Table of Contents

Table of Contents

Consolidated Financial Statements

Management’s Responsibility for Financial Information

The management of The Bank of Nova Scotia (the Bank) is responsible for the integrity and fair presentation of the financial information contained in this Annual Report. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board. The consolidated financial statements also comply with the accounting requirements of the Bank Act.

The consolidated financial statements, where necessary, include amounts which are based on the best estimates and judgment of management. Financial information presented elsewhere in this Annual Report is consistent with that shown in the consolidated financial statements.

Management has always recognized the importance of the Bank maintaining and reinforcing the highest possible standards of conduct in all of its actions, including the preparation and dissemination of statements fairly presenting the financial condition of the Bank. In this regard, management has developed and maintains a system of accounting and reporting which provides for the necessary internal controls to ensure that transactions are properly authorized and recorded, assets are safeguarded against unauthorized use or disposition, and liabilities are recognized. The system is augmented by written policies and procedures, the careful selection and training of qualified staff, the establishment of organizational structures providing an appropriate and well-defined division of responsibilities, and the communication of policies and guidelines of Scotiabank’s Code of Conduct throughout the Bank.

Management, under the supervision of and the participation of the President and Chief Executive Officer and the Executive Vice President and Chief Financial Officer, have a process in place to evaluate disclosure controls and procedures and internal control over financial reporting in line with Canadian and U.S. securities regulations.

The system of internal controls is further supported by a professional staff of internal auditors who conduct periodic audits of all aspects of the Bank’s operations. As well, the Bank’s Chief Auditor has full and free access to, and meets periodically with the Audit and Conduct Review Committee of the Board of Directors. In addition, the Bank’s compliance function maintains policies, procedures and programs directed at ensuring compliance with regulatory requirements, including conflict of interest rules.

The Office of the Superintendent of Financial Institutions Canada, which is mandated to protect the rights and interests of the depositors and creditors of the Bank, examines and enquires into the business and affairs of the Bank, as deemed necessary, to determine whether the provisions of the Bank Act are being complied with, and that the Bank is in a sound financial condition.

The Audit and Conduct Review Committee, composed entirely of outside directors, reviews the consolidated financial statements with both management and the independent auditors before such statements are approved by the Board of Directors and submitted to the shareholders of the Bank.

The Audit and Conduct Review Committee reviews and reports its findings to the Board of Directors on all related party transactions that may have a material impact on the Bank.

KPMG LLP, the independent auditors appointed by the shareholders of the Bank, have audited the consolidated financial position of the Bank as at October 31, 2019 and October 31, 2018 and its consolidated financial performance and its consolidated cash flows for each of the years in the three-year period ended October 31, 2019 prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board in accordance with Canadian Generally Accepted Auditing Standards and the standards of the Public Company Accounting Oversight Board (United States) and the effectiveness of internal control over financial reporting and have expressed their opinions upon completion of such audits in the reports to the shareholders. The Shareholders’ Auditors have full and free access to, and meet periodically with, the Audit and Conduct Review Committee to discuss their audits, including any findings as to the integrity of the Bank’s accounting, financial reporting and related matters.

Toronto, Canada

November 26, 2019

136 | 2019 Scotiabank Annual Report

Table of Contents

(This page intentionally left blank)

2019 Scotiabank Annual Report | 137

Table of Contents

(This page intentionally left blank)

138 | 2019 Scotiabank Annual Report

Table of Contents

(This page intentionally left blank)

2019 Scotiabank Annual Report | 139

Table of Contents

Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm

To the Shareholders of The Bank of Nova Scotia

Opinion on the Consolidated Financial Statements

We have audited the accompanying consolidated statements of financial position of The Bank of Nova Scotia (the Bank) as at October 31, 2019 and 2018, the related consolidated statements of income, comprehensive income, changes in equity and cash flows for each of the years in the three-year period ended October 31, 2019, and the related notes (collectively, the consolidated financial statements). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Bank as at October 31, 2019 and 2018, and its financial performance and its cash flows for each of the years in the three-year period ended October 31, 2019 in conformity with International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board.

We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States) (PCAOB), the Bank’s internal control over financial reporting as of October 31, 2019, based on criteria established in Internal Control – Integrated Framework (2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission, and our report dated November 26, 2019 expressed an unqualified opinion on the effectiveness of the Bank’s internal control over financial reporting.

Basis for Opinion

These consolidated financial statements are the responsibility of the Bank’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We are a public accounting firm registered with the PCAOB and are required to be independent with respect to the Bank in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement, whether due to error or fraud. Our audits included performing procedures to assess the risks of material misstatement of the consolidated financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the consolidated financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the consolidated financial statements that were communicated or required to be communicated to the Audit and Conduct Review Committee and that: (1) relate to accounts or disclosures that are material to the consolidated financial statements and (2) involved our especially challenging, subjective, or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

| (i) | Assessment of Allowance for Credit Losses on Financial Assets (ACL) |

As discussed in Notes 3 and 13 to the consolidated financial statements, the Bank’s ACL for credit losses was $5,077 million as at October 31, 2019. The Bank applies a three-stage approach to measure the ACL, using an expected credit loss (ECL) approach as required under IFRS 9 Financial Instruments. The estimation of the ACL involves the use of complex models and incorporates inputs, assumptions and techniques that involve significant management judgment. The ACL reflects a probability-weighted outcome that considers multiple economic scenarios based on the Bank’s view of forecast economic conditions, and is determined as a function of the Bank’s assessment of the probability of default (PD), loss given default (LGD) and exposure at default (EAD) associated with the financial asset. When the Bank determines that there has been a significant increase in credit risk subsequent to origination or where the financial asset is in default, lifetime ACL is recorded; otherwise, ACL equal to 12 month expected credit losses is recorded. Qualitative adjustments or overlays may also be recorded by the Bank using expert credit judgment where the inputs, assumptions and/or modelling techniques do not capture all relevant risk factors.

We identified the assessment of the ACL as a critical audit matter. There is a high degree of measurement uncertainty associated with the ACL as a result of the judgments relating to the inputs, assumptions, adjustments and techniques and complex models involved, as described above. Assessing the ACL required significant auditor attention and complex auditor judgment, involving our credit risk, economics, and information technology specialists, as well as knowledge and experience in the industry.

The primary procedures we performed to address this critical audit matter included the following. With the involvement of our credit risk, economics, and information technology professionals with specialized skills, industry knowledge and relevant experience, we tested certain internal controls over the Bank’s ACL process. These included controls related to: (1) validation of the models that determine PD, LGD and EAD; (2) the Bank’s monitoring over the determination of the ACL; (3) information technology controls over the data inputs into the ACL models and the ACL calculation; (4) the assessment to identify whether there has been a significant increase in credit risk; (5) the review of the macroeconomic variables and probability weighting of scenarios used in the ACL models; and (6) the assessment of qualitative adjustments. Additionally for non-retail loans, we tested the controls related to loan reviews, including the determination of loan risk grades and write-offs. We involved credit risk, economics, and information technology professionals with specialized skills, industry knowledge and relevant experience who assisted in: (1) evaluating the methodology and key inputs used in determining PD, LGD and EAD parameters produced by the models; (2) evaluating macroeconomic variables and probability weighting of scenarios used in the ACL models, including consideration of alternative inputs for certain variables; (3) recalculating a sample of ECL models and related inputs; and (4) assessing the qualitative adjustments applied to the ACL. Additionally for a sample of non-retail loans, we evaluated the Bank’s assigned credit risk ratings to loans against the Bank’s borrower risk rating scale, and the Bank’s judgment on whether there was a significant increase in credit risk, and the related ACL.

| (ii) | Assessment of the Measurement of Fair Value of Certain Difficult-to-value Financial Instruments |

As discussed in Notes 3 and 7 to the consolidated financial statements, the Bank measures $229,830 million of financial assets and $83,005 million of financial liabilities as at October 31, 2019 at fair value on a recurring basis. Included in these amounts are certain difficult-to-value financial instruments for which the Bank determines fair value using internal models and third party pricing that use significant

140 | 2019 Scotiabank Annual Report

Table of Contents

Consolidated Financial Statements

unobservable inputs. Unobservable inputs require the use of significant management judgment. The key unobservable inputs used in the Bank’s internal models to value such difficult-to-value financial instruments include net asset value, volatility and correlation.

We identified the assessment of the measurement of fair value for difficult-to-value financial instruments as a critical audit matter. Due to the significant measurement uncertainty associated with the fair value of difficult-to-value financial assets and financial liabilities, there was a high degree of subjectivity and judgment in evaluating the methodology used in developing the models. Subjective auditor judgment was also required to evaluate the models’ significant inputs and assumptions which were not directly observable in financial markets, such as net asset value, volatility and correlation.

The primary procedures we performed to address this critical audit matter included the following. We tested certain internal controls over the Bank’s process to determine the fair value of its difficult-to-value financial instruments with the involvement of valuation and information technology professionals with specialized skills, industry knowledge and relevant experience. These included controls related to: (1) development and ongoing validation of the models and methodologies; (2) review of significant unobservable model inputs and assumptions; (3) independent price verification; and (4) segregation of duties and access controls. We tested, with involvement of valuation professionals with specialized skills, industry knowledge and relevant experience, the fair value of a sample of difficult-to-value financial instruments. Depending on the nature of the financial instruments, we did this by comparing the key unobservable inputs to external information or by developing an independent estimate of fair value and comparing it to the fair value determined by the Bank.

| (iii) | Assessment of Uncertain Tax Provisions |

As discussed in Notes 3 and 27 to the consolidated financial statements, in determining the provision for income taxes, the Bank records its best estimate of the amount required to settle uncertain tax positions based on its assessment of relevant factors.

We identified the assessment of uncertain tax provisions as a critical audit matter. There is a high degree of subjectivity and complex auditor judgment required in assessing the Bank’s interpretation of tax law and its estimate of the ultimate resolution of tax positions.

The primary procedures we performed to address this critical audit matter included the following. We tested certain internal controls over the Bank’s income tax uncertainties process with the involvement of taxation professionals with specialized skills, industry knowledge and relevant experience. This included controls related to the (1) identification of tax uncertainties, including the interpretation of tax law and (2) determination of the best estimate of the provision required to settle these tax uncertainties. Since tax law is complex and often subject to interpretation, we involved tax professionals with specialized skills and knowledge, who assisted in: (1) evaluating the Bank’s interpretations of tax laws and the assessment of certain tax uncertainties, including, if applicable, the measurement thereof; (2) reading advice obtained by the Bank from external specialists; and (3) inspecting correspondence with taxation authorities.

Chartered Professional Accountants, Licensed Public Accountants

We have served as the Bank’s auditor since 2006 and as joint auditor for 14 years prior to that.

Toronto, Canada

November 26, 2019

2019 Scotiabank Annual Report | 141

Table of Contents

Consolidated Financial Statements

| Aaron W. Regent | Brian J. Porter | |||

| Chairman of the Board | President and Chief Executive Officer |

The accompanying notes are an integral part of these consolidated financial statements.

142 | 2019 Scotiabank Annual Report

Table of Contents

Consolidated Financial Statements

Consolidated Statement of Income

| For the year ended October 31 ($ millions) | Note | 2019 | 2018 | 2017 | ||||||||||||

| Revenue |

||||||||||||||||

| Interest income(1)(2) |

32 | |||||||||||||||

| Loans |

$ | 29,116 | $ | 24,991 | $ | 21,719 | ||||||||||

| Securities |

2,238 | 1,771 | 1,403 | |||||||||||||

| Securities purchased under resale agreements and securities borrowed |

502 | 446 | 283 | |||||||||||||

| Deposits with financial institutions |

928 | 859 | 522 | |||||||||||||

| 32,784 | 28,067 | 23,927 | ||||||||||||||

| Interest expense |

32 | |||||||||||||||

| Deposits |

13,871 | 10,544 | 7,878 | |||||||||||||

| Subordinated debentures |

294 | 214 | 226 | |||||||||||||

| Other |

1,442 | 1,118 | 788 | |||||||||||||

| 15,607 | 11,876 | 8,892 | ||||||||||||||

| Net interest income |

17,177 | 16,191 | 15,035 | |||||||||||||

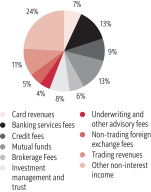

| Non-interest income(1) |

||||||||||||||||

| Card revenues(3) |

977 | 1,105 | 1,018 | |||||||||||||

| Banking services fees |

1,812 | 1,705 | 1,684 | |||||||||||||

| Credit fees |

1,316 | 1,191 | 1,153 | |||||||||||||

| Mutual funds |

1,849 | 1,714 | 1,639 | |||||||||||||

| Brokerage fees |

876 | 895 | 1,047 | |||||||||||||

| Investment management and trust |

1,050 | 732 | 632 | |||||||||||||

| Underwriting and other advisory |

497 | 514 | 598 | |||||||||||||

| Non-trading foreign exchange |

667 | 622 | 557 | |||||||||||||

| Trading revenues |

33 | 1,488 | 1,420 | 986 | ||||||||||||

| Net gain on sale of investment securities |

12 | (e) | 351 | 146 | 380 | |||||||||||

| Net income from investments in associated corporations |

17 | 650 | 559 | 407 | ||||||||||||

| Insurance underwriting income, net of claims |

676 | 686 | 626 | |||||||||||||

| Other fees and commissions |

949 | 841 | 903 | |||||||||||||

| Other |

699 | 454 | 490 | |||||||||||||

| 13,857 | 12,584 | 12,120 | ||||||||||||||

| Total revenue |

31,034 | 28,775 | 27,155 | |||||||||||||

| Provision for credit losses(1) |

13 | (e) | 3,027 | 2,611 | 2,249 | |||||||||||

| 28,007 | 26,164 | 24,906 | ||||||||||||||

| Non-interest expenses |

||||||||||||||||

| Salaries and employee benefits |

8,443 | 7,455 | 7,375 | |||||||||||||

| Premises and technology |

2,807 | 2,577 | 2,436 | |||||||||||||

| Depreciation and amortization |

1,053 | 848 | 761 | |||||||||||||

| Communications |

459 | 447 | 437 | |||||||||||||

| Advertising and business development |

625 | 581 | 581 | |||||||||||||

| Professional |

861 | 881 | 775 | |||||||||||||

| Business and capital taxes |

515 | 464 | 423 | |||||||||||||

| Other(3) |

1,974 | 1,805 | 1,842 | |||||||||||||

| 16,737 | 15,058 | 14,630 | ||||||||||||||

| Income before taxes |

11,270 | 11,106 | 10,276 | |||||||||||||

| Income tax expense |

27 | 2,472 | 2,382 | 2,033 | ||||||||||||

| Net income |

$ | 8,798 | $ | 8,724 | $ | 8,243 | ||||||||||

| Net income attributable to non-controlling interests in subsidiaries |

31 | (b) | 408 | 176 | 238 | |||||||||||

| Net income attributable to equity holders of the Bank |

$ | 8,390 | $ | 8,548 | $ | 8,005 | ||||||||||

| Preferred shareholders and other equity instrument holders |

182 | 187 | 129 | |||||||||||||

| Common shareholders |

$ | 8,208 | $ | 8,361 | $ | 7,876 | ||||||||||

| Earnings per common share (in dollars) |

||||||||||||||||

| Basic |

34 | $ | 6.72 | $ | 6.90 | $ | 6.55 | |||||||||

| Diluted |

34 | 6.68 | 6.82 | 6.49 | ||||||||||||

| Dividends paid per common share (in dollars) |

24 | (a) | 3.49 | 3.28 | 3.05 | |||||||||||

| (1) | The amounts for the years ended October 31, 2019 and October 31, 2018 have been prepared in accordance with IFRS 9; prior year amounts have not been restated. |

| (2) | Interest income on financial assets measured at amortized cost and FVOCI is calculated using the effective interest method. Includes interest income for the year ended October 31, 2019 of $32,436 (October 31, 2018 – $27,854) from these financial assets. |

| (3) | The amounts for the year ended October 31, 2019 have been prepared in accordance with IFRS 15; prior year amounts have not been restated (refer to Notes 3 and 4). |

The accompanying notes are an integral part of these consolidated financial statements.

2019 Scotiabank Annual Report | 143

Table of Contents

Consolidated Financial Statements

Consolidated Statement of Comprehensive Income

| For the year ended October 31 ($ millions) | 2019 | 2018 | 2017 | |||||||||

| Net income |

$ | 8,798 | $ | 8,724 | $ | 8,243 | ||||||

| Other comprehensive income (loss) |

||||||||||||

| Items that will be reclassified subsequently to net income |

||||||||||||

| Net change in unrealized foreign currency translation gains (losses): |

||||||||||||

| Net unrealized foreign currency translation gains (losses) |

(626 | ) | (406 | ) | (1,564 | ) | ||||||

| Net gains (losses) on hedges of net investments in foreign operations |

(232 | ) | (281 | ) | 404 | |||||||

| Income tax expense (benefit): |

||||||||||||

| Net unrealized foreign currency translation gains (losses) |

21 | (7 | ) | (8 | ) | |||||||

| Net gains (losses) on hedges of net investments in foreign operations |

(60 | ) | (74 | ) | 107 | |||||||

| (819 | ) | (606 | ) | (1,259 | ) | |||||||

| Net change in unrealized gains (losses) on available-for-sale securities (debt and equity)(1): |

||||||||||||

| Net unrealized gains (losses) on available-for-sale securities |

n/a | n/a | (217 | ) | ||||||||

| Reclassification of net (gains) losses to net income(2) |

n/a | n/a | 143 | |||||||||

| Income tax expense (benefit): |

||||||||||||

| Net unrealized gains (losses) on available-for-sale securities |

n/a | n/a | (61 | ) | ||||||||

| Reclassification of net (gains) losses to net income |

n/a | n/a | 42 | |||||||||

| n/a | n/a | (55 | ) | |||||||||

| Net change in fair value due to change in debt instruments measured at fair value through other comprehensive income(1): |

||||||||||||

| Net gains (losses) in fair value |

1,265 | (605 | ) | n/a | ||||||||

| Reclassification of net (gains) losses to net income |

(1,150 | ) | 281 | n/a | ||||||||

| Income tax expense (benefit): |

||||||||||||

| Net gains (losses) in fair value |

308 | (145 | ) | n/a | ||||||||

| Reclassification of net (gains) losses to net income |

(298 | ) | 73 | n/a | ||||||||

| 105 | (252 | ) | n/a | |||||||||

| Net change in gains (losses) on derivative instruments designated as cash flow hedges: |

||||||||||||

| Net gains (losses) on derivative instruments designated as cash flow hedges |

361 | (1,181 | ) | 1,722 | ||||||||

| Reclassification of net (gains) losses to net income |

596 | 695 | (1,761 | ) | ||||||||

| Income tax expense (benefit): |

||||||||||||

| Net gains (losses) on derivative instruments designated as cash flow hedges |

86 | (307 | ) | 454 | ||||||||

| Reclassification of net (gains) losses to net income |

163 | 182 | (465 | ) | ||||||||

| 708 | (361 | ) | (28 | ) | ||||||||

| Other comprehensive income (loss) from investments in associates |

103 | 66 | 56 | |||||||||

| Items that will not be reclassified subsequently to net income |

||||||||||||

| Net change in remeasurement of employee benefit plan asset and liability: |

||||||||||||

| Actuarial gains (losses) on employee benefit plans |

(1,096 | ) | 444 | 805 | ||||||||

| Income tax expense (benefit) |

(281 | ) | 126 | 213 | ||||||||

| (815 | ) | 318 | 592 | |||||||||

| Net change in fair value due to change in equity instruments designated at fair value through other comprehensive income(1): |

||||||||||||

| Net gains (losses) in fair value |

121 | 75 | n/a | |||||||||

| Income tax expense (benefit) |

26 | 15 | n/a | |||||||||

| 95 | 60 | n/a | ||||||||||

| Net change in fair value due to change in own credit risk on financial liabilities designated under the fair value option: |

||||||||||||

| Change in fair value due to change in own credit risk on financial liabilities designated under the fair value option |

11 | (30 | ) | (28 | ) | |||||||

| Income tax expense (benefit) |

3 | (8 | ) | (7 | ) | |||||||

| 8 | (22 | ) | (21 | ) | ||||||||

| Other comprehensive income (loss) from investments in associates |

(10 | ) | (7 | ) | 6 | |||||||

| Other comprehensive income (loss) |

(625 | ) | (804 | ) | (709 | ) | ||||||

| Comprehensive income |

$ | 8,173 | $ | 7,920 | $ | 7,534 | ||||||

| Comprehensive income attributable to non-controlling interests |

205 | 65 | 192 | |||||||||

| Comprehensive income attributable to equity holders of the Bank |

$ | 7,968 | $ | 7,855 | $ | 7,342 | ||||||

| Preferred shareholders and other equity instrument holders |

182 | 187 | 129 | |||||||||

| Common shareholders |

$ | 7,786 | $ | 7,668 | $ | 7,213 | ||||||

| (1) | The amounts for the years ended October 31, 2019 and October 31, 2018 have been prepared in accordance with IFRS 9; prior period amounts have not been restated. |

| (2) | Includes amounts related to qualifying hedges. |

The accompanying notes are an integral part of these consolidated financial statements.

144 | 2019 Scotiabank Annual Report

Table of Contents

Consolidated Financial Statements

Consolidated Statement of Changes in Equity

| Accumulated other comprehensive income (loss) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ($ millions) | Common shares (Note 24) |

Retained earnings(1) |

Foreign currency translation |

Available- for-sale securities |

Debt instruments FVOCI |

Equity instruments FVOCI |

Cash flow hedges |

Other(2) | Other reserves |

Total common equity |

Preferred shares and other equity instruments (Note 24) |

Total attributable holders |

Non- controlling interests in subsidiaries (Note 31(b)) |

Total | ||||||||||||||||||||||||||||||||||||||||||

| Balance as at October 31, 2018 |

$ | 18,234 | $ | 41,414 | $ | 1,441 | $ | – | $ | (68 | ) | $ | (126 | ) | $ | (121 | ) | $ | (134 | ) | $ | 404 | $ | 61,044 | $ | 4,184 | $ | 65,228 | $ | 2,452 | $ | 67,680 | ||||||||||||||||||||||||

| Cumulative effect of adopting IFRS 15(3) |

– | (58 | ) | – | – | – | – | – | – | – | (58 | ) | – | (58 | ) | – | (58 | ) | ||||||||||||||||||||||||||||||||||||||

| Balance as at November 1, 2018 |

18,234 | 41,356 | 1,441 | – | (68 | ) | (126 | ) | (121 | ) | (134 | ) | 404 | 60,986 | 4,184 | 65,170 | 2,452 | 67,622 | ||||||||||||||||||||||||||||||||||||||

| Net income |

– | 8,208 | – | – | – | – | – | – | – | 8,208 | 182 | 8,390 | 408 | 8,798 | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

– | – | (641 | ) | – | 105 | 71 | 771 | (728 | ) | – | (422 | ) | – | (422 | ) | (203 | ) | (625 | ) | ||||||||||||||||||||||||||||||||||||

| Total comprehensive income |

$ | – | $ | 8,208 | $ | (641 | ) | $ | – | $ | 105 | $ | 71 | $ | 771 | $ | (728 | ) | $ | – | $ | 7,786 | $ | 182 | $ | 7,968 | $ | 205 | $ | 8,173 | ||||||||||||||||||||||||||

| Shares issued |

255 | – | – | – | – | – | – | – | (37 | ) | 218 | – | 218 | – | 218 | |||||||||||||||||||||||||||||||||||||||||

| Shares repurchased/redeemed |

(225 | ) | (850 | ) | – | – | – | – | – | – | – | (1,075 | ) | (300 | ) | (1,375 | ) | – | (1,375 | ) | ||||||||||||||||||||||||||||||||||||

| Dividends and distributions paid to equity holders |

– | (4,260 | ) | – | – | – | – | – | – | – | (4,260 | ) | (182 | ) | (4,442 | ) | (150 | ) | (4,592 | ) | ||||||||||||||||||||||||||||||||||||

| Share-based payments(4) |

– | – | – | – | – | – | – | – | 7 | 7 | – | 7 | – | 7 | ||||||||||||||||||||||||||||||||||||||||||

| Other |

– | (15 | ) | – | – | – | – | – | – | (9 | ) | (24 | ) | – | (24 | ) | 163 | (5) | 139 | |||||||||||||||||||||||||||||||||||||

| Balance as at October 31, 2019 |

$ | 18,264 | $ | 44,439 | $ | 800 | $ | – | $ | 37 | $ | (55) | $ | 650 | $ | (862 | ) | $ | 365 | $ | 63,638 | $ | 3,884 | $ | 67,522 | $ | 2,670 | $ | 70,192 | |||||||||||||||||||||||||||

| Balance as at October 31, 2017 |

$ | 15,644 | $ | 38,117 | $ | 1,861 | $ | (46) | $ | – | $ | – | $ | 235 | $ | (473 | ) | $ | 116 | $ | 55,454 | $ | 4,579 | $ | 60,033 | $ | 1,592 | $ | 61,625 | |||||||||||||||||||||||||||

| Cumulative effect of adopting IFRS 9 |

– | (564 | ) | – | 46 | 184 | (179 | ) | – | – | – | (513 | ) | – | (513 | ) | (97 | ) | (610 | ) | ||||||||||||||||||||||||||||||||||||

| Balance as at November 1, 2017 |

15,644 | 37,553 | 1,861 | – | 184 | (179 | ) | 235 | (473 | ) | 116 | 54,941 | 4,579 | 59,520 | 1,495 | 61,015 | ||||||||||||||||||||||||||||||||||||||||

| Net income |

– | 8,361 | – | – | – | – | – | – | – | 8,361 | 187 | 8,548 | 176 | 8,724 | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

– | – | (477 | ) | – | (252 | ) | 53 | (356 | ) | 339 | – | (693 | ) | – | (693 | ) | (111 | ) | (804 | ) | |||||||||||||||||||||||||||||||||||

| Total comprehensive income |

$ | – | $ | 8,361 | $ | (477) | $ | – | $ | (252 | ) | $ | 53 | $ | (356 | ) | $ | 339 | $ | – | $ | 7,668 | $ | 187 | $ | 7,855 | $ | 65 | $ | 7,920 | ||||||||||||||||||||||||||

| Shares issued |

2,708 | – | – | – | – | – | – | – | (19 | ) | 2,689 | 300 | 2,989 | – | 2,989 | |||||||||||||||||||||||||||||||||||||||||

| Shares repurchased/redeemed |

(118 | ) | (514 | ) | – | – | – | – | – | – | – | (632 | ) | (695 | ) | (1,327 | ) | – | (1,327 | ) | ||||||||||||||||||||||||||||||||||||

| Dividends and distributions paid to equity holders |

– | (3,985 | ) | – | – | – | – | – | – | – | (3,985 | ) | (187 | ) | (4,172 | ) | (199 | ) | (4,371 | ) | ||||||||||||||||||||||||||||||||||||

| Share-based payments(4) |

– | – | – | – | – | – | – | – | 6 | 6 | – | 6 | – | 6 | ||||||||||||||||||||||||||||||||||||||||||

| Other |

– | (1 | ) | 57 | – | – | – | – | – | 301 | (5) | 357 | – | 357 | 1,091 | (5) | 1,448 | |||||||||||||||||||||||||||||||||||||||

| Balance as at October 31, 2018 |

$ | 18,234 | $ | 41,414 | $ | 1,441 | $ | – | $ | (68 | ) | $ | (126) | $ | (121) | $ | (134 | ) | $ | 404 | $ | 61,044 | $ | 4,184 | $ | 65,228 | $ | 2,452 | $ | 67,680 | ||||||||||||||||||||||||||

| Balance as at November 1, 2016 |

$ | 15,513 | $ | 34,752 | $ | 3,055 | $ | 14 | $ | – | $ | – | $ | 264 | $ | (1,093 | ) | $ | 152 | $ | 52,657 | $ | 3,594 | $ | 56,251 | $ | 1,570 | $ | 57,821 | |||||||||||||||||||||||||||

| Net income |

– | 7,876 | – | – | – | – | – | – | – | 7,876 | 129 | 8,005 | 238 | 8,243 | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) |

– | – | (1,194 | ) | (60 | ) | – | – | (29 | ) | 620 | – | (663 | ) | – | (663 | ) | (46 | ) | (709 | ) | |||||||||||||||||||||||||||||||||||

| Total comprehensive income |

$ | – | $ | 7,876 | $ | (1,194) | $ | (60) | $ | – | $ | – | $ | (29 | ) | $ | 620 | $ | – | $ | 7,213 | $ | 129 | $ | 7,342 | $ | 192 | $ | 7,534 | |||||||||||||||||||||||||||

| Shares and other equity instruments issued |

313 | – | – | – | – | – | – | – | (44 | ) | 269 | 1,560 | 1,829 | – | 1,829 | |||||||||||||||||||||||||||||||||||||||||

| Shares repurchased/redeemed |

(182 | ) | (827 | ) | – | – | – | – | – | – | – | (1,009 | ) | (575 | ) | (1,584 | ) | – | (1,584 | ) | ||||||||||||||||||||||||||||||||||||

| Dividends and distributions paid to equity holders |

– | (3,668 | ) | – | – | – | – | – | – | – | (3,668 | ) | (129 | ) | (3,797 | ) | (133 | ) | (3,930 | ) | ||||||||||||||||||||||||||||||||||||

| Share-based payments(4) |

– | – | – | – | – | – | – | – | 8 | 8 | – | 8 | – | 8 | ||||||||||||||||||||||||||||||||||||||||||

| Other |

– | (16 | ) | – | – | – | – | – | – | – | (16 | ) | – | (16 | ) | (37 | )(5) | (53 | ) | |||||||||||||||||||||||||||||||||||||

| Balance as at October 31, 2017 |

$ | 15,644 | $ | 38,117 | $ | 1,861 | $ | (46 | ) | $ | – | $ | – | $ | 235 | $ | (473 | ) | $ | 116 | $ | 55,454 | $ | 4,579 | $ | 60,033 | $ | 1,592 | $ | 61,625 | ||||||||||||||||||||||||||

| (1) | Includes undistributed retained earnings of $61 (2018 – $62; 2017 – $61) related to a foreign associated corporation, which is subject to local regulatory restriction. |

| (2) | Includes Share from associates, Employee benefits and Own credit risk. |

| (3) | Refer to Note 4 for a summary of the adjustments on initial application of IFRS 15. |

| (4) | Represents amounts on account of share-based payments (refer to Note 26). |

| (5) | Includes changes to non-controlling interests arising from business combinations and related transactions. |

The accompanying notes are an integral part of these consolidated financial statements

2019 Scotiabank Annual Report | 145

Table of Contents

Consolidated Financial Statements

Consolidated Statement of Cash Flows

| Sources (uses) of cash flows for the year ended October 31 ($ millions) | 2019(1) | 2018(1) | 2017 | |||||||||

| Cash flows from operating activities |

||||||||||||

| Net income |

$ | 8,798 | $ | 8,724 | $ | 8,243 | ||||||

| Adjustment for: |

||||||||||||

| Net interest income |

(17,177 | ) | (16,191 | ) | (15,035 | ) | ||||||

| Depreciation and amortization |

1,053 | 848 | 761 | |||||||||

| Provision for credit losses |

3,027 | 2,611 | 2,249 | |||||||||

| Equity-settled share-based payment expense |

7 | 6 | 8 | |||||||||

| Net gain on sale of investment securities |

(351 | ) | (146 | ) | (380 | ) | ||||||

| Net (gain)/loss on divestitures |

125 | – | (62 | ) | ||||||||

| Net income from investments in associated corporations |

(650 | ) | (559 | ) | (407 | ) | ||||||

| Income tax expense |

2,472 | 2,382 | 2,033 | |||||||||

| Changes in operating assets and liabilities: |

||||||||||||

| Trading assets |

(27,514 | ) | 111 | 8,377 | ||||||||

| Securities purchased under resale agreements and securities borrowed |

(27,235 | ) | (7,721 | ) | (4,631 | ) | ||||||

| Loans |

(44,337 | ) | (31,848 | ) | (32,589 | ) | ||||||

| Deposits |

60,705 | 40,338 | 27,516 | |||||||||

| Obligations related to securities sold short |

(1,694 | ) | 239 | 7,533 | ||||||||

| Obligations related to securities sold under repurchase agreements and securities lent |

22,727 | 4,387 | 849 | |||||||||

| Net derivative financial instruments |

1,964 | 440 | (391 | ) | ||||||||

| Other, net |

(8,881 | ) | (188 | ) | (1,997 | ) | ||||||

| Dividends received |

520 | 332 | 1,600 | |||||||||

| Interest received |

32,696 | 27,384 | 23,649 | |||||||||

| Interest paid |

(15,322 | ) | (11,400 | ) | (8,730 | ) | ||||||

| Income tax paid |

(2,958 | ) | (1,938 | ) | (2,012 | ) | ||||||

| Net cash from/(used in) operating activities |

(12,025 | ) | 17,811 | 16,584 | ||||||||

| Cash flows from investing activities |

||||||||||||

| Interest-bearing deposits with financial institutions |

18,014 | (704 | ) | (14,006 | ) | |||||||

| Purchase of investment securities |

(89,018 | ) | (91,896 | ) | (64,560 | ) | ||||||

| Proceeds from sale and maturity of investment securities |

86,956 | 84,336 | 66,179 | |||||||||

| Acquisition/divestiture of subsidiaries, associated corporations or business units, net of cash acquired |

20 | (3,862 | ) | 229 | ||||||||

| Property and equipment, net of disposals |

(186 | ) | (416 | ) | 3 | |||||||

| Other, net |

(568 | ) | (1,183 | ) | (385 | ) | ||||||

| Net cash from/(used in) investing activities |

15,218 | (13,725 | ) | (12,540 | ) | |||||||

| Cash flows from financing activities |

||||||||||||

| Proceeds from issue of subordinated debentures |

3,250 | – | – | |||||||||

| Redemption/repayment of subordinated debentures |

(1,771 | ) | (233 | ) | (1,500 | ) | ||||||

| Proceeds from preferred shares and other equity instruments issued |

– | 300 | 1,560 | |||||||||

| Redemption of preferred shares |

(300 | ) | (695 | ) | (575 | ) | ||||||

| Proceeds from common shares issued |

255 | 1,830 | 313 | |||||||||

| Common shares purchased for cancellation |

(1,075 | ) | (632 | ) | (1,009 | ) | ||||||

| Cash dividends and distributions paid |

(4,442 | ) | (4,172 | ) | (3,797 | ) | ||||||

| Distributions to non-controlling interests |

(150 | ) | (199 | ) | (133 | ) | ||||||

| Other, net |

2,945 | 931 | 2,209 | |||||||||

| Net cash from/(used in) financing activities |

(1,288 | ) | (2,870 | ) | (2,932 | ) | ||||||

| Effect of exchange rate changes on cash and cash equivalents |

2 | (44 | ) | (142 | ) | |||||||

| Net change in cash and cash equivalents |

1,907 | 1,172 | 970 | |||||||||

| Cash and cash equivalents at beginning of year(2) |

8,997 | 7,825 | 6,855 | |||||||||

| Cash and cash equivalents at end of year(2) |

$ | 10,904 | $ | 8,997 | $ | 7,825 | ||||||

| (1) | The amounts for years ended October 31, 2019 and October 31, 2018 have been prepared in accordance with IFRS 9; prior year amounts have not been restated. |

| (2) | Represents cash and non-interest bearing deposits with financial institutions (refer to Note 6). |

The accompanying notes are an integral part of these consolidated financial statements.

146 | 2019 Scotiabank Annual Report

Table of Contents

Table of Contents

Consolidated Financial Statements

| 1 | Reporting Entity |

The Bank of Nova Scotia (the Bank) is a chartered Schedule I bank under the Bank Act (Canada) (the Bank Act) and is regulated by the Office of the Superintendent of Financial Institutions (OSFI). The Bank is a global financial services provider offering a diverse range of products and services, including personal, commercial, corporate and investment banking. The head office of the Bank is located at 1709 Hollis Street, Halifax, Nova Scotia, Canada and its executive offices are at Scotia Plaza, 44 King Street West, Toronto, Canada. The common shares of the Bank are listed on the Toronto Stock Exchange and the New York Stock Exchange.

| 2 | Basis of Preparation |

Statement of compliance

These consolidated financial statements were prepared in accordance with International Financial Reporting Standards (IFRS) as issued by International Accounting Standards Board (IASB) and accounting requirements of OSFI in accordance with Section 308 of the Bank Act. Section 308 states that, except as otherwise specified by OSFI, the financial statements are to be prepared in accordance with IFRS.

The consolidated financial statements for the year ended October 31, 2019 have been approved by the Board of Directors for issue on November 26, 2019.

Certain comparative amounts have been restated to conform with the basis of presentation in the current year.

Basis of measurement

The consolidated financial statements have been prepared on the historical cost basis except for the following material items that are measured at fair value in the Consolidated Statement of Financial Position:

| • | Financial assets and liabilities measured at fair value through profit or loss |

| • | Financial assets and liabilities designated at fair value through profit or loss |

| • | Derivative financial instruments |

| • | Available-for-sale investment securities (applicable prior to November 1, 2017) |

| • | Equity instruments designated at fair value through other comprehensive income (effective November 1, 2017) |

| • | Debt instruments measured at fair value through other comprehensive income (effective November 1, 2017) |

Functional and presentation currency

These consolidated financial statements are presented in Canadian dollars, which is the Bank’s functional currency. All financial information presented in Canadian dollars has been rounded to the nearest million unless otherwise stated.

Management’s use of estimates, assumptions and judgments

The Bank’s accounting policies require estimates, assumptions and judgments that relate to matters that are inherently uncertain. The Bank has established procedures to ensure that accounting policies are applied consistently. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized in the year in which the estimates are revised and in any future years affected.

Use of estimates and assumptions

The preparation of these consolidated financial statements, in conformity with IFRS, requires management to make estimates and assumptions that affect the reported amount of assets and liabilities at the date of the consolidated financial statements, other comprehensive income and income and expenses during the reporting period. Estimates made by management are based on historical experience and other assumptions that are believed to be reasonable. Key areas of estimation uncertainty include those relating to the allowance for credit losses, the fair value of financial instruments (including derivatives), corporate income taxes, employee benefits, goodwill and intangible assets, the fair value of all identifiable assets and liabilities as a result of business combinations, impairment of non-financial assets, derecognition of financial assets and liabilities and provisions. While management makes its best estimates and assumptions, actual results could differ from these and other estimates.

Significant judgments

In the preparation of these consolidated financial statements, management is required to make significant judgments in the classification and presentation of transactions and instruments and accounting for involvement with other entities.

148 | 2019 Scotiabank Annual Report

Table of Contents

Consolidated Financial Statements

Significant estimates, assumptions and judgments have been made in the following areas and are discussed as noted in the consolidated financial statements:

| Allowance for credit losses | Note 3 Note 13(d) | |

| Fair value of financial instruments | Note 3 Note 7 | |

| Corporate income taxes | Note 3 Note 27 | |

| Employee benefits | Note 3 Note 28 | |

| Goodwill and intangible assets | Note 3 Note 18 | |

| Fair value of all identifiable assets and liabilities as a result of business combinations | Note 3 Note 37 | |

| Impairment of investment securities | Note 3 Note 12 | |

| Impairment of non-financial assets | Note 3 Note 16 | |

| Structured entities | Note 3 Note 15 | |

| De facto control of other entities | Note 3 Note 31 | |

| Derecognition of financial assets and liabilities | Note 3 Note 14 | |

| Provisions | Note 3 Note 23 | |

| 3 | Significant Accounting Policies |

The significant accounting policies used in the preparation of these consolidated financial statements, including any additional accounting requirements of OSFI, as set out below, have been applied consistently to all periods presented in these consolidated financial statements, with the exception of the adoption of IFRS 15, effective November 1, 2018 (refer to Note 4), and IFRS 9, effective November 1, 2017.

Basis of consolidation

The consolidated financial statements include the assets, liabilities, financial performance and cash flows of the Bank and all of its subsidiaries, after elimination of intercompany transactions and balances. Subsidiaries are defined as entities controlled by the Bank and exclude associates and joint arrangements. The Bank’s subsidiaries can be classified as entities controlled through voting interests or structured entities. The Bank consolidates a subsidiary from the date it obtains control. The Bank controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. For the Bank to control an entity, all of the three elements of control should be in existence:

| • | power over the investee; |

| • | exposure, or rights, to variable returns from involvement with the equity investee; and |

| • | the ability to use power over the investee to affect the amount of the Bank’s returns. |

The Bank does not control an investee when it is acting as an agent. The Bank assesses whether it is an agent by determining whether it is primarily engaged to act on behalf of and for the benefit of another party or parties. The Bank reassesses whether it controls an investee if facts and circumstances indicate that one or more of the elements of control has changed. Non-controlling interests are presented within equity in the Consolidated Statement of Financial Position separate from equity attributable to equity holders of the Bank. Partial sales and incremental purchases of interests in subsidiaries that do not result in a change of control are accounted for as equity transactions with non-controlling interest holders. Any difference between the carrying amount of the interest and the transaction amount is recorded as an adjustment to retained earnings.

Voting-interest subsidiaries

Control is presumed with an ownership interest of more than 50% of the voting rights in an entity unless there are other factors that indicate that the Bank does not control the entity despite having more than 50% of voting rights.

The Bank may consolidate an entity when it owns less than 50% of the voting rights when it has one or more other attributes of power:

| • | by virtue of an agreement, over more than half of the voting rights; |

| • | to govern the financial and operating policies of the entity under a statute or an agreement; |

| • | to appoint or remove the majority of the members of the board of directors or equivalent governing body and control of the entity is by that board or body; or |

| • | to govern the financial and operating policies of the entity through the size of its holding of voting rights relative to the size and dispersion of holding of the other vote holders and voting patterns at shareholder meetings (i.e., de facto control). |

Structured entities

Structured entities are designed to accomplish certain well-defined objectives and for which voting or similar rights are not the dominant factor in deciding who controls the entity. The Bank may become involved with structured entities either at the formation stage or at a later date. The Bank controls an investee when it is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee.

The Bank consolidates all structured entities that it controls.

2019 Scotiabank Annual Report | 149

Table of Contents

Consolidated Financial Statements

Investments in associates

An associate is an entity in which the Bank has significant influence, but not control, over the operating and financial policies of the entity. Significant influence is ordinarily presumed to exist when the Bank holds between 20% and 50% of the voting rights. The Bank may also be able to exercise significant influence through board representation. The effects of potential voting rights that are currently exercisable or convertible are considered in assessing whether the Bank has significant influence.

Investments in associates are recognized initially at cost, which includes the purchase price and other costs directly attributable to the purchase. Associates are accounted for using the equity method which reflects the Bank’s share of the increase or decrease of the post-acquisition earnings and other movements in the associate’s equity.

If there is a loss of significant influence and the investment ceases to be an associate, equity accounting is discontinued from the date of loss of significant influence. If the retained interest on the date of loss of significant influence is a financial asset, it is measured at fair value and the difference between the fair value and the carrying value is recorded as an unrealized gain or loss in the Consolidated Statement of Income.

Investments in associates are evaluated for impairment at the end of each financial reporting period, or more frequently if events or changes in circumstances indicate the existence of objective evidence of impairment.

For purposes of applying the equity method for an investment that has a different reporting period from the Bank, adjustments are made for the effects of any significant events or transactions that occur between the reporting date of the investment and the reporting date of the Bank.

Joint arrangements

A joint arrangement is an arrangement over which two or more parties have joint control. Joint control exists only when decisions about the relevant activities (i.e., those that significantly affect the returns of the arrangement) require the unanimous consent of the parties sharing the control of the arrangement. Investments in joint arrangements are classified as either joint operations or joint ventures depending on the contractual rights and obligations of each investor, rather than the legal structure of the joint arrangement.

Similar to accounting for investment in associates, for joint ventures, investments are recognized initially at cost and accounted for using the equity method which reflects the Bank’s share of the increase or decrease of the post-acquisition earnings and other movements in the joint venture’s equity. Investments in joint ventures are evaluated for impairment at the end of each financial reporting period, or more frequently if events or changes in circumstances indicate the existence of objective evidence of impairment.

If there is a loss of joint control and it does not result in the Bank having significant influence over the joint venture, equity accounting is discontinued from the date of loss of joint control. If the retained interest in the former joint venture on the date of loss of joint control is a financial asset, it is measured at fair value and the difference between the fair value and the carrying value is recorded as an unrealized gain or loss in the Consolidated Statement of Income.

Translation of foreign currencies

The financial statements of each of the Bank’s foreign operations are measured using its functional currency, being the currency of the primary economic environment of the foreign operation.

Translation gains and losses related to the Bank’s monetary items are recognized in non-interest income in the Consolidated Statement of Income. Revenues and expenses denominated in foreign currencies are translated using average exchange rates, except for depreciation and amortization of buildings, equipment and leasehold improvements of the Bank, purchased in foreign currency, which are translated using historical rates. Foreign currency non-monetary items that are measured at historical cost are translated into the functional currency at historical rates. Foreign currency non-monetary items measured at fair value are translated into functional currency using the rate of exchange at the date the fair value was determined. Foreign currency gains and losses on non-monetary items are recognized in the Consolidated Statement of Income or Consolidated Statement of Comprehensive Income consistent with the gain or loss on the non-monetary item.

Unrealized gains and losses arising upon translation of foreign operations, together with any gains or losses arising from hedges of those net investment positions to the extent effective, are credited or charged to net change in unrealized foreign currency translation gains/losses in other comprehensive income in the Consolidated Statement of Comprehensive Income. On disposal or meeting the definition of partial disposal of a foreign operation, an appropriate portion of the translation differences previously recognized in other comprehensive income are recognized in the Consolidated Statement of Income.

Financial assets and liabilities

Recognition and initial measurement

The Bank, on the date of origination or purchase, recognizes loans, debt and equity securities, deposits and subordinated debentures at the fair value of consideration paid. Regular-way purchases and sales of financial assets are recognized on the settlement date. All other financial assets and liabilities, including derivatives, are initially recognized on the trade date at which the Bank becomes a party to the contractual provisions of the instrument.

The initial measurement of a financial asset or liability is at fair value plus transaction costs that are directly attributable to its purchase or issuance. For instruments measured at fair value through profit or loss, transaction costs are recognized immediately in profit or loss.

Classification and measurement, derecognition, and impairment of financial instruments effective November 1, 2017

Classification and measurement

Classification and measurement of financial assets

Financial assets are classified into one of the following measurement categories:

| • | Amortized cost; |

| • | Fair value through other comprehensive income (FVOCI); |

| • | Fair value through profit or loss (FVTPL); |

| • | Elected at fair value through other comprehensive income (Equities only); or |

| • | Designated at FVTPL |

150 | 2019 Scotiabank Annual Report

Table of Contents

Consolidated Financial Statements

Financial assets include both debt and equity instruments.

Debt instruments

Debt instruments, including loans and debt securities, are classified into one of the following measurement categories:

| • | Amortized cost; |

| • | Fair value through other comprehensive income (FVOCI); |

| • | Fair value through profit or loss (FVTPL); or |

| • | Designated at FVTPL |

Classification of debt instruments is determined based on:

| (i) | The business model under which the asset is held; and |

| (ii) | The contractual cash flow characteristics of the instrument. |

Business model assessment

Business model assessment involves determining how financial assets are managed in order to generate cash flows. The Bank’s business model assessment is based on the following categories:

| • | Held to collect: The objective of the business model is to hold assets and collect contractual cash flows. Any sales of the asset are incidental to the objective of the model. |

| • | Held to collect and for sale: Both collecting contractual cash flows and sales are integral to achieving the objectives of the business model. |

| • | Other business model: The business model is neither held-to-collect nor held-to-collect and for sale. |

The Bank assesses business model at a portfolio level reflective of how groups of assets are managed together to achieve a particular business objective. For the assessment of a business model, the Bank takes into consideration the following factors:

| • | How the performance of assets in a portfolio is evaluated and reported to group heads and other key decision makers within the Bank’s business lines; |

| • | How compensation is determined for the Bank’s business lines’ management that manages the assets; |

| • | Whether the assets are held for trading purposes i.e., assets that the Bank acquires or incurs principally for the purpose of selling or repurchasing in the near term, or holds as part of a portfolio that is managed together for short-term profit or position taking; |

| • | The risks that affect the performance of assets held within a business model and how those risks are managed; and |

| • | The frequency and volume of sales in prior periods and expectations about future sales activity. |

Contractual cash flow characteristics assessment

The contractual cash flow characteristics assessment involves assessing the contractual features of an instrument to determine if they give rise to cash flows that are consistent with a basic lending arrangement. Contractual cash flows are consistent with a basic lending arrangement if they represent cash flows that are solely payments of principal and interest on the principal amount outstanding (SPPI).

Principal is defined as the fair value of the instrument at initial recognition. Principal may change over the life of the instrument due to repayments or amortization of premium/discount.

Interest is defined as the consideration for the time value of money and the credit risk associated with the principal amount outstanding and for other basic lending risks and costs (liquidity risk and administrative costs), and a profit margin.

If the Bank identifies any contractual features that could significantly modify the cash flows of the instrument such that they are no longer consistent with a basic lending arrangement, the related financial asset is classified and measured at FVTPL.

Debt instruments measured at amortized cost

Debt instruments are measured at amortized cost if they are held within a business model whose objective is to hold for collection of contractual cash flows where those cash flows represent solely payments of principal and interest. After initial measurement, debt instruments in this category are carried at amortized cost. Interest income on these instruments is recognized in interest income using the effective interest rate method. The effective interest rate is the rate that discounts estimated future cash payments or receipts through the expected life of the financial asset to the gross carrying amount of a financial asset. Amortized cost is calculated by taking into account any discount or premium on acquisition, transaction costs and fees that are an integral part of the effective interest rate.

Impairment on debt instruments measured at amortized cost is calculated using the expected credit loss approach. Loans and debt securities measured at amortized cost are presented net of the allowance for credit losses (ACL) in the statement of financial position.

Debt instruments measured at FVOCI

Debt instruments are measured at FVOCI if they are held within a business model whose objective is to hold for collection of contractual cash flows and for selling financial assets, where the assets’ cash flows represent payments that are solely payments of principal and interest. Subsequent to initial recognition, unrealized gains and losses on debt instruments measured at FVOCI are recorded in other comprehensive income (OCI), unless the instrument is designated in a fair value hedge relationship. When designated in a fair value hedge relationship, any changes in fair value due to changes in the hedged risk are recognized in Non-interest income in the Consolidated Statement of Income. Upon derecognition, realized gains and losses are reclassified from OCI and recorded in Non-interest income in the Consolidated Statement of Income on an average cost basis. Foreign exchange gains and losses that relate to the amortized cost of the debt instrument are recognized in the Consolidated Statement of Income. Premiums, discounts and related transaction costs are amortized over the expected life of the instrument to Interest income in the Consolidated Statement of Income using the effective interest rate method.

Impairment on debt instruments measured at FVOCI is calculated using the expected credit loss approach. The ACL on debt instruments measured at FVOCI does not reduce the carrying amount of the asset in the Consolidated Statement of Financial Position, which remains at its fair value. Instead, an amount equal to the allowance that would arise if the assets were measured at amortised cost is recognised in OCI with a corresponding charge to Provision for credit losses in the Consolidated Statement of Income. The accumulated allowance recognised in OCI is recycled to the Consolidated Statement of Income upon derecognition of the debt instrument.

2019 Scotiabank Annual Report | 151

Table of Contents

Consolidated Financial Statements

Debt instruments measured at FVTPL

Debt instruments are measured at FVTPL if assets:

| (i) | Are held for trading purposes; |

| (ii) | Are held as part of a portfolio managed on a fair value basis; or |

| (iii) | Whose cash flows do not represent payments that are solely payments of principal and interest. |

These instruments are measured at fair value in the Consolidated Statement of Financial Position, with transaction costs recognized immediately in the Consolidated Statement of Income as part of Non-interest income. Realized and unrealized gains and losses are recognized as part of Non-interest income in the Consolidated Statement of Income.

Debt instruments designated at FVTPL

Financial assets classified in this category are those that have been designated by the Bank upon initial recognition, and once designated, the designation is irrevocable. The FVTPL designation is available only for those financial assets for which a reliable estimate of fair value can be obtained. Financial assets are designated at FVTPL if doing so eliminates or significantly reduces an accounting mismatch which would otherwise arise.

Financial assets designated at FVTPL are recorded in the Consolidated Statement of Financial Position at fair value. Changes in fair value are recognized in Non-interest income in the Consolidated Statement of Income.

Equity instruments

Equity instruments are classified into one of the following measurement categories:

| • | Fair value through profit or loss (FVTPL); or |

| • | Elected at fair value through other comprehensive income (FVOCI). |

Equity instruments measured at FVTPL

Equity instruments are measured at FVTPL, unless an election is made to designate them at FVOCI upon purchase, with transaction costs recognized immediately in the Consolidated Statement of Income as part of Non-interest income. Subsequent to initial recognition the changes in fair value and dividends received are recognized as part of Non-interest income in the Consolidated Statement of Income.

Equity instruments measured at FVOCI

At initial recognition, there is an irrevocable option for the Bank to classify non-trading equity instruments at FVOCI. This election is used for certain equity investments for strategic or longer term investment purposes. This election is made on an instrument-by-instrument basis and is not available to equity instruments that are held for trading purposes.

Gains and losses on these instruments including when derecognized/sold are recorded in OCI and are not subsequently reclassified to the Consolidated Statement of Income. As such, there is no specific impairment requirement. Dividends received are recorded in Interest income in the Consolidated Statement of Income. Any transaction costs incurred upon purchase of the security are added to the cost basis of the security and are not reclassified to the Consolidated Statement of Income on sale of the security.

Classification and measurement of financial liabilities

Financial liabilities are classified into one of the following measurement categories:

| • | Fair value through profit or loss (FVTPL); |

| • | Amortized cost; or |

| • | Designated at FVTPL. |

Financial liabilities measured at FVTPL

Financial liabilities measured at FVTPL are held principally for the purpose of repurchasing in the near term, or form part of a portfolio of identified financial instruments that are managed together and for which there is evidence of a recent actual pattern of short term profit-taking. Financial liabilities are recognized on a trade date basis and are accounted for at fair value, with changes in fair value and any gains or losses recognized in the Consolidated Statement of Income as part of the non-interest income. Transaction costs are expensed as incurred.

Financial liabilities measured at amortized cost

Deposits, subordinated notes and debentures are accounted for at amortized cost. Interest on deposits, calculated using the effective interest rate method, is recognized as interest expense. Interest on subordinated notes and debentures, including capitalized transaction costs, is recognized using the effective interest rate method as interest expense.

Financial liabilities designated at FVTPL

Financial liabilities classified in this category are those that have been designated by the Bank upon initial recognition, and once designated, the designation is irrevocable. The FVTPL designation is available only for those financial liabilities for which a reliable estimate of fair value can be obtained.

Financial liabilities are designated at FVTPL when one of the following criteria is met:

| • | The designation eliminates or significantly reduces an accounting mismatch which would otherwise arise; or |

| • | A group of financial liabilities are managed and their performance is evaluated on a fair value basis, in accordance with a documented risk management strategy; or |

| • | The financial liability contains one or more embedded derivatives which significantly modify the cash flows otherwise required. |

Financial liabilities designated at FVTPL are recorded in the Consolidated Statement of Financial Position at fair value. Any changes in fair value are recognized in Non-interest income in the Consolidated Statement of Income, except for changes in fair value arising from changes in the Bank’s own credit risk which are recognized in the OCI. Changes in fair value due to changes in the Bank’s own credit risk are not subsequently reclassified to Consolidated Statement of Income upon derecognition/extinguishment of the liabilities.

152 | 2019 Scotiabank Annual Report

Table of Contents

Consolidated Financial Statements

Determination of fair value

Fair value of a financial asset or liability is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants in the principal, or in its absence, the most advantageous market to which the Bank has access at the measurement date.

The Bank values instruments carried at fair value using quoted market prices, where available. Unadjusted quoted market prices for identical instruments represent a Level 1 valuation. When quoted market prices are not available, the Bank maximizes the use of observable inputs within valuation models. When all significant inputs are observable, the valuation is classified as Level 2. Valuations that require the significant use of unobservable inputs are considered Level 3.

Inception gains and losses are only recognized where the valuation is dependent only on observable market data, otherwise, they are deferred and amortized over the life of the related contract or until the valuation inputs become observable.

IFRS 13 permits a measurement exception that allows an entity to determine the fair value of a group of financial assets and liabilities with offsetting risks based on the sale or transfer of its net exposure to a particular risk (or risks). The Bank has adopted this exception through an accounting policy choice. Consequently, the fair values of certain portfolios of financial instruments are determined based on the net exposure of those instruments to particular market, credit or funding risk.

In determining fair value for certain instruments or portfolios of instruments, valuation adjustments or reserves may be required to arrive at a more accurate representation of fair value. These adjustments include those made for credit risk, bid-offer spreads, unobservable parameters, constraints on prices in inactive or illiquid markets and when applicable funding costs.

Derecognition of financial assets and liabilities

Derecognition of financial assets

The derecognition criteria are applied to the transfer of part of an asset, rather than the asset as a whole, only if such part comprises specifically identified cash flows from the asset, a fully proportionate share of the cash flows from the asset, or a fully proportionate share of specifically identified cash flows from the asset.

A financial asset is derecognized when the contractual rights to the cash flows from the asset has expired; or the Bank transfers the contractual rights to receive the cash flows from the financial asset; or has assumed an obligation to pay those cash flows to an independent third-party; or the Bank has transferred substantially all the risks and rewards of ownership of that asset to an independent third-party. Management determines whether substantially all the risk and rewards of ownership have been transferred by quantitatively comparing the variability in cash flows before and after the transfer. If the variability in cash flows remains significantly similar subsequent to the transfer, the Bank has retained substantially all of the risks and rewards of ownership.

Where substantially all the risks and rewards of ownership of the financial asset are neither retained nor transferred, the Bank derecognizes the transferred asset only if it has lost control over that asset. Control over the asset is represented by the practical ability to sell the transferred asset. If the Bank retains control over the asset, it will continue to recognize the asset to the extent of its continuing involvement. At times such continuing involvement may be in the form of investment in senior or subordinated tranches of notes issued by non-consolidated structured entities.

On derecognition of a financial asset, the difference between the carrying amount and the sum of (i) the consideration received (including any new asset obtained less any new liability assumed) and (ii) any cumulative gain or loss that had been recognized in other comprehensive income is recognized in the Consolidated Statement of Income.

Transfers of financial assets that do not qualify for derecognition are reported as secured financings in the Consolidated Statement of Financial Position.

Derecognition of financial liabilities

A financial liability is derecognized when the obligation under the liability is discharged, canceled or expires. If an existing financial liability is replaced by another from the same counterparty on substantially different terms, or the terms of the existing liability are substantially modified, such an exchange or modification is treated as a derecognition of the original liability and the recognition of a new liability at fair value. The difference in the respective carrying amount of the existing liability and the new liability is recognized as a gain/loss in the Consolidated Statement of Income.

Impairment

Scope

The Bank applies a three-stage approach to measure allowance for credit losses, using an expected credit loss approach as required under IFRS 9, for the following categories of financial instruments that are not measured at fair value through profit or loss:

| • | Amortized cost financial assets; |

| • | Debt securities classified as at FVOCI; |

| • | Off-balance sheet loan commitments; and |

| • | Financial guarantee contracts. |

Expected credit loss impairment model

The Bank’s allowance for credit losses calculations are outputs of models with a number of underlying assumptions regarding the choice of variable inputs and their interdependencies. The expected credit loss impairment model reflects the present value of all cash shortfalls related to default events either (i) over the following twelve months or (ii) over the expected life of a financial instrument depending on credit deterioration from inception. The allowance for credit losses reflects an unbiased, probability-weighted outcome which considers multiple scenarios based on reasonable and supportable forecasts.

This impairment model measures credit loss allowances using a three-stage approach based on the extent of credit deterioration since origination:

| • | Stage 1 – Where there has not been a significant increase in credit risk (SIR) since initial recognition of a financial instrument, an amount equal to 12 months expected credit loss is recorded. The expected credit loss is computed using a probability of default occurring over the next 12 months. For those instruments with a remaining maturity of less than 12 months, a probability of default corresponding to remaining term to maturity is used. |

2019 Scotiabank Annual Report | 153

Table of Contents

Consolidated Financial Statements

| • | Stage 2 – When a financial instrument experiences a SIR subsequent to origination but is not considered to be in default, it is included in Stage 2. This requires the computation of expected credit loss based on the probability of default over the remaining estimated life of the financial instrument. |

| • | Stage 3 – Financial instruments that are considered to be in default are included in this stage. Similar to Stage 2, the allowance for credit losses captures the lifetime expected credit losses. |

Measurement of expected credit loss

The probability of default (PD), exposure at default (EAD), and loss given default (LGD) inputs used to estimate expected credit losses are modelled based on macroeconomic variables that are most closely related with credit losses in the relevant portfolio.

Details of these statistical parameters/inputs are as follows:

| • | PD – The probability of default is an estimate of the likelihood of default over a given time horizon. A default may only happen at a certain time over the remaining estimated life, if the facility has not been previously derecognized and is still in the portfolio. |

| • | EAD – The exposure at default is an estimate of the exposure at a future default date, taking into account expected changes in the exposure after the reporting date, including repayments of principal and interest, whether scheduled by contract or otherwise, expected drawdowns on committed facilities, and accrued interest from missed payments. |

| • | LGD – The loss given default is an estimate of the loss arising in the case where a default occurs at a given time. It is based on the difference between the contractual cash flows due and those that the lender would expect to receive, including from the realization of any collateral. It is usually expressed as a percentage of the EAD. |

Forward-looking information

The estimation of expected credit losses for each stage and the assessment of significant increases in credit risk consider information about past events and current conditions as well as reasonable and supportable forecasts of future events and economic conditions. The estimation and application of forward-looking information may require significant judgment.

Macroeconomic factors

In its models, the Bank relies on a broad range of forward-looking economic information as inputs, such as: GDP growth, unemployment rates, central-bank interest rates, and house-price indices. The inputs and models used for calculating expected credit losses may not always capture all characteristics of the market at the date of the financial statements. Qualitative adjustments or overlays may be made as temporary adjustments using expert credit judgment.

Multiple forward-looking scenarios

The Bank determines its allowance for credit losses using three probability-weighted forward-looking scenarios. The Bank considers both internal and external sources of information and data in order to achieve an unbiased projections and forecasts. The Bank prepares the scenarios using forecasts generated by Scotiabank Economics (SE). The forecasts are created using internal and external models which are modified by SE as necessary to formulate a ‘base case’ view of the most probable future direction of relevant economic variables as well as a representative range of other possible forecast scenarios. The process involves the development of two additional economic scenarios and consideration of the relative probabilities of each outcome.