UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to §240.14a-12

Superior Uniform Group, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X ] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

1. |

Title of each class of securities to which transaction applies: |

|

2. |

Aggregate number of securities to which transaction applies: |

|

3. |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|

4. |

Proposed maximum aggregate value of transaction: |

|

5. |

Total fee paid: |

|

[ ] |

Fee paid previously with preliminary materials: |

|

[ ] |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

1. |

Amount previously paid: |

|

|

2. |

Form, Schedule or Registration Statement No.: |

|

|

3. |

Filing Party: |

|

|

4. |

Date Filed: |

|

|

Superior Uniform Group, Inc. 10055 Seminole Boulevard Seminole, FL 33772-2539 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 1, 2015

NOTICE IS HEREBY GIVEN that the Annual Meeting of the shareholders of SUPERIOR UNIFORM GROUP, INC., (the "Company") will be held at the offices of the Company, 10055 Seminole Boulevard, Seminole, Florida, 33772 on May 1, 2015 at 12:00 p.m. (Local Time) for the following purposes:

|

1. |

To elect six Directors to hold office until the next annual meeting of shareholders and until their respective successors are duly elected or appointed and qualified; |

|

2. |

To ratify the appointment of Mayer Hoffman McCann P.C. as our independent auditors for the year ending December 31, 2015; and |

|

3. |

To transact such other business as may properly come before the meeting or any adjournment thereof. |

The close of business on February 25, 2015 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the meeting and any adjournment thereof.

You are cordially invited to attend the meeting. Whether or not you plan to attend the meeting, please cast your votes as instructed on your proxy card or voting instruction form as promptly as possible to ensure that your shares are represented and voted in accordance with your wishes.

By Order of the Board of Directors,

|

Seminole, Florida, March 16, 2015 |

JORDAN M. ALPERT |

| Secretary |

IMPORTANT

TO ENSURE YOUR REPRESENTATION AT THIS MEETING PLEASE MARK,

DATE AND SIGN THE ENCLOSED PROXY AND RETURN IT

PROMPTLY. THANK YOU.

SUPERIOR UNIFORM GROUP, INC.

10055 Seminole Boulevard

Seminole, Florida 33772

PROXY STATEMENT FOR 2015

ANNUAL MEETING OF SHAREHOLDERS

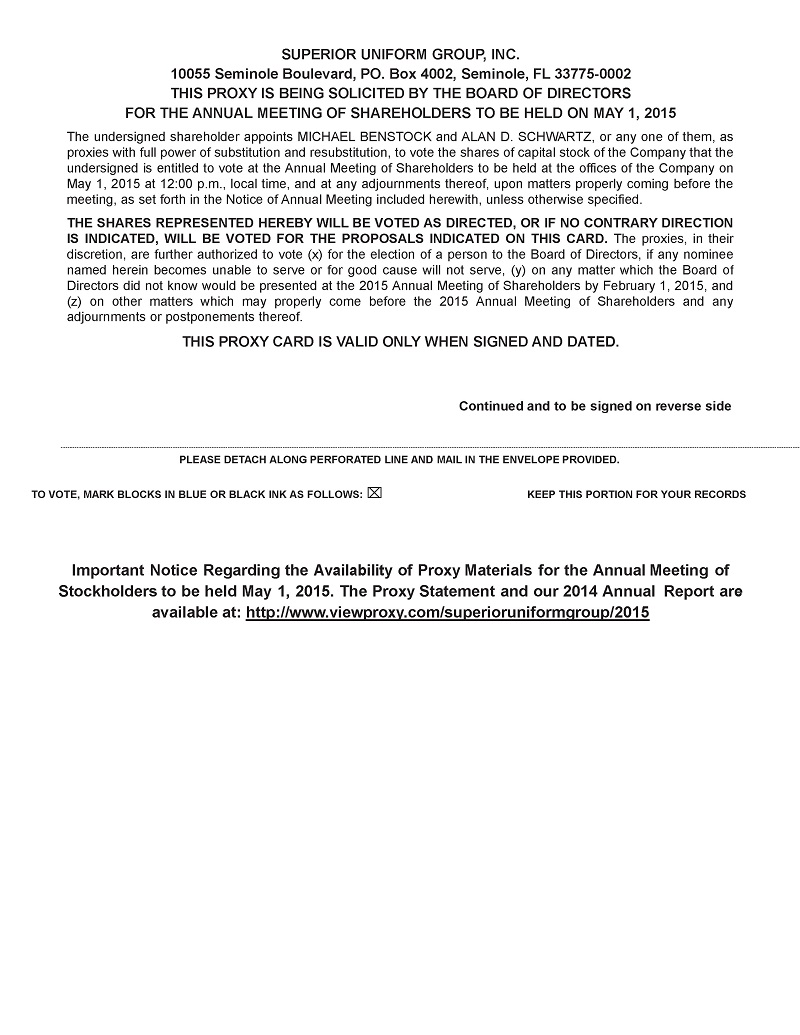

This proxy statement and the accompanying form of proxy are first being sent to our shareholders on or about March 16, 2015 in connection with the solicitation by our Board of Directors of proxies to be used at our 2015 annual meeting of shareholders (the “Annual Meeting”). The Annual Meeting will be held on Friday, May 1, 2015, at 12:00 p.m., (Local Time) at the offices of Superior Uniform Group, Inc. (the “Company,” “we,” “our,” and “us”), 10055 Seminole Boulevard, Seminole, Florida 33772.

Our Board of Directors has designated Michael Benstock and Alan Schwartz, and each or any of them, as proxies to vote the shares of common stock solicited on its behalf. If you sign and return the accompanying form of proxy, you may nevertheless revoke it at any time before it is exercised by (1) giving timely written notice to our Corporate Secretary, (2) timely delivering a later dated proxy, or (3) attending the Annual Meeting and voting in person. The shares represented by your proxy will be voted unless the proxy is mutilated or otherwise received in such form or at such time as to render it not votable. Proxies will be tabulated by Alliance Advisors.

If the Annual Meeting is adjourned for any reason, at any subsequent reconvening of the Annual Meeting all proxies may be voted in the same manner as the proxies would have been voted at the original convening of the Annual Meeting (except for any proxies that have been properly revoked or withdrawn).

The close of business on February 25, 2015 has been designated as the record date for the determination of shareholders entitled to receive notice of and to vote at the Annual Meeting (the “Record Date”). As of February 25, 2015, 13,599,969 shares of the Company's common stock, par value $.001 per share (the "Common Stock"), were issued and outstanding. Each shareholder will be entitled to one vote for each share of Common Stock registered in his or her name on the books of the Company on the close of business on the Record Date for the Annual Meeting on all matters that come before the Annual Meeting.

INTERNET AVAILABILITY OF PROXY MATERIALS

Under rules approved by the Securities Exchange Commission (“SEC”), the Company is furnishing proxy materials on the Internet in addition to mailing paper copies of the materials to each shareholder of record. Instructions on how to access and review the proxy materials on the Internet can be found on the proxy card and on the Notice of Internet Availability of Proxy Materials (the “Notice”) sent to shareholders who hold their shares in “street name” (i.e. in the name of a broker, bank or other record holder). The Notice will also include instructions for shareholders who hold their shares in street name on how to access the proxy card to vote over the Internet. Voting over the Internet will not affect your right to vote in person if you decide to attend the Annual Meeting.

All shareholders should refer to their proxy card or their Notice for their viewing, voting and hard copy ordering needs, which may include Internet and telephone voting options.

INTERNET ACCESS OR ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS

If you have previously signed up to receive shareholder materials, including proxy statements and annual reports by mail, you may choose to receive these materials by accessing the Internet in the future, which can help us achieve a substantial reduction in our printing and mailing costs as well as be environmentally friendly. If you choose to receive your proxy materials by accessing the Internet, then before next year’s annual meeting, you will receive a Notice when the proxy materials and annual report are available over the Internet.

Your election to receive your proxy materials by accessing the Internet will remain in effect for all future shareholder meetings unless you revoke it before the meeting by contacting Joan Petronella at our offices at 10055 Seminole Boulevard, Seminole, Florida 33772, phone: (727) 397-9611, ext. 1309.

If you hold your shares in an account at a brokerage firm or bank participating in a “street name” program, you can sign up for delivery of proxy materials in the future by contacting your broker.

HOUSEHOLDING

The Securities and Exchange Commission’s rules permit us to deliver a single set of annual meeting materials to one address shared by two or more of our shareholders. This delivery method is referred to as “householding” and can result in significant cost savings. To take advantage of this opportunity, we have delivered only one Notice or proxy statement and annual report, as applicable, to multiple shareholders who share an address, unless we received contrary instructions from the impacted shareholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate copy of the Notice, proxy statement or annual report, as applicable, to any shareholder at a shared address to which a single copy of those documents was delivered. If you prefer to receive separate copies of the Notice, proxy statement or annual report (with respect to the Annual Meeting or in the future), contact Joan Petronella at our offices at 10055 Seminole Boulevard, Seminole, Florida, 33772, phone: (727) 397-9611, ext. 1309.

If you are currently a shareholder sharing an address with another shareholder and wish to receive only one copy of future Notices, proxy statements or annual reports for your household, please contact Joan Petronella at our offices at 10055 Seminole Boulevard, Seminole, Florida 33772, phone: (727) 397-9611, ext. 1309.

VOTING SECURITIES

Quorum

The Company’s Bylaws provide that the holders of a majority of the shares of the Company’s common stock issued and outstanding on the Record Date and entitled to vote must be present in person or by proxy at the Annual Meeting in order to have a quorum for the transaction of business. Abstentions will be counted as present for purposes of determining the presence of a quorum. Shares held by brokers, banks or other nominees for beneficial owners (which we refer to as “brokers”) will also be counted for purposes of determining whether a quorum is present if the broker has the discretion to vote on at least one of the matters presented, even though the broker may not exercise discretionary voting power with respect to other matters and even though voting instructions have not been received from the beneficial owner (a “broker non-vote”). Brokers have discretionary voting power with respect to the ratification of the appointment of Mayer Hoffman McCann P.C. as independent auditors for 2015.

Votes Required

If a quorum is present, the six nominees for director receiving the highest number of affirmative votes of the shares present or represented and entitled to be voted for them shall be elected as directors. Abstentions and broker non-votes will not affect the outcome of the vote on such proposal.

In order to ratify the appointment of Mayer Hoffman McCann P.C. as independent auditors for 2015, abstentions will be disregarded and will not be counted as votes for or against such proposal. However, since brokers may exercise discretionary voting power with respect to this proposal, a shareholder’s failure to provide voting instructions will not prevent a broker vote and can therefore affect the outcome of the auditor ratification proposal.

We note that your broker will NOT be able to vote your shares with respect to the election of directors if you have not provided voting instructions to your broker. We strongly encourage you to complete and submit your proxy card and exercise your right to vote as a shareholder.

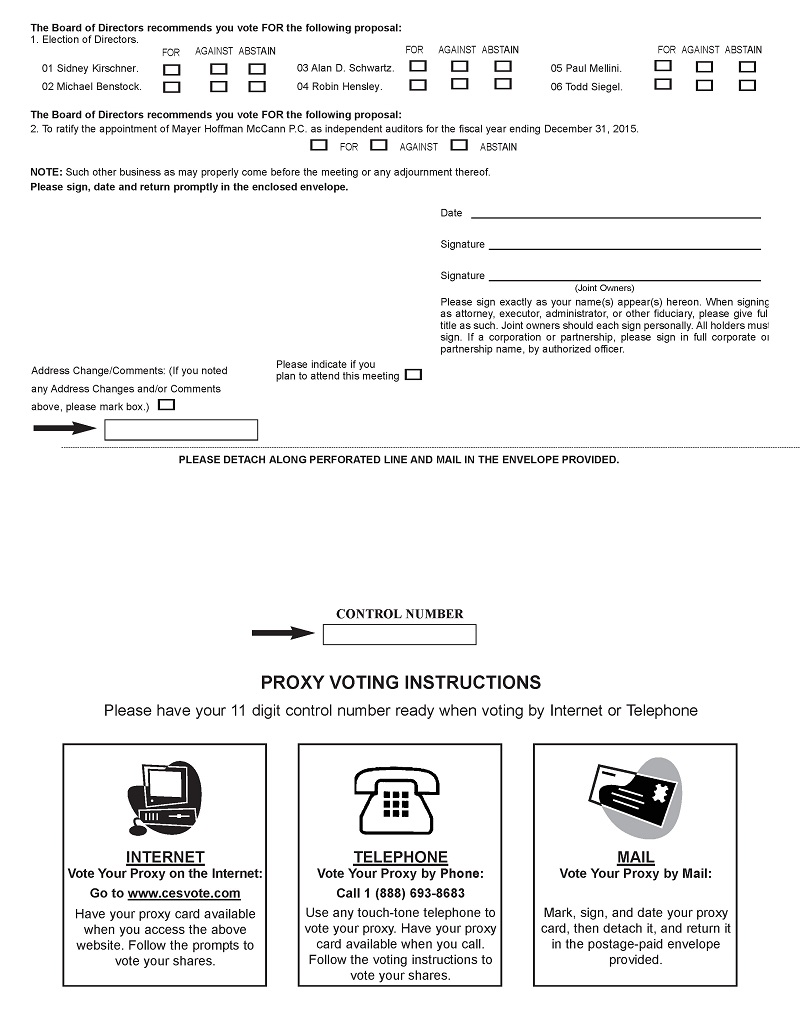

ELECTION OF DIRECTORS (Proposal 1)

The Bylaws of the Company set the size of the Board of Directors at not less than three nor more than nine members. The size of the Board of Directors is currently set at six members. As described below, the Board of Directors is nominating six (6) Directors to be elected at the Annual Meeting. The Board of Directors determined to maintain its current size of six members, and, as it deems appropriate, seek to fill the vacancies resulting from nominating fewer nominees than authorized by the Company’s Bylaws. Directors generally hold their positions until the annual meeting at which time their term expires and their respective successors are duly elected and qualified.

The Board of Directors recommends that six (6) Directors be elected at the Annual Meeting to hold office until the Company's annual meeting in 2016 and until their successors are duly elected and qualified or until their earlier resignation, removal from office or death. The persons designated as nominees for election as director to serve the term described above are Sidney Kirschner, Michael Benstock, Alan D. Schwartz, Robin M. Hensley, Paul Mellini and Todd Siegel. See "Management - Directors and Executive Officers" for further information on such nominees. In the event any of the nominees should be unable to serve, which is not anticipated, the Board of Directors may designate substitute nominees, in which event the persons named in the enclosed proxy will vote for such other person or persons for the office of Director as the Board of Directors may recommend.

Shareholders may vote for up to six (6) nominees and the six (6) nominees receiving the highest number of votes shall be elected. Shareholders may not vote cumulatively in the election of Directors.

The Board of Directors recommends a vote “FOR” each of the nominees.

MANAGEMENT

Directors and Executive Officers

The following table sets forth the names and ages of the Company’s director-nominees and executive officers as of March, 2015 and the positions they hold with the Company. Executive officers serve at the pleasure of the Board of Directors.

|

Name |

Age |

Position | |

|

Sidney Kirschner |

80 |

Chairperson of the Board and a member of the Audit, Corporate Governance, Nominating & Ethics, Compensation*, and Executive* Committees. | |

|

Michael Benstock |

59 |

Chief Executive Officer, Director, and a member of the Executive Committee. | |

|

Alan D. Schwartz |

64 |

President, Director, and a member of the Executive Committee. | |

|

Robin M. Hensley |

58 |

Director and a member of the Audit* Committee. | |

|

Paul Mellini |

62 |

Director and a member of the Audit, Corporate Governance, Nominating & Ethics*, and Compensation Committees. | |

|

Todd Siegel |

56 |

Director and a member of Corporate Governance, Nominating & Ethics Committee. | |

|

Peter Benstock |

53 |

Executive Vice President. | |

|

Andrew D. Demott, Jr. |

51 |

Executive Vice President, Chief Financial Officer and Treasurer. | |

|

Dominic Leide |

39 |

President, The Office Gurus and Vice President of Administration and Customer Support. | |

|

Jordan M. Alpert |

38 |

Vice President, General Counsel and Secretary. | |

|

* Chairperson of the Committee |

The following includes information about the skills, qualities, experience and attributes of each of the nominees and executive officers of the Company:

Sidney Kirschner is the Chairperson of the Board of Directors. He has served in this capacity since July 1, 2012. He has been a Director of the Company since September 25, 1996. Since December 2010, he has been chief executive officer of Piedmont Physicians, a comprehensive healthcare provider in the Southeast region. From March 2006 until December 2010, he was Head of The Alfred and Adele Davis Academy, which is an educational institution for children from kindergarten through eighth grade. He retired in August 2004 as chairperson and chief executive officer of Northside Hospital, Inc., positions that he had held since November 1992. Prior thereto, he served as chairperson of the board and president and chief executive officer of National Service Industries, Inc. National Service Industries was a conglomerate, including operations in the textile rental business. He also currently serves as a director of Crown Crafts, Inc. Mr. Kirschner’s tenure and significant contributions on the Board of the Company, and his extensive experience as a chief executive, are the reasons for his nomination for re-election.

Michael Benstock has served as Chief Executive Officer of the Company since October 24, 2003. Mr. Benstock previously served as Co-President of the Company beginning May 1, 1992. Prior to such date, Mr. Benstock served as Executive Vice President of the Company. Mr. Benstock has served as a Director of the Company since 1985. He also serves as a director of USAmeriBank, Inc. Mr. Benstock’s vast experience with the Company is the reason for his nomination for re-election.

Alan D. Schwartz has served as President of the Company since October 24, 2003. Mr. Schwartz previously served as Co-President of the Company beginning May 1, 1992. Prior to such date, Mr. Schwartz served as Executive Vice President of the Company. Mr. Schwartz has served as a Director of the Company since 1981. Mr. Schwartz’s vast experience with the Company is the reason for his nomination for re-election.

Robin M. Hensley has been a Director of the Company since July 28, 2000. She has served as president and business development coach of Raising the Bar since May 2004. Raising the Bar provides executive coaching, primarily in the area of business development. Previously, she was president of Personal Construction, LLC from January 2000 until May 2004. Prior thereto, she was vice president of Patton Construction from December 1995 to January 2000. Her background also includes experience in public accounting with Ernst & Young. Ms. Hensley’s contributions on the Audit Committee, as the chairperson and financial expert, and her extensive experience in executive coaching are the reasons for her nomination for re-election.

Paul Mellini has been a Director of the Company since May 7, 2004. Mr. Mellini has been chief executive officer and president of Nature Coast Bank in Citrus County, Florida since March 7, 2005. He is also a board member (treasurer) of the Citrus County Economic Development Association. He was chief executive officer and president of Premier Community Bank of Florida and Premier Community Bank of South Florida from January 2002 until August 2004 and chief executive officer and president of PCB Bancorp Inc. from January 2003 until August 2004. Prior thereto, he was regional president of First Union Bank of the Greater Bay Area from April 1995 to December 2001. Mr. Mellini’s tenure and significant contributions on the Board of the Company, and his extensive experience as a chief executive, are the reasons for his nomination for re-election.

Todd Siegel has been a Director of the Company since February 7, 2014. He served as president and chief executive officer of MTS Medication Technologies, Inc. from approximately 1992 to 2012, chairman from 1993 to 2009 and a director from approximately 1986 to 2012. MTS Medication Technologies was a publicly-held company through December 2009. Mr. Siegel previously served at MTS Medication Technologies in other capacities, including executive vice president, vice president of sales and marketing and corporate secretary. MTS Medication Technologies manufactures and markets pharmaceutical packaging automation and the related consumable supplies. Prior to his tenure with MTS Medication Technologies, Mr. Siegel was an account executive for AMI Diagnostic Service, a diagnostic imaging company, and held sales and national sales management positions with Chamberlin Corporation, a pharmaceutical manufacturer. Mr. Siegel’s extensive experience as chief executive, chairman, and director of a publicly-held company are the reasons for his nomination for election.

Peter Benstock has served as Executive Vice President of the Company since February 8, 2002. In that role, Mr. Benstock is responsible for the Company’s sales efforts. Before such date, Mr. Benstock served as a Senior Vice President of the Company beginning February 7, 1994. Mr. Benstock was a Director of the Company from 1990 to August 2007.

Andrew D. Demott, Jr. has served as Executive Vice President, Chief Financial Officer, and Treasurer of the Company since May 5, 2010. Formerly, he served as Senior Vice President, Chief Financial Officer, and Treasurer of the Company since February 8, 2002. Prior to that, he served as Vice President, Chief Financial Officer, and Treasurer of the Company beginning June 15, 1998. Mr. Demott served as the Company’s Secretary from July 31, 1998 through June 14, 2002. Prior to such dates, Mr. Demott served as an Audit Senior Manager with Deloitte & Touche, LLP since September 1995. Prior to that date, Mr. Demott was an Audit Manager with Deloitte & Touche LLP since September 1992.

Dominic Leide has served as the President of The Office Gurus since 2014. Formerly, he served as Managing Director of The Office Gurus since 2010. Mr. Leide also has served as Vice President of Administration and Customer Support of the Company since May 5, 2009. Formerly, he served as U.S. Manager of near-shore operations of the Company since 2008 and Director of Customer Excellence of the Company since 2007. Prior to that he served as Manager of Special Projects of the Company since 2006.

Jordan M. Alpert has served as Vice President, General Counsel, and Secretary of the Company since November 7, 2011. Before that, he served as secretary since May 6, 2011 and general counsel since March 28, 2011. Mr. Alpert previously held the position of general counsel for Grand Army Entertainment, LLC during 2010. He also was an attorney with the firms Grais & Ellsworth LLP and Willkie, Farr & Gallagher LLP during 2001-2011. Mr. Alpert has been granted Authorized House Counsel status for the Company by the State of Florida. He is admitted to the New York Bar, Southern District of New York, and Eastern District of New York.

Honorary Directors

Gerald M. Benstock has served as Chairman Emeritus of the Board of Directors since May 2, 2013. Previously, Mr. Benstock had been Chairman of the Board of Directors between October 24, 2003 and June 30, 2012. Prior to October 24, 2003, he served as Chief Executive Officer of the Company. Prior to May 1, 1992, Mr. Benstock served as President of the Company. Mr. Benstock also served as a Director of the Company from 1951 to December 31, 2012.

The following family relationships exist between the Company's Directors, nominees and executive officers. Michael Benstock and Peter Benstock are sons of Gerald M. Benstock, and Alan D. Schwartz is his son-in-law.

BOARD LEADERSHIP STRUCTURE AND ROLE IN RISK OVERSIGHT

The Board does not have a policy on whether or not the roles of Chief Executive Officer and Chairperson of the Board should be separate and, if they are to be separate, whether the Chairperson of the Board should be selected from the non-employee Directors or be an employee. The Board believes that it should be free to make a choice from time to time in any manner that is in the best interests of the Company and its shareholders.

Effective June 30, 2012, Gerald M. Benstock stepped down from his position as Chairperson of the Board. He was replaced in that role by Sidney Kirschner, effective July 1, 2012. Michael Benstock continues to serve as a Director and Chief Executive Officer. The Board of Directors believes this is the most appropriate structure for the Company at this time because it makes the best use of both individuals’ skills and experiences.

Companies face a variety of risks, including credit risk, liquidity risk, and operational risk. In fulfilling its risk oversight role, the Board focuses on the adequacy of the Company’s risk management process and overall risk management system. The Board believes an effective risk management system will (1) adequately identify the material risks that the Company faces in a timely manner, (2) implement appropriate risk management strategies that are responsive to the Company’s risk profile and specific material risk exposures, (3) integrate consideration of risk and risk management into business decision-making throughout the Company, and (4) include policies and procedures that adequately transmit necessary information with respect to material risks to senior executives and, as appropriate, to the Board or relevant committee.

The full Board also periodically receives information about the Company’s risk management system and the most significant risks that the Company faces. This is principally accomplished through management reports to the Board. The Board strives to generate serious and thoughtful attention to the Company’s risk management process and system, the nature of the material risks the Company faces, and the adequacy of the Company’s policies and procedures designed to respond to and mitigate these risks.

The Board encourages management to promote a corporate culture that understands risk management and incorporates it into the overall corporate strategy and day-to-day business operations. The Company’s risk management structure also includes an ongoing effort to assess and analyze the most likely areas of future risk for the Company. As a result, the Board periodically asks the Company’s executives to discuss the most likely sources of material future risks and how the Company is addressing any significant potential vulnerability.

DIRECTOR COMMITTEES AND MEETINGS

The Board of Directors held five meetings during 2014. In 2014, each incumbent Director who was a director in 2014 attended at least 75% of all meetings of the Board and of each committee of which he/she was a member. The Company expects all members of the Board to attend the Company’s annual meeting of shareholders barring other significant commitments or special circumstances. All of the Company’s Board members who were directors at the time attended the Company’s 2014 annual meeting of shareholders.

The Board has a standing Audit Committee, Compensation Committee and Corporate Governance, Nominating & Ethics Committee. The Board also has a standing Executive Committee.

The Board has determined that Mr. Sidney Kirschner, Ms. Robin M. Hensley, Mr. Paul Mellini, and Mr. Todd Siegel are independent, as that term is defined by the applicable rules of the Securities and Exchange Commission and The NASDAQ Stock Market LLC® (“NASDAQ”). The Board has further determined that all members of the Audit, Compensation, and Corporate Governance, Nominating & Ethics Committees are independent and satisfy the relevant Securities and Exchange Commission and NASDAQ independence requirements and other requirements for members of such committees.

The Board conducts an annual self-evaluation and an annual evaluation of the Audit Committee.

Audit Committee

The current members of the Audit Committee are Ms. Robin Hensley, Chairperson, and Messrs. Sidney Kirschner and Paul Mellini. The Audit Committee, which was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, assists the Board of Directors in fulfilling the Board’s responsibilities relating to safeguarding of assets and oversight of the quality and integrity of the accounting, auditing and reporting practices of the Company. The Board of Directors has determined that each member of the Audit Committee is independent, as that term is defined in NASDAQ listing standards applicable to audit committee members. The Board has also determined that Robin Hensley qualifies as an “audit committee financial expert,” as defined in the rules of the Securities and Exchange Commission. The Audit Committee met four times during 2014. The Audit Committee has a charter, which may be found on our website at www.superioruniformgroup.com under Investor Information.

The Audit Committee conducts an annual self-evaluation.

Compensation Committee

The current members of the Compensation Committee are Messrs. Sidney Kirschner, Chairperson, and Paul Mellini. The Board of Directors has determined that each member of the Compensation Committee is independent as defined by NASDAQ listing standards applicable to compensation committee members. The Compensation Committee met five times during 2014. The Compensation Committee has a charter, which can be found on our website at www.superioruniformgroup.com under Investor Information.

The duties and responsibilities of the Compensation Committee include to:

|

|

● |

determine and approve the compensation of the Company's Chief Executive Officer; |

|

|

● |

make recommendations to the Board with respect to executive compensation for executive officers other than the Chief Executive Officer; |

|

|

● |

review, approve, and administer incentive compensation plans and equity-based plans for executive officers, staff vice presidents, and director level employees; |

|

|

● |

review the Company’s incentive compensation arrangements to determine whether they encourage excessive risk-taking, to review and discuss at least annually the relationship between risk management policies and practices and compensation, and to evaluate compensation policies and practices that could mitigate any such risk; and |

|

|

● |

report regularly to the Board regarding its actions and make recommendations to the Board as appropriate. |

Our Chief Executive Officer currently initiates the compensation discussions with the Compensation Committee, providing requests and seeking approval from the Committee and the Board of Directors before employment arrangements or bonus plans related to executives of the Company are finalized. The Compensation Committee approves the annual incentive award for the Chief Executive Officer and each officer below the Chief Executive Officer level based on the Chief Executive Officer's recommendations. During 2014, the Committee utilized the assistance of a compensation consultant retained by the Committee and selected in accordance with the procedures specified in the Compensation Committee Charter. The consultant was tasked by the Committee to advise on the compensation of the independent members of the Board and of the Chief Executive Officer, Chief Financial Officer, and President of the Company; these Company executive officers were afforded an opportunity to provide input to the consultant concerning how compensation was structured. For additional information regarding the Compensation Committee’s processes and procedures for determining executive and director compensation, please see the footnotes to the Summary Compensation Table and Director Compensation for 2014 in the section entitled “Executive and Director Compensation” below.

As part of its decision-making process, the Compensation Committee reviews compensation practices at peer companies in an effort to set total compensation levels that it believes are reasonably competitive.

The Compensation Committee conducts an annual self-evaluation.

Corporate Governance, Nominating & Ethics Committee

The current members of the Corporate Governance, Nominating & Ethics Committee are Messrs. Paul Mellini, Chairperson, and Sidney Kirschner, and Mr. Todd Siegel. The Board of Directors has determined that each member of the Corporate Governance, Nominating & Ethics Committee is independent as defined by NASDAQ listing standards applicable to nominating committee members.

The Corporate Governance, Nominating & Ethics Committee develops and recommends to the Board of Directors a set of corporate governance principles applicable to the Company. It also assists in identifying qualified individuals to become directors and recommends to the Board candidates for all director positions to be filled by the Board or by shareholders of the Company. The Corporate Governance, Nominating & Ethics Committee held four meetings during 2014. The Corporate Governance, Nominating & Ethics Committee has a charter, which can be found on our website at www.superioruniformgroup.com under Investor Information.

The Corporate Governance, Nominating & Ethics Committee has recommended the candidates to be nominated to stand for election to the Board of Directors at the Annual Meeting.

The Corporate Governance, Nominating & Ethics Committee conducts an annual self-evaluation.

Executive Committee

The current members of the Executive Committee are Messrs. Sidney Kirschner, Chairperson, Michael Benstock, and Alan D. Schwartz. The Executive Committee is authorized to act in place of the Board of Directors during periods between Board meetings. The Executive Committee did not hold any formal meetings during 2014. The Executive Committee acted by unanimous written consent on six occasions during 2014. Each action taken by the Executive Committee pursuant to a unanimous written consent was subsequently reviewed and ratified by the Board of Directors.

Nominations of Directors

The Board selects the director nominees to stand for election at the Company’s annual meetings of shareholders and to fill vacancies occurring on the Board based on the recommendations of the Corporate Governance, Nominating & Ethics Committee. In identifying and evaluating potential nominees to serve as directors, the Corporate Governance, Nominating & Ethics Committee will examine each nominee on a case-by-case basis regardless of who recommended the nominee and take into account all factors it considers appropriate. However, the Corporate Governance, Nominating & Ethics Committee believes the following minimum qualifications must be met by a director nominee to be recommended to the Board:

|

● |

Each director must display high personal and professional ethics, integrity and values. |

|

● |

Each director must have the ability to exercise sound business judgment. |

|

● |

Each director must be highly accomplished in his or her respective field, with broad experience at the executive and/or policy-making level in business, government, education, technology or public interest. |

|

● |

Each director must have relevant expertise and experience, and be able to offer advice and guidance based on that expertise and experience. |

|

● |

Each director must be able to represent all shareholders of the Company and be committed to enhancing long-term shareholder value. |

|

● |

Each director must have sufficient time available to devote to activities of the Board and to enhance his or her knowledge of the Company’s business. |

The Board also believes the following qualities or skills are necessary for one or more directors to possess:

|

● |

At least one independent director should have the requisite experience and expertise to be designated as an “audit committee financial expert” as defined by applicable rules of the Securities and Exchange Commission and which results in the director’s “financial sophistication” as defined by the rules of the NASDAQ Stock Market. |

|

● |

One or more of the directors generally should be active or former chief executive officers of public or private companies or leaders of major organizations, including commercial, scientific, government, educational and other similar institutions. |

|

● |

Directors should be selected so that the Board is a diverse body. |

The Company believes that it is important for its Board to be comprised of individuals with diverse backgrounds, skills and experiences, and to ensure a fair representation of shareholder interests. To maintain a diverse mix of individuals, primary consideration is given to the depth and breadth of members’ business and civic experience in leadership positions, as well as their ties to the Company’s markets and other similar factors. The Corporate Governance, Nominating & Ethics Committee does not have a formal diversity policy. It identifies qualified potential candidates without regard to any candidate’s race, color, disability, gender, national origin, religion or creed.

The Company has a mandatory retirement policy for its directors. The policy states that: No person shall be nominated by the Board of Directors to serve as a director after he or she has passed his or her 72nd birthday; except that anyone serving on the Board as of February 6, 2015, the date this policy is adopted, may remain on the Board until completion of the term that encompasses his or her 74th birthday or completion of the term that concludes at least five but no more than six years after this policy is adopted, whichever will result in a longer Board tenure.

The Corporate Governance, Nominating & Ethics Committee will consider recommendations for directorships submitted by shareholders. Recommendations for consideration by the Corporate Governance, Nominating & Ethics Committee, including recommendations from shareholders of the Company, should be sent in writing to the Board of Directors, care of the Secretary of the Company, at the Company’s headquarters. Such nominations must include a description of the specific qualifications the candidate possesses and a discussion as to the effect on the composition and effectiveness of the Board.

Compensation Committee Interlocks and Insider Participation

Messrs. Sidney Kirschner and Paul Mellini served as members of the Compensation Committee during the fiscal year ended December 31, 2014. Neither of these individuals is or has ever been an officer or employee of the Company or any of its subsidiaries. In addition, neither of these individuals has had any relationship requiring disclosure by the Company under any paragraph of Item 404 of SEC Regulation S-K. During the fiscal year ended December 31, 2014, none of the Company’s executive officers served as a member of the board of directors or the compensation committee (or other board committee performing equivalent functions) of any other entity that had one or more executive officers serving as members of our Board of Directors or Compensation Committee.

Code of Business and Ethical Conduct

The Company has adopted a Code of Business and Ethical Conduct, which sets forth the guiding principles and rules of behavior by which we operate our Company and conduct our daily business with our customers, vendors, shareholders and employees. This Code applies to all of the directors and employees of the Company.

The purpose of the Code of Business and Ethical Conduct is to promote honest and ethical conduct and compliance with the law. The law in many cases is about what we can do; what is legally permissible. We consider it important to focus on what we should do and what ethical principles we should embrace in guiding our behavior to engender trust and loyalty within our work forces and with all our key stakeholders, customers, suppliers, dealers and investors. The Code of Business and Ethical Conduct can be found on our website at www.superioruniformgroup.com under Investor Information. We will post any amendments to the Code of Business and Ethical Conduct, as well as any waivers, that are required to be disclosed by the rules of either the SEC or NASDAQ, on such website.

Communications with Board of Directors

Shareholders may communicate with the full Board or individual Directors by submitting such communications in writing to Superior Uniform Group, Inc., Attention: Board of Directors (or the individual director(s)), 10055 Seminole Boulevard, Seminole, Florida 33772. Such communications will be delivered directly to the Directors.

EXECUTIVE AND DIRECTOR COMPENSATION

Summary Compensation Table for 2014 and 2013

The following table sets forth for each of the Company’s named executive officers: (i) the dollar value of base salary and bonus earned during the years ended December 31, 2014 and 2013; (ii) for stock and option awards, the aggregate grant date fair value computed in accordance with FASB ASC Topic 718; (iii) the dollar value of earnings for services pursuant to awards granted during 2014 and 2013 under non-equity incentive plans; (iv) all other compensation for 2014 and 2013; and, finally, (v) the dollar value of total compensation for 2014 and 2013. All share and per share information in the footnotes to this table have been adjusted to give retroactive effect to the 2-for-1 stock split effective on February 4, 2015.

|

Non-Equity |

|||||||||||||||||||||||||||||

|

Incentive |

All |

||||||||||||||||||||||||||||

|

Stock |

Option |

Plan |

Other |

||||||||||||||||||||||||||

|

Name and |

Salary |

Bonus |

Awards |

Awards |

Compensation |

Compensation |

Total |

||||||||||||||||||||||

|

Principal Position |

Year |

($) |

($) (1) |

($) (2) |

($) (3) |

($) (4) |

($) (5) |

($) |

|||||||||||||||||||||

|

Michael Benstock |

2014 |

467,292 | - | 257,600 | 80,800 | 591,435 | 20,290 | 1,417,417 | |||||||||||||||||||||

|

Chief Executive |

2013 |

454,122 | - | - | 80,190 | 556,527 | 20,190 | 1,111,029 | |||||||||||||||||||||

|

Officer |

|||||||||||||||||||||||||||||

|

Alan D. Schwartz |

2014 |

375,794 | - | 184,000 | 68,680 | 387,892 | 21,062 | 1,037,428 | |||||||||||||||||||||

|

President |

2013 |

365,203 | - | - | 62,370 | 447,556 | 20,478 | 895,607 | |||||||||||||||||||||

|

Andrew D. Demott, Jr. |

2014 |

284,934 | - | 147,200 | 60,600 | 360,631 | 21,850 | 875,215 | |||||||||||||||||||||

|

Executive V.P. & CFO |

2013 |

276,904 | - | - | 53,460 | 339,346 | 20,639 | 690,349 | |||||||||||||||||||||

|

(1) |

No discretionary bonuses were earned during the periods indicated. |

(2) Refer to Note 12 – Share Based Compensation in the Notes to Consolidated Financial Statements in the Annual Report on Form 10-K filed on February 26, 2015 for the relevant assumptions used to determine the valuation. On February 7, 2014, Mr. Benstock, Mr. Schwartz and Mr. Demott were awarded 17,500, 12,500 and 10,000 restricted shares of the Company’s common stock. These shares are unvested and will vest on February 7, 2017 if the executives are still employed by the Company on that date.

(3) Stock-settled stock appreciation rights (“SARs”) and options for our executive officers and other key employees are granted annually in conjunction with the review of the individual performance of our executive officers. This review takes place at the regularly scheduled meeting of the Compensation Committee, which is held in conjunction with the quarterly meeting of our Board in the first quarter of each year. On February 7, 2014, Mr. Benstock, Mr. Schwartz and Mr. Demott were each awarded 13,586 stock options. On February 7, 2014 Mr. Benstock, Mr. Schwartz and Mr. Demott were awarded 26,414, 20,414 and 16,414 SARs, respectively. The SARs and stock options were granted with an exercise price of $7.36 per share, were exercisable immediately upon grant and expire 5 years from the date of grant. On February 1, 2013, Mr. Benstock, Mr. Schwartz and Mr. Demott were each awarded 17,714 stock options. On February 1, 2013, Mr. Benstock, Mr. Schwartz and Mr. Demott were awarded 36,286, 24,286 and 18,286 SARs, respectively. The SARs and stock options were granted with an exercise price of $5.645 per share, were exercisable immediately upon grant and expire 5 years from the date of grant. Refer to Note 12 – Share-Based Compensation in the Notes to Consolidated Financial Statements included in the Annual Report on Form 10-K filed on February 26, 2015 for the relevant assumptions used to determine the valuation of our share-based awards. All such awards are granted with an exercise price equal to the closing price of the common stock on the date of grant as reported on NASDAQ.

(4) The amounts in this column include incentive bonuses earned during the respective calendar year. These amounts are paid during February of the following year.

(5) The Company provides the named executive officers with certain group life, health, medical and other non-cash benefits generally available to all salaried employees and not included in this column pursuant to SEC guidance, because they do not discriminate in scope, terms or operation in favor of executive officers. The amounts shown in this column include the following: matching contributions on 401(k) deferrals, insurance premiums for a Supplemental Medical Plan, which is a fully insured hospital and medical expense reimbursement plan covering certain key management employees and their dependents, and personal automobile use.

Executive Incentive Bonuses

Our annual executive incentive bonuses are intended to compensate officers for achieving our annual financial goals at corporate levels (and for achieving measurable individual annual performance objectives). Our annual incentive bonus plan provides for a cash bonus, dependent upon the level of achievement of the stated corporate goals (and personal performance goals), calculated as a percentage of the officer's base salary. The annual incentive bonus ties incentive compensation to net earnings per share as reported in the Company’s audited financial statements adjusted for certain items (“BEPS”). Under this plan, the Compensation Committee establishes a minimum BEPS target that must be reached before any bonuses are earned. The target BEPS is based upon the annually established financial growth plan and goal. The Compensation Committee also establishes for each participant in the Plan, including executive officers, individual incentive amounts (“TIA”) that may be earned, in whole or in part, depending upon whether the minimum BEPS target is reached and by how much it is exceeded during the fiscal year. At the minimum target BEPS level, the plan participants will earn a bonus equal to 20% of the TIA. For 2015, the target incentive awards (as a percentage of base salary) will be as follows: Chief Executive Officer, 50%; Chief Financial Officer, 40%; President, 40% and Executive Vice President, 40%. These targets are consistent with the 2014 and 2013 percentages, except for the Chief Executive Officer’s percentage which was 40% in 2014 and 2013. The payout continues to increase as BEPS increases and there is no maximum bonus payment. The BEPS level for 100% payout of the TIA in 2015 is equal to $0.72 per share. The Company’s BEPS was $0.99 for the year ended December 31, 2014 and $0.71 for the year ended December 31, 2013.

Outstanding Equity Awards at 2014 Fiscal Year End

The following table sets forth information regarding outstanding option awards held by the named executive officers at December 31, 2014, including the number of shares underlying both exercisable and unexercisable portions of each stock option and SAR as well as the exercise price and expiration date of each outstanding award. All share and per share information in this table has been adjusted to give retroactive effect to the 2-for-1 stock split effective on February 4, 2015.

|

Option Awards |

Stock Awards |

||||||||||||||||||||||||||||||||||

|

Name |

Number of Securities Underlying Unexercised Options Exercisable # (1) |

Number of Securities Underlying Unexercised Options Unexercisable # |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date (2) |

Number of Shares or Units of Stock that have not Vested (#)(3) |

Market Value of Shares or Units of Stock that have not Vested ($) |

Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) |

Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights that have not Vested ($) |

||||||||||||||||||||||||||

|

Michael Benstock, |

19,592 | 4.90 |

2/4/2015 |

35,000 | 514,150 | - | - | ||||||||||||||||||||||||||||

|

Chief Executive |

72,000 | - | - | 5.62 |

2/4/2016 |

||||||||||||||||||||||||||||||

|

Officer |

40,000 | - | - | 6.575 |

2/3/2017 |

||||||||||||||||||||||||||||||

| 54,000 | 5.645 |

2/1/2018 |

|||||||||||||||||||||||||||||||||

| 40,000 | 7.36 |

2/7/2019 |

|||||||||||||||||||||||||||||||||

|

Alan D. Schwartz, |

13,592 | 4.90 |

2/4/2015 |

25,000 | 367,250 | - | - | ||||||||||||||||||||||||||||

|

President |

60,000 | - | - | 5.62 |

2/4/2016 |

||||||||||||||||||||||||||||||

| 34,000 | - | - | 6.575 |

2/3/2017 |

|||||||||||||||||||||||||||||||

| 42,000 | 5.645 |

2/1/2018 |

|||||||||||||||||||||||||||||||||

| 34,000 | 7.36 |

2/7/2019 |

|||||||||||||||||||||||||||||||||

|

Andrew D. Demott, Jr., |

54,000 | - | - | 5.62 |

2/4/2016 |

20,000 | 293,800 | - | - | ||||||||||||||||||||||||||

|

Executive V.P. & CFO |

30,000 | - | - | 6.575 |

2/3/2017 |

||||||||||||||||||||||||||||||

| 36,000 | 5.645 |

2/1/2018 |

|||||||||||||||||||||||||||||||||

| 30,000 | 7.36 |

2/7/2019 |

|||||||||||||||||||||||||||||||||

|

(1) |

Options and stock-settled stock appreciation rights are exercisable immediately upon grant. |

|

(2) |

The expiration date of each grant occurs five years after the date of grant. |

|

(3) |

On February 7, 2014, Mr. Benstock, Mr. Schwartz and Mr. Demott were awarded restricted shares of the Company’s common stock. These shares are unvested and will vest on February 7, 2017 if the executives are still employed by the Company on that date. |

Pension Benefits/Retirement Plans

Since 1942, the Company has had a retirement plan (the "Basic Plan") which has been qualified under the Internal Revenue Code. The Basic Plan is a "defined benefit" plan, with benefits normally beginning at age 65, is non-contributory by an employee, and the Company's contributions are not allocated to the account of any particular employee. All domestic employees of the Company (except employees included in a retirement plan negotiated as part of a union contract) are eligible to participate in the Basic Plan prior to June 30, 2013. After June 30, 2013, benefits are provided under a Defined Contribution Plan and the Basic Plan benefit accruals are frozen. The Company also commenced, effective November 1, 1994, the Superior Uniform Group, Inc. Supplemental Pension Plan (the "Supplemental Plan") which is available to certain eligible employees of the Company, including certain of its executive officers. Retirement benefits available under the Supplemental Plan are based on the same provisions as in the qualified plan but ignore the salary limitations imposed by the Internal Revenue Service ($260,000 in 2014). The Supplemental Plan is not frozen.

The Supplemental Plan provides benefits based on years of service and earnings above and below the Covered Compensation Base (the wage bases on which maximum Social Security taxes are payable). The normal monthly retirement benefit is 17.5% of an employee's average monthly compensation during the highest paid five years of the ten years immediately preceding retirement up to his Covered Compensation Base plus 32.5% of such average monthly compensation in excess of his Covered Compensation Base, reduced in the event such employee has less than 25 years of service. An employee's compensation includes overtime pay, commissions and any bonus received and therefore includes executive officers’ compensation as described in the Salary and Bonus columns of the Summary Compensation Table shown above. There is no offset in retirement benefits for Social Security benefits or other retirement plans or statutory benefits. The Basic Plan was amended as of November 1, 1989. Prior to the amendment, the Basic Plan provided benefits based on years of service and earnings in excess of the Covered Compensation Base. Benefits accrued prior to November 1, 1989 under the Basic Plan would be paid, if higher than the sums set forth above.

Nonqualified Deferred Compensation

The Company has no nonqualified defined contribution or other nonqualified deferred compensation plans.

Termination or Change in Control Provisions

We have entered into retention agreements with each of our named executive officers. The retention agreements generally provide that, if within 24 months following a change in control the executive officer’s employment is terminated for reasons other than for cause (as defined in the retention agreement) or by the executive for good reason (as defined in the retention agreement, including the ability for the executive to make an election within a forty-five day period beginning 180 days after a change in control), we will make a lump-sum cash payment to the executive officer equal to two times the sum of the executive officer’s annual base salary at the rate in effect at the termination date or, if greater, the highest rate in effect at any time during the ninety day period prior to a change in control and the average of the annual cash bonuses paid to the executive during the three full fiscal years prior to the termination date or, if greater, the three full fiscal years immediately prior to the change in control date. The retention agreements also provide that, under such circumstances, we will continue to provide benefits to each executive for a period of two years after the date of his or her termination. Additionally, the agreements provide for each executive to be paid additional amounts under the Company’s defined benefit plans and defined contribution plans as though they were employed for an additional two years. The current agreements expire on November 23, 2015, but are subject to automatic one-year extensions unless we give the executive officer prior notification. The retention agreements are intended to promote stability and continuity of management should the Company consider a change in control transaction.

Director Compensation for 2014

The following table sets forth information regarding the compensation received by each of the Company's Directors during the year ended December 31, 2014.

|

Fees Earned or |

Stock |

Option |

All Other |

||

|

Paid in Cash |

Awards |

Awards |

Compensation |

Total | |

|

Name |

($) |

($)(2) |

($) (1) |

($) |

($) |

|

Sidney Kirschner |

35,250 |

17,988 |

16,730 |

- |

69,968 |

|

Robin Hensley |

27,750 |

17,988 |

16,730 |

- |

62,468 |

|

Paul Mellini |

29,000 |

17,988 |

16,730 |

- |

63,718 |

|

Todd Siegel |

21,500 |

17,988 |

16,730 |

- |

56,218 |

(1) Stock options for our non-employee Directors are granted annually. On May 2, 2014, each of the non-employee Directors was awarded 7,000 options. The options were granted with an exercise price of $7.955 per share. The amount shown in this column is the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. Refer to Note 12 – Share-Based Compensation in the Notes to Consolidated Financial Statements included in the Annual Report on Form 10-K filed on February 26, 2015 for the relevant assumptions used to determine the valuation of our option awards. All such awards are granted with an exercise price equal to the closing price of the common stock on the date of grant as reported on NASDAQ, are exercisable six months from the date of grant, and generally expire ten years after the date of grant. As of December 31, 2014, Mr. Kirschner had 62,000 options outstanding; Ms. Hensley had 62,000 options outstanding; Mr. Mellini had 58,166 options outstanding and Mr. Siegel had 7,000 options outstanding. All such options are exercisable.

(2) On November 7, 2014 the Board of Directors approved a restricted stock grant under the terms of the 2013 Stock and Awards Plan to the four independent members of the Board of Directors for 1,504 shares to each such director. The fair value on the date of grant was $11.96 per share. These shares are unvested and will vest if the directors are still serving on the Company’s Board of Directors on November 7, 2017. The shares are subject to accelerated vesting under certain circumstances as outlined in the 2013 Stock and Awards Plan.

All share and per share information in the footnotes to the above table has been adjusted to give retroactive effect to the 2-for-1 stock split effective on February 4, 2015.

Directors who are employees of the Company receive no extra compensation for their services as Directors. Commencing as of February 7, 2014, each non-employee Director receives up to $2,000 per Board of Directors meeting attended, $18,000 per year in restricted common stock of the Company which vests three years after date of grant, and grants of 5,500 stock options per year. Commencing as of February 7, 2014, each non-employee Director also receives an annual retainer (paid in quarterly installments) as follows: Sidney Kirschner -- $30,000; Robin Hensley - $18,000; Paul Mellini - $17,000; and Todd Siegel - $12,000. Members of the Audit Committee receive $500 per committee meeting attended, members of the Compensation Committee receive $250 per committee meeting attended, and members of the Corporate Governance, Nominating and Ethics Committee receive $250 per committee meeting attended. Non-employee Directors are entitled to reimbursement for expenses incurred in connection with their attendance at Board of Directors meetings and committee meetings. In addition, non-employee Directors are eligible to receive additional stock option grants pursuant to our 2013 Incentive Stock and Awards Plan.

SECURITY OWNERSHIP OF MANAGEMENT AND OTHERS

The following table sets forth, as of the Record Date (except as noted), information regarding the beneficial ownership of the Company's Common Stock by (i) each person known to the Company to be the beneficial owner of more than 5% of the Company's Common Stock, (ii) each Director, (iii) each nominee for election as a Director, (iv) each named executive officer, and (v) all Directors and executive officers as a group.

Except as set forth below, percentage ownership is based on 13,599,969 shares of the Company’s Common Stock outstanding as of the Record Date. Shares issuable upon exercise of options and SARs within 60 days after the Record Date are deemed to be outstanding for the purpose of computing the percentage ownership and overall voting power of each person deemed to beneficially own such securities, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. All share and per share information in the footnotes to the above table has been adjusted to give retroactive effect to the 2-for-1 stock split effective on February 4, 2015.

|

SECURITY OWNERSHIP | ||||

|

Name and Address |

Amount and Nature of |

Percent of | ||

|

of Beneficial Owner |

Beneficial Ownership (1) |

Class | ||

|

BENSTOCK-SUPERIOR LTD. |

2,782,088 |

(2) |

20.5% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

MOCHELLE A. STETTNER |

1,238,648 |

(7) |

9.1% | |

|

2331 Lehigh Parkway N. |

||||

|

Allentown, PA 18130 |

||||

|

DIMENSIONAL FUND ADVISORS, LP |

1,114,440 |

(5) |

8.2% | |

|

6300 Bee Cave Road |

||||

|

Austin, TX 78746 |

||||

|

VENATOR CAPITAL MANAGEMENT LTD. |

838,000 |

(6) |

6.2% | |

|

2 Bloor Street West |

||||

|

Toronto, Canada M4W 3E2 |

||||

|

MICHAEL BENSTOCK |

638,445 |

(3)(8)(9)(10) |

4.7% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

ALAN D. SCHWARTZ |

573,378 |

(4)(8)(10) |

4.2% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

PETER BENSTOCK |

449,210 |

(8)(10) |

3.3% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

|

||||

|

ANDREW D. DEMOTT, JR. |

215,443 |

(8)(9)(10) |

1.6% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

JORDAN M. ALPERT |

45,034 |

(8) |

0.3% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

DOMINIC LEIDE |

39,392 |

(8) |

0.3% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

SIDNEY KIRSCHNER |

71,504 |

(8)(11) |

0.5% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

ROBIN HENSLEY |

65,504 |

(8)(11) |

0.5% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

PAUL MELLINI |

67,104 |

(8)(11) |

0.5% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

TODD SIEGEL |

18,504 |

(8)(11) |

0.1% | |

|

10055 Seminole Boulevard |

||||

|

Seminole, Florida 33772 |

||||

|

All Directors and Executive Officers as a group (10 persons) |

4,965,606 |

(2)(3)(4)(9)(10)(11) |

36.5% | |

(1) The number of shares beneficially owned is determined under rules promulgated by the Securities and Exchange Commission (the “SEC”), and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rules, beneficial ownership includes any shares as to which the individual has sole or shared voting power or investment power and also any shares which the individual has the right to acquire within 60 days after the Record Date through the exercise of any stock option or other right. Inclusion in the table of such shares, however, does not constitute an admission that the director, nominee, named executive officer or principal stockholder is a direct or indirect beneficial owner of such shares. Except as set forth herein, the persons listed have sole voting and investment power with respect to the shares referred to in the table.

(2) Represents shares held of record by Benstock-Superior Ltd., a Florida limited partnership ("Reporting Person"). The general partners of the Reporting Person are Susan B. Schwartz, the wife of our President, Michael Benstock and Peter Benstock (the “General Partners”). The General Partners of the Reporting Person each own three hundred thirty-three and one-third (333 1/3) of the one thousand (1,000) total outstanding general partnership units. The voting and disposition of the Company's Common Stock owned by the Reporting Person requires approval of a majority of the General Partners pursuant to the limited partnership agreement of the Reporting Person. Accordingly, each General Partner disclaims individual beneficial ownership of the shares of the Company’s Common Stock owned by the Reporting Person.

(3) Includes 22,600 shares held of record by Mr. M. Benstock’s wife. Mr. Benstock disclaims beneficial ownership of such shares.

(4) Includes 244,928 shares held of record by Mr. Schwartz’s wife. Mr. Schwartz disclaims beneficial ownership of such shares.

(5) This disclosure is based on a Schedule 13G/A filed with the Securities and Exchange Commission on February 5, 2015. Dimensional Fund Advisors LP, an investment adviser registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts (such investment companies, trusts and accounts, collectively referred to as the “Funds”). In certain cases, subsidiaries of Dimensional Fund Advisors LP may act as an adviser or sub-adviser to certain Funds. In its role as investment adviser, sub-adviser and/or manager, Dimensional Fund Advisors LP or its subsidiaries (collectively, “Dimensional”) possess voting and/or investment power over the securities of the Company that are owned by the Funds, and may be deemed to be the beneficial owner of the shares of the Company held by the Funds. However, all securities reported in this schedule are owned of record by the Funds. Dimensional disclaims beneficial ownership of such securities.

(6) This disclosure is based on a Schedule 13G/A filed with the Securities and Exchange Commission on February 17, 2015. Venator Capital Management Ltd. (“Venator”) serves as investment manager to each of Venator Founders Fund, Venator Partners Fund, Venator Master Fund, Venator Select Fund, Income Fund and Focus 900. Mr. Osten is Chief Executive Officer, portfolio manager and controlling shareholder of Venator. In such capacities, Venator and Mr. Osten may be deemed to have voting and dispositive power over the shares held for the accounts of Venator Founders Fund, Venator Partners Fund, Venator master fund, Venator Select Fund, Income Fund and Focus 900.

(7) Includes 10,288 shares owned by a Trust of which Mrs. Stettner is a Co-Trustee with two of her adult children, and 1,824 shares held as custodian for her children who are now adults. Mrs. Stettner disclaims beneficial ownership of all of these shares.

(8) The share ownership of the following individuals includes that number of shares underlying stock awards following his or her name, which are currently exercisable or are exercisable within 60 days of the Record Date, pursuant to the Company’s 2013 and 2003 Incentive and Stock and Awards Plans: Mr. M. Benstock – 224,945 shares; Mr. Schwartz – 165,808 shares; Mr. P. Benstock – 162,000 shares; Mr. Demott – 125,792 shares; Mr. Kirschner – 62,000 shares; Ms. Hensley – 62,000 shares; Mr. Mellini – 53,166 shares; Mr. Siegel – 7,000 shares; Mr. Alpert – 39,300 shares; and Mr. Leide – 27,154 shares.

(9) Mr. M. Benstock has pledged approximately 68,000 of the shares listed in the table as security for a loan. Mr. Demott has pledged 69,651 of the shares listed in the table as security for a loan.

(10) Includes unvested restricted shares granted on February 7, 2014. These shares will vest on February 7, 2017 if the respective executive is still employed by the Company. The executives have the ability to vote these shares currently. Mr. M. Benstock has 35,000 shares; Mr. Schwartz has 25,000 shares; and Mr. P. Benstock and Mr. Demott have 20,000 shares each.

(11) Includes unvested restricted shares granted on November 7, 2014. These shares will vest on November 7, 2017 if the respective director is still serving on the Board of Directors of the Company. The directors have the ability to vote these shares currently. Each director has 1,504 shares.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s officers and directors, and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the SEC. Officers, directors and greater than ten percent beneficial owners are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file. Based solely on its review of the copies of such forms received by it and written representations from certain reporting persons, the Company believes that, during its most recently completed fiscal year ended on December 31, 2014, all Section 16(a) reports required to be filed by its officers, directors, and greater than ten percent beneficial owners were timely filed, except for two late Filings by Mr. Siegel: one Form 3 and one Form 4.

CERTAIN TRANSACTIONS

Director and Officer Liability Insurance

As authorized by Section 607.0850(12) of the Florida Business Corporation Act, the Company maintains insurance to indemnify it and its Directors and officers from certain liabilities to the extent permitted by law. Such insurance, in the face amount of $12,000,000, was obtained pursuant to contracts dated August 27, 2014. Under the terms of the contract, the Company paid an annual premium of $91,618 for the insurance. During 2013, such insurance, in the face amount of $12,000,000, was obtained pursuant to contracts dated August 27, 2013. Under the terms of the contracts, the Company paid an annual premium of $83,573 for the insurance. No sums have been paid or sought under any such indemnification insurance.

Related Party Transactions

On December 17, 2012, the Company and Mr. Gerald M. Benstock entered into a separation, general release, non-compete, and advisory services agreement. The agreement has a three-year term that is subject to early termination by either party. During each year of the term, Mr. Benstock will receive $150,000, for an aggregate amount of up to $450,000, plus payments for, or reimbursements of, certain pre-approved travel, lodging, entertainment, and business expenses. Under the agreement, Mr. Benstock also will retain access to an automobile leased for him by the Company for the remainder of the automobile’s term, and at the Company’s discretion thereafter for the remainder of the term of the agreement. Mr. Benstock also received additional consulting fees for consulting services provided in 2014 and 2013.

REPORT OF THE AUDIT COMMITTEE1

The Company’s Audit Committee serves to assist the Board in fulfilling the Board’s responsibilities relating to safeguarding of assets and oversight of the quality and integrity of the accounting, auditing and reporting practices of the Company. The members of the Audit Committee meet the independence and experience requirements of NASDAQ and the Securities and Exchange Commission.

The Company’s management has primary responsibility for the preparation, presentation and integrity of the Company’s financial statements and its financial reporting process. The Company’s independent auditing firm, Mayer Hoffman McCann P.C., is responsible for expressing an opinion on the conformity of the Company’s audited financial statements to accounting principles generally accepted in the United States of America. The Audit Committee’s responsibility is to monitor and oversee these processes. In connection with these responsibilities, the Audit Committee reports as follows:

1 The material in this report is not “soliciting material” and is not deemed “filed” with the SEC and is not to be incorporated by reference in any of our filings under the Securities Act of 1933, as amended, or the Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

|

1. The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2014 with the Company’s management. | |

|

2. The Audit Committee has discussed with Mayer Hoffman McCann P.C. the matters required to be discussed by the statement on Auditing Standards No. 16, as adopted by the Public Company Accounting Oversight Board. | |

|

3. The Audit Committee has received the written disclosures and the letter from Mayer Hoffman McCann P.C. required by applicable requirements of the Public Company Accounting Oversight Board regarding Mayer Hoffman McCann P.C.’s communications with the Audit Committee concerning independence, and has discussed with Mayer Hoffman McCann P.C. its independence. | |

|

4. Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014 for filing with the Securities and Exchange Commission. |

BY: Robin Hensley, Sidney Kirschner, and Paul Mellini

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS (Proposal 2)

Although the Audit Committee has the sole authority to appoint the independent auditors, the Audit Committee continues its long-standing practice of recommending that the Board ask the shareholders, at the Annual Meeting, to ratify the appointment of the independent auditors. The Audit Committee has appointed Mayer Hoffman McCann P.C., independent registered public accountants, to audit the financial statements of the Company for the year ending December 31, 2015.

Shareholder ratification of the Company's independent registered public accountants is not required by the Company's Bylaws or otherwise. The Audit Committee and the Board of Directors have elected to seek such ratification as a matter of good corporate practice. If the shareholders do not ratify this appointment, the Audit Committee will consider the appointment of other auditors, but may also decide to retain Mayer Hoffman McCann P.C. as independent auditors for 2015. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

The Company expects representatives of Mayer Hoffman McCann P.C. to be present and available to respond to appropriate questions at the 2015 Annual Meeting. Representatives of Mayer Hoffman McCann P.C. will have the opportunity to make a statement if they so desire.

Audit Fees and All Other Fees

The following table sets forth information regarding fees paid by the Company to Mayer Hoffman McCann P.C. during 2014 and 2013:

|

Mayer Hoffman McCann, P.C. |

||||||||

|

and CBIZ, Inc. |

2014 |

2013 |

||||||

|

Audit Fees(1) |

$ | 210,000 | $ | 303,000 | ||||

|

Tax Fees |

10,000 | 16,000 | ||||||

|

Other Fees (2) |

- | 79,000 | ||||||

|

Total Fees |

$ | 220,000 | $ | 398,000 | ||||

|

(1) |

Fees for audit services include fees associated with the annual audits and quarterly reviews in 2014 and 2013 and $131,000 related to the Mayer Hoffman McCann P.C. audits of HPI filed with the Company’s 8-K/A following the 2013 acquisition of HPI. |

|

(2) |

Other fees include consulting services paid to CBIZ, Inc. associated with the acquisition completed in 2013. |

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee has concluded that Mayer Hoffman McCann P.C.’s provision of the audit and non-audit services described above is compatible with maintaining Mayer Hoffman McCann P.C.'s independence. The Audit Committee pre-approved all of such services. The Audit Committee has established pre-approval policies and procedures with respect to audit and non-audit services to be provided by its independent auditors. Pursuant to these policies and procedures, the Audit Committee may form, and delegate authority to, subcommittees consisting of one or more members when appropriate to grant such pre-approvals, provided that decisions of such subcommittee to grant pre-approvals are presented to the full Audit Committee at its next scheduled meeting. The Audit Committee's pre-approval policies do not permit the delegation of the Audit Committee's responsibilities to management.

Compensation of Independent Auditors’ Employees

Mayer Hoffman McCann P.C. leases substantially all of its personnel, who work under the control of Mayer Hoffman McCann P.C. shareholders, from wholly-owned subsidiaries of CBIZ, Inc., in an alternative practice structure.

The Board of Directors recommends a vote “FOR” the proposal to ratify the appointment of Mayer Hoffman McCann P.C. as our independent auditors for the year ending December 31, 2015.

EXPENSES OF SOLICITATION

The cost of soliciting proxies will be borne by the Company. We may reimburse brokers and other persons holding stock in their names, or in the names of nominees, for their expenses for sending proxy materials to principals and obtaining their proxies.

ANNUAL REPORT ON FORM 10-K

We will provide without charge to each person solicited by this proxy statement, upon the written request of any such person, a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as filed with the Securities and Exchange Commission, including the financial statements and a list of exhibits to the Form 10-K. We will furnish to any such person any exhibit described in the list accompanying the Form 10-K upon the advance payment of reasonable fees. Requests for copies of the Form 10-K and/or any exhibits should be directed to Joan Petronella, c/o Superior Uniform Group, Inc., 10055 Seminole Boulevard, Seminole, Florida 33772. Your request must contain a representation that, as of February 25, 2015, you were a beneficial owner of shares entitled to vote at the 2015 Annual Meeting of Shareholders.

You may review our filings with the Securities and Exchange Commission by visiting our website at www.superioruniformgroup.com.

OTHER BUSINESS

Management of the Company does not know of any other business that may be presented at the Meeting. If any matter not described herein should be presented for shareholder action at the Meeting, the persons named in the enclosed Proxy will vote or refrain from voting the shares represented thereby in accordance with their best judgment on such matters after consultation with the Board of Directors.

SHAREHOLDER PROPOSALS FOR

PRESENTATION AT THE 2016

ANNUAL MEETING