|

PRELIMINARY PRICING SUPPLEMENT

Subject To Completion, dated May 29, 2024

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-261476

(To Product Supplement No. WF-1 dated August 29, 2022,

Prospectus Supplement dated December 29, 2021

and Prospectus dated December 29, 2021)

|

|

|||

|

The Bank of Nova Scotia

Senior Note Program, Series A

Equity Linked Securities

|

||||

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature

and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc.

due June 22, 2027

|

||||

|

■

Linked to the common stock of Marvell Technology, Inc. (the “Underlying Stock”)

■

Unlike ordinary debt securities, the securities do not provide for fixed payments of interest, do not repay a fixed amount of principal at stated maturity and are subject to

potential automatic call prior to stated maturity upon the terms described below. Whether the securities pay a contingent coupon payment, whether the securities are automatically called prior to stated maturity and, if they are not

automatically called, whether you receive the face amount of your securities at stated maturity will depend, in each case, on the stock closing price of the Underlying Stock on the relevant calculation day.

■

Contingent Coupon. The securities will pay a contingent coupon payment on a quarterly basis until the earlier of stated

maturity or automatic call if, and only if, the stock closing price of the Underlying Stock on the calculation day for that quarter is greater than or equal to the coupon threshold price. If the stock closing price of the Underlying Stock on one or more calculation days is less than the coupon threshold price

and, on a subsequent calculation day, the stock closing price of the Underlying Stock on that subsequent calculation day is greater than or equal to the coupon threshold price, the securities will pay the contingent coupon payment due for

that subsequent calculation day plus all previously unpaid contingent coupon payments (without interest on amounts previously unpaid). If the stock closing price of the Underlying Stock on a calculation day is less than the coupon

threshold price, you will not receive any contingent coupon on the related quarterly contingent coupon payment date. In addition, if the stock closing price of the Underlying Stock on a calculation day is less than the coupon threshold

price and the stock closing price of the Underlying Stock on each subsequent calculation day up to and including the final calculation day is less than the coupon threshold price, you will not receive the unpaid contingent coupon payments

in respect of those calculation days. If the stock closing price of the Underlying Stock is less than the coupon threshold price on every calculation day, you will not receive any contingent coupon payments throughout the entire term of

the securities. The coupon threshold price for the Underlying Stock is equal to 60% of the starting price. The contingent coupon rate will be determined on the pricing date and will be at least 12.50% per annum

■ Automatic Call. If the stock closing price of the Underlying Stock on any of the quarterly calculation days from December 2024 to March 2027,

inclusive, is greater than or equal to the starting price, the securities will be automatically called for the face amount plus a final contingent coupon and any previously unpaid contingent coupon payments

■

Potential Loss of Principal. If the securities are not automatically called prior to stated maturity, you will receive the face

amount at stated maturity if, and only if, the stock closing price of the Underlying Stock on the final calculation day is greater than or equal to the downside threshold price. If the stock

closing price of the Underlying Stock on the final calculation day is less than the downside threshold price, you will lose more than 40%, and possibly all, of the face amount of your securities. The downside threshold price for the Underlying Stock is equal to 60% of the starting price

■

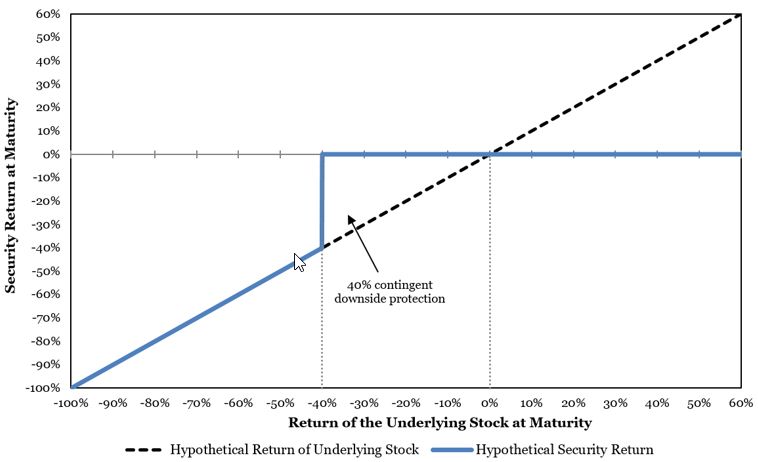

If the securities are not automatically called prior to stated maturity, you will have full downside exposure to the Underlying Stock from the starting price if the

stock closing price on the final calculation day is less than the downside threshold price, but you will not participate in any appreciation of the Underlying Stock and will not receive any dividends

■

All payments on the securities are subject to the credit risk of The Bank of Nova Scotia (the “Bank”)

■

No exchange listing; designed to be held to maturity

|

||||

|

Original Offering Price

|

Agent Discount(1)

|

Proceeds to The Bank of Nova Scotia(2)

|

||

|

Per Security

|

$1,000.00

|

$25.75

|

$974.25

|

|

|

Total

|

| (1) |

Scotia Capital (USA) Inc. or one of our affiliates will purchase the aggregate face amount of the securities and as part of the distribution, will sell the securities to WFS at a discount of up to $25.75

(2.575%) per security. WFS may provide selected dealers, which may include Wells Fargo Advisors (“WFA”, the trade name of the retail brokerage business of Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC),

with a selling concession of up to $17.50 (1.75%) per security, and WFA may receive a distribution expense fee of $0.75 (0.075%) per security for securities sold by WFA. In respect of certain securities sold in this offering, we may pay a

fee of up to $2.00 per security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the securities to other securities dealers. See “Terms of the Securities—Agents” herein

and “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement for additional information.

|

| (2) |

Excludes any profits from hedging. For additional considerations relating to hedging activities see “Selected Risk Considerations — Risks Relating To The Estimated Value Of The Securities And Any Secondary

Market — The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices” in this pricing supplement.

|

|

Scotia Capital (USA) Inc.

|

Wells Fargo Securities

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Terms of the Securities

|

|

Issuer:

|

The Bank of Nova Scotia (the “Bank”).

|

||

|

Market Measure:

|

Common stock of Marvell Technology, Inc. (the “Underlying Stock”).

|

||

|

Pricing Date*:

|

June 17, 2024.

|

||

|

Issue Date*:

|

June 21, 2024. We expect that delivery of the securities will be made against payment for the securities on the issue date, which is more than one business day following

the pricing date. Notwithstanding anything to the contrary in the accompanying product supplement, under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in one

business day, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the securities on any date prior to one business day before delivery will be required to specify alternative settlement

arrangements to prevent a failed settlement.

|

||

|

Original Offering

Price:

|

$1,000 per security.

|

||

|

Face Amount:

|

$1,000 per security. References in this pricing supplement to a “security” are to a security with a face amount of $1,000.

|

||

|

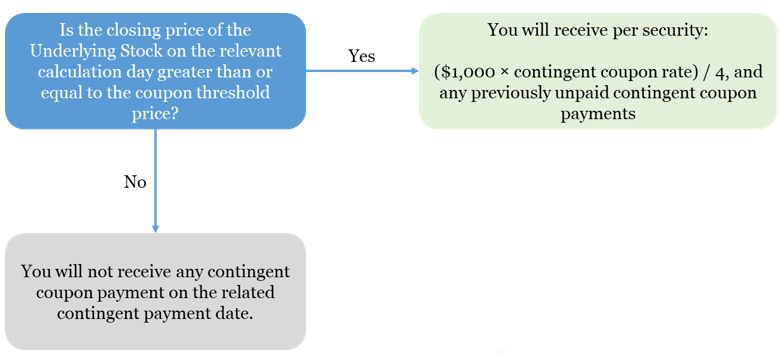

Contingent Coupon Payment (with Memory Feature):

|

On each contingent coupon payment date, you will receive a contingent coupon payment at a per annum rate equal to the contingent coupon rate if, and only if, the stock closing price of the Underlying Stock on the related calculation day is greater than or equal to the coupon threshold price. Each “contingent coupon payment,” if any, will be calculated per

security as follows: ($1,000 × contingent coupon rate) / 4. Any contingent coupon payment will be rounded to the nearest cent, with one-half cent rounded upward. In addition, if the stock closing price of the Underlying Stock on one or more

calculation days is less than the coupon threshold price and, on a subsequent calculation day, the stock closing price of the Underlying Stock on that subsequent calculation day is greater than or equal to the coupon threshold price, the

securities will pay the contingent coupon payment due for that subsequent calculation day plus all previously unpaid contingent coupon payments (without interest on amounts previously unpaid).

If the stock closing price of the Underlying Stock on any calculation day is less than the coupon threshold price, you will not receive any contingent

coupon payment on the related contingent coupon payment date. In addition, if the stock closing price of the Underlying Stock on a calculation day is less than the coupon threshold price and the stock closing price of the Underlying Stock

on each subsequent calculation day up to and including the final calculation day is less than the coupon threshold price, you will not receive the unpaid contingent coupon payments in respect of those calculation days. If the stock closing

price of the Underlying Stock is less than the coupon threshold price on all calculation days, you will not receive any contingent coupon payments over the term of the securities.

|

||

|

Contingent Coupon

Payment Dates:

|

Quarterly, on the third business day following each calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement

Provisions” below, if applicable); provided that the contingent coupon payment date with respect to the final calculation day will be the stated maturity date.

|

||

|

Contingent Coupon

Rate:

|

The “contingent coupon rate” will be determined on the pricing date and will be at least 12.50% per annum.

|

||

|

Automatic Call:

|

If the stock closing price of the Underlying Stock on any of the calculation days from December 2024 to March 2027, inclusive, is greater than or equal to the starting

price, the securities will be automatically called, and on the related call settlement date you will be entitled to receive a cash payment per security in U.S. dollars equal to the face amount plus a final contingent coupon payment, and any

previously unpaid contingent coupons. The securities will not be subject to automatic call until the second calculation day, which is approximately six months after the issue date.

If the securities are automatically called, they will cease to be outstanding on the related call settlement date and you will have no further rights under the securities

after such call settlement date. You will not receive any notice from us if the securities are automatically called.

|

||

|

Calculation Days*:

|

Quarterly, on the 17th day of each March, June, September and December, commencing in September 2024 and ending in June 2027, each subject to postponement as described

below under “—Market Disruption Events and Postponement Provisions.” We refer to the calculation day scheduled to occur in June 2027 (expected to be June 17, 2027) as the “final calculation day.”

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Call Settlement Date:

|

Three business days after the applicable calculation day (as each such calculation day may be postponed pursuant to “—Market Disruption Events and Postponement Provisions”

below, if applicable).

|

||

|

Stated Maturity

Date*:

|

June 22, 2027, subject to postponement. The securities are not subject to repayment at the option of any holder of the securities prior to the stated maturity date.

|

||

|

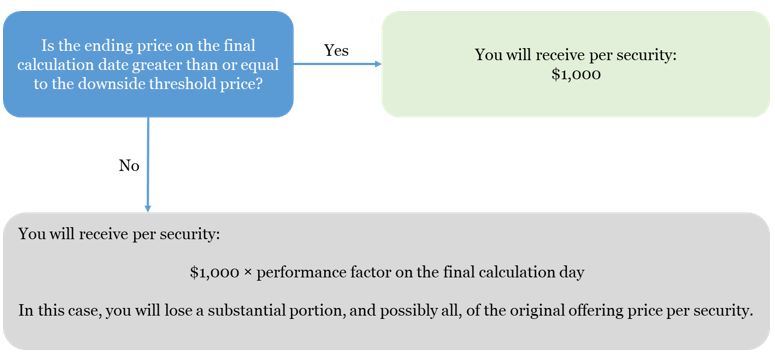

Maturity Payment

Amount:

|

If the securities are not automatically called prior to the stated maturity date, you will be entitled to receive on the stated maturity date a cash payment per security

in U.S. dollars equal to the maturity payment amount (in addition to the final contingent coupon payment and any previously unpaid contingent coupon payments, if due). The “maturity payment amount” per security will equal:

• if the ending price is greater than or equal to the downside threshold price: $1,000; or

• if the ending price is less than the downside threshold price:

|

||

|

$1,000 × performance factor

|

|||

|

If the securities are not automatically called prior to stated maturity and the ending price is less than the downside threshold price, you will lose

more than 40%, and possibly all, of the face amount of your securities at stated maturity.

Any return on the securities will be limited to the sum of your contingent coupon payments, if any. You will not participate in any appreciation of the

Underlying Stock, but you will have full downside exposure to the Underlying Stock if the ending price is less than the downside threshold price.

|

|||

|

Performance Factor:

|

The ending price divided by the starting price (expressed as a percentage).

|

||

|

Stock Closing Price:

|

Stock closing price, closing price and adjustment factor have the meanings set forth under “General Terms of the Securities—Certain Terms for Securities Linked to an

Underlying Stock—Certain Definitions” in the accompanying product supplement.

|

||

|

Starting Price:

|

$ , the stock closing price of the Underlying Stock on the pricing date.

|

||

|

Ending Price:

|

The “ending price” will be the stock closing price of the Underlying Stock on the final calculation day.

|

||

|

Coupon Threshold

Price:

|

$ , which is equal to 60% of the starting price.

|

||

|

Downside Threshold

Price:

|

$ , which is equal to 60% of the starting price.

|

||

|

Market Disruption

Events and

Postponement

Provisions:

|

Each calculation day is subject to postponement due to non-trading days and the occurrence of a market disruption event. In addition, the stated maturity date will be

postponed if the final calculation day is postponed and will be adjusted for non-business days. For more information regarding adjustments to the calculation days and the stated maturity date, see “General Terms of the

Securities—Consequences of a Market Disruption Event; Postponement of a Calculation Day—Securities Linked to a Single Market Measure” and “—Payment Dates” in the accompanying product supplement. For purposes of the accompanying product

supplement, each call settlement date and the stated maturity date is a “payment date.” In addition, for information regarding the circumstances that may result in a market disruption event, see “General Terms of the Securities—Certain

Terms for Securities Linked to an Underlying Stock—Market Disruption Events” in the accompanying product supplement.

|

||

|

Calculation Agent:

|

Scotia Capital Inc., an affiliate of the Bank

|

||

|

Material Tax

Consequences:

|

For a discussion of Canadian income tax considerations to a holder of owning the securities, see “Canadian Income Tax Consequences” herein. For a discussion of United

States federal income tax considerations to a holder's ownership and disposition of the securities, see “U.S. Federal Income Tax Consequences” herein.

|

||

|

Tax Redemption:

|

The Bank (or its successor) may redeem the securities, in whole but not in part, at a redemption price determined by the Calculation Agent in a manner reasonably

calculated to preserve your and our relative economic position, if it is determined that changes in tax laws of Canada (or the jurisdiction of organization of the successor to the Bank) or of any political subdivision or taxing authority

thereof or therein affecting taxation or their interpretation will result in the Bank (or its successor) becoming obligated to pay additional amounts with respect to the securities. See “Tax Redemption” in the accompanying product

supplement.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Agents:

|

Scotia Capital (USA) Inc. and Wells Fargo Securities, LLC.

Scotia Capital (USA) Inc. or one of our affiliates will purchase the aggregate face amount of the securities and as part of the distribution, will sell the securities to

WFS at a discount of up to $25.75 (2.575%) per security. WFS may provide selected dealers, which may include WFA, with a selling concession of up to $17.50 (1.75%) per security, and WFA may receive a distribution expense fee of $0.75

(0.075%) per security for securities sold by WFA.

In addition, in respect of certain securities sold in this offering, we may pay a fee of up to $2.00 per security to selected securities dealers in consideration for

marketing and other services in connection with the distribution of the securities to other securities dealers.

See also “Supplemental Plan of Distribution (Conflicts of Interest)” in the accompanying product supplement.

The price at which you purchase the securities includes costs that the Bank, the Agents or their respective affiliates expect to incur and profits that the Bank, the

Agents or their respective affiliates expect to realize in connection with hedging activities related to the securities, as set forth above. These costs and profits will likely reduce the secondary market price, if any secondary market

develops, for the securities. As a result, you may experience an immediate and substantial decline in the market value of your securities on the pricing date. See “Selected Risk Considerations — Risks Relating To The Estimated Value Of The

Securities And Any Secondary Market — The Inclusion of Dealer Spread and Projected Profit from Hedging in the Original Offering Price is Likely to Adversely Affect Secondary Market Prices” in this pricing supplement.

|

||

|

Status:

|

The securities will constitute direct, senior, unsubordinated and unsecured obligations of the Bank ranking pari passu with all

other direct, senior, unsecured and unsubordinated indebtedness of the Bank from time to time outstanding (except as otherwise prescribed by law). Holders will not have the benefit of any insurance under the provisions of the CDIC Act, the

U.S. Federal Deposit Insurance Act or under any other deposit insurance regime.

|

||

|

Listing:

|

The securities will not be listed on any securities exchange or automated quotation system

|

||

|

Use of Proceeds:

|

General corporate purposes

|

||

|

Clearance and Settlement:

|

The Depository Trust Company

|

||

|

Canadian Bail-in:

|

The securities are not bail-inable debt securities under the CDIC Act

|

||

|

Denominations:

|

$1,000 and any integral multiple of $1,000.

|

||

|

CUSIP / ISIN:

|

06417YY94 / US06417YY943

|

| * |

To the extent that we make any change to the expected pricing date or expected issue date, the calculation days and stated maturity date may also be changed in our discretion to ensure that the term of the

securities remains the same.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Additional Information about the Issuer and the Securities

|

| • |

Product Supplement No. WF-1 dated August 29, 2022:

|

| • |

Prospectus Supplement dated December 29, 2021:

|

| • |

Prospectus dated December 29, 2021:

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Estimated Value of the Securities

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Investor Considerations

|

| • |

seek an investment with contingent coupon payments at a rate of at least 12.50% per annum (to be determined on the pricing date) until the earlier of stated maturity or automatic call, if, and only if,

the stock closing price of the Underlying Stock on the applicable calculation day is greater than or equal to 60% of the starting price;

|

| • |

understand that if the ending price has declined by more than 40% from the starting price, they will be fully exposed to the decline in the Underlying Stock from the starting price and will lose more than 40%, and possibly all, of the

face amount at stated maturity;

|

| • |

are willing to accept the risk that they may receive few or no contingent coupon payments over the term of the securities;

|

| • |

understand that the securities may be automatically called prior to stated maturity and that the term of the securities may be as short as approximately six months;

|

| • |

understand and are willing to accept the full downside risks of the Underlying Stock;

|

| • |

are willing to forgo participation in any appreciation of the Underlying Stock and dividends on the Underlying Stock; and

|

| • |

are willing to hold the securities until maturity.

|

| • |

seek a liquid investment or are unable or unwilling to hold the securities to maturity;

|

| • |

require full payment of the face amount of the securities at stated maturity;

|

| • |

seek a security with a fixed term;

|

| • |

are unwilling to purchase securities with an estimated value as of the pricing date that is lower than the original offering price and that may be as low as the lower estimated value set forth on the cover page;

|

| • |

are unwilling to accept the risk that the stock closing price of the Underlying Stock on the final calculation day may decline by more than 40% from the starting price;

|

| • |

seek certainty of current income over the term of the securities;

|

| • |

seek exposure to the upside performance of the Underlying Stock;

|

| • |

are unwilling to accept the risk of exposure to the Underlying Stock;

|

| • |

are unwilling to accept the credit risk of the Bank; or

|

| • |

prefer the lower risk of conventional fixed income investments with comparable maturities issued by companies with comparable credit ratings.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Determining Payment On A Contingent Coupon Payment Date and at Maturity

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Hypothetical Payout Profile

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Selected Risk Considerations

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

| • |

Investing In The Securities Is Not The Same As Investing In The Underlying Stock. Investing in the securities is not equivalent to investing in the Underlying

Stock. As an investor in the securities, your return will not reflect the return you would realize if you actually owned and held the Underlying Stock for a period similar to the term of the securities because you will not receive any

dividend payments, distributions or any other payments paid on the Underlying Stock. As a holder of the securities, you will not have any voting rights or any other rights that holders of the Underlying Stock would have.

|

| • |

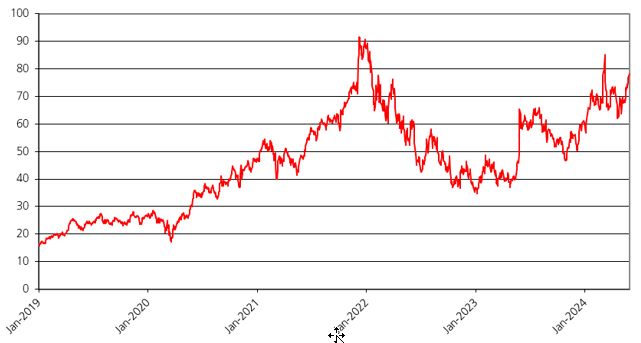

Historical Prices Of The Underlying Stock Should Not Be Taken As An Indication Of The Future Performance Of The Underlying Stock During The Term Of The Securities.

|

| • |

The Securities May Become Linked To The Common Stock Of A Company Other Than An Original Underlying Stock Issuer.

|

| • |

We, The Agents And Our Respective Affiliates Cannot Control Actions By An Underlying Stock Issuer.

|

| • |

We, The Agents And Our Respective Affiliates Have No Affiliation With Any Underlying Stock Issuer And Have Not Independently Verified Their Public Disclosure Of Information.

|

| • |

You Have Limited Anti-dilution Protection.

|

| • |

Hedging Activities By The Bank And/Or The Agents May Negatively Impact Investors In The Securities And Cause Our Respective Interests And Those Of Our Clients And Counterparties To Be Contrary To Those Of

Investors In The Securities.

|

| • |

Market Activities By The Bank Or The Agents For Their Own Respective Accounts Or For Their Respective Clients Could Negatively Impact Investors In The Securities.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

| • |

The Bank, The Agents And Their Respective Affiliates Regularly Provide Services To, Or Otherwise Have Business Relationships With, A Broad Client Base, Which Has Included And May Include Issuers Of An

Underlying Stock, The Sponsor Or Investment Advisor For A Fund And/Or The Issuers Of Securities Included In An Underlying Stock Or Held By A Fund.

|

| • |

Other Investors In The Securities May Not Have The Same Interests As You.

|

| • |

There Are Potential Conflicts Of Interest Between You And The Calculation Agent.

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Hypothetical Returns

|

|

Hypothetical performance factor

|

Hypothetical maturity payment amount

per security

|

|

175.00%

|

$1,000.00

|

|

160.00%

|

$1,000.00

|

|

150.00%

|

$1,000.00

|

|

140.00%

|

$1,000.00

|

|

130.00%

|

$1,000.00

|

|

120.00%

|

$1,000.00

|

|

110.00%

|

$1,000.00

|

|

100.00%

|

$1,000.00

|

|

90.00%

|

$1,000.00

|

|

80.00%

|

$1,000.00

|

|

70.00%

|

$1,000.00

|

|

60.00%

|

$1,000.00

|

|

59.00%

|

$590.00

|

|

50.00%

|

$500.00

|

|

40.00%

|

$400.00

|

|

30.00%

|

$300.00

|

|

25.00%

|

$250.00

|

|

0.00%

|

$0.00

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Hypothetical Contingent Coupon Payments

|

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical stock closing price on hypothetical calculation day #1:

|

$90.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical stock closing price on hypothetical calculation day #2:

|

$59.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical stock closing price on hypothetical calculation day #3:

|

$115.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Hypothetical Payment at Stated Maturity

|

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$145.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

|

|

Hypothetical downside threshold price:

|

$60.00

|

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$80.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

|

|

Hypothetical downside threshold price:

|

$60.00

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Hypothetical starting price:

|

$100.00

|

|

|

Hypothetical ending price:

|

$45.00

|

|

|

Hypothetical coupon threshold price:

|

$60.00

|

|

|

Hypothetical downside threshold price:

|

$60.00

|

|

|

Performance factor (ending price divided by starting price):

|

45.00%

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

The Underlying Stock

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|

|

Canadian Income Tax Consequences

|

|

U.S. Federal Income Tax Consequences

|

|

Market Linked Securities—Auto-Callable with Contingent Coupon with Memory Feature and Contingent Downside

Principal at Risk Securities Linked to the common stock of Marvell Technology, Inc. due June 22, 2027

|

|