|

Date of fiscal year end:

|

10/31

|

|

Date of reporting period:

|

10/31/2014

|

|

ITEM 1.

|

REPORT TO STOCKHOLDERS

|

|

3 Letter to Shareholders

4 Portfolio Management Review

12 Performance Summary

15 Investment Portfolio

48 Statement of Assets and Liabilities

50 Statement of Operations

52 Statement of Changes in Net Assets

53 Financial Highlights

59 Notes to Financial Statements

78 Report of Independent Registered Public Accounting Firm

79 Information About Your Fund's Expenses

81 Tax Information

82 Advisory Agreement Board Considerations and Fee Evaluation

87 Board Members and Officers

92 Account Management Resources

|

|

Former Name

|

New name, effective August 11, 2014

|

|

DWS Investments Distributors, Inc.

|

DeAWM Distributors, Inc.

|

|

DWS Trust Company

|

DeAWM Trust Company

|

|

DWS Investments Service Company

|

DeAWM Service Company

|

|

Investment Process

The fund invests in a broad range of both traditional asset classes (such as equity and fixed-income investments) and alternative asset classes (such as real estate, infrastructure, convertibles, commodities, currencies and absolute return strategies). The fund can buy many types of securities, among them common stocks, including dividend-paying stocks, convertible securities, corporate bonds, government bonds, inflation-indexed bonds, mortgage- and asset-backed securities, and exchange-traded funds (ETFs). The fund can invest in securities of any size, investment style category or credit quality, and from any country (including emerging markets).

|

|

"The fund comfortably outperformed the 4.65% average return of the funds in its Morningstar peer group, Tactical Allocation Funds."

|

|

Five Largest Equity Holdings at October 31, 2014 (15.4% of Net Assets)

|

|

|

1. British American Tobacco PLC

Manufactures, markets and sells cigarettes and other tobacco products

|

3.6%

|

|

2. Procter & Gamble Co.

Manufacturer of diversified consumer products

|

3.2%

|

|

3. UGI Corp.

Distributes and markets energy products and services

|

3.0%

|

|

4. PepsiCo, Inc.

Provider of soft drinks, snack foods and food services

|

2.9%

|

|

5. Verizon Communications, Inc.

An integrated telecommunications company

|

2.7%

|

|

Five Largest Fixed-Income Long-Term Securities at October 31, 2014 (5.3% of Net Assets)

|

|

|

1. U.S. Treasury Note

1.0%, 8/31/2016

|

2.2%

|

|

2. Government of New Zealand

6.0%, 12/15/2017

|

1.0%

|

|

3. Republic of Singapore

3.375%, 9/1/2033

|

1.0%

|

|

4. Canadian Government Bond

3.5%, 12/1/2045

|

0.6%

|

|

5. Reynolds Group Issuer, Inc.

5.75%, 10/15/2020

|

0.5%

|

|

Portfolio holdings and characteristics are subject to change.

|

|

|

Class A

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 10/31/14

|

|||

|

Unadjusted for Sales Charge

|

5.49%

|

8.68%

|

4.87%

|

|

Adjusted for the Maximum Sales Charge (max 5.75% load)

|

–0.57%

|

7.40%

|

4.26%

|

|

Russell 1000® Index†

|

16.78%

|

16.98%

|

8.54%

|

|

Barclays U.S. Aggregate Bond Index††

|

4.14%

|

4.22%

|

4.64%

|

|

S&P® Target Risk Moderate Index†††

|

6.14%

|

7.46%

|

5.32%

|

|

Class B

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 10/31/14

|

|||

|

Unadjusted for Sales Charge

|

4.52%

|

7.59%

|

4.15%

|

|

Adjusted for the Maximum Sales Charge (max 4.00% CDSC)

|

1.52%

|

7.44%

|

4.15%

|

|

Russell 1000® Index†

|

16.78%

|

16.98%

|

8.54%

|

|

Barclays U.S. Aggregate Bond Index††

|

4.14%

|

4.22%

|

4.64%

|

|

S&P® Target Risk Moderate Index†††

|

6.14%

|

7.46%

|

5.32%

|

|

Class C

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 10/31/14

|

|||

|

Unadjusted for Sales Charge

|

4.74%

|

7.79%

|

4.01%

|

|

Adjusted for the Maximum Sales Charge (max 1.00% CDSC)

|

4.74%

|

7.79%

|

4.01%

|

|

Russell 1000® Index†

|

16.78%

|

16.98%

|

8.54%

|

|

Barclays U.S. Aggregate Bond Index††

|

4.14%

|

4.22%

|

4.64%

|

|

S&P® Target Risk Moderate Index†††

|

6.14%

|

7.46%

|

5.32%

|

|

Class S

|

1-Year

|

5-Year

|

Life of Class*

|

|

Average Annual Total Returns as of 10/31/14

|

|||

|

No Sales Charges

|

5.70%

|

8.91%

|

4.84%

|

|

Russell 1000® Index†

|

16.78%

|

16.98%

|

8.26%

|

|

Barclays U.S. Aggregate Bond Index††

|

4.14%

|

4.22%

|

4.88%

|

|

S&P® Target Risk Moderate Index†††

|

6.14%

|

7.46%

|

5.27%

|

|

Institutional Class

|

1-Year

|

5-Year

|

10-Year

|

|

Average Annual Total Returns as of 10/31/14

|

|||

|

No Sales Charges

|

5.77%

|

8.98%

|

5.17%

|

|

Russell 1000® Index†

|

16.78%

|

16.98%

|

8.54%

|

|

Barclays U.S. Aggregate Bond Index††

|

4.14%

|

4.22%

|

4.64%

|

|

S&P® Target Risk Moderate Index†††

|

6.14%

|

7.46%

|

5.32%

|

|

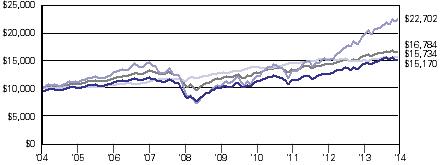

Growth of an Assumed $10,000 Investment (Adjusted for Maximum Sales Charge)

|

|

|

|

Yearly periods ended October 31

|

|

Class A

|

Class B

|

Class C

|

Class S

|

Institutional Class

|

||||||||||||||||

|

Net Asset Value

|

||||||||||||||||||||

|

10/31/14

|

$ | 10.36 | $ | 10.37 | $ | 10.35 | $ | 10.36 | $ | 10.35 | ||||||||||

|

10/31/13

|

$ | 10.31 | $ | 10.31 | $ | 10.29 | $ | 10.31 | $ | 10.30 | ||||||||||

|

Distribution Information as of 10/31/14

|

||||||||||||||||||||

|

Income Dividends, Twelve Months

|

$ | .34 | $ | .24 | $ | .26 | $ | .36 | $ | .37 | ||||||||||

|

Capital Gain Distributions, Twelve Months

|

$ | .16 | $ | .16 | $ | .16 | $ | .16 | $ | .16 | ||||||||||

|

Shares

|

Value ($)

|

|||||||

|

Common Stocks 50.1%

|

||||||||

|

Consumer Discretionary 3.8%

|

||||||||

|

Hotels, Restaurants & Leisure 0.0%

|

||||||||

|

Dawn Holdings, Inc.* (a)

|

3 | 6,628 | ||||||

|

Trump Entertainment Resorts, Inc.*

|

8 | 0 | ||||||

| 6,628 | ||||||||

|

Media 1.4%

|

||||||||

|

Pearson PLC

|

273,371 | 5,121,208 | ||||||

|

Wolters Kluwer NV

|

348,417 | 9,306,351 | ||||||

| 14,427,559 | ||||||||

|

Specialty Retail 0.3%

|

||||||||

|

Staples, Inc. (b)

|

224,405 | 2,845,455 | ||||||

|

Textiles, Apparel & Luxury Goods 2.1%

|

||||||||

|

Coach, Inc.

|

649,495 | 22,329,638 | ||||||

|

Consumer Staples 15.0%

|

||||||||

|

Beverages 2.9%

|

||||||||

|

PepsiCo, Inc.

|

316,273 | 30,415,974 | ||||||

|

Food & Staples Retailing 1.1%

|

||||||||

|

Tesco PLC

|

4,170,999 | 11,599,993 | ||||||

|

Food Products 2.8%

|

||||||||

|

Nestle SA (Registered)

|

99,341 | 7,272,827 | ||||||

|

Unilever NV (CVA)

|

544,064 | 21,123,555 | ||||||

| 28,396,382 | ||||||||

|

Household Products 3.2%

|

||||||||

|

Procter & Gamble Co.

|

373,287 | 32,576,757 | ||||||

|

Tobacco 5.0%

|

||||||||

|

British American Tobacco PLC

|

658,764 | 37,415,921 | ||||||

|

Imperial Tobacco Group PLC

|

325,586 | 14,136,735 | ||||||

| 51,552,656 | ||||||||

|

Energy 3.0%

|

||||||||

|

Energy Equipment & Services 0.7%

|

||||||||

|

Transocean Ltd. (b)

|

229,605 | 6,849,117 | ||||||

|

Oil, Gas & Consumable Fuels 2.3%

|

||||||||

|

Canadian Natural Resources Ltd.

|

221,398 | 7,725,995 | ||||||

|

Canadian Oil Sands Ltd. (b)

|

1,027,134 | 16,094,394 | ||||||

| 23,820,389 | ||||||||

|

Financials 6.1%

|

||||||||

|

Diversified Financial Services 1.3%

|

||||||||

|

Leucadia National Corp.

|

542,537 | 12,901,530 | ||||||

|

Insurance 2.9%

|

||||||||

|

PartnerRe Ltd.

|

147,481 | 17,062,077 | ||||||

|

Powszechny Zaklad Ubezpieczen SA

|

45,486 | 6,822,401 | ||||||

|

Sampo Oyj "A"

|

118,768 | 5,689,793 | ||||||

| 29,574,271 | ||||||||

|

Real Estate Investment Trusts 1.9%

|

||||||||

|

HCP, Inc. (REIT)

|

454,065 | 19,965,238 | ||||||

|

Health Care 2.5%

|

||||||||

|

Health Care Equipment & Supplies 0.6%

|

||||||||

|

Stryker Corp.

|

66,056 | 5,781,882 | ||||||

|

Health Care Providers & Services 0.2%

|

||||||||

|

Rhoen-Klinikum AG

|

82,754 | 2,464,545 | ||||||

|

Pharmaceuticals 1.7%

|

||||||||

|

Novartis AG (Registered)

|

86,098 | 7,985,074 | ||||||

|

Sanofi

|

106,593 | 9,873,455 | ||||||

| 17,858,529 | ||||||||

|

Industrials 7.2%

|

||||||||

|

Aerospace & Defense 0.6%

|

||||||||

|

BAE Systems PLC

|

852,513 | 6,263,999 | ||||||

|

Air Freight & Logistics 1.9%

|

||||||||

|

C.H. Robinson Worldwide, Inc. (b)

|

234,997 | 16,264,142 | ||||||

|

Singapore Post Ltd.

|

2,459,682 | 3,792,481 | ||||||

| 20,056,623 | ||||||||

|

Building Products 0.0%

|

||||||||

|

Congoleum Corp.*

|

11,440 | 0 | ||||||

|

Commercial Services & Supplies 0.0%

|

||||||||

|

Quad Graphics, Inc.

|

61 | 1,345 | ||||||

|

Industrial Conglomerates 3.7%

|

||||||||

|

Jardine Matheson Holdings Ltd.

|

403,986 | 24,339,670 | ||||||

|

Koninklijke Philips NV

|

329,526 | 9,217,313 | ||||||

|

Smiths Group PLC

|

236,773 | 4,418,284 | ||||||

| 37,975,267 | ||||||||

|

Machinery 1.0%

|

||||||||

|

CNH Industrial NV

|

1,211,802 | 9,879,320 | ||||||

|

Information Technology 4.4%

|

||||||||

|

Communications Equipment 1.4%

|

||||||||

|

Cisco Systems, Inc.

|

592,244 | 14,492,211 | ||||||

|

Software 1.6%

|

||||||||

|

Microsoft Corp.

|

345,057 | 16,200,426 | ||||||

|

Technology Hardware, Storage & Peripherals 1.4%

|

||||||||

|

Diebold, Inc. (b)

|

168,275 | 5,961,983 | ||||||

|

Wincor Nixdorf AG

|

193,276 | 8,878,403 | ||||||

| 14,840,386 | ||||||||

|

Materials 1.2%

|

||||||||

|

Chemicals 0.6%

|

||||||||

|

Air Liquide SA

|

52,633 | 6,357,946 | ||||||

|

Metals & Mining 0.6%

|

||||||||

|

Franco-Nevada Corp.

|

124,405 | 5,823,706 | ||||||

|

Telecommunication Services 2.7%

|

||||||||

|

Diversified Telecommunication Services

|

||||||||

|

Verizon Communications, Inc.

|

547,985 | 27,536,005 | ||||||

|

Utilities 4.2%

|

||||||||

|

Electric Utilities 1.0%

|

||||||||

|

Southern Co.

|

224,973 | 10,429,748 | ||||||

|

Gas Utilities 3.0%

|

||||||||

|

UGI Corp. (b)

|

816,492 | 30,773,583 | ||||||

|

Multi-Utilities 0.2%

|

||||||||

|

National Grid PLC

|

178,707 | 2,649,536 | ||||||

|

Total Common Stocks (Cost $451,347,074)

|

516,646,644 | |||||||

|

Preferred Stock 0.0%

|

||||||||

|

Financials

|

||||||||

|

Ally Financial, Inc. Series G, 144A, 7.0% (Cost $280,281)

|

295 | 296,917 | ||||||

|

Rights 0.0%

|

||||||||

|

Health Care

|

||||||||

|

Rhoen-Klinikum AG, Expiration Date 10/14/2015* (Cost $0)

|

82,754 | 69,689 | ||||||

|

Warrants 0.0%

|

||||||||

|

Materials

|

||||||||

|

GEO Specialty Chemicals, Inc., Expiration Date 3/31/2015*

|

57,540 | 38,243 | ||||||

|

Hercules Trust II, Expiration Date 3/31/2029*

|

506 | 4,425 | ||||||

|

Total Warrants (Cost $90,209)

|

42,668 | |||||||

|

Principal Amount ($)(c)

|

Value ($)

|

||||||||

|

Corporate Bonds 25.9%

|

|||||||||

|

Consumer Discretionary 3.2%

|

|||||||||

|

AmeriGas Finance LLC:

|

|||||||||

|

6.75%, 5/20/2020

|

280,000 | 298,200 | |||||||

|

7.0%, 5/20/2022

|

840,000 | 907,200 | |||||||

|

Apex Tool Group LLC, 144A, 7.0%, 2/1/2021 (b)

|

190,000 | 171,000 | |||||||

|

APX Group, Inc.:

|

|||||||||

|

6.375%, 12/1/2019

|

195,000 | 191,588 | |||||||

|

144A, 8.75%, 12/1/2020

|

195,000 | 168,675 | |||||||

|

Asbury Automotive Group, Inc., 8.375%, 11/15/2020

|

55,000 | 59,400 | |||||||

|

Ashtead Capital, Inc., 144A, 6.5%, 7/15/2022

|

305,000 | 329,400 | |||||||

|

Ashton Woods U.S.A. LLC, 144A, 6.875%, 2/15/2021

|

325,000 | 318,500 | |||||||

|

Avis Budget Car Rental LLC, 5.5%, 4/1/2023

|

200,000 | 201,000 | |||||||

|

Bed Bath & Beyond, Inc.:

|

|||||||||

|

4.915%, 8/1/2034

|

340,000 | 338,036 | |||||||

|

5.165%, 8/1/2044

|

410,000 | 409,619 | |||||||

|

Block Communications, Inc., 144A, 7.25%, 2/1/2020

|

70,000 | 72,800 | |||||||

|

Boyd Gaming Corp., 9.0%, 7/1/2020 (b)

|

150,000 | 162,000 | |||||||

|

CCO Holdings LLC, 7.375%, 6/1/2020

|

3,610,000 | 3,869,469 | |||||||

|

Cequel Communications Holdings I LLC:

|

|||||||||

|

144A, 5.125%, 12/15/2021

|

1,390,000 | 1,356,987 | |||||||

|

144A, 6.375%, 9/15/2020

|

1,105,000 | 1,151,962 | |||||||

|

Clear Channel Worldwide Holdings, Inc.:

|

|||||||||

|

Series A, 6.5%, 11/15/2022

|

240,000 | 247,200 | |||||||

|

Series B, 6.5%, 11/15/2022

|

1,195,000 | 1,236,825 | |||||||

|

Series A, 7.625%, 3/15/2020

|

20,000 | 21,100 | |||||||

|

Series B, 7.625%, 3/15/2020

|

1,190,000 | 1,265,862 | |||||||

|

Cogeco Cable, Inc., 144A, 4.875%, 5/1/2020

|

25,000 | 25,000 | |||||||

|

Columbus International, Inc., 144A, 7.375%, 3/30/2021

|

1,500,000 | 1,590,000 | |||||||

|

CSC Holdings LLC, 144A, 5.25%, 6/1/2024

|

585,000 | 586,462 | |||||||

|

Cumulus Media Holdings, Inc., 7.75%, 5/1/2019 (b)

|

700,000 | 717,500 | |||||||

|

DISH DBS Corp.:

|

|||||||||

|

4.25%, 4/1/2018

|

290,000 | 297,250 | |||||||

|

5.0%, 3/15/2023

|

845,000 | 841,831 | |||||||

|

7.875%, 9/1/2019

|

1,120,000 | 1,300,600 | |||||||

|

Getty Images, Inc., 144A, 7.0%, 10/15/2020

|

245,000 | 188,650 | |||||||

|

Group 1 Automotive, Inc., 144A, 5.0%, 6/1/2022

|

335,000 | 331,650 | |||||||

|

Harron Communications LP, 144A, 9.125%, 4/1/2020

|

250,000 | 272,500 | |||||||

|

HD Supply, Inc.:

|

|||||||||

|

7.5%, 7/15/2020

|

130,000 | 138,450 | |||||||

|

11.5%, 7/15/2020

|

125,000 | 145,625 | |||||||

|

Hot Topic, Inc., 144A, 9.25%, 6/15/2021

|

160,000 | 172,000 | |||||||

|

iHeartCommunications, Inc.:

|

|||||||||

|

9.0%, 12/15/2019

|

870,000 | 879,244 | |||||||

|

11.25%, 3/1/2021

|

265,000 | 280,238 | |||||||

|

InRetail Consumer, 144A, 5.25%, 10/10/2021

|

1,000,000 | 1,012,500 | |||||||

|

Isle of Capri Casinos, Inc., 5.875%, 3/15/2021

|

130,000 | 133,250 | |||||||

|

Jo-Ann Stores Holdings, Inc., 144A, 9.75%, 10/15/2019 (PIK)

|

160,000 | 147,200 | |||||||

|

Live Nation Entertainment, Inc.:

|

|||||||||

|

144A, 5.375%, 6/15/2022

|

60,000 | 60,150 | |||||||

|

144A, 7.0%, 9/1/2020

|

370,000 | 393,125 | |||||||

|

MDC Partners, Inc., 144A, 6.75%, 4/1/2020

|

150,000 | 155,625 | |||||||

|

Mediacom Broadband LLC:

|

|||||||||

|

5.5%, 4/15/2021

|

45,000 | 45,788 | |||||||

|

6.375%, 4/1/2023

|

145,000 | 152,975 | |||||||

|

Mediacom LLC, 7.25%, 2/15/2022

|

20,000 | 21,600 | |||||||

|

MGM Resorts International:

|

|||||||||

|

6.625%, 12/15/2021 (b)

|

1,895,000 | 2,075,025 | |||||||

|

6.75%, 10/1/2020 (b)

|

560,000 | 614,600 | |||||||

|

8.625%, 2/1/2019

|

85,000 | 98,388 | |||||||

|

Numericable Group SA:

|

|||||||||

|

144A, 4.875%, 5/15/2019

|

470,000 | 468,825 | |||||||

|

144A, 6.0%, 5/15/2022

|

700,000 | 715,750 | |||||||

|

144A, 6.25%, 5/15/2024

|

850,000 | 874,437 | |||||||

|

Pinnacle Entertainment, Inc., 6.375%, 8/1/2021

|

265,000 | 283,550 | |||||||

|

Quebecor Media, Inc., 5.75%, 1/15/2023

|

200,000 | 206,000 | |||||||

|

Sabre Holdings Corp., 8.35%, 3/15/2016

|

20,000 | 21,425 | |||||||

|

Seminole Hard Rock Entertainment, Inc., 144A, 5.875%, 5/15/2021

|

130,000 | 128,050 | |||||||

|

Serta Simmons Holdings LLC, 144A, 8.125%, 10/1/2020 (b)

|

215,000 | 230,588 | |||||||

|

Servicios Corporativos Javer SAPI de CV, 144A, 9.875%, 4/6/2021

|

500,000 | 541,250 | |||||||

|

Springs Industries, Inc., 6.25%, 6/1/2021 (b)

|

310,000 | 304,187 | |||||||

|

Starz LLC, 5.0%, 9/15/2019

|

160,000 | 164,800 | |||||||

|

Taylor Morrison Communities, Inc., 144A, 5.25%, 4/15/2021

|

250,000 | 251,783 | |||||||

|

Time Warner Cable, Inc., 7.3%, 7/1/2038

|

245,000 | 337,077 | |||||||

|

TRI Pointe Holdings, Inc., 144A, 4.375%, 6/15/2019

|

215,000 | 213,925 | |||||||

|

Unitymedia Hessen GmbH & Co., KG, 144A, 5.5%, 1/15/2023

|

2,855,000 | 2,976,337 | |||||||

|

Viking Cruises Ltd., 144A, 8.5%, 10/15/2022

|

195,000 | 211,088 | |||||||

| 33,383,121 | |||||||||

|

Consumer Staples 1.7%

|

|||||||||

|

Big Heart Pet Brands, 7.625%, 2/15/2019

|

315,000 | 315,787 | |||||||

|

Chiquita Brands International, Inc., 7.875%, 2/1/2021

|

181,000 | 198,648 | |||||||

|

Cott Beverages, Inc., 144A, 5.375%, 7/1/2022

|

355,000 | 351,450 | |||||||

|

FAGE Dairy Industry SA, 144A, 9.875%, 2/1/2020

|

230,000 | 243,513 | |||||||

|

JBS Investments GmbH:

|

|||||||||

|

144A, 7.25%, 4/3/2024

|

470,000 | 499,375 | |||||||

|

144A, 7.75%, 10/28/2020

|

2,000,000 | 2,191,260 | |||||||

|

JBS U.S.A. LLC, 144A, 8.25%, 2/1/2020 (b)

|

2,040,000 | 2,182,800 | |||||||

|

Marfrig Overseas Ltd., 144A, 9.5%, 5/4/2020

|

500,000 | 528,125 | |||||||

|

Minerva Luxembourg SA:

|

|||||||||

|

144A, 7.75%, 1/31/2023

|

1,500,000 | 1,567,500 | |||||||

|

144A, 12.25%, 2/10/2022

|

500,000 | 577,500 | |||||||

|

Pilgrim's Pride Corp., 7.875%, 12/15/2018

|

2,046,000 | 2,132,955 | |||||||

|

Post Holdings, Inc., 144A, 6.75%, 12/1/2021

|

60,000 | 59,925 | |||||||

|

Reynolds Group Issuer, Inc., 5.75%, 10/15/2020

|

5,380,000 | 5,595,200 | |||||||

|

Smithfield Foods, Inc., 6.625%, 8/15/2022

|

250,000 | 272,500 | |||||||

|

The WhiteWave Foods Co., 5.375%, 10/1/2022

|

245,000 | 257,862 | |||||||

|

Tonon Bioenergia SA, 144A, 9.25%, 1/24/2020 (b)

|

1,000,000 | 810,000 | |||||||

| 17,784,400 | |||||||||

|

Energy 3.5%

|

|||||||||

|

Access Midstream Partners LP, 6.125%, 7/15/2022

|

60,000 | 65,250 | |||||||

|

Afren PLC, 144A, 10.25%, 4/8/2019

|

2,203,000 | 2,291,561 | |||||||

|

Antero Resources Corp., 144A, 5.125%, 12/1/2022

|

245,000 | 245,049 | |||||||

|

Antero Resources Finance Corp., 5.375%, 11/1/2021

|

190,000 | 192,850 | |||||||

|

Baytex Energy Corp.:

|

|||||||||

|

144A, 5.125%, 6/1/2021

|

335,000 | 326,625 | |||||||

|

144A, 5.625%, 6/1/2024

|

145,000 | 139,925 | |||||||

|

Berry Petroleum Co., LLC:

|

|||||||||

|

6.375%, 9/15/2022

|

195,000 | 181,350 | |||||||

|

6.75%, 11/1/2020

|

195,000 | 185,250 | |||||||

|

BreitBurn Energy Partners LP:

|

|||||||||

|

7.875%, 4/15/2022

|

1,065,000 | 1,021,734 | |||||||

|

8.625%, 10/15/2020

|

15,000 | 15,300 | |||||||

|

California Resources Corp.:

|

|||||||||

|

144A, 5.5%, 9/15/2021 (b)

|

245,000 | 249,900 | |||||||

|

144A, 6.0%, 11/15/2024

|

50,000 | 51,000 | |||||||

|

Chaparral Energy, Inc., 7.625%, 11/15/2022

|

345,000 | 336,375 | |||||||

|

Chesapeake Energy Corp., 3.481%**, 4/15/2019

|

270,000 | 270,186 | |||||||

|

CONSOL Energy, Inc., 144A, 5.875%, 4/15/2022

|

95,000 | 96,425 | |||||||

|

DCP Midstream LLC, 144A, 9.75%, 3/15/2019

|

850,000 | 1,087,316 | |||||||

|

Delek & Avner Tamar Bond Ltd., 144A, 5.082%, 12/30/2023

|

500,000 | 509,996 | |||||||

|

Ecopetrol SA, 5.875%, 5/28/2045

|

1,000,000 | 1,027,500 | |||||||

|

Endeavor Energy Resources LP, 144A, 7.0%, 8/15/2021

|

545,000 | 550,450 | |||||||

|

EP Energy LLC:

|

|||||||||

|

6.875%, 5/1/2019

|

145,000 | 150,800 | |||||||

|

7.75%, 9/1/2022

|

865,000 | 912,575 | |||||||

|

9.375%, 5/1/2020

|

65,000 | 71,013 | |||||||

|

EV Energy Partners LP, 8.0%, 4/15/2019

|

1,210,000 | 1,191,850 | |||||||

|

Halcon Resources Corp., 8.875%, 5/15/2021 (b)

|

1,508,000 | 1,236,560 | |||||||

|

Hilcorp Energy I LP, 144A, 5.0%, 12/1/2024

|

255,000 | 244,800 | |||||||

|

Holly Energy Partners LP, 6.5%, 3/1/2020

|

20,000 | 20,750 | |||||||

|

Ithaca Energy, Inc., 144A, 8.125%, 7/1/2019

|

225,000 | 193,500 | |||||||

|

Jupiter Resources, Inc., 144A, 8.5%, 10/1/2022

|

245,000 | 216,213 | |||||||

|

Kodiak Oil & Gas Corp., 5.5%, 1/15/2021

|

400,000 | 406,000 | |||||||

|

Linn Energy LLC, 6.25%, 11/1/2019 (b)

|

2,595,000 | 2,387,400 | |||||||

|

MEG Energy Corp., 144A, 7.0%, 3/31/2024

|

1,390,000 | 1,396,950 | |||||||

|

Memorial Resource Development Corp., 144A, 5.875%, 7/1/2022

|

255,000 | 248,625 | |||||||

|

Midstates Petroleum Co., Inc.:

|

|||||||||

|

9.25%, 6/1/2021 (b)

|

210,000 | 178,500 | |||||||

|

10.75%, 10/1/2020

|

230,000 | 204,700 | |||||||

|

Murphy Oil U.S.A., Inc., 6.0%, 8/15/2023

|

320,000 | 335,200 | |||||||

|

NGL Energy Partners LP, 144A, 5.125%, 7/15/2019

|

255,000 | 256,594 | |||||||

|

Northern Oil & Gas, Inc., 8.0%, 6/1/2020

|

680,000 | 634,100 | |||||||

|

Nostrum Oil & Gas Finance BV, 144A, 6.375%, 2/14/2019

|

1,000,000 | 1,002,500 | |||||||

|

Oasis Petroleum, Inc.:

|

|||||||||

|

6.5%, 11/1/2021

|

1,600,000 | 1,640,000 | |||||||

|

6.875%, 1/15/2023

|

125,000 | 130,000 | |||||||

|

7.25%, 2/1/2019

|

315,000 | 324,450 | |||||||

|

Offshore Drilling Holding SA, 144A, 8.625%, 9/20/2020

|

1,000,000 | 1,050,200 | |||||||

|

Pacific Rubiales Energy Corp., 144A, 5.625%, 1/19/2025 (b)

|

905,000 | 860,610 | |||||||

|

Pertamina Persero PT:

|

|||||||||

|

144A, 5.25%, 5/23/2021

|

520,000 | 546,000 | |||||||

|

144A, 5.625%, 5/20/2043

|

1,000,000 | 957,500 | |||||||

|

Petroleos de Venezuela SA:

|

|||||||||

|

144A, 9.0%, 11/17/2021

|

2,200,000 | 1,394,250 | |||||||

|

144A, 9.75%, 5/17/2035

|

1,700,000 | 1,037,850 | |||||||

|

Petroleos Mexicanos, 2.251%**, 7/18/2018

|

1,000,000 | 1,035,000 | |||||||

|

QGOG Constellation SA, 144A, 6.25%, 11/9/2019

|

1,000,000 | 985,000 | |||||||

|

Regency Energy Partners LP, 5.0%, 10/1/2022

|

150,000 | 153,000 | |||||||

|

Reliance Holding U.S.A., Inc., 144A, 5.4%, 2/14/2022

|

1,000,000 | 1,088,873 | |||||||

|

RSP Permian, Inc., 144A, 6.625%, 10/1/2022

|

150,000 | 149,595 | |||||||

|

Sabine Pass Liquefaction LLC:

|

|||||||||

|

5.625%, 2/1/2021

|

685,000 | 717,537 | |||||||

|

5.625%, 4/15/2023

|

155,000 | 160,425 | |||||||

|

144A, 5.75%, 5/15/2024 (b)

|

610,000 | 630,587 | |||||||

|

SESI LLC, 7.125%, 12/15/2021

|

1,220,000 | 1,317,600 | |||||||

|

Seventy Seven Energy, Inc., 144A, 6.5%, 7/15/2022

|

70,000 | 65,800 | |||||||

|

Talos Production LLC, 144A, 9.75%, 2/15/2018

|

380,000 | 382,850 | |||||||

|

Targa Resources Partners LP, 144A, 4.125%, 11/15/2019

|

95,000 | 96,425 | |||||||

|

Transocean, Inc., 3.8%, 10/15/2022 (b)

|

1,155,000 | 1,039,991 | |||||||

|

Triangle U.S.A. Petroleum Corp., 144A, 6.75%, 7/15/2022

|

205,000 | 179,375 | |||||||

|

WPX Energy, Inc., 5.25%, 9/15/2024

|

185,000 | 180,375 | |||||||

| 36,255,965 | |||||||||

|

Financials 4.3%

|

|||||||||

|

AerCap Aviation Solutions BV, 6.375%, 5/30/2017

|

545,000 | 577,700 | |||||||

|

AerCap Ireland Capital Ltd., 144A, 3.75%, 5/15/2019

|

70,000 | 69,475 | |||||||

|

Banco Continental SAECA, 144A, 8.875%, 10/15/2017

|

1,000,000 | 1,065,000 | |||||||

|

Banco Davivienda SA, 144A, 5.875%, 7/9/2022 (b)

|

1,000,000 | 1,017,500 | |||||||

|

Banco do Brasil SA, 144A, 9.0%, 6/29/2049

|

1,300,000 | 1,277,900 | |||||||

|

Banco Santander Brasil SA, 144A, 8.0%, 3/18/2016

|

BRL

|

1,000,000 | 386,416 | ||||||

|

Barclays Bank PLC, 7.625%, 11/21/2022

|

1,000,000 | 1,089,375 | |||||||

|

BBVA Bancomer SA:

|

|||||||||

|

144A, 6.008%, 5/17/2022

|

500,000 | 521,875 | |||||||

|

144A, 6.75%, 9/30/2022

|

1,750,000 | 1,981,875 | |||||||

|

CBL & Associates LP, (REIT), 4.6%, 10/15/2024 (b)

|

1,525,000 | 1,536,881 | |||||||

|

CIMPOR Financial Operations BV, 144A, 5.75%, 7/17/2024

|

500,000 | 480,750 | |||||||

|

CIT Group, Inc.:

|

|||||||||

|

5.0%, 5/15/2017

|

170,000 | 178,075 | |||||||

|

5.25%, 3/15/2018

|

4,528,000 | 4,777,040 | |||||||

|

Country Garden Holdings Co., Ltd., 144A, 11.125%, 2/23/2018 (b)

|

2,400,000 | 2,565,000 | |||||||

|

Credit Agricole SA, 144A, 7.875%, 1/29/2049

|

605,000 | 624,481 | |||||||

|

Credit Suisse Group AG, 144A, 6.25%, 12/29/2049

|

340,000 | 330,650 | |||||||

|

Credito Real SAB de CV, 144A, 7.5%, 3/13/2019

|

2,000,000 | 2,110,000 | |||||||

|

Development Bank of Kazakhstan JSC, Series 3, REG S, 6.5%, 6/3/2020

|

1,000,000 | 1,085,000 | |||||||

|

Dubai Holding Commercial Operations MTN Ltd., 6.0%, 2/1/2017

|

GBP

|

1,000,000 | 1,634,574 | ||||||

|

E*TRADE Financial Corp., 6.375%, 11/15/2019

|

555,000 | 591,769 | |||||||

|

Everest Reinsurance Holdings, Inc., 4.868%, 6/1/2044

|

525,000 | 523,150 | |||||||

|

Fondo MIVIVIENDA SA, 144A, 3.5%, 1/31/2023

|

500,000 | 478,750 | |||||||

|

Hospitality Properties Trust, (REIT), 5.0%, 8/15/2022

|

940,000 | 990,902 | |||||||

|

HSBC Holdings PLC:

|

|||||||||

|

5.625%, 12/29/2049 (b)

|

1,015,000 | 1,031,469 | |||||||

|

6.375%, 12/29/2049

|

1,140,000 | 1,162,800 | |||||||

|

International Lease Finance Corp.:

|

|||||||||

|

3.875%, 4/15/2018

|

400,000 | 401,252 | |||||||

|

6.25%, 5/15/2019

|

350,000 | 382,812 | |||||||

|

8.75%, 3/15/2017

|

1,150,000 | 1,293,750 | |||||||

|

Kaisa Group Holdings Ltd., 144A, 8.875%, 3/19/2018

|

250,000 | 252,500 | |||||||

|

Lloyds Banking Group PLC, 4.5%, 11/4/2024 (d)

|

1,185,000 | 1,185,952 | |||||||

|

Macquarie Group Ltd., 144A, 6.0%, 1/14/2020

|

1,265,000 | 1,426,467 | |||||||

|

Morgan Stanley, Series H, 5.45%, 7/29/2049

|

140,000 | 140,656 | |||||||

|

MPT Operating Partnership LP, (REIT), 6.375%, 2/15/2022

|

30,000 | 31,875 | |||||||

|

National Savings Bank, 144A, 5.15%, 9/10/2019

|

500,000 | 495,000 | |||||||

|

Navient Corp., 5.5%, 1/25/2023 (b)

|

535,000 | 535,000 | |||||||

|

Neuberger Berman Group LLC, 144A, 5.625%, 3/15/2020

|

55,000 | 57,475 | |||||||

|

Popular, Inc., 7.0%, 7/1/2019

|

195,000 | 196,462 | |||||||

|

Royal Bank of Scotland Group PLC, 6.1%, 6/10/2023

|

800,000 | 864,909 | |||||||

|

Schahin II Finance Co. SPV Ltd., 144A, 5.875%, 9/25/2022 (b)

|

2,158,400 | 2,039,688 | |||||||

|

The Goldman Sachs Group, Inc., Series L, 5.7%, 12/29/2049 (b)

|

235,000 | 240,287 | |||||||

|

TIAA Asset Management Finance Co., LLC:

|

|||||||||

|

144A, 2.95%, 11/1/2019

|

945,000 | 946,802 | |||||||

|

144A, 4.125%, 11/1/2024

|

780,000 | 784,129 | |||||||

|

Trust F/1401, (REIT), 144A, 6.95%, 1/30/2044 (b)

|

2,000,000 | 2,270,000 | |||||||

|

Turkiye Is Bankasi, 144A, 6.0%, 10/24/2022 (b)

|

1,500,000 | 1,494,375 | |||||||

|

UniCredit SpA, REG S, 8.0%, 4/3/2049

|

300,000 | 300,750 | |||||||

|

Yapi ve Kredi Bankasi AS, 144A, 5.5%, 12/6/2022

|

1,000,000 | 951,216 | |||||||

| 44,379,764 | |||||||||

|

Health Care 1.5%

|

|||||||||

|

Aviv Healthcare Properties LP, 7.75%, 2/15/2019

|

110,000 | 115,500 | |||||||

|

Biomet, Inc.:

|

|||||||||

|

6.5%, 8/1/2020

|

330,000 | 353,100 | |||||||

|

6.5%, 10/1/2020

|

95,000 | 100,463 | |||||||

|

CHS/Community Health Systems, Inc.:

|

|||||||||

|

5.125%, 8/15/2018

|

1,080,000 | 1,123,200 | |||||||

|

6.875%, 2/1/2022 (b)

|

2,000,000 | 2,155,000 | |||||||

|

7.125%, 7/15/2020

|

735,000 | 795,637 | |||||||

|

Crimson Merger Sub, Inc., 144A, 6.625%, 5/15/2022

|

475,000 | 444,125 | |||||||

|

Endo Finance LLC, 144A, 5.375%, 1/15/2023

|

290,000 | 283,475 | |||||||

|

HCA, Inc.:

|

|||||||||

|

5.25%, 4/15/2025

|

190,000 | 196,888 | |||||||

|

6.5%, 2/15/2020

|

2,020,000 | 2,254,825 | |||||||

|

7.5%, 2/15/2022

|

2,220,000 | 2,577,975 | |||||||

|

Hologic, Inc., 6.25%, 8/1/2020

|

220,000 | 231,275 | |||||||

|

IMS Health, Inc., 144A, 6.0%, 11/1/2020

|

240,000 | 249,000 | |||||||

|

Mallinckrodt International Finance SA, 4.75%, 4/15/2023

|

370,000 | 355,200 | |||||||

|

Par Pharmaceutical Companies, Inc., 7.375%, 10/15/2020

|

350,000 | 371,875 | |||||||

|

Physio-Control International, Inc., 144A, 9.875%, 1/15/2019

|

52,000 | 56,030 | |||||||

|

Tenet Healthcare Corp., 6.25%, 11/1/2018

|

1,110,000 | 1,205,737 | |||||||

|

Valeant Pharmaceuticals International, Inc.:

|

|||||||||

|

144A, 6.375%, 10/15/2020

|

365,000 | 374,581 | |||||||

|

144A, 7.5%, 7/15/2021

|

1,515,000 | 1,621,050 | |||||||

| 14,864,936 | |||||||||

|

Industrials 2.6%

|

|||||||||

|

ADT Corp., 3.5%, 7/15/2022 (b)

|

220,000 | 196,900 | |||||||

|

Aguila 3 SA, 144A, 7.875%, 1/31/2018

|

190,000 | 190,475 | |||||||

|

Avianca Holdings SA, 144A, 8.375%, 5/10/2020

|

1,300,000 | 1,361,750 | |||||||

|

BE Aerospace, Inc., 6.875%, 10/1/2020

|

515,000 | 556,844 | |||||||

|

Belden, Inc., 144A, 5.5%, 9/1/2022

|

330,000 | 335,775 | |||||||

|

Bombardier, Inc.:

|

|||||||||

|

144A, 4.75%, 4/15/2019 (b)

|

140,000 | 143,850 | |||||||

|

144A, 5.75%, 3/15/2022 (b)

|

1,480,000 | 1,517,000 | |||||||

|

144A, 6.0%, 10/15/2022

|

235,000 | 241,316 | |||||||

|

144A, 7.75%, 3/15/2020

|

25,000 | 27,750 | |||||||

|

Carlson Travel Holdings, Inc., 144A, 7.5%, 8/15/2019 (PIK)

|

200,000 | 200,500 | |||||||

|

DigitalGlobe, Inc., 144A, 5.25%, 2/1/2021

|

145,000 | 141,012 | |||||||

|

Empresas ICA SAB de CV, 144A, 8.875%, 5/29/2024

|

1,000,000 | 1,015,000 | |||||||

|

Florida East Coast Holdings Corp., 144A, 6.75%, 5/1/2019

|

425,000 | 438,549 | |||||||

|

FTI Consulting, Inc., 6.0%, 11/15/2022

|

195,000 | 199,631 | |||||||

|

Gates Global LLC, 144A, 6.0%, 7/15/2022

|

285,000 | 276,450 | |||||||

|

GenCorp, Inc., 7.125%, 3/15/2021

|

500,000 | 531,250 | |||||||

|

Grupo KUO SAB De CV, 144A, 6.25%, 12/4/2022

|

1,900,000 | 1,953,903 | |||||||

|

Huntington Ingalls Industries, Inc.:

|

|||||||||

|

6.875%, 3/15/2018

|

65,000 | 67,925 | |||||||

|

7.125%, 3/15/2021

|

255,000 | 274,125 | |||||||

|

Kazakhstan Temir Zholy Finance BV, 144A, 6.375%, 10/6/2020

|

1,750,000 | 1,911,875 | |||||||

|

Kenan Advantage Group, Inc., 144A, 8.375%, 12/15/2018

|

390,000 | 407,550 | |||||||

|

Meritor, Inc.:

|

|||||||||

|

6.25%, 2/15/2024

|

95,000 | 96,900 | |||||||

|

6.75%, 6/15/2021

|

305,000 | 321,775 | |||||||

|

Mersin Uluslararasi Liman Isletmeciligi AS, 144A, 5.875%, 8/12/2020

|

2,000,000 | 2,125,400 | |||||||

|

Navios Maritime Holdings, Inc., 144A, 7.375%, 1/15/2022 (b)

|

1,400,000 | 1,407,000 | |||||||

|

Noble Group Ltd., REG S, 6.0%, 6/24/2049

|

1,000,000 | 971,200 | |||||||

|

Nortek, Inc., 8.5%, 4/15/2021

|

885,000 | 951,375 | |||||||

|

OAS Finance Ltd., 144A, 8.0%, 7/2/2021

|

1,000,000 | 935,000 | |||||||

|

Odebrecht Offshore Drilling Finance Ltd., 144A, 6.75%, 10/1/2022

|

762,960 | 799,201 | |||||||

|

Ply Gem Industries, Inc., 144A, 6.5%, 2/1/2022

|

185,000 | 181,994 | |||||||

|

Sanmina Corp., 144A, 4.375%, 6/1/2019

|

30,000 | 30,038 | |||||||

|

TAM Capital 3, Inc., 144A, 8.375%, 6/3/2021

|

500,000 | 535,000 | |||||||

|

TransDigm, Inc.:

|

|||||||||

|

6.0%, 7/15/2022

|

590,000 | 596,637 | |||||||

|

6.5%, 7/15/2024

|

175,000 | 180,250 | |||||||

|

7.5%, 7/15/2021

|

1,035,000 | 1,117,800 | |||||||

|

Triumph Group, Inc., 5.25%, 6/1/2022

|

145,000 | 146,812 | |||||||

|

United Rentals North America, Inc.:

|

|||||||||

|

6.125%, 6/15/2023

|

20,000 | 21,525 | |||||||

|

7.375%, 5/15/2020

|

100,000 | 108,500 | |||||||

|

7.625%, 4/15/2022

|

2,260,000 | 2,519,900 | |||||||

|

Votorantim Cimentos SA, 144A, 7.25%, 4/5/2041

|

1,000,000 | 1,039,500 | |||||||

|

Watco Companies LLC, 144A, 6.375%, 4/1/2023

|

150,000 | 152,250 | |||||||

|

XPO Logistics, Inc., 144A, 7.875%, 9/1/2019 (b)

|

120,000 | 125,700 | |||||||

| 26,353,187 | |||||||||

|

Information Technology 1.6%

|

|||||||||

|

Activision Blizzard, Inc., 144A, 5.625%, 9/15/2021

|

1,195,000 | 1,271,181 | |||||||

|

Alliance Data Systems Corp., 144A, 5.25%, 12/1/2017

|

245,000 | 252,350 | |||||||

|

Audatex North America, Inc., 144A, 6.0%, 6/15/2021

|

65,000 | 68,738 | |||||||

|

BMC Software Finance, Inc., 144A, 8.125%, 7/15/2021

|

370,000 | 354,275 | |||||||

|

Boxer Parent Co., Inc., 144A, 9.0%, 10/15/2019 (PIK)

|

280,000 | 251,126 | |||||||

|

Cardtronics, Inc., 144A, 5.125%, 8/1/2022

|

205,000 | 203,975 | |||||||

|

CDW LLC:

|

|||||||||

|

6.0%, 8/15/2022

|

280,000 | 295,400 | |||||||

|

8.5%, 4/1/2019

|

2,376,000 | 2,518,560 | |||||||

|

CyrusOne LP, 6.375%, 11/15/2022

|

95,000 | 99,988 | |||||||

|

EarthLink Holdings Corp., 7.375%, 6/1/2020

|

265,000 | 270,300 | |||||||

|

Entegris, Inc., 144A, 6.0%, 4/1/2022

|

140,000 | 142,450 | |||||||

|

Equinix, Inc., 5.375%, 4/1/2023

|

690,000 | 711,563 | |||||||

|

First Data Corp.:

|

|||||||||

|

144A, 6.75%, 11/1/2020

|

432,000 | 462,240 | |||||||

|

144A, 7.375%, 6/15/2019 (b)

|

2,800,000 | 2,968,000 | |||||||

|

144A, 8.75%, 1/15/2022 (PIK)

|

190,000 | 207,575 | |||||||

|

144A, 8.875%, 8/15/2020

|

745,000 | 806,463 | |||||||

|

Hughes Satellite Systems Corp.:

|

|||||||||

|

6.5%, 6/15/2019

|

250,000 | 270,625 | |||||||

|

7.625%, 6/15/2021

|

915,000 | 1,017,937 | |||||||

|

KLA-Tencor Corp., 4.65%, 11/1/2024 (d)

|

920,000 | 922,961 | |||||||

|

NXP BV, 144A, 3.75%, 6/1/2018

|

330,000 | 332,475 | |||||||

|

Tencent Holdings Ltd., 144A, 3.375%, 5/2/2019

|

3,000,000 | 3,050,346 | |||||||

| 16,478,528 | |||||||||

|

Materials 2.5%

|

|||||||||

|

Anglo American Capital PLC:

|

|||||||||

|

144A, 4.125%, 4/15/2021

|

550,000 | 557,925 | |||||||

|

144A, 4.125%, 9/27/2022 (b)

|

1,000,000 | 1,007,688 | |||||||

|

Berry Plastics Corp., 5.5%, 5/15/2022

|

1,095,000 | 1,099,106 | |||||||

|

Braskem Finance Ltd., 6.45%, 2/3/2024

|

1,600,000 | 1,697,200 | |||||||

|

Cascades, Inc., 144A, 5.5%, 7/15/2022

|

215,000 | 212,313 | |||||||

|

Cemex SAB de CV, 144A, 6.5%, 12/10/2019

|

1,000,000 | 1,071,250 | |||||||

|

Clearwater Paper Corp., 144A, 5.375%, 2/1/2025

|

355,000 | 359,437 | |||||||

|

Cliffs Natural Resources, Inc., 5.2%, 1/15/2018 (b)

|

620,000 | 545,600 | |||||||

|

Corp. Nacional del Cobre de Chile, 144A, 4.875%, 11/4/2044 (d)

|

300,000 | 296,945 | |||||||

|

Evraz Group SA, 144A, 6.75%, 4/27/2018

|

600,000 | 564,226 | |||||||

|

First Quantum Minerals Ltd.:

|

|||||||||

|

144A, 6.75%, 2/15/2020

|

969,000 | 937,507 | |||||||

|

144A, 7.0%, 2/15/2021

|

499,000 | 489,644 | |||||||

|

FMG Resources (August 2006) Pty Ltd., 144A, 6.0%, 4/1/2017

|

130,000 | 132,600 | |||||||

|

Fresnillo PLC, 144A, 5.5%, 11/13/2023

|

1,000,000 | 1,051,700 | |||||||

|

Glencore Funding LLC, 144A, 4.125%, 5/30/2023

|

530,000 | 527,908 | |||||||

|

GTL Trade Finance, Inc., 144A, 5.893%, 4/29/2024

|

2,000,000 | 2,075,000 | |||||||

|

Hexion U.S. Finance Corp.:

|

|||||||||

|

6.625%, 4/15/2020

|

1,030,000 | 1,030,000 | |||||||

|

8.875%, 2/1/2018

|

450,000 | 444,937 | |||||||

|

Huntsman International LLC, 5.125%, 4/15/2021

|

EUR

|

250,000 | 326,345 | ||||||

|

Kaiser Aluminum Corp., 8.25%, 6/1/2020

|

225,000 | 246,375 | |||||||

|

Metalloinvest Finance Ltd., 144A, 5.625%, 4/17/2020

|

500,000 | 453,125 | |||||||

|

Novelis, Inc., 8.75%, 12/15/2020

|

4,725,000 | 5,156,156 | |||||||

|

Polymer Group, Inc., 7.75%, 2/1/2019

|

297,000 | 308,880 | |||||||

|

Rain CII Carbon LLC, 144A, 8.25%, 1/15/2021 (b)

|

200,000 | 204,000 | |||||||

|

Sealed Air Corp.:

|

|||||||||

|

144A, 8.125%, 9/15/2019

|

30,000 | 32,513 | |||||||

|

144A, 8.375%, 9/15/2021

|

30,000 | 33,975 | |||||||

|

Signode Industrial Group Lux SA, 144A, 6.375%, 5/1/2022

|

190,000 | 184,300 | |||||||

|

Tronox Finance LLC, 6.375%, 8/15/2020 (b)

|

225,000 | 231,188 | |||||||

|

Turkiye Sise ve Cam Fabrikalari AS, 144A, 4.25%, 5/9/2020

|

2,000,000 | 1,963,480 | |||||||

|

Vedanta Resources PLC, 144A, 6.0%, 1/31/2019

|

900,000 | 918,000 | |||||||

|

WR Grace & Co-Conn:

|

|||||||||

|

144A, 5.125%, 10/1/2021

|

120,000 | 125,026 | |||||||

|

144A, 5.625%, 10/1/2024

|

60,000 | 63,225 | |||||||

|

Yamana Gold, Inc., 144A, 4.95%, 7/15/2024

|

1,040,000 | 1,017,206 | |||||||

| 25,364,780 | |||||||||

|

Telecommunication Services 4.3%

|

|||||||||

|

Altice SA, 144A, 7.75%, 5/15/2022

|

220,000 | 231,000 | |||||||

|

America Movil SAB de CV, 6.45%, 12/5/2022

|

MXN

|

7,000,000 | 510,253 | ||||||

|

Bharti Airtel International Netherlands BV, 144A, 5.35%, 5/20/2024

|

1,500,000 | 1,612,020 | |||||||

|

CenturyLink, Inc., Series V, 5.625%, 4/1/2020

|

100,000 | 106,000 | |||||||

|

Cincinnati Bell, Inc.:

|

|||||||||

|

8.375%, 10/15/2020

|

3,615,000 | 3,877,087 | |||||||

|

8.75%, 3/15/2018

|

807,000 | 835,245 | |||||||

|

CommScope, Inc., 144A, 5.0%, 6/15/2021

|

290,000 | 289,275 | |||||||

|

Digicel Group Ltd.:

|

|||||||||

|

144A, 7.125%, 4/1/2022

|

760,000 | 763,800 | |||||||

|

144A, 8.25%, 9/30/2020

|

910,000 | 950,950 | |||||||

|

Digicel Ltd., 144A, 8.25%, 9/1/2017

|

3,450,000 | 3,531,937 | |||||||

|

Frontier Communications Corp.:

|

|||||||||

|

6.25%, 9/15/2021

|

185,000 | 191,128 | |||||||

|

6.875%, 1/15/2025

|

185,000 | 187,313 | |||||||

|

7.125%, 1/15/2023

|

940,000 | 1,001,100 | |||||||

|

8.5%, 4/15/2020

|

1,645,000 | 1,895,862 | |||||||

|

Intelsat Jackson Holdings SA:

|

|||||||||

|

5.5%, 8/1/2023

|

595,000 | 596,488 | |||||||

|

7.25%, 10/15/2020

|

45,000 | 48,038 | |||||||

|

7.5%, 4/1/2021

|

4,720,000 | 5,109,400 | |||||||

|

Intelsat Luxembourg SA, 8.125%, 6/1/2023

|

100,000 | 106,250 | |||||||

|

Level 3 Communications, Inc., 8.875%, 6/1/2019

|

70,000 | 75,075 | |||||||

|

Level 3 Escrow II, Inc., 144A, 5.375%, 8/15/2022

|

830,000 | 844,525 | |||||||

|

Level 3 Financing, Inc.:

|

|||||||||

|

144A, 6.125%, 1/15/2021 (b)

|

525,000 | 550,594 | |||||||

|

7.0%, 6/1/2020

|

725,000 | 773,938 | |||||||

|

8.625%, 7/15/2020

|

2,480,000 | 2,728,000 | |||||||

|

Millicom International Cellular SA, 144A, 4.75%, 5/22/2020

|

2,510,000 | 2,478,625 | |||||||

|

SBA Communications Corp., 5.625%, 10/1/2019

|

190,000 | 197,600 | |||||||

|

Sprint Communications, Inc.:

|

|||||||||

|

6.0%, 11/15/2022 (b)

|

340,000 | 339,150 | |||||||

|

144A, 7.0%, 3/1/2020

|

365,000 | 407,158 | |||||||

|

144A, 9.0%, 11/15/2018

|

1,745,000 | 2,052,556 | |||||||

|

Sprint Corp., 144A, 7.125%, 6/15/2024

|

1,485,000 | 1,525,837 | |||||||

|

T-Mobile U.S.A., Inc., 6.625%, 11/15/2020

|

740,000 | 779,775 | |||||||

|

tw telecom holdings, Inc.:

|

|||||||||

|

5.375%, 10/1/2022

|

330,000 | 364,650 | |||||||

|

6.375%, 9/1/2023

|

265,000 | 302,100 | |||||||

|

UPCB Finance III Ltd., 144A, 6.625%, 7/1/2020

|

450,000 | 473,625 | |||||||

|

UPCB Finance V Ltd., 144A, 7.25%, 11/15/2021

|

1,660,000 | 1,826,000 | |||||||

|

UPCB Finance VI Ltd., 144A, 6.875%, 1/15/2022

|

150,000 | 163,875 | |||||||

|

Wind Acquisition Finance SA, 144A, 6.5%, 4/30/2020

|

210,000 | 218,400 | |||||||

|

Windstream Corp.:

|

|||||||||

|

6.375%, 8/1/2023 (b)

|

245,000 | 246,838 | |||||||

|

7.5%, 4/1/2023

|

80,000 | 84,000 | |||||||

|

7.75%, 10/15/2020 (b)

|

2,555,000 | 2,721,075 | |||||||

|

7.75%, 10/1/2021

|

720,000 | 770,400 | |||||||

|

7.875%, 11/1/2017

|

2,595,000 | 2,888,754 | |||||||

| 44,655,696 | |||||||||

|

Utilities 0.7%

|

|||||||||

|

AES Corp.:

|

|||||||||

|

3.234%**, 6/1/2019

|

160,000 | 159,150 | |||||||

|

8.0%, 10/15/2017

|

14,000 | 15,890 | |||||||

|

8.0%, 6/1/2020

|

95,000 | 110,306 | |||||||

|

Calpine Corp.:

|

|||||||||

|

5.375%, 1/15/2023

|

340,000 | 343,400 | |||||||

|

5.75%, 1/15/2025 (b)

|

340,000 | 344,250 | |||||||

|

Dynegy Finance I, Inc., 144A, 7.625%, 11/1/2024

|

65,000 | 68,900 | |||||||

|

Hrvatska Elektroprivreda, 144A, 6.0%, 11/9/2017

|

2,000,000 | 2,096,000 | |||||||

|

NRG Energy, Inc., 144A, 6.25%, 5/1/2024

|

1,270,000 | 1,311,275 | |||||||

|

Perusahaan Listrik Negara PT, 144A, 5.25%, 10/24/2042 (b)

|

3,000,000 | 2,715,000 | |||||||

|

RJS Power Holdings LLC, 144A, 5.125%, 7/15/2019

|

260,000 | 258,700 | |||||||

| 7,422,871 | |||||||||

|

Total Corporate Bonds (Cost $264,627,493)

|

266,943,248 | ||||||||

|

Asset-Backed 0.7%

|

|||||||||

|

Automobile Receivables 0.2%

|

|||||||||

|

AmeriCredit Automobile Receivables Trust, "E", Series 2011-2, 144A, 5.48%, 9/10/2018

|

1,939,864 | 1,993,144 | |||||||

|

Miscellaneous 0.5%

|

|||||||||

|

ARES CLO Ltd., "D", Series 2012-3A, 144A, 4.878%**, 1/17/2024

|

2,000,000 | 2,000,156 | |||||||

|

Hilton Grand Vacations Trust, "B", Series 2014-AA, 144A, 2.07%, 11/25/2026

|

1,828,036 | 1,811,256 | |||||||

|

VOLT XXIV LLC, "A1", Series 2014-NPL3, 144A, 3.25%, 11/25/2053

|

1,504,975 | 1,507,129 | |||||||

| 5,318,541 | |||||||||

|

Total Asset-Backed (Cost $7,304,036)

|

7,311,685 | ||||||||

|

Mortgage-Backed Securities Pass-Throughs 0.3%

|

|||||||||

|

Federal Home Loan Mortgage Corp., 6.0%, 11/1/2021

|

96,184 | 108,560 | |||||||

|

Federal National Mortgage Association:

|

|||||||||

|

3.0%, 8/1/2041 (d)

|

3,000,000 | 2,992,149 | |||||||

|

6.5%, with various maturities from 4/1/2017 until 6/1/2017

|

142,095 | 150,188 | |||||||

|

Government National Mortgage Association, 6.5%, 8/20/2034

|

116,379 | 132,607 | |||||||

|

Total Mortgage-Backed Securities Pass-Throughs (Cost $3,368,867)

|

3,383,504 | ||||||||

|

Commercial Mortgage-Backed Securities 0.5%

|

|||||||||

|

Del Coronado Trust, "M", Series 2013-HDMZ, 144A, 5.153%**, 3/15/2018

|

470,000 | 471,034 | |||||||

|

JPMorgan Chase Commercial Mortgage Securities Corp.:

|

|||||||||

|

"C", Series 2012-HSBC, 144A, 4.021%, 7/5/2032

|

1,180,000 | 1,204,885 | |||||||

|

"A4", Series 2007-C1, 5.716%, 2/15/2051

|

821,868 | 895,783 | |||||||

|

LB-UBS Commercial Mortgage Trust, "A4", Series 2007-C6, 5.858%, 7/15/2040

|

1,033,760 | 1,096,162 | |||||||

|

Prudential Commercial Mortgage Trust, "F", Series 2003-PWR1, 144A, 4.98%**, 2/11/2036

|

1,700,000 | 1,683,150 | |||||||

|

Total Commercial Mortgage-Backed Securities (Cost $5,356,939)

|

5,351,014 | ||||||||

|

Collateralized Mortgage Obligations 2.0%

|

|||||||||

|

Federal Home Loan Mortgage Corp.:

|

|||||||||

|

"KO", Series 4180, Principal Only, Zero Coupon, 1/15/2043

|

823,535 | 502,770 | |||||||

|

"HI", Series 3979, Interest Only, 3.0%, 12/15/2026

|

2,517,242 | 276,471 | |||||||

|

"IC", Series 3971, Interest Only, 3.0%, 3/15/2026

|

1,115,146 | 119,210 | |||||||

|

"IK", Series 4048, Interest Only, 3.0%, 5/15/2027

|

3,541,935 | 464,810 | |||||||

|

"PI", Series 3987, Interest Only, 3.0%, 1/15/2027

|

4,683,904 | 590,308 | |||||||

|

"PI", Series 4017, Interest Only, 3.0%, 3/15/2027

|

1,437,011 | 167,668 | |||||||

|

"ZG", Series 4213, 3.5%, 6/15/2043

|

2,451,572 | 2,434,346 | |||||||

|

"LI", Series 3720, Interest Only, 4.5%, 9/15/2025

|

3,562,229 | 529,775 | |||||||

|

"PI", Series 3843, Interest Only, 4.5%, 5/15/2038

|

4,542,218 | 545,804 | |||||||

|

Federal National Mortgage Association:

|

|||||||||

|

"WO", Series 2013-27, Principal Only, Zero Coupon, 12/25/2042

|

1,200,000 | 593,337 | |||||||

|

"JZ", Series 2012-4, 4.0%, 9/25/2041

|

1,723,692 | 1,850,132 | |||||||

|

"I", Series 2003-84, Interest Only, 6.0%, 9/25/2033

|

605,188 | 121,911 | |||||||

|

"PI", Series 2006-20, Interest Only, 6.528%***, 11/25/2030

|

2,949,680 | 493,095 | |||||||

|

Freddie Mac Structured Agency Credit Risk Debt Notes:

|

|||||||||

|

"M3", Series 2014-DN2, 3.755%**, 4/25/2024

|

3,500,000 | 3,284,876 | |||||||

|

"M3", Series 2014-DN4, 4.702%, 10/25/2024

|

1,930,000 | 1,931,372 | |||||||

|

Government National Mortgage Association:

|

|||||||||

|

"ZJ", Series 2013-106, 3.5%, 7/20/2043

|

479,447 | 470,863 | |||||||

|

"QI", Series 2011-112, Interest Only, 4.0%, 5/16/2026

|

2,414,048 | 256,897 | |||||||

|

"AI", Series 2010-25, Interest Only, 4.5%, 3/16/2023

|

784,833 | 26,668 | |||||||

|

"BI", Series 2010-30, Interest Only, 4.5%, 7/20/2039

|

631,497 | 91,436 | |||||||

|

"ND", Series 2010-130, 4.5%, 8/16/2039

|

3,400,000 | 3,712,015 | |||||||

|

"NI", Series 2011-80, Interest Only, 4.5%, 5/16/2038

|

2,426,767 | 170,423 | |||||||

|

"IN", Series 2009-69, Interest Only, 5.5%, 8/20/2039

|

2,050,818 | 346,523 | |||||||

|

"IQ", Series 2011-18, Interest Only, 5.5%, 1/16/2039

|

775,582 | 88,428 | |||||||

|

"IV", Series 2009-69, Interest Only, 5.5%, 8/20/2039

|

2,024,932 | 357,559 | |||||||

|

"IJ", Series 2009-75, Interest Only, 6.0%, 8/16/2039

|

1,522,876 | 282,221 | |||||||

|

"AI", Series 2007-38, Interest Only, 6.308%***, 6/16/2037

|

439,377 | 68,316 | |||||||

|

"SC", Series 2002-33, Interest Only, 7.248%***, 5/16/2032

|

852,574 | 147,645 | |||||||

|

Residential Funding Mortgage Securities I, Inc., "M1", Series 2003-S17, 5.5%, 9/25/2033

|

1,157,152 | 1,080,284 | |||||||

|

Total Collateralized Mortgage Obligations (Cost $19,647,197)

|

21,005,163 | ||||||||

|

Government & Agency Obligations 8.9%

|

|||||||||

|

Other Government Related (e) 0.2%

|

|||||||||

|

Banco de Costa Rica, 144A, 5.25%, 8/12/2018

|

800,000 | 822,720 | |||||||

|

TMK OAO, 144A, 6.75%, 4/3/2020

|

1,000,000 | 901,250 | |||||||

| 1,723,970 | |||||||||

|

Sovereign Bonds 4.2%

|

|||||||||

|

Canadian Government Bond, 3.5%, 12/1/2045

|

CAD

|

5,660,000 | 5,998,731 | ||||||

|

Government of New Zealand, Series 1217, REG S, 6.0%, 12/15/2017

|

NZD

|

12,700,000 | 10,561,835 | ||||||

|

Kingdom of Bahrain, 144A, 6.0%, 9/19/2044

|

870,000 | 897,188 | |||||||

|

Perusahaan Penerbit SBSN Indonesia III, 144A, 4.35%, 9/10/2024 (b)

|

500,000 | 501,250 | |||||||

|

Republic of Belarus, REG S, 8.75%, 8/3/2015

|

1,000,000 | 1,020,200 | |||||||

|

Republic of Colombia, 5.625%, 2/26/2044

|

300,000 | 334,982 | |||||||

|

Republic of Costa Rica, 144A, 4.25%, 1/26/2023

|

300,000 | 285,000 | |||||||

|

Republic of Croatia, 144A, 6.75%, 11/5/2019

|

2,250,000 | 2,494,687 | |||||||

|

Republic of Ecuador, 144A, 7.95%, 6/20/2024

|

1,446,000 | 1,511,070 | |||||||

|

Republic of El Salvador:

|

|||||||||

|

144A, 6.375%, 1/18/2027

|

425,000 | 435,625 | |||||||

|

144A, 7.65%, 6/15/2035

|

1,200,000 | 1,308,000 | |||||||

|

Republic of Hungary:

|

|||||||||

|

4.0%, 3/25/2019

|

1,000,000 | 1,024,500 | |||||||

|

Series 19/A, 6.5%, 6/24/2019

|

HUF

|

90,600,000 | 422,333 | ||||||

|

Republic of Panama, 4.0%, 9/22/2024

|

520,000 | 531,700 | |||||||

|

Republic of Paraguay, 144A, 6.1%, 8/11/2044 (b)

|

600,000 | 642,750 | |||||||

|

Republic of Peru, 144A, 5.7%, 8/12/2024

|

300,000 | 102,581 | |||||||

|

Republic of Singapore, 3.375%, 9/1/2033

|

SGD

|

12,377,000 | 10,386,015 | ||||||

|

Republic of Slovenia, 144A, 5.5%, 10/26/2022

|

200,000 | 219,750 | |||||||

|

Republic of South Africa, Series R204, 8.0%, 12/21/2018

|

ZAR

|

13,200,000 | 1,237,465 | ||||||

|

Republic of Sri Lanka, 144A, 5.125%, 4/11/2019

|

1,000,000 | 1,028,800 | |||||||

|

Republic of Turkey, 7.1%, 3/8/2023

|

TRY

|

1,700,000 | 699,840 | ||||||

|

United Mexican States:

|

|||||||||

|

Series M, 4.75%, 6/14/2018

|

MXN

|

10,400,000 | 774,294 | ||||||

|

Series M 20, 8.5%, 5/31/2029

|

MXN

|

5,200,000 | 459,357 | ||||||

| 42,877,953 | |||||||||

|

U.S. Government Sponsored Agency 0.4%

|

|||||||||

|

Federal National Mortgage Association, 3.0%, 11/15/2027

|

4,500,000 | 4,285,720 | |||||||

|

U.S. Treasury Obligations 4.1%

|

|||||||||

|

U.S. Treasury Bills:

|

|||||||||

|

0.03%****, 12/11/2014 (f)

|

390,000 | 389,996 | |||||||

|

0.035%****, 2/12/2015 (f)

|

3,625,000 | 3,624,797 | |||||||

|

0.055%****, 12/11/2014 (f)

|

156,000 | 155,998 | |||||||

|

U.S. Treasury Bonds:

|

|||||||||

|

3.375%, 5/15/2044

|

1,570,000 | 1,665,549 | |||||||

|

3.625%, 2/15/2044

|

887,000 | 984,362 | |||||||

|

5.375%, 2/15/2031

|

2,000,000 | 2,701,250 | |||||||

|

U.S. Treasury Notes:

|

|||||||||

|

1.0%, 8/31/2016 (g) (h)

|

22,480,000 | 22,704,800 | |||||||

|

1.0%, 9/30/2016

|

2,500,000 | 2,523,827 | |||||||

|

1.5%, 5/31/2019

|

500,000 | 499,063 | |||||||

|

1.625%, 7/31/2019

|

965,000 | 967,337 | |||||||

|

1.625%, 8/15/2022

|

3,000,000 | 2,891,016 | |||||||

|

2.375%, 8/15/2024

|

1,288,000 | 1,293,031 | |||||||

|

2.5%, 5/15/2024

|

1,754,000 | 1,782,229 | |||||||

| 42,183,255 | |||||||||

|

Total Government & Agency Obligations (Cost $91,748,113)

|

91,070,898 | ||||||||

|

Convertible Bond 0.1%

|

|||||||||

|

Materials

|

|||||||||

|

GEO Specialty Chemicals, Inc., 144A, 7.5%, 3/31/2015 (PIK) (Cost $628,435)

|

622,934 | 1,090,631 | |||||||

|

Loan Participations and Assignments 5.8%

|

|||||||||

|

Senior Loans**

|

|||||||||

|

Alliance Mortgage Cycle Loan, Term Loan A, 9.5%, 6/15/2010*

|

233,333 | 0 | |||||||

|

Atlantic Broadband Finance LLC, Term Loan B, 3.25%, 12/2/2019

|

1,365,482 | 1,352,339 | |||||||

|

Avis Budget Car Rental LLC, Term Loan B, 3.0%, 3/15/2019

|

1,492,424 | 1,477,500 | |||||||

|

Berry Plastics Holding Corp.:

|

|||||||||

|

Term Loan D, 3.5%, 2/8/2020

|

1,492,424 | 1,464,449 | |||||||

|

Term Loan E, 3.75%, 1/6/2021

|

2,542,009 | 2,502,290 | |||||||

|

Big Heart Pet Brands, Term Loan, 3.5%, 3/8/2020

|

5,054,600 | 4,876,122 | |||||||

|

CBS Outdoor Americas Capital LLC, Term Loan B, 3.0%, 1/31/2021

|

1,500,000 | 1,477,125 | |||||||

|

Cequel Communications LLC, Term Loan B, 3.5%, 2/14/2019

|

1,492,343 | 1,479,942 | |||||||

|

Chrysler Group LLC, Term Loan B, 3.25%, 12/31/2018

|

1,492,500 | 1,480,560 | |||||||

|

CSC Holdings, Inc., Term Loan B, 2.654%, 4/17/2020

|

2,719,623 | 2,664,550 | |||||||

|

DaVita HealthCare Partners, Inc., Term Loan B, 3.5%, 6/24/2021

|

4,398,975 | 4,370,690 | |||||||

|

Del Monte Foods, Inc., First Lien Term Loan, 4.253%, 2/18/2021

|

2,873,731 | 2,707,601 | |||||||

|

Delos Finance SARL, Term Loan B, 3.5%, 3/6/2021

|

1,500,000 | 1,495,312 | |||||||

|

Hilton Worldwide Finance LLC, Term Loan B2, 3.5%, 10/26/2020

|

4,634,386 | 4,595,573 | |||||||

|

Level 3 Financing, Inc., Term Loan B5, 3.5%, 1/31/2022

|

605,000 | 608,497 | |||||||

|

NRG Energy, Inc., Term Loan B, 2.75%, 7/2/2018

|

4,158,889 | 4,096,069 | |||||||

|

Par Pharmaceutical Companies, Inc., Term Loan B2, 4.0%, 9/30/2019

|

1,497,695 | 1,477,731 | |||||||

|

Pinnacle Foods Finance LLC:

|

|||||||||

|

Term Loan G, 3.25%, 4/29/2020

|

781,815 | 768,692 | |||||||

|

Term Loan H, 3.25%, 4/29/2020

|

2,671,508 | 2,626,666 | |||||||

|

Ply Gem Industries, Inc., Term Loan, 4.0%, 2/1/2021

|

4,611,314 | 4,539,285 | |||||||

|

Polymer Group, Inc., First Lien Term Loan, 4.25%, 12/19/2019

|

1,500,000 | 1,505,625 | |||||||

|

Quebecor Media, Inc., Term Loan B1, 3.25%, 8/17/2020

|

2,038,505 | 1,986,279 | |||||||

|

Samson Investment Co., Second Lien Term Loan, 5.0%, 9/25/2018

|

720,000 | 668,830 | |||||||

|

SBA Senior Financial II LLC, Term Loan B1, 3.25%, 3/24/2021

|

1,496,250 | 1,473,634 | |||||||

|

Seminole Tribe of Florida, Term Loan, 3.0%, 4/29/2020

|

1,443,548 | 1,441,296 | |||||||

|

Spansion LLC, Term Loan, 3.75%, 12/19/2019

|

1,492,462 | 1,471,008 | |||||||

|

Transdigm, Inc., Term Loan C, 3.0%, 2/28/2020

|

1,500,000 | 1,478,677 | |||||||

|

Valeant Pharmaceuticals International, Inc.:

|

|||||||||

|

Term Loan B, 3.5%, 12/11/2019

|

340,803 | 338,646 | |||||||

|

Term Loan B, 3.5%, 2/13/2019

|

1,298,670 | 1,290,554 | |||||||

|

Visteon Corp., Term Delay Draw B, 3.5%, 4/9/2021

|

1,496,250 | 1,479,417 | |||||||

|

Total Loan Participations and Assignments (Cost $60,322,117)

|

59,194,959 | ||||||||

|

Preferred Security 0.0%

|

|||||||||

|

Materials

|

|||||||||

|

Hercules, Inc., 6.5%, 6/30/2029 (Cost $71,425)

|

141,000 | 128,310 | |||||||

|

Contract Amount

|

Value ($)

|

|||||||

|

Call Options Purchased 0.0%

|

||||||||

|

Options on Interest Rate Swap Contracts

|

||||||||

|

Pay Fixed Rate — 3.72% – Receive Floating — LIBOR, Swap Expiration Date 4/22/2026, Option Expiration Date 4/20/20161 (Cost $463,890)

|

9,400,000 | 117,039 | ||||||

|

Shares

|

Value ($)

|

|||||||

|

Securities Lending Collateral 5.7%

|

||||||||

|

Daily Assets Fund Institutional, 0.08% (i) (j) (Cost $58,864,912)

|

58,864,912 | 58,864,912 | ||||||

|

Cash Equivalents 6.0%

|

||||||||

|

Central Cash Management Fund, 0.07% (i) (Cost $61,462,135)

|

61,462,135 | 61,462,135 | ||||||

|

% of Net Assets

|

Value ($)

|

|||||||

|

Total Investment Portfolio (Cost $1,025,583,123)†

|

106.0 | 1,092,979,416 | ||||||

|

Other Assets and Liabilities, Net

|

(6.0 | ) | (61,383,597 | ) | ||||

|

Net Assets

|

100.0 | 1,031,595,819 | ||||||

|

Security

|

Coupon

|

Maturity Date

|

Principal Amount

|

Cost ($)

|

Value ($)

|

|||||||||||||

|

Alliance Mortgage Cycle Loan*

|

9.5 | % |

6/15/2010

|

USD

|

233,333 | 233,333 | 0 | |||||||||||

|

Schedule of Restricted Securities

|

Acquisition Date

|

Cost ($)

|

Value ($)

|

Value as % of Net Assets

|

|||||||||

|

Dawn Holdings, Inc.*

|

August 2013

|

9,378 | 6,628 | 0.00 | |||||||||

|

Futures

|

Currency

|

Expiration Date

|

Contracts

|

Notional Value ($)

|

Unrealized Appreciation/ (Depreciation) ($)

|

|||||||||

|

10 Year Australian Bond

|

AUD

|

12/15/2014

|

142 | 15,343,916 | 308,270 | |||||||||

|

10 Year Canadian Bond

|

CAD

|

12/18/2014

|

35 | 4,255,401 | (20,264 | ) | ||||||||

|

10 Year U.S. Treasury Note

|

USD

|

12/19/2014

|

616 | 77,837,375 | 627,079 | |||||||||

|

U.S. Treasury Long Bond

|

USD

|

12/19/2014

|

50 | 7,054,688 | 104,203 | |||||||||

|

Total net unrealized appreciation

|

1,019,288 | |||||||||||||

|

Futures

|

Currency

|

Expiration Date

|

Contracts

|

Notional Value ($)

|

Unrealized Appreciation/ (Depreciation) ($)

|

|||||||||

|

10 Year U.S. Treasury Note

|

USD

|

12/19/2014

|

49 | 6,191,609 | 99,440 | |||||||||

|

5 Year U.S. Treasury Note

|

USD

|

12/31/2014

|

390 | 46,577,578 | (343,034 | ) | ||||||||

|

Euro-OAT Futures

|

EUR

|

12/8/2014

|

55 | 9,984,223 | (183,201 | ) | ||||||||

|

U.S. Treasury Long Bond

|

USD

|

12/19/2014

|

134 | 18,906,563 | (353,817 | ) | ||||||||

|

Ultra Long U.S. Treasury Bond

|

USD

|

12/19/2014

|

25 | 3,920,313 | (75,831 | ) | ||||||||

|

Total net unrealized depreciation

|

(856,443 | ) | ||||||||||||

|

Bilateral Swaps

|

|||||||||||||||||||||

|

Effective/

Expiration Dates

|

Notional Amount ($) (k)

|

Fixed Cash Flows Received

|

Underlying Debt Obligation/

Quality Rating (l)

|

Value ($)

|

Upfront Payments Paid ($)

|

Unrealized Appreciation ($)

|

|||||||||||||||

|

12/20/2011

3/20/2017

|

150,000 | 2 | 5.0 | % |

CIT Group, Inc.,

5.5%, 2/15/2019, BB–

|

14,783 | 3,014 | 11,769 | |||||||||||||

|

9/20/2012

12/20/2017

|

490,000 | 3 | 5.0 | % |

General Motors Corp., 3.3%, 12/20/2017, BB+

|

63,165 | 22,843 | 40,322 | |||||||||||||

|

Total unrealized appreciation

|

52,091 | ||||||||||||||||||||

|

Centrally Cleared Swaps

|

||||||||||||||

|

Effective/

Expiration Dates

|

Notional Amount ($)

|

Cash Flows Paid by the

Fund

|

Cash Flows Received by the Fund

|

Value ($)

|

Unrealized Appreciation/ (Depreciation)

($)

|

|||||||||

|

6/3/2014

6/3/2025

|

8,800,000 |

Fixed — 3.0%

|

Floating — LIBOR

|

(499,818 | ) | (487,373 | ) | |||||||

|

10/21/2014

10/21/2044

|

19,000,000 |

Fixed — 3.093%

|

Floating — LIBOR

|

(187,321 | ) | (187,321 | ) | |||||||

|

12/30/2014

12/30/2024

|

11,100,000 |

Fixed — 3.524%

|

Floating — LIBOR

|

(990,919 | ) | (989,861 | ) | |||||||

|

12/30/2014

12/30/2034

|

2,200,000 |

Fixed — 4.01%

|

Floating — LIBOR

|

(353,531 | ) | (354,174 | ) | |||||||

|

5/11/2015

5/11/2045

|

8,800,000 |

Fixed — 3.56%

|

Floating — LIBOR

|

(755,893 | ) | (750,963 | ) | |||||||

|

12/30/2014

12/30/2016

|

2,700,000 |

Floating — LIBOR

|

Fixed — 1.173%

|

19,253 | 19,563 | |||||||||

|

12/30/2014

12/30/2019

|

10,400,000 |

Floating — LIBOR

|

Fixed — 2.522%

|

341,035 | 349,396 | |||||||||

|

12/30/2014

12/30/2044

|

1,800,000 |

Floating — LIBOR

|

Fixed — 4.081%

|

363,606 | 365,815 | |||||||||

|

Total net unrealized depreciation

|

(2,034,918 | ) | ||||||||||||

|

Bilateral Swap

|

||||||||||||||||||

|

Effective/

Expiration Dates

|

Notional Amount ($)

|

Cash Flows Paid by the Fund

|

Cash Flows Received by the Fund

|

Value ($)

|

Upfront Payments Paid/

(Received) ($)

|

Unrealized Appreciation

($)

|

||||||||||||

|

6/3/2013

6/3/2025

|

8,800,000 | 1 |

Floating — LIBOR

|

Fixed — 3.0%

|

69,646 | — | 69,646 | |||||||||||

|

Options on Interest Rate Swap Contracts

|

||||||||||||||

|

Swap Effective/

Expiration Dates

|

Contract Amount

|

Option Expiration Date

|

Premiums Received ($)

|

Value ($) (m)

|

||||||||||

|

Call Options

Receive Fixed — 4.22% – Pay Floating — LIBOR

|

4/22/2016

4/22/2026

|

9,400,000 | 1 |

4/20/2016

|

335,110 | (54,899 | ) | |||||||

|

Receive Fixed — 4.48% – Pay Floating — LIBOR

|

5/9/2016

5/11/2026

|

8,800,000 | 1 |

5/5/2016

|

98,780 | (36,947 | ) | |||||||

|

Receive Fixed — 5.132% – Pay Floating — LIBOR

|

3/17/2016

3/17/2026

|

8,800,000 | 1 |

3/15/2016

|

63,580 | (8,233 | ) | |||||||

|

Receive Fixed — 5.132% – Pay Floating — LIBOR

|

3/17/2016

3/17/2026

|

8,800,000 | 4 |

3/15/2016

|

103,840 | (8,233 | ) | |||||||

|

Total Call Options

|

601,310 | (108,312 | ) | |||||||||||

|

Put Options

Pay Fixed — 1.132% – Receive Floating — LIBOR

|

3/17/2016

3/17/2026

|

8,800,000 | 1 |

3/15/2016

|

63,580 | (4,520 | ) | |||||||

|

Pay Fixed — 1.132% – Receive Floating — LIBOR

|

3/17/2016

3/17/2026

|

8,800,000 | 4 |

3/15/2016

|

22,440 | (4,520 | ) | |||||||

|

Pay Fixed — 2.48% – Receive Floating — LIBOR

|

5/9/2016

5/11/2026

|

8,800,000 | 1 |

5/5/2016

|

98,780 | (149,841 | ) | |||||||

|

Pay Fixed — 2.64% – Receive Floating — LIBOR

|

8/10/2015

8/10/2045

|

7,900,000 | 1 |

8/6/2015

|

73,865 | (117,658 | ) | |||||||

|

Pay Fixed — 2.796% – Receive Floating — LIBOR

|

6/5/2015

6/5/2045

|

7,900,000 | 4 |

6/3/2015

|

84,530 | (137,054 | ) | |||||||

|

Pay Fixed — 2.88% – Receive Floating — LIBOR

|

9/30/2015

9/30/2045

|

19,000,000 | 5 |

9/28/2015

|

397,537 | (579,285 | ) | |||||||

|

Pay Fixed — 3.005% – Receive Floating — LIBOR

|

3/6/2015

3/6/2045

|

7,900,000 | 1 |

3/4/2015

|

82,950 | (183,975 | ) | |||||||

|

Pay Fixed — 3.035% – Receive Floating — LIBOR

|

2/15/2015

2/3/2045

|

7,900,000 | 4 |

1/30/2015

|

97,565 | (180,047 | ) | |||||||

|

Pay Fixed — 3.088% – Receive Floating — LIBOR

|

1/28/2015

1/28/2045

|

8,800,000 | 6 |

1/26/2015

|

88,771 | (232,036 | ) | |||||||

|

Total Put Options

|

1,010,018 | (1,588,936 | ) | |||||||||||

|

Total

|

1,611,328 | (1,697,248 | ) | |||||||||||

|

Contracts to Deliver

|