UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant |  |

Filed by a Party other than the Registrant |

| Check the appropriate box: | |

|

Preliminary Proxy Statement |

|

CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material Pursuant to §240.14a-12 |

SYSCO CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment of Filing Fee (Check the appropriate box): | |

|

No fee required. |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

(1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: | |

|

Fee paid previously with preliminary materials. |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) Amount Previously Paid: (2) Form, Schedule or Registration Statement No.: (3) Filing Party: (4) Date Filed: | |

LETTER FROM OUR CEO AND EXECUTIVE CHAIRMAN

Dear Sysco Stockholder,

This past year has been historic for Sysco on many levels. Fiscal 2020 marked the Company’s 50th anniversary, we made a number of key hires in our executive ranks to continue driving our strategy, and we are managing through what can easily be described as the biggest crisis our industry has faced in modern times. Amidst the many changes, opportunities and challenges of this year, it is the Company’s proud, successful history, our commitment to sound corporate governance, and a foundation strongly rooted in the passion and commitment of our global associates that enables us to rise up in the face of adversity and emerge as a stronger company.

Our Strategy and Performance in Fiscal 20201

The impact of the COVID-19 crisis on our FY20 outcomes has been more substantial than any other event throughout the Company’s history. Through concerted action, our team swiftly put into place a thorough four-part plan to address the current environment and position Sysco for future success: creating new sources of revenue, implementing immediate cost controls, strengthening our liquidity, and accelerating the strategic initiatives that will enhance our success in the post-COVID world. Executing on these measures quickly and effectively has enabled us to stabilize the business, and we are highly confident in our plan to continue navigating beyond the current crisis.

The COVID-19 crisis significantly impacted Sysco’s FY20 financial results; its impact has been more substantial than any other event throughout the company’s history.

Sysco sales were $52.9 billion in Fiscal 2020, a decrease of $7.2 billion versus the prior year. Volume and sales softness as a result of the pandemic drove a gross profit decrease of 13% to $9.9 billion. Operating expense increased 1% and adjusted operating expense decreased 6%, which resulted in an operating income decrease of 68% to $750 million and an adjusted operating income decrease of 37% to $1.7 billion. Despite these declines, we remain a profitable company. We delivered earnings per share of $0.42, and adjusted earnings per share of $2.01, while returning more than $1.7 billion in value to shareholders through dividends and share buybacks.

Sysco’s Transformation for Long-Term, Profitable Growth

Looking ahead, we are accelerating our strategic transformation as we continue into Fiscal 2021. We have a strong plan in place, which includes several key areas of focus that will enable us to deliver on our commitments and drive the results needed to position our customers, and Sysco, for success. Our transformative change will be driven by the following key areas:

| 1. | Customer Digital Platforms – We are accelerating work across our customer-facing tools and technology, including our digital order entry platform, Sysco Shop, and our CRM tool utilized by our salesforce. |

| 2. | Sales Transformation – We are elevating our selling effectiveness with an improved, more customer-centric structure and enhanced specialist expertise to increase our competitive advantage, better support our customers and unleash the full power of our sales organization. |

| 3. | Regionalization – We are regionalizing our U.S. Broadline business, which is the key enabler of our other U.S. transformation initiatives. |

| 4. | Structural Cost Out – We removed $350 million of annualized, permanent costs from the business and will further advance our ability to reduce structural costs in the coming fiscal year. |

These priorities will keep our team focused on delivering the capabilities needed to accelerate our progress and succeed in the marketplace and position us to be a stronger Sysco for the future.

Board Leadership

At Sysco, we continuously strive for the most effective Board and leadership structure to oversee our strategy, promote the Company’s performance, drive meaningful operating improvements, and represent the long-term interests of Sysco’s stockholders. As a result of the Board’s continual assessment, and as part of our thoughtful succession process, at this Annual Meeting, our Board will be transitioning to an independent, non-executive Chairman structure. You will find detailed information about our Board leadership structure on page 12.

| 1 | This paragraph contains non-GAAP financial measures, which are denoted as “adjusted.” See pages 89 through 94 in the accompanying Proxy Statement for a reconciliation of these non-GAAP measures to the corresponding GAAP results and an explanation of the adjustments that we have made in order to calculate these adjusted measures. |

SYSCO CORPORATION - 2020 Proxy Statement 4

Sysco’s Ongoing Commitment to Corporate Social Responsibility

Our Board is actively engaged in overseeing Sysco’s Corporate Social Responsibility (CSR) efforts, manifested in our objective of Delivering a Better Tomorrow and three-pillar commitment to People, Products and Planet. By caring for our people, responsibly sourcing our products and working to protect the planet, we continue to make considerable progress toward achieving the 2025 CSR goals that we established two years ago. Since the start of the pandemic, Sysco has donated more than 30 million meals as part of our community response strategy, and we are proud to partner with organizations like Feeding America, Second Harvest and many other charitable organizations to ensure much-needed food is getting to those in greatest need. In addition to meal donations, we continue to place substantial focus on diversity and inclusiveness at Sysco and have specific initiatives in progress to drive further improvements. We recognize that a conscientious approach to environmental stewardship, community responsibility and human capital management is crucial to building a sustainable business and protecting long-term value.

On behalf of our Board of Directors and all our Sysco associates, thank you for your continued support and trust in Sysco.

|

| |

| Kevin Hourican, President and Chief Executive Officer | Ed Shirley, Executive Chairman | |

|

|

SYSCO CORPORATION - 2020 Proxy Statement 5

1390 Enclave Parkway

Houston, Texas 77077-2099

| Notice of Annual Meeting of Stockholders |

November 20, 2020

10:00 a.m. (Central Time)

The Annual Meeting of Stockholders of Sysco Corporation, a Delaware corporation, will be held on Friday, November 20, 2020, at 10:00 a.m. (Central Time). Due to the public health concerns regarding the novel coronavirus disease (“COVID-19”) pandemic, we are holding the Annual Meeting in a virtual-only meeting format to support the health and well-being of our stockholders and our employees. You will not be able to attend the Annual Meeting at a physical location. We believe this format will provide you a consistent experience and allow your participation in the Annual Meeting regardless of your location. You will be able to submit questions during the meeting using online tools, providing you with the opportunity for meaningful engagement with the Company. For more information about the virtual-only meeting format, please see Question 5, “How do I attend the Annual Meeting?” on page 85 of the accompanying proxy statement.

| Items of Business |

During the Annual Meeting, you will be asked to:

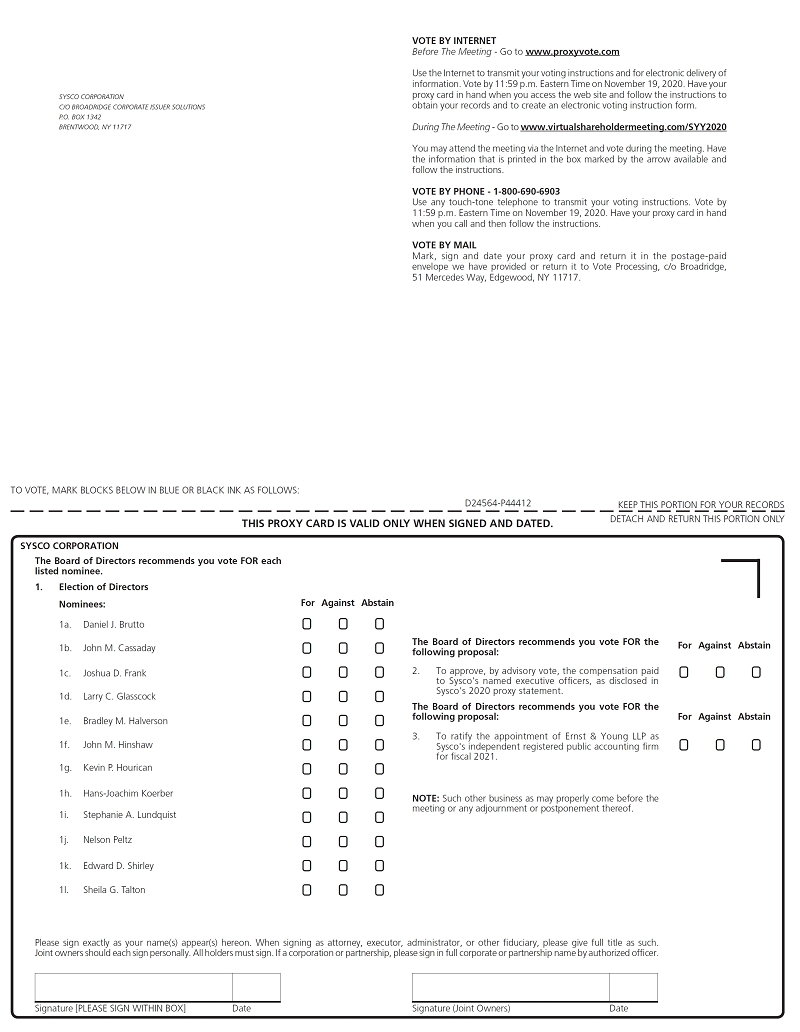

| 1. | Elect as directors the twelve nominees named in the accompanying proxy statement to serve until the Annual Meeting of Stockholders in 2021; |

| 2. | Vote on an advisory resolution to approve the compensation paid to Sysco’s named executive officers, as disclosed in this proxy statement; |

| 3. | Ratify the appointment of Ernst & Young LLP as Sysco’s independent registered public accounting firm for fiscal 2021; and |

| 4. | Transact any other business as may properly be brought before the meeting or any adjournment or postponement thereof. |

| Record Date |

The record date for the Annual Meeting is September 21, 2020. Only stockholders of record of the Company’s common stock at the close of business on the record date will be entitled to receive notice of and to vote during the Annual Meeting or any adjournment or postponement thereof.

SYSCO CORPORATION - 2020 Proxy Statement 7

| Voting Your Proxy |

For instructions on voting, please refer to the notice you received in the mail or, if you requested a hard copy of the proxy statement, on your enclosed proxy card. To cast your vote during the Annual Meeting, you will need to enter the 16-digit control number found on the notice or proxy card, as applicable, at the time you log into the meeting at virtualshareholdermeeting.com/SYY2020. You may inspect a list of stockholders of record at the Company’s headquarters during regular business hours within the 10-day period before the Annual Meeting or during the Annual Meeting when you log in at virtualshareholdermeeting.com/SYY2020.

Dated and first mailed to stockholders on or about October 7, 2020

Houston, Texas

By Order of the Board of Directors

Eve M. McFadden

Senior Vice President, Legal, General Counsel

and Corporate Secretary

| Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on November 20, 2020 |

| The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the fiscal year ended June 27, 2020 are available at www.proxyvote.com. |

SYSCO CORPORATION - 2020 Proxy Statement 8

Sysco Corporation

1390 Enclave Parkway

Houston, Texas 77077-2099

October 7, 2020

We are providing you with a Notice of Internet Availability of Proxy Materials and access to these proxy materials, which include this 2020 Proxy Statement, the proxy card for the 2020 Annual Meeting of Stockholders (the “Annual Meeting”) and our Annual Report on Form 10-K for fiscal 2020, because our Board of Directors is soliciting your proxy to vote your shares at the Annual Meeting. Unless the context otherwise requires, the terms “we,” “our,” “us,” the “Company” or “Sysco,” as used in this proxy statement, refer to Sysco Corporation.

2020 Annual Meeting of Stockholders

| • | Date and Time: Friday, November 20, 2020 at 10:00 a.m. (Central Time) |

| • | Venue: Virtual Annual Meeting (available at www.virtualshareholdermeeting.com/SYY2020). Our Annual Meeting will be held online in a virtual-only meeting format. For more information about the virtual-only meeting format, please see “Questions and Answers About the Meeting and Voting—5 How do I attend the Annual Meeting?” below. |

| • | Record Date: September 21, 2020. At the close of business on the Record Date, there were 509,093,137 shares of Sysco Corporation common stock (“common stock”) outstanding and entitled to vote at the Annual Meeting. All of our current directors and executive officers (23 persons) beneficially owned, directly or indirectly, an aggregate of 26,342,235 shares, which was approximately 5.17% of our outstanding Common Stock as of the Record Date. |

Only owners of shares of common stock as of the close of business on the Record Date are entitled to notice of, and to vote during the Annual Meeting or at any adjournments or postponements of the Annual Meeting. Each stockholder is entitled to one vote for each share owned on the Record Date on each matter presented at the Annual Meeting.

Voting Matters and Board Recommendations

| Our Board Vote Recommendation | |

| Election of Twelve Director Nominees (page 20) | FOR each Director Nominee |

| Advisory Vote on Executive Compensation (page 79) | FOR |

| Ratification of Independent Registered Public Accounting Firm (page 82) | FOR |

Important Dates for 2021 Annual Meeting of Stockholders (page 83)

| • | If you would like to present a proposal under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), at our 2021 Annual Meeting of Stockholders, send the proposal in time for us to receive it no later than June 9, 2021. If the date of our 2021 Annual Meeting is subsequently changed by more than 30 days from the date of this year’s Annual Meeting, we will inform you of the change and the date by which we must receive proposals. |

| • | If you would like to present business at our 2021 Annual Meeting outside of the stockholder proposal rules of Rule 14a-8 of the Exchange Act and, instead, pursuant to Article I, Section 8 of the Company’s Bylaws, the Corporate Secretary must receive notice of your proposal by August 22, 2021, but not before July 13, 2021, and you must be a stockholder of record on the date you provide notice of your proposal to the Company and on the record date for determining stockholders entitled to notice of the meeting and to vote. |

SYSCO CORPORATION - 2020 Proxy Statement 9

We believe good corporate governance is critical to achieving business success. The Board has adopted certain documents, referred to herein as our Governance Documents, to provide a general framework for the Company and reflect our commitment to sound governance practices, including:

| • | Sysco’s bylaws; |

| • | the Corporate Governance Guidelines; |

| • | the Charters of the Board’s committees; and |

| • | the Global Code of Conduct. |

These Governance Documents outline the functions of the Board, each of the Board’s committees, director responsibilities, and various processes and procedures designed to ensure effective and responsive governance.

The Corporate Governance Guidelines comply with the listing standards of the New York Stock Exchange (“NYSE”) and include guidelines for determining director independence and qualifications. These guidelines define qualities and characteristics utilized in evaluating if an existing Board member or candidate meets the qualifications for service as a Sysco Board member. Additionally, diversity, skills, experience and time available for service (including consideration of other board service) are all important considerations. The Corporate Governance and Nominating Committee regularly reviews the Governance Documents and recommends revisions to the Board from time to time to reflect developments in the law and corporate governance practices.

Copies of the Governance Documents can be accessed from the corporate governance section of the Company’s website at “Investors—Corporate Governance” at www.sysco.com. These documents will also be provided without charge to any stockholder upon written request to the Corporate Secretary at Sysco Corporation, 1390 Enclave Parkway, Houston, Texas 77077. The information on any website referenced in this proxy statement, including www.sysco.com, is not deemed to be part of or incorporated by reference into this proxy statement.

SYSCO CORPORATION - 2020 Proxy Statement 10

Governance Highlights

| BOARD COMPOSITION AND ACCOUNTABILITY: | ||

| Board Leadership | • | In January 2020, the Board of Directors elected Mr. Shirley as Executive Chairman, on an interim basis, succeeding Mr. Bené as Chairman of the Board, effective on January 10, 2020 |

| • | The independent directors elected Mr. Bradley M. Halverson as the Company’s independent Lead Director, effective on January 10, 2020 | |

| • | In January 2020, the Board of Directors elected Mr. Hourican as President and Chief Executive Officer, succeeding Mr. Bené as President and Chief Executive Officer, effective February 1, 2020 | |

| • | Each Board committee (other than the Executive Committee) is chaired by an independent director | |

| Board Refreshment & Director Tenure Policy | • | Established 15-year limit on director tenure |

| • | Since 2016, the Board has elected six new independent directors – Messrs. Brutto, Halverson and Shirley (in | |

| September 2016), Ms. Talton (in September 2017), Mr. Hinshaw (in April 2018) and Ms. Lundquist (in November 2019) | ||

| • | Ms. Newcomb is not standing for re-election at the Annual Meeting | |

| Board Evaluations | • | Annual Board and committee self-evaluations aim to increase Board effectiveness and inform future Board refreshment efforts |

| • | Periodic 360-degree individual director performance evaluations of selected directors | |

| Director Independence | • | At least a majority of our directors must meet the NYSE criteria for independence, as well as the additional criteria set forth in the Corporate Governance Guidelines |

| • | All members of the Audit, Compensation and Leadership Development and Corporate Governance and Nominating Committees must be independent under the applicable NYSE and SEC standards | |

| • | Our Board has determined that all director nominees, other than the CEO, are (or in the case of Mr. Shirley, will be) independent under these standards (representing 91.7% of the Board); Mr. Shirley, our current Executive Chairman serving on an interim basis, will be independent at the time of the Annual Meeting upon the effectiveness of his appointment as Non-Executive Chairman of the Board | |

| Annual Elections | • | All of our directors are elected annually |

| Director Overboarding Policy | • | Non-employee directors should generally not serve on more than four additional public-company boards of directors |

| Change in Occupation | • | Any director who materially changes principal occupation or business association is required to tender his or her offer to resign to Chairman of the Board and Chairman of the Corporate Governance and Nominating Committee |

| Risk Oversight | • | Board works through its committees and senior management to exercise oversight of the enterprise risk management process |

| STOCKHOLDER RIGHTS: | ||

| Proxy Access | • | Stockholders who have beneficially owned 3% or more of our outstanding common stock continuously for at least 3 years (as of the time of submission of the nomination) may nominate a number of director nominees equal to the greater of 2 or 20% (rounded down) of the total number of directors constituting our Board, subject to applicable limitations and procedural requirements |

| Right to Call Special Meeting | • | Stockholders holding at least 25% of our outstanding common stock have the right to call a special meeting of stockholders, subject to applicable limitations and procedural requirements |

| Action by Written Consent | • | Stockholders having at least the minimum voting power required to take a corporate action may do so by a written consent in lieu of calling a stockholders meeting |

| Majority Voting Standard | • | Each of our directors is elected by a majority of votes cast in an uncontested election |

| • | Any incumbent director failing to receive more “for” than “against” votes is required to tender his or her offer to resign to the Board | |

| Single Voting Class | • | We have only one class of stock, common stock, that is entitled to vote on the election of directors and other matters submitted to a vote of stockholders |

| Stockholder Engagement | • | We prioritize a program of regular engagement with our stockholders regarding matters of corporate governance |

| • | Participation by Mr. Shirley, our Executive Chairman, Mr. Cassaday, the Chair of our Compensation and Leadership Development Committee, and Mr. Glasscock, the Chair of our Corporate Governance and Nominating Committee | |

| No Poison Pill | • | We do not have a poison pill or similar stockholder rights plan |

SYSCO CORPORATION - 2020 Proxy Statement 11

Effective February 1, 2020, the Board appointed Mr. Kevin P. Hourican as President and Chief Executive Officer (“CEO”) and as a member of the Board and the Executive Committee of the Board, to succeed Mr. Thomas L. Bené, who voluntarily resigned from his officer and director positions with the Company. In addition, effective as of January 10, 2020, the Board named Mr. Edward D. Shirley, the former independent Lead Director of the Board, as the Executive Chair of the Board on an interim basis, to facilitate Mr. Hourican’s successful transition to his new role as Sysco’s CEO. The Board also named Mr. Bradley M. Halverson as the independent Lead Director of the Board, effective as of January 10, 2020.

In his role as Executive Chair, Mr. Shirley provided guidance and coaching to the CEO to support his transition, in addition to his other responsibilities, which include:

| • | reviewing meeting agendas and schedules for meetings of the Board with the CEO and the independent Lead Director; |

| • | overseeing and approving information and materials sent to the Board; |

| • | being available for consultation and director communication; |

| • | reviewing with the independent Lead Director and the CEO the nature and content of director communications in response to inquiries from outside parties; and |

| • | in consultation with the independent Lead Director and the CEO, reviewing written communications between directors and officers or employees of the Company. |

In August 2020, the Board determined to conclude Mr. Shirley’s interim service as Executive Chairman of the Board, appointing him as the independent, non-executive Chairman of the Board, effective as of the Annual Meeting. Concurrent with this appointment, Mr. Halverson is expected to conclude his service as independent Lead Director, as the Lead Director’s key responsibilities, including serving as the primary liaison between the independent directors and the CEO, and presiding at meetings of the non-employee and independent directors, will be fulfilled by the non-executive Chairman of the Board.

With respect to the roles of Chairman and CEO, the Corporate Governance Guidelines provide that the roles may be separated or combined, and the Board exercises its discretion in combining or separating these positions as it deems appropriate in light of prevailing circumstances.

The Board believes, at this time, that the separation of the roles of Chairman and CEO is in the best interest of Sysco and its stockholders and the most effective leadership structure for the Company. The Board regularly reviews its leadership structure, including during the Board’s annual evaluation process, to determine the most appropriate arrangement. Since the Company was founded in 1969, the Board from time to time has established a variety of Board leadership structures, including independent Board Chairs, as well as those serving as Executive Chair or combined CEO/Chair.

The Board believes that its approved leadership structure, which includes its independent, non-executive Chairman of the Board as described above, best enables the Board to provide effective, independent oversight of the Company. In addition, the Board has implemented several corporate governance policies and practices that promote a strong, effective and independent Board, which are described above under “—Governance Highlights.”

The independent directors meet regularly in executive session without the CEO or any other member of management present, and in fiscal 2020 met five times. Mr. Shirley, followed by Mr. Halverson beginning in January 2020, each serving as independent Lead Director, presided over the sessions of the independent directors in fiscal 2020.

Our Board recognizes the importance of consistent, deliberate Board refreshment and succession planning to ensure that the directors possess a composite set of skills, experience and qualifications necessary for the Board to successfully establish and oversee management’s execution of the Company’s strategic priorities (see “Board of Directors Matters – Election of Directors at 2020 Annual Meeting (Item 1) – Director Qualifications and Board Succession” below for a discussion of the key qualifications considered by the Corporate Governance and Nominating Committee in evaluating candidates). In order to promote thoughtful Board refreshment, in 2016 our Board adopted a Board refreshment plan, pursuant to which the Board has elected an additional six independent, non-employee directors to the Board.

Director Tenure Policy. In July 2016, our Board, upon the recommendation of the Corporate Governance and Nominating Committee, established our director tenure policy, which provides that no individual who, as of the date of the election to which any nomination relates, will have served as a non-employee director for 15 years will be eligible to be nominated for election or re-election to the Board. Since the adoption of this policy, the four longest-tenured directors retired from the Board, including the former Chairman of the Board, the former Chair of the Audit Committee and the former Chair of the Corporate Social Responsibility Committee, and six new independent directors were elected to the Board. Collectively, these Board refreshment efforts have significantly lowered the average tenure of our independent directors.

The dramatic impact of the COVID-19 pandemic on the Company and its business has significantly increased the challenges associated with management retention, as the value of the annual and long-term incentive awards held by Sysco’s executive officers has declined significantly. In recognition of Mr. Cassaday’s valuable ongoing contribution (as an experienced, respected leader and the Chair of the Compensation and Leadership Development Committee) to the Board’s efforts to develop compensation programs that retain and incentivize the Company’s highly-talented executives in this challenging environment, and in light of the Board’s significant progress on refreshment, the Board, as recommended by the Corporate Governance and Nominating Committee, has approved an exception to the director tenure policy for Mr. Cassaday and requested

SYSCO CORPORATION - 2020 Proxy Statement 12

that he stand for re-election at the Annual Meeting. Although the Board considers the current average independent director tenure of 7 years to be appropriate, it remains committed to deliberate Board refreshment and succession planning and expects any future exceptions to the tenure policy to be granted infrequently under similarly limited or unusual circumstances. See “Compensation Discussion and Analysis—Executive Summary—Business Highlights” for further discussion of the impact of the COVID-19 pandemic upon our financial results and our outstanding annual and long-term incentive awards.

Director Recruitment. Since the adoption of our Board refreshment plan in 2016, our Board has periodically engaged the services of a third-party search firm to assist with identifying and recruiting appropriate director candidates. Several director candidates have been referred by our then-current directors and identified by a third-party search firm, and our Board evaluated the skills, experience and qualifications of each candidate in the context of the Board’s composition and the Company’s strategic priorities. Following consideration of each of these candidates, and in each case upon the unanimous recommendation of our Corporate Governance and Nominating Committee, the Board elected a total of six new independent, non-employee directors: Messrs. Brutto, Halverson and Shirley (in September 2016), Ms. Talton (in September 2017), Mr. Hinshaw (in April 2018) and Ms. Lundquist (in November 2019). As our incumbent directors retire from the Board from time to time, we will continue our director recruitment efforts to help ensure that the size of the Board may be maintained at an appropriate level.

Communicating with stakeholders, whether customers, suppliers, employees or stockholders, has always been an important part of how Sysco does business. Beginning in 2015, in furtherance of these efforts, we began a more formal engagement process with our stockholders regarding matters of corporate governance. This engagement process is incremental to our customary participation at industry and investment community conferences, investor road shows and analyst meetings.

At the direction of our Corporate Governance and Nominating Committee, senior leaders from the Company met with representatives at many of our top institutional stockholders to discuss Sysco’s governance practices, executive compensation, compliance programs, and other environmental, social, and governance related matters. Management reported regularly to the Board and the Corporate Governance and Nominating Committee concerning these meetings, including feedback on the concerns and issues raised by our stockholders.

Since fiscal 2016, this engagement program has been expanded to include selected directors, including Messrs. Shirley, Cassaday and Glasscock, who have participated, or are expected to participate, in meetings with many of our top institutional stockholders to discuss the same governance and compensation matters described above. Insight gained from engagement discussions remains a key consideration for the Board as it continues to evaluate our corporate governance and executive compensation practices for potential refinement.

We look forward to gaining further insight from our stockholders during future engagements.

Communicating with the Board

Interested parties, including, but not limited to, our stockholders, may communicate with the Chairman of the Board, the independent Lead Director, the independent directors as a group and the other individual members of the Board by confidential web submission or by mail. All such correspondence will be delivered to the parties to whom they are addressed. The Board requests that items unrelated to the duties and responsibilities of the Board not be submitted, such as product inquiries and complaints, job inquiries, business solicitations and junk mail. You may access the form to communicate by confidential web submission in the corporate governance section of Sysco’s website under “Investors —Corporate Governance — Contact the Board” at www.sysco.com. You can contact any of our directors by mail in care of the Corporate Secretary, Sysco Corporation, 1390 Enclave Parkway, Houston, Texas 77077.

During fiscal 2020, the Board held seven meetings, including four regular meetings and three special meetings, and committees of the Board held a total of 32 meetings. Overall attendance at such meetings was approximately 96.6%. Each director attended 75% or more of the aggregate of all meetings of the Board and the committees on which he or she served during fiscal 2020. The Board has an Audit Committee, a Compensation and Leadership Development Committee (the “CLD Committee”), a Corporate Governance and Nominating Committee (the “Governance Committee”), a Corporate Social Responsibility Committee, and an Executive Committee. Current copies of the written charters for the Audit Committee, the CLD Committee, the Governance Committee, the Corporate Social Responsibility Committee, and the Executive Committee are published on our website under “Investors — Corporate Governance” at www.sysco.com. The current membership and primary responsibilities of the committees are summarized in the following table.

SYSCO CORPORATION - 2020 Proxy Statement 13

| Committee Name & Current Members |

Primary Responsibilities | Fiscal 2020 Meetings |

| Audit(1) Mr. Halverson (Chair) Mr. Frank Mr. Hinshaw Dr. Koerber Ms. Newcomb |

• Oversees and reports to the Board with respect to various auditing and accounting matters, including the selection of the independent public accountants, the scope of audit procedures, the nature of all audit and non-audit services to be performed by the independent public accountants, the fees to be paid to the independent public accountants, and the performance of the independent public accountants • Oversees and reports to the Board with respect to Sysco’s accounting practices and policies • Oversees and reports to the Board with respect to certain treasury/finance matters, including the Company’s policies governing capital structure, debt limits, dividends and liquidity, and reviews and recommends to the Board the issuance and repurchase of Company securities • Assists the Board with its oversight and monitoring of the Company’s risk assessment and risk management policies and processes • Oversees and reports to the Board with respect to compliance with legal and regulatory requirements, corporate accounting, reporting practices and the integrity of the financial statements of the Company |

10 |

| Compensation and Leadership Development(2)(3) Mr. Cassaday (Chair) Mr. Frank Mr. Glasscock Mr. Halverson Mr. Hinshaw Ms. Lundquist |

• Establishes executive compensation philosophies, policies, plans and programs to ensure that compensation actions link pay for performance, provide competitive pay opportunity to attract and retain key executive talent, provide accountability for short and long-term performance and align the interests of the “senior officers” (i.e., the CEO and those reporting to the CEO) with those of stockholders • Establishes and approves all compensation, including the corporate goals on which compensation shall be based, of the CEO and the other senior officers, including the named executive officers (or “NEOs,” as defined below) • Oversees the process for the evaluation of management, including the CEO • Reviews and approves any clawback policy allowing the recoupment of compensation paid to associates, including the senior officers • Reviews and determines equity awards to the senior officers, and oversees management’s exercise of its previously-delegated equity grant authority • Reviews, approves and, as required by law, recommends the establishment or amendment of any compensation or retirement program (i) in which any senior officer will participate, (ii) that requires stockholder approval or (iii) that could reasonably be expected to have a material cost impact • Reviews and discusses with the CEO the Company’s leadership development programs and succession planning for the other senior officers • Reviews the Company’s human capital policies and strategies |

11 |

| Corporate Governance and Nominating(2)(3) Mr. Glasscock (Chair) Mr. Brutto Mr. Cassaday Mr. Peltz Ms. Talton |

• Proposes directors, committee members and officers to the Board for election or reelection • Reviews the performance of the members of the Board and its committees • Recommends to the Board the annual compensation of non-employee directors • Reviews related person transactions and reviews and makes recommendations regarding changes to Sysco’s Related Person Transaction Policy • Reviews and makes recommendations regarding the organization and effectiveness of the Board and its committees, the establishment of corporate governance principles, the conduct of meetings, succession planning and Sysco’s Governing Documents • Reviews and makes recommendations regarding changes to Sysco’s Global Code of Conduct, periodically reviews overall compliance with the Code and approves any waivers to the Code given to Sysco’s executive officers and directors • Monitors compliance with and approves waivers to Sysco’s Policy on Trading in Company Securities |

8 |

| Corporate Social Responsibility Mr. Brutto (Chair) Dr. Koerber Ms. Lundquist Ms. Newcomb Mr. Shirley Ms. Talton |

• Reviews and acts in an advisory capacity to the Board and management with respect to policies and strategies that affect Sysco’s role as a socially responsible organization • Reviews, evaluates, and provides input on the development and implementation of Sysco’s Corporate Social Responsibility (“CSR”) Strategy, which focuses on three pillars—People, Products and Planet—and on the implementation of any CSR goals previously established by the Board • Reviews philanthropic giving, agriculture programs, and warehouse and transportation initiatives designed to improve the environmental impact of the Company |

3 |

| Executive Mr. Shirley (Chair) Mr. Brutto Mr. Cassaday Mr. Glasscock Mr. Halverson Mr. Hourican |

• Exercises all of the powers of the Board when necessary, to the extent permitted by applicable law |

0 |

| (1) | Each member of the Audit Committee has been determined by the Board to be independent, as defined in the NYSE’s listing standards, Section 10A of the Exchange Act and the Company’s Corporate Governance Guidelines. The Board has determined that each member of the Audit Committee is financially literate and that each of Messrs. Halverson and Frank and Ms. Newcomb meets the definition of an audit committee financial expert as promulgated by the SEC. No Audit Committee member serves on the audit committees of more than two other public companies. |

| (2) | Each member of the CLD Committee and the Governance Committee has been determined by the Board to be independent, as defined in the NYSE’s listing standards and the Company’s Corporate Governance Guidelines. |

| (3) | Except for decisions that impact the compensation of Sysco’s CEO, the CLD Committee is generally authorized to delegate any decisions it deems appropriate to a subcommittee. In such a case, the subcommittee must promptly report any action that it takes to the full CLD Committee. In addition, the CLD Committee may delegate to any one or more members of the Board its full equity grant authority with respect to any equity-based grants (other than grants made to Sysco’s senior officers); and the CLD Committee has delegated such authority to the CEO with respect to certain non-executive employees, subject to specified limitations. In carrying out its duties, the CLD Committee may also delegate its oversight of Sysco’s employee and executive benefit plans to any administrative committees of the respective plans or to such officers or employees of Sysco as the CLD Committee deems appropriate, except that it may not delegate its powers to amend, establish or terminate any benefit plan that is maintained primarily for the benefit of Sysco’s senior officers, resolve claims under a benefit plan with respect to any senior officer, or modify the compensation of any senior officer as provided under any nonqualified or executive incentive compensation plan. For a detailed description of the CLD Committee’s processes and procedures for consideration and determination of executive compensation, including the role of executive officers and compensation consultants in recommending the amount and form of executive compensation, see “— Compensation Consultants” and “Compensation Discussion and Analysis.” |

SYSCO CORPORATION - 2020 Proxy Statement 14

During fiscal 2020, the Board conducted an annual self-evaluation to determine whether the Board and its committees functioned effectively during the prior fiscal year. As part of the evaluation process, each director completed a Board self-evaluation questionnaire developed by the Governance Committee. The questionnaire responses were compiled and reviewed by legal counsel, which provided a summary of the responses, without attribution to any individual director, to the Chairman of the Board and the Chairman of the Governance Committee. The results of the questionnaires were subsequently discussed by the Governance Committee and presented to the full Board for review and discussion.

In addition, each Board committee conducted a similar self-evaluation of its performance focused on the committee’s key responsibilities. Feedback from the committees’ self-evaluations was reviewed by the applicable committee and also presented to the full Board for review and discussion. Key learnings from these Board and committee self-evaluations play an important role in informing the Board’s approach to refreshment and succession planning.

As a direct result of the 2019 Board and committee evaluations, the Board:

| • | Enhanced its efforts to recruit gender diverse executive officer candidates. |

| • | Invited operating company leaders to attend and participate in regular Board and committee Meetings, adding management perspectives beyond the executive leadership team. |

| • | Directed management to rationalize the volume of detail in the Board and committee materials, focusing on the key strategic issues and allowing more time for discussions among directors and with management. |

Beginning in fiscal 2017, the Board’s self-evaluation process was enhanced to include periodic “360 degree” individual director performance reviews, which involve a confidential evaluation of the performance of selected directors by each of his or her fellow directors, key members of senior management and representatives of certain independent, third-party firms that routinely interact with the directors assessed. The feedback from these reviews are compiled and communicated to the directors assessed by an independent, third-party corporate governance firm.

Our Corporate Governance Guidelines require that at least a majority of our directors meet the criteria for independence that the NYSE has established for continued listing, as well as the additional criteria set forth in the Guidelines. Additionally, we require that all members of the Audit Committee, CLD Committee, and Governance Committee be independent, that all members of the Audit Committee satisfy the additional requirements of the NYSE and applicable rules promulgated under the Exchange Act, and that all members of the CLD Committee satisfy the additional requirements of the NYSE.

Under the NYSE listing standards, to consider a director to be independent, our Board must determine that he or she has no material relationship with Sysco other than as a director. The standards specify the criteria by which the Board must determine whether directors are independent and contain guidelines for directors and their immediate family members with respect to employment or affiliation with Sysco or its independent registered public accounting firm.

In addition to the NYSE’s standards for independence, our Corporate Governance Guidelines contain categorical standards that provide that the following relationships will not impair a director’s independence:

| • | if a Sysco director is an executive officer of another company that does business with Sysco and the annual sales to, or purchases from, Sysco are less than two percent of the annual revenues of the company for which he or she serves as an executive officer; |

| • | if a Sysco director is an executive officer of another company which is indebted to Sysco, or to which Sysco is indebted, and the total amount of either company’s indebtedness to the other is less than two percent of the total consolidated assets of the company for which he or she serves as an executive officer, so long as payments made or received by Sysco as a result of such indebtedness do not exceed the two percent thresholds provided above with respect to sales and purchases; and |

| • | if a Sysco director serves as an officer, director or trustee of a tax-exempt charitable organization, and Sysco’s discretionary charitable contributions to the organization are less than two percent of that organization’s total annual charitable receipts; Sysco’s automatic matching of employee charitable contributions will not be included in the amount of Sysco’s contributions for this purpose. |

The Board has reviewed all relevant relationships between those individuals who served as a director at any time during fiscal 2020 (and/or who are nominated for election at the Annual Meeting) and Sysco. The relationships reviewed included any described under “Certain Relationships and Related Person Transactions,” and several relationships that did not automatically make the individual non-independent under the NYSE standards or our Corporate Governance Guidelines, either because of the type of affiliation between the director and the other entity or because the amounts involved did not meet the applicable thresholds.

These additional relationships include the following (for purposes of this section, “Sysco,” “we,” “us” and “our” include our operating companies):

| • | Mr. Cassaday serves as a director of one of our suppliers; |

| • | Mr. Frank is a Partner of Trian Fund Management, L.P. (“Trian”), which owns approximately 4.8% of Sysco’s outstanding common stock; |

| • | Mr. Glasscock serves as a director of one of our customers; |

| • | Mr. Halverson serves as Treasurer of a charitable organization that is one of our customers; |

| • | Mr. Hinshaw serves as a director of one of our suppliers; Mr. Hinshaw also serves as an executive officer of a banking and financial services organization that provides commercial lending services to Sysco and that has received from Sysco, in each of the past three fiscal years, an aggregate amount significantly less than the maximum amount permitted under the NYSE listing standards for director independence (i.e., 2% of consolidated gross revenues); |

SYSCO CORPORATION - 2020 Proxy Statement 15

| • | Ms. Lundquist serves as an executive officer of a Sysco customer and supplier that has paid to Sysco, and received from Sysco, in each of the past three fiscal years, an aggregate amount significantly less than the maximum amount permitted under the NYSE listing standards for director independence (i.e., 2% of consolidated gross revenues); |

| • | Mr. Peltz is Chief Executive Officer and a Founding Partner of Trian, which owns approximately 4.8% of Sysco’s outstanding common stock; he also serves as a director of three Sysco customers; and |

| • | Mr. Shirley serves as a director of one of our customers; Mr. Shirley has also served as Sysco’s Executive Chairman of the Board on an interim basis since January 10, 2020, and will continue to serve in that capacity until the Annual Meeting, as described under “—Board Leadership Structure” above. |

After reviewing such information, the Board has determined that each of Mr. Brutto, Mr. Cassaday, Mr. Frank, Mr. Glasscock, Mr. Halverson, Mr. Hinshaw, Dr. Koerber, Ms. Lundquist, Mr. Peltz and Ms. Talton, Ms. Newcomb has no material relationship with Sysco and is independent under the NYSE standards and the categorical standards set forth in the Corporate Governance Guidelines and described above. In addition, due to the interim nature of Mr. Shirley’s service as Executive Chairman of the Board, as discussed above under “—Board Leadership Structure,” the Board has also determined that Mr. Shirley will qualify as independent under the NYSE standards upon his appointment to non-executive Chairman of the Board effective at the Annual Meeting.

The Board also determined that (i) Mr. Hourican, who served as an executive officer of the Company during fiscal 2020, is not independent pursuant to the NYSE independence standards due to such service, and (ii) during the time he served as a director, Mr. Bené, who also served as an executive officer until his resignation on January 10, 2020, was not independent pursuant to the NYSE independence standards due to such service as an executive officer.

The Board has also determined that each member of the Audit Committee, CLD Committee and Governance Committee is independent. Our Corporate Governance Guidelines also provide that no independent director who is a member of the Audit, CLD or Governance Committees may receive any compensation from Sysco, other than in his or her capacity as a non-employee director or committee member. The Board has determined that no non-employee director received any compensation from Sysco at any time since the beginning of fiscal 2020, other than in his or her capacity as a non-employee director, committee member, committee chairman or Chairman of the Board.

Certain Relationships and Related Person Transactions

Related Person Transactions Policies and Procedures

The Board has adopted written policies and procedures for review and approval or ratification of transactions with related persons. We subject the following related persons to these policies: directors, director nominees, executive officers, beneficial owners of more than five percent of our stock and any immediate family members of these persons.

We follow the policies and procedures below for any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships in which Sysco was or is to be a participant, the amount involved exceeds $100,000, and in which any related person had or will have a direct or indirect material interest. These policies specifically apply without limitation to purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness, and employment by Sysco of a related person. The Board has determined that the following do not create a material direct or indirect interest on behalf of the related person, and are, therefore, not related person transactions to which these policies and procedures apply:

| • | Interests arising only from the related person’s position as a director of another corporation or organization that is a party to the transaction; |

| • | Interests arising only from the direct or indirect ownership by the related person and all other related persons in the aggregate of less than a 10% equity interest, other than a general partnership interest, in another entity which is a party to the transaction; |

| • | Interests arising from both the position and ownership level described in the two bullet points above; |

| • | Interests arising solely from the ownership of a class of Sysco’s equity securities if all holders of that class of equity securities receive the same benefit on a pro rata basis, such as dividends; |

| • | A transaction that involves compensation to an executive officer if the compensation has been approved by the CLD Committee, the Board or a group of independent directors of Sysco performing a similar function; or |

| • | A transaction that involves compensation to a director for services as a director of Sysco if such compensation will be reported pursuant to Item 402(k) of Regulation S-K. |

Any of our employees, officers or directors who have knowledge of a proposed related person transaction must report the transaction to our chief legal officer. Whenever practicable, before the transaction goes effective or becomes consummated, the proposed transaction will be reviewed and approved by the Board or, pursuant to authority delegated by the Board, by (i) the Chair of the Governance Committee, if the aggregate amount involved is expected to be less than $200,000; or (ii) the Governance Committee, if the aggregate amount involved is expected to be less than $500,000. If a potential related person transaction is entered into without prior approval pursuant to this policy, the Governance Committee will review and recommend to the Board, and the Board will determine, in its discretion, whether to ratify the transaction.

In addition, any related person transaction that was previously approved and is ongoing in nature will be reviewed by the Governance Committee and the Board during the first quarter of each fiscal year to:

| • | ensure that such transaction has been conducted in accordance with the previous approval; |

| • | ensure that Sysco makes all required disclosures regarding the transaction; and |

| • | determine if Sysco should continue, modify or terminate the transaction. |

SYSCO CORPORATION - 2020 Proxy Statement 16

We will consider a related person transaction approved or ratified if the transaction is authorized by the Chair, the Governance Committee or the Board, as applicable, in accordance with the standards described below, after full disclosure of the related person’s interests in the transaction. As appropriate for the circumstances, the Chair, the Governance Committee and/or the Board will review and consider such of the following as it deems necessary or appropriate:

| • | the related person’s interest in the transaction; |

| • | the approximate dollar value of the amount involved in the transaction; |

| • | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

| • | whether the transaction was undertaken in Sysco’s ordinary course of business; |

| • | whether the transaction with the related person is proposed to be, or was, entered into on terms no less favorable to Sysco than terms that could have been reached with an unrelated third party; |

| • | the purpose of, and the potential benefits to Sysco of, the transaction; and |

| • | any other information regarding the transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

The Chair, the Governance Committee or the Board, as applicable, will review such additional information about the transaction as it deems relevant in its sole discretion. The applicable reviewer may approve or ratify the transaction only if it determines that, based on its review, the transaction is in, or is not inconsistent with, the best interests of Sysco. The Chair, the Governance Committee or the Board, as applicable, may, in its sole discretion, impose such conditions as it deems appropriate on Sysco or the related person when approving a transaction. If the Board determines not to ratify a related person transaction, we will either rescind or modify the transaction, as the Board directs, as soon as practicable following the failure to ratify the transaction. The Chair will report to the Governance Committee at its next regularly scheduled meeting any action that he or she has taken under the authority delegated pursuant to this policy. If any director has an interest in a related person transaction, he or she is not allowed to participate in any discussion or approval of the transaction, except that the director is required to provide all material information concerning the transaction to the applicable reviewer.

Transactions with Related Persons

In addition to receiving compensation during fiscal 2020 for his service as an independent director and the independent Lead Director, beginning upon his appointment as the Executive Chairman of the Board on January 10, 2020, Mr. Shirley received payment from the Company for his service in such capacity. See “Director Compensation – Overview of Non-Employee Director Compensation” below for a discussion of Mr. Shirley’s compensation as Executive Chairman of the Board.

One of the primary oversight functions of the Board is to ensure that Sysco has an appropriate enterprise risk management process in place that is consistent with both the short- and long-term goals of the Company. In order to effectively fulfill this oversight role, the Board relies on various individuals and committees within management and among our Board members. See “Board of Directors Matters—Election of Directors at 2020 Annual Meeting (Item 1)—Director Qualifications and Board Succession” and “Board of Directors Matters—Board Composition” below for a description of individual director qualifications, including risk management experience.

Management is responsible for identifying, managing and mitigating enterprise risks, and reports directly to the Audit Committee and the Board on a regular basis with respect to enterprise risk management. As discussed above under “Board Meetings and Committees,” the Audit Committee reviews Sysco’s process by which management assesses and manages the Company’s exposure to enterprise risk. The Audit Committee also makes recommendations to the Board with respect to the process by which members of the Board and relevant committees will be made aware of the Company’s significant risks, including recommendations regarding what committee of the Board would be most appropriate to take responsibility for oversight of management with respect to the most material risks faced by the Company. On an annual basis, management reviews with the Board the Board-level enterprise risks identified in the process, such as strategic, operational, financial, external/regulatory and reputation risks, as well as management’s process and resources needed for addressing and mitigating the potential effects of such risks. Sysco has developed an enhanced enterprise risk management process that includes frequent discussion and prioritization of enterprise-level risk issues by the executive management team, a deep dive approach to fully understand the risks, creation of an enterprise risk management plan in support of lowering the risk’s exposure to the level of management’s preferred tolerance, and tracking and monitoring of risk information and management’s execution of the plan, all within a governance and reporting cadence.

The Board’s committees help oversee the enterprise risk management process within the respective areas of the committees’ delegated oversight authority. The Audit Committee is primarily responsible for hiring and evaluating our independent registered public accounting firm, reviewing our internal controls, overseeing our internal audit function, overseeing customer credit risk, reviewing contingent liabilities that may be material to the Company and various regulatory and compliance oversight functions. The CLD Committee is responsible for ensuring that our executive compensation policies and practices do not incentivize excessive or inappropriate risk-taking by employees. The Governance Committee monitors risk by ensuring that proper corporate governance standards are maintained, that the Board is comprised of qualified directors, and that qualified individuals are chosen as senior officers. The Chairman of the Board coordinates the flow of information regarding enterprise risk oversight from each respective committee to the independent directors and participates in the review of the agenda for each Board and committee meeting. As the areas of oversight among committees sometimes overlap, committees may hold joint meetings when appropriate and address certain enterprise risk oversight issues at the full Board level. The Board considers enterprise risk in evaluating the Company’s strategy, including specific strategic and emerging risks, and annually reviews and approves corporate goals and capital budgets. The Board also monitors any specific enterprise risks for which it has chosen to retain oversight rather than delegating oversight to one of its committees, such as risks related to competitive threats and senior leadership succession planning.

SYSCO CORPORATION - 2020 Proxy Statement 17

Corporate Social Responsibility

The Board, through its Corporate Social Responsibility Committee, oversees the Company’s development and implementation of Sysco’s CSR strategy, including its progress toward the 2025 CSR goals established in 2018. Sysco’s CSR strategy focuses on three key areas: people, products and planet, with the objective of Delivering A Better Tomorrow. This strategy sets a clear path for the future and demonstrates the Company’s continued commitment to caring for people, sourcing products responsibly and protecting the planet. For further discussion of Sysco’s CSR strategy and 2025 CSR Goals, see our website at www.sysco.com in the About section under “Corporate Social Responsibility.”

Our Global Code of Conduct (the “Code”) is guided by our values and expectations which we believe are important to delivering exceptional service with the highest degree of integrity. We require all of our directors, officers and associates, including our principal executive officer, principal financial officer, principal accounting officer and controller, to understand and abide by the Code, as it represents our commitment to continuously deliver excellence with integrity by conducting our business in accordance with the highest standards of moral and ethical behavior in accordance with our values: Integrity, Excellence, Teamwork, Inclusiveness, Responsibility.

Our Global Code of Conduct addresses the following, among other topics:

| • | fraud; |

| • | anti-corruption and anti-bribery; |

| • | export/import laws and trade sanctions; |

| • | human rights; |

| • | diversity and inclusion; |

| • | workplace safety; |

| • | antitrust; |

| • | competition and fair dealing; |

| • | professional conduct, including customer relationships, equal opportunity, payment of gratuities and receipt of payments or gifts; |

| • | political contributions; |

| • | conflicts of interest; |

| • | insider trading; |

| • | financial disclosure; |

| • | intellectual property; and |

| • | confidential information. |

Our Code, which is reviewed annually by our Governance Committee, requires strict adherence to all laws and regulations applicable to our business and requires employees to report any violations or suspected violations of the Code. We have published the Global Code of Conduct on our website in the Overview section under “Investors—Corporate Governance” at www.sysco.com. We intend to disclose any future amendments to or waivers of our Code on our website at www.sysco.com under the heading “Investors—Corporate Governance.”

Reporting a Concern or Violation

Our Code explains that there are multiple channels for an employee to report a concern, including to an associate’s manager, a human resource professional, our Legal or Ethics and Compliance department, or to the Sysco Ethics Line. Our Ethics Line is available 24 hours a day, seven days a week, 365 days a year, worldwide, to receive calls or web submissions from anyone wishing to report a concern or complaint, anonymous or otherwise. Our Ethics Line contact information can be found on our website at www.sysco.com under the heading “About Sysco – The Sysco Story – Code of Conduct.”

Any report to any one of our multiple channels for reporting concerns that raises a concern or allegation of impropriety relating to our accounting, internal controls or other financial or audit matters is immediately forwarded to our Senior Vice President, Legal, General Counsel and Corporate Secretary, who is then responsible for reporting such matters, unfiltered, to the Chair of our Audit Committee. All such matters are investigated and responded to in accordance with the procedures established by the Audit Committee to ensure compliance with the Sarbanes-Oxley Act of 2002.

SYSCO CORPORATION - 2020 Proxy Statement 18

The CLD Committee has retained Semler Brossy Consulting Group, LLC (“Semler Brossy”) as its executive compensation consultant. Retained by and reporting directly to the Committee, Semler Brossy provided the CLD Committee with assistance in evaluating Sysco’s executive compensation programs and policies, and, where appropriate, assisted with the redesign and enhancement of elements of the prograMs. The scope of Semler Brossy’s assignments with regard to fiscal 2020 and 2021 executive compensation included:

| • | Reviewed the continuing appropriateness of the compensation peer group described below; |

| • | Prepared executive compensation studies for the CLD Committee, in May 2019 and May 2020, which included a comparison of base salaries and estimation of total cash compensation and total direct compensation, inclusive of annual incentive and LTI opportunities for the NEOs relative to the applicable peer or other comparison group; |

| • | Conducted a pay for performance analysis, comparing the relationship between actual realizable pay for the NEOs and the Company’s total shareholder return to that of the applicable peer group; and |

| • | Compared Sysco’s aggregate equity usage to the applicable peer group. |

The CLD Committee consulted Semler Brossy for all executive compensation decisions made for fiscal 2020 and fiscal 2021, including: (i) base salary determinations and annual and LTI awards and (ii) the compensation packages offered to Messrs. Hourican and Foster and Ms. Robinson, including the make-whole components. Semler Brossy also worked with the CLD Committee to develop appropriate compensation and benefits for Mr. Bené in connection with his separation from employment.

Semler Brossy also advised the Governance Committee with respect to non-employee director compensation. At the Governance Committee’s request, Semler Brossy provided data regarding the amounts and types of compensation paid to non-employee directors at the companies in Sysco’s peer group, and also identified trends in director compensation. All decisions regarding non-employee director compensation are recommended by the Governance Committee and approved by the Board. In addition to providing background information and written materials, Semler Brossy representatives attended meetings at which the committee Chairmen believed that their expertise would be beneficial to the committees’ discussions. Neither Semler Brossy nor any of its affiliates provided any additional services to Sysco and its affiliates in fiscal 2020, or any such services in fiscal 2021 through the date of this proxy statement, and Sysco does not expect Semler Brossy to provide any such services to Sysco in the future. The CLD Committee has determined that Semler Brossy is independent from the Company and that no conflicts of interest exist related to Semler Brossy’s services provided to the CLD Committee. See “Compensation Discussion and Analysis–How Executive Pay is Established—Committee Oversight.”

For a discussion of the role of the CEO and other executive officers in determining or recommending NEO compensation, see “Compensation Discussion and Analysis – How Executive Pay is Established – Role of CEO and/or Other Executive Officers in Determining NEO Compensation.”

SYSCO CORPORATION - 2020 Proxy Statement 19

Election of Directors at 2020 Annual Meeting (Item 1)

Current Members of Our Board of Directors and Board Nominees

| Name | Age | Director since | Experience | Independent | Committee Memberships(1) |

Other Public Company Boards | ||||||

| Daniel J. Brutto | 64 | September 2016 | Former President, UPS International and Senior Vice President, United Parcel Service, Inc. | Yes | CGN CSR* Executive |

• Illinois Tool Works Inc. | ||||||

| John M. Cassaday | 67 | November 2004 | Former President, CEO and director of Corus Entertainment Inc. | Yes | CLD* CGN Executive |

• Manulife Financial Corporation • Sleep Country Canada Holdings Inc. | ||||||

| Joshua D. Frank | 41 | August 2015 | Partner of Trian Fund Management L.P. | Yes | Audit CLD |

|||||||

| Larry C. Glasscock | 72 | September 2010 | Former Chairman of the Board of Directors, CEO and President of WellPoint, Inc. | Yes | CLD CGN* Executive |

• Simon Property Group, Inc. • Zimmer Biomet Holdings, Inc. | ||||||

| Bradley M. Halverson(2) | 60 | September 2016 | Former Group President, Financial Products and Corporate Services and Chief Financial Officer of Caterpillar Inc. | Yes | Audit* CLD Executive |

• Lear Corporation | ||||||

| John M. Hinshaw | 50 | April 2018 | GMD Chief Operating Officer, HSBC Group Management Services, Ltd. | Yes | Audit CLD |

|||||||

| Kevin P. Hourican | 47 | February 2020 | President and Chief Executive Officer, Sysco Corporation | No | ||||||||

| Hans-Joachim Koerber | 74 | January 2008 | Former chairman and CEO of METRO Group (Germany) | Yes | Audit CSR |

• Eurocash SA | ||||||

| Stephanie A. Lundquist | 44 | November 2019 | President, Food and Beverage of Target Corporation | Yes | CLD CSR |

|||||||

| Nancy S. Newcomb(3) | 75 | February 2006 | Former Senior Corporate Officer, Risk Management, of Citigroup | Yes | Audit CSR |

|||||||

| Nelson Peltz | 78 | August 2015 | Chief Executive Officer and a Founding Partner of Trian Fund Management L.P. | Yes | CGN | • The Madison Square Garden Sports Corp. • Procter & Gamble • The Wendy’s Company | ||||||

| Edward D. Shirley(4) | 63 | September 2016 | Executive Chairman of the Board, Sysco Corporation | No | CSR Executive* |

|||||||

| Sheila G. Talton | 67 | September 2017 | President and Chief Executive Officer of Gray Matter Analytics | Yes | CGN CSR |

• Deere & Company • OGE Energy Corp. |

| (1) | Full committee names are as follows: | ||

| Audit – Audit Committee | CGN – Corporate Governance and Nominating Committee | Executive – Executive Committee | |

| CLD – Compensation and Leadership Development Committee | CSR – Corporate Social Responsibility Committee | ||

| (2) | Mr. Halverson currently serves as the independent Lead Director. For more details see page 12. | ||

| (3) | Ms. Newcomb is not standing for re-election. | ||

| (4) | Mr. Shirley currently serves as the Executive Chairman of the Board on an interim basis. For more details, see page 12. | ||

| * | Denotes committee chairperson | ||

SYSCO CORPORATION - 2020 Proxy Statement 20

Election Process

The Company’s bylaws provide for majority voting in uncontested director elections. Majority voting means that directors are elected by a majority of the votes cast—that is, the number of shares voted “for” a director must exceed the number of shares voted “against” that director. Any incumbent director who is not re-elected in an election in which majority voting applies shall tender his or her resignation promptly following certification of the stockholders’ vote. The Governance Committee will consider the tendered resignation and recommend to the Board whether to accept or reject the resignation offer, or whether other action should be taken. The director who tenders his or her resignation may not participate in the recommendation of the Governance Committee or the decision of the Board with respect to his or her resignation. The Board must act on the recommendation within 120 days following certification of the stockholders’ vote and will promptly disclose its decision regarding whether to accept the director’s resignation offer. In contested elections, where there are more nominees than seats on the Board as of the record date of the meeting at which the election will take place, directors are elected by a plurality vote. This means that the nominees who receive the most votes of all the votes cast for directors will be elected.

Nomination Process

The Governance Committee is responsible for identifying and evaluating candidates for election to Sysco’s Board of Directors.

Director Candidates Identified by the Board and Management

In identifying candidates for election to the Board, the Governance Committee will determine which of the incumbent directors has an interest in being nominated for re-election at the next meeting of stockholders. The Governance Committee will also identify and evaluate new candidates for election to the Board for the purpose of filling vacancies. The Governance Committee will solicit recommendations for nominees from persons that the Governance Committee believes are likely to be familiar with qualified candidates, including current members of the Board and Sysco’s management. The Governance Committee may also determine to engage a professional search firm to assist in identifying qualified candidates. When such a search firm is engaged, the Governance Committee will set its fees and scope of engagement.

Director Candidates Recommended by Stockholders

The Governance Committee will also consider candidates recommended by stockholders. The Governance Committee will evaluate such recommendations using the same criteria that it uses to evaluate other director candidates. Stockholders can recommend candidates for consideration by the Governance Committee by writing to the Corporate Secretary, 1390 Enclave Parkway, Houston, Texas 77077, and including the following information:

| • | the name and address of the stockholder; |

| • | the name and address of the person to be nominated; |

| • | a representation that the stockholder is a holder of the Sysco stock entitled to vote at the meeting to which the director recommendation relates; |

| • | a statement in support of the stockholder’s recommendation, including a description of the candidate’s qualifications; |

| • | information regarding the candidate as would be required to be included in a proxy statement filed in accordance with the rules of the SEC; and |

| • | the candidate’s written, signed consent to serve if elected. |

The Governance Committee will consider, in advance of Sysco’s next annual meeting of stockholders, those director candidate recommendations that the Governance Committee receives by April 30, 2021.

In addition, if we receive by June 8, 2021, a recommendation of a director candidate from one or more stockholders who have beneficially owned at least 5% of our outstanding common stock for at least one year as of the date the stockholder makes the recommendation, then we will disclose in our next proxy materials relating to the election of directors the identity of the candidate, the identity of the nominating stockholder(s) and whether the Governance Committee determined to nominate such candidate for election to the Board. However, we will not provide this disclosure without first obtaining written consent of such disclosure from both the nominating stockholder and the candidate it is planning to recommend. The Governance Committee will maintain appropriate records regarding its process of identifying and evaluating candidates for election to the Board. The Governance Committee has not received any recommendations for director nominees for election at the Annual Meeting from any Sysco stockholders beneficially owning more than 5% of Sysco’s outstanding common stock.

Proxy Access Director Candidates

Our “proxy access” bylaw provisions permit an eligible stockholder (or a group of up to 20 eligible stockholders), who have continuously owned for a period of three years at least 3% of the aggregate of our outstanding common stock, to nominate a number of director nominees equal to 20% (rounded down) of the total number of directors constituting our Board (provided that, if the total number of directors is less than 10, an eligible stockholder or group may nominate up to two persons), which nominees will be included in our proxy statement for the relevant annual stockholders meeting if the nominating stockholder(s) and the respective nominee(s) comply with all applicable eligibility, procedural and disclosure requirements set forth in our bylaws.

SYSCO CORPORATION - 2020 Proxy Statement 21

Evaluation of Director Candidates

In evaluating all incumbent and new director candidates that the Governance Committee determines merit consideration, the Governance Committee will:

| • | cause to be assembled information concerning the background and qualifications of the candidate, including information required to be disclosed in a proxy statement under the rules of the SEC or any other regulatory agency or exchange or trading system on which Sysco’s securities are listed, and any relationship between the candidate and the person or persons recommending the candidate; |

| • | determine if the candidate demonstrates the characteristics described below, including the highest personal and professional ethics, integrity and values; |

| • | consider the candidate’s skills, experience and qualifications in the context of the composition of the Board as a whole and the Company’s strategic priorities (see “— Director Qualifications and Board Succession” below for a discussion of the key qualifications that the Governance Committee considers in evaluating candidates); |

| • | consider the absence or presence of material relationships with Sysco that might impact independence; |

| • | consider the contribution that the candidate can be expected to make to the overall functioning of the Board; |

| • | consider the candidate’s capacity to be an effective director in light of the time required by the candidate’s primary occupation and service on other boards; |

| • | consider the extent to which the membership of the candidate on the Board will promote diversity among the directors; and |

| • | consider, with respect to an incumbent director, whether the director satisfactorily performed his or her duties as a director during the preceding term, including attendance and participation at Board and committee meetings, and other contributions as a director. |