UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2017

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _______________

Commission File Number 001-05869

SUPERIOR UNIFORM GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Florida |

11-1385670 |

10055 Seminole Blvd.

Seminole, Florida 33772

(Address of Principal Executive Offices, including Zip Code)

Registrant’s telephone number, including area code: (727) 397-9611

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of Each Exchange on Which Registered |

|

Common Stock, par value $.001 per share |

NASDAQ Stock Market |

Securities registered pursuant to Section 12(g) of the Act: N/A

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes No X

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No X

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes X No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. __

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer Accelerated filer X Non-accelerated filer Smaller Reporting Company ___ Emerging Growth

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ___

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes No X

At June 30, 2017, the aggregate market value of the registrant’s common shares held by non-affiliates, computed by reference to the last sales price ($22.35) as reported by the NASDAQ Stock Market, was approximately $228.3 million (based on the assumption, solely for purposes of this computation, that all directors and officers of the registrant were affiliates of the registrant).

The number of shares of common stock outstanding as of February 20, 2018 was 15,134,611 shares.

Documents Incorporated by Reference:

Portions of the registrant's Definitive Proxy Statement to be filed with the Commission not later than 120 days after the conclusion of the registrant’s fiscal year ended December 31, 2017, relating to its Annual Meeting of Shareholders to be held May 3, 2018, are incorporated by reference to furnish the information required by Items 10, 11, 12, 13 and 14 of Part III.

The exhibit index may be found on Pages 63 and 64.

PART I

References Used

References in this Form 10-K to “the Company,” “Superior,” “we,” “our,” or “us” mean Superior Uniform Group, Inc. together with its subsidiaries, except where the context otherwise requires. Unless otherwise indicated, all share and per share information in this Form 10-K has been adjusted for all periods presented to give retroactive effect to the 2-for-1 stock split effective on February 4, 2015.

Special Note Regarding Forward-Looking Statements

Certain matters discussed in this Form 10-K are "forward-looking statements" intended to qualify for the safe harbors from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements can generally be identified by use of the words “may,” “will,” “should,” “could,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “project,” “potential” or “plan” or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements in this Form 10-K may include, without limitation: (1) projections of revenue, income, and other items relating to our financial position and results of operations, (2) statements of our plans, objectives, strategies, goals and intentions, (3) statements regarding the capabilities, capacities, market position and expected development of our business operations, and (4) statements of expected industry and general economic trends.

Such forward-looking statements are subject to certain risks and uncertainties that may materially adversely affect the anticipated results. Such risks and uncertainties include, but are not limited to, the following: the impact of competition; general economic conditions, including employment levels in the areas of the United States in which the Company’s customers are located; changes in the healthcare, industrial, commercial, leisure and public safety industries where uniforms and service apparel are worn; our ability to identify suitable acquisition targets, successfully integrate any acquired businesses, successfully manage our expanding operations, or discover liabilities associated with such businesses in the diligence process; the price and availability of cotton and other manufacturing materials; attracting and retaining senior management and key personnel, and those risks discussed under Item 1A of this report entitled “Risk Factors.” Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements made herein and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this Form 10-K and we disclaim any obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

|

Item 1. |

Business |

Overview

Superior Uniform Group, Inc. was organized in 1920 and was incorporated in 1922 as a New York company under the name Superior Surgical Mfg. Co., Inc. In 1998, the Company changed its name to Superior Uniform Group, Inc. (“Superior” or the “Company”) and its state of incorporation to Florida.

On July 1, 2013, the Company acquired substantially all of the assets of HPI Direct, Inc. (“HPI”), a company specializing in the design, manufacture and distribution of uniforms to major domestic retailers, foodservice chains, transportation and other service industries throughout the United States. The purchase price for the asset acquisition consisted of approximately $32.5 million in cash, and inclusive of the real estate purchase described below, the issuance of approximately 418,000 restricted shares of Superior’s common stock, the potential future payment of up to $7.2 million in additional contingent consideration through 2017, and the assumption of certain liabilities of HPI. The transaction also included the acquisition of the corporate offices and warehouse distribution facility from an entity related to HPI.

On March 8, 2016, the Company closed on the acquisition of substantially all of the assets of BAMKO, Inc.. The transaction had an effective date of March 1, 2016. The purchase price for the asset acquisition consisted of approximately $15.2 million in cash, net of cash acquired, the issuance of approximately 324,000 restricted shares of Superior’s common stock that vests over a five-year period, the potential future payments of approximately $5.5 million in additional contingent consideration through 2021, and the assumption of certain liabilities of BAMKO, Inc. The transaction also included the acquisition of BAMKO’s subsidiaries in Hong Kong, China, Brazil and England as well as an affiliate in India. Depending on the context, when using the term “BAMKO” in this Form10-K, we refer either to the Company’s wholly-owned subsidiary housing the acquired business (BAMKO, LLC) or to the business acquired in the transaction, as subsequently grown through additional acquisitions. BAMKO is a full-service merchandise sourcing and promotional products company based in Los Angeles. With sales offices in the United States and Brazil, as well as support offices in China, Hong Kong, and India, BAMKO serves many well-known brands.

On August 21, 2017, the Company, through BAMKO, acquired substantially all of the assets of PublicIdentity, Inc. (“Public Identity”). Public Identity is a promotional products and branded merchandise agency that provides promotional products and branded merchandise to corporate clients and universities. The purchase price consisted of $0.8 million in cash, the issuance of approximately 54,000 restricted shares of Superior’s common stock and future payments of approximately $0.4 million in additional consideration through 2020. The majority of the shares issued vest over a three-year period.

On November 30, 2017, BAMKO closed on the acquisition of substantially all of the assets of Tangerine Promotions, Ltd and Tangerine Promotions West, Inc. (collectively, “Tangerine”), a promotional products and branded merchandise agency that serves many well-known brands. Tangerine is one of the leading providers of Point-of-Purchase (POP) and Point-of-Sale (POS) merchandise in the country. The transaction had an effective date of December 1, 2017. The purchase price for the asset acquisition consisted of approximately $7.2 million in cash, subject to adjustment, the issuance of approximately 83,000 restricted shares of Superior’s common stock that vests over a four-year period, the potential future payments of approximately $5.5 million in additional contingent consideration through 2021, and the assumption of certain liabilities of Tangerine.

Superior has realigned its organizational structure and updated its reportable operating segments as a result of changes in its business primarily related to the acquisition of BAMKO effective March 1, 2016. A new Promotional Products segment has been created and consists of sales to customers of promotional products. Superior is now comprised of three reportable business segments: (1) Uniforms and Related Products, (2) Remote Staffing Solutions, and (3) Promotional Products. Superior’s Uniforms and Related Products segment, through its signature marketing brands Fashion Seal Healthcare®, HPI Direct®, Superior I.D.™, Worklon®, and UniVogue®, manufactures and sells a wide range of uniforms, corporate identity apparel, career apparel and accessories for the hospital and healthcare fields; hotels; fast food and other restaurants; transportation; and the private security, industrial and commercial markets. In excess of 95% of Superior’s Uniforms and Related Products segment’s net sales are from the sale of uniforms and service apparel and directly-related products. Because the addition of the Promotional Products segment did not affect the composition of Superior’s other two segments, the Company did not restate segment information for prior periods.

Superior services its Remote Staffing Solutions segment through multiple The Office Gurus entities, including its direct and indirect subsidiaries in El Salvador, Belize, and the United States, (collectively, “TOG”). TOG is a near-shore premium provider of cost effective multilingual telemarketing and total office support solutions.

The Promotional Products segment services customers that primarily purchase promotional and related products. The segment currently has sales offices in the United States and Brazil with support services in China, Hong Kong, and India.

Products

Superior manufactures and sells a wide range of uniforms, corporate identity apparel, career apparel and accessories for the medical and health fields as well as for the industrial, commercial, leisure, and public safety markets in its Uniforms and Related Products segment. The Promotional Products segment produces and sells products for a wide variety of industries primarily to support marketing efforts.

Superior’s principal products are:

| ● | Uniforms and service apparel and related products for personnel of: | |

| ● | Hospitals and health facilities; | |

|

● |

Hotels, commercial buildings, residential buildings, and food service facilities; |

|

|

● |

Retail stores; |

|

|

● |

General and special purpose industrial uses; |

|

|

● |

Commercial enterprises (career apparel for banks, airlines, etc.); |

|

|

● |

Public and private safety and security organizations; and |

|

|

● |

Miscellaneous service uses. |

| ● | Miscellaneous products: | |

| ● | directly related to uniforms and service apparel specified above (e.g. boots and bags); and | |

|

● |

for use by linen suppliers and industrial launderers, to whom a substantial portion of Superior's uniforms and service apparel are sold; such products being primarily industrial laundry bags. |

|

|

● |

for use by private safety and security organizations; and |

|

|

● |

Miscellaneous service uses. |

| ● |

Promotional and related products to support: |

|

| ● | Branded marketing programs; | |

|

● |

Event promotions; |

|

| ● | Employee rewards and incentives; and | |

| ● | Specialty packaging and displays |

Uniforms and related products are typically distributed through distribution centers in the United States. Promotional products are typically shipped directly from our vendors to our customers.

We do not consider sales in any of our segments to be highly seasonal.

For a depiction of revenues from external customers, income before taxes on income and total assets by segment for each of the years ended December 31, 2017, 2016 and 2015, please refer to “Note 17. Operating Segment Information:” in the notes to the consolidated financial statements in this Form 10-K.

During the years ended December 31, 2017, 2016 and 2015, uniforms and service apparel and related products accounted for approximately 77%, 83% and 94% of net sales; during the years ended December 31, 2017 and 2016, promotional and related products accounted for approximately 16% and 11% of net sales and no other single class of product listed above accounted for more than 10% of net sales.

Services

Through the recruitment and employment of highly qualified English-speaking agents, we provide our customers with extended office support from a versatile call and contact center environment in our Remote Staffing Solutions segment.

Competition

Superior competes in its Uniforms and Related Products segment with more than three dozen firms, including divisions of larger corporations. Superior competes with national and regional manufacturers, such as Cintas Corporation, Unifirst Corporation and ARAMARK—a division of ARAMARK Corporation. Superior also competes with local firms in most major metropolitan areas. The nature and degree of competition varies with the customer and the market. Industry statistics are not available, but we believe Superior is one of the leading suppliers of garments to hospitals, industrial clean rooms, hotels, motels, and food service establishments, and uniforms to linen suppliers. Superior experiences competition primarily based on breadth of products offered, styling and pricing. We believe that the strength of our brands and marketing, coupled with the quality of our products, allow us to compete effectively.

The market in which TOG operates has evolved into a global multi-billion dollar marketplace that is highly competitive and fragmented. TOG’s competitors in the Remote Staffing Solutions segment range in size from very small firms offering specialized services or short-term project completion to very large independent firms, and include the in-house operations of many customers and potential customers. We compete directly and indirectly with various companies that provide contact center and other business process solutions on an outsourced basis. These companies include, but are certainly not limited to, global providers such as APAC Customer Services, Convergys, Sitel, Atento, Sykes, Harte Hanks, and Teleperformance. TOG also competes with local entities in other offshore geographies. The list of potential competitors includes both publicly traded and privately held companies.

The promotional products industry is highly fragmented. We compete with a multitude of foreign, regional, and local competitors that vary by market. Major competitors in the Promotional Products segment include Staples, Inc. and BDA, Inc. We believe our creative services, product development, proprietary web platforms and our extensive global sourcing network along with our success with major brands will enable us to continue to be competitive and grow in this market.

Customers

The Uniform and Related Products segment has a substantial number of customers, the largest of which accounted for approximately 7.7% of that segment’s 2017 net sales. The Remote Staffing Solutions segment’s largest customer represented 17.9% of that segment’s 2017 external revenues, and the largest customer in the Promotional Products segment represented 7.6% of that segment’s net sales in 2017.

Backlog

The Uniform and Related Products segment normally completes shipments of orders from stock within one week after the receipt of the order. As of February 19, 2018, the backlog of all orders that we believe to be firm for our Uniform and Related Products segment was approximately $7.1 million, compared to approximately $6.6 million as of February 20, 2017. The Promotional Products segment typically produces custom products based upon confirmed orders. The average length of time to produce orders is four to six months. The backlog of all orders for our Promotional Products segment was approximately $25.0 million as of February 19, 2018 as compared to $12.8 million as of February 20, 2017.

Raw Materials, Working Capital and Inventory

The principal fabrics used in our Uniforms and Related Products segment are made from cotton, polyester, wool, silk, synthetic and cotton-synthetic blends. The majority of such fabrics are sourced in the Far East. The raw materials used in the fabrics we source from our suppliers are primarily cotton, polyester yarn, dyestuffs and chemical components of synthetic fabrics.

Superior’s Uniform and Related Products segment markets itself to its customers as a "stock house." Therefore, Superior at all times carries substantial inventories of raw materials (principally piece goods) and finished garments, which requires substantial working capital. The segment’s principal raw materials are textile products. In 2017 and 2016, approximately 32% and 32%, respectively, of the segment’s products were obtained from suppliers located in Central America and Haiti, and approximately 28% and 31%, respectively, were sourced from or contained raw materials sourced from China. Superior does not believe that it is dependent upon any of its suppliers, despite the concentration of its purchasing from a few sources, as other suppliers of the same or similar products are readily available. However, if Superior’s Uniform and Related Products segment is unable to continue to obtain its products from Central America, Haiti and China, it could significantly disrupt Superior’s business. Because the Company manufactures and sources products in Central America, Haiti and China, the Company is affected by economic and political conditions in those countries, including possible employee turnover, labor and other unrest and lack of developed infrastructure, as well as decisions by the U.S. government to impose or increase import duties or other import regulations.

The Promotional Products segment relies on the supply of different types of raw materials, including plastic, glass, fabric and metal. Prices within the promotional products industry are directly affected by the cost of raw materials. The market for promotional products is price sensitive and has historically exhibited price and demand cyclicality. The Promotional Products segment has flexibility in its suppliers, as other suppliers of the same or similar products are widely available. Additionally, the nature of the promotional products industry is such that should specific types of raw materials undergo significant cost increases, it is possible that alternative products using different materials could be utilized for similar promotional activities. However, if cost increases cannot be entirely passed on to customers and alternative suppliers or suitable product alternatives are unavailable, profit margins could decline. Moreover, in 2017 and 2016, because approximately 67% and 59%, respectively, of the raw materials and products sourced by the Promotional Products segment came from China, economic and political conditions in China or the United States, including those resulting in the imposition or increase of import duties and other import regulations, could have a material adverse effect on this business segment.

Intellectual Property

Superior owns and uses several trademarks and service marks relating to its brands that have significant value and are instrumental to its ability to market its products. Superior’s most significant trademark is its mark "Fashion Seal Healthcare" (presently registered with the United States Patent and Trademark Office until 2027). The Fashion Seal Healthcare trademark is critically important to the marketing and operation of Superior’s business, as more than 22% of Superior's products are sold under that name.

Environmental Matters

In view of the nature of our business, compliance with federal, state, and local laws regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, has had no material effect upon our operations or earnings, and we do not expect it to have a material impact in the foreseeable future.

Employees

Superior employed 2,280 persons, of which 2,237 were full-time employees, as of December 31, 2017.

Securities Exchange Act Reports

The Company maintains an internet website at the following address: www.superioruniformgroup.com. The information on the Company's website is not incorporated by reference in this annual report on Form 10-K.

We make available on or through our website certain reports and amendments to those reports that we file with or furnish to the Securities and Exchange Commission (the "SEC") in accordance with the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These include our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, and Section 16 filings by our officers, directors and 10% shareholders. We make this information available on our website free of charge as soon as reasonably practicable after we or they electronically file the information with, or furnish it to, the SEC.

Item 1A. Risk Factors

Our business, operations and financial condition are subject to various risks, and many of those risks are driven by factors that we cannot control or predict. The following discussion addresses those risks that management believes are the most significant. You should take those risks into account in evaluating or making any investment decision involving the Company. Additional risks and uncertainties not presently known or that we currently believe to be less significant may also adversely affect us.

Risks Relating To Our Industry

We face intense competition within our industry and our revenue and/or profits may decrease if we are not able to respond to this competition effectively.

Customers in the uniform and corporate identity apparel industry and in the promotional products industry choose suppliers primarily based upon the quality, price and breadth of products offered. We encounter competition from a number of companies in the geographic areas we serve. Major competitors for our Uniforms and Related Products segment include publicly held companies such as Cintas Corporation, Unifirst Corporation, as well as ARAMARK — a division of ARAMARK Corporation. Major competitors for our Promotional Products segment include companies such as Staples, Inc. and BDA, Inc.. We also compete with a multitude of foreign, regional and local competitors that vary by market. If our existing or future competitors seek to gain or retain market share by reducing prices, we may be required to lower our prices, which would adversely affect our operating results. Similarly, if customers or potential customers perceive the products offered by our existing or future competitors to be of higher quality than ours or part of a broader product mix, our revenues may decline, which would adversely affect our operating results. In addition, our competitors generally compete with us for acquisition candidates, which can increase the price for acquisitions and reduce the number of acquisition candidates available to us.

Regional or national economic slowdowns, high unemployment levels, or cost increases might have an adverse effect on our operating results.

Our primary products are provided to workers employed by our customers and, as a result, our business prospects are dependent upon levels of employment and overall economic conditions, among other factors. Our revenues are impacted by our customers’ opening and closing of locations and reductions and increases in headcount, including from voluntary turnover, which affect the quantity of uniform orders on a per-employee basis.

If we are unable to offset these effects through the addition of new customers (through acquisition or otherwise), the penetration of existing customers with a broader mix of product and service offerings, or decreased production costs that can be passed on in the form of lower prices, our revenue growth rates will be negatively impacted. Events or conditions in a particular geographic area, such as adverse weather and other factors, could also hurt our operating results. While we do not believe that our exposure is greater than that of our competitors, we could be adversely affected by increases in the prices of fabric, natural gas, gasoline, wages, employee benefits, insurance costs and other components of product cost unless we can recover such increases through proportional increases in the prices for our products and services. Competitive and general economic conditions might limit our ability and that of our competitors to increase prices to cover such increases in our product cost.

Volatility in the global financial markets could adversely affect results.

In the past, global financial markets have experienced extreme disruption, including, among other things, volatility in security prices, diminished liquidity and credit availability, rating downgrades of certain investments and declining valuations of others. In addition, global equity markets have been highly volatile recently. There can be no assurance that there will not be further change or volatility, which could lead to challenges in our business and negatively impact our financial results. The tightening of credit in financial markets adversely affects the ability of our customers and suppliers to obtain financing for significant purchases and operations and could result in a decrease in orders and spending for our products and services. We are unable to predict the likely duration and severity of any disruption in financial markets and adverse economic conditions and the effects they may have on our business and financial condition.

The uniform and corporate identity apparel and promotional products industries are subject to pricing pressures that may cause us to lower the prices we charge for our products and adversely affect our financial performance.

Many of our competitors source their product requirements from developing countries to achieve a lower cost operating environment, possibly with lower costs than our offshore facilities, and those manufacturers may use these cost savings to reduce prices. To remain competitive, we must adjust our prices from time to time in response to these industry-wide pricing pressures. Moreover, increased customer demands for allowances, incentives and other forms of economic support could reduce our gross margins and affect our profitability. Our financial performance may be negatively affected by these pricing pressures if we are forced to reduce our prices and we cannot reduce our product costs proportionally or if our product costs increase and we cannot increase our prices proportionately.

Increases in the price of finished goods and raw materials used to manufacture our products could materially increase our costs and decrease our profitability.

The principal fabrics used for our uniforms are made from cotton, wool, silk, synthetic and cotton-synthetic blends. The principal components in our promotional products are plastic, glass, fabric and metal. The prices we pay for these fabrics and components and our finished goods are dependent on the market price for the raw materials used to produce them, primarily cotton and chemical components of synthetic fabrics including raw materials such as chemicals and dyestuffs. These finished goods and raw materials are subject to price volatility caused by weather, supply conditions, government regulations, economic and political climate, currency exchange rates, labor costs, and other unpredictable factors. Fluctuations in petroleum prices also may influence the prices of related items such as chemicals, dyestuffs and polyester yarn.

Any increase in raw material prices increases our cost of sales and can decrease our profitability unless we are able to pass the costs on to our customers in the form of higher prices. In addition, if one or more of our competitors is able to reduce their production costs by taking advantage of any reductions in raw material prices or favorable sourcing agreements, we may face pricing pressures from those competitors and may be forced to reduce our prices or face a decline in net sales, either of which could have a material adverse effect on our business, results of operations and financial condition.

Changes to trade regulation, quotas, duties or tariffs, caused by the changing U.S. and geopolitical environments or otherwise, may increase our costs or limit the amount of products that we can import.

Our operations are subject to various international trade agreements and regulations, such as the Dominican Republic–Central America Free Trade Agreement (CAFTA-DR), Caribbean Basin Trade Partnership Act (CBTPA), Haitian Hemispheric Opportunity through Partnership Encouragement Act, as amended (HOPE), the Food Conservation and Energy Act of 2008 (HOPE II), the Haiti Economic Lift Program of 2010 (HELP), the African Growth and Opportunity Act (AGOA), and the activities and regulations of the World Trade Organization (WTO). Generally, these trade agreements benefit our business by reducing or eliminating the duties and/or quotas assessed on products manufactured in a particular country. However, trade agreements can also impose requirements that negatively affect our business, such as limiting the countries from which we can purchase raw materials or limiting the products that qualify as duty free, and setting duties or quotas on products that may be imported into the United States from a particular country. In addition, increased competition from developing countries could have a material adverse effect on our business, results of operations or financial condition.

The countries in which our products are manufactured or into which they are imported may from time to time impose new quotas, duties, tariffs and requirements as to where raw materials must be purchased to qualify for free or reduced duty. These countries may also create additional workplace regulations or other restrictions on our imports or adversely modify existing restrictions. Adverse changes in these costs and restrictions could harm our business. We cannot assure you that future trade agreements will not provide our competitors an advantage over us, or increase our costs, either of which could have a material adverse effect on our business, results of operations or financial condition. Nor can we assure you that the changing geopolitical and U.S. political environments will not result in a trade agreement or regulation being altered which adversely affects our company. Specifically, the current U.S. administration has voiced strong concerns about imports from countries that it perceives as engaging in unfair trade practices, and may decide to impose import duties or other restrictions on products or raw materials sourced from those countries, which may include China and other countries from which we import raw materials or in which we manufacture our products. Any such duties or restrictions could have a material adverse effect on our business, results of operations or financial condition.

The corporate identity apparel and uniform industry is subject to changing fashion trends and if we misjudge consumer preferences, the image of one or more of our brands may suffer and the demand for our products may decrease.

The apparel industry, including uniforms and corporate identity apparel, is subject to shifting customer demands and evolving fashion trends and our success is also dependent upon our ability to anticipate and promptly respond to these changes. Failure to anticipate, identify or promptly react to changing trends or styles may result in decreased demand for our products, as well as excess inventories and markdowns, which could have a material adverse effect on our business, results of operations, and financial condition. In addition, if we misjudge consumer preferences, our brand image may be impaired. We believe our products are, however, in general, less subject to fashion trends compared to many other apparel manufacturers because we manufacture and sell uniforms, corporate identity apparel and other accessories.

Risks Relating To Our Business

Our success depends upon the continued protection of our trademarks and other intellectual property rights and we may be forced to incur substantial costs to maintain, defend, protect and enforce our intellectual property rights.

Our owned intellectual property and certain of our licensed intellectual property have significant value and are instrumental to our ability to market our products. While we own and use several trademarks, our “Fashion Seal Healthcare” mark is critically important to our business, as more than 22% of our products are sold under that name. We cannot assure you that our owned or licensed intellectual property or the operation of our business does not infringe on or otherwise violate the intellectual property rights of others. We cannot assure you that third parties will not assert claims against us on any such basis or that we will be able to successfully resolve such claims. In addition, although we seek international protection of our intellectual property, the laws of some foreign countries may not allow us to protect, defend or enforce our intellectual property rights to the same extent as the laws of the United States. We could also incur substantial costs to defend legal actions relating to use of our intellectual property or prosecute legal actions against others using our intellectual property, either of which could have a material adverse effect on our business, results of operations or financial condition. There also can be no assurance that we will be able to negotiate and conclude extensions of existing license agreements on similar economic terms or at all.

Our customers may cancel or decrease the quantity of their orders, which could negatively impact our operating results.

Although we have long-standing customer relationships, we do not have long-term contracts with many of our customers. Sales to many of our customers are on an order-by-order basis. If we cannot fill customers’ orders on time, orders may be cancelled and relationships with customers may suffer, which could have an adverse effect on us, especially if the relationship is with a major customer. Furthermore, if any of our customers experience a significant downturn in their business, or fail to remain committed to our programs or brands, the customer may reduce or discontinue purchases from us. The reduction in the amount of our products purchased by customers could have a material adverse effect on our business, results of operations or financial condition.

In addition, some of our customers have experienced significant changes and difficulties, including consolidation of ownership, increased centralization of buying decisions, restructurings, bankruptcies and liquidations. A significant adverse change in a customer relationship or in a customer’s financial position could cause us to limit or discontinue business with that customer, require us to assume more credit risk relating to that customer’s receivables or limit our ability to collect amounts related to previous purchases by that customer, all of which could have a material adverse effect on our business, results of operations or financial condition.

We pursue acquisitions from time-to-time to expand our business, which may pose risks to our business.

We selectively pursue acquisitions from time to time as part of our growth strategy. We compete with others within our industry for suitable acquisition candidates. This competition may increase the price for acquisitions and reduce the number of acquisition candidates available to us. As a result, acquisition candidates may not be available to us in the future on favorable terms.

Even if we are able to acquire businesses on favorable terms, managing growth through acquisition is a difficult process that includes integration and training of personnel, combining plant and operating procedures, and additional matters related to the integration of acquired businesses within our existing organization. Unanticipated issues related to integration may result in additional expense and in disruption to our operations, and may require a disproportionate amount of our management’s attention, any of which could negatively impact our ability to achieve anticipated benefits, such as cost synergies. Growth of our business through acquisitions will also likely require us to increase our work force and the scope of our operating and financial systems and may require us to increase the geographic area of our operations. This would increase our operating complexity and the level of responsibility for both existing and new management personnel. Managing and sustaining our growth and expansion may require substantial enhancements to our operational and financial systems and controls, as well as additional administrative, operational and financial resources. There can be no assurance that we will be successful in integrating acquired businesses or managing our expanding operations.

In addition, although we conduct due diligence investigations prior to each acquisition, there can be no assurance that we will discover or adequately protect against all material liabilities of an acquired business for which we may be responsible as a successor owner or operator. The failure to identify suitable acquisitions, successfully integrate these acquired businesses, successfully manage our expanding operations, or to discover liabilities associated with such businesses in the diligence process, could adversely affect our business, results of operations or financial condition.

In order to finance such acquisitions, we may need to obtain additional funds either through public or private financings, including bank and other secured and unsecured borrowings and/or the issuance of equity or debt securities. There can be no assurance that such financings would be available to us on reasonable terms. Any future issuances of equity securities or debt securities with equity features may be dilutive to our shareholders.

If our information technology systems suffer interruptions or failures, including as a result of cyber-attacks, our business operations could be disrupted and our reputation could suffer.

We rely on information technology systems to process transactions, communicate with customers, manage our business, and process and maintain information The measures we have in place to monitor and protect our information technology systems might not offer sufficient protection from catastrophic events, power surges, viruses, malicious malware, attempts to gain unauthorized access to data or other types of cyber-based attacks. Cyber based attacks in particular are becoming more frequent, sophisticated and damaging. Any such events could product disruptions that result in an unexpected delay in operations, loss of confidential or otherwise protected information, corruption of data, and expenses related to the repair or replacement of our information technology systems. Compromising and/or loss of information could result in loss of sales or legal or regulatory claims which could adversely affect our revenues and profits or damage our reputation.

We have significant pension obligations with respect to our employees and our available cash flow may be adversely affected in the event that payments become due under any pension plans that are unfunded or underfunded.

A portion of our active and retired employees participate in defined benefit pension plans under which we are obligated to provide prescribed levels of benefits regardless of the value of the underlying assets, if any, of the applicable pension plan. If our obligations under a plan are unfunded or underfunded, we will have to use cash flow from operations and other sources to pay our obligations either as they become due or over some shorter funding period. As of December 31, 2017, we had approximately $8.4 million in unfunded or underfunded obligations related to our pension plans, compared to $9.5 million as of December 31, 2016.

We are subject to international, federal, state and local laws and regulations and failure to comply with them may expose us to potential liability.

We are subject to international, federal, state and local laws and regulations affecting our business, including those promulgated under the Occupational Safety and Health Act, the Consumer Product Safety Act, the Flammable Fabrics Act, the Textile Fiber Product Identification Act, the rules and regulations of the Consumer Products Safety Commission and various labor, workplace and related laws, as well as environmental laws and regulations. Failure to comply with such laws may expose us to potential liability and have an adverse effect on our results of operations.

Shortages of supply of sourced goods or raw materials from suppliers, interruptions in our manufacturing, and local conditions in the countries in which we operate could adversely affect our results of operations.

We utilize multiple supply sources and manufacturing facilities. However, an unexpected interruption in any of the sources or facilities could temporarily adversely affect our results of operations until alternate sources or facilities can be secured. In 2017 and 2016, approximately 28% and 31%, respectively, of products for our Uniform and Related Products segment were sourced from or contained raw materials sourced from China. In 2017 and 2016, approximately 32% and 32%, respectively, of products for our Uniform and Related Products segment were obtained from suppliers located in Central America and Haiti. In 2017 and 2016, approximately 67% and 59%, respectively, of our products for our Promotional Products segment were sourced from China. If we are unable to continue to obtain our products from China, Central America and/or Haiti, it could significantly disrupt our business. Because we source products and raw materials and maintain operations in these locations, we are affected by economic and political conditions in those countries, including possible employee turnover, labor and other unrest and lack of developed infrastructure, as well as decisions by the U.S. government to impose or increase import duties or other import regulations.

Our business may be impacted by adverse weather and other unpredicted events

Our corporate headquarters is located in Florida, which is a hurricane-sensitive area. Should a hurricane occur, the possibly resulting infrastructure damage and disruption to the area could negatively affect Superior, such as by damage to, or total destruction of, our headquarters, surrounding transportation infrastructure, network communications, and other forms of communication. Some of our suppliers, such as those located in Central America and Haiti, are exposed to hurricanes and earthquakes; the damages that such events could produce could affect the supply of our products. In addition, similar disruptions to the business of our customers located in areas affected by hurricanes or earthquakes may adversely impact sales of our products.

Implementation of technology initiatives could disrupt our operations in the near term and fail to provide the anticipated benefits.

As our business grows, we continue to make significant investments in our technology, including in the areas of warehouse management and product design. The costs, potential problems and interruptions associated with the implementation of technology initiatives could disrupt or reduce the efficiency of our operations in the near term. They may also require us to divert resources from our core business to ensure that implementation is successful. In addition, new or upgraded technology might not provide the anticipated benefits; it might take longer than expected to realize the anticipated benefits; the technology might fail or cost more than anticipated.

Our Remote Staffing Solutions business is dependent on the trend toward outsourcing.

Our business and growth depend in large part on the industry trend toward outsourced customer contact management services. Outsourcing means that an entity contracts with a third party, such as us, to provide customer contact services rather than perform such services in-house. There can be no assurance that this trend will continue, as organizations may elect to perform such services themselves. A significant change in this trend could have a material adverse effect on our business, financial condition and results of operations.

Inability to attract and retain key management or other personnel could adversely impact our business.

Our success is dependent on the skills, experience, and efforts of our senior management and other key personnel. If, for any reason, one or more senior executive or key personnel was not to remain active in our company, or if we were unable to attract and retain senior management or key personnel, our results of operations could be adversely affected.

Certain existing shareholders have significant control.

At December 31, 2017, our executive officers, Directors, and certain of their family members collectively owned 35.2% of our outstanding common stock. As a result, our executive officers and certain of their family members have significant influence over the election of our Board of Directors, the approval or disapproval of any other matters requiring shareholder approval, and the affairs and policies of our company.

|

Item 1B. |

Unresolved Staff Comments |

None.

|

Item 2. |

Properties |

As of December 31, 2017, the Company owned or leased approximately 24 facilities containing an aggregate of approximately 957,000 square feet located in the United States, Central America, South America, Haiti and Asia, which are used for manufacturing, distribution, and office space supporting our Uniforms and Related Products, Remote Staffing Solutions, and Promotional Products segments. Our owned facilities total approximately 452,000 square feet, including our 66,000 square feet corporate headquarters in Seminole, Florida (which also houses a call center and is involved with all of our segments), and 75,000 square feet warehousing and distribution location in Alpharetta, GA (used in conjunction with our Uniforms and Related Products segment), and 43,000 square feet call center in El Salvador (which serves our Remote Staffing Solutions segment). Our principal Promotional Products locations are leased office space in Los Angeles, CA and Chicago, IL; we also lease office space for use with this segment in other countries, including Brazil, India and China. Our distribution center in Eudora, AR, which is used primarily for our Uniforms and Related Products segment, is rented for a nominal amount from a municipality providing incentives for businesses to locate in that area and may be purchased for a nominal amount.

The Company has an ongoing program designed to maintain and improve its facilities. The Company's properties have adequate productive capacity to meet the Company’s present needs as well as those of the foreseeable future.

|

Item 3. |

Legal Proceedings |

We are a party to certain lawsuits in the ordinary course of business. We do not believe that these proceedings, individually or in the aggregate, will have a material adverse effect on our financial position, results of operations or cash flows.

|

Item 4. |

Mine Safety Disclosures |

Not applicable.

PART II

|

Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The principal market on which Superior's common shares are traded is the NASDAQ Stock Market under the symbol “SGC”.

The following table sets forth the high and low sales prices and cash dividends declared on our common stock by quarter for 2017 and 2016 as reported in the consolidated transaction reporting system of the NASDAQ Stock Market.

| QUARTER ENDED | ||||||||||||||||||||||||||||||||

| 2017 | 2016 | |||||||||||||||||||||||||||||||

|

|

Mar. 31 |

June 30 |

Sept. 30 |

Dec. 31 |

Mar. 31 |

June 30 |

Sept. 30 |

Dec. 31 |

||||||||||||||||||||||||

| Common Shares: | ||||||||||||||||||||||||||||||||

|

High |

$ | 19.69 | $ | 23.33 | $ | 23.63 | $ | 28.85 | $ | 18.27 | $ | 20.45 | $ | 20.50 | $ | 21.02 | ||||||||||||||||

|

Low |

$ | 16.65 | $ | 17.13 | $ | 20.70 | $ | 22.24 | $ | 13.71 | $ | 15.79 | $ | 15.53 | $ | 15.79 | ||||||||||||||||

|

Dividends (total for 2017-$0.37; 2016-$0.34) |

$ | 0.088 | $ | 0.088 | $ | 0.095 | $ | 0.095 | $ | 0.083 | $ | 0.083 | $ | 0.088 | $ | 0.088 | ||||||||||||||||

We declared cash dividends of $0.0875 per share in the first and second quarters and $0.095 per share in the third and fourth quarters during the fiscal year ended December 31, 2017.

We intend to pay regular quarterly distributions to our holders of common shares, the amount of which may change from time to time; however, there can be no assurances that we will in fact pay such distributions on a regular basis. Future distributions will be declared and paid at the discretion of our Board of Directors, and will depend upon cash generated by operating activities, our financial condition, capital requirements, and such other factors as our Board of Directors deem relevant.

Under our credit agreement with Branch Banking and Trust Company (“BB&T”), if an event of default exists, we may not make distributions to our shareholders. The Company is in full compliance with all terms, conditions and covenants of its credit agreement.

On December 29, 2014, the Board of Directors declared a 2-for-1 stock split of the Company’s common stock. The record date for the split was January 12, 2015, and the stock split became effective on February 4, 2015.

On February 20, 2018, we had 153 shareholders of record and the closing price for our common shares on the NASDAQ Stock Market was $24.37 per share.

Information regarding the Company’s equity compensation plans is incorporated by reference to the information set forth in Item 12 of Part III of this Form 10-K under the section entitled “Equity Compensation Plan Information.”

Stock Performance Graph

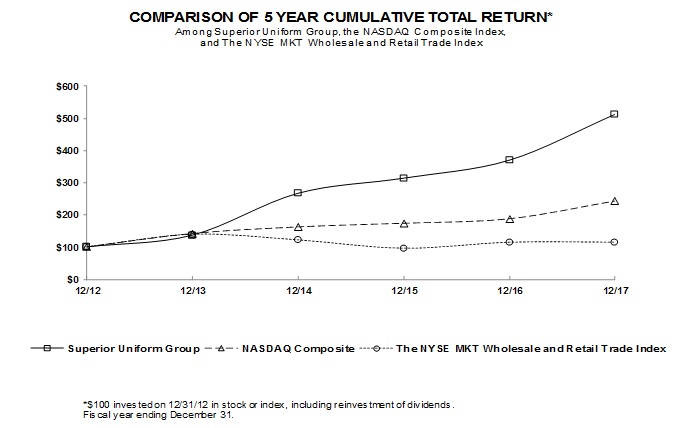

The following graph shows a five-year comparison of the cumulative total return on $100 invested in our common stock, The NASDAQ Composite Index and The NYSE MKT Wholesale and Retail Trade Index, which is comprised of all NYSE American companies with SIC codes from 5000 through 5999.

The graph illustrates the cumulative values at the end of each succeeding fiscal year resulting from the change in the stock price, assuming a reinvestment of dividends. Over the five year period, Superior Uniform Group, Inc. stock grew to $512.74, compared to $242.29 for the NASDAQ Composite Index and $114.87 for the NYSE Wholesale and Retail Trade Index.

|

12/12 |

12/13 |

12/14 |

12/15 |

12/16 |

12/17 |

|||||||||||||||||||

|

Superior Uniform Group |

100.00 | 136.44 | 266.84 | 314.06 | 369.92 | 512.74 | ||||||||||||||||||

|

NASDAQ Composite |

100.00 | 141.63 | 162.09 | 173.33 | 187.19 | 242.29 | ||||||||||||||||||

|

NYSE MKT Wholesale and Retail Trade Index |

100.00 | 139.71 | 122.06 | 95.92 | 114.65 | 114.87 | ||||||||||||||||||

Issuer Purchases of Equity Securities

The table below sets forth information with respect to purchases made by or on behalf of Superior Uniform Group, Inc. or any “affiliated purchaser” (as defined in Rule 10b-18(a)(3) under the Exchange Act) of our common shares during the three months ended December 31, 2017.

|

Period |

(a) Total Number of Shares Purchased |

(b) Average Price Paid per Share |

(c) Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs |

(d) Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs1 |

|

Month #1 |

|

|

|

|

|

(October 1, 2017 to |

- |

- |

- |

|

|

October 31, 2017) |

|

|

|

|

|

Month #2 |

|

|

|

|

|

(November 1, 2017 to |

- |

- |

- |

|

|

November 30, 2017) |

|

|

|

|

|

Month #3 |

|

|

|

|

|

(December 1, 2017 to |

- |

- |

- |

|

|

December 31, 2017) |

|

|

|

|

|

TOTAL |

- |

- |

- |

216,575 |

1On August 1, 2008, the Company’s Board of Directors approved an increase to the outstanding authorization to allow for the repurchase of 1,000,000 additional shares of the Company’s outstanding shares of common stock. There is no expiration date or other restriction governing the period over which we can make our share repurchases under the program. All such purchases were open market transactions.

Item 6. Selected Financial Data

You should read the following selected consolidated financial data together with our consolidated financial statements and the related notes and with "Item 7" - Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this Form 10-K.

We have derived the consolidated statement of operations data for the years ended December 31, 2017, 2016, and 2015 and the consolidated balance sheet data as of December 31, 2017 and 2016 from our audited consolidated financial statements, which are included elsewhere in this Form 10-K. We have derived the consolidated statements of operations data for the years ended December 31, 2014 and 2013 and the consolidated balance sheet data as of December 31, 2015, 2014, and 2013 from our audited consolidated financial statements that are not included in this Form 10K. Our historical results for any prior period are not indicative of results to be expected in any future period.

|

SUPERIOR UNIFORM GROUP, INC. AND SUBSIDIARIES |

|

FIVE YEAR FINANCIAL SUMMARY |

|

YEARS ENDED DECEMBER 31, |

|

(In thousands, except per share amounts) |

|

2017 |

2016 |

2015 |

2014 |

2013 |

||||||||||||||||

|

Net sales |

$ | 266,814 | $ | 252,596 | $ | 210,317 | $ | 196,249 | $ | 151,496 | ||||||||||

|

Costs and expenses: |

||||||||||||||||||||

|

Cost of goods sold |

170,462 | 165,614 | 138,884 | 127,512 | 98,938 | |||||||||||||||

|

Selling and administrative expenses |

71,816 | 66,396 | 52,018 | 50,724 | 43,873 | |||||||||||||||

|

Interest expense |

802 | 688 | 519 | 484 | 195 | |||||||||||||||

| 243,080 | 232,698 | 191,421 | 178,720 | 143,006 | ||||||||||||||||

|

Gain on sale of property, plant and equipment |

1,048 | - | - | - | - | |||||||||||||||

|

Income before taxes on income |

24,782 | 19,898 | 18,896 | 17,529 | 8,490 | |||||||||||||||

|

Taxes on income |

9,760 | 5,260 | 5,830 | 6,180 | 2,640 | |||||||||||||||

|

Net income |

$ | 15,022 | $ | 14,638 | $ | 13,066 | $ | 11,349 | $ | 5,850 | ||||||||||

|

Per Share Data: |

||||||||||||||||||||

|

Basic |

||||||||||||||||||||

|

Net income |

$ | 1.04 | $ | 1.04 | $ | 0.95 | $ | 0.85 | $ | 0.47 | ||||||||||

|

Diluted |

||||||||||||||||||||

|

Net income |

$ | 0.99 | $ | 0.98 | $ | 0.90 | $ | 0.82 | $ | 0.46 | ||||||||||

|

Cash dividends per common share |

$ | 0.365 | $ | 0.340 | $ | 0.315 | $ | 0.285 | $ | 0.068 | ||||||||||

|

At year end: |

||||||||||||||||||||

|

Total assets |

$ | 218,938 | $ | 196,848 | $ | 151,731 | $ | 139,937 | $ | 125,494 | ||||||||||

|

Long-term debt |

$ | 32,933 | $ | 36,227 | $ | 21,131 | $ | 22,660 | $ | 24,500 | ||||||||||

|

Working capital |

$ | 95,315 | $ | 93,107 | $ | 79,380 | $ | 77,191 | $ | 69,801 | ||||||||||

|

Shareholders' equity |

$ | 124,968 | $ | 110,550 | $ | 92,690 | $ | 80,412 | $ | 71,935 | ||||||||||

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion should be read in conjunction with our consolidated financial statements, which present our results of operations for the years ended December 31, 2017, 2016 and 2015, as well as our financial positions at December 31, 2017 and 2016, contained elsewhere in this Form 10-K. Some of the information contained in this discussion and analysis or set forth elsewhere in this Form 10-K, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. You should review the “Special Note Regarding Forward Looking Statements” and “Risk Factors” sections of this Form 10-K for a discussion of important factors that could cause actual results to differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis.

Recent Acquisitions

As described in “Item 1. Business – Overview,” on March 8, 2016, the Company closed on the acquisition of substantially all of the assets of BAMKO, Inc. with an effective date of March 1, 2016. BAMKO is a full-service merchandise sourcing and promotional products company based in Los Angeles, CA. The purchase price for the asset acquisition consisted of approximately $15.2 million cash, net of cash acquired, the issuance of approximately 324,000 restricted shares of Superior’s common stock that vests over a five-year period, the potential future payments of approximately $5.5 million in additional contingent consideration through 2021, and the assumption of certain liabilities of BAMKO. Depending on the context, when using the term “BAMKO” in this Form 10-K, we refer either to the Company’s wholly-owned subsidiary housing the acquired business (BAMKO, LLC) or to the business acquired in the transaction, as subsequently grown through additional acquisitions.

On August 21, 2017, the Company, BAMKO, acquired substantially all of the assets of PublicIdentity, Inc. (“Public Identity”). Public Identity is a promotional products and branded merchandise agency that provides promotional products and branded merchandise to corporate clients and universities. The purchase price consisted of $0.8 million in cash, the issuance of approximately 54,000 restricted shares of Superior’s common stock and future payments of approximately $0.4 million in additional consideration through 2020. The majority of the shares issued vest over a three-year period.

On November 30, 2017, BAMKO closed on the acquisition of substantially all of the assets of Tangerine Promotions, Ltd. and Tangerine Promotions West, Inc. (collectively “Tangerine”). The transaction had an effective date of December 1, 2017. Tangerine is a promotional products and branded merchandise agency that serves many well-known brands. The company is one of the leading providers of Point-of-Purchase (POP) and Point-of-Sale (POS) merchandise in the country. The purchase price for the asset acquisition consisted of approximately $7.2 million in cash, subject to adjustment, the issuance of approximately 83,000 restricted shares of Superior’s common stock that vests over a four-year period, the potential future payments of approximately $5.5 million in additional contingent consideration through 2021, and the assumption of certain liabilities of Tangerine.

Primarily as a result of its acquisition of BAMKO, Superior realigned its organizational structure and updated its reportable operating segments. A new Promotional Products segment has been created and consists of sales to customers of promotional products. Superior is now comprised of three reportable business segments: (1) Uniforms and Related Products, (2) Remote Staffing Solutions, and (3) Promotional Products.

Business Outlook

Uniforms and Related Products

Historically, we have manufactured and sold a wide range of uniforms, career apparel and accessories, which comprises our Uniforms and Related Products segment. Our primary products are provided to workers employed by our customers and, as a result, our business prospects are dependent upon levels of employment and overall economic conditions, among other factors. Our revenues are impacted by our customers’ opening and closing of locations and reductions and increases in headcount. Additionally, voluntary employee turnover at our customers can have a significant impact on our business. The current economic environment in the United States is continuing to see moderate improvement in the employment environment and voluntary employee turnover has been increasing. We also continue to see an increase in the demand for employees in the healthcare sector. These factors are expected to have positive impacts on our prospects for growth in net sales in 2018.

We have continued our efforts to increase penetration of the health care market. We have been and continue to pursue acquisitions to increase our market share in the Uniforms and Related Products segment.

Remote Staffing Solutions

This business segment, which operates in El Salvador, Belize and the United States, was initially started to provide remote staffing services for the Company at a lower cost structure in order to improve our own operating results. It has in fact enabled us to reduce operating expenses in our Uniforms and Related Products segment and to more effectively service our customers’ needs in that segment. We began selling remote staffing services to other companies at the end of 2009. We have grown this business from approximately $1.0 million in net sales to outside customers in 2010 to approximately $19.3 million in net sales to outside customers in 2017. We have spent significant effort over the last several years improving the depth of our management infrastructure and expanding our facilities in this segment to support significant growth in this segment in 2018 and beyond. We increased net sales to outside customers in this segment by approximately 34% in 2017 compared to 2016, 20% in 2016 as compared to 2015 and 49% in 2015 compared to 2014.

Promotional Products

We have been involved in the sale of promotional products, on a limited basis, to our Uniforms and Related Products customers for over a decade. However, we lacked the scale and expertise to be a recognized name in this market prior to our acquisition of substantially all of the assets of BAMKO effective March 1, 2016. BAMKO has been operating in the promotional products industry for more than 15 years and we believe that BAMKO’s strong back office and support systems located in India, China and Hong Kong, as well as their “direct to factory” sourcing operations provide us with a competitive advantage. We believe that BAMKO has well developed systems and processes that can serve as a platform for additional acquisitions that we expect to complete in this highly fragmented market - we believe this product line is a synergistic fit with our uniform business. We completed two additional acquisitions in this segment in late 2017.

Year Ended December 31, 2017 vs. 2016

Operations

Net Sales

|

(In thousands, except percentages) |

||||||||||||

|

2017 |

2016 |

% Change |

||||||||||

|

Uniforms and Related Products |

$ | 204,644 | $ | 210,373 | (2.7 |

%) |

||||||

|

Remote Staffing Solutions |

23,021 | 17,953 | 28.2 | |||||||||

|

Promotional Products |

42,904 | 27,816 | 54.2 | |||||||||

|

Net intersegment eliminations |

(3,755 | ) | (3,546 | ) | 5.9 | |||||||

|

Consolidated Net Sales |

$ | 266,814 | $ | 252,596 | 5.6 |

% |

||||||

Net Sales

Net sales for the Company increased 5.6% from $252.6 million in 2016 to $266.8 million in 2017. The aggregate increase in net sales is attributed to the acquisitions of BAMKO effective March 1, 2016, Public Identity on August 21, 2017, and Tangerine on December 1, 2017 (contributing 6.0%), increases in net sales after intersegment eliminations from our Remote Staffing Solutions segment (contributing 1.9%), partially offset by a reduction in net sales from our Uniforms and Related Products segment (contributing a decrease of 2.3%).

Uniforms and Related Products net sales decreased 2.7% in 2017 compared to 2016. The decrease in net sales in this segment is attributed to several factors. One of our larger customers was acquired by one of its competitors in 2016. The acquiring company was serviced by a different uniform provider that has taken over this account. We will continue to service this customer at a reduced rate. The net reduction from this customer was approximately $4.6 million. The reduction of recurring sales to this customer was partially offset by sales of remaining inventory in the second quarter. Finally, one of our large customers elected not to repeat two large promotional uniform programs that have been a part of their business for several years now. This resulted in a decrease in net sales of approximately $2.9 million. These decreases were partially offset by continued market penetration and increases in voluntary employee turnover.

Remote Staffing Solutions net sales increased 28.2% before intersegment eliminations and 33.7% after intersegment eliminations in 2017. These increases are attributed to continued market penetration in 2017, both with respect to new and existing customers.

Promotional Products net sales increased 54.2% in 2017 compared to the period from the BAMKO acquisition date of March 1, 2016 through December 31, 2016. The increase is partially due to two additional months of sales in 2017 (contributing 23.0%), and two acquisitions in the latter part of 2017 (contributing 16.0%). The balance of the increase is primarily due to new customer acquisitions and expanded programs with existing customers.

Cost of Goods Sold

Cost of goods sold consists primarily of direct costs of acquiring inventory, including cost of merchandise, inbound freight charges, purchasing costs, and inspection costs for our Uniforms and Related Products and Promotional Products segments. Cost of goods sold for our Remote Staffing Solutions segment includes salaries and payroll related benefits for agents. The Company includes shipping and handling fees billed to customers in net sales. Shipping and handling costs associated with out-bound freight are generally recorded in cost of goods sold. Other shipping and handling costs are included in selling and administrative expenses.

As a percentage of net sales, cost of goods sold for our Uniforms and Related Products segment was 64.6% in 2017 and 66.7% in 2016. The decrease as a percentage of net sales is primarily attributed to a decrease in direct product costs as a percentage of net sales during 2017.

As a percentage of net sales, cost of goods sold for our Remote Staffing Solutions segment was 45.9% in 2017, and 46.4% in 2016. The percentage decrease in 2017 as compared to 2016 is primarily attributed to a decrease in the percentage of segment revenue coming from the domestic portion of our Remote Staffing Solutions segment from 29.2% in 2016 to 19.8% in 2017. The hourly rates charged for domestic services are higher than offshore services but the margin percentage earned is lower.

As a percentage of net sales, cost of goods sold for our Promotional Products segment was 67.7% in 2017 and 65.2% in 2016. Cost of goods sold as a percentage of revenue for this segment can fluctuate based on the service requirements of individual contracts.

Selling and Administrative Expenses

As a percentage of net sales, selling and administrative expenses for our Uniforms and Related Products segment approximated 24.8% in 2016 and 26.4% in 2017. The increase as a percentage of net sales was primarily due to lower net sales in 2017 to cover operating expenses (contributing 0.7%) and increased salaries, wages and benefits exclusive of medical costs (contributing 0.5%), higher bad debt expense due primarily to a customer bankruptcy (contributing 0.3%) and other minor increases (contributing 0.3%). These increases were partially offset by lower medical claims in 2017 (contributing 0.2%).

As a percentage of net sales, selling and administrative expenses for our Remote Staffing Solutions segment approximated 34.2% in 2017 and 34.0% in 2016. The increase as a percentage of net sales is attributed primarily to an increase in payroll related costs (contributing 3.3%), higher broker fees (contributing 1.1%), higher facilities costs and depreciation due to our expanded facility in El Salvador (contributing 2.2%) and other minor increases (contributing 3.4%). These increases were mostly offset by higher net sales to cover operating expenses (contributing 9.8%).

As a percentage of net sales, selling and administrative expenses for our Promotional Products segment were 28.4% in 2017 and 37.3% from the BAMKO acquisition date of March 1, 2016 through December 31, 2016. Included within these expenses for 2017 was approximately $0.3 million in of expenses for acquisitions. Included within these expenses for 2016 was approximately $1.1 million of expenses associated with the BAMKO acquisition. Net of these acquisition related expenses, selling and administrative expenses would have been 27.3% of net sales in 2017 and 33.2% of net sales in 2016. The decrease is primarily related to higher sales to cover operating costs, partially offset by a higher payroll related costs (contributing 1.8%) and a lower gain on foreign currency (contributing 0.9%).

Gain on Sale of Property, Plant and Equipment

In the quarter ended March 31, 2017, we sold our former call center building and related assets in El Salvador in our Remote Staffing Solutions segment for net proceeds of $2.8 million and realized a gain on sale of $1.0 million.

Interest Expense

Interest expense increased to $0.8 million for the year ended December 31, 2017 from $0.7 million for the year ended December 31, 2016. This increase is attributed primarily to higher average borrowings outstanding primarily due to the BAMKO acquisition.

Income Taxes

On December 22, 2017, the U.S. enacted the Tax Cuts and Jobs Act (“Tax Act”) that instituted fundamental changes to the U.S. tax system. The Tax Act includes changes to the taxation of foreign earnings by implementing a dividend exemption system, expansion of the current anti-deferral rules, a minimum tax on low-taxed foreign earnings and new measures to deter base erosion. The Tax Act also permanently reduces the corporate tax rate from 34% to 21%, imposes a one-time mandatory transition tax on the historical earnings of foreign affiliates and implements a territorial style tax system. The impacts of these changes are reflected in the 2017 tax expense which resulted in a provisional charge of approximately $4.0 million, which is subject to adjustment given the provisional nature of the charge. This resulted in an effective tax rate higher than the statutory rate in 2017. As a result of the transition tax under The Act, the Company will no longer consider its undistributed earnings from foreign subsidiaries as indefinitely reinvested and has provided a deferred tax liability primarily for foreign withholding taxes that would be expected to apply when the Company dividends these earnings back to the United States. The effective income tax rate in 2017 was 39.4% and in 2016 was 26.4%. The 13.0% increase in the effective tax rate is attributed primarily to the Tax Act (17.1%) and other increases (0.1), partially offset by an increase in the benefit of foreign sourced income (1.4%) and an increase in the excess tax benefit associated with share based compensation (2.8%).

The Company currently expects an effective tax rate for 2018 to be slightly below the statutory rate. The effective tax rate may vary from quarter to quarter due to unusual or infrequently occurring items, the resolution of income tax audits, changes in tax laws, the tax impact from employee share-based payments, taxes incurred in connection to the territorial style tax system, or other items.

The Tax Act imposes a U.S. tax on global intangible low taxed income (“GILTI”) that is earned by certain foreign affiliates owned by a U.S. shareholder. The computation of GILTI is still subject to interpretation and additional clarifying guidance is expected, but is generally intended to impose tax on the earnings of a foreign corporation that are deemed to exceed a certain threshold return relative to the underlying business investment. In accordance with guidance issued by FASB, the Company has made a policy election to treat future taxes related to GILTI as a current period expense in the reporting period in which the tax is incurred. The company does expect to be impacted by GILTI relative to the earnings of its foreign subsidiaries in 2018 and beyond.

For further discussion of changes in the effective tax rate, refer to the Note 7 to the Consolidated Financial Statements.

Year Ended December 31, 2016 vs. 2015

Operations

Net Sales

|

(In thousands, except percentages) |

||||||||||||

|

2016 |

2015 |

% Change |

||||||||||

|

Uniforms and Related Products |

$ | 210,373 | $ | 198,319 | 6.1 |

% |

||||||

|

Remote Staffing Solutions |

17,953 | 15,604 | 15.1 | |||||||||

|

Promotional Products |

27,816 | - | N/A | |||||||||

|

Net intersegment eliminations |

(3,546 | ) | (3,606 | ) | (1.7 | ) | ||||||

|

Consolidated Net Sales |

$ | 252,596 | $ | 210,317 | 20.1 |

% |

||||||

Net Sales

Net sales for the Company increased 20.1% from $210.3 million in 2015 to $252.6 million in 2016. The aggregate increase in net sales is split between growth in our Uniforms and Related Products segment (contributing 5.8%), increases in net sales after intersegment eliminations from our Remote Staffing Solutions segment (contributing 1.1%) and the effect of the acquisition of BAMKO in our new Promotional Products segment (contributing 13.2%).

Uniforms and Related Products net sales increased 6.1% in 2016 compared to 2015. The increase in net sales is attributed primarily to our continued market penetration as well as continued increases in voluntary employee turnover in the marketplace.

Remote Staffing Solutions net sales increased 15.1% before intersegment eliminations and 20.1% after intersegment eliminations in 2016. These increases are attributed to continued market penetration in 2016, both with respect to new and existing customers.

Promotional Products net sales of $27.8 million, from the acquisition date of March 1, 2016 through December 31, 2016 represented 11.0% of consolidated net sales in 2016.

Cost of Goods Sold