PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 25, 2011

BEL FUSE INC.

__________, 2011

Dear Fellow Shareholder:

Since November 2008, Bel Fuse Inc. (Nasdaq: BELFA/BELFB), a leading producer of electronic products (“Bel Fuse” or “we”), has attempted to privately and constructively engage in serious negotiations with members of the Board of Directors (the “Pulse Board”) of Pulse Electronics Corporation (the “Company” or “Pulse”) to enter into a business combination that we strongly believe would create significantly more value for Pulse shareholders than Pulse can achieve on a standalone basis. Unfortunately, despite our exhaustive efforts to convince the Pulse Board of the clear benefits a business combination would yield for both companies and the value such a transaction would create for all shareholders, the Pulse Board has refused to negotiate with us.

We believe the current Pulse Board has not acted, is not acting, and will not act, in your best interests. Specifically, we believe the Pulse Board’s continued refusal to enter into serious negotiations with us, including with respect to our latest proposal to acquire the Company for per share consideration of $6.00 (discussed in more detail in the attached Proxy Statement) is contrary to the best interests of the Company’s shareholders. Although the Pulse Board has rejected our proposal, they have made no attempt to enter into negotiations with us to structure a transaction that makes the most sense and provides the greatest tax advantages for Pulse shareholders. In addition, to the detriment of Pulse shareholders, the Pulse Board has not given any indication that they will conduct a comprehensive examination of all strategic alternatives - including a complete sale of the business to the highest and most qualified bidder.

We are therefore seeking your support at the annual meeting of shareholders (the “Annual Meeting”) scheduled to be held on Wednesday, May 18, 2011, at 10 AM (PDT) at the offices of Pulse at 12220 World Trade Drive, San Diego, CA 92128, to elect our two director nominees to the Pulse Board. If elected, our nominees will represent a minority of the members of the Pulse Board. We are not seeking control of the Pulse Board. At the Annual Meeting, shareholders of the Company will be asked to consider the following:

|

|

1.

|

To approve amendments to Pulse’s Amended and Restated Articles of Incorporation and Amended and Restated By-Laws to provide for plurality voting in contested director elections;

|

|

|

2.

|

To elect Bel Fuse’s slate of two director nominees to the Pulse Board in opposition to the Company’s incumbent directors;

|

|

|

3.

|

To conduct an advisory vote on executive compensation;

|

|

|

4.

|

To conduct an advisory vote on the frequency of holding an advisory vote on executive compensation; and

|

|

|

5.

|

To transact any other business that may properly come before the Annual Meeting.

|

We believe our nominees are highly qualified and completely independent within the meaning of the listing standards of the New York Stock Exchange. None of our nominees are affiliated with Bel Fuse. Our nominees are committed to exercising their independent judgment in all matters before the Pulse Board and, if elected, they will work constructively with the other members of the Pulse Board to ensure that the interests of all Pulse shareholders are protected. Specifically, if elected, our nominees intend to, subject to their fiduciary duties, urge the other members of the Pulse Board to conduct a comprehensive examination of all strategic alternatives available to Pulse, including a complete sale of the Pulse business to the highest and most qualified bidder.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed GOLD proxy card today. The attached Proxy Statement and the enclosed GOLD proxy card are first being furnished to the shareholders on or about __________, 2011.

If you have already voted for the incumbent slate you have every right to change your vote by signing, dating and returning a later dated GOLD proxy card or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact Alliance Advisors, LLC, which is assisting us, at their address and toll-free numbers listed below.

Thank you for your support,

Daniel Bernstein

President and CEO of Bel Fuse Inc.

| |

|

If you have any questions, require assistance in voting your GOLD proxy card,

or need additional copies of Bel Fuse’s proxy materials, please call

Alliance Advisors, LLC at the phone numbers or email listed below.

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

(973) 873-7706 (Call Collect)

whassan@allianceadvisorsllc.com

or

CALL TOLL FREE (877)-777-5017

|

| |

2011 ANNUAL MEETING OF SHAREHOLDERS

OF

PULSE ELECTRONICS CORPORATION

_________________________

PROXY STATEMENT

OF

BEL FUSE INC.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED GOLD PROXY CARD TODAY

Bel Fuse Inc., a New Jersey corporation (“Bel Fuse” or “we”), is a shareholder of Pulse Electronics Corporation, a Pennsylvania corporation (the “Company” or “Pulse”). We believe the Board of Directors of the Company (the “Pulse Board”) is not acting in the best interests of its shareholders. We are writing to seek your support for the election of our two director nominees to the Pulse Board at the annual meeting of shareholders scheduled to be held Wednesday, May 18, 2011, at 10 AM (PDT) at the offices of Pulse at 12220 World Trade Drive, San Diego, CA 92128 (including any adjournments or postponements thereof and any meeting which may be called in lieu thereof, the “Annual Meeting”). At the Annual Meeting, shareholders of the Company will be asked to consider the following:

|

|

1.

|

To approve amendments to Pulse’s Amended and Restated Articles of Incorporation (the “Articles of Incorporation”) and Amended and Restated By-Laws (the “By-Laws”) to provide for plurality voting in contested director elections;

|

|

|

2.

|

To elect Bel Fuse’s director nominees, Timothy E. Brog and James Dennedy (each a “Nominee” and, collectively, the “Nominees”), to serve as directors of the Company, in opposition to the Company’s incumbent directors whose terms expire at the Annual Meeting;

|

|

|

3.

|

To conduct an advisory vote on executive compensation (the “Say on Pay Proposal”);

|

|

|

4.

|

To conduct an advisory vote on the frequency of holding an advisory vote on executive compensation (the “Say When on Pay Proposal”); and

|

|

|

5.

|

To transact any other business that may properly come before the Annual Meeting.

|

This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed GOLD proxy card may only be voted for our Nominees and does not confer voting power with respect to any of Pulse’s director nominees. Shareholders who return the GOLD proxy card will only be able to vote for our two Nominees and will not have the opportunity to vote for the four other seats up for election at the Annual Meeting. See “Voting and Proxy Procedures” on page ___ for additional information. You can only vote for Pulse’s director nominees by signing and returning a proxy card provided by Pulse. Shareholders should refer to Pulse’s proxy statement for the names, backgrounds, qualifications and other information concerning Pulse’s nominees.

The Company has set the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting as March 4, 2011 (the “Record Date”). The mailing address of the principal executive offices of the Company is 1210 Northbrook Drive, Suite 470, Trevose, Pennsylvania 19053. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 41,618,607 shares of Common Stock, par value $0.125 per share (the “Shares”), outstanding and entitled to vote at the Annual Meeting. As of the Record Date, Bel Fuse beneficially owned an aggregate of 341,725 Shares. We intend to vote such Shares FOR the approval of amendments to Pulse’s Articles of Incorporation and By-Laws to provide for plurality voting in contested director elections, cumulatively FOR one or both of our Nominees, at our sole discretion, in order to elect as many of our Nominees as possible, in a manner consistent with the recommendation of Institutional Shareholder Services Inc. (“ISS”), a leading proxy advisory firm, with respect to the Say on Pay Proposal and for future advisory votes on executive compensation to be held every ONE year with respect to the Say When on Pay Proposal as described herein.

Bel Fuse, Bel Ventures Inc., a Delaware corporation, and wholly-owned subsidiary of Bel Fuse (“Bel Ventures”), the Nominees and our directors, officers and employees listed on Schedule I are deemed to be participants in this proxy solicitation.

THIS SOLICITATION IS BEING MADE BY BEL FUSE AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH WE ARE NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED GOLD PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

WE URGE YOU TO SIGN, DATE AND RETURN THE GOLD PROXY CARD IN FAVOR OF THE ELECTION OF OUR NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY PULSE MANAGEMENT OR THE PULSE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE FOR EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED GOLD PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting

This Proxy Statement and GOLD proxy card are available at

[_____________________________]

IMPORTANT

Your vote is important, no matter how many Shares you own. We urge you to sign, date, and return the enclosed GOLD proxy card today to vote FOR the election of our Nominees.

|

|

·

|

If your Shares are registered in your own name, please sign and date the enclosed GOLD proxy card and return it to Bel Fuse, c/o Alliance Advisors, LLC, in the enclosed envelope today.

|

|

|

·

|

If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with a GOLD voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your Shares on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

|

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold,” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our two independent Nominees only on our GOLD proxy card. So please make certain that the latest dated proxy card you return is the GOLD proxy card.

| |

|

If you have any questions, require assistance in voting your GOLD proxy card,

or need additional copies of Bel Fuse’s proxy materials, please call

Alliance Advisors, LLC at the phone numbers or email listed below.

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

(973) 873-7706 (Call Collect)

whassan@allianceadvisorsllc.com

or

CALL TOLL FREE (877)-777-5017

|

| |

BACKGROUND TO SOLICITATION

The following is a chronology of events leading up to this proxy solicitation:

|

|

·

|

In 2006 and through July 2007, representatives of Bel Fuse and the Company discussed, from time to time, a framework for a potential business combination between the two companies. During this time, both parties agreed that a combination of the two companies made strong strategic sense and that the combined company would be well positioned to generate significant additional value to their respective shareholders and employees.

|

|

|

·

|

On March 23, 2007, we received an offer from the Company to purchase all of our capital stock for cash (the “March 2007 Offer”).

|

|

|

·

|

On April 17, 2007, representatives of Bel Fuse and Pulse met to discuss the March 2007 Offer. At the meeting, we explained our conditions to accepting the March 2007 Offer, including increasing the purchase price, adding Company stock as a component of the consideration, spinning off the Company’s non-core businesses, restructuring the Company’s management team and reconstituting the Pulse Board. The Company ultimately rejected our conditions.

|

|

|

·

|

On June 28, 2007, we delivered a letter to the Company seeking to renew discussions regarding a potential business combination. In the letter, we stated that a cash sale at the price level set forth in the March 2007 Offer would not be in the best interests of Bel Fuse shareholders. Specifically, we stated that our shareholders would realize greater value in the long-term by allowing our management team to continue to implement its business plan and strategic initiatives. However, a stock merger with the Company under the proper conditions could allow shareholders of both companies the opportunity to fully benefit from the synergies of the combined business. Recognizing that a successful merger requires that the combined company implement a strategy that would yield the greatest return to shareholders, we outlined in the letter our proposed long-term plan for the combined company including the following: |

|

|

§

|

Spinning-off AMI Doduco in order to concentrate on business segments where the combined company would or could be a market leader.

|

|

|

§

|

Using the proceeds from the sale of AMI Doduco to buy back shares of the combined company in order to maximize value for shareholders.

|

|

|

§

|

Reviewing strategic alternatives to the Bel Fuse Power Group, Pulse Automotive Group and Pulse Consumer Products Group consistent with our views on the ability of these divisions to become market leaders.

|

|

|

§

|

Seeking acquisitions in the antennae area in order to reduce dependence on a single customer.

|

In the letter, we also addressed concerns representatives of the Company had previously communicated to us regarding our desire to control a majority of the board of directors of the combined entity and for our then and current CEO, Daniel Bernstein, to lead the new management team. We expressed our view that in light of announced and planned retirements of key members of the Company’s management team, the road was paved for a board of directors of the combined company that would be controlled by Bel Fuse directors. We also explained that we were confident that Bel Fuse director Avi Eden, in particular, as former Executive Vice President and Vice Chairman of Vishay Intertechnology, then a NYSE Fortune 1,000 company with sales of $2.5 billion and one of the world’s largest manufacturers of discrete semiconductors and passive electronic components, could provide the necessary guidance and the benefit of 30 years of experience as Chairman of the combined company.

|

|

·

|

On July 3, 2007, we received a letter from the Company expressing its unwillingness to enter into a business combination on the terms outlined in our letter of June 28, 2007.

|

|

|

·

|

On November 3, 2008, Mr. Eden sent an email to James M. Papada, then the Company’s Chairman and CEO, asking if the Company would be willing to renew discussions regarding a potential business combination. Mr. Eden expressed his belief that such a transaction, especially involving stock consideration, was still compelling.

|

|

|

·

|

On December 15, 2008, Mr. Papada sent an email to Mr. Eden stating that “while the board still perceives there to be significant upside to such a combination, the timing is just not right for us at this particular time.” Mr. Papada advised that the Company would defer any additional discussions about this matter until it had a clearer outlook for 2009.

|

|

|

·

|

On August 3, 2009, the Company announced that its AMI Doduco business was for sale.

|

|

|

·

|

On September 28, 2009, the Company announced that Mr. Papada would retire no later than March 31, 2010.

|

|

|

·

|

On October 6, 2009, we delivered a letter to the Company stating that Mr. Papada’s recently announced retirement and the sale of the AMI Doduco business presents an excellent opportunity to renew discussions regarding a possible business combination. We stated that Bel Fuse has continued to generate cash and strengthen its balance sheet despite the economic turmoil. In addition, the sale of the AMI Doduco business left the Company with a product portfolio that is very similar to that of Bel Fuse, making Mr. Bernstein a suitable leader for the combined company.

|

|

|

·

|

On October 22, 2009, Mr. Eden received an email from Mr. Papada stating that the Pulse Board did not view it as an appropriate time to consider any kind of transaction with Bel Fuse. Mr. Papada also stated that discussions about a business combination should be postponed until the Company has identified a replacement CEO and the sale of the AMI Doduco business is complete.

|

|

|

·

|

On February 22, 2010, the Company announced that Daniel Moloney would replace Mr. Papada as the Company’s next President and CEO, effective in March 2010.

|

|

|

·

|

On March 22, 2010, Mr. Moloney was appointed as a director of the Company and entered into a three-year employment agreement to serve as the Company’s President and CEO. Under this agreement, the Company agreed to pay Mr. Moloney a $1.2 million “signing payment” ($300,000 to be paid within three days, $300,000 to be paid after six months and $600,000 to be paid on the one-year anniversary of his employment), a minimum base salary of $650,000 per annum, an annual bonus incentive equivalent to 250% of base salary, stock options and various other perquisites.

|

|

|

·

|

On August 2, 2010, the Company announced that Mr. Moloney would be leaving the Company but would continue to serve as a director. On the same day, the Company announced that Drew Moyer, the Company’s CFO, would take on the additional responsibility of Interim CEO while the Pulse Board continued to search for a permanent CEO.

|

|

|

·

|

On August 2, 2010, the Company also announced that it had entered into a definitive agreement for the sale of the AMI Doduco business for EUR 33.0 million.

|

|

|

·

|

On August 4, 2010, Mr. Eden sent an email to John Burrows, the Company’s Lead Independent Director, inviting Mr. Burrows to contact him to pursue negotiations. Mr. Burrows’ email response was as follows: “Thanks for your note, we appreciate your interest but this is not the right time for a conversation.”

|

|

|

·

|

On December 14, 2010, we delivered a letter to the Company expressing our interest in renewing discussions regarding a potential business combination. In the letter, we stated our belief that the strategic and operational rationale underlying a combination of the respective businesses is profound and the logic and substantial benefits associated with such a transaction appear even more compelling following the Company’s disposition of certain assets and its continuing search for a permanent CEO. In the letter, we also expressed our desire to commence a meaningful dialogue privately, but also stated our intention to preserve all of our options, including nominating directors for election to the Pulse Board.

|

|

|

·

|

On December 21, 2010, we received a letter from Mr. Burrows stating that the Company did not see the “unique opportunity” that we saw in a possible business combination. However, he expressed his willingness to meet with us to discuss our views “out of courtesy.” Mr. Burrows also stated that if the Company decided to continue discussions after the meeting, the Company would expect such discussions to be conditioned on the exchange of customary confidentiality and standstill agreements.

|

|

|

·

|

On December 23, 2010, we delivered a letter to the Company nominating Timothy E. Brog, James Dennedy and a third nominee for election to the Pulse Board at the Annual Meeting (the “Nomination Letter”).

|

|

|

·

|

On January 5, 2011, the Company issued a press release announcing that Ralph E. Faison had been appointed President and CEO of the Company and that Mr. Faison would also be appointed to the Pulse Board.

|

|

|

·

|

On January 14, 2011, Mr. Eden met with Mr. Burrows and Howard Deck, another director of the Company. During the meeting, Mr. Eden again expressed Bel Fuse’s willingness to enter into a business combination with the Company or a purchase by Bel Fuse of a portion of the Company’s assets. Mr. Eden indicated that Bel Fuse was flexible as to the structure of the transaction and the form of consideration and was open to an acquisition of the Company’s Network Product Group for cash or Bel Fuse shares, or a combination thereof.

|

|

|

·

|

On January 18, 2011, in light of Mr. Faison’s appointment to the Pulse Board, we delivered to the Company a supplement to the Nomination Letter nominating a fourth nominee for election to the Pulse Board at the Annual Meeting.

|

|

|

·

|

On February 7, 2011, Mr. Eden and Mr. Faison had a meeting during which Mr. Eden reiterated Bel Fuse’s willingness to enter into a business combination with the Company or a purchase by Bel Fuse of a portion of the Company’s assets. Mr. Faison requested that discussions regarding a transaction be deferred for another 18 to 24 months in order to allow the Company to execute its strategic plan.

|

|

|

·

|

On February 28, 2011, we delivered a letter to the Company proposing to acquire all of the outstanding Shares of the Company for per share consideration of $6.00 based on Bel Fuse’s closing share price on February 25, 2011, payable in the form of $6.00 in cash or 0.272 of a share of Class B Common Stock of Bel Fuse. See the section entitled “Reasons For Our Solicitation” for a more detailed description of this proposal.

|

|

|

·

|

On March 1, 2011, Mr. Bernstein met with Mr. Faison to discuss the merits of a business combination. During the meeting, Mr. Bernstein stated that our financing sources are supportive of the proposed transaction and reiterated our willingness to consummate a transaction that makes the most sense for the Company and that provides the greatest tax advantages for the Company’s shareholders. Mr. Faison responded by requesting that merger discussions between the two parties be deferred for another 18 to 24 months. On the same day, the Company issued a press release indicating that the Pulse Board would review our proposal with its advisors.

|

|

|

·

|

On March 10, 2011, the Company sent a letter to us and issued a press release rejecting our acquisition proposal.

|

|

|

·

|

On March 21, 2011, we delivered a letter to Mr. Faison responding to the Company’s rejection of our acquisition proposal and announcing our intention to seek to solicit proxies to elect two highly qualified, independent directors to the Pulse Board.

|

* * * *

REASONS FOR OUR SOLICITATION

Bel Fuse urges all shareholders of the Company to vote FOR the election of our highly-qualified Nominees on the GOLD proxy card.

A vote FOR the election of our Nominees will send a strong message to the Pulse Board and management team that:

|

|

·

|

Pulse shareholders want the Pulse Board to conduct a comprehensive examination of all strategic alternatives, including a complete sale of the business to the highest and most qualified bidder.

|

|

|

·

|

Pulse shareholders want the Pulse Board to constructively engage with Bel Fuse to examine a business combination that makes the most sense for all shareholders.

|

|

|

·

|

The status quo is no longer acceptable.

|

The Pulse Board has refused to engage in serious negotiations with us to enter into a business combination that we believe will be in the best interests of all shareholders.

Since 2008, we have attempted to engage in serious negotiations with members of the Pulse Board to enter into a business combination that we strongly believe would create a stronger and more competitive global business. Unfortunately, despite our exhaustive efforts to convince the Pulse Board of the clear benefits a business combination would yield for both companies and the value such a transaction would create for all shareholders, the Company has refused to negotiate with us. Each time, we were either told by members of the Pulse Board that it was “not the right time for a conversation” or that they wanted to defer merger talks until the new management team had time to implement its strategic plan, which based on the Company’s March 10, 2011 letter is another 18 to 24 months.

We believe the strategic and operational rationale for a business combination between Bel Fuse and the Company is compelling. In our opinion, a combined company would create a more competitive global business through lower operating costs, a wider product portfolio and a stronger platform of engineering capabilities.

The Pulse Board has yet to seriously engage us regarding our latest offer to acquire the Company for $6.00 per share in cash or stock.

On February 28, 2011, we proposed to acquire all of the outstanding Shares of the Company for per share consideration of $6.00 based on Bel Fuse’s closing share price on February 25, 2011, payable in the form of $6.00 in cash or 0.272 of a share of Class B Common Stock of Bel Fuse (the “Offer”). The Offer consideration represents:

|

|

·

|

a premium of approximately 38% to the Company’s closing Share price on the last trading day prior to the date the Company publicly disclosed our interest in discussing a potential business combination and intention to nominate candidates for election at the Annual Meeting;

|

|

|

·

|

a premium of approximately 23% to the Company’s average closing Share price for the 60 trading days ended February 25, 2011; and

|

|

|

·

|

a premium of approximately 11% to the Company’s closing Share price on February 25, 2011.

|

We believe our Offer provides immediate liquidity to the Company’s shareholders who prefer to receive cash and presents others with a very attractive investment opportunity to be shareholders of a combined company with a robust and flexible capital structure available for future expansion.

We indicated in our Offer that if the Pulse Board would prefer to allow Pulse shareholders to choose to receive a combination of cash and stock, we are willing to structure a transaction that makes the most sense and provides the greatest tax advantages for Pulse shareholders. We also reiterated in our Offer that we remain flexible as to the type of purchase and form of consideration we would be willing to consider as part of an alternative transaction, including an acquisition of the Company’s Network Product Group. Instead of directly engaging in discussions with us regarding our Offer or the other alternatives discussed therein, the Company rejected our Offer, stating that it needed another 18 to 24 months to execute its business strategy.

We do not believe the Company’s reasons for refusing to enter into a business combination are compelling.

On March 10, 2011, the Company sent a letter to us and issued a press release rejecting our Offer for reasons we do not believe are compelling. The Pulse Board stated that our Offer does not reflect the actions the Company has taken recently to improve its performance. We believe that these actions, while important and indeed necessary to meet the minimum standard necessary to remain competitive in our industry, are all long overdue. In fact, in our letter to the Company dated June 28, 2007, we recommended that several of these actions be taken as the best way to generate the greatest return for our combined shareholders following a business combination. See the section entitled “Background To Solicitation” for a more detailed description of the June 28, 2007 letter. We believe it is ironic that the Company is now claiming that these initiatives are the primary reasons for not entering into a business combination with us today.

Furthermore, we do not believe the “strategic actions” the Company “committed” to undertake over the next 18 to 24 months in its March 10, 2011 letter, such as lowering operating expenses and rationalizing the Company’s manufacturing footprint, are compelling reasons for not entering into discussions with us. In fact, we believe a combined entity would have the ability to achieve these objectives more quickly, with far less execution risk and at a much lower cost. We believe that consummating a combination of the highly complementary synergies of both organizations has the potential to achieve significantly more value for shareholders than the Company can achieve on a standalone basis. These potential synergies include:

|

|

·

|

The ability to rapidly increase global sales through a broader and more complete product portfolio.

|

|

|

·

|

An integrated operational and organizational infrastructure better able to serve customers.

|

|

|

·

|

Benefits from economies of scale with regards to procurement, engineering capabilities, IT infrastructure and customer service.

|

|

|

·

|

Improved margins and considerable cost savings, which are expected to yield more than $15 million annually when fully realized, primarily from rationalizing redundant operational costs and duplicate public company costs.

|

|

|

·

|

A more robust and flexible capital structure with greater access to capital for future expansion.

|

The Company has a lackluster track record of managing investments while highly compensating select executives.

Over the past five years, the Company spent approximately $480 million on acquisitions (a total of approximately $590 million including the LK Products acquisition in September 2005) and an additional $180 million on Research and Development. During the same period, the Company’s revenue declined 31% from approximately $627 million in FY2006 to approximately $432 million in FY2010, while income from continuing operations fell from approximately $46 million in FY2006 to a loss of approximately $28 million in FY2010. We believe the Pulse Board’s lackluster investment record is also reflected in significant goodwill and intangible asset write-downs primarily related to these acquisitions, totaling approximately $411 million from FY2006 - FY2010.

Meanwhile, from 2006 to 2010, the Pulse Board rewarded James Papada, the Company’s CEO and Drew Moyer, the Company’s CFO and subsequently the Company’s Interim CEO, with approximately $25.7 million in salary, stock awards, tax gross ups, social club memberships, retirement plan benefits and other perks. In June 2009, these two individuals collected one-time change-in-control payments totaling more than $4.0 million following the sale of the Company’s Medtech subsidiary, a business acquired under the same management team less than 18 months earlier. Soon after these payments were made, the CEO retired (on April 2, 2010) and collected $9.3 million in retirement benefits associated with the termination of the Company’s Supplemental Retirement Plan, while the CFO, who was later given the additional title of Interim CEO, earned $1.4 million in total compensation in 2010.

We believe shareholders should take into consideration the Company’s questionable acquisition strategy and compensation practices discussed above when evaluating whether our Offer or the status quo is in the best interest of shareholders.

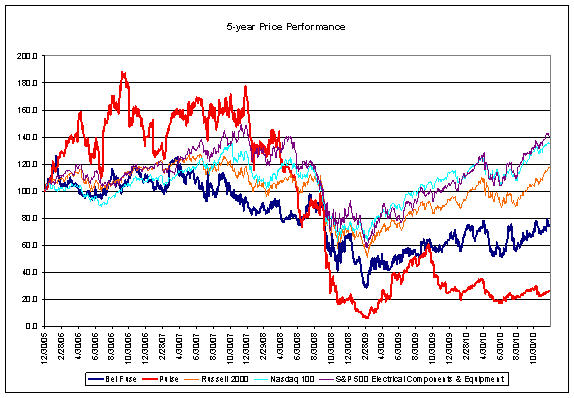

The Company’s market value has declined by more than $750 million during the past five years.

We believe the Company’s deteriorating financial performance and questionable acquisition strategy discussed above has contributed to an unacceptable loss of shareholder value. The Company’s share price significantly underperformed the relevant benchmark indices and Bel Fuse shares over the 1-year, 3-year, and 5-year periods prior to December 28, 2010.

We believe shareholders should take into consideration the Company’s share price performance illustrated above when evaluating whether our Offer or the status quo is in the best interest of shareholders.

By voting for our Nominees, you will send a strong message to the Company that shareholders want directors who would objectively evaluate all value enhancing proposals, including our Offer.

We are not seeking control of the Pulse Board. If our Nominees are elected at the Annual Meeting, they will constitute a minority of the Pulse Board and, subject to their fiduciary duties, will work with other board members to evaluate all value enhancing proposals, including our Offer. Your vote to elect our Nominees does not constitute a vote in favor of our Offer or any other transaction with Bel Fuse. Our Nominees are independent and we expect that, if elected, they will exercise their independent judgment in all matters before the Pulse Board, including the Offer or any other transaction with Bel Fuse, in accordance with their fiduciary duties.

PROPOSAL NO. 1

PULSE’S PROPOSED AMENDMENTS TO ITS ARTICLES OF INCORPORATION AND BY-LAWS TO PROVIDE FOR PLURALITY VOTING IN CONTESTED DIRECTOR ELECTIONS

As discussed in further detail in the Company’s proxy statement, at the Annual Meeting shareholders will have the opportunity to approve the adoption of the following resolutions to provide for plurality voting in contested director elections:

1. The adoption of an amendment to the Articles of Incorporation is hereby approved to add a new Article NINTH to read as follows:

“NINTH: Each director shall be elected by the vote of the majority of the votes cast with respect to the director at any meeting for the election of directors at which a quorum is present, provided that if the number of nominees exceeds the number of directors to be elected, then the nominees receiving the highest number of votes up to the number of directors to be elected shall be elected. For purposes of this Article, a majority of the votes cast means that the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that director nominee (excluding abstentions).”

2. The By-Laws are hereby amended by revising Section 9 of Article II to read as follows (proposed new text is underlined and proposed deleted text is stricken):

Section 9. Each shareholder shall at every meeting of the shareholders be entitled to one vote in person or by proxy for each share having voting power held by such shareholder, but no proxy shall be voted on or after three years from its date, unless coupled with an interest, and, except where the transfer books of the corporation have been closed or a date has been fixed as a record date for the determination of its shareholders entitled to vote, transferees of shares which are transferred on the books of the corporation within ten days next preceding the date of such meeting shall not be entitled to vote at such meeting. In each election for directors, every shareholder entitled to vote shall have the right, in person or by proxy, to multiply the number of votes to which he may be entitled by the total number of directors to be elected in the same election, and he may cast the whole number of such votes for one candidate or he may distribute them among any two or more candidates. All candidates receiving a majority of the votes cast shall be elected. Each director shall be elected by the vote of the majority of the votes cast with respect to the director at any meeting for the election of directors at which a quorum is present, provided that if the number of nominees exceeds the number of directors to be elected, then the nominees receiving the highest number of votes up to the number of directors to be elected shall be elected. For purposes of this Article, a majority of the votes cast means that the number of shares voted “for” a director nominee must exceed the number of votes cast “against” that director nominee (excluding abstentions).

YOU ARE URGED TO VOTE FOR THE APPROVAL OF AMENDMENTS TO PULSE’S ARTICLES OF INCORPORATION AND BY-LAWS TO PROVIDE FOR PLURALITY VOTING IN CONTESTED DIRECTOR ELECTIONS.

PROPOSAL NO. 2

ELECTION OF DIRECTORS

The Pulse Board is currently composed of three classes of directors. The terms of two Class I directors and two Class II directors, one of whom has not been nominated for election at the Annual Meeting, are expiring at the Annual Meeting. Pulse has also nominated three additional persons who have not previously served as directors for election at the Annual Meeting. Accordingly, shareholders will have the opportunity to vote for the election of six directors at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our Nominees in opposition to the Company’s director nominees.

Shareholders have cumulative voting rights with respect to the election of directors. This means that you can multiply the number of votes to which you are entitled by the total number of directors to be elected. You may then cast the whole number of votes for one candidate or distribute them among any two or more candidates in any proportion. If you want to vote in person and use cumulative voting for electing directors, you must notify the Chairman of the Annual Meeting before voting. Unless otherwise instructed, Shares represented by properly executed GOLD proxy cards will be voted cumulatively at the Annual Meeting in favor of one or both of our Nominees, at our sole discretion, in order to elect as many of our Nominees as possible.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of each of the Nominees. This information also includes for each of the Nominees the specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as directors of the Company. This information has been furnished to us by the Nominees. The Nominees are citizens of the United States of America.

Timothy E. Brog (Age 47) has served as Chairman of the Board of Directors of Peerless Systems Corporation, a licensor of imaging and networking technologies, since June 2008 and a member of the Board of Directors since July 2007. He has also served as the Chief Executive Officer of Peerless Systems Corporation since August 2010. He served as the Managing Director of Locksmith Capital Management LLC, the portfolio manager of an investment partnership, from September 2007 to August 2010. Mr. Brog was the Managing Director of E2 Investment Partners LLC, an investment partnership, from March 2007 to July 2008. He was President of Pembridge Capital Management LLC, the portfolio manager of an investment partnership, from June 2004 to September 2007. He was the Founder and Managing Director of The Edward Andrews Group Inc., a boutique investment bank, from 1996 to September 2007. He currently serves as a director of Eco-Bat Technologies Limited, which through its subsidiaries, engages principally in the smelting, refining, manufacturing, and marketing of lead and lead products in the United Kingdom, France, Germany, Italy, Austria, and United States of America, as well as in South Africa. He served as a director of The Topps Company, Inc., a leading creator and marketer of sports and related cards, entertainment products, and distinctive confectionery, from August 2006 until its sale in October 2007 to Michael Eisner’s holding company, The Tornante Co., and Madison Dearborn Partners. From 1989 to 1995, Mr. Brog was a corporate finance and mergers and acquisitions associate at the law firm Skadden, Arps, Slate, Meagher & Flom LLP. He received a BA in 1986 from Tufts University and a JD in 1989 from Fordham University School of Law. Mr. Brog’s background serving as a director of multiple public companies in various industries and his extensive legal and investment banking experience would well position him to serve on the Board and assist the Company with achieving Company goals and executing strategic initiatives. The principal business address of Mr. Brog is 300 Atlantic Street, Suite 301, Stamford, Connecticut 06901.

James Dennedy (Age 45) has served as a director and Chairman of the Audit Committee of NaviSite, Inc., a leading worldwide provider of enterprise-class, cloud-enabled hosting, managed applications and services, since January 2003. He has been a Principal and Chief Investment Officer of Arcadia Capital Advisors, LLC, a capital management and advisory services company, since April 2008. He was the Managing Partner of Hamilton-Madison Group, LLC, a capital management and corporate development company, from June 2007 to April 2008. He was the President and Chief Executive Officer of Engyro Corporation, an enterprise systems and network management company, from November 2004 until its acquisition by Microsoft in June 2007. He served as a Managing Partner of Mitchell-Wright, LLC, a technology buy-out and investment company, from September 2003 to November 2004. Mr. Dennedy has served as a director of Agilysys, Inc., a leading provider of innovative IT solutions, since June 2009. He previously served as a director of I-Many, Inc., a leading provider of contract management software and services, from March 2009 until its sale in June 2009, and as a director of Entrust, Inc., a solutions company providing secure digital identities and information for consumers, enterprises and governments, from June 2008 until its sale in July 2009. He also previously served as a director of Abridean, Inc., an enterprise software company providing software provisioning and identity management solutions. Mr. Dennedy received a BS in Economics from the United States Air Force Academy, an MA in Economics from the University of Colorado and an MBA from Ohio State University. Mr. Dennedy has more than twenty years of leadership experience in corporate development, corporate finance with public and private companies in the United States and Europe, and strategic direction. Mr. Dennedy’s contributions are complemented by his experience serving as an outside director of multiple public companies, including serving on such companies’ audit, corporate governance, nominating and compensation committees. The principal business address of Mr. Dennedy is 175 Great Neck Road, Suite 406, Great Neck, New York 11021.

Bel Fuse has entered into letter agreements pursuant to which it has agreed to indemnify each of the Nominees (as well as two other individuals we previously nominated but for whom we are not soliciting proxies) against claims arising from the solicitation of proxies from the Company’s shareholders in connection with the Annual Meeting and any related transactions.

On January 18, 2011, each of Bel Fuse, Bel Ventures and the Nominees (as well as two other individuals we previously nominated but for whom we are not soliciting proxies) entered into a Solicitation Agreement in which, among other things, (i) they agreed to the joint filing on behalf of each of them of statements on Schedule 13D with respect to the securities of the Company to the extent required by applicable law, (ii) they agreed to solicit proxies or written consents for the election of the Nominees to the Pulse Board at the Annual Meeting and (iii) Bel Fuse agreed to bear all expenses incurred in connection with their activities with respect to this solicitation, subject to certain limitations.

If elected as a director of the Company, each of the Nominees would be an “independent director” within the meaning of (i) applicable NASDAQ listing standards applicable to board composition, (ii) applicable New York Stock Exchange listing standards applicable to board composition and (iii) Section 301 of the Sarbanes-Oxley Act of 2002.

Other than as stated herein, there are no arrangements or understandings between the Nominees and Bel Fuse or any other person or persons pursuant to which the nomination described herein is to be made, other than the consent by each of the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting.

We do not expect that the Nominees will be unable to stand for election, but, in the event that such persons are unable to serve or for good cause will not serve, the Shares represented by the enclosed GOLD proxy card will be voted for substitute nominees, to the extent this is not prohibited under the By-Laws and applicable law. In addition, we reserve the right to nominate substitute persons if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying the Nominees, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, Shares represented by the enclosed GOLD proxy card will be voted for such substitute nominees. We reserve the right to nominate additional persons, to the extent this is not prohibited under the By-Laws and applicable law, if the Company increases the size of the Pulse Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of Bel Fuse that any attempt to increase the size of the current Pulse Board constitutes an unlawful manipulation of the Company’s corporate machinery.

YOU ARE URGED TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED GOLD PROXY CARD.

PROPOSAL NO. 3

PULSE’S SAY ON PAY PROPOSAL

As discussed in further detail in the Company’s proxy statement, the Company is providing shareholders with the opportunity to cast an advisory vote on the compensation of the executive officers named in the summary compensation table of the Company’s proxy statement. This proposal is required by Schedule 14A of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The final vote on this proposal not binding on the Company and is advisory in nature.

ALTHOUGH WE HAVE CONCERNS WITH CERTAIN ASPECTS OF THE COMPANY’S PAST COMPENSATION PRACTICES, WE MAKE NO RECOMMENDATION WITH RESPECT TO THE SAY ON PAY PROPOSAL AND INTEND TO VOTE OUR SHARES CONSISTENT WITH THE RECOMMENDATION OF ISS WITH RESPECT TO THIS PROPOSAL.

PROPOSAL NO. 4

PULSE’S SAY WHEN ON PAY PROPOSAL

As discussed in further detail in the Company’s proxy statement, Schedule 14A of the Exchange Act requires that the Company ask shareholders to vote on how frequently the Company should conduct a vote on a proposal similar to the Say on Pay Proposal. Shareholders voting on this proposal have the option of choosing every year, every two years or every three years. Shareholders can also choose to abstain from voting on this matter. The advisory vote on the frequency of future advisory votes on executive compensation is non-binding.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE SAY WHEN ON PAY PROPOSAL AND INTEND TO VOTE OUR SHARES FOR FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION TO BE HELD EVERY “ONE” YEAR.

VOTING AND PROXY PROCEDURES

Only shareholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Shareholders who sell Shares before the Record Date (or acquire them without voting rights after the Record Date) may not vote such Shares. Shareholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such Shares after the Record Date. Based on publicly available information, we believe that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the Shares.

Shareholders have cumulative voting rights with respect to the election of directors. This means that you can multiply the number of votes to which you are entitled by the total number of directors to be elected. You may then cast the whole number of votes for one candidate or distribute them among any two or more candidates in any proportion. If you want to vote in person and use cumulative voting for electing directors, you must notify the Chairman of the Annual Meeting before voting. Unless otherwise instructed, Shares represented by properly executed GOLD proxy cards will be voted cumulatively at the Annual Meeting in favor of one or both of our Nominees, at our sole discretion, in order to elect as many of our Nominees as possible.

Additionally, GOLD proxy cards, in the absence of specific instructions, will be voted FOR the approval of amendments to Pulse’s Articles of Incorporation and By-Laws to provide for plurality voting in contested director elections, ABSTAIN on the Say on Pay Proposal and for future advisory votes on executive compensation to be held every ONE year with respect to the Say When on Pay Proposal and in the discretion of the persons named as proxies on all other matters as may properly come before the Annual Meeting.

According to the Company’s proxy statement for the Annual Meeting, the current Pulse Board intends to nominate six candidates for election as directors at the Annual Meeting. This Proxy Statement is soliciting proxies to elect only our Nominees. Accordingly, the enclosed GOLD proxy card may only be voted for our Nominees and does not confer voting power with respect to the Company’s director nominees. Under applicable proxy rules, we are only permitted to solicit proxies for our Nominees. Therefore, stockholders who return the GOLD proxy card will only be able to vote for our two Nominees and will not have the opportunity to vote for the four other seats up for election at the Annual Meeting. You can only vote for the Company’s director nominees by signing and returning a proxy card provided by the Company. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if our Nominees are elected.

QUORUM

The holders of a majority of the outstanding Shares entitled to vote, present in person or by proxy, represent a quorum for the conduct of business at the Annual Meeting. Abstentions are counted as present for establishing a quorum so long as the shareholder has executed a valid proxy or is physically present at the Annual Meeting.

VOTES REQUIRED FOR APPROVAL; ABSTENTIONS AND BROKER NON-VOTES;

Approval of the amendments to Pulse’s Articles of Incorporation and By-Laws. According to the Company’s proxy statement, approval of this proposal requires the affirmative vote of a majority of the votes cast on the proposal. An abstention or a broker non-vote is not a vote cast and will not affect the number of votes required to approve the proposal.

Vote required for the election of directors. According to the Company’s proxy statement, each director will be elected by the vote of the majority of votes cast with respect to that director nominee, unless the amendments to Pulse’s Articles of Incorporation and By-Laws to provide for plurality voting in contested director elections are approved at the Annual Meeting. If the amendments to Pulse’s Articles of Incorporation and By-Laws to provide for plurality voting in contested director elections are approved at the Annual Meeting, the director nominees receiving the highest number of votes, up to the number of directors to be elected, will be elected.

Approval of the Say on Pay Proposal. According to the Company’s proxy statement, the Company is providing shareholders with the opportunity to cast an advisory vote on the compensation of the executive officers named in the summary compensation table of the Company’s proxy statement. Because the vote is advisory, it will not be binding on the Pulse Board. However, the Pulse Board and its Compensation Committee will consider the result of the vote when making future decisions regarding executive compensation policies and procedures.

Vote required with respect to the Say When on Pay Proposal. According to the Company’s proxy statement, shareholders may vote for the frequency of future advisory votes on executive compensation to occur every one, two or three years, or may abstain from voting. Because the vote is advisory, it will not be binding on the Pulse Board. However, the Pulse Board will consider the result of the vote in determining the frequency of future advisory votes on executive compensation.

REVOCATION OF PROXIES

Shareholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered either to Bel Fuse in care of Alliance Advisors, LLC at the address set forth on the back cover of this Proxy Statement or to the Company at 1210 Northbrook Drive, Suite 470, Trevose, Pennsylvania 19053, or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to Bel Fuse in care of Alliance Advisors, LLC at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding Shares. Additionally, Alliance Advisors, LLC may use this information to contact shareholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE PULSE BOARD PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED GOLD PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by Bel Fuse. Proxies may be solicited by mail, facsimile, telephone, telegraph, Internet, in person and by advertisements.

Bel Fuse has entered into an agreement with Alliance Advisors, LLC for solicitation and advisory services in connection with this solicitation, for which Alliance Advisors, LLC will receive a fee not to exceed $____________, together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified against certain liabilities and expenses, including certain liabilities under the federal securities laws. Alliance Advisors, LLC will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. We have requested banks, brokerage houses and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the Shares they hold of record. We will reimburse these record holders for their reasonable out-of-pocket expenses in so doing. It is anticipated that Alliance Advisors, LLC will employ approximately ___ persons to solicit the Company’s shareholders for the Annual Meeting.

The entire expense of soliciting proxies is being borne by Bel Fuse. Costs of this solicitation of proxies are currently estimated to be approximately $__________. We estimate that through the date hereof, our expenses in connection with this solicitation are approximately $___________.

ADDITIONAL PARTICIPANT INFORMATION

Bel Fuse, Bel Ventures, the Nominees and our directors, officers and employees listed on Schedule I are deemed to be participants in this solicitation. Bel Fuse, a leading producer of electronic products, is primarily engaged in the design, manufacture and sale of products used in networking, telecommunications, high speed data transmission and consumer electronics. Bel Ventures is a wholly-owned subsidiary of Bel Fuse. The address of the principal office of each of Bel Fuse and Bel Ventures is c/o Bel Fuse Inc., 206 Van Vorst Street, Jersey City, New Jersey 07302. See Schedule I for additional information relating to our directors, officers and employees who are deemed participants in this solicitation. No additional compensation will be paid to these individuals in connection with this solicitation.

As of the date hereof, Bel Fuse may be deemed to beneficially own an aggregate of 341,725 Shares, consisting of 368 Shares owned directly by Bel Fuse and 341,357 Shares owned directly by Bel Ventures. As of the date hereof, none of the other participants in this solicitation directly owned any Shares.

Each of the participants, as a member of a “group” for the purposes of Section 13(d)(3) of the Exchange Act, may be deemed to beneficially own the Shares owned directly by the other members of the group. Each of the participants in this solicitation specifically disclaims beneficial ownership of such Shares that he or it does not directly own. For information regarding purchases and sales during the past two years by the participants in this solicitation, see Schedule II.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to each of the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Other than as discussed above, we are unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which we are not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed GOLD proxy card will vote on such matters in their discretion.

SHAREHOLDER PROPOSALS

Under the rules of the Securities and Exchange Commission, eligible shareholders may submit proposals for inclusion in the Company’s proxy statement for the Company’s 2012 annual meeting of shareholders (the “2012 Annual Meeting”). Shareholder proposals must be submitted in writing and must be received by the Pulse Corporate Secretary at the address provided by the Company in its proxy statement by ______________, 2011 for such proposals to be considered for inclusion in the Company’s 2012 proxy statement.

Under the By-Laws, shareholders may present proposals in person at the 2012 Annual Meeting if they are a shareholder entitled to vote at the 2012 Annual Meeting. The Pulse Corporate Secretary must receive any proposals to be presented, which will not be included in the Company’s 2012 proxy statement, no earlier than __________, 2011 and not later than _________, 2011. If the 2012 Annual Meeting is held after April 30, 2012, any such proposals may be submitted no later than 90 days before the meeting date, unless the Company publicly announces the date of the 2012 Annual Meeting less than 90 days before the meeting date, in which case the Pulse Corporate Secretary must receive any such proposals no later than ten days after such public announcement. Proposals received after the deadline, including any proposal nominating a person as a director, may not be presented at the 2012 Annual Meeting. Any shareholder submitting a proposal must also comply with the notice requirements contained in the By-Laws.

The information set forth above regarding the procedures for submitting shareholder proposals and nominations for consideration at the 2012 Annual Meeting is based on information contained in the Company’s proxy statement. The incorporation of this information in this Proxy Statement should not be construed as an admission by us that such procedures are legal, valid or binding.

Incorporation by Reference

We have omitted from this Proxy Statement certain disclosure required by applicable law that is already included in the Company’s proxy statement relating to the Annual Meeting. This disclosure includes, among other things, current biographical information on the Company’s directors, information concerning executive compensation, and other important information. Although we do not have any knowledge indicating that any statement made by it herein is untrue, we do not take any responsibility for the accuracy or completeness of statements taken from public documents and records that were not prepared by or on our behalf, or for any failure by the Company to disclose events that may affect the significance or accuracy of such information. See Schedule III for information regarding persons who beneficially own more than 5% of the Shares and the ownership of the Shares by the directors and management of the Company.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

|

BEL FUSE INC.

|

| |

| |

|

_____________, 2011

|

SCHEDULE I

INFORMATION CONCERNING BEL FUSE’S DIRECTORS, OFFICERS AND EMPLOYEES WHO ARE DEEMED TO BE PARTICIPANTS IN THIS SOLICITATION

The principal occupations and business addresses of our directors, executive officers and employees who are deemed to be participants in this solicitation are set forth below.

|

Name and Position

|

|

Principal Occupation

|

|

Principal Business Address

|

|

Daniel Bernstein,

President and Chief Executive Officer and Director

|

|

President and Chief Executive Officer of Bel Fuse Inc.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Howard B. Bernstein,

Director

|

|

Currently retired. Former Vice President and Treasurer of Bel Fuse Inc.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Avi Eden,

Director

|

|

Independent Consultant for business development matters, including mergers and acquisitions for companies in the electronics industry.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Peter Gilbert,

Director

|

|

Currently retired. Former President and Chief Executive Officer of Gilbert Manufacturing Co., Inc., a manufacturer of electronics components.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

John S. Johnson,

Director

|

|

Independent consultant.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Robert H. Simandl,

Director

|

|

Attorney.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

John F. Tweedy,

Director

|

|

Member and operating manager of Tweedy Financial Services, LLC, a registered investment adviser.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Colin Dunn,

Vice President of Finance, Treasurer and Secretary

|

|

Vice President of Finance, Treasurer and Secretary of Bel Fuse Inc.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Dennis Ackerman,

Vice President of Operations

|

|

Vice President of Operations of Bel Fuse Inc.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

| |

|

|

|

|

|

Raymond Cheung,

Vice President Asia Operations

|

|

Vice President Asia Operations of Bel Fuse Inc.

|

|

c/o Bel Fuse Inc.

206 Van Vorst Street

Jersey City, New Jersey 07302

|

SCHEDULE II

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

All transactions were made in the open market

|

Class of

Security

|

Securities

Purchased

|

Price Per

Share ($)

|

Date of

Purchase

|

Bel Fuse Inc.

|

Common Stock

|

100

|

|

4.21

|

12/21/10

|

Bel Ventures Inc.

|

Common Stock

|

3,251

|

|

3.49

|

08/27/10

|

|

Common Stock

|

10,000

|

|

3.55

|

08/30/10

|

|

Common Stock

|

127,500

|

|

3.68

|

09/02/10

|

|

Common Stock

|

37,600

|

|

3.68

|

09/03/10

|

|

Common Stock

|

25,900

|

|

3.70

|

09/10/10

|

|

Common Stock

|

15,400

|

|

3.70

|

09/13/10

|

|

Common Stock

|

20,741

|

|

3.70

|

09/14/10

|

|

Common Stock

|

50,400

|

|

3.71

|

09/15/10

|

|

Common Stock

|

29,394

|

|

3.87

|

09/16/10

|

|

Common Stock

|

1,671

|

|

4.90

|

02/15/11

|

|

Common Stock

|

19,500

|

|

5.25

|

02/16/11

|

SCHEDULE III

The following table is reprinted from the Company’s proxy statement filed with the Securities and Exchange Commission on _________.

PERSONS OWNING MORE THAN FIVE PERCENT OF OUR STOCK

The following table describes persons we know to have beneficial ownership of more than 5% of our common stock at March 4, 2011. Our knowledge is based on reports filed with the Securities and Exchange Commission by each person or entity listed below. Beneficial ownership refers to shares of common stock that are held directly or indirectly by the owner. No other classes of stock are outstanding.

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

|

|

Ameriprise Financial, Inc.

145 Ameriprise Financial Center

Minneapolis, MN 55474

|

|

|

3,152,897 |

(1) |

|

|

7.60 |

% |

| |

|

|

|

|

|

|

|

|

|

BlackRock, Inc.

40 East 52nd Street

New York, NY 10022

|

|

|

3,098,478 |

(2) |

|

|

7.47 |

% |

| |

|

|

|

|

|

|

|

|

|

Royce and Associates, LLC

745 Fifth Avenue

New York, NY 10151

|

|

|

2,716,939 |

(3) |

|

|

6.55 |

% |

| |

|

|

|

|

|

|

|

|

|

Wells Fargo and Company

420 Montgomery Street

San Francisco, CA 94104

|

|

|

2,611,381 |

(4) |

|

|

6.29 |

% |

|

(1)

|

Of the 3,152,897 shares reported as beneficially owned by Ameriprise Financial, it has shared voting power over 2,466,932 shares and shared dispositive power over all 3,152,897 shares with its subsidiary Columbia Management Investment Advisers, LLC. This information is based on a Schedule 13G filed on February 11, 2011.

|

|

(2)

|

Of the 3,098,478 shares reported as beneficially owned by BlackRock, it has both sole voting power and sole dispositive power over all 3,098,478 shares. This information is based on a Schedule 13G/A filed on February 8, 2011.

|

|

(3)

|

Of the 2,716,939 shares reported as beneficially owned by Royce and Associates, it has both sole voting power and sole dispositive power over all 2,716,939 shares. This information is based on a Schedule 13G/A filed on January 20, 2011.

|

|

(4)

|

Of the 2,611,381 shares reported as beneficially owned by Wells Fargo, it has sole voting power over 1,853,938 shares and sole dispositive power over 2,611,181 shares. This information is based on a Schedule 13G/A filed on January 20, 2011.

|

STOCK OWNED BY DIRECTORS AND OFFICERS

The following table describes the beneficial ownership of common stock by each of our named executive officers, directors and nominees, and our named executive officers and directors as a group, at March 4, 2011:

|

|

|

Amount and Nature of Beneficial Ownership(1)

|

|

|

|

Alan H. Benjamin

|

|

|

102,697 |

(3) |

|

|

* |

|

|

John E. Burrows, Jr.

|

|

|

46,067 |

(2) |

|

|

* |

|

|

Justin C. Choi

|

|

|

0 |

|

|

|

0 |

|

|

Steven G. Crane

|

|

|

0 |

|

|

|

0 |

|

|

Howard C. Deck

|

|

|

19,084 |

(2) |

|

|

* |

|

|

Ralph E. Faison

|

|

|

0 |

|

|

|

* |

|

|

Edward M. Mazze

|

|

|

43,187 |

(2) |

|

|

* |

|

|

Michael J. McGrath

|

|

|

46,806 |

(2) |

|

|

* |

|

|

C. Mark Melliar-Smith

|

|

|

36,317 |

(2) |

|

|

* |

|

|

Drew A. Moyer

|

|

|

113,083 |

(4) |

|

|

* |

|

|

Lawrence P. Reinhold

|

|

|

0 |

|

|

|

0 |

|

|

Roger Shahnazarian

|

|

|

77,761 |

(2) |

|

|

* |

|

|

Directors and executive officers as a group (14 people)

|

|

|

654,229 |

|

|

|

1.48 |

% |

|

*

|

Less than one percent (1%).

|

|

(1)

|

Includes shares with restrictions and forfeiture risks under our restricted stock plan. Owners of restricted stock have the same voting and dividend rights as our other shareholders except they do not have the right to sell or transfer the shares until the applicable restricted period has ended. See “Compensation Discussion and Analysis — Long-Term Equity Incentives” on page 18.

|

|

(2)

|

All shares are directly owned by the officer or director.

|

|

(3)

|

Includes shares directly owned and shares owned by a trust of which Mr. Benjamin is a trustee.

|

|

(4)

|

Includes shares directly owned and shares owned jointly with spouse.

|

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many Shares you own, please give us your proxy FOR the election of our Nominees by taking three steps:

|

|

·

|

SIGNING the enclosed GOLD proxy card,

|

|

|

·

|

DATING the enclosed GOLD proxy card, and

|

|

|

·

|

MAILING the enclosed GOLD proxy card TODAY in the envelope provided (no postage is required if mailed in the United States).

|

If any of your Shares are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such Shares and only upon receipt of your specific instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed GOLD voting form.

If you have any questions or require any additional information concerning this Proxy Statement, please contact Alliance Advisors, LLC at the address set forth below.

| |

|

If you have any questions, require assistance in voting your GOLD proxy card,

or need additional copies of Bel Fuse’s proxy materials, please call

Alliance Advisors, LLC at the phone numbers or email listed below.

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

(973) 873-7706 (Call Collect)

whassan@allianceadvisorsllc.com

or

CALL TOLL FREE (877)-777-5017

|

| |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH 25, 2011

PULSE ELECTRONICS CORPORATION

2011 ANNUAL MEETING OF SHAREHOLDERS

THIS PROXY IS SOLICITED ON BEHALF OF BEL FUSE INC.

THE BOARD OF DIRECTORS OF PULSE ELECTRONICS CORPORATION

IS NOT SOLICITING THIS PROXY

P R O X Y