Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to §240. 14a-12

Teradyne, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

TERADYNE, INC.

600 Riverpark Drive

North Reading, Massachusetts 01864

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS:

The Annual Meeting of Shareholders of Teradyne, Inc., a Massachusetts corporation, will be held on Tuesday, May 21, 2013 at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864, for the following purposes:

1. To elect the eight nominees named in the accompanying proxy statement to the Board of Directors to serve as directors for a one-year term.

2. To approve, in a non-binding, advisory vote, the compensation of the Company’s named executive officers.

3. To approve an amendment to the 2006 Equity and Cash Compensation Incentive Plan to increase the aggregate number of shares of common stock that may be issued pursuant to the plan by 10,000,000 shares.

4. To approve an amendment to the 1996 Employee Stock Purchase Plan to increase the aggregate number of shares of common stock that may be issued pursuant to the plan by 5,000,000 shares.

5. To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013.

6. To transact such other business as may properly come before the meeting and any postponements or adjournments thereof.

Shareholders entitled to notice of and to vote at the meeting shall be determined as of the close of business on March 28, 2013, the record date fixed by the Board of Directors for such purpose.

By Order of the Board of Directors,

Charles J. Gray, Secretary

April 11, 2013

Shareholders are requested to vote in one of the following three ways: (1) by completing, signing and dating the proxy card provided by Teradyne and returning it by return mail to Teradyne in the enclosed envelope or at the address indicated on the proxy card, (2) by completing a proxy using the toll-free telephone number listed on the proxy card, or (3) by completing a proxy on the Internet at the address listed on the proxy card.

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| PROPOSAL NO. 2: ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS |

6 | |||

| PROPOSAL NO. 3: APPROVAL OF AN AMENDMENT TO 2006 EQUITY AND CASH COMPENSATION INCENTIVE PLAN |

8 | |||

| PROPOSAL NO. 4: APPROVAL OF AN AMENDMENT TO 1996 EMPLOYEE STOCK PURCHASE PLAN |

18 | |||

| PROPOSAL NO. 5: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

22 | |||

| 23 | ||||

| 23 | ||||

| 25 | ||||

| 25 | ||||

| 27 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 30 | ||||

| 32 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 35 | ||||

| 37 | ||||

| 41 | ||||

| 43 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 51 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

| 54 | ||||

i

Table of Contents

TERADYNE, INC.

600 Riverpark Drive

North Reading, Massachusetts 01864

April 11, 2013

Proxies in the form provided by Teradyne, Inc. (“Teradyne” or the “Company”) are solicited by the Board of Directors (“Board”) of Teradyne for use at the Annual Meeting of Shareholders to be held on Tuesday, May 21, 2013, at 10:00 A.M. Eastern Time, at the offices of Teradyne, Inc. at 600 Riverpark Drive, North Reading, Massachusetts 01864.

Only shareholders of record as of the close of business on March 28, 2013 (the “Record Date”) will be entitled to vote at this annual meeting and any adjournments thereof. As of the Record Date, 190,559,637 shares of common stock were issued and outstanding. Each share outstanding as of the Record Date will be entitled to one vote, and shareholders may vote in person or by proxy. Delivery of a proxy will not in any way affect a shareholder’s right to attend the annual meeting and vote in person. Any shareholder delivering a proxy has the right to revoke it only by written notice to the Secretary or Assistant Secretary delivered at any time before it is exercised, including at the annual meeting. All properly completed proxy forms returned in time to be cast at the annual meeting will be voted.

Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting to be Held on May 21, 2013

This Proxy Statement and the Accompanying Annual Report on Form 10-K, Letter to Shareholders, and Notice, are available at www.proxyvote.com

At the meeting, the shareholders will consider and vote upon the following proposals put forth by the Board:

1. To elect the eight nominees named in this proxy statement to the Board of Directors to serve as directors for a one-year term.

2. To approve, in a non-binding, advisory vote, the compensation of the Company’s named executive officers.

3. To approve an amendment to the 2006 Equity and Cash Compensation Incentive Plan to increase the aggregate number of shares of common stock that may be issued pursuant to the plan by 10,000,000 shares.

4. To approve an amendment to the 1996 Employee Stock Purchase Plan to increase the aggregate number of shares of common stock that may be issued pursuant to the plan by 5,000,000 shares.

5. To ratify the selection of the firm of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2013.

The Board recommends that you vote FOR the proposals listed above.

On or about April 11, 2013, the Company mailed to its stockholders of record as of March 28, 2013 a notice containing instructions on how to access this proxy statement and the Company’s annual report online and to vote. Also on April 11, 2013, the Company began mailing printed copies of these proxy materials to stockholders that have requested printed copies.

If you received a notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. Instead, the notice instructs you on how to access and review all of the important information contained in the proxy statement and annual report. The notice also instructs you on how you may submit your

proxy over the Internet. If you received a notice by mail and would like to receive a printed copy of the proxy materials, you should follow the instructions for requesting such materials included in the notice.

1

Table of Contents

If a shareholder completes and submits a proxy, the shares represented by the proxy will be voted in accordance with the instructions for such proxy. If a shareholder submits a proxy card but does not fill out the voting instructions, shares represented by such proxy will be voted FOR the proposals listed above.

Shareholders may vote in one of the following three ways:

1. by completing, signing and dating the proxy card provided by Teradyne and returning it in the enclosed envelope or by return mail to Teradyne at the address indicated on the proxy card,

2. by completing a proxy using the toll-free telephone number listed on the proxy card or notice, or

3. by completing a proxy on the Internet at the address listed on the proxy card or notice.

A majority of the outstanding shares represented at the meeting in person or by proxy shall constitute a quorum for the transaction of business. Abstentions and broker “non-votes” are counted as present or represented for purposes of determining the presence or absence of a quorum for the meeting. A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. For this annual meeting, on all matters being submitted to shareholders, an affirmative vote of at least a majority of the shares voting on the matter at the meeting is required for approval. The vote on each matter submitted to shareholders is tabulated separately. Abstentions are not included in the number of shares present, or represented, and voting on each separate matter. Broker “non-votes” are also not included. An automated system administered by Teradyne’s transfer agent tabulates the votes.

The Board knows of no other matter to be presented at the annual meeting. If any other matter should be presented at the annual meeting upon which a vote properly may be taken, shares represented by all proxies received by the Board will be voted in accordance with the judgment of those officers named as proxies and in accordance with the Securities and Exchange Commission’s (“SEC’s”) proxy rules. See the section entitled “Shareholder Proposals for 2014 Annual Meeting of Shareholders” for additional information.

ELECTION OF DIRECTORS

The Board presently consists of eight members, seven of whom are independent directors. Each director is elected annually for a one-year term. The terms of the directors expire at the 2013 Annual Meeting of Shareholders. The Board, based on the recommendation of the Nominating and Corporate Governance Committee, has nominated all current directors for re-election. Teradyne has no reason to believe that any of the nominees will be unable to serve; however, if that should be the case, proxies will be voted for the election of some other person (nominated in accordance with Teradyne’s bylaws) or the Board will decrease the number of directors that currently serve on the Board. If elected, each director will hold office until the 2014 Annual Meeting of Shareholders.

The Board recommends a vote FOR the election to the Board of each of Messrs. Bagley, Bradley, Carnesale, Christman, Gillis, Guertin, Tufano and Vallee.

The following table sets forth the nominees to be elected at this annual meeting, the year each person was first appointed or elected, the principal occupation of that person during at least the past five years, that person’s age, any other public company boards on which he serves or has served in the past five years, and the nominee’s qualifications to serve on the Board. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he should serve as a director, Teradyne also believes that all of its director nominees have a reputation for integrity, honesty and adherence to high ethical standards. They each have demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to Teradyne and the Board. Additionally, Teradyne values the directors’ significant experience on other public company boards of directors and board committees.

2

Table of Contents

| Name |

Year Became Director |

Background and Qualifications | ||||

| James W. Bagley |

1996 | Mr. Bagley, 74, served as Executive Chairman of the Board of Directors of Lam Research Corporation from June 2005 to November 2012. He was Lam Research Corporation’s Chief Executive Officer and Chairman of the Board of Directors from September 1998 to June 2005 and the Chief Executive Officer and a director from August 1997 to September 1998. He also was Chairman and Chief Executive Officer of OnTrak Systems, Inc. from May 1996 until July 1997. From November 1981 until May 1996, Mr. Bagley held various positions at Applied Materials, Inc., including President and Chief Operating Officer from 1987 through 1993, Vice Chairman and Chief Operating Officer from January 1994 until October 1995, and Vice Chairman from October 1995 until May 1996. Mr. Bagley also served as a director of Micron Technology, Inc. from 1997 to January 2012.

Mr. Bagley contributes valuable executive experience within the semiconductor equipment industry and widespread knowledge of the issues confronting complex global technology and manufacturing companies. | ||||

| Michael A. Bradley |

2004 | Mr. Bradley, 64, has served as a director since April 2004 and as Chief Executive Officer since May 2004. He was President of Teradyne from May 2003 until January 2013, President of the Semiconductor Test Division from April 2001 until May 2003 and Chief Financial Officer from July 1999 until April 2001. From 1992 until 2001, he held various Vice President positions at Teradyne. Mr. Bradley has been a director of Entegris, Inc., and its predecessor company Mykrolis Corporation, since 2001 and of Avnet, Inc. since November 2012.

Mr. Bradley contributes valuable executive experience from his 34 years in multiple management roles, including as President and Chief Executive Officer, within Teradyne. | ||||

| Albert Carnesale |

1993 | Mr. Carnesale, 76, has been Chancellor Emeritus and Professor of the University of California, Los Angeles since July 2006 and served as Chancellor from July 1997 to July 2006. He held the position of Provost of Harvard University from October 1994 until June 1997 and the Dean of The John F. Kennedy School of Government from November 1991 through December 1995 where he also was a Professor of Public Policy from 1974 through 1997. From August 2005 to October 2008, Mr. Carnesale served as a director of Westwood One, Inc.; since May 2009, as a director of Nano Pacific Holdings, Inc.; and since February 2011, as a director of Amicrobe, Inc.

Mr. Carnesale contributes a very broad business perspective as well as extensive domestic and foreign public policy expertise. | ||||

3

Table of Contents

| Name |

Year Became Director |

Background and Qualifications | ||||

| Daniel W. Christman |

2010 | Mr. Christman, 69, has served as Senior Counselor to the President of the U.S. Chamber of Commerce since 2009 and as Senior Vice President of International Affairs at the Chamber from 2003 until 2009. In 2001, he retired in the grade of Lieutenant General after a career in the United States Army that spanned more than 36 years. Immediately prior to his retirement, Mr. Christman was the Superintendent of the United States Military Academy at West Point from 1996 to 2001. From 1994 to 1996, he served as Assistant to the Chairman of the Joint Chiefs of Staff of the United States. Mr. Christman has been a director of Entegris, Inc., and its predecessor company Mykrolis Corporation, since 2001. Mr. Christman was a director of the United Services Automobile Association from 1995 to November 2010 and a director of Ultralife Batteries, Inc. from 2001 to March 2010 where he also was the Chairman from September 2009 to March 2010.

Mr. Christman contributes his considerable experience with international business issues as well as expertise in leadership and management gained from his 36 plus years as a military leader. | ||||

| Edwin J. Gillis |

2006 | Mr. Gillis, 64, has worked as a business consultant and private investor since January 2006. From July 2005 to December 2005, he was the Senior Vice President of Administration and Integration of Symantec Corporation, following the merger of Veritas Software Corporation and Symantec Corporation. He served as Executive Vice President and Chief Financial Officer of Veritas Software Corporation from November 2002 to June 2005, as the Executive Vice President and Chief Financial Officer of Parametric Technology Corporation from September 1995 to November 2002, and as the Chief Financial Officer of Lotus Development Corporation from 1991 to September 1995. Prior to joining Lotus, Mr. Gillis was a Certified Public Accountant and partner at Coopers & Lybrand L.L.P. Mr. Gillis has been a director of LogMeIn, Inc. since November 2007, a director of Sophos Plc. since November 2009 and a director of Responsys Inc. since March 2011. Mr. Gillis was also a director of BladeLogic, Inc. from 2007 to its acquisition by BMC Software in 2008 and a director of EqualLogic, Inc. from 2006 to its acquisition by Dell Computer in 2008.

Mr. Gillis contributes extensive experience relating to the issues confronting global technology companies and financial reporting expertise as a former Chief Financial Officer of several publicly-traded technology companies. | ||||

4

Table of Contents

| Name |

Year Became Director |

Background and Qualifications | ||||

| Timothy E. Guertin |

2011 | Mr. Guertin, 63, has been the Vice Chairman of the Board of Directors of Varian Medical Systems, Inc. since September 2012 and a director of Varian since 2005. He served as Chief Executive Officer of Varian from February 2006 to September 2012 and as President from August 2005 to September 2012. He served as Chief Operating Officer from October 2004 to February 2006 and as Corporate Executive Vice President from October 2002 to August 2006. Prior to that time, he was President of Varian’s Oncology Systems business unit from 1992 to January 2005 and a Corporate Vice President from 1992 to 2002.

Mr. Guertin contributes significant executive experience at a global technology and manufacturing company with issues similar to those confronting Teradyne. | ||||

| Paul J. Tufano |

2005 | Mr. Tufano, 59, has been the Chief Operating Officer of Alcatel-Lucent since January 2013 and Chief Financial Officer since December 2008. He was Executive Vice President of Alcatel-Lucent from December 2008 to January 2013. Mr. Tufano was the Executive Vice President and Chief Financial Officer of Solectron Corporation from January 2006 to October 2007 and Interim Chief Executive Officer from February 2007 to October 2007. Prior to joining Solectron, Mr. Tufano worked at Maxtor Corporation where he was President and Chief Executive Officer from February 2003 to November 2004, Executive Vice President and Chief Operating Officer from April 2001 to February 2003 and Chief Financial Officer from July 1996 to April 2001. From 1979 until he joined Maxtor Corporation in 1996, Mr. Tufano held a variety of management positions in finance and operations at International Business Machines Corporation.

Mr. Tufano contributes widespread knowledge of the issues confronting complex technology and manufacturing companies and extensive financial reporting expertise. | ||||

| Roy A. Vallee |

2000 | Mr. Vallee, 60, served as Executive Chairman of the Board of Directors of Avnet, Inc. from July 2011 to November 2012 and as a director of Avnet, Inc. from 1991 to 2012. From July 1998 to July 2011, he was Chairman of the Board of Directors and Chief Executive Officer of Avnet, Inc. He also was Vice Chairman of the Board of Directors from November 1992 to July 1998 and President and Chief Operating Officer from March 1992 until July 1998. Since 2003, Mr. Vallee has been a director of Synopsys, Inc. He is currently a member of both the Federal Reserve’s 12th District Advisory Council and the Board of the National Association of Wholesalers.

Mr. Vallee contributes valuable executive experience within the global technology industry as well as extensive knowledge of the issues affecting complex technology companies. | ||||

5

Table of Contents

ADVISORY VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Company is providing shareholders with the opportunity at the 2013 Annual Meeting to vote on the following advisory resolution, commonly known as “Say-on-Pay”:

RESOLVED, that the shareholders of the Company approve, in a non-binding, advisory vote, the compensation of the Company’s named executive officers as disclosed in the Company’s proxy statement under the headings “Compensation Discussion and Analysis” and “Executive Compensation Tables” pursuant to Item 402 of Regulation S-K.

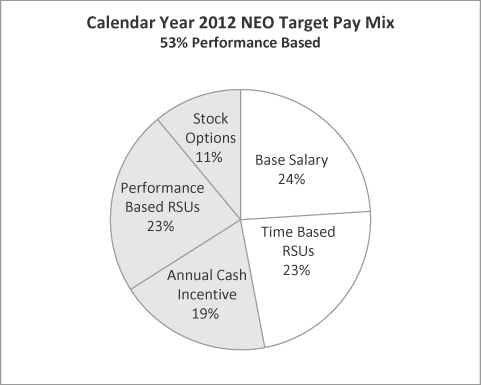

Teradyne’s Board of Directors has implemented an executive compensation program that rewards performance. The Board fosters a performance-oriented environment by tying a significant portion of each executive officer’s cash and equity compensation to the achievement of short- and long-term performance targets that are important to the Company and its shareholders. The Board of Directors has designed the Company’s executive compensation program to attract, motivate, reward and retain the senior management talent required to achieve the Company’s corporate objectives and increase shareholder value. The Company believes that the compensation policies and program are centered on a pay-for-performance philosophy and are strongly aligned with the long-term interests of shareholders.

The performance-based executive compensation program resulted in compensation for the Company’s named executive officers that reflects the Company’s outstanding financial results for 2012. The Company increased revenues by 16% to $1.66 billion, generated significant free cash flow, and maintained its industry-leading profitability rate. The Company’s Wireless Test Division, formed as a result of the 2011 acquisition of LitePoint Corporation, had record growth with revenue more than doubling from 2011.

The Company’s performance-based variable compensation is tied both to its rate of profitability and to the achievement of strategic business goals, including market share gains, strategic customer wins, engineering project milestones, cost controls and other growth targets – the achievement of which positively impact the Company’s long-term performance. Due to the Company’s market-leading rate of profitability and achievement of certain business goals in 2012, executive officers received 153% of their target variable cash compensation payout and 200% of their target performance-based restricted stock units.

The compensation of the executive officers over the last five years demonstrates the correlation between pay and performance. The compensation for the named executive officers in 2012, 2011 and 2010 contrasts to compensation received for 2008 and 2009 where executive officers received compensation well below target. In 2008 and 2009, executive officers received payouts well below their target variable cash compensation and were not granted any performance-based restricted stock units due to the severe industry downturn. Furthermore, in 2009, executive officers took base salary pay cuts which were only restored late in the year when business improved. By contrast, in 2010 and 2011, due to the Company’s record profitability and achievement of strategic business goals, the executive officers received at or close to the maximum 200% of their target variable cash compensation payout and 200% of their target performance-based restricted stock units. In 2012, the Company had record results in its Wireless Test Division as well as superior performance in its Semiconductor Test Division and Military/Aerospace Business Unit, but mixed results in its other businesses. As a result, the variable cash compensation payout for executives decreased to 153% reflecting a strong year, but not as strong as 2010 or 2011.

The Company’s shareholders voted to approve the Say-on-Pay advisory resolution at the 2012 Annual Meeting of Shareholders with 99% of the votes cast approving the resolution. Notwithstanding the approval of the resolution, the Board of Directors continues to assess the Company’s executive compensation program to ensure it remains aligned with both short- and long-term performance.

6

Table of Contents

The Company will report the results of the “Say-on-Pay” vote in a Form 8-K following the 2013 Annual Meeting of Shareholders. The Company also will disclose in subsequent proxy statements how the Company’s compensation policies and decisions take into account the results of the shareholder advisory vote on executive compensation.

The Board recommends a vote FOR the advisory resolution approving the compensation of the Company’s named executive officers as described in this proxy statement.

7

Table of Contents

APPROVAL OF AN AMENDMENT TO 2006 EQUITY AND CASH COMPENSATION INCENTIVE PLAN

Proposed Amendment

On March 28, 2013, the Board adopted an amendment to the 2006 Equity and Cash Compensation Incentive Plan (the “Plan”) which is subject to the approval of the shareholders. The Board has approved and recommends the shareholders approve an amendment to the Plan that will increase the aggregate number of shares of common stock authorized for issuance under the Plan by 10,000,000 shares. The Plan, as amended including the proposed amendment for the shareholders to approve, is attached as Appendix A. Our equity compensation program is a critical part of our compensation policy to attract, motivate and retain talented employees, align employee and stockholder interests, link employee compensation with company performance and maintain a culture based on employee stock ownership. We have prudently managed our equity awards program to achieve significant reductions in overhang and burn rate since our shareholders approved a share increase in 2009.

As of March 15, 2013, only 4.4 million shares remained authorized for issuance under the Plan. Assuming the current usage rate and stock price levels, Teradyne expects these remaining shares will be granted over the next 18 months. If the increase in the number of shares authorized for issuance under the Plan is not approved, Teradyne would have no further ability to make equity-based grants pursuant to the Plan subsequent to having made grants for the remaining 4.4 million shares. The Board believes that without a continued ability to make grants of equity-based awards pursuant to the Plan, Teradyne would suffer a severe competitive disadvantage in the recruitment, retention and motivation of its employees.

Since initially adopted, there has been one increase in the number of shares originally approved for issuance under the Plan. At the 2009 Annual Meeting, Teradyne’s shareholders approved an amendment to the Plan of an increase in the number of shares of Common Stock authorized for issuance under the Plan by 10,000,000 shares.

In offering equity as part of the Company’s long-term incentive compensation program, the Compensation Committee assesses the impact of the equity on shareholders using standard metrics, including “burn rate,” “overhang” and dilution. The Compensation Committee retained Compensia, an independent compensation consultant, to provide an analysis of the Company’s Plan, including “burn rate,” “overhang,” and dilution and to advise the Committee on the number of shares to propose for approval by the shareholders. Based on its analysis, Compensia recommended an increase of 10,000,000 shares. Compensia’s report to the Committee is summarized below.

Share Information

As of March 15, 2013, the Plan had 8,135,946 shares subject to currently outstanding equity awards including 4,590,190 shares subject to outstanding restricted stock awards (performance-based or time-based) and 3,545,756 outstanding options with a weighted average remaining option term of 5.66 years and a weighted average exercise price of $5.45 and 4,418,639 shares available for future issuance.

8

Table of Contents

Burn Rate

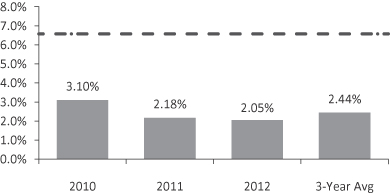

“Burn rate” was analyzed by Compensia to provide a measure of the potential dilutive impact of the Company’s annual equity award program. “Burn rate” is the number of shares granted during a calendar year divided by the undiluted weighted average number of common shares outstanding for that year. As shown in the following graph, the Company’s three-year average annual burn rate for 2010 through 2012 is 2.44%, which is below the Institutional Shareholder Services (ISS) burn rate maximum of 6.58% applicable to Teradyne’s industry grouping, the Russell 3000 Semiconductor Equipment segment. The Company has reduced the burn rate from 3.10% to 2.05% over the last 3 years.

For purposes of this calculation, in accordance with ISS’s methodology, full value awards, such as restricted stock awards and performance-based restricted stock awards, were multiplied by a factor of 2.0.

Overhang

“Overhang” was analyzed by Compensia to measure the potential dilutive effect of all outstanding equity awards and shares available for future grants. “Total Overhang” is the total number of equity awards outstanding, plus shares available to be granted, divided by total common shares outstanding. “Issued Overhang” is the total number of equity awards outstanding divided by total common shares outstanding. As of March 15, 2013, the Company’s Issued Overhang was 4.3% and the Company’s Total Overhang was 6.6%. Assuming the approval of the increase in the number of shares authorized for issuance under the Plan, the Total Overhang would be 11.8%. As illustrated in the table below, the Company’s overhang percentages have steadily decreased over the last three years.

| As of December 31 |

Issued Stock Overhang |

Total Stock Overhang |

||||||

| 2012 |

4.7 | % | 8.1 | % | ||||

| 2011 |

6.1 | % | 10.6 | % | ||||

| 2010 |

7.7 | % | 16.0 | % | ||||

The Company’s Issued Overhang, current Total Overhang and Total Overhang assuming the approval of the increase in the number of shares authorized for issuance under the Plan are, in each case, below the median of its peer group.

9

Table of Contents

Dilution Cost

Compensia also conducted an analysis of the equity plan dilution cost or shareholder value transfer. The cost of the Company’s equity plan is determined using a dilution model which calculates the Company’s shareholder value transfer based on the fair value of:

| • | Shares available under the plan, plus |

| • | Shares requested to be added to the plan, plus |

| • | Granted, but unexercised shares subject to outstanding options and unvested RSUs. |

The sum of the above is calculated as a percent of the Company’s market capitalization based on a 200-day average stock price as of the applicable measurement date. The percentage then is compared to guidelines based on the Company’s industry and performance. Based on this analysis, Compensia advised the Committee that the dilution cost was within acceptable guidelines.

Usage Rate

In recommending the increase in shares for the equity plan, Compensia also reviewed the Company’s 3-year average share usage rate which is set forth in the table below.

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

| Restricted Stock Units: |

||||||||||||

| Non-vested at January 1 |

5,840 | 6,963 | 6,896 | |||||||||

| Awarded |

1,844 | 1,936 | 2,626 | |||||||||

| Vested |

(2,510 | ) | (2,624 | ) | (2,406 | ) | ||||||

| Forfeited |

(204 | ) | (435 | ) | (153 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Non-vested at December 31 |

4,970 | 5,840 | 6,963 | |||||||||

|

|

|

|

|

|

|

|||||||

| Stock Options: |

||||||||||||

| Outstanding at January 1 |

5,335 | 7,194 | 11,238 | |||||||||

| Granted |

151 | 145 | 329 | |||||||||

| Assumed from acquisition |

— | 2,828 | — | |||||||||

| Exercised |

(1,396 | ) | (965 | ) | (4,031 | ) | ||||||

| Forfeited |

(203 | ) | — | — | ||||||||

| Cancelled |

(46 | ) | (3,867 | ) | (342 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Outstanding at December 31 |

3,841 | 5,335 | 7,194 | |||||||||

|

|

|

|

|

|

|

|||||||

Total shares available for the years 2012, 2011 and 2010:

| 2012 | 2011 | 2010 | ||||||||||

| (in thousands) | ||||||||||||

| Shares available: |

||||||||||||

| Available for grant at January 1 |

8,205 | 9,851 | 12,653 | |||||||||

| Options granted |

(151 | ) | (145 | ) | (329 | ) | ||||||

| Restricted stock units granted |

(1,844 | ) | (1,936 | ) | (2,626 | ) | ||||||

| Restricted stock units forfeited |

204 | 435 | 153 | |||||||||

|

|

|

|

|

|

|

|||||||

| Available for grant at December 31 |

6,414 | 8,205 | 9,851 | |||||||||

With the increase in shares requested, based on the 3-year historical average usage, the Plan would have a sufficient number of shares for approximately five (5) to six (6) years. This estimate would be impacted by a significant decrease in participation in the equity program such as through an employee reduction or divestiture

10

Table of Contents

or a significant increase in participation such as through an acquisition or an increase in hiring. This estimate also is impacted by Teradyne’s share price which impacts the number of shares issued to employees under the Plan.

The Compensation Committee reviewed Compensia’s analysis and approved the recommendation for an increase of 10,000,000 shares. Teradyne and the Compensation Committee have actively advanced shareholder interests in the administration of its equity compensation program, reducing both its burn rate and overhang percentages in recent years. The Board believes that the overhang and burn rate are reasonable in relation to those of the Company’s peer group and reflect a judicious use of equity for compensation programs.

The Board recommends a vote for approval of the amendment to the Plan. The following is a summary of the material features of the Plan. The complete text of the Plan, giving effect to the proposed amendment, is attached as Appendix A.

General Description of the Plan, as amended

The purpose of the Plan is to provide equity ownership and compensation opportunities in Teradyne (each, an “Award”) to employees, officers and directors of Teradyne and its subsidiaries, all of whom are eligible to receive Awards under the Plan. Under present law, however, incentive stock options within the meaning of Section 422 of the Code, a type of stock-based Award that may be granted pursuant to the Plan, may be granted only to employees of Teradyne or subsidiaries of Teradyne. Any person to whom an Award is granted will be called a “Participant.” As of March 15, 2013, there are approximately 3,600 employees who are eligible to be Participants in the Plan.

The Plan is administered by the Compensation Committee (the “Committee”) composed solely of members of Teradyne’s Board of Directors that are “independent,” as defined pursuant to Rule 10A-3(b)(1) of the Exchange Act and Rule 303A.02 of the NYSE Listed Company Manual. The Committee has the authority to grant Awards, to adopt, amend and repeal rules relating to the Plan, to interpret and correct the provisions of the Plan and any Award, and subject to the limitations of the Plan, to modify and amend any Award, except that the Committee may not reprice Awards without shareholder approval or accelerate the vesting of full-value stock-based Awards without shareholder approval other than in the event of death, disability or retirement of a Participant or an acquisition of Teradyne by another entity. The Plan also provides that authority to grant Awards to employees may be delegated to one or more executive officers of Teradyne, with certain limitations.

Awards under the Plan may be either or both stock- and cash-based. Stock-based Awards may take the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted stock, restricted stock units, phantom stock or any other stock-based interests as the Committee shall determine.

Awards may be granted subject to time-based vesting schedules and/or performance-based vesting measured by Performance Criteria specified in an Award. “Performance Criteria” means any one or more of the following performance criteria, applied to either Teradyne as a whole or to a division, business unit or subsidiary, and measured either annually or cumulatively over a period of years, on an absolute basis or relative to a pre-established target, to previous years’ results or to a designated comparison group, in each case as specified by the Committee in the Award: cash flow; earnings per share; earnings before interest, taxes and amortization; return on equity; total shareholder return; share price performance; return on capital; return on assets or net assets; revenue; income or net income; operating income or net operating income; operating profit or net operating profit; income from operations less restructuring and other, net, amortization of intangibles and acquisition and divestiture related charges or credits; operating margin or profit margin; return on operating revenue; return on invested capital; market segment share; product release schedules; new product innovation; product cost reduction; brand recognition/acceptance; product ship targets; process improvement results; verification of business strategy and/or business plan; improvement of strategic position; adaptation to changes in the

11

Table of Contents

marketplace or environment; or customer satisfaction. If the Award is subject to Performance Criteria and the Award so provides, evaluation of achievement against Performance Criteria may take into account any of the following events that occur during a performance period: asset write-downs; litigation or claim judgments or settlements; the effect of changes in tax law; accounting principles or other such laws or provisions affecting reported results; accruals for reorganization and restructuring programs and any extraordinary non-recurring charges or other events.

Stock-Based Awards

Authorized Shares. The number of shares of Common Stock that may be delivered pursuant to Awards granted under the Plan was originally 12 million shares of Common Stock in May 2006, when the Plan was first approved by the shareholders. The shareholders approved an increase in the number of shares of Common Stock that may be delivered pursuant to Awards granted under the Plan to 22 million at the 2009 Annual Meeting. As of March 15, 2013, the number of shares of Common Stock that remained available for issuance was approximately 4.4 million. The maximum number of shares of stock-based Awards that may be granted to any individual Participant under the Plan during any one fiscal year may not exceed 2 million.

Terms of Stock-Based Awards. The Committee shall determine the terms and conditions of each stock-based Award, including the number of shares subject to such Award or a formula for making this determination; the exercise or purchase price, as applicable, of such Award (subject to limitations discussed subsequently) and the means of payment for shares; the vesting schedule; the Performance Criteria, if any, that determine the number of shares or options granted, issued, retainable and/or vested; other terms and conditions on the grant, issuance and/or forfeiture of the shares or options; and such further terms and conditions as may be determined by the Committee.

Stock Options. Stock options represent the right to purchase shares of Common Stock within a specified period of time at a specified price. The exercise price for options will be not less than 100% (110% for an incentive stock option granted to a 10% or more shareholder) of the fair market value of Common Stock on the date of grant. The aggregate fair market value, determined on the date the option is granted, of the stock for which any person may be granted incentive stock options which become exercisable for the first time by such person in any calendar year cannot exceed the sum of $100,000 or such sum as is allowed by the Code (determined on the date such option is granted). No incentive stock option will be granted to a person who is not an “employee” as defined in the applicable provisions of the Code, and regulations issued thereunder. Options shall expire in no more than ten years (five years in the case of an incentive stock option granted to a 10% or more shareholder) after the date of grant.

Each option or installment may be exercised at any time or from time to time, in whole or in part, for up to the total number of shares with respect to which it is then exercisable, by delivery of a properly signed written notice of exercise to Teradyne at its principal office address or to such transfer agent as Teradyne shall designate, or by notification to the Teradyne-designated third party commercial provider. The Committee has the right to accelerate the date of exercise of any installment of any option at any time, despite the fact that such acceleration may disqualify all or part of any option as an incentive stock option. Payment for the exercise of options under the Plan may be made by one or any combination of the following forms of payment:

| • | by cash or by check payable to the order of Teradyne, or by fund transfer from the holder’s account maintained with the Teradyne-designated third party commercial provider, if any, |

| • | at the discretion of the Committee, through delivery of shares of Common Stock having a fair market value equal as of the date of exercise to the cash exercise price of the option, provided that such shares were not acquired by the Participant in the prior six months, or |

| • | at the discretion of the Committee, by delivery of a sufficient amount of the proceeds from the sale of the Common Stock acquired upon exercise of the option by the optionee’s broker or selling agent. |

12

Table of Contents

Stock Appreciation Rights. A stock appreciation right (an “SAR”) is an Award entitling the holder, upon exercise, to receive cash or shares of Common Stock, or a combination thereof, in an amount determined solely by reference to appreciation, from and after the date of grant, in the fair market value of a share of Common Stock. SARs may be granted separately from or expressly in tandem with an option. An SAR granted in tandem with an option will be exercisable only at such time or times, and to the extent, that the related option is exercisable, provided that the SAR will generally terminate upon exercise of the related option and the option will terminate and no longer be exercisable upon the exercise of the related SAR.

Restricted Stock and Restricted Stock Units. Restricted stock is Common Stock that is subject to a risk of forfeiture or other restrictions that will lapse upon satisfaction of specified conditions. Restricted stock units represent the right to receive shares of Common Stock in the future, with the right to future delivery of the shares subject to a risk of forfeiture or other restrictions that will lapse upon satisfaction of specified conditions. Subject to any restrictions applicable to the Award, a Participant holding restricted stock, whether vested or unvested, will be entitled to enjoy all rights of a shareholder with respect to such restricted stock, including the right to receive dividends and to vote the shares. A Participant holding restricted stock units may not vote the shares represented by those units. Restricted stock and restricted stock units issued under the Plan will be subject to minimum vesting periods of no less than 1 year for Awards subject to Performance Criteria and no less than 3 years for all other restricted stock or restricted stock unit Awards, unless the applicable restricted stock and restricted stock unit Awards fall under the exception to minimum vesting periods described below.

Phantom Stock. Phantom stock is an Award entitling recipients to receive, in cash or shares, the fair market value of shares of Common Stock upon the satisfaction of conditions specified by the Committee in connection with the grant of such Award. A Participant may not vote the shares represented by a phantom stock Award.

Other Stock-Based Awards. The Plan provides the flexibility to grant other forms of Awards based upon Common Stock, having the terms and conditions established at the time of grant by the Committee. A minimum vesting period of no less than 1 year for full-value stock-based Awards subject to Performance Criteria and no less than 3 years for all other full-value stock-based Awards is required under the Plan, unless such Awards fall under the exception to minimum vesting periods described below.

Non-Employee Director Formula Grants. The Plan provides that each non-employee director of Teradyne will be automatically granted an Award, either in equity or cash, having a fair market value equal to (1) a dollar amount approved by the Board of Directors not to exceed $200,000 on the date first elected or appointed to the Board (other than pursuant to an election at an annual meeting of shareholders), prorated daily to reflect the period between the director’s date of election or appointment and the date of the next annual grant, and (2) a dollar amount approved by the Board of Directors not to exceed $200,000 on the date in each year which is the earlier of the date of the annual meeting of shareholders and the last Thursday in May. At the discretion of the Board of Directors, such Award may include any of the following, individually or in combination: a restricted stock unit, restricted stock, nonstatutory stock option, SAR or cash. Awards of restricted stock or restricted stock units to non-employee directors will have a minimum vesting period of no less than 1 year for Awards subject to Performance Criteria and no less than 3 years for all other Awards, unless such Awards fall under the exception to minimum vesting periods. Any options, SARs, phantom stock or other cash Awards issued to non-employee directors may, at the Committee’s discretion, be immediately exercisable on the date of grant. Awards granted under the Plan shall be in addition to the annual Board and committee cash retainers paid by Teradyne to non-employee directors.

Exception to Minimum Vesting Periods. The Committee can exclude from the minimum vesting period requirements up to 5% of the shares of Common Stock authorized for issuance under the Plan in the form of restricted stock Awards, restricted stock units and other stock-based Awards.

13

Table of Contents

Adjustment. In the event of any stock split, stock dividend, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, combination, exchange of shares, liquidation, spin-off, split-up, or other similar change in capitalization or event, the following shall be equitably adjusted:

| • | the number and class of securities available for Awards under the Plan and the per-Participant share limit, |

| • | the number and class of securities, vesting schedule and exercise price per share subject to each outstanding Award, and |

| • | the repurchase price per security subject to repurchase. |

The terms of each other outstanding stock-based Award shall be adjusted by Teradyne (or substituted Awards may be made) to the extent the Committee shall determine, in good faith, that such an adjustment (or substitution) is appropriate.

Cash Awards

The Plan permits the granting of cash Awards either alone, in addition to, or in tandem with other Awards granted under the Plan to Participants. These cash Awards may be based on a predetermined variable compensation factor and performance criteria, and may not exceed $3 million per fiscal year. The variable compensation factor is a percentage of the Participant’s base annual salary, starting at a minimum of 5% for new Participants. Variable compensation factors are reviewed annually and typically do not exceed 100%.

General Terms

Eligibility Under Section 162(m). In general, under Section 162(m) of the Code, Teradyne cannot deduct, for federal income tax purposes, compensation in excess of $1 million paid in a year to certain executive officers. This deduction limitation, however, does not apply to compensation that constitutes “qualified performance-based compensation” within the meaning of Section 162(m) of the Code and the regulations promulgated thereunder. The regulations under Section 162(m) of the Code contain a “safe harbor” that treats stock options granted at fair market value as qualified performance-based compensation (assuming certain other requirements are satisfied). Teradyne considered the limitations on deduction imposed by Section 162(m) of the Code when preparing the Plan. Included at page 41 in Compensation Discussion and Analysis under the subheading “Impact of Accounting and Tax Treatment on Executive Pay” is a further discussion of Section 162(m) of the Code.

Transferability. Except as the Committee may otherwise determine or provide in an Award, Awards may be transferred only by will or by the laws of descent and distribution; provided, however, that nonstatutory stock options may be transferred to a grantor retained annuity trust or a similar estate planning vehicle under which the trust is bound by all provisions of the option which are applicable to the holder thereof.

Treatment upon Acquisition. Unless otherwise expressly provided in the applicable Award, upon the occurrence of an acquisition of Teradyne by another entity, appropriate provision must be made for the continuation or the assumption by the surviving or acquiring entity of all Awards. In addition to or in lieu of the foregoing, the Committee may provide that Awards granted under the Plan must be exercised by a certain date or shall be terminated, that Awards shall be terminated in exchange for a cash payment, or that Awards under the Plan may be substituted for stock and stock-based awards issued by an entity acquired by or merged into Teradyne. The Committee is also authorized in connection with an acquisition of Teradyne to accelerate in full or in part any Awards of options, restricted stock, other stock-based Awards or Awards then-outstanding under the Plan that may be settled in whole or in part in cash.

Effect of Termination, Disability or Death. The Committee determines the effect on an Award of the disability, death, retirement, authorized leave of absence or other change in the employment or other status of a Participant and the extent to which, and the period during which, the Participant, or the Participant’s legal

14

Table of Contents

representative, conservator, guardian or designated beneficiary, may exercise rights under the Award, subject to applicable law and the provisions of the Code. The Committee is permitted to authorize in connection with the occurrence of such an event the acceleration in full or in part any Award of options or Awards that may be settled in cash. The Committee is permitted to authorize the acceleration of restricted stock or restricted stock unit Awards or other full-value stock-based Awards only in the event of the Participant’s disability, death, retirement or upon the acquisition in control of Teradyne by another entity.

Amendment of Awards. The Committee may, without shareholder approval, amend, modify or terminate any outstanding Award, except that: (1) the Committee may not materially and adversely change the terms of a Participant’s Award without the Participant’s consent; (2) previously-issued options may not be amended without shareholder approval to reduce the price at which such previously-issued options are exercisable or to extend the period of time beyond ten years for which such previously-issued options shall be exercisable; and (3) previously-issued full-value stock-based Awards may not be accelerated without shareholder approval, other than in the event of death, disability or retirement of a Participant or an acquisition of Teradyne.

Termination of Plan; Amendments. Awards may be granted under the Plan at any time on or prior to May 24, 2016, but Awards granted before that date may be exercised thereafter. The Committee may amend, suspend or terminate the Plan or any portion thereof at any time; provided, however, that any material amendment to the Plan will not be effective unless approved by Teradyne’s shareholders. If any stock-based Award expires, or is terminated, surrendered or forfeited, in whole or in part, the unissued shares covered by such Award shall again be available for the grant of Awards under the Plan.

United States Federal Income Tax Consequences

Incentive Stock Options. The following general rules are applicable under current United States federal income tax law to incentive stock options (“ISOs”) granted under Teradyne’s Plan.

1. In general, no taxable income results to the optionee upon the grant of an ISO or upon the issuance of shares to him or her upon the exercise of the ISO, and no corresponding federal tax deduction is allowed to Teradyne upon either grant or exercise of an ISO.

2. If shares acquired upon exercise of an ISO are not disposed of within (i) two years following the date the option was granted or (ii) one year following the date the shares are issued to the optionee pursuant to the ISO exercise (the “Holding Periods”), the difference between the amount realized on any subsequent disposition of the shares and the exercise price will generally be treated as long-term capital gain or loss to the optionee.

3. If shares acquired upon exercise of an ISO are disposed of before the Holding Periods are met (a “Disqualifying Disposition”), then in most cases the lesser of (i) any excess of the fair market value of the shares at the time of exercise of the ISO over the exercise price or (ii) the actual gain on disposition will be treated as compensation to the optionee and will be taxed as ordinary income in the year of such disposition.

4. In any year that an optionee recognizes ordinary income as the result of a Disqualifying Disposition, Teradyne generally should be entitled to a corresponding deduction for federal income tax purposes.

5. Any excess of the amount realized by the optionee as the result of a Disqualifying Disposition over the sum of (i) the exercise price and (ii) the amount of ordinary income recognized under the above rules will be treated as capital gain to the optionee.

6. Capital gain or loss recognized by an optionee upon a disposition of shares will be long-term capital gain or loss if the optionee’s holding period for the shares exceeds one year.

7. An optionee may be entitled to exercise an ISO by delivering shares of Teradyne’s Common Stock to Teradyne in payment of the exercise price. If an optionee exercises an ISO in such fashion, special rules will apply.

15

Table of Contents

8. In addition to the tax consequences described above, the exercise of an ISO may result in additional tax liability to the optionee under the alternative minimum tax rules. The Code provides that an alternative minimum tax (at a maximum rate of 28%) will be applied against a taxable base which is equal to “alternative minimum taxable income” reduced by a statutory exemption. In general, the amount by which the value of the Common Stock received upon exercise of the ISO exceeds the exercise price is included in the optionee’s alternative minimum taxable income. A taxpayer is required to pay the higher of his or her regular tax liability or the alternative minimum tax. A taxpayer that pays alternative minimum tax attributable to the exercise of an ISO may be entitled to a tax credit against his or her regular tax liability in later years.

9. Special rules apply if the stock acquired is subject to vesting, or is subject to certain restrictions on resale under federal securities laws applicable to directors, officers or 10% shareholders.

Nonstatutory Stock Options. The following general rules are applicable under current United States federal income tax law to options that do not qualify as ISOs (“Nonstatutory Stock Options”) granted under Teradyne’s Plan:

1. The optionee generally does not realize any taxable income upon the grant of a Nonstatutory Stock Option, and Teradyne is not allowed a federal income tax deduction by reason of such grant.

2. The optionee generally will recognize ordinary income at the time of exercise of a Nonstatutory Stock Option in an amount equal to the excess, if any, of the fair market value of the shares on the date of exercise over the exercise price.

3. When the optionee sells the shares acquired pursuant to a Nonstatutory Stock Option, he or she generally will recognize a capital gain or loss in an amount equal to the difference between the amount realized upon the sale of the shares and his or her basis in the shares (generally, the exercise price plus the amount taxed to the optionee as ordinary income). If the optionee’s holding period for the shares exceeds one year, such gain or loss will be a long-term capital gain or loss.

4. Teradyne generally should be entitled to a corresponding tax deduction for federal income tax purposes when the optionee recognizes ordinary income.

5. An optionee may be entitled to exercise a Nonstatutory Stock Option by delivering shares of Teradyne’s Common Stock to Teradyne in payment of the exercise price. If an optionee exercises a Nonstatutory Stock Option in such fashion, special rules will apply.

6. Special rules apply if the stock acquired is subject to vesting, or is subject to certain restrictions on resale under federal securities laws applicable to directors, officers or 10% shareholders.

Awards and Purchases. The following general rules are applicable under current federal income tax law to awards of restricted stock and restricted stock units (“Restricted Awards”), the granting of opportunities to make direct stock purchases under Teradyne’s Plan (“Purchases”) or the granting of an SAR or phantom stock that is settled in shares (a “Stock-Settled Award”):

1. Persons receiving Common Stock pursuant to a Restricted Award, a Purchase or a Stock-Settled Award generally will recognize ordinary income at the time of vesting, purchase or settlement, as applicable, in an amount equal to the fair market value of the shares received, reduced by the purchase price paid, if any.

2. Teradyne generally should be entitled to a corresponding deduction for federal income tax purposes when such person recognizes ordinary income. When such Common Stock is sold, the seller generally will recognize capital gain or loss equal to the difference between the amount realized upon the sale and the seller’s tax basis in the Common Stock (generally, the amount that the seller paid for such stock plus the amount taxed to the Seller as ordinary income).

3. Special rules apply if the stock acquired pursuant to an Award of stock or direct stock purchase is subject to vesting, or is subject to certain restrictions on resale under federal securities laws applicable to directors, officers or 10% shareholders.

16

Table of Contents

Cash Awards. The following general rules are applicable under current federal income tax law to cash Awards or Awards settled in cash:

1. Persons receiving a cash Award or Award settled in cash generally will recognize ordinary income equal to the amount of the cash Award.

2. Teradyne should be entitled to a corresponding deduction for federal income tax purposes at the time of making the cash Award or Award settled in cash.

Other Tax Considerations

A Participant who receives accelerated vesting, exercise or payment of awards contingent upon or in connection with a change of control of Teradyne may be deemed to have received an “excess parachute payment” under Section 280G of the Code. In such event, the Participant may be subject to a 20% excise tax and Teradyne may be denied a tax deduction for such payments.

It is the intention of Teradyne that Awards will comply with Section 409A of the Code regarding nonqualified deferred compensation arrangements or will satisfy the conditions of applicable exemptions. However, if an Award is subject to and fails to comply with the requirements of Section 409A, the Participant may recognize ordinary income on the amounts deferred under the Award, to the extent vested, prior to the time when the compensation is received. In addition, Section 409A imposes a 20% penalty tax, as well as interest, on the Participant with respect to such amounts.

The Patient Protection and Affordable Care Act, which was enacted on March 23, 2010, introduced a new Net Investment Income Tax. For taxable years beginning after December 31, 2012, dividends paid to and capital gains recognized by individuals with incomes over certain threshold amounts may be subject to an additional 3.8% tax on this Net Investment Income

The Board recommends a vote FOR approval of the amendment to the Plan.

17

Table of Contents

APPROVAL OF AN AMENDMENT TO 1996 EMPLOYEE STOCK PURCHASE PLAN

Proposed Amendment

On March 28, 2013, the Board adopted an amendment to the 1996 Employee Stock Purchase Plan (the “ESPP”) which is subject to the approval of the shareholders. The Board has approved and recommends the shareholders approve an amendment to the ESPP that will increase the aggregate number of shares of common stock authorized for issuance under the ESPP by 5,000,000 shares. The ESPP, as amended including the proposed amendment for the shareholders to approve, is attached as Appendix B.

Teradyne’s equity compensation program is a critical part of our compensation policy to attract, motivate and retain talented employees, align employee and stockholder interests, link employee compensation with company performance and maintain a culture based on employee stock ownership. The ESPP encourages broad employee stock ownership in Teradyne. The proposed amendment is essential to permit the Company to continue the pursuit of these objectives.

Under the ESPP, eligible employees may purchase shares of common stock through regular payroll deductions of up to 10% of their compensation, to a maximum of shares with a fair market value of $25,000 per calendar year, not to exceed 6,000 shares. Under the ESPP, prior to January 2013, the price paid for the common stock was equal to 85% of the lower of the fair market value of Teradyne’s common stock on the first business day and the last business day of each six month purchase period within each year. Beginning in January 2013, the price paid is equal to 85% of the stock price on the last business day of the purchase period.

The Compensation Committee retained Compensia, an independent compensation consultant, to provide an analysis of the Company’s ESPP and to advise the Committee on the number of shares to propose for approval by the shareholders. Based on its analysis, Compensia recommended an increase of 5,000,000 shares. Compensia’s report to the Committee is summarized below.

Compensia assessed historical usage and participation rates as well as peer practice and customary industry standards. The following table sets forth the historical usage under the ESPP.

| Year |

Shares Added |

Issued | Balance | |||||||||

| 1996 Authorized |

5,400,000 | |||||||||||

| 2001 |

390,000 | |||||||||||

| 2002 |

5,000,000 | (1,661,781 | ) | 3,728,219 | ||||||||

| 2003 |

(1,638,975 | ) | 2,089,244 | |||||||||

| 2004 |

5,000,000 | (1,638,975 | ) | 5,450,269 | ||||||||

| 2005 |

(2,248,501 | ) | 3,201,768 | |||||||||

| 2006 |

(1,318,839 | ) | 1,882,929 | |||||||||

| 2007 |

5,000,000 | (1,175,325 | ) | 5,707,604 | ||||||||

| 2008 |

(1,510,679 | ) | 4,196,925 | |||||||||

| 2009 |

5,000,000 | (2,458,891 | ) | 6,738,034 | ||||||||

| 2010 |

(1,406,128 | ) | 5,331,906 | |||||||||

| 2011 |

(1,376,328 | ) | 3,955,578 | |||||||||

| 2012 |

(1,123,040 | ) | 2,832,538 | |||||||||

| 2013 |

(585,969 | ) | 2,246,569 | |||||||||

| Total |

25,400,000 | (18,143,431 | ) | 2,246,569 | ||||||||

The Company expects the usage rate to decrease modestly as the Compensation Committee has amended the ESPP to eliminate the “look back” to the first business day of the payment period to determine the purchase price. This decrease will be partially offset by an expected increase in the participation rate based on increased hiring.

18

Table of Contents

As amended, the ESPP would authorize the issuance of up to 5,000,000 shares of common stock in addition to the 25,400,000 shares of common stock previously authorized under the plan. Upon approval, the total number of shares available for issuance under the ESPP would be 7,246,569 representing approximately 3.8% of total shares outstanding which is well below the less than 10% guideline recommended by ISS.

Based on the 3-year average usage and the current participation rate, Teradyne expects that the 5,000,000 share increase would provide sufficient shares, at share price levels as of April 1, 2013, for approximately five (5) years. This estimate would be impacted by a significant decrease in participation such as through an employee reduction or divestiture or a significant increase in participation such as through an acquisition or an increase in the Company’s hiring. This estimate also is impacted by Teradyne’s share price which determines the number of shares purchased by employees under the ESPP.

The Compensation Committee reviewed Compensia’s analysis and approved the recommendation for an increase of 5,000,000 shares. As of March 15, 2013, only 2.2 million shares remained authorized for issuance under the ESPP. Assuming current participation rates and stock price levels, Teradyne expects these remaining shares would be issued by mid 2014, after which the Company would no longer be able to provide a broad-based equity incentive plan to encourage employee ownership in Teradyne. An absence of a suitable long-term, equity-based incentive plan might negatively impact the recruitment and retention of present and future employees.

Description of the ESPP, as amended

The ESPP is intended to encourage stock ownership by all eligible employees so that they may share in the company’s growth by acquiring or increasing their ownership interest in Teradyne. The ESPP is designed to encourage eligible employees to remain employed by Teradyne. Under the ESPP, payroll deductions are used to purchase common stock for eligible, participating employees. As of March 15, 2013, approximately fifty percent of world-wide employees participated in the ESPP.

The ESPP is an “employee stock purchase plan” within the meaning of Section 423(b) of the Code. It is administered by the Compensation Committee of the Board. The Committee has the power to interpret the ESPP, determine all questions or issues that might arise under the ESPP, and to adopt and amend rules and regulations for administration of the ESPP, as the Committee may deem appropriate. The Committee or the Board may from time to time adopt amendments to the ESPP. However, the approval of the shareholders is required for any amendment that:

| • | increases the number of shares that may be issued under the ESPP; |

| • | changes the class of employees eligible to receive options under the ESPP, if such change would be treated as the adoption of a new plan for the purposes of the applicable provisions of the Code; |

| • | causes Rule 16b-3 under the Exchange Act to be inapplicable to the ESPP; or |

| • | requires shareholder approval pursuant to the rules and regulations of the New York Stock Exchange. |

The ESPP may be terminated at any time by the Board; however, such termination will not affect options then outstanding under the ESPP. If, at any time, shares of Teradyne’s common stock reserved for issuance under the ESPP remain available for purchase, but not in sufficient number to satisfy all then unfilled purchase requirements, the available shares will be apportioned among participants in proportion to the amount of payroll deductions accumulated on behalf of each participant that would otherwise be used to purchase stock, and the ESPP will terminate. Upon termination of the ESPP, all payroll deductions not used to purchase common stock will be refunded to ESPP participants without interest.

As amended, the ESPP would authorize the issuance of up to 5,000,000 shares of common stock in addition to the 25,400,000 shares of common stock previously authorized under the plan. In 2012, employees purchased approximately 1.1 million shares pursuant to the ESPP. With the increase of 5,000,000 shares as requested, based

19

Table of Contents

on historical purchase and participation rates, Teradyne expects the available shares to last for approximately another 5 years. This estimate would be impacted by a significant decrease in participation such as through an employee reduction or divestiture or a significant increase in participation such as through an acquisition. This estimate also is impacted by Teradyne’s share price which determines the number of shares purchased by employees under the ESPP. Participants are generally protected against dilution in the event of certain capital changes such as a recapitalization, stock split, merger, consolidation, reorganization, combination, liquidation, stock dividend or similar transaction.

An employee electing to participate in the ESPP must authorize an amount (a whole percentage not less than 2% nor more than 10% of the employee’s cash compensation) to be deducted from the employee’s pay and applied toward the purchase of common stock under the plan. For the duration of the ESPP, the payment period is two six-month periods commencing on the first day of January and ending on the last day of June, and commencing on the first day of July and ending on the last day of December, of each calendar year.

Employees of Teradyne (and participating subsidiaries) whose customary employment is not less than 20 hours per week and is more than 5 months per calendar year are eligible to participate in the ESPP and may join the ESPP on the first business day of a payment period and those employees who become eligible to participate after the first business day of a business period may join on the first business day of the next succeeding payment period. An employee may not be granted an option under the ESPP if, after the granting of the option, such employee would be treated as owning five percent or more of the common stock. Non-employee directors cannot participate in the ESPP.

On the first business day of each payment period, Teradyne will grant to each participant an option to purchase a maximum of 3,000 shares of common stock. On the last day of the payment period, the employee will be deemed to have exercised this option, at the option price, to the extent of such employee’s accumulated payroll deductions, on the condition that the employee remains eligible to participate in the ESPP throughout the payment period. If the participant’s accumulated payroll deductions on the last day of the payment period would enable the participant to purchase more than 3,000 shares except for the 3,000 share limitation, the excess of the amount of the accumulated payroll deductions over the aggregate purchase price of the 3,000 shares shall be promptly refunded to the participant by Teradyne, without interest. However, in no event may the employee exercise an option granted under the ESPP for more than $25,000 of fair market value of the shares during a calendar year. Furthermore, no employee may be granted an option which permits that employee to purchase shares of common stock under the ESPP to accrue at a rate which exceeds $25,000 of fair market value of such stock (determined on the respective date(s) of grant) for each calendar year in which the option is outstanding. Any excess accumulation of payroll deductions will be promptly refunded to the employee without interest.

Under the terms of the ESPP, the option price is an amount equal to 85% of the fair market value of the common stock on the last business day of the payment period.

Teradyne will accumulate and hold for the employee’s account the amounts deducted from the employee’s pay. No interest will be paid on these amounts. An employee may participate in the ESPP by delivering an authorization stating the initial percentage to be deducted from the employee’s pay and authorizing the purchase of shares of common stock for the employee in each payment period in accordance with the terms of the ESPP.

Under the ESPP, the “fair market value” is (i) the closing price (on that date) of the common stock on the New York Stock Exchange, the principal national securities exchange on which the common stock is traded; or (ii) the average of the closing bid and asked prices last quoted (on that date) by an established quotation service for over-the-counter securities, if the common stock is not traded on a principal national securities exchange; or (iii) if the common stock is not publicly traded, the fair market value is determined by the Committee after taking into consideration all factors which it deems appropriate, including, without limitation, recent sale and offer prices of the common stock in private transactions negotiated at arm’s length.

20

Table of Contents

Unless an employee files a new authorization or withdraws from the ESPP, the deductions and purchases under the authorization the employee has on file under the ESPP will continue from the initial payment period to succeeding payment periods as long as the ESPP remains in effect. Deductions may not be increased during a payment period. Deductions may be decreased during a payment period, provided that an employee may not decrease his deduction more than once during any payment period.

An employee may withdraw from the ESPP, in whole but not in part, at any time prior to the last business day of each payment period by delivering a withdrawal notice to us, in which event Teradyne will refund the entire balance of the employee’s deductions not previously used to purchase stock under the ESPP.

If an employee is not a participant in the ESPP on the last day of the payment period, the employee generally is not entitled to exercise his option. An employee’s rights under the ESPP generally terminate upon his voluntary withdrawal from the ESPP at any time, or when he ceases employment because of retirement, resignation, discharge, death, change of status or any other reason, except that if an employee is laid-off or retires during the last three months of any payment period, that employee is nevertheless deemed to be a participant in the ESPP on the last day of the payment period.

An employee’s rights under the ESPP are the employee’s alone and may not be transferred to, assigned to, or availed of by, any other person, except by will or the laws of descent and distribution. Any option granted to an employee may be exercised, during the employee’s lifetime, only by the employee.

The proceeds received by Teradyne from the sale of the common stock pursuant to the ESPP will be used for general corporate purposes. The obligation to deliver shares of common stock is subject to the approval of any governmental authority required in connection with the sale or issuance of such shares.

The following general rules are currently applicable for United States federal income tax purposes upon the grant and exercise of options to purchase shares of common stock pursuant to the ESPP:

1. The amounts deducted from an employee’s pay under the ESPP will be included in the employee’s compensation subject to federal income tax. In general, no additional income will be recognized by the employee either at the time options are granted pursuant to the ESPP or at the time the employee purchases shares pursuant to the ESPP.

2. If the employee disposes of shares of common stock more than two years after the first business day of the payment period in which the employee acquired the shares, then upon such disposition the employee will recognize compensation income in an amount equal to the lesser of (a) the excess, if any, of the fair market value of the shares on the date of disposition over the amount the employee paid for the shares, or (b) approximately 15% of the fair market value of the shares on the first business day of the payment period. In addition, the employee generally will recognize capital gain or loss in an amount equal to the difference between the amount realized upon the sale of shares and the employee’s adjusted tax basis in the shares (generally, the amount the employee paid for the shares plus the amount, if any, taxed as compensation income). If the employee’s holding period for the shares exceeds one year, such gain or loss will be long-term capital gain or loss.