UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

| | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

| | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number

TENNANT COMPANY

(Exact name of registrant as specified in its charter)

| | | |

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification No.) |

(Address of principal executive offices)

(Zip Code)

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of exchange on which registered | ||

| | | |

| Securities registered pursuant to Section 12(g) of the Act: None | |||||

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. | ☑ | | No | ||

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. | Yes | ☑ | | ||

| Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | ☑ | | No | ||

| Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | ☑ | | No | ||

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See definitions of “large accelerated filer,” "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. | |||||

| | ☑ | Accelerated filer | ☐ | ||

| Non-accelerated filer | ☐ | Smaller reporting company | | ||

| Emerging growth company | | ||||

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ | ||||

| Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. | |||||

| Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | | Yes | ☑ | No |

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2021, was $

As of January 28, 2022, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2022 annual meeting of shareholders (the “2022 Proxy Statement”) are incorporated by reference in Part III.

Form 10–K

Table of Contents

2021

ANNUAL REPORT

Form 10–K

(Pursuant to Securities Exchange Act of 1934)

PART I

ITEM 1 – Business

General Development of Business

Founded in 1870 by George H. Tennant, Tennant Company ("the Company, we, us, or our"), headquartered in Eden Prairie, Minnesota, is a world leader in the design, manufacture and marketing of solutions that help create a cleaner, safer and healthier world. Tennant was incorporated as a Minnesota corporation in 1909 and began as a one-man woodworking business, eventually evolving into a successful wood flooring and wood products company, and finally into a manufacturer of floor cleaning equipment. Throughout its history, the Company has remained focused on advancing our industry by aggressively pursuing new technologies and creating a culture that celebrates innovation.

Today, the Company has 11 global manufacturing locations and operates in three geographic areas including the Americas, Europe, Middle East and Africa (EMEA) and Asia Pacific (APAC). We aggregate our operating segments into one reportable segment that consists of the design, manufacture and sale and servicing of products used primarily in the maintenance of nonresidential surfaces. The Company is committed to developing innovative and sustainable solutions that help our customers clean spaces more effectively with high-performance solutions that minimize waste, reduce costs, improve safety and further sustainability goals.

The Company is focused on achieving operating efficiencies as we continue to innovate and invest in our product portfolio to deliver value to our customers and drive profitable growth for our shareholders.

Principal Products, Markets and Distribution

The Company offers products and solutions consisting of mechanized cleaning equipment for both industrial and commercial use, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair services, and business solutions such as financing, rental and leasing programs, and machine-to-machine asset management solutions. The Company is committed to developing cleaning technologies, including autonomous solutions, which increase cleaning productivity. We have strong brand presence in the global markets we serve, offering both premium and mid-tier products for each region to meet customer needs.

The Company's products are used in many types of environments including: retail establishments, distribution centers, factories and warehouses, public venues such as arenas and stadiums, office buildings, schools and universities, hospitals and clinics, parking lots and streets, and more. The Company markets its offerings under the following brands: Tennant®, Nobles®, Alfa Uma Empresa Tennant™, IRIS®, VLX™, IPC brands, Gaomei and Rongen brands as well as private-label brands. The Company's more than 40,000 customers include contract cleaners to whom organizations outsource facilities maintenance, as well as businesses that perform facilities maintenance themselves. The Company reaches these customers through the industry's largest direct sales and service organization and through a strong and well-supported network of authorized distributors worldwide.

The Company's global field service network is the most extensive in the industry. We sell products directly in 15 countries and through distributors in more than 100 countries.

Raw Materials and Component Parts

Steel, metal alloys and resin are the primary raw materials used to manufacture our mechanized cleaning equipment. We purchase various goods, including component parts and services used in production, logistics and product development processes from third parties. In 2021, the coronavirus (“COVID-19”) pandemic caused imbalances within global supply markets. As markets re-opened and demand increased following COVID lockdowns, the Company experienced raw material price inflation and constrained supply of certain raw materials and component parts. The Company continues work to minimize the impact of price inflation and market supply challenges by employing local-for-local and region-for-region manufacturing and sourcing to allow us to manufacture our products closer to our customers. At the same time, our engineering teams are evaluating platform design to allow for available parts and to increase our sourcing flexibility. We expect price inflation and market supply challenges to continue which may negatively impact our financial results.

Intellectual Property

The Company owns a broad range of intellectual property rights in both the United States and a number of foreign countries. Our patents, proprietary technologies and trade secrets, customer relationships, licenses, trademarks, trade names and brand names in the aggregate constitute a valuable asset, but we do not regard our business as being materially dependent upon any single item or category of intellectual property. We take appropriate measures to protect our intellectual property to the extent such intellectual property can be protected.

Research and Development

Research and development expenses include scientific research costs such as salaries, prototypes, shop supplies, testing, technical information technology and administrative expenditures as well as an allocation of corporate costs. We conduct research and development activities to develop new products and to enhance the functionality, effectiveness, ease of use and reliability of our existing products. We believe that our research and development efforts have been, and continue to be, key drivers of our success in the marketplace.

Seasonality

Although the Company’s business is not seasonal in the traditional sense, the percentage of revenues in each quarter typically ranges from 22% to 28% of the total year. The first quarter tends to be at the low end of the range reflecting customers’ initial slow ramp up of capital purchases and the Company’s efforts to close out orders at the end of each year. The second and fourth quarters tend to be toward the high end of the range and the third quarter is typically in the middle of the range.

Major Customers

The Company sells a wide range of products to a diversified base of customers around the world and has no material concentration of credit risk or significant payment terms extended to customers.

Competition

Public industry data concerning global market share is limited; however, through an assessment of validated third-party sources and sponsored third-party market studies, the Company is confident in its position as a world-leading manufacturer of floor maintenance and cleaning equipment. Several global competitors compete with the Company in virtually every geography of the world. However, small regional competitors are also significant competitors who vary by country, vertical market, product category or channel. The Company competes primarily on the basis of offering a broad line of high-quality, innovative products supported by an extensive sales and service network in major markets.

Human Capital

Tennant Company has a commitment to our employees to foster a culture of integrity and stewardship. This guides our actions as we manage our business and holds us accountable to our colleagues to care for one another and work together to bring to market sustainable cleaning innovations that empower others to create a cleaner, safer, and healthier world. To that end, our executive leadership, as well as our Board of Directors, emphasize the importance of positive human capital management. The following are key human capital measures and objectives that the Company currently focuses on:

Ethics and Employee Safety

We prioritize the health and safety of all of our employees. In our manufacturing facilities, we have established safety teams that proactively identify areas of improvement and help to reinforce employee behaviors in order to reduce or eliminate incidents. In our manufacturing facilities, behavioral safety culture is a primary focus, with a specific growing emphasis on “near-miss” reporting and resolution. We define a near-miss event as a situation where no property was damaged, and no personal injury was sustained, but given a slight shift in time or position, damage and/or injury could have occurred. This focus has increased awareness to potential incidents at our facilities. In addition to our established safety programs, our teams have continued our enhanced COVID-19 safety protocols in our manufacturing, distribution and office facilities. The result is we continue to meet or exceed our safety metrics. Additionally, we have an experienced team of Enterprise Health and Safety professionals that provide onsite and corporate-level support to our global teams.

Diversity, Equity, and Inclusion

Tennant is proud to be an equal opportunity employer where we foster and maintain an ethical work environment free of discrimination. Employment decisions are made on the basis of individual skill, ability, reliability, productivity, and other factors important to performance. In 2021, we launched our Diversity Equity and Inclusion strategy with a vision to establish our worldwide diversity as a differentiator for our organization. We progressed work around diagnosing current state and establishing our baseline, putting in place executive oversight, communicating our strategy to our global workforce, starting leader education and initiating employee involvement through Employee Resource Groups (ERGs).

Diversity in Governance

As of December 31, 2021, women represented 57% of our executive management team and 33% of our Board of Directors.

Gender Equitable Pay

In November 2021, Tennant Company performed its annual gender wage gap analysis to evaluate any gender differences in pay. Our results showed the median income for women working full time in the United States was reported to be 98.76% as compared to their male counterparts. In other words, women at Tennant were seen to be making 98.76 cents to every $1 men earned. To put this figure in context, Tennant’s wage gap findings were compared to the national average. According to the national statistics published by the Bureau of Labor Statistics (BLS) in 2020, women on average made 82.3% of the earnings made by males. The adjusted pay gap at Tennant was found to be 100.56% after controlling for variables such as title, grade, and work location, which are legitimate and non-discretionary reasons for pay difference. This analysis suggests there is no evidence of pay gap at Tennant Company.

The following table represents employees by gender and region as of December 31, 2021:

| Female | Male | Total | |||

| Americas | 404 | 1,776 | 2,180 | ||

| Europe, Middle East, Africa | 406 | 1,265 | 1,671 | ||

| Asia Pacific | 156 | 256 | 412 | ||

| Total | 966 | 3,297 | 4,263 |

Competitive Pay and Benefits

Our overall objective is to align executive compensation with our operating goals and the interests of our shareholders. We seek to offer a comprehensive compensation package that is competitive with those of similarly sized U.S. durable goods manufacturing companies. Our compensation programs take into account that an executive’s actual compensation level may be greater or less than targeted based on our annual and long-term financial performance against pre-established goals, the individual’s performance and the individual’s scope of responsibilities. Specifically, our compensation programs are designed to create a relationship between pay and performance by providing a strong link between our short- and long-term business goals and executive compensation, attract and retain high-caliber key executive officers who can create long-term financial success for the company and enhance shareholder return, motivate executive officers to achieve our goals by placing a significant portion of pay at risk, align the interests of executive officers with those of our shareholders by providing a significant portion of compensation in stock-based awards, and discourage risk-taking behavior that would likely have a material adverse effect on the company.

Tennant Company’s philosophy is to reward employees competitively for the work they perform so that we retain and attract new talent and remain competitive within our marketplace. As an employer we offer pay, benefits, recognition and well-being programs which are tailored for geographic location, statutory requirements and competitive practice as appropriate. We provide employee wages that are competitive and consistent with employee positions, skill levels, experience, knowledge and geographic location.

Talent

We believe attraction, development, engagement and retention of talent is key to achieving our organizational objectives. We focus on creating a high-performance culture, including our annual performance management process for all employees which aligns with our employee and leadership competency framework. In addition, we engage in annual talent conversations to help us identify, develop and deploy talent to achieve our objectives and address talent risks. We believe employee feedback is key to engagement and survey our employees twice a year and make improvements as necessary.

Available Information

The Company's internet address is www.tennantco.com. The Company makes available free of charge, through the Investor Relations website at investors.tennantco.com, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable when such material is filed electronically with, or furnished to, the Securities and Exchange Commission (“SEC”). The SEC also maintains an internet site that contains reports, proxy and information statements, and other information, which can be accessed at sec.gov.

Information About Our Executive Officers

The list below identifies those persons designated as executive officers of the Company, including their age, positions held with the Company and their business experience during the past five or more years.

Barb Balinski, Senior Vice President, Innovation and Technology

Barb Balinski (58) joined the Company in 2018 as Vice President of Engineering and in March 2021, she was named SVP, Innovation and Technology, leading R&D, marketing, and IT functions for Tennant Company. Prior to joining Tennant, Barb held leadership positions of increasing responsibility with the engineering team for the Integrated Business Units at Whirlpool Corporation, a multinational manufacturer of home appliances, from 2005 to 2017, most recently as Director, Product Development, from 2013 to 2017. Prior to Whirlpool Corporation, she spent eleven years with Saturn Corporation, a subsidiary of General Motors.

Daniel E. Glusick, Senior Vice President, Global Operations

Daniel E. Glusick (49) joined the Company in November 2020 as Senior Vice President of Global Operations. Prior to joining Tennant, he was Senior Vice President of Operations at The Vollrath Company, a manufacturer of foodservice equipment and supplies, from June 2018 to October 2020. Prior to his time at The Vollrath Company, he held different roles with increasing responsibilities at Rexnord Industries, a machinery manufacturer, from 2008 to June 2018, leaving when he was VP of Engineering, Innovation and Rexnord Business System. Prior to Rexnord, Mr. Glusick also served for three years as Director, Global Manufacturing at Intermatic and for nine years he held various operations and supply chain leadership roles at Harley-Davidson.

David W. Huml, President and Chief Executive Officer

David W. Huml (53) has served the Company's President and Chief Executive Officer since March 2021, after serving as Chief Operating Officer from March 2020 to March 2021. Mr. Huml joined the Company in November 2014 as Senior Vice President, Global Marketing and was named President and Chief Executive Officer March 1, 2021. In January 2016, he also assumed oversight for the Company's APAC business unit, and in January 2017, he assumed oversight for the Company's EMEA business. From 2006 to October 2014, he held various positions with Pentair plc, a global manufacturer of water and fluid solutions, valves and controls, equipment protection and thermal management products, most recently as Vice President, Applied Water Platform. From 1992 to 2006, he held various positions with Graco Inc., a designer, manufacturer and marketer of systems and equipment to move, measure, control, dispense and spray fluid and coating materials, including Worldwide Director of Marketing, Contractor Equipment Division.

Carol E. McKnight, Senior Vice President, Chief Administrative Officer

Carol E. McKnight (54) joined the Company in June 2014 as Senior Vice President of Global Human Resources. In 2017, she was named Senior Vice President and Chief Administrative Officer. Prior to joining the Company, she was Vice President of Human Resources at Alliant Techsystems (ATK) where she held divisional and corporate leadership positions in the areas of compensation, talent management, talent acquisition and general human resource management from 2002 to 2014. Prior to ATK, she was with New Jersey-based NRG Energy, Inc.

Kristin A. Stokes, Senior Vice President, General Counsel and Corporate Secretary

Kristin A. Stokes (49) has served as the Company's Senior Vice President, General Counsel and Corporate Secretary since December 2020. Ms. Stokes joined the Company's legal department in April 2008, serving in roles of increasing responsibility, including as Vice President, Deputy General Counsel and Chief Compliance Officer from 2019 to 2020, and as Interim General Counsel and Corporate Secretary in 2020. Prior to joining Tennant in 2008, she served as Senior Counsel and Assistant Secretary for MoneyGram International, Inc., from 2004 to 2008. She started her career as a corporate attorney for Lindquist & Vennum, PLLP (n/k/a Ballard Spahr LLP).

Fay West, Senior Vice President, Chief Financial Officer

Fay West (52) joined the Company in April 2021 as Senior Vice President and Chief Financial Officer. Prior to joining Tennant, she was Senior Vice President and Chief Financial Officer of SunCoke Energy, Inc., a raw material processing and handling company, from 2014 to 2021. Before joining SunCoke Energy, Inc., in 2011, as Vice President and Controller, she was Assistant Controller at United Continental Holdings, Inc. Prior to that role, she served in several leadership roles at PepsiAmericas, Inc., including Vice President of Accounting and Financial Reporting, and Director of Financial Reporting. Prior to joining PepsiAmericas, Inc., she was Vice President and Controller of GATX Rail Company.

Richard H. Zay, Senior Vice President, Chief Commercial Officer

Richard H. Zay (51) has served as the Company's Senior Vice President, Chief Commercial Officer since March 2021. Mr. Zay joined the Company in June 2010 as Vice President, Global Marketing and was named Senior Vice President, Global Marketing in October 2013 and Senior Vice President of the Americas business unit for the Company in 2014. In 2018 he assumed responsibility for Tennant Research and Development as well. From 2006 to June 2010, he held various positions with Whirlpool Corporation, most recently as General Manager, KitchenAid Brand. From 1993 to 2006, he held various positions with Maytag Corporation, including Vice President, Jenn-Air Brand, Director of Marketing, Maytag Brand, and Director of Cooking Category Management.

The following are risk factors known to us that could materially adversely affect our business, financial condition or operating results.

Macroeconomic Risks

We may encounter financial difficulties if the United States or other global economies experience an additional or continued long-term economic downturn, decreasing the demand for our products and negatively affecting our sales growth.

Our product sales are sensitive to declines in capital spending by our customers. Decreased demand for our products could result in decreased revenues, profitability and cash flows and may impair our ability to maintain our operations and fund our obligations to others. In the event of a continued long-term economic downturn in the U.S. or other global economies, our revenues could decline to the point that we may have to take cost-saving measures, such as restructuring actions. In addition, other fixed costs would have to be reduced to a level that is in line with a lower level of sales. A long-term economic downturn that puts downward pressure on sales could also negatively affect investor perception relative to our publicly stated growth targets.

Uncertainty surrounding the impacts and duration of the COVID-19 pandemic.

The coronavirus ("COVID-19") pandemic continues to have a significant disruptive impact on global economies, supply chains and industrial production. We have effectively managed our global operations throughout the pandemic, implementing rigorous protocols focused on the health and safety of our employees and ensuring business continuity across our supplier, manufacturing and distribution networks. However, the impact of COVID-19, or any variant thereof, on our business and financial performance depends on evolving factors that we cannot accurately predict, including the ongoing labor shortages, supply chain constraints, additional government mandated lockdowns or similar restrictions, and the pace of economic recovery stemming from the COVID-19 pandemic.

Our global operations are subject to laws and regulations that impose significant compliance costs and create reputational and legal risk.

Due to the international scope of our operations, we are subject to a complex system of commercial, tax and trade regulations around the world. Recent years have seen an increase in the development and enforcement of laws regarding trade, tax compliance, data-privacy, labor and safety and anti-corruption, including the U.S. Foreign Corrupt Practices Act, and similar laws from other countries. Our numerous foreign subsidiaries and affiliates are governed by laws, rules and business practices that differ from those of the U.S., but because we are a U.S.-based company, oftentimes they are also subject to U.S. laws which can create a conflict. Despite our due diligence, there is a risk that we do not have adequate resources or comprehensive processes to stay current on changes in laws or regulations applicable to us worldwide and maintain compliance with those changes. Increased compliance requirements may lead to increased costs and erosion of desired profit margin. As a result, it is possible that the activities of these entities may not comply with U.S. laws or business practices or our Business Ethics Guide. Violations of the U.S. or local laws may result in severe criminal or civil sanctions, could disrupt our business, and result in an adverse effect on our reputation, business and results of operations or financial condition. We cannot predict the nature, scope or effect of future regulatory requirements to which our operations might be subject or the manner in which existing laws might be administered or interpreted.

Industry Risks

We may be unable to take advantage of product pricing due to the competitive marketplace and increased price sensitivity.

Simplification of our customer product pricing is a key initiative to reduce the complexity in which we operate. The current competitive landscape, coupled with macroeconomic factors such as inflation, could impact our ability to achieve our pricing targets. These pressures, along with internal constraints, may limit our ability to sell our products at our expected prices and may result in a change to the mix of product offerings or where we have a competitive advantage. Increasing our prices in this competitive market, where customers are very price sensitive, could have an adverse effect on our financial condition or operating results.

We are subject to competitive risks associated with developing innovative products and technologies, including, but not limited to, our inability to expand as rapidly or aggressively in the global market as our competitors, our customers ceasing to pay for innovation and competitive challenges to our products, technology and the underlying intellectual property.

Our products are sold in competitive markets throughout the world. Competition is based on product features and design, brand recognition, reliability, durability, technology, breadth of product offerings, price, customer relationships and after-sale service. Although we believe that the performance and price characteristics of our products will produce competitive solutions for our customers’ needs, our products are generally priced higher than our competitors’ products. This is due to our dedication to innovation and continued investments in research and development. We believe that customers will pay for the innovations and quality in our products. However, it may be difficult for us to compete with lower priced products offered by our competitors and there can be no assurance that our customers will continue to choose our products over products offered by our competitors. If our products, markets and services are not competitive, we may experience a decline in sales volume, an increase in price discounting and a loss of market share, which would adversely impact our revenues, margin and the success of our operations.

Competitors may also initiate litigation to challenge the validity of our patents or claims, allege that we infringe upon their patents, violate our patents or they may use their resources to design comparable products that avoid infringing our patents. Regardless of whether such litigation is successful, such litigation could significantly increase our costs and divert management’s attention from the operation of our business, which could adversely affect our results of operations and financial condition.

Disruption in the availability of, quality, or increases in the cost of, raw materials and components that we purchase or labor required to manufacture our products could negatively impact our operating results or financial condition.

Our sales growth, expanding geographical footprint and continued use of sole-source vendors, coupled with suppliers’ potential credit issues, could lead to an increased risk of a breakdown in our supply chain. Our use of sole-source vendors creates a concentration risk. There is an increased risk of defects due to the highly configured nature of our purchased component parts that could result in quality issues, returns or production slowdowns. In addition, modularization may lead to more sole-sourced products, and as we seek to outsource the design of certain key components, we risk loss of proprietary control and becoming more reliant on a sole source. There is also a risk that the vendors we choose to supply our parts and equipment fail to comply with our quality expectations, thus damaging our reputation for quality and negatively impacting sales.

Global supplier production for various component parts, including semiconductors, is limited. We have experienced significant disruption of the supply of raw materials and component parts. We expect price inflation and market supply challenges to continue which may negatively impact our financial results.

We have and may continue to experience higher than normal wage inflation due to skilled labor shortages. In addition, we have incurred costs associated with tariffs on certain raw materials used in our manufacturing processes. The labor shortages and tariff costs have unfavorably impacted our gross profit margins and could continue to do so if actions we are taking are not effective at offsetting these rising costs. Changes and uncertainties related to government fiscal and tax policies, including increased duties, tariffs, or other restrictions, could adversely affect demand for our products, the cost of the products we manufacture or our ability to cost-effectively source raw materials, all of which could have a negative impact on our financial results.

Increasing cost pressures could negatively impact our ability to achieve our strategic objectives and affect our financial results.

We are dependent on key suppliers to make certain materials available at a contracted price. Labor, overhead, and material costs have increased and we may not be able to offset these increased manufacturing costs with a higher finished product price. We also may not be able to push those direct cost increases onto our customers in a timely manner given the competitive environment. A decline in demand for our products may have a direct impact on our ability to achieve better pricing through volume discounts.

We are subject to product liability claims and product quality issues that could adversely affect our operating results or financial condition.

Our business exposes us to potential product liability risks that are inherent in the design, manufacturing and distribution of our products. If products are used incorrectly by our customers, injury may result leading to product liability claims against us. Some of our products or product improvements may have defects or risks that we have not yet identified that may give rise to product quality issues, liability and warranty claims. Quality issues may also arise due to changes in parts or specifications with suppliers and/or changes in suppliers. If product liability claims are brought against us for damages that are in excess of our insurance coverage or for uninsured liabilities and it is determined we are liable, our business could be adversely impacted. Any losses we suffer from any liability claims, and the effect that any product liability litigation may have upon the reputation and marketability of our products, may have a negative impact on our business and operating results. We could experience a material design or manufacturing failure in our products, a quality system failure, other safety issues, or heightened regulatory scrutiny that could warrant a recall of some of our products. Any unforeseen product quality problems could result in loss of market share, reduced sales and higher warranty expense.

Operational Risks

Our ability to effectively operate our Company could be adversely affected if we are unable to attract and retain key personnel and other highly skilled employees, provide employee development opportunities and create effective succession planning strategies.

Our growth strategy, expanding global footprint, changing workforce demographics and increased improvements in technology and business processes designed to enhance the customer experience are putting increased pressure on human capital strategies designed to recruit, retain and develop top talent.

Our continued success will depend on, among other things, the skills and services of our executive officers and other key personnel. Our ability to attract and retain highly qualified managerial, technical, manufacturing, research, sales and marketing personnel also impacts our ability to effectively operate our business. As companies grow and increase their hiring activities, there is an inherent risk of increased employee turnover and the loss of valuable employees in key positions, especially in emerging markets. We believe the increased loss of key personnel within a concentrated region could adversely affect our sales growth.

In addition, there is a risk that we may not have adequate talent acquisition resources and employee development resources to support our future hiring needs and provide training and development opportunities to all employees. This, in turn, could impede our workforce from embracing change and leveraging the improvements we have made in technology and other business process enhancements.

We may not be able to develop or manage strategic planning and growth processes or the related operational plans to deliver on our strategies and establish a broad organization alignment, thereby impairing our ability to achieve future performance expectations.

We are continuing to refine our global company strategy to guide our next phase of performance as our structure has become more complex due to recent acquisitions. We continue to consolidate and reallocate resources as part of our ongoing efforts to optimize our cost structure and to drive synergies and growth. Our operating results may be negatively impacted if we are unable to implement new processes and manage organizational changes, which include changes to our go-to-market strategy, systems and processes; simultaneous focus on expense control and growth; and introduction of alternative cleaning methods. In addition, if we do not effectively realize and sustain the benefits that these transformations are designed to produce, we may not fully realize the anticipated savings of these actions or they may negatively impact our ability to serve our customers or meet our strategic objectives.

We may not be able to upgrade and evolve our information technology systems as quickly as we wish and we may encounter difficulties as we upgrade and evolve these systems to support our growth strategy and business operations, which could adversely impact our abilities to accomplish anticipated future cost savings and better serve our customers.

We have many information technology systems that are important to the operation of our business and are in need of upgrading in order to effectively implement our growth strategy. Given our greater emphasis on customer-facing technologies, we may not have adequate resources to upgrade our systems at the pace which the current business environment demands. Additionally, significantly upgrading and evolving the capabilities of our existing systems could lead to inefficient or ineffective use of our technology due to lack of training or expertise in these evolving technology systems. These factors, among other things, could lead to significant expenses, adversely impacting our results of operations and hindering our ability to offer better technology solutions to our customers.

We may encounter risks to our IT infrastructure, such as access and security, that may not be adequately designed to protect critical data and systems from theft, corruption, unauthorized usage, viruses, sabotage or unintentional misuse.

Global cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to IT systems to sophisticated and targeted measures known as advanced persistent threats, directed at the Company, its products and its customers. We seek to deploy comprehensive measures to deter, prevent, detect, react to and mitigate these threats, including identity and access controls, data protection, vulnerability assessments, continuous monitoring of our IT networks and systems and maintenance of backup and protective systems.

Despite these efforts, cybersecurity incidents, depending on their nature and scope, could potentially result in the misappropriation, destruction, corruption or unavailability of critical data and confidential or proprietary information (our own or that of third parties) and the disruption of business operations. The potential consequences of a material cybersecurity incident include financial loss, reputational damage, litigation with third parties, theft of intellectual property, diminution in the value of our investment in research, development and engineering, and increased cybersecurity protection and remediation costs due to the increasing sophistication and proliferation of threats, which in turn could adversely affect our competitiveness and results of operations.

We may be unable to conduct business if we experience a significant business interruption in our computer systems, manufacturing plants or distribution facilities for a significant period of time.

We rely on our computer systems, manufacturing plants and distribution facilities to efficiently operate our business. If we experience an interruption in the functionality in any of these items for a significant period of time for any reason, we may not have adequate business continuity planning contingencies in place to allow us to continue our normal business operations on a long-term basis. In addition, the increase in customer-facing technology raises the risk of a lapse in business operations. Therefore, significant long-term interruption in our business could cause a decline in sales, an increase in expenses and could adversely impact our financial results.

Our ability to manage the health and safety of our global workforce may lead to increased business disruption and financial penalties.

We remain focused on the health and safety measures that impact our business from a manufacturing perspective. The Company had to adjust quickly to new working conditions as a result of the COVID-19 pandemic, including making enhancements as new health information was received. In the future, the Company may not adapt to new health crises quickly enough, resulting in a decrease in resource capacity and overall health and wellness of our workforce that could cause fines, reputational damage, or business disruptions. Also, there may be further enhancements and costs to the Company related to any new health guidelines and protocols. Our manufacturing teams monitor the effectiveness of our wellness and safety programs, while the Company continues to implement more tailored health initiatives for those working from home. Managing additional health guidelines and protocols for the health and safety of our employees may adversely affect our business, financial conditions or operating results.

We may consider acquisitions of suitable candidates to accomplish our growth objectives. We may not be able to successfully integrate the businesses we acquire to achieve operational efficiencies, including synergistic and other benefits of acquisition.

We may consider, as part of our growth strategy, supplementing our organic growth through acquisitions of complementary businesses or products. We have engaged in acquisitions in the past and we may determine that future acquisitions may provide meaningful opportunities to grow our business and improve profitability. Acquisitions allow us to enhance the breadth of our product offerings and expand the market and geographic participation of our products and services.

However, our success in growing by acquisition is dependent upon identifying businesses to acquire, integrating the newly acquired businesses with our existing businesses and complying with the terms of our credit facilities. We may incur difficulties in the realignment and integration of business activities when assimilating the operations and products of an acquired business or in realizing projected efficiencies, cost savings, revenue synergies and profit margins. Acquired businesses may not achieve the levels of revenue, profit, productivity or otherwise perform as expected. We are also subject to incurring unanticipated liabilities and contingencies associated with an acquired entity that are not identified or fully understood in the due diligence process. Current or future acquisitions may not be successful or accretive to earnings if the acquired businesses do not achieve expected financial results.

In addition, we may record significant goodwill or other intangible assets in connection with an acquisition. We are required to perform impairment tests at least annually and whenever events indicate that the carrying value may not be recoverable from future cash flows. If we determine that any intangible asset values need to be written down to their fair values, this could result in a charge that may be material to our operating results and financial condition.

Inadequate funding or insufficient innovation of new technologies may result in an inability to develop and commercialize new innovative products and services.

We strive to develop new and innovative products and services to differentiate ourselves in the marketplace. New product development relies heavily on our financial and resource investments in both the short term and long term. If we fail to adequately fund product development projects or fund a project which ultimately does not gain the market acceptance we anticipated, we risk not meeting our customers' expectations, which could result in decreased revenues, declines in margin and loss of market share.

ITEM 1B – Unresolved Staff Comments

None.

The Company’s corporate offices are owned by the Company and are located in the Minneapolis, Minnesota, metropolitan area. Manufacturing facilities located in Minneapolis, Minnesota; Holland, Michigan; Uden, The Netherlands and the Italian cities of Venice, Cremona and Reggio Emilia and in the Province of Padua are owned by the Company. Manufacturing facilities located in Louisville, Kentucky; São Paulo, Brazil; Hefei, China, and another facility in the Province of Padua are leased to the Company. In addition, IPC Group (IPC) uses a dedicated, third-party plant in Germany that specially manufactures heavy–duty stainless steel scrubbers and sweepers to IPC designs. IPC also owns a minor tools and supplies assembly operation in China to service local customers. The facilities are in good operating condition, suitable for their respective uses and adequate for current needs.

Sales offices, warehouse and storage facilities are leased in various locations in the United States, Canada, Mexico, Portugal, Spain, Italy, Germany, France, The Netherlands, Belgium, Norway, the United Kingdom, Japan, China, India, Australia, New Zealand and Brazil. The Company’s facilities are in good operating condition, suitable for their respective uses and adequate for current needs.

Further information regarding the Company’s property and lease commitments is included in Note 15 to the consolidated financial statements.

There are no material pending legal proceedings other than ordinary routine litigation incidental to the Company’s business.

ITEM 4 – Mine Safety Disclosures

Not applicable.

ITEM 5 – Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

MARKET INFORMATION – Tennant's common stock is traded on the New York Stock Exchange, under the ticker symbol TNC. As of February 11, 2022, there were 270 shareholders of record.

DIVIDEND INFORMATION – Cash dividends on Tennant’s common stock have been paid for 77 consecutive years. Tennant’s annual cash dividend payout increased for the 50th consecutive year to $0.94 per share in 2021, an increase of $0.05 per share over 2020. Dividends are generally declared each quarter. On February 9, 2022, the Company announced a quarterly cash dividend of $0.25 per share payable March 15, 2022, to shareholders of record on March 3, 2022.

DIVIDEND REINVESTMENT OR DIRECT DEPOSIT OPTIONS – Shareholders have the option of reinvesting quarterly dividends in additional shares of Company stock or having dividends deposited directly to a bank account. The Transfer Agent should be contacted for additional information.

TRANSFER AGENT AND REGISTRAR – Shareholders with a change of address or questions about their account may contact:

Equiniti Trust Company

Shareowner Services

P.O. Box 64874

St. Paul, MN 55164-0854

(800) 468-9716

SHARE REPURCHASES – Share repurchases are made from time to time in the open market or through privately negotiated transactions. During the twelve months ended December 31, 2021, the Company paid $15.0 million to repurchase 196,982 shares of its common stock. The most recent share repurchase program approved by the Board of Directors on October 31, 2016 authorized the repurchase of 1,000,000 shares of our common stock. This is in addition to the 193,414 shares that remain authorized under the prior program that was authorized by the Board of Directors on June 22, 2015.

| For the Quarter Ended |

Total Number of Shares |

Average Price Paid |

Total Number of Shares Purchased as Part of Publicly Announced Plans or |

Maximum Number of Shares that May Yet Be Purchased Under the Plans or |

||||||||

| December 31, 2021 |

Purchased(a) |

Per Share |

Programs |

Programs |

||||||||

| October 1–31, 2021 |

63,692 | $77.26 | 63,674 | 1,224,493 | ||||||||

| November 1–30, 2021 |

31,173 | $82.97 | 31,079 | 1,193,414 | ||||||||

| December 1–31, 2021 |

8,902 | $83.46 | — | 1,193,414 | ||||||||

| Total |

103,767 | $79.51 | 94,753 | 1,193,414 |

| (a) |

Includes 9,014 shares delivered or attested to in satisfaction of the exercise price and/or tax withholding obligations by employees who exercised stock options or restricted stock under employee share-based compensation plans. |

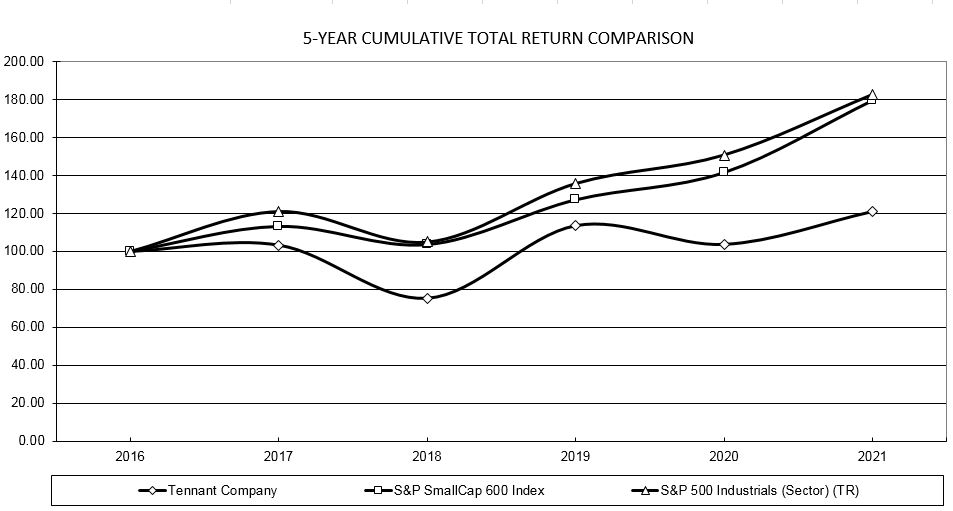

STOCK PERFORMANCE GRAPH – The following graph compares the cumulative total shareholder return on Tennant’s common stock to two indices: S&P SmallCap 600 and S&P 500 Industrials (Sector). The graph below compares the performance for the last five fiscal years, assuming an investment of $100 on December 31, 2016, including the reinvestment of all dividends.

| 2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|||||||||||||||||||

| Tennant Company |

$ | 100 | $ | 103 | $ | 75 | $ | 114 | $ | 104 | $ | 121 | ||||||||||||

| S&P SmallCap 600 |

$ | 100 | $ | 113 | $ | 104 | $ | 127 | $ | 142 | $ | 180 | ||||||||||||

| S&P 500 Industrials (Sector) (TR) |

$ | 100 | $ | 121 | $ | 105 | $ | 136 | $ | 151 | $ | 183 | ||||||||||||

NOTE: Prepared by Zacks Investment Research, Inc. Used with permission. All rights reserved. Copyright 1980-2022.

NOTE: Index Data: Copyright Standard and Poor’s, Inc. Used with permission. All rights reserved.

ITEM 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

Tennant Company is a world leader in designing, manufacturing and marketing solutions that empower customers to achieve quality cleaning performance, reduce environmental impact and help create a cleaner, safer, healthier world. The Company is committed to creating and commercializing breakthrough, sustainable cleaning innovations to enhance its broad suite of products, including floor maintenance and cleaning equipment, detergent-free and other sustainable cleaning technologies, aftermarket parts and consumables, equipment maintenance and repair service, and asset management solutions. Our products are used in many types of environments, including retail establishments, distribution centers, factories and warehouses, public venues such as arenas and stadiums, office buildings, schools and universities, hospitals and clinics, and more. Customers include contract cleaners to whom organizations outsource facilities maintenance as well as businesses that perform facilities maintenance themselves. The Company reaches these customers through the industry's largest direct sales and service organization and through a strong and well-supported network of authorized distributors worldwide.

The year-over-year comparisons in this Management's Discussion and Analysis of Financial Condition and Results of Operations are as of and for the years ended December 31, 2021 and December 31, 2020, unless stated otherwise. The discussion of 2019 results and related year-over-year comparisons as of and for the years ended December 31, 2020 and December 31, 2019 are found in Part II, Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations," of our Form 10-K for the year ended December 31, 2020.

Impact of COVID-19

We continue to actively manage our business to respond to the COVID-19 pandemic and related impacts.

Throughout 2021 and into 2022, we have experienced disruption in the supply of raw materials and component parts, as well as raw material price inflation and inefficiencies as a result of supply chain issues. Although we regularly monitor the financial health and operations of companies in our supply chain, financial hardship or government restrictions on our suppliers or sub-suppliers caused by the COVID-19 pandemic could cause a disruption in our ability to obtain raw materials or component parts required to manufacture our products and adversely affect our operations. We have established frequent communications with suppliers to review, track and prioritize high-risk components. We have also identified and activated alternative suppliers, materials and components as needed. The Company continues work to minimize the impact of price inflation in inputs and market supply challenges by employing local-for-local and region-for-region manufacturing and sourcing to allow us to manufacture our products closer to our customers. At the same time, our engineering teams are evaluating platform design to allow for available parts and to increase our sourcing flexibility. Regarding transportation, we have set up tracking, reporting and communication channels with carriers to understand their risks and to evaluate available options where necessary. We expect the supply chain challenges and inflationary trends to continue into 2022.

We maintain our commitment to protect the health and safety of our employees and customers. We have continued our enhanced safety protocols for those on-site at our manufacturing facilities, and we have implemented work-from home processes for much of our workforce which partially remain in effect. We continue to monitor the evolving situation and guidance from local authorities.

All indications are that 2022 will require us to be agile as we manage through the year. However, as many governments shift their COVID-19 governance strategies from pandemic to endemic, and demand for our products remains strong, we remain confident in the long-term growth trends for all our products and locations.

For more information regarding factors and events that may impact our business, results of operations and financial condition as a result of the COVID-19 pandemic, see Item 1A. Risk Factors

Historical Results

The following table compares the historical results of operations for the years ended December 31, 2021, 2020 and 2019 in dollars and as a percentage of Net Sales (in millions, except per share amounts and percentages):

| 2021 |

% |

2020 |

% |

2019 |

% |

|||||||||||||||||||

| Net sales |

1,090.8 | 100.0 | 1,001.0 | 100.0 | 1,137.6 | 100.0 | ||||||||||||||||||

| Cost of sales |

652.8 | 59.8 | 593.2 | 59.3 | 675.9 | 59.4 | ||||||||||||||||||

| Gross profit |

438.0 | 40.2 | 407.8 | 40.7 | 461.7 | 40.6 | ||||||||||||||||||

| Selling and administrative expense |

321.9 | 29.5 | 314.0 | 31.4 | 357.2 | 31.4 | ||||||||||||||||||

| Research and development expense |

32.2 | 3.0 | 30.1 | 3.0 | 32.7 | 2.9 | ||||||||||||||||||

| Gain on sale of business |

(9.8 | ) | (0.9 | ) | — | — | — | — | ||||||||||||||||

| Operating income |

93.7 | 8.6 | 63.7 | 6.4 | 71.8 | 6.3 | ||||||||||||||||||

| Interest expense, net |

(7.3 | ) | (0.7 | ) | (17.4 | ) | (1.7 | ) | (17.8 | ) | (1.6 | ) | ||||||||||||

| Net foreign currency transaction loss |

(0.7 | ) | (0.1 | ) | (5.3 | ) | (0.5 | ) | (0.7 | ) | (0.1 | ) | ||||||||||||

| Loss on extinguishment of debt |

(11.3 | ) | (1.0 | ) | — | — | — | — | ||||||||||||||||

| Other (expense) income, net |

(0.3 | ) | — | 0.1 | — | 0.7 | 0.1 | |||||||||||||||||

| Income before income taxes |

74.1 | 6.8 | 41.1 | 4.1 | 54.0 | 4.7 | ||||||||||||||||||

| Income tax expense |

9.2 | 0.8 | 7.4 | 0.7 | 8.1 | 0.7 | ||||||||||||||||||

| Net income including noncontrolling interest |

64.9 | 5.9 | 33.7 | 3.4 | 45.9 | 4.0 | ||||||||||||||||||

| Net income attributable to noncontrolling interest |

— | — | — | — | 0.1 | — | ||||||||||||||||||

| Net income attributable to Tennant Company |

$ | 64.9 | 5.9 | $ | 33.7 | 3.4 | $ | 45.8 | 4.0 | |||||||||||||||

| Net income attributable to Tennant Company per share - diluted |

$ | 3.44 | $ | 1.81 | $ | 2.48 | ||||||||||||||||||

Net Sales

Consolidated net sales in 2021 totaled $1,090.8 million, a 9.0% increase as compared to consolidated net sales of $1,001.0 million in 2020.

The 9.0% increase in consolidated net sales for 2021 as compared to 2020 was driven by:

| • |

Organic sales increase of approximately 9.1% which excludes the effects of foreign currency exchange and divestitures. The organic sales increase was primarily driven by volume growth across all business units due to continued recovery from COVID-19 in 2021. Incremental pricing also favorably impacted sales in 2021; |

|

| • | An unfavorable impact from the divestiture of our Coatings business of 2.1%; and |

| • |

A net favorable impact from foreign currency exchange across all business units of approximately 2.0%. |

The following table sets forth annual net sales by geographic area and the related percentage change from the prior year (in millions, except percentages):

| 2021 |

% |

2020 |

% |

2019 |

||||||||||||||||

| Americas |

$ | 658.3 | 4.3 | $ | 631.0 | (12.7 | ) | $ | 722.4 | |||||||||||

| Europe, Middle East and Africa |

331.9 | 19.3 | 278.2 | (9.6 | ) | 307.6 | ||||||||||||||

| Asia Pacific |

100.6 | 9.6 | 91.8 | (14.7 | ) | 107.6 | ||||||||||||||

| Total |

$ | 1,090.8 | 9.0 | $ | 1,001.0 | (12.0 | ) | $ | 1,137.6 | |||||||||||

Americas

Net sales in the Americas were $658.3 million in 2021, an increase of 4.3% from 2020. Organic sales growth in the Americas favorably impacted net sales by approximately 7.4% due to volume growth in most business units and product categories compared to 2020, which was more impacted by COVID-19. Price increases also contributed to organic sales growth. Foreign currency exchange within the Americas favorably impacted net sales by approximately 0.2% in 2021. The growth was partly offset by declines in the Company's AMR business, due to the lapping of a large order in North America in the prior year. At the same time, the business unit was directly impacted by global supply chain and labor constraints, which resulted in lower revenue than expected and increased backlog levels. The divestiture of the Coatings business resulted in a decline in net sales of approximately 3.3% in 2021.

Europe, Middle East and Africa ("EMEA")

EMEA net sales were $331.9 million in 2021, an increase of 19.3% from 2020. Organic sales growth in EMEA favorably impacted net sales by approximately 14.2% in 2021 primarily due to market growth across the business unit and product categories compared to 2020, which was more impacted by COVID-19. Foreign currency exchange within EMEA favorably impacted net sales by approximately 5.1% in 2021.

Asia Pacific ("APAC")

APAC net sales were $100.6 million in 2021, an increase of 9.6% from 2020. Organic sales growth in APAC favorably impacted net sales by approximately 5.6% in 2021 primarily due to growth in Korea and Australia, partly offset by supply chain and labor challenges in our North American plants that supply APAC. Foreign currency exchange within APAC favorably impacted net sales by approximately 4.0% in 2021.

Gross Profit

Gross profit margin of 40.2% was 50 basis points lower in 2021 compared to 2020. The margin rate decrease was primarily driven by significant raw material and component parts inflation and higher freight costs, partly offset by higher selling prices.

Operating Expenses

Selling and Administrative Expense

Selling and Administrative ("S&A") expense was $321.9 million in 2021, an increase of $7.9 million compared to 2020. As a percentage of net sales, S&A expense in 2021 decreased 190 basis points to 29.5% from 31.4% in 2020. The S&A increase in 2021 was primarily driven by more normalized spending as profitability improved compared to 2020, when the Company took cost containment actions, including employee furloughs, reduction in travel spending, and temporary pay reductions, as well as benefits from government programs received related to COVID-19. The benefits represented wage subsidies received from various European and Canadian authorities that are not required to be repaid.

Research and Development Expense

Research and Development ("R&D") expense was $32.2 million, or 3% of net sales, in 2021, nearly flat as a percentage of net sales compared to 2020.

We believe that our research and development efforts have been, and continue to be, key drivers of our success in the marketplace.

Gain on Sale of Business

Gain on sale of business was $9.8 million in 2021 as a result of the sale of the Coatings business that occurred in the first quarter of 2021.

Total Other Expense, Net

Interest Expense, Net

Interest expense, net was $7.3 million of net expense in 2021, compared to $17.4 million in 2020, respectively. The decrease in 2021 was due to the restructuring of debt in the second quarter of 2021, which resulted in lower interest expense from more favorable interest rates and a lower amount of outstanding debt.

Net Foreign Currency Transaction Loss

Net foreign currency transaction loss was $0.7 million in 2021, compared to $5.3 million in 2020. The unfavorable impact from foreign currency transactions in 2021 and 2020 was primarily due to strengthening of the U.S. dollar relative to the Brazilian real. The reduction of losses recognized in 2021 compared to 2020 is driven by stabilization in the currency markets in the current year versus the previous year.

Loss on Extinguishment of Debt

Loss on extinguishment of debt was $11.3 million in 2021 due to the restructuring of debt that occurred in the second quarter of 2021.

Income Taxes

The effective tax rate for 2021 was 12.5% compared to 17.9% in 2020. The effective tax rate in 2021 decreased primarily due to a tax benefit resulting from an election to step-up the tax basis of certain assets for Italian tax purposes, as well as the release of certain valuation allowances related to net operating loss carryovers.

In general, it is our practice and intention to permanently reinvest the earnings of our foreign subsidiaries and repatriate earnings only when the tax impact is zero or immaterial. No deferred taxes have been provided for withholding taxes or other taxes that would result upon repatriation of our foreign investments to the U.S.

Backlog

Backlog is one of the many indicators of business conditions in the Company's markets. Our order backlog at December 31, 2021 was approximately 3x - 5x larger compared to previous years. The increase in our order backlog year over year was primarily due to higher order rates coupled with persistent supply chain challenges and labor constraints. We expect this level of backlog to continue in 2022. Backlog includes orders that can be cancelled or postponed at the option of the customer at any time without penalty.

Liquidity and Capital Resources

Liquidity

Our primary liquidity needs are to fund working capital, fund investments, service our debt, maintain cash reserves and capital expenditures. Our sources of liquidity include cash generated from operations, borrowings under our revolving credit facility and from time to time, debt and equity offerings. We believe our current resources are sufficient to meet our working capital requirements for our current business for at least the next 12 months and thereafter for the foreseeable future.

Cash, cash equivalents and restricted cash totaled $123.6 million at December 31, 2021, as compared to $141.0 million as of December 31, 2020. Wherever possible, cash management is centralized and intercompany financing is used to provide working capital to subsidiaries as needed. Our current ratio was 1.8 as of December 31, 2021 and 1.9 as of December 31, 2020, and our primary working capital, which is comprised of accounts receivable, inventories and accounts payable was $250.5 million and $221.3 million, respectively. Our debt-to-capital ratio was 38.1% as of December 31, 2021, compared to 43.2% as of December 31, 2020.

In the second quarter of 2021, we signed an agreement (the "2021 Credit Agreement") that restructured our previous credit agreement. The 2021 Credit Agreement provides greater flexibility with fewer restrictive covenants and more favorable interest rates than the previous arrangement, consisting of a term loan facility in an amount up to $100.0 million and a revolving facility in an amount up to $450.0 million with an option to expand the revolving facility by up to $275.0 million with the consent of the lenders willing to provide additional borrowings in the form of increases to their revolving facility commitment or funding of incremental term loans. As a result, we expect future interest expense to be lower by approximately $1.0 million per month as compared to periods prior to the debt restructuring. In the second quarter of 2021, we used the proceeds from the 2021 Credit Agreement to retire our 5.625% Senior Notes due 2025. As of December 31, 2021, we had outstanding borrowings of $98.8 million and $168.0 million under our term loan facility and revolving facility, respectively. As of December 31, 2021, we had letters of credit and bank guarantees outstanding in the amount of $2.9 million, leaving approximately $279.1 million of unused borrowing capacity on our revolving facility. See Note 9 to the consolidated financial statements for more detail on the 2021 Credit Agreement.

The Company's Board of Directors has authorized a quarterly cash dividend of $0.25 per share payable March 15, 2022, to shareholders of record on March 3, 2022.

Cash Flow from Operating Activities

Operating activities provided $69.4 million of cash in 2021. Cash provided by operating activities was driven primarily by inflows from a strong performance influencing net income, by adding back non-cash items of $52.9 million and an increase in accounts payable of $19.1 million offset by outflows from an increase in inventory of $56.0 million and an increase in receivables of $20.3 million.

Cash Flow from Investing Activities

Investing activities in 2021 provided $1.7 million, resulting from $24.7 million of proceeds from the sale of our Coatings business net of cash divested, partially offset by $19.4 million of capital expenditures and $3.7 million from investments in leased assets. Cash used for capital expenditures decreased from 2020 due to the investments in the new corporate headquarters that occurred in 2020.

Cash Flow from Financing Activities

Net cash used in financing activities was $84.5 million in 2021. Proceeds from borrowings of $315.8 million and issuance of common stock of $5.0 million were mainly offset by payments of debt of $362.0 million, dividend payments of $17.5 million, repurchases of common stock of $15.0 million, a debt extinguishment payment of $8.4 million, and a contingent consideration payment of $2.5 million.

Contractual Obligations

The company believes the liquidity available from the combination of expected cash generated by operating activities, existing cash and available credit under existing credit facilities will be sufficient to meet its short-term and long-term cash requirements. Significant contractual obligations include principal and interest payments on long-term debt (Note 9) and operating lease commitments (Note 15). We also have contractual purchase obligations of $125.7 million for 2022.

Newly Issued Accounting Guidance

See Note 2 to the consolidated financial statements for information on new accounting pronouncements.

No other new accounting pronouncements issued but not yet effective have had, or are expected to have, a material impact on our results of operations or financial position.

Critical Accounting Policies and Estimates

Our consolidated financial statements are based on the selection and application of accounting principles generally accepted in the United States of America, which require us to make estimates and assumptions about future events that affect the amounts reported in our consolidated financial statements and the accompanying notes. Our significant accounting policies are described in Note 1 to the consolidated financial statements. Future events and their effects cannot be determined with absolute certainty. Therefore, the determination of estimates requires the exercise of judgment. Actual results could differ from those estimates, and any such differences may be material to the consolidated financial statements. We believe that the following policies may involve a higher degree of judgment and complexity in their application and represent the critical accounting policies used in the preparation of our consolidated financial statements. If different assumptions or conditions were to prevail, the results could be materially different from our reported results.

Goodwill – Goodwill represents the excess of cost over the fair value of net assets of businesses acquired and is allocated to our reporting units at the time of the acquisition. We analyze goodwill on an annual basis and when an event occurs or circumstances change that may reduce the fair value of a reporting unit below its carrying amount. We have the option of first analyzing qualitative factors to determine whether it is more likely than not that the fair value of any reporting unit is less than its carrying amount. However, we may elect to perform a quantitative goodwill impairment test in lieu of the qualitative test. An entity must recognize an impairment charge for the amount by which the carrying amount exceeds the reporting unit’s fair value. Subsequent reversal of goodwill impairment charges is not permitted.

When we perform a qualitative goodwill test, we analyze qualitative factors to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount as a basis for determining whether it is necessary to perform the quantitative goodwill impairment test. If the qualitative test indicates there may be an impairment, we perform the quantitative test, which measures the amount of the goodwill impairment, if any. To perform the quantitative test, we calculate the fair value of each reporting unit, primarily utilizing the income approach. The income approach is based on discounted cash flow models that use reporting unit estimates for forecasted future financial performance, including revenues, margins, operating expenses, capital expenditures, depreciation, amortization, tax and discount rates. These estimates are developed as part of our planning process based on assumed growth rates, along with historical data and various internal estimates. Projected future cash flows are then discounted to a present value employing a discount rate that properly accounts for the estimated risk-adjusted weighted-average cost of capital relevant to each reporting unit.

We perform our annual goodwill impairment analysis as of October 1 and when an event occurs or circumstances change that may reduce the fair value of a reporting unit below its carrying amount. In 2020, we changed the goodwill impairment assessment date from December 31 to October 1 to better align with the timing of our annual planning process. The change did not result in any adjustments to our consolidated financial statements.

In 2021, we performed the qualitative goodwill test on all reporting units except on Europe, Middle East and Africa (EMEA) for which we performed a quantitative goodwill test. Our tests indicated that there was no goodwill impairment in any of our reporting units as of our annual assessment date.

We had goodwill of $193.1 million and $207.8 million at December 31, 2021 and 2020, respectively.

Income Taxes – We are required to estimate our income taxes in each of the jurisdictions in which we operate. This process involves estimating our actual current tax obligations based on expected income, statutory tax rates and tax planning opportunities in the various jurisdictions. We also establish reserves for uncertain tax matters that are complex in nature and uncertain as to the ultimate outcome. Although we believe that our tax return positions are fully supportable, we consider our ability to ultimately prevail in defending these matters when establishing these reserves. We adjust our reserves in light of changing facts and circumstances, such as the closing of a tax audit. We believe that our current reserves are adequate. However, the ultimate outcome may differ from our estimates and assumptions and could impact the income tax expense reflected in our consolidated statements of income.

Tax law requires certain items to be included in our tax return at different times than the items are reflected in our results of operations. Some of these differences are permanent, such as expenses that are not deductible in our tax returns, and some differences will reverse over time, such as depreciation expense on property, plant and equipment. These temporary differences result in deferred tax assets and liabilities, which are included within our consolidated balance sheets. Deferred tax assets generally represent items that can be used as a tax deduction or credit in our tax returns in future years but have already been recorded as an expense in our consolidated statements of income. We assess the likelihood that our deferred tax assets will be recovered from future taxable income, and, based on management’s judgment, to the extent we believe that recovery is not more likely than not, we establish a valuation allowance against those deferred tax assets. The deferred tax asset valuation allowance could be materially different from actual results because of changes in the mix of future taxable income, the relationship between book and taxable income and our tax planning strategies. As of December 31, 2021, a valuation allowance of $4.8 million was recorded against foreign and state tax credit carryforwards.

Cautionary Factors Relevant to Forward-Looking Information

This Annual Report on Form 10-K, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7, contains certain statements that are considered “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “project,” or “continue” or similar words or the negative thereof. These statements do not relate to strictly historical or current facts and provide current expectations of forecasts of future events. Any such expectations or forecasts of future events are subject to a variety of factors. Particular risks and uncertainties presently facing us include:

| • |

Geopolitical and economic uncertainty throughout the world. |

|

| • |

Uncertainty surrounding the COVID-19 pandemic. | |

| • | Ability to comply with global laws and regulations. | |

| • | Ability to adapt to price sensitivity. |

|

| • | Competition in our business. | |

| • | Fluctuations in the cost, quality or availability of raw materials and purchased components. | |

| • | Ability to adjust pricing to respond to cost pressures. | |

| • | Unforeseen product liability claims or product quality issues. | |

| • | Ability to attract, retain and develop key personnel and create effective succession planning strategies. | |

| • | Ability to effectively manage strategic plan or growth processes. | |

| • | Ability to successfully upgrade and evolve our information technology systems. | |

| • | Ability to successfully protect our information technology systems from cybersecurity risks. | |

| • | Occurrence of a significant business interruption. | |

| • | Ability to maintain the health and safety of our workforce. | |

| • | Ability to integrate acquisitions. | |

| • |

Ability to develop and commercialize new innovative products and services. |

We caution that forward-looking statements must be considered carefully and that actual results may differ in material ways due to risks and uncertainties both known and unknown. Information about factors that could materially affect our results can be found in Part I, Item 1A "Risk Factors" of this Form 10-K. Shareholders, potential investors and other readers are urged to consider these factors in evaluating forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements.

We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Investors are advised to consult any further disclosures by us in our filings with the SEC and in other written statements on related subjects. It is not possible to anticipate or foresee all risk factors, and investors should not consider any list of such factors to be an exhaustive or complete list of all risks or uncertainties.

ITEM 7A – Quantitative and Qualitative Disclosures About Market Risk

Commodity Risk – We are subject to exposures resulting from potential cost increases related to our purchase of raw materials or other product components. We do not use derivative commodity instruments to manage our exposures to changes in commodity prices such as steel, oil, gas, lead and other commodities.

Various factors beyond our control affect the price of oil and gas, including, but not limited to, worldwide and domestic supplies of oil and gas, political instability or armed conflict in oil-producing regions, the price and level of foreign imports, the level of consumer demand, the price and availability of alternative fuels, domestic and foreign governmental regulation, weather-related factors and the overall economic environment. We purchase petroleum-related component parts for use in our manufacturing operations. In addition, our freight costs associated with shipping and receiving product and sales and service vehicle fuel costs are impacted by fluctuations in the cost of oil and gas.

Fluctuations in worldwide demand and other factors affect the price for lead, steel and related products. We do not maintain an inventory of raw or fabricated steel or batteries in excess of near-term production requirements. As a result, increases in the price of lead or steel can significantly increase the cost of our lead- and steel-based raw materials and component parts.