UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 1)

Filed by the Registrant o

Filed by a Party other than the Registrant x

Check the appropriate box:

x Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2))

¨ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Under Rule 14a-12

|

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

|

|

(Name of Registrant as Specified in Its Charter)

|

|

GAMCO ASSET MANAGEMENT INC.

MARIO J. GABELLI

GLENN J. ANGIOLILLO

PHILIP T. BLAZEK

WALTER M. SCHENKER

|

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

¨ Fee paid previously with preliminary materials:

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1) Amount previously paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 1, 2015

GAMCO ASSET MANAGEMENT INC.

___________________, 2015

Dear Fellow Shareholder:

GAMCO Asset Management Inc. (“GAMCO Asset Management”) and the other participants in this solicitation (collectively, “GAMCO” or “we”) are the beneficial owners of an aggregate of 3,384,411 shares of common stock, no par value per share (the “Common Stock”), of Superior Industries International, Inc., a California corporation (“Superior Industries” or the “Company”), representing approximately 12.56% of the outstanding shares of Common Stock. For the reasons set forth in the attached Proxy Statement, we are seeking representation on the Board of Directors of the Company (the “Board”). We are seeking your support at the annual meeting of shareholders scheduled to be held at The Westin Hotel, 1500 Town Center, Southfield, Michigan 48075 on Tuesday, May 5, 2015, at 9:30 a.m. Eastern Time, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

|

|

1.

|

To elect GAMCO’s three (3) director nominees, Glenn J. Angiolillo, Philip T. Blazek, and Walter M. Schenker (each a “Nominee” and, collectively, the “Nominees”), to the Board to serve until the 2016 annual meeting of shareholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To approve, in a non-binding advisory vote, executive compensation;

|

|

|

3.

|

To approve the Company’s reincorporation from California to Delaware by means of a merger with and into a wholly-owned Delaware subsidiary;

|

|

|

4.

|

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 27, 2015; and

|

|

|

5.

|

To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

|

We believe that the Company is in urgent need of fresh perspective and a focus on enhancing shareholder value, which, we believe, the Nominees will provide.

We are seeking to add three representatives on the Board to, in our view, better ensure that the interests of the shareholders, the true owners of the Company, are more appropriately represented in the boardroom. There are currently eight directors serving on the Board, all of whose terms expire at the Annual Meeting after shareholders approved an amendment and restatement of the Company’s Amended and Restated Articles of Incorporation to declassify the Board at the 2013 Annual Meeting over a two-year period and provide for the annual election of all directors beginning with the Annual Meeting. As stated in the Company’s proxy statement, one incumbent director, Philip Colburn, will retire from the Board at the Annual Meeting and the Board has reduced the size of the Board by resolution from eight members to seven members effective with the Annual Meeting. Through the attached Proxy Statement and enclosed BLUE proxy card, we are soliciting proxies to elect the Nominees. Stockholders who vote on the enclosed BLUE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than Paul J. Humphries, Timothy C. McQuay and Francisco S. Uranga. Stockholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. The names, backgrounds and qualifications of the Company’s Nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if all or some of our Nominees are elected.

We urge you to carefully consider the information contained in the attached Proxy Statement and then support our efforts by signing, dating and returning the enclosed BLUE proxy card today. The attached Proxy Statement and the enclosed BLUE proxy card are first being furnished to the shareholders on or about April [___], 2015.

If you have already voted for the incumbent management slate, you have every right to change your vote by signing, dating and returning a later dated proxy or by voting in person at the Annual Meeting.

If you have any questions or require any assistance with your vote, please contact GAMCO at our address listed below.

Thank you for your support.

/s/ Mario J. Gabelli

Mario J. Gabelli

GAMCO Asset Management Inc.

Sign, date and return the BLUE proxy card today.

|

Important!

1. Regardless of how many shares your own, your vote is very important. Please sign, date and mail the enclosed BLUE proxy card. You may also vote via the Internet or by telephone by following the voting instructions on the BLUE proxy card.

Please vote each BLUE proxy card you receive since each account must be voted separately. Only your latest dated proxy counts.

2. We urge you NOT to sign any white proxy card sent to you by Superior Industries.

3. Even if you have sent a white proxy card to Superior Industries, you have every right to change your vote. You may revoke that proxy by signing, dating and mailing the enclosed BLUE proxy card in the enclosed envelope.

If you have any questions, require assistance in voting your BLUE proxy card,

or need additional copies of GAMCO’s proxy materials,

please contact GAMCO at the phone number listed below.

GAMCO ASSET MANAGEMENT INC.

ONE CORPORATE CENTER

RYE, NEW YORK 10580

(800) 422-3554

|

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED APRIL 1, 2015

2015 ANNUAL MEETING OF SHAREHOLDERS

OF

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

_________________________

PROXY STATEMENT

OF

GAMCO ASSET MANAGEMENT INC.

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE PROXY CARD TODAY

GAMCO Asset Management Inc. (“GAMCO Asset Management”), Mario J. Gabelli and certain of their affiliates (collectively, “GAMCO” or “we”) are significant shareholders of Superior Industries International, Inc., a California corporation (“Superior Industries” or the “Company”), owning in the aggregate approximately 12.56% of the outstanding shares of common stock, no par value per share (the “Common Stock”), of the Company. We are seeking to add three representatives on the Board of Directors of the Company (the “Board”) because we believe that the Board could be improved by the addition of directors who have strong, relevant background and who are committed to fully exploring all opportunities to enhance shareholder value. We are seeking your support at the annual meeting of shareholders scheduled to be held at The Westin Hotel, 1500 Town Center, Southfield, Michigan 48075 on Tuesday, May 5, 2015, at 9:30 a.m. Eastern Time, including any adjournments or postponements thereof and any meeting which may be called in lieu thereof (the “Annual Meeting”), for the following:

|

|

1.

|

To elect GAMCO’s three (3) director nominees, Glenn J. Angiolillo, Philip T. Blazek and Walter M. Schenker (each a “Nominee” and, collectively, the “Nominees”), to the Board to serve until the 2016 annual meeting of shareholders and until their respective successors are duly elected and qualified;

|

|

|

2.

|

To approve, in a non-binding advisory vote, executive compensation (commonly known as “Say-on-Pay”);

|

|

|

3.

|

To approve the Company’s reincorporation from California to Delaware by means of a merger with and into a wholly-owned Delaware subsidiary;

|

|

|

4.

|

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 27, 2015; and

|

|

|

5.

|

To transact such other business as may properly come before the Annual Meeting or any postponements or adjournments thereof.

|

As of the date hereof, GAMCO Asset Management and its affiliates collectively own 3,384,301 shares of Common Stock, constituting approximately 12.56% of the outstanding shares of Common Stock. We intend to vote such shares of Common Stock FOR the election of the Nominees, AGAINST on the approval of the Say-on-Pay Proposal, FOR on the approval of the reincorporation of the Company from California to Delaware and FOR the ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm, as described herein.

The Company has set the close of business on March 9, 2015 as the record date for determining shareholders entitled to notice of and to vote at the Annual Meeting (the “Record Date”). The mailing address of the principal executive offices of the Company is 24800 Denso Drive, Suite 225, Southfield, Michigan 48033. Shareholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. According to the Company, as of the Record Date, there were 26,944,247 shares of Common Stock outstanding.

THIS SOLICITATION IS BEING MADE BY GAMCO AND NOT ON BEHALF OF THE BOARD OF DIRECTORS OR MANAGEMENT OF THE COMPANY. WE ARE NOT AWARE OF ANY OTHER MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS SET FORTH IN THIS PROXY STATEMENT. SHOULD OTHER MATTERS, WHICH GAMCO IS NOT AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED BLUE PROXY CARD WILL VOTE ON SUCH MATTERS IN OUR DISCRETION.

GAMCO URGES YOU TO SIGN, DATE AND RETURN THE BLUE PROXY CARD IN FAVOR OF THE ELECTION OF THE NOMINEES.

IF YOU HAVE ALREADY SENT A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS PROXY STATEMENT BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE PROXY CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT COUNTS. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting—This Proxy Statement and our BLUE proxy card are available at

[_______________________]

______________________________

2

IMPORTANT

Your vote is important, no matter how few shares of Common Stock you own. GAMCO urges you to sign, date, and return the enclosed BLUE proxy card today to vote FOR the election of the Nominees and in accordance with GAMCO’s recommendations on the other proposals on the agenda for the Annual Meeting.

|

|

·

|

If your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE proxy card and return it to GAMCO in the enclosed postage-paid envelope today.

|

|

|

·

|

If your shares of Common Stock are held in a brokerage account or bank, you are considered the beneficial owner of the shares of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your shares of Common Stock on your behalf without your instructions.

|

|

|

·

|

Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form.

|

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our Nominees only on our BLUE proxy card. So please make certain that the latest dated proxy card you return is the BLUE proxy card.

|

GAMCO ASSET MANAGEMENT INC.

ONE CORPORATE CENTER

RYE, NEW YORK 10580

(800) 422-3554

|

3

Background to the Solicitation

The following is a chronology of material events leading up to this proxy solicitation.

|

|

·

|

On December 5, 2013, GAMCO submitted a shareholder proposal (“GAMCO’s Proposal”) for inclusion in the Company’s proxy and proxy statement for the Annual Meeting, pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) requesting that the Board authorize a “Dutch Auction” tender offer to repurchase at least $40 million of the Company’s outstanding Common Stock. Also on December 5, 2013, GAMCO filed Amendment No. 14 to the Schedule 13D in which it disclosed its intention to nominate up to four individuals for election as directors of the Company at the Annual Meeting.

|

|

|

·

|

On January 13, 2014, GAMCO delivered a nomination letter to the Company, in accordance with the requirements of the the Company’s Restated Bylaws (the “Bylaws”), with respect to its nomination of Ryan J. Morris and Messrs. Blazek and Schenker for election as directors of the Company at the 2014 Annual Meeting.

|

|

|

·

|

On February 12, 2014, GAMCO met with directors James McElya and Philip Colburn. During the discussion, Messrs. McElya and Colburn indicated that the Company would be open to adding one of the Nominees, Mr. Blazek, to the Board and a mutually agreeable second candidate. In order to ensure that the best interests of shareholders are appropriately represented in the boardroom, GAMCO responded with its belief that adding two of its Nominees to the Board could be an agreeable solution to avoid a proxy contest. GAMCO continued such discussions with Company representatives, including Ms. Dano, through early June of 2014 in an effort to avoid a proxy contest.

|

|

|

·

|

On March 10, 2014, Paula Winner Barnett, the Company’s Corporate Counsel and Corporate Secretary, sent a letter to GAMCO acknowledging the Company’s receipt of GAMCO’s nomination letter and stating that the Nominating and Corporate Governance Committee of the Board would like to interview the Nominees. The letter further requested that the Nominees complete the Company’s director and officer questionnaire.

|

|

|

·

|

On March 17, 2014, GAMCO responded on behalf of the Nominees that it has provided all required information with respect to the Nominees under the Company’s Bylaws, and that it will be happy to make the Nominees available once the Company has shown commitment to a productive change on the Board by agreeing to a mutually-agreeable framework on Board composition.

|

|

|

·

|

On April 30, 2014, the Company appointed Donald J. Stebbins as its President and CEO and as a member of the Board, effective May 5, 2014.

|

|

|

·

|

On June 2, 2014, Ms. Barnett sent a letter to GAMCO informing GAMCO that the Company intends to include GAMCO’s Proposal in the Company’s proxy statement for the 2014 Annual Meeting.

|

|

|

·

|

On June 6, 2014, the Company filed its preliminary proxy statement with respect to the 2014 Annual Meeting.

|

4

|

|

·

|

On June 27, 2014, GAMCO delivered a letter to the Company withdrawing GAMCO’s Proposal. Also, on June 27, 2014, GAMCO filed its preliminary proxy statement with respect to the 2014 Annual Meeting.

|

|

|

·

|

On July 7, 2014, the Company filed its definitive proxy statement with respect to the 2014 Annual Meeting.

|

|

|

·

|

On July 8, 2014, GAMCO filed a revised preliminary proxy statement with respect to the 2014 Annual Meeting.

|

|

|

·

|

On July 14, 2014, GAMCO filed a second revised preliminary proxy statement with respect to the 2014 Annual Meeting. Also, on July 14, 2014, GAMCO filed its definitive proxy statement with respect to the 2014 Annual Meeting.

|

|

|

·

|

On July 30, 2014, the Company announced that the proxy advisory firm Institutional Shareholder Services Inc. (ISS) had recommended that shareholders vote for the Company’s nominees at the 2014 Annual Meeting rather than GAMCO’s nominees.

|

|

|

·

|

On August 4, 2014, the Company announced that the proxy advisory firm Glass, Lewis & Co., LLC, had recommended that shareholders vote for the Company’s nominees at the 2014 Annual Meeting rather than GAMCO’s nominees.

|

|

|

·

|

On August 6, 2014, the Company announced that the proxy advisory firm Egan-Jones Proxy Services, had recommended that shareholders vote for the Company’s nominees at the 2014 Annual Meeting rather than GAMCO’s nominees.

|

|

|

·

|

On August 15, 2014, the Company held its 2014 Annual Meeting. At the 2014 Annual Meeting, the Company’s director nominees were elected as directors for a one-year term expiring in 2015. None of GAMCO’s nominees were elected by the Company’s shareholders to the Board of Directors.

|

|

|

·

|

On August 20, 2014, the Company filed a Form 8-K with the SEC reporting the results of the 2014 Annual Meeting.

|

|

|

·

|

On November 4, 2014, Mr. Stebbins and Kerry Shiba, the Company’s Chief Financial Officer, met with representatives of GAMCO at Gabelli & Company’s Annual Automotive Aftermarket Symposium in Las Vegas, Nevada.

|

|

|

·

|

On November 19, 2014, the Company announced that the Annual Meeting is to be held on May 5, 2015 and that the deadline for nominating directors for election at the Annual Meeting was February 4, 2015.

|

|

|

·

|

On February 3, 2015, GAMCO delivered a nomination letter to the Company, in accordance with the requirements of the Bylaws, with respect to its nomination of Messrs. Angiolillo, Blazek and Schenker for election as directors of the Company at the Annual Meeting.

|

|

|

·

|

On March 11, 2015, GAMCO sent a letter to the Company’s Chairman regarding, among other things, the Annual Meeting and the Company’s response to GAMCO’s February 3, 2015 nomination letter.

|

5

|

|

·

|

Also on March 11, 2015, the Company filed its preliminary proxy statement with respect to the Annual Meeting.

|

|

|

·

|

On March 16, 2015, GAMCO sent a letter to the Company requesting that a shareholder list and certain other records relating to the ownership of the Company’s capital stock be made available for inspection and copying by GAMCO pursuant to Section 1600 of the California Corporations Code.

|

|

|

·

|

On March 17, 2015, the Company sent a follow-up communication to GAMCO, requesting the ability to conduct interviews with GAMCO’s nominees on April 1, 2015.

|

|

|

·

|

On March 19, 2015, the Company filed a revised preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

Also on March 19, 2015, GAMCO filed its preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 23, 2015, the Company responded to GAMCO’s shareholder records request letter indicating that it would make all the requested records available beginning on March 24, 2015 in accordance with Section 1600 of the California Corporations Code.

|

|

|

·

|

Also on March 23, 2015, the Company filed a revised preliminary proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 26, 2015, the Company filed its definitive proxy statement with the SEC with respect to the 2015 Annual Meeting.

|

|

|

·

|

On March 27, 2015, the Company filed a revised definitive proxy statement with the SEC with respect to the Annual Meeting.

|

6

REASONS FOR THE SOLICITATION

GAMCO BELIEVES THAT DIRECTORS WHO BETTER REPRESENT SHAREHOLDERS’

INTERESTS ARE NEEDED IN THE SUPERIOR INDUSTRIES’ BOARDROOM TO HELP

ENSURE THAT THE BEST INTERESTS OF THE SHAREHOLDERS ARE THE PRIMARY

CONSIDERATION IN THE COMPANY’S CAPITAL ALLOCATION DECISIONS

INTERESTS ARE NEEDED IN THE SUPERIOR INDUSTRIES’ BOARDROOM TO HELP

ENSURE THAT THE BEST INTERESTS OF THE SHAREHOLDERS ARE THE PRIMARY

CONSIDERATION IN THE COMPANY’S CAPITAL ALLOCATION DECISIONS

GAMCO is Concerned with Superior’s Continued Underperformance and Market Share Losses

In its most recent Annual Report on Form 10K, Superior Industries reported disappointing financial results for its 2014 fiscal year. Sales declined 6% or $44.2 million, to $745.4 million, with wheel shipments down 7%, despite broader production growth of 5% in the Company’s core North American light vehicle market. EBITDA declined $13.4 million to $50.2 million, driven by lower unit shipments, costs associated with the closing of the Company’s manufacturing facility in Arkansas, the sales process of the Company’s two aircraft, and the impairment of an investment in an unconsolidated Indian subsidiary. Even after adjusting for costs the Company considered to be “one-time” in nature, EBITDA still declined from $63.6 million to $55.8 million.

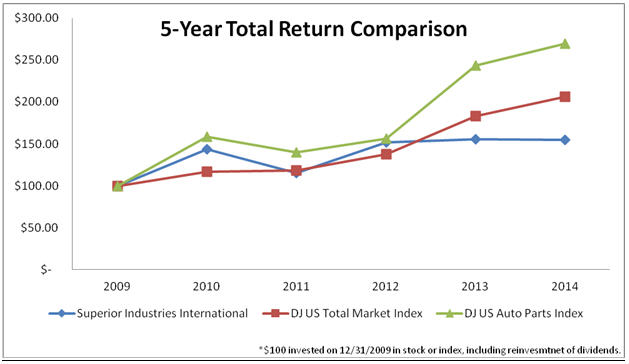

We are Concerned that Superior’s Stock Performance Continues to Lag Behind the Market and its Peers

The following chart provides a comparison of SUP’ cumulative total return (assumes reinvestment of dividends) to shareholders (stock price appreciation plus dividends) during the previous five years to the returns of the Dow Jones U.S. Total Market Index and the Dow Jones U.S. Auto Parts Index.

7

|

Superior Industries International

|

DJ US Total Market Index

|

DJ US Auto Parts Index

|

|

|

2009

|

$100.00

|

$100.00

|

$100.00

|

|

2010

|

$143.96

|

$116.65

|

$158.18

|

|

2011

|

$114.97

|

$118.22

|

$139.53

|

|

2012

|

$151.98

|

$137.52

|

$156.14

|

|

2013

|

$155.21

|

$182.86

|

$243.66

|

|

2014

|

$154.47

|

$206.53

|

$269.56

|

Source: Superior Industries International, Inc. 2014 10K

We are Concerned with the Board’s Minimal Stock Ownership

The Company’s director candidates seeking election at the Annual Meeting lack a meaningful investment in the stock of the Company, as they collectively own less than 1% of the outstanding shares of the Common Stock. We are concerned the directors’ failure to have “skin in the game” shows they may be more focused on self-preservation than enhancing shareholder value.

We are Concerned with the Board’s Poor Compensation Decisions

We are concerned by compensation decisions that, in our opinion, are not congruent with Superior’s size and performance. Total compensation for the Company’s non-employee directors more than doubled to $1.19 million in 2014 versus $582,000 in 2013. On an individual basis, base cash compensation was increased to $50,000 from $42,000, while stock consideration more than doubled, both from a dollar value and share basis (stock compensation via restricted stock awards (RSA’s) of 2,000 shares increased to 5,000). At the same time, the Board chose to lower the bar by which management was to be judged, as the EBITDA target for the CEO Annual Incentive Bonus Plan was dropped to $55,760,000 from $65,772,000 in 2013.

We Question the Board’s Actions in Reaction to our Nomination of Highly Qualified Individuals to the Board

GAMCO is concerned by the actions of the Board in response to GAMCO’s February 2015 nomination letter. GAMCO submitted its notice to the Company of its intent to nominate Mr. Blazek, Mr. Schenker and Mr. Angiolillo on February 3, 2015. On March 6, 2015, representatives of the Company indicated to GAMCO that the Board’s Nominating and Corporate Governance Committee would like to interview GAMCO’s proposed nominees. Representatives of the Company informed us the Company believes it is extremely important to conduct in-person interviews of GAMCO’s Nominees. GAMCO is puzzled by the Board’s decision to wait over 30 days to request these interviews and demand such interviews to take place within a three-day span just a few days before the Company planned on filing its preliminary proxy statement disclosing its slate of director candidates. In light of these actions, GAMCO questions whether the Company was acting in good faith to establish a mutually agreeable resolution with one of its largest, long-term shareholders to improve the composition of the Company’s Board. Moreover, we are concerned that Superior Industries’ legal advisors have asked us not to communicate with any directors or executives of the Company. As one of the largest shareholders of the Company, owning greater than 12.5% of the outstanding shares, we believe GAMCO should be allowed to communicate with the Company’s directors who serve as shareholder representatives on the Board.

8

WE BELIEVE THAT OUR THREE NOMINEES HAVE THE EXPERIENCE,

QUALIFICATIONS AND OBJECTIVITY THAT IS BEST SUITED TO FULLY EXPLORE

AVAILABLE OPPORTUNITIES TO ENHANCE VALUE FOR SHAREHOLDERS

On behalf of our clients, GAMCO is one of the largest shareholders of Superior Industries. We are concerned that the Board, in our belief, lacks the appropriate objectivity and commitment to act in the best interests of shareholders. We have identified three highly qualified, independent directors who we believe, based on their background and corporate governance philosophy, will bring a fresh perspective and increased commitment to shareholder value into the boardroom and would be extremely helpful in evaluating and executing on initiatives to enhance value at the Company. Our Nominees do not have any specific plans for the Company and, if elected, will review objectively all opportunities to enhance value for shareholders.

Glenn J. Angiolillo. Mr. Angiolillo has significant investment and consulting experience as well as legal expertise in the areas of commercial and corporate law. In addition, Mr. Angiolillo has extensive experience serving as a director on the board of several public companies. GAMCO believes that the Board will benefit greatly from Mr. Angiolillo’s impressive and varied background.

Philip T. Blazek. Mr. Blazek has vast financial, strategic and investment experience working with companies in a wide range of industries. GAMCO believes that Mr. Blazek brings extensive investment experience and will be an invaluable addition to the Board that will help improve effective oversight of the Company and strengthen the Board’s focus on enhancing shareholder value.

9

Walter M. Schenker. Mr. Schenker has extensive investment expertise built over more than 40 years of experience in the investment business. Mr. Schenker brings deep knowledge of many aspects of public company investing including accounting, financial reporting, capital allocation, strategic transactions and investor relations. Further, Mr. Schenker has followed the automotive parts industry since the mid-1970’s and is the author of over 200 pieces of published research on the industry. GAMCO believes that the Board will greatly benefit from Mr. Schenker’s public company investment experience and that his addition will help the Board surface shareholder value.

10

PROPOSALS NO. 1

ELECTION OF DIRECTORS

The Board is currently composed of eight directors, all of whose terms expire at the Annual Meeting. As stated in the Company’s proxy statement, one incumbent director, Philip Colburn, will retire from the Board at the Annual Meeting and the Board has reduced the size of the Board by resolution from eight members to seven members effective with the Annual Meeting. We are seeking your support at the Annual Meeting to elect our three Nominees, Glenn J. Angiolillo, Philip T. Blazek and Walter M. Schenker. Your vote to elect the Nominees will have the legal effect of replacing three incumbent directors of the Company with the Nominees. If elected, the Nominees will represent a minority of the members of the Board and therefore it is not guaranteed that they will have the ability to enhance shareholder value.

THE NOMINEES

The following information sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices, or employments for the past five years of the Nominees. The nomination was made in a timely manner and in compliance with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills that led us to conclude that the Nominees should serve as director of the Company is set forth above in the section entitled “Reasons for the Solicitation.” This information has been furnished to us by the Nominees. All of the Nominees are citizens of the United States of America.

Glenn J. Angiolillo, age 61, has served as the President of GJA Management Corporation, a consulting and advisory firm specializing in wealth management since 1998. Previously, Mr. Angiolillo was a partner and member of the Management Committee in the law firm of Cummings & Lockwood, where he concentrated in the areas of corporate law, mergers and acquisitions, and banking and finance. Mr. Angiolillo has served on the boards of Gaylord Entertainment Company (now known as Ryman Hospitality Properties, Inc.), from May 2009 to May 2013, Trans-Lux Corporation, from December 2009 to November 2011, LICT Corporation, from May 2006 to June 2013 and NYMagic, Inc., from May 2002 to November 2010. Mr. Angiolillo has served as a director of Sevcon, Inc (NasdaqCM: SEV) since December 2013, where he also serves as the Chairman of its board’s audit committee. Mr. Angiolillo graduated from the University of Pennsylvania, with a Bachelor of Science degree, and received a Masters in Business Administration from the Wharton School of Business and a JD from Georgetown Law School.

GAMCO believes that Mr. Angiolillo’s qualifications to serve on the Board of Directors include his experience with commercial and corporate law as well as his extensive record of service on the boards of several public companies. GAMCO believes Mr. Angiolillo brings extensive corporate governance and investment experience and GAMCO strongly supports the nomination of Mr. Angiolillo for election to the Board of Directors of the Company at the Annual Meeting.

Philip T. Blazek, age 47, has served as the President and Principal Executive Officer of Special Diversified Opportunities Inc. (OTC Markets: SDOI) (“SDOI”) since July 23, 2013. Mr. Blazek joined SDOI on May 31, 2013 to transition out the former Chief Executive Officer, who officially left SDOI on July 12, 2013 when SDOI completed the sale of substantially all of its assets. Upon joining SDOI, Mr. Blazek led this public company through the closing of the sale of its former operating business and related operational wind down and through the strategic alternatives process to deploy its cash. Mr. Blazek served as Managing Director at Korenvaes Management LLC, a family office firm focused on deep value debt and equity investments, from February 2012 until the firm’s founder closed the fund for personal reasons in July 2012. From 2008 through January 2012, Mr. Blazek was President and Chief Investment Officer of Blazek Crow Holdings Capital, LP, an equity small-cap value investment fund he founded with the Crow Holdings Family Office. From 2005 to 2008, he served as a Partner of Greenway Capital, LP, an investment firm focused on providing new capital and actively working with managements of small-cap public companies. Mr. Blazek’s investment banking advisory tenure included the Mergers & Acquisitions Group of Wasserstein Perella (and successor Dresdner Kleinwort Wasserstein) from 1996 to 2004 and the Telecom/Media/Technology Group in the Investment Banking Division of Goldman Sachs from 1991 to 1994. He previously served on the board of directors of State Wide Aluminum, an Elkhart, Indiana supplier to the auto industry, from January 2000 to December 2001. Mr. Blazek received an Economics degree at Harvard University in 1990 and MBA degree at Harvard Business School in 1996. He is a Chartered Financial Analyst.

11

GAMCO believes the Board will benefit from Mr. Blazek’s breadth of experience working with management teams, of both larger mature and smaller growth companies, regarding corporate strategy, allocation of capital, financial and strategic transactions, and business model improvements and transformations.

Walter M. Schenker, age 68, is the sole Principal of MAZ Capital Advisors, LLC, a firm he founded in June 2010, which manages a hedge fund that largely invests on a long term basis in small-cap and mid-cap companies. Mr. Schenker has served as a director of Sevcon, Inc. (NasdaqCM: SEV) since December 2013, where he also serves as the Chairman of its board’s compensation committee. In 1999, Mr. Schenker co-founded Titan Capital Management, LLC, a registered investment advisor and hedge fund, where he remained until his partner’s retirement in June 2010. In 2007, Titan Capital Management, LLC, TCMP3 Partners, L.P., its general partner, TCMP3 Capital, LLC, its investment manager, and portfolio managers Steven E. Slawson and Mr. Schenker agreed to a settlement with the SEC in connection with unregistered securities offerings, which are commonly referred to as “PIPEs” (Private Investment in Public Equity), without admitting or denying the allegations. During the 1970’s and early 1980’s, Mr. Schenker was a sell side analyst for a number of brokerage firms including Lehman Brothers, Drexel Burnham Lambert and Bear Stearns. Throughout this period he consistently followed the auto parts industry (both manufacturers and distributors) and regularly published written research on the industry and specific companies in the industry. He published in excess of 200 research pieces on topics relating to the industry or companies therein. He was also interviewed and quoted in publications, including among others, The Wall Street Journal. Mr. Schenker has continues to follow the industry and companies. Mr. Schenker was also previously employed by the following additional leading brokerage/investment banks and money management firms: Steinhardt Partners, Gabelli & Company, Inc., and Glickenhaus & Company. Mr. Schenker has worked in the investment business for over 40 years. In the course of his career, Mr. Schenker has worked with public and private companies to advise and assist with raising capital. Mr. Schenker has been the lead plaintiff in securities class actions, and is knowledgeable on corporate governance issues. Mr. Schenker graduated from Cornell University, with a Bachelor of Arts degree, and received a Masters in Business Administration from Columbia University.

GAMCO believes that Mr. Schenker’s vast experience in finance, capital allocation, strategic transactions and investor relations from more than 40 years of experience in the investment business, including as the principal of hedge funds and a registered investment adviser and at a number of leading brokerage/investment banks as well as money management firms, will improve the Board’s ability to enhance shareholder value.

The principal business address of Mr. Angiolillo is c/o GJA Management Corporation, 2 Benedict Place, Greenwich, CT, 06830. The principal business address of Mr. Blazek is c/o Special Diversified Opportunities Inc., 500 Crescent Court, Suite 230, Dallas, TX, 75201. The principal business address of Mr. Schenker is c/o MAZ Capital Advisors, LLC, 1130 Route 46, Suite 22, Parsippany, NJ, 07054.

As of the date hereof, Mr. Schenker directly owns 110 shares of Common Stock in his personal IRA account. As of the date hereof, neither of Messrs. Angiolillo and Blazek own beneficially or of record any securities of the Company, nor have they made any purchases or sales of any securities of the Company in the past two years. Depending on market conditions and other factors, if elected, Messrs. Angiolillo and Blazek intend to acquire shares of Common Stock, and Mr. Schenker intends to acquire additional shares of Common Stock. For information regarding purchases and sales of securities of the Company during the past two years by the Nominees, see Schedule I.

12

GAMCO and its affiliates are beneficial owners, on behalf of their investment advisory clients, of 37.80% of the common stock of Sevcon, Inc., for which Mr. Schenker and Mr. Angiolillo serve as directors.

Certain affiliates of GAMCO are beneficial owners of 1.02% of the common stock of Special Diversified Opportunities Inc., for which Mr. Blazek serves as President.

Other than as set forth herein, there are no arrangements or understandings between GAMCO or any of its affiliates of clients and the Nominees or any other person or persons pursuant to which the nomination of the Nominees described herein is to be made, other than the consent by the Nominees to be named in this Proxy Statement and to serve as a director of the Company if elected as such at the Annual Meeting. None of the Nominees is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries in any material pending legal proceedings.

Each Nominee presently is, and if elected as a director of the Company would be, an “independent director” within the meaning of (i) applicable NYSE listing standards applicable to board composition, including Rule 303.A and (ii) Section 301 of the Sarbanes-Oxley Act of 2002. No Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s applicable independence standards.

We do not expect that the Nominees will be unable to stand for election, but, in the event that any Nominee is unable to serve or for good cause will not serve, the shares of Common Stock represented by the enclosed BLUE proxy card will be voted for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right to nominate substitute person(s) if the Company makes or announces any changes to its Bylaws or takes or announces any other action that has, or if consummated would have, the effect of disqualifying any Nominee, to the extent this is not prohibited under the Bylaws and applicable law. In any such case, shares of Common Stock represented by the enclosed BLUE proxy card will be voted for such substitute nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at the Annual Meeting. Additional nominations made pursuant to the preceding sentence are without prejudice to the position of GAMCO that any attempt to increase the size of the current Board constitutes an unlawful manipulation of the Company’s corporate machinery.

WE URGE YOU TO VOTE FOR THE ELECTION OF THE NOMINEES ON THE ENCLOSED BLUE PROXY CARD.

13

PROPOSAL NO. 2

ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s proxy statement, the Company is asking shareholders to indicate their support for the compensation of the Company’s named executive officers. This proposal, commonly known as a “Say-on-Pay” proposal, is not intended to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking shareholders to vote for the following resolution:

“RESOLVED, that the shareholders approve the compensation of Superior’s named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules, including the Compensation Discussion & Analysis, the compensation tables and narrative discussion.”

According to the Company’s proxy statement, the Say-on-Pay vote is advisory only and not binding on the Company, the Compensation and Benefits Committee of the Board or the Board, but the results will be taken into consideration when making future compensation decisions for the Company’s named executive officers.

GAMCO recommends that shareholders vote AGAINST this proposal for the reasons set forth in this Proxy Statement in the REASONS FOR THE SOLICITATION section under the heading “We are Concerned with the Board’s Poor Compensation Decisions.”

WE RECOMMEND A VOTE “AGAINST” ON THE APPROVAL OF THE NON-BINDING

RESOLUTION REGARDING EXECUTIVE COMPENSATION AND INTEND TO VOTE OUR

SHARES “AGAINST” THIS PROPOSAL.

14

PROPOSAL NO. 3

REINCORPORATION OF THE COMPANY FROM CALIFORNIA TO DELAWARE

As discussed in further detail in the Company’s proxy statement, the Company is asking shareholders to approve the reincorporation of the Company from California to Delaware through a merger of the Company with and into a wholly-owned Delaware subsidiary. According to the Company’s proxy statement, a vote to approve the reincorporation would also constitute a vote to approve the new certificate of incorporation and bylaws of the newly formed Delaware corporation.

According to the Company’s proxy statement, California law requires the affirmative vote of a majority of the outstanding shares of common stock of the Company to approve the merger agreement pursuant to which the Company and its wholly-owned Delaware subsidiary would effect the reincorporation.

WE RECOMMEND A VOTE “FOR” THE APPROVAL OF THE REINCORPORATION

OF THE COMPANY FROM CALIFORNIA TO DELAWARE BY MEANS OF A MERGER

WITHIN AND INTO A WHOLLY-OWNED DELAWARE SUBSIDIARY AND INTEND TO

VOTE OUR SHARES “FOR” THIS PROPOSAL.

15

PROPOSAL NO. 4

RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further detail in the Company’s proxy statement, the Audit Committee of the Board has preliminarily selected Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 27, 2015 and is proposing that shareholders ratify such appointment.

As disclosed in the Company’s proxy statement, this vote is an advisory vote only, and therefore it will not bind the Company, the Board or the Audit Committee. The Company is not required to obtain shareholder ratification of the selection of Deloitte & Touche LLP as its independent registered public accounting firm by its Bylaws or otherwise. However, according to the Company’s proxy statement, should the shareholders fail to ratify the selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm, the Audit Committee will reconsider the appointment. The Company’s proxy statement further provided that even if the appointment is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the Company’s and its shareholders’ best interests.

WE RECOMMEND A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY FOR ITS FISCAL YEAR ENDING DECEMBER 27, 2015 AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

16

VOTING AND PROXY PROCEDURES

Only shareholders of record on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Shareholders who sell their shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may not vote such shares of Common Stock. Shareholders of record on the Record Date will retain their voting rights in connection with the Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, GAMCO believes that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common Stock represented by properly executed BLUE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees, AGAINST on the approval of the Say-on-Pay Proposal, FOR the reincorporation of the Company from California to Delaware, and FOR the ratification of the selection of Deloitte & Touche LLP.

According to the Company’s proxy statement for the Annual Meeting, the current Board intends to nominate seven candidates for election at the Annual Meeting. This Proxy Statement is soliciting proxies to elect our three Nominees. Shareholders who vote on the enclosed BLUE proxy card will also have the opportunity to vote for the candidates who have been nominated by the Company other than Paul J. Humphries, Timothy C. McQuay and Francisco S. Uranga. Shareholders will therefore be able to vote for the total number of directors up for election at the Annual Meeting. Under applicable proxy rules we are required either to solicit proxies only for our Nominees, which could result in limiting the ability of shareholders to fully exercise their voting rights with respect to the Company’s nominees, or to solicit for our Nominees while also allowing shareholders to vote for fewer than all of the Company’s nominees, which enables a shareholder who desires to vote for our Nominees to also vote for certain of the Company’s nominees. The names, backgrounds and qualifications of the Company’s nominees, and other information about them, can be found in the Company’s proxy statement. There is no assurance that any of the Company’s nominees will serve as directors if all or some of our Nominees are elected.

QUORUM; BROKER NON-VOTES; DISCRETIONARY VOTING

A quorum is the minimum number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business at the meeting. For the Annual Meeting, the presence, in person or by proxy, of the holders of at least 13,472,124 shares of Common Stock, which represents a majority of the 26,944,247 shares of Common Stock outstanding as of the Record Date and entitled to vote, will be considered a quorum allowing votes to be taken and counted for the matters before the shareholders.

Abstentions are counted as present and entitled to vote for purposes of determining a quorum. Shares represented by “broker non-votes” also are counted as present and entitled to vote for purposes of determining a quorum. However, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under current NYSE rules, your broker will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals that are put to a vote at the Annual Meeting.

If you are a shareholder of record, you must deliver your vote by mail or attend the Annual Meeting in person and vote in order to be counted in the determination of a quorum.

17

If you are a beneficial owner, your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers do not have discretionary authority to vote on any of the matters to be presented at the Annual Meeting. Accordingly, unless you vote via proxy card or provide instructions to your broker, your shares of Common Stock will not count for purposes of attaining a quorum.

VOTES REQUIRED FOR APPROVAL

Election of Directors ─ According to the Company’s proxy statement, the seven persons receiving the largest number of “yes” votes will be elected as a director. Under California law, since there is no particular percentage of either the outstanding shares or the shares represented at the meeting required to elect a director, abstentions and broker non-votes will have no effect on the election of directors. With respect to the election of directors, neither an abstention nor a broker non-vote will count as a vote cast “for” or “against” a director nominee. Therefore, abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Other Proposals ─ According to the Company’s proxy statement, the affirmative vote of a majority of shares of Common Stock represented and voting at the Annual Meeting at which a quorum is present, together with the affirmative vote of at least a majority of the required quorum, shall be required to approve each of the other proposals. Shares of Common Stock that are voted “FOR,” “AGAINST” or “ABSTAIN” on the proposal are treated as being present at the Annual Meeting for purposes of establishing the quorum, but only shares of Common Stock voted “FOR” or “AGAINST” are treated as shares of Common Stock “represented and voting” at the Annual Meeting with respect to the proposal. Accordingly, abstentions and broker non-votes will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. However, abstentions and broker non-votes will not be counted for purposes of determining the number of shares “represented and voting” with respect to the proposal. If you sign and submit your BLUE proxy card without specifying how you would like your shares voted, your shares will be voted in accordance with GAMCO’s recommendations specified herein and in accordance with the discretion of the persons named on the BLUE proxy card with respect to any other matters that may be voted upon at the Annual Meeting.

REVOCATION OF PROXIES

Shareholders of the Company may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute revocation of a proxy) or by delivering a written notice of revocation. The delivery of a subsequently dated proxy which is properly completed will constitute a revocation of any earlier proxy. The revocation may be delivered to GAMCO at the address set forth on the back cover of this Proxy Statement or to the Company at 24800 Denso Drive, Suite 225, Southfield, Michigan 48033 or any other address provided by the Company. Although a revocation is effective if delivered to the Company, we request that either the original or photostatic copies of all revocations be mailed to GAMCO at the address set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock. Additionally, we may use this information to contact shareholders who have revoked their proxies in order to solicit later dated proxies for the election of the Nominees.

IF YOU WISH TO VOTE FOR THE ELECTION OF THE NOMINEES TO THE BOARD, PLEASE SIGN, DATE AND RETURN PROMPTLY THE ENCLOSED BLUE PROXY CARD IN THE POSTAGE-PAID ENVELOPE PROVIDED.

18

SOLICITATION OF PROXIES

The solicitation of proxies pursuant to this Proxy Statement is being made by GAMCO. It is anticipated that the Participants and certain staff members of GAMCO will participate in the solicitation of proxies in support of our Nominees set forth in this Proxy Statement. Such staff members will receive no additional consideration if they assist in the solicitation of proxies. Solicitations of proxies may be made in person, by telephone, by email, through the internet, by mail and by facsimile. Although no precise estimate can be made at the present time, it is estimated that the total expenditures in furtherance of, or in connection with, the solicitation of shareholders will not exceed $[_________]. The total expenditures to date in furtherance of, or in connection with, the solicitation of shareholders is approximately $[_________].

Costs related to this solicitation of proxies, including expenditures for attorneys, accountants, public relations and financial advisors, proxy solicitors, advertising, printing, transportation and related expenses will be borne by GAMCO. To the extent legally permissible, GAMCO will seek reimbursement from the Company for those expenses if any of our Nominees is elected. GAMCO does not currently intend to submit the question of such reimbursement to a vote of the shareholders.

ADDITIONAL PARTICIPANT INFORMATION

The Nominees, GAMCO Asset Management and Mr. Gabelli are participants in this solicitation. The principal business of GAMCO Asset Management, a New York corporation, is acting as an investment manager providing discretionary managed account services for employee benefit plans, private investors, endowments, foundations and others. GAMCO Asset Management is an investment adviser registered under the Advisers Act. Mr. Gabelli is the controlling shareholder, Chief Executive Officer and a director of GGCP, Inc. and Chairman and Chief Executive Officer of GAMCO Investors, Inc. Mr. Gabelli is also a member of GGCP Holdings LLC and the controlling shareholder of Teton Advisors, Inc.

The address of the principal office of each of GAMCO Asset Management and Mr. Gabelli is One Corporate Center, Rye, New York 10580.

As of the date hereof, GAMCO Asset Management beneficially owns 2,081,301 shares of Common Stock. GAMCO Asset Management has dispositive power with respect to all of these shares of Common Stock, and has voting power with respect to 1,858,301 shares of Common Stock. As of the date hereof, GAMCO Asset Management’s affiliates beneficially own an additional 1,303,000 shares of Common Stock. By virtue of his respective position with each of GAMCO Asset Management and its affiliates, Mr. Gabelli may be deemed to be the beneficial owner of all of the shares of Common Stock held by GAMCO Asset Management and its affiliates. As of the date hereof, GAMCO Asset Management, its affiliates and Mr. Gabelli own an aggregate of 3,384,301 shares of Common Stock.

The shares of Common Stock beneficially owned by each of GAMCO Asset Management and its affiliates were purchased with funds that were provided through the accounts of certain investment advisory clients (and, in the case of some of such accounts at GAMCO Asset Management, may be through borrowings from client margin accounts). For information regarding purchases and sales of securities of the Company during the past two years by the participants in this solicitation, see Schedule I.

19

Except as set forth in this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no participant in this solicitation has been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no participant in this solicitation directly or indirectly beneficially owns any securities of the Company; (iii) no participant in this solicitation owns any securities of the Company which are owned of record but not beneficially; (iv) no participant in this solicitation has purchased or sold any securities of the Company during the past two years; (v) no part of the purchase price or market value of the securities of the Company owned by any participant in this solicitation is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no participant in this solicitation is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any participant in this solicitation owns beneficially, directly or indirectly, any securities of the Company; (viii) no participant in this solicitation owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no participant in this solicitation or any of his or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no participant in this solicitation or any of his or its associates has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no participant in this solicitation has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting.

There are no material proceedings to which any participant in this solicitation or any of his or its associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries. With respect to the Nominees, none of the events enumerated in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten years.

OTHER MATTERS AND ADDITIONAL INFORMATION

GAMCO is unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which GAMCO is not aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed BLUE proxy card will vote on such matters in their discretion.

SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be presented at the 2016 Annual Meeting, in order to be included in the Company’s proxy statement and the form of proxy for the 2016 Annual Meeting, must be made by a qualified shareholder and received by the Company’s Corporate Secretary at Superior Industries International, Inc., 24800 Denso Drive, Suite 225, Southfield, Michigan 48033 no later than December 1, 2015 (the date that is 120 calendar days before the one year anniversary date of the Company’s proxy statement released to shareholders for the Annual Meeting). However, if the 2016 Annual Meeting date has changed more than 30 days from this year’s meeting, then the deadline is a reasonable time before the Company begins to print and send out proxy materials.

Under the Bylaws of the Company, any shareholder proposals (other than those made under Rule 14a-8 of the Exchange Act) and any nomination of one or more persons for election as a director must be made not later than the close of business on the 90th day nor earlier than the close of business on the 120th day prior to the one-year anniversary of the date of the preceding year’s annual meeting. Therefore, in order for a shareholder proposal or director nomination to be considered at the 2016 Annual Meeting, a written notice of the proposal or the nomination must be received by the Secretary of the Company no later than February 5, 2016 (assuming that the 2016 Annual Meeting is held on May 5, 2016, the anniversary of the 2015 Annual Meeting). However, if the date of the 2016 Annual Meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the 2015 Annual Meeting, then, for notice by the shareholder to be timely, it must be received by the Secretary of the Company not earlier than the 120th day prior to the date of the 2016 Annual Meeting and not later than the close of business on the later of (i) the 90th day prior to the 2016 Annual Meeting, or (ii) the tenth day following the day on which public announcement of the date of the 2016 Annual Meeting is first made. In order for shareholder proposals that are submitted outside of SEC Rule 14a-8 and are intended to be considered by the shareholders at the 2016 Annual Meeting to be considered “timely” for purposes of SEC Rule 14a-4(c) under the Exchange Act, the proposal must be received by the Secretary of the Company no later than February 5, 2016. The notice must set forth the information required by the Bylaws with respect to each director nomination and shareholder proposal that the shareholder intends to present at the 2016 Annual Meeting. The proxy solicited by the Board of Directors for the 2016 Annual Meeting will confer discretionary voting authority with respect to any proposal presented by a shareholder at that meeting for which the Company has not been provided with timely notice, or, even if there is timely notice, the shareholder does not comply with the requirements of Rule 14a-4(c)(2) promulgated under the Exchange Act. Notices must be delivered to the Company’s Secretary by mail at 24800 Denso Drive, Suite 225, Southfield, Michigan 48033.

20

The information set forth above regarding the procedures for submitting shareholder proposals for consideration at the 2016 Annual Meeting is based on information contained in the Company’s proxy statement and organizational documents filed by the Company with the SEC. The incorporation of this information in this proxy statement should not be construed as an admission by GAMCO that such procedures are legal, valid or binding.

INCORPORATION BY REFERENCE

WE HAVE OMITTED FROM THIS PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING TO THE ANNUAL MEETING. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS, INFORMATION CONCERNING EXECUTIVE COMPENSATION, AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE II FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

The information concerning the Company contained in this Proxy Statement and the Schedules attached hereto has been taken from, or is based upon, publicly available information.

GAMCO ASSET MANAGEMENT INC.

April ____, 2015

21

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

|

Purchase / Sale

|

Date of

Purchase / Sale

|

Shares of Common Stock

Purchased / Sold

|

|

GAMCO ASSET MANAGEMENT INC.

|

||

|

Purchase

|

04/01/2013

|

4,000

|

|

Purchase

|

04/02/2013

|

4,000

|

|

Purchase

|

04/08/2013

|

4,000

|

|

Purchase

|

04/08/2013

|

3,000

|

|

Purchase

|

04/09/2013

|

6,000

|

|

Purchase

|

04/09/2013

|

3,000

|

|

Purchase

|

04/16/2013

|

1,452

|

|

Purchase

|

04/16/2013

|

4,760

|

|

Purchase

|

04/17/2013

|

548

|

|

Purchase

|

04/17/2013

|

4,240

|

|

Purchase

|

04/23/2013

|

500

|

|

Purchase

|

04/29/2013

|

5,000

|

|

Sale

|

06/05/2013

|

200

|

|

Purchase

|

06/10/2013

|

10,000

|

|

Sale

|

06/17/2013

|

400

|

|

Purchase

|

06/17/2013

|

100

|

|

Purchase

|

06/17/2013

|

100

|

|

Purchase

|

06/18/2013

|

1,000

|

|

Sale

|

06/19/2013

|

400

|

|

Purchase

|

06/19/2013

|

1,000

|

|

Purchase

|

06/21/2013

|

2,000

|

|

Purchase

|

06/25/2013

|

1,300

|

|

Purchase

|

06/26/2013

|

1,000

|

|

Purchase

|

06/27/2013

|

3,000

|

|

Purchase

|

06/28/2013

|

10,000

|

|

Purchase

|

07/01/2013

|

2,000

|

|

Purchase

|

07/03/2013

|

3,000

|

|

Purchase

|

07/08/2013

|

4,000

|

|

Purchase

|

07/08/2013

|

6,503

|

|

Purchase

|

07/08/2013

|

4,000

|

|

Purchase

|

07/08/2013

|

700

|

|

Purchase

|

07/09/2013

|

3,497

|

|

Purchase

|

07/11/2013

|

256

|

|

Purchase

|

07/12/2013

|

2,000

|

|

Purchase

|

07/12/2013

|

302

|

|

Purchase

|

07/12/2013

|

400

|

|

Purchase

|

07/12/2013

|

7,500

|

|

Purchase

|

07/12/2013

|

7,500

|

|

Purchase

|

07/12/2013

|

744

|

|

Purchase

|

07/15/2013

|

5,000

|

|

Purchase

|

07/15/2013

|

1,000

|

|

Purchase

|

07/16/2013

|

7,500

|

|

Purchase

|

07/16/2013

|

7,500

|

|

Purchase

|

07/16/2013

|

5,000

|

|

Purchase

|

07/18/2013

|

14,700

|

|

Purchase

|

07/18/2013

|

8,000

|

|

Purchase

|

07/18/2013

|

4,000

|

|

Purchase

|

07/23/2013

|

3,000

|

|

Purchase

|

07/23/2013

|

5,000

|

|

Purchase

|

07/25/2013

|

4,000

|

|

Purchase

|

07/25/2013

|

10,000

|

|

Purchase

|

07/26/2013

|

3,000

|

|

Purchase

|

07/29/2013

|

4,000

|

|

Purchase

|

08/01/2013

|

35,500

|

|

Purchase

|

08/01/2013

|

35,574

|

|

Purchase

|

08/01/2013

|

9,000

|

|

Purchase

|

08/01/2013

|

1,900

|

|

Purchase

|

08/01/2013

|

1,300

|

|

Purchase

|

08/01/2013

|

800

|

|

Purchase

|

08/02/2013

|

500

|

|

Purchase

|

08/02/2013

|

1,000

|

|

Purchase

|

08/02/2013

|

2,000

|

|

Purchase

|

08/02/2013

|

2,000

|

|

Purchase

|

08/02/2013

|

700

|

|

Purchase

|

08/02/2013

|

2,000

|

|

Purchase

|

08/02/2013

|

200

|

|

Purchase

|

08/02/2013

|

1,091

|

|

Purchase

|

08/02/2013

|

200

|

|

Purchase

|

08/02/2013

|

1,000

|

|

Purchase

|

08/02/2013

|

2,000

|

|

Purchase

|

08/02/2013

|

1,926

|

|

Purchase

|

08/02/2013

|

2,000

|

|

Purchase

|

08/02/2013

|

2,000

|

|

Purchase

|

08/02/2013

|

250

|

|

Purchase

|

08/02/2013

|

250

|

|

Purchase

|

08/05/2013

|

2,909

|

|

Purchase

|

08/05/2013

|

1,000

|

|

Purchase

|

08/05/2013

|

1,000

|

|

Purchase

|

08/05/2013

|

1,000

|

|

Purchase

|

08/06/2013

|

1,000

|

|

Purchase

|

08/08/2013

|

50,000

|

|

Purchase

|

08/08/2013

|

10,000

|

|

Purchase

|

08/09/2013

|

2,000

|

|

Purchase

|

08/09/2013

|

1,000

|

|

Purchase

|

08/14/2013

|

10,000

|

|

Sale

|

08/14/2013

|

2,400

|

|

Sale

|

08/14/2013

|

600

|

|

Purchase

|

08/15/2013

|

9,582

|

|

Purchase

|

08/15/2013

|

500

|

|

Purchase

|

08/15/2013

|

400

|

|

Purchase

|

08/15/2013

|

100

|

|

Purchase

|

08/16/2013

|

10,418

|

|

Purchase

|

08/16/2013

|

1,000

|

|

Purchase

|

08/16/2013

|

800

|

|

Purchase

|

08/16/2013

|

500

|

|

Purchase

|

08/19/2013

|

400

|

|

Purchase

|

08/19/2013

|

300

|

|

Purchase

|

08/21/2013

|

500

|

|

Purchase

|

08/21/2013

|

300

|

|

Purchase

|

08/21/2013

|

200

|

|

Purchase

|

08/22/2013

|

10,000

|

|

Purchase

|

08/23/2013

|

4,000

|

|

Purchase

|

08/27/2013

|

400

|

|

Purchase

|

08/27/2013

|

400

|

|

Purchase

|

08/27/2013

|

200

|

|

Purchase

|

08/28/2013

|

2,000

|

|

Purchase

|

08/29/2013

|

500

|

|

Purchase

|

08/29/2013

|

500

|

|

Purchase

|

08/29/2013

|

300

|

|

Purchase

|

08/29/2013

|

200

|

|

Purchase

|

08/30/2013

|

3,000

|

|

Purchase

|

09/04/2013

|

6,000

|

|

Purchase

|

09/04/2013

|

2,000

|

|

Purchase

|

09/04/2013

|

1,900

|

|

Purchase

|

09/04/2013

|

1,400

|

|

Purchase

|

09/04/2013

|

700

|

|

Purchase

|

09/06/2013

|

2,000

|

|

Purchase

|

09/06/2013

|

4,000

|

|

Purchase

|

09/06/2013

|

1,000

|

|

Purchase

|

09/06/2013

|

2,000

|

|

Purchase

|

09/06/2013

|

3,000

|

|

Purchase

|

09/10/2013

|

500

|

|

Purchase

|

09/10/2013

|

300

|

|

Purchase

|

09/10/2013

|

200

|

|

Purchase

|

09/11/2013

|

4,200

|

|

Purchase

|

09/11/2013

|

3,200

|

|

Purchase

|

09/11/2013

|

1,600

|

|

Purchase

|

09/12/2013

|

3,216

|

|

Purchase

|

09/12/2013

|

2,000

|

|

Purchase

|

09/13/2013

|

4,784

|

|

Purchase

|

09/18/2013

|

1,000

|

|

Purchase

|

09/18/2013

|

500

|

|

Purchase

|

09/18/2013

|

3,000

|

|

Purchase

|

09/18/2013

|

2,400

|

|

Purchase

|

09/18/2013

|

1,700

|

|

Purchase

|

09/18/2013

|

900

|

|

Purchase

|

09/23/2013

|

300

|

|

Purchase

|

09/23/2013

|

877

|

|

Purchase

|

09/24/2013

|

2,000

|

|

Purchase

|

09/24/2013

|

800

|

|

Purchase

|

09/24/2013

|

800

|

|

Purchase

|

09/24/2013

|

400

|

|

Purchase

|

09/24/2013

|

400

|

|

Purchase

|

09/24/2013

|

800

|

|

Purchase

|

09/24/2013

|

400

|

|

Purchase

|

09/24/2013

|

400

|

|

Purchase

|

09/25/2013

|

300

|

|

Purchase

|

09/26/2013

|

1,900

|

|

Purchase

|

09/26/2013

|

1,500

|

|

Purchase

|

09/26/2013

|

1,000

|

|

Purchase

|

09/26/2013

|

500

|

|

Purchase

|

09/27/2013

|

1,000

|

|

Purchase

|

09/27/2013

|

2,123

|

|

Purchase

|

09/30/2013

|

4,000

|

|

Purchase

|

09/30/2013

|

1,000

|

|

Purchase

|

09/30/2013

|

5,000

|

|

Purchase

|

10/01/2013

|

2,000

|

|

Purchase

|

10/01/2013

|

10,000

|

|

Purchase

|

10/01/2013

|

633

|

|

Purchase

|

10/01/2013

|

400

|

|

Purchase

|

10/02/2013

|

5,000

|

|

Purchase

|

10/02/2013

|

200

|

|

Purchase

|

10/02/2013

|

867

|

|

Purchase

|

10/02/2013

|

600

|

|

Purchase