UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

Investment Company Act file number: 811-01236

Deutsche DWS Market Trust

(Exact Name of Registrant as Specified in Charter)

875 Third Avenue

New York, NY 10022-6225

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code: (212) 454-4500

Diane Kenneally

100 Summer Street

Boston, MA 02110

(Name and Address of Agent for Service)

| Date of fiscal year end: | 3/31 |

| Date of reporting period: | 3/31/2024 |

| ITEM 1. | REPORT TO STOCKHOLDERS |

| (a) |

Contents

|

4

|

|

|

9

|

|

|

13

|

|

|

15

|

|

|

25

|

|

|

27

|

|

|

28

|

|

|

29

|

|

|

35

|

|

|

50

|

|

|

52

|

|

|

53

|

|

|

55

|

|

|

56

|

|

|

57

|

|

|

62

|

|

|

68

|

|

2

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund

|

|

|

3

|

|

4

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund

|

|

|

5

|

|

6

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund

|

|

|

7

|

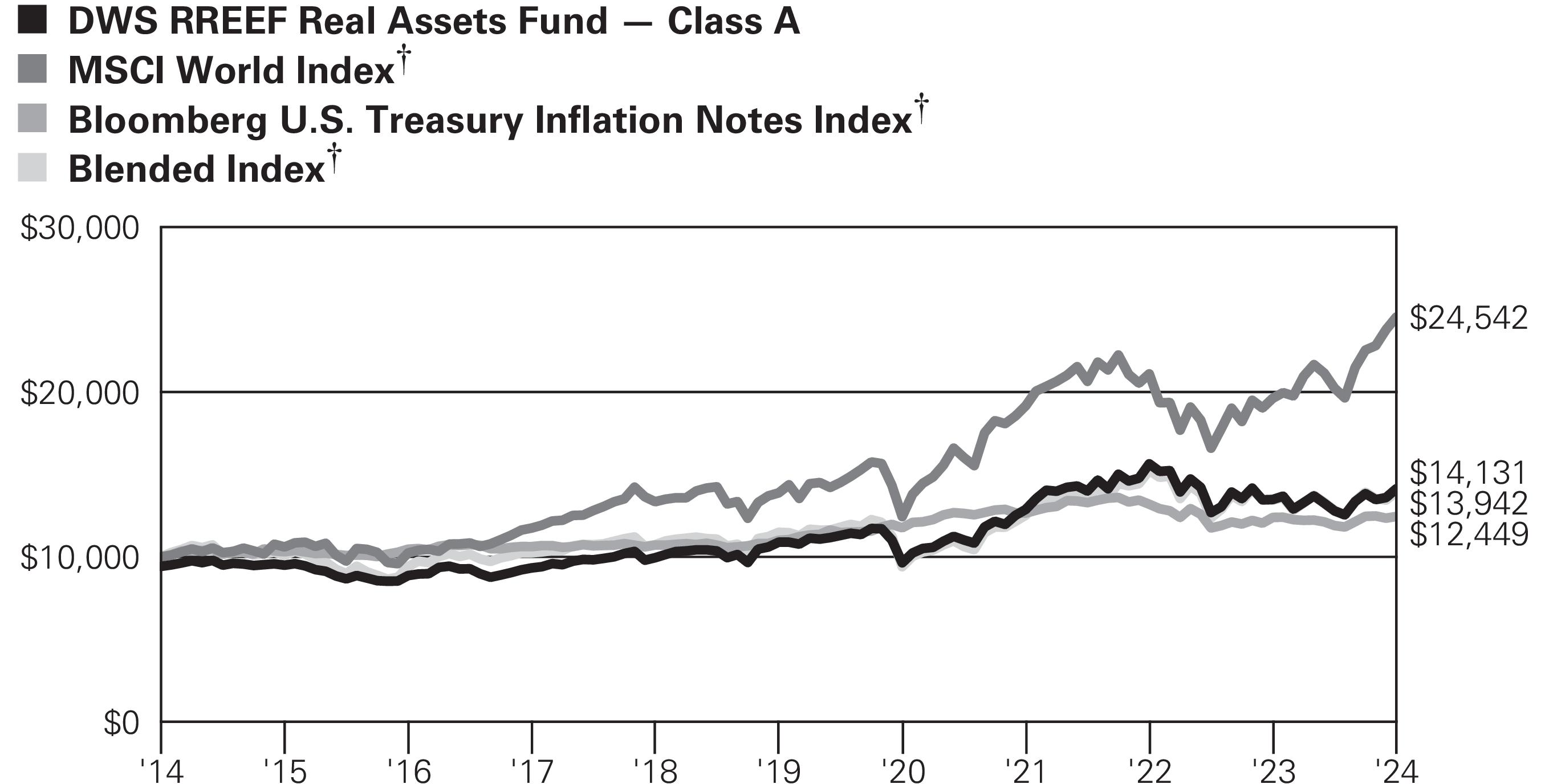

Index returns do not reflect fees or expenses and it is not possible to invest directly into an index.

|

8

|

|

|

DWS RREEF Real Assets Fund

|

|

Class A

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 3/31/24

|

|||

|

Unadjusted for Sales Charge

|

4.83%

|

5.34%

|

4.13%

|

|

Adjusted for the Maximum Sales Charge

(max 5.75% load)

|

–1.20%

|

4.10%

|

3.52%

|

|

MSCI World Index†

|

25.11%

|

12.07%

|

9.39%

|

|

Bloomberg U.S. Treasury Inflation Notes Index†

|

0.45%

|

2.49%

|

2.21%

|

|

Blended Index†

|

3.73%

|

3.94%

|

3.38%

|

|

Class C

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 3/31/24

|

|||

|

Unadjusted for Sales Charge

|

3.97%

|

4.56%

|

3.35%

|

|

Adjusted for the Maximum Sales Charge

(max 1.00% CDSC)

|

3.97%

|

4.56%

|

3.35%

|

|

MSCI World Index†

|

25.11%

|

12.07%

|

9.39%

|

|

Bloomberg U.S. Treasury Inflation Notes Index†

|

0.45%

|

2.49%

|

2.21%

|

|

Blended Index†

|

3.73%

|

3.94%

|

3.38%

|

|

Class R

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 3/31/24

|

|||

|

No Sales Charges

|

4.46%

|

5.06%

|

3.87%

|

|

MSCI World Index†

|

25.11%

|

12.07%

|

9.39%

|

|

Bloomberg U.S. Treasury Inflation Notes Index†

|

0.45%

|

2.49%

|

2.21%

|

|

Blended Index†

|

3.73%

|

3.94%

|

3.38%

|

|

Class R6

|

1-Year

|

5-Year

|

Life of

Class*

|

|

Average Annual Total Returns as of 3/31/24

|

|||

|

No Sales Charges

|

5.10%

|

5.67%

|

4.58%

|

|

MSCI World Index†

|

25.11%

|

12.07%

|

9.44%

|

|

Bloomberg U.S. Treasury Inflation Notes Index†

|

0.45%

|

2.49%

|

2.07%

|

|

Blended Index†

|

3.73%

|

3.94%

|

3.31%

|

|

DWS RREEF Real Assets Fund

|

|

|

9

|

|

Class S

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 3/31/24

|

|||

|

No Sales Charges

|

4.92%

|

5.49%

|

4.28%

|

|

MSCI World Index†

|

25.11%

|

12.07%

|

9.39%

|

|

Bloomberg U.S. Treasury Inflation Notes Index†

|

0.45%

|

2.49%

|

2.21%

|

|

Blended Index†

|

3.73%

|

3.94%

|

3.38%

|

|

Institutional Class

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 3/31/24

|

|||

|

No Sales Charges

|

5.10%

|

5.67%

|

4.45%

|

|

MSCI World Index†

|

25.11%

|

12.07%

|

9.39%

|

|

Bloomberg U.S. Treasury Inflation Notes Index†

|

0.45%

|

2.49%

|

2.21%

|

|

Blended Index†

|

3.73%

|

3.94%

|

3.38%

|

|

10

|

|

|

DWS RREEF Real Assets Fund

|

Yearly periods ended March 31

Yearly periods ended March 31|

*

|

Class R6 shares commenced operations on November 28, 2014.

|

|

DWS RREEF Real Assets Fund

|

|

|

11

|

|

†

|

The Morgan Stanley Capital International (MSCI) World Index is an unmanaged index

representing large and mid-cap equity performance across 23 developed markets

countries. It covers approximately 85% of the free float-adjusted market capitalization in

each country.

The Bloomberg U.S. Treasury Inflation Notes Index includes all publicly issued

U.S. Treasury inflation-protected securities that have at least one year remaining to

maturity, are rated investment grade, and have $250 million or more of outstanding

face value.

The Blended Index is composed of 30% in the Dow Jones Brookfield Global

Infrastructure Index, 30% in the FTSE EPRA/NAREIT Developed Index, 15% in the

Bloomberg Commodity Index, 15% in the S&P Global Natural Resources Index and 10%

in the Bloomberg U.S. Treasury Inflation Notes Index. Dow Jones Brookfield Global

Infrastructure Index measures the stock performance of companies worldwide whose

primary business is the ownership and operation of (rather than service of) infrastructure

assets. To be included in the indices, a company must have more than 70% of estimated

cash flows (based on publicly available information) derived from the following

infrastructure sectors: airports, toll roads, ports, communications, electricity transmission

and distribution, oil and gas storage and transportation, water, and other sectors. FTSE

EPRA/NAREIT Developed Index is an unmanaged, market-weighted index designed to

track the performance of listed real estate companies and REITS worldwide. Bloomberg

Commodity Index is an unmanaged index that tracks a diversified group of commodities

and commodities futures contracts traded on both U.S. and London exchanges. S&P

Global Natural Resources Index includes 90 of the largest publicly-traded companies in

natural resources and commodities businesses that meet specific investability

requirements, offering investors diversified and investable equity exposure across

3 primary commodity-related sectors: agribusiness, energy, and metals & mining.

|

|

|

Class A

|

Class C

|

Class R

|

Class R6

|

Class S

|

Institutional

Class

|

|

Net Asset Value

|

||||||

|

3/31/24

|

$11.59

|

$11.50

|

$11.65

|

$11.50

|

$11.49

|

$11.50

|

|

3/31/23

|

$11.29

|

$11.21

|

$11.36

|

$11.21

|

$11.20

|

$11.21

|

|

Distribution Information as of 3/31/24

|

||||||

|

Income Dividends, Twelve Months

|

$.24

|

$.15

|

$.21

|

$.27

|

$.25

|

$.27

|

|

12

|

|

|

DWS RREEF Real Assets Fund

|

|

Asset Allocation (As a % of Net Assets)

|

3/31/24

|

3/31/23

|

|

Common Stocks

|

|

|

|

Infrastructure

|

36%

|

37%

|

|

Real Estate

|

28%

|

27%

|

|

Natural Resource Equities

|

15%

|

13%

|

|

Commodity Futures

|

11%

|

12%

|

|

Treasury Inflation Protected Securities

|

9%

|

9%

|

|

Cash Equivalents, U.S. Treasury Notes, Short-Term U.S. Treasury

Obligations and Other Assets and Liabilities, net*

|

1%

|

2%

|

|

|

100%

|

100%

|

|

*

|

Net of notional exposure to futures contracts

|

|

Sector Diversification (As a % of Common Stocks)

|

3/31/24

|

3/31/23

|

|

Real Estate

|

41%

|

43%

|

|

Energy

|

18%

|

13%

|

|

Utilities

|

17%

|

21%

|

|

Materials

|

12%

|

10%

|

|

Industrials

|

9%

|

8%

|

|

Communication Services

|

2%

|

3%

|

|

Consumer Staples

|

1%

|

2%

|

|

Information Technology

|

—

|

0%

|

|

|

100%

|

100%

|

|

Geographical Diversification (As a % of Common Stocks

and Government & Agency Obligations)

|

3/31/24

|

3/31/23

|

|

United States

|

63%

|

60%

|

|

Canada

|

10%

|

8%

|

|

United Kingdom

|

5%

|

7%

|

|

Japan

|

4%

|

4%

|

|

France

|

3%

|

2%

|

|

Spain

|

3%

|

3%

|

|

Australia

|

2%

|

2%

|

|

Hong Kong

|

2%

|

4%

|

|

Switzerland

|

1%

|

2%

|

|

Singapore

|

1%

|

2%

|

|

Other

|

6%

|

6%

|

|

|

100%

|

100%

|

|

DWS RREEF Real Assets Fund

|

|

|

13

|

|

Ten Largest Equity Holdings at March 31, 2024

(20.2% of Net Assets)

|

Country

|

Percent

|

|

|

1American Tower Corp.

|

|

United States

|

2.8%

|

|

Operator and developer of wireless communications and

broadcast towers

|

|

|

|

|

2ONEOK, Inc.

|

|

United States

|

2.7%

|

|

Operator of natural gas and natural gas liquids business

|

|

|

|

|

3National Grid PLC

|

|

United Kingdom

|

2.5%

|

|

Provider of electricity and natural gas

transmission services

|

|

|

|

|

4Vinci SA

|

|

France

|

2.0%

|

|

Provider of electrical, mechanical, civil engineering and

construction services

|

|

|

|

|

5Prologis, Inc.

|

|

United States

|

1.9%

|

|

Owner, operator and developer of industrial real estate

|

|

|

|

|

6Targa Resources Corp.

|

|

United States

|

1.9%

|

|

Provider of midstream gas and natural gas liquid services

|

|

|

|

|

7Equinix, Inc.

|

|

United States

|

1.7%

|

|

Provider of technology-related real estate

|

|

|

|

|

8SBA Communications Corp.

|

|

United States

|

1.6%

|

|

Operator of wireless communication infrastructure

|

|

|

|

|

9Simon Property Group, Inc.

|

|

United States

|

1.6%

|

|

Owner and operator of regional shopping malls

|

|

|

|

|

10Sempra

|

|

United States

|

1.5%

|

|

Provider of electric and natural gas products and services

|

|

|

|

|

14

|

|

|

DWS RREEF Real Assets Fund

|

|

|

Shares

|

Value ($)

|

|

|

Common Stocks 79.1%

|

|

|

|

|

Communication Services 1.7%

|

|

||

|

Diversified Telecommunication Services

|

|

||

|

Cellnex Telecom SA 144A*

|

|

1,694,176

|

59,895,748

|

|

China Tower Corp. Ltd. “H” 144A

|

|

139,006,000

|

15,984,029

|

|

|

|

|

75,879,777

|

|

Consumer Staples 0.5%

|

|

||

|

Food Products

|

|

||

|

Darling Ingredients, Inc.*

|

|

512,800

|

23,850,328

|

|

Energy 13.9%

|

|

||

|

Energy Equipment & Services 0.4%

|

|

||

|

Schlumberger NV

|

|

311,900

|

17,095,239

|

|

Oil, Gas & Consumable Fuels 13.5%

|

|

||

|

BP PLC

|

|

1,819,292

|

11,382,358

|

|

Cenovus Energy, Inc.

|

|

1,570,500

|

31,397,246

|

|

Cheniere Energy, Inc.

|

|

106,308

|

17,145,354

|

|

Chevron Corp.

|

|

155,910

|

24,593,243

|

|

ConocoPhillips

|

|

212,500

|

27,047,000

|

|

Diamondback Energy, Inc.

|

|

73,390

|

14,543,696

|

|

DT Midstream, Inc.

|

|

187,400

|

11,450,140

|

|

Enbridge, Inc.

|

|

1,864,801

|

67,389,176

|

|

Gazprom PJSC (ADR)* (a)

|

|

1,013,306

|

0

|

|

Keyera Corp.

|

|

1,144,783

|

29,486,899

|

|

LUKOIL PJSC ** (a)

|

|

91,202

|

0

|

|

Marathon Petroleum Corp.

|

|

113,738

|

22,918,207

|

|

ONEOK, Inc.

|

|

1,504,974

|

120,653,766

|

|

Pembina Pipeline Corp.

|

|

1,443,400

|

50,946,037

|

|

Phillips 66

|

|

67,637

|

11,047,828

|

|

Targa Resources Corp.

|

|

769,163

|

86,138,564

|

|

TotalEnergies SE

|

|

581,899

|

39,845,303

|

|

Williams Companies, Inc.

|

|

976,883

|

38,069,131

|

|

|

|

|

604,053,948

|

|

DWS RREEF Real Assets Fund

|

|

|

15

|

|

|

Shares

|

Value ($)

|

|

|

Industrials 7.3%

|

|

||

|

Commercial Services & Supplies 1.8%

|

|

||

|

GFL Environmental, Inc.

|

|

1,361,069

|

46,956,880

|

|

Waste Connections, Inc.

|

|

194,662

|

33,483,811

|

|

|

|

|

80,440,691

|

|

Construction & Engineering 2.7%

|

|

||

|

Eiffage SA

|

|

44,924

|

5,096,226

|

|

Ferrovial SE

|

|

666,405

|

26,371,122

|

|

Vinci SA

|

|

697,358

|

89,348,446

|

|

|

|

|

120,815,794

|

|

Ground Transportation 1.2%

|

|

||

|

Norfolk Southern Corp.

|

|

68,700

|

17,509,569

|

|

Union Pacific Corp.

|

|

138,370

|

34,029,334

|

|

|

|

|

51,538,903

|

|

Transportation Infrastructure 1.6%

|

|

||

|

Aena SME SA 144A

|

|

184,680

|

36,351,703

|

|

Grupo Aeroportuario del Pacifico SAB de CV (ADR) (b)

|

|

44,183

|

7,209,340

|

|

Grupo Aeroportuario del Sureste SAB de CV (ADR)

|

|

30,773

|

9,806,740

|

|

Japan Airport Terminal Co., Ltd.

|

|

444,942

|

17,544,317

|

|

|

|

|

70,912,100

|

|

Materials 9.5%

|

|

||

|

Chemicals 2.7%

|

|

||

|

CF Industries Holdings, Inc.

|

|

120,160

|

9,998,514

|

|

Corteva, Inc.

|

|

602,488

|

34,745,483

|

|

FMC Corp.

|

|

220,000

|

14,014,000

|

|

Nutrien Ltd. (b)

|

|

760,277

|

41,304,333

|

|

The Mosaic Co.

|

|

587,400

|

19,067,004

|

|

|

|

|

119,129,334

|

|

Containers & Packaging 1.6%

|

|

||

|

Amcor PLC

|

|

1,076,800

|

10,240,368

|

|

SIG Group AG

|

|

716,800

|

15,896,214

|

|

Smurfit Kappa Group PLC

|

|

443,636

|

20,231,126

|

|

Westrock Co.

|

|

545,589

|

26,979,376

|

|

|

|

|

73,347,084

|

|

Metals & Mining 4.8%

|

|

||

|

Agnico Eagle Mines Ltd.

|

|

236,150

|

14,081,308

|

|

Barrick Gold Corp.

|

|

843,000

|

14,021,476

|

|

First Quantum Minerals Ltd.

|

|

862,185

|

9,267,590

|

|

Franco-Nevada Corp.

|

|

85,640

|

10,204,345

|

|

16

|

|

|

DWS RREEF Real Assets Fund

|

|

|

Shares

|

Value ($)

|

|

|

Freeport-McMoRan, Inc.

|

|

221,686

|

10,423,676

|

|

Glencore PLC

|

|

3,860,844

|

21,212,009

|

|

Ivanhoe Mines Ltd. “A” *

|

|

1,223,790

|

14,600,012

|

|

Nippon Steel Corp. (b)

|

|

909,700

|

21,808,041

|

|

Norsk Hydro ASA

|

|

2,434,000

|

13,318,476

|

|

Nucor Corp.

|

|

70,800

|

14,011,320

|

|

Rio Tinto Ltd.

|

|

287,040

|

22,775,163

|

|

Teck Resources Ltd. “B”

|

|

340,966

|

15,606,579

|

|

Vale SA (ADR)

|

|

1,945,200

|

23,711,988

|

|

Wheaton Precious Metals Corp.

|

|

243,800

|

11,483,105

|

|

|

|

|

216,525,088

|

|

Paper & Forest Products 0.4%

|

|

||

|

Stora Enso Oyj “R”

|

|

1,199,000

|

16,667,276

|

|

Real Estate 32.9%

|

|

||

|

Diversified REITs 1.8%

|

|

||

|

British Land Co. PLC

|

|

3,828,953

|

19,098,878

|

|

Daiwa House REIT Investment Corp.

|

|

4,047

|

6,913,425

|

|

Essential Properties Realty Trust, Inc.

|

|

1,144,392

|

30,509,491

|

|

KDX Realty Investment Corp.

|

|

11,010

|

11,702,398

|

|

Mori Trust Reit, Inc.

|

|

28,700

|

13,821,046

|

|

|

|

|

82,045,238

|

|

Health Care REITs 1.5%

|

|

||

|

American Healthcare REIT, Inc. (b)

|

|

1,150,472

|

16,969,462

|

|

Ventas, Inc.

|

|

15,176

|

660,763

|

|

Welltower, Inc.

|

|

528,344

|

49,368,463

|

|

|

|

|

66,998,688

|

|

Hotel & Resort REITs 1.0%

|

|

||

|

Ryman Hospitality Properties, Inc.

|

|

394,864

|

45,650,227

|

|

Industrial REITs 4.6%

|

|

||

|

CapitaLand Ascendas REIT

|

|

7,401,000

|

15,182,944

|

|

EastGroup Properties, Inc.

|

|

182,803

|

32,862,495

|

|

Goodman Group

|

|

988,200

|

21,772,307

|

|

Industrial & Infrastructure Fund Investment Corp.

|

|

11,143

|

10,106,579

|

|

Prologis, Inc.

|

|

661,856

|

86,186,888

|

|

Segro PLC

|

|

1,571,198

|

17,923,142

|

|

STAG Industrial, Inc.

|

|

522,700

|

20,092,588

|

|

|

|

|

204,126,943

|

|

DWS RREEF Real Assets Fund

|

|

|

17

|

|

|

Shares

|

Value ($)

|

|

|

Office REITs 1.3%

|

|

||

|

Alexandria Real Estate Equities, Inc.

|

|

175,398

|

22,610,556

|

|

SL Green Realty Corp.

|

|

660,200

|

36,396,826

|

|

|

|

|

59,007,382

|

|

Real Estate Management & Development 5.0%

|

|

||

|

Castellum AB*

|

|

1,448,604

|

19,068,414

|

|

CTP NV 144A

|

|

933,120

|

16,630,625

|

|

ESR Group Ltd. 144A

|

|

6,639,800

|

7,100,528

|

|

Fastighets AB Balder “B” *

|

|

3,039,961

|

22,345,304

|

|

Mitsubishi Estate Co., Ltd.

|

|

2,183,900

|

39,601,040

|

|

Mitsui Fudosan Co., Ltd.

|

|

3,409,800

|

36,568,968

|

|

PSP Swiss Property AG (Registered)

|

|

136,860

|

17,937,409

|

|

Sun Hung Kai Properties Ltd.

|

|

1,879,700

|

18,119,992

|

|

Vonovia SE

|

|

1,197,884

|

35,410,035

|

|

Wharf Real Estate Investment Co., Ltd.

|

|

2,656,000

|

8,636,267

|

|

|

|

|

221,418,582

|

|

Residential REITs 2.8%

|

|

||

|

American Homes 4 Rent “A”

|

|

357,800

|

13,159,884

|

|

AvalonBay Communities, Inc.

|

|

211,462

|

39,238,889

|

|

Boardwalk Real Estate Investment Trust

|

|

235,204

|

13,557,808

|

|

Essex Property Trust, Inc.

|

|

70,614

|

17,287,013

|

|

InterRent Real Estate Investment Trust (b)

|

|

1,068,860

|

10,700,042

|

|

Sun Communities, Inc.

|

|

121,313

|

15,598,426

|

|

UNITE Group PLC

|

|

1,406,491

|

17,361,478

|

|

|

|

|

126,903,540

|

|

Retail REITs 4.0%

|

|

||

|

Brixmor Property Group, Inc.

|

|

483,800

|

11,345,110

|

|

CapitaLand Integrated Commercial Trust

|

|

11,005,900

|

16,138,998

|

|

Japan Metropolitan Fund Invest

|

|

10,900

|

6,789,999

|

|

Klepierre SA (b)

|

|

505,310

|

13,083,688

|

|

Link REIT

|

|

2,231,341

|

9,593,150

|

|

NETSTREIT Corp.

|

|

569,695

|

10,465,297

|

|

Regency Centers Corp.

|

|

152,393

|

9,228,920

|

|

Region RE Ltd.

|

|

5,948,900

|

9,265,076

|

|

Simon Property Group, Inc.

|

|

451,170

|

70,603,593

|

|

The Macerich Co.

|

|

1,215,602

|

20,944,822

|

|

|

|

|

177,458,653

|

|

Specialized REITs 10.9%

|

|

||

|

American Tower Corp.

|

|

626,542

|

123,798,434

|

|

Big Yellow Group PLC

|

|

687,466

|

9,232,169

|

|

CubeSmart

|

|

757,004

|

34,231,721

|

|

18

|

|

|

DWS RREEF Real Assets Fund

|

|

|

Shares

|

Value ($)

|

|

|

Digital Realty Trust, Inc.

|

|

320,974

|

46,233,095

|

|

Equinix, Inc.

|

|

90,552

|

74,735,282

|

|

Iron Mountain, Inc.

|

|

557,499

|

44,716,995

|

|

Keppel DC REIT

|

|

5,882,300

|

7,536,663

|

|

Public Storage

|

|

177,657

|

51,531,189

|

|

SBA Communications Corp.

|

|

331,994

|

71,943,100

|

|

Weyerhaeuser Co.

|

|

569,291

|

20,443,240

|

|

|

|

|

484,401,888

|

|

Utilities 13.3%

|

|

||

|

Electric Utilities 4.0%

|

|

||

|

Exelon Corp.

|

|

1,312,374

|

49,305,891

|

|

Hydro One Ltd. 144A

|

|

581,700

|

16,962,940

|

|

PG&E Corp.

|

|

3,892,907

|

65,245,121

|

|

Terna - Rete Elettrica Nazionale

|

|

5,572,349

|

46,049,838

|

|

|

|

|

177,563,790

|

|

Gas Utilities 2.7%

|

|

||

|

APA Group (Units)

|

|

4,013,410

|

21,994,999

|

|

Atmos Energy Corp.

|

|

265,870

|

31,603,967

|

|

China Resources Gas Group Ltd.

|

|

2,179,400

|

6,947,326

|

|

ENN Energy Holdings Ltd.

|

|

1,947,700

|

15,005,470

|

|

Kunlun Energy Co., Ltd.

|

|

16,524,000

|

13,786,010

|

|

Snam SpA

|

|

2,695,800

|

12,726,999

|

|

Tokyo Gas Co., Ltd.

|

|

841,500

|

19,100,238

|

|

|

|

|

121,165,009

|

|

Multi-Utilities 6.4%

|

|

||

|

CenterPoint Energy, Inc.

|

|

1,353,284

|

38,555,061

|

|

National Grid PLC

|

|

8,387,038

|

112,843,542

|

|

NiSource, Inc.

|

|

2,351,120

|

65,031,979

|

|

Sempra

|

|

942,840

|

67,724,197

|

|

|

|

|

284,154,779

|

|

Water Utilities 0.2%

|

|

||

|

Severn Trent PLC

|

|

137,700

|

4,292,811

|

|

United Utilities Group PLC

|

|

335,000

|

4,350,820

|

|

|

|

|

8,643,631

|

|

Total Common Stocks (Cost $3,177,848,594)

|

|

|

3,529,793,912

|

|

DWS RREEF Real Assets Fund

|

|

|

19

|

|

|

Principal

Amount ($)

|

Value ($)

|

|

|

Government & Agency Obligations 17.1%

|

|

||

|

U.S. Treasury Obligations

|

|

||

|

U.S. Treasury Inflation-Indexed Bonds:

|

|

|

|

|

0.875%, 2/15/2047

|

|

21,779,926

|

16,786,538

|

|

1.375%, 2/15/2044

|

|

17,768,044

|

15,577,153

|

|

U.S. Treasury Inflation-Indexed Notes:

|

|

|

|

|

0.125%, 7/15/2031

|

|

31,051,729

|

27,470,881

|

|

0.25%, 7/15/2029

|

|

44,852,085

|

41,354,907

|

|

0.375%, 7/15/2025

|

|

63,565,493

|

62,176,932

|

|

0.375%, 1/15/2027

|

|

76,631,424

|

73,090,865

|

|

0.375%, 7/15/2027

|

|

56,429,933

|

53,692,979

|

|

0.625%, 1/15/2026

|

|

73,445,430

|

71,332,809

|

|

0.625%, 7/15/2032

|

|

18,456,924

|

16,735,855

|

|

0.875%, 1/15/2029

|

|

23,441,754

|

22,344,678

|

|

U.S. Treasury notes:

|

|

|

|

|

4.375%, 10/31/2024

|

|

23,500,000

|

23,380,052

|

|

4.5%, 11/30/2024

|

|

40,000,000

|

39,807,812

|

|

U.S. Treasury Notes:

|

|

|

|

|

2.0%, 5/31/2024

|

|

50,000,000

|

49,730,100

|

|

2.5%, 4/30/2024

|

|

60,000,000

|

59,861,347

|

|

3.0%, 6/30/2024

|

|

45,500,000

|

45,233,843

|

|

3.0%, 7/31/2024

|

|

35,000,000

|

34,727,246

|

|

3.25%, 8/31/2024

|

|

78,000,000

|

77,341,875

|

|

4.25%, 9/30/2024

|

|

35,000,000

|

34,824,658

|

|

Total Government & Agency Obligations (Cost $780,992,817)

|

765,470,530

|

||

|

|

Shares

|

Value ($)

|

|

|

Securities Lending Collateral 3.2%

|

|

||

|

DWS Government & Agency Securities Portfolio “DWS

Government Cash Institutional Shares” , 5.26% (c) (d)

(Cost $141,295,546)

|

|

141,295,546

|

141,295,546

|

|

Cash Equivalents 0.9%

|

|

||

|

DWS Central Cash Management Government Fund,

5.36% (c) (Cost $39,852,398)

|

|

39,852,398

|

39,852,398

|

|

20

|

|

|

DWS RREEF Real Assets Fund

|

|

|

|

% of

Net Assets

|

Value ($)

|

|

Total Consolidated Investment Portfolio

(Cost $4,139,989,355)

|

|

100.3

|

4,476,412,386

|

|

Other Assets and Liabilities, Net(b)

|

|

(0.3

)

|

(11,970,696

)

|

|

Net Assets

|

|

100.0

|

4,464,441,690

|

|

Value ($)

at

3/31/2023

|

Pur-

chases

Cost

($)

|

Sales

Proceeds

($)

|

Net

Real-

ized

Gain/

(Loss)

($)

|

Net

Change

in

Unreal-

ized

Appreci-

ation

(Depreci-

ation)

($)

|

Income

($)

|

Capital

Gain

Distri-

butions

($)

|

Number of

Shares at

3/31/2024

|

Value ($)

at

3/31/2024

|

|

Securities Lending Collateral 3.2%

|

||||||||

|

DWS Government & Agency Securities Portfolio “DWS Government Cash Institutional Shares” ,

5.26% (c) (d)

|

||||||||

|

23,744,750

|

117,550,796 (e)

|

—

|

—

|

—

|

852,823

|

—

|

141,295,546

|

141,295,546

|

|

Cash Equivalents 0.9%

|

||||||||

|

DWS Central Cash Management Government Fund, 5.36% (c)

|

||||||||

|

100,676,680

|

2,359,609,673

|

2,420,433,955

|

—

|

—

|

3,171,936

|

—

|

39,852,398

|

39,852,398

|

|

124,421,430

|

2,477,160,469

|

2,420,433,955

|

—

|

—

|

4,024,759

|

—

|

181,147,944

|

181,147,944

|

|

*

|

Non-income producing security.

|

|

**

|

Non-income producing security; due to applicable sanctions, dividend income was

not recorded.

|

|

(a)

|

Investment was valued using significant unobservable inputs.

|

|

(b)

|

All or a portion of these securities were on loan. In addition, “Other Assets and

Liabilities, Net” include pending transactions of $60,000,000 that are also on loan. The

value of securities loaned at March 31, 2024 amounted to $135,830,002, which is 3.0%

of net assets.

|

|

(c)

|

Affiliated fund managed by DWS Investment Management Americas, Inc. The rate

shown is the annualized seven-day yield at period end.

|

|

(d)

|

Represents cash collateral held in connection with securities lending. Income earned by

the Fund is net of borrower rebates.

|

|

(e)

|

Represents the net increase (purchase cost) or decrease (sales proceeds) in the amount

invested in cash collateral for the year ended March 31, 2024.

|

|

144A: Security exempt from registration under Rule 144A of the Securities Act of 1933.

These securities may be resold in transactions exempt from registration, normally to

qualified institutional buyers.

|

|

ADR: American Depositary Receipt

|

|

HRW: Hard Red Winter

|

|

LME: London Metal Exchange

|

|

PJSC: Public Joint Stock Company

|

|

DWS RREEF Real Assets Fund

|

|

|

21

|

|

RBOB: Reformulated Blendstock for Oxygenate Blending

|

|

REIT: Real Estate Investment Trust

|

|

ULSD: Ultra-Low Sulfur Diesel

|

|

WTI: West Texas Intermediate

|

|

Futures

|

Currency

|

Expiration

Date

|

Contracts

|

Notional

Amount ($)

|

Notional

Value ($)

|

Unrealized

Appreciation/

(Depreciation) ($)

|

|

Brent Crude

Oil Futures

|

USD

|

5/31/2024

|

527

|

43,006,494

|

45,401,050

|

2,394,556

|

|

Coffee

Futures

|

USD

|

5/20/2024

|

64

|

4,475,401

|

4,532,400

|

56,999

|

|

Copper

Futures

|

USD

|

5/29/2024

|

410

|

39,663,234

|

41,071,750

|

1,408,516

|

|

Corn Futures

|

USD

|

5/14/2024

|

1,032

|

23,288,240

|

22,807,200

|

(481,040)

|

|

Cotton No.

2 Futures

|

USD

|

5/8/2024

|

97

|

4,278,030

|

4,431,930

|

153,900

|

|

Gasoline

RBOB

Futures

|

USD

|

4/30/2024

|

108

|

11,436,138

|

12,340,642

|

904,504

|

|

Gold 100 oz.

Futures

|

USD

|

6/26/2024

|

425

|

92,312,598

|

95,132,000

|

2,819,402

|

|

Kansas City

HRW Wheat

Futures

|

USD

|

9/13/2024

|

76

|

2,272,569

|

2,244,850

|

(27,719)

|

|

Lean Hogs

Futures

|

USD

|

6/14/2024

|

251

|

10,152,323

|

10,185,580

|

33,257

|

|

Live Cattle

Futures

|

USD

|

6/28/2024

|

149

|

10,952,280

|

10,742,900

|

(209,380)

|

|

Live Cattle

Futures

|

USD

|

8/30/2024

|

120

|

8,721,847

|

8,553,600

|

(168,247)

|

|

LME Nickel

Futures

|

USD

|

5/13/2024

|

87

|

8,652,348

|

8,697,642

|

45,294

|

|

LME Primary

Aluminium

Futures

|

USD

|

5/13/2024

|

724

|

40,601,287

|

42,009,738

|

1,408,451

|

|

LME Zinc

Futures

|

USD

|

5/13/2024

|

146

|

8,846,410

|

8,835,519

|

(10,891)

|

|

Low Sulfur

Gas Oil

Futures

|

USD

|

5/10/2024

|

276

|

22,191,452

|

22,300,800

|

109,348

|

|

Natural Gas

Futures

|

USD

|

4/26/2024

|

733

|

15,745,536

|

12,922,790

|

(2,822,746)

|

|

22

|

|

|

DWS RREEF Real Assets Fund

|

|

Futures

|

Currency

|

Expiration

Date

|

Contracts

|

Notional

Amount ($)

|

Notional

Value ($)

|

Unrealized

Appreciation/

(Depreciation) ($)

|

|

NY Harbor

ULSD

Futures

|

USD

|

4/30/2024

|

91

|

10,169,626

|

10,023,959

|

(145,667)

|

|

Silver Futures

|

USD

|

5/29/2024

|

260

|

29,947,698

|

32,390,800

|

2,443,102

|

|

Soybean

Futures

|

USD

|

5/14/2024

|

258

|

15,736,450

|

15,370,350

|

(366,100)

|

|

Soybean

Meal Futures

|

USD

|

5/14/2024

|

358

|

12,139,806

|

12,089,660

|

(50,146)

|

|

Soybean Oil

Futures

|

USD

|

5/14/2024

|

306

|

8,420,808

|

8,803,620

|

382,812

|

|

Sugar No.

11 Futures

|

USD

|

4/30/2024

|

267

|

6,876,418

|

6,734,381

|

(142,037)

|

|

Sugar No.

11 Futures

|

USD

|

9/30/2024

|

226

|

5,475,600

|

5,581,296

|

105,696

|

|

Wheat

Futures

|

USD

|

5/14/2024

|

528

|

15,508,617

|

14,790,600

|

(718,017)

|

|

WTI Crude

Futures

|

USD

|

4/22/2024

|

310

|

23,528,728

|

25,782,700

|

2,253,972

|

|

Total

|

|

483,777,757

|

9,377,819

|

|||

|

Futures

|

Currency

|

Expiration

Date

|

Contracts

|

Notional

Amount ($)

|

Notional

Value ($)

|

Unrealized

Appreciation/

(Depreciation) ($)

|

|

LME Nickel

Futures

|

USD

|

5/13/2024

|

26

|

2,580,679

|

2,599,296

|

(18,617)

|

|

LME Zinc

Futures

|

USD

|

5/13/2024

|

42

|

2,658,187

|

2,541,724

|

116,463

|

|

Total

|

5,141,020

|

97,846

|

||||

|

USD

|

United States Dollar

|

|

DWS RREEF Real Assets Fund

|

|

|

23

|

|

Assets

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Common Stocks

|

|

|

|

|

|

Communication Services

|

$75,879,777

|

$—

|

$—

|

$75,879,777

|

|

Consumer Staples

|

23,850,328

|

—

|

—

|

23,850,328

|

|

Energy

|

621,149,187

|

—

|

0

|

621,149,187

|

|

Industrials

|

323,707,488

|

—

|

—

|

323,707,488

|

|

Materials

|

425,668,782

|

—

|

—

|

425,668,782

|

|

Real Estate

|

1,468,011,141

|

—

|

—

|

1,468,011,141

|

|

Utilities

|

591,527,209

|

—

|

—

|

591,527,209

|

|

Government & Agency

Obligations

|

—

|

765,470,530

|

—

|

765,470,530

|

|

Short-Term Investments (a)

|

181,147,944

|

—

|

—

|

181,147,944

|

|

Derivatives (b)

|

|

|

|

|

|

Futures Contracts

|

14,636,272

|

—

|

—

|

14,636,272

|

|

Total

|

$3,725,578,128

|

$765,470,530

|

$0

|

$4,491,048,658

|

|

Liabilities

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|

Derivatives (b)

|

|

|

|

|

|

Futures Contracts

|

$(5,160,607

)

|

$—

|

$—

|

$(5,160,607

)

|

|

Total

|

$(5,160,607

)

|

$—

|

$—

|

$(5,160,607

)

|

|

(a)

|

See Consolidated Investment Portfolio for additional detailed categorizations.

|

|

(b)

|

Derivatives include unrealized appreciation (depreciation) on open futures contracts.

|

|

24

|

|

|

DWS RREEF Real Assets Fund

|

|

Assets

|

|

|

Investments in non-affiliated securities, at value (cost $3,958,841,411) —

including $75,830,002 of securities loaned

|

$4,295,264,442

|

|

Investment in DWS Government & Agency Securities Portfolio

(cost $141,295,546)*

|

141,295,546

|

|

Investment in DWS Central Cash Management Government Fund

(cost $39,852,398)

|

39,852,398

|

|

Cash

|

7,525,903

|

|

Foreign currency, at value (cost $4,505,876)

|

4,457,747

|

|

Deposit with broker for futures contracts

|

31,200,594

|

|

Receivable for investments sold

|

25,962,995

|

|

Due from securities lending agent

|

60,000,000

|

|

Receivable for Fund shares sold

|

8,079,267

|

|

Dividends receivable

|

8,047,550

|

|

Interest receivable

|

4,669,501

|

|

Affiliated securities lending income receivable

|

66,997

|

|

Foreign taxes recoverable

|

794,285

|

|

Other assets

|

131,882

|

|

Total assets

|

4,627,349,107

|

|

Liabilities

|

|

|

Payable upon return of securities loaned

|

141,295,546

|

|

Payable for investments purchased

|

13,207,827

|

|

Payable for Fund shares redeemed

|

4,042,924

|

|

Payable for variation margin on futures contracts

|

10,727

|

|

Accrued management fee

|

2,712,512

|

|

Accrued Trustees' fees

|

52,362

|

|

Other accrued expenses and payables

|

1,585,519

|

|

Total liabilities

|

162,907,417

|

|

Net assets, at value

|

$4,464,441,690

|

|

Net Assets Consist of

|

|

|

Distributable earnings (loss)

|

(630,355,405

)

|

|

Paid-in capital

|

5,094,797,095

|

|

Net assets, at value

|

$4,464,441,690

|

|

DWS RREEF Real Assets Fund

|

|

|

25

|

|

Net Asset Value

|

|

|

Class A

|

|

|

Net Asset Value and redemption price per share

($92,420,087 ÷ 7,977,168 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized)

|

$11.59

|

|

Maximum offering price per share (100 ÷ 94.25 of $11.59)

|

$12.30

|

|

Class C

|

|

|

Net Asset Value, offering and redemption price

(subject to contingent deferred sales charge) per share

($15,621,339 ÷ 1,358,449 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized)

|

$11.50

|

|

Class R

|

|

|

Net Asset Value, offering and redemption price per share

($2,110,369 ÷ 181,117 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized)

|

$11.65

|

|

Class R6

|

|

|

Net Asset Value, offering and redemption price per share

($177,658,307 ÷ 15,447,724 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized)

|

$11.50

|

|

Class S

|

|

|

Net Asset Value, offering and redemption price per share

($191,923,409 ÷ 16,703,507 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized)

|

$11.49

|

|

Institutional Class

|

|

|

Net Asset Value, offering and redemption price per share

($3,984,708,179 ÷ 346,571,039 outstanding shares of beneficial interest,

no par value, unlimited number of shares authorized)

|

$11.50

|

|

26

|

|

|

DWS RREEF Real Assets Fund

|

|

Investment Income

|

|

|

Income:

|

|

|

Dividends (net of foreign taxes withheld of $6,643,851)

|

$129,090,479

|

|

Interest (net of foreign taxes withheld of $331,149)

|

43,743,081

|

|

Income distributions — DWS Central Cash Management

Government Fund

|

3,171,936

|

|

Affiliated securities lending income

|

852,823

|

|

Total income

|

176,858,319

|

|

Expenses:

|

|

|

Management fee

|

37,385,473

|

|

Administration fee

|

4,686,455

|

|

Services to shareholders

|

5,038,194

|

|

Distribution and service fees

|

441,796

|

|

Custodian fee

|

238,111

|

|

Professional fees

|

139,261

|

|

Reports to shareholders

|

371,169

|

|

Registration fees

|

375,456

|

|

Trustees' fees and expenses

|

205,959

|

|

Other

|

294,407

|

|

Total expenses before expense reductions

|

49,176,281

|

|

Expense reductions

|

(4,693,074

)

|

|

Total expenses after expense reductions

|

44,483,207

|

|

Net investment income

|

132,375,112

|

|

Realized and Unrealized Gain (Loss)

|

|

|

Net realized gain (loss) from:

|

|

|

Investments

|

(323,480,867

)

|

|

Futures

|

(43,501,176

)

|

|

Foreign currency

|

26,313

|

|

|

(366,955,730

)

|

|

Change in net unrealized appreciation (depreciation) on:

|

|

|

Investments

|

412,521,122

|

|

Futures

|

13,488,173

|

|

Foreign currency

|

(87,173

)

|

|

|

425,922,122

|

|

Net gain (loss)

|

58,966,392

|

|

Net increase (decrease) in net assets resulting from operations

|

$191,341,504

|

|

DWS RREEF Real Assets Fund

|

|

|

27

|

|

|

Years Ended March 31,

|

|

|

Increase (Decrease) in Net Assets

|

2024

|

2023

|

|

Operations:

|

|

|

|

Net investment income

|

$132,375,112

|

$127,406,450

|

|

Net realized gain (loss)

|

(366,955,730

)

|

(389,268,715

)

|

|

Change in net unrealized appreciation

(depreciation)

|

425,922,122

|

(641,323,569

)

|

|

Net increase (decrease) in net assets resulting

from operations

|

191,341,504

|

(903,185,834

)

|

|

Distributions to shareholders:

|

|

|

|

Class A

|

(2,031,109

)

|

(5,276,345

)

|

|

Class T

|

—

|

(390

)

|

|

Class C

|

(240,674

)

|

(803,109

)

|

|

Class R

|

(38,677

)

|

(101,955

)

|

|

Class R6

|

(3,884,849

)

|

(5,689,006

)

|

|

Class S

|

(5,712,656

)

|

(16,823,577

)

|

|

Institutional Class

|

(99,221,047

)

|

(221,636,463

)

|

|

Total distributions

|

(111,129,012

)

|

(250,330,845

)

|

|

Fund share transactions:

|

|

|

|

Proceeds from shares sold

|

1,327,833,310

|

3,528,736,002

|

|

Reinvestment of distributions

|

99,804,605

|

218,163,907

|

|

Payments for shares redeemed

|

(2,736,757,680

)

|

(2,397,150,805

)

|

|

Net increase (decrease) in net assets from Fund

share transactions

|

(1,309,119,765

)

|

1,349,749,104

|

|

Increase (decrease) in net assets

|

(1,228,907,273

)

|

196,232,425

|

|

Net assets at beginning of period

|

5,693,348,963

|

5,497,116,538

|

|

Net assets at end of period

|

$4,464,441,690

|

$5,693,348,963

|

|

28

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund — Class A

|

|||||

|

|

Years Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Selected Per Share Data

|

|||||

|

Net asset value, beginning of period

|

$11.29

|

$13.64

|

$11.50

|

$8.73

|

$10.05

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

Net investment incomea

|

.27

|

.22

|

.15

|

.11

|

.15

|

|

Net realized and unrealized gain (loss)

|

.27

|

(2.10)

|

2.29

|

2.80

|

(1.28)

|

|

Total from investment operations

|

.54

|

(1.88)

|

2.44

|

2.91

|

(1.13)

|

|

Less distributions from:

|

|

|

|

|

|

|

Net investment income

|

(.24)

|

(.47)

|

(.30)

|

(.14)

|

(.19)

|

|

Net asset value, end of period

|

$11.59

|

$11.29

|

$13.64

|

$11.50

|

$8.73

|

|

Total Return (%)b,c

|

4.83

|

(13.83)

|

21.49

|

33.59

|

(11.51)

|

|

Ratios to Average Net Assets and Supplemental Data

|

|||||

|

Net assets, end of period ($ millions)

|

92

|

116

|

147

|

92

|

70

|

|

Ratio of expenses before expense reductions (%)

|

1.28

|

1.27

|

1.29

|

1.33

|

1.36

|

|

Ratio of expenses after expense reductions (%)

|

1.21

|

1.22

|

1.22

|

1.22

|

1.22

|

|

Ratio of net investment income (%)

|

2.44

|

1.88

|

1.15

|

1.07

|

1.48

|

|

Portfolio turnover rate (%)

|

68

|

86

|

65

|

74

|

88

|

|

a

|

Based on average shares outstanding during the period.

|

|

b

|

Total return does not reflect the effect of any sales charges.

|

|

c

|

Total return would have been lower had certain expenses not been reduced.

|

|

DWS RREEF Real Assets Fund

|

|

|

29

|

|

DWS RREEF Real Assets Fund — Class C

|

|||||

|

|

Years Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Selected Per Share Data

|

|||||

|

Net asset value, beginning of period

|

$11.21

|

$13.54

|

$11.42

|

$8.67

|

$9.97

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

Net investment incomea

|

.19

|

.13

|

.05

|

.03

|

.08

|

|

Net realized and unrealized gain (loss)

|

.25

|

(2.08)

|

2.27

|

2.78

|

(1.27)

|

|

Total from investment operations

|

.44

|

(1.95)

|

2.32

|

2.81

|

(1.19)

|

|

Less distributions from:

|

|

|

|

|

|

|

Net investment income

|

(.15)

|

(.38)

|

(.20)

|

(.06)

|

(.11)

|

|

Net asset value, end of period

|

$11.50

|

$11.21

|

$13.54

|

$11.42

|

$8.67

|

|

Total Return (%)b,c

|

3.97

|

(14.47)

|

20.53

|

32.58

|

(12.05)

|

|

Ratios to Average Net Assets and Supplemental Data

|

|||||

|

Net assets, end of period ($ millions)

|

16

|

24

|

24

|

12

|

16

|

|

Ratio of expenses before expense reductions (%)

|

2.01

|

2.01

|

2.02

|

2.08

|

2.10

|

|

Ratio of expenses after expense reductions (%)

|

1.96

|

1.97

|

1.97

|

1.97

|

1.97

|

|

Ratio of net investment income (%)

|

1.70

|

1.12

|

.40

|

.28

|

.79

|

|

Portfolio turnover rate (%)

|

68

|

86

|

65

|

74

|

88

|

|

a

|

Based on average shares outstanding during the period.

|

|

b

|

Total return does not reflect the effect of any sales charges.

|

|

c

|

Total return would have been lower had certain expenses not been reduced.

|

|

30

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund — Class R

|

|||||

|

|

Years Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Selected Per Share Data

|

|

|

|

|

|

|

Net asset value, beginning of period

|

$11.36

|

$13.72

|

$11.57

|

$8.79

|

$10.11

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

Net investment incomea

|

.24

|

.20

|

.12

|

.08

|

.13

|

|

Net realized and unrealized gain (loss)

|

.26

|

(2.11)

|

2.30

|

2.82

|

(1.28)

|

|

Total from investment operations

|

.50

|

(1.91)

|

2.42

|

2.90

|

(1.15)

|

|

Less distributions from:

|

|

|

|

|

|

|

Net investment income

|

(.21)

|

(.45)

|

(.27)

|

(.12)

|

(.17)

|

|

Net asset value, end of period

|

$11.65

|

$11.36

|

$13.72

|

$11.57

|

$8.79

|

|

Total Return (%)b

|

4.46

|

(14.02)

|

21.16

|

33.15

|

(11.65)

|

|

Ratios to Average Net Assets and Supplemental Data

|

|||||

|

Net assets, end of period ($ millions)

|

2

|

2

|

3

|

3

|

2

|

|

Ratio of expenses before expense reductions (%)

|

1.66

|

1.64

|

1.67

|

1.71

|

1.75

|

|

Ratio of expenses after expense reductions (%)

|

1.46

|

1.47

|

1.47

|

1.47

|

1.47

|

|

Ratio of net investment income (%)

|

2.17

|

1.64

|

.93

|

.80

|

1.26

|

|

Portfolio turnover rate (%)

|

68

|

86

|

65

|

74

|

88

|

|

a

|

Based on average shares outstanding during the period.

|

|

b

|

Total return would have been lower had certain expenses not been reduced.

|

|

DWS RREEF Real Assets Fund

|

|

|

31

|

|

DWS RREEF Real Assets Fund — Class R6

|

|||||

|

|

Years Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Selected Per Share Data

|

|

|

|

|

|

|

Net asset value, beginning of period

|

$11.21

|

$13.55

|

$11.42

|

$8.67

|

$9.97

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

Net investment incomea

|

.30

|

.25

|

.18

|

.21

|

.17

|

|

Net realized and unrealized gain (loss)

|

.26

|

(2.08)

|

2.29

|

2.71

|

(1.25)

|

|

Total from investment operations

|

.56

|

(1.83)

|

2.47

|

2.92

|

(1.08)

|

|

Less distributions from:

|

|

|

|

|

|

|

Net investment income

|

(.27)

|

(.51)

|

(.34)

|

(.17)

|

(.22)

|

|

Net asset value, end of period

|

$11.50

|

$11.21

|

$13.55

|

$11.42

|

$8.67

|

|

Total Return (%)b

|

5.10

|

(13.59)

|

21.92

|

33.94

|

(11.17)

|

|

Ratios to Average Net Assets and Supplemental Data

|

|||||

|

Net assets, end of period ($ millions)

|

178

|

160

|

117

|

37

|

4

|

|

Ratio of expenses before expense reductions (%)

|

.91

|

.90

|

.91

|

.95

|

1.00

|

|

Ratio of expenses after expense reductions (%)

|

.90

|

.90

|

.90

|

.93

|

.95

|

|

Ratio of net investment income (%)

|

2.74

|

2.16

|

1.44

|

2.04

|

1.66

|

|

Portfolio turnover rate (%)

|

68

|

86

|

65

|

74

|

88

|

|

a

|

Based on average shares outstanding during the period.

|

|

b

|

Total return would have been lower had certain expenses not been reduced.

|

|

32

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund — Class S

|

|||||

|

|

Years Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Selected Per Share Data

|

|||||

|

Net asset value, beginning of period

|

$11.20

|

$13.53

|

$11.41

|

$8.66

|

$9.97

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

Net investment incomea

|

.29

|

.24

|

.16

|

.12

|

.17

|

|

Net realized and unrealized gain (loss)

|

.25

|

(2.08)

|

2.28

|

2.79

|

(1.27)

|

|

Total from investment operations

|

.54

|

(1.84)

|

2.44

|

2.91

|

(1.10)

|

|

Less distributions from:

|

|

|

|

|

|

|

Net investment income

|

(.25)

|

(.49)

|

(.32)

|

(.16)

|

(.21)

|

|

Net asset value, end of period

|

$11.49

|

$11.20

|

$13.53

|

$11.41

|

$8.66

|

|

Total Return (%)b

|

4.92

|

(13.69)

|

21.65

|

33.81

|

(11.38)

|

|

Ratios to Average Net Assets and Supplemental Data

|

|||||

|

Net assets, end of period ($ millions)

|

192

|

372

|

392

|

243

|

149

|

|

Ratio of expenses before expense reductions (%)

|

1.12

|

1.10

|

1.12

|

1.16

|

1.17

|

|

Ratio of expenses after expense reductions (%)

|

1.06

|

1.07

|

1.07

|

1.07

|

1.07

|

|

Ratio of net investment income (%)

|

2.60

|

2.03

|

1.29

|

1.23

|

1.68

|

|

Portfolio turnover rate (%)

|

68

|

86

|

65

|

74

|

88

|

|

a

|

Based on average shares outstanding during the period.

|

|

b

|

Total return would have been lower had certain expenses not been reduced.

|

|

DWS RREEF Real Assets Fund

|

|

|

33

|

|

DWS RREEF Real Assets Fund — Institutional Class

|

|||||

|

|

Years Ended March 31,

|

||||

|

|

2024

|

2023

|

2022

|

2021

|

2020

|

|

Selected Per Share Data

|

|||||

|

Net asset value, beginning of period

|

$11.21

|

$13.54

|

$11.42

|

$8.67

|

$9.97

|

|

Income (loss) from investment operations:

|

|

|

|

|

|

|

Net investment incomea

|

.30

|

.26

|

.19

|

.15

|

.17

|

|

Net realized and unrealized gain (loss)

|

.26

|

(2.08)

|

2.27

|

2.77

|

(1.25)

|

|

Total from investment operations

|

.56

|

(1.82)

|

2.46

|

2.92

|

(1.08)

|

|

Less distributions from:

|

|

|

|

|

|

|

Net investment income

|

(.27)

|

(.51)

|

(.34)

|

(.17)

|

(.22)

|

|

Net asset value, end of period

|

$11.50

|

$11.21

|

$13.54

|

$11.42

|

$8.67

|

|

Total Return (%)b

|

5.10

|

(13.53)

|

21.83

|

33.94

|

(11.17)

|

|

Ratios to Average Net Assets and Supplemental Data

|

|||||

|

Net assets, end of period ($ millions)

|

3,985

|

5,020

|

4,815

|

1,146

|

340

|

|

Ratio of expenses before expense reductions (%)

|

1.00

|

1.00

|

1.00

|

1.03

|

1.07

|

|

Ratio of expenses after expense reductions (%)

|

.90

|

.90

|

.90

|

.94

|

.95

|

|

Ratio of net investment income (%)

|

2.76

|

2.20

|

1.50

|

1.49

|

1.72

|

|

Portfolio turnover rate (%)

|

68

|

86

|

65

|

74

|

88

|

|

a

|

Based on average shares outstanding during the period.

|

|

b

|

Total return would have been lower had certain expenses not been reduced.

|

|

34

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund

|

|

|

35

|

|

36

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund

|

|

|

37

|

|

38

|

|

|

DWS RREEF Real Assets Fund

|

|

DWS RREEF Real Assets Fund

|

|

|

39

|

|

Undistributed ordinary income*

|

$21,921,093

|

|

Capital loss carryforwards

|

$(742,402,805

)

|

|

Net unrealized appreciation (depreciation) on investments

|

$123,086,449

|

|

40

|

|

|

DWS RREEF Real Assets Fund

|

|

|

Years Ended March 31,

|

|

|

|

2024

|

2023

|

|

Distributions from ordinary income*

|

$111,129,012

|

$250,330,845

|

|

*

|

For tax purposes, short-term capital gain distributions are considered ordinary

income distributions.

|

|

DWS RREEF Real Assets Fund

|

|

|

41

|

|

Asset Derivatives

|

Futures

Contracts

|

|

Commodity Contracts (a)

|

$14,636,272

|

|

The above derivative is located in the following Consolidated Statement of Assets and

Liabilities account:

|

|

|

(a)

|

Futures contracts are reported in the table above using cumulative appreciation of

futures contracts, as reported in the futures contracts table following the Fund’s

Consolidated Investment Portfolio; within the Consolidated Statement of Assets and

Liabilities, the variation margin at period end is reported as Receivable (Payable) for

variation margin on futures contracts.

|

|

42

|

|

|

DWS RREEF Real Assets Fund

|

|

Liability Derivatives

|

Futures

Contracts

|

|

Commodity Contracts (a)

|

$(5,160,607

)

|

|

The above derivative is located in the following Consolidated Statement of Assets and

Liabilities account:

|

|

|

(a)

|

Futures contracts are reported in the table above using cumulative depreciation of

futures contracts, as reported in the futures contracts table following the Fund’s

Consolidated Investment Portfolio; within the Consolidated Statement of Assets and

Liabilities, the variation margin at period end is reported as Receivable (Payable) for

variation margin on futures contracts.

|

|

Realized Gain (Loss)

|

Futures

Contracts

|

|

Commodity Contracts

(a)

|

$(43,501,176

)

|

|

The above derivative is located in the following Consolidated Statement of