Live audio Web broadcast of the Bank’s analysts’ conference call. See page 91 for details. |

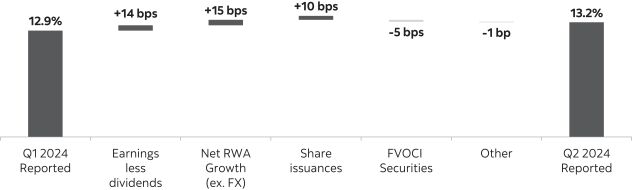

Quarterly Report to Shareholders Scotiabank reports second quarter results TORONTO, May 28, 2024 – Adjusted net income (1) for the second quarter was $2,105 million and adjusted diluted EPS(1) was $1.58, down from $1.69 last year. Adjusted return on equity(1) was 11.3% compared to 12.3% a year ago.“The Bank delivered solid results this quarter against a backdrop of ongoing macroeconomic uncertainty, reporting positive operating leverage driven by revenue growth and continued expense discipline. We are executing on our commitment to balanced growth as our deposit momentum continues, while maintaining strong capital and liquidity metrics,” said Scott Thomson, President and CEO of Scotiabank. “I am proud to see Scotiabankers across our global footprint rallying behind our new strategy and coming together to drive our key strategic initiatives forward.” Canadian Banking delivered adjusted earnings (1) of $1 billion this quarter. Solid revenue growth outpaced expense growth resulting in another quarter of positive operating leverage, while provision for credit losses increased compared to the prior year. In addition, deposit growth, a key component of the refreshed strategy, was up 7% year-over-year.International Banking generated adjusted earnings (1) of $701 million. Revenue growth driven by strong margin expansion, disciplined expense and capital management, were offset by higher provision for credit losses. Adjusted return on equity(1) was 14.5%, a 120 basis point improvement from last year.Global Wealth Management adjusted earnings (1) were $389 million, up 8% year over year. Assets under management(2) of $349 billion increased by 6% resulting in strong revenue growth, partly offset by investments to support long-term business growth.Global Banking and Markets reported earnings of $428 million, up 7% compared to the prior year. Results were supported by higher fee-based revenue and lower provision for credit losses. The Bank reported a Common Equity Tier 1 (CET1) capital ratio (3) of 13.2%, up from 12.3% last year.(1) Refer to Non-GAAP Measures section starting on page 5.(2) Refer to Glossary on page 55 for the description of the measure.(3) The Q2 2024 regulatory capital ratios are based on Revised Basel III requirements as determined in accordance with OSFI Guideline –Capital Adequacy Requirements (November 2023). The Q2 2023 regulatory capital ratios were based on Revised Basel III requirements as determined in accordance with OSFI Guideline – Capital Adequacy Requirements (February 2023). |

Reference Table for EDTF |

||||||||||||||||||||||||||

| Q2 2024 | 2023 Annual Report | |||||||||||||||||||||||||

| Type of risk | Number | Disclosure | Quarterly Report |

Supplementary Regulatory Capital Disclosures |

MD&A | Financial Statements |

||||||||||||||||||||

General |

1 | The index of risks to which the business is exposed. | 16 | |||||||||||||||||||||||

| 2 | The Bank’s risk to terminology, measures and key parameters. | 75-79 |

||||||||||||||||||||||||

| 3 | Top and emerging risks, and the changes during the reporting period. | 81-82, 86-93 |

||||||||||||||||||||||||

| 4 | Discussion on the regulatory development and plans to meet new regulatory ratios. | 50-53 | |

56-59, 101-104, 117-119 |

|

|||||||||||||||||||||

| Risk governance, risk management and business model | 5 | The Bank’s Risk Governance structure. | 73-75 |

|||||||||||||||||||||||

| 6 | Description of risk culture and procedures applied to support the culture. | 75-79 |

||||||||||||||||||||||||

| 7 | Description of key risks from the Bank’s business model. | 80 | ||||||||||||||||||||||||

| 8 | Stress testing use within the Bank’s risk governance and capital management. | 76-77 |

||||||||||||||||||||||||

| Capital Adequacy and risk-weighted assets | 9 | Pillar 1 capital requirements, and the impact for global systemically important banks. | 50-51 | 4-5 |

56-59 |

210 | ||||||||||||||||||||

| 10 | a) Regulatory capital components. | 50-51, 79 | 22-24 |

60 | ||||||||||||||||||||||

| b) Reconciliation of the accounting balance sheet to the regulatory balance sheet. | 19-20 |

|||||||||||||||||||||||||

| 11 | Flow statement of the movements in regulatory capital since the previous reporting period, including changes in common equity tier 1, additional tier 1 and tier 2 capital. | 50-51 | 91 | 61-62 |

||||||||||||||||||||||

| 12 | Discussion of targeted level of capital, and the plans on how to establish this. | 56-59 |

||||||||||||||||||||||||

| 13 | Analysis of risk-weighted assets by risk type, business, and market risk RWAs. | |

7, 37-40, 44-61, 70-75, 79, 94, 100 |

|

64-68, 80, 127 |

179, 233 | ||||||||||||||||||||

| 14 | Analysis of the capital requirements for each Basel asset class. | |

17-18, 37-62, 68-75, 79, 84-87 |

|

64-68 |

|

179, 227-233 |

| ||||||||||||||||||

| 15 | Tabulate credit risk in the Banking Book. | 83-84 | 17-18, 37-62, 84-87 |

64-68 |

228 | |||||||||||||||||||||

| 16 | Flow statements reconciling the movements in risk-weighted assets for each risk-weighted asset type. | 63, 78, 93 | 64-68 |

|||||||||||||||||||||||

| 17 | Discussion of Basel III Back-testing requirement including credit risk model performance and validation. | 98 | 65-67 |

|||||||||||||||||||||||

| Liquidity Funding | 18 | Analysis of the Bank’s liquid assets. | 41-44 | 98-104 |

||||||||||||||||||||||

| 19 | Encumbered and unencumbered assets analyzed by balance sheet category. | 41-44 | 101 | |||||||||||||||||||||||

| 20 | Consolidated total assets, liabilities and off-balance sheet commitments analyzed by remaining contractual maturity at the balance sheet date. |

48-49 | 105-107 |

|||||||||||||||||||||||

| 21 | Analysis of the Bank’s sources of funding and a description of the Bank’s funding strategy. | 46-47 | 104-105 |

|||||||||||||||||||||||

| Market Risk | 22 | Linkage of market risk measures for trading and non-trading portfolios and the balance sheet. |

40-41 | 97-98 |

||||||||||||||||||||||

| 23 | Discussion of significant trading and non-trading market risk factors. |

85 | 93-98 |

232-233 |

||||||||||||||||||||||

| 24 | Discussion of changes in period on period VaR results as well as VaR assumptions, limitations, backtesting and validation. | 39-40, 85 | 93-98 |

232-233 |

||||||||||||||||||||||

| 25 | Other risk management techniques e.g. stress tests, stressed VaR, tail risk and market liquidity horizon. | 93-98 |

233 | |||||||||||||||||||||||

| Credit Risk | 26 | Analysis of the aggregate credit risk exposures, including details of both personal and wholesale lending. | |

7, 37-40, 44-61, 70-75 |

|

86-93, 121-127 |

|

189-190, 229-231 |

| |||||||||||||||||

| 27 | Discussion of the policies for identifying impaired loans, defining impairments and renegotiated loans, and explaining loan forbearance policies. | |

158-160, 190 |

| ||||||||||||||||||||||

| 28 | Reconciliations of the opening and closing balances of impaired loans and impairment allowances during the year. | 68 | 34-35 |

|

89, 121-122, 124-125 |

|

190 | |||||||||||||||||||

| 29 | Analysis of counterparty credit risk that arises from derivative transactions. | |

51-52, 83-84 |

|

99 | 84-85 |

177-180 |

|||||||||||||||||||

| 30 | Discussion of credit risk mitigation, including collateral held for all sources of credit risk. | 83-84 | 84-85, 90 |

|||||||||||||||||||||||

Other risks |

31 | Quantified measures of the management of operational risk. | 68, 108 | |||||||||||||||||||||||

| 32 | Discussion of publicly known risk items. | 52 | 72 | |||||||||||||||||||||||

2 |

Scotiabank Second Quarter Report 2024 |

Contents | ||||

Management’s Discussion and Analysis | ||

4 |

Financial Highlights | |

5 |

Non-GAAP Measures | |

16 |

Overview of Performance | |

18 |

Group Financial Performance | |

20 |

Business Segment Review | |

| Scotiabank Second Quarter Report 2024 | 3 |

| As at and for the three months ended | As at and for the six months ended |

|||||||||||||||||||

(Unaudited) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Operating results ($ millions) |

||||||||||||||||||||

Net interest income |

4,694 |

4,773 | 4,460 | 9,467 |

9,023 | |||||||||||||||

Non-interest income |

3,653 |

3,660 | 3,453 | 7,313 |

6,852 | |||||||||||||||

Total revenue |

8,347 |

8,433 | 7,913 | 16,780 |

15,875 | |||||||||||||||

Provision for credit losses |

1,007 |

962 | 709 | 1,969 |

1,347 | |||||||||||||||

Non-interest expenses |

4,711 |

4,739 | 4,574 | 9,450 |

9,035 | |||||||||||||||

Income tax expense |

537 |

533 | 484 | 1,070 |

1,589 | |||||||||||||||

Net income |

2,092 |

2,199 | 2,146 | 4,291 |

3,904 | |||||||||||||||

Net income attributable to common shareholders |

1,943 |

2,066 | 2,018 | 4,009 |

3,638 | |||||||||||||||

Operating performance |

||||||||||||||||||||

Basic earnings per share ($) |

1.59 |

1.70 | 1.69 | 3.29 |

3.05 | |||||||||||||||

Diluted earnings per share ($) |

1.57 |

1.68 | 1.68 | 3.25 |

3.02 | |||||||||||||||

Return on equity (%) (2) |

11.2 |

11.8 | 12.2 | 11.6 |

11.0 | |||||||||||||||

Return on tangible common equity (%) (3) |

13.8 |

14.6 | 15.3 | 14.2 |

13.8 | |||||||||||||||

Productivity ratio (%) (2) |

56.4 |

56.2 | 57.8 | 56.3 |

56.9 | |||||||||||||||

Net interest margin (%) (3) |

2.17 |

2.19 | 2.12 | 2.18 |

2.12 | |||||||||||||||

Financial position information ($ millions) |

||||||||||||||||||||

Cash and deposits with financial institutions |

58,631 |

67,249 | 63,893 | |||||||||||||||||

Trading assets |

132,280 |

126,387 | 114,695 | |||||||||||||||||

Loans |

753,526 |

743,892 | 764,068 | |||||||||||||||||

Total assets |

1,399,430 |

1,392,886 | 1,373,466 | |||||||||||||||||

Deposits |

942,028 |

939,773 | 945,538 | |||||||||||||||||

Common equity |

70,577 |

69,977 | 69,051 | |||||||||||||||||

Preferred shares and other equity instruments |

8,779 |

8,779 | 8,075 | |||||||||||||||||

Assets under administration (2) |

738,927 |

715,941 | 684,170 | |||||||||||||||||

Assets under management (2) |

348,644 |

339,604 | 329,502 | |||||||||||||||||

Capital and liquidity measures |

||||||||||||||||||||

Common Equity Tier 1 (CET1) capital ratio (%) (4) |

13.2 |

12.9 | 12.3 | |||||||||||||||||

Tier 1 capital ratio (%) (4) |

15.2 |

14.8 | 14.1 | |||||||||||||||||

Total capital ratio (%) (4) |

17.1 |

16.7 | 16.2 | |||||||||||||||||

Total loss absorbing capacity (TLAC) ratio (%) (5) |

28.9 |

28.9 | 28.3 | |||||||||||||||||

Leverage ratio (%) (6) |

4.4 |

4.3 | 4.2 | |||||||||||||||||

TLAC Leverage ratio (%) (5) |

8.4 |

8.4 | 8.4 | |||||||||||||||||

Risk-weighted assets ($ millions) (4) |

450,191 |

451,018 | 451,063 | |||||||||||||||||

Liquidity coverage ratio (LCR) (%) (7) |

129 |

132 | 131 | |||||||||||||||||

Net stable funding ratio (NSFR) (%) (8) |

117 |

117 | 111 | |||||||||||||||||

Credit quality |

||||||||||||||||||||

Net impaired loans ($ millions) |

4,399 |

4,215 | 3,554 | |||||||||||||||||

Allowance for credit losses ($ millions) (9) |

6,768 |

6,597 | 5,931 | |||||||||||||||||

Gross impaired loans as a % of loans and acceptances (2) |

0.83 |

0.80 | 0.67 | |||||||||||||||||

Net impaired loans as a % of loans and acceptances (2) |

0.57 |

0.55 | 0.45 | |||||||||||||||||

Provision for credit losses as a % of average net loans and acceptances (annualized) (2)(10) |

0.54 |

0.50 | 0.37 | 0.52 |

0.35 | |||||||||||||||

Provision for credit losses on impaired loans as a % of average net loans and acceptances (annualized) (2)(10) |

0.52 |

0.49 | 0.33 | 0.51 |

0.31 | |||||||||||||||

Net write-offs as a % of average net loans and acceptances (annualized) (2) |

0.48 |

0.42 | 0.29 | 0.45 |

0.29 | |||||||||||||||

Adjusted results (3) |

||||||||||||||||||||

Adjusted net income ($ millions) |

2,105 |

2,212 | 2,161 | 4,317 |

4,513 | |||||||||||||||

Adjusted diluted earnings per share ($) |

1.58 |

1.69 | 1.69 | 3.27 |

3.53 | |||||||||||||||

Adjusted return on equity (%) |

11.3 |

11.9 | 12.3 | 11.6 |

12.8 | |||||||||||||||

Adjusted return on tangible common equity (%) |

13.8 |

14.6 | 15.3 | 14.2 |

16.0 | |||||||||||||||

Adjusted productivity ratio (%) |

56.2 |

56.0 | 57.5 | 56.1 |

56.6 | |||||||||||||||

Common share information |

||||||||||||||||||||

Closing share price ($) |

63.16 |

62.87 | 67.63 | |||||||||||||||||

Shares outstanding (millions) |

||||||||||||||||||||

Average – Basic |

1,223 |

1,214 | 1,192 | 1,218 |

1,192 | |||||||||||||||

Average – Diluted |

1,228 |

1,221 | 1,197 | 1,225 |

1,199 | |||||||||||||||

End of period |

1,230 |

1,222 | 1,198 | |||||||||||||||||

Dividends paid per share ($) |

1.06 |

1.06 | 1.03 | 2.12 |

2.06 | |||||||||||||||

Dividend yield (%) (2) |

6.4 |

7.0 | 6.0 | 6.7 |

6.0 | |||||||||||||||

Market capitalization ($ millions) |

77,660 |

76,835 | 81,033 | |||||||||||||||||

Book value per common share ($) (2) |

57.40 |

57.26 | 57.63 | |||||||||||||||||

Market value to book value multiple (2) |

1.1 |

1.1 | 1.2 | |||||||||||||||||

Price to earnings multiple (trailing 4 quarters) (2) |

10.5 |

10.3 | 10.0 | |||||||||||||||||

Other information |

||||||||||||||||||||

Employees (full-time equivalent) |

89,090 |

89,249 | 91,030 | |||||||||||||||||

Branches and offices |

2,316 |

2,351 | 2,398 | |||||||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Refer to Glossary on page 55 for the description of the measure. |

| (3) | Refer to Non-GAAP Measures section starting on page 5. |

| (4) | Commencing Q1 2024, regulatory capital ratios are based on Revised Basel III requirements as determined in accordance with OSFI Guideline – Capital Adequacy Requirements (November 2023). The Q2 2023 regulatory capital ratios were based on Revised Basel III requirements as determined in accordance with OSFI Guideline – Capital Adequacy Requirements (February 2023). |

| (5) | This measure has been disclosed in this document in accordance with OSFI Guideline – Total Loss Absorbing Capacity (September 2018). |

| (6) | The leverage ratios are based on Revised Basel III requirements as determined in accordance with OSFI Guideline – Leverage Requirements (February 2023). |

| (7) | This measure has been disclosed in this document in accordance with OSFI Guideline – Public Disclosure Requirements for Domestic Systemically Important Banks on Liquidity Coverage Ratio (April 2015). |

| (8) | This measure has been disclosed in this document in accordance with OSFI Guideline – Net Stable Funding Ratio Disclosure Requirements (January 2021). |

| (9) | Includes allowance for credit losses on all financial assets – loans, acceptances, off-balance sheet exposures, debt securities and deposits with financial institutions. |

| (10) | Includes provision for credit losses on certain financial assets – loans, acceptances and off-balance sheet exposures. |

4 |

Scotiabank Second Quarter Report 2024 |

| Scotiabank Second Quarter Report 2024 | 5 |

| For the three months ended | For the six months ended | |||||||||||||||||||

($ millions) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Reported Results |

||||||||||||||||||||

Net interest income |

$ |

4,694 |

$ | 4,773 | $ | 4,460 | $ |

9,467 |

$ | 9,023 | ||||||||||

Non-interest income |

3,653 |

3,660 | 3,453 | 7,313 |

6,852 | |||||||||||||||

Total revenue |

8,347 |

8,433 | 7,913 | 16,780 |

15,875 | |||||||||||||||

Provision for credit losses |

1,007 |

962 | 709 | 1,969 |

1,347 | |||||||||||||||

Non-interest expenses |

4,711 |

4,739 | 4,574 | 9,450 |

9,035 | |||||||||||||||

Income before taxes |

2,629 |

2,732 | 2,630 | 5,361 |

5,493 | |||||||||||||||

Income tax expense |

537 |

533 | 484 | 1,070 |

1,589 | |||||||||||||||

Net income |

$ |

2,092 |

$ | 2,199 | $ | 2,146 | $ |

4,291 |

$ | 3,904 | ||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

26 |

25 | 24 | 51 |

61 | |||||||||||||||

Net income attributable to equity holders |

2,066 |

2,174 | 2,122 | 4,240 |

3,843 | |||||||||||||||

Net income attributable to preferred shareholders and other equity instrument holders |

123 |

108 | 104 | 231 |

205 | |||||||||||||||

Net income attributable to common shareholders |

$ |

1,943 |

$ | 2,066 | $ | 2,018 | $ |

4,009 |

$ | 3,638 | ||||||||||

Diluted earnings per share (in dollars) |

$ |

1.57 |

$ | 1.68 | $ | 1.68 | $ |

3.25 |

$ | 3.02 | ||||||||||

Weighted average number of diluted common shares outstanding (millions) |

1,228 |

1,221 | 1,197 | 1,225 |

1,199 | |||||||||||||||

Adjustments |

||||||||||||||||||||

Adjusting items impacting non-interest expenses (Pre-tax) |

||||||||||||||||||||

Amortization of acquisition-related intangible assets |

$ |

18 |

$ | 18 | $ | 21 | $ |

36 |

$ | 42 | ||||||||||

Total non-interest expense adjusting items (Pre-tax) |

18 |

18 | 21 | 36 |

42 | |||||||||||||||

Total impact of adjusting items on net income before taxes |

18 |

18 | 21 | 36 |

42 | |||||||||||||||

Impact of adjusting items on income tax expense |

||||||||||||||||||||

Canada recovery dividend |

– |

– | – | – |

579 | |||||||||||||||

Amortization of acquisition-related intangible assets |

(5 |

) |

(5 | ) | (6 | ) | (10 |

) |

(12 | ) | ||||||||||

Total impact of adjusting items on income tax expense |

(5 |

) |

(5 | ) | (6 | ) | (10 |

) |

567 | |||||||||||

Total impact of adjusting items on net income |

$ |

13 |

$ | 13 | $ | 15 | $ |

26 |

$ | 609 | ||||||||||

Impact of adjusting items on NCI |

– |

– | – | – |

– | |||||||||||||||

Total impact of adjusting items on net income attributable to equity holders and common shareholders |

$ |

13 |

$ | 13 | $ | 15 | $ |

26 |

$ | 609 | ||||||||||

Adjusted Results |

||||||||||||||||||||

Net interest income |

$ |

4,694 |

$ | 4,773 | $ | 4,460 | $ |

9,467 |

$ | 9,023 | ||||||||||

Non-interest income |

3,653 |

3,660 | 3,453 | 7,313 |

6,852 | |||||||||||||||

Total revenue |

8,347 |

8,433 | 7,913 | 16,780 |

15,875 | |||||||||||||||

Provision for credit losses |

1,007 |

962 | 709 | 1,969 |

1,347 | |||||||||||||||

Non-interest expenses |

4,693 |

4,721 | 4,553 | 9,414 |

8,993 | |||||||||||||||

Income before taxes |

2,647 |

2,750 | 2,651 | 5,397 |

5,535 | |||||||||||||||

Income tax expense |

542 |

538 | 490 | 1,080 |

1,022 | |||||||||||||||

Net income |

$ |

2,105 |

$ | 2,212 | $ | 2,161 | $ |

4,317 |

$ | 4,513 | ||||||||||

Net income attributable to NCI |

26 |

25 | 24 | 51 |

61 | |||||||||||||||

Net income attributable to equity holders |

2,079 |

2,187 | 2,137 | 4,266 |

4,452 | |||||||||||||||

Net income attributable to preferred shareholders and other equity instrument holders |

123 |

108 | 104 | 231 |

205 | |||||||||||||||

Net income attributable to common shareholders |

$ |

1,956 |

$ | 2,079 | $ | 2,033 | $ |

4,035 |

$ | 4,247 | ||||||||||

Diluted earnings per share (in dollars) |

$ |

1.58 |

$ | 1.69 | $ | 1.69 | $ |

3.27 |

$ | 3.53 | ||||||||||

Impact of adjustments on diluted earnings per share (in dollars) |

$ |

0.01 |

$ | 0.01 | $ | 0.01 | $ |

0.02 |

$ | 0.51 | ||||||||||

Weighted average number of diluted common shares outstanding (millions) |

1,228 |

1,221 | 1,197 | 1,225 |

1,199 | |||||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

6 |

Scotiabank Second Quarter Report 2024 |

1. |

All reported periods were adjusted for: |

2. |

The Bank’s fiscal 2023 reported results were adjusted for the following items. These amounts were recorded in the Other operating segment. |

3. |

The Bank’s Q4 2022 reported results were adjusted for the following items. These amounts were recorded in the Other operating segment. |

| a) | Restructuring charge – The Bank recorded a restructuring charge of $85 million ($66 million after-tax) related to the realignment of the Global Banking and Markets businesses in Asia Pacific and reductions in technology employees, driven by ongoing technology modernization and digital transformation. |

| b) | Divestitures and wind-down of operations – The Bank sold investments in associates in Venezuela and Thailand. Additionally, the Bank wound down its operations in India and Malaysia in relation to its realignment of the business in the Asia Pacific region. Collectively, the sale and wind-down of these entities resulted in a net loss of $361 million ($340 million after-tax). |

| c) | Support costs for the Scene+ loyalty program – The Bank recorded costs of $133 million ($98 million after-tax) to support the expansion of the Scene+ loyalty program to include Empire Company Limited as a partner. |

| Scotiabank Second Quarter Report 2024 | 7 |

For the three months ended April 30, 2024 (1) |

||||||||||||||||||||||||

($ millions) |

Canadian Banking (2) |

International Banking (2) |

Global Wealth Management |

Global Banking and Markets |

Other |

Total (2) |

||||||||||||||||||

Reported net income (loss) |

$ |

1,008 |

$ |

695 |

$ |

382 |

$ |

428 |

$ |

(421 |

) |

$ |

2,092 |

|||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

– |

24 |

2 |

– |

– |

26 |

||||||||||||||||||

Reported net income attributable to equity holders |

1,008 |

671 |

380 |

428 |

(421 |

) |

2,066 |

|||||||||||||||||

Reported net income attributable to preferred shareholders and other equity instrument holders |

– |

– |

– |

– |

123 |

123 |

||||||||||||||||||

Reported net income attributable to common shareholders |

$ |

1,008 |

$ |

671 |

$ |

380 |

$ |

428 |

$ |

(544 |

) |

$ |

1,943 |

|||||||||||

Adjustments: |

||||||||||||||||||||||||

Adjusting items impacting non-interest expenses (Pre-tax) |

||||||||||||||||||||||||

Amortization of acquisition-related intangible assets |

1 |

8 |

9 |

– |

– |

18 |

||||||||||||||||||

Total non-interest expenses adjustments (Pre-tax) |

1 |

8 |

9 |

– |

– |

18 |

||||||||||||||||||

Total impact of adjusting items on net income before taxes |

1 |

8 |

9 |

– |

– |

18 |

||||||||||||||||||

Impact of adjusting items on income tax expense |

(1 |

) |

(2 |

) |

(2 |

) |

– |

– |

(5 |

) | ||||||||||||||

Total impact of adjusting items on net income |

– |

6 |

7 |

– |

– |

13 |

||||||||||||||||||

Total impact of adjusting items on net income attributable to equity holders and common shareholders |

– |

6 |

7 |

– |

– |

13 |

||||||||||||||||||

Adjusted net income (loss) |

$ |

1,008 |

$ |

701 |

$ |

389 |

$ |

428 |

$ |

(421 |

) |

$ |

2,105 |

|||||||||||

Adjusted net income attributable to equity holders |

$ |

1,008 |

$ |

677 |

$ |

387 |

$ |

428 |

$ |

(421 |

) |

$ |

2,079 |

|||||||||||

Adjusted net income attributable to common shareholders |

$ |

1,008 |

$ |

677 |

$ |

387 |

$ |

428 |

$ |

(544 |

) |

$ |

1,956 |

|||||||||||

| (1) | Refer to Business Segment Review on page 20. |

| (2) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| For the three months ended January 31, 2024 (1) |

||||||||||||||||||||||||

($ millions) |

Canadian Banking (2) |

International Banking (2) |

Global Wealth Management |

Global Banking and Markets |

Other | Total (2) |

||||||||||||||||||

Reported net income (loss) |

$ | 1,095 | $ | 768 | $ | 371 | $ | 439 | $ | (474 | ) | $ | 2,199 | |||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

– | 22 | 3 | – | – | 25 | ||||||||||||||||||

Reported net income attributable to equity holders |

1,095 | 746 | 368 | 439 | (474 | ) | 2,174 | |||||||||||||||||

Reported net income attributable to preferred shareholders and other equity instrument holders |

1 | 1 | – | 1 | 105 | 108 | ||||||||||||||||||

Reported net income attributable to common shareholders |

$ | 1,094 | $ | 745 | $ | 368 | $ | 438 | $ | (579 | ) | $ | 2,066 | |||||||||||

Adjustments: |

||||||||||||||||||||||||

Adjusting items impacting non-interest expenses (Pre-tax) |

||||||||||||||||||||||||

Amortization of acquisition-related intangible assets |

1 | 8 | 9 | – | – | 18 | ||||||||||||||||||

Total non-interest expenses adjustments (Pre-tax) |

1 | 8 | 9 | – | – | 18 | ||||||||||||||||||

Total impact of adjusting items on net income before taxes |

1 | 8 | 9 | – | – | 18 | ||||||||||||||||||

Impact of adjusting items on income tax expense |

– | (2 | ) | (3 | ) | – | – | (5 | ) | |||||||||||||||

Total impact of adjusting items on net income |

1 | 6 | 6 | – | – | 13 | ||||||||||||||||||

Total impact of adjusting items on net income attributable to equity holders and common shareholders |

1 | 6 | 6 | – | – | 13 | ||||||||||||||||||

Adjusted net income (loss) |

$ | 1,096 | $ | 774 | $ | 377 | $ | 439 | $ | (474 | ) | $ | 2,212 | |||||||||||

Adjusted net income attributable to equity holders |

$ | 1,096 | $ | 752 | $ | 374 | $ | 439 | $ | (474 | ) | $ | 2,187 | |||||||||||

Adjusted net income attributable to common shareholders |

$ | 1,095 | $ | 751 | $ | 374 | $ | 438 | $ | (579 | ) | $ | 2,079 | |||||||||||

| (1) | Refer to Business Segment Review on page 20. |

| (2) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

8 |

Scotiabank Second Quarter Report 2024 |

| For the three months ended April 30, 2023 (1) |

||||||||||||||||||||||||

($ millions) |

Canadian Banking (2) |

International Banking (2) |

Global Wealth Management |

Global Banking and Markets |

Other | Total (2) |

||||||||||||||||||

Reported net income (loss) |

$ | 1,055 | $ | 657 | $ | 356 | $ | 401 | $ | (323 | ) | $ | 2,146 | |||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

– | 21 | 3 | – | – | 24 | ||||||||||||||||||

Reported net income attributable to equity holders |

1,055 | 636 | 353 | 401 | (323 | ) | 2,122 | |||||||||||||||||

Reported net income attributable to preferred shareholders and other equity instrument holders |

1 | 1 | 1 | 1 | 100 | 104 | ||||||||||||||||||

Reported net income attributable to common shareholders |

$ | 1,054 | $ | 635 | $ | 352 | $ | 400 | $ | (423 | ) | $ | 2,018 | |||||||||||

Adjustments: |

||||||||||||||||||||||||

Adjusting items impacting non-interest expenses (Pre-tax) |

||||||||||||||||||||||||

Amortization of acquisition-related intangible assets |

1 | 11 | 9 | – | – | 21 | ||||||||||||||||||

Total non-interest expenses adjustments (Pre-tax) |

1 | 11 | 9 | – | – | 21 | ||||||||||||||||||

Total impact of adjusting items on net income before taxes |

1 | 11 | 9 | – | – | 21 | ||||||||||||||||||

Impact of adjusting items on income tax expense |

– | (3 | ) | (3 | ) | – | – | (6 | ) | |||||||||||||||

Total impact of adjusting items on net income |

1 | 8 | 6 | – | – | 15 | ||||||||||||||||||

Total impact of adjusting items on net income attributable to equity holders and common shareholders |

1 | 8 | 6 | – | – | 15 | ||||||||||||||||||

Adjusted net income (loss) |

$ | 1,056 | $ | 665 | $ | 362 | $ | 401 | $ | (323 | ) | $ | 2,161 | |||||||||||

Adjusted net income attributable to equity holders |

$ | 1,056 | $ | 644 | $ | 359 | $ | 401 | $ | (323 | ) | $ | 2,137 | |||||||||||

Adjusted net income attributable to common shareholders |

$ | 1,055 | $ | 643 | $ | 358 | $ | 400 | $ | (423 | ) | $ | 2,033 | |||||||||||

| (1) | Refer to Business Segment Review on page 20. |

| (2) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

For the six months ended April 30, 2024 (1) |

||||||||||||||||||||||||

($ millions) |

Canadian Banking (2) |

International Banking (2) |

Global Wealth Management |

Global Banking and Markets |

Other |

Total (2) |

||||||||||||||||||

Reported net income (loss) |

$ |

2,103 |

$ |

1,463 |

$ |

753 |

$ |

867 |

$ |

(895 |

) |

$ |

4,291 |

|||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

– |

46 |

5 |

– |

– |

51 |

||||||||||||||||||

Reported net income attributable to equity holders |

2,103 |

1,417 |

748 |

867 |

(895 |

) |

4,240 |

|||||||||||||||||

Reported net income attributable to preferred shareholders and other equity instrument holders |

1 |

1 |

– |

1 |

228 |

231 |

||||||||||||||||||

Reported net income attributable to common shareholders |

$ |

2,102 |

$ |

1,416 |

$ |

748 |

$ |

866 |

$ |

(1,123 |

) |

$ |

4,009 |

|||||||||||

Adjustments: |

||||||||||||||||||||||||

Adjusting items impacting non-interest expenses (Pre-tax) |

||||||||||||||||||||||||

Amortization of acquisition-related intangible assets |

2 |

16 |

18 |

– |

– |

36 |

||||||||||||||||||

Total non-interest expenses adjustments (Pre-tax) |

2 |

16 |

18 |

– |

– |

36 |

||||||||||||||||||

Total impact of adjusting items on net income before taxes |

2 |

16 |

18 |

– |

– |

36 |

||||||||||||||||||

Impact of adjusting items on income tax expense |

(1 |

) |

(4 |

) |

(5 |

) |

– |

– |

(10 |

) | ||||||||||||||

Total impact of adjusting items on net income |

1 |

12 |

13 |

– |

– |

26 |

||||||||||||||||||

Total impact of adjusting items on net income attributable to equity holders and common shareholders |

1 |

12 |

13 |

– |

– |

26 |

||||||||||||||||||

Adjusted net income (loss) |

$ |

2,104 |

$ |

1,475 |

$ |

766 |

$ |

867 |

$ |

(895 |

) |

$ |

4,317 |

|||||||||||

Adjusted net income attributable to equity holders |

$ |

2,104 |

$ |

1,429 |

$ |

761 |

$ |

867 |

$ |

(895 |

) |

$ |

4,266 |

|||||||||||

Adjusted net income attributable to common shareholders |

$ |

2,103 |

$ |

1,428 |

$ |

761 |

$ |

866 |

$ |

(1,123 |

) |

$ |

4,035 |

|||||||||||

| (1) | Refer to Business Segment Review on page 20. |

| (2) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| Scotiabank Second Quarter Report 2024 | 9 |

| For the six months ended April 30, 2023 (1) |

||||||||||||||||||||||||

($ millions) |

Canadian Banking (2) |

International Banking (2) |

Global Wealth Management |

Global Banking and Markets |

Other | Total (2) |

||||||||||||||||||

Reported net income (loss) |

$ | 2,141 | $ | 1,336 | $ | 743 | $ | 920 | $ | (1,236 | ) | $ | 3,904 | |||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

– | 56 | 5 | – | – | 61 | ||||||||||||||||||

Reported net income attributable to equity holders |

2,141 | 1,280 | 738 | 920 | (1,236 | ) | 3,843 | |||||||||||||||||

Reported net income attributable to preferred shareholders and other equity instrument holders |

2 | 2 | 1 | 2 | 198 | 205 | ||||||||||||||||||

Reported net income attributable to common shareholders |

$ | 2,139 | $ | 1,278 | $ | 737 | $ | 918 | $ | (1,434 | ) | $ | 3,638 | |||||||||||

Adjustments: |

||||||||||||||||||||||||

Adjusting items impacting non-interest expenses (Pre-tax) Amortization of acquisition-related intangible assets |

3 | 21 | 18 | – | – | 42 | ||||||||||||||||||

Total non-interest expenses adjustments (Pre-tax) |

3 | 21 | 18 | – | – | 42 | ||||||||||||||||||

Total impact of adjusting items on net income before taxes |

3 | 21 | 18 | – | – | 42 | ||||||||||||||||||

Impact of adjusting items on income tax expense |

||||||||||||||||||||||||

Canada recovery dividend |

– | – | – | – | 579 | 579 | ||||||||||||||||||

Impact of other adjusting items on income tax expense |

(1 | ) | (6 | ) | (5 | ) | – | – | (12 | ) | ||||||||||||||

Total impact of adjusting items on income tax expense |

(1 | ) | (6 | ) | (5 | ) | – | 579 | 567 | |||||||||||||||

Total impact of adjusting items on net income |

2 | 15 | 13 | – | 579 | 609 | ||||||||||||||||||

Total impact of adjusting items on net income attributable to equity holders and common shareholders |

2 | 15 | 13 | – | 579 | 609 | ||||||||||||||||||

Adjusted net income (loss) |

$ | 2,143 | $ | 1,351 | $ | 756 | $ | 920 | $ | (657 | ) | $ | 4,513 | |||||||||||

Adjusted net income attributable to equity holders |

$ | 2,143 | $ | 1,295 | $ | 751 | $ | 920 | $ | (657 | ) | $ | 4,452 | |||||||||||

Adjusted net income attributable to common shareholders |

$ | 2,141 | $ | 1,293 | $ | 750 | $ | 918 | $ | (855 | ) | $ | 4,247 | |||||||||||

| (1) | Refer to Business Segment Review on page 20. |

| (2) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

Reported Results |

For the three months ended | For the six months ended | ||||||||||||||||||||||||||||||||||

($ millions) |

January 31, 2024 (1) |

April 30, 2023 (1) |

April 30, 2023 (1) |

|||||||||||||||||||||||||||||||||

(Taxable equivalent basis) |

Reported | Foreign exchange |

Constant dollar |

Reported | Foreign exchange |

Constant dollar |

Reported | Foreign exchange |

Constant dollar |

|||||||||||||||||||||||||||

Net interest income |

$ | 2,246 | $ | 19 | $ | 2,227 | $ | 1,999 | $ | 8 | $ | 1,991 | $ | 3,891 | $ | (82 | ) | $ | 3,973 | |||||||||||||||||

Non-interest income |

857 | 6 | 851 | 743 | (88 | ) | 831 | 1,535 | (163 | ) | 1,698 | |||||||||||||||||||||||||

Total revenue |

3,103 | 25 | 3,078 | 2,742 | (80 | ) | 2,822 | 5,426 | (245 | ) | 5,671 | |||||||||||||||||||||||||

Provision for credit losses |

574 | 6 | 568 | 436 | (3 | ) | 439 | 840 | (27 | ) | 867 | |||||||||||||||||||||||||

Non-interest expenses |

1,571 | 2 | 1,569 | 1,478 | (23 | ) | 1,501 | 2,911 | (98 | ) | 3,009 | |||||||||||||||||||||||||

Income tax expense |

190 | 4 | 186 | 171 | (10 | ) | 181 | 339 | (20 | ) | 359 | |||||||||||||||||||||||||

Net income |

$ | 768 | $ | 13 | $ | 755 | $ | 657 | $ | (44 | ) | $ | 701 | $ | 1,336 | $ | (100 | ) | $ | 1,436 | ||||||||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

$ | 22 | $ | – | $ | 22 | $ | 21 | $ | 2 | $ | 19 | $ | 56 | $ | 4 | $ | 52 | ||||||||||||||||||

Net income attributable to equity holders of the Bank |

$ | 746 | $ | 13 | $ | 733 | $ | 636 | $ | (46 | ) | $ | 682 | $ | 1,280 | $ | (104 | ) | $ | 1,384 | ||||||||||||||||

Other measures |

||||||||||||||||||||||||||||||||||||

Average assets ($ billions) |

$ | 236 | $ | 1 | $ | 235 | $ | 239 | $ | 3 | $ | 236 | $ | 233 | $ | (2 | ) | $ | 235 | |||||||||||||||||

Average liabilities ($ billions) |

$ | 184 | $ | 2 | $ | 182 | $ | 181 | $ | 4 | $ | 177 | $ | 175 | $ | (1 | ) | $ | 176 | |||||||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

10 |

Scotiabank Second Quarter Report 2024 |

Adjusted Results |

For the three months ended | For the six months ended | ||||||||||||||||||||||||||||||||||

($ millions) |

January 31, 2024 (1) |

April 30, 2023 (1) |

April 30, 2023 (1) |

|||||||||||||||||||||||||||||||||

(Taxable equivalent basis) |

Adjusted | Foreign exchange |

Constant dollar adjusted |

Adjusted | Foreign exchange |

Constant dollar adjusted |

Adjusted | Foreign exchange |

Constant dollar adjusted |

|||||||||||||||||||||||||||

Net interest income |

$ | 2,246 | $ | 19 | $ | 2,227 | $ | 1,999 | $ | 8 | $ | 1,991 | $ | 3,891 | $ | (82 | ) | $ | 3,973 | |||||||||||||||||

Non-interest income |

857 | 6 | 851 | 743 | (88 | ) | 831 | 1,535 | (163 | ) | 1,698 | |||||||||||||||||||||||||

Total revenue |

3,103 | 25 | 3,078 | 2,742 | (80 | ) | 2,822 | 5,426 | (245 | ) | 5,671 | |||||||||||||||||||||||||

Provision for credit losses |

574 | 6 | 568 | 436 | (3 | ) | 439 | 840 | (27 | ) | 867 | |||||||||||||||||||||||||

Non-interest expenses |

1,563 | 2 | 1,561 | 1,467 | (24 | ) | 1,491 | 2,890 | (99 | ) | 2,989 | |||||||||||||||||||||||||

Income tax expense |

192 | 4 | 188 | 174 | (10 | ) | 184 | 345 | (20 | ) | 365 | |||||||||||||||||||||||||

Net income |

$ | 774 | $ | 13 | $ | 761 | $ | 665 | $ | (43 | ) | $ | 708 | $ | 1,351 | $ | (99 | ) | $ | 1,450 | ||||||||||||||||

Net income attributable to non-controlling interests in subsidiaries (NCI) |

$ | 22 | $ | – | $ | 22 | $ | 21 | $ | 2 | $ | 19 | $ | 56 | $ | 4 | $ | 52 | ||||||||||||||||||

Net income attributable to equity holders of the Bank |

$ | 752 | $ | 13 | $ | 739 | $ | 644 | $ | (45 | ) | $ | 689 | $ | 1,295 | $ | (103 | ) | $ | 1,398 | ||||||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| Scotiabank Second Quarter Report 2024 | 11 |

| For the three months ended | For the six months ended | |||||||||||||||||||

($ millions) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Average total assets – Reported (2) |

$ |

1,411,181 |

$ | 1,423,337 | $ | 1,390,729 | $ |

1,417,472 |

$ | 1,385,836 | ||||||||||

Less: Non-earning assets |

108,405 |

110,932 | 111,531 | 109,849 |

115,611 | |||||||||||||||

Average total earning assets (2) |

$ |

1,302,776 |

$ | 1,312,405 | $ | 1,279,198 | $ |

1,307,623 |

$ | 1,270,225 | ||||||||||

Less: |

||||||||||||||||||||

Trading assets |

144,737 |

142,014 | 115,611 | 143,360 |

117,829 | |||||||||||||||

Securities purchased under resale agreements and securities borrowed |

191,661 |

194,807 | 189,757 | 193,251 |

182,227 | |||||||||||||||

Other deductions |

62,497 |

72,504 | 73,073 | 67,556 |

71,908 | |||||||||||||||

Average core earning assets (2) |

$ |

903,881 |

$ | 903,080 | $ | 900,757 | $ |

903,456 |

$ | 898,261 | ||||||||||

Net interest income – Reported |

$ |

4,694 |

$ | 4,773 | $ | 4,460 | $ |

9,467 |

$ | 9,023 | ||||||||||

Less: Non-core net interest income |

(139 |

) |

(198 | ) | (204 | ) | (337 |

) |

(409 | ) | ||||||||||

Core net interest income |

$ |

4,833 |

$ | 4,971 | $ | 4,664 | $ |

9,804 |

$ | 9,432 | ||||||||||

Net interest margin |

2.17 |

% |

2.19 | % | 2.12 | % | 2.18 |

% |

2.12 | % | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average balances represent the average of daily balances for the period. |

| For the three months ended | For the six months ended | |||||||||||||||||||

($ millions) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Average total assets – Reported (2) |

$ |

444,923 |

$ | 444,856 | $ | 450,634 | $ |

444,889 |

$ | 450,332 | ||||||||||

Less: Non-earning assets |

4,191 |

4,312 | 3,957 | 4,252 |

3,997 | |||||||||||||||

Average total earning assets (2) |

$ |

440,732 |

$ | 440,544 | $ | 446,677 | $ |

440,637 |

$ | 446,335 | ||||||||||

Less: |

||||||||||||||||||||

Other deductions |

22,421 |

28,843 | 28,655 | 25,667 |

27,958 | |||||||||||||||

Average core earning assets (2) |

$ |

418,311 |

$ | 411,701 | $ | 418,022 | $ |

414,970 |

$ | 418,377 | ||||||||||

Net interest income – Reported |

$ |

2,634 |

$ | 2,653 | $ | 2,342 | $ |

5,287 |

$ | 4,729 | ||||||||||

Less: Non-core net interest income |

– |

– | – | – |

– | |||||||||||||||

Core net interest income |

$ |

2,634 |

$ | 2,653 | $ | 2,342 | $ |

5,287 |

$ | 4,729 | ||||||||||

Net interest margin |

2.56 |

% |

2.56 | % | 2.30 | % | 2.56 |

% |

2.28 | % | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average balances represent the average of daily balances for the period. |

| For the three months ended | For the six months ended | |||||||||||||||||||

($ millions) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Average total assets – Reported (2) |

$ |

235,303 |

$ | 236,467 | $ | 238,705 | $ |

235,873 |

$ | 233,454 | ||||||||||

Less: Non-earning assets |

16,554 |

16,956 | 20,050 | 16,757 |

19,569 | |||||||||||||||

Average total earning assets (2) |

$ |

218,749 |

$ | 219,511 | $ | 218,655 | $ |

219,116 |

$ | 213,885 | ||||||||||

Less: |

||||||||||||||||||||

Trading assets |

6,534 |

6,778 | 6,059 | 6,657 |

5,587 | |||||||||||||||

Securities purchased under resale agreements and securities borrowed |

4,314 |

3,431 | 2,868 | 3,868 |

2,952 | |||||||||||||||

Other deductions |

7,640 |

7,731 | 7,240 | 7,686 |

7,406 | |||||||||||||||

Average core earning assets (2) |

$ |

200,261 |

$ | 201,571 | $ | 202,488 | $ |

200,905 |

$ | 197,940 | ||||||||||

Net interest income – Reported |

$ |

2,261 |

$ | 2,246 | $ | 1,999 | $ |

4,507 |

$ | 3,891 | ||||||||||

Less: Non-core net interest income |

60 |

35 | (28 | ) | 95 |

(82 | ) | |||||||||||||

Core net interest income |

$ |

2,201 |

$ | 2,211 | $ | 2,027 | $ |

4,412 |

$ | 3,973 | ||||||||||

Net interest margin |

4.47 |

% |

4.36 | % | 4.10 | % | 4.42 |

% |

4.05 | % | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average balances represent the average of daily balances for the period. |

12 |

Scotiabank Second Quarter Report 2024 |

For the three months ended April 30, 2024 |

||||||||||||||||||||||||

($ millions) |

Canadian Banking (1) |

International Banking (1) |

Global Wealth Management |

Global Banking and Markets |

Other |

Total (1) |

||||||||||||||||||

Reported |

||||||||||||||||||||||||

Net income attributable to common shareholders |

$ |

1,008 |

$ |

671 |

$ |

380 |

$ |

428 |

$ |

(544 |

) |

$ |

1,943 |

|||||||||||

Total average common equity (2)(3) |

20,507 |

18,927 |

10,222 |

14,865 |

5,756 |

70,277 |

||||||||||||||||||

Return on equity |

20.0 |

% |

14.4 |

% |

15.1 |

% |

11.7 |

% |

nm |

(4) |

11.2 |

% | ||||||||||||

Adjusted (5) |

||||||||||||||||||||||||

Net income attributable to common shareholders |

$ |

1,008 |

$ |

677 |

$ |

387 |

$ |

428 |

$ |

(544 |

) |

$ |

1,956 |

|||||||||||

Return on equity |

20.0 |

% |

14.5 |

% |

15.4 |

% |

11.7 |

% |

nm |

(4) |

11.3 |

% | ||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average amounts calculated using methods intended to approximate the daily average balances for the period. |

| (3) | Effective Q1 2024, the Bank increased the capital attributed to business lines to approximate 11.5% of Basel III common equity capital requirements. Previously, capital was attributed to approximate 10.5%. Prior period amounts have not been restated. |

| (4) | Not meaningful. |

| (5) | Refer to Tables on page 6. |

| For the three months ended January 31, 2024 | For the three months ended April 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

($ millions) |

Canadian Banking (1) |

International Banking (1) |

Global Wealth Management |

Global Banking and Markets |

Other | Total (1) |

Canadian Banking (1) |

International Banking (1) |

Global Wealth Management |

Global Banking and Markets |

Other | Total (1) |

||||||||||||||||||||||||||||||||||||

Reported |

||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to common shareholders |

$ |

1,094 |

$ |

745 |

$ |

368 |

$ |

438 |

$ |

(579 |

) |

$ |

2,066 |

$ |

1,054 |

$ |

635 |

$ |

352 |

$ |

400 |

$ |

(423 |

) |

$ |

2,018 |

||||||||||||||||||||||

Total average common equity (2)(3) |

20,015 |

19,398 |

10,193 |

15,734 |

4,032 |

69,372 |

19,077 |

19,866 |

9,732 |

15,587 |

3,312 |

67,574 |

||||||||||||||||||||||||||||||||||||

Return on equity |

21.7 |

% |

15.3 |

% |

14.3 |

% |

11.1 |

% |

nm |

(4) |

11.8 |

% |

22.7 |

% |

13.1 |

% |

14.8 |

% |

10.5 |

% |

nm |

(4) |

12.2 |

% | ||||||||||||||||||||||||

Adjusted (5) |

||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to common shareholders |

$ |

1,095 |

$ |

751 |

$ |

374 |

$ |

438 |

$ |

(579 |

) |

$ |

2,079 |

$ |

1,055 |

$ |

643 |

$ |

358 |

$ |

400 |

$ |

(423 |

) |

$ |

2,033 |

||||||||||||||||||||||

Return on equity |

21.8 |

% |

15.4 |

% |

14.6 |

% |

11.1 |

% |

nm |

(4) |

11.9 |

% |

22.7 |

% |

13.3 |

% |

15.1 |

% |

10.5 |

% |

nm |

(4) |

12.3 |

% | ||||||||||||||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average amounts calculated using methods intended to approximate the daily average balances for the period. |

| (3) | Effective Q1 2024, the Bank increased the capital attributed to business lines to approximate 11.5% of Basel III common equity capital requirements. Previously, capital was attributed to approximate 10.5%. Prior period amounts have not been restated. |

| (4) | Not meaningful. |

| (5) | Refer to Tables on page 6. |

| Scotiabank Second Quarter Report 2024 | 13 |

For the six months ended April 30, 2024 |

For the six months ended April 30, 2023 | |||||||||||||||||||||||||||||||||||||||||||||||

($ millions) |

Canadian Banking (1) |

International Banking (1) |

Global Wealth Management |

Global Banking and Markets |

Other |

Total (1) |

Canadian Banking (1) |

International Banking (1) |

Global Wealth Management |

Global Banking and Markets |

Other | Total (1) |

||||||||||||||||||||||||||||||||||||

Reported |

||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to common shareholders |

$ |

2,102 |

$ |

1,416 |

$ |

748 |

$ |

866 |

$ |

(1,123 |

) |

$ |

4,009 |

$ | 2,139 | $ | 1,278 | $ | 737 | $ | 918 | $ | (1,434 | ) | $ | 3,638 | ||||||||||||||||||||||

Total average common equity (2)(3) |

20,258 |

19,165 |

10,207 |

15,304 |

4,840 |

69,774 |

18,913 | 19,580 | 9,784 | 15,561 | 2,928 | 66,766 | ||||||||||||||||||||||||||||||||||||

Return on equity |

20.9 |

% |

14.9 |

% |

14.7 |

% |

11.4 |

% |

nm |

(4) |

11.6 |

% |

22.8 | % | 13.2 | % | 15.2 | % | 11.9 | % | nm | (4) |

11.0 | % | ||||||||||||||||||||||||

Adjusted (5) |

||||||||||||||||||||||||||||||||||||||||||||||||

Net income attributable to common shareholders |

$ |

2,103 |

$ |

1,428 |

$ |

761 |

$ |

866 |

$ |

(1,123 |

) |

$ |

4,035 |

$ | 2,141 | $ | 1,293 | $ | 750 | $ | 918 | $ | (855 | ) | $ | 4,247 | ||||||||||||||||||||||

Return on equity |

20.9 |

% |

15.0 |

% |

15.0 |

% |

11.4 |

% |

nm |

(4) |

11.6 |

% |

22.8 | % | 13.3 | % | 15.5 | % | 11.9 | % | nm | (4) |

12.8 | % | ||||||||||||||||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average amounts calculated using methods intended to approximate the daily average balances for the period. |

| (3) | Effective Q1 2024, the Bank increased the capital attributed to business lines to approximate 11.5% of Basel III common equity capital requirements. Previously, capital was attributed to approximate 10.5%. Prior period amounts have not been restated. |

| (4) | Not meaningful. |

| (5) | Refer to Tables on page 6. |

| For the three months ended | For the six months ended | |||||||||||||||||||

($ millions) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Average common equity – Reported (2) |

$ |

70,277 |

$ | 69,372 | $ | 67,574 | $ |

69,774 |

$ | 66,766 | ||||||||||

Average goodwill (2)(3) |

(9,065 |

) |

(9,108 | ) | (9,514 | ) | (9,104 |

) |

(9,409 | ) | ||||||||||

Average acquisition-related intangibles (net of deferred tax) (2) |

(3,635 |

) |

(3,651 | ) | (3,747 | ) | (3,644 |

) |

(3,754 | ) | ||||||||||

Average tangible common equity (2) |

$ |

57,577 |

$ | 56,613 | $ | 54,313 | $ |

57,026 |

$ | 53,603 | ||||||||||

Net income attributable to common shareholders – reported |

$ |

1,943 |

$ | 2,066 | $ | 2,018 | $ |

4,009 |

$ | 3,638 | ||||||||||

Amortization of acquisition-related intangible assets (after-tax) (4) |

13 |

13 | 15 | 26 |

30 | |||||||||||||||

Net income attributable to common shareholders adjusted for amortization of acquisition-related intangible assets (after-tax) |

$ |

1,956 |

$ | 2,079 | $ | 2,033 | $ |

4,035 |

$ | 3,668 | ||||||||||

Return on tangible common equity (5) |

13.8 |

% |

14.6 | % | 15.3 | % | 14.2 |

% |

13.8 | % | ||||||||||

Adjusted (4) |

||||||||||||||||||||

Adjusted net income attributable to common shareholders |

$ |

1,956 |

$ | 2,079 | $ | 2,033 | $ |

4,035 |

$ | 4,247 | ||||||||||

Return on tangible common equity – adjusted (5) |

13.8 |

% |

14.6 | % | 15.3 | % | 14.2 |

% |

16.0 | % | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Average amounts calculated using methods intended to approximate the daily average balances for the period. |

| (3) | Includes imputed goodwill from investments in associates. |

| (4) | Refer to Table on page 6. |

| (5) | Calculated on full dollar amounts. |

14 |

Scotiabank Second Quarter Report 2024 |

| Scotiabank Second Quarter Report 2024 | 15 |

16 |

Scotiabank Second Quarter Report 2024 |

| Average exchange rate | % Change | |||||||||||||||||||

| For the three months ended | April 30 2024 |

January 31 2024 |

April 30 2023 |

April 30, 2024 vs. January 31, 2024 |

April 30, 2024 vs. April 30, 2023 |

|||||||||||||||

U.S. dollar/Canadian dollar |

0.737 |

0.740 | 0.738 | (0.4 | )% | (0.1 | )% | |||||||||||||

Mexican Peso/Canadian dollar |

12.443 |

12.734 | 13.549 | (2.3 | )% | (8.2 | )% | |||||||||||||

Peruvian Sol/Canadian dollar |

2.762 |

2.772 | 2.799 | (0.4 | )% | (1.3 | )% | |||||||||||||

Colombian Peso/Canadian dollar |

2,871.913 |

2,932.809 | 3,469.331 | (2.1 | )% | (17.2 | )% | |||||||||||||

Chilean Peso/Canadian dollar |

710.545 |

659.613 | 594.071 | 7.7 | % | 19.6 | % | |||||||||||||

| Average exchange rate | % Change | |||||||||||||||||||

| For the six months ended | April 30 2024 |

April 30 2023 |

April 30, 2024 vs. April 30, 2023 |

|||||||||||||||||

U.S. dollar/Canadian dollar |

0.739 |

0.740 | (0.1 | )% | ||||||||||||||||

Mexican Peso/Canadian dollar |

12.590 |

13.952 | (9.8 | )% | ||||||||||||||||

Peruvian Sol/Canadian dollar |

2.767 |

2.827 | (2.1 | )% | ||||||||||||||||

Colombian Peso/Canadian dollar |

2,902.673 |

3,519.268 | (17.5 | )% | ||||||||||||||||

Chilean Peso/Canadian dollar |

684.800 |

620.625 | 10.3 | % | ||||||||||||||||

| For the three months ended | For the six months ended |

|||||||||||||||||||

| Impact on net income (1) ($ millions except EPS) |

April 30, 2024 vs. April 30, 2023 |

April 30, 2024 vs. January 31, 2024 |

April 30, 2024 vs. April 30, 2023 |

|||||||||||||||||

Net interest income |

$ | (27 | ) | $ | (20 | ) | $ | 70 | ||||||||||||

Non-interest income(2) |

24 | (46 | ) | 249 | ||||||||||||||||

Total revenue |

(3 | ) | (66 | ) | 319 | |||||||||||||||

Non-interest expenses |

(28 | ) | (2 | ) | (114 | ) | ||||||||||||||

Other items (net of tax) (2) |

– | 19 | (81 | ) | ||||||||||||||||

Net income |

$ | (31 | ) | $ | (49 | ) | $ | 124 | ||||||||||||

Earnings per share (diluted) |

$ | (0.03 | ) | $ | (0.04 | ) | $ | 0.10 | ||||||||||||

Impact by business line ($ millions) |

||||||||||||||||||||

Canadian Banking |

$ | – | $ | – | $ | – | ||||||||||||||

International Banking (2) |

(3 | ) | (15 | ) | 108 | |||||||||||||||

Global Wealth Management |

2 | – | 2 | |||||||||||||||||

Global Banking and Markets |

(1 | ) | 2 | (2 | ) | |||||||||||||||

Other (2) |

(29 | ) | (36 | ) | 16 | |||||||||||||||

Net income |

$ | (31 | ) | $ | (49 | ) | $ | 124 | ||||||||||||

| (1) | Includes the impact of all currencies. |

| (2) | Includes the impact of foreign currency hedges. |

| Scotiabank Second Quarter Report 2024 | 17 |

18 |

Scotiabank Second Quarter Report 2024 |

| Scotiabank Second Quarter Report 2024 | 19 |

| • | The Bank analyzes revenues on a taxable equivalent basis (TEB) for business lines. This methodology grosses up tax-exempt income earned on certain securities reported in either net interest income or non-interest income to an equivalent before tax basis. A corresponding increase is made to the provision for income taxes; hence, there is no impact on net income. Management believes that this basis for measurement provides a uniform comparability of net interest income and non-interest income arising from both taxable and non-taxable sources and facilitates a consistent basis of measurement. While other banks may also use TEB, their methodology may not be comparable to the Bank’s methodology. A segment’s revenue and provision for income taxes are grossed up by the taxable equivalent amount. The elimination of the TEB gross-up is recorded in the Other segment. |

| • | For business line performance assessment and reporting, net income from associated corporations, which is an after tax number, is adjusted to normalize for income taxes. The tax normalization adjustment grosses up the amount of net income from associated corporations and normalizes the effective tax rate in the business lines to better present the contribution of the associated corporations to the business line results. |

T8 TEB Gross-up |

||||||||||||||||||||

| For the three months ended | For the six months ended | |||||||||||||||||||

($ millions) |

April 30 2024 |

January 31 2024 |

April 30 2023 |

April 30 2024 |

April 30 2023 |

|||||||||||||||

Net interest income |

$ |

– |

$ | 2 | $ | 10 | $ |

2 |

$ | 20 | ||||||||||

Non-interest income |

4 |

41 | 109 | 45 |

219 | |||||||||||||||

Total revenue and provision for taxes |

$ |

4 |

$ | 43 | $ | 119 | $ |

47 |

$ | 239 | ||||||||||

Canadian Banking |

||||||||||||||||||||

T9 Canadian Banking financial performance |

||||||||||||||||||||

| For the three months ended | For the six months ended | |||||||||||||||||||

(Unaudited) ($ millions) (Taxable equivalent basis) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Reported Results |

||||||||||||||||||||

Net interest income |

$ |

2,634 |

$ | 2,653 | $ | 2,342 | $ |

5,287 |

$ | 4,729 | ||||||||||

Non-interest income(2) |

702 |

734 | 786 | 1,436 |

1,562 | |||||||||||||||

Total revenue |

3,336 |

3,387 | 3,128 | 6,723 |

6,291 | |||||||||||||||

Provision for credit losses |

428 |

378 | 218 | 806 |

436 | |||||||||||||||

Non-interest expenses |

1,518 |

1,498 | 1,456 | 3,016 |

2,905 | |||||||||||||||

Income tax expense |

382 |

416 | 399 | 798 |

809 | |||||||||||||||

Net income |

$ |

1,008 |

$ | 1,095 | $ | 1,055 | $ |

2,103 |

$ | 2,141 | ||||||||||

Net income attributable to non-controlling interests in subsidiaries |

$ |

– |

$ | – | $ | – | $ |

– |

$ | – | ||||||||||

Net income attributable to equity holders of the Bank |

$ |

1,008 |

$ | 1,095 | $ | 1,055 | $ |

2,103 |

$ | 2,141 | ||||||||||

Other financial data and measures |

||||||||||||||||||||

Return on equity (3) |

20.0 |

% |

21.7 | % | 22.7 | % | 20.9 |

% |

22.8 | % | ||||||||||

Net interest margin (3) |

2.56 |

% |

2.56 | % | 2.30 | % | 2.56 |

% |

2.28 | % | ||||||||||

Provision for credit losses – performing (Stage 1 and 2) |

$ |

29 |

$ | 12 | $ | (5 | ) | $ |

41 |

$ | 26 | |||||||||

Provision for credit losses – impaired (Stage 3) |

$ |

399 |

$ | 366 | $ | 223 | $ |

765 |

$ | 410 | ||||||||||

Provision for credit losses as a percentage of average net loans and acceptances (annualized) (4) |

0.40 |

% |

0.34 | % | 0.20 | % | 0.37 |

% |

0.20 | % | ||||||||||

Provision for credit losses on impaired loans as a percentage of average net loans and acceptances (annualized) (4) |

0.37 |

% |

0.33 | % | 0.21 | % | 0.35 |

% |

0.19 | % | ||||||||||

Net write-offs as a percentage of average net loans and acceptances (annualized) (4) |

0.33 |

% |

0.29 | % | 0.18 | % | 0.31 |

% |

0.17 | % | ||||||||||

Average assets ($ billions) |

$ |

445 |

$ | 445 | $ | 451 | $ |

445 |

$ | 450 | ||||||||||

Average liabilities ($ billions) |

$ |

389 |

$ | 393 | $ | 367 | $ |

391 |

$ | 362 | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Includes income (on a taxable equivalent basis) from associated corporations for the three months ended April 30, 2024 – $(7) (January 31, 2024 – nil; April 30, 2023 – $25) and for six months ended April 30, 2024 – $(7) (April 30 2023 – $40). |

| (3) | Refer to Non-GAAP Measures starting on page 5. |

| (4) | Refer to Glossary on page 55 for the description of the measure. |

20 |

Scotiabank Second Quarter Report 2024 |

T9A Adjusted Canadian Banking financial performance |

||||||||||||||||||||

| For the three months ended | For the six months ended | |||||||||||||||||||

(Unaudited) ($ millions) (Taxable equivalent basis) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Adjusted Results (2) |

||||||||||||||||||||

Net interest income |

$ |

2,634 |

$ | 2,653 | $ | 2,342 | $ |

5,287 |

$ | 4,729 | ||||||||||

Non-interest income |

702 |

734 | 786 | 1,436 |

1,562 | |||||||||||||||

Total revenue |

3,336 |

3,387 | 3,128 | 6,723 |

6,291 | |||||||||||||||

Provision for credit losses |

428 |

378 | 218 | 806 |

436 | |||||||||||||||

Non-interest expenses(3) |

1,517 |

1,497 | 1,455 | 3,014 |

2,902 | |||||||||||||||

Income tax expense |

383 |

416 | 399 | 799 |

810 | |||||||||||||||

Net income |

$ |

1,008 |

$ | 1,096 | $ | 1,056 | $ |

2,104 |

$ | 2,143 | ||||||||||

Net income attributable to non-controlling interests in subsidiaries |

$ |

– |

$ | – | $ | – | $ |

– |

$ | – | ||||||||||

Net income attributable to equity holders of the Bank |

$ |

1,008 |

$ | 1,096 | $ | 1,056 | $ |

2,104 |

$ | 2,143 | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Refer to Non-GAAP Measures starting on page 5 for adjusted results. |

| (3) | Includes adjustment for amortization of acquisition-related intangible assets, excluding software for the three months ended April 30, 2024 – $1 (January 31, 2024 – $1; April 30, 2023 – $1) and for the six months ended April 30, 2024 – $2 (April 30, 2023 – $3). |

| Scotiabank Second Quarter Report 2024 | 21 |

22 |

Scotiabank Second Quarter Report 2024 |

International Banking |

||||||||||||||||||||

T10 International Banking financial performance |

||||||||||||||||||||

| For the three months ended | For the six months ended | |||||||||||||||||||

(Unaudited) ($ millions) (Taxable equivalent basis) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Reported Results |

||||||||||||||||||||

Net interest income |

$ |

2,261 |

$ | 2,246 | $ | 1,999 | $ |

4,507 |

$ | 3,891 | ||||||||||

Non-interest income(2) |

731 |

857 | 743 | 1,588 |

1,535 | |||||||||||||||

Total revenue |

2,992 |

3,103 | 2,742 | 6,095 |

5,426 | |||||||||||||||

Provision for credit losses |

566 |

574 | 436 | 1,140 |

840 | |||||||||||||||

Non-interest expenses |

1,537 |

1,571 | 1,478 | 3,108 |

2,911 | |||||||||||||||

Income tax expense |

194 |

190 | 171 | 384 |

339 | |||||||||||||||

Net income |

$ |

695 |

$ | 768 | $ | 657 | $ |

1,463 |

$ | 1,336 | ||||||||||

Net income attributable to non-controlling interests in subsidiaries |

$ |

24 |

$ | 22 | $ | 21 | $ |

46 |

$ | 56 | ||||||||||

Net income attributable to equity holders of the Bank |

$ |

671 |

$ | 746 | $ | 636 | $ |

1,417 |

$ | 1,280 | ||||||||||

Other financial data and measures |

||||||||||||||||||||

Return on equity (3) |

14.4 |

% |

15.3 | % | 13.1 | % | 14.9 |

% |

13.2 | % | ||||||||||

Net interest margin (3) |

4.47 |

% |

4.36 | % | 4.10 | % | 4.42 |

% |

4.05 | % | ||||||||||

Provision for credit losses – performing (Stage 1 and 2) |

$ |

(1 |

) |

$ | (3 | ) | $ | 40 | $ |

(4 |

) |

$ | 69 | |||||||

Provision for credit losses – impaired (Stage 3) |

$ |

567 |

$ | 577 | $ | 396 | $ |

1,144 |

$ | 771 | ||||||||||

Provision for credit losses as a percentage of average net loans and acceptances (annualized) (4) |

1.38 |

% |

1.35 | % | 1.03 | % | 1.36 |

% |

0.99 | % | ||||||||||

Provision for credit losses on impaired loans as a percentage of average net loans and acceptances (annualized) (4) |

1.38 |

% |

1.35 | % | 0.94 | % | 1.37 |

% |

0.91 | % | ||||||||||

Net write-offs as a percentage of average net loans and acceptances (annualized) (4) |

1.30 |

% |

1.13 | % | 0.83 | % | 1.22 |

% |

0.86 | % | ||||||||||

Average assets ($ billions) |

$ |

235 |

$ | 236 | $ | 239 | $ |

236 |

$ | 233 | ||||||||||

Average liabilities ($ billions) |

$ |

183 |

$ | 184 | $ | 181 | $ |

183 |

$ | 175 | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Includes income (on a taxable equivalent basis) from associated corporations for the three months ended April 30, 2024 – $57 (January 31, 2024 – $60; April 30, 2023 – $69) and for the six months ended April 30, 2024 – $117 (April 30, 2023 – $132). |

| (3) | Refer to Non-GAAP Measures starting on page 5. |

| (4) | Refer to Glossary on page 55 for the description of the measure. |

T10A Adjusted International Banking financial performance |

||||||||||||||||||||

| For the three months ended | For the six months ended | |||||||||||||||||||

(Unaudited) ($ millions) (Taxable equivalent basis) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Adjusted Results (2) |

||||||||||||||||||||

Net interest income |

$ |

2,261 |

$ | 2,246 | $ | 1,999 | $ |

4,507 |

$ | 3,891 | ||||||||||

Non-interest income |

731 |

857 | 743 | 1,588 |

1,535 | |||||||||||||||

Total revenue |

2,992 |

3,103 | 2,742 | 6,095 |

5,426 | |||||||||||||||

Provision for credit losses |

566 |

574 | 436 | 1,140 |

840 | |||||||||||||||

Non-interest expenses(3) |

1,529 |

1,563 | 1,467 | 3,092 |

2,890 | |||||||||||||||

Income tax expense |

196 |

192 | 174 | 388 |

345 | |||||||||||||||

Net income |

$ |

701 |

$ | 774 | $ | 665 | $ |

1,475 |

$ | 1,351 | ||||||||||

Net income attributable to non-controlling interests in subsidiaries |

$ |

24 |

$ | 22 | $ | 21 | $ |

46 |

$ | 56 | ||||||||||

Net income attributable to equity holders of the Bank |

$ |

677 |

$ | 752 | $ | 644 | $ |

1,429 |

$ | 1,295 | ||||||||||

| (1) | The Bank adopted IFRS 17 effective November 1, 2023. As required under the new accounting standard, prior period amounts have been restated. Refer to Note 4 of the condensed interim consolidated financial statements. |

| (2) | Refer to Non-GAAP Measures starting on page 5 for adjusted results. |

| (3) | Includes adjustment for amortization of acquisition-related intangible assets, excluding software for the three months ended April 30, 2024 – $8 (January 31, 2024 – $8; April 30, 2023 – $11) and for the six months ended April 30, 2024 – $16 (April 30, 2023 – $21). |

| Scotiabank Second Quarter Report 2024 | 23 |

T11 International Banking financial performance on reported and constant dollar basis |

||||||||||||||||||||

| For the three months ended | For the six months ended | |||||||||||||||||||

(Unaudited) ($ millions) (Taxable equivalent basis) |

April 30 2024 (1) |

January 31 2024 (1) |

April 30 2023 (1) |

April 30 2024 (1) |

April 30 2023 (1) |

|||||||||||||||

Constant dollars – Reported (2) |

||||||||||||||||||||

Net interest income |

$ |

2,261 |

$ | 2,227 | $ | 1,991 | $ |

4,507 |

$ | 3,973 | ||||||||||

Non-interest income(3) |

731 |

851 | 831 | 1,588 |

1,698 | |||||||||||||||

Total revenue |

2,992 |

3,078 | 2,822 | 6,095 |

5,671 | |||||||||||||||

Provision for credit losses |

566 |

568 | 439 | 1,140 |

867 | |||||||||||||||

Non-interest expenses |

1,537 |

1,569 | 1,501 | 3,108 |

3,009 | |||||||||||||||

Income tax expense |

194 |

186 | 181 | 384 |

359 | |||||||||||||||

Net income |

$ |

695 |

$ | 755 | $ | 701 | $ |

1,463 |

$ | 1,436 | ||||||||||

Net income attributable to non-controlling interests in subsidiaries |

$ |

24 |

$ | 22 | $ | 19 | $ |

46 |

$ | 52 | ||||||||||

Net income attributable to equity holders of the Bank |

$ |

671 |

$ | 733 | $ | 682 | $ |

1,417 |

$ | 1,384 | ||||||||||

Other financial data and measures |

||||||||||||||||||||

Average assets ($ billions) |

$ |

235 |

$ | 235 | $ | 236 | $ |

236 |

$ | 235 | ||||||||||

Average liabilities ($ billions) |

$ |

183 |

$ | 182 | $ | 177 | $ |

183 |

$ | 176 | ||||||||||