UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12 | |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

|

A NOTE FROM DONALD J. STEBBINS

|

March 26, 2018

Dear Superior Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Superior Industries International, Inc. (the “Annual Meeting”), which will be held at Superior Industries International, Inc. (the “Company” or “Superior”) headquarters at 26600 Telegraph Road, Southfield, Michigan 48033 on May 7, 2018, at 10:00 a.m. Eastern Daylight Time.

During 2017, Superior continued to drive improvement in our financial and operational performance, return capital to our stockholders and engage with our stockholders on important topics such as executive compensation.

Below are a few of the Company’s recent key initiatives:

Transformational Acquisition. Consistent with our strategic plan, Superior acquired 94.1% of the shares of UNIWHEELS AG (“Uniwheels”) in 2017, becoming one of the largest aluminum wheel suppliers in the world. With approximately 50% of our revenues now in Europe, Superior is the third largest wheel supplier in Europe and the leader in the European aftermarket. We now operate nine manufacturing facilities in four countries with combined annual manufacturing capacity of approximately 22 million wheels. Through the acquisition, we diversified our customer base so that our three largest customers now represent 51% of our revenue compared to 82% pre-acquisition.

Operating Performance Improvement. We continued our focus on operational excellence in 2017. We successfully implemented initiatives for safety, quality, delivery, cost, and talent acquisition during the past year. Following the acquisition of Uniwheels, we combined our manufacturing resources to implement best practices across North America and Europe.

Physical Vapor Deposition (“PVD”) Facility. As customer demand for premium finishes continues to rise, we completed preparations for launch of our new PVD facility in Mexico, enabling Superior to establish market leadership on in-house application of high-end finishes. Beyond PVD, we continue to increase revenues through pad printing, laser etching, and other customization sought by our customers.

AluLite™ Patent. Superior was awarded its first product patent for cast aluminum wheels on November 14, 2017. The patented AluLite™ technology uses design and processing techniques to enable Superior to manufacture wheels that are up to 10% lighter than a traditional wheel, yet still meet the stringent strength and ride characteristics we provide to our customers.

Further highlights of our 2017 performance can also be found in the “2017 Performance & Business Highlights” and “Compensation, Discussion and Analysis” sections of the attached Proxy Statement.

Strategic Plan. We reaffirmed our commitment to the strategic plan we introduced in 2015, which is focused on improving our global competitiveness, building on our culture of product innovation and technology, evaluating opportunities for disciplined growth and value creation, maintaining a balanced approach to capital allocation and increasing our visibility with the financial community. We are seeking to achieve these priorities by, among other actions:

| • | Increasing our manufacturing and finishing capacities and capabilities; |

| • | Reducing our cost per wheel; |

| • | Enhancing product quality and focusing on more complex products; |

| • | Executing strategic investment in our intellectual property portfolio; |

| • | Engaging with customers on design ideas and engineering concepts; |

| • | Establishing additional global relationships; and |

| • | Continuing to balance our capital allocation to enhance returns to our stockholders and reduce leverage while maintaining appropriate financial flexibility to pursue strategic initiatives. |

Our management works closely with our Board of Directors (the “Board”) to monitor the progress being made on our strategic plan. The Board reviews Superior’s strategic plan at least annually and more frequently as significant opportunities or events arise.

Your Vote is Important. We, and the rest of the Board, invite you to attend the Annual Meeting. If you are not able to attend in person, we encourage you to vote by proxy. The Proxy Statement contains detailed information about the matters on which we are asking you to vote. Whether or not you plan to attend the Annual Meeting, your vote is important, and we encourage you to vote promptly. You can vote your shares over the telephone, via the Internet or by completing, dating, signing and returning a proxy card, as described in the Proxy Statement.

Thank you for your ongoing support of, and continued interest in, Superior.

In this Proxy Statement, you will note that Jack Hockema has chosen not to run for reelection as a member of our Board. He made this decision after giving consideration to his ongoing responsibilities as Chairman and Chief Executive Officer of Kaiser Aluminum.

I cannot emphasize how much Jack will be missed. He has provided the Company with valuable insight based on his great familiarity with the aluminum fabrication business. As the Chair of the Nominating and Corporate Governance Committee, Jack provided support on a number of matters, including spearheading the addition of Ellen Richstone and Ransom Langford to the Board and assisting in the transition of the Chairman of the Board role to Timothy McQuay. He also enhanced the good governance principles of Superior by, among other things, improving shareholder outreach and assisting with the addition of a proxy access bylaw. All of these efforts combined to make Superior one of the best suppliers of automotive and light truck wheels in the world.

I trust you share the sentiment of the other Board members and all employees of Superior in wishing Jack continuing success in both his professional and personal pursuits.

Donald J. Stebbins

President and Chief Executive Officer

This Proxy Statement is dated March 26, 2018 and is first being made available to stockholders via the Internet on or about March 26, 2018.

|

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

|

| Time and Date: |

Monday, May 7, 2018 at 10:00 a.m. Eastern Time | |

| Place: |

Superior Industries International, Inc. 26600 Telegraph Road Southfield, Michigan 48033 | |

| Record Date: |

March 19, 2018

Each holder of Superior common stock and Series A Preferred Stock as of the Record Date will be entitled to one vote on each matter for each share of common stock held, or into which such holder’s Series A Preferred Stock is convertible, on the Record Date. | |

| Items to Be Voted On: |

1. To elect the following eight nominees to the Board of Directors (the “Board”): Michael R. Bruynesteyn, Paul J. Humphries, Ransom A. Langford, James S. McElya, Timothy C. McQuay, Ellen B. Richstone, Donald J. Stebbins and Francisco S. Uranga;

2. To approve, in a non-binding advisory vote, executive compensation of the Company’s named executive officers;

3. To approve the amendment and restatement of the Superior Industries International, Inc. Amended and Restated 2008 Equity Incentive Plan (the “2008 Equity Plan,” and as amended and restated, the “2018 Equity Plan”);

4. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018; and

5. To act upon such other matters as may properly come before the Annual Meeting or any postponements or adjournments thereof. | |

| How to Vote: |

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE YOUR SHARES PROMPTLY BY COMPLETING, DATING, SIGNING AND RETURNING A PROXY CARD, OVER THE TELEPHONE OR VIA THE INTERNET, AS DESCRIBED IN THE PROXY STATEMENT. | |

| BY ORDER OF THE BOARD OF DIRECTORS, |

| /s/ Joanne M. Finnorn |

| Joanne M. Finnorn |

| Senior Vice President, General Counsel and Corporate Secretary |

Southfield, Michigan

March 26, 2018

Notice of Electronic Availability of Proxy Statement and Annual Report

As permitted by rules adopted by the United States Securities and Exchange Commission (the “SEC”), we are making this Proxy Statement and our Annual Report available to stockholders electronically via the Internet. On or about March 26, 2018, we will mail to most of our stockholders a notice (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and to vote via the Internet or by telephone.

The Notice also contains instructions on how to request a printed copy of the proxy materials. In addition, you may elect to receive future proxy materials in printed form by mail or electronically by e-mail by following the instructions included in the Notice. If you have previously elected to receive our proxy materials electronically, you will continue to receive these materials via e-mail, unless you elect otherwise.

Superior Industries International, Inc. • Table of Contents

TABLE OF CONTENTS

2018 Proxy Statement | i

Proxy Summary • 2018 Annual Meeting of Stockholders

2018 Annual Meeting of Stockholders – Annual Meeting Information

| Time and Date: |

Monday, May 7, 2018 at 10:00 a.m. Eastern Time | |

|

Place: |

Superior Industries International, Inc. 26600 Telegraph Road Southfield, Michigan 48033 | |

| Record Date: |

March 19, 2018 | |

| Voting: |

You are entitled to vote at the meeting if you were a stockholder of record of Superior’s common stock or Series A Preferred Stock at the close of business on March 19, 2018 (the “Record Date”). Each holder of Superior common stock or Series A Preferred Stock as of the Record Date will be entitled to one vote on each matter for each share of common stock held, or into which such holder’s Series A Preferred Stock is convertible, on the Record Date. |

For more information regarding the Annual Meeting and voting, please see our “Information About the Annual Meeting and Voting” Section, found at page 65.

2018 Annual Meeting of Stockholders – Agenda and Voting Recommendations

| Proposals: |

Board Voting Recommendation: |

Page Reference for More Detail: | ||||

| 1. |

Election of Directors | “FOR” all nominees | 6 | |||

| 2. |

To approve, in a non-binding advisory vote, executive compensation of the Company’s named executive officers | “FOR” | 24 | |||

| 3. |

To approve the amendment and restatement of the Amended and Restated Superior Industries International, Inc. 2008 Equity Incentive Plan | “FOR” | 26 | |||

| 4. |

Ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2018 | “FOR” | 34 | |||

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, your vote is important, and we encourage you to vote promptly. You can vote your shares over the telephone, via the Internet or by completing, dating, signing and returning a proxy card, as described in the Proxy Statement. Your prompt cooperation is greatly appreciated.

2018 Proxy Statement | 1

Proxy Summary • 2017 Performance & Business Highlights

2017 Performance & Business Highlights

Recent Business Highlights/Company Performance

The following chart highlights key metrics of our financial and operating performance in 2017 as compared to 2016:

| Key Metric |

2017 Results | 2017 vs. 2016 | ||

| Units Shipped |

17.0 million | 38.2% increase | ||

| Net Sales |

$1,108 million | 51.2% increase | ||

| Value-Added Sales(1) |

$617 million | 50.9% increase | ||

| Value-Added Sales per Wheel |

$36.27 | 8.8% increase | ||

| Adjusted EBITDA(2) |

$140.1 million | 58.3% increase | ||

| Adjusted EBITDA(2) % of value-added sales(1) |

22.7% | 106 basis point improvement | ||

| Net cash provided by operating activities |

$64 million | 18.8% decrease |

| (1) | Value-added sales is a financial measure that is not calculated according to GAAP, and we are including our 2017 results for this measure to show an aspect of our performance. See Appendix A to this Proxy Statement for a reconciliation of net sales, the most comparable GAAP measure, to value-added sales. |

| (2) | Adjusted EBITDA is a key measure that is not calculated according to GAAP, and we are including our 2017 results for this measure to show an aspect of our performance. See Appendix A to this Proxy Statement for a reconciliation of net income, the most comparable GAAP measure, to Adjusted EBITDA. |

2 | Superior Industries International, Inc.

Proxy Summary • Executive Compensation Highlights

Executive Compensation Highlights

Highlights of our 2017 executive compensation program are summarized as follows.

| • | Individual Performance Component of Annual Incentive. Our Annual Incentive Performance Plan (the “AIPP”) plays an important role in our approach to total compensation. We believe it motivates participants to focus on improving our performance on key financial measures during the year because it requires that we achieve defined, objectively determinable goals before participants become eligible for an incentive payout. |

| • | 2017 AIPP Payouts. While the AIPP Adjusted EBITDA(1) for 2017 for the North American Operations fell slightly below the $88 million threshold target, the combined Company performance achieved Adjusted EBITDA of $140.1 million in 2017. The Compensation and Benefits Committee considered the efforts by management to identify and successfully finalize the transformational acquisition of Uniwheels during the year, using its discretion to fund the 2017 AIPP bonus pool for our Named Executive Officers (“NEOs”) at 80% of target. |

| • | Long-Term Incentive Plan (“LTIP”) Performance Measures. In 2017, we granted performance-based restricted stock units (“PRSUs”) that can be earned based on our achievement of the following three performance measures as calculated over a three-year period:(2) |

| Return on Invested Capital 40% weighting

(“ROIC”) |

Cumulative Earnings per Share 40% weighting

(“Cumulative EPS”) |

Relative Total Shareholder Return 20% weighting

(“Relative TSR”) |

As discussed in the “2017 Executive Compensation Components – Long-Term Equity Incentive Compensation” section of this Proxy Statement, these performance measures were developed after a rigorous bottom-up financial analysis of our business.

| (1) | Please see the “Annual Incentive Compensation and Bonuses” portion of the “Compensation Discussion and Analysis” section of this Proxy Statement for a discussion of how AIPP Adjusted EBITDA is calculated. |

| (2) | Please see the “Long-Term Equity Incentive Compensation” portion of the “Compensation Discussion and Analysis” section of this Proxy Statement for a discussion of how each of these performance measures are calculated. |

Corporate Governance Highlights

2018 Proxy Statement | 3

Proxy Summary • Corporate Governance Highlights

4 | Superior Industries International, Inc.

Proxy Summary • Director Nominee Highlights

| Name |

Age | Director Since |

Principal Occupation | Independent | Board Committees | |||||

| Michael R. Bruynesteyn |

54 | 2015 | Treasurer & Vice President, Strategic Finance of Turner Construction Company | X | • Audit Committee • Nominating & Corporate Governance Committee | |||||

| Paul J. Humphries |

63 | 2014 | President of High Reliability Solution (a business group of Flex LTD) | X | • Audit Committee • Compensation & Benefits Committee | |||||

| Ransom A. Langford |

46 | 2017 | Partner, TPG Growth | X |

• Compensation & Benefits Committee | |||||

| James S. McElya |

70 | 2013 | Retired Chairman of the Board of Directors, Affinia Group Intermediate Holdings Inc. | X |

• Compensation & Benefits Committee (Chair) • Nominating & Corporate Governance Committee | |||||

| Timothy C. McQuay |

66 | 2011 | Retired Managing Director, Investment Banking with Noble Financial Markets | X | • Chairman of the Board • Nominating & Corporate Governance Committee (Chair)* | |||||

| Ellen B. Richstone |

66 | 2016 | Retired Chief Financial Officer, Rohr Aerospace | X | • Audit Committee (Chair) • Nominating & Corporate Governance Committee | |||||

| Donald J. Stebbins |

60 | 2014 | President and CEO of Superior Industries International, Inc. | |||||||

| Francisco S. Uranga |

54 | 2007 | Corporate Vice President & Chief Business Operations Officer for Latin America, Foxconn | X |

• Compensation & Benefits Committee • Nominating & Corporate Governance Committee |

| * | As a result of Mr. Hockema’s anticipated retirement from the Board, the Board appointed Mr. McQuay to serve as the Chairman of the Nominating and Corporate Governance Committee on March 8, 2018. |

2018 Proxy Statement | 5

Proposal No. 1 • General

ELECTION OF DIRECTORS

The Board, through the Nominating and Corporate Governance Committee, considers the following experience, qualifications, attributes and skills of both potential director nominees as well as existing members of the Board:

For more information regarding director nominations and qualifications, see the sections titled “Information about Director Nominees” (beginning on page 7) and “Director Selection” (beginning on page 15).

6 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

Information about Director Nominees

| MICHAEL R. BRUYNESTEYN

Treasurer and Vice President, Strategic Finance, Turner Construction Company

Independent

Age: 54

Director since: 2015

Board Committees: Audit and Nominating and Corporate Governance

Education: Mr. Bruynesteyn holds a Bachelor of Applied Science in Mechanical Engineering from the University of British Columbia and a Master of Business Administration from the London Business School. Mr. Bruynesteyn is a National Association of Corporate Directors Governance Fellow.

Current Directorships: None

Former Directorships: None |

Qualifications: Mr. Bruynesteyn has developed a deep understanding of capital markets from hands-on experience over the last 20 years. He cultivated a firm grasp of the investor’s perspective from the vantage points of directing investor relations for General Motors, leading the award-winning sell-side research team covering the automotive industry for Prudential Securities, and investing on the buy-side as part of a $6 billion hedge fund owned by Lehman Brothers. Mr. Bruynesteyn built on this knowledge base by providing deal-making advice to automotive and energy storage companies with boutique investment bank Strauss Capital. He remains active in the capital markets in his current role as Treasurer of Turner Construction, where he leads a team focused on cash generation and is responsible for investing more than $1 billion of the company’s funds. Mr. Bruynesteyn continues his engagement in the automotive industry as a member of the Advisory Board of ClearMotion, Inc., a developer of breakthrough active suspension technology.

Mr. Bruynesteyn is Treasurer and Vice President, Strategic Finance of Turner Construction Company, the largest non-residential commercial construction company in the United States, a position he has held since 2013. He previously was a Managing Director at the investment banking firm Strauss Capital Partners, where he served middle-market clients by raising capital, providing board-level financial advisory services and executing M&A transactions from 2008 to 2012. Prior to that, Mr. Bruynesteyn was a Managing Director in the asset management division of Lehman Brothers, where he focused on transportation-related investments from 2006 to 2008. From 1999 to 2006, Mr. Bruynesteyn was a Senior Equity Research Analyst at Prudential Equity Group in the Automotive Group, where he acted as a sell-side analyst. Prior to his position at Prudential Equity Group, Mr. Bruynesteyn worked at General Motors, where he held various finance positions until he departed as Director of Investor Relations in 1998. |

2018 Proxy Statement | 7

Proposal No. 1 • Information about Director Nominees

| PAUL J. HUMPHRIES

President of High Reliability Solutions, a business group at Flex LTD

Independent

Director since: 2014

Age: 63

Board Committees: Audit and Compensation and Benefits

Education: Mr. Humphries has a B.A. in applied social studies from Lanchester Polytechnic (now Coventry University) and post-graduate certification in human resources management from West Glamorgan Institute of Higher Education.

Current Directorships: ALearn Silicon Valley Education Foundation

Former Directorships: None |

Qualifications: Mr. Humphries has extensive experience in the automotive supplier industry and senior level management experience with multinational public companies, providing valuable expertise in strategy, growth, human resources and global operations. Further, Mr. Humphries has extensive experience in planning, implementing and integrating mergers and acquisitions.

Mr. Humphries is the President of High Reliability Solutions, a business group at Flex LTD (NASDAQ: FLEX) (“Flex”), a global end-to-end supply chain solutions company that serves the medical, automotive and aerospace and defense markets, a position he has held since 2011. From 2006 to 2011, Mr. Humphries served as Executive Vice President of Human Resources at Flex. In that capacity, he led Flex’s global human resources organization, programs and related functions including global loss prevention, environmental compliance and management systems. Mr. Humphries joined Flex with the acquisition of Chatham Technologies Incorporated in April 2000. While at Chatham Technologies, he served as Senior Vice President of Global Operations. Prior to that, Mr. Humphries held several senior management positions at Allied Signal, Inc. (NYSE: ALD) and its successor Honeywell Inc. (NYSE: HON), BorgWarner Inc. (NYSE: BWA) and Ford Motor Company (NYSE: F). |

| RANSOM A. LANGFORD

Partner, TPG Growth

Independent

Director since: 2017

Age: 46

Board Committees: Compensation and Benefits

Education: Mr. Langford earned a B.A. with Highest Distinction from University of North Carolina, Chapel Hill and an M.B.A. from the Wharton School at University of Pennsylvania.

Current Directorships: Frank Recruitment Group, Inc., Gavin de Becker & Associates, LP, TopTech Holdings, LLC, Artel, LLC and Microgame S.p.A. |

Qualifications: Mr. Langford is a Partner and Investment Committee member for TPG Growth based in New York, where he leads the platform’s investments in industrial and business services. Mr. Langford has extensive experience as a board member, serving on boards of directors for several TPG portfolio companies, including Frank Recruitment Group, Gavin de Becker & Associates, HotSchedules (alternatively named Red Book Connect, Inc.), Artel and Microgame. Mr. Langford’s substantial board and investment experience make him a valuable contributor to the Board.

Prior to joining TPG Growth in 2009, Mr. Langford was a Managing Director and Partner with J.H. Whitney & Co., where he was a senior member of the investment team responsible for investing several private equity partnerships and was a member of the firm’s Investment Committee. Prior to his tenure at J.H. Whitney, Mr. Langford was an Associate at Brentwood Associates, representing a number of portfolio companies as a member of the investment team. Mr. Langford has also spent time as an analyst in the Mergers & Acquisitions group at New York-based investment bank Donaldson, Lufkin & Jenrette. |

8 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

| JAMES S. MCELYA

Retired Chairman of the Board of Directors, Affinia Group Intermediate Holdings Inc.

Independent

Director since: 2013

Age: 70

Board Committees: Compensation and Benefits (Chair) and Nominating and Corporate Governance

Education: Mr. McElya attended West Chester University.

Current Directorships: None.

Former Directorships: Cooper Standard Holdings Inc.; Affinia Group Intermediate Holdings Inc.

|

Qualifications: Mr. McElya has expertise in the automotive industry as well as leadership experience, including his services as the former Chief Executive Officer of a public company. Mr. McElya also provides substantial experience with mergers and acquisitions in the automotive industry – Mr. McElya was instrumental in bringing Cooper Standard from a $1.5 billion business in 2004 to over $3.0 billion when he retired as CEO in 2012. This growth was predominantly a result of a comprehensive M&A strategy. He contributes leadership and strategy experience combined with operation and management expertise.

Mr. McElya was chairman of the board of directors of Affinia Group Intermediate Holdings Inc. until August 2016, when the company was sold. Until 2013, Mr. McElya was chairman of the board of directors and, until 2012, Chief Executive Officer of Cooper Standard Holdings Inc. Previously, he had served as president of Cooper-Standard Automotive (NYSE: CSA) (“Cooper Standard”), the principal operating company of Cooper Standard Holdings, and as corporate vice president of Cooper Tire & Rubber Company, the parent company of Cooper Standard, until 2004. Mr. McElya has also served as President of Siebe Automotive Worldwide and over a 22-year period, held various senior management positions with Handy & Harman. Mr. McElya is a past chairman of the Motor Equipment Manufacturers Association (MEMA) and a past chairman of the board of directors of the Original Equipment Supplier Association (OESA). |

| TIMOTHY C. MCQUAY

Retired Managing Director, Investment Banking, Noble Financial Capital Markets

Independent

Director since: 2011

Age: 66

Board Committees: Nominating and Corporate Governance (Chair) and Chairman of the Board

Education: Mr. McQuay received an A.B. degree in economics from Princeton University and a M.B.A. degree in finance from the University of California at Los Angeles.

Current Directorships: None.

Former Directorships: BSD Medical Corp., Keystone Automotive Industries, Inc. (Chair, Audit Committee); Meade Instruments Corp. (Chairman); Perseon Corp. (Chairman)

|

Qualifications: Mr. McQuay provides, among other qualifications, his extensive business and financial experience and his public company board experience, which includes extensive experience on compensation and audit committees. Further, Mr. McQuay provides a deep knowledge of the capital markets and significant investment banking experience, having been involved in mergers and acquisitions representing in aggregate more than $4 billion. Mr. McQuay also brings to the Board valuable insight into corporate strategy and risk management that he has gained from his 37 years of experience in the investment banking and financial services industries. Of particular relevance to his service on our Board, while Mr. McQuay served on Keystone’s board, the company made eight strategic acquisitions between 1996 and 2007 representing more than $400 million in aggregate value. Mr. McQuay served on Keystone’s special committee in connection with the company’s sale to LKQ Corporation in 2007 for $800 million.

Mr. McQuay brings with him nearly 37 years of financial advisory experience to the Board. From November 2011 until his retirement in December 2015, he served as Managing Director, Investment Banking with Noble Financial Capital Markets, an investment banking firm. Previously, he served as Managing Director, Investment Banking with B. Riley & Co., an investment banking firm, from September 2008 to November 2011. From August 1997 to December 2007, he served as Managing Director – Investment Banking at A.G. Edwards & Sons, Inc. From May 1995 to August 1997, Mr. McQuay was a Partner at Crowell, Weedon & Co. and from October 1994 to August 1997, he also served as Managing Director of Corporate Finance. From May 1993 to October 1994, Mr. McQuay served as Vice President, Corporate Development with Kerr Group, Inc., a New York Stock Exchange listed plastics manufacturing company. From May 1990 to May 1993, Mr. McQuay served as Managing Director of Merchant Banking with Union Bank. |

2018 Proxy Statement | 9

Proposal No. 1 • Information about Director Nominees

| ELLEN B. RICHSTONE

Retired Chief Financial Officer, Rohr Aerospace

Independent

Director since: 2016

Age: 66

Board Committees: Audit (Chair) and Nominating and Corporate Governance

Education: Ms. Richstone received a bachelor’s degree from Scripps College in Claremont California and holds graduate degrees from the Fletcher School of Law and Diplomacy at Tufts University. Ms. Richstone also completed the Advanced Professional Certificate in Finance at New York University’s Graduate School of Business Administration and attended the Executive Development program at Cornell University’s Business School. Ms. Richstone holds an Executive Master’s Certification in Director Governance from the American College of Corporate Directors – Gold Level.

Current Directorships: eMagin Corp.; Bioamber Inc.; Orion Energy Systems, Inc.

Former Directorships: Parnell Pharmaceutical Inc.; American Power Conversion; The Oneida Group (formerly EveryWare Global) |

Qualifications: Ms. Richstone provides, among other qualifications, her extensive business and financial experience as Chief Financial Officer of public and private companies ranging in size up to $4 billion in revenue over a 24-year period and her public company board experience, which includes being awarded the first annual Distinguished Director Award from the American College of Corporate Directors.

Ms. Richstone has served as the Chief Financial Officer of several public and private companies between 1989 and 2012, including Rohr Aerospace, a Fortune 500 company. From 2002 to 2004, Ms. Richstone was the President and Chief Executive Officer of the Entrepreneurial Resources Group. From 2004 until its sale in 2007, Ms. Richstone served as the financial expert on the board of directors of American Power Conversion, an S&P 500 company. Ms. Richstone currently sits on the board of the National Association of Corporate Directors (NACD) in New England, as well as other non-profit organizations. In January 2018, Ms. Richstone was named as an NACD Board Leadership Fellow, signifying that she has demonstrated her commitment to the highest level of leadership in the boardroom. |

10 | Superior Industries International, Inc.

Proposal No. 1 • Information about Director Nominees

| DONALD J. STEBBINS

Superior Industries International, Inc. President and Chief Executive Officer

Director since: 2014

Age: 60

Board Committees: None

Education: Mr. Stebbins has an M.B.A. from the University of Michigan and a B.S. in Finance from Miami University.

Current Directorships: Snap-On Incorporated

Former Directorships: Visteon Corporation; ITT Corp.; WABCO Holdings |

Qualifications: Mr. Stebbins has more than 30 years of leadership experience in global operations and finance, including over 20 years of experience in the automotive supplier industry. Mr. Stebbins was appointed to the Board of the Company because of his knowledge of the Company as Chief Executive Officer and based on the entirety of his experience and skills, including, in particular, his significant experience in the automotive industry and background in corporate finance and growth as part of the senior management team at Lear. Mr. Stebbins contributed to that company’s significant growth in revenue (from approximately $800 million to $17 billion). This experience includes the operational and financial analysis of operating units, as well as managing all aspects of significant merger and acquisition and financial transactions – in particular, as Chief Financial Officer of Lear, Mr. Stebbins was involved in $15 billion of capital markets transactions (including over 17 acquisitions).

Mr. Stebbins was appointed as the Company’s President and Chief Executive Officer effective May 5, 2014. He was previously Chairman, President and Chief Executive Officer of Visteon Corporation (NYSE: VC) (“Visteon”), a global supplier of automotive systems, modules and components to global automotive original equipment manufacturers, from December 1, 2008 through August 2012. Mr. Stebbins was a member of the board of directors of Visteon from December 2006 through August 2012. Prior to that, Mr. Stebbins was Visteon’s President and Chief Executive Officer from June 2008 through November 2008, and its President and Chief Operating Officer from May 2005 through May 2008. After leaving Visteon in 2012, Mr. Stebbins provided consulting services for several private equity firms. Before joining Visteon, Mr. Stebbins served as President and Chief Operating Officer of operations in Europe, Asia and Africa for Lear Corporation (NYSE: LEA) (“Lear”), a supplier of automotive seating and electrical distribution systems, since August 2004, President and Chief Operating Officer of Lear’s operations in the Americas since September 2001 and prior to that, as Lear’s Chief Financial Officer. |

2018 Proxy Statement | 11

Proposal No. 1 • Information about Director Nominees

| FRANCISCO S. URANGA

Corporate Vice President and Chief Business Operations Officer for Latin America, Foxconn

Independent

Director since: 2007

Age: 54

Board Committees: Compensation and Benefits and Nominating and Corporate Governance

Education: He earned a B.B.A. in Marketing from the University of Texas at El Paso and a Diploma in English as a Second Language from Brigham Young University.

Current Directorships: Corporación Inmobiliaria Vesta; Tenet Hospitals, the Hospitals of Providence Transmountain Campus

Former Directorships: None |

Qualifications: Given the Company’s significant operations in Mexico, Mr. Uranga’s expertise in developing and managing operations in that country is a valuable contribution to the Board.

Mr. Uranga is Corporate Vice President and Chief Business Operations Officer for Latin America at Taiwan-based Foxconn Electronics, Inc., the largest electronic manufacturing services company in the world, a position he has held since 2005. In this position, Mr. Uranga is responsible in Latin America for government relations, regulatory affairs, incentives, tax and duties, legal, customs, immigration and land and construction issues. From 1998 to 2004, he served as Secretary of Industrial Development for the state government of Chihuahua, Mexico. Previously, Mr. Uranga was Deputy Chief of Staff and then Chief of Staff for Mexican Commerce and Trade Secretary Herminio Blanco, where he actively participated in implementing the North American Free Trade Agreement and in negotiating key agreements for the Mexican government as part of the country’s trade liberalization. Earlier, Mr. Uranga was Sales and Marketing Manager for American Industries International Corporation. |

The Board unanimously recommends a vote “FOR” its eight nominees for election as Director. Proxies solicited by the Board will be voted “FOR” Superior’s eight nominees unless stockholders specify a contrary vote.

12 | Superior Industries International, Inc.

Board Structure and Committee Composition • Board Composition

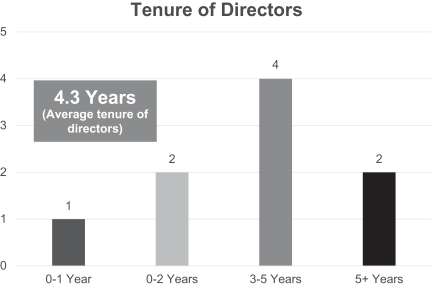

Independent directors comprise 89% of our Board and the average tenure of our directors will be 4.3 years as of the date of the Annual Meeting:

Tenure by Director

| Director |

Start Date | Tenure | ||

| Donald J. Stebbins |

May 5, 2014 | 4.0 years | ||

| Michael R. Bruynesteyn |

November 3, 2015 | 2.5 years | ||

| Jack A. Hockema |

December 16, 2014 | 3.4 years | ||

| Paul J. Humphries |

August 15, 2014 | 3.7 years | ||

| Ransom A. Langford |

May 22, 2017 | 1.0 years | ||

| James S. McElya |

December 6, 2013 | 4.4 years | ||

| Timothy C. McQuay |

November 15, 2011 | 6.5 years | ||

| Ellen B. Richstone |

October 25, 2016 | 1.5 years | ||

| Francisco S. Uranga |

January 1, 2007 | 11.4 years |

14 | Superior Industries International, Inc.

Board Structure and Committee Composition • Director Selection

Our Nominating and Corporate Governance Committee seeks to build and maintain an effective, well-rounded, financially literate and diverse Board that represents all of our stockholders.

Process for Identification and Review of Directors Candidates to Join the Board

2018 Proxy Statement | 15

Board Structure and Committee Composition • Stockholder Nominations

16 | Superior Industries International, Inc.

Board Structure and Committee Composition • Committees of the Board

Superior has three standing committees: the Audit Committee, the Compensation and Benefits Committee and the Nominating and Corporate Governance Committee. Each of these Committees has a written charter approved by the Board. A copy of each charter can be found by clicking on “Board Committee Charters” in the “Governance” section of our website at www.supind.com. This website address is included for reference only. The information contained on the Company’s website is not incorporated by reference into this Proxy Statement.

| AUDIT COMMITTEE |

NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | |||

| Members: Ellen B. Richstone, Chairperson Michael R. Bruynesteyn Jack A. Hockema Paul J. Humphries

Meetings in 2017: 7 |

Members: Timothy C. McQuay, Chairperson* Michael R. Bruynesteyn Jack A. Hockema James S. McElya Ellen B. Richstone Francisco S. Uranga

Meetings in 2017: 5 | |||

| Independence:

The Board has determined that each member of the Audit Committee is “independent” under the NYSE listing standards and satisfies the other requirements under the NYSE listing standards and SEC rules regarding audit committee membership, that each of Ms. Richstone and Messrs. Hockema and Bruynesteyn qualifies as an “audit committee financial expert” and that each member of the Audit Committee satisfies the “financial literacy” requirements of the NYSE listing standards.

Key Responsibilities:

The Audit Committee is responsible for reviewing the financial information which will be provided to stockholders and others, reviewing the system of internal controls which management and the Board have established, appointing, retaining and overseeing the performance of the independent registered public accounting firm, overseeing Superior’s accounting and financial reporting processes and the audits of Superior’s financial statements, and pre-approving audit and permissible non-audit services provided by the independent registered public accounting firm.

The report of the Audit Committee is on page 64 of this Proxy Statement. |

* As a result of Mr. Hockema’s anticipated retirement from the Board, the Board appointed Mr. McQuay to serve as the Chairman of the Nominating and Corporate Governance Committee on March 8, 2018.

Independence:

Each member of this Committee is an independent director under applicable NYSE listing standards.

Key Responsibilities:

The Nominating and Corporate Governance Committee is responsible for overseeing, reviewing and making periodic recommendations concerning Superior’s corporate governance policies, for recommending to the Board candidates for election to the Board and to Committees of the Board, and overseeing the Board’s annual self-evaluation. |

2018 Proxy Statement | 17

Board Structure and Committee Composition • Committees of the Board

| COMPENSATION AND BENEFITS COMMITTEE |

directing a review of our compensation practices and policies generally, including conducting an evaluation of the design of our executive compensation program, in light of our risk management policies and programs. Additional information regarding the Compensation and Benefits Committee’s risk management review appears in the “Compensation Philosophy and Objectives” portion of the “Compensation Discussion and Analysis” section of this Proxy Statement.

On an annual basis, the Compensation and Benefits Committee reviews and makes recommendations to the Board regarding the compensation of non-employee directors, non-employee chairpersons, lead directors and Board committee members. In 2017, the Compensation and Benefits Committee engaged Willis Towers Watson to compile compensation surveys for review by the Compensation and Benefits Committee and to compare compensation paid to Superior’s directors with compensation paid to directors at companies included in the surveys. Additionally, the Compensation and Benefits.

The Compensation and Benefits Committee reviews the Company’s CEO pay ratio disclosure, CEO succession planning and management development.

For additional description of the Compensation and Benefits Committee’s processes and procedures for consideration and determination of executive officer compensation, see the “Compensation Discussion and Analysis” section of this Proxy Statement. The report of the Compensation Committee is on page 54 of this Proxy Statement. | |||

| Members: James S. McElya, Chairperson Paul J. Humphries Ransom A. Langford Francisco S. Uranga

Meetings in 2017: 6 |

||||

|

Independence:

The Board has determined that each member of the Compensation and Benefits Committee is “independent” under the NYSE listing standards and is an “outside director” within the meaning of Section 162(m) of the Internal Revenue Code of 1986, as amended, referred to as the Internal Revenue Code, and is a “non-employee director” within the meaning of Section 16 of the Securities Exchange Act of 1934 (the “Exchange Act”).

Key Responsibilities:

The Compensation and Benefits Committee’s responsibility is to review the performance and development of Superior’s management in achieving corporate goals and objectives and to assure that Superior’s executive officers are compensated effectively in a manner consistent with Superior’s strategy, competitive practice, sound corporate governance principles and stockholder interests. The Compensation and Benefits Committee determines and approves the compensation of our Chief Executive Officer and reports annually to the Board on the Chief Executive Officer succession plan. It also reviews and approves Superior’s compensation to other officers and key employees based upon compensation and benefit proposals presented to the Compensation and Benefits Committee by the Chief Executive Officer and our Human Resources Department.

The Compensation and Benefits Committee’s responsibilities and duties include an annual review and approval of Superior’s compensation strategy to ensure that it promotes stockholder interests and supports Superior’s strategic and tactical objectives, and that it provides appropriate rewards and incentives for management and employees, including administration of the 2008 Equity Plan (and, following approval at the 2018 annual meeting of stockholders, the 2018 Equity Plan) and review of compensation-related risk management. For 2017, the Compensation and Benefits Committee performed these oversight responsibilities and duties by, among other things, |

18 | Superior Industries International, Inc.

Compensation of Directors • 2017 Total Compensation

The following table provides information as to compensation for services of the non-employee directors during 2017.

Director Compensation Table

|

Name(1) |

Fees Earned or Paid in Cash ($) |

Stock Awards(2) ($) |

Pension

Value and Nonqualified Deferred Compensation Earnings(3) ($) |

Total ($) |

||||||||||||

| Michael R. Bruynesteyn |

$ | 72,167 | $ | 100,027 | — | $ | 172,194 | |||||||||

| Margaret S. Dano(4) |

$ | 62,500 | — | $ | 92,026 | $ | 154,526 | |||||||||

| Jack A. Hockema |

$ | 73,667 | $ | 100,027 | — | $ | 173,694 | |||||||||

| Paul J. Humphries |

$ | 74,167 | $ | 100,027 | — | $ | 174,194 | |||||||||

| Ransom A. Langford(5) |

— | — | — | — | ||||||||||||

| James S. McElya |

$ | 70,167 | $ | 100,027 | — | $ | 170,194 | |||||||||

| Timothy C. McQuay(6) |

$ | 124,333 | $ | 100,027 | — | $ | 224,361 | |||||||||

| Ellen B. Richstone |

$ | 73,667 | $ | 100,027 | — | $ | 173,694 | |||||||||

| Francisco S. Uranga |

$ | 68,167 | $ | 100,027 | $ | 47,213 | $ | 215,407 | ||||||||

| (1) | For a description of the annual non-employee director retainer fees and retainer fees for chair positions and for service as Chairperson of the Board, see the disclosure above under “2017 Cash Compensation.” |

| (2) | Reflects the aggregate grant date fair value of RSUs granted pursuant to the 2008 Equity Plan to each non-employee director computed in accordance with FASB ASC 718 and based on the fair market value of Superior’s common stock on the date of grant. As of the last day in fiscal year 2017, our directors held the following number of unvested RSUs: Ms. Richstone and Messrs. Bruynesteyn, Hockema, Humphries, McElya, McQuay and Uranga – 4,260 shares. Ms. Dano held no unvested RSUs as of the end of fiscal year 2017. |

| (3) | This value is the increase in the actuarial present value of non-employee director benefits under the Salary Continuation Plan, which is a frozen plan covering certain directors. The discount rate used in the present value calculation remained at 3.74% in 2017. Subject to certain vesting requirements, the plan provides for a benefit based on final average compensation, which becomes payable on the employee’s death or upon attaining age 65, if retired. The Company purchases life insurance policies on certain participants to provide in part for future liabilities. The plan was closed to new participants effective February 3, 2011. |

| (4) | Ms. Dano retired from the Board on April 25, 2017. |

| (5) | Mr. Langford began serving on the Board on May 22, 2017 and does not receive any compensation from the Company for his service on the Board or any committees of the Board. |

| (6) | Mr. McQuay serves as Chairperson of the Board. |

Non-Employee Director Stock Ownership

2018 Proxy Statement | 23

Proposal No. 3 • Summary of the 2018 Equity Plan

28 | Superior Industries International, Inc.

Proposal No. 3 • Summary of the 2018 Equity Plan

2018 Proxy Statement | 29

Proposal No. 3 • Summary of the 2018 Equity Plan

30 | Superior Industries International, Inc.

Proposal No. 3 • Summary of the 2018 Equity Plan

2018 Proxy Statement | 31

Proposal No. 3 • Recommendation of the Board

Securities Authorized for Issuance under Equity Compensation Plans

The following table contains information about securities authorized for issuance under Superior’s equity compensation plans. The features of these plans are described in Note 18, “Stock-Based Compensation” in Notes to the Consolidated Financial Statements in Item 8, “Financial Statements and Supplementary Data” of the Annual Report on Form 10-K for the year ended December 31, 2017 filed with the SEC on March 15, 2018.

| Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) (#) |

Weighted-average exercise price of outstanding options, warrants and rights ($) |

Number of securities remaining available for future issuances under equity compensation plans(2) (#) |

|||||||||

| Equity Compensation Plans approved by security holders |

145,625 | $ | 18.96 | 1,672,741 | ||||||||

| Equity Compensation Plans not approved by security holders |

— | — | — | |||||||||

| Total |

145,625 | $ | 18.96 | 1,672,741 | ||||||||

| (1) | As of December 31, 2017, the average remaining term of all outstanding options is 2.0 years. |

| (2) | Represents the number of remaining shares available for grant as of December 31, 2017 under the 2008 Equity Plan. All shares remaining available for future issuance as of December 31, 2017 may be used for grants of options or stock appreciation rights, whereas, over the life of this plan, only 600,000 of these shares may be granted as full-value awards. |

2018 Proxy Statement | 33

Proposal No. 4 • General

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Principal Accountant Fees and Services

The following is a summary of the fees billed to Superior by its independent registered public accounting firm, Deloitte & Touche LLP for professional services rendered for the years ended December 31, 2017 and December 25, 2016:

| Fee Category |

Fiscal 2017 Fees |

Fiscal 2016 Fees |

||||||

| Audit Fees |

$ | 1,810,000 | $ | 1,197,000 | ||||

| Audit-Related Fees |

520,000 | 6,000 | ||||||

| Tax Compliance/Preparation Fees |

423,000 | 595,500 | ||||||

| All Other Fees |

67,000 | 909,000 | ||||||

| Total Fees |

$ | 2,820,000 | $ | 2,707,500 | ||||

34 | Superior Industries International, Inc.

Proposal No. 4 • Principal Accountant Fees and Services

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

The Board unanimously recommends that you vote “FOR” the ratification of the appointment of Deloitte to serve as Superior’s independent registered public accounting firm for the fiscal year ending December 31, 2018. Proxies solicited by the board will be voted for the proposal unless stockholders specify a contrary vote.

2018 Proxy Statement | 35

Voting Securities and Principal Ownership • Beneficial Ownership Table

VOTING SECURITIES AND PRINCIPAL OWNERSHIP

| Name and Address(1) of Beneficial Owner |

Shares Beneficially Owned(1) |

Percentage of Common |

Percentage of Total Voting Power(1)(2) |

|||||||||

| 5% Beneficial Stockholders: |

||||||||||||

| TPG Group Holdings (SBS) Advisors, Inc.(3) |

5,326,327 | 17.6 | % | 17.6 | % | |||||||

| BlackRock, Inc.(4) |

3,080,792 | 12.3 | % | 10.2 | % | |||||||

| The Vanguard Group, Inc.(5) |

2,354,587 | 9.4 | % | 7.8 | % | |||||||

| GAMCO Asset Management, Inc.(6) |

2,242,958 | 9.0 | % | 7.4 | % | |||||||

| Dimensional Fund Advisors LP(7) |

2,094,982 | 8.4 | % | 6.9 | % | |||||||

| Steven J. Borick(8)(9) |

1,538,101 | 6.2 | % | 5.1 | % | |||||||

| The Louis L. Borick Foundation(8) |

1,500,100 | 6.0 | % | 4.9 | % | |||||||

| Directors and Named Executive Officers: |

||||||||||||

| Donald J. Stebbins(10) |

258,946 | 1.0 | % | * | ||||||||

| Nadeem Moiz(10) |

26,930 | * | * | |||||||||

| Kerry A. Shiba(12) |

13,893 | * | * | |||||||||

| Parveen Kakar(10)(11) |

79,810 | * | * | |||||||||

| James F. Sistek(10) |

27,683 | * | * | |||||||||

| Robert Tykal(10) |

41,141 | * | * | |||||||||

| Timothy C. McQuay(10) |

22,175 | * | * | |||||||||

| Michael R. Bruynesteyn(10) |

12,206 | * | * | |||||||||

| Jack A. Hockema(10) |

46,175 | * | * | |||||||||

| Paul Humphries(10) |

11,175 | * | * | |||||||||

| Ransom A. Langford(13) |

— | * | * | |||||||||

| James S. McElya(10) |

35,974 | * | * | |||||||||

| Ellen B. Richstone(10) |

4,260 | * | * | |||||||||

| Francisco S. Uranga(10)(11) |

36,175 | * | * | |||||||||

| Superior’s Directors and Executive Officers as a Group (17 persons)(10)(11) |

653,329 | 2.6 | % | 2.1 | % | |||||||

| * | Less than 1%. |

| (1) | All persons have the Company’s principal office as their address, except as otherwise indicated. Except as indicated in the footnotes to this table, and subject to applicable community property laws, the persons listed have sole voting and investment power with respect to all shares of Superior’s common stock beneficially owned by them. |

| (2) | The percentage ownership of common stock is based on 24,984,791 shares of common stock outstanding as of March 19, 2018. The percentage of total voting power is based on 30,311,117 total votes represented by 24,984,791 shares of common stock outstanding and 5,326,326 shares of common stock underlying 150,000 shares of Series A Preferred Stock as of March 19, 2018. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. For the purpose of computing the number of shares beneficially owned, percentage ownership of common stock and voting power, derivative securities that are convertible into common stock are deemed to be outstanding and beneficially owned by the person holding such |

36 | Superior Industries International, Inc.

Voting Securities and Principal Ownership • Beneficial Ownership Table

| derivative securities, but are not deemed to be outstanding for the purpose of computing beneficial ownership of any other person. |

| (3) | Represents shares of common stock underlying the 150,000 shares of Series A Preferred Stock held by TPG Group Holdings (SBS) Advisors, Inc. (“Group Advisors”), which were convertible into common stock as of August 30, 2017. The information with respect to the holdings of Group Advisors is based solely on Amendment No. 1 to the Schedule 13D filed September 1, 2017 by Group Advisors, David Bonderman and James G. Coulter. Group Advisors is the sole member of TPG Group Holdings (SBS) Advisors, LLC, a Delaware limited liability company, which is the general partner of TPG Group Holdings (SBS), L.P., a Delaware limited partnership, which is the sole member of TPG Holdings I-A, LLC, a Delaware limited liability company, which is the general partner of TPG Holdings I, L.P., a Delaware limited partnership, which is the sole member of TPG Growth GenPar III Advisors, LLC, a Delaware limited liability company, which is the general partner of TPG Growth GenPar III, L.P., a Delaware limited partnership, which is the general partner of TPG Growth III Sidewall, L.P., a Delaware limited partnership (“TPG Growth Sidewall”), which directly holds 150,000 shares of Series A Preferred Stock. David Bonderman is the President of Group Advisors and officer, director and/or manager of other affiliated entities. James G. Coulter is the Senior Vice President of Group Advisors and officer, director and/or manager of other affiliated entities. Group Advisors’ address is TPG Global, LLC, 301 Commerce Street, Suite 3300, Fort Worth, Texas 76102. |

| (4) | The information with respect to the holdings of BlackRock, Inc. (“BlackRock”), a registered investment advisor, is based solely on Amendment No. 9 to the Schedule 13G filed January 19, 2018 by BlackRock. By virtue of being the parent holding company of the holders of such shares, BlackRock has sole voting power with respect to 3,028,433 shares and sole dispositive power with respect to all 3,080,792 shares. BlackRock’s address is 55 East 52nd Street, New York, New York 10022. |

| (5) | The information with respect to the holdings of The Vanguard Group, Inc. (“Vanguard”), a registered investment advisor, is based on Amendment No. 5 to the Schedule 13G filed February 9, 2018 by Vanguard. The aggregate amount beneficially owned by Vanguard is 2,354,587 shares. Of such shares, Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of Vanguard, is the beneficial owner of 25,110 shares by virtue of its serving as investment manager of certain collective trust accounts, and Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of Vanguard, is the beneficial owner of 3,340 shares by virtue of its serving as investment manager of Australian investment offerings. Vanguard has sole voting power with respect to 26,732 shares, shared voting power with respect to 1,718 shares, sole dispositive power with respect to 2,327,759 shares and shared dispositive power with respect to 26,828 shares. The address for Vanguard is 100 Vanguard Blvd., Malvern, Pennsylvania 19355. |

| (6) | The information with respect to the holdings of GAMCO Asset Management Inc. (“GAMCO”), a registered investment advisor, is based solely on Amendment No. 39 to the Schedule 13D filed January 24, 2017 by Gabelli Funds, LLC (“Gabelli Funds”), GAMCO, Teton Advisors, Inc. (“Teton Advisors”), GGCP, Inc. (“GGCP”), GAMCO Investors, Inc. (“GBL”), Associated Capital Group, Inc. (“AC”) and Mario G. Gabelli (“Mario Gabelli”). Subject to certain restrictions, (i) GAMCO holds 1,208,075 shares and has sole voting power with respect to 1,117,075 shares; (ii) Gabelli Funds holds 543,000 shares and has sole voting and dispositive power with respect to such shares; (iii) Teton Advisors holds 483,883 shares and has sole voting and dispositive power with respect to such shares; and (iv) AC holds 8,000 shares and has sole voting and dispositive power with respect to such shares. None of GGCP, GBL or Mario Gabelli directly hold or have voting or dispositive power over any shares. Each of Gabelli Funds and GAMCO is wholly-owned subsidiary of GBL. Mario Gabelli is (i) the controlling stockholder, chief executive officer, chief investment officer and a director of GGCP, (ii) chairman and executive officer of GBL, (iii) chief investment officers of Gabelli Funds and (iv) controlling stockholder of Teton. The address for these holders is One Corporate Center, Rye, New York 10580-1435. |

| (7) | The information with respect to the holdings of Dimensional Fund Advisors LP (“Dimensional Fund”), a registered investment advisor, is based solely on Amendment No. 11 to the Schedule 13G filed February 9, 2018 by Dimensional Fund. Dimensional Fund serves as investment advisor to four registered investment companies and as investment manager to certain other commingled group trusts and separate accounts (collectively, the “Funds”), which own all shares. The Funds have sole voting power with respect to 2,012,806 shares owned by the Funds and sole dispositive power with respect to all 2,094,982 shares owned by the Funds. The address for the Dimensional Fund is Building One, 6300 Bee Cave Road, Austin, Texas 78746. |

| (8) | The information with respect to the share ownership of Steven J. Borick and The Louis L. Borick Foundation |

2018 Proxy Statement | 37

Voting Securities and Principal Ownership • Beneficial Ownership Table

| (the “Foundation”), of which Mr. Borick is the President, is based solely on Amendment No. 12 to the Schedule 13G filed on February 14, 2017. The Foundation and Mr. Borick share voting and dispositive power over the shares; however, Mr. Borick disclaims beneficial ownership of the shares held by the Foundation. The address for Mr. Borick and the Foundation is 2707 Kipling Street, Houston, Texas 77098. |

| (9) | Also includes 100 shares of common stock and 8,000 shares held by Blake Mills David Trust, of which Mr. Borick is the sole trustee and 40,000 shares held by Liatis Foundation, of which Mr. Borick is the President and member of the board. |

| (10) | Includes restricted stock units, subject to solely time-based vesting requirements, (“RSUs”) in the amount of 105,357 unvested RSUs for Mr. Stebbins, 13,670 unvested RSUs for Mr. Moiz, 14,299 unvested RSUs for Mr. Kakar, 14,253 unvested RSUs for Mr. Sistek, 35,128 unvested RSUs for Mr. Tykal and 4,260 unvested RSUs for each of Messrs. Bruynesteyn, Hockema, Humphries, McElya, McQuay and Uranga and Ms. Richstone. These RSUs are subject to all of the economic risks of stock ownership but may not be voted or sold and are subject to vesting provisions as set forth in the respective grant agreements. Mr. Hockema will retire from the Board at the expiration of his term at the Annual Meeting, at which time, the vesting of his outstanding 1,229 unvested restricted stock units will be accelerated. |

| (11) | Includes stock options in the amount of 42,500 for Mr. Kakar and 15,000 for Mr. Uranga that are currently or will become exercisable within 60 days of March 19, 2018. |

| (12) | Mr. Shiba’s employment with the Company terminated, effective June 30, 2017. The information regarding Mr. Shiba’s beneficial ownership is based solely on his Section 16 filings through his Form 4 filed on March 9, 2017. As of the date of his termination, Mr. Shiba forfeited all unvested awards and any unexercised stock options. |

| (13) | Does not include shares of common stock underlying the Series A Preferred Stock held by Group Advisors as described in footnote 3 above. Mr. Langford is a partner of TPG, an affiliate of Group Advisors. Mr. Langford disclaims beneficial ownership of the shares of common stock beneficially owned by Group Advisors. |

Section 16(a) Beneficial Ownership Reporting Compliance

38 | Superior Industries International, Inc.

Executive Compensation and Related Information • Compensation Discussion and Analysis

Recent Business Highlights/Company Performance

The following chart highlights key metrics of our financial and operating performance in 2017 as compared to 2016:

| Key Metric |

2017 Results | 2017 vs. 2016 | ||

| Units Shipped |

17.0 million | 38.2% increase | ||

| Net Sales |

$1,108 million | 51.2% increase | ||

| Value-Added Sales(1) |

$617 million | 50.9% increase | ||

| Value-Added Sales per Wheel |

$36.27 | 8.8% increase | ||

| Adjusted EBITDA(2) |

$140.1 million | 58.3% increase | ||

| Adjusted EBITDA(2) % of value-added sales(1) |

22.7% | 106 basis point improvement | ||

| Net cash provided by operating activities |

$64 million | 18.8% decrease |

| (1) | Value-added sales is a financial measure that is not calculated according to GAAP, and we are including our 2017 results for this measure to show an aspect of our performance. See Appendix A to this Proxy Statement for a reconciliation of net sales, the most comparable GAAP measure, to value-added sales. |

| (2) | Adjusted EBITDA is a key measure that is not calculated according to GAAP, and we are including our 2017 results for this measure to show an aspect of our performance. See Appendix A to this Proxy Statement for a reconciliation of net income, the most comparable GAAP measure, to Adjusted EBITDA. |

Executive Compensation Highlights

Highlights of our 2017 executive compensation program are summarized as follows.

| • | Individual Performance Component of Annual Incentive. The AIPP plays an important role in our approach to total compensation. We believe it motivates participants to focus on improving our performance on key financial measures during the year because it requires that we achieve defined, objectively determinable goals before participants become eligible for an incentive payout. |

| • | 2017 AIPP Payouts. While the AIPP Adjusted EBITDA(1) for 2017 for the North American Operations fell slightly below the $88 million threshold target, the combined Company performance achieved Adjusted EBITDA of $140.1 million in 2017. The Compensation and Benefits Committee considered the efforts by management to identify and successfully finalize the transformational acquisition of Uniwheels during the year, using its discretion to fund the 2017 AIPP bonus pool for our NEOs at 80% of target. |

2018 Proxy Statement | 41

Executive Compensation and Related Information • Compensation Discussion and Analysis

| • | LTIP Performance Measures. In 2017, we granted PRSUs that can be earned based on our achievement of the following three performance measures as calculated over a three-year period: |

| Return on Invested Capital 40% weighting

(“ROIC”) |

Cumulative Earnings per Share 40% weighting

(“Cumulative EPS”) |

Relative Total Shareholder Return 20% weighting

(“Relative TSR”) |

As discussed in the “2017 Executive Compensation Components – Long-Term Equity Incentive Compensation” section of this Proxy Statement, these performance measures were developed after a rigorous bottom-up financial analysis of our business.

| • | LTIP Heavily Performance-Based. Approximately 2/3 of the target annual LTIP awards consist of PRSUs and 1/3 consist of time-based restricted stock units (“RSUs”). Consequently, the target total direct compensation for our NEOs is heavily performance-based as shown in the following chart: |

2017 Total Direct Compensation Allocation

(assuming performance-based components earned at target)

|

|

42 | Superior Industries International, Inc.

Executive Compensation and Related Information • Compensation Discussion and Analysis

2018 Proxy Statement | 43

Executive Compensation and Related Information • Compensation Discussion and Analysis

44 | Superior Industries International, Inc.

Executive Compensation and Related Information • Compensation Discussion and Analysis

2018 Proxy Statement | 45

Executive Compensation and Related Information • 2017 Executive Compensation Components

2017 Executive Compensation Components

Introduction – Elements of Pay

The following is a summary of the 2017 direct core compensation elements (base salary, annual incentives and long-term incentives) of our executive compensation program.

| Element |

Purpose | Performance Measure(s) | Fixed vs. Variable |

Cash vs. Equity |

Payout Range | |||||

| Base Salary |

Provide a competitive rate of pay to attract, motivate and retain executive officers of the Company | Individual performance, experience, time in position and critical skills | Fixed | Cash | n/a | |||||

| AIPP |

Align a portion of annual pay to a key element of performance for the year | AIPP Adjusted EBITDA | Variable | Cash | 0-200% of target(1) | |||||

| Performance- |

Align executive pay with long-term stockholder interests through equity-based compensation tied to key performance metrics of the Company | Cumulative EPS (40%) ROIC (40%) Relative TSR (20%) |

Variable | Equity | 0-200% of target number of shares; PRSU value fluctuates with stock price movement | |||||

| Time-Based RSUs |

Directly align executive pay with long-term stockholder interests through equity-based compensation | Stock price alignment (3 yr. ratable vesting) | Variable | Equity | Fluctuates with stock price movement |

| (1) | This number is subject to adjustment for individual performance for all of our NEOs other than our CEO. |

46 | Superior Industries International, Inc.

Executive Compensation and Related Information • 2017 Executive Compensation Components

2017 Base Salaries – NEO

| Officer Name |

Date | Reason | Increase | Salary | ||||

| Don Stebbins |

n/a | n/a | 0.00% | $900,000.00 | ||||

| Nadeem Moiz* |

n/a | n/a | 0.00% | $405,000.00 | ||||

| Parveen Kakar |

4/01/17 | Merit** | 4.00% | $405,600.00 | ||||

| James Sistek |

4/01/17 | Merit** | 4.00% | $405,600.00 | ||||

| Robert Tykal* |

n/a | n/a | 0.00% | $400,000.00 | ||||

| Kerry Shiba |

n/a | n/a | 0.00% | $420,000.00 |

| * | Mr. Tykal commenced employment with Superior on June 12, 2017, and Mr. Moiz commenced employment with Superior on July 1, 2017. |

| ** | Merit increase related to attainment of performance objectives under the 2016 Annual Performance Management Program. |

2018 Update. Annual base salary rates to be effective as of April 1, 2018:

2018 Base Salaries – NEO

| Officer Name |

Date | Reason | Increase | Salary | ||||

| Don Stebbins |

4/01/18 | n/a | 0.00% | $900,000.00 | ||||

| Nadeem Moiz |

4/01/18 | Merit* | 3.00% | $417,000.00 | ||||

| Parveen Kakar |

4/01/18 | Merit* | 3.50% | $420,000.00 | ||||

| James Sistek |

4/01/18 | Merit* | 3.50% | $420,000.00 | ||||

| Robert Tykal |

4/01/18 | Merit* | 5.00% | $420,000.00 |

| * | Merit increase related to attainment of performance objectives under the 2017 Annual Performance Management Program (as discussed further in the following “Annual Incentive Compensation and Bonuses” section). |

2018 Proxy Statement | 47

Executive Compensation and Related Information • 2017 Executive Compensation Components

Under the 2017 AIPP, Mr. Stebbins was eligible to receive a cash bonus ranging from 0% to 200% of his base salary depending on Superior’s level of achievement of AIPP Adjusted EBITDA goals, set forth in the following table, which were set by the Compensation and Benefits Committee and approved by the Board:

| AIPP Adjusted EBITDA Goal ($) |

% of AIPP Adjusted EBITDA Target |

% of CEO Salary Payable |

Actual % of CEO Salary Earned |

Total Amount Paid | ||||

| <88,000,000 |

<80.0% | 0% | ||||||

| 88,000,000 |

80.0% | 80.0% | ||||||

| 99,000,000 |

90.0% | 90.0% | ||||||

| 110,000,000 |

100.0% | 100.0% | ||||||

| 121,000,000 |

110.0% | 120.0% | ||||||

| 132,000,000 |

120.0% | 160.0% | ||||||

| 140,100,000* |

127.4%* | 189.0% | 80.0%* | $720,000 | ||||

| 143,000,000 |

130.0% | 200.0% | ||||||

| >143,000,000 |

130.0% | 200.0% |

| * | Actual 2017 AIPP Adjusted EBITDA achieved. Actual percentage of salary payable to the CEO reduced pursuant to the discretion of the Compensation and Benefits Committee in funding the AIPP pool at a lower amount as described below. |

48 | Superior Industries International, Inc.

Executive Compensation and Related Information • 2017 Executive Compensation Components

The following table illustrates the payout opportunities under the AIPP Adjusted EBITDA and individual performance components of the AIPP for 2017:

| AIPP Adjusted EBITDA Goal ($) |

% of AIPP Adjusted EBITDA Target |

Incentive % of Target |

% of Salary Payable | Individual Performance Multiplier | ||||

| <88,000,000 |

<80.0% | 0% | 0% | n/a | ||||

| 88,000,000 |

80.0% | 80.0% | 40.0% - 52.0% | 0-200% | ||||

| 99,000,000 |

90.0% | 90.0% | 45.0% - 58.5% | 0-200% | ||||

| 110,000,000 |

100.0% | 100.0% | 50.0% - 65.0% | 0-200% | ||||

| 121,000,000 |

110.0% | 120.0% | 60.0% - 78.0% | 0-200% | ||||

| 132,000,000 |

120.0% | 160.0% | 80.0% - 104.0% | 0-200% | ||||

| 140,100,000* |

127.4%* | 189.0% | 94.5% - 123.9%* | 0-200% | ||||

| 143,000,000 |

130.0% | 200.0% | 100.0% - 130.0% | 0-200% | ||||

| >143,000,000 |

130.0% | 200.0% | 100.0% - 130.0% | 0-200% |

| * | Actual 2017 AIPP Adjusted EBITDA achieved, on an adjusted basis, as described above. Actual percentage of salary payable to the NEOs reduced pursuant to the discretion of the Compensation and Benefits Committee in funding the AIPP pool at a lower amount as described below. |

The 2017 year was a year of a transformational acquisition, which resulted in the Company exceeding the AIPP Adjusted EBITDA target. However, given the results of the North American Operations, the Compensation and Benefits Committee used discretion to reduce funding of the 2017 AIPP bonus pool to 80% of the target bonus pool amount. The following table shows the target award, AIPP Adjusted EBITDA performance multiplier, individual performance multiplier, and amounts paid to the NEOs other than the CEO under the AIPP for 2017:

| Name |

Target Award |

AIPP Adjusted EBITDA Performance Multiplier |

Individual Performance Multiplier |

Total Amount Earned | ||||

| N. Moiz |

$263,250 | 80.0% | 90.0%(1) | $189,000 | ||||

| P. Kakar |

$202,800 | 80.0% | 112.1%(2) | $182,000 | ||||

| J. Sistek |

$202,800 | 80.0% | 112.1%(3) | $182,000 | ||||

| R. Tykal(4) |

$200,000 | 80.0% | 112.5%(4) | $180,000 | ||||

| K. Shiba(5) |

$252,000 | 80.0% | 100.0%(5) | $100,800 |

| (1) | Mr. Moiz substantially achieved his performance objectives due to his leadership and results of the following: continued investor outreach program, provided key support to the CEO in support of board communications, managed investment bank relationships along with the CEO in support of transaction funding, and led financial group transition. |

| (2) | Mr. Kakar exceeded his performance objectives due to his leadership and results of the following: provided excellent acquisition support pre- and post-deal, obtained new business awards valued at $197 million, awarded patent on Alulite, worked to build Development Center infrastructure and team, and maintained an excellent work ethic. |

| (3) | Mr. Sistek exceeded his performance objectives due to his leadership and results of the following: delivered $4.4 million in purchasing savings, improved customer relationships and scorecards, added bench strength to quality, program management, supply chain and IT staff, provided operational support to the Company’s Mexican plants in the first and second quarters of 2017, and enhanced the Program Management function and staffed it with an experienced product director. |

| (4) | Mr. Tykal exceeded his performance objectives due to his leadership and results of the following: displayed outstanding leadership skills, worked to upgrade the Operations talent in Mexico, and improved operational results. |

| (5) | Pursuant to the terms of Mr. Shiba’s separation agreement with the Company, Mr. Shiba remained eligible to receive a prorated payout under the 2017 AIPP with respect to the portion of 2017 in which he remained employed. |

2018 Update. The Compensation and Benefits Committee has approved the following target values for the 2018 AIPP awards for our NEOs, as a percentage of base salary: Mr. Stebbins – 100%; Mr. Moiz – 65%; Mr. Kakar – 55%; Mr. Sistek – 55%; and Mr. Tykal – 55%.

2018 Proxy Statement | 49

Executive Compensation and Related Information • 2017 Executive Compensation Components

The total target award opportunities for our NEOs, expressed as a percentage of each NEO’s annual base salary (at date of grant), is as follows: Mr. Stebbins – 200%, Mr. Moiz – 90%, Mr. Kakar – 90%, Mr. Sistek – 90%, and Mr. Tykal – 90%. The numbers of units awarded to our NEOs in 2017 are set forth in the following chart:

2017 NEO Long-Term Incentive Awards

| Name |

2015-2017 PRSUs |

2016-2018 PRSUs |

2017-2019 PRSUs |

RSUs (#) |

||||||||||||

| Don Stebbins |

— | — | 50,209 | 25,105 | ||||||||||||

| Nadeem Moiz |

— | — | 12,120 | 6,060 | ||||||||||||

| Parveen Kakar |

— | — | 9,791 | 4,895 | ||||||||||||

| James Sistek |

— | — | 9,791 | 4,895 | ||||||||||||

| Robert Tykal* |

3,912 | 7,824 | 11,736 | 31,296 | ||||||||||||

| Kerry Shiba** |

— | — | — | — | ||||||||||||

50 | Superior Industries International, Inc.

Executive Compensation and Related Information • 2017 Executive Compensation Components

| * | In connection with the commencement of his employment, Mr. Tykal received a special, sign-on award of time-vesting RSUs in addition to his regular RSU grant for 2017 and prorated PRSU awards with respect to the 2015-2017 and 2016-2018 performance periods already in progress, in addition to his regular PRSU grant for the 2017-2019 performance period. |

| ** | Mr. Shiba forfeited all unvested awards upon his termination of employment on June 30, 2017. |

Vesting of 2015-2017 PRSUs. Each of our NEOs (other than Mr. Moiz, whose employment with Superior did not commence until July 1, 2017) received grants of PRSUs for the 2015 to 2017 performance period. The 2015-2017 PRSUs could be earned based on the Company’s achievement over the three-year performance period with respect to certain performance metrics (EBITDA margin, ROIC and relative TSR). The metrics were satisfied at 80.4% of the overall target, and the resulting shares earned by the NEOs are set forth in the table below:

2015-2017 PRSU NEO Payouts

| Name |

PRSUs (at target) |

Actual Performance (%) |

Actual Shares Earned (#) |

|||||||||

| Don Stebbins |