ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification Number) |

| |

| |

| (Address of Principal Executive Offices) |

(Zip Code) |

| Title of e ach c lass |

Trading Symbol(s) |

|

Name of e ach e xchange on w hich r egistered | |

| |

|

|

|

|

| |

|

|

|

| |

|

Page No. |

| |||

| | ||||||

| Item 1. |

|

|

|

1 |

| |

| Item 1A. |

|

|

|

10 |

| |

| Item 1B. |

|

|

|

21 |

| |

| Item 2. |

|

|

|

21 |

| |

| Item 3. |

|

|

|

22 |

| |

| Item 4. |

|

|

|

22 |

| |

| |

| |||||

| | ||||||

| Item 5. |

|

|

|

23 |

| |

| Item 6. |

|

|

|

23 |

| |

| Item 7. |

|

|

|

24 |

| |

| Item 7A. |

|

|

|

40 |

| |

| Item 8. |

|

|

|

42 |

| |

| Item 9. |

|

|

|

107 |

| |

| Item 9A. |

|

|

|

107 |

| |

| Item 9B. |

|

|

|

108 |

| |

| |

| |||||

| | ||||||

| Item 10. |

|

|

|

109 |

| |

| Item 11. |

|

|

|

109 |

| |

| Item 12. |

|

|

|

109 |

| |

| Item 13. |

|

|

|

109 |

| |

| Item 14. |

|

|

|

109 |

| |

| |

| |||||

| | ||||||

| Item 15. |

|

|

|

110 |

| |

| Item 16. |

|

|

|

111 |

| |

| |

|

|

117 |

| ||

Item 1: |

Business |

| • | semiconductor test (“Semiconductor Test”) systems; |

| • | defense/aerospace (“Defense/Aerospace”) test instrumentation and systems, storage test (“Storage Test”) systems, and circuit-board test and inspection (“Production Board Test”) systems (collectively these products represent “System Test”); |

| • | industrial automation (“Industrial Automation”) products; and |

| • | wireless test (“Wireless Test”) systems. |

| • | improve and control product quality; |

| • | measure and improve product performance; |

| • | reduce time to market; and |

| • | increase production yields. |

| • | A high efficiency multi-site architecture that reduces tester overhead such as instrument setup, synchronization and data movement, and signal processing; |

| • | The IG-XL ™ software operating system which provides fast program development, including instant conversion from single to multi-site test; and |

| • | Broad technology coverage by instruments designed to cover the range of test parameters, coupled with a universal slot test head design that allows easy test system reconfiguration to address changing test needs. |

| • | easy programming using a graphical interface which allows users to program the collaborative robot in a few hours; |

| • | flexibility and ease of use in allowing customers to change the task the collaborative robot is performing as their production demands dictate; |

| • | safe operations as collaborative robots can assist workers in side by side production environments requiring no special safety enclosures or shielding to protect workers; and |

| • | short payback period, on average less than 12 months. |

| • | easy programming using a graphical interface which allows users to program the collaborative robot in a few hours; |

| • | ease of use, speed of deployment and flexibility in allowing customers to change the task as their demands dictate; |

| • | reliable autonomous navigation over large manufacturing and warehouse areas; and |

| • | short payback period, on average 12–18 months. |

| • | highly flexible, adaptive, robot motion control; and |

| • | task optimized robotic path planning. |

| 2019 |

2018 |

|||||||

| (in millions) |

||||||||

| Semiconductor Test |

$ | 543.2 |

$ | 367.5 |

||||

| System Test |

206.0 |

149.5 |

||||||

| Wireless Test |

42.9 |

32.0 |

||||||

| Industrial Automation |

17.9 |

19.7 |

||||||

| $ | 810.0 |

$ | 568.7 |

|||||

| • | patents; |

| • | copyrights; |

| • | trademarks; |

| • | trade secrets; |

| • | standards of business conduct and related business practices; and |

| • | technology license agreements, software license agreements, non-disclosure agreements, employment agreements, and other agreements. |

| Executive Officer |

Age |

Position |

Business Experience for The Past 5 Years | |||||

| Mark E. Jagiela |

59 |

Chief Executive Officer and President |

Chief Executive Officer since February 2014; President of Teradyne since January 2013; President of Semiconductor Test from 2003 to February 2016; Vice President of Teradyne from 2001 to 2013. | |||||

| Sanjay Mehta |

51 |

Vice President, Chief Financial Officer and Treasurer |

Vice President, Chief Financial Officer and Treasurer of Teradyne since April 2019; Senior Vice President and General Manager of Compute and XR Products at Qualcomm Technologies, Inc. (“Qualcomm”) from June 2018 to March 2019; President of Qualcomm’s semiconductor segment (“QCT”) China from March 2016 to June 2018; Senior Vice President Business Operations of QCT at Qualcomm from November 2015 to March 2016; Chief Financial Officer and Senior Vice President, Sales Operations, of QCT at Qualcomm from October 2010 to November 2015. | |||||

| Charles J. Gray |

58 |

Vice President, General Counsel and Secretary |

Vice President, General Counsel and Secretary of Teradyne since April 2009. | |||||

| Bradford B. Robbins |

61 |

President of Wireless Test |

President of Wireless Test since August 2014; Chief Operating Officer of LitePoint Corporation from 2012 to 2014; Vice President of Teradyne since 2001. | |||||

| Gregory S. Smith |

56 |

President of Semiconductor Test |

President of Semiconductor Test since February 2016; Vice President, SOC Business Group and Marketing Manager for Semiconductor Test Group from January 2014 to February 2016; Business Unit Manager, Complex SOC Business Unit from 2009 to January 2014. | |||||

| Walter G. Vahey |

55 |

Executive Vice President, Business Development |

Executive Vice President, Business Development since December 2017; President of System Test from July 2012 to December 2017; Vice President of Teradyne since 2008; General Manager of Storage Test from 2008 to December 2017; General Manager of Production Board Test from April 2013 to December 2017. | |||||

Item 1A: |

Risk Factors |

| • | a worldwide economic slowdown or disruption in the global financial or industrial markets; |

| • | competitive pressures on selling prices; |

| • | our ability to introduce, and the market acceptance of, new products; |

| • | changes in product revenues mix resulting from changes in customer demand; |

| • | the level of orders received which can be shipped in a quarter because of the tendency of customers to wait until late in a quarter to commit to purchase due to capital expenditure approvals and constraints occurring at the end of a quarter, or the hope of obtaining more favorable pricing from a competitor seeking the business; |

| • | engineering and development investments relating to new product introductions, and the expansion of manufacturing, outsourcing and engineering operations in Asia; |

| • | provisions for excess and obsolete inventory relating to the lack of demand for and the discontinuance of products; |

| • | impairment charges for certain long-lived and intangible assets, and goodwill; |

| • | an increase in the leasing of our products to customers; |

| • | disruption caused by health epidemics, such as the coronavirus outbreak; |

| • | our ability to expand our global distribution channel for our collaborative and mobile robots; |

| • | parallel or multi-site testing which could lead to a decrease in the ultimate size of the market for our semiconductor and electronic test products; and |

| • | the ability of our suppliers and subcontractors to meet product quality or delivery requirements needed to satisfy customer orders for our products, especially if consolidated revenues increase. |

| • | unexpected changes in legal and regulatory requirements affecting international markets; |

| • | changes in tariffs and exchange rates; |

| • | social, political and economic instability, acts of terrorism and international conflicts; |

| • | disruption caused by health epidemics, such as the coronavirus outbreak; |

| • | difficulties in protecting intellectual property; |

| • | difficulties in accounts receivable collection; |

| • | cultural differences in the conduct of business; |

| • | difficulties in staffing and managing international operations; |

| • | compliance with anti-corruption laws; |

| • | compliance with data privacy regulations; |

| • | compliance with customs and trade regulations; and |

| • | compliance with international tax laws and regulations. |

| • | new product selection; |

| • | ability to meet customer requirements including with respect to safety and cyber security; |

| • | development of competitive products by competitors; |

| • | timely and efficient completion of product design; |

| • | timely and efficient implementation of manufacturing and manufacturing processes; |

| • | timely remediation of product performance issues, if any, identified during testing; |

| • | assembly processes and product performance at customer locations; |

| • | differentiation of our products from our competitors’ products; |

| • | management of customer expectations concerning product capabilities and product life cycles; |

| • | transition of customers to new product platforms; |

| • | compliance with product safety regulations; |

| • | ability to protect products from cyber attacks when used by our customers; |

| • | ability to attract and retain technical talent; and |

| • | innovation that does not infringe on the intellectual property rights of third parties. |

| • | restrict our ability to expand facilities; |

| • | restrict our ability to ship certain products; |

| • | require us to modify our operations logistics; |

| • | require us to acquire costly equipment; or |

| • | require us to incur other significant costs and expenses. |

| • | make it difficult to make payments on this indebtedness and our other obligations; |

| • | make it difficult to obtain any necessary future financing for working capital, capital expenditures, debt service requirements or other purposes; |

| • | require the dedication of a substantial portion of any cash flow from operations to service for indebtedness, thereby reducing the amount of cash flow available for other purposes, including capital expenditures; and |

| • | limit our flexibility in planning for, or reacting to, changes in our business and the industries in which we compete. |

Item 1B: |

Unresolved Staff Comments |

Item 2: |

Properties |

Item 3: |

Legal Proceedings |

Item 4: |

Mine Safety Disclosure |

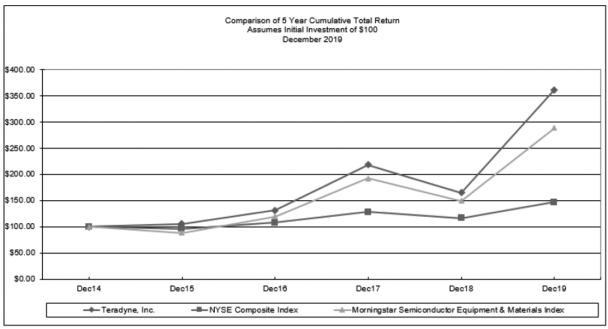

Item 5: |

Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

| Period |

(a) Total Number of Shares (or Units) Purchased |

(b) Average Price Paid per Share (or Unit) |

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that may Yet Be Purchased Under the Plans or Programs |

||||||||||||

| September 30, 2019 – October 27, 2019 |

757 |

$ | 59.49 |

756 |

$ | 262,786 |

||||||||||

| October 28, 2019 – November 24, 2019 |

690 |

$ | 63.81 |

689 |

$ | 218,846 |

||||||||||

| November 25, 2019 – December 31, 2019 |

658 |

$ | 64.38 |

657 |

$ | 176,522 |

||||||||||

| 2,105 |

(1) | $ | 62.43 |

(1) | 2,102 |

|||||||||||

| (1) | Includes approximately three thousand shares at an average price of $60.44 withheld from employees for the payment of taxes. |

Item 6: |

Selected Financial Data |

| Years Ended December 31, |

||||||||||||||||||||

| 2019 |

2018 |

2017 |

2016 |

2015 |

||||||||||||||||

| (dollars in thousands, except per share amounts) |

||||||||||||||||||||

| Consolidated Statement of Operations Data (1)(2)(3)(4)(5): |

||||||||||||||||||||

| Revenues |

$ | 2,294,965 |

$ | 2,100,802 |

$ | 2,136,606 |

$ | 1,753,250 |

$ | 1,639,578 |

||||||||||

| Net income (loss) |

$ | 467,468 |

$ | 451,779 |

$ | 257,692 |

$ | (43,421 |

) | $ | 206,477 |

|||||||||

| Net income (loss) per common share-basic |

$ | 2.74 |

$ | 2.41 |

$ | 1.30 |

$ | (0.21 |

) | $ | 0.98 |

|||||||||

| Net income (loss) per common share-diluted |

$ | 2.60 |

$ | 2.35 |

$ | 1.28 |

$ | (0.21 |

) | $ | 0.97 |

|||||||||

| Cash dividend declared per common share |

$ | 0.36 |

$ | 0.36 |

$ | 0.28 |

$ | 0.24 |

$ | 0.24 |

||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||

| Total assets |

$ | 2,787,014 |

$ | 2,706,606 |

$ | 3,109,545 |

$ | 2,762,493 |

$ | 2,548,674 |

||||||||||

| Long-term debt obligations |

$ | 394,687 |

$ | 379,981 |

$ | 365,987 |

$ | 352,669 |

$ | — |

||||||||||

| (1) | The year ended December 31, 2019 includes a $26.0 million tax benefit from the release of uncertain tax position reserves due to the IRS completion of its audit of our 2015 Federal tax return, a $15.0 million charge for the impairment of the investment in RealWear, $8.2 million of pension actuarial losses, and the results of operations of Lemsys and AutoGuide from January 30, 2019 and November 13, 2019, respectively. |

| (2) | The year ended December 31, 2018 includes $49.5 million of tax benefit related to the finalization of the U.S. transition tax liability, $3.3 million of pension actuarial gains, and the results of operations of Mobile Industrial Robots and Energid from April 25, 2018 and February 26, 2018, respectively. |

| (3) | The year ended December 31, 2017 includes $186.0 million of provisional tax expense related to the Tax Reform Act and $6.6 million of pension actuarial gains. |

| (4) | The year ended December 31, 2016 includes a $254.9 million goodwill impairment charge and an $83.3 million acquired intangible assets impairment charge related to the Wireless Test segment, and $3.2 million of pension actuarial gains. |

| (5) | The year ended December 31, 2015 includes $17.7 million of pension actuarial losses, a $5.4 million gain from the sale of an equity investment and the results of operations of Universal Robots from June 12, 2015. |

Item 7: |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| • | semiconductor test (“Semiconductor Test”) systems; |

| • | defense/aerospace (“Defense/Aerospace”) test instrumentation and systems, storage test (“Storage Test”) systems, and circuit-board test and inspection (“Production Board Test”) systems (collectively these products represent “System Test”); |

| • | industrial automation (“Industrial Automation”) products; and |

| • | wireless test (“Wireless Test”) systems. |

| • | We account for a contract with a customer when there is written approval, the contract is committed, the rights of the parties, including payment terms, are identified, the contract has commercial substance and consideration is probable of collection. |

| • | We periodically enter into contracts with customers in which a customer may purchase a combination of goods and services, such as products with extended warranty obligations. We determine performance obligations by assessing whether the products or services are distinct from the other elements of the contract. In order to be distinct, the product or service must perform either on its own or with readily available resources and must be separate within the context of the contract. |

| • | We consider the amount stated on the face of the purchase order to be the transaction price. We do not have variable consideration which could impact the stated purchase price agreed to by us and the customer. |

| • | Transaction price is allocated to each individual performance obligation based on the standalone selling price of that performance obligation. We use standalone transactions when available to value each performance obligation. If standalone transactions are not available, we will estimate the standalone selling price through market assessments or cost plus a reasonable margin analysis. Any discounts from standalone selling price are spread proportionally to each performance obligation. |

| • | In order to determine the appropriate timing for revenue recognition, we first determine if the transaction meets any of three criteria for over time recognition. If the transaction meets the criteria for over time recognition, we recognize revenue as the good or service is delivered. We use input variables such as hours or months utilized or costs incurred to determine the amount of revenue to recognize in a given period. Input variables are used as they best align consumption with benefit to the customer. For transactions that do not meet the criteria for over time recognition, we will recognize revenue at a point in time based on an assessment of the five criteria for transfer of control. We have concluded that revenue should be recognized when shipped or delivered based on contractual terms. Typically, acceptance of our products and services is a formality as we deliver similar systems, instruments and robots to standard specifications. In cases where acceptance is not deemed a formality, we will defer revenue recognition until customer acceptance. |

| • | The length of time and the extent to which the market value has been less than cost; |

| • | The financial condition and near-term prospects of the issuer; and |

| • | The intent and ability to retain the investment in the issuer for a period of time sufficient to allow for any anticipated recovery in market value. |

| Years Ended December 31, |

||||||||

| 2019 |

2018 |

|||||||

| Percentage of revenues: |

||||||||

| Revenues: |

||||||||

| Products |

82.3 |

% | 82.3 |

% | ||||

| Services |

17.7 |

17.7 |

||||||

| Total revenues |

100.0 |

100.0 |

||||||

| Cost of revenues: |

||||||||

| Cost of products |

34.1 |

34.6 |

||||||

| Cost of services |

7.5 |

7.3 |

||||||

| Total cost of revenues (exclusive of acquired intangible assets amortization shown separately below) |

41.6 |

41.9 |

||||||

| Gross profit |

58.4 |

58.1 |

||||||

| Operating expenses: |

||||||||

| Selling and administrative |

19.0 |

18.6 |

||||||

| Engineering and development |

14.1 |

14.4 |

||||||

| Acquired intangible assets amortization |

1.7 |

1.9 |

||||||

| Restructuring and other |

(0.6 |

) | 0.7 |

|||||

| Total operating expenses |

34.3 |

35.5 |

||||||

| Income from operations |

24.1 |

22.6 |

||||||

| Non-operating (income) expenses: |

||||||||

| Interest income |

(1.1 |

) | (1.3 |

) | ||||

| Interest expense |

1.0 |

1.5 |

||||||

| Other (income) expense, net |

1.3 |

0.1 |

||||||

| Income before income taxes |

22.9 |

22.3 |

||||||

| Income tax provision |

2.5 |

0.8 |

||||||

| Net income |

20.4 |

% | 21.5 |

% | ||||

| 2019 |

2018 |

2018-2019 Dollar Change |

||||||||||

| (in millions) |

||||||||||||

| Semiconductor Test |

$ | 1,552.6 |

$ | 1,492.4 |

$ | 60.2 |

||||||

| Industrial Automation |

298.1 |

261.5 |

36.6 |

|||||||||

| System Test |

287.5 |

216.1 |

71.4 |

|||||||||

| Wireless Test |

157.3 |

132.0 |

25.3 |

|||||||||

| Corporate and Other |

(0.5 |

) | (1.2 |

) | 0.7 |

|||||||

| $ | 2,295.0 |

$ | 2,100.8 |

$ | 194.2 |

|||||||

| 2019 |

2018 |

|||||||

| Semiconductor Test |

68 |

% | 71 |

% | ||||

| Industrial Automation |

13 |

12 |

||||||

| System Test |

13 |

10 |

||||||

| Wireless Test |

7 |

6 |

||||||

| 100 |

% | 100 |

% | |||||

| 2019 |

2018 |

|||||||

| China |

22 |

% | 17 |

% | ||||

| Taiwan |

21 |

25 |

||||||

| United States |

15 |

13 |

||||||

| Korea |

10 |

8 |

||||||

| Europe |

10 |

11 |

||||||

| Japan |

8 |

8 |

||||||

| Thailand |

4 |

3 |

||||||

| Singapore |

4 |

5 |

||||||

| Malaysia |

3 |

6 |

||||||

| Philippines |

2 |

4 |

||||||

| Rest of the World |

2 |

2 |

||||||

| 100 |

% | 100 |

% | |||||

| (1) | Revenues attributable to a country are based on the location of the customer site. |

| 2019 |

2018 |

2018-2019 Dollar Change |

||||||||||

| (in millions) |

||||||||||||

| Products revenues |

$ | 1,887.7 |

$ | 1,729.6 |

$ | 158.1 |

||||||

| Services revenues |

407.3 |

371.2 |

36.1 |

|||||||||

| $ | 2,295.0 |

$ | 2,100.8 |

$ | 194.2 |

|||||||

| 2019 |

2018 |

2018-2019 Dollar / Point Change |

||||||||||

| (dollars in millions) |

||||||||||||

| Gross profit |

$ | 1,339.8 |

$ | 1,220.4 |

$ | 119.4 |

||||||

| Percent of total revenues |

58.4 |

% | 58.1 |

% | 0.3 |

|||||||

| 2019 |

2018 |

2018-2019 Dollar / Point Change |

||||||||||

| (dollars in millions) |

||||||||||||

| Product gross profit |

$ | 1,105.6 |

$ | 1,002.5 |

$ | 103.1 |

||||||

| Percent of product revenues |

58.6 |

% | 58.0 |

% | 0.6 |

|||||||

| Service gross profit |

$ | 234.2 |

$ | 217.9 |

$ | 16.3 |

||||||

| Percent of service revenues |

57.5 |

% | 58.7 |

% | (1.2 |

) | ||||||

| 2019 |

2018 |

2018-2019 Change |

||||||||||

| (dollars in millions) |

||||||||||||

| Selling and administrative |

$ | 437.1 |

$ | 390.7 |

$ | 46.4 |

||||||

| Percent of total revenues |

19.0 |

% | 18.6 |

% | ||||||||

| 2019 |

2018 |

2018-2019 Change |

||||||||||

| (dollars in millions) |

||||||||||||

| Engineering and development |

$ | 322.8 |

$ | 301.5 |

$ | 21.3 |

||||||

| Percent of total revenues |

14.1 |

% | 14.4 |

% | ||||||||

| 2019 |

2018 |

2018-2019 Change |

||||||||||

| (in millions) |

||||||||||||

| Interest income |

$ | (24.8 |

) | $ | (26.7 |

) | $ | 1.9 |

||||

| Interest expense |

23.1 |

31.3 |

(8.2 |

) | ||||||||

| Other (income) expense, net |

29.5 |

1.4 |

28.1 |

|||||||||

| 2019 |

2018 |

2018-2019 Change |

||||||||||

| (in millions) |

||||||||||||

| Semiconductor Test |

$ | 417.0 |

$ | 397.6 |

$ | 19.4 |

||||||

| System Test |

93.5 |

48.9 |

44.6 |

|||||||||

| Wireless Test |

35.6 |

29.1 |

6.5 |

|||||||||

| Industrial Automation |

(5.9 |

) | 7.7 |

(13.6 |

) | |||||||

| Corporate and Other (1) |

(14.4 |

) | (15.4 |

) | 1.0 |

|||||||

| $ | 525.8 |

$ | 467.8 |

$ | 58.0 |

|||||||

| (1) | Included in Corporate and Other are the following: contingent consideration adjustments, investment impairment, pension and postretirement plans actuarial (gains) and losses, interest (income) and expense, net foreign exchange (gains) and losses, intercompany eliminations and acquisition related charges. |

| Payments Due by Period |

||||||||||||||||||||||||

| Total |

Less than 1 year |

1-3 years |

3-5 years |

More than 5 years |

Other |

|||||||||||||||||||

| (in thousands) |

||||||||||||||||||||||||

| Convertible debt |

$ | 460,000 |

$ | — |

$ | — |

$ | 460,000 |

$ | — |

$ | — |

||||||||||||

| Purchase obligations |

415,582 |

$ | 412,948 |

2,634 |

— |

— |

— |

|||||||||||||||||

| Retirement plans contributions |

139,451 |

5,069 |

10,464 |

10,336 |

113,582 |

— |

||||||||||||||||||

| Transition tax payable (1) |

88,157 |

5,515 |

15,741 |

22,628 |

44,273 |

— |

||||||||||||||||||

| Operating lease obligations |

72,505 |

21,933 |

30,582 |

11,602 |

8,388 |

— |

||||||||||||||||||

| Interest on long term debt |

23,000 |

5,750 |

11,500 |

5,750 |

— |

— |

||||||||||||||||||

| Fair value of contingent consideration |

39,705 |

9,106 |

30,599 |

— |

— |

— |

||||||||||||||||||

| Other long-term liabilities reflected on the balance sheet under GAAP (2) |

79,579 |

— |

39,156 |

6,348 |

470 |

33,605 |

||||||||||||||||||

| Total |

$ | 1,317,979 |

$ | 460,321 |

$ | 140,676 |

$ | 516,664 |

$ | 166,713 |

$ | 33,605 |

||||||||||||

| (1) | Represents the transition tax liability associated with our accumulated foreign earnings as a result of enactment of the Tax Reform Act on December 22, 2017. |

| (2) | Included in other long-term liabilities are liabilities for customer advances, extended warranty, uncertain tax positions, deferred tax liabilities and other obligations. For certain long-term obligations, we are unable to provide a reasonably reliable estimate of the timing of future payments relating to these obligations and therefore we included these amounts in the column marked “Other.” |

| Plan category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column one) |

|||||||||

| Equity plans approved by shareholders |

2,542 |

(1) | $ | 34.52 |

8,543 |

(2) | ||||||

| Equity plans not approved by shareholders (3) |

47 |

2.89 |

— |

|||||||||

| Total |

2,589 |

29.91 |

8,543 |

|||||||||

| (1) | Includes 2,269,426 shares of restricted stock units that are not included in the calculation of the weighted average exercise price. |

| (2) | Consists of 6,719,918 securities available for issuance under the 2006 Equity Plan and 1,822,724 of securities available for issuance under the Employee Stock Purchase Plan. |

| (3) | In connection with the 2011 acquisition of LitePoint Corporation (the “LitePoint Acquisition”), we assumed the options granted under the LitePoint Corporation 2002 Stock Plan (the “LitePoint Plan”). Upon the consummation of the LitePoint Acquisition, these options were converted automatically into options to purchase an aggregate of 2,828,344 shares of our common stock. No additional awards were granted under the LitePoint Plan. As of December 31, 2019, there were outstanding options exercisable for an aggregate of |

| 46,518 shares of our common stock pursuant to the LitePoint Plan, with a weighted average exercise price of $2.89 per share. |

Item 7A: |

Quantitative and Qualitative Disclosures about Market Risks |

| Hypothetical Change in Teradyne Stock Price |

Fair Value |

Estimated change in fair value |

Hypothetical percentage increase (decrease) in fair value |

|||||||||

| 10% Increase |

$ | 1,103,496 |

$ | 93,221 |

9.2 |

% | ||||||

| No Change |

1,010,275 |

— |

— |

|||||||||

| 10% Decrease |

918,822 |

(91,453 |

) | (9.1 |

) | |||||||

Item 8: |

Financial Statements and Supplementary Data |

| 2019 |

2018 |

|||||||

| (in thousands, except per share information) |

||||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | |

$ | |

||||

| Marketable securities |

|

|

||||||

| Accounts receivable, less allowance for doubtful accounts of $ |

|

|

||||||

| Inventories, net |

|

|

||||||

| Prepayments and other current assets |

|

|

||||||

| Total current assets |

|

|

||||||

| Property, plant and equipment, net |

|

|

||||||

| Operating lease right-of-use assets, net |

|

— |

||||||

| Marketable securities |

|

|

||||||

| Deferred tax assets |

|

|

||||||

| Retirement plans assets |

|

|

||||||

| Other assets |

|

|

||||||

| Acquired intangible assets, net |

|

|

||||||

| Goodwill |

|

|

||||||

| Total assets |

$ |

|

$ | |

||||

| LIABILITIES |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | |

$ | |

||||

| Accrued employees’ compensation and withholdings |

|

|

||||||

| Deferred revenue and customer advances |

|

|

||||||

| Other accrued liabilities |

|

|

||||||

| Operating lease liabilities |

|

— |

||||||

| Contingent consideration |

|

|

||||||

| Income taxes payable |

|

|

||||||

| Total current liabilities |

|

|

||||||

| Retirement plans liabilities |

|

|

||||||

| Long-term deferred revenue and customer advances |

|

|

||||||

| Long-term contingent consideration |

|

|

||||||

| Deferred tax liabilities |

|

|

||||||

| Long-term other accrued liabilities |

|

|

||||||

| Long-term operating lease liabilities |

|

— |

||||||

| Long-term income taxes payable |

|

|

||||||

| Debt |

|

|

||||||

| Total liabilities |

|

|

||||||

| Commitments and contingencies (Note M) |

||||||||

| SHAREHOLDERS’ EQUITY |

||||||||

| Common stock, $ |

|

|

||||||

| Additional paid-in capital |

|

|

||||||

| Accumulated other comprehensive los s |

( |

) | ( |

) | ||||

| Accumulated deficit |

( |

) | ( |

) | ||||

| Total shareholders’ equity |

|

|

||||||

| Total liabilities and shareholders’ equity |

$ | |

$ | |

||||

Years Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

(in thousands, except per share amounts) |

||||||||||||

Revenues: |

||||||||||||

Products |

$ | $ | $ | |||||||||

Services |

||||||||||||

Total revenues |

||||||||||||

Cost of revenues: |

||||||||||||

Cost of products |

||||||||||||

Cost of services |

||||||||||||

Total cost of revenues (exclusive of acquired intangible assets amortization shown separately below) |

||||||||||||

Gross profit |

||||||||||||

Operating expenses: |

||||||||||||

Selling and administrative |

||||||||||||

Engineering and development |

||||||||||||

Acquired intangible assets amortization |

||||||||||||

Restructuring and other |

( |

) | ||||||||||

Total operating expenses |

||||||||||||

Income from operations |

||||||||||||

Non-operating (income) expenses: |

||||||||||||

Interest income |

( |

) | ( |

) | ( |

) | ||||||

Interest expense |

||||||||||||

Other (income) expense, net |

( |

) | ||||||||||

Income before income taxes |

||||||||||||

Income tax provision |

||||||||||||

Net income |

$ | $ | $ | |||||||||

Net income per common share: |

||||||||||||

Basic |

$ | $ | $ | |||||||||

Diluted |

$ | $ | $ | |||||||||

Weighted average common shares—basic |

||||||||||||

Weighted average common shares—diluted |

||||||||||||

Cash dividend declared per common share |

$ | $ | $ | |||||||||

| Years Ended December 31, |

||||||||||||

| 2019 |

2018 |

2017 |

||||||||||

| (in thousands) |

||||||||||||

| Net income |

$ | |

$ | |

$ | |

||||||

| Other comprehensive income, net of tax: |

||||||||||||

| Foreign currency translation adjustment, net of tax of $ |

( |

) | ( |

) | |

|||||||

| Available-for-sale marketable securities: |

||||||||||||

| Unrealized gains (losses) on deb securities arising during period, net of tax of $t |

|

( |

) | |

||||||||

| Less: Reclassification adjustment for (gains) losses included in net income, net of tax of $( |

( |

) | |

( |

) | |||||||

| |

( |

) | |

|||||||||

| Defined benefit pension and post-retirement plans: |

||||||||||||

| Amortization of prior service benefit included in net periodic pension and post-retirement benefit , net of tax $( |

( |

) | ( |

) | ( |

) | ||||||

| Other comprehensive (loss) income |

( |

) | ( |

) | |

|||||||

| Comprehensive income |

$ | |

$ | |

$ | |

||||||

| Common Stock Shares |

Common Stock Value |

Additional Paid-in Capital |

Accumulated Other Comprehensive (Loss) Income |

Retained Earnings (Accumulated Deficit) |

Total Shareholders’ Equity |

|||||||||||||||||||

| (in thousands) |

||||||||||||||||||||||||

| Year Ended December 31, 2016 |

|

$ |

|

$ |

|

$ |

( |

) |

$ |

|

$ |

|

||||||||||||

| Net issuance of common stock under stock-based plans |

|

|

|

|

||||||||||||||||||||

| Stock-based compensation expense |

|

|

||||||||||||||||||||||

| Repurchase of common stock |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||||

| Tax benefit related to stock options and restricted stock units |

|

|

||||||||||||||||||||||

| Cash dividends ($ |

( |

) |

( |

) | ||||||||||||||||||||

| Net income |

|

|

||||||||||||||||||||||

| Other comprehensive income |

|

|

||||||||||||||||||||||

| Year Ended December 31, 2017 |

|

|

|

|

|

|

||||||||||||||||||

| Net issuance of common stock under stock-based plans |

|

|

( |

) |

|

|||||||||||||||||||

| Stock-based compensation expense |

|

|

||||||||||||||||||||||

| Repurchase of common stock |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||||

| Cash dividends ($ |

( |

) |

( |

) | ||||||||||||||||||||

| Net income |

|

|

||||||||||||||||||||||

| Other comprehensive loss |

( |

) |

( |

) | ||||||||||||||||||||

| Reclassification of unrealized gains on equity securities |

( |

) |

|

— |

||||||||||||||||||||

| Reclassification of tax effects resulting from the Tax Reform Act |

|

( |

) |

— |

||||||||||||||||||||

| Cumulative effect of changes in accounting principle related to revenue recognition |

|

|

||||||||||||||||||||||

| Year Ended December 31, 2018 |

|

|

|

( |

) |

( |

) |

|

||||||||||||||||

| Net issuance of common stock under stock-based plans |

|

|

|

|

||||||||||||||||||||

| Stock-based compensation expense |

|

|

||||||||||||||||||||||

| Repurchase of common stock |

( |

) |

( |

) |

( |

) |

( |

) | ||||||||||||||||

| Cash dividends ($ |

( |

) |

( |

) | ||||||||||||||||||||

| Net income |

|

|

||||||||||||||||||||||

| Other comprehensive loss |

( |

) |

( |

) | ||||||||||||||||||||

| Year Ended December 31, 2019 |

|

$ |

|

$ |

|

$ |

( |

) |

$ |

( |

) |

$ |

|

|||||||||||

Years Ended December 31, |

||||||||||||

2019 |

2018 |

2017 |

||||||||||

(in thousands) |

||||||||||||

Cash flows from operating activities: |

||||||||||||

Net income |

$ |

$ |

$ |

|||||||||

Adjustments to reconcile net income from operations to net cash provided by operating activities: |

||||||||||||

Depreciation |

||||||||||||

Amortization |

||||||||||||

Stock-based compensation |

||||||||||||

Deferred taxes |

( |

) |

||||||||||

Provision for excess and obsolete inventory |

||||||||||||

Investment impairment |

— | — | ||||||||||

Contingent consideration fair value adjustment |

( |

) |

||||||||||

(Gains) losses on investments |

( |

) |

( |

) | ||||||||

Retirement plans actuarial losses ( gains) |

( |

) |

( |

) | ||||||||

Property insurance recovery, net |

— |

— |

( |

) | ||||||||

Other |

||||||||||||

Changes in operating assets and liabilities, net of businesses acquired: |

||||||||||||

Accounts receivable |

( |

) |

( |

) |

( |

) | ||||||

Inventories |

( |

) |

( |

) |

||||||||

Prepayments and other assets |

( |

) |

( |

) |

||||||||

Accounts payable and other liabilit ies |

||||||||||||

Deferred revenue and customer advances |

||||||||||||

Retirement plan contributions |

( |

) |

( |

) |

( |

) | ||||||

Income taxes |

( |

) |

( |

) |

||||||||

Net cash provided by operating activities |

||||||||||||

Cash flows from investing activities: |

||||||||||||

Purchases of property, plant and equipment |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from government subsidy for property, plant and equipment |

— |

— |

||||||||||

Purchases of marketable securities |

( |

) |

( |

) |

( |

) | ||||||

Proceeds from maturities of marketable securities |

||||||||||||

Proceeds from sales of marketable securities |

||||||||||||

Proceeds from insurance |

||||||||||||

Purchase of investment and acquisition of businesses, net of cash acquired |

( |

) |

( |

) |

— |

|||||||

Net cash (used for) provided by investing activities |

( |

) |

( |

) | ||||||||

Cash flows from financing activities: |

||||||||||||

Issuance of common stock under stock purchase and stock option plans |

||||||||||||

Repurchase of common stock |

( |

) |

( |

) |

( |

) | ||||||

Dividend payments |

( |

) |

( |

) |

( |

) | ||||||

Payments related to net settlement of employee stock compensation awards |

( |

) |

( |

) |

( |

) | ||||||

Payments of contingent consideration |

( |

) |

( |

) |

( |

) | ||||||

Net cash used for financing activities |

( |

) |

( |

) |

( |

) | ||||||

Effects of exchange rate changes on cash and cash equivalents |

( |

) |

||||||||||

(Decrease) Increase in cash and cash equivalents |

( |

) |

||||||||||

Cash and cash equivalents at beginning of year |

||||||||||||

Cash and cash equivalents at end of year |

$ |

$ |

$ |

|||||||||

Supplementary disclosure of cash flow information: |

||||||||||||

Cash paid for: |

||||||||||||

Interest |

$ |

$ |

$ |

|||||||||

Income taxes |

$ |

$ |

$ |

|||||||||

| • | semiconductor test (“Semiconductor Test”) systems; |

| • | industrial automation (“Industrial Automation”) products; |

| • | defense/aerospace (“Defense/Aerospace”) test instrumentation and systems, storage test (“Storage Test”) systems, and circuit-board test and inspection (“Production Board Test”) systems (collectively these products represent “System Test”); and |

| • | wireless test (“Wireless Test”) systems. |

• |

Teradyne accounts for a contract with a customer when there is written approval, the contract is committed, the rights of the parties, including payment terms, are identified, the contract has commercial substance and consideration is probable of collection. |

• |

Teradyne periodically enters into contracts with customers in which a customer may purchase a combination of goods and services, such as products with extended warranty obligations. Teradyne determines performance obligations by assessing whether the products or services are distinct from the other elements of the contract. In order to be distinct, the product or service must perform either on its own or with readily available resources and must be separate within the context of the contract. |

• |

Teradyne considers the amount stated on the face of the purchase order to be the transaction price. Teradyne does not have material variable consideration which could impact the stated purchase price agreed to by Teradyne and the customer. |

• |

Transaction price is allocated to each individual performance obligation based on the standalone selling price of that performance obligation. Teradyne uses standalone transactions when available to value each performance obligation. If standalone transactions are not available, Teradyne will estimate the standalone selling price through market assessments or cost plus a reasonable margin analysis. Any discounts from standalone selling price are spread proportionally to each performance obligation. |

• |

In order to determine the appropriate timing for revenue recognition, Teradyne first determines if the transaction meets any of three criteria for over time recognition. If the transaction meets the criteria for over time recognition, Teradyne recognizes revenue as the good or service is delivered. Teradyne uses input variables such as hours or months utilized or costs incurred to determine the amount of revenue to recognize in a given period. Input variables are used as they best align consumption with benefit to the customer. For transactions that do not meet the criteria for over time recognition, Teradyne will recognize revenue at a point in time based on an assessment of the five criteria for transfer of control. Teradyne has concluded that revenue should be recognized when shipped or delivered based on contractual terms. Typically, acceptance of Teradyne’s products and services is a formality as Teradyne delivers similar systems, instruments and robots to standard specifications. In cases where acceptance is not deemed a formality, Teradyne will defer revenue recognition until customer acceptance. |

| 2019 |

2018 |

|||||||

| (in thousands) |

||||||||

| Maintenance , service and training |

$ | |

$ | |

||||

| Extended warranty |

|

|

||||||

| Customer advances, undelivered elements and other |

|

|

||||||

| Total deferred revenue and customer advances |

$ | |

$ | |

||||

| Amount |

||||

| (in thousands) |

||||

| Balance at December 31, 2016 |

$ |

|

||

| Accruals for warranties issued during the period |

|

|||

| Accruals related to pre-existing warranties |

( |

) | ||

| Settlements made during the period |

( |

) | ||

| Balance at December 31, 2017 |

|

|||

| Acquisition |

|

|||

| Accruals for warranties issued during the period |

|

|||

| Accruals related to pre-existing warranties |

|

|||

| Settlements made during the period |

( |

) | ||

| Balance at December 31, 2018 |

|

|||

| Acquisition |

|

|||

| Accruals for warranties issued during the period |

|

|||

| Accruals related to pre-existing warranties |

|

|||

| Settlements made during the period |

( |

) | ||

| Balance at December 31, 2019 |

$ |

|

||

| Amount |

||||

| (in thousands) |

||||

| Balance at December 31, 2016 |

$ |

|

||

| Deferral of new extended warranty revenue |

|

|||

| Recognition of extended warranty deferred revenue |

( |

) | ||

| Balance at December 31, 2017 |

|

|||

| Deferral of new extended warranty revenue |

|

|||

| Recognition of extended warranty deferred revenue |

( |

) | ||

| Balance at December 31, 2018 |

|

|||

| Deferral of new extended warranty revenue |

|

|||

| Recognition of extended warranty deferred revenue |

( |

) | ||

| Balance at December 31, 2019 |

$ |

|

||

| • | The length of time and the extent to which the market value has been less than cost; |

| • | The financial condition and near-term prospects of the issuer; and |

| • | The intent and ability to retain the investment in the issuer for a period of time sufficient to allow for any anticipated recovery in market value. |

| 2019 |

2018 |

|||||||

| (in thousands) |

||||||||

| Contract manufacturer and supplier prepayments |

$ | |

$ | |

||||

| Prepaid taxes |

|

|

||||||

| Prepaid maintenance and other services |

|

|

||||||

| Other prepayments |

|

|

||||||

| Total prepayments |

$ | |

$ | |

||||

| Buildings |

|

|||

| Building improvements |

|

|||

| Leasehold improvements |

|

|||

| Furniture and fixtures |

|

|||

| Test systems manufactured internally |

|

|||

| Machinery , equipment and software |

|

| Purchase Price Allocation |

||||

| (in thousands) |

||||

| Goodwill |

$ | |

||

| Intangible assets |

|

|||

| Tangible assets acquired and liabilities assumed: |

||||

| Other c |

|

|||

| Non-current assets |

|

|||

| Accounts payable and current liabilities |

( |

) | ||

| Long-term other liabilities |

( |

) | ||

| Total purchase price |

$ | |

||

| Fair Value |

Estimated Useful Life |

|||||||

| (in thousands) |

(in years) |

|||||||

| Developed technology |

$ | |

|

|||||

| Customer relationships |

|

|

||||||

| Trademarks and tradenames |

|

|

||||||

| Backlog |

|

|

||||||

| Total intangible assets |

$ | |

|

|||||

| Purchase Price Allocation |

||||

| (in thousands) |

||||

| Goodwill |

$ | |

||

| Intangible assets |

|

|||

| Tangible assets acquired and liabilities assumed: |

||||

| Current assets |

|

|||

| Non-current assets |

|

|||

| Accounts payable and current liabilities |

( |

) | ||

| Long-term deferred tax liabilities |

( |

) | ||

| Other long-term liabilities |

( |

) | ||

| Total purchase price |

$ | |

||

| Fair Value |

Estimated Useful Life |

|||||||

| (in thousands) |

(in years) |

|||||||

| Developed technology |

$ | |

|

|||||

| Trademarks and tradenames |

|

|

||||||

| Customer relationships |

|

|

||||||

| Backlog |

|

|

||||||

| Total intangible assets |

$ | |

|

|||||

For the Year Ended |

||||||||

December 31, 2019 |

December 31, 2018 |

|||||||

(in thousands, except per share amounts) |

||||||||

Revenues |

$ |

$ |

||||||

Net income |

$ |

$ |

||||||

Net income per common share: |

||||||||

Basic |

$ |

$ |

||||||

Diluted |

$ |

$ |

||||||

Semiconductor |

Industrial Automation |

System Test |

Wireless Test |

Corporate and Other |

Total |

|||||||||||||||||||||||||||||||||||

System on-a-chip |

Memory |

Universal Robots |

Mobile Industrial Robots |

AutoGuide |

Energid |

|||||||||||||||||||||||||||||||||||

(in thousands) |

||||||||||||||||||||||||||||||||||||||||

For the Year Ended December 31, 2019 (1) |

||||||||||||||||||||||||||||||||||||||||

Timing of Revenue Recognition |

||||||||||||||||||||||||||||||||||||||||

Point in Time |

$ |

$ |

$ |

$ |

$ |

$ |

— |

$ |

$ |

$ |

( |

) |

$ |

|||||||||||||||||||||||||||

Over Time |

— |

|||||||||||||||||||||||||||||||||||||||

Total |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

( |

) |

$ |

||||||||||||||||||||||||||||

Geographical Market |

||||||||||||||||||||||||||||||||||||||||

Asia Pacific |

$ |

$ |

$ |

$ |

$ |

— |

$ |

$ |

$ |

$ |

— |

$ |

||||||||||||||||||||||||||||

Americas |

( |

) |

||||||||||||||||||||||||||||||||||||||

Europe, Middle East and Africa |

— |

|||||||||||||||||||||||||||||||||||||||

Total |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

$ |

( |

) |

$ |

||||||||||||||||||||||||||||

For the Year Ended December 31, 2018 (1) |

||||||||||||||||||||||||||||||||||||||||

Timing of Revenue Recognition |

||||||||||||||||||||||||||||||||||||||||

Point in Time |

$ |

$ |

$ |

$ |

$ |

— |

$ |

$ |

$ |

$ |

( |

) |

$ |

|||||||||||||||||||||||||||

Over Time |

— |

— |

— |

|||||||||||||||||||||||||||||||||||||

Total |

$ |

$ |

$ |

$ |

$ |

— |

$ |

$ |

$ |

$ |

( |

) |

$ |

|||||||||||||||||||||||||||

Geographical Market |

||||||||||||||||||||||||||||||||||||||||

Asia Pacific |

$ |

$ |

$ |

$ |

$ |

— |

$ |

$ |

$ |

$ |

— |

$ |

||||||||||||||||||||||||||||

Americas |

— |

( |

) |

|||||||||||||||||||||||||||||||||||||

Europe, Middle East and Africa |

— |

— |

||||||||||||||||||||||||||||||||||||||

Total |

$ |

$ |

$ |

$ |

$ |

— |

$ |

$ |

$ |

$ |

( |

) |

$ |

|||||||||||||||||||||||||||

(1) |

Includes $ “Revenue from Contracts with Customers.” |

| 2019 |

2018 |

|||||||

| (in thousands) |

||||||||

| Raw material |

$ | |

$ | |

||||

| Work-in-process |

|

|

||||||

| Finished g oods |

|

|

||||||

| $ | |

$ | |

|||||

| 2019 |

2018 |

|||||||

| (in thousands) |

||||||||

| Land |

$ | |

$ | |

||||

| Buildings |

|

|

||||||

| Machinery , equipment and s oftware |

|

|

||||||

| Furniture and fixtures |

|

|

||||||

| Leasehold improvements |

|

|

||||||

| Construction in progress |

|

|

||||||

| |

|

|||||||

| Less: accumulated depreciation |

|

|

||||||

| $ | |

$ | |

|||||

| December 31, 2019 |

||||||||||||||||

| Quoted Prices in Active Markets for Identical Instruments (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total |

|||||||||||||

| (in thousands) |

||||||||||||||||

| Assets |

||||||||||||||||

| Cash |

$ | |

$ | — |

$ | — |

$ | |

||||||||

| Cash equivalents |

|

|

— |

|

||||||||||||

| Available for sale securities: |

||||||||||||||||

| Corporate debt securities |

— |

|

— |

|

||||||||||||

| Commercial paper |

— |

|

— |

|

||||||||||||

| U.S. Treasury securities |

— |

|

— |

|

||||||||||||

| U.S. government agency securities |

— |

|

— |

|

||||||||||||

| Debt mutual funds |

|

— |

— |

|

||||||||||||

| Certificates of deposit and time deposits |

— |

|

— |

|

||||||||||||

| Non-U.S. government securities |

— |

|

— |

|

||||||||||||

| Equity securities: |

||||||||||||||||

| Equity mutual funds |

|

— |

— |

|

||||||||||||

| Total |

$ | |

$ | |

$ | — |

$ | |

||||||||

| Derivative assets |

— |

|

— |

|

||||||||||||

| Total |

$ | |

$ | |

$ | — |

$ | |

||||||||

| Liabilities |

||||||||||||||||

| Contingent consideration |

$ | — |

$ | — |

$ | |

$ | |

||||||||

| Derivative liabilities |

— |

|

— |

|

||||||||||||

| Total |

$ | — |

$ | |

$ | |

$ | |

||||||||

(Level 1) |

(Level 2) |

(Level 3) |

Total |

|||||||||||||

(in thousands) |

||||||||||||||||

Assets |

||||||||||||||||

Cash and cash equivalents |

$ | $ | $ | — |

$ | |||||||||||

Marketable securities |

— |

— |

||||||||||||||

Long-term marketable securities |

— |

|||||||||||||||

Prepayments |

— |

— |

||||||||||||||

Total |

$ | $ | $ | — |

$ | |||||||||||

Liabilities |

||||||||||||||||

Other current liabilities |

$ | — |

$ | $ | — |

$ | ||||||||||

Contingent consideration |

— |

— |

||||||||||||||

Long-term contingent consideration |

— |

— |

||||||||||||||

Total |

$ | — |

$ | $ | $ | |||||||||||

December 31, 2018 |

||||||||||||||||

Quoted Prices in Active Markets for Identical Instruments (Level 1) |

Significant Other Observable Inputs (Level 2) |

Significant Unobservable Inputs (Level 3) |

Total |

|||||||||||||

(in thousands) |

||||||||||||||||

Assets |

||||||||||||||||

Cash |

$ |

$ |

— |

$ |

— |

$ |

||||||||||

Cash equivalents |

— |

|||||||||||||||

Available for sale securities: |

||||||||||||||||

U.S. Treasury securities |

— |

— |

||||||||||||||

Commercial paper |

— |

— |

||||||||||||||

Corporate debt securities |

— |

— |

||||||||||||||

U.S. government agency securities |

— |

— |

||||||||||||||

Certificates of deposit and time deposits |

— |

— |

||||||||||||||

Debt mutual funds |

— |

— |

||||||||||||||

Non-U.S. |

— |

— |

||||||||||||||

Equity securities: |

||||||||||||||||

Equity mutual funds |

— |

— |

||||||||||||||

$ |

$ |

$ |

— |

$ |

||||||||||||

Derivative assets |

— |

— |

||||||||||||||

Total |

$ |

$ |

$ |

— |

$ |

|||||||||||

Liabilities |

||||||||||||||||

Contingent consideration |

$ |

— |

$ |

— |

$ |

$ |

||||||||||

Derivative liabilities |

— |

— |

||||||||||||||

Total |

$ |

— |

$ |

$ |

$ |

|||||||||||

(Level 1) |

(Level 2) |

(Level 3) |

Total |

|||||||||||||

(in thousands) |

||||||||||||||||

Assets |

||||||||||||||||

Cash and cash equivalents |

$ | $ | $ | — |

$ | |||||||||||

Marketable securities |

— |

— |

||||||||||||||

Long-term marketable securities |

— |

|||||||||||||||

Prepayments |

— |

— |

||||||||||||||

| $ | $ | $ | — |

$ | ||||||||||||

Liabilities |

||||||||||||||||

Other current liabilities |

$ | — |

$ | $ | — |

$ | ||||||||||

Contingent consideration |

— |

— |

||||||||||||||

Long-term contingent consideration |

— |

— |

||||||||||||||

| $ | — |

$ | $ | $ | ||||||||||||

Contingent Consideration |

||||

(in thousands) |

||||

Balance at December 31, 2017 |

$ |

|||

Acquisition of MiR |

||||

Foreign currency impact |

( |

) | ||

Payments ( 1 ) |

( |

) | ||

Fair value adjustment ( 2 ) |

||||

Balance at December 31, 2018 |

||||

Acquisition of AutoGuide |

||||

Foreign currency impact |

( |

) | ||

Payments (3) |

( |

) | ||

Fair value adjustment (4) |

( |

) | ||

Balance at December 31, 2019 |

$ |

|||

| (1) | During the year ended December 31, 201 8 , Teradyne paid $earn-out in connection with the acquisition of Un iversal Robots. |

| (2) | During the year ended December 31, 2018, the fair value of contingent consideration for the earn-out in connection with the acquisition of MiR was increased by $ the fair value of contingent consideration for the earn-out in connection with the acquisition of Universal Robots was de creased by $a de crease in forecasted revenues. |

| (3) | During the year ended December 31, 201 9 , Teradyne paid $and $ of contingent consideration for the earn-out in connection with the acquisitions s of MiR Universal Robotsa nd , respectively . |

| (4) | During the year ended December 31, 201 9 , the fair value of contingent consideration for the earn-out in connection with the acquisition of MiR was de creased by $de crease in forecasted revenues partially offset by the impact from modification of the earn-out structure. During the year ended December 31, 2019 , the fair value of contingent consideration for the earn-out in connection with the acquisition of Auto was G uidein creased by $n in in forecasted c rease revenues . |

| Liability |

December 31, 2019 Fair Value |

Valuation Technique |

Unobservable Inputs |

Weighted Average |

||||||||||||

| (in thousands) |

||||||||||||||||

| Contingent c onsideration (AutoGuide) |

$ |

|

Monte Carlo simulation |

Revenue Volatility |

% |

|||||||||||

| Discount Rate |

% |

|||||||||||||||

| Contingent c onsideration (MiR) |

$ | |

Monte Carlo simulation |

Revenue Volatility |

% |

|||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |||

| Discount Rate |

% |

|||||||||||||||

| (1) | Contingent consideration related to MiR of $ 20 . |

| December 31, 2019 |

December 31, 2018 |

|||||||||||||||

| Carrying Value |

Fair Value |

Carrying Value |

Fair Value |

|||||||||||||

| (in thousands) |

||||||||||||||||

| Assets |

||||||||||||||||

| Cash and cash equivalents |

$ | |

$ | |

$ | |

$ | |

||||||||

| Marketable securities |

|

|

|

|

||||||||||||

| Derivative assets |

|

|

|

|

||||||||||||

| Liabilities |

||||||||||||||||

| Contingent consideration |

|

|

|

|

||||||||||||

| Derivative liabilities |

|

|

|

|

||||||||||||

| Convertible debt (1) |

|

|

|

|

||||||||||||

| (1) | The carrying value represents the bifurcated debt component only, while the fair value is based on quoted market prices for the convertible note which includes the equity conversion features. |

| December 31, 2019 |

||||||||||||||||||||

| Available-for-Sale |

||||||||||||||||||||

| Cost |

Unrealized Gain |

Unrealized (Loss) |

Fair Market Value |

Fair Market Value of Investments with Unrealized Losses |

||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Corporate debt securities |

$ | |

$ | |

$ | ( |

) | $ | |

$ | |

|||||||||

| Commercial paper |

|

|

( |

) | |

|

||||||||||||||

| U.S. Treasury securities |

|

|

( |

) | |

|

||||||||||||||

| U.S. government agency securities |

|

|

( |

) | |

|

||||||||||||||

| Debt mutual funds |

|

|

— |

|

— |

|||||||||||||||

| Certificates of deposit and time deposits |

|

|

— |

|

— |

|||||||||||||||

| Non-U.S. government securities |

|

— |

— |

|

— |

|||||||||||||||

| $ | |

$ | |

$ | ( |

) | $ | |

$ | |

||||||||||

| Cost |

Unrealized Gain |

Unrealized (Loss) |

Fair Market Value |

Fair Market Value of Investments with Unrealized Losses |

||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Marketable securities |

$ | |

$ | |

$ | ( |

) | $ | |

$ | |

|||||||||

| Long-term marketable securities |

|

|

( |

) | |

|

||||||||||||||

| $ | |

$ | |

$ | ( |

) | $ | |

$ | |

||||||||||

| December 31, 2018 |

||||||||||||||||||||

| Available-for-Sale |

||||||||||||||||||||

| Cost |

Unrealized Gain |

Unrealized (Loss) |

Fair Market Value |

Fair Market Value of Investments with Unrealized Losses |

||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| U.S. Treasury securities |

$ | |

$ | |

$ | ( |

) | $ | |

$ | |

|||||||||

| Commercial paper |

|

|

( |

) | |

|

||||||||||||||

| Corporate debt securities |

|

|

( |

) | |

|

||||||||||||||

| U.S. government agency securities |

|

|

( |

) | |

|

||||||||||||||

| Certificates of deposit and time deposits |

|

— |

— |

|

— |

|||||||||||||||

| Debt mutual funds |

|

|

— |

|

— |

|||||||||||||||

| Non-U.S. government securities |

|

— |

— |

|

— |

|||||||||||||||

| $ | |

$ | |

$ | ( |

) | $ | |

$ | |

||||||||||

| Cost |

Unrealized Gain |

Unrealized (Loss) |

Fair Market Value |

Fair Market Value of Investments with Unrealized Losses |

||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Marketable securities |

$ | |

$ | |

$ | ( |

) | $ | |

$ | |

|||||||||

| Long-term marketable securities |

|

|

( |

) | |

|

||||||||||||||

| $ | |

$ | |

$ | ( |

) | $ | |

$ | |

||||||||||

Cost |

Fair Value |

|||||||

(in thousands) |

||||||||

Due within one year |

$ | $ | ||||||

Due after 1 year through 5 years |

||||||||

Due after 5 years through 10 years |

||||||||

Due after 10 years |

||||||||

Total |

$ | $ | ||||||

December 31, 2019 |

December 31, 2018 |

|||||||||||||||||||||||

Buy Position |

Sell Position |

Net Total |

Buy Position |

Sell Position |

Net Total |

|||||||||||||||||||

(in millions) |

||||||||||||||||||||||||

Japanese Yen |

$ | ( |

) | $ | — |

$ | ( |

) | $ | ( |

) | $ | — |

$ | ( |

) | ||||||||

Taiwan Dollar |

( |

) | — |

( |

) | ( |

) | — |

( |

) | ||||||||||||||

Korean Won |

( |

) | — |

( |

) | ( |

) | — |

( |

) | ||||||||||||||

British Pound Sterling |

( |

) | — |

( |

) | ( |

) | — |

( |

) | ||||||||||||||

Euro |

— |

— |

||||||||||||||||||||||

Singapore Dollar |

— |

— |

||||||||||||||||||||||

Philippine Peso |

— |

— |

||||||||||||||||||||||

Chinese Yuan |

— |

— |

||||||||||||||||||||||

Total |

$ | ( |

) | $ | $ | $ | ( |

) | $ | $ | ||||||||||||||

December 31, 2019 |

December 31, 2018 |

|||||||||

(in thousands) |

||||||||||

Derivatives not designated as hedging instruments: |

||||||||||

Foreign exchange contracts |

Prepayments |

$ | $ | |||||||

Foreign exchange contracts |

Other current liabilities |

( |

) | ( |

) | |||||

Total |

$ | $ | ( |

) | ||||||

Location of (Gains) Losses Recognized in Statement of Operations |

December 31, 2019 |

December 31, 2018 |

December 31, 2017 |

||||||||||||

(in thousands) |

|||||||||||||||

Derivatives not designated as hedging instruments: |

|||||||||||||||

Foreign exchange contracts |

Other (income) expense, net |

$ | $ | $ | ( |

) | |||||||||

| (1) | The table does not reflect the corresponding gains and losses from the remeasurement of the monetary assets and liabilities denominated in foreign currencies. |

| (2) | For the years ended December 31, 2019 and 2018, net gains from the remeasurement of monetary assets and liabilities denominated in foreign currencies were $ |

| (3) | For the year ended December 31, 2017, net losses from the remeasurement of monetary assets and liabilities denominated in foreign currencies were $ |

| For the Year Ended |

||||

| December 31, 2019 |

||||

| |

(in thousands) |

| ||

| Cash paid for amounts included in the measurement of lease liabilities included in operating cash flows |

$ | |

||

| Right-of-use assets obtained in exchange for new lease obligations |

|

|||

| Operating Lease |

||||

| (in thousands) |

||||

| 2020 |

$ | |

||

| 2021 |

|

|||

| 2022 |

|

|||

| 2023 |

|

|||

| 2024 |

|

|||

| Thereafter |

|

|||

| Total lease payments |

|

|||

| Less imputed interest |

( |

) | ||

| Total lease liabilities |

$ | |

||

| Operating Lease |

||||

| (in thousands) |

||||

| 2019 |

$ | |

||

| 2020 |

|

|||

| 2021 |

|

|||

| 2022 |

|

|||

| 2023 |

|

|||

| Thereafter |

|

|||

| Total lease payments |

$ | |

||

| December 31, 2019 |

December 31, 2018 |

|||||||

| (in thousands) |

||||||||

| Debt p rincipal |

$ | |

$ | |

||||

| Unamortized discount |

|

|

||||||

| Net c arrying amount of convertible debt |

$ | |

$ | |

||||

| For the year ended |

||||||||

| December 31, 2019 |

December 31, 2018 |

|||||||

| (in thousands) |

||||||||

| Contractual interest expense on the coupon |

$ | |

$ | |

||||

| Amortization of the discount component and debt issue fees recognized as interest expense |

|

|

||||||

| Total interest expense on the convertible debt |

$ | |

$ | |

||||

| Foreign Currency Translation Adjustment |

Unrealized Gain s (Losses) on Marketable Securities |

Retirement Plans Prior Service Credit |

Total |

|||||||||||||

| (in thousands) |

||||||||||||||||

| Balance at December 31, 2017, net of tax of $ |

$ | |

$ | |

$ | |

$ | |

||||||||

| Other comprehensive loss before reclassifications, net of tax of $ |

( |

) | ( |

) | — |

( |

) | |||||||||

| Amounts reclassified from accumulated other comprehensive income, net of tax of $ |

— |

|

( |

) | |

|||||||||||

| Net current period other comprehensive loss , net of tax of $ |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||

| Reclassification of tax effects resulting f rom the Tax Reform Act, net of tax of $ |

— |

|

|

|

||||||||||||

| Reclassification of unrealized gains on equity securities, net of tax of $ |

— |

( |

) | — |

( |

) | ||||||||||

| Balance at December 31, 2018, net of tax of $ |

( |

) | ( |

) | |

( |

) | |||||||||

| Other comprehensive (loss) income before reclassifications, net of tax of $ |

( |

) | |

— |

( |

) | ||||||||||

| Amounts reclassified from accumulated other comprehensive income, net of tax of $ |

— |

( |

) | ( |

) | ( |

) | |||||||||

| Net current period other comprehensive (loss) income, net of tax of $ |

( |

) | |

( |

) | ( |

) | |||||||||

| Balance at December 31, 2019, net of tax of $ |

$ | ( |

) | $ | |

$ | |

$ | ( |

) | ||||||

| (a) | In the year ended December 31, 2018, Teradyne early adopted ASU 2018-02, “Income Statement—Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income.” |

| (b) | In the year ended December 31, 2018, Teradyne adopted ASU 2016-01, “Financial Instruments—Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities |

| Details about Accumulated Other Comprehensive Income Components |

For the year ended |

Affected Line Item in the Statements of Operations |

||||||||||||||

| December 31, 2019 |

December 31, 2018 |

December 31, 2017 |

||||||||||||||

| (in thousands) |

||||||||||||||||

| Available-for-sale marketable securities |

||||||||||||||||

| Unrealized gains (losses), net of tax of $ |

$ | |

$ | ( |

) | $ | |

Interest income (expense) |

||||||||

| Defined benefit pension and postretirement plans: |

||||||||||||||||

| Amortization of prior service benefit, net of tax of $ |

|

|

|

(a) |

||||||||||||

| Total reclassifications, net of tax of $ |

$ | |

$ | ( |

) | $ | |

Net income |

||||||||

| (a) | The amortization of prior service credit is included in the computation of net periodic pension cost and postretirement benefit; see Note P: “Retirement Plans.” |

Industrial Automation |

Wireless Test |

Semiconductor Test |

System Test |

Total |

||||||||||||||||

(in thousands) |

||||||||||||||||||||

Balance at December 31, 2017: |

||||||||||||||||||||

Goodwill |

$ | $ | $ | $ | $ | |||||||||||||||

Accumulated impairment losses |

( |

) | ( |

) | ( |

) | ( |

) | ||||||||||||

— |

||||||||||||||||||||

MiR acquisition |

— |

— |

— |

|||||||||||||||||

Energid acquisition |

— |

— |

— |

|||||||||||||||||

Foreign currency translation adjustment |

( |

) | — |