UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

GAMCO ASSET MANAGEMENT INC.

MARIO J. GABELLI

MATTHEW GOLDFARB

F. JACK LIEBAU, JR.

RYAN J. MORRIS

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH __, 2016

GAMCO ASSET MANAGEMENT INC.

___________________, 2016

Dear Fellow Shareholder:

GAMCO Asset Management Inc. (“GAMCO Asset Management”) and the other participants in this solicitation (collectively, “GAMCO” or “we”) are the beneficial owners of an aggregate of 3,059,552 shares of common stock, $.01 par value per share (the “Common Stock”), of Superior Industries International, Inc., a Delaware corporation (“Superior Industries” or the “Company”), representing approximately 12.03% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we are seeking representation on the Board of Directors of the Company (the “Board”). We are seeking your support at the annual meeting of stockholders scheduled to be held at [__________________________] on [_____________], 2016, at [___________________], including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

|

|

1.

|

To elect GAMCO’s three (3) director nominees, Matthew Goldfarb, F. Jack Liebau, Jr. and Ryan J. Morris (each a “Nominee” and, collectively, the “Nominees”), to the Board to serve until the 2017 annual meeting of stockholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To approve, in a non-binding advisory vote, executive compensation;

|

|

|

3.

|

To approve the material terms of the performance goals under the Company’s Annual Incentive Performance Plan;

|

|

|

4.

|

To consider a proposal regarding proxy access;

|

|

|

5.

|

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 25, 2016; and

|

|

|

6.

|

To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

|

We believe that the Company is in urgent need of fresh perspective and a focus on enhancing stockholder value, which, we believe, the Nominees will provide.

For the reasons set forth in the attached Proxy Statement and specifically the “Reasons for Our Solicitation” section, we are seeking to add three representatives on the Board to help ensure that the interests of the stockholders, the true owners of the Company, are more appropriately represented in the boardroom. There are currently eight directors serving on the Board, all of whose terms expire at the Annual Meeting. Through the attached Proxy Statement and enclosed BLUE proxy card, we are soliciting proxies to elect the Nominees. Stockholders who vote on the enclosed BLUE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than [_________], [_________], and [_________]. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. The names, backgrounds and qualifications of the Company’s Nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if all or some of our Nominees are elected.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed BLUE proxy card today. The attached Proxy Statement and the enclosed BLUE proxy card are first being furnished to the stockholders on or about April [___], 2016.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact GAMCO at our address listed below.

|

Thank you for your support.

|

| /s/ Mario J. Gabelli |

|

Mario J. Gabelli

|

|

GAMCO Asset Management Inc.

|

Sign, date and return the BLUE proxy card today.

|

Important!

|

|

|

1.

|

Regardless of how many shares your own, your vote is very important. Please sign, date and mail the enclosed BLUE proxy card. You may also vote via the Internet or by telephone by following the voting instructions on the BLUE proxy card.

|

|

Please vote each BLUE proxy card you receive since each account must be voted separately.

|

|

|

Only your latest dated proxy counts.

|

|

|

2.

|

We urge you NOT to sign any white proxy card sent to you by Superior Industries.

|

|

3.

|

Even if you have sent a white proxy card to Superior Industries, you have every right to change your vote. You may revoke that proxy by signing, dating and mailing the enclosed BLUE proxy card in the enclosed envelope.

|

|

If you have any questions, require assistance in voting your BLUE proxy card,

|

|

|

or need additional copies of GAMCO’s proxy materials,

|

|

|

please contact GAMCO at the phone number listed below.

|

|

|

GAMCO ASSET MANAGEMENT INC.

|

|

|

ONE CORPORATE CENTER

|

|

|

RYE, NEW YORK 10580

|

|

|

(800) 422-3554

|

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED MARCH __, 2016

2016 ANNUAL MEETING OF STOCKHOLDERS

OF

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

_________________________

PROXY STATEMENT

OF

GAMCO ASSET MANAGEMENT INC.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

GAMCO Asset Management Inc. (“GAMCO Asset Management”), Mario J. Gabelli and certain of their affiliates (collectively, “GAMCO” or “we”) are significant stockholders of Superior Industries International, Inc., a Delaware corporation (“Superior Industries” or the “Company”), owning in the aggregate approximately 12.03% of the outstanding shares of common stock, $.01 par value per share (the “Common Stock”), of the Company. We are seeking to add three representatives on the Board of Directors of the Company (the “Board”) because we believe that the Board could be improved by the addition of directors who have strong, relevant background and who are committed to fully exploring all opportunities to enhance stockholder value. We are seeking your support at the annual meeting of stockholders scheduled to be held at [__________________________] on [_____________], 2016, at [___________________], including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

|

|

1.

|

To elect GAMCO’s three (3) director nominees, Matthew Goldfarb, F. Jack Liebau, Jr. and Ryan J. Morris (each a “Nominee” and, collectively, the “Nominees”), to the Board to serve until the 2017 annual meeting of stockholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To approve, in a non-binding advisory vote, executive compensation;

|

|

|

3.

|

To approve the material terms of the performance goals under the Company’s Annual Incentive Performance Plan;

|

|

|

4.

|

To consider a proposal regarding proxy access;

|

|

|

5.

|

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 25, 2016; and

|

|

|

6.

|

To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

|

As of the date hereof, GAMCO Asset Management and its affiliates collectively own 3,059,552 shares of Common Stock, constituting approximately 12.03% of the outstanding shares of Common Stock. We intend to vote such shares of Common Stock FOR the election of the Nominees, FOR the proxy access proposal, FOR the ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm, ABSTAIN on the approval of the Say-on-Pay Proposal, and ABSTAIN on the approval of the material terms of the performance goals under the Company’s Annual Incentive Performance Plan, as described herein.

The Company has set the close of business on March 11, 2016 as the record date for determining stockholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 26600 Telegraph Rd., Suite 400, Southfield, Michigan 48034. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were [__,___,___] shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY GAMCO AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH GAMCO IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

GAMCO URGES YOU TO SIGN, DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our BLUE proxy card are available at

[_________________]

______________________________

2

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. GAMCO urges you to sign, date, and return the enclosed BLUE proxy card today to vote FOR the election of the Nominees and in accordance with GAMCO’s recommendations on the other proposals on the agenda for the Annual Meeting.

|

|

·

|

If your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE proxy card and return it to GAMCO in the enclosed postage-paid envelope today.

|

|

|

·

|

If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

|

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our Nominees only on our BLUE proxy card. So please make certain that the latest dated proxy card you return is the BLUE proxy card.

|

GAMCO ASSET MANAGEMENT INC.

ONE CORPORATE CENTER

RYE, NEW YORK 10580

(800) 422-3554

|

3

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation.

|

|

·

|

On February 3, 2015, GAMCO delivered a nomination letter to the Company, in accordance with the requirements of the Bylaws, with respect to its nomination of Messrs. Angiolillo, Blazek and Schenker for election as directors of the Company at the 2015 Annual Meeting.

|

|

|

·

|

On March 11, 2015, GAMCO sent a letter to the Company’s Chairman regarding, among other things, the 2015 Annual Meeting and the Company’s response to GAMCO’s February 3, 2015 nomination letter.

|

|

|

·

|

Also on March 11, 2015, the Company filed its preliminary proxy statement with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 16, 2015, GAMCO sent a letter to the Company requesting that a stockholder list and certain other records relating to the ownership of the Company’s capital stock be made available for inspection and copying by GAMCO pursuant to Section 1600 of the California Corporations Code.

|

|

|

·

|

On March 17, 2015, the Company sent a follow-up communication to GAMCO, requesting the ability to conduct interviews with GAMCO’s nominees on April 1, 2015.

|

|

|

·

|

On March 19, 2015, the Company filed a revised preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

Also on March 19, 2015, GAMCO filed its preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 23, 2015, the Company responded to GAMCO’s stockholder records request letter indicating that it would make all the requested records available beginning on March 24, 2015 in accordance with Section 1600 of the California Corporations Code.

|

|

|

·

|

Also on March 23, 2015, the Company filed a revised preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 26, 2015, the Company filed its definitive proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 30, 2015, the Company issued a press release announcing that it had filed its definitive proxy statement with the SEC with respect to the 2015 Annual Meeting and, in conjunction therewith, was also mailing a letter to stockholders in which the Company comments on the proxy contest by GAMCO with respect to the 2015 Annual Meeting.

|

|

|

·

|

On April 1, 2015, GAMCO filed a revised preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On April 7, 2015, GAMCO filed a revised preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

4

|

|

·

|

Also on April 7, 2015, the Company issued a press release announcing that the Company was mailing a letter to stockholders in which it comments on the proxy contest by GAMCO with respect to the 2015 Annual Meeting.

|

|

|

·

|

On April 13, 2015, GAMCO filed its definitive proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On April 20, 2015, GAMCO filed a letter with the SEC addressed to the Company’s stockholders soliciting support for the election of GAMCO’s nominees at the 2015 Annual Meeting.

|

|

|

·

|

On May 5, 2015, the Company held the 2015 Annual Meeting and Messrs. Angiolillo, Blazek and Schenker were not elected as directors.

|

|

|

·

|

On May 15, 2015, the Company changed its state of incorporation from California to Delaware, and began to be governed by the Delaware General Corporation Law and an amended Certificate of Incorporation and Bylaws.

|

|

|

·

|

In July 2015, the Chairman of the Company’s Board, Margaret Dano, contacted Mario Gabelli in advance of a previously scheduled meeting set to occur on August 26, 2015. During their discussion, Ms. Dano communicated to Mr. Gabelli that the Board had engaged in a search for an additional director. In order to ensure that the best interests of stockholders are appropriately represented in the boardroom and in an effort to avoid a proxy contest, Mr. Gabelli recommended two individuals for the Company’s consideration in its director search process.

|

|

|

·

|

On August 26, 2015, representatives of the Company met with Mr. Gabelli. The Company’s failure to propose a solution in the best interest of stockholders led Mr. Gabelli to inform the representatives of the Company that he anticipated engaging in a proxy contest in 2016.

|

|

|

·

|

On November 3, 2015, the Company appointed Michael Bruynesteyn to the Board, filling a vacancy which was created when the Board increased the number of directors to eight in accordance with the Company’s Bylaws.

|

|

|

·

|

On December 28, 2015, GAMCO filed Amendment No. 29 to the Schedule 13D in which it disclosed its intention to nominate one or more individuals for election as directors of the Company at the 2016 Annual Meeting.

|

|

|

·

|

On February 4, 2016, GAMCO delivered a nomination letter to the Company, in accordance with the requirements of the Bylaws, with respect to its nomination of Messrs. Goldfarb, Liebau and Morris for election as directors of the Company at the 2016 Annual Meeting.

|

|

|

·

|

On February 10, 2016, Kerry A. Shiba, the Company’s Chief Financial Officer and Secretary, sent a letter to GAMCO acknowledging the Company’s receipt of GAMCO’s nomination letter, and stating that the Nominating and Corporate Governance Committee of the Board would like to interview the Nominees. The letter further requested that the Nominees complete the Company’s director and officer questionnaire.

|

5

|

|

·

|

On February 16, 2016, GAMCO emailed the Company on the behalf of the Nominees and provided completed versions of the Company’s director and officer questionnaire for each of the Nominees.

|

|

|

·

|

On February 17, 2016, GAMCO emailed the Company on behalf of the Nominees and provided multiple dates on which each of the Nominees would be available for an in-person interview with the Nominating and Corporate Governance Committee of the Board.

|

|

|

·

|

On February 29, 2016, GAMCO submitted a stockholder proposal for inclusion in the Company’s proxy and proxy statement for the 2017 Annual Meeting, pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requesting that the Board adopt a “Proxy Access” bylaw.

|

|

|

·

|

On March 3, 2016, Mr. Morris and Mr. Goldfarb met with representatives of the Company in Birmingham, Michigan. Also on March 3, 2016, Mr. Liebau met telephonically with representatives of the Company.

|

|

|

·

|

On March 10, 2016, the Company filed a preliminary proxy statement with the SEC with respect to the 2016 Annual Meeting.

|

|

|

·

|

On March 14, 2016, GAMCO sent a letter to the Company requesting that a stockholder list and certain other records relating to the ownership of the Company’s capital stock be made available for inspection and copying by GAMCO pursuant to Section 220 of the Delaware General Corporation Law.

|

6

REASONS FOR THE SOLICITATION

GAMCO BELIEVES THAT STOCKHOLDER REPRESENTATIVES ARE NEEDED IN SUPERIOR’S BOARDROOM TO HELP ENSURE THAT THE BEST INTEREST OF THE STOCKHOLDERS ARE THE PRIMARY CONSIDERATION IN ALL DECISION-MAKING, INCLUDING THE CRITICAL DECISIONS RELATING TO THE ALLOCATION OF CAPITAL

Stockholders deserve to have representation in the boardroom to ensure the Board does not approve acquisitions or major capital deployment projects that are not in the best interest of all stockholders, particularly in light of political dynamics, currency issues, and production cycles in the U.S. automotive industry.

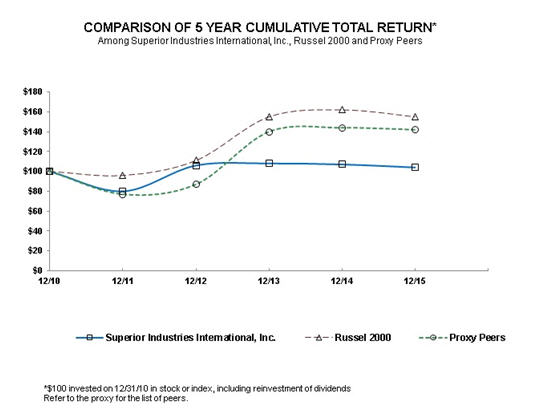

We are Concerned that Superior’s Stock Performance Continues to Lag Behind the Market and its Peers

The following chart provides a comparison of Superior’s cumulative total return (assumes reinvestment of dividends) to stockholders (stock price appreciation plus dividends) during the previous five years to the returns of the Russell 2000 Index and the Company’s self-selected Proxy Peers.

7

|

Superior Industries

International, Inc.

|

Russell 2000

|

Proxy Peers

|

|

|

2011

|

$80

|

$96

|

$77

|

|

2012

|

$106

|

$111

|

$87

|

|

2013

|

$108

|

$155

|

$140

|

|

2014

|

$107

|

$162

|

$144

|

|

2015

|

$104

|

$155

|

$142

|

Source: Superior Industries International, Inc. 2015 Form 10-K, as filed with the SEC on March 11, 2016.

WE BELIEVE THAT OUR THREE NOMINEES HAVE THE EXPERIENCE, QUALIFICATIONS AND OBJECTIVITY THAT ARE BEST SUITED TO FULLY EXPLORE AVAILABLE OPPORTUNITIES TO ENHANCE VALUE FOR STOCKHOLDERS

On behalf of our clients, GAMCO is the largest stockholder of Superior Industries. We are concerned that the Board, which has overseen lasting underperformance, lacks either the ability or willingness to adequately protect stockholder value. We have identified three highly qualified, independent directors who we believe, based on their background and diverse expertise will bring a fresh perspective and increased commitment to stockholder value into the boardroom and would be extremely helpful in evaluating and executing on initiatives to enhance value at the Company. Our Nominees do not have any specific plans at this time for the Company and, if elected, will review objectively all opportunities to enhance value for ALL stockholders.

Matthew Goldfarb. Mr. Goldfarb has significant investment and consulting experience as well as legal expertise in the areas of commercial and corporate law. In addition, Mr. Goldfarb has extensive experience serving as a director on the board of several public companies. GAMCO believes that the Board will benefit greatly from Mr. Goldfarb’s impressive and varied background.

F. Jack Liebau, Jr. Mr. Liebau has vast financial, strategic, executive and investment experience working with companies in a wide range of industries. GAMCO believes Mr. Liebau’s experience serving on boards (both corporate and non-profit) gives him pertinent insights into working effectively with management teams, analyzing strategic options, and communicating with various constituencies and strongly supports the nomination of Mr. Liebau for election to the Board of Directors of the Company at the Annual Meeting.

Ryan J. Morris. Mr. Morris has extensive investment experience, financial expertise and public company board experience, which GAMCO believes will help the Board surface stockholder value.

8

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of eight directors, all of whose terms expire at the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three Nominees, Matthew Goldfarb, F. Jack Liebau, Jr. and Ryan J. Morris. Your vote to elect the Nominees will have the legal effect of replacing three incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board and therefore it is not guaranteed that they will have the ability to enhance stockholder value.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of the Nominees. The nomination was made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as director of the Company is set forth above in the section entitled “Reasons for the Solicitation.” This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States of America.

Matthew Goldfarb, age 44, has served as Chief Restructuring Officer and Acting Chief Executive Officer of Cline Mining Corporation, a Canadian mining company whose primary asset is the New Elk coking coal mine in southern Colorado, since December 2013. Mr. Goldfarb served as Chief Executive Officer of Xinergy Ltd. (formerly TSX:XRG), a Central Appalachian coal producer, having previously served as its Vice Chairman and lead independent director since its IPO in December 2009 through November 2013. From January 2009 until January 2010, Mr. Goldfarb managed a leveraged loan trading business at Pali Capital, Inc., a boutique investment banking firm. Previously, Mr. Goldfarb was a Director and Senior Investment Analyst of GSO Capital Partners, an alternative asset management firm acquired by The Blackstone Group L.P. (NYSE:BX), from January 2007 until December 2008 and a Director and Senior Investment Analyst at Pirate Capital LLC, an event-driven hedge fund, from January 2005 until September 2006. Prior to that, Mr. Goldfarb was with Icahn Associates Corp. (“Icahn”) for approximately five years and prior to joining Icahn, was associated with the law firm of Schulte Roth & Zabel LLP. Mr. Goldfarb has served as a director of Sevcon, Inc. (NASDAQ:SEV), a leading electrical engineering company, since February 2016, Midway Gold Corporation (OTCMKTS:MDWCQ), an emerging gold producer, since January 2016. Mr. Goldfarb has served on the boards of directors of The Pep Boys – Manny, Moe & Jack (formerly NYSE:PBY), a full-service and tire automotive aftermarket chain, from July 2015 to February 2016, Huntingdon Capital Corp. (formerly TSX:HNT), an owner and operator of affordable business premises in markets across Canada, from June 2013 to November 2014, Fisher Communications, Inc. (formerly NASDAQ:FSCI), a media company, from May 2011 to August 2013, CKE Restaurants, Inc. (formerly NYSE:CKR), the parent company of the Carl’s Jr., Hardee’s, Green Burrito, and Red Burrito restaurant chains, from 2006 to 2010, and James River Coal Company (OTCMKTS:JRCCQ), a coal producer, from August 2006 to October 2006. Mr. Goldfarb graduated from the University of Wisconsin, with a Bachelor of Arts in Economics, and received a J.D. from Fordham University School of Law.

In December 2013 and in contemplation of a financial restructuring, Mr. Goldfarb was retained by the Cline Mining Corporation board of directors, at the instruction of its senior lenders, to lead the financial restructuring and optimization of the mining assets of the TSX-listed issuer. CCAA insolvency proceedings and related Chapter 15 "recognition" proceedings relating to the “work-out” of Cline Mining Corporation were initiated in December 2014, and the company emerged therefrom in July 2015.

9

Mr. Goldfarb resigned as the Chief Executive Officer of Xinergy, Ltd. In November 2013. Xinergy filed for bankruptcy protection under Chapter 11 in July 2015 due to challenging market conditions, given its exposure to metallurgical coal pricing.

On June 22, 2015, Midway Gold Corporation and certain of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the District of Colorado, seeking ancillary relief in Canada pursuant to the Companies' Creditors Arrangement Act in the Supreme Court of British Columbia in Vancouver, Canada. On January 29, 2016, Mr. Goldfarb was appointed as an independent director of Midway to assist the issuer in its ongoing financial restructuring efforts.

GAMCO believes that Mr. Goldfarb’s qualifications to serve on the Board of Directors include his vast investing experience, his experience with commercial and corporate law as well as his extensive record of service on the boards of several public companies. GAMCO believes Mr. Goldfarb brings extensive executive and investment experience and GAMCO strongly supports the nomination of Mr. Goldfarb for election to the Board of Directors of the Company at the Annual Meeting.

F. Jack Liebau, Jr., age 52, has served on the Board of Directors of Myers Industries, Inc. (NYSE:MYE)(“Myers”) since April 2015, and upon his reelection at Myers’ 2016 annual meeting of shareholders, will serve as Chairman. Mr. Liebau served on the Board of Directors of The Pep Boys – Manny, Moe & Jack (formerly NYSE:PBY), a full-service and tire automotive aftermarket chain, from July 2015 through the completion of the company’s acquisition by Icahn Enterprises L.P. in February 2016. From July 2013 to February 2015, Mr. Liebau served as President and Chief Executive Officer of Roundwood Asset Management, a subsidiary of Alleghany Corporation (NYSE:Y)(“Alleghany”) that managed public equities for Alleghany’s insurance companies. Mr. Liebau served as a director of Media General, Inc. (NYSE:MEG), a media company, from 2008 to 2009, and Herley Industries, Inc. (formerly NASDAQ:HRLY), an American company that specializes in supplying microwave and millimeter wave products to the defense and aerospace industries, from 2010 until the company was acquired by Kratos Defense & Security Solutions, Inc. (NASDAQ:KTOS) in April 2011. Mr. Liebau has been in the investment management industry for thirty years. From September 2011 to July 2013, he served as a partner and portfolio manager at Davis Funds. From September 2003 to September 2011, he served as the founder of Liebau Asset Management Company (“Liebau Asset”), which managed money for individuals, foundations, and corporations. From 1986 to 2003, Mr. Liebau was with Primecap Management Company, where he was a partner and portfolio manager. Mr. Liebau began his career in 1984 as a research analyst with The Capital Group. Mr. Liebau is a graduate of Phillips Academy, Andover, and received his A.B. in Economics (with honors) from Stanford University.

GAMCO believes that Mr. Liebau’s qualifications to serve on the Board of Directors include his vast financial, strategic, executive and investment experience working with companies in a wide range of industries. GAMCO believes Mr. Liebau’s experience serving on boards (both corporate and non-profit) gives him pertinent insights into working effectively with management teams, analyzing strategic options, and communicating with various constituencies and strongly supports the nomination of Mr. Liebau for election to the Board of Directors of the Company at the Annual Meeting.

Ryan J. Morris, age 31, is the President of Meson Capital Partners LLC ("Meson LLC"), a San Francisco-based investment partnership, which he founded in February 2009. Mr. Morris currently serves on the board of InfuSystem Holdings, Inc., (NYSEMKT:INFU), since April 2012, and also served as its Executive Chairman, from April 2012 to May 2015. Mr. Morris served as a director of Lucas Energy, Inc. (NYSEMKT:LEI) from October 2012 to October 2014. Mr. Morris served as Chairman of the Board of Lucas Energy, Inc. from December 2012 through November 2013. Mr. Morris has served as a director of Sevcon, Inc. (NASDAQ:SEV) since December 2013. From June 2011 through July 2012, Mr. Morris served as a member of the equity committee responsible for maximizing value to the stockholders of HearUSA, Inc. Prior to founding Meson LLC, in July 2008 he co-founded and was Chief Executive Officer of VideoNote LLC, a small and profitable educational software company with customers including Cornell University and The World Bank. Mr. Morris has a Bachelor's of Science and Masters of Engineering degree in Operations Research & Information Engineering from Cornell University. Mr. Morris is a Chartered Financial Analyst and is a member of YPO and the Guardsmen in San Francisco.

10

GAMCO believes Mr. Morris brings extensive investment experience, board experience, and strongly supports the nomination of Mr. Morris for election to the Board of Directors of the Company at the Annual Meeting.

The principal business address of Mr. Goldfarb is c/o Cline Mining Corporation, 47 Colborne Street, Toronto, Ontario, Canada M5E 1E3. The principal business address of Mr. Liebau is P.O. Box 848, New Canaan, Connecticut, 06840. The principal business address of Mr. Morris is c/o Meson Capital Partners LLC, One Sansome Street, Unit 1895, San Francisco, California 94965.

As of the date hereof, none of Messrs. Goldfarb, Liebau and Morris own beneficially or of record any securities of the Company, nor have they made any purchases or sales of any securities of the Company in the past two years. Depending on market conditions and other factors, if elected, Messrs. Goldfarb, Liebau and Morris intend to acquire shares of Common Stock.

GAMCO and its affiliates are beneficial owners, on behalf of their investment advisory clients, of 34.14% of the common stock of Sevcon, Inc., for which Mr. Goldfarb and Mr. Morris serve as directors.

GAMCO and its affiliates are beneficial owners, on behalf of their investment advisory clients, of 23.49% of the common stock of Myers Industries, Inc., for which Mr. Liebau serves as a director.

Other than as set forth herein, there are no arrangements or understandings between GAMCO or any of its affiliates of clients and the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

GAMCO believes, each Nominee presently is, and if elected as a director of the Company would be, subject to the final determination of the Board, an “independent director” within the meaning of (i) applicable NYSE listing standards applicable to board composition, including Rule 303.A and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

We do not expect that the Nominees will be unable to stand for election, but, in the event that any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed BLUE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by the enclosed BLUE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of GAMCO that any attempt to increase the size of the current Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

11

PROPOSAL NO. 2

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “Say-on-Pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED, that the stockholders approve the compensation of Superior’s named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules, including the Compensation Discussion & Analysis, the compensation tables and narrative discussion.”

According to the Company’s proxy statement, the Say-on-Pay vote is advisory only and not binding on the Company, the Compensation and Benefits Committee of the Board or the Board, but the results will be taken into consideration when making future compensation decisions for the Company’s named executive officers.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE APPROVAL OF THE NON-BINDING RESOLUTION REGARDING EXECUTIVE COMPENSATION AND INTEND TO “ABSTAIN” ON THIS PROPOSAL.

12

PROPOSAL NO. 3

APPROVAL OF THE MATERIAL TERMS OF THE PERFORMANCE GOALS INCLUDED IN THE COMPANY’S ANNUAL INCENTIVE PERFORMANCE PLAN

As discussed in further detail in the Company’s proxy statement, the Company is asking stockholders to approve the material terms of the performance goals under the Company’s Annual Incentive Performance Plan, as previously amended and restated effective December 28, 2015. The Annual Incentive Performance Plan is being submitted for stockholder approval so that certain awards under the Annual Incentive Performance Plan may qualify as performance-based compensation under Section 162(m) of the Internal Revenue Code.

WE MAKE NO RECOMMENDATION WITH RESPECT TO THE APPROVAL OF THE MATERIAL TERMS OF THE PERFORMANCE GOALS INCLUDED IN THE COMPANY’S ANNUAL INCENTIVE PERFORMANCE PLAN AND INTEND TO “ABSTAIN” ON THIS PROPOSAL.

13

PROPOSAL NO. 4

ADVISORY VOTE REGARDING PROXY ACCESS

As discussed in further detail in the Company’s proxy statement, following a request by GAMCO for a stockholder proposal regarding proxy access, the Company has included in its proxy statement a proxy access proposal for evaluation by stockholders which, if supported by the stockholders and adopted by the Board, would allow any stockholder or group of stockholders that has maintained ownership of 3% or more of the Company’s shares continuously for at least 3 years to include a specified number of director nominees in the Company’s proxy materials at the Company’s annual meeting of stockholders, subject to certain procedures set forth the Company’s proxy statement. Accordingly, the Company is asking stockholders to vote for the following resolution:

“RESOLVED: Stockholders of the Company to ask the Board to consider a “proxy access” amendment to the Bylaws. Such an amendment to the Bylaws shall require the Company to include in its proxy materials prepared for a stockholder meeting at which directors are to be elected the name and supporting statement of any person nominated by a stockholder or group of stockholders that meets the criteria established in the Bylaw amendment. Such an amendment to the Bylaws shall also allow stockholders to vote for such a nominee on the Company’s proxy card.”

According to the Company’s proxy statement, the proxy access proposal vote is advisory only and not binding on the Company, the Nominating and Corporate Governance Committee of the Board or the Board, but the results would constitute a recommendation to the Board, if approved, to provide access to the Company’s proxy for stockholders meeting the criteria described in the proposal.

We believe that the proxy access stockholder proposal submitted by GAMCO for consideration at the 2017 Annual Meeting is far less restrictive than the proxy access proposal put forth by the Company this year. Given the advisory nature of this proposal we intend to vote FOR this proposal as we believe proxy access is an important right for stockholders at Superior.

WE RECOMMEND A VOTE “FOR” THIS PROXY ACCESS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

14

PROPOSAL NO. 5

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has preliminarily selected Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 25, 2016 and is proposing that stockholders ratify such appointment.

As disclosed in the Company’s proxy statement, this vote is an advisory vote only, and therefore it will not bind the Company, the Board or the Audit Committee. The Company is not required to obtain stockholder ratification of the selection of Deloitte & Touche LLP as its independent registered public accounting firm by its Bylaws or otherwise. However, according to the Company’s proxy statement, should the stockholders fail to ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm, the Audit Committee will reconsider the appointment. The Company’s proxy statement further provided that even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and its stockholders’ best interests.

WE RECOMMEND A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR ITS FISCAL YEAR ENDING DECEMBER 25, 2016 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

15

VOTING AND PROXY PROCEDURES

Only stockholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Stockholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, GAMCO believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common Stock represented by properly executed BLUE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, FOR the proxy access proposal, FOR the ratification of the selection of Deloitte & Touche LLP, ABSTAIN on the approval of the Say-on-Pay Proposal, and ABSTAIN the approval of the performance goals included in the Company’s Annual Incentive Performance Plan.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate eight candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect our three Nominees. Stockholders who vote on the enclosed BLUE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than [_________], [_________], and [_________]. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. Under applicable proxy rules we are required either to solicit proxies only for our Nominees, which could result in limiting the ability of stockholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominees while also allowing stockholders to vote for fewer than all of the Company’s nominees, which enables a stockholder who desires to vote for our Nominees to also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if all or some of our Nominees are elected.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least [________] shares of Common Stock, which represents a majority of the [________] shares of Common Stock outstanding as of the Record Date and entitled to vote, will be considered a quorum allowing votes to be taken and counted for the matters before the stockholders.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under current NYSE rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals that are put to a vote at the Annual Meeting.

If you are a stockholder of record, you must deliver your vote by mail or attend the Annual Meeting in person and vote in order to be counted in the determination of a quorum.

16

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the matters to be presented at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will not count for purposes of attaining a quorum.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ According to the Company’s proxy statement, the election of directors is determined by plurality voting, meaning that the eight persons receiving the largest number of “yes” votes will be elected as a director. Under Delaware law, since there is no particular percentage of either the outstanding shares or the shares represented at the meeting required to elect a director, abstentions and broker non-votes will have no effect on the election of directors.

Other Proposals ─ According to the Company’s proxy statement, the affirmative vote of a majority of shares of Common Stock represented and voting at the Annual Meeting at which a quorum is present, together with the affirmative vote of at least a majority of the required quorum, shall be required to approve each of the other proposals. Shares of Common Stock that are voted “FOR,” “AGAINST” or “ABSTAIN” on the proposal are treated as being present at the Annual Meeting for purposes of establishing the quorum, but only shares of Common Stock voted “FOR” or “AGAINST” are treated as shares of Common Stock “represented and voting” at the Annual Meeting with respect to the proposal. Accordingly, abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. However, abstentions and broker non-votes will not be counted for purposes of determining the number of shares “represented and voting” with respect to the proposal. If you sign and submit your BLUE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with GAMCO’s recommendations specified herein and in accordance with the discretion of the persons named on the BLUE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Stockholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered to GAMCO at the address set forth on the back cover of this Proxy Statement or to the Company at 26600 Telegraph Rd., Suite 400, Southfield, Michigan 48034 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to GAMCO at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, we may use this information to contact stockholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

17

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by GAMCO. It is anticipated that the Participants and certain staff members of GAMCO will participate in the solicitation of proxies in support of our Nominees set forth in this Proxy Statement. Such staff members will receive no additional consideration if they assist in the solicitation of proxies. Solicitations of proxies may be made in person, by telephone, by email, through the internet, by mail and by facsimile. Although no precise estimate can be made at the present time, it is estimated that the total expenditures in furtherance of, or in connection with, the solicitation of stockholders will not exceed $[_________]. The total expenditures to date in furtherance of, or in connection with, the solicitation of stockholders is approximately $[_________].

Costs related to this solicitation of proxies, including expenditures for attorneys, accountants, public relations and financial advisors, proxy solicitors, advertising, printing, transportation and related expenses will be borne by GAMCO. To the extent legally permissible, GAMCO will seek reimbursement from the Company for those expenses if any of our Nominees is elected. GAMCO does not currently intend to submit the question of such reimbursement to a vote of the stockholders.

ADDITIONAL PARTICIPANT INFORMATION

The Nominees, GAMCO Asset Management and Mr. Gabelli are participants in this solicitation. The principal business of GAMCO Asset Management, a New York corporation, is acting as an investment manager providing discretionary managed account services for employee benefit plans, private investors, endowments, foundations and others. GAMCO Asset Management is an investment adviser registered under the Advisers Act. Mr. Gabelli is the controlling stockholder, Chief Executive Officer and a director of GGCP, Inc. and Chairman and Chief Executive Officer of GAMCO Investors, Inc. Mr. Gabelli is also a member of GGCP Holdings LLC and the controlling stockholder of Teton Advisors, Inc.

The address of the principal office of each of GAMCO Asset Management and Mr. Gabelli is One Corporate Center, Rye, New York 10580.

As of the date hereof, GAMCO Asset Management beneficially owns 1,779,252 shares of Common Stock. GAMCO Asset Management has dispositive power with respect to all of these shares of Common Stock, and has voting power with respect to 1,586,252 shares of Common Stock. As of the date hereof, GAMCO Asset Management’s affiliates beneficially own an additional 1,280,300 shares of Common Stock. By virtue of his respective position with each of GAMCO Asset Management and its affiliates, Mr. Gabelli may be deemed to be the beneficial owner of all of the shares of Common Stock held by GAMCO Asset Management and its affiliates. As of the date hereof, GAMCO Asset Management, its affiliates and Mr. Gabelli own an aggregate of 3,059,552 shares of Common Stock.

The shares of Common Stock beneficially owned by each of GAMCO Asset Management and its affiliates were purchased with funds that were provided through the accounts of certain investment advisory clients (and, in the case of some of such accounts at GAMCO Asset Management, may be through borrowings from client margin accounts). For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting.

18

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

OTHER MATTERS AND ADDITIONAL INFORMATION

GAMCO is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which GAMCO is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed BLUE proxy card will vote on such matters in their discretion.

STOCKHOLDER PROPOSALS

Proposals of stockholders intended to be presented at the 2017 Annual Meeting, in order to be included in the Company’s proxy statement and the form of proxy for the 2017 Annual Meeting, must be made by a qualified stockholder and received by the Company’s Corporate Secretary at Superior Industries International, Inc., 26600 Telegraph Rd., Suite 400, Southfield, Michigan 48034 no later than [__________], 2016 (the date that is 120 calendar days before the one year anniversary date of the Company’s proxy statement released to stockholders for the Annual Meeting). However, if the 2017 Annual Meeting date has changed more than 30 days from this year’s meeting, then the deadline is a reasonable time before the Company begins to print and send out proxy materials.

Under the Bylaws of the Company, any stockholder proposals (other than those made under Rule 14a-8 of the Exchange Act) and any nomination of one or more persons for election as a director must be made not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the one-year anniversary of the date of the preceding year’s annual meeting. Therefore, in order for a stockholder proposal or director nomination to be considered at the 2017 Annual Meeting, a written notice of the proposal or the nomination must be received by the Secretary of the Company no later than [__________], 2017 (assuming that the 2017 Annual Meeting is held on [__________], 2017, the anniversary of the 2016 Annual Meeting). However, if the date of the 2017 Annual Meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the 2016 Annual Meeting, then, for notice by the stockholder to be timely, it must be received by the Secretary of the Company not earlier than the 120th day prior to the date of the 2017 Annual Meeting and not later than the close of business on the later of (i) the 90th day prior to the 2017 Annual Meeting, or (ii) the tenth day following the day on which public announcement of the date of the 2017 Annual Meeting is first made. In order for stockholder proposals that are submitted outside of SEC Rule 14a-8 and are intended to be considered by the stockholders at the 2017 Annual Meeting to be considered “timely” for purposes of SEC Rule 14a-4(c) under the Exchange Act, the proposal must be received by the Secretary of the Company no later than [__________], 2016. The notice must set forth the information required by the Bylaws with respect to each director nomination and stockholder proposal that the stockholder intends to present at the 2017 Annual Meeting. The proxy solicited by the Board of Directors for the 2017 Annual Meeting will confer discretionary voting authority with respect to any proposal presented by a stockholder at that meeting for which the Company has not been provided with timely notice, or, even if there is timely notice, the stockholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Exchange Act. Notices must be delivered to the Company’s Secretary by mail at 26600 Telegraph Rd., Suite 400, Southfield, Michigan 48034.

19

The information set forth above regarding the procedures for submitting stockholder proposals for consideration at the 2017 Annual Meeting is based on information contained in the Company’s proxy statement and organizational documents filed by the Company with the SEC. The incorporation of this information in this proxy statement should not be construed as an admission by GAMCO that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

GAMCO ASSET MANAGEMENT INC.

[__________], 2016

20

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

|

Purchase / Sale

|

Date of

Purchase / Sale

|

Shares of Common Stock

Purchased / Sold

|

|

GAMCO ASSET MANAGEMENT INC.

|

||

|

Sale

|

03/20/2014

|

2,000

|

|

Sale

|

03/21/2014

|

2,000

|

|

Sale

|

03/24/2014

|

500

|

|

Sale

|

03/24/2014

|

6,000

|

|

Sale

|

03/25/2014

|

2,000

|

|

Sale

|

03/25/2014

|

4,000

|

|

Sale

|

03/25/2014

|

2,000

|

|

Sale

|

03/27/2014

|

6,000

|

|

Sale

|

03/31/2014

|

2,000

|

|

Sale

|

03/31/2014

|

250

|

|

Sale

|

03/31/2014

|

250

|

|

Sale

|

04/01/2014

|

4,000

|

|

Sale

|

04/01/2014

|

1,000

|

|

Sale

|

04/01/2014

|

1,000

|

|

Sale

|

04/02/2014

|

2,000

|

|

Sale

|

04/03/2014

|

5,821

|

|

Sale

|

04/04/2014

|

1,179

|

|

Sale

|

04/08/2014

|

900

|

|

Sale

|

04/08/2014

|

700

|

|

Sale

|

04/08/2014

|

400

|

|

Sale

|

04/08/2014

|

400

|

|

Sale

|

04/08/2014

|

800

|

|

Sale

|

04/08/2014

|

400

|

|

Sale

|

04/08/2014

|

400

|

|

Sale

|

04/10/2014

|

4,205

|

|

Sale

|

04/10/2014

|

200

|

|

Sale

|

04/10/2014

|

1,100

|

|

Sale

|

04/11/2014

|

2,000

|

|

Sale

|

04/17/2014

|

2,000

|

|

Sale

|

04/17/2014

|

500

|

|

Sale

|

04/21/2014

|

2,500

|

|

Sale

|

04/22/2014

|

2,000

|

|

Sale

|

04/23/2014

|

4,500

|

|

Purchase

|

04/30/2014

|

200

|

|

Purchase

|

04/30/2014

|

200

|

|

Purchase

|

04/30/2014

|

200

|

|

Sale

|

05/06/2014

|

2,000

|

|

Purchase

|

05/07/2014

|

2,200

|

|

Purchase

|

05/07/2014

|

1,000

|

|

Purchase

|

05/07/2014

|

800

|

I-1

|

Purchase

|

05/08/2014

|

1,500

|

|

Purchase

|

05/08/2014

|

600

|

|

Purchase

|

05/08/2014

|

1,000

|

|

Purchase

|

05/08/2014

|

200

|

|

Purchase

|

05/08/2014

|

200

|

|

Purchase

|

05/08/2014

|

200

|

|

Purchase

|

05/12/2014

|

4,000

|

|

Sale

|

05/13/2014

|

1,000

|

|

Purchase

|

05/13/2014

|

4,000

|

|

Sale

|

05/19/2014

|

3,000

|

|

Sale

|

05/19/2014

|

2,000

|

|

Purchase

|

05/21/2014

|

800

|

|

Purchase

|

05/21/2014

|

800

|

|

Purchase

|

05/21/2014

|

800

|

|

Purchase

|

05/23/2014

|

473

|

|

Purchase

|

06/03/2014

|

1,152

|

|

Purchase

|

06/04/2014

|

848

|

|

Purchase

|

06/05/2014

|

1

|

|

Purchase

|

06/05/2014

|

800

|

|

Purchase

|

06/09/2014

|

1,500

|

|

Purchase

|

06/09/2014

|

500

|

|

Purchase

|

06/09/2014

|

500

|

|

Purchase

|

06/09/2014

|

2,200

|

|

Purchase

|

06/10/2014

|

5,000

|

|

Purchase

|

06/11/2014

|

4,000

|

|

Sale

|

06/19/2014

|

2,000

|

|

Sale

|

06/20/2014

|

2,000

|

|

Sale

|

06/20/2014

|

2,000

|

|

Purchase

|

06/26/2014

|

400

|

|

Purchase

|

06/26/2014

|

800

|

|

Sale

|

07/01/2014

|

1,000

|

|

Sale

|

07/03/2014

|

344

|

|

Purchase

|

07/07/2014

|

200

|

|

Purchase

|

07/08/2014

|

400

|

|

Purchase

|

07/14/2014

|

1,000

|

|

Purchase

|

07/14/2014

|

500

|

|

Purchase

|

07/16/2014

|

600

|

|

Purchase

|

07/16/2014

|

500

|

|

Purchase

|

07/17/2014

|

400

|

|

Sale

|

07/22/2014

|

100

|

|

Purchase

|

07/22/2014

|

1,000

|

|

Purchase

|

07/23/2014

|

500

|

|

Purchase

|

07/28/2014

|

500

|

|

Purchase

|

07/31/2014

|

2,000

|

|

Purchase

|

07/31/2014

|

2,000

|

|

Sale

|

08/08/2014

|

200

|

|

Purchase

|

08/13/2014

|

984

|

|

Purchase

|

08/13/2014

|

400

|

|

Purchase

|

08/14/2014

|

2,000

|

|

Purchase

|

08/14/2014

|

3,016

|

I-2

|

Purchase

|

08/18/2014

|

400

|

|

Sale

|

08/25/2014

|

4,000

|

|

Purchase

|

08/27/2014

|

500

|

|

Sale

|

09/02/2014

|

2,000

|

|

Sale

|

09/05/2014

|

600

|

|

Purchase

|

09/12/2014

|

1,100

|

|

Purchase

|

09/12/2014

|

400

|

|

Purchase

|

09/12/2014

|

300

|

|

Purchase

|

09/16/2014

|

300

|

|

Purchase

|

09/17/2014

|

700

|

|

Purchase

|

09/17/2014

|

700

|

|

Purchase

|

09/17/2014

|

300

|

|

Sale

|

09/24/2014

|

500

|

|

Purchase

|

10/01/2014

|

1,410

|

|

Purchase

|

10/01/2014

|

1,590

|

|

Sale

|

10/02/2014

|

200

|

|

Purchase

|

10/03/2014

|

200

|

|

Purchase

|

10/13/2014

|

2,000

|

|

Purchase

|

10/13/2014

|

200

|

|

Purchase

|

10/14/2014

|

2,000

|

|

Purchase

|

10/16/2014

|

900

|

|

Purchase

|

10/16/2014

|

1,100

|

|

Sale

|

10/17/2014

|

1,000

|

|

Sale

|

10/21/2014

|

1,000

|

|

Sale

|

10/22/2014

|

1,000

|

|

Purchase

|

10/23/2014

|

500

|

|

Sale

|

10/27/2014

|

700

|

|

Sale

|

10/27/2014

|

1,000

|

|

Sale

|

10/29/2014

|

1,000

|

|

Sale

|

10/29/2014

|

200

|

|

Sale

|

10/29/2014

|

300

|

|

Sale

|

10/30/2014

|

1,000

|

|

Purchase

|

11/12/2014

|

500

|

|

Purchase

|

11/13/2014

|

1,444

|

|

Purchase

|

11/13/2014

|

14,000

|

|

Sale

|

11/14/2014

|

200

|

|

Purchase

|

11/17/2014

|

2,020

|

|

Purchase

|

11/17/2014

|

980

|

|

Sale

|

11/20/2014

|

3,000

|

|

Sale

|

11/28/2014

|

400

|

|

Sale

|

12/12/2014

|

3,000

|

|

Sale

|

12/12/2014

|

300

|

|

Sale

|

12/17/2014

|

700

|

|

Sale

|

12/18/2014

|

500

|

|

Sale

|

12/18/2014

|

3,000

|

|

Sale

|

12/18/2014

|

500

|

|

Sale

|

12/19/2014

|

4,000

|

|

Sale

|

12/22/2014

|

14,000

|

|

Sale

|

12/22/2014

|

1,000

|

|

Sale

|

12/22/2014

|

2,000

|

I-3

|

Purchase

|

12/22/2014

|

100

|

|

Purchase

|

12/23/2014

|

464

|

|

Purchase

|

12/23/2014

|

500

|

|

Purchase

|

12/23/2014

|

500

|

|

Sale

|

12/23/2014

|

6,000

|

|

Purchase

|

12/23/2014

|

400

|

|

Sale

|

12/24/2014

|

5,035

|

|

Sale

|

12/24/2014

|

1,000

|

|

Sale

|

12/24/2014

|

2,000

|

|

Purchase

|

12/26/2014

|

500

|

|

Sale

|

12/26/2014

|

400

|

|

Sale

|

12/26/2014

|

3,000

|

|

Purchase

|

12/26/2014

|

3,000

|

|

Sale

|

12/29/2014

|

2,400

|

|

Purchase

|

12/30/2014

|

200

|

|

Purchase

|

01/07/2015

|

1,000

|

|

Purchase

|

01/22/2015

|

200

|

|

Purchase

|

01/22/2015

|

200

|

|

Purchase

|

01/23/2015

|

200

|

|

Sale

|

01/30/2015

|

1,000

|

|

Sale

|

02/02/2015

|

12,000

|

|

Purchase

|

02/04/2015

|

400

|

|

Purchase

|

02/04/2015

|

5,000

|

|

Purchase

|

02/10/2015

|

1,000

|

|

Purchase

|

02/10/2015

|

500

|

|

Sale

|

02/10/2015

|

500

|

|

Sale

|

02/10/2015

|

300

|

|

Purchase

|

02/10/2015

|

200

|

|

Purchase

|

02/10/2015

|

10,000

|

|

Purchase

|

02/19/2015

|

1,000

|

|

Purchase

|

02/25/2015

|

2,000

|

|

Purchase

|

02/27/2015

|

3,000

|

|

Purchase

|

03/11/2015

|

1,000

|

|

Purchase

|

03/12/2015

|

1,000

|

|

Purchase

|

03/20/2015

|

500

|

|

Sale

|

03/25/2015

|

1,000

|

|

Sale

|

03/26/2015

|

2,000

|

|

Sale

|

04/09/2015

|

2,000

|

|

Purchase

|

04/13/2015

|

300

|

|

Sale

|

04/14/2015

|

6,000

|

|

Sale

|

04/17/2015

|

4,000

|

|

Purchase

|

04/20/2015

|

9,000

|

|

Purchase

|

04/20/2015

|

500

|

|

Purchase

|

04/28/2015

|

500

|

|

Purchase

|

04/28/2015

|

500

|

|

Purchase

|

04/29/2015

|

3,000

|

|

Purchase

|

04/29/2015

|

1,500

|

|

Purchase

|

04/30/2015

|

1,000

|

|

Purchase

|

04/30/2015

|

1,000

|

|

Purchase

|

04/30/2015

|

2,000

|

I-4

|

Purchase

|

04/30/2015