UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to ______________

Commission file number 000-53035

SOLAR WIND ENERGY TOWER INC.

(Exact name of registrant as specified in its charter)

| Nevada | 82-6008752 |

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) |

| 1997 Annapolis Exchange Parkway, Annapolis, MD | 21401 |

| (Address of Principal Executive Offices) | (Zip Code) |

(410) 972-4713

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, $0.0001 par value | Over the Counter Bulletin Board |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(b) of the Act. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities and Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes o No

Check if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and no disclosure will be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | |

| Non-accelerated filer o | Smaller reporting company x | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) o Yes x No

The aggregate market value of the voting Common Stock held by non-affiliates (based upon the closing sale price of $0.02 per share on the (Over the Counter Bulletin Board) of the registrant as of June 30, 2013: $3,058,715.

Number of issued and outstanding shares of the registrant’s par value $0.0001 common stock as of March 27, 2014: 458,910,896

SOLAR WIND ENERGY TOWER INC.

FORM 10-K

INDEX

| Page | ||

| Part I | ||

| Item 1. | Description of Business | 2 |

| Item 1A. | Risk Factors | 11 |

| Item 1B. | Unresolved Staff Comments | 22 |

| Item 2. | Properties | 22 |

| Item 3. | Legal Proceedings | 23 |

| Item 4. | Mine Safety Disclosures | 23 |

| Part II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 23 |

| Item 6. | Selected Financial Data | 24 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 31 |

| Item 8. | Financial Statements and Supplementary Data | 32 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 32 |

| Item 9A. | Controls and Procedures | 32 |

| Item 9B. | Other Information | 34 |

| Part III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 34 |

| Item 11. | Executive Compensation | 36 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 38 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 39 |

| Item 14. | Principal Accounting Fees and Services | 40 |

| Part IV | ||

| Item 15. | Exhibits, Financial Statement Schedules | 41 |

| i |

PART I

Cautionary Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K (this "Annual Report") contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements in this Annual Report other than statements of historical fact are “forward-looking statements” for purposes of these provisions, including any statements of the plan and objectives for future operations and any statement of assumptions underlying any of the foregoing.

In light of the significant uncertainties inherent in the forward-looking statements made in this Annual Report, particularly in view of the Company’s early stage of operations, the inclusion of this information should not be regarded as a representation by the Company or any other person that its objectives, future results, levels of activity, performance or plans will be achieved. These statements are further qualified by important factors that could cause actual results to differ materially from those contemplated in the forward-looking statements, including, without limitation, the following:

| · | the Company’s ability to raise sufficient capital; |

| · | the passage of adverse or burdensome government regulation; |

| · | litigation and legal liability; |

| · | the Company’s ability to attract and retain qualified personnel; |

| · | reliance on third-party product providers; |

| · | the Company’s ability to attract and retain new customers and increase revenues; |

| · | the Company’s ability to market, commercialize and achieve market acceptance of its products; |

| · | the Company’s ability to protect its intellectual property; |

| · | changes in the competitive environment; |

| · | the impact of, and potential challenges in complying with, legislation and regulation in the jurisdictions in which the Company plans to operate, particularly given the global scope of the Company’s proposed businesses and the possibility of conflicting regulatory requirements across jurisdictions in which it proposes to do business; |

| · | environmental impacts of the Company’s planned operations and possible adverse publicity; and |

| · | political, social and economic conditions in the United States in general. |

Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They use words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe” or words of similar meaning. They may also use words such as “would,” “should,” “could” or “may.” Factors that may cause the Company’s actual results to differ materially from those described in forward-looking statements include the risks discussed elsewhere in this Annual Report under the caption “Risk Factors” and risk factors discussed in the documents filed by the Company with the SEC.

| 1 |

This Annual Report may contain forward-looking statements that involve risks and uncertainties, including but not limited to the Company's ability to produce a cost-effective wind energy conversion device. Among the important factors that could cause actual events to differ materially from those indicated by forward-looking statements in this Annual Report are the failure of the Company to achieve or maintain necessary zoning approvals with respect to the location of its proposed projects; to successfully complete its proposed projects on time and remain competitive; the inability of the Company to sell its planned products and/or services in the future, if needed, to finance the marketing and sales of its planned products and/or services, general economic conditions, and those risk factors detailed in this Annual Report.

All references in this Form 10-K that refer to the “Company,” “Solar Wind Energy Tower” (f/k/a Clean Wind Energy Tower, Inc.), “Solar Wind,” “we,” “us” or “our” are to Solar Wind Energy Tower Inc. and unless otherwise differentiated, its subsidiary, Solar Wind Energy, Inc. (f/k/a Clean Wind Energy, Inc.) All references to “Solar Wind Energy (f/k/a Clean Wind Energy, Inc.)” are to our subsidiary, Solar Wind Energy, Inc. (f/k/a Clean Wind Energy, Inc.)

ITEM 1. DESCRIPTION OF BUSINESS

Corporate History

On December 29, 2010, Solar Wind Energy Tower Inc. (f/k/a Clean Wind Energy Tower, Inc.), a Nevada corporation (the “Company” or "Solar Wind"), completed a reverse merger (the “Merger”) with Solar Wind Energy, Inc. (f/k/a Clean Wind Energy, Inc.), a corporation formed under the laws of the State of Delaware on July 26, 2010 (“Solar Wind - Subsidiary”). In connection with the Merger, the Company issued to the stockholders of Solar Wind - Subsidiary in exchange for their Solar Wind - Subsidiary Common Stock, the right to receive an aggregate of 300,000,000 shares of the Company’s Common Stock. As a result of the reverse merger, Solar Wind - Subsidiary is now a wholly-owned subsidiary of the Company.

For accounting purposes, Solar Wind - Subsidiary was the surviving entity. The transaction was accounted for as a recapitalization of Solar Wind - Subsidiary pursuant to which Solar Wind - Subsidiary was treated as the surviving and continuing entity although the Company is the legal acquirer rather than a reverse acquisition. Accordingly, the Company’s historical financial statements are those of Solar Wind - Subsidiary immediately following the consummation of the reverse merger. Also, going forward the business operations of Solar Wind - Subsidiary will become the Company’s principal business operations.

The Company was incorporated under the laws of the State of Idaho on January 22, 1962, as Superior Mines Company. In 1964, the Company’s name was changed to Superior Silver Mines, Inc. On December 27, 2010, the Company reincorporated as a Nevada corporation. Prior to the Merger, the Company had been dormant for a number of years and had no known mineral reserves. On January 21, 2011, the Company changed its name from Superior Silver Mines, Inc. to Clean Wind Energy Tower, Inc. On March 11, 2013, the Company changed its name to Solar Wind Energy Tower Inc. On the same day, Company’s wholly-owned subsidiary, a corporation formed under the laws of the State of Delaware, Clean Wind Energy, Inc. changed its name to Solar Wind Energy, Inc. In addition, effective January 24, 2011, the Company’s quotation symbol on the Over-the-Counter Bulletin Board was changed from SSVM.OB to CWET.OB and on March 11, 2013, in conjunction with our name change, the Company’s quotation symbol on the Over-the-Counter Bulletin Board was changed from CWET.OB to SWET.OB.

The Company’s executive offices are located at 1997 Annapolis Exchange Parkway, Suite 300, Annapolis, Maryland 21401.

| 2 |

Overview

Our Company’s core objective and focus is to become a leading provider of clean efficient green energy to the world communities at a reasonable cost without the destructive residuals of fossil fuel, while continuing to generate innovative technological solutions for today and tomorrow’s electrical power needs.

Solar Wind has assembled a team of experienced business professionals, engineering and scientific consultants with the proven ability to bring the idea to market. Solar Wind has filed and been issued patents that the Company believes will further enhance this potentially revolutionary technology. Solar Wind is based in Annapolis, MD, and is traded on the OTCBB under the symbol ‘SWET’.

Solar Wind has, designed, engineered, developed and is preparing to construct large “Solar Wind Downdraft Towers” that use benevolent, non-toxic natural elements to generate electricity economically by integrating and synthesizing numerous proven as well as emerging technologies. In addition to constructing Solar Wind Downdraft Towers in the United States and abroad, the Company intends to establish partnerships at home and abroad to propagate these systems and meet increasing global demand for electricity.

A Bold New Energy Solution

The United States and other nations are aggressively pursuing energy independence with clean, sustainable energy solutions. Solar Wind offers a bold new approach to overcome the current limitations of other known alternative energy sources. The Solar Wind Downdraft Tower combines dry air heated by the solar rays of the sun with water added as a catalyst to create a powerful natural downdraft.

Hybrid Solar/Wind Technology

We view ourselves as a hybrid solar/wind technology because the simplicity of our solution is the harnessing of the natural power of a downdraft created when water is introduced to hot dry air within the confines of our tower structure.

The Solar Wind Downdraft Tower

| · | Avoids the adverse effects associated with fossil and nuclear fuels. | |

| · | Is capable of operating 24/7 and can outperform solar collectors that produce only when the sun shines in the daytime and wind turbines that produce only when the wind blows | |

| · | Has the capability of being operated with virtually no carbon footprint, fuel consumption or waste production. | |

| · | Has the potential to generate clean, cost effective and efficient electrical power without the damaging effects caused by using fossil or nuclear fuels, and other know alternative power sources. | |

| · | Uses benevolent non-toxic natural elements to generate electricity. |

Technology

Innovative Renewable Energy Technology

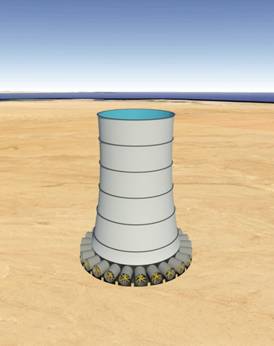

The Solar Wind Downdraft Tower is a hollow cylinder reaching skyward into the hot dry atmosphere heated by the solar rays of the sun. The water introduced by the injection system evaporates and is absorbed by the hot dry air which has been heated by the solar rays of the sun. The air becomes cooler, denser and heavier than the outside warmer air and falls through the cylinder at speeds up to and in excess of 50 mph and is diverted into wind tunnels surrounding the base of the Tower where turbines inside the tunnels power generators to produce electricity.

In geographic areas where atmospheric conditions are conducive, the exterior of the Solar Wind Downdraft Tower may be constructed with vertical “wind vanes” that capture the prevailing wind and channel it to produce supplemental electrical power. This dual renewable energy resource enhances the capability and productivity of the Solar Wind Energy system.

| 3 |

|

Physical Principles

Evaporating water to create or diminish energy (for cooling) is a well-understood physical principle. Evaporative coolers are used not just throughout the United States Southwest region (hot & arid), but widely in the power industry to cool gas, coal and nuclear power plants.

Similarly, cooling towers adorn the roofs of countless buildings in large cities, providing affordable energy. Airline pilots are very familiar with downdrafts and diligently avoid downdrafts associated with thunderstorms, especially when near the ground, where downdrafts can force a 200 ton airplane dangerously downward.

Solar Wind’s Energy Tower uses the same fundamental physical principle of evaporative cooling which creates a downdraft. Cool, moist, dense air always falls through hot dry air. What most people are unaware of is that the wind speed in an energy tower can exceed 50mph.

In summary, it is clear that Solar Wind’s Energy Tower creates and harnesses the downdraft, using widely applied and well-understood physical principles, to produce abundant electricity.

|

|

Abundant, Clean, Affordable Electricity Production

The Company has successfully managed to downsize the Tower, reducing capital costs and improving projected financial performance. The Company recently announced the completion of weather data models that confirm that the first Tower height can be lowered from 3,000 feet down to 2,250 feet. This development was made possible by utilizing our proprietary software which can calculate and predict energy production by our Solar Wind Downdraft Towers given local weather data. By feeding the weather data for southwestern Arizona / northern Mexico into the program, the Tower’s height and diameter can be adjusted along with the amount of water added as fuel to create a desired amount of energy. The outcome dictates the optimum size of the Tower’s height and width.

Under the most recent design specifications, the first San Luis Tower has a design capacity on an hourly basis, of up to 1250 megawatt hours, gross. Using a 60% capacity factor, the Tower’s potential hourly yield would be 600 megawatt hours from which approximately 18.5% will be used to power its operations, yielding approximately 500 megawatt hours available for sale to the power grid. Due to lower capacities during winter days, the average daily output for sale to the grid for the entire year is approximately 435 megawatt hours. Currently in California avoided costs are running approximately $0.11 per kilowatt hour. As an independent power producer of clean renewable energy the Company will not be selling power directly to consumers, but rather to the grid.

| 4 |

Intellectual Property

The Company has filed numerous patent applications with the U.S. Patent and Trademark Office to protect its intellectual property. The Company has been awarded two patents, and currently has two other patent applications which have been designated with a “Notice of Allowance” and is awaiting issuance of the actual patent documents. The Company has judiciously pursued the patent applications that we feel are instrumental to the core development of our technology and project:

Patent #8120191 issued 2/21/2012 “Efficient Energy Conversion Devices & Methods

The patent covers a novel hydraulic system capable of maintaining high efficiency hydraulic to electric conversion under a wide variance of wind speeds, as coupled to a plurality of wind turbines in wind tunnels.

Patent #8,517,662B2 issued 8/27/2013 “Atmospheric Energy Extraction Devices & Methods

The patent covers a structure for producing electricity, specifically a Tower capable of adding moisture at the top of the structure to hot-dry air so as to generate a downdraft of wind within the interior of the Tower, vanes coupled to the exterior of the Tower that at least partially define a plurality of elongated pockets to the exterior of the Tower, and flaps located to redirect the incident wind downwards into tunnels to convert wind to electricity.

Patent #8,643,204 B2 issued 2/4/2014 “Efficient Energy Conversion Devices and Methods”

This application enhances and broadens previously issued Patent #8120191

Patent Application # 13/947,625 date of Notice of Allowance 1/27/2014 (to be issued)

The patent claims are targeted to represent the advantages of the new Tower structural shape, the configuration of the Tower walls, their composition as well as the wall thicknesses for a given height, along with more efficient construction methodology and enhanced wind force resistance over prior Tower designs.

Site Requirements

Solar Wind’s (f/k/a Clean Wind’s) planned Downdraft Tower requires very specific site conditions. The location must provide appropriate climate and atmospheric conditions. The site must have access to reliable water sources, either fresh or salt water, in which case desalinization may be required. Additionally, the site should have access to rail service and other logistical ease of access. The Company is investigating the feasibility of locating a Downdraft Tower in Arizona.

Considerations

The Downdraft Tower works best in hot, dry climates near a reliable water source. Prime production periods are daytime during spring, summer and fall, which closely aligns with electricity demand patterns.

The External Wind Capture keeps working 24/7 including cold winter months and at night whenever a wind is blowing - from the surface up to 4,000 feet - where much stronger winds blow far more constantly (at least twice as often as on the surface and at much higher speeds).

There are numerous appropriate sites around the globe that are hot, dry, and near water adequate to support numerous Energy Towers that efficiently turn the sun’s energy into electricity.

| 5 |

The Distinct Advantages

Solar Wind (f/k/a Clean Wind) enjoys one major advantage over all other wind energy producers: a constant, high speed downdraft that blows for more than half the year. While ordinary wind turbine farms struggle with 20% to 30% capacity factors and wind speeds that are often useless or marginal (too low or too high), Solar Wind’s (f/k/a Clean Wind’s) Energy Tower can continuously channel 50 mph winds (or higher) into a controlled environment where the vast majority the wind’s energy can be captured to generate electricity.

Power industry experts know that when computing wind power, the velocity is cubed (not squared). Thus a 50 mph wind in a Solar Wind turbine will produce more than 15 times as much power as a 20 mph wind striking a conventional turbine.

Global Energy Generation Calculator

The Company has developed a software based analytical program to determine the energy generation capabilities of its Solar Wind Downdraft Towers based on the climate in geographic locations around the world, and has taken the appropriate steps to protect its intellectual property invention.

This essential tool has been under development by the Company for over one year and applies “known” scientific meteorology data of a specific area to the Solar Wind Downdraft Tower’s variables in order to determine and project energy outputs on a daily basis. Advancements in the scientific community over the last decade that predict and pin-point specific weather conditions provided significant insights to the development of this innovative tool.

This analytical tool, combined with our proprietary operating systems technology and existing core patents, clearly provides the Company with a unique opportunity to allow global positioning of this alternative solution to the world’s energy needs. Solar Wind can now rapidly respond to a request from virtually any country reasonably suitable to host a project and determine specifically where the Solar Wind Downdraft Tower should be located, the size of the Tower and the amount of electricity it can produce.

Development

The master development plan for a site requires a series of steps:

| · | explore, select, and qualify site; | |

| · | negotiate and execute land lease (site) and rights of way (water pipeline, transmission line, highway and railway access); | |

| · | survey and identify any artifacts and cultural resources that may be impacted by site exploration, project construction or operation; | |

| · | acquire water rights; | |

| · | determine and design access to and availability of electrical grid, roads, rail transportation, sewer, water, and power for construction and operation; | |

| · | create project site plan for offices, storage buildings for construction equipment, etc.; | |

| · | coordinate and provide, to the extent possible, resource carry-over (i.e., buildings and facilities) to the locale after construction; | |

| · | determine the type and number of jobs created during study, construction and operational phases; | |

| · | determine the cost of the project (currently estimated at $1.5 billion); and | |

| · | determine the electricity produced (currently estimated at $450 million annually). |

| 6 |

Business Model

The business model of our Company is to create an Energy Compound of Towers to be developed individually with a common water supply and rail/water port for supplies and equipment delivery, and common component assembly plant and labor force. Energy Compounds could actually be developed simultaneously in North America, North Africa (to serve the European grid by piping direct current across the Mediterrean), India and the Middle East. The world market can support all the materials needed and can certainly use the electricity. The cost per kilowatt is similar to that of a typical coal or gas-fired facility. SWET has positioned itself to take advantage of this solution and bring the first project to market, thereby setting the stage for a global “game changing” opportunity.

Project Partnering

The Company’s business plan involves “partnering” with various entities such as utilities, sovereign nations and independent power producers, to provide the ability to bring this solution to the market as rapidly as possible.

Each Solar Wind Downdraft Tower is its own independent project. Solar Wind Energy’s (f/k/a Clean Wind Energy’s) involvement in each project is to facilitate the Tower’s development with its expertise, intellectual property and project management team. Solar Wind will receive development fees, licensing fees, and royalties on power sales from each project and/or ownership interests.

Coordinated World Class Expertise

SWET is evaluating potential sites for a possible first Tower here in the United States and received key patents to protect its techniques to extract the energy from the Solar Wind Downdraft Tower. Some of the best consultants in the world have been and continue to support SWET's efforts to bring this first Downdraft Tower to market.

First Solar Wind Downdraft Tower

The ideal first site is near San Luis, Arizona and the Mexico/US border. The weather data has been updated for the first sites and final reports accurately calculate the Tower's output capacity 24/7. Those reports now support and validate SWET’s goal to develop its first Tower at the minimum size and design output possible, which preserves cash flow of 2:1 for debt service coverage. Concurrently, Solar Wind Energy has been exploring another site opportunity in Mexico that has the ideal attributes required for the Downdraft Tower. The proposed property is located in a particularly exceptional area for the development of these projects as it possesses suitable access along with the required topography. The land purchase is subject to the seller providing a clear title and unrestricted access to the property, as well as acquiring all of the needed prerequisites and approvals for the implementation of the Tower, including access to the power grid and the Company securing a satisfactory Power Purchase Agreement.

| 7 |

Customers

Energy produced by the Downdraft Tower could provide low cost electricity to the power grid. Solar Wind (f/k/a Clean Wind) plans to ultimately build and operate wind energy plants and sell the electricity either through contracts with utilities, which is the traditional method for independent power plants, or directly into the open market or electricity commodities market like a merchant plant similar to many natural gas fired power plants. The Company may also sell the power plants themselves to large customers or utilities and/or operate such plants for customers or utilities.

The sale of electricity to power brokers is more profitable than selling directly to the electricity commodities market. If the cost of the marketing infrastructure of selling green energy at a $0.02 per kWh premium is justified as opposed to the wholesale contracting of electricity at a lower price, then Solar Wind (f/k/a Clean Wind) plans to market the electricity to green energy brokers. The green power is energy from clean energy production sources like wind energy in which consumers are willing to pay a premium in order to promote clean energy. If Solar Wind (f/k/a Clean Wind) chooses to work through power brokers, it believes the potential exists to sell the environmental correct “green” power at a premium price being higher than conventional fuel sources. Power brokers usually receive a premium of $0.015 per kWh above the wholesale price paid on the open market. However, the market is new and subject to uncertainty including price fluctuations.

Markets

Wind energy experienced a 39% annual growth for the past five years according to the American Wind Energy Association, the industry’s trade organization based in Washington, D.C. Recent national surveys show that approximately 40-70% of the population surveyed indicate a willingness to pay a premium for renewable energy. Although 10% of the respondents say they will participate in such a program, actual participation is estimated at 1%. Currently, more than a dozen utilities have green marketing programs. Public Service Company of Colorado, Central and South West Services Corporation of Texas, and Fort Collins Light and Power Company are leading the effort in wind related green electricity marketing.

The Company is investigating the feasibility of locating a Downdraft Tower in California. California has three major regulated investor-owned utilities and many municipal utilities, all of which are required by state law to have renewable sources of generation in their resource portfolios, whether generated or purchased. Arizona utilities have similar requirements. Due to federal regulations requiring that transmission owners provide service on the same terms to all generators requesting service, known as “open access”, independent power producers (which the Company would be under its business model), are able to develop wind energy projects in areas where such resources are most prevalent and sell power to anyone interconnected with the transmission grid in California. California’s transmission grid is operated by a regional transmission organization (“RTO”), the California Independent System Operator (“CAISO”). Other states belong to other RTOs.

Competition

The Downdraft Tower project requires a large land base and specific conditions. Given these constraints and the increasing focus on renewable energy to offset the environmental problems caused by fossil fuels, the renewable energy industry is highly competitive.

In the markets where the Company plans to conduct its business, it will compete with many energy producers including electric utilities and large independent power producers. There is also competition from fossil fuel sources such as natural gas and coal, and other renewable energy sources such as solar, traditional wind, hydro and geothermal. The competition depends on the resources available within the specific markets. Although the cost to produce clean, reliable, renewable energy is becoming more competitive with traditional fossil fuel sources, it generally remains more expensive to produce, and the reliability of its supply is less consistent than traditional fossil fuel. Deregulation and consumer preference are becoming important factors in increasing the development of alternative energy projects.

| 8 |

The Company believes that governments and consumers recognize the importance of renewable energy resources in the energy mix, and are facilitating the implementation of wind and other renewable technologies through renewable portfolio standards and revenue and tax incentives.

Arizona and California are primarily served by large utilities, such as Southern California Edison Company, Pacific Gas & Electric Company, San Diego Gas & Electric Company, Arizona Public Service Company (“Arizona Public Service”) and UNS. All of these companies have non-regulated subsidiaries or sister companies that develop generating facilities. In addition, utilities from other states and countries have established large wind energy generating companies, such as Florida Power & Light Company, enXco, Inc. and PPM Energy, Inc. (now part of a large Spanish renewable company, Iberdrola Renovables, S.A.).

According to the Electric Power Research Institute, the past ten years have seen traditional energy costs increase while wind energy costs have declined. The advances in technology, larger-scale and more efficient manufacturing processes, and increased experience in wind turbine operations has contributed substantially to this trend. This cost decline is paralleled with a several hundred fold increase in installed wind energy capacity. As a result, maintenance costs have fallen significantly. Wind energy sources comprise less than 1% of the current electricity generating industry.

A new assessment released by the National Renewable Energy Laboratory in 2010 shows that U.S. wind resources are even larger than previously estimated and potential capacity of the land-based wind resource is more than 10,000 GW, far exceeding the 300 GW required to meet 20% of the nation’s electrical demand with wind in 2030. This figure does not factor the potential of Downdraft Towers. The estimated levelized cost of new generation resources by the Energy Information Administration shows the cost of wind energy is competitive to other conventional means of energy generation. The cumulative capacity-weighted average price of wind power, including the production tax credit, was about 4.4 cents per kilowatt hour in 2009 — a price that competes with fossil fuel-generated electricity.

| 9 |

Environmental

Various parties in the United States and other nations are pursuing clean energy solutions that use efficient and cost- effective renewable resources to serve society while avoiding the adverse effects associated with fossil and nuclear fuels, and also the obvious limitations of solar collectors that work only when the sun shines or wind turbines that work only when the wind blows.

The Solar Wind Downdraft Tower has the capability of being operated with virtually no carbon footprint, fuel consumption, or waste production. The technology has the potential to generate clean, cost effective and efficient electrical power without the damaging effects caused by using fossil or nuclear fuels, and other conventional power sources. The Company also believes that increasing emphasis on green technologies and governmental incentives in the energy industry should have a positive long-term effect on the Company's planned business and the wind energy industry in general.

Numerous federal and state environmental laws can affect the development of renewable energy, such as the California Environmental Quality Act. These laws require that certain studies be conducted to ensure that there are no significant adverse impacts on wildlife, humans and the environment generally. The significant impacts of wind energy projects are on visibility, noise, birds, wildlife habitat and soil erosion. Changes in environmental laws can pose significant expenses on renewable energy development.

International treaties and protocols, such as the Kyoto Protocol, have significantly impacted the development and implementation of renewable energy technologies. Certain countries and regions also have established emission trading programs. Under emission trading programs, utilities and factories are permitted to produce a certain level of emissions. If such an entity produces fewer emissions than its allotment, the entity may sell its excess allotment to parties exceeding their emissions allotments. To date, these mechanisms are at an early stage of development within the United States. Credit trading provides the potential for creating additional income for renewable energy producers, rationalizing of electricity prices for utilities and reducing the overall retail price for green power.

The Company believes that increasing emphasis on green technologies and governmental incentives in the energy industry should have a positive long-term effect on the Company’s planned business and the wind energy industry in general.

Industry Analysis

According to the American Wind Energy Association (“AWEA”), wind energy was the world’s fastest growing energy source during most of the 1990s, expanding at annual rates ranging from 25% to 35%. The AWEA estimates the global industry growth rate has averaged 32% over the five years from 2004 through 2008, with a growth rate of 39% in 2009. The U.S. wind industry broke all previous records by installing over 10,000 MW of new wind capacity in 2009. Current installed capacity worldwide at the end of 2009 was 35,086 MW, compared to 25,076 MW at the end of 2008. The major contributing growth factor is the federal stimulus package passed in 2009 that extended a tax credit and provided other investment incentives for alternative energy sources. The U.S. Energy Information Administration attributes 1.9% of total electric generation in the nation to wind power.

Not factoring the Company’s planned Downdraft Tower product, World Energy Council expects new wind capacity worldwide to continue to grow. The continued evolution of this technology is evident with the existence of varying wind turbine designs. However, there is division in the wind industry between those who want to capitalize on the emerging respect the business community has for established, mature wind technology, and those who seek new technologies designed to bring about significant cost reductions. Solar Wind (f/k/a Clean Wind) chooses to seek new horizons beyond current perception and knowledge by developing new technologies that it believes will be capable of significantly reducing wind energy costs.

As wind energy technology gains wider acceptance, competition may increase as large, well-capitalized companies enter the business. Although one or more may be successful, the Company believes that its technological expertise and early entry will provide a degree of competitive protection.

| 10 |

Licensing and Regulation

In the United States, many state governments have amended their utility regulations and significantly changed certain competition and marketing rules with respect to generation, transmission and distribution of electric energy. Among other things, deregulation allows consumers to purchase electricity from a source of their choice, and requires utilities to purchase electricity from independent power producers and to offer transmission to independent power producers at reasonable prices.

In California, deregulation legislation, such as the Assembly Bill 1890 and the Renewable Energy Program, were implemented in the mid-1990s to encourage the development of renewable power generation projects through various incentives. In addition, Assembly Bill 995 and Senate Bill 1038 were passed to further facilitate the development of renewable resources. In November 2008, the governor of the State of California signed Executive Order S-14-08 requiring that California utilities reach a 33% renewable energy goal by 2020, exceeding the previous legislative mandate that electric utilities supply 20% of their total retail power sales from renewable resources by 2010. In September 2009, the Governor signed Executive Order S-21-09, requiring the Air Resources Board under the California Environmental Protection Agency to adopt a regulation by July 1, 2010 requiring California’s load-serving entities to meet the 33% renewable energy goal through the creation and use of renewable energy sources to ensure reduction of greenhouse gas emissions.

In Arizona, access to the electricity market has been established through Arizona’s Retail Electric Competition Rules, which, in the Company’s opinion, provide a favorable environment for renewable energy generators. Electricity producers are subject to the Federal Public Utilities Regulatory Policies Act (“PURPA”) and state regulations. In addition, power producers must also meet standards set by the Arizona Corporations Commission (the “ACC”).

The Federal Energy Policy Act of 2005 provided further benefits to independent power producers by requiring transmission companies to provide access to third parties at a reasonable price. On October 3, 2008, the President of the United States signed the Emergency Economic Stabilization Act of 2008 into law. This legislation contains a number of tax incentives designed to encourage both individuals and businesses to make investments in renewable energy, including an eight-year extension of the business solar investment tax credit (“ITC”). The ITC is a 30% tax credit on solar property effective through December 31, 2016. The American Recovery and Reinvestment Act of 2009 further extended the U.S.$0.021/kWh Production Tax Credit (“PTC”) through December 31, 2012, and provide an option to elect a 30% ITC or an equivalent cash grant from the U.S. Department of Energy.

Employees

As of March 27, 2014, the Company had a total of 3 full time employees. The Company anticipates that in 2014 it may need to hire additional staff in the areas of engineering, marketing and administration.

ITEM 1A. RISK FACTORS

The Company’s results of operations, financial condition and cash flows can be adversely affected by various risks. These risks include, but are not limited to, the principal factors listed below and the other matters set forth in this annual report on Form 10-K. You should carefully consider all of these risks before making an investment decision.

Risks Related to Our Business and the Industry in Which We Compete

Our independent auditors have expressed substantial doubt about our ability to continue as a going concern, which may hinder our ability to obtain future financing.

The report of our independent auditors dated March 28, 2014 on our consolidated financial statements for the year ended December 31, 2013 included an explanatory paragraph indicating that there is substantial doubt about our ability to continue as a going concern. Our auditors’ doubts are based on our inability to generate sufficient cash flow to sustain our operations without securing additional financing, deficit accumulated during development stage, negative cash flows from operations and our limited cash balances and working capital deficit position. Our ability to continue as a going concern will be determined by our ability to obtain additional funding in the short term to enable us to realize the commercialization of our planned business operations. Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertain.

| 11 |

We are an early development stage company. We have not yet commenced with the construction of our Downdraft Towers or the production of electricity.

The Company has a limited operating history and has primarily engaged in operations relating to the development of its business plan. As an early-stage entity, the Company is subject to many of the risks common to such enterprises, including the ability of the Company to implement its business plan, market acceptance of its proposed business, under-capitalization, cash shortages, limitations with respect to personnel, financing and other resources, and uncertainty of the Company’s ability to generate revenues. There can be no assurance that the Company’s activities will be successful or result in any revenues or profit for the Company, and the likelihood of the Company’s success must be considered in light of the stage in its development. To date, the Company has generated no revenue and has generated losses.

The Company believes it has engaged professionals and consultants experienced in the type of business contemplated by the Company; however, there can be no assurance that the predictions, opinions, analyses, or conclusions of such professionals will prove to be accurate. In addition, no assurance can be given that the Company will be able to consummate its business strategy and plans or that financial or other limitations may force the Company to modify, alter, significantly delay, or significantly impede the implementation of such plans or the Company’s ability to continue operations. If the Company is unable to successfully implement its business strategy and plans, investors may lose their entire investment in the Company.

Potential investors should also be aware of the difficulties normally encountered by new renewable energy companies. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the inception of the enterprise that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to construction, operation and distribution, and additional costs and expenses that may exceed current estimates.

Future financings will involve a dilution of the interests of the stockholders of the Company upon the issuance of additional shares of Common Stock or other securities.

We will need to engage in additional financings in the future. There can be no assurances that such financings will ever be completed, but any such financings will involve a dilution of the interests of our stockholders upon the issuance of additional shares of Common Stock or other securities. Attaining such additional financing may not be possible, or if additional capital may be otherwise available, the terms on which such capital may be available may not be commercially feasible or advantageous to existing shareholders. We expect to issue shares of our Common Stock and/or other securities in exchange for additional financing.

We anticipate significant future capital needs and the availability of future capital is uncertain.

The Company has experienced negative cash flows from operations since its inception. The Company will be required to spend substantial funds to continue research and development. The Company will need to raise additional capital. The Company’s capital requirements will depend on many factors, primarily relating to the problems, delays, expenses and complications frequently encountered by development stage companies; the progress of the Company’s research and development programs; the costs and timing of seeking regulatory approvals of the Company’s products under development; the Company’s ability to obtain such regulatory approvals; costs in filing, prosecuting, defending, and enforcing any patent claims and other intellectual property rights; the extent and terms of any collaborative research, manufacturing, marketing, or other arrangements; and changes in economic, regulatory, or competitive conditions or the Company’s planned business. To satisfy its capital requirements, the Company may seek to raise funds in the public or private capital markets. The Company may seek additional funding through corporate collaborations and other financing vehicles. There can be no assurance that any such funding will be available to the Company, or if available, that it will be available on acceptable terms. If adequate funds are not available, the Company may be required to curtail significantly one or more of its research or development programs or it may be required to obtain funds through arrangements with future collaborative partners or others that may require the Company to relinquish rights to some or all of its technologies or products under development. If the Company is successful in obtaining additional financing, the terms of the financing may have the effect of diluting or adversely affecting the holdings or the rights of the holders of Common Stock.

| 12 |

We have a history of losses.

We expect to incur non-capitalized development costs and general and administrative expenses prior to the completion of construction and commencement of operation of our proposed projects. We cannot predict if we will ever achieve profitability and, if we do, we may not be able to sustain or increase our profitability. If we cannot achieve or maintain profitability, we may not be able to continue to absorb the resulting financial losses. If we continue to suffer financial losses, our business may be jeopardized and our shareholders may lose all of their investment in our shares.

The Company’s strategies for development of the business might not be successful.

The Company is currently evaluating potential development strategies for its business. It may take several years, if ever, for the Company to achieve cumulative positive cash flow. The Company could experience significant difficulties in executing its business plan, including: inability to successfully implement the Company’s business plan; changes in market conditions; inability to obtain necessary financing; delays in completion of the Company’s projects or their underlying technologies; inaccurate cost estimates; changes in government or political reform; or the Company may not benefit from the proposed projects as the Company expected. The Company’s inability to develop and market the Company’s business successfully and to generate positive cash flows from these operations in a timely manner would have a material adverse effect on the Company’s ability to meet the Company’s working capital requirements.

We expect to rely upon strategic relationships in order to execute our business plan and the Company may not be able to consummate the strategic relationships necessary to execute its business plan.

The Company plans to enter into and rely on strategic relationships with other parties, in particular to acquire rights necessary to develop and build proposed projects and to develop and build such projects. These strategic relationships could include licensing agreements, partnerships, joint ventures, or even business combinations. The Company believes that these relationships will be particularly important to the Company’s future growth and success due to the size and resources of the Company and the resources necessary to complete the Company’s proposed projects. The Company may, however, not be able to successfully identify potential strategic relationships. Even if the Company does identify one or more potentially beneficial strategic relationships, it may not be able to consummate these relationships on favorable terms or at all, obtain the benefits it anticipates from such relationships or maintain such relationships. In addition, the dynamics of the Company’s relationships with possible strategic partners may require the Company to incur expenses or undertake activities it would not otherwise be inclined to undertake in order to fulfill the Company’s obligations to these partners or maintain the Company’s relationships.

To the extent the Company consummates strategic relationships; it may become reliant on the performance of independent third parties under such relationships. Moreover, certain potentially critical strategic relationships are only in the early stages of discussion and have not been officially agreed to and formalized. If strategic relationships are not identified, established or maintained, or are established or maintained on terms that become unfavorable, the Company’s business prospects may be limited, which could have a negative impact on the Company’s ability to execute the Company’s business plan, diminish the Company’s ability to conduct the Company’s operations and/or materially and adversely affect the Company’s business and financial results.

| 13 |

Project development or construction activities may not be successful and proposed projects may not receive required permits or construction may not proceed as planned.

The development and construction of our proposed projects will involve numerous risks. We may be required to spend significant sums for preliminary engineering, permitting, legal, and other expenses before we can determine whether a project is feasible, economically attractive or capable of being built. Success in developing a particular project is contingent upon, among other things: (i) negotiation of satisfactory engineering, procurement and construction agreements; (ii) receipt of required governmental permits and approvals, including the right to interconnect to the electric grid on economically acceptable terms; (iii) payment of interconnection and other deposits (some of which may be non-refundable); (iv) obtaining construction financing; and (v) timely implementation and satisfactory completion of construction.

Successful completion of a particular project may be adversely affected by numerous factors, including: (i) delays in obtaining required governmental permits and approvals with acceptable conditions; (ii) uncertainties relating to land costs for projects on land subject to Bureau of Land Management procedures; (iii) unforeseen engineering problems; (iv) construction delays and contractor performance shortfalls; (v) work stoppages; (vi) cost over-runs; (vii) equipment and materials supply; (viii) adverse weather conditions; and (ix) environmental and geological conditions.

The estimates and projections contained in this Annual Report may not be realized.

Any estimates or projections in this Annual Report have been prepared on the basis of assumptions and hypotheses, which the Company believes to be reasonable. However, no assurance can be given that the potential benefits described in this Annual Report will prove to be available. Such assumptions are highly speculative and, while based on management’s best estimates of projected sales levels, operational costs, consumer preferences, and the Company’s general economic and competitive conditions in the industry, there can be no assurance that the Company will operate profitably or remain solvent. To date, the Company has not operated profitably and has a history of losses. If the Company’s plans prove unsuccessful, investors could lose all or part of their investment. There can be no assurance that the Company will be able to generate any revenue or profits.

Our business is subject to significant government regulation and, as a result, changes to such regulations may adversely affect our business.

Although independent and small power producers may generate electricity and engage in wholesale sales of energy without being subject to the full panoply of state and/or provincial and federal regulation to the same extent as a public utility company, our planned operations will nonetheless be subject to changes in government regulatory requirements, such as regulations related to the environment, zoning and permitting, financial incentives, taxation, competition, pricing, and FERC and state PUC regulations on competition. The operation of our proposed projects will be subject to regulation by various U.S. government agencies at the federal, state and municipal level. There is always the risk of change in government policies and laws, including but not limited to laws and regulations relating to income, capital, sales, corporate or local taxes, and the removal of tax incentives. Changes in these regulations could have a negative impact on our potential profitability. Laws and tax policies may change and such changes may be favorable or unfavorable to the Company, which may result in the cancellation of proposed projects or reduce anticipated revenues and cash flow.

| 14 |

We may be unable to acquire or lease land and/or obtain the approvals, licenses and permits necessary to build and operate our proposed projects in a timely and cost effective manner, and regulatory agencies, local communities or labor unions may delay, prevent or increase the cost of construction and operation of our proposed projects.

In order to construct and operate our proposed projects, we need to acquire or lease land and obtain all necessary local, county, state and federal approvals, licenses and permits. We may be unable to acquire the land or lease interests needed, may not receive or retain the requisite approvals, permits and licenses or may encounter other problems which could delay or prevent us from successfully constructing and operating proposed projects.

Proposed projects may be located on or require access through public lands administered by federal and state agencies pursuant to competitive public leasing and right-of-way procedures and processes. The authorization for the use, construction and operation of our proposed projects and associated transmission facilities on federal, state and private lands will also require the assessment and evaluation of mineral rights, private rights-of-way and other easements; environmental, agricultural, cultural, recreational and aesthetic impacts; and the likely mitigation of adverse impacts to these and other resources and uses. The inability to obtain the required permits and, potentially, excessive delay in obtaining such permits due, for example, to litigation, could prevent us from successfully constructing and operating our proposed projects. Moreover, project approvals subject to project modifications and conditions, including mitigation requirements and costs, could affect the financial success of our proposed projects.

Our ability to manage our growth successfully is crucial to our future.

We are subject to a variety of risks associated with a growing business. Our ability to operate successfully in the future depends upon our ability to finance, develop, and construct future renewable energy projects, implement and improve the administration of financial and operating systems and controls, expand our technical capabilities and manage our relationships with landowners and contractors. Our failure to manage growth effectively could have a material adverse effect on our business or results of operations.

Notwithstanding the Recovery Act and other regulatory incentives, we may not be able to finance the development or the construction costs of building our planned projects.

We do not have sufficient funds from the cash flow of our operations to fully finance the development or the construction costs of building our proposed projects. Additional funds will be required to complete the development and construction of our proposed projects, to find and carry out the development of properties, and to pay the general and administrative costs of operating our business. Additional financing may not be available on acceptable terms, if at all. If we are unable to raise additional funds when needed, we may be required to delay development and construction of our proposed projects, reduce the scope of our proposed projects, and/or eliminate or sell some or all of our development projects, if any.

We may not be able to obtain access to the transmission lines necessary to deliver the power we plan to produce and sell.

We will depend on access to transmission facilities so that we may deliver power to purchasers. If existing transmission facilities do not have available transmission capacity, we would be required to pay for the upgrade of existing transmission facilities or to construct new ones. There can be no assurance that we will be able to secure access to transmission facilities at a reasonable cost, or at all. As a result, expected profitability on a proposed project may be lower than anticipated or, if we have no access to electricity transmission facilities, we may not be able to fulfill our obligations to deliver power or to construct the project or we may be required to pay liquidated damages.

| 15 |

Changes in interest rates and debt covenants and increases in turbine and generator prices and construction costs may result in our proposed projects not being economically feasible.

Increases in interest rates and changes in debt covenants may reduce the amounts that we can borrow, reduce the cash flow, if any, generated by our proposed projects, and increase the equity required to complete the construction of our proposed projects. The cost of wind turbines, generators and construction costs have increased significantly over the last four years. Further increases may increase the cost of our proposed projects to the point that such projects are not feasible given the prices utilities are willing to pay. There can be no assurance that we will be able to negotiate power purchase agreements with sufficiently profitable electricity prices in the future.

We may not be able to secure power purchase agreements.

We may not be able to secure power purchase agreements for our proposed projects. In the event that we do secure power purchase agreements, if we fail to construct our proposed projects in a timely manner, we may be in breach of our power purchase agreements and such agreements may be terminated.

The operation of our proposed projects may be subject to equipment failure.

After the construction of our proposed projects, the electricity produced may be lower than anticipated because of equipment malfunction. Unscheduled maintenance can result in lower electricity production for several months or possibly longer depending on the nature of the outage, and correspondingly, in lower revenues.

Changes in weather patterns may affect our ability to operate our proposed projects.

Meteorological data we collect during the development phase of a proposed project may differ from actual results achieved after the project is erected. While long-term precipitation patterns have not varied significantly, short-term patterns, either on a seasonal or on a year-to-year basis may vary substantially. These variations may result in lower revenues and higher operating losses.

Environmental damage on our properties may cause us to incur significant financial expenses.

Environmental damage may result from the development and operation of our proposed projects. The construction of our proposed initial Downdraft Tower involves, among other things, land excavation and the installation of concrete foundations. Equipment can be a source of environmental concern, including noise pollution, damage to the soil as a result of oil spillage, and peril to certain migratory birds and animals that live, feed on, fly over, or cross the property. In addition, environmental regulators may impose restrictions on our operations, which would limit our ability to obtain the appropriate zoning or conditional use permits for our project. We may also be assessed significant financial penalties for any environmental damage caused on properties that are leased, and we may be unable to sell properties that are owned. Financial losses and liabilities that may result from environmental damage could affect our ability to continue to do business.

Larger developers have greater resources and expertise in developing and constructing renewable energy projects.

We face significant competition from large power project developers, including electric utilities and large independent power producers that have greater project development, construction, financial, human resources, marketing and management capabilities than the Company. They have a track record of completing projects and may be able to acquire funding more easily to develop and construct projects. They have also established relationships with energy utilities, transmission companies, turbine suppliers, and plant contractors that may make our access to such parties more difficult.

| 16 |

Renewable energy must compete with traditional fossil fuel sources.

In addition to competition from other industry participants, we face competition from fossil fuel sources such as natural gas and coal, and other renewable energy sources such as solar, traditional wind, hydro and geothermal. The competition depends on the resources available within the specific markets. Although the cost to produce clean, reliable, renewable energy is becoming more competitive with traditional fossil fuel sources, it generally remains more expensive to produce, and the reliability of its supply is less consistent than traditional fossil fuel. However, deregulation, legislative mandates for renewable energy, and consumer preference for environmentally more benign energy sources are becoming important factors in increasing the development of alternative energy projects.

The wind energy industry in California is highly competitive since wind plays an integral role in the electricity portfolio in California.

The Company is investigating the feasibility of locating a Downdraft Tower in California. Since wind plays an integral role in the electricity portfolio in California and wind energy requires a significant amount of land resource, the wind energy industry in California is highly competitive. Wind developers compete for leased and owned land with favorable wind characteristics, limited supply of turbines and contractors, and for purchasers and available transmission capacity. There is no guarantee that we will be able to acquire the significant land resources needed to develop projects in California.

Our ability to hire and retain qualified personnel and contractors will be an important factor in the success of our business. Our failure to hire and retain qualified personnel may result in our inability to manage and implement our plans for expansion and growth.

Competition for qualified personnel in the renewable energy industry is significant. To manage growth effectively, we must continue to implement and improve our management systems and to recruit and train new personnel. We may not be able to continue to attract and retain the qualified personnel necessary to carry on our business. If we are unable to retain or hire additional qualified personnel as required, we may not be able to adequately manage and implement our plans for expansion and growth.

The market in which we operate is rapidly evolving and we may not be able to maintain our profitability.

As a result of the emerging nature of the markets in which we plan to compete and the rapidly evolving nature of our industry, it is particularly difficult for us to forecast our revenues or earnings accurately. Our current and future expense levels are based largely on our investment plans and estimates of future revenues and are, to a large extent, fixed. We may not be able to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenues relative to our planned expenditures would have an immediate adverse effect on our business, results of operations and financial condition.

We depend on key personnel, the loss of which could have a material adverse effect on us.

Our performance depends substantially on the continued services and on the performance of our senior management and other key personnel. Our ability to retain and motivate these and other officers and employees is fundamental to our performance. The unexpected loss of services of one or more of these individuals could have a material adverse effect on us. We are not protected by a material amount of key-person or similar life insurance covering our executive officers and other directors. We have entered into employment agreements with our executive officers, but the non-compete period with respect to certain executive officers could, in some circumstances in the event of their termination of employment with the Company, end prior to the employment term set forth in their employment agreements.

| 17 |

Certain legal proceedings and regulatory matters could adversely impact our results of operations.

We may be subject from time to time to various claims involving alleged breach of contract claims, intellectual property and other related claims, and other litigations. Certain of these lawsuits and claims, if decided adversely to us or settled by us, could result in material liability to the Company or have a negative impact on the Company’s reputation or relations with its employees, customers, licensees or other third parties. In addition, regardless of the outcome of any litigation or regulatory proceedings, such proceedings could result in substantial costs and may require that the Company devotes substantial time and resources to defend itself. Further, changes in governmental regulations in the U.S. could have an adverse impact on our results of operations.

Our results may be adversely affected by the impact that disruptions in the credit and financial markets have on our customers and the energy industry.

Beginning in late 2008 and continuing throughout 2009, energy and utility companies faced difficult conditions as a result of significant disruptions in the global economy, the repricing of credit risk and the deterioration of the financial markets. Continued volatility and further deterioration in the credit markets may reduce our access to financing. These events could negatively impact our operations and financial condition and our ability to raise the additional capital necessary to finance our operations.

The effects of the recent global economic crisis may impact the Company’s business, operating results, or financial condition.

The recent global economic crisis has caused disruptions and extreme volatility in global financial markets and increased rates of default and bankruptcy, and has impacted levels of spending. These macroeconomic developments could negatively affect the Company’s business, operating results, or financial condition in a number of ways. For example, potential clients may delay or decrease spending with the Company or may not pay the Company.

The Company’s insurance coverage may not be adequate.

If the Company was held liable for amounts exceeding the limits of its insurance coverage in place at any given time or for claims outside the scope of that coverage, its business, results of operations and financial conditions could be materially and adversely affected.

Our business is subject to extensive governmental regulation that could reduce our profitability, limit our growth, or increase competition.

Our planned businesses are subject to extensive federal, state and foreign governmental regulation and supervision, which could reduce our potential profitability or limit our potential growth by increasing the costs of regulatory compliance, limiting or restricting the products or services we plan to sell or the methods by which we plan to sell our products and services, or subjecting our businesses to the possibility of regulatory actions or proceedings.

In all jurisdictions the applicable laws and regulations are subject to amendment or interpretation by regulatory authorities. Generally, such authorities are vested with relatively broad discretion to grant, renew and revoke licenses and approvals and to implement regulations. Accordingly, we may be precluded or temporarily suspended from carrying on some or all of our planned activities or otherwise fined or penalized in a given jurisdiction. No assurances can be given that our business will be allowed to be, or continue to be, conducted in any given jurisdiction as we plan.

Competition resulting from these developments could cause the supply of, and demand for, our planned products and services to change, which could adversely affect our results of operations and financial condition.

| 18 |

Our planned operations will expose us to various international risks that could adversely affect our business.

We are seeking to reach agreements for the provision of key aspects of our business with foreign operators, specifically in Mexico. Accordingly, we may become subject to legal, economic and market risks associated with operating in foreign countries, including:

| · | the general economic and political conditions existing in those countries; | |

| · | devaluations and fluctuations in currency exchange rates; | |

| · | imposition of limitations on conversion of foreign currencies or remittance of dividends and other payments by foreign subsidiaries; | |

| · | imposition or increase of withholding and other taxes on remittances and other payments by subsidiaries; | |

| · | hyperinflation in certain foreign countries; | |

| · | imposition or increase of investment and other restrictions by foreign governments; | |

| · | longer payment cycles; | |

| · | greater difficulties in accounts receivable collection; and | |

| · | the requirement of complying with a wide variety of foreign laws. |

Our ability to conduct business in foreign countries may be affected by legal, regulatory, political and economic risks.

Our ability to conduct business in foreign countries is subject to risks associated with international operations. These include:

| · | the burdens of complying with a variety of foreign laws and regulations; | |

| · | unexpected changes in regulatory requirements; and | |

| · | new tariffs or other barriers in some international markets. |

We are also subject to general political and economic risks in connection with our international operations, including:

| · | political instability and terrorist attacks; | |

| · | changes in diplomatic and trade relationships; and | |

| · | general economic fluctuations in specific countries or markets. |

We cannot predict whether quotas, duties, taxes, or other similar restrictions will be imposed by the U.S. or foreign countries upon our business in the future, or what effect any of these actions would have on our business, financial condition or results of operations. Changes in regulatory, geopolitical, social or economic policies and other factors may have a material adverse effect on our business in the future or may require us to significantly modify our current business practices.

The occurrence of natural or man-made disasters could adversely affect our financial condition and results of operations.

We are exposed to various risks arising out of natural disasters, including earthquakes, hurricanes, fires, floods and tornadoes, and pandemic health events such as H1N1 influenza, as well as man-made disasters, including acts of terrorism and military actions. The continued threat of terrorism and ongoing military actions may cause significant volatility in global financial markets, and a natural or man-made disaster could trigger an economic downturn in the areas directly or indirectly affected by the disaster. These consequences could, among other things, result in a decline in business and increased claims from those areas. Disasters also could disrupt public and private infrastructure, including communications and financial services, which could disrupt our normal business operations.

Our inability to successfully recover should we experience a disaster or other business continuity problem could cause material financial loss, loss of human capital, regulatory actions, reputational harm or legal liability.

| 19 |

Should we experience a local or regional disaster or other business continuity problem, such as an earthquake, hurricane, terrorist attack, pandemic, security breach, power loss, telecommunications failure or other natural or man-made disaster, our continued success will depend, in part, on the availability of our personnel, our office facilities, and the proper functioning of our computer, telecommunication and other related systems and operations.

Our operations are dependent upon our ability to protect our technology infrastructure against damage from business continuity events that could have a significant disruptive effect on our operations. We could potentially lose operation of our projects or experience material adverse interruptions to our operations or delivery of services to our clients in a disaster recovery scenario.

We plan to regularly assess and take steps to improve upon our existing business continuity plans and key management succession. However, a disaster on a significant scale or affecting certain of our key operating areas within or across regions, or our inability to successfully recover should we experience a disaster or other business continuity problem, could materially interrupt our business operations and cause material financial loss, loss of human capital, regulatory actions, reputational harm, damaged client relationships or legal liability.

Assertions by a third party that the Company infringes its intellectual property could result in costly and time-consuming litigation, expensive licenses or the inability to operate as planned.

The energy and technology industries are characterized by the existence of a large number of patents, copyrights, trademarks and trade secrets and by frequent litigation based on allegations of infringement or other violations of intellectual property rights. There is a possibility of intellectual property rights claims against the Company. The Company’s technologies may not be able to withstand third-party claims or rights restricting their use. Companies, organizations or individuals, including the Company’s competitors, may hold or obtain patents or other proprietary rights that would prevent, limit or interfere with the Company’s ability to provide the Company’s services or develop new products or services, which could make it more difficult for the Company to operate the Company’s business. Any litigation or claims, whether or not valid, could be time-consuming, expensive to litigate or settle and could divert the Company’s managements’ attention and financial resources. If the Company is determined to have infringed upon a third party’s intellectual property rights, the Company may be required to pay substantial damages, stop using technology found to be in violation of a third party’s rights or seek to obtain a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms, or at all, and may significantly increase the Company’s operating expenses or may require the Company to restrict the Company’s business activities in one or more respects.