10-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

|

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 27, 2015

Commission file number: 1-6615

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

| | |

Delaware | | 95-2594729 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

26600 Telegraph Road, Suite 400 | |

Southfield, Michigan | | 48034 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (248) 352-7300

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, $0.01 par value | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if the disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405) is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer [ ] | Accelerated filer [X] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the registrant’s $0.01 par value common equity held by non-affiliates as of the last business day of the registrant’s most recently completed second quarter was $499,546,000, based on a closing price of $18.69. On March 4, 2016, there were 25,436,582 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s 2016 Annual Proxy Statement, to be filed with the Securities and Exchange Commission within 120 days after the close of the registrant’s fiscal year, are incorporated by reference into Part III of this Form 10-K.

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by us or on our behalf. We have included or incorporated by reference in this Annual Report on Form 10-K (including in the sections entitled "Risk Factors" and "Management’s Discussion and Analysis of Financial Condition and Results of Operations"), and from time to time our management may make, statements that may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based upon management's current expectations, estimates, assumptions and beliefs concerning future events and conditions and may discuss, among other things, anticipated future performance (including sales and earnings), expected growth, future business plans and costs and potential liability for environmental-related matters. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as “expects,” “anticipates,” “believes,” “will,” “will likely result,” “will continue,” “plans to” and similar expressions. These statements include our belief and statements regarding general automotive industry and market conditions and growth rates, as well as general domestic and international economic conditions.

Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of the company, which could cause actual results to differ materially from such statements and from the company's historical results and experience. These risks, uncertainties and other factors include, but are not limited to those described in Part I - Item 1A - Risk Factors and Part II - Item 7 - "Management's Discussion and Analysis of Financial Condition and Results of Operations" of this Annual Report on Form 10-K and elsewhere in the Annual Report and those described from time to time in our future reports filed with the Securities and Exchange Commission.

Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the risks described herein should not be considered to be a complete list. Any forward-looking statement speaks only as of the date on which such statement is made, and the company undertakes no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

PART I

ITEM 1 - BUSINESS

Description of Business and Industry

The principal business of Superior Industries International, Inc. (referred to herein as the “company” or in the first person notation “we,” “us” and “our”) is the design and manufacture of aluminum wheels for sale to original equipment manufacturers ("OEMs"). We are one of the largest suppliers of cast aluminum wheels to the world's leading automobile and light truck manufacturers, with wheel manufacturing operations in the United States and Mexico. Products made in our North American facilities are delivered primarily to automotive assembly operations in North America for global OEMs. Our OEM aluminum wheels primarily are sold for factory installation, as either optional or standard equipment, on many vehicle models manufactured by BMW, Fiat Chrysler Automobiles N.V. ("FCA"), Ford, General Motors ("GM"), Mitsubishi, Nissan, Subaru, Tesla, Toyota and Volkswagen.

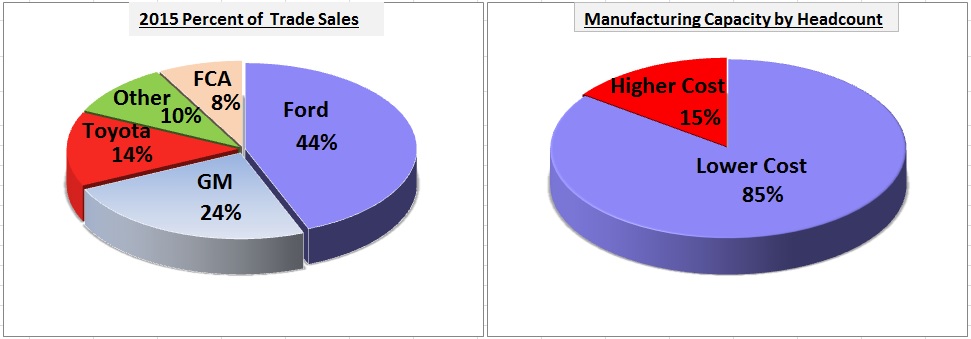

We have gone through a transformation over the last several years as we have shifted our manufacturing base from higher cost to lower cost sources. With the diversification and increased demands for more customized premium wheels, we have made investments in engineering and design. With these investments, we are enhancing our capabilities to become a leader in premium wheels. We have doubled the wheel finishes that we offer in the last couple of years and we have developed patents, which is all part of our strategic evolution to become a competitive full line manufacturer of aluminum wheels. Another part of our evolution was to move our corporate office to Southfield, Michigan to be closer to many of our customers so we can further strengthen relationships and partner with them to design world class products. We have made significant strides with our customers over the last year as evidenced by receiving the 2015 supplier of the year award from GM. With the addition of our new facility in Mexico we have expanded our manufacturing capacity to allow for growth in the next couple of years. We continue to explore and implement operating improvements to further expand manufacturing capacity with relatively low capital investment. We are also investigating acquisition opportunities to further enhance the value and drive the growth of our business. The charts below show our major customers and our manufacturing capacity by headcount split between lower cost and higher cost sourced labor.

Our industry is mainly driven by production levels in North America and to a much lesser extent in South America. The North American production level, in 2015, was 17.4 million vehicles, a 3 percent, or 0.5 million unit, increase over 2014. We track annual production rates based on information from Ward's Automotive Group. The North American annual production levels of automobiles and light-duty trucks (including SUV's, vans and "crossover vehicles") continue the trend of growth since the 2009 recession. Current economic conditions, low consumer interest rates and relatively inexpensive gas prices have been generally supportive of market growth and, in addition, the relatively high average age of vehicles on the road appears to be contributing to higher rates of vehicle replacement. It was reported in 2015 that the average age of all light vehicles in the U.S. increased to an all-time high of 11.5 years, according to IHS Automotive.

In 2014, production of automobiles and light-duty trucks in North America reached 16.9 million units, an increase of 5 percent over 2013. Production in 2013 reached 16.1 million units, an increase of 0.7 million, or 5 percent, from 15.4 million vehicles in 2012.

We were initially incorporated in Delaware in 1969 and reincorporated in California in 1994. In 2015, we moved our headquarters from Van Nuys, California to Southfield, Michigan and reincorporated in Delaware in 2015. Our stock is traded on the New York Stock Exchange under the symbol "SUP."

Raw Materials

The raw materials used in manufacturing our products are readily available and are obtained through numerous suppliers with whom we have established trade relations. We purchase aluminum for the manufacture of our aluminum wheels, which accounted for the vast majority of our total raw material requirements during 2015. The majority of our aluminum requirements are met through purchase orders with certain major producers, with physical supply coming from North American locations. Generally, the orders are fixed as to minimum and maximum quantities of aluminum, which the producers must supply during the term of the orders. During 2015, we were able to successfully secure aluminum commitments from our primary suppliers to meet production requirements and we anticipate being able to source aluminum requirements to meet our expected level of production in 2016. We procure other raw materials through numerous suppliers with whom we have established trade relationships.

When market conditions warrant, we also may enter into purchase commitments to secure the supply of certain commodities used in the manufacture of our products, such as aluminum, natural gas and other raw materials. We had purchase commitments for the delivery of natural gas through the end of 2015. These natural gas contracts were considered to be derivatives under U.S. generally accepted accounting principles ("GAAP"), and when entering into these contracts, it was expected that we would take full delivery of the contracted quantities of natural gas over the normal course of business. Accordingly, at inception, these contracts qualified for the normal purchase, normal sale ("NPNS") exemption provided under U.S. GAAP.

Customer Dependence

We have proven our ability to be a consistent producer of high quality aluminum wheels with the capability to meet our customers' price, quality, delivery and service requirements. We strive to continually enhance our relationships with our customers through continuous improvement programs, not only through our manufacturing operations but in the engineering, design, development and quality areas as well. These key business relationships have resulted in multiple vehicle supply contract awards with our key customers over the past year.

Ford, GM, Toyota and FCA were our only customers individually accounting for more than 10 percent of our consolidated trade sales. Net sales to these customers in 2015, 2014 and 2013 were as follows (dollars in millions):

|

| | | | | | | | | | | | |

| | 2015 | | 2014 | | 2013 |

| | Percent of Net Sales | | Dollars | | Percent of Net Sales | | Dollars | | Percent of Net Sales | | Dollars |

Ford | | 44% | | $315.1 | | 44% | | $321.6 | | 45% | | $349.7 |

GM | | 24% | | $175.6 | | 24% | | $175.8 | | 24% | | $186.4 |

Toyota | | 14% | | $104.5 | | 12% | | $88.3 | | 12% | | $92.1 |

FCA | | 8% | | $56.3 | | 10% | | $72.0 | | 10% | | $78.1 |

The loss of all or a substantial portion of our sales to Ford, GM, Toyota or FCA would have a significant adverse effect on our financial results. See also Item 1A - Risk Factors of this Annual Report.

Foreign Operations

We manufacture a significant portion of our products in Mexico that are sold both in the United States and Mexico. Net sales of wheels manufactured in our Mexico operations in 2015 totaled $550.7 million and represented 76 percent of our total net sales. The portion of our products produced in Mexico versus the United States will increase in 2016, as we expect to achieve full commercial production at a new wheel plant in Mexico for most of 2016. Net property, plant and equipment used in our operations in Mexico totaled $190.4 at December 31, 2015, including $112.2 million related to our recently completed wheel plant. The overall cost for us to manufacture wheels in Mexico currently is lower than the cost to manufacture wheels in the U.S., in particular, because of reduced labor cost due to lower prevailing wage rates. Such current advantages to manufacturing our product in Mexico can be affected by changes in cost structures, trade protection laws, policies and other regulations affecting trade and investments, social, political, labor, or general economic conditions in Mexico. Other factors that can affect the business and financial results of our Mexican operations include, but are not limited to, valuation of the peso, availability and competency of personnel and tax

regulations in Mexico. See also Item 1A- Risk Factors - International Operations and Item 1A - Risk Factors - Foreign Currency Fluctuations.

Net Sales Backlog

We receive OEM purchase orders to produce aluminum wheels typically for multiple model years. These purchase orders are typically for one year for vehicle wheel programs that usually last three to five years. We manufacture and ship based on customer release schedules, normally provided on a weekly basis, which can vary in part due to changes in demand, industry and/or customer maintenance cycles, new program introductions or dealer inventory levels. Accordingly, even though customer purchase orders cover multiple model years, our management does not believe that our firm backlog is a meaningful indicator of future operating results.

Competition

Competition in the market for aluminum wheels is based primarily on price, technology, quality, delivery and overall customer service. We are one of the leading suppliers of aluminum wheels for OEM installations in the world, and are the largest producer in North America. We currently supply approximately 20 percent of the aluminum wheels installed on passenger cars and light-duty trucks in North America. Competition is global in nature with growing exports from Asia into North America. There are several competitors with facilities in North America but we have more than twice the North American production capacity of any competitor based on our current estimation. See also Item 1A - Risk Factors of this Annual Report. Other types of road wheels, such as those made of steel, also compete with our products. According to Ward's Automotive Group, the aluminum wheel penetration rate on passenger cars and light-duty trucks in the U.S. was 79 percent for the 2015 model year and 81 percent for the 2014 model year, compared to 80 percent for the 2013 model year. We expect the ratio of aluminum to steel wheels to remain relatively stable. However, several factors can affect this rate including price, fuel economy requirements and styling preference. Although aluminum wheels currently are more costly than steel, aluminum is a lighter material than steel, which is desirable for fuel efficiency and generally viewed as aesthetically superior to steel, and thus more desirable to the OEMs and their customers.

Research and Development

Our policy is to continuously review, improve and develop our engineering capabilities to satisfy our customer requirements in the most efficient and cost effective manner available. We strive to achieve this objective by attracting and retaining top engineering talent and by maintaining the latest state-of-the-art computer technology to support engineering development. A fully staffed engineering center, located in Fayetteville, Arkansas, supports our research and development manufacturing needs. We also have a technical sales center at our corporate headquarters in Southfield, Michigan that maintains a complement of engineering staff centrally located near some of our largest customers' headquarters and engineering and purchasing offices.

Research and development costs (primarily engineering and related costs), which are expensed as incurred, are included in cost of sales in our consolidated income statements. Amounts expended on research and development costs during each of the last three years were $2.6 million in 2015; $4.4 million in 2014; and $4.8 million in 2013.

Government Regulation

Safety standards in the manufacture of vehicles and automotive equipment have been established under the National Traffic and Motor Vehicle Safety Act of 1966. We believe that we are in compliance with all federal standards currently applicable to OEM suppliers and to automotive manufacturers.

Environmental Compliance

Our manufacturing facilities, like most other manufacturing companies, are subject to solid waste, water and air pollution control standards mandated by federal, state and local laws. Violators of these laws are subject to fines and, in extreme cases, plant closure. We believe our facilities are in material compliance with all presently applicable standards. However, costs related to environmental protection may grow due to increasingly stringent laws and regulations. The cost of environmental compliance was approximately $0.7 million in 2015; $0.4 million in 2014; and $0.5 million in 2013. We expect that future environmental compliance expenditures will approximate these levels and will not have a material effect on our consolidated financial position. Furthermore, climate change legislation or regulations restricting emission of "greenhouse gases" could result in increased operating costs and reduced demand for the vehicles that use our products. See also Item 1A - Risk Factors - Environmental Matters of this Annual Report.

Employees

As of December 31, 2015, we had approximately 3,050 full-time employees compared to approximately 3,000 employees at December 31, 2014. None of our employees are covered by a collective bargaining agreement.

Fiscal Year End

Our fiscal year is the 52- or 53-week period ending generally on the last Sunday of the calendar year. The fiscal years 2015, 2014 and 2013 comprised the 52-week periods ended on December 27, 2015, December 28, 2014 and December 29, 2013, respectively. For convenience of presentation, all fiscal years are referred to as beginning as of January 1, and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

Segment Information

We operate as a single integrated business and, as such, have only one operating segment - automotive wheels. Financial information about this segment and geographic areas is contained in Note 5 - Business Segments in Notes to Consolidated Financial Statements in Item 8 - Financial Statements and Supplementary Data of this Annual Report.

Seasonal Variations

The automotive industry is cyclical and varies based on the timing of consumer purchases of vehicles, which in turn vary based on a variety of factors such as general economic conditions, availability of consumer credit, interest rates and fuel costs. While there have been no significant seasonal variations in the past few years, production schedules in our industry can vary significantly from quarter to quarter to meet the scheduling demands of our customers.

Available Information

Our Annual Report on Form 10-K, quarterly reports on Form 10-Q and any amendments thereto are available, without charge, on or through our website, www.supind.com, under “Investors,” as soon as reasonably practicable after they are filed electronically with the Securities and Exchange Commission ("SEC"). The public may read and copy any materials filed with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, which contains these reports, proxy and information statements and other information regarding the company. Also included on our website, www.supind.com, under "Investor," is our Code of Conduct, which, among others, applies to our Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer. Copies of all SEC filings and our Code of Conduct are also available, without charge, upon request from Superior Industries International, Inc., Shareholder Relations, 26600 Telegraph Road, Suite 400, Southfield, MI 48034.

The content on any website referred to in this Annual Report on Form 10-K is not incorporated by reference in this Annual Report on Form 10-K unless expressly noted.

ITEM 1A - RISK FACTORS

The following discussion of risk factors contains “forward-looking” statements, which may be important to understanding any statement in this Annual Report or elsewhere. The following information should be read in conjunction with Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") and Item 8 - Financial Statements and Supplementary Data of this Annual Report.

Our business routinely encounters and addresses risks and uncertainties. Our business, results of operations and financial condition could be materially adversely affected by the factors described below. Discussion about the important operational risks that our business encounters can also be found in the MD&A section and in the business description in Item 1 - Business of this Annual Report. Below, we have described our present view of the most significant risks and uncertainties we face. Additional risks and uncertainties not presently known to us, or that we currently do not consider significant, could also potentially impair our business, results of operations and financial condition. Our reactions to these risks and uncertainties as well as our competitors' reactions will affect our future operating results.

Risks Relating To Our Company

The automotive industry is cyclical and volatility in the automotive industry could adversely affect our financial performance.

The majority of our sales are made in domestic U.S. markets and almost exclusively within North America. Therefore, our financial performance depends largely on conditions in the U.S. automotive industry, which in turn can be affected significantly by broad economic and financial market conditions. Consumer demand for automobiles is subject to considerable volatility as a result of consumer confidence in general economic conditions, levels of employment, prevailing wages, fuel prices and the availability and cost of consumer credit. With steady improvement in the North American automotive industry since the global recession that began in 2008, vehicle production levels in 2015 reached the highest level in the last decade. However, there can be no guarantee that the improvements in recent years will be sustained or that reductions from current production levels will not occur in future periods. Demand for aluminum wheels can be further affected by other factors, including pricing and performance comparisons to competitive materials such as steel. Finally, the demand for our products is influenced by shifts of market share between vehicle manufacturers and the specific market penetration of individual vehicle platforms being sold by our customers.

A limited number of customers represent a large percentage of our sales. The loss of a significant customer or decrease in demand could adversely affect our operating results.

Ford, GM, Toyota and FCA, together represented approximately 90 percent of our total wheel sales in 2015. Our OEM customers are not required to purchase any minimum amount of products from us. Increasingly global procurement practices, the pace of new vehicle introduction and demand for price reductions may make it more difficult to maintain long-term supply arrangements with our customers, and there are no guarantees that we will be able to negotiate supply arrangements with our customers on terms acceptable to us in the future. The contracts we have entered into with most of our customers provide that we will manufacture wheels for a particular vehicle model, rather than manufacture a specific quantity of products. Such contracts range from one year to the life of the model (usually three to five years), typically are non-exclusive, and do not require the purchase by the customer of any minimum number of wheels from us. Therefore, a significant decrease in consumer demand for certain key models or group of related models sold by any of our major customers, or a decision by a manufacturer not to purchase from us, or to discontinue purchasing from us, for a particular model or group of models, could adversely affect our results of operations and financial condition.

Our new operations at a recently constructed facility in Mexico may not achieve the expected benefits.

In anticipation of continued growth in demand for aluminum wheels in the North American market, we constructed a new manufacturing facility in Mexico. Initial commercial production at this facility began in early 2015. The new manufacturing facility entails a number of risks, including the ability to ramp-up commercial production within the cost and time-frame estimated and to attract a sufficient number of skilled workers to meet the needs of the new facility. Additionally, our assessment of the projected benefits associated with the construction of a new manufacturing facility is subject to a number of estimates and assumptions, including future demand for our products, which in turn are subject to significant economic, competitive and other uncertainties that are beyond our control. Operating results could be unfavorably impacted by start-up costs until production levels at the new facility reach planned levels. Additionally, our overall ability to increase total company revenues in the future can be affected by factors affecting the volume of products manufactured at our existing factories.

We experience continual pressure to reduce costs.

The vehicle market is highly competitive at the OEM level, which drives continual cost-cutting initiatives by our customers. Customer concentration, relative supplier fragmentation and product commoditization have translated into continual pressure from OEMs to reduce the price of our products. It is possible that pricing pressures beyond our expectations could intensify as OEMs pursue restructuring and cost-cutting initiatives. If we are unable to generate sufficient production cost savings in the future to offset such price reductions, our gross margin, rate of profitability and cash flows could be adversely affected. In addition, changes in OEMs' purchasing policies or payment practices could have an adverse effect on our business. Our OEM customers typically attempt to qualify more than one wheel supplier for the programs we participate in and for programs we may bid on in the future. As such, our OEM customers are able to negotiate favorable pricing or may decrease sales volume. Such actions may result in decreased sales volumes and unit price reductions for our company, resulting in lower revenues, gross profit, operating income and cash flows.

We operate in a highly competitive industry.

The automotive component supply industry is highly competitive, both domestically and internationally. Competition is based on a number of factors, including price, technology, quality, delivery and overall customer service and available capacity to meet

customer demands. Some of our competitors are companies, or divisions or subsidiaries of companies, which are larger and have greater financial and other resources than we do. We cannot ensure that our products will be able to compete successfully with the products of these competitors. In particular, our ability to increase manufacturing capacity typically requires significant investments in facilities, equipment and personnel. Our operating facilities are at full or near to full capacity levels which may cause us to incur labor costs at premium rates in order to meet customer requirements, experience increased maintenance expenses or require us to replace our machinery and equipment on an accelerated basis. Furthermore, the nature of the markets in which we compete has attracted new entrants, particularly from low cost countries. As a result, our sales levels and margins continue to be adversely affected by pricing pressures reflective of significant competition from producers located in low-cost foreign markets, such as China. Such competition with lower cost structures poses a significant threat to our ability to compete internationally and domestically. These factors have led to our customers awarding business to foreign competitors in the past, and they may continue to do so in the future. In addition, any of our competitors may foresee the course of market development more accurately, develop products that are superior to our products, have the ability to produce similar products at a lower cost, or adapt more quickly to new technologies or evolving customer requirements. Consequently, our products may not be able to compete successfully with competitors' products.

Our international operations make us vulnerable to risks associated with doing business in foreign countries.

We manufacture a substantial portion of our products in Mexico, have a minor investment in a wheel manufacturing company in India and we sell our products internationally. Accordingly, unfavorable changes in foreign cost structures, trade protection laws, regulations and policies affecting trade and investments and social, political, labor, or economic conditions in a specific country or region, among other factors, could have a negative effect on our business and results of operations. Legal and regulatory requirements differ among jurisdictions worldwide. Violations of these laws and regulations could result in fines, criminal sanctions, prohibitions on the conduct of our business, and damage to our reputation. Although we have policies, controls, and procedures designed to ensure compliance with these laws, our employees, contractors, or agents may violate our policies.

Fluctuations in foreign currencies may adversely impact our financial condition.

Due to the growth of our operations outside of the United States, we have experienced increased exposure to foreign currency gains and losses in the ordinary course of our business. As a result, fluctuations in the exchange rate between the U.S. dollar, the Mexican peso and any currencies of other countries in which we conduct our business may have a material impact on our financial condition, as cash flows generated in foreign currencies may be used, in part, to service our U.S. dollar-denominated liabilities, or vice versa.

In addition, due to customer requirements, we have experienced a significant shift in the currency denominated in our contracts with our customers. As a result of this change, we currently project that in 2016 and beyond the vast majority of our revenues will be denominated in the US dollar, rather than a more balanced mix of U.S. dollar and Mexican peso. In the past we have relied upon significant revenues denominated in the Mexican peso to provide a "natural hedge" against foreign exchange rate changes impacting our peso denominated costs incurred at our facilities in Mexico. Accordingly, the foreign exchange exposure associated with peso denominated costs is a growing risk and could have a material adverse effect on our operating results.

Fluctuations in foreign currency exchange rates may also affect the value of our foreign assets as reported in U.S. dollars, and may adversely affect reported earnings and, accordingly, the comparability of period-to-period results of operations. Changes in currency exchange rates may affect the relative prices at which we and our foreign competitors sell products in the same market. In addition, changes in the value of the relevant currencies may affect the cost of certain items required in our operations. We cannot ensure that fluctuations in exchange rates will not otherwise have a material adverse effect on our financial condition or results of operations, or cause significant fluctuations in quarterly and annual results of operations.

We may enter into foreign currency forward and option contracts with financial institutions to protect against foreign exchange risks associated with certain existing assets and liabilities, certain firmly committed transactions and forecasted future cash flows. We have implemented a program to hedge a portion of our material foreign exchange exposures, typically for up to 36 months. However, we may choose not to hedge certain foreign exchange exposures for a variety of reasons, including but not limited to accounting considerations and the prohibitive economic cost of hedging particular exposures. There is no guarantee that our hedge program will effectively mitigate our exposures to foreign exchange changes which could have material adverse effects on our cash flows and results of operations.

Increases in the costs and restrictions on availability of raw materials could adversely affect our operating margins and cash flow.

Generally, we obtain our raw materials, supplies and energy requirements from various sources. Although we currently maintain alternative sources, our business is subject to the risk of price increases and periodic delays in delivery. Fluctuations in the prices

of raw materials may be driven by the supply/demand relationship for that commodity or governmental regulation. In addition, if any of our suppliers seek bankruptcy relief or otherwise cannot continue their business as anticipated, the availability or price of raw materials could be adversely affected.

Although we are able to periodically pass certain aluminum cost increases on to our customers, we may not be able to pass along all changes in aluminum costs and our customers are not obligated to accept energy or other supply cost increases that we may attempt to pass along to them. In addition, fixed price natural gas contracts that expire in the future may expose us to higher costs that cannot be immediately recouped in selling prices. This inability to pass on these cost increases to our customers could adversely affect our operating margins and cash flow, possibly resulting in lower operating income and profitability.

Interruption in our production capabilities could reduce our operating results.

An interruption in production capabilities at any of our facilities as a result of equipment failure, interruption of raw materials or other supplies, labor disputes or other reasons could result in our inability to produce our products, which would reduce our sales and operating results for the affected period and harm our customer relationships. We have, from time to time, undertaken significant re-tooling and modernization initiatives at our facilities, which, in the past have caused, and in the future may cause, unexpected delays and plant underutilization, and such adverse consequences may continue to occur as we continue to modernize our production facilities. In addition, we generally deliver our products only after receiving the order from the customer and thus typically do not hold large inventories. In the event of a production interruption at any of our manufacturing facilities, even if only temporary, or if we experience delays as a result of events that are beyond our control, delivery times to our customers could be severely affected. Any significant delay in deliveries to our customers could lead to premium freight costs and other performance penalties, as well as contract cancellations, and cause us to lose future sales and expose us to other claims for damages. Our manufacturing facilities are also subject to the risk of catastrophic loss due to unanticipated events such as fires, earthquakes, explosions or violent weather conditions. We have in the past, and may in the future, experience plant shutdowns or periods of reduced production which could have a material adverse effect on our results of operations or financial condition.

Similarly, it also is possible that our customers may experience production delays or disruptions for a variety of reasons, which could include supply-chain disruption for parts other than wheels, equipment breakdowns or other events affecting vehicle assembly rates that impact us, work stoppages or slow-downs at factories where our products are consumed, or even catastrophic events such as fires, disruptive weather conditions or natural disasters. Such disruptions at the customer level may cause the affected customer to halt or limit the purchase of our products.

Aluminum and alloy pricing may have a material effect on our operating margins and results of operations.

The cost of aluminum is a significant component in the overall cost of a wheel and in our selling prices to OEM customers. The price for aluminum we purchase is adjusted monthly based primarily on changes in certain published market indices, but the timing of such adjustments is based on specific customer agreements and can vary from monthly to quarterly. As a result, the timing of aluminum price adjustments flowing through sales rarely will match the timing of such changes in cost, and can result in fluctuations to our gross profit. This is especially true during periods of frequent increases or decreases in the market price of aluminum.

The aluminum we use to manufacture wheels also contains additional alloying materials, including silicon. The cost of alloying materials also is a component of the overall cost of a wheel. The price of the alloys we purchase is also based on certain published market indices; however, most of our customer agreements do not provide price adjustments for changes in market prices of alloying materials. Increases or decreases in the market prices of these alloying materials could have a material effect on our operating margins and results of operations.

Implementing a new enterprise resource planning system could interfere with our business or operations.

We are in the process of implementing a new enterprise resource planning (ERP) system. This project requires a significant investment of capital and human resources, the re-engineering of many processes of our business, and the attention of many personnel who would otherwise be focused on other aspects of our business. Should the system not be implemented successfully, or if the system does not perform in a satisfactory manner once implementation is complete, our business and operations could be disrupted and our results of operations negatively affected, including our ability to report accurate and timely financial results.

We are from time to time subject to litigation, which could adversely impact our financial condition or results of operations.

The nature of our business exposes us to litigation in the ordinary course of our business. We are exposed to potential product liability and warranty risks that are inherent in the design, manufacture and sale of automotive products, the failure of which could result in property damage, personal injury or death. Accordingly, individual or class action suits alleging product liability or

warranty claims could result. Although we currently maintain what we believe to be suitable and adequate product liability insurance in excess of our self-insured amounts, we cannot assure you that we will be able to maintain such insurance on acceptable terms or that such insurance will provide adequate protection against potential liabilities. In addition, if any of our products prove to be defective, we may be required to participate in a recall. A successful claim brought against us in excess of available insurance coverage, if any, or a requirement to participate in any product recall, could have a material adverse effect on our results of operations or financial condition. We cannot give assurance that any current or future claims will not adversely affect our cash flows, financial condition or results of operations.

We may be unable to successfully implement cost-saving measures or achieve expected benefits under our plans to improve operations.

As part of our ongoing focus on being a low-cost provider of high quality products, we continually analyze our business to further improve our operations and identify cost-cutting measures. We may be unable to successfully identify or implement plans targeting these initiatives, or fail to realize the benefits of the plans we have already implemented, as a result of operational difficulties, a weakening of the economy or other factors. Cost reductions may not fully offset decreases in the prices of our products due to the time required to develop and implement cost reduction initiatives. Additional factors such as inconsistent customer ordering patterns, increasing product complexity and heightened quality standards are making it increasingly more difficult to reduce our costs. It is possible that as we incur costs to implement improvement strategies, the impact on our financial position, results of operations and cash flow may be negative.

We may be unable to successfully launch new products and/or achieve technological advances.

In order to effectively compete in the automotive supply industry, we must be able to launch new products and adopt technology to meet our customers' demand in a timely manner. However, we cannot ensure that we will be able to install and certify the equipment needed for new product programs in time for the start of production, or that the transitioning of our manufacturing facilities and resources under new product programs will not impact production rates or other operational efficiency measures at our facilities. In addition, we cannot ensure that our customers will execute the launch of their new product programs on schedule. We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, delays in product development and failure of products to operate properly. Further, changes in competitive technologies may render certain of our products obsolete or less attractive. Our ability to anticipate changes in technology and to successfully develop and introduce new and enhanced products on a timely basis will be a significant factor in our ability to remain competitive. Our failure to successfully and timely launch new products or adopt new technologies, or a failure by our customers to successfully launch new programs, could adversely affect our results. We cannot ensure that we will be able to achieve the technological advances that may be necessary for us to remain competitive or that certain of our products will not become obsolete.

We are subject to various environmental laws

We incur significant costs to comply with applicable environmental, health and safety laws and regulations in the ordinary course of our business. We cannot ensure that we have been or will be at all times in complete compliance with such laws and regulations. Failure to be in compliance with such laws and regulations could result in material fines or sanctions. Additionally, changes to such laws or regulations may have a significant impact on our cash flows, financial condition and results of operations.

We are also subject to various foreign, federal, state and local environmental laws, ordinances, and regulations, including those governing discharges into the air and water, the storage, handling and disposal of solid and hazardous wastes, the remediation of soil and groundwater contaminated by hazardous substances or wastes, and the health and safety of our employees. The nature of our current and former operations and the history of industrial uses at some of our facilities expose us to the risk of liabilities or claims with respect to environmental and worker health and safety matters which could have a material adverse effect on our financial health. In addition, some of our properties are subject to indemnification and/or cleanup obligations of third parties with respect to environmental matters. However, in the event of the insolvency or bankruptcy of such third parties, we could be required to bear the liabilities that would otherwise be the responsibility of such third parties.

Further, changes in legislation or regulation imposing reporting obligations on, or limiting emissions of greenhouse gases from, or otherwise impacting or limiting our equipment and operations or from the vehicles that use our products could adversely affect demand for those vehicles or require us to incur costs to become compliant with such regulations.

We may be unable to attract and retain key personnel.

Our success depends, in part, on our ability to attract, hire, train and retain qualified managerial, engineering, sales and marketing personnel. We face significant competition for these types of employees in our industry. We may be unsuccessful in attracting

and retaining the personnel we require to conduct our operations successfully. In addition, key personnel may leave us and compete against us. Our success also depends to a significant extent on the continued service of our senior management team. We may be unsuccessful in replacing key managers who either resign or retire. The loss of any member of our senior management team or other experienced senior employees could impair our ability to execute our business plans and strategic initiatives, cause us to lose customers and experience reduced net sales, or lead to employee morale problems and/or the loss of other key employees. In any such event, our financial condition, results of operations, internal control over financial reporting, or cash flows could be adversely affected.

Our share repurchase program may limit our flexibility to pursue other initiatives.

Although our existing cash and funds available under our senior secured credit facility are currently adequate to fund our approved common stock repurchase plan, dedication of our financial resources to the repurchase of outstanding shares will reduce our liquidity and working capital, which in turn may limit our flexibility to pursue other initiatives to grow our business or to return capital to our shareholders through other means. After making such expenditures, a significant change in our business, the economy or an unexpected decrease in our cash flow for any reason could result in the need for additional outside financing.

We may be unable to maintain effective internal control over financial reporting.

Management is responsible for establishing and maintaining adequate internal control over financial reporting. Many of our key controls rely on maintaining personnel with an appropriate level of accounting knowledge, experience and training in the application of accounting principles generally accepted in the United States of America in order to operate effectively. Material weaknesses or deficiencies may cause our financial statements to contain material misstatements, unintentional errors, or omissions, and late filings with regulatory agencies may occur.

A disruption in our information technology systems, including a disruption related to cybersecurity, could adversely affect our financial performance.

A cyber-attack that bypasses our information technology ("IT") security systems causing an IT security breach may lead to a material disruption of our IT business systems and/or the loss of business information resulting in adverse consequences to our business, including: an adverse impact on our operations due to the theft, destruction, loss, misappropriation or release of confidential data or intellectual property, operational or business delays resulting from the disruption of IT systems and subsequent clean-up and mitigation activities, an inability to timely prepare and file our financial reports with the Securities Exchange Commission and negative publicity resulting in reputation or brand damage with our customers, partners or industry peers.

We may be unable to successfully achieve expected benefits from our joint ventures or acquisitions.

As we continue to expand globally, we have engaged, and may continue to engage, in joint ventures and we may pursue acquisitions that involve potential risks, including failure to successfully integrate and realize the expected benefits of such joint ventures or acquisitions. Integrating acquired operations is a significant challenge and there is no assurance that we will be able to manage the integrations successfully. Failure to successfully integrate operations or to realize the expected benefits of such joint ventures or acquisitions may have an adverse impact on our results of operations and financial condition.

ITEM 1B - UNRESOLVED STAFF COMMENTS

None.

ITEM 2 - PROPERTIES

Our worldwide headquarters is located in Southfield, Michigan. We currently maintain and operate a total of five facilities that manufacture aluminum wheels for the automotive industry. Four of these five facilities are located in Chihuahua, Mexico and one facility is located in Fayetteville, Arkansas. One of the facilities in Chihuahua, Mexico is new, with construction completed in 2014. The new facility also produces aluminum wheels for the automotive industry, and production levels reached initial rated capacity in the fourth quarter of 2015. An expansion to this facility is in the process of being installed and is expected to be completed during the first quarter of 2016. Excluding the Rogers, Arkansas location which was closed in 2014, the five active facilities encompass 2,540,000 square feet of manufacturing space. We own all of our manufacturing facilities, and we lease one warehouse in Rogers, Arkansas and our worldwide headquarters located in Southfield, Michigan.

In general, our manufacturing facilities, which have been constructed at various times over the past several years, are in good operating condition and are adequate to meet our current production capacity requirements. There are active maintenance programs to keep these facilities in good condition, and we have an active capital spending program to replace equipment as needed to maintain factory reliability and remain technologically competitive on a worldwide basis.

Additionally, reference is made to Note 1 - Summary of Significant Accounting Policies, Note 8 - Property, Plant and Equipment and Note 11 - Leases and Related Parties, in Notes to the Consolidated Financial Statements in Item 8 - Financial Statements and Supplementary Data of this Annual Report.

ITEM 3 - LEGAL PROCEEDINGS

We are party to various legal and environmental proceedings incidental to our business. Certain claims, suits and complaints arising in the ordinary course of business have been filed or are pending against us. Based on facts now known, we believe all such matters are adequately provided for, covered by insurance, are without merit, and/or involve such amounts that would not materially adversely affect our consolidated results of operations, cash flows or financial position. See also under Item 1A - Risk Factors - Legal Proceedings of this Annual Report.

ITEM 4 - MINE SAFETY DISCLOSURES

Not applicable.

ITEM 4A - EXECUTIVE OFFICERS OF THE REGISTRANT

Information regarding executive officers who are also Directors is contained in our 2016 Annual Proxy Statement under the caption “Election of Directors.” Such information is incorporated into Part III, Item 10 - Directors, Executive Officers and Corporate Governance. With the exception of the Chief Executive Officer ("CEO"), all executive officers are appointed annually by the Board of Directors and serve at the will of the Board of Directors. For a description of the CEO’s employment agreement, see “Employment Agreements” in our 2016 Annual Proxy Statement, which is incorporated herein by reference.

Listed below are the name, age, position and business experience of each of our officers, as of the filing date, who are not directors:

|

| | | |

| | | Assumed |

Name | Age | Position | Position |

| | | |

Scot S. Bowie | 42 | Vice President and Corporate Controller | 2015 |

| | Corporate Controller, Black Diamond Equipment. | 2014 |

| | Chief Accounting Officer, Affinia Group Inc. | 2011 |

| | Corporate Controller of External Reporting, Affinia Group Inc. | 2008 |

| | | |

Parveen Kakar | 49 | Senior Vice President Sales, Marketing and Product Development | 2014 |

| | Senior Vice President, Corporate Engineering and Product Development | 2008 |

| | Vice President, Program Development | 2003 |

| | | |

| | | |

Lawrence R. Oliver | 51 | Senior Vice President, Manufacturing Operations | 2015 |

| | Vice President, Operations, GAF Materials Corporation | 2014 |

| | Vice President, Operations & Integrated Supply Chain, Ingersoll Rand PLC | 2011 |

| | General Manager and Director of Texas Operations, Residential, Commercial Water, ITT Corporation | 2009 |

| | | |

Kerry A. Shiba | 61 | Executive Vice President and Chief Financial Officer | 2010 |

| | Director - Ramsey Industries, LLC, a manufacturer of winches, truck mounted cranes and industrial drives | 2010 |

| | Senior Vice President and Chief Financial Officer - Remy International, a manufacturer of electrical automotive components | 2006 |

| | | |

James F. Sistek | 52 | Senior Vice President, Business Operations | 2014 |

| | and Systems | |

| | Chief Executive Officer and Founder - Infologic, Inc. | 2013 |

| | Vice President, Shared Services and Chief Information Officer - Visteon Corporation | 2009 |

PART II

ITEM 5 - MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Our common stock is traded on the New York Stock Exchange (symbol: SUP). We had approximately 417 shareholders of record and 25.4 million shares issued and outstanding as of March 4, 2016.

|

| | | | | | | | | | | |

| Superior Industries International, Inc. | | Russel 2000 | | Proxy Peers |

2011 | $ | 80 |

| | $ | 96 |

| | $ | 77 |

|

2012 | $ | 106 |

| | $ | 111 |

| | $ | 87 |

|

2013 | $ | 108 |

| | $ | 155 |

| | $ | 140 |

|

2014 | $ | 107 |

| | $ | 162 |

| | $ | 144 |

|

2015 | $ | 104 |

| | $ | 155 |

| | $ | 142 |

|

Dividends

Per share cash dividends declared totaled $0.72 during 2015 and 2014. Dividends declared and paid in 2013 totaled $0.20 per share and excluded an accelerated payment of the 2013 regular cash dividend that was paid in December 2012 equal to $0.16 per share. In the third quarter of 2013, the Board of Directors approved a $0.02 increase in the company's quarterly dividend to $0.18 per share from $0.16 per share, or on an annualized basis to $0.72 per share from $0.64 per share. Continuation of dividends is contingent upon various factors, including economic and market conditions, none of which can be accurately predicted, and the approval of our Board of Directors.

Quarterly Common Stock Price Information

The following table sets forth the high and low sales price per share of our common stock during the fiscal periods indicated.

|

| | | | | | | | | | | | | | | |

| 2015 | | 2014 |

| High | | Low | | High | | Low |

First Quarter | $ | 20.12 |

| | $ | 17.63 |

| | $ | 20.75 |

| | $ | 16.89 |

|

Second Quarter | $ | 19.68 |

| | $ | 18.17 |

| | $ | 21.77 |

| | $ | 18.82 |

|

Third Quarter | $ | 20.22 |

| | $ | 16.60 |

| | $ | 20.97 |

| | $ | 17.94 |

|

Fourth Quarter | $ | 20.45 |

| | $ | 17.75 |

| | $ | 20.25 |

| | $ | 17.04 |

|

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On March 27, 2013, our Board of Directors approved a new stock repurchase program (the "2013 Repurchase Program") authorizing the repurchase of up to $30.0 million of our common stock. Through December 31, 2014, we repurchased and retired 1,510,759 shares under the program at a total cost of $30.0 million under the 2013 Repurchase Program.

In October 2014, our Board of Directors approved a new stock repurchase program (the "2014 Repurchase Program") authorized the repurchase of up to $30.0 million of our common stock. Under the 2014 Repurchase Program, we repurchased common stock from time to time on the open market or in private transactions, totaling 1,056,954 shares of company stock at a cost of $19.6 million in 2015 and 585,970 shares for $10.3 million in January 2016.

In January of 2016, our Board of Directors approved a new stock repurchase program (the “2016 Repurchase Program”), authorizing the repurchase of up to an additional $50.0 million of common stock. Under the 2016 Repurchase Program, we may repurchase common stock from time to time on the open market or in private transactions. The timing and extent of the repurchases under the 2016 Repurchase Program will depend upon market conditions and other corporate considerations in our sole discretion.

Recent Sales of Unregistered Securities

During the fiscal year 2015, there were no sales of unregistered securities.

In 2015, we withheld 12,260 shares at an average price per share of $19.36 for withholding taxes pertaining to a grant of common stock and the vesting of shares of restricted stock.

ITEM 6 - SELECTED FINANCIAL DATA

The following selected consolidated financial data should be read in conjunction with Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations and Item 8 - Financial Statements and Supplementary Data of this Annual Report.

Our fiscal year is the 52- or 53-week period ending generally on the last Sunday of the calendar year. The fiscal years 2015, 2014, 2013 and 2011 comprised the 52-week periods ended on December 27, 2015, December 28, 2014, December 29, 2013, and December 25, 2011, respectively. The 2012 fiscal year comprised the 53-week period ended December 30, 2012. For convenience of presentation, all fiscal years are referred to as beginning as of January 1, and ending as of December 31, but actually reflect our financial position and results of operations for the periods described above.

|

| | | | | | | | | | | | | | | | | | | | |

Fiscal Year Ended December 31, | | 2015 | | 2014 | | 2013 | | 2012 | | 2011 |

Income Statement (000s) | | | | | | | | | | |

Net sales | | $ | 727,946 |

| | $ | 745,447 |

| | $ | 789,564 |

| | $ | 821,454 |

| | $ | 822,172 |

|

Value added sales (1) | | $ | 360,846 |

| | $ | 369,355 |

| | $ | 400,591 |

| | $ | 397,915 |

| | $ | 380,120 |

|

Closure and Impairment Costs (2) | | $ | 7,984 |

| | $ | 8,429 |

| | $ | — |

| | $ | — |

| | $ | 1,337 |

|

Gross profit | | $ | 71,217 |

| | $ | 50,222 |

| | $ | 64,061 |

| | $ | 60,607 |

| | $ | 67,060 |

|

Income from operations | | $ | 36,294 |

| | $ | 17,913 |

| | $ | 34,593 |

| | $ | 32,880 |

| | $ | 39,835 |

|

Income before income taxes | | | | |

| | |

| | |

| | |

|

and equity earnings | | $ | 35,283 |

| | $ | 15,702 |

| | $ | 36,841 |

| | $ | 34,489 |

| | $ | 41,926 |

|

Income tax (provision) benefit (3) | | $ | (11,339 | ) | | $ | (6,899 | ) | | $ | (14,017 | ) | | $ | (3,598 | ) | | $ | 25,243 |

|

Adjusted EBITDA (4) | | $ | 76,053 |

| | $ | 55,753 |

| | $ | 63,616 |

| | $ | 59,599 |

| | $ | 69,700 |

|

Net income | | $ | 23,944 |

| | $ | 8,803 |

| | $ | 22,824 |

| | $ | 30,891 |

| | $ | 67,169 |

|

Balance Sheet (000s) | | | | |

| | |

| | |

| | |

|

Current assets | | $ | 245,820 |

| | $ | 276,011 |

| | $ | 384,218 |

| | $ | 404,908 |

| | $ | 404,283 |

|

Current liabilities | | $ | 73,862 |

| | $ | 71,962 |

| | $ | 99,430 |

| | $ | 66,578 |

| | $ | 68,550 |

|

Working capital | | $ | 171,958 |

| | $ | 204,049 |

| | $ | 284,788 |

| | $ | 338,330 |

| | $ | 335,733 |

|

Total assets | | $ | 539,929 |

| | $ | 579,910 |

| | $ | 653,388 |

| | $ | 599,601 |

| | $ | 593,231 |

|

Long-term debt | | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

Shareholders' equity | | $ | 413,912 |

| | $ | 439,006 |

| | $ | 483,063 |

| | $ | 466,905 |

| | $ | 460,515 |

|

Financial Ratios | | | | |

| | |

| | |

| | |

|

Current ratio (5) | | 3.3:1 |

| | 3.8:1 |

| | 3.9:1 |

| | 6.1:1 |

| | 5.9:1 |

|

Return on average shareholders' equity (6) | | 5.6 | % | | 1.9 | % | | 4.8 | % | | 6.7 | % | | 15.4 | % |

Share Data | | | | |

| | |

| | |

| | |

|

Net income | | | | |

| | |

| | |

| | |

|

- Basic | | $ | 0.90 |

| | $ | 0.33 |

| | $ | 0.83 |

| | $ | 1.13 |

| | $ | 2.48 |

|

- Diluted | | $ | 0.90 |

| | $ | 0.33 |

| | $ | 0.83 |

| | $ | 1.13 |

| | $ | 2.46 |

|

Shareholders' equity at year-end | | $ | 15.86 |

| | $ | 16.42 |

| | $ | 17.79 |

| | $ | 17.11 |

| | $ | 16.96 |

|

Dividends declared | | $ | 0.72 |

| | $ | 0.72 |

| | $ | 0.20 |

| | $ | 1.12 |

| | $ | 0.64 |

|

(1) Value added sales is a key measure that is not calculated according to U.S. generally accepted accounting principles (“GAAP”). In the discussion of operating results, we provide information regarding value added sales. Value added sales represents net sales less the value of aluminum and services provided by outside service providers that are included in net sales. As discussed further below, arrangements with our customers allow us to pass on changes in aluminum prices and outside service provider costs; therefore, fluctuations in underlying aluminum prices and the use of outside service providers generally do not directly impact our profitability. Accordingly, value added sales is worthy of being highlighted for the benefit of users of our financial statements. Our intent is to allow users of the financial statements to consider our net sales information both with and without the aluminum and outside service provider cost components thereof. During 2015, we modified the presentation of value added sales to also exclude third-party manufacturing costs passed directly through to customers and retrospectively applied this modification to 2011 thru 2014. See the Non-GAAP financial measures section of this annual report for reconciliation of value added sales to net sales.

(2) See Note 2 - Restructuring in Notes to Consolidated Financial Statements in Item 8 - Financial Statements and Supplementary Data in this Annual Report for a discussion of restructuring charges. During 2015, we completed the shutdown of the Rogers facility which resulted in a gross margin loss of $8.0 million. We incurred $4.3 million in restructuring costs related to an impairment of fixed assets and other associated costs such as asset relocation costs. Additionally, we incurred $2.0 million of further closure costs including carrying costs for the closed facility and $1.7 million in depreciation. The adjusted EBITDA impact of the Rogers facility closure for 2015 was $6.3 million, which includes the $4.3 million of restructuring costs and $2.0 million of carrying costs related to the closed facility. The carrying costs for the closed facility are not included in restructuring line in the Consolidated Income Statements of our Consolidated Financial Statements. During 2014, we had $8.4 million of restructuring costs related to the closure of the Rogers facility.

(3) See Note 10 - Income Taxes in Notes to Consolidated Financial Statements in Item 8 - Financial Statements and Supplementary Data in this Annual Report for a discussion of material items impacting the 2015, 2014 and 2013 income tax provisions.

(4) Adjusted EBITDA is a key measure that is not calculated according to GAAP. Adjusted EBITDA is defined as earnings before interest income and expense, income taxes, depreciation, amortization, restructuring and other closure costs and impairments of long-lived assets and investments. We use Adjusted EBITDA as an important indicator of the operating performance of our business. We use Adjusted EBITDA in internal forecasts and models when establishing internal operating budgets, supplementing the financial results and forecasts reported to our board of directors and evaluating short-term and long-term operating trends in our operations. We believe the Adjusted EBITDA financial measure assists in providing a more complete understanding of our underlying operational measures to manage our business, to evaluate our performance compared to prior periods and the marketplace, and to establish operational goals. We believe that these non-GAAP financial adjustments are useful to investors because they allow investors to evaluate the effectiveness of the methodology and information used by management in our financial and operational decision-making. Adjusted EBITDA is a non-GAAP financial measure and should not be considered in isolation or as a substitute for financial information provided in accordance with GAAP. This non-GAAP financial measure may not be computed in the same manner as similarly titled measures used by other companies. See the Non-GAAP Financial Measures section of this annual report for a reconciliation of our Adjusted EBITDA to net income.

(5) The current ratio is current assets divided by current liabilities.

(6) Return on average shareholders' equity is net income divided by average shareholders' equity. Average shareholders' equity is the beginning of the year shareholders' equity plus the end of year shareholders' equity divided by two.

ITEM 7 - MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our Consolidated Financial Statements and the Notes to the Consolidated Financial Statements included in Item 8 - Financial Statements and Supplementary Data in this Annual Report. This discussion contains forward-looking statements, which involve risks and uncertainties. For cautions about relying on such forward-looking statements, please refer to the section entitled “Forward Looking Statements” at the beginning of this Annual Report immediately prior to Item 1. Our actual results could differ materially from those anticipated in the forward-looking statements as a result of certain factors, including but not limited to those discussed in Item 1A - Risk Factors and elsewhere in this Annual Report.

Executive Overview

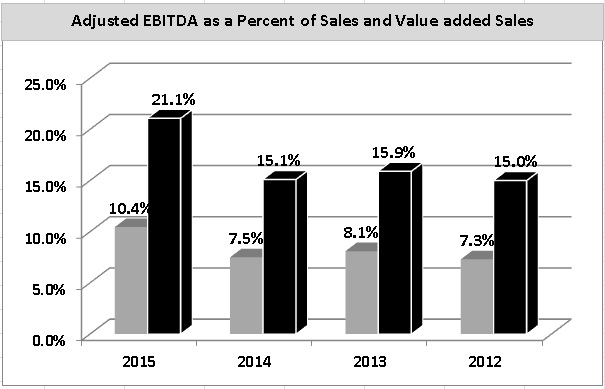

Adjusted EBITDA as a percent of value added sales grew to 21.1% in 2015 from 15.1% in 2014 as our initiatives to reduce costs in the current year and the prior year were realized. During the fourth quarter of 2014, we opened a new facility in Mexico and closed an older facility in Rogers. We ramped up the new facility to full capacity by the end of 2015. The new facility expands our capacity to take on new business and includes a state of the art paint facility, which improves our competitive position in higher value-added products. The transition of unit production to our operations in Mexico after the closure of the Rogers manufacturing facility and other cost-cutting initiatives resulted in a 14% decrease in manufacturing labor cost per wheel in 2015 when compared with 2014. The Company continued its strategic initiatives by moving its headquarters to Southfield, Michigan from California. This move brought all of its corporate departments together in one location, in order to be closer to and better serve its customers. The total estimated costs related to the relocation were approximately $4 million and were mainly incurred during the third and fourth quarters of 2015. Excluding the relocation costs, EBITDA as a percent of value added sales would have been 22.2%. The chart below illustrates the EBITDA margin improvement in the current year.

We continue to focus on research and development to further customize our products and expand our market share.

We anticipate in 2016 that with our new plant at full capacity for the entire year we will continue to see improvements. During 2015, we completed the shutdown of the Rogers facility, which resulted in a gross margin loss of $8.0 million. We incurred $4.3 million in restructuring costs related to an impairment of fixed assets and other associated costs such as asset relocation costs. Additionally, we also experienced $2.0 million of further closure costs including inefficiencies and $1.7 million in depreciation. The adjusted EBITDA impact of the Rogers facility closure for 2015 was $6.3 million, which includes the $4.3 million of restructuring costs and $2.0 million of inefficiency costs related to the closure.

Overall North American production of passenger cars and light-duty trucks in 2015 was reported by industry publications as being flat versus 2014, with production of light-duty trucks which includes pick-up trucks, SUV's, vans and "crossover vehicles"--increasing 5 percent with production of passenger cars decreasing 1 percent. Current production levels of the North American automotive industry now have reached the highest level in the past decade. Results for 2015, 2014 and 2013 reflect the continuing trend of growth since the 2009 recession. Current economic conditions and low consumer interest rates have been generally supportive of market growth and, in addition, the continuing high levels in the average age of vehicles on the road appears to be contributing to higher rates of vehicle replacement.

Net sales in 2015 decreased $17.5 million to $727.9 million from $745.4 million in 2014. Wheel sales in 2015 decreased $15.4 million to $721.1 million from $736.5 million in 2014, while our wheel unit shipments increased 0.1 million to 11.2 million in 2015. Value added sales in 2015 decreased $8.6 million to $360.8 million from $369.4 million in 2014. See the Non-GAAP Financial Measures section of this annual report for a reconciliation of value added sales to net sales.

Gross profit in 2015 was $71.2 million, or 10 percent of net sales, compared to $50.2 million, or 7 percent of net sales, in 2014. Net income for 2015 was $23.9 million, or $0.90 per diluted share, including income tax expense of $11.3 million, compared to net income in 2014 of $8.8 million, or $0.33 per diluted share, which included an income tax expense of $6.9 million. Net income as a percentage of net sales was 3 percent in 2015, as compared to 1 percent in 2014. Adjusted EBITDA as a percentage of value added sales in 2015 was 21 percent, as compared to 15 percent in 2014. See the Non-GAAP Financial Measures section of this annual report for a reconciliation of Adjusted EBITDA to net income, and value added sales to net sales.

The comparisons below of 2015 and 2014 operating results reflect higher margins due primarily to the impacts of the company’s cost reduction efforts. The comparisons below of 2014 and 2013 operating results reflect the impact of costs in 2014 totaling $12.2 million ($8.6 million after tax, or $0.32 per share) associated with several items including the closure of our Rogers facility, the sale of the company's two aircraft and the impairment of an investment in an unconsolidated subsidiary located in India. Adjustments for the Rogers facility closure reduced gross profit $8.4 million, while adjustments for the aircraft added charges totaling $1.3 million in SG&A and a $2.5 million impairment charge for the investment in the unconsolidated Indian subsidiary

is included in other income (expense). Lower costs in 2013 resulted from several factors including improved equipment and manufacturing process reliability as a result of capital reinvestment and more rigorous maintenance programs.

We continue to focus on programs to reduce costs overall through improved operational and procurement practices, capital reinvestment and more rigorous factory maintenance to improve equipment reliability. These investments typically consisted of equipment upgrades and other capital projects focused on improving equipment reliability, increasing production efficiency and enhancing manufacturing process control to better accommodate newer, more complex wheel programs. While our capital investment projects decreased in 2015 following significant increases in 2014 and 2013 resulting from the construction of the new plant in Mexico, it is possible that capital expenditure levels will continue at 2015 levels as we continue to focus on achieving further improvement to operational efficiencies and manufacturing process capability.

We announced in 2013 our plans to build a new manufacturing facility in Mexico. Initial commercial production began the first quarter of 2015 and reached initial rated capacity during the fourth quarter. We began a project to expand production capacity at this facility which we expect to be completed during the first quarter of 2016. The total costs incurred to date were $132.7 million of which $127.0 million related to the initial rated capacity of the new facility and $5.7 million related to the expansion.

Committed to enhance shareholder value, in March 2013, our Board of Directors approved the 2013 Repurchase Program, authorizing the repurchase of up to $30.0 million of our common stock. Under the 2013 Repurchase Program we repurchased 1,510,759 shares of company stock at a cost of $30.0 million of which 1,089,560 shares were repurchased for $21.8 million in 2014. In October 2014, our Board of Directors approved the 2014 Repurchase Program, authorizing the repurchase of up to $30.0 million of our common stock. Under the 2014 Repurchase Program, we repurchased 1,056,954 shares of company stock at a cost of $19.6 million in 2015 and 585,970 shares for $10.3 million in January 2016. In January of 2016, our Board of Directors approved the 2016 Repurchase Program, authorizing the repurchase of up to $50.0 million of common stock.

We established a senior secured revolving credit facility in December 2014. The facility provides an initial aggregate principal amount of $100.0 million. In addition, the company is entitled to request, under the terms and conditions of the agreement, an increase in the aggregate revolving commitments under the facility or to obtain incremental term loans in an aggregate amount not to exceed $50.0 million, which currently is uncommitted to by any lenders. At December 31, 2015, we had no borrowings under the facility.

Listed in the table below are several key indicators we use to monitor our financial condition and operating performance.

Results of Operations

|

| | | | | | | | | | | | | |

Fiscal Year Ended December 31, | | 2015 | | 2014 | | 2013 | |

(Thousands of dollars, except per share amounts) | | | | | | |

Net sales | | $ | 727,946 |

| | $ | 745,447 |

| | $ | 789,564 |

| |

Value added sales (1) | | $ | 360,846 |

| | $ | 369,355 |

| | $ | 400,591 |

| |

Gross profit | | $ | 71,217 |

| | $ | 50,222 |

| | $ | 64,061 |

| |

Percentage of net sales | | 9.8 | % | | 6.7 | % | | 8.1 | % | |

Income from operations | | $ | 36,294 |

| | $ | 17,913 |

| | $ | 34,593 |

| |

Percentage of net sales | | 5.0 | % | | 2.4 | % | | 4.4 | % | |

Adjusted EBITDA (2) | | $ | 76,053 |

| | $ | 55,753 |

| | $ | 63,616 |

| |

Percentage of net sales (3) | | 10.4 | % | | 7.5 | % | | 8.1 | % | |

Percentage of value added sales (4) | | 21.1 | % | | 15.1 | % | | 15.9 | % | |

Net income | | $ | 23,944 |

| | $ | 8,803 |

| | $ | 22,824 |

| |

Percentage of net sales | | 3.3 | % | | 1.2 | % | | 2.9 | % | |

Diluted earnings per share | | $ | 0.90 |

| | $ | 0.33 |

| | $ | 0.83 |

| |