EX-2

|

|

|

|

|

| |

16 |

|

|

Forward-looking statements |

| |

17 |

|

|

Non-GAAP measures |

| |

18 |

|

|

Financial highlights |

|

|

|

|

|

| |

OVERVIEW |

|

|

| |

19 |

|

|

Financial results |

| |

21 |

|

|

Outlook |

| |

21 |

|

|

Shareholder returns |

| |

21 |

|

|

Impact of foreign currency

translation |

| |

21 |

|

|

Impact of acquisitions |

|

|

|

|

|

| |

GROUP FINANCIAL PERFORMANCE |

|

|

| |

22 |

|

|

Total revenue |

| |

22 |

|

|

Net interest income |

| |

24 |

|

|

Net fee and commission revenues |

| |

25 |

|

|

Other operating income |

| |

26 |

|

|

Operating expenses |

| |

27 |

|

|

Taxes |

| |

27 |

|

|

Credit quality |

| |

34 |

|

|

Fourth quarter review |

| |

36 |

|

|

Summary of quarterly results |

| |

37 |

|

|

Financial results review: 2013

vs 2012 |

|

|

|

|

|

| |

GROUP FINANCIAL CONDITION |

|

|

| |

40 |

|

|

Statement of financial position |

| |

41 |

|

|

Capital management |

| |

50 |

|

|

Off-balance sheet arrangements |

| |

52 |

|

|

Financial instruments |

| |

52 |

|

|

Selected credit instruments – publically known risk items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

BUSINESS LINES |

|

|

| |

54 |

|

|

Overview |

| |

56 |

|

|

Canadian Banking |

| |

58 |

|

|

International Banking |

| |

60 |

|

|

Global Wealth & Insurance |

| |

62 |

|

|

Global Banking & Markets |

| |

64 |

|

|

Other |

|

|

|

|

|

| |

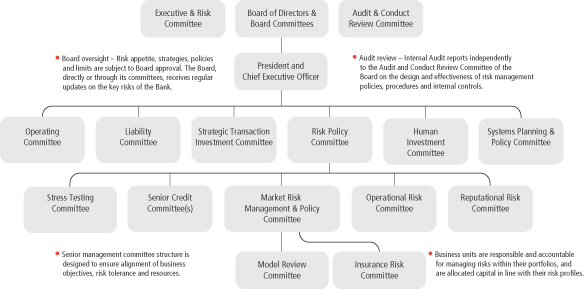

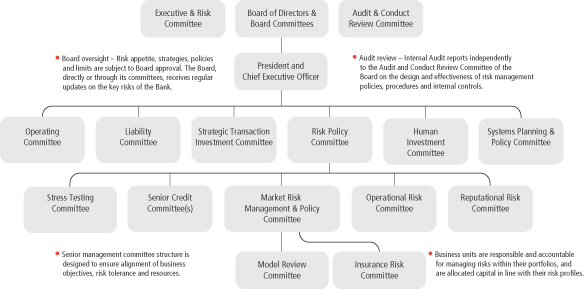

RISK MANAGEMENT |

|

|

| |

65 |

|

|

Overview |

| |

71 |

|

|

Credit risk |

| |

75 |

|

|

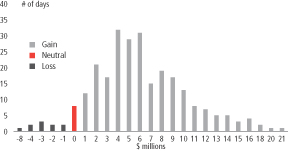

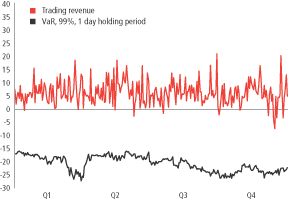

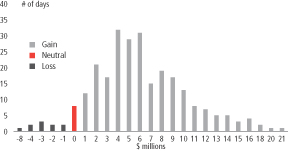

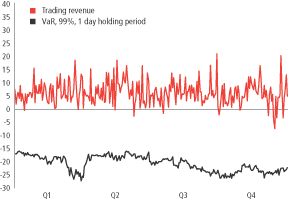

Market risk |

| |

81 |

|

|

Liquidity risk |

| |

87 |

|

|

Other risks |

|

|

|

|

87 Operational risk |

|

|

|

|

88 Reputational risk |

|

|

|

|

88 Environmental risk |

|

|

|

|

89 Insurance risk |

|

|

|

|

89 Strategic risk |

|

|

|

|

|

| |

CONTROLS AND ACCOUNTING POLICIES |

|

|

| |

90 |

|

|

Controls and procedures |

| |

90 |

|

|

Critical accounting estimates |

| |

96 |

|

|

Future accounting developments |

| |

96 |

|

|

Regulatory developments |

| |

97 |

|

|

Related party transactions |

|

|

|

|

|

| |

SUPPLEMENTARY DATA |

|

|

| |

98 |

|

|

Geographic information |

| |

100 |

|

|

Credit risk |

| |

105 |

|

|

Revenues and expenses |

| |

107 |

|

|

Selected quarterly information |

| |

108 |

|

|

Eleven-year statistical review |

2014 Scotiabank Annual Report 15

MANAGEMENT’S DISCUSSION AND ANALYSIS

FORWARD LOOKING STATEMENTS

Our public communications often include oral or written forward-looking statements. Statements of this type are

included in this document, and may be included in other filings with Canadian securities regulators or the U.S. Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbour”

provisions of the U.S. Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. Forward-looking statements may include, but are not limited to, statements made in this Management’s Discussion and

Analysis in the Bank’s 2014 Annual Report under the headings “Overview-Outlook,” for Group Financial Performance “Outlook,” for each business segment “Outlook” and in other statements regarding the Bank’s

objectives, strategies to achieve those objectives, expected financial results (including those in the area of risk management), and the outlook for the Bank’s businesses and for the Canadian, U.S. and global economies. Such statements are

typically identified by words or phrases such as “believe,” “expect,” “anticipate,” “intent,” “estimate,” “plan,” “may increase,” “may fluctuate,” and similar

expressions of future or conditional verbs, such as “will,” “should,” “would” and “could.”

By

their very nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, and the risk that predictions and other forward-looking statements will not prove to be accurate. Do not unduly

rely on forward-looking statements, as a number of important factors, many of which are beyond our control, could cause actual results to differ materially from the estimates and intentions expressed in such forward-looking statements. These factors

include, but are not limited to: the economic and financial conditions in Canada and globally; fluctuations in interest rates and currency values; liquidity; significant market volatility and interruptions; the failure of third parties to comply

with their obligations to us and our affiliates; the effect of changes in monetary policy; legislative and regulatory developments in Canada and elsewhere, including changes in tax laws; the effect of changes to our credit ratings; amendments to,

and interpretations of, risk-based capital guidelines and reporting instructions and liquidity regulatory guidance; operational and reputational risks; the risk that the Bank’s risk management models may not take into account all relevant

factors; the accuracy and completeness of information the Bank receives on customers and counterparties; the timely development and introduction of new products and services in receptive markets; the Bank’s ability to expand existing

distribution channels and to develop and realize revenues from new distribution channels; the Bank’s ability to complete and integrate acquisitions and its other growth strategies; changes in accounting policies and methods the Bank uses to

report its financial condition and financial performance, including uncertainties associated with critical accounting assumptions and estimates (See “Controls and Accounting Policies - Critical accounting estimates” in the Bank’s 2014

Annual Report, as updated by quarterly reports); the effect of applying future accounting changes (See “Controls and Accounting Policies - Future accounting developments” in the Bank’s 2014 Annual Report, as updated by quarterly

reports); global capital markets activity; the Bank’s ability to attract and retain key executives; reliance on third parties to provide components of the Bank’s business infrastructure; unexpected changes in consumer spending and saving

habits; technological developments; fraud by internal or external

parties, including the use of new technologies in unprecedented ways to defraud the Bank or its customers; increasing cyber security risks which may include theft of assets, unauthorized access

to sensitive information or operational disruption; consolidation in the Canadian financial services sector; competition, both from new entrants and established competitors; judicial and regulatory proceedings; acts of God, such as earthquakes and

hurricanes; the possible impact of international conflicts and other developments, including terrorist acts and war on terrorism; the effects of disease or illness on local, national or international economies; disruptions to public infrastructure,

including transportation, communication, power and water; and the Bank’s anticipation of and success in managing the risks implied by the foregoing. A substantial amount of the Bank’s business involves making loans or otherwise committing

resources to specific companies, industries or countries. Unforeseen events affecting such borrowers, industries or countries could have a material adverse effect on the Bank’s financial results, businesses, financial condition or liquidity.

These and other factors may cause the Bank’s actual performance to differ materially from that contemplated by forward-looking statements. For more information, see the “Risk Management” section starting on page 65 of the

Bank’s 2014 Annual Report.

Material economic assumptions underlying the forward-looking statements contained in this document are

set out in the 2014 Annual Report under the heading “Overview-Outlook,” as updated by quarterly reports; and for each business segment “Outlook”. The “Outlook” sections in this document are based on the Bank’s

views and the actual outcome is uncertain. Readers should consider the above-noted factors when reviewing these sections.

The

preceding list of important factors is not exhaustive. When relying on forward-looking statements to make decisions with respect to the Bank and its securities, investors and others should carefully consider the preceding factors, other

uncertainties and potential events. The Bank does not undertake to update any forward-looking statements, whether written or oral, that may be made from time to time by or on its behalf.

Additional information relating to the Bank, including the Bank’s Annual Information Form, can be located on the SEDAR website at

www.sedar.com and on the EDGAR section of the SEC’s website at www.sec.gov.

December 5, 2014

16 2014 Scotiabank Annual Report

MANAGEMENT’S DISCUSSION AND ANALYSIS | OVERVIEW

Non-GAAP Measures

The Bank uses a number of financial measures to assess its performance. Some of these measures are not calculated in accordance with Generally Accepted Accounting Principles (GAAP), which are based on International

Financial Reporting Standards (IFRS), are not defined by GAAP and do not have standardized meanings that would ensure consistency and comparability between companies using these measures. These non-GAAP measures are used throughout this report and

defined below.

Assets under administration (AUA)

AUA are assets administered by the Bank which are beneficially owned by clients and therefore not reported on the Bank’s Consolidated Statement of Financial Position. Services provided for AUA are of an

administrative nature, such as trusteeship, custodial, safekeeping, income collection and distribution, securities trade settlements, customer reporting, and other similar services.

Assets under management (AUM)

AUM are assets managed by the Bank on a discretionary basis and in

respect of which the Bank earns investment management fees. AUM are beneficially owned by clients and are therefore not reported on the Bank’s Consolidated Statement of Financial Position. Some AUM are also administered assets and are therefore

included in assets under administration.

Adjusted diluted earnings per share

The adjusted diluted earnings per share is calculated by adjusting the diluted earnings per share to add back the non-cash, after-tax amortization of intangible assets related to acquisitions (excluding software).

Economic equity and return on economic equity

For internal reporting purposes, the Bank attributes capital to its business segments based on their risk profile and uses a methodology that considers credit, market, operational and other risks inherent in each

business segment. The amount of risk capital attributed is commonly referred to as economic equity. The economic equity methodology, models and assumptions are updated annually and applied prospectively. Return on economic equity for the business

segments is calculated as a ratio of net income attributable to common shareholders of the business segment and the economic equity attributed.

Core banking assets

Core banking assets are average earning assets excluding bankers’

acceptances and total average assets related to the Global Capital Markets business within Global Banking & Markets.

Core banking

margin (TEB)

This ratio represents net interest income (on a taxable equivalent basis) divided by average core banking assets. This is consistent with

the Bank’s Consolidated Statement of Income presentation where net interest income from trading operations is recorded in trading revenues included in other operating income.

Operating leverage (TEB)

The Bank defines operating leverage as the rate of growth in total revenue

(on a taxable equivalent basis), less the rate of growth in operating expenses.

Productivity ratio (TEB)

Management uses the productivity ratio as a measure of the Bank’s efficiency. This ratio represents operating expenses as a percentage of total revenue (TEB).

Return on equity

Return on equity is a

profitability measure that presents the net income attributable to common shareholders as a percentage of common shareholders’ equity. The Bank calculates its return on equity using average common shareholders’ equity.

Regulatory capital ratios

Regulatory capital

ratios, such as Common Equity Tier 1 (CET1), Tier 1 and Total Capital ratios, have standardized meanings as defined by the Office of the Superintendent of Financial Institutions, Canada.

Taxable equivalent basis

The Bank analyzes net interest income, other operating income, and total

revenue on a taxable equivalent basis (TEB). This methodology grosses up tax-exempt income earned on certain securities reported in either net interest income or other operating income to an equivalent before tax basis. A corresponding increase is

made to the provision for income taxes; hence, there is no impact on net income. Management believes that this basis for measurement provides a uniform comparability of net interest income and other operating income arising from both taxable and

non-taxable sources and facilitates a consistent basis of measurement. While other banks also use TEB, their methodology may not be comparable to the Bank’s methodology. For purposes of segmented reporting, a segment’s revenue and

provision for income taxes are grossed up by the taxable equivalent amount. The elimination of the TEB gross up is recorded in the Other segment. The TEB gross up to net interest income, other operating income, total revenue, and provision for

income taxes are presented below:

T1 TEB gross up

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the year ended October 31 ($ millions) |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| Net interest income |

|

$ |

17 |

|

|

$ |

15 |

|

|

$ |

17 |

|

| Other operating income |

|

|

337 |

|

|

|

297 |

|

|

|

271 |

|

| Total revenue and provision for income taxes |

|

$ |

354 |

|

|

$ |

312 |

|

|

$ |

288 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Tax normalization adjustment of net income from associated

corporations

For business line performance assessment and reporting, net income from associated

corporations, which is an after-tax number, is adjusted to normalize for income taxes.

The tax normalization adjustment grosses up the amount of net

income from associated corporations and normalizes the effective tax rate in the business lines to better present the contribution of the associated corporations to the business line results.

2014 Scotiabank Annual Report 17

MANAGEMENT’S DISCUSSION AND ANALYSIS

T2 Financial highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

IFRS

|

|

|

|

|

CGAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As at and for the years ended October 31(1) |

|

2014 |

|

|

2013(2) |

|

|

2012(2) |

|

|

2011 |

|

|

|

|

2010 |

|

| Operating results ($ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

|

12,305 |

|

|

|

11,350 |

|

|

|

9,970 |

|

|

|

9,014 |

|

|

|

|

|

8,621 |

|

| Net interest income (TEB(3)) |

|

|

12,322 |

|

|

|

11,365 |

|

|

|

9,987 |

|

|

|

9,035 |

|

|

|

|

|

8,907 |

|

| Non-interest revenue |

|

|

11,299 |

|

|

|

9,949 |

|

|

|

9,676 |

|

|

|

8,296 |

|

|

|

|

|

6,884 |

|

| Non-interest revenue (TEB(3)) |

|

|

11,636 |

|

|

|

10,246 |

|

|

|

9,947 |

|

|

|

8,562 |

|

|

|

|

|

6,884 |

|

| Total revenue |

|

|

23,604 |

|

|

|

21,299 |

|

|

|

19,646 |

|

|

|

17,310 |

|

|

|

|

|

15,505 |

|

| Total revenue (TEB(3)) |

|

|

23,958 |

|

|

|

21,611 |

|

|

|

19,934 |

|

|

|

17,597 |

|

|

|

|

|

15,791 |

|

| Provision for credit losses |

|

|

1,703 |

|

|

|

1,288 |

|

|

|

1,252 |

|

|

|

1,076 |

|

|

|

|

|

1,239 |

|

| Operating expenses |

|

|

12,601 |

|

|

|

11,664 |

|

|

|

10,436 |

|

|

|

9,481 |

|

|

|

|

|

8,182 |

|

| Provision for income taxes |

|

|

2,002 |

|

|

|

1,737 |

|

|

|

1,568 |

|

|

|

1,423 |

|

|

|

|

|

1,745 |

|

| Provision for income taxes (TEB(3)) |

|

|

2,356 |

|

|

|

2,049 |

|

|

|

1,856 |

|

|

|

1,710 |

|

|

|

|

|

2,031 |

|

| Net income |

|

|

7,298 |

|

|

|

6,610 |

|

|

|

6,390 |

|

|

|

5,330 |

|

|

|

|

|

4,339 |

|

| Net income attributable to common shareholders |

|

|

6,916 |

|

|

|

6,162 |

|

|

|

5,974 |

|

|

|

4,965 |

|

|

|

|

|

4,038 |

|

| Operating performance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share ($) |

|

|

5.69 |

|

|

|

5.15 |

|

|

|

5.27 |

|

|

|

4.63 |

|

|

|

|

|

3.91 |

|

| Diluted earnings per share ($) |

|

|

5.66 |

|

|

|

5.11 |

|

|

|

5.18 |

|

|

|

4.53 |

|

|

|

|

|

3.91 |

|

| Adjusted diluted earnings per share(3)(4) ($) |

|

|

5.72 |

|

|

|

5.17 |

|

|

|

5.23 |

|

|

|

4.58 |

|

|

|

|

|

3.94 |

|

| Return on equity(3) (%) |

|

|

16.1 |

|

|

|

16.6 |

|

|

|

19.9 |

|

|

|

20.3 |

|

|

|

|

|

18.3 |

|

| Productivity ratio (%)(TEB(3)) |

|

|

52.6 |

|

|

|

54.0 |

|

|

|

52.4 |

|

|

|

53.9 |

|

|

|

|

|

51.8 |

|

| Core banking margin (%)(TEB(3)) |

|

|

2.39 |

|

|

|

2.31 |

|

|

|

2.31 |

|

|

|

2.32 |

|

|

|

|

|

N/A |

(5) |

| Financial position information ($ millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and deposits with financial institutions(6) |

|

|

56,730 |

|

|

|

53,338 |

|

|

|

47,337 |

|

|

|

38,723 |

|

|

|

|

|

39,530 |

|

| Trading assets |

|

|

113,248 |

|

|

|

96,489 |

|

|

|

87,596 |

|

|

|

75,799 |

|

|

|

|

|

N/A |

(5) |

| Loans(6) |

|

|

424,309 |

|

|

|

402,215 |

|

|

|

352,578 |

|

|

|

319,056 |

|

|

|

|

|

284,224 |

|

| Total assets |

|

|

805,666 |

|

|

|

743,644 |

|

|

|

668,225 |

|

|

|

594,423 |

|

|

|

|

|

526,657 |

|

| Deposits(6)(7) |

|

|

554,017 |

|

|

|

517,887 |

|

|

|

465,689 |

|

|

|

421,234 |

|

|

|

|

|

361,650 |

|

| Common equity |

|

|

44,965 |

|

|

|

40,165 |

|

|

|

34,335 |

|

|

|

26,356 |

|

|

|

|

|

23,656 |

|

| Preferred shares |

|

|

2,934 |

|

|

|

4,084 |

|

|

|

4,384 |

|

|

|

4,384 |

|

|

|

|

|

3,975 |

|

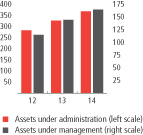

| Assets under administration(3) |

|

|

427,547 |

|

|

|

377,766 |

|

|

|

327,977 |

|

|

|

297,668 |

|

|

|

|

|

243,817 |

|

| Assets under management(3) |

|

|

164,820 |

|

|

|

145,470 |

|

|

|

114,694 |

|

|

|

102,733 |

|

|

|

|

|

53,532 |

|

| Capital measures(2)(8) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Equity Tier 1 (CET1) ratio (%) |

|

|

10.8 |

|

|

|

9.1 |

|

|

|

N/A |

|

|

|

N/A |

|

|

|

|

|

N/A |

|

| Tier 1 capital ratio (%) |

|

|

12.2 |

|

|

|

11.1 |

|

|

|

13.6 |

|

|

|

12.2 |

|

|

|

|

|

11.8 |

|

| Total capital ratio (%) |

|

|

13.9 |

|

|

|

13.5 |

|

|

|

16.7 |

|

|

|

13.9 |

|

|

|

|

|

13.8 |

|

| Assets to capital multiple |

|

|

17.1 |

|

|

|

17.1 |

|

|

|

15.0 |

|

|

|

16.6 |

|

|

|

|

|

17.0 |

|

| CET1 risk-weighted assets ($ millions)(9) |

|

|

312,473 |

|

|

|

288,246 |

|

|

|

253,309 |

|

|

|

233,970 |

|

|

|

|

|

215,034 |

|

| Credit quality |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net impaired loans ($ millions)(10) |

|

|

2,002 |

|

|

|

1,808 |

|

|

|

2,005 |

|

|

|

1,957 |

|

|

|

|

|

3,044 |

|

| Allowance for credit losses ($ millions) |

|

|

3,641 |

|

|

|

3,273 |

|

|

|

2,977 |

|

|

|

2,689 |

|

|

|

|

|

2,787 |

|

| Net impaired loans as a % of loans and

acceptances(6)(10) |

|

|

0.46 |

|

|

|

0.44 |

|

|

|

0.55 |

|

|

|

0.60 |

|

|

|

|

|

1.04 |

|

| Provision for credit losses as a % of average loans and acceptances (annualized)(6) |

|

|

0.40 |

|

|

|

0.32 |

|

|

|

0.36 |

|

|

|

0.34 |

|

|

|

|

|

0.45 |

|

| Common share information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share price ($)(TSX) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| High |

|

|

74.93 |

|

|

|

64.10 |

|

|

|

57.18 |

|

|

|

61.28 |

|

|

|

|

|

55.76 |

|

| Low |

|

|

59.92 |

|

|

|

52.30 |

|

|

|

47.54 |

|

|

|

49.00 |

|

|

|

|

|

44.12 |

|

| Close |

|

|

69.02 |

|

|

|

63.39 |

|

|

|

54.25 |

|

|

|

52.53 |

|

|

|

|

|

54.67 |

|

| Shares outstanding (millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average – Basic |

|

|

1,214 |

|

|

|

1,195 |

|

|

|

1,133 |

|

|

|

1,072 |

|

|

|

|

|

1,032 |

|

| Average – Diluted |

|

|

1,222 |

|

|

|

1,209 |

|

|

|

1,160 |

|

|

|

1,108 |

|

|

|

|

|

1,034 |

|

| End of period |

|

|

1,217 |

|

|

|

1,209 |

|

|

|

1,184 |

|

|

|

1,089 |

|

|

|

|

|

1,043 |

|

| Dividends per share ($) |

|

|

2.56 |

|

|

|

2.39 |

|

|

|

2.19 |

|

|

|

2.05 |

|

|

|

|

|

1.96 |

|

| Dividend yield (%)(11) |

|

|

3.8 |

|

|

|

4.1 |

|

|

|

4.2 |

|

|

|

3.7 |

|

|

|

|

|

3.9 |

|

| Market capitalization ($ millions)(TSX) |

|

|

83,969 |

|

|

|

76,612 |

|

|

|

64,252 |

|

|

|

57,204 |

|

|

|

|

|

57,016 |

|

| Book value per common share ($) |

|

|

36.96 |

|

|

|

33.23 |

|

|

|

28.99 |

|

|

|

24.20 |

|

|

|

|

|

22.68 |

|

| Market value to book value multiple |

|

|

1.9 |

|

|

|

1.9 |

|

|

|

1.9 |

|

|

|

2.2 |

|

|

|

|

|

2.4 |

|

| Price to earnings multiple |

|

|

12.1 |

|

|

|

12.3 |

|

|

|

10.3 |

|

|

|

11.3 |

|

|

|

|

|

14.0 |

|

| Other information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Employees |

|

|

86,932 |

|

|

|

86,690 |

(7) |

|

|

81,497 |

|

|

|

75,362 |

|

|

|

|

|

70,772 |

|

| Branches and offices |

|

|

3,288 |

|

|

|

3,330 |

|

|

|

3,123 |

|

|

|

2,926 |

|

|

|

|

|

2,784 |

|

| (1) |

Amounts and financial ratios for periods after 2010 were prepared in accordance with International Financial Reporting Standards (IFRS). Amounts and financial ratios for 2010

were prepared in accordance with Canadian Generally Accepted Accounting Principles (CGAAP). |

| (2) |

Certain prior period amounts are retrospectively adjusted to reflect the adoption of new and amended IFRS standards (IFRS 10 and IAS 19) in 2014 (refer to Note 4 in the

consolidated financial statements). Capital measures have not been restated for the new and amended IFRS standards as they represent the actual amounts in the period for regulatory purposes. |

| (3) |

Refer to page 17 for a discussion of non-GAAP measures. |

| (4) |

Amounts for periods before 2013 have been restated to reflect the current period definition. Refer to non-GAAP measures on page 17. |

| (5) |

N/A not applicable/not presented under CGAAP. |

| (6) |

Amounts and related ratios for 2012 and 2011 have been restated to reflect the current period presentation of deposits with financial institutions and cash collateral on

securities borrowed and derivative transactions. |

| (7) |

Prior period amounts have been restated to conform with current period presentation. |

| (8) |

Effective November 1, 2012 regulatory capital ratios are determined in accordance with Basel III rules on an all-in basis (Refer to page 41). Comparative amounts for prior

periods were determined in accordance with Basel II rules and have not been restated. |

| (9) |

As at October 31, 2014, credit valuation adjustment (CVA) risk-weighted assets were calculated using scalars of 0.57, 0.65 and 0.77 to compute CET1, Tier 1 and Total Capital

ratios, respectively. |

| (10) |

Excludes Federal Deposit Insurance Corporation (FDIC) guaranteed loans related to the acquisition of R-G Premier Bank of Puerto Rico. |

| (11) |

Based on the average of the high and low common share price for the year. |

18 2014 Scotiabank Annual Report

MANAGEMENT’S DISCUSSION AND ANALYSIS | OVERVIEW

Overview

Financial Results

Scotiabank had good performance in 2014 with respect to its medium-term

financial objectives. Net income was $7,298 million, $688 million or 10% higher than last year’s results. Diluted earnings per share (EPS) were $5.66 as compared to $5.11 in 2013. Return on Equity was 16.1% compared to 16.6% last year.

The current year’s net income included an after-tax gain of $555 million on the sale of a majority of the Bank’s holding in CI Financial Corp.

(“the disposition”), after-tax restructuring charges of $110 million (“restructuring charges”), and after-tax impact of other notable items of $155 million, or collectively 23 cents per share (refer T3). Last

year’s net income benefited from a non-recurring after-tax benefit of $90 million or 7 cents per share in International Banking. Adjusting for these items, net income grew by $488 million or 7% and diluted earnings per share were $5.43 as

compared to $5.04 in 2013, an increase of 8%. Underlying Return on Equity was 15.5% compared to 16.3% last year.

Total revenues on a taxable

equivalent basis (TEB) rose 11% from the prior year to $23,958 million. Adjusting for the notable items (refer T3) in 2014 of $566 million and in 2013 of $150 million, underlying revenues increased by 9%. The positive impact of foreign currency

translation contributed approximately 2% of this growth.

Net interest income (TEB) increased $957 million or 8% to $12,322 million, primarily from

growth in core banking assets and improved margin, including the favourable impact of foreign currency translation.

Net fee and commission revenue was

$7,737 million, up $820 million or 12% year over year. Growth was primarily in wealth management fees, from higher mutual fund fees and brokerage commissions. Banking revenue growth was broad-based across all revenue categories.

Other operating income (TEB) was $3,899 million, an increase of $570 million or 17% from the prior year. Adjusting for the notable items in 2014 of $566 million and

$150 million in the prior year (refer T3), the underlying increase in operating income was 5%.

The total provision for credit losses was $1,703 million

in 2014, up $415 million from last year. Adjusting for the notable item of $62 million (refer T3), the underlying increase was $353 million. Additional loan loss provisions primarily in the Caribbean hospitality portfolio and a change in loss

parameters in the Canadian retail portfolio accounted for $109 million of the increase. The remainder of the increase reflected higher provisions in International and Canadian Banking.

Operating expenses rose 8% over last year to $12,601 million. Adjusting for the notable items in 2014 of $203 million and $74 million in the prior year (refer T3), underlying expenses increased $808 million or 7%.

The negative impact of foreign currency translation contributed to 1% of this growth. The remaining increase reflects higher compensation costs and initiatives to support business growth. Operating leverage was positive 2.8%, or positive 2.0% after

adjusting for the above noted items.

The provision for income taxes was $2,002 million, an increase from $1,737 million last year. The Bank’s

overall effective tax rate for the year was 21.5% compared to 20.8% for 2013. The increase in the effective tax rate was due primarily to higher taxes in foreign jurisdictions and a proportionately lower benefit from tax-exempt income, partially

offset by lower taxes on the disposition gain in the current year.

The all-in Basel III common equity Tier 1 ratio was 10.8% as at October 31,

2014, well above last year and the regulatory minimum, in part reflecting the impact of the disposition gain.

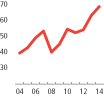

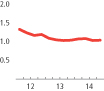

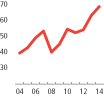

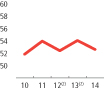

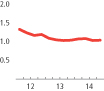

| C1 |

|

Earnings per share (diluted)(1) |

| (1) |

Amounts prior to 2011 calculated under CGAAP |

| (2) |

Certain amounts are retrospectively adjusted to reflect the adoption of new and amended IFRS standards (IFRS 10 and IAS 19) in 2014 (refer to Note 4 in

the consolidated financial statements) |

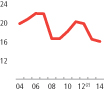

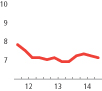

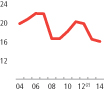

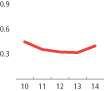

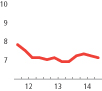

| C2 |

|

Closing common share price |

as at October

31

| (1) |

Amounts prior to 2011 calculated under CGAAP |

| (2) |

Certain amounts are retrospectively adjusted to reflect the adoption of new and amended IFRS standards (IFRS 10 and IAS 19) in 2014 (refer to Note 4 in

the consolidated financial statements) |

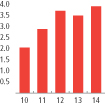

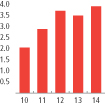

| C4 |

|

Return to common shareholders |

Share price

appreciation plus dividends reinvested, 2004=100

2014 Scotiabank Annual Report 19

MANAGEMENT’S DISCUSSION AND ANALYSIS

Notable Items

There were several notable items in 2014 totaling a net benefit of $290 million ($301 million pre-tax), or approximately 23 cents per share as outlined in the table

below.

T3 Notable Items

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

2014 |

|

|

2013 |

|

|

2012 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

For the years ended October 31 ($

millions, except EPS) |

|

Notes |

|

|

Pre-tax |

|

|

After-tax |

|

|

EPS

Impact |

|

|

Pre-tax |

|

|

After-tax |

|

|

EPS

Impact |

|

|

Pre-tax |

|

|

After-tax |

|

|

EPS

Impact |

|

| Gain on sale |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sale of holdings in CI Financial Corp. |

|

|

1 |

|

|

$ |

643 |

|

|

$ |

555 |

|

|

$ |

0.45 |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

|

$ |

– |

|

| Sale of subsidiary by Thanachart Bank |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

150 |

|

|

|

150 |

|

|

|

0.12 |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Sale of real estate assets |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

838 |

|

|

|

708 |

|

|

|

0.62 |

|

| Restructuring charges |

|

|

2 |

|

|

|

(148 |

) |

|

|

(110 |

) |

|

|

(0.09 |

) |

|

|

(27 |

) |

|

|

(20 |

) |

|

|

(0.02 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Provision for credit losses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Unsecured bankrupt retail accounts in

Canada |

|

|

3 |

|

|

|

(62 |

) |

|

|

(46 |

) |

|

|

(0.04 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Increase in collective allowance |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(100 |

) |

|

|

(74 |

) |

|

|

(0.06 |

) |

| Valuation adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Funding valuation adjustment |

|

|

4 |

|

|

|

(30 |

) |

|

|

(22 |

) |

|

|

(0.02 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Revaluation of monetary assets in

Venezuela |

|

|

5 |

|

|

|

(47 |

) |

|

|

(47 |

) |

|

|

(0.04 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Acquisition-related receivables in Puerto

Rico |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

(47 |

) |

|

|

(40 |

) |

|

|

(0.03 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Legal provisions |

|

|

6 |

|

|

|

(55 |

) |

|

|

(40 |

) |

|

|

(0.03 |

) |

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

|

|

– |

|

| Total |

|

|

|

|

|

$ |

301 |

|

|

$ |

290 |

|

|

$ |

0.23 |

|

|

$ |

76 |

|

|

$ |

90 |

|

|

$ |

0.07 |

|

|

$ |

738 |

|

|

$ |

634 |

|

|

$ |

0.56 |

|

| By Business line |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Canadian Banking |

|

|

|

|

|

$ |

(98 |

) |

|

$ |

(73 |

) |

|

|

|

|

|

$ |

– |

|

|

$ |

– |

|

|

|

|

|

|

$ |

– |

|

|

$ |

– |

|

|

|

|

|

| International Banking |

|

|

|

|

|

|

(88 |

) |

|

|

(79 |

) |

|

|

|

|

|

|

76 |

|

|

|

90 |

|

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

| Global Wealth & Insurance |

|

|

|

|

|

|

604 |

|

|

|

526 |

|

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

| Global Banking & Markets |

|

|

|

|

|

|

(31 |

) |

|

|

(22 |

) |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

| Other |

|

|

|

|

|

|

(86 |

) |

|

|

(62 |

) |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

738 |

|

|

|

634 |

|

|

|

|

|

| Total |

|

|

|

|

|

$ |

301 |

|

|

$ |

290 |

|

|

$ |

0.23 |

|

|

$ |

76 |

|

|

$ |

90 |

|

|

$ |

0.07 |

|

|

$ |

738 |

|

|

$ |

634 |

|

|

$ |

0.56 |

|

| By Consolidated Statement of Income

line |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Trading revenues |

|

|

|

|

|

$ |

(30 |

) |

|

$ |

(22 |

) |

|

|

|

|

|

$ |

– |

|

|

$ |

– |

|

|

|

|

|

|

$ |

– |

|

|

$ |

– |

|

|

|

|

|

| Other operating income – other |

|

|

|

|

|

|

596 |

|

|

|

508 |

|

|

|

|

|

|

|

150 |

|

|

|

150 |

|

|

|

|

|

|

|

838 |

|

|

|

708 |

|

|

|

|

|

| Other operating income/Total revenue |

|

|

|

|

|

|

566 |

|

|

|

486 |

|

|

|

– |

|

|

|

150 |

|

|

|

150 |

|

|

|

– |

|

|

|

838 |

|

|

|

708 |

|

|

|

– |

|

| Provision for credit losses |

|

|

|

|

|

|

(62 |

) |

|

|

(46 |

) |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

|

|

(100 |

) |

|

|

(74 |

) |

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

(203 |

) |

|

|

(150 |

) |

|

|

|

|

|

|

(74 |

) |

|

|

(60 |

) |

|

|

|

|

|

|

– |

|

|

|

– |

|

|

|

|

|

| Total |

|

|

|

|

|

$ |

301 |

|

|

$ |

290 |

|

|

$ |

0.23 |

|

|

$ |

76 |

|

|

$ |

90 |

|

|

$ |

0.07 |

|

|

$ |

738 |

|

|

$ |

634 |

|

|

$ |

0.56 |

|

Notes

(1) Sale of majority of Bank’s holding in CI Financial Corp.

In the third quarter of 2014, the Bank sold a majority of its holding in CI Financial Corp. resulting in an after-tax gain of $555 million ($643 million pre tax) or 45 cents per share. This included an

after-tax unrealized gain of $152 million on the reclassification of the Bank’s remaining investment in CI Financial Corp. to available-for-sale securities.

(2) Restructuring charges

The Bank recorded restructuring charges of $148 million

($110 million after tax), the majority relating to employee severance charges. These charges will drive greater operational efficiencies. In Canada, the charges relate to recent initiatives to centralize and automate several mid-office

branch functions, as well as reductions in required wealth management operational support. In International Banking, the charges are primarily for closing or downsizing approximately 120 branches, which will allow us to focus on high-growth

markets, minimize branch overlap, and realize synergies resulting from recent acquisitions. The Bank also made a series of changes to simplify its leadership structure and operating model, recorded in the Other segment.

(3) Provision for credit losses

The Bank changed

its write-off policy on unsecured bankrupt retail accounts in Canada in order to accelerate write-offs upon notification of a bankruptcy filing. As a result, a charge of $62 million ($46 million after tax) was recorded.

(4) Funding valuation adjustment

During the fourth

quarter of 2014, the Bank enhanced the fair value methodology and recognized a funding valuation adjustment (FVA) charge

of $30 million ($22 million after tax), to reflect the implied funding cost on uncollateralized derivative instruments.

(5) Venezuela

Venezuela has been designated as hyper-inflationary and measures of exchange controls

have been imposed by the Venezuelan government. These restrictions have limited the Bank’s ability to repatriate cash and dividends out of Venezuela.

The Bank’s Venezuelan Bolivar (VEF) exposures include its investment in Banco del Caribe, and unremitted dividends and other cash amounts (“monetary

assets”) in Venezuela.

During the year, two new exchange rates have been announced by the Venezuelan government, SICAD 1 (1 USD to 11 VEF) and

SICAD II (1 USD to 50 VEF). The official exchange rate, as published by the Central Bank of Venezuela, is 1 USD to 6.3 VEF. Currently, the Bank has concluded that the SICAD II is the most likely rate that will be available to the Bank for any

future remittances.

As at October 31, 2014, the Bank has remeasured its net investment and monetary assets at the SICAD II rate. As a result, the Bank

has recorded a charge of $47 million in the Consolidated Statement of Income representing the revaluation impact on the monetary assets and a reduction in carrying value of the net investment of $129 million has been charged to Other Comprehensive

Income.

(6) Legal provision

The Bank

recorded a legal provision of approximately $55 million ($40 million after tax) related to certain ongoing legal claims.

20 2014 Scotiabank Annual Report

MANAGEMENT’S DISCUSSION AND ANALYSIS | OVERVIEW

Outlook

The pace of growth in many overseas economies remains slow and uneven. Sluggish activity in the euro zone has been reinforced by renewed weakness in the region’s growth leader, Germany. Japan’s nascent

recovery and rebound in inflation have been pressured by the hefty increase in consumption taxes last spring. Some large emerging market economies, Brazil and Russia for example, have continued to decelerate alongside lacklustre global growth and

moderating commodity prices, especially oil. Even the globe’s growth leader, China, has posted more moderate output gains in response to reduced international trade and domestic efforts to rein in excess credit in the property market.

In contrast, the U.S. economy is regaining momentum, with consumer spending buoyed by pent-up demand, increasing employment, and improved household

balance sheets. Industrial output is

being underpinned by strengthening orders for machinery and equipment, rising oil and gas production, and

increasing capital investments. Manufacturing activity in Canada is benefiting from improving conditions in the United States as well as a lower-valued exchange rate. Mexico and a number of Latin American economies are piggybacking on the improving

U.S. demand, with weaker local currencies providing an added boost.

Internationally, the drop in oil prices and longer-term borrowing costs should help

support global activity, as will pro-growth initiatives in many underperforming regions around the world alongside the strengthening in the United States. The Bank’s presence in the markets expected to show economic growth, along with its

diversification and strong capital levels, will position the Bank to grow earnings in 2015 and beyond.

Shareholder Returns

Amidst equity market volatility and mixed stock performance, the Bank delivered a positive total shareholder return of 13.2%, a decrease from 21.7% in

2013, as shown in Table 4.

The total compound annual shareholder return on the Bank’s shares over the past five years was 13.1%, and 9.9% over the

past 10 years. This exceeded the total return of the S&P/TSX Composite Index, which was 9.1% over the past five years and 8.0% over the last ten years, as shown in Chart 4.

Quarterly dividends were raised twice during the year – a 3% increase effective in the second quarter and a further 3% effective in the fourth quarter. As a result, dividends per share totaled $2.56 for the

year, up 7% from 2013. With a payout ratio of 45% for the year, the Bank was within its target payout range of 40-50%.

The Bank’s Return on Equity

was 16.1% for fiscal 2014 compared to 16.6% in 2013, due in part to higher capital levels.

T4 Shareholder returns

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the years ended October 31 |

|

2014 |

|

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2010 |

|

| Closing market price per common share ($) |

|

|

69.02 |

|

|

|

63.39 |

|

|

|

54.25 |

|

|

|

52.53 |

|

|

|

54.67 |

|

| Dividends paid ($ per share) |

|

|

2.56 |

|

|

|

2.39 |

|

|

|

2.19 |

|

|

|

2.05 |

|

|

|

1.96 |

|

| Dividend yield (%)(1) |

|

|

3.8 |

|

|

|

4.1 |

|

|

|

4.2 |

|

|

|

3.7 |

|

|

|

3.9 |

|

| Increase (decrease) in share price (%) |

|

|

8.9 |

|

|

|

16.8 |

|

|

|

3.3 |

|

|

|

(3.9 |

) |

|

|

20.8 |

|

| Total annual shareholder return (%)(2) |

|

|

13.2 |

|

|

|

21.7 |

|

|

|

7.6 |

|

|

|

(0.4 |

) |

|

|

25.7 |

|

| (1) |

Dividend yield is calculated as the dividend paid divided by the average of the high stock price and the low stock price for the year. |

| (2) |

Total annual shareholder return assumes reinvestment of quarterly dividends, and therefore may not equal the sum of dividend and share price returns in the table.

|

Impact of Foreign Currency Translation

The impact of foreign currency translation on net income is shown in Table 5.

T5 Impact of foreign currency translation

|

|

|

|

|

|

|

|

|

|

|

|

| Average exchange rate |

|

2014 |

|

|

2013 |

|

| U.S. dollar/Canadian dollar |

|

|

0.918 |

|

|

|

0.981 |

|

|

|

|

| Impact on income(1) ($ millions except

EPS) |

|

2014

vs. 2013 |

|

|

2013

vs. 2012 |

|

| Net interest income |

|

$ |

191 |

|

|

$ |

71 |

|

| Net fees and commission revenues |

|

|

99 |

|

|

|

38 |

|

| Other operating income(2) |

|

|

96 |

|

|

|

(25 |

) |

| Operating expenses |

|

|

(134 |

) |

|

|

(65 |

) |

| Other items (net of tax) |

|

|

(70 |

) |

|

|

(10 |

) |

| Net income |

|

$ |

182 |

|

|

$ |

9 |

|

| Earnings per share (diluted) |

|

$ |

0.15 |

|

|

$ |

0.01 |

|

| Impact by business line ($ millions) |

|

|

|

|

|

|

|

|

| Canadian Banking |

|

$ |

9 |

|

|

$ |

1 |

|

| International Banking(2) |

|

|

85 |

|

|

|

22 |

|

| Global Wealth & Insurance |

|

|

10 |

|

|

|

2 |

|

| Global Banking & Markets |

|

|

74 |

|

|

|

6 |

|

| Other(2) |

|

|

4 |

|

|

|

(22 |

) |

|

|

$ |

182 |

|

|

$ |

9 |

|

| (1) |

Includes impact of all currencies. |

| (2) |

Includes the impact of foreign currency hedges. |

Impact of

Acquisitions

There was no significant impact to the Bank’s reported net income in 2014 from acquisitions.

2014 Scotiabank Annual Report 21

MANAGEMENT’S DISCUSSION AND ANALYSIS

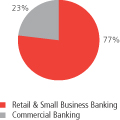

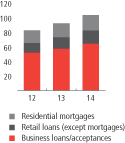

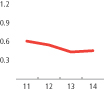

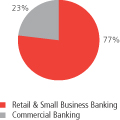

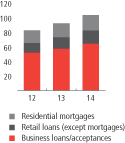

| C5 |

|

Net interest income by business line(1) |

TEB, $ millions

| (1) |

Excludes Other segment |

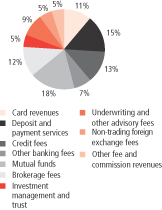

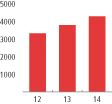

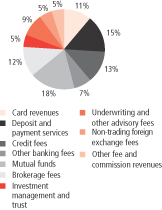

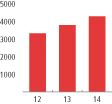

| C6 |

|

Net fee and commission revenues by business line(1)

|

$ millions

| (1) |

Excludes Other segment |

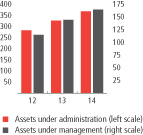

| C7 |

|

Average core banking assets and margin |

TEB, $

billions

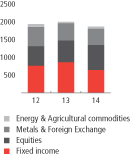

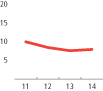

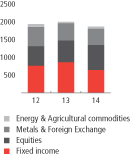

| C8 |

|

Other operating income by business line(1) |

TEB, $ millions

| (1) |

Excludes Other segment |

GROUP FINANCIAL PERFORMANCE

Total revenue

Total revenue (TEB) was $23,958 million in 2014, an increase of $2,347

million or 11% from the prior year. Revenue growth benefited from strong growth in net interest income, fee and commission revenues and the impact of notable items (refer T3) in other operating income. Other operating income increased $570 million

or 17% from 2013. Adjusting for the notable items in 2014 of $566 million and $150 million in the prior year (refer T3), total revenue growth was 9% including 2% from the positive impact of foreign currency translation.

The increase in net interest income (TEB) of $957 million or 8% was due to growth in average core banking assets and a widening of the core banking margin, and

included a favourable impact of foreign currency translation of $191 million. Higher net interest income in Canadian Banking was driven by an increase in both average earning assets and the margin. International Banking’s 12% growth in average

earning assets was partly offset by a reduction in the margin. There was strong loan growth in Latin America, including 13% in Mexico and 14% in Colombia.

Net fee and commission revenue was $820 million or 12% higher than last year, including $99 million from the positive impact of foreign currency translation.

Strong growth in wealth management revenues, banking revenues and underwriting and other advisory fees all contributed to this increase. Wealth management revenues increased from higher mutual fund fees and brokerage revenues. Growth in banking

revenues was widespread with increases in credit cards, deposit and payment services, credit fees and cash management fees. Underwriting and other advisory fees increased primarily from significant growth in equity and debt issues and from increased

advisory activities in investment banking.

Other operating income (TEB), adjusting for notable items, was up $154 million or 5%. The increase was

primarily from higher net gains on investment securities, largely offset by lower trading revenues, primarily in fixed income, and lower earnings from investments in associated corporations mainly due to the disposition.

Net Interest Income

Net interest income (TEB) was

$12,322 million, an increase of $957 million or 8% from the prior year, driven primarily by a 5% increase in core earning assets and an eight basis point widening of the core banking margin.

Core asset volumes increased $26 billion or 5% to $515 billion, primarily from $14 billion growth in International Banking – mainly retail and commercial loans, $2 billion growth in residential mortgages in

Canada or $6 billion excluding Tangerine run-off portfolio, $5 billion growth in consumer auto loans in Canada, and $2 billion growth in corporate lending in the U.S., Europe and Canada, as well as $3 billion growth in deposits with banks.

The core banking margin was 2.39%, an eight basis point increase from the previous year. The core banking margin benefited from lower funding costs as

maturing high-rate debentures and deposits were replaced with funding at lower current rates and wider margins in Canadian Banking. Partly offsetting was margin compression in Global Banking & Markets. International Banking did not have any

impact on the Bank’s core margin, as the narrower margin in International Banking was offset by the increase in asset volumes.

Canadian Banking

margin increased five basis points to 2.09%, mainly from higher mortgage, credit card and credit line spreads, as well as strong growth in higher spread assets, including credit cards. Partially offsetting were lower spreads on core deposits and

business accounts as a result of the low rate environment.

International Banking margin fell from 4.11% to 4.00% due to narrower margins across all

regions.

Global Banking & Markets margin fell primarily due to lower loan origination fees and lower performing loan spreads in U.S. corporate

lending.

Outlook

The Bank’s

net interest income is expected to increase in 2015 mainly from moderate growth in core banking assets, a wider margin, as well as the impact of acquisitions expected to close in 2015. The core banking margin is expected to benefit from a change in

asset mix with a continued focus on volume growth in higher margin products.

22 2014 Scotiabank Annual Report

MANAGEMENT’S DISCUSSION AND ANALYSIS | GROUP FINANCIAL

PERFORMANCE

T6 Net interest income and core banking margin(1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

2012 |

|

| ($ billions, except percentage amounts) |

|

Average

balance |

|

|

Interest |

|

|

Average

rate |

|

|

Average

balance |

|

|

Interest |

|

|

Average

rate |

|

|

Average

balance |

|

|

Interest |

|

|

Average

rate |

|

| Total average assets and net interest income |

|

$ |

795.6 |

|

|

$ |

12.3 |

|

|

|

|

|

|

$ |

748.9 |

|

|

$ |

11.3 |

|

|

|

|

|

|

$ |

659.5 |

|

|

$ |

9.9 |

|

|

|

|

|

| Less: total assets in Global Capital Markets(2) |

|

|

232.5 |

|

|

|

– |

|

|

|

|

|

|

|

212.0 |

|

|

|

– |

|

|

|

|

|

|

|

183.8 |

|

|

|

– |

|

|

|

|

|

| Banking margin on average total assets |

|

$ |

563.1 |

|

|

$ |

12.3 |

|

|

|

2.19 |

% |

|

$ |

536.9 |

|

|

$ |

11.3 |

|

|

|

2.11 |

% |

|

$ |

475.7 |

|

|

$ |

9.9 |

|

|

|

2.09 |

% |

| Less: non-earning assets and customer’s liability under acceptances |

|

|

48.0 |

|

|

|

|

|

|

|

|

|

|

|

47.4 |

|

|

|

|

|

|

|

|

|

|

|

46.0 |

|

|

|

|

|

|

|

|

|

| Core banking assets and margin |

|

$ |

515.1 |

|

|

$ |

12.3 |

|

|

|

2.39 |

% |

|

$ |

489.5 |

|

|

$ |

11.3 |

|

|

|

2.31 |

% |

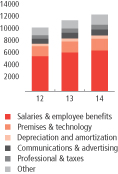

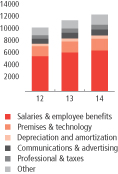

|

$ |

429.7 |

|

|

$ |

9.9 |

|

|

|

2.31 |

% |

| (1) |

Taxable equivalent basis. Refer to non-GAAP measures on page 17. |

| (2) |

Net interest income in Global Capital Markets trading assets is recorded in trading revenues in other operating income. |

T7 Average balance sheet(1) and net interest income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013(4) |

|

|

2012(4) |

|

|

|

|

|

|

|

|

|

|

|

| TEB(2)

For the fiscal years ($ billions) |

|

Average

balance |

|

|

Interest |

|

|

Average

rate |

|

|

Average

balance |

|

|

Interest |

|

|

Average

rate |

|

|

Average

balance |

|

|

Interest |

|

|

Average

rate |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits with banks |

|

$ |

60.1 |

|

|

$ |

0.3 |

|

|

|

0.44 |

% |

|

$ |

55.6 |

|

|

$ |

0.3 |

|

|

|

0.50 |

% |

|

$ |

56.9 |

|

|

$ |

0.3 |

|

|

|

0.50 |

% |

| Trading assets |

|

|

113.3 |

|

|

|

0.1 |

|

|

|

0.12 |

% |

|

|

105.1 |

|

|

|

0.1 |

|

|

|

0.12 |

% |

|

|

90.8 |

|

|

|

0.1 |

|

|

|

0.15 |

% |

| Securities purchases under resale agreements |

|

|

91.1 |

|

|

|

0.2 |

|

|

|

0.20 |

% |

|

|

80.0 |

|

|

|

0.2 |

|

|

|

0.24 |

% |

|

|

60.1 |

|

|

|

0.2 |

|

|

|

0.37 |

% |

| Investment securities |

|

|

41.2 |

|

|

|

0.8 |

|

|

|

1.91 |

% |

|

|

40.3 |

|

|

|

0.8 |

|

|

|

2.20 |

% |

|

|

34.7 |

|

|

|

0.9 |

|

|

|

2.68 |

% |

| Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residential mortgages |

|

|

210.9 |

|

|

|

7.6 |

|

|

|

3.60 |

% |

|

|

206.6 |

|

|

|

7.4 |

|

|

|

3.59 |

% |

|

|

167.9 |

|

|

|

6.5 |

|

|

|

3.86 |

% |

| Personal and credit cards |

|

|

79.6 |

|

|

|

6.1 |

|

|

|

7.61 |

% |

|

|

72.1 |

|

|

|

5.6 |

|

|

|

7.70 |

% |

|

|

65.7 |

|

|

|

4.9 |

|

|

|

7.49 |

% |

| Business and government |

|

|

128.5 |

|

|

|

4.3 |

|

|

|

3.39 |

% |

|

|

116.9 |

|

|

|

4.4 |

|

|

|

3.76 |

% |

|

|

105.0 |

|

|

|

4.2 |

|

|

|

3.99 |

% |

| Allowance for credit losses |

|

|

(3.6 |

) |

|

|

|

|

|

|

|

|

|

|

(3.3 |

) |

|

|

|

|

|

|

|

|

|

|

(2.9 |

) |

|

|

|

|

|

|

|

|

| Total loans |

|

$ |

415.4 |

|

|

$ |

18.0 |

|

|

|

4.34 |

% |

|

$ |

392.3 |

|

|

$ |

17.4 |

|

|

|

4.42 |

% |

|

$ |

335.7 |

|

|

$ |

15.6 |

|

|

|

4.65 |

% |

| Total earning assets |

|

$ |

721.1 |

|

|

$ |

19.4 |

|

|

|

2.69 |

% |

|

$ |

673.3 |

|

|

$ |

18.8 |

|

|

|

2.80 |

% |

|

$ |

578.2 |

|

|

$ |

17.1 |

|

|

|

2.97 |

% |

| Customer’s liability under acceptances |

|

|

10.4 |

|

|

|

|

|

|

|

|

|

|

|

10.2 |

|

|

|

|

|

|

|

|

|

|

|

8.8 |

|

|

|

|

|

|

|

|

|

| Other assets |

|

|

64.1 |

|

|

|

|

|

|

|

|

|

|

|

65.4 |

|

|

|

|

|

|

|

|

|

|

|

72.5 |

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

795.6 |

|

|

$ |

19.4 |

|

|

|

2.43 |

% |

|

$ |

748.9 |

|

|

$ |

18.8 |

|

|

|

2.52 |

% |

|

$ |

659.5 |

|

|

$ |

17.1 |

|

|

|

2.60 |

% |

| Liabilities and equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|