Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2018

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 1-6615

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 95-2594729 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(I.R.S. Employer Identification No.) | |

| 26600 Telegraph Road, Suite 400 Southfield, Michigan |

48033 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

(248) 352-7300

Registrant’s Telephone Number, Including Area Code:

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer | ☐ | Accelerated Filer | ☒ | |||

| Non-Accelerated Filer | ☐ | Smaller Reporting Company | ☐ | |||

| Emerging Growth Company | ☐ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Number of shares of common stock outstanding as of May 7, 2018: 25,006,001

Table of Contents

Table of Contents

FINANCIAL INFORMATION

Superior Industries International, Inc.

Condensed Consolidated Statements of Operations

(Dollars in thousands, except per share data)

(Unaudited)

| Three months ended |

March 31, 2018 |

March 26, 2017 |

||||||

| NET SALES |

$ | 386,448 | $ | 174,220 | ||||

| Cost of sales: |

||||||||

| Cost of sales |

336,457 | 154,808 | ||||||

| Restructuring costs |

— | 208 | ||||||

|

|

|

|

|

|||||

| 336,457 | 155,016 | |||||||

|

|

|

|

|

|||||

| GROSS PROFIT |

49,991 | 19,204 | ||||||

| Selling, general and administrative expenses |

22,357 | 15,260 | ||||||

|

|

|

|

|

|||||

| INCOME FROM OPERATIONS |

27,634 | 3,944 | ||||||

| Interest expense, net |

(11,857 | ) | (296 | ) | ||||

| Other expense, net |

(2,988 | ) | (348 | ) | ||||

| Change in fair value of redeemable preferred stock embedded derivative |

898 | — | ||||||

|

|

|

|

|

|||||

| INCOME BEFORE INCOME TAXES |

13,687 | 3,300 | ||||||

| Income tax provision |

(3,370 | ) | (198 | ) | ||||

|

|

|

|

|

|||||

| NET INCOME |

10,317 | 3,102 | ||||||

|

|

|

|

|

|||||

| EARNINGS PER SHARE – BASIC |

$ | 0.07 | $ | 0.12 | ||||

|

|

|

|

|

|||||

| EARNINGS PER SHARE – DILUTED |

$ | 0.07 | $ | 0.12 | ||||

|

|

|

|

|

|||||

| DIVIDENDS DECLARED PER SHARE |

$ | 0.09 | $ | 0.18 | ||||

|

|

|

|

|

|||||

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements

1

Table of Contents

Superior Industries International, Inc.

Condensed Consolidated Statements of Comprehensive Income

(Dollars in thousands)

(Unaudited)

| Three months ended |

March 31, 2018 |

March 26, 2017 |

||||||

|

|

|

|

|

|||||

| Net income attributable to Superior |

$ | 10,317 | $ | 3,102 | ||||

|

|

|

|

|

|||||

| Other comprehensive income, net of tax: |

||||||||

| Foreign currency translation gain, net of tax |

20,904 | 9,050 | ||||||

|

|

|

|

|

|||||

| Change in unrecognized gains (losses) on derivative instruments: |

||||||||

| Change in fair value of derivatives |

17,672 | 17,394 | ||||||

| Tax provision |

(3,762 | ) | (335 | ) | ||||

|

|

|

|

|

|||||

| Change in unrecognized gains (losses) on derivative instruments, net of tax |

13,910 | 17,059 | ||||||

|

|

|

|

|

|||||

| Defined benefit pension plan: |

||||||||

| Amortization of actuarial loss |

109 | 92 | ||||||

| Tax provision |

(22 | ) | (24 | ) | ||||

|

|

|

|

|

|||||

| Pension changes, net of tax |

87 | 68 | ||||||

|

|

|

|

|

|||||

| Other comprehensive income, net of tax |

34,901 | 26,177 | ||||||

|

|

|

|

|

|||||

| Comprehensive income |

$ | 45,218 | $ | 29,279 | ||||

|

|

|

|

|

|||||

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements.

2

Table of Contents

Superior Industries International, Inc.

Condensed Consolidated Balance Sheets

(Dollars in thousands)

(Unaudited)

| March 31, 2018 | December 31, 2017 | |||||||

| ASSETS |

||||||||

| Current assets: |

||||||||

| Cash and cash equivalents |

$ | 23,334 | $ | 46,360 | ||||

| Short-term investments |

750 | 750 | ||||||

| Accounts receivable, net |

197,522 | 160,167 | ||||||

| Inventories |

183,264 | 173,999 | ||||||

| Income taxes receivable |

10,075 | 6,929 | ||||||

| Other current assets |

33,853 | 29,178 | ||||||

|

|

|

|

|

|||||

| Total current assets |

448,798 | 417,383 | ||||||

| Property, plant and equipment, net |

552,152 | 536,686 | ||||||

| Deferred income tax assets, net |

56,953 | 54,302 | ||||||

| Goodwill |

312,441 | 304,805 | ||||||

| Intangibles |

201,559 | 203,473 | ||||||

| Other non-current assets |

45,898 | 34,603 | ||||||

|

|

|

|

|

|||||

| Total assets |

$ | 1,617,801 | $ | 1,551,252 | ||||

|

|

|

|

|

|||||

| LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ EQUITY |

||||||||

| Current liabilities: |

||||||||

| Accounts payable |

$ | 127,330 | $ | 118,424 | ||||

| Short term debt |

3,280 | 4,000 | ||||||

| Accrued expenses |

75,968 | 68,786 | ||||||

| Income taxes payable |

1,703 | 3,849 | ||||||

|

|

|

|

|

|||||

| Total current liabilities |

208,281 | 195,059 | ||||||

| Long-term debt (less current portion) |

687,120 | 679,552 | ||||||

| Embedded derivative liability |

3,787 | 4,685 | ||||||

| Non-current income tax liabilities |

14,834 | 5,731 | ||||||

| Deferred income tax liabilities, net |

29,268 | 28,539 | ||||||

| Other non-current liabilities |

45,817 | 47,269 | ||||||

| Mezzanine equity: |

||||||||

| Preferred stock, $.01 par value |

||||||||

| Authorized – 1,000,000 shares; issued and outstanding – 150,000 shares (150,000 shares at December 31, 2017) |

148,863 | 144,694 | ||||||

| Uniwheels noncontrolling redeemable equity |

55,551 | — | ||||||

| Shareholders’ equity: |

||||||||

| Common stock, $.01 par value |

||||||||

| Authorized—100,000,000 shares; issued and outstanding – 24,984,791 shares (24,917,025 shares at December 31, 2017) |

86,259 | 89,755 | ||||||

| Accumulated other comprehensive loss |

(54,220 | ) | (89,121 | ) | ||||

| Retained earnings |

392,241 | 393,146 | ||||||

|

|

|

|

|

|||||

| Superior shareholders’ equity |

424,280 | 393,780 | ||||||

| Noncontrolling interests |

— | 51,943 | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

424,280 | 445,723 | ||||||

|

|

|

|

|

|||||

| Total liabilities, mezzanine and shareholders’ equity |

$ | 1,617,801 | $ | 1,551,252 | ||||

|

|

|

|

|

|||||

3

Table of Contents

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

| March 31, | March 26, | |||||||

| Three months ended |

2018 | 2017 | ||||||

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES |

$ | 14,361 | $ | (1,577 | ) | |||

|

|

|

|

|

|||||

| CASH FLOWS FROM INVESTING ACTIVITIES: |

||||||||

| Additions to property, plant and equipment |

(22,674 | ) | (16,823 | ) | ||||

| Acquisition of Uniwheels, net of cash acquired |

(17 | ) | — | |||||

| Proceeds from sales of fixed assets |

— | 2 | ||||||

|

|

|

|

|

|||||

| NET CASH USED IN INVESTING ACTIVITIES |

(22,691 | ) | (16,821 | ) | ||||

|

|

|

|

|

|||||

| CASH FLOWS FROM FINANCING ACTIVITIES: |

||||||||

| Debt repayment |

(1,819 | ) | — | |||||

| Cash dividends paid |

(9,452 | ) | (4,511 | ) | ||||

| Cash paid for common stock repurchase |

— | (5,014 | ) | |||||

| Payments related to tax withholdings for stock-based compensation |

(607 | ) | (955 | ) | ||||

| Proceeds from borrowings on revolving credit facility |

26,100 | — | ||||||

| Repayments of borrowings on revolving credit facility |

(26,100 | ) | — | |||||

|

|

|

|

|

|||||

| NET CASH USED IN FINANCING ACTIVITIES |

(11,878 | ) | (10,480 | ) | ||||

|

|

|

|

|

|||||

| Effect of exchange rate changes on cash |

(2,818 | ) | (80 | ) | ||||

|

|

|

|

|

|||||

| Net decrease in cash and cash equivalents |

(23,026 | ) | (28,958 | ) | ||||

| Cash and cash equivalents at the beginning of the period |

46,360 | 57,786 | ||||||

|

|

|

|

|

|||||

| Cash and cash equivalents at the end of the period |

$ | 23,334 | $ | 28,828 | ||||

|

|

|

|

|

|||||

The accompanying unaudited notes are an integral part of these condensed consolidated financial statements

4

Table of Contents

Superior Industries International, Inc.

Condensed Consolidated Statement of Shareholders’ Equity

(Dollars in thousands)

(Unaudited)

| Common Stock | Accumulated Other Comprehensive (Loss) Income |

|||||||||||||||||||||||||||||||

| Number of Shares |

Amount | Unrecognized Gains (Losses) on Derivative Instruments |

Pension Obligations |

Cumulative Translation Adjustment |

Retained Earnings |

Non-controlling Interest |

Total | |||||||||||||||||||||||||

| Balance at December 31, 2017 |

24,917,025 | $ | 89,755 | $ | (8,498 | ) | $ | (5,257 | ) | $ | (75,366 | ) | $ | 393,146 | $ | 51,943 | $ | 445,723 | ||||||||||||||

| Net income |

— | — | — | — | — | 10,317 | — | 10,317 | ||||||||||||||||||||||||

| Change in unrecognized gains (losses) on derivative instruments, net of tax |

— | — | 13,910 | — | — | — | — | 13,910 | ||||||||||||||||||||||||

| Change in employee benefit plans, net of taxes |

— | — | — | 87 | — | — | — | 87 | ||||||||||||||||||||||||

| Net foreign currency translation adjustment |

— | — | — | — | 20,904 | — | — | 20,904 | ||||||||||||||||||||||||

| Restricted stock awards granted, net of forfeitures |

67,766 | — | — | — | — | (330 | ) | — | (330 | ) | ||||||||||||||||||||||

| Stock-based compensation expense |

— | 129 | — | — | — | — | — | 129 | ||||||||||||||||||||||||

| Cash dividends declared ($0.09 per share) |

— | — | — | — | — | (2,250 | ) | — | (2,250 | ) | ||||||||||||||||||||||

| Redeemable preferred dividend and accretion |

— | — | — | — | — | (8,069 | ) | — | (8,069 | ) | ||||||||||||||||||||||

| Reclassification to Uniwheels non-controlling redeemable equity |

— | — | — | — | — | — | (51,943 | ) | (51,943 | ) | ||||||||||||||||||||||

| Adjust Uniwheels non-controlling redeemable equity to redemption value |

— | (3,625 | ) | — | — | — | — | — | (3,625 | ) | ||||||||||||||||||||||

| Dividends to Uniwheels non-controlling redeemable equity |

— | — | — | — | — | (573 | ) | — | (573 | ) | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

| Balance at March 31, 2018 |

24,984,791 | $ | 86,259 | $ | 5,412 | $ | (5,170 | ) | $ | (54,462 | ) | $ | 392,241 | $ | — | $ | 424,280 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

5

Table of Contents

Superior Industries International, Inc.

Notes to Condensed Consolidated Financial Statements

March 31, 2018

(Unaudited)

Note 1 – Nature of Operations

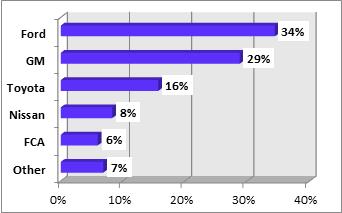

The principal business of Superior Industries International, Inc. (referred to herein as the “company” or “we,” “us” and “our”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers (“OEMs”) and aftermarket customers. We are one of the largest suppliers of cast aluminum wheels to the world’s leading automobile and light truck manufacturers, with manufacturing operations in the United States, Mexico, Germany and Poland. Our OEM aluminum wheels are sold primarily for factory installation, as either standard equipment or optional equipment, on vehicle models manufactured by Audi, BMW, Fiat Chrysler Automobiles N.V. (“FCA”), Ford, General Motors (“GM”), Jaguar-Land Rover, Mercedes-Benz, Mitsubishi, Nissan, Subaru, Tesla, Toyota, Volkswagen and Volvo. We sell aluminum wheels to the European aftermarket under the brands ATS, RIAL, ALUTEC and ANZIO. North America and Europe represent the principal markets for our products, but we have a global presence and influence with North American, European and Asian OEMs. With the acquisition of Uniwheels AG (“Uniwheels” or our “European operations”), on May 30, 2017, we diversified our customer base from predominately North American OEMs (e.g. Ford and G.M.) to a global customer base of OEMs (e.g. Audi and Mercedes-Benz). As a result of the acquisition, we have determined that our North American and European business should be treated as separate reportable segments as further described in Note 7, “Business Segments.”

Note 2 – Presentation of Condensed Consolidated Financial Statements

Presentation

During interim periods, we follow the accounting policies set forth in our Annual Report on Form 10-K for the fiscal year ended December 31, 2017 (the “2017 Annual Report on Form 10-K”) and apply appropriate interim financial reporting standards for a fair statement of our operating results and financial position in conformity with accounting principles generally accepted in the United States of America, as codified by the Financial Accounting Standards Board (“FASB”) in the Accounting Standards Codification (“ASC”) (referred to herein as “U.S. GAAP”), as indicated below. Users of financial information produced for interim periods in 2018 are encouraged to read this Quarterly Report on Form 10-Q in conjunction with our consolidated financial statements and notes thereto filed with the Securities and Exchange Commission (“SEC”) in our 2017 Annual Report on Form 10-K.

In the past, Superior has used a 4-4-5 convention for our fiscal quarters, which are thirteen-week periods (referred to as quarters) ending on the last Sunday of each calendar quarter. Therefore, the first quarter in 2017 started on December 26, 2016 and ended on March 26, 2017. Our European operations have historically reported on a calendar year basis, and, beginning on December 31, 2017, both our North American and European operations were reported on a calendar fiscal year with each month ending on the last day of the calendar month. Thus, the first quarter of 2018 ended on March 31, 2018.

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the SEC’s requirements for quarterly reports on Form 10-Q and U.S. GAAP and, in our opinion, contain all adjustments, of a normal and recurring nature, which are necessary for a fair statement of (i) the condensed consolidated statements of operations for the three month periods ended March 31, 2018 and March 26, 2017, (ii) the condensed consolidated statements of comprehensive income for the three month periods ended March 31, 2018 and March 26, 2017, (iii) the condensed consolidated balance sheets at March 31, 2018 and December 31, 2017, (iv) the condensed consolidated statements of cash flows for the three month periods ended March 31, 2018 and March 26, 2017, and (v) the condensed consolidated statement of shareholders’ equity for the three month period ended March 31, 2018. However, the accompanying unaudited condensed consolidated financial statements do not include all information and notes required by U.S. GAAP. The condensed consolidated balance sheet as of December 31, 2017, included in this report was derived from our 2017 audited financial statements, but does not include all disclosures required by U.S. GAAP.

6

Table of Contents

Interim financial reporting standards require us to make estimates that are based on assumptions regarding the outcome of future events and circumstances not known at that time, including the use of estimated effective tax rates. Inevitably, some assumptions will not materialize, unanticipated events or circumstances may occur which vary from those estimates and such variations may significantly affect our future results. Additionally, interim results may not be indicative of our results for future interim periods or our annual results.

New Accounting Standards

Adoption of New Accounting Standards

ASU 2014-09, Topic 606,“Revenue – Revenue from Contracts with Customers” (including all related amendments). On January 1, 2018, we adopted “Revenue from Contracts with Customers” and all the related amendments (the “new revenue standard”) to all contracts using the modified retrospective method. Implementation of the standard does not have a material effect on our financial position or results of operations as the company’s method for recognizing revenue under the new standard does not vary significantly from revenue recognition practices under the prior standard.

ASU 2017-12 Improvements to Hedge Accounting Activities.” On January 1, 2018, we adopted the “Targeted Improvements to Accounting for Hedging Activities.” This standard removes the requirement to recognize hedge ineffectiveness in income prior to settlement, allows documentation of hedge effectiveness at inception to be completed by quarter-end, allows qualitative rather than quantitative assessment of effectiveness (subsequent to initial quantitative assessment), allows critical terms match for cash flow hedges of a group of forecasted transactions (if derivatives mature within the same month as transactions), permits use of the “back up” long haul method for hedges initially designated using the short cut method and permits cash flow hedging of a component of purchases and sales of non-financial assets (i.e., commodity price excluding transportation) resulting in higher hedge effectiveness. The standard also permits fair value hedging of the benchmark interest rate component of interest rate risk as well as partial term hedging, permits cash flow hedging of interest rate risk for a contractually specified rate rather than a benchmark rate and permits exclusion of cross currency basis spread in determining effectiveness.

The provisions of this standard apply prospectively so there is no cumulative balance sheet adjustment or restatement associated with adoption of this standard. The principal change in accounting for hedges under this standard is that hedge ineffectiveness (for qualifying hedges subject to hedge accounting) will be recognized in other comprehensive income (rather than earnings) until the hedged item is recognized in earnings, at which point accumulated gains or losses will be recognized in earnings and classified with the underlying hedged expense. In the past, we had applied hedge accounting to our foreign currency hedging activity. The company has elected to apply hedge accounting to aluminum swaps used to hedge the commodity price component of its aluminum purchases for its aftermarket business effective March 1, 2018.

ASU 2016-16, “Classification of Certain Cash Receipts and Cash Payments.” We adopted this standard as of January 1, 2018. The objective of the ASU is to address the diversity in practice in the presentation of certain cash receipts and cash payments in the statement of cash flows. We do not expect this standard to have a material effect on our financial condition or results of operations.

ASU 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost.” In March 2017, the FASB issued this standard to improve the reporting of net benefit cost in the financial statements. We have adopted this standard as of January 1, 2018. Due to the immateriality of our pension and postretirement costs, this standard does not have a material effect on our financial condition or results of operations. Accordingly, no restatement of previously issued financial statements is necessary and the provisions of this standard will be applied prospectively.

ASU 2017-11, “(Part I) Accounting for Certain Financial Instruments with Down Round Features, (Part II) Replacement of the Indefinite Deferral for Mandatorily Redeemable Financial instruments of Certain Nonpublic Entities and Certain Mandatorily Redeemable Noncontrolling Interests with a Scope Exception.” The objective of this standard is to reduce the complexity in

7

Table of Contents

accounting for certain financial instruments with down round features. When determining whether certain financial instruments should be classified as debt or equity instruments, a down round feature would no longer preclude equity classification when assessing whether the instrument is indexed to an entity’s own stock. As a result, a freestanding equity-linked financial instrument (or embedded conversion option) no longer would be accounted for as a derivative liability at fair value as a result of the existence of a down round feature. The company has no relevant transactions at the present time. As a result, this standard does not have a material effect on our financial condition or results of operations.

ASU 2017-01, “Clarifying the Definition of a Business.” We have adopted this standard as of January 1, 2018. The objective of the ASU is to add guidance to assist entities with evaluating whether transactions should be accounted for as acquisitions (or disposals) of assets or businesses. This standard does not have a material effect on our financial condition or results of operations since we have no imminent acquisitions.

ASU 2016-18, “Restricted Cash.” The objective of the ASU is to address the diversity in practice that exists in the classification and presentation of changes in restricted cash on the statement of cash flows. This standard does not have a material effect on our financial condition or results of operations since we have no restricted cash balances at the present time.

ASU 2016-16, “Intra-Entity Transfers of Assets Other than Inventory.” The objective of the ASU is to improve the accounting for the income tax consequences of intra-entity transfers of assets other than inventory. This standard does not have a material effect on our financial condition or results of operations since we have no significant intra-entity transfers other than inventory.

Accounting Standards Issued But Not Yet Adopted

ASU 2016-02, “Leases.” In February of 2016, the FASB issued “Leases”. ASU 2016-02 requires an entity to recognize right-of-use assets and lease liabilities on its balance sheet and disclose key information about leasing arrangements. ASU 2016-02 offers specific accounting guidance for a lessee, a lessor and sale and leaseback transactions. Lessees and lessors are required to disclose qualitative and quantitative information about leasing arrangements to enable a user of the financial statements to assess the amount, timing and uncertainty of cash flows arising from leases. For public companies, ASU 2016-02 is effective for annual reporting periods beginning after December 15, 2018, including interim periods within that reporting period, and requires modified retrospective adoption, with early adoption permitted. We are evaluating the impact this guidance will have on our financial position and statement of operations.

ASU 2017-04, “Simplifying the Test for Goodwill Impairment.” In January 2017, the FASB issued an ASU entitled “Intangibles—Goodwill and Other (Topic 350): Simplifying the Test for Goodwill Impairment.” The objective of the ASU is to simplify how an entity is required to test goodwill for impairment by eliminating Step 2 from the goodwill impairment test. Step 2 measures a goodwill impairment loss by comparing the implied fair value of a reporting unit’s goodwill with the carrying amount of that goodwill. This ASU is effective for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. Early adoption is permitted. We are evaluating the impact this guidance will have on our financial position and statement of operations.

ASU 2018-02, “Income Statement — Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income.” In January 2018, the FASB issued ASU 2018-02, “Income Statement — Reporting Comprehensive Income (Topic 220): Reclassification of Certain Tax Effects from Accumulated Other Comprehensive Income,” which gives entities the option to reclassify to retained earnings the tax effects resulting from the Tax Cuts and Jobs Act (“the Act”) related to items in accumulated other comprehensive income (AOCI) that the FASB refers to as having been stranded in AOCI. The new guidance may be applied retrospectively to each period in which the effect of the Act is recognized in the period of adoption. The Company must adopt this guidance for fiscal years beginning after 15 December 2018 and interim periods within those fiscal years. Early adoption is permitted for periods for which financial statements have not yet been issued or made available for issuance, including the period the Act was enacted. The guidance, when adopted, will require new disclosures regarding a company’s accounting policy for releasing the tax effects in AOCI and permit the company the option to reclassify to retained earnings the tax effects resulting from the Act that are stranded in AOCI. We are evaluating the impact this guidance will have on our financial position and statement of operations.

8

Table of Contents

Note 3 – Acquisition

On March 23, 2017, Superior entered into various agreements to commence a tender offer to acquire 100 percent of the outstanding equity interests of Uniwheels (the “Acquisition”) through a newly-formed, wholly-owned subsidiary (the “Acquisition Sub”). The acquisition was effected through a multi-step process as more fully described below.

In the first step of the Acquisition, on March 23, 2017, Superior obtained a commitment from the owner of approximately 61 percent of the outstanding stock of Uniwheels, Uniwheels Holding (Malta) Ltd. (the “Significant Holder”), evidenced by an irrevocable undertaking agreement (the “Undertaking Agreement”) to tender such stock in the second step of the Acquisition. In connection with the Undertaking Agreement, on March 23, 2017: (i) Superior entered into a business combination agreement with Uniwheels pursuant to which, subject to the provisions of the German Stock Corporation Act, Uniwheels and its subsidiaries undertook to, among other things, cooperate with the financing of the Acquisition; and (ii) Superior and the Significant Holder entered into a guarantee and indemnification agreement pursuant to which Superior will hold the Significant Holder harmless for claims that may arise relating to its involvement with Uniwheels. As Uniwheels was a company listed on the Warsaw Stock Exchange, the Acquisition was required to be carried out in accordance with the Polish Act of 29 July 2005 on Public Offerings and the Conditions for Introducing Financial Instruments to Organized Trading and Public Companies (the “Public Offering Act”).

Following the publication of a formal tender offer document by Superior, as required by the Public Offering Act, Superior commenced the acceptance period for the tender offer (the “Tender Offer”) on April 12, 2017, pursuant to which, Superior offered to purchase all (but not less than 75 percent) of the outstanding stock of Uniwheels and, upon the consummation of the Tender Offer, agreed to purchase the stock of the Significant Holder along with all other stock of Uniwheels tendered pursuant to the Tender Offer. On May 30, 2017, Superior acquired 92.3 percent of the outstanding stock of Uniwheels for approximately $703.0 million (based on an exchange rate of 1.00 Dollar = 3.74193 Polish Zloty). We refer to this acquisition as the “First Step Acquisition.”

Under the terms of the Tender Offer:

| • | the Significant Holder received cash consideration of Polish Zloty 226.5 per share; and |

| • | Uniwheels’ other shareholders received cash consideration of Polish Zloty 247.87 per share, equivalent to the volume weighted-average-price of Uniwheels’ shares for the three months prior to commencement of the Tender Offer, plus 5.0 percent. |

On June 30, 2017, the company announced that it had commenced the delisting and associated tender process for the remaining outstanding shares of Uniwheels. As of July 31, 2017, 153,251 additional shares (representing1.2 percent of Uniwheels shares) were tendered at Polish Zloty 247.87 per share. On December 15, 2017, an additional 75,000 shares (representing 0.6 percent of Uniwheels shares) were tendered at Polish Zloty 262.50 per share.

Superior decided to pursue a Domination Profit and Loss Transfer Agreement (“DPLTA”) without concurrently pursuing a merger/squeeze-out. This approach enables Superior to realize substantial synergies of a consolidated entity without the distraction or expense associated with simultaneously pursuing the purchase of the remaining shares. According to the terms of the DPLTA, Superior AG offered to purchase any further tendered shares for cash consideration of Euro 62.18, or approximately Polish Zloty 264 per share. This cash consideration may be subject to change based on appraisal proceedings that the minority shareholders of Uniwheels have initiated. Because the aggregate equity purchase price of the Acquisition (assuming an exchange rate of 1.00 Dollar = 3.74193 Polish Zloty) was determined at the time of the initial acquisition, any increase in the resulting price must be reflected as a reduction of paid in capital (common stock). For each share that is not tendered, Superior will be obligated to pay a guaranteed annual dividend of Euro 3.23 as long as the DPLTA is in effect beginning in 2019.

9

Table of Contents

The DPLTA became effective by entry on the commercial registry on January 17, 2018, with retroactive effect as of January 1, 2018. As a result, the carrying value of the noncontrolling interests related to the Uniwheels common shares outstanding of $51.9 million, which was presented as a component of total equity as of December 31, 2017, was reclassified to Uniwheels noncontrolling redeemable equity during the first quarter of 2018. For the period of time that the DPLTA is in effect, the noncontrolling interests related to Uniwheels common shares will remain in Uniwheel noncontrolling redeemable equity and presented outside of stockholders’ equity in the condensed consolidated balance sheets. A total of 223 additional shares were tendered at the DPLTA price of Euro 62.18 in the first quarter of 2018.

The company’s condensed consolidated financial statements include Uniwheels results of operations subsequent to May 30, 2017 (please see Note 7, “Business Segments” for the Uniwheels results included within the condensed consolidated financial statements for the three month period ended March 31, 2018). The company’s condensed consolidated financial statements reflect the purchase accounting adjustments in accordance with ASC 805 “Business Combinations”, whereby the purchase price was allocated to the assets acquired and liabilities assumed based upon their estimated fair values on the acquisition date.

During the fourth quarter of 2017, the company obtained an updated valuation of the identifiable assets acquired and the liabilities assumed. The following is the preliminary allocation of the purchase price:

(Dollars in thousands)

Estimated purchase price

| Cash consideration |

$ | 703,000 | ||

|

|

|

|||

| Non-controlling interest |

63,200 | |||

|

|

|

|||

| Preliminary purchase price allocation |

||||

| Cash and cash equivalents |

12,296 | |||

| Accounts receivable |

60,580 | |||

| Inventories |

83,901 | |||

| Prepaid expenses and other current assets |

11,859 | |||

|

|

|

|||

| Total current assets |

168,636 | |||

| Property and equipment |

259,784 | |||

| Intangible assets (1) |

205,000 | |||

| Goodwill |

286,249 | |||

| Other assets |

32,987 | |||

|

|

|

|||

| Total assets acquired |

952,656 | |||

|

|

|

|||

| Accounts payable |

61,883 | |||

| Other current liabilities |

40,903 | |||

|

|

|

|||

| Total current liabilities |

102,786 | |||

| Other long-term liabilities |

83,670 | |||

|

|

|

|||

| Total liabilities assumed |

186,456 | |||

|

|

|

|||

| Net assets acquired |

$ | 766,200 | ||

|

|

|

| (1) | Intangible assets are recorded at estimated fair value, as determined by management based on available information which includes a preliminary valuation prepared by an independent third party. The fair values assigned to identifiable intangible assets were determined through the use of the income approach, specifically the relief from royalty and multi-period excess earnings methods. The major assumptions used in arriving at the estimated identifiable intangible asset values included management’s estimates of future cash flows, discounted at an appropriate rate of return which are based on the weighted average cost of capital for both the company and other market participants. The useful lives for intangible assets were determined based upon the remaining useful economic lives of the intangible assets that are expected to contribute directly or indirectly to future cash flows. The estimated fair value of intangible assets and related useful lives as included in the preliminary purchase price allocation include: |

10

Table of Contents

| Estimated Fair Value |

Estimated Useful Life (in Years) |

|||||||

| (Dollars in thousands) | ||||||||

| Brand name |

$ | 9,000 | 5-6 | |||||

| Technology |

15,000 | 4-6 | ||||||

| Customer relationships |

167,000 | 6-11 | ||||||

| Trade names |

14,000 | Indefinite | ||||||

|

|

|

|||||||

| $ | 205,000 | |||||||

|

|

|

|||||||

The above goodwill represents future economic benefits expected to be recognized from the company’s expansion into the European wheel market, as well as expected future synergies and operating efficiencies from combining operations with Uniwheels. Acquisition goodwill of $312.4 million (initial balance of $286.2 million, increased for post-acquisition translation adjustments) has been allocated to the European segment.

Note 4 – Revenue

On January 1, 2018, we adopted ASU 2014-09, Topic ASC 606, “Revenue from Contracts with Customers.” Under this new standard, revenue is recognized when performance obligations under our contracts are satisfied. Generally, this occurs upon shipment when control of products transfers to our customers. At this point, revenue is recognized in an amount reflecting the consideration we expect to be entitled to under the terms of our contract.

In accordance with ASC 606, the company disaggregates revenue from contracts with customers into segments, North America and Europe. Revenues by segment for the three months ended March 31, 2018 are summarized in the table below (in thousands):

| Three Months Ended |

||||

| March 31, 2018 |

||||

| North America |

204,150 | |||

| Europe |

182,298 | |||

|

|

|

|||

| Total |

$ | 386,448 | ||

|

|

|

|||

The company maintains long term business relationships with our OEM customers and aftermarket distributors; however, there are no definitive long-term volume commitments under these arrangements. Volume commitments are limited to near-term customer requirements authorized under purchase orders or production releases generally with delivery periods of less than a month. Sales do not involve any significant financing component since customer payment is generally due 40-60 days after shipment. Payments for tooling are generally due upon customer acceptance. Contract assets and liabilities consist of receivables and deferred revenue related to tooling. When the timing of product delivery is different than payments made by customers, the company recognizes either a contract asset (performance precedes payment) or a contract liability (customer payment precedes performance, such as deferred tooling revenue reimbursement).

At contract inception, the Company assesses goods and services promised in its contracts with customers and identifies a performance obligation for each promise to deliver a good or service (or bundle of goods or services) that is distinct. Principal performance obligations under our customer contracts consist of manufacture and delivery of aluminum wheels, including production parts, service parts and replacement parts. As a part of the delivery of the wheels, we develop tooling necessary to produce the wheels. Accordingly, tooling costs which are explicitly recoverable from our customers are capitalized as preproduction costs and amortized over the average life of the vehicle wheel program (refer to Note 11, “Preproduction Cost Related to Long Term Supply Arrangements”). Customer reimbursement for tooling is deferred and amortized over the life of the vehicle wheel program.

11

Table of Contents

In the normal course of business, the Company does not accept product returns unless the item is defective as manufactured and the company’s warranties are limited to product specifications. Accordingly, warranty costs are treated as a cost of fulfillment subject to accrual under ASC 460, rather than a performance obligation. The Company establishes provisions for estimated returns and warranties. In addition, the Company does not typically provide customers with the right to a refund but provides for product replacement.

Prices allocated to production, service and replacement parts are based on prices established in our purchase orders which represent the standalone selling price. Prices for service and replacement parts are commensurate with production parts with adjustment for any special packaging. Customer tooling reimbursement is generally based on quoted prices or cost not to exceed quoted prices. In addition, prices are subject to retrospective adjustment for changes in commodity prices for certain raw materials, aluminum and silicon, as well as production efficiencies and wheel weight variations from specifications used in pricing. These price adjustments are treated as variable consideration.

We estimate variable consideration by using the “most likely” amount estimation approach. For commodity price fluctuations, estimates are based on the commodity index at contract inception. Prices incorporate the wheel weight price component based on product specifications. Weights are monitored and prices adjusted as variations arise. Price adjustments due to production efficiencies are generally recognized as and when negotiated with customers. Changes in commodity prices are monitored and revenue is adjusted as changes in the commodity index occur. Customer contract prices are generally adjusted quarterly to incorporate retroactive price adjustments. Based on timely accrual, timeliness of contract price adjustments and extensive experience, we do not believe that these adjustments would result in any significant cumulative reversal of revenue.

Revenues are recognized at the point in time when our performance obligations are completed and control generally transfers to the customer. The point in time at which the company transfers control of products to customers occurs generally upon shipment. At this point, title and risk of loss transfer to the customer, payment is due and the customer obtains possession of the goods.

The opening and closing balances of the company’s receivables and current and long-term contract liabilities are as follows (in thousands):

| March 31, 2018 |

January 1, 2018 |

Change | ||||||||||

| Receivables |

$ | 188,817 | $ | 150,151 | $ | 38,666 | ||||||

| Contract liabilities - current |

5,450 | 5,736 | (286 | ) | ||||||||

| Contract liabilities - noncurrent |

5,638 | 5,222 | 416 | |||||||||

The changes in receivables and liability balances primarily result from timing differences between our performance and customer payment. During the three months ended March 31, 2018, the company recognized tooling reimbursement revenue of $1.6 million which had been deferred in prior periods and was included in the current portion of the contract liability (deferred revenue) as of December 31, 2017. The company also recognized revenue of $1.7 million from obligations satisfied in prior periods as a result of retrospective price adjustments arising from changes in commodity prices, production efficiencies or wheel weight.

Under the company’s policies, shipping costs are treated as a cost of fulfillment. In addition, as permitted under a practical expedient relating to disclosure of performance obligations, the company does not disclose remaining performance obligations under its contracts since contract terms are substantially less than a year (generally less than one month)

12

Table of Contents

Note 5 – Fair Value Measurements

The company applies fair value accounting for all financial assets and liabilities and non-financial assets and liabilities that are recognized or disclosed at fair value in the financial statements on a recurring basis, while other assets and liabilities are measured at fair value on a nonrecurring basis, such as when we have an asset impairment. Fair value is estimated by applying the following hierarchy, which prioritizes the inputs used to measure fair value into three levels and bases the categorization within the hierarchy upon the lowest level of input that is available and significant to the fair value measurement:

Level 1 – Quoted prices in active markets for identical assets or liabilities.

Level 2 – Observable inputs other than quoted prices in active markets for identical assets and liabilities, quoted prices for identical or similar assets or liabilities in inactive markets, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

Level 3 – Inputs that are generally unobservable and typically reflect management’s estimate of assumptions that market participants would use in pricing the asset or liability.

The carrying amounts for cash and cash equivalents, investments in certificates of deposit, accounts receivable, accounts payable and accrued expenses approximate their fair values due to the short period of time until maturity.

Cash and Cash Equivalents

Included in cash and cash equivalents are highly liquid investments that are readily convertible to known amounts of cash, and which are subject to an insignificant risk of change in value due to interest rates, quoted price or penalty on withdrawal. A debt security is classified as a cash equivalent if it meets these criteria and if it has a remaining time to maturity of three months or less from the date of acquisition. Amounts on deposit and available upon demand, or negotiated to provide for daily liquidity without penalty, are classified as cash and cash equivalents. Time deposits, certificates of deposit and money market accounts that meet the above criteria are reported at par value on our balance sheet and are excluded from the table below.

Derivative Financial Instruments

Our derivatives are over-the-counter customized derivative transactions and are not exchange traded. We estimate the fair value of these instruments using industry-standard valuation models such as a discounted cash flow. These models project future cash flows and discount the future amounts to a present value using market-based expectations for interest rates, foreign exchange rates, commodity prices and the contractual terms of the derivative instruments. The discount rate used is the relevant interbank deposit rate (e.g., LIBOR) plus an adjustment for non-performance risk. In certain cases, market data may not be available, and we may use broker quotes and models (e.g., Black-Scholes) to determine fair value. This includes situations where there is lack of liquidity for a particular currency or commodity or when the instrument is longer dated. The fair value measurements of the redeemable preferred shares embedded derivatives are based upon Level 3 unobservable inputs reflecting management’s own assumptions about the inputs used in pricing the liability – refer to Note 6,” Derivative Financial Instruments.”

Cash Surrender Value

The cash surrender value of the life insurance policies is the sum of money the insurance company will pay to the company in the event the policy is voluntarily terminated before its maturity or the insured event occurs. Over the term of the life insurance contracts, the cash surrender value changes as a result of premium payments and investment income offset by investment losses, charges and miscellaneous fees. The amount of the asset recorded for the investment in the life insurance contracts is equal to the cash surrender value which is the amount that will be realized under the contract as of the balance sheet date if the insured event occurs.

13

Table of Contents

The following table categorizes items measured at fair value at March 31, 2018:

| Fair Value Measurement at Reporting Date Using | ||||||||||||||||

| Quoted Prices | Significant Other | Significant | ||||||||||||||

| in Active Markets | Observable | Unobservable | ||||||||||||||

| for Identical Assets | Inputs | Inputs | ||||||||||||||

| March 31, 2018 |

(Level 1) | (Level 2) | (Level 3) | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| Certificates of deposit |

$ | 750 | — | 750 | — | |||||||||||

| Cash surrender value |

8,136 | — | 8,136 | — | ||||||||||||

| Derivative contracts |

12,433 | — | 12,433 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

21,319 | — | 21,319 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Derivative contracts |

7,937 | — | 7,937 | — | ||||||||||||

| Embedded derivative liability |

3,787 | — | — | 3,787 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 11,724 | — | 7,937 | 3,787 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table categorizes items measured at fair value at December 31, 2017:

| Fair Value Measurement at Reporting Date Using | ||||||||||||||||

| Quoted Prices | Significant Other | Significant | ||||||||||||||

| in Active Markets | Observable | Unobservable | ||||||||||||||

| for Identical Assets | Inputs | Inputs | ||||||||||||||

| December 31, 2017 |

(Level 1) | (Level 2) | (Level 3) | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Assets |

||||||||||||||||

| Certificates of deposit |

$ | 750 | $ | — | $ | 750 | $ | — | ||||||||

| Cash surrender value |

8,040 | — | 8,040 | — | ||||||||||||

| Derivative contracts |

6,342 | — | 6,342 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

15,132 | — | 15,132 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Liabilities |

||||||||||||||||

| Derivative contracts |

16,106 | — | 16,106 | — | ||||||||||||

| Embedded derivative liability |

4,685 | — | — | 4,685 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

$ | 20,791 | $ | — | $ | 16,106 | $ | 4,685 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table summarizes the changes during the first quarter of 2018 in level 3 fair value measurement of the embedded derivative liability relating to the redeemable preferred shares issued in connection with the acquisition of Uniwheels:

| Three Months Ended March 31, |

2018 | |||

| (Dollars in thousands) | ||||

| Change in fair value: |

||||

| Beginning fair value – December 31, 2017 |

$ | 4,685 | ||

| Change in fair value of redeemable preferred stock embedded derivative liability |

(898 | ) | ||

|

|

|

|||

| Ending fair value at March 31, 2018 |

$ | 3,787 | ||

|

|

|

|||

14

Table of Contents

Note 6 – Derivative Financial Instruments

Debt Instruments

The carrying values of the company’s debt instruments vary from their fair values. The fair values were determined by reference to transacted prices of these securities (Level 2 input based on the GAAP fair value hierarchy). The estimated fair value, as well as the carrying value, of the company’s debt instruments are shown below (in thousands):

| March 31, 2018 | ||||

| (Dollars in thousands) | ||||

| Estimated aggregate fair value |

$ | 714,431 | ||

| Aggregate carrying value (1) |

713,747 | |||

| (1) | Long-term debt excluding the impact of unamortized debt issuance costs. |

Derivative Instruments and Hedging Activities

We use derivatives to partially offset our business exposure to foreign currency risk. We may enter into forward contracts, option contracts, swaps, collars or other derivative instruments to offset some of the risk on expected future cash flows and on certain existing assets and liabilities. However, we may choose not to hedge certain exposures for a variety of reasons including, but not limited to, accounting considerations and the prohibitive economic cost of hedging particular exposures. There can be no assurance the hedges will offset more than a portion of the financial impact resulting from movements in foreign currency exchange rates.

To help protect gross margins from fluctuations in foreign currency exchange rates, certain of our subsidiaries, whose functional currency is the U.S. dollar or the Euro, hedge a portion of forecasted foreign currency costs denominated in the Mexican Peso and Polish Zloty, respectively. We may hedge portions of our forecasted foreign currency exposure up to 48 months.

We record all derivatives in the condensed consolidated balance sheets at fair value. Our accounting treatment for these instruments is based on the hedge designation. The cash flow hedges that are designated as hedging instruments are recorded in Accumulated Other Comprehensive Income (“AOCI”) until the hedged item is recognized in earnings, at which point accumulated gains or losses will be recognized in earnings and classified with the underlying hedged expense. Derivatives that are not designated as hedging instruments are adjusted to fair value through earnings in the financial statement line item to which the derivative relates. At March 31, 2018, the company held derivatives that were designated as hedging instruments as well as derivatives that did not qualify for designation as hedging instruments as discussed below.

Deferred gains and losses associated with cash flow hedges of foreign currency costs are recognized as a component of cost of sales in the same period as the related cost is recognized. Our foreign currency transactions hedged with cash flow hedges as of March 31, 2018, are expected to occur within 1 month to 48 months.

Derivative instruments designated as cash flow hedges must be de-designated as hedges when it is probable the forecasted hedged transaction will not occur in the initially identified time period or within a subsequent two-month time period. Deferred gains and losses in AOCI associated with such derivative instruments are reclassified immediately into other expense. Any subsequent changes in fair value of such derivative instruments are reflected in other expense unless they are re-designated as hedges of other transactions.

Currency option derivative contracts not designated for hedge accounting consist principally of certain option contracts to purchase the Polish Zloty and the Euro and a Euro-U.S. dollar cross currency swap. See Note 3, “Acquisition.”

15

Table of Contents

Redeemable Preferred Stock Embedded Derivative

We have determined that the conversion option embedded in Series A redeemable preferred stock is required to be accounted for separately from the Series A redeemable preferred stock as a derivative liability. Separation of the conversion option as a derivative liability is required because its economic characteristics are considered more akin to an equity instrument and therefore the conversion option is not considered to be clearly and closely related to the economic characteristics of the redeemable preferred stock. This is because the economic characteristics of the redeemable preferred stock are considered more akin to a debt instrument due to the fact that the shares are redeemable at the holder’s option, the redemption value is significantly greater than the face amount, the shares carry a fixed mandatory dividend and the stock price necessary to make conversion more attractive than redemption ($56.324) is significantly greater than the price at the date of issuance ($19.05), all of which lead to the conclusion that redemption is more likely than conversion. For additional information on the redeemable preferred stock, see Note 14, “Redeemable Preferred Shares”.

We have also determined that the early redemption option upon the occurrence of a redemption event (e.g. change of control, etc.) must also be bifurcated and accounted for separately from the redeemable preferred stock at fair value, because the debt host contract involves a substantial discount (face of $150.0 million as compared to the redemption value of $300 million) and exercise of the early redemption option would accelerate the holder’s option to redeem the shares.

Accordingly, we have recorded an embedded derivative liability representing the combined fair value of the right of holders to receive common stock upon conversion of Series A redeemable preferred stock at any time (the “conversion option”) and the right of the holders to exercise their early redemption option upon the occurrence of a redemption event (the “early redemption option”). The embedded derivative liability is adjusted to reflect fair value at each period end with changes in fair value recorded in the “Change in fair value of redeemable preferred stock embedded derivative liability” financial statement line item of the company’s condensed consolidated statements of operations (see “Note 14, Redeemable Preferred Shares”).

A binomial option pricing model is used to estimate the fair value of the conversion and early redemption options embedded in the redeemable preferred stock. The binomial model utilizes a “decision tree” whereby future movement in the company’s common stock price is estimated based on the volatility factor. The binomial options pricing model requires the development and use of assumptions. These assumptions include estimated volatility of the value of our common stock, assumed possible conversion or early redemption dates, an appropriate risk-free interest rate, risky bond rate and dividend yield.

The expected volatility of the company’s equity is estimated based on the historical volatility of our common stock. The assumed base case term used in the valuation model is the period remaining until May 22, 2024 (the earliest date at which the holder may exercise its unconditional redemption option). A number of other scenarios incorporate earlier redemption dates to address the possibility of early redemption upon the occurrence of a redemption event. The risk-free interest rate is based on the yield on the U.S. Treasury zero coupon yield curve with a remaining term equal to the expected term of the conversion and early redemption options. The significant assumptions utilized in the company’s valuation of the embedded derivative at March 31, 2018 are as follows: valuation scenario terms between 3.75 and 6.14 years, volatility of 34 percent, risk-free rate of 2.5 percent to 2.6 percent related to the respective assumed terms, a risky bond rate of 19.3 percent and a dividend yield of 2.7 percent.

Based on the foregoing assumptions, the fair value of the redeemable preferred stock embedded derivative liability at March 31, 2018 is $3.8 million and the change in fair value of redeemable preferred stock embedded derivative liability during the first quarter was $0.9 million mainly due to the decline in our stock price and the reduction in the remaining term of the options used in the valuation scenarios due to the months elapsed since issuance.

16

Table of Contents

The following tables display the fair value of derivatives by balance sheet line item at March 31, 2018 and December 31, 2017:

| March 31, 2018 | ||||||||||||||||

| Other Current Assets |

Other Non-current Assets |

Accrued Liabilities |

Other Non-current Liabilities |

|||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Foreign exchange forward contracts and collars designated as hedging instruments |

$ | 4,410 | 7,255 | 766 | 2,871 | |||||||||||

| Foreign exchange forward contracts not designated as hedging instruments |

766 | — | 66 | — | ||||||||||||

| Aluminum forward contracts designated as hedges |

2 | — | 1,310 | — | ||||||||||||

| Cross currency swap not designated as hedging instrument |

— | — | 2,190 | 734 | ||||||||||||

| Embedded derivative liability |

— | — | — | 3,787 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total derivative financial instruments |

$ | 5,178 | 7,255 | 4,332 | 7,392 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| December 31, 2017 | ||||||||||||||||

| Other Current Assets |

Other Non-current Assets |

Accrued Liabilities |

Other Non-current Liabilities |

|||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Foreign exchange forward contracts and collars designated as hedging instruments |

$ | 3,065 | 723 | 4,922 | 8,405 | |||||||||||

| Foreign exchange forward contracts not designated as hedging instruments |

721 | — | 206 | — | ||||||||||||

| Aluminum forward contracts not designated as hedges |

1,833 | — | — | — | ||||||||||||

| Cross currency swap not designated as hedging instrument |

— | — | 1,467 | 1,106 | ||||||||||||

| Embedded derivative liability |

— | — | — | 4,685 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total derivative financial instruments |

$ | 5,619 | 723 | 6,595 | 14,196 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

The following table summarizes the notional amount and estimated fair value of our derivative financial instruments:

| March 31, 2018 | December 31, 2017 | |||||||||||||||

| Notional U.S. Dollar Amount |

Fair Value | Notional U.S. Dollar Amount |

Fair Value | |||||||||||||

| (Dollars in thousands) | ||||||||||||||||

| Foreign currency forward contracts and collars designated as hedging instruments |

$ | 514,333 | $ | 8,028 | $ | 397,744 | $ | (9,539 | ) | |||||||

| Foreign exchange forward contracts not designated as hedging instruments |

29,004 | 700 | 23,305 | 515 | ||||||||||||

| Aluminum forward contracts designated as hedges |

24,038 | (1,308 | ) | — | — | |||||||||||

| Aluminum forward contracts not designated as hedges |

— | — | 15,564 | 1,833 | ||||||||||||

| Cross currency swap not designated as hedging instrument |

30,378 | (2,924 | ) | 36,454 | (2,573 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total derivative financial instruments |

$ | 597,753 | $ | 4,496 | $ | 473,067 | $ | (9,764 | ) | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

17

Table of Contents

Notional amounts are presented on a gross basis. The notional amounts of the derivative financial instruments do not represent amounts exchanged by the parties and, therefore, are not a direct measure of our exposure to the financial risks described above. The amounts exchanged are calculated by reference to the notional amounts and by other terms of the derivatives, such as interest rates, foreign currency exchange rates or commodity volumes and prices.

The following table provides the impact of derivative instruments designated as cash flow hedges on our statement of operations:

| Three Months Ended March 31, 2018 |

Amount of Gain or (Loss) Recognized in AOCI on Derivatives (Effective Portion), Net of Tax |

Amount of Pre-tax

Gain or (Loss) Reclassified from AOCI into Income (Effective Portion) |

Amount of Pre-tax Gain or (Loss) Recognized in Income on Derivatives (Amount Excluded from Effectiveness Testing) |

|||||||||

| (Dollars in thousands) | ||||||||||||

| Derivative contracts |

$ | 13,910 | $ | 585 | $ | (744 | ) | |||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 13,910 | $ | 585 | $ | (744 | ) | |||||

|

|

|

|

|

|

|

|||||||

| Three Months ended March 26, 2017 |

Amount of Gain or (Loss) Recognized in AOCI on Derivatives (Effective Portion), Net of Tax |

Amount of Pre-tax

Gain or (Loss) Reclassified from AOCI into Income (Effective Portion) |

Amount of Pre-tax Gain or (Loss) Recognized in Income on Derivatives (Amount Excluded from Effectiveness Testing) |

|||||||||

| (Dollars in thousands) | ||||||||||||

| Derivative contracts |

$ | 17,059 | $ | (2,491 | ) | $ | 168 | |||||

|

|

|

|

|

|

|

|||||||

| Total |

$ | 17,059 | $ | (2,491 | ) | $ | 168 | |||||

|

|

|

|

|

|

|

|||||||

Note 7 – Business Segments

As a result of the Acquisition, the company expanded into the European market and extended its customer base to include the principal European OEMs. As a consequence, we have realigned our executive management structure, organization and operations to focus on our performance in our North American and European regions. In accordance with the requirements of ASC Topic 280, “Segment Reporting,” we have concluded that our North American and European businesses represent separate operating segments in view of significantly different markets, customers and products within each of these regions. Each operating segment has discrete financial information which is evaluated regularly by the company’s CEO in determining resource allocation and assessing performance. Within each of these regions, markets, customers, products and production processes are similar and production can be readily transferred between production facilities. Moreover, our business within each region leverages common systems, processes and infrastructure. Accordingly, North America and Europe comprise the company’s reportable segments for purposes of segment reporting.

18

Table of Contents

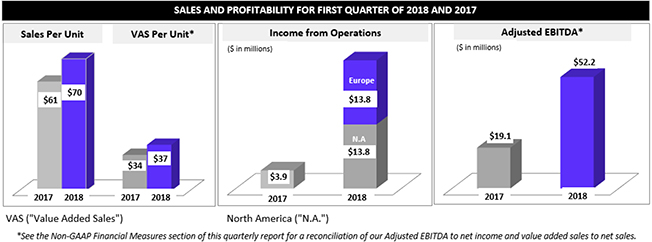

| (Dollars in thousands) | ||||||||||||||||

| Net Sales | Income from Operations | |||||||||||||||

| Three months ended | March 31, 2018 | March 26, 2017 | March 31, 2018 | March 26, 2017 | ||||||||||||

| North America |

$ | 204,150 | $ | 174,220 | $ | 13,785 | $ | 3,944 | ||||||||

| Europe |

182,298 | — | 13,849 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 386,448 | $ | 174,220 | $ | 27,634 | $ | 3,944 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Dollars in thousands) | ||||||||||||||||

| Depreciation and Amortization | Capital Expenditures | |||||||||||||||

| Three months ended | March 31, 2018 | March 26, 2017 | March 31, 2018 | March 26, 2017 | ||||||||||||

| North America |

$ | 8,797 | $ | 8,370 | $ | 10,028 | $ | 16,823 | ||||||||

| Europe |

15,556 | — | 12,646 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 24,353 | $ | 8,370 | $ | 22,674 | $ | 16,823 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Dollars in thousands) | ||||||||||||||||

| Property, Plant and Equipment, net | Long-lived Intangible Assets | |||||||||||||||

| March 31, 2018 | December 31, 2017 | March 31, 2018 | December 31, 2017 | |||||||||||||

| North America |

$ | 251,874 | $ | 245,178 | $ | — | $ | — | ||||||||

| Europe |

300,278 | 291,508 | 201,559 | 203,473 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| $ | 552,152 | $ | 536,686 | $ | 201,559 | $ | 203,473 | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Dollars in thousands) | ||||||||

| Total Assets | ||||||||

| March 31, 2018 | December 31, 2017 | |||||||

| North America |

$ | 569,798 | $ | 519,192 | ||||

| Europe |

1,048,003 | 1,032,060 | ||||||

|

|

|

|

|

|||||

| $ | 1,617,801 | $ | 1,551,252 | |||||

|

|

|

|

|

|||||

Geographic information

Net sales by geographic location is the following:

| Three months ended |

March 31, 2018 |

March 26, 2017 |

||||||

| (Dollars in thousands) | ||||||||

| Net sales: |

||||||||

| U.S. |

$ | 30,484 | $ | 33,731 | ||||

| Mexico |

173,666 | 140,489 | ||||||

| Germany |

71,225 | — | ||||||

| Poland |

111,073 | — | ||||||

|

|

|

|

|

|||||

| Consolidated net sales |

$ | 386,448 | $ | 174,220 | ||||

|

|

|

|

|

|||||

19

Table of Contents

Note 8 – Short-Term Investments

Certificates of deposit and fixed deposits whose original maturity is greater than three months and is one year or less are classified as short-term investments and certificates of deposit and fixed deposits whose maturity is greater than one year at the balance sheet date are classified as non-current assets in our condensed consolidated balance sheets. The purchase of any certificates of deposit or fixed deposits that are classified as short-term investments or non-current assets appear in the investing section of our condensed consolidated statements of cash flows.

Restricted Deposits

We purchase certificates of deposit that mature within twelve months and are used to secure or collateralize letters of credit securing our workers’ compensation obligations. At each of March 31, 2018 and December 31, 2017, certificates of deposit totaling $0.8 million were restricted in use and were classified as short-term investments on our condensed consolidated balance sheets.

Note 9 – Inventories

| March 31, 2018 | December 31, 2017 | |||||||

| (Dollars in thousands) | ||||||||

| Raw materials |

$ | 56,094 | $ | 59,353 | ||||

| Work in process |

47,424 | 48,803 | ||||||

| Finished goods |

79,746 | 65,843 | ||||||

|

|

|

|

|

|||||

| Inventories |

$ | 183,264 | $ | 173,999 | ||||

|

|

|

|

|

|||||

Service wheel and supplies inventory included in other non-current assets in the consolidated balance sheets totaled $9.1 million and $8.1 million at March 31, 2018 and December 31, 2017, respectively. Raw materials included operating supplies and spare parts totaling $14.7 million and $12.5 million at March 31, 2018 and December 31, 2017, respectively.

Note 10 – Property, Plant and Equipment

| March 31, 2018 | December 31, 2017 | |||||||

| (Dollars in thousands) | ||||||||

| Land and buildings |

$ | 144,325 | $ | 136,918 | ||||

| Machinery and equipment |

755,148 | 720,175 | ||||||

| Leasehold improvements and others |

12,447 | 12,192 | ||||||

| Construction in progress |

61,230 | 58,753 | ||||||

|

|

|

|

|

|||||

| 973,150 | 928,038 | |||||||

| Accumulated depreciation |

(420,998 | ) | (391,352 | ) | ||||

|

|

|

|

|

|||||

| Property, plant and equipment, net |

$ | 552,152 | $ | 536,686 | ||||

|

|

|

|

|

|||||

Depreciation expense was $17.5 million and $8.4 million for the three months ended March 31, 2018 and March 26, 2017, respectively.

20

Table of Contents

Note 11 – Preproduction Costs Related to Long-Term Supply Arrangements

We incur preproduction engineering and tooling costs related to the products produced for our customers under long-term supply agreements. We expense all preproduction engineering costs for which reimbursement is not contractually guaranteed by the customer or which are in excess of the contractually guaranteed reimbursement amount. We amortize the cost of the customer-owned tooling over the expected life of the wheel program on a straight-line basis. Also, we defer any reimbursements made to us by our customers and recognize the tooling reimbursement revenue over the same period in which the tooling is in use. Changes in the facts and circumstances of individual wheel programs may accelerate the amortization of both the cost of customer-owned tooling and the deferred tooling reimbursement revenues. Recognized tooling reimbursement revenues, which totaled $1.6 million and $1.7 million for the three months ended March 31, 2018 and March 31, 2017, respectively, are included in net sales in the condensed consolidated statements of operations (see Note 4, “Revenue” for further information regarding revenue recognition and accounting for contract assets, pre-production costs and customer reimbursement).

The following tables summarize the unamortized customer-owned tooling costs included in our non-current assets, and the deferred tooling revenues included in accrued expenses and other non-current liabilities:

| March 31, 2018 |

December 31, 2017 |

|||||||

| (Dollars in thousands) | ||||||||

| Customer-Owned Tooling Costs |

||||||||

| Preproduction costs |

$ | 92,232 | $ | 84,198 | ||||

| Accumulated amortization |

(73,722 | ) | (71,409 | ) | ||||

|

|

|

|

|

|||||

| Net preproduction costs |

$ | 18,510 | $ | 12,789 | ||||

|

|

|

|

|

|||||

| Deferred Tooling Revenues |

||||||||

| Accrued expenses |

$ | 5,450 | $ | 4,654 | ||||

| Other non-current liabilities |

5,638 | 1,974 | ||||||

|

|

|

|

|

|||||

| Total deferred tooling revenues |

$ | 11,088 | $ | 6,628 | ||||

|

|

|

|

|

|||||

Note 12 – Goodwill and Other Intangible Assets

Goodwill and indefinite-lived assets, such as certain trade names acquired in connection with the acquisition of Uniwheels on May 30, 2017, are not amortized, but are instead evaluated for impairment on an annual basis at the end of the fiscal year, or more frequently if events or circumstances indicate that impairment may be more likely. During the three months ended March 31, 2018, no impairment charges have been taken against the company’s goodwill or indefinite-lived intangible assets. At March 31, 2018, the goodwill is $312.4 million, consisting of the initial balance of $286.2 million, increased for post-acquisition translation adjustments. The carrying amount of goodwill arose from the Acquisition described in Note 3, “Acquisition.”

The company’s other intangible assets primarily consist of assets with finite lives. These assets are amortized on a straight-line basis over their estimated useful lives. Following is a summary of the company’s finite-lived and indefinite-lived intangible for the three months ended March 31, 2018.

21

Table of Contents

| December 31, 2017 |

Amortization Expense |

Currency Translation |

March 31, 2018 |

Remaining Weighted Average Amortization Period |

||||||||||||||||

| (Dollars in thousands | ||||||||||||||||||||

| Brand name |

$ | 8,490 | $ | (493 | ) | $ | 205 | $ | 8,202 | 5-6 | ||||||||||

| Technology |

14,150 | (821 | ) | 340 | 13,669 | 4-6 | ||||||||||||||

| Customer relationships |

165,746 | (5,535 | ) | 3,980 | 164,191 | 6-11 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total finite |

188,386 | (6,849 | ) | 4,525 | 186,062 | |||||||||||||||

| Trade names |

15,087 | — | 410 | 15,497 | Indefinite | |||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

$ | 203,473 | $ | (6,849 | ) | $ | 4,935 | $ | 201,559 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

Amortization expense for these intangible assets was $6.8 million for the three months ended March 31, 2018. The anticipated annual amortization expense for these intangible assets is $25.0 million for 2019 to 2021, $22.2 million for 2022, and $20.2 million for 2023.

Note 13 – Debt

A summary of long-term debt and the related weighted average interest rates is shown below (in thousands):

| March 31, 2018 | ||||||||||||||||

| Debt Instrument | Total Debt | Debt Issuance Costs (1) |

Total Debt, Net |

Weighted Average Interest Rate |

||||||||||||

| Term loan facility |

$ | 385,800 | $ | 15,122 | $ | 370,678 | 6.4 | % | ||||||||