Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 25, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 1-5418

SUPERVALU INC.

(Exact name of registrant as specified in its charter)

| DELAWARE | 41-0617000 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 7075 FLYING CLOUD DRIVE EDEN PRAIRIE, MINNESOTA |

55344 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (952) 828-4000

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $1.00 per share | New York Stock Exchange | |

| Preferred Share Purchase Rights | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company ¨ |

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of September 9, 2011 was approximately $1,576,822,212 (based upon the closing price of registrant’s Common Stock on the New York Stock Exchange).

As of April 13, 2012, there were 212,256,863 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of registrant’s definitive Proxy Statement filed for the registrant’s 2012 Annual Meeting of Stockholders are incorporated by reference into Part III, as specifically set forth in Part III.

Table of Contents

SUPERVALU INC.

Annual Report on Form 10-K

2

Table of Contents

CAUTIONARY STATEMENTS FOR PURPOSES OF THE SAFE HARBOR PROVISIONS OF THE SECURITIES LITIGATION REFORM ACT

Any statements contained in this Annual Report on Form 10-K regarding the outlook for the Company’s businesses and their respective markets, such as projections of future performance, guidance, statements of the Company’s plans and objectives, forecasts of market trends and other matters, are forward-looking statements based on the Company’s assumptions and beliefs. Such statements may be identified by such words or phrases as “will likely result,” “are expected to,” “will continue,” “outlook,” “will benefit,” “is anticipated,” “estimate,” “project,” “management believes” or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, SUPERVALU INC. claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events.

Certain factors could cause the Company’s future results to differ materially from those expressed or implied in any forward-looking statements contained in this Annual Report on Form 10-K. These factors include the factors discussed in Part I, Item 1A of this Annual Report on Form 10-K under the heading “Risk Factors,” the factors discussed below and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive.

Competitive Practices

| — | The Company’s ability to attract and retain customers |

| — | Competition from other food or drug retail chains, supercenters, non-traditional competitors and alternative formats in the Company’s markets |

| — | Competition for employees, store sites and products |

| — | The ability of the Company’s Independent business to maintain or increase sales due to wholesaler competition or increased customer self-distribution |

| — | Changes in demographics or consumer preferences that affect consumer spending or buying habits |

| — | The success of the Company’s promotional and sales programs and the Company’s ability to respond to the promotional and pricing practices of competitors |

Execution of Initiatives

| — | The Company’s ability to execute customer-focused initiatives designed to support the Company’s vision of becoming “America’s Neighborhood Grocer” and its “8 Plays to Win” strategy |

| — | The effectiveness of cost reduction strategies |

| — | The adequacy of the Company’s capital resources to fund new store growth and remodeling activities that achieve appropriate returns on capital investment |

| — | The effectiveness of the Company’s price investment strategy |

Substantial Indebtedness

| — | The impact of the Company’s substantial indebtedness on its business and financial flexibility |

| — | The Company’s ability to comply with debt covenants or to refinance the Company’s debt obligations |

| — | A downgrade in the Company’s debt ratings, which may increase the cost of borrowing or adversely affect the Company’s ability to access one or more financial markets |

| — | The availability of favorable credit and trade terms |

| — | The Company’s review of all relevant factors under Delaware law prior to the repurchase of Company stock or payment of dividends in light of recent changes to the Company’s stockholders’ equity |

3

Table of Contents

Economic Conditions

| — | Continued volatility in the economy and financial markets due to uncertainties related to energy costs, availability of credit, difficulties in the banking and financial sectors, the decline in the housing market, the low level of consumer confidence and high unemployment rates that affect consumer spending or buying habits |

| — | Increases in unemployment, healthcare costs, energy costs and commodity prices, which could impact consumer spending or buying habits and the cost of doing business |

| — | Changes in interest rates |

| — | Food and drug inflation or deflation |

Labor Relations

| — | The Company’s ability to renegotiate labor agreements with its unions |

| — | Resolution of issues associated with rising pension, healthcare and employee benefits costs |

| — | Potential for work disruption from labor disputes |

Employee Benefit Costs

| — | Increased operating costs resulting from rising employee benefit costs and pension funding obligations |

| — | Required funding of multiemployer pension plans |

Governmental Regulations

| — | The ability to timely obtain permits, comply with government regulations or make capital expenditures required to maintain compliance with government regulations |

| — | Changes in applicable laws and regulations that impose additional requirements or restrictions on the operation of the Company’s businesses |

Food Safety

| — | Events that give rise to actual or potential food contamination, drug contamination or foodborne illness or any adverse publicity relating to these types of concerns, whether or not valid |

Self-Insurance

| — | Variability in actuarial projections regarding workers’ compensation, automobile and general liability |

| — | Potential increase in the number or severity of claims for which the Company is self-insured |

Legal and Administrative Proceedings

| — | Unfavorable outcomes in litigation, governmental or administrative proceedings or other disputes |

| — | Adverse publicity related to such unfavorable outcomes |

Information Technology

| — | Dependence of the Company’s businesses on computer hardware and software systems which are vulnerable to security breach by computer hackers and cyber terrorists |

| — | Difficulties in developing, maintaining or upgrading information technology systems |

| — | Business disruptions or losses resulting from data theft, information espionage, or other criminal activity directed at the Company’s computer or communications systems |

Severe Weather, Natural Disasters and Adverse Climate Changes

| — | Property damage or business disruption resulting from severe weather conditions and natural disasters that affect the Company and the Company’s customers or suppliers |

| — | Unseasonably adverse climate conditions that impact the availability or cost of certain products in the grocery supply chain |

4

Table of Contents

Goodwill and Intangible Asset Impairment Charges

| — | Unfavorable changes in the Company’s industry, the broader economy, market conditions, business operations, competition or the Company’s stock price and market capitalization |

Accounting Matters

| — | Changes in accounting standards that impact the Company’s financial statements |

5

Table of Contents

PART I

| ITEM 1. | BUSINESS |

General

SUPERVALU INC. (“SUPERVALU” or the “Company”), a Delaware corporation, was organized in 1925 as the successor to two wholesale grocery firms established in the 1870’s. The Company’s principal executive offices are located at 7075 Flying Cloud Drive, Eden Prairie, Minnesota 55344 (Telephone: 952-828-4000). All references to the “Company,” “we,” “us,” “our” and “SUPERVALU” relate to SUPERVALU INC. and its majority-owned subsidiaries.

SUPERVALU is one of the largest companies in the United States retail grocery channel. Additionally, the Company is one of the largest wholesale distributors to Independent retail customers across the United States.

On June 2, 2006, the Company acquired New Albertson’s, Inc. (“New Albertsons”) consisting of the core supermarket businesses (the “Acquired Operations”) formerly owned by Albertson’s, Inc. (“Albertsons”) operating approximately 1,125 stores under the banners of Acme, Albertsons, Jewel-Osco, Shaw’s, Star Market, the related in-store pharmacies under the Osco and Sav-on banners, 10 distribution centers and certain regional and corporate offices (the “Acquisition”). As part of the Acquisition, the Company acquired the Acme, Albertsons, Jewel, Osco, Sav-on and Shaw’s trademarks and tradenames (the “Acquired Trademarks”). The Acquisition greatly increased the size of the Company.

SUPERVALU is focused on long-term retail growth through business transformation to meet the demands of each neighborhood the Company serves, and targeted store remodels and new store development in the hard-discount format. During fiscal 2012, the Company added 83 new stores through new store development and closed or sold 43 stores, including planned disposals. The Company leverages its distribution operations by providing wholesale distribution and logistics and service solutions to its independent retail customers through its Independent business segment.

The Company makes available free of charge at its internet website (www.supervalu.com) its annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) as soon as reasonably practicable after such material is electronically filed with or furnished to the Securities and Exchange Commission (the “SEC”). Information on the Company’s website is not deemed to be incorporated by reference into this Annual Report on Form 10-K. The Company will also provide its SEC filings free of charge upon written request to Investor Relations, SUPERVALU INC., P.O. Box 990, Minneapolis, MN 55440.

All dollar and share amounts in this Annual Report on Form 10-K are in millions, except per share data and where otherwise noted.

Financial Information About Reportable Segments

The Company’s business is classified by management into two reportable segments: Retail food and Independent business (formerly Supply chain services). These reportable segments are two distinct businesses, one retail and one wholesale, each with a different customer base, marketing strategy and management structure. The Retail food reportable segment is an aggregation of the Company’s two retail operating segments, which are organized based on format (traditional retail food stores and hard-discount food stores). The Retail food reportable segment derives revenues from the sale of groceries at retail locations operated by the Company (both the Company’s own stores and stores licensed by the Company). The Independent business reportable segment derives revenues from wholesale distribution to independently-owned retail food stores and other customers (collectively referred to as “independent retail customers”). Substantially all of the Company’s operations are domestic. Refer to the Consolidated Segment Financial Information set forth in Part II, Item 8 of this Annual Report on Form 10-K for financial information concerning the Company’s operations by reportable segment.

6

Table of Contents

Retail Food

The Company conducts its Retail food operations through a total of 2,434 traditional and hard-discount retail food stores, including 935 licensed Save-A-Lot stores, located throughout the United States. The Company’s Retail food operations are supplied by 22 dedicated distribution centers and nine distribution centers that are part of the Independent business segment providing wholesale distribution to both the Company’s own stores and stores of independent retail customers.

The Company operates 1,102 traditional retail food stores which range in size from approximately 40,000 to 60,000 square feet and operate under the Acme, Albertsons, Cub Foods, Farm Fresh, Hornbacher’s, Jewel-Osco, Lucky, Shaw’s, Shop ’n Save, Shoppers Food & Pharmacy and Star Market banners which have strong local and regional brand recognition in the markets in which they operate. The Company’s traditional retail food stores provide an extensive grocery offering and, depending on size, a variety of additional products including, general merchandise, health and beauty care, and pharmacy.

The Company owns 397 hard-discount food stores operating under the Save-A-Lot banner and licenses an additional 935 Save-A-Lot stores to independent operators. Save-A-Lot is one of the leading retailers in the U.S. hard-discount grocery-retailing sector. Save-A-Lot food stores typically are approximately 15,000 square feet in size, and stock primarily custom-branded high-volume food items generally in a single size for each product sold.

Independent Business

The Company’s Independent business segment primarily provides wholesale distribution of products to independent retailers and is the largest public company food wholesaler in the nation. The Company’s Independent business network spans 47 states and serves as primary grocery supplier to approximately 1,900 stores of independent retail customers, in addition to the Company’s own stores, as well as serving as secondary grocery supplier to approximately 760 stores of independent retail customers. The Company’s wholesale distribution customers include single and multiple grocery store independent operators, regional and national chains, mass merchants and the military.

The Company has established a network of strategically located distribution centers utilizing a multi-tiered logistics system. The network includes facilities that carry slow turn or fast turn groceries, perishables, general merchandise and health and beauty care products. The network is comprised of 22 distribution facilities, nine of which supply the Company’s own stores in addition to stores of independent retail customers. Deliveries to retail stores are made from the Company’s distribution centers by Company-owned trucks, third-party independent trucking companies or customer-owned trucks. In addition, the Company provides certain facilitative services between its independent retailers and vendors related to products that are delivered directly by suppliers to retail stores under programs established by the Company. These services include sourcing, invoicing and payment services.

Products

The Company offers a wide variety of nationally advertised brand name and private-label products, primarily including grocery (both perishable and nonperishable), general merchandise and health and beauty care, and pharmacy, which are sold through the Company’s own and licensed retail food stores to shoppers and through its Independent business segment to independent retail customers. The Company believes that it has adequate and alternative sources of supply for most of its purchased products. The Company’s Net sales include the product sales of the Company’s own stores, product sales to stores licensed by the Company and product sales of the Company’s Independent business segment to independent retail customers.

7

Table of Contents

The following table provides additional detail on the percentage of Net sales for each group of similar products sold in the Retail food and Independent business segments:

| 2012 | 2011 | 2010 | ||||||||||

| Retail food: |

||||||||||||

| Nonperishable grocery products (1) |

42 | % | 41 | % | 43 | % | ||||||

| Perishable grocery products (2) |

22 | 22 | 21 | |||||||||

| Pharmacy products |

6 | 6 | 6 | |||||||||

| General merchandise and health and beauty care products (3) |

5 | 5 | 5 | |||||||||

| Fuel |

1 | 2 | 2 | |||||||||

| Other |

1 | 1 | 1 | |||||||||

|

|

|

|

|

|

|

|||||||

| 77 | 77 | 78 | ||||||||||

| Independent business: |

||||||||||||

| Product sales to independent retail customers |

23 | 22 | 22 | |||||||||

| Services to independent retail customers |

— | 1 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| 23 | 23 | 22 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Net sales |

100 | % | 100 | % | 100 | % | ||||||

|

|

|

|

|

|

|

|||||||

| (1) | Includes such items as dry goods, beverages, dairy, frozen foods and candy |

| (2) | Includes such items as meat, produce, deli and bakery |

| (3) | Includes such items as household products, over-the-counter medication, beauty care, personal care, seasonal items and tobacco |

Private-Label Products

The Company’s private-label products are produced to the Company’s specification by many suppliers and compete in many areas of the Company’s stores. Private-label products include: the premium brand Culinary Circle™, which offers unique, premium quality products in highly competitive categories; first tier brands, including Essential Everyday™, Wild Harvest™, Flavorite™, Richfood™, equaline™, HomeLife™ and several others, which provide shoppers quality national brand equivalent products at a competitive price; and the value brand, Shopper’s Value™, which offers budget conscious consumers a quality alternative to national brands at substantial savings.

Trademarks

The Company offers some independent retail customers the opportunity to franchise a concept or license a service mark. This program helps these customers compete by providing, as part of the franchise or license program, a complete business concept, group advertising, private-label products and other benefits. The Company is the franchisor or licensor of certain service marks such as CUB FOODS, SAVE-A-LOT, SENTRY, FESTIVAL FOODS, COUNTY MARKET, SHOP ’N SAVE, NEWMARKET, FOODLAND, JUBILEE, SUPERVALU and SUPERVALU PHARMACIES.

In connection with the Acquisition, the Company entered into a trademark license agreement with Albertson’s LLC, the purchaser of the non-core supermarket business of Albertsons, under which Albertson’s LLC may use legacy Albertsons trademarks, such as ALBERTSONS, SAV-ON and LUCKY. Under the trademark license agreement, Albertson’s LLC is also allowed to enter into sublicense agreements with transferees of Albertson’s LLC stores, which allows such transferees to use many of the same legacy Albertsons trademarks.

8

Table of Contents

The Company registers a substantial number of its trademarks/service marks in the United States Patent and Trademark Office, including many of its private-label product trademarks and service marks. U.S. trademark and service mark registrations are generally for a term of 10 years, renewable every 10 years as long as the trademark is used in the regular course of trade. The Company considers certain of its trademarks and service marks to be of material importance to its Retail food and Independent business segments and actively defends and enforces such trademarks and service marks.

Working Capital

Normal operating fluctuations in working capital balances can result in changes to cash flow from operations presented in the Consolidated Statements of Cash Flows that are not necessarily indicative of long-term operating trends. There are no unusual industry practices or requirements relating to working capital items.

Competition

The Company’s Retail food and Independent business segments are highly competitive. The Company believes that the success of its Retail food and Independent business segments are dependent upon the ability of its own stores and stores licensed by the Company, as well as the stores of independent retail customers it supplies, to compete successfully with other retail food stores. Principal competition comes from traditional grocery retailers, including regional and national chains and independent food store operators, and non-traditional retailers, such as supercenters, membership warehouse clubs, specialty supermarkets, drug stores, discount stores, dollar stores, convenience stores and restaurants. The Company believes that the principal competitive factors faced by its own stores and stores licensed by the Company, as well as the stores of independent retail customers it supplies, include price, quality, assortment, brand recognition, store location, in-store marketing and merchandising, promotional strategies and other competitive activities.

The traditional wholesale distribution component of the Company’s Independent business segment competes directly with a number of traditional grocery wholesalers. The Company believes it competes in this business on the basis of price, quality, assortment, schedule and reliability of deliveries, service fees and distribution facility locations.

Employees

As of February 25, 2012, the Company had approximately 130,000 employees. Approximately 84,000 employees are covered by collective bargaining agreements. During fiscal 2012, 56 collective bargaining agreements covering approximately 38,000 employees were renegotiated and 32 collective bargaining agreements covering approximately 5,500 employees expired without their terms being renegotiated. Negotiations are expected to continue with the bargaining units representing the employees subject to those expired agreements. During fiscal 2013, 76 collective bargaining agreements covering approximately 36,000 employees will expire. The majority of employees covered by these expiring collective bargaining agreements are located in Midwestern markets. The Company is focused on ensuring competitive cost structures in each market in which it operates while meeting its employees’ needs for attractive wages and affordable healthcare and retirement benefits. The Company believes that it has generally good relations with its employees and with the labor unions that represent employees covered by collective bargaining agreements. Upon the expiration of collective bargaining agreements with employees, work stoppages could occur if we are unable to negotiate new contracts. A prolonged work stoppage at a significant number of stores may have a material impact on the Company’s business, financial condition or results of operations.

9

Table of Contents

EXECUTIVE OFFICERS OF THE COMPANY

The following table provides certain information concerning the executive officers of the Company as of April 18, 2012.

| Name |

Age | Present Position |

Calendar Year Elected to Present Position |

Other Positions Recently Held with the Company or | ||||

| Craig R. Herkert (1) |

52 | Chief Executive Officer and President | 2009 | |||||

| Leon G. Bergmann (2) |

44 | Senior Vice President and President Independent Business | 2011 | President, Independent Business, 2011; President, Independent Sales, Marketing and Merchandising, 2011 | ||||

| Michael Moore (3) |

47 | Executive Vice President, Chief Marketing Officer | 2012 | Business Transformation Officer | ||||

| Janel S. Haugarth |

56 | Executive Vice President; Merchandising and Logistics | 2011 | Executive Vice President; President and Chief Operating Officer Independent business, 2006-2011 | ||||

| J. Andrew Herring |

53 | Executive Vice President Real Estate, Market Development and Legal | 2010 | Executive Vice President Market and Real Estate Development, 2010; Senior Vice President Real Estate and Store Development, 2006-2010 | ||||

| Keith E. Kravcik (4) |

51 | Group Vice President, Controller | 2011 | |||||

| David E. Pylipow |

54 | Executive Vice President, Human Resources and Communications | 2006 | |||||

| Wayne R. Shurts (5) |

52 | Executive Vice President and Chief Information Officer | 2010 | |||||

| Sherry M. Smith |

50 | Executive Vice President and Chief Financial Officer | 2010 | Senior Vice President, Finance, 2002-2010 | ||||

| Peter J. Van Helden |

51 | Executive Vice President; President, Retail Operations | 2009 | Executive Vice President, Retail West, 2007-2009; Senior Vice President; President, Retail West, 2006-2007 | ||||

| (1) | Craig R. Herkert was appointed Chief Executive Officer in May 2009 and President in August 2009. Prior to joining the Company, Mr. Herkert served as President and CEO of the Americas for Wal-Mart Stores, Inc., from 2004 to 2009. |

| (2) | Prior to joining the Company, Leon G. Bergmann served in a number of positions with C&S Wholesale Grocers, Inc. from 2005 to 2011 most recently as it Senior Vice President, Sales & Customer Service from 2009 to 2011. |

10

Table of Contents

| (3) | Michael Moore was appointed Executive Vice President, Chief Marketing Officer in January 2012. Prior to joining the Company, Mr. Moore served in a number of roles at Procter & Gamble from 1987 to 2011, most recently as its Director of Customer Business Development from 2007 to 2011. |

| (4) | Keith E. Kravcik was appointed to Group Vice President, Controller and Corporate Officer effective April 2011. Prior to joining the Company Mr. Kravcik was Corporate Vice President and Controller for McDonald’s USA, LLC from 2004-2010. |

| (5) | Wayne R. Shurts was appointed Executive Vice President and Chief Information Officer in November 2010. Prior to joining the Company, Mr. Shurts was the Global Chief Information Officer for Cadbury plc from 2008 to 2010 and the Senior Vice President of Cadbury Schweppes Americas from 2006 to 2008. |

The term of office of each executive officer is from one annual meeting of the Board of Directors until the next annual meeting of Board of Directors or until a successor is elected. There are no arrangements or understandings between any executive officer of the Company and any other person pursuant to which any executive officer was selected as an officer of the Company. There are no family relationships between or among any of the executive officers of the Company.

Each of the executive officers of the Company has been in the employ of the Company or its subsidiaries for more than five consecutive years, except for Craig R. Herkert, Leon Bergmann, Michael Moore, Keith E. Kravcik, and Wayne R. Shurts.

| ITEM 1A. | RISK FACTORS |

Various risks and uncertainties may affect the Company’s business. Any of the risks described below or elsewhere in this Annual Report on Form 10-K or the Company’s other SEC filings may have a material impact on the Company’s business, financial condition or results of operations.

Competition in the Retail food and Independent business segments

The grocery business is intensely competitive. The Company’s Retail food segment faces competition for customers, employees, store sites and products from traditional grocery retailers, including regional and national chains and independent food store operators, and non-traditional retailers, such as supercenters, membership warehouse clubs, specialty supermarkets, drug stores, discount stores, dollar stores, convenience stores and restaurants. The Company’s ability to differentiate itself from its competitors and create an attractive value proposition for its customers is dependent upon a combination of price, quality, assortment, brand perception, store location, in-store marketing and merchandising and promotional strategies. The grocery industry is also characterized by relatively small gross margins, and the nature and extent to which the Company’s competitors implement various pricing and promotional activities in response to increasing competition and the Company’s response to these competitive actions, can adversely affect profitability.

The Company’s Independent business segment is primarily wholesale distribution, which competes with traditional grocery wholesalers on the basis of price, quality, assortment, schedule and reliability of deliveries, service fees and distribution facility locations. The profitability of the Independent business segment is dependent upon sufficient volume to support the Company’s operating infrastructure, and the loss of customers to a competing wholesaler, closure or vertical integration may negatively impact the Company’s sales and gross margin.

Execution of initiatives

The Company is positioned in the retail food industry as the only traditional food retailer with multiple formats and ownership models that can be used to address differing customer needs across the United States. Management believes that this diversity of go-to-market options differentiates the Company and is part of its vision of becoming “America’s Neighborhood Grocer” and the Company’s “8 Plays to Win” strategy. The “8

11

Table of Contents

Plays to Win” strategy’s business initiatives include providing simplified business processes, funding for price investment and liquidity, greater customer value offerings, fresher products, including produce, business flexibility to meet the demands of their neighborhood and a hassle free customer experience, expanding the Company’s presence, and aligning the Company with its independent retail customers. The Company plans to roll out price investments across its banners, increase the number of hard-discount stores and to reinvest in its existing retail store base through remodels and merchandising initiatives tailored to the unique needs of each particular store’s neighborhood. If the Company is unable to execute on these initiatives, the Company’s financial condition and results of operations may be adversely affected.

Substantial indebtedness

The Company has, and expects to continue to have, a substantial amount of debt. The Company’s substantial indebtedness may increase the Company’s borrowing costs and decrease the Company’s business flexibility, making it more vulnerable to adverse economic conditions. For example, high levels of debt could:

| • | require the Company to use a substantial portion of its cash flow from operations for the payment of principal and interest on its indebtedness, thereby reducing the availability of cash flow to fund working capital, capital expenditures, acquisitions, and other purposes; |

| • | limit the Company’s ability to obtain, or increase the cost at which the Company is able to obtain financing in order to refinance existing indebtedness and fund working capital, capital expenditures, acquisitions and other purposes; |

| • | limit the Company’s ability to adjust to changing business and market conditions placing the Company at a competitive disadvantage relative to its competitors that have less debt; and |

| • | in combination with recent reductions to the book value of the Company’s stockholders’ equity on the Company’s balance sheet and its associated surplus under Delaware law, require consideration of additional factors prior to repurchasing stock or paying dividends. |

There are various financial covenants and other restrictions in the Company’s debt instruments. If the Company fails to comply with any of these requirements, the related indebtedness (and other unrelated indebtedness) could become due and payable prior to its stated maturity and the Company may not be able to repay the indebtedness that becomes due. A default under the Company’s debt instruments may also significantly affect the Company’s ability to obtain additional or alternative financing.

The Company’s ability to comply with the covenants or to refinance the Company’s obligations with respect to the Company’s indebtedness will depend on the Company’s operating and financial performance, which in turn is subject to prevailing economic conditions and to financial, business and other factors beyond the Company’s control. In particular, the uncertainties of the global economy and capital markets may impact the Company’s ability to obtain debt financing. These conditions and factors may also negatively impact the Company’s debt ratings, which may increase the cost of borrowing, adversely affect the Company’s ability to access one or more financial markets or result in a default under the Company’s debt instruments.

Any of these outcomes may adversely affect the Company’s financial condition and results of operations.

Current economic conditions

All of the Company’s store locations are located in the United States making its results highly dependent on U.S. consumer confidence and spending habits. The U.S. economy has experienced economic volatility in recent years due to uncertainties related to higher unemployment rates, energy costs, a decline in the housing market, and

12

Table of Contents

limited availability of credit, all of which have contributed to suppressed consumer confidence. Consumer spending has declined as consumers trade down to a less expensive mix of products and seek out discounters for grocery items. In addition, inflation continues to be unpredictable; food deflation could reduce sales growth and earnings, while food inflation, combined with reduced consumer spending, could reduce gross profit margins. If these consumer spending patterns continue or worsen, along with an ongoing soft economy, the Company’s financial condition and results of operations may be adversely affected.

Labor relations

As of February 25, 2012, the Company is a party to 224 collective bargaining agreements covering approximately 84,000 of its employees, of which 76 collective bargaining agreements covering approximately 36,000 employees are scheduled to expire in fiscal 2013. These expiring agreements cover approximately 42 percent of the Company’s union-affiliated employees. In addition, during fiscal 2012, 32 collective bargaining agreements covering approximately 5,500 employees expired without their terms being renegotiated. Negotiations are expected to continue with the bargaining units representing the employees subject to those agreements. In future negotiations with labor unions, the Company expects that, among other issues, rising healthcare, pension and employee benefit costs will be important topics for negotiation. There can be no assurance that the Company will be able to negotiate the terms of expiring or expired agreements in a manner acceptable to the Company. Therefore, potential work disruptions from labor disputes could disrupt the Company’s businesses and adversely affect the Company’s financial condition and results of operations.

Costs of employee benefits

The Company provides health benefits and sponsors defined pension, defined contribution pension, and other postretirement plans for substantially all employees not participating in multiemployer health and pension plans. The Company’s costs to provide such benefits continue to increase annually. The Company uses actuarial valuations to determine the Company’s benefit obligations for certain benefit plans, which require the use of significant estimates, including the discount rate, expected long-term rate of return on plan assets, mortality rates, and the rates of increase in compensation and health care costs. Changes to these significant estimates could increase the cost of these plans, which could also have a material adverse effect on the Company’s financial condition and results of operations.

The Company’s largest defined benefit pension plan is closed for eligibility and frozen for credited benefit service for the vast majority of participants effective December 2007. In December 2012 that plan will be frozen as to credited service and earnings for the vast majority of participants, although vesting service may continue to accrue. The other Company sponsored defined benefit pension plan covers a group of employees whose employment terms are governed by a collective bargaining agreement and is not frozen. The projected benefit obligations of the Company sponsored plans exceed the fair value of those plans’ assets. Required contributions have increased in recent years due to a combination of lower pension discount rates, the effect of the Pension Protection Act of 2006 and lower actual return on plan assets resulting from the significant decline in financial markets during fiscal 2008 and 2009.

In addition, the Company participates in various multiemployer health and pension plans for a majority of its union-affiliated employees, and the Company is required to make contributions to these plans in amounts established under collective bargaining agreements. The costs of providing benefits through such plans have increased in recent years. The amount of any increase or decrease in the Company’s required contributions to these multiemployer plans will depend upon many factors, including the outcome of collective bargaining, actions taken by trustees who manage the plans, government regulations, the actual return on assets held in the plans and the potential payment of a withdrawal liability if the Company chooses to exit a market. Increases in the costs of benefits under these plans coupled with adverse developments in the stock and capital markets that have reduced the return on plan assets have caused most multiemployer plans in which the Company participates to be underfunded. The unfunded liabilities of these plans may result in increased future payments by the

13

Table of Contents

Company and the other participating employers. Underfunded multiemployer pension plans may impose a surcharge requiring additional pension contributions. The Company’s risk of such increased payments may be greater if any of the participating employers in these underfunded plans withdraws from the plan due to insolvency and is not able to contribute an amount sufficient to fund the unfunded liabilities associated with its participants in the plan. The Great Atlantic & Pacific Tea Company (“A&P”) emerged from bankruptcy on February 28, 2012, and is a participant in five multiemployer plans with the Company. Each of those multiemployer plans has filed a claim as an unsecured creditor under A&P’s Plan of Reorganization for withdrawal liability incurred prior to A&P’s emergence from bankruptcy. Based on the information available to the Company the resolution of those claims and the impact of the A&P bankruptcy on the Company’s future payments or unfunded liabilities is not currently probable or reasonably estimable. A significant increase to funding requirements could adversely affect the Company’s financial condition, results of operations or cash flows.

If the Company is unable to control healthcare benefits and pension costs, the Company may experience increased operating costs, which may adversely affect the Company’s financial condition and results of operations.

Governmental regulations

The Company’s businesses are subject to various federal, state and local laws, regulations and administrative practices. These laws require the Company to comply with numerous provisions regulating health and sanitation standards, equal employment opportunity, employee benefits, minimum wages and licensing for the sale of food, drugs and alcoholic beverages. The Company’s inability to timely obtain permits, comply with government regulations or make capital expenditures required to maintain compliance with governmental regulations may adversely impact the Company’s business operations and prospects for future growth and its ability to participate in federal and state healthcare programs. In addition, the Company cannot predict the nature of future laws, regulations, interpretations or applications, nor can the Company determine the effect that additional governmental regulations or administrative orders, when and if promulgated, or disparate federal, state and local regulatory schemes would have on the Company’s future business. They may, however, impose additional requirements or restrictions on the products the Company sells or manner in which the Company operates its businesses. Any or all of such requirements may adversely affect the Company’s financial condition and results of operations.

Food and drug safety concerns and related unfavorable publicity

There is increasing governmental scrutiny and public awareness regarding food and drug safety. The Company may be adversely affected if consumers lose confidence in the safety and quality of the Company’s food and drug products. Any events that give rise to actual or potential food contamination, drug contamination or food-borne illness may result in product liability claims and a loss of consumer confidence. In addition, adverse publicity about these types of concerns whether valid or not, may discourage consumers from buying the Company’s products or cause production and delivery disruptions, which may adversely affect the Company’s financial condition and results of operations.

Insurance claims

The Company uses a combination of insurance and self-insurance to provide for potential liabilities for workers’ compensation, automobile and general liability, property insurance and employee healthcare benefits. The Company estimates the liabilities associated with the risks retained by the Company, in part, by considering historical claims experience, demographic and severity factors and other actuarial assumptions which, by their nature, are subject to a degree of variability. Any actuarial projection of losses concerning workers’ compensation and general and automobile liability is subject to a degree of variability. Among the causes of this variability are unpredictable external factors affecting future inflation rates, discount rates, litigation trends, legal interpretations, benefit level changes and actual claim settlement patterns.

14

Table of Contents

Some of the many sources of uncertainty in the Company’s reserve estimates include changes in benefit levels, medical fee schedules, medical utilization guidelines, vocation rehabilitation and apportionment. If the number or severity of claims for which the Company’s self-insured increases, or the Company is required to accrue or pay additional amounts because the claims prove to be more severe than the Company’s original assessments, the Company’s financial condition and results of operations may be adversely affected.

Legal Proceedings

The Company’s businesses are subject to the risk of legal proceedings by employees, consumers, suppliers, stockholders, governmental agencies or others through private actions, class actions, administrative proceedings, regulatory actions or other litigation. The outcome of litigation, particularly class action lawsuits and regulatory actions, is difficult to assess or quantify. Plaintiffs in these types of lawsuits may seek recovery of very large or indeterminate amounts, and the magnitude of the potential loss relating to such lawsuits may remain unknown for substantial periods of time. The cost to defend future litigation may be significant. There may also be adverse publicity associated with litigation that may decrease consumer confidence in the Company’s businesses, regardless of whether the allegations are valid or whether the Company is ultimately found liable. As a result, litigation may adversely affect the Company’s financial condition and results of operations.

Information technology systems

The efficient operation of the Company’s businesses is dependent on computer hardware and software systems. Information systems are vulnerable to security breach by computer hackers and cyber terrorists. The Company relies on industry accepted security measures and technology to securely maintain confidential and proprietary information maintained on the Company’s information systems, and continues to invest in maintaining and upgrading the systems and applications to ensure risk is controlled. However, these measures and technology may not adequately prevent security breaches. In addition, the unavailability of the information systems or failure of these systems to perform as anticipated for any reason could disrupt the Company’s business and could result in decreased performance and increased overhead costs, causing the Company’s business and results of operations to suffer.

Additionally, the Company’s businesses involve the receipt and storage of personal information about the Company’s customers. Data theft, information espionage or other criminal activity directed at the grocery or drug store industry, the transportation industry, or computer or communications systems may adversely affect the Company’s businesses by causing the Company to implement costly security measures in recognition of actual or potential threats, by requiring the Company to expend significant time and resources developing, maintaining or upgrading technology systems and by causing the Company to incur significant costs to reimburse third parties for damages. If the Company experiences a data security breach, it could be exposed to governmental enforcement actions and private litigation. The Company may also lose credibility with its customers, resulting in lost future sales.

Weather and natural disasters

Severe weather conditions such as hurricanes, earthquakes or tornadoes, as well as other natural disasters, in areas in which the Company has stores or distribution facilities or from which the Company obtains products may cause physical damage to the Company’s properties, closure of one or more of the Company’s stores or distribution facilities, lack of an adequate work force in a market, temporary disruption in the supply of products, disruption in the transport of goods, delays in the delivery of goods to the Company’s distribution centers or stores and a reduction in the availability of products in the Company’s stores. In addition, adverse climate conditions and adverse weather patterns, such as drought or flood, that impact growing conditions and the quantity and quality of crops yielded by food producers may adversely affect the availability or cost of certain products within the grocery supply chain. Any of these factors may disrupt the Company’s businesses and adversely affect the Company’s financial condition and results of operations.

15

Table of Contents

Impairment charges for goodwill or other intangible assets

The Company is required to annually test goodwill and intangible assets with indefinite useful lives, including the goodwill associated with past acquisitions and any future acquisitions, to determine if impairment has occurred. Additionally, interim reviews are performed whenever events or changes in circumstances indicate that impairment may have occurred. If the testing performed indicates that impairment has occurred, the Company is required to record a non-cash impairment charge for the difference between the carrying value of the goodwill or other intangible assets and the implied fair value of the goodwill or other intangible assets in the period the determination is made.

The testing of goodwill and other intangible assets for impairment requires the Company to make significant estimates about its weighted average cost of capital, future revenue, profitability, cash flows, fair value of assets and liabilities, as well as other assumptions. These estimates may be affected by significant variability, including potential changes in economic, industry or market conditions, changes in business operations, changes in competition or changes in the Company’s stock price and market capitalization. Changes in these factors, or changes in actual performance compared with estimates of the Company’s future performance, may affect the fair value of goodwill or other intangible assets, which may result in an impairment charge. The Company cannot accurately predict the amount and timing of any impairment of assets. Should the value of goodwill or other intangible assets become impaired, the Company’s financial condition and results of operations may be adversely affected.

Changes in accounting standards

Accounting principles generally accepted in the Unites States of America (“accounting standards”) and interpretations by various governing bodies, including the SEC, for many aspects of the Company’s business, such as accounting for insurance and self-insurance, inventories, goodwill and intangible assets, store closures, leases, income taxes and stock-based compensation, are complex and involve subjective judgments. Changes in these rules or their interpretation may significantly change or add volatility to the Company’s reported earnings without a comparable underlying change in cash flow from operations. As a result, changes in accounting standards may materially impact the Company’s financial condition and results of operations.

| ITEM 1B. | UNRESOLVED STAFF COMMENTS |

None.

| ITEM 2. | PROPERTIES |

Total retail square footage as of February 25, 2012 was 64 million, of which approximately 62 percent was leased. In addition to its principal executive offices in Eden Prairie, Minnesota, the Company maintains store support centers in Boise, Idaho and St. Louis, Missouri. Additional information on the Company’s properties can be found in Part I, Item 1 of this Annual Report on Form 10-K. The Company’s properties are in good condition, well maintained and suitable to carry on its business.

| ITEM 3. | LEGAL PROCEEDINGS |

The Company is subject to various lawsuits, claims and other legal matters that arise in the ordinary course of conducting business. In the opinion of management, based upon currently-available facts, it is remote that the ultimate outcome of any lawsuits, claims and other proceedings will have a material adverse effect on the overall results of the Company’s operations, its cash flows or its financial position.

In September 2008, a class action complaint was filed against the Company, as well as International Outsourcing Services, LLC (“IOS”), Inmar, Inc., Carolina Manufacturer’s Services, Inc., Carolina Coupon Clearing, Inc. and

16

Table of Contents

Carolina Services, in the United States District Court in the Eastern District of Wisconsin. The plaintiffs in the case are a consumer goods manufacturer, a grocery co-operative and a retailer marketing services company who allege on behalf of a purported class that the Company and the other defendants (i) conspired to restrict the markets for coupon processing services under the Sherman Act and (ii) were part of an illegal enterprise to defraud the plaintiffs under the Federal Racketeer Influenced and Corrupt Organizations Act. The plaintiffs seek monetary damages, attorneys’ fees and injunctive relief. The Company intends to vigorously defend this lawsuit, however all proceedings have been stayed in the case pending the result of the criminal prosecution of certain former officers of IOS.

In December 2008, a class action complaint was filed in the United States District Court for the Western District of Wisconsin against the Company alleging that a 2003 transaction between the Company and C&S Wholesale Grocers, Inc. (“C&S”) was a conspiracy to restrain trade and allocate markets. In the 2003 transaction, the Company purchased certain assets of the Fleming Corporation as part of Fleming Corporation’s bankruptcy proceedings and sold certain assets of the Company to C&S which were located in New England. Since December 2008, three other retailers have filed similar complaints in other jurisdictions. The cases have been consolidated and are proceeding in the United States District Court for the District of Minnesota. The complaints allege that the conspiracy was concealed and continued through the use of non-compete and non-solicitation agreements and the closing down of the distribution facilities that the Company and C&S purchased from the other. Plaintiffs are seeking monetary damages, injunctive relief and attorneys’ fees. The Company is vigorously defending these lawsuits. Separately from these civil lawsuits, on September 14, 2009, the United States Federal Trade Commission (“FTC”) issued a subpoena to the Company requesting documents related to the C&S transaction as part of the FTC’s investigation into whether the Company and C&S engaged in unfair methods of competition. The Company cooperated with the FTC. On March 18, 2011, the FTC notified the Company that it has determined that no additional action is warranted by the FTC and that it has closed its investigation.

Predicting the outcomes of claims and litigation and estimating related costs and exposures involves substantial uncertainties that could cause actual outcomes, costs and exposures to vary materially from current expectations. The Company regularly monitors its exposure to the loss contingencies associated with these matters and may from time to time change its predictions with respect to outcomes and its estimates with respect to related costs and exposures. With respect to the two matters discussed above, the Company believes the chance of a negative outcome is remote. It is possible, although management believes it is remote, that material differences in actual outcomes, costs and exposures relative to current predictions and estimates, or material changes in such predictions or estimates, could have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

| ITEM 4. | MINE SAFETY DISCLOSURES |

Not applicable.

17

Table of Contents

PART II

| ITEM 5. | MARKET FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s common stock is listed on the New York Stock Exchange under the symbol SVU. As of April 13, 2012, there were 20,614 stockholders of record.

Common Stock Price

| Common Stock Price Range | Dividends Declared Per Share |

|||||||||||||||||||||||

| 2012 | 2011 | 2012 | 2011 | |||||||||||||||||||||

| Fiscal | High | Low | High | Low | ||||||||||||||||||||

| First Quarter |

$ | 11.77 | $ | 7.18 | $ | 17.89 | $ | 11.93 | $ | 0.0875 | $ | 0.0875 | ||||||||||||

| Second Quarter |

9.71 | 6.40 | 13.16 | 9.67 | 0.0875 | 0.1750 | ||||||||||||||||||

| Third Quarter |

8.75 | 6.26 | 12.45 | 8.38 | 0.0875 | — | ||||||||||||||||||

| Fourth Quarter |

8.57 | 6.58 | 9.87 | 7.06 | 0.0875 | 0.0875 | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

| Year |

11.77 | 6.26 | 17.89 | 7.06 | $ | 0.3500 | $ | 0.3500 | ||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||

Dividend payment dates are on or about the 15th day of March, June, September and December, subject to the Board of Directors approval.

Company Purchases of Equity Securities

The following table sets forth the Company’s purchases of equity securities for the periods indicated:

| (in millions, except shares and per share Period (1) |

Total Number of Shares Purchased (2) |

Average Price Paid Per Share |

Total Number of Shares Purchased as Part of Publicly Announced Treasury Stock Purchase Program (3) |

Approximate Dollar Value of Shares that May Yet be Purchased Under the Treasury Stock Purchase Program (3) |

||||||||||||

| First four weeks |

||||||||||||||||

| December 4, 2011 to December 31, 2011 |

19,500 | $ | 7.17 | — | $ | — | ||||||||||

| Second four weeks |

||||||||||||||||

| January 1, 2012 to January 28, 2012 |

835 | $ | 7.59 | — | $ | — | ||||||||||

| Third four weeks |

||||||||||||||||

| January 29, 2012 to February 25, 2012 |

1,845 | $ | 6.96 | — | $ | — | ||||||||||

|

|

|

|

|

|||||||||||||

| Totals |

22,180 | $ | 7.16 | — | $ | — | ||||||||||

|

|

|

|

|

|||||||||||||

| (1) | The reported periods conform to the Company’s fiscal calendar composed of thirteen 28-day periods. The fourth quarter of fiscal 2012 contains three 28-day periods. |

| (2) | These amounts include the deemed surrender by participants in the Company’s compensatory stock plans of 22,180 shares of previously issued common stock. These are in payment of the purchase price for shares acquired pursuant to the exercise of stock options and satisfaction of tax obligations arising from such exercises, as well as from the vesting of restricted stock awards granted under such plans. |

| (3) | On June 24, 2010, the Board of Directors of the Company adopted and announced a new annual share repurchase program authorizing the Company to purchase up to $70 of the Company’s common stock. Stock purchases will be made from the cash generated from the settlement of stock options. This annual authorization program replaced the previously existing share purchase program and expired June 30, 2011. |

18

Table of Contents

Stock Performance Graph

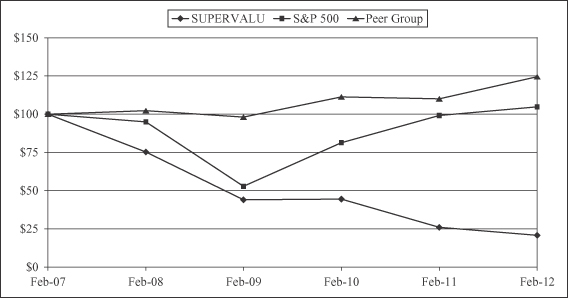

The following graph compares the yearly change in the Company’s cumulative shareholder return on its common stock for the period from the end of fiscal 2007 to the end of fiscal 2012 to that of the Standard & Poor’s (“S&P”) 500 and a group of peer companies in the retail grocery industry. The stock price performance shown below is not necessarily indicative of future performance.

COMPARISON OF CUMULATIVE TOTAL SHAREHOLDER RETURN AMONG

SUPERVALU, S&P 500 AND PEER GROUP (1)

February 23, 2007 through February 24, 2012 (2)

| Date |

SUPERVALU | S&P 500 | Peer Group (3) | |||||||||

| February 23, 2007 |

$ | 100.00 | $ | 100.00 | $ | 100.00 | ||||||

| February 22, 2008 |

$ | 75.39 | $ | 95.03 | $ | 102.45 | ||||||

| February 27, 2009 |

$ | 44.06 | $ | 52.97 | $ | 98.16 | ||||||

| February 26, 2010 |

$ | 44.48 | $ | 81.37 | $ | 111.34 | ||||||

| February 25, 2011 |

$ | 26.03 | $ | 99.18 | $ | 110.11 | ||||||

| February 24, 2012 |

$ | 20.90 | $ | 104.84 | $ | 124.69 | ||||||

| (1) | Total return assuming $100 invested on February 23, 2007 and reinvestment of dividends on the day they were paid. |

| (2) | The Company’s fiscal year ends on the last Saturday in February. |

| (3) | The Company’s peer group consists of Delhaize Group SA, Koninklijke Ahold NV, The Kroger Co., Safeway Inc. and Wal-Mart Stores, Inc. Great Atlantic & Pacific Tea Company, Inc. was a member of the Company’s peer group prior to fiscal 2012 but was removed due to their bankruptcy proceedings. |

The performance graph above is being furnished solely to accompany this Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K, is not being filed for purposes of Section 18 of the Exchange Act, and is not to be incorporated by reference into any filing of the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

19

Table of Contents

| ITEM 6. | SELECTED FINANCIAL DATA |

| (Dollars and shares in millions, except |

2012 (52 weeks) |

2011 (52 weeks) |

2010 (52 weeks) |

2009 (53 weeks) |

2008 (52 weeks) |

|||||||||||||||

| Operating Results |

||||||||||||||||||||

| Net sales |

$ | 36,100 | $ | 37,534 | $ | 40,597 | $ | 44,564 | $ | 44,048 | ||||||||||

| Identical store retail sales increase (decrease) (1) |

(2.8 | )% | (6.0 | )% | (5.1 | )% | (1.2 | )% | 0.5 | % | ||||||||||

| Cost of sales |

28,081 | 29,124 | 31,444 | 34,451 | 33,943 | |||||||||||||||

| Selling and administrative expenses |

7,106 | 7,516 | 7,952 | 8,746 | 8,421 | |||||||||||||||

| Goodwill and intangible asset impairment charges (2) |

1,432 | 1,870 | — | 3,524 | — | |||||||||||||||

| Operating earnings (loss) |

(519 | ) | (976 | ) | 1,201 | (2,157 | ) | 1,684 | ||||||||||||

| Interest expense, net |

509 | 547 | 569 | 622 | 707 | |||||||||||||||

| Earnings (loss) before income taxes |

(1,028 | ) | (1,523 | ) | 632 | (2,779 | ) | 977 | ||||||||||||

| Income tax provision (benefit) |

12 | (13 | ) | 239 | 76 | 384 | ||||||||||||||

| Net earnings (loss) |

(1,040 | ) | (1,510 | ) | 393 | (2,855 | ) | 593 | ||||||||||||

| Net earnings (loss) as a percent of net sales |

(2.88 | )% | (4.02 | )% | 0.97 | % | (6.41 | )% | 1.35 | % | ||||||||||

| Net earnings (loss) per share—diluted |

(4.91 | ) | (7.13 | ) | 1.85 | (13.51 | ) | 2.76 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Financial Position |

||||||||||||||||||||

| Inventories (FIFO) (3) |

$ | 2,492 | $ | 2,552 | $ | 2,606 | $ | 2,967 | $ | 2,956 | ||||||||||

| Working capital (3) |

(23 | ) | (84 | ) | (192 | ) | (109 | ) | (280 | ) | ||||||||||

| Property, plant and equipment, net |

6,362 | 6,604 | 7,026 | 7,528 | 7,533 | |||||||||||||||

| Total assets |

12,053 | 13,758 | 16,436 | 17,604 | 21,062 | |||||||||||||||

| Debt and capital lease obligations |

6,256 | 6,751 | 7,635 | 8,484 | 8,833 | |||||||||||||||

| Stockholders’ equity |

21 | 1,340 | 2,887 | 2,581 | 5,953 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Statistics |

||||||||||||||||||||

| Return on average stockholders’ equity |

(103.55 | )% | (76.36 | )% | 14.42 | % | (59.32 | )% | 10.44 | % | ||||||||||

| Book value per share |

$ | 0.10 | $ | 6.32 | $ | 13.62 | $ | 12.19 | $ | 28.13 | ||||||||||

| Current ratio (3) |

0.99:1 | 0.98:1 | 0.95:1 | 0.98:1 | 0.94:1 | |||||||||||||||

| Debt to capital ratio (4) |

99.7 | % | 83.4 | % | 72.6 | % | 76.7 | % | 59.7 | % | ||||||||||

| Dividends declared per share |

$ | 0.3500 | $ | 0.3500 | $ | 0.6100 | $ | 0.6875 | $ | 0.6750 | ||||||||||

| Weighted average shares outstanding—diluted |

212 | 212 | 213 | 211 | 215 | |||||||||||||||

| Depreciation and amortization |

$ | 884 | $ | 925 | $ | 957 | $ | 1,057 | $ | 1,017 | ||||||||||

| Capital expenditures (5) |

$ | 700 | $ | 604 | $ | 691 | $ | 1,212 | $ | 1,227 | ||||||||||

| Retail stores as of fiscal year end (6) |

2,434 | 2,394 | 2,349 | 2,421 | 2,474 | |||||||||||||||

20

Table of Contents

| (1) | The change in identical store sales is calculated as the change in net sales for stores operating for four full quarters, including store expansions and excluding fuel and planned store dispositions. Fiscal 2008 identical store sales are calculated as if the Acquired Operations stores were in the identical store base for four full quarters in fiscal 2008 and 2007. |

| (2) | The Company recorded goodwill and intangible asset impairment charges of $1,432 before tax ($1,292 after tax, or $6.10 per diluted share) in fiscal 2012, $1,870 before tax ($1,743 after tax, or $8.23 per diluted share) in fiscal 2011 and $3,524 before tax ($3,326 after tax, or $15.71 per diluted share) in fiscal 2009. |

| (3) | Inventories (FIFO), working capital and current ratio are calculated after adding back the LIFO reserve. The LIFO reserve for each year is as follows: $342 for fiscal 2012, $282 for fiscal 2011, $264 for fiscal 2010, $258 for fiscal 2009 and $180 for fiscal 2008. |

| (4) | The debt to capital ratio is calculated as debt and capital lease obligations divided by the sum of debt and capital lease obligations and stockholders’ equity. The increases in fiscal 2012, 2011 and 2009 are primarily due to the write-down of goodwill and intangible assets. |

| (5) | Capital expenditures include fixed asset and capital lease additions. |

| (6) | Retail stores as of fiscal year end includes licensed hard-discount food stores and is adjusted for planned sales and closures as of the end of each fiscal year. |

Historical data is not necessarily indicative of the Company’s future results of operations or financial condition. See discussion of “Risk Factors” in Part I, Item 1A of this Annual Report on Form 10-K.

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

RESULTS OF OPERATIONS

The challenging economic environment has continued to negatively impact consumer confidence and spending in fiscal 2012. As a result, consumer spending is pressured and consumers are seeking greater value offerings.

The Company is focused on its business transformation plan to become America’s Neighborhood Grocer, which draws upon the Company’s “8 Plays to Win” strategy. Key drivers of this strategy include simplification of business processes, generation of incremental funding for further price investment and a greater focus on meeting the demands of each neighborhood.

A key tenet for improving sales through the “8 Plays to Win” strategy, is the implementation of an overall pricing philosophy referred to as “fair pricing plus promotion.” Under this strategy, the Company will offer lower, more competitive everyday pricing on non-promoted items while continuing to offer compelling weekly promotions to attract customers. As the strategy unfolds, price investments necessary to fully implement “fair pricing plus promotion” have, and are expected to continue to, initially reduce identical store sales until such time as unit volumes increase.

Another element of the Company’s strategy is to better match the offerings and experience of each store to its surrounding community, what is referred to as “hyper-local retailing”. Store directors have been given more authority over the items they display and promote so their store better reflects the neighborhood preferences and creates a more relevant in-store experience for customers.

The Company also believes it can increase sales through greater sales of its private label products as the competitive prices for such products drive additional sales. The Company has launched Essential Everyday, its national-brand-equivalent private label offering. Essential Everyday’s clean packaging and appealing graphics complement the Company’s other recognized private label brands such as Shoppers Value, Culinary Circle and Wild Harvest. Essential Everyday has been introduced across a number of categories, and additional items are being introduced each quarter.

To provide funding for planned price investments, the Company is improving its operations through the introduction and implementation of a number of business support tools. These tools enable management to

21

Table of Contents

design more effective promotions, determine more appropriate display sizes, order product quantities that better match sales forecasts, and take actions to improve product availability-all based on historical data.

The grocery sector experienced higher-than-normal levels of commodity inflation during fiscal 2012 and fiscal 2011, and the Company is anticipating modest inflation to continue in fiscal 2013. The Company, and the majority of its key competitors, have stated it will generally pass through vendor cost increases in the form of higher retail prices, thus mitigating the potential impact of lower gross margin rates. The Company analyzes inflation by product or product group and evaluates whether to pass on the cost inflation in conjunction with its overall price investment strategy. The Company does not expect inflation to have a material impact on its ability to execute its business strategy.

The following discussion summarizes operating results in fiscal 2012 compared to fiscal 2011 and for fiscal 2011 compared to fiscal 2010. Comparability is affected by income and expense items that fluctuated significantly between and among periods:

| (In millions, except per share data) | February 25, 2012 (52 weeks) |

February 26, 2011 (52 weeks) |

February 27, 2010 (52 weeks) |

|||||||||||||||||||||

| Net sales |

$ | 36,100 | 100.0 | % | $ | 37,534 | 100.0 | % | $ | 40,597 | 100.0 | % | ||||||||||||

| Cost of sales |

28,081 | 77.8 | 29,124 | 77.6 | 31,444 | 77.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Gross profit |

8,019 | 22.2 | 8,410 | 22.4 | 9,153 | 22.5 | ||||||||||||||||||

| Selling and administrative expenses |

7,106 | 19.7 | 7,516 | 20.0 | 7,952 | 19.6 | ||||||||||||||||||

| Goodwill and intangible asset impairment charges |

1,432 | 4.0 | 1,870 | 5.0 | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating earnings (loss) |

(519 | ) | (1.4 | ) | (976 | ) | (2.6 | ) | 1,201 | 3.0 | ||||||||||||||

| Interest expense, net |

509 | 1.4 | 547 | 1.5 | 569 | 1.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings (loss) before income taxes |

(1,028 | ) | (2.8 | ) | (1,523 | ) | (4.1 | ) | 632 | 1.6 | ||||||||||||||

| Income tax provision (benefit) |

12 | 0.0 | (13 | ) | 0.0 | 239 | 0.6 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net earnings (loss) |

$ | (1,040 | ) | (2.9 | )% | $ | (1,510 | ) | (4.0 | )% | $ | 393 | 1.0 | % | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net earnings (loss) per share—diluted |

$ | (4.91 | ) | $ | (7.13 | ) | $ | 1.85 | ||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

Comparison of fifty-two weeks ended February 25, 2012 (fiscal 2012) with fifty-two weeks ended February 26, 2011 (fiscal 2011):

Net sales for fiscal 2012 were $36,100, compared with $37,534 last year. Net loss for fiscal 2012 was $1,040, or $4.91 per basic and diluted share, compared with net loss of $1,510, or $7.13 per basic and diluted share last year. Results for fiscal 2012 include non-cash goodwill and intangible asset impairment charges of $1,432 before tax ($1,292 after tax, or $6.10 per diluted share) and $20 of severance charge ($13 after tax, or $0.06 per diluted share). Results for fiscal 2011 include net charges of $1,987 before tax ($1,806 after tax, or $8.52 per diluted share) comprised of non-cash goodwill and intangible asset impairment charges of $1,870 before tax ($1,743 after tax, or $8.23 per diluted share), store closure and exit costs of $99 before tax ($77 after tax, or $0.37 per diluted share) and employee-related expenses, primarily labor buyout costs, severance, and the impact of a labor dispute of $80 before tax ($51 after tax, or $0.23 per diluted share), partially offset by a gain on the sale of Total Logistic Control of $62 before tax ($65 after tax, or $0.31 per diluted share).

Net Sales

Net sales for fiscal 2012 were $36,100, compared with $37,534 last year, a decrease of $1,434 or 3.8 percent. Retail food sales were 77.3 percent of Net sales and Independent business net sales were 22.7 percent of Net sales for fiscal 2012, compared with 77.0 percent and 23.0 percent, respectively, last year.

22

Table of Contents

Retail food sales for fiscal 2012 were $27,906, compared with $28,911 last year, a decrease of $1,005, or 3.5 percent. The decrease is primarily due to market exits and store dispositions of $765 and negative identical store retail sales of 2.8% over fiscal 2011 or $691 (defined as stores operating for four full quarters, including store expansions and excluding fuel and planned store dispositions). Negative identical store retail sales performance was primarily a result of heightened value-focused competitive activity and the impact of the challenging economic environment on consumers. During fiscal 2012, customer count declined approximately 3.8 percent while average basket size increased approximately 1.1 percent driven by moderate levels of inflation, offset in part by fewer items per customer.

During fiscal 2012 the Company added 83 new stores through new store development, comprised of one traditional retail food store and 82 hard-discount food stores, and sold or closed 43 stores, including planned dispositions, of which 13 were traditional retail food stores and 30 were hard-discount food stores. Total retail square footage as of the end of fiscal 2012 was approximately 64 million, a decrease of 0.4 percent from the end of fiscal 2011. Total retail square footage, excluding actual and planned store dispositions, increased 0.8 percent from the end of fiscal 2011. New stores and licensed hard-discount stores contributed $481 to retail sales increases in fiscal 2012.

Independent business sales for fiscal 2012 were $8,194, compared with $8,623 last year, a decrease of $429 or 5.0 percent. The decrease is primarily due to reduced volume from a national retail customer’s transition of volume to self-distribution and the sale of Total Logistic Control in the fourth quarter of fiscal 2011, which on a combined basis resulted in decreased sales of $536. Sales to existing independent retail customers increased $107.

Gross Profit

Gross profit for fiscal 2012 was $8,019, compared with $8,410 last year, a decrease of $391, or 4.6 percent. The decrease in Gross profit dollars is primarily due to a decline in the Company’s sales volume. Negative identical store Retail food sales, previously announced market exits and store dispositions combined with the divestiture of Total Logistic Control and volume lost to self-distribution resulted in decreases in Gross profit of $381.

Gross profit, as a percent of Net sales, was 22.2 percent for fiscal 2012 compared with 22.4 percent last year. Retail food gross profit as a percent of Retail food Net sales was 27.3 percent for fiscal 2012 compared with 27.5 percent last year. The 20 basis point decrease in Retail food gross profit rate is due to a 30 basis point decline from changes in business mix and increased advertising and other costs, and a 10 basis point decline in gross profit due to a higher LIFO charge. Partially offsetting these amounts are a 20 basis point increase due to the impact of improved effectiveness of promotional activities and lower costs, net of the Company’s investments in lower retail prices.