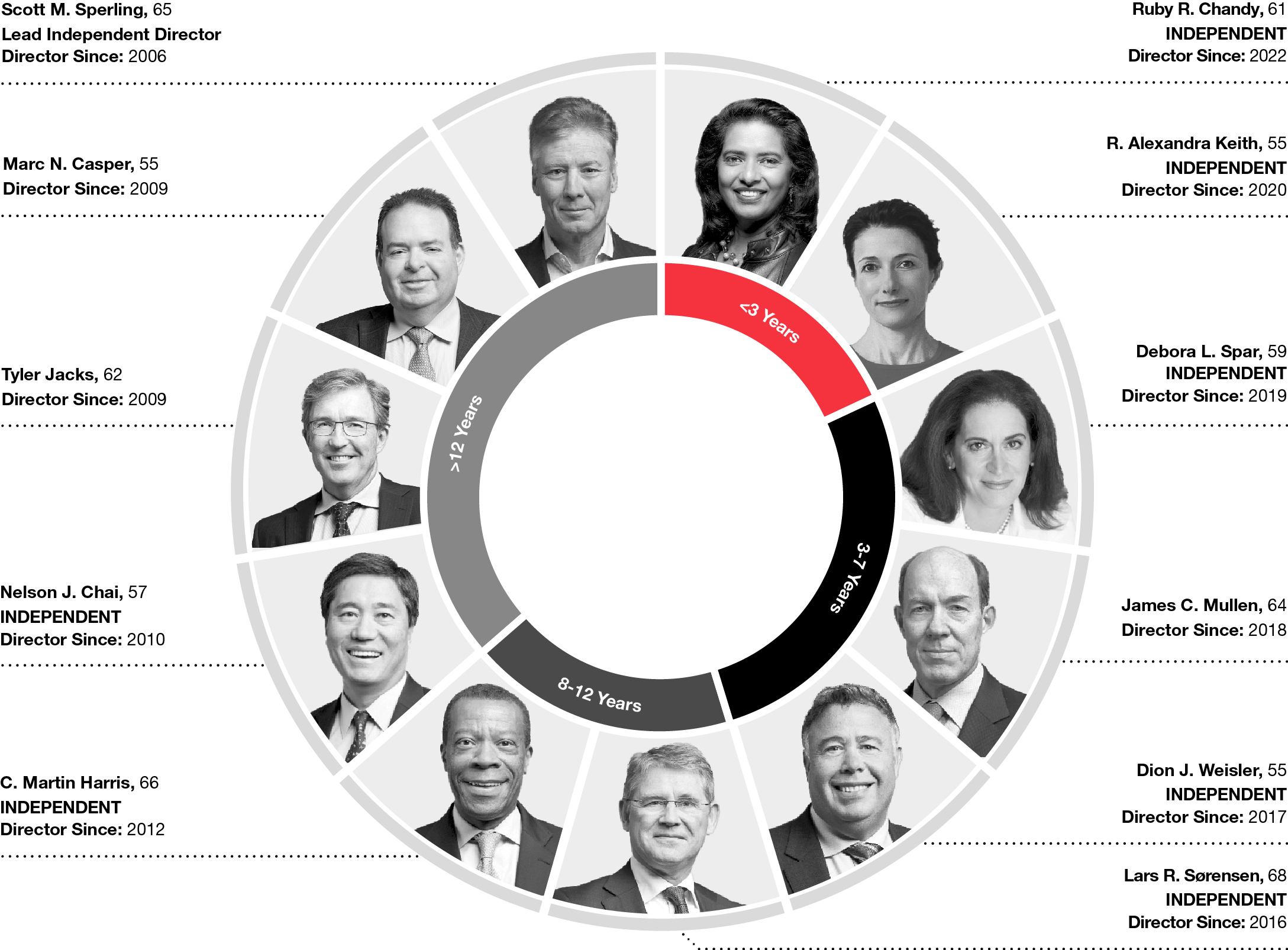

Active Board refreshment | | | | | | | | | | | |

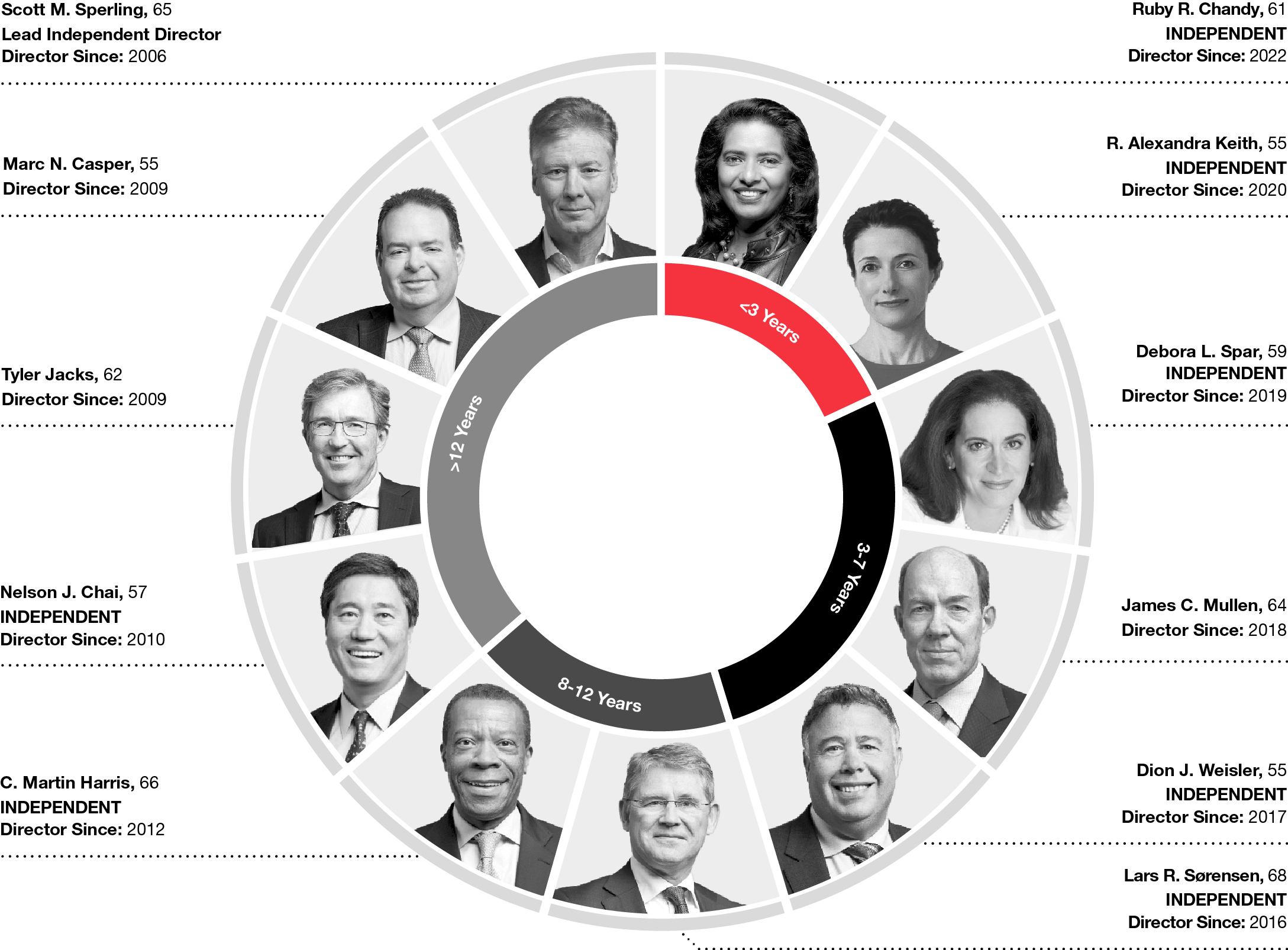

The N&CG Committee annually assesses the composition of the Board, and in connection with the Board’s nomination of a slate of directors, assesses such matters as the experiences and diversity represented on the Board. In addition, under our Corporate Governance Guidelines, any director who reaches the age of 72 will retire from the Board effective at the end of his or her then current term. On the recommendation of the N&CG Committee, the Board may waive this requirement if it deems a waiver to be in the best interests of the Company. In furtherance of the Board’s active role in refreshment and succession planning, since 2017, the Board has appointed 5 new directors, and 5 directors have retired, including Mr. Manzi, who is not standing for reelection this year. As a result of the Board’s ongoing refreshment, the average tenure of the Board has decreased to 8.8 years. | | | |

Refreshment since 2017: | |

| 5 new directors added to the Board 3 new directors are female 5 directors retired, including Mr. Manzi | |

Skills and experiences added: | |

| •digital and information technology •industry experience •CEO experience •global experience •public company board experience | |

| | |

Enhancing the diversity of our Board

We believe that the varied perspectives and experiences resulting from having a diverse Board enhance the quality of decision-making. We also believe diversity can help the Board identify and respond more effectively to the needs of customers, shareholders, employees, suppliers and other stakeholders. The Board and the N&CG Committee consider attributes such as race, gender, ethnicity, age, culture and nationality in seeking to develop a Board that, as a whole, reflects diverse viewpoints, backgrounds, skills, experiences and expertise. The Board is committed to identifying and evaluating highly qualified women and under-represented racially and ethnically diverse candidates as well as candidates with other diverse backgrounds, industry experience and other unique characteristics. To this end, as discussed above, our Corporate Governance Guidelines require that the N&CG Committee seek to include diverse candidates, including women and minorities, in the pool of candidates from which it recommends director nominees and request that any search firm it engages include diverse candidates.

The Board is actively seeking to increase its gender diversity and is committed to a Board composition that is at least 30% gender diverse, though this number may fluctuate from time to time during director transitions.

Creating an experienced Board with diversity of tenure

We believe that having directors with differing tenures is important in order to provide both fresh perspectives and deep experience and knowledge of the Company. Our longer-tenured directors have significant institutional knowledge and deep understanding of the Company’s business, which enhances the Board’s oversight of strategy and risk. The Board believes that a mix of these long-tenured directors and short-tenured directors with fresh perspectives ensures an appropriate balance of views and insights and allows the Board as a whole to benefit.

Nominee diversity and tenure

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 15 |

Annual evaluation process

Each year, our Board conducts a self-evaluation in order to assess its own effectiveness and dynamics, and identify areas for enhancement. Our Board’s annual self-evaluation also is a key component of director succession planning.

The N&CG Committee reviews and determines the overall process, scope, and content of our Board’s annual self-evaluation each year, including whether it is appropriate for the evaluation to be conducted internally or by an independent consultant. For 2022, the evaluation was conducted by the N&CG Committee Chair. Each of our Board committees also conducts a separate self-evaluation annually which is led by the respective committee chair.

The following chart reflects the key components of the Board’s annual self-evaluation process. Additional information on the topics covered in the scope of the evaluation is included below.

| | | | | | | | | | | |

| | | |

| | PROCESS DECISION •N&CG Committee considers options for the format of the Board self-evaluation process during the July Board meeting. For 2022, the N&CG Committee decided to have the Chair of the N&CG Committee conduct the Board self-evaluation (committee evaluations were conducted by each committee chair) | |

| | |

| | | |

| | EVALUATION SURVEY •Questions were sent by the N&CG Committee Chair to each director to solicit feedback on various topics related to the Board •Questions were sent by each of the committee chairs to each committee member | |

| | |

| | | |

| | ONE-ON-ONE DIRECTOR DISCUSSIONS •Individual calls with the N&CG Committee Chair were held with each director to obtain candid feedback for Board evaluation | |

| | |

| | | |

| | GROUP DISCUSSION •Discussion of overall Board evaluation was led by the N&CG Committee Chair •Summary of assessment was provided to the N&CG Committee, and then to the Board •Committee evaluations were led by each committee chair during committee meetings and reported to the full Board | |

| | |

| | | |

| | FEEDBACK COMMUNICATED AND ACTED UPON •Feedback was provided to management by the N&CG Committee Chair on areas for improvement •Changes were implemented | |

| | |

| | | |

2022 topics, key findings and takeaways

| | | | | | | | |

| | |

Board

composition, performance,

and materials | | •Board and committee composition and performance, including mix of skills, experience, tenure, and background •Identification of knowledge, background, and skill-sets that would be useful additions to the Board •Board refreshment, succession planning and onboarding of new directors •Board materials and management reporting, including the quality of materials and Board member interactions with management |

| | |

| | |

| Structure and effectiveness | | •Board and committee leadership, responsibilities, and effectiveness •Committee structure and functioning, responsibilities, communication, and reporting from committees to the Board •Effectiveness of meeting structure •Board’s ability to operate and conduct its business successfully and efficiently |

| | |

| | |

Board

responsibilities | | •Knowledge of the Company •Strategic planning, including the process, format, and materials for the Board’s strategy review sessions •Talent management and succession planning for the Chief Executive Officer (“CEO”) and other senior management, including diversity and inclusion •Candor of communications with the CEO and other senior management |

| | |

| | |

| Key findings and takeaways | | •Prioritized criteria for recruitment of director nominees •Affirmed the effectiveness of the Board’s current leadership structure •Affirmed the importance of inclusion of senior business leaders at Board dinners to foster increased oversight, talent development and collaboration with management •Restructured the annual strategy review session to allow for additional time for discussion on corporate strategy |

| | | | | | | | | | | | | | |

16 | 2023 Proxy Statement | | thermofisher.com | |

Board leadership structure

Annual review of leadership structure

On an annual basis, our N&CG Committee evaluates and makes recommendations to the Board concerning the Board’s leadership structure, including whether the roles of Chairman and CEO should be separated or combined, and recommends a Chairman from among the directors. The Board believes that it is in the best interests of the Company and its shareholders for the Board to determine which director is best qualified to serve as Chairman in light of the circumstances at the time, rather than based on a fixed policy, giving the Board flexibility to choose its optimal leadership structure depending upon the Company’s particular needs and circumstances and to structure its leadership in the most effective manner. In the event that the Chairman is not an independent director, an independent Lead Director is elected on an annual basis by a majority of the independent directors upon a recommendation from the N&CG Committee.

Since February 2020, our Board has combined the positions of Chairman and CEO under the leadership of Marc N. Casper, and designated an independent Lead Director, currently Scott Sperling. The Board continues to believe that it is in the best interest of the Company and its shareholders to combine the roles of Chairman and CEO.

The Board believes that having Mr. Casper serve as Chairman promotes unity of leadership between management and the Board and fosters increased alignment of the Company’s long-term strategic planning with its operational execution, subject to effective oversight by the independent Lead Director and the other independent directors. The Board believes the significant insight and expertise of the Company and the industry that Mr. Casper has gained throughout his long tenure with Thermo Fisher is invaluable. The Board believes that Mr. Casper’s thorough familiarity with the Company and its history, together with his wide-ranging industry expertise, makes him exceptionally qualified to lead the Board.

| | | | | | | | | | | | | | |

Independent Lead Director | |

The role of the independent Lead Director The role of the independent Lead Director is to provide independent leadership for the Board and assist the other independent directors in overseeing and shaping the partnership between management and the Board. The Board routinely reviews the independent Lead Director’s responsibilities to ensure that these responsibilities enhance its independent oversight of management. | | | | |

| | Considerations in selecting the independent Lead Director Several factors are considered in selecting the independent Lead Director, including areas of expertise (with a focus on leadership and corporate governance), experience serving on public company boards, tenure on the Thermo Fisher Board, interest, integrity, and ability to meet the time requirements of the position. After considering all of the above factors, the Board selected Scott Sperling to serve as independent Lead Director effective as of May 2022. Prior to becoming Lead Director, Mr. Sperling served as an active director including service on various Thermo Fisher committees. Mr. Sperling possesses significant leadership skills that are critical to the role of a strong and independent Lead Director. Mr. Sperling has also served on a myriad of public company Boards, which provides him with deep knowledge and understanding of corporate governance practices and trends. Mr. Sperling has a long tenure on our Board, and during that tenure he has demonstrated independent thinking and established strong working relationships with his fellow directors, garnering their trust and respect. As a long-standing director, he also brings significant institutional knowledge and a long-term perspective to the Board. For these reasons, the Board believes that Mr. Sperling is exceptionally well-qualified to serve as our independent Lead Director. | |

| | |

| | |

The independent Lead Director has the following duties (and may also perform other functions at the Board’s request), as detailed in the Company’s Corporate Governance Guidelines: | | | |

•leading meetings of the non-employee or independent directors •presiding over meetings of the Board at which the Chairman is not present •calling meetings of non-employee or independent directors •approving meeting agendas for the Board •approving meeting schedules to help ensure sufficient time for discussion •serving as a liaison between independent directors and the Chairman; however, each director remains free to communicate directly with the Chairman •being available to meet with shareholders as appropriate | | | |

| | | |

| | |

As discussed in more detail in the “Shareholder engagement” section of this Proxy Statement, the Board encourages a robust, ongoing investor engagement program. During these engagements, the independent Lead Director is available as the primary Board contact for direct communication with our significant investors. In general, investors, including those who are philosophically opposed to combining the positions of Chairman and CEO, have overwhelmingly communicated that they have minimal, if any, concerns about our Board policies and leadership structure. More specifically, these investors have voiced confidence in the strong counterbalancing structure of the robust independent Lead Director role. | | | |

| | | | |

Executive sessions

The Board recognizes the importance of independent Board oversight of the CEO and management and has developed policies and procedures designed to ensure independent oversight. In addition to conducting an annual review of the CEO’s performance, independent directors meet regularly, and at least semi-annually, in executive sessions without management, and at such other times as may be requested by any independent director. Our independent Lead Director presides at the meetings of the Company’s independent directors.

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 17 |

Board committees

| | | | | | | | | | | |

| | | |

| Audit Committee | Meetings in 2022: 12 | |

| | | |

| | | |

| | | |

Nelson J. Chai (Chair) | Ruby R. Chandy | Debora L. Spar | Dion J. Weisler |

| | | |

•All members are independent, financially literate. •The Board has determined that Messrs. Chai and Weisler each qualify as an Audit Committee financial expert. |

| | | |

| | | |

KEY RESPONSIBILITIES AND AREAS OF OVERSIGHT •integrity of the Company’s financial statements •compliance with legal and regulatory requirements •independent auditor’s qualifications, independence, and performance •performance of the Company’s internal audit function •external reporting on CSR matters, in coordination with the N&CG Committee •cybersecurity and information technology risks and programs, including data privacy •risk assessment and risk management policies, including governing guidelines and policies •major financial risk exposures and steps taken to monitor and control such exposures •procedures for complaints regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters |

| | | |

| | | | | | | | | | | |

| | | |

| Compensation Committee | Meetings in 2022: 7 | |

| | | |

| | | |

| | | |

Dion J. Weisler (Chair) | R. Alexandra Keith | Jim P. Manzi(1) | Scott M. Sperling |

| | | |

•All members are independent. |

| | | |

| | | |

KEY RESPONSIBILITIES AND AREAS OF OVERSIGHT •compensation matters for the CEO and other officers •management succession plans •administration of incentive compensation and equity-based plans •risk assessments of the Company’s compensation policies and practices •annual report on executive compensation •review and recommendation of director compensation •appointment and compensation of third party compensation consultant |

| | | |

(1) Mr. Manzi will serve on the Compensation Committee until the 2023 Annual Meeting.

| | | | | | | | | | | | | | |

18 | 2023 Proxy Statement | | thermofisher.com | |

| | | | | | | | | | | | | | |

| | | | |

| Nominating and Corporate Governance Committee | | Meetings in 2022: 5 |

| | | | | |

| | | |

| | | |

Lars R. Sørensen (Chair) | Nelson J. Chai | C. Martin Harris | R. Alexandra Keith |

| | | |

•All members are independent. |

| | | | |

| | | | |

KEY RESPONSIBILITIES AND AREAS OF OVERSIGHT •identify and recommend persons qualified to be nominated by the Board and to serve as members of the Board and its committees •CSR efforts and associated risks •Corporate Governance Guidelines •political spending •annual self-evaluation of the Board |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

| Strategy and Finance Committee | Meetings in 2022: 3 | |

| | | | |

| | | | |

| | | | |

Debora L. Spar (Chair) | Marc N. Casper | Tyler Jacks | James C. Mullen | Lars R. Sørensen |

| | | | |

| | | | |

KEY RESPONSIBILITIES AND AREAS OF OVERSIGHT •annual strategic plan •significant strategic decisions •material financial matters, including investments and acquisitions and divestitures |

| | | | |

| | | | | | | | | | | | | | |

| | | | | |

| Science and Technology Committee | | Meetings in 2022: 1 | |

| | | | | |

| | | | |

| | |

Tyler Jacks (Chair) | Marc N. Casper | C. Martin Harris |

| | | | |

| | | | |

KEY RESPONSIBILITIES AND AREAS OF OVERSIGHT •staying abreast of new technologies, markets and applications for the Company’s products, including ethical use •the Company’s Scientific Advisory Board •monitoring and evaluating trends in science and recommending emerging technologies for building the Company’s technological strength |

| | | | |

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 19 |

2022 Board engagement

Our directors engage beyond the boardroom, which provides them with additional insights into our business, risk management and industry, as well as valuable perspectives from senior leaders and the performance of our Company that strengthens their understanding and oversight of our business, strategy, and key priorities.

The commitment of our directors extends well beyond the preparation for, and attendance at, regular and special meetings.

| | | | | | | | |

| Ongoing Collaboration | Stakeholder Engagement | Regularly Informed |

| | |

| Our directors have frequent interactions with each other, senior management and key employees globally on topics such as strategy, performance, risk management, culture and talent development. | Our Board values the input of our shareholders and receives periodic updates on shareholder engagement led by management. Our Board also responds to and participates in communications where appropriate. From time to time, directors participate in direct engagement with our shareholders to discuss specific matters of mutual importance. | Our CEO provides our Board with periodic updates on major business developments, milestones, important internal initiatives and communications. In addition, the Board receives and reviews information on significant developments, press coverage, and current events that relate to our business, our employees, and our industry. |

| | |

Our independent Lead Director and committee chairs provide additional independent leadership by setting meeting agendas:

•For example, each chair sets the agenda for his or her respective committee meetings, and reviews and provides feedback on the form and type of related materials, in each case taking into account whether his or her committee is appropriately carrying out its core responsibilities and focusing on the key issues facing the Company, as may be applicable from time to time. To do so, each chair engages with key members of management and subject matter experts in advance of committee meetings.

•In addition, our independent Lead Director also sets the Board agenda (working with our Chairman) and approves the form and type of related materials. Our independent Lead Director also approves the schedule of meetings, taking into account whether there is sufficient time for discussion of all agenda items at each meeting.

Key areas of Board oversight

Our Board is elected by the shareholders to oversee their interests in the long-term health and overall success of the Company’s business and financial strength. Throughout the year, our Board and its committees discuss operations and Company strategy, which for 2022 focused on navigating a dynamic macroeconomic and geopolitical environment, while accelerating the Company’s growth strategy to realize our 2030 Vision. Our Board meetings include regular sessions with business leaders and executives across key corporate functions including finance, tax, information technology, cybersecurity, risk and human resources, through which the Board remains informed on the implementation of operational goals, performance, and strategies. At regular meetings, the Board also considers drivers of our business execution along with key risks, challenges and opportunities and considers how they relate to the effectiveness of our Company strategy. The Board also dedicates an annual session to focus on long-term strategy and the future needs of, and opportunities for, the Company.

Oversight of strategy

The Board believes that overseeing and monitoring strategy - one of its key responsibilities - is a continuous process, and takes a multilayered approach in exercising its duties.

| | | | | | | | |

| The Board is committed to oversight of the Company’s business strategy and strategic planning, including work embedded in regular Board meetings and a dedicated meeting each year to focus on strategy. | | This ongoing effort enables the Board to focus on Company performance over the short, intermediate and long term, as well as the quality of operations. In addition to financial and operational performance, non-financial measures are discussed regularly by the Board and Board committees. |

The Board oversees development of the Company’s long-term vision and strategic plan. The Strategy and Finance Committee of the Board meets with management each year to discuss and agree on the agenda for a focused Board strategy session. During this dedicated two-day strategy session, the Company leadership meets with the Board to discuss the long-term vision and strategic plan for the overall Company, as well as its capital allocation strategy. The strategic plan informs the key strategic questions and priorities for each of the Company’s primary businesses, which are reviewed by the Board at its regularly scheduled meetings throughout the year. At these meetings, the Board also receives progress updates from management on the execution of the strategic plans.

Our Mission is our purpose, to enable our customers to make the world healthier, cleaner, and safer. Our teams around the world strive to achieve this Mission every day, and our actions ultimately create an even brighter future for Thermo Fisher and all our stakeholders. Our formula for success starts with our aspirations for the decade ahead, which were established by management, with oversight by our Board, and articulated in our 2030 Vision. To achieve our vision, the Company sets and executes on a rolling 5-year strategic plan in order to identify key opportunities in the markets we serve and develop a roadmap to capture those opportunities, both through organic initiatives and through mergers and acquisitions. Focused execution is key to our success. Our annual goal tree represents our priorities for the year ahead, which are translated into the key objectives that we need to accomplish to ensure that our businesses and functions have clear goals that are aligned to our short- and long-term success. Our work is powered by our PPI Business System, a deeply ingrained philosophy of operational excellence, as well as our 4i Values and our ESG strategy. We continue to build on our

| | | | | | | | | | | | | | |

20 | 2023 Proxy Statement | | thermofisher.com | |

Mission-driven culture through the exceptional talent we attract and develop, that brings its best to work each day and focuses on the priorities we have established.

Our annual goals and metrics are communicated through our goal tree, which represents our key priorities for the year ahead, the key objectives we need to accomplish so that we can translate these annual goals into the objectives that our businesses and functions need to achieve. All of this is enabled by our strong cultural foundation, based on our 4iValues, our PPI Business System and our ESG strategy, and we continue to build on that foundation through the exceptional talent we attract and develop. Our culture fuels engagement from our teams to bring their best to work each day and focus on the priorities we have established.

Oversight of risk

| | |

|

Board The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to the Company. The Board does not view risk in isolation. Risks are considered in virtually every business decision. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Rather, purposeful and appropriate risk-taking is essential for the Company to be competitive on a global basis and to achieve the Company’s long-term strategic objectives. The Board administers its risk oversight role directly and through its committee structure and the committees’ regular communications with the full Board. The Board reviews risks including: •strategic, financial, economic, and execution risks and exposures associated with our operations and strategy •senior management succession planning •matters that may present material risk to our business, industry, operations, financial position, or cash flows, and, as applicable, significant transactions •legal, quality, and regulatory risks and other matters that may present material risk to our prospects or reputation, including those related to our global operations The Board also has a formal, annual discussion of the Company’s findings from its enterprise risk management (“ERM”) program, a global process for considering a broad range of risks to the Company. |

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| AUDIT COMMITTEE Oversees risks associated with our financial and accounting systems and accounting policies, in addition to finance-related public reporting, regulatory compliance and certain other matters delegated to the Audit Committee, including risks associated with our information systems and technology (including cybersecurity). | COMPENSATION COMMITTEE Oversees risks related to our compensation practices to ensure that these practices are not reasonably likely to have a material adverse effect on the Company or encourage employees to take unnecessary or excessive risks; also oversees risks related to talent management and succession planning for our leadership team. | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE Oversees risks related to corporate governance matters and certain other risks, including, but not limited to, the Company’s CSR strategy and political spending approach. | SCIENCE AND TECHNOLOGY COMMITTEE Oversees risks related to our products and technologies, including oversight of our Scientific Advisory Board and bioethics. | STRATEGY AND FINANCE COMMITTEE Oversees risks related to the Company’s capital allocation framework, including sources and uses of cash and capital generation and allocation versus targets and plans; also oversees the Company’s strategic plans. | |

| | | | | | |

| | |

The committees report back to the full Board at each regular meeting, and certain risk topics may be brought to the full Board for consideration where deemed appropriate to ensure broad Board understanding of the nature of the risk. |

The risk oversight function of the Board is reinforced by its leadership structure. Our CEO’s service on the Board promotes open communication between management and the directors relating to risk. Additionally, each exchange-mandated Board committee is comprised solely of independent directors, all directors are actively involved in the risk oversight function, and no element of Board oversight is reliant on the expertise of a single director.

Enterprise risk management process

Throughout the year, members of a cross-functional team within the Company conduct interviews with Company experts, leaders, and specialists across functions, geographies, and levels. This team seeks to identify, on a continuous basis, the most pressing current and future potential risks facing the Company. Annually, the full Board discusses with senior management the most significant risks identified in the ERM process, providing input on the steps taken to mitigate each risk and plans for additional mitigation in the year ahead.

| | | | | | | | | | | | | | |

| 2023 Proxy Statement | | thermofisher.com | 21 |

Oversight of ESG

As the world leader in serving science, we’ve taken many steps over the years to positively contribute to society, strengthen our local communities, and mitigate the impacts of climate change in order to create a healthier, cleaner and more sustainable world. Our ESG strategy is informed by robust stakeholder engagement and is actively refreshed to identify value creation opportunities and minimize risk. Board-level governance is held within our N&CG Committee, which oversees the Company’s governance and CSR efforts and reports to the full Board as appropriate. Our Audit Committee also plays a role in the oversight of reporting on these matters in Securities and Exchange Commission (“SEC”) filings and the data quality related to this reporting.

CSR is an integrated aspect of how we think about strategy and risk. Our Company leadership team ensures our ESG priorities are embedded in business decisions and operating practices, which we believe also strengthens our organizational culture to drive results and success. Strategic investments in technology, products, people and the planet help to ensure sustainable growth and enable us to deliver long-term value and strong returns for our shareholders.

More information on our ESG priorities and progress can be found in our Corporate Social Responsibility Report, which is available on our website at www.thermofisher.com/CSR and guided by internationally recognized standards and frameworks including the Global Reporting Initiative (“GRI") Standards, the International Financial Reporting Standards (“IFRS”) Foundation’s SASB Standards, the Task Force on Climate-Related Financial Disclosures (“TCFD”) and the United Nations Sustainable Development Goals (“SDGs”).

Oversight of cybersecurity and information technology

Our Audit Committee is responsible for overseeing our cybersecurity and data privacy risks. Our cybersecurity program is led by the Company’s Vice President, Chief Information Security Officer, who, along with Thermo Fisher’s Senior Vice President, Chief Information Officer, provide regular updates each quarter to the Audit Committee regarding this program, including information about the cybersecurity threat landscape, investments in infrastructure and opportunities to protect and enhance the Company’s systems and security of products and operations. In addition, the Board receives an annual overview of the cybersecurity program and receives periodic briefings from management.

Cybersecurity is a critical component of our risk management process. We use a risk-based, “defense in depth” approach to identify, protect, detect, respond to and recover from cyber threats. Recognizing that no single technology, process or business control can effectively prevent or mitigate all risks, we employ multiple technologies, processes and controls, all working independently but as part of a cohesive strategy to minimize risk. This strategy is tested through audits, independent program assessments, penetration testing and other exercises designed to assess effectiveness.