UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement | |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ |

Definitive Proxy Statement | |

| ☐ |

Definitive Additional Materials | |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 | |

Teleflex Incorporated

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. | |||

| ☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) |

Title of each class of securities to which transaction applies:

| |||

| (2) |

Aggregate number of securities to which transaction applies:

| |||

| (3) |

Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) |

Proposed maximum aggregate value of transaction:

| |||

| (5) |

Total fee paid:

| |||

| ☐ |

Fee paid previously with preliminary materials. | |||

| ☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

550 East Swedesford Road, Suite 400

Wayne, Pennsylvania 19087

Notice of Annual Meeting of Stockholders

To Be Held on May 1, 2020

March 27, 2020

TO THE STOCKHOLDERS OF TELEFLEX INCORPORATED:

The annual meeting of stockholders (the “Annual Meeting”) of Teleflex Incorporated will be held on Friday, May 1, 2020 at 11:00 a.m., local time, at the Company’s headquarters, located at 550 East Swedesford Road, Wayne, Pennsylvania 19087, for the following purposes:

1. To elect three directors to serve on our Board of Directors for a term of three years and until their successors have been duly elected and qualified;

2. To vote upon a proposal to approve, on an advisory basis, the compensation of our named executive officers;

3. To vote upon a proposal to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020; and

4. To transact such other business as may properly come before the meeting.

Our Board of Directors has fixed Monday, March 2, 2020 as the record date for the Annual Meeting. This means that owners of our common stock at the close of business on that date are entitled to receive notice of, and to vote at, the Annual Meeting.

As part of our precautions regarding the coronavirus (COVID-19), we are sensitive to the public health and travel concerns that our stockholders may have, as well as any protocols that federal, state and local governments may impose. In the event it is not possible or advisable for stockholders to attend the Annual Meeting in person, we will announce in advance via press release alternative arrangements for the meeting, which may include holding the Annual Meeting solely by means of remote communication. The press release, which will include details on how to access the meeting, will be posted on our website and filed with the SEC as additional proxy materials. If you are planning to participate in the Annual Meeting, please check our website prior to the meeting date. As always, you are encouraged to vote your shares prior to the Annual Meeting.

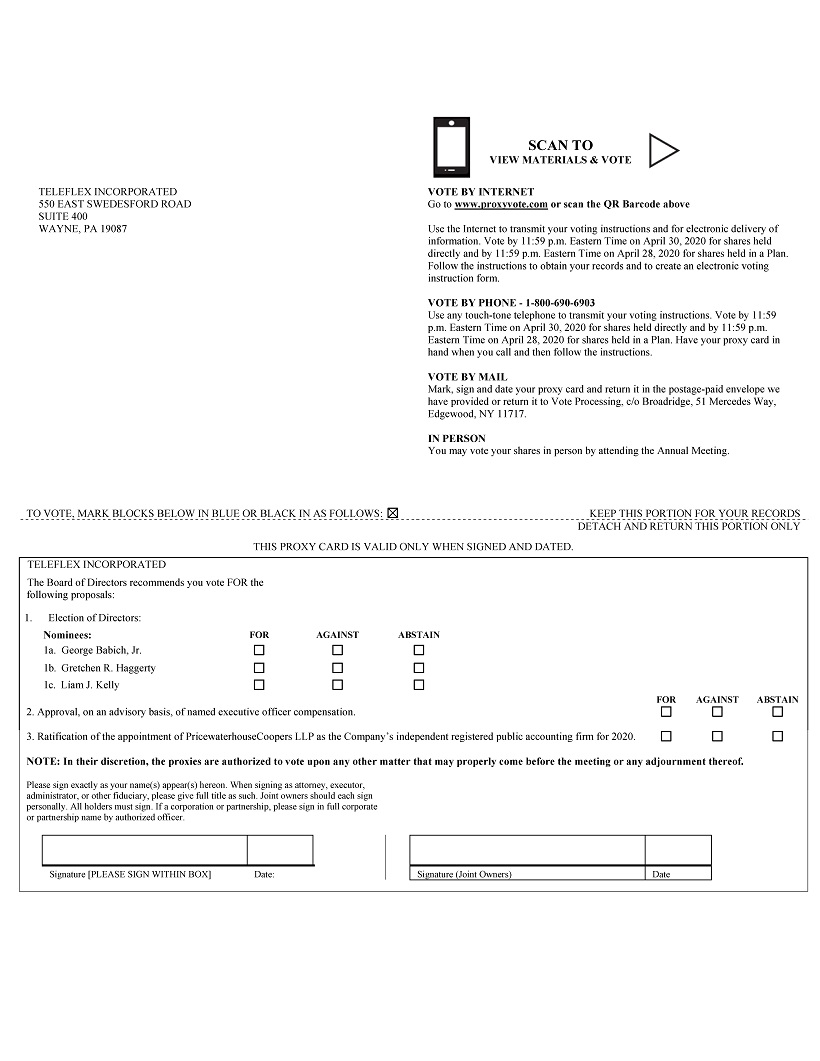

Stockholders are requested to date, sign and return the enclosed proxy card in the enclosed envelope. No postage is necessary if mailed in the United States or Canada. You may also vote by telephone by calling toll free 1-800-690-6903, or via the internet at www.proxyvote.com.

| By Order of the Board of Directors, |

| James J. Leyden, Secretary |

PLEASE VOTE — YOUR VOTE IS IMPORTANT

| Page | ||||

| 1 | ||||

| 2 | ||||

| 5 | ||||

| 11 | ||||

| Corporate Governance Principles and Other Corporate Governance Documents |

11 | |||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 16 | ||||

| 16 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 21 | ||||

| 24 | ||||

| 37 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| 47 | ||||

| 49 | ||||

| 50 | ||||

| 51 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

58 | |||

| 60 | ||||

| 60 | ||||

| PROPOSAL 2: ADVISORY VOTE ON COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS |

61 | |||

| PROPOSAL 3: RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

62 | |||

| 62 | ||||

| 62 | ||||

| 63 | ||||

| 63 | ||||

TELEFLEX INCORPORATED

550 East Swedesford Road, Suite 400

Wayne, Pennsylvania 19087

PROXY STATEMENT

This proxy statement is furnished to stockholders in connection with the solicitation of proxies by the Board of Directors of Teleflex Incorporated (the “Company” or “Teleflex”) for use at the Company’s annual meeting of stockholders (the “Annual Meeting”) to be held on Friday, May 1, 2020 at 11:00 a.m., local time, at the Company’s headquarters, located at 550 East Swedesford Road, Wayne, Pennsylvania 19087. The proxies may also be voted at any adjournment or postponement of the Annual Meeting. Only stockholders of record at the close of business on March 2, 2020, the record date for the meeting, are entitled to vote. Each stockholder of record on the record date is entitled to one vote for each share of common stock held. On the record date, the Company had 46,370,724 shares of common stock outstanding.

This proxy statement and the enclosed form of proxy are being mailed to stockholders on or about March 27, 2020. A copy of the Company’s 2019 Annual Report is provided with this proxy statement.

The Company will pay the cost of solicitation of proxies. In addition to this mailing, proxies may be solicited, without extra compensation, by our officers and employees, by mail, telephone, facsimile, electronic mail and other methods of communication. The Company reimburses banks, brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses in forwarding solicitation materials to the beneficial owners of the Company’s common stock.

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to be Held on May 1, 2020

This proxy statement, the accompanying Notice of Annual Meeting, proxy card and

our 2019 Annual Report are available at http://www.teleflex.com/ProxyMaterials.

1

| 1. | What is a “proxy”? |

It is your way of legally designating another person to vote for you. That other person is called a “proxy.” If you designate another person as your proxy in writing, the written document is called a “proxy” or “proxy card.”

| 2. | What is a “proxy statement”? |

It is a document required by the Securities and Exchange Commission (the “SEC”) that contains information about the matters that stockholders will vote upon at the Annual Meeting. The proxy statement also includes other information required by SEC regulations.

| 3. | What is a “quorum”? |

A quorum is the minimum number of stockholders who must be present at the Annual Meeting or voting by proxy to conduct business at the meeting. A majority of the outstanding shares of our common stock, whether present in person or represented by proxy, will constitute a quorum at the Annual Meeting.

| 4. | How many votes are required to elect director nominees and approve the proposals? |

To be elected at the meeting, a director nominee must receive the affirmative vote of a majority of the votes cast. For this purpose, a majority of the votes cast means that the number of votes cast in favor of a director nominee must exceed the number of votes cast against that director nominee. Abstentions and “broker non-votes” will have no effect on the vote.

Approval of each of the other proposals requires the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting and entitled to vote on the proposal. Accordingly, abstentions have the same effect as votes against a proposal, while broker non-votes will not be included in the vote count and will have no effect on the vote.

| 5. | What is a “broker non-vote”? |

A broker “non-vote” occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner. Under New York Stock Exchange rules, brokers are not permitted to vote on the election of directors or the advisory vote on executive compensation; therefore, if your shares are held by a broker, you must provide voting instructions if you want your broker to vote on these matters. Your broker or its designee should provide you with a voting instruction form for this purpose.

| 6. | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, you are considered the stockholder of record, or a “record holder,” with respect to those shares, and you may submit a proxy card and vote those shares in the manner described in this proxy statement.

Most of our stockholders hold their shares as a beneficial owner through a broker, bank or other nominee rather than directly in their own name. If your shares are held through a broker, bank or other nominee, you are considered the “beneficial owner” of the shares. As the beneficial owner, you

2

generally have the right to direct your broker, bank or other nominee on how to vote your shares. Your broker, bank or other nominee should provide you with a voting instruction form that you use to give instructions as to how your shares are to be voted.

| 7. | How do I vote? |

If you were a record holder on the record date, you may vote through any of the following methods:

| • | attend the Annual Meeting in person and submit a ballot, |

| • | sign and date each proxy card you receive and return it in the prepaid envelope included in your proxy package, |

| • | vote by telephone by calling 1-800-690-6903 or |

| • | vote via the internet at www.proxyvote.com. |

The shares represented by a proxy will be voted in accordance with the instructions you provide on the proxy card or that you submit via telephone or the internet, unless the proxy is revoked before it is exercised. Any proxy card which is signed and returned but does not indicate voting instructions will be treated as authorizing a vote FOR the election of the director nominees described in this proxy statement, FOR the approval, on an advisory basis, of the compensation of our named executive officers and FOR the ratification of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2020.

If you were a beneficial owner of shares at the close of business on the record date, you may vote your shares by providing instructions to your broker, bank or other nominee. Your broker, bank or other nominee should provide a voting instruction form that you can use to give instructions as to how your shares are to be voted; please refer to the instructions it provides for voting your shares. If you want to vote those shares in person at the Annual Meeting, you must bring a signed proxy from the broker, bank or other holder of record giving you the right to vote the shares.

| 8. | What should I do if I receive more than one proxy card? |

If you hold shares registered in more than one account, you may receive more than one copy of the proxy materials, including multiple paper copies of this proxy statement and multiple proxy cards. To vote all of your shares by proxy, you must complete, sign, date and return each proxy card that you receive or, if you submit a proxy by telephone or the internet, submit one proxy for each proxy card you receive.

| 9. | How can I revoke my proxy? |

You may revoke your proxy at any time before the proxy is exercised by delivering a signed statement indicating your revocation to our Corporate Secretary at our principal executive offices at 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087 at or prior to the Annual Meeting. Alternatively, you may revoke your proxy by timely executing and delivering, by internet, telephone, mail, or in person at the Annual Meeting, another proxy dated as of a later date. You also may revoke your proxy by attending the Annual Meeting in person and voting by ballot. Attendance at the Annual Meeting will not by itself revoke a previously granted proxy.

If your shares are held by a broker, bank or other nominee, contact that institution for instructions.

3

| 10. | What happens if a change to the Annual Meeting is necessary due to exigent circumstances? |

As part of our precautions regarding the coronavirus (COVID-19), we are sensitive to the public health and travel concerns that our stockholders may have, as well as any protocols that federal, state and local governments may impose. In the event it is not possible or advisable for stockholders to attend our annual meeting in person, we will announce in advance via press release alternative arrangements for the meeting, which may include holding the Annual Meeting solely by means of remote communication. The press release, which will include details on how to access the meeting, will be posted on our website and filed with the SEC as additional proxy materials. If you are planning to participate in the Annual Meeting, please check our website prior to the meeting date. As always, you are encouraged to vote your shares prior to the Annual Meeting.

4

ELECTION OF DIRECTORS

Our Board of Directors (the “Board”) currently consists of ten members divided into three classes, with one class being elected each year for a three-year term. Benson F. Smith, who is in the director class having a term that expires at the Annual Meeting, has reached the mandatory retirement age under our Corporate Governance Principles and will leave the Board upon the expiration of his term at the Annual Meeting. The Board extends its gratitude to Mr. Smith for his contributions to our company during his tenure on the Board. In connection with and effective upon Mr. Smith’s departure, our Board approved a decrease in the size of the Board from ten to nine directors.

At the Annual Meeting, three directors will be elected for terms expiring at our annual meeting of stockholders in 2023 and upon their successors being duly elected and qualified. The Board, upon the recommendation of the Nominating and Governance Committee, has nominated George Babich, Jr., Gretchen R. Haggerty and Liam J. Kelly for election to the Board for three-year terms. Messrs. Babich and Kelly and Ms. Haggerty are continuing directors who previously were elected by our stockholders. Our bylaws require that each class of our directors must be as nearly equal as possible. Therefore, Mr. Kelly, who currently is serving in the class having a term expiring in 2021, has been nominated to fill the seat in the class to be elected at the Annual Meeting created as a result of Mr. Smith’s retirement and will vacate his current seat following his election as a Director at the Annual Meeting.

Our bylaws generally require that, in order to be elected in an uncontested election of directors, a director nominee must receive a majority of the votes cast with respect to that director nominee’s election (for this purpose, a majority of the votes cast means that the number of votes cast “for” a director nominee must exceed the number of votes cast “against” that nominee). If a nominee who is currently serving as a director is not re-elected, Delaware law provides that the director will continue to serve on the board of directors. However, under our Corporate Governance Principles, the Board will not nominate for election as a director any incumbent director unless the director has submitted in writing his or her irrevocable resignation, which would be effective if the director does not receive the required majority vote and the Board accepts the resignation. Generally, if an incumbent director does not receive the required majority vote, our Nominating and Governance Committee will make a recommendation to the Board on whether to accept or reject the resignation, or whether to take other action. The Board would act on the resignation, generally within 90 days from the date that the election results are certified. The Board’s decision and an explanation of any determination with respect to the director’s resignation will be disclosed promptly in a current report on Form 8-K filed with the SEC.

We seek to assemble a Board that operates cohesively and works with management in a constructive way so as to deliver long term stockholder value. In addition, the Board believes it operates best when its membership reflects a diverse range of experiences and areas of expertise. To this end, the Board seeks to identify candidates whose respective experience expands or complements the Board’s existing expertise in overseeing our company. Our Corporate Governance Principles provide that directors are expected to possess the highest character and integrity and to have business, professional, academic, government or other experience which is relevant to our business and operations. In evaluating nominees for election to the Board, our Board and Nominating and Governance Committee consider diversity principally from the standpoint of differences in occupational experience, education, skills, race, gender and national origin. However, there is no set list of qualities or areas of expertise used by the Board in its analysis because it assesses the attributes each particular candidate could bring to the Board in light of the then-current composition of the Board. We believe our current directors possess valuable experience in a variety of areas, which enables them to guide Teleflex in the best interests of the stockholders. Information regarding each of our nominees and continuing directors is set forth below.

5

Nominees for election to the Board of Directors – Terms Expiring in 2023

| George Babich, Jr. | - | Mr. Babich, 68, has been a director of Teleflex since 2005 and currently serves as Lead Director and as chair of the Compensation Committee. Mr. Babich retired in May 2016 after serving for three years as the President and Chief Executive Officer of Checkpoint Systems, Inc., a provider of retail security, labeling and merchandising systems and products. He served as interim President and Chief Executive Officer of Checkpoint from May 2012 to February 2013. Previously, Mr. Babich had been retired since 2005 after serving for nine years in various executive and senior level positions at The Pep Boys — Manny Moe & Jack, an automotive retail and service chain. Most recently, Mr. Babich served as President of Pep Boys from 2004 to 2005 and as President and Chief Financial Officer from 2002 to 2004. Prior to joining Pep Boys, Mr. Babich held various financial executive positions with Morgan, Lewis & Bockius LLP, The Franklin Mint, PepsiCo Inc. and Ford Motor Company.

Mr. Babich’s executive and senior management experience enables him to provide a wide range of perspectives on management, operations and strategic planning. In addition, his long experience as a financial executive enables him to assist the Board in addressing a variety of financial and budgeting matters.

| ||

| Gretchen R. Haggerty | - | Ms. Haggerty, 64, has been a director of Teleflex since 2016 and currently serves as a member of the Audit Committee. Ms. Haggerty retired in August 2013 after a 37-year career with United States Steel Corporation, an integrated global steel producer, and its predecessor, USX Corporation, which, in addition to its steel production, also conducted energy operations, principally through Marathon Oil Corporation. From March 2003 until her retirement, she served as Executive Vice President & Chief Financial Officer and also served as Chairman of the U. S. Steel & Carnegie Pension Fund and its Investment Committee. Earlier, she served in various financial executive positions at U.S. Steel and USX, beginning in November 1991 when she became Vice President & Treasurer. Ms. Haggerty is currently a director of Johnson Controls International plc.

Ms. Haggerty’s background in executive management of a large, complex global corporation, as well as her experience gained through other public company directorships, enables her to share valuable perspectives with the Board on a wide range of financial and business matters. Her lengthy tenure as a financial executive renders her well-qualified to assist the Board with a variety of financial and budgeting matters, and in its oversight of our financial statements and internal controls.

| ||

| Liam J. Kelly | - | Mr. Kelly, 53, has been a director of Teleflex since 2018. He became our President and Chief Executive Officer on January 1, 2018. From May 2016 to December 31, 2017, Mr. Kelly served as our President and Chief Operating Officer, and from April 2015 to April 2016, he served as our Executive Vice President and Chief Operating Officer. Mr. Kelly also served as our Executive Vice President and President, Americas from April 2014 to April 2015, and as our Executive Vice President and President, International from June 2012 to April 2014. |

6

| Earlier, he held several positions with regard to our EMEA segment, including President from June 2011 to June 2012, Executive Vice President from November 2009 to June 2011, and Vice President of Marketing from April 2009 to November 2009. Prior to joining Teleflex, Mr. Kelly held various senior level positions with Hill-Rom Holdings, Inc., a medical device company, from October 2002 to April 2009, serving as its Vice President of International Marketing and R&D from August 2006 to February 2009.

Mr. Kelly’s extensive experience in the medical device industry and intimate knowledge of our business enables him to provide meaningful perspectives regarding our operations, strategic planning and growth initiatives. |

In the unlikely event that any nominee becomes unable or unwilling to stand for election, the proxies may be voted for one or more substitute nominees designated by the Board, or the Board may decide to reduce the number of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF ALL NOMINEES.

The following individuals currently serve as directors in the two other classes. Their terms will end at the Annual Meetings in 2021 and 2022, respectively. Biographical information regarding Mr. Kelly, who currently is in the class with a term that expires at the annual meeting in 2021, is set forth above under “Nominees for election to the Board of Directors.” As described above, Mr. Kelly will vacate his current seat following the election of Directors at the Annual Meeting.

Terms Expiring in 2021

| Candace H. Duncan | - | Ms. Duncan, 66, has been a director of Teleflex since 2015 and currently serves as chair of the Audit Committee. Ms. Duncan retired in November 2013 after a 35-year career with KPMG LLP, a public accounting firm. From 2009 until her retirement, she was the managing partner of KPMG’s Washington, D.C. office and served on KPMG’s board of directors. Earlier, Ms. Duncan served in various capacities at KPMG, including managing partner for audit for the Mid-Atlantic area and audit partner in charge of KPMG’s Virginia business unit. Ms. Duncan is currently a director of Discover Financial Services.

Ms. Duncan’s extensive experience in public accounting enables her to provide helpful insights to the Board on financial matters. Her background renders her especially well-qualified to assist the Board in addressing a variety of financial and budgeting matters and in its oversight of the integrity of our financial statements and our internal controls.

|

7

| Stephen K. Klasko, M.D. | - | Dr. Klasko, 66, has been a director of Teleflex since 2008 and currently serves as a member of the Nominating and Governance Committee. Since June 2013, he has been the President and Chief Executive Officer of Thomas Jefferson University and Jefferson Health. From September 2004 to June 2013, Dr. Klasko served as Dean of the College of Medicine of the University of South Florida. From 2009 to June 2013, Dr. Klasko also served as the Chief Executive Officer of USF Health, which encompasses the University of South Florida’s colleges of medicine, nursing and public health. He was a Vice President of USF Health from 2004 to 2009. Dr. Klasko served as Dean of the College of Medicine of Drexel University from 2000 to 2004.

Dr. Klasko’s background in medicine and business enables him to provide valuable insights with regard to our strategic and growth initiatives. His background in medicine enables him to provide a unique and practical perspective regarding the application and marketing of our medical device products, as well as trends in global healthcare markets.

| ||

| Stuart A. Randle | - | Mr. Randle, 60, has been a director of Teleflex since 2009 and currently serves as chair of the Nominating and Governance Committee and as a member of the Compensation Committee. Mr. Randle retired in December 2018 after serving for three years as the Chief Executive Officer of Ivenix, Inc., a medical device company that provides infusion delivery systems. Previously, Mr. Randle had been retired since September 2014 after serving for 10 years as President and Chief Executive Officer of GI Dynamics, Inc., a medical device company. From 2003 to 2004, he served as Interim Chief Executive Officer of Optobionics Corporation, a medical device company. From 2002 to 2003, Mr. Randle held the position of Entrepreneur in Residence of Advanced Technology Ventures, a healthcare and information technology venture capital firm. From 1998 to 2001, he was President and Chief Executive Officer of Act Medical, Inc. Prior to 1998, Mr. Randle held various senior management positions with Allegiance Healthcare Corporation and Baxter International Inc. Mr. Randle currently serves as a director of Beacon Roofing Supply, Inc.

Mr. Randle’s medical device company experience, coupled with past senior management positions at medical device companies, enables him to provide valuable insights regarding a variety of business, management and technical issues. |

8

Terms Expiring in 2022

| John C. Heinmiller | - | Mr. Heinmiller, 65, has been a director of Teleflex since 2019 and currently serves as a member of the Audit Committee. Prior to his retirement in January 2017, Mr. Heinmiller was Executive Vice President of St. Jude Medical, Inc. (“St. Jude Medical”), a global medical device company. During his 19-year career with St. Jude Medical, Mr. Heinmiller served in various executive and senior level positions, including Executive Vice President from August 2012 to January 2017; Executive Vice President and Chief Financial Officer from May 2004 to August 2012; Vice President, Finance and Chief Financial Officer from September 1998 to May 2004; and Vice President of Corporate Business Development from May 1998 to September 1998. Prior to joining St. Jude Medical, Mr. Heinmiller held senior management positions with and was a member of the board of directors of Daig Corporation, a medical device company, and LifeCore Biomedical, a medical technology company.

Mr. Heinmiller’s executive and senior management experience in the medical device industry will enable him to provide a wide range of perspectives on financial and business initiatives. In addition, his extensive experience as a financial executive renders him especially well qualified to assist the Board in addressing a variety of financial and budgeting matters and in its oversight of the integrity of our financial statements and our internal controls.

| ||

| Andrew A. Krakauer | - | Mr. Krakauer, 65, has been a director of Teleflex since 2018 and currently serves as a member of the Compensation Committee. Prior to his retirement in October 2016, Mr. Krakauer was Chief Executive Officer of Cantel Medical Corp. (“Cantel”), a provider of infection control products and services. During his 12 years at Cantel, Mr. Krakauer served in various executive and senior level positions, including Chief Executive Officer from November 2014 to July 2016; President and Chief Executive Officer from March 2009 to November 2014; President from April 2008 to March 2009; and Executive Vice President and Chief Operating Officer from August 2004 through April 2008. Mr. Krakauer also served as a member of Cantel’s board of directors from 2009 to 2016. Prior to joining Cantel, Mr. Krakauer was President of the Ohmeda Medical Division of Instrumentarium Corp. (which was acquired by General Electric Company in 2003), a provider of medical devices, from 1998 to 2004.

Mr. Krakauer’s executive and senior management experience in the medical device industry enables him to provide valuable insights regarding a wide range of business matters, including strategy, acquisitions, management, operations and growth initiatives.

| ||

| Richard A. Packer | - | Mr. Packer, 62, has been a director of Teleflex since 2017 and currently serves as a member of the Nominating and Governance Committee. Since April 2016, Mr. Packer has served as a Primary Executive Officer of Asahi Kasei Corporation, a diversified manufacturing company, co-leader of Asahi Kasei’s healthcare business unit and non-executive Chairman of ZOLL Medical Corporation, a subsidiary of Asahi Kasei. (Prior to its acquisition by Asahi Kasei in April 2012, ZOLL was a public |

9

| company.) Mr. Packer previously served in a number of capacities for ZOLL, including Chief Executive Officer from November 1999 to April 2016, Chairman from 1999 until November 2010 (as noted above, he again became Chairman in April 2016), Vice President of Operations from 1992 to 1996, and Chief Financial Officer and Head of North American Sales from 1995 to 1996. He has been a director of ZOLL since 1996. Prior to joining ZOLL, Mr. Packer held various positions with Whistler Corporation, a consumer electronics company, and PRTM/KPMG LLP, a consulting firm. Mr. Packer currently serves as a director of Bruker Corporation.

Mr. Packer’s executive and senior management experience in the medical device industry enables him to provide valuable insights regarding a wide range of business, management, operations and strategic planning matters. |

10

Corporate Governance Principles and Other Corporate Governance Documents

Our Corporate Governance Principles, which include guidelines for the determination of director independence, the operation, structure and meetings of the Board and the committees of the Board and other matters relating to our corporate governance, are available on the Investors page of our website, www.teleflex.com. Also available on the Investors page are other corporate governance documents, including the Code of Ethics, the Code of Ethics for Chief Executive Officer and Senior Financial Officers and the charters of the Audit, Compensation and Nominating and Governance Committees. You may request these documents in print form by contacting us at Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Secretary. Any amendments to, or waivers of, the codes of ethics that apply to our principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar function and that relate to any element of the code of ethics definition enumerated in Item 406(b) of the SEC’s Regulation S-K will be disclosed on our website promptly following the date of such amendment or waiver.

The Board has affirmatively determined that George Babich, Jr., Candace H. Duncan, Gretchen R. Haggerty, John C. Heinmiller, Stephen K. Klasko, Andrew A. Krakauer, Richard A. Packer and Stuart A. Randle are independent within the meaning of the listing standards of the New York Stock Exchange (the “NYSE”). All of the independent directors meet the categorical standards set forth in the Corporate Governance Principles described below, which were adopted by the Board to assist it in making determinations of independence. The Board has further determined that the members of the Audit, Compensation and Nominating and Governance Committees are independent within the meaning of the NYSE listing standards, and that the members of the Audit and Compensation Committees meet the additional independence requirements of the NYSE and the SEC applicable to audit committee and compensation committee members. In making its determination with respect to Dr. Klasko, the Board considered the Company’s sale of products to an entity for which he serves as chief executive officer, and in making its determination with regard to Mr. Heinmiller, the Board considered the Company’s sale of products to an entity for which he serves as a director. Based on its review, and after considering the amounts involved and the lack of Dr. Klasko’s or Mr. Heinmiller’s direct or indirect involvement in the respective transactions, the Board concluded that Dr. Klasko’s and Mr. Heinmiller’s relationships with the respective entities did not impair their independence.

To assist the Board in making independence determinations, the Board has adopted the following categorical standards that, if applicable, automatically would result in a determination that the director is not independent. The Board may determine that a director is not independent notwithstanding that none of the following categorical disqualifications apply. However, if any of the following categorical disqualifications apply to a director, he or she may not be considered independent:

| • | A director who is an employee of our company, or whose immediate family member is an executive officer of our company, may not be considered independent until the expiration of three years after the end of such employment. |

| • | A director who has received, or who has an immediate family member (unless such immediate family member has ceased to be an immediate family member or has become incapacitated) that has been an executive officer of ours who, while an executive officer, has received more than $120,000 in direct compensation from us during any twelve-month period during the preceding three years, other than director and committee fees, pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service) and compensation received by the director for former service as an interim Chairman or CEO may not be considered independent. |

11

| • | A director who is a current partner or is employed by, or whose immediate family member is a current partner of a firm that is our internal or external auditor, or is an immediate family member who is a current employee of such a firm and personally works on the Company’s audit, may not be considered independent. |

| • | A director who was, or whose immediate family member was, during the immediately preceding three years, a partner or employee of a firm that is our internal or external auditor and personally worked on our audit during that period may not be considered independent. |

| • | A director who is employed, or whose immediate family member is employed, as an executive officer of another company where any of our present executives serve on such other company’s compensation committee may not be considered independent until the expiration of three years after the end of such service or employment relationship or such person ceases to be an immediate family member or becomes incapacitated, as may be applicable. |

| • | A director who is an employee, or whose immediate family member is an executive officer, of a company that makes payments to us, or receives payments from us, for property or services in an amount which, in any single fiscal year, exceeds the greater of $1 million or 2% of such other company’s consolidated gross revenues may not be considered independent until the expiration of the three years after such receipts or payments fall below such threshold or after such person ceases to be an immediate family member or becomes incapacitated, as may be applicable. |

The Lead Director is an independent director of the Board whose duties and responsibilities include:

| • | coordinating and developing the agenda for, and presiding over, executive sessions of the Board’s independent directors; |

| • | discussing with our directors any concerns our directors may have about our company and our performance, relaying those concerns, where appropriate, to the full Board, and consulting with our Chief Executive Officer regarding those concerns; |

| • | consulting with our senior executives as to any concerns they may have; |

| • | providing the Chairman of the Board with input as to the agendas for Board and Board committee meetings; |

| • | advising the Chairman of the Board as to the quality, quantity and timeliness of the flow of information from our management to the Board; |

| • | interviewing, along with the Nominating and Governance Committee Chair, and making recommendations to the Nominating and Governance Committee and the Board concerning Board candidates; and |

| • | providing input to the members of the Compensation Committee regarding the Chief Executive Officer’s performance, and, along with the Compensation Committee Chair, meeting with the Chief Executive Officer to discuss the Board’s evaluation. |

The Lead Director is appointed annually by the independent directors of the Board. The independent directors of the Board have the authority to modify the Lead Director’s duties and responsibilities, remove the Lead Director and appoint a successor. Mr. Babich currently serves as our Lead Director.

12

The Board’s goal is to achieve the best board leadership structure for effective oversight and management of our company. The Board believes there is no single, generally accepted approach to providing effective board leadership, and that the leadership structure of a board must be considered in the context of the individuals involved and the specific circumstances facing the company. Accordingly, what the Board determines to be the right board leadership structure for Teleflex may vary from time to time as circumstances warrant.

Mr. Smith, who currently serves as Chairman of our Board, will retire from the Board at the Annual Meeting. The Board has appointed Mr. Kelly to succeed Mr. Smith as Chairman, effective upon Mr. Smith’s departure. In making its decision to appoint Mr. Kelly as Chairman, our Board determined that, in his role as our President and Chief Executive Officer, Mr. Kelly is the director most familiar with our business and most capable of effectively identifying strategic priorities and leading the discussion and execution of strategy. Moreover, Mr. Kelly is able to effectively communicate Board strategy to the other members of management and efficiently implement Board directives.

Following the Annual Meeting, with the exception of Mr. Kelly, all of the directors on our Board will be independent, which facilitates the provision of independent oversight and input. Mr. Kelly is not a member of our principal Board committees, and the independent directors regularly meet in executive session outside the presence of management and under the leadership of our Lead Director, as discussed in more detail below under “Executive Sessions of Non-Management Directors.” The activities of the Lead Director further enhance the Board’s ability to evaluate management performance and otherwise fulfill its oversight responsibilities. Moreover, the Lead Director is consulted on the proposed agendas for Board and committee meetings in order to make sure that key issues and concerns of the Board are addressed.

Executive Sessions of Non-Management Directors

Directors who are not executive officers or otherwise employed by us or any of our subsidiaries, whom we refer to as the “non-management directors,” meet regularly in accordance with a schedule adopted at the beginning of each year and on such additional occasions as any non-management director may request. Such meetings are held in executive session, outside the presence of any directors who are executive officers. The Lead Director presides over such meetings.

Stockholders or other interested persons wishing to communicate with members of the Board should send such communications to Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Secretary. These communications will be forwarded to specified individual directors, or, if applicable, to all the members of the Board as deemed appropriate. Stockholders or other interested persons may also communicate directly and confidentially with the Lead Director, the non-management directors as a group or the Chairman or other members of the Audit Committee through the Teleflex ethics line website at www.teleflexethicsline.com.

The Board and Board Committees

The Board held six meetings in 2019. Each of the directors attended at least 75 percent of the total number of meetings of the Board and the Board committees of which the director was a member during 2019. The Board does not have a formal policy concerning attendance at our annual meeting of stockholders, but encourages all directors to attend. Nine of our Board members attended the 2019 annual meeting of stockholders.

The Board has established a Nominating and Governance Committee, a Compensation Committee and an Audit Committee. The Board also has established a Non-Executive Equity Awards Committee, whose sole member is Mr. Kelly. The Non-Executive Equity Awards Committee has authority to grant equity awards, under specified circumstances, to employees who are neither executive officers nor persons reporting to the Chief Executive Officer. See “Compensation Discussion and Analysis – 2019 Compensation – Our Equity Grant Practices” for additional information.

13

Nominating and Governance Committee

The Nominating and Governance Committee is responsible for identifying qualified individuals to be nominees for election to the Board. In addition, the Nominating and Governance Committee reviews and makes recommendations to the Board as to the size and composition of the Board and Board committees, eligibility criteria for Board and Board committee membership and board compensation. The Nominating and Governance Committee also is responsible for developing and recommending to the Board corporate governance principles and overseeing the evaluation of the Board and management.

The Nominating and Governance Committee considers candidates for Board membership. Our Corporate Governance Principles provide that directors are expected to possess the highest character and integrity, and to have business, professional, academic, government or other experience which is relevant to our business and operations. In addition, directors must be able to devote substantial time to our affairs. The charter of the Nominating and Governance Committee provides that in evaluating nominees, the Nominating and Governance Committee should consider the attributes set forth above.

To assist in identifying candidates for nomination as directors, the Nominating and Governance Committee sometimes employs a third-party search firm and also receives recommendations of candidates from Board members. In addition, the Nominating and Governance Committee will consider recommendations for director candidates from stockholders. Stockholders can recommend candidates for nomination by delivering or mailing written recommendations to Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Secretary. In order to enable consideration of a candidate in connection with our 2021 Annual Meeting, a stockholder must submit the following information by January 31, 2021:

| • | the name of the candidate and information about the candidate that would be required to be included in a proxy statement under SEC rules; |

| • | information about the relationship between the candidate and the recommending stockholder; |

| • | the consent of the candidate to serve as a director; and |

| • | proof of the number of shares of our common stock that the recommending stockholder owns and the length of time the shares have been owned. |

In considering any candidate proposed by a stockholder, the Nominating and Governance Committee will reach a conclusion based on the criteria described above. The Nominating and Governance Committee may seek additional information regarding the candidate. After full consideration, the stockholder proponent will be notified of the decision of the Nominating and Governance Committee. The Nominating and Governance Committee will consider all potential candidates in the same manner regardless of the source of the recommendation.

The current members of the Nominating and Governance Committee are Messrs. Klasko, Packer and Randle. Mr. Randle currently serves as chair of the Nominating and Governance Committee. The Nominating and Governance Committee held four meetings in 2019.

Compensation Committee

The duties and responsibilities of the Compensation Committee include, among others, the following:

| • | review and recommend to the Board for approval all compensation plans in which any director or executive officer may participate; |

14

| • | review and recommend to the independent directors for approval corporate goals and objectives relevant to the compensation of our Chief Executive Officer and, together with the Lead Director, evaluate annually our Chief Executive Officer’s performance in light of those goals and objectives; |

| • | review and recommend to the independent directors for approval our Chief Executive Officer’s compensation and any employment agreements, severance agreements, retention agreements, change in control agreements and other similar agreements for the benefit of our Chief Executive Officer; |

| • | review and approve compensation of our senior executives, which include our executive officers (other than our Chief Executive Officer) and such other executives of our company as the Compensation Committee may determine (other than our Chief Executive Officer), and any employment agreements, severance agreements, retention agreements, change in control agreements and other similar agreements for the benefit of any of our senior executives (other than our Chief Executive Officer); |

| • | establish goals for performance-based awards under incentive compensation plans (including stock compensation plans); |

| • | administer and grant, or recommend to the Board the grant of, stock options and other equity-based compensation awards under our stock compensation plans (the Board has delegated to its Non-Executive Equity Awards Committee, whose sole member is Mr. Smith, authority to grant equity awards under specified circumstances to employees other than executive officers and persons reporting to the Chief Executive Officer); |

| • | review and recommend to the other independent directors for approval all material executive benefits and perquisites for the Chief Executive Officer’s benefit; and |

| • | review and approve all material executive benefits and perquisites for the benefit of any of our senior executives (other than the Chief Executive Officer). |

The Compensation Committee has the authority to select, retain and terminate compensation consultants, legal counsel and other advisers to assist it in connection with the performance of its responsibilities. During 2019, the Compensation Committee considered the recommendations of and data provided by its compensation consultant, Frederick W. Cook & Co., Inc. See “Compensation Discussion and Analysis” for additional information.

The current members of the Compensation Committee are Messrs. Babich, Krakauer and Randle. Mr. Babich currently serves as chair of the Compensation Committee. The Compensation Committee held five meetings in 2019.

Audit Committee

The Audit Committee has responsibility to assist the Board in its oversight of the following matters, among others:

| • | the integrity of our financial statements; |

| • | our internal control compliance; |

| • | our compliance with legal and regulatory requirements; |

| • | our independent registered public accounting firm’s qualifications, performance and independence; |

| • | the performance of our internal audit function; |

15

| • | our risk management process; and |

| • | the funding of our defined benefit pension plan and the investment performance of plan assets. |

The Audit Committee has sole authority to appoint, retain, compensate, evaluate and terminate our independent registered public accounting firm, and reviews and approves in advance all audit and lawfully permitted non-audit services performed by the independent registered public accounting firm and related fees. In addition, the Audit Committee periodically meets separately with management, our independent auditors and our own internal auditors. The Audit Committee also periodically discusses with management our policies with respect to risk assessment and risk management.

Stockholders and other persons may contact our Audit Committee to report complaints about our accounting, internal accounting controls or auditing matters by writing to the following address: Teleflex Incorporated, 550 East Swedesford Road, Suite 400, Wayne, Pennsylvania 19087, Attention: Audit Committee. Stockholders and such other persons, including employees, can report their concerns to the Audit Committee anonymously or confidentially.

The current members of the Audit Committee are Mses. Duncan and Haggerty and Mr. Heinmiller. Ms. Duncan currently serves as chair of the Audit Committee. The Audit Committee held six meetings in 2019. The Board has determined that each of the Audit Committee members is an “audit committee financial expert” as that term is defined in SEC regulations.

The Board, acting principally through the Audit Committee, is actively involved in the oversight and management of risks that could affect us. It fulfills this function largely through its oversight of our annual company-wide risk assessment process, which is designed to identify our key strategic, operational, compliance and financial risks, as well as steps to mitigate and manage each risk. The risk assessment process is conducted by our compliance officer, who surveys and interviews several of our key business leaders, functional heads and other managers to identify and discuss the key risks pertaining to Teleflex, including the potential magnitude of each risk and likelihood of occurrence of adverse consequences of such risk. As part of this process, the senior executive responsible for managing the risk, the potential impact of the risk and management’s initiatives to manage the risk are identified and discussed. After receiving a report of the risk assessment results from the compliance officer, members of Teleflex senior management review and discuss the results with the Audit Committee. Thereafter, the Audit Committee provides the full Board with an overview of the risk assessment process, the key risks identified and measures being taken to address those risks. Due to the dynamic nature of risk, the overall status of our enterprise risks is updated periodically during the course of each year and reviewed with the Audit Committee. We believe this process facilitates the Board’s ability to fulfill its oversight responsibilities with respect to risks that we encounter.

The Compensation Committee oversees the review and assessment of our compensation policies and practices. We use a number of approaches to mitigate excessive risk taking in designing our compensation programs, including significant weighting towards long-term incentive compensation, inclusion of qualitative goals in addition to quantitative metrics in our incentive programs and maintenance of equity ownership guidelines. We believe the risks arising from our compensation policies and practices for our employees are not reasonably likely to have a material adverse effect on our company.

Each director who is not a Teleflex employee receives compensation for his or her service as a director, which consists of an annual cash retainer, payable in equal monthly installments, an annual stock option grant, a restricted stock unit award and meeting attendance fees. Our chairman (if he or she is not a Teleflex employee) and the chairpersons of our Audit, Compensation and Nominating and

16

Governance Committees receive an additional annual cash retainer, and our Lead Director receives an additional annual restricted stock unit award. In addition, upon their first election or appointment to the Board, non-management directors receive a grant of an option to purchase shares of our common stock.

For 2019, the amounts payable under our non-management director compensation program were as follows:

| • Annual Cash Retainer – All Non-Management Directors |

$55,000 | |||

| • Additional Annual Cash Retainer – Chairman |

$100,000 | |||

| • Additional Annual Cash Retainer – Committee Chairs: |

||||

|

¡ Audit Committee Chair |

$20,000 | |||

|

¡ Compensation Committee Chair |

$15,000 | |||

|

¡ Nominating and Governance Committee Chair |

$12,000 | |||

| • Annual Equity Grants – All Non-Management Directors: |

||||

|

¡ Restricted Stock Units |

$102,000 | |||

|

¡ Stock Options |

$68,000 | |||

| • Additional Annual Equity Grant – Lead Director: |

||||

|

¡ Restricted Stock Units |

$25,000 | |||

| • Stock Option Grant Upon Initial Election |

$136,000 | |||

| • Meeting Fees (per meeting): |

||||

|

¡ Board of Directors (participation in person) |

$2,000 | |||

|

¡ Board of Directors (participation by telephone) |

$1,000 | |||

|

¡ Committees (participation in person or by telephone) |

$1,000 | |||

In February 2020, our Board approved changes with respect to certain components of its annual compensation, effective immediately after conclusion of the Annual Meeting. Specifically, the Board approved increases in the value of the annual equity awards granted to all non-management directors, the value of stock options granted to non-management directors upon their initial election to the Board and the annual cash retainer paid to committee chairs. In addition, the additional annual cash retainer paid to the Chairman was eliminated in light of Mr. Kelly’s appointment to succeed Mr. Smith as Chairman. The Board approved these changes after considering the results of a director compensation review undertaken by its compensation consultant, Frederic W. Cook & Co., Inc. The amounts payable under our director compensation program, as revised, are as follows:

| • Annual Cash Retainer – All Non-Management Directors |

$55,000 | |||

| • Additional Annual Cash Retainer – Committee Chairs: |

||||

|

¡ Audit Committee Chair |

$22,500 | |||

|

¡ Compensation Committee Chair |

$17,500 | |||

|

¡ Nominating and Governance Committee Chair |

$14,000 | |||

| • Annual Equity Grants – All Non-Management Directors: |

||||

|

¡ Restricted Stock Units |

$117,000 | |||

|

¡ Stock Options |

$78,000 | |||

| • Additional Annual Equity Grant – Lead Director: |

||||

|

¡ Restricted Stock Units |

$25,000 | |||

| • Stock Option Grant Upon Initial Election |

$156,000 | |||

| • Meeting Fees (per meeting): |

||||

|

¡ Board of Directors (participation in person) |

$2,000 | |||

|

¡ Board of Directors (participation by telephone) |

$1,000 | |||

|

¡ Committees (participation in person or by telephone) |

$1,000 |

17

The table below summarizes the compensation paid to non-management directors during the fiscal year ended December 31, 2019.

| Name |

Fees Earned Or Paid in Cash (1) |

Stock Awards (2) |

Option Awards (3) |

Change in Pension Value and Nonqualified Deferred Compensation Earnings (4) |

All Other Compensation |

Total | ||||||||||||||||||

| George Babich, Jr. |

$ | 96,833 | $ | 126,857 | $ | 67,978 | $ | 212 | – | $ | 291,880 | |||||||||||||

| Candace H. Duncan |

$ | 104,250 | $ | 101,897 | $ | 67,978 | – | – | $ | 274,125 | ||||||||||||||

| Gretchen R. Haggerty |

$ | 81,583 | $ | 101,897 | $ | 67,978 | – | – | $ | 251,458 | ||||||||||||||

| John C. Heinmiller |

$ | 78,583 | $ | 136,442 | $ | 205,810 | – | – | $ | 420,835 | ||||||||||||||

| Stephen K. Klasko |

$ | 77,583 | $ | 101,897 | $ | 67,978 | $ | 79 | – | $ | 247,537 | |||||||||||||

| Andrew A. Krakauer |

$ | 84,583 | $ | 101,897 | $ | 67,978 | $ | 22 | – | $ | 254,480 | |||||||||||||

| Richard A. Packer |

$ | 76,583 | $ | 101,897 | $ | 67,978 | – | – | $ | 246,458 | ||||||||||||||

| Stuart A. Randle |

$ | 92,583 | $ | 101,897 | $ | 67,978 | – | – | $ | 262,458 | ||||||||||||||

| Benson F. Smith |

$ | 182,917 | $ | 101,897 | $ | 67,978 | $ | 7,106 | – | $ | 359,898 | |||||||||||||

| (1) | Includes, for Ms. Duncan and Messrs. Klasko and Krakauer, $59,583, $59,583 and $55,000, respectively, in cash fees that they elected to allocate to their respective deferral accounts under our Deferred Compensation Plan. See “Nonqualified Deferred Compensation – 2019” for additional information regarding our Deferred Compensation Plan, the terms of which generally apply in the same manner with respect to deferrals of directors’ cash fees as they apply with respect to deferrals of executives’ cash compensation. We do not, however, provide matching contributions to our non-employee directors under the Deferred Compensation Plan. |

| (2) | The amounts shown in this column represent the aggregate grant date fair value of the restricted stock units we granted to each non-employee director in 2019, determined in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718, “Compensation—Stock Compensation” (“ASC Topic 718”). A discussion of the assumptions used in calculating grant date fair values may be found in Notes 1 and 14 to the consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC. In May 2019, we granted to each non-management director 347 restricted stock units, and we granted to Mr. Babich an additional 85 restricted stock units in respect of his service as Lead Director. The restricted stock units each had a grant date fair value per share of $293.65 and vested six months after the date of grant. In connection with Mr. Heinmiller’s initial election to the Board, we granted to him, in January 2019, 134 restricted stock units, which vested six months after the date of grant (the amount of the restricted stock units was prorated to reflect the portion of the annual period between restricted stock unit grants that elapsed prior to Mr. Heinmiller’s election to the Board). The restricted stock units granted to Mr. Heinmiller in January 2019 had a grant date fair value per share of $257.80. Upon vesting, the restricted stock units are settled by the delivery to a director of shares of our common stock on the basis of one share of common stock for each restricted stock unit held by the director. Ms. Duncan and Messrs. Klasko and Krakauer deferred receipt of the common stock underlying 100% of the restricted stock units granted to them in 2019, the value of which was credited to a deferral account under our Deferred Compensation Plan. See “Nonqualified Deferred Compensation – 2019” for additional information regarding our Deferred Compensation Plan, which generally operates in the same manner with respect to deferrals of directors’ receipt of common stock underlying restricted stock units as it does with respect to such deferrals by executives. |

| (3) | The amounts shown in this column represent the aggregate grant date fair value of the stock option awards we granted to each non-employee director in 2019, determined in accordance with ASC Topic 718. A discussion of the assumptions used in calculating grant date fair values may be found in Notes 1 and 14 to the consolidated financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, as filed with the SEC. We granted to each non-management director stock options to purchase 976 shares in May 2019, which had a grant date fair value per share of $69.65. These options are fully vested at the time of grant. In connection with Mr. Heinmiller’s election to the Board, we granted to him, in January 2019, stock options to purchase 2,331 shares, which had a grant date fair value per share of $59.13. The options granted to Mr. Heinmiller in January 2019 vested six months after the date of grant. As of December 31, 2019, the number of shares underlying options held by the current directors listed in the table were: Mr. Babich: 3,517; Ms. Duncan: 10,352; Ms. Haggerty: 6,907; Mr. Heinmiller: 3,307; Mr. Klasko: 19,792; Mr. Krakauer: 4,285; Mr. Packer: 4,927; Mr. Randle: 17,792; and Mr. Smith: 399,191. |

| (4) | The amounts shown in this column reflect above-market interest earned in respect of deferred compensation under our Deferred Compensation Plan. |

18

Director Stock Ownership Guidelines

We have stock ownership guidelines for our non-management directors to further align the interests of our directors with those of our stockholders. The stock ownership guidelines require our non-management directors to own shares of our common stock with an aggregate value equal to five times the annual cash retainer paid to our directors (exclusive of additional amounts provided to the committee chairs), which, based on the current $55,000 annual cash retainer, is equal to $275,000. Directors may not sell shares of stock underlying equity awards granted to them in respect of their service on our Board until such time as they have met the required ownership level; provided, however, that, prior to meeting the required ownership level, directors may sell shares to cover the exercise price of stock options and taxes.

As set forth in the table below, at December 31, 2019, each of our current non-management directors satisfied the stock ownership requirements.

| Name |

Stock Ownership Value at 12/31/2019(1) |

|||

| George Babich, Jr. |

$ | 4,193,784 | ||

| Candace H. Duncan |

$ | 1,971,157 | ||

| Gretchen R. Haggerty |

$ | 1,508,442 | ||

| John C. Heinmiller |

$ | 829,170 | ||

| Stephen K. Klasko |

$ | 5,787,022 | ||

| Andrew A. Krakauer |

$ | 941,563 | ||

| Richard A. Packer |

$ | 1,240,135 | ||

| Stuart A. Randle |

$ | 3,171,441 | ||

| Benson F. Smith(2) |

$ | 74,517,691 | ||

|

|

||||

| (1) | Stock ownership value is calculated based on the number of shares owned by the director or members of his or her immediate family residing in the same household and the number of restricted stock units held by the director, multiplied by $376.44, which was the closing stock price of a share of our common stock on December 31, 2019, as reported by the New York Stock Exchange. In addition, stock ownership value includes one-half of the aggregate amount by which shares underlying vested, “in-the-money” stock options held by the director, multiplied by the closing stock price of a share of our common stock December 31, 2019, exceeds the aggregate exercise price of those options. |

| (2) | Mr. Smith retired as our Chief Executive Officer on December 31, 2017. |

19

The Audit Committee assists the Board in its oversight of the integrity of Teleflex’s financial statements, Teleflex’s internal control over financial reporting, the performance and independence of Teleflex’s independent registered public accounting firm, the performance of the internal audit function and compliance with legal and regulatory requirements. Management has primary responsibility for preparing Teleflex’s consolidated financial statements and for its financial reporting process. Management also has the responsibility to assess the effectiveness of Teleflex’s internal control over financial reporting. PricewaterhouseCoopers LLP, Teleflex’s independent registered public accounting firm, is responsible for expressing an opinion on (i) whether Teleflex’s financial statements present fairly, in all material respects, its financial position and results of operations in accordance with generally accepted accounting principles and (ii) the effectiveness of Teleflex’s internal control over financial reporting.

In this context, the Audit Committee has:

| • | reviewed and discussed with management and PricewaterhouseCoopers LLP Teleflex’s audited consolidated financial statements for the fiscal year ended December 31, 2019; |

| • | discussed with PricewaterhouseCoopers LLP the matters required to be discussed pursuant to Public Company Accounting Oversight Board Auditing Standard No. 1301, “Communications with Audit Committees;” and |

| • | received the written disclosures and the letter from PricewaterhouseCoopers LLP regarding PricewaterhouseCoopers LLP’s independence, as required by the applicable requirements of the Public Company Accounting Oversight Board, and has discussed with PricewaterhouseCoopers LLP that firm’s independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the Board, and the Board has approved, the inclusion of the audited consolidated financial statements in Teleflex’s Annual Report on Form 10-K for the year ended December 31, 2019, for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE | ||||

| CANDACE H. DUNCAN, CHAIR | ||||

| GRETCHEN R. HAGGERTY |

JOHN C. HEINMILLER | |||

20

COMPENSATION DISCUSSION AND ANALYSIS

In this Compensation Discussion and Analysis, we address the compensation paid or awarded to the following current and former executive officers of our company, who are listed in the Summary Compensation Table that follows this discussion and who we refer to as our “named executive officers”:

| Name |

Title | |

| Liam J. Kelly |

President and Chief Executive Officer | |

| Thomas E. Powell |

Executive Vice President and Chief Financial Officer | |

| James J. Leyden |

Corporate Vice President, General Counsel and Secretary | |

| Cameron P. Hicks |

Corporate Vice President, Human Resources and Communications | |

| Karen T. Boylan |

Corporate Vice President, Strategic Projects | |

In December 2019, following completion of the transition of quality assurance and regulatory affairs responsibilities from Ms. Boylan to Mario Wijker, Teleflex’s Corporate Vice President, Quality Assurance and Regulatory Affairs, Ms. Boylan has continued to serve Teleflex in a non-executive officer capacity. In February 2020, Mr. Wijker was designated an executive officer.

EXECUTIVE COMPENSATION OVERVIEW

Compensation Objectives

Our executive compensation program is designed to promote the achievement of specific annual and long-term goals by our executive management team and to align our executives’ interests with those of our stockholders. In this regard, the components of the compensation program for our executives, including the named executive officers, are intended to meet the following objectives:

| • | Provide compensation that enables us to attract and retain highly skilled executives. We refer to this objective as “competitive compensation.” |

| • | Create a compensation structure that in large part is based on the achievement of performance goals. We refer to this objective as “performance incentives.” |

| • | Provide long-term incentives to align executive and stockholder interests. We refer to this objective as “stakeholder incentives.” |

| • | Provide an incentive for long-term continued employment with us. We refer to this objective as “retention incentives.” |

We fashioned the components of our 2019 executive compensation program to meet these objectives as follows:

| Type of Compensation |

Objectives Addressed | |

| Salary |

Competitive Compensation | |

| Annual Bonus |

Performance Incentives | |

| Competitive Compensation | ||

| Equity Incentive Compensation |

Stakeholder Incentives | |

| Performance Incentives | ||

| Competitive Compensation | ||

| Retention Incentives | ||

21

Role of Compensation Committee, Chief Executive Officer and Compensation Consultant

The Compensation Committee of the Board is responsible for the oversight of our executive compensation program. In 2019, the Compensation Committee generally made all decisions concerning compensation awarded to the named executive officers other than Mr. Kelly. Determinations concerning Mr. Kelly’s compensation were made by the independent members of the Board. In making these compensation decisions, both the Compensation Committee and the independent members of the Board were assisted by the Compensation Committee’s independent compensation consultant, Frederic W. Cook & Co., Inc., which we refer to below as “FW Cook.” FW Cook was engaged directly by the Compensation Committee. The Compensation Committee has assessed the independence of FW Cook pursuant to NYSE rules and concluded that the work of FW Cook has not raised any conflict of interest in connection with its service as an independent consultant to the Compensation Committee.

Mr. Kelly, with the assistance of our human resources department and FW Cook, provided statistical data to the Compensation Committee to assist it in determining appropriate compensation levels for our executives. He also provided the Compensation Committee with recommendations as to components of the compensation of our executives. Mr. Kelly did not make recommendations as to his own compensation. While the Compensation Committee utilized this information and considered Mr. Kelly’s observations with regard to other executive officers, the ultimate determinations regarding compensation for our executive officers, other than Mr. Kelly, were made by the Compensation Committee. The Compensation Committee also provided recommendations regarding Mr. Kelly’s compensation, subject to approval by the independent members of the Board.

Determination of Compensation

In making its compensation determinations and recommendations for 2019, the Compensation Committee considered an executive compensation review report provided by FW Cook in December 2018 that included data regarding compensation for executives of other companies serving in capacities similar to the named executive officers. Specifically, the report analyzed the compensation of our named executive officers in comparison to compensation provided to executives serving in similar capacities for companies within our designated peer group (with respect to Messrs. Kelly, Powell and Leyden) and included in selected national survey data (with respect to all of our named executive officers). The peer group compensatory data and survey compensatory data referenced in the executive compensation review report was adjusted to January 1, 2019, using a 3% per annum rate of increase.

Generally, in selecting a peer group company, we use the following selection criteria:

| • | Operations and Scale – We seek companies that have one-third to three times our market capitalization and revenues. In prior years, our selection criteria focused on companies that have one-half to two times our market capitalization and revenues. We modified the criteria in light of industry consolidation that has occurred over the past several years. |

| • | Business Characteristics – |

| • | Industry – The peer group company should be similar to Teleflex and included in the Health Care Equipment & Supplies Industry Group within the Global Industry Classification Standard (GICS). |

| • | Demographics – The peer group company should be publicly traded in the United States, similar in terms of items such as business complexity and labor markets and serve as a potential source of executive talent. |

| • | Business model – The peer group company should have a similar business model to ours. |

22

| • | Prevalence as a Peer – We give preference to companies already in the peer group, companies named as a peer by four or more of our already designated peers, companies that name us as a peer and companies that a major proxy advisory firm includes in our peer group for purposes of its analysis of our executive compensation. |

To assist the Compensation Committee in selecting a peer group, FW Cook provided a report to the Compensation Committee in October 2018 that included recommendations regarding the composition of the peer group, which the Compensation Committee considered in determining the companies to be included in the peer group described above. Not every company in the peer group ultimately selected meets all of the peer group selection criteria. Nevertheless, we believe that each of the companies selected represents a reasonable peer from the standpoint of size and business attributes.

Based largely on the foregoing criteria, the Compensation Committee added ICU Medical, Inc., Intuitive Surgical, Inc., LivaNova PLC and NuVasive,Inc. to the peer group, and removed C.R. Bard, Inc., CONMED, Inc., Haemonetics Corporation, IDEXX Laboratories, Inc. and West Pharmaceuticals, Inc. from the peer group. The principal reasons for the changes in the peer group are described below:

Companies removed from the peer group:

CONMED Corporation – Market capitalization was considerably below the selection criteria range.

C.R.Bard, Inc. – acquired by Becton, Dickenson and Company.

Haemonetics Corporation – Both revenue and market capitalization are close to the low end of the selection criteria range; removal will position Teleflex closer to the median of the peer group companies.

IDEXX Laboratories, Inc. – principal products are directed to the veterinary market.

West Pharmaceutical Services, Inc. – dissimilar business model.

Companies added to the peer group:

The four companies we added to the peer group met several of our selection criteria, including, in addition to certain similar business characteristics, the following quantitative or “prevalence as a peer” criteria:

Revenue – all added companies.

Market capitalization – ICU Medical, LivaNova, Intuitive Surgical.

Prevalence as a peer – Intuitive Surgical (listed by eight of our then-current peer group companies), NuVasive (listed by six of our then-current peer group companies)

Teleflex named as a peer – Intuitive Surgical, LivaNova.

Included by a major proxy advisory firm in our peer group for purposes of its analysis of our executive compensation – Intuitive Surgical, LivaNova, NuVasive.

As a result of the changes described above, the peer group included the following companies (sometimes referred to below as the “Executive Compensation Peer Group”):

| • Align Technology, Inc. |

• Integra LifeSciences Holdings Corporation | |

| • The Cooper Companies, Inc. |

• Intuitive Surgical, Inc. | |

| • DENTSPLY SIRONA Inc. |

• LivaNova, PLC | |

| • Edwards Lifesciences Corporation |

• NuVasive, Inc. | |

| • Hill-Rom Holdings, Inc. |

• ResMed Inc. | |

| • Hologic, Inc. |

• STERIS plc | |

| • ICU Medical, Inc. |

• Varian Medical Systems, Inc. |

23

To provide an additional competitive reference source for Messrs. Kelly, Powell and Leyden, and a reference source for the other named executive officers, the Compensation Committee also considered data included in FW Cook’s executive compensation review report that was derived from the Radford Global Technology Survey relating to companies with revenues in the range of $1-3 billion. In reviewing the survey data, the Compensation Committee considered only the aggregated data provided by the surveys. The identity of the individual companies comprising the survey data was not reviewed or considered by the Compensation Committee in its evaluation process. Therefore, the Compensation Committee does not consider the identity of the companies comprising the survey data to be material information in this context.

The historical data provided by FW Cook was adjusted to January 1, 2019, using a 3% per annum rate of increase, unless forward-looking compensation was disclosed. The peer group data and the survey data described above were the Compensation Committee’s primary sources of comparative data that it used in making compensation determinations.