EXHIBIT 10.1

*TEXT OMITTED AND FILED SEPARATELY

CONFIDENTIAL TREATMENT REQUESTED

BY CLEAN DIESEL TECHNOLOGIES, INC.

UNDER 17 C.F.R SECTION 200.80(B)(4), 200.83 AND 240.24B-2

JOINT VENTURE AGREEMENT

dated 19 February, 2013

between

PIRELLI & C. AMBIENTE S.P.A.

and

CLEAN DIESEL TECHNOLOGIES INC.

THIS JOINT VENTURE AGREEMENT (the “Agreement”) is dated 19 February, 2013 and made between:

(1)

PIRELLI & C. AMBIENTE S.P.A., a company incorporated under the laws of Italy, having its registered office at Viale Piero e Alberto Pirelli, 25, Milan, Italy (“Pirelli”); and

(2)

CLEAN DIESEL TECHNOLOGIES INC., a corporation incorporated under the laws of Delaware, having its registered office at 4567 Telephone Road, Suite 100, Ventura CA 93003 USA (“CDTI”, and, together with Pirelli, the “Parties”, and each individually, a “Party”).

RECITALS:

(A)

The Parties have agreed to incorporate a company, in the corporate form of a società a responsabilità limitata under the laws of Italy and under the name of –Eco Emission Enterprise S.r.L. (the “Company”), in which each of the Parties will own 50% of the share capital.

(C)

the Parties have agreed to operate the Company as a company engaged in the Business (as defined below) upon the terms and conditions set out in this Agreement.

NOW, THEREFORE, the Parties agree as follows:

ARTICLE I

DEFINITIONS AND INTERPRETATION

1.1

Definitions. Capitalised terms used in this Agreement have the meanings specified in this Section 1.1 or elsewhere in this Agreement.

“Accounting Principles” means the Italian GAAP integrated by IFRS.

“Affiliate” means, in respect of any Person, any other Person that, directly or indirectly, controls, is controlled by or is under common control with that Party. For the purposes of this definition, for a Person to be “controlled” by another means that the other (whether directly or indirectly and whether by the ownership of share capital or the possession of voting power, by contract or otherwise) has the power to appoint and/or remove all or the majority of the members of the board of directors or other governing body of that Person or has the right to give that Person instructions (directions) of mandatory nature, and “control” and “controls” shall be construed accordingly.

“Ancillary Agreements” means the following agreements:

(a)

Long Term Supply Agreement between Pirelli (or an Affiliate of Pirelli) and the Company covering the purchase of the Products by the Company and to be entered into in the form attached hereto as Exhibit A (“Pirelli LTSA”);

(b)

Long Term Supply Agreement between CDTI (or an Affiliate of CDTI) and the Company covering the purchase of the Products by the Company and to be entered into in the form attached hereto as Exhibit B (“CDTI LTSA”);

2

(c)

Services Agreement between Pirelli (or an Affiliate of Pirelli) and the Company covering the services to be granted to the Company and to be entered into in the form attached hereto as Exhibit C (“Services Agreement”);

and any other written agreements entered into by any of the Parties or their Affiliates and the Company in order to effect the transactions contemplated by this Agreement.

“Articles” means the Articles of Association of the Company as initially set out in the Deed of Incorporation, as soon as practicable after the date of this Agreement in the form attached hereto as Exhibit D, and thereafter as amended from time to time by the agreement of the Parties.

“Board” means the board of directors of the Company from time to time.

“Business Day” means any day except a Saturday or Sunday or statutory holiday in any of Ventura, California and Milan, Italy.

“Director” means a member of the Board.

“Encumbrance” means any claim, charge (fixed or floating), usufruct, mortgage, security, pledge, lien, option, equity, power of sale, hypothecation, trust, right of set off or other third party rights or interest (legal or equitable), including any reservation or retention of title, right of pre-emption, right of first refusal, assignment by way of security or any other security interest of any kind, howsoever created or arising or any other agreement or arrangement (including) a sale and repurchase agreement having a similar effect.

“Financial Year” means an accounting reference period of the Company starting on January 1 and ending on December 31.

“Party’s Group” means the Pirelli Group or the CDTI Group.

“Person” means an individual, body corporate, partnership, trust, firm, government, governmental agency, unincorporated body or association (whether or not having separate legal personality).

“Pirelli Group” and “CDTI Group” mean Pirelli and its Affiliates and CDTI and its Affiliates, respectively.

“Products” means the Pirelli Products and the CDTI Products separately listed in Exhibit E.

“Quota Holders’ Meeting” means the meeting of the Quota Holders of the Company.

“Quotas” means the ordinary Quotas of € 1,00 each in the capital of the Company from time to time in issue.

“Territory” means Europe and the CIS countries.

“Transfer” means to sell, assign, transfer, bequeath, distribute, hypothecate, convey, pledge, grant any option over or otherwise encumber or dispose of a legal or beneficial interest.

3

1.2

Headings, References and Usage of Terms. The headings contained in this Agreement are for purposes of convenience only and shall not affect the meaning or interpretation of this Agreement. The singular includes the plural and vice versa. Save where the context requires otherwise, references to articles, Sections and Exhibits shall be references to the articles, Sections and Exhibits of this Agreement.

1.3

Performance of Obligations. Where any obligation pursuant to this Agreement is expressed to be undertaken or assumed by any Party, such obligation shall be construed as requiring the Party concerned to exercise all rights and powers of control over the affairs of any other Person which that Party is able to exercise (whether directly or indirectly) in order to secure performance of such obligation as soon as reasonably practicable.

1.4

Reference to Period. Where any period in days is referred to in this Agreement, such period shall be calculated in calendar days unless expressly provided otherwise, and the day on which any period is expressed to commence shall not be counted for the purpose of such period’s calculation.

1.5

Exhibits an Integral Part of this Agreement. The Exhibits to this Agreement form an integral party hereof and shall be interpreted as though they were set out in the main text of this Agreement.

ARTICLE II

ESTABLISHMENT OF THE JOINT VENTURE

2.1

Company Incorporation. Within ten (10) Business Days after the date of this Agreement the Parties shall incorporate the Company, as a società a responsabilità limitata, under the laws of the Italy with an authorized capital of €100,000 divided into 100,000 ordinary Quotas of €1.00 each, of which 50,000 Quotas representing 50% of the Company’s capital will be subscribed, paid up and owned by Pirelli and 50,000 Quotas representing 50% of the Company’s share capital will be subscribed, paid up and owned by CDTI. The registered office of the Company shall be in Via Piero e Alberto Pirelli 27, 20126, Milan, Italy.

2.2

Corporate Governance. The governance structure of the Company shall be incorporated into the Articles. Each Party shall exercise all voting rights and other powers available to it so as to give full effect to the terms of this Agreement and the Articles. In the event of any lack of consistency between the provisions of this Agreement and the Articles, the provisions of this Agreement shall be given effect as a contract between the Parties, to be enforced and implemented except as prohibited by the governing law of this Agreement. To the extent any terms of this Agreement are not included in the Articles each Party agrees to carry into effect such other terms as if they were embodied in the Articles.

4

2.3

Ancillary Agreements. Upon registration of the establishment of the Company, the Parties shall cause the Company to enter into the Ancillary Agreements.

ARTICLE III

BUSINESS OF THE COMPANY

3.1

The Business. The principal business of the Company shall be to engage in the marketing and sale of the Products manufactured by the Quota Holders and/or their Affiliates, and purchased by the Company under the Pirelli LTSA and the CDTI LTSA including any and all related activities generally associated with such business, and any additional businesses agreed by the Parties from time to time (the “Business”). The Company’s head offices shall be located in Via Piero e Alberto Pirelli 27, 20126, Milan, Italy.

3.2

Further Assurances. Each Party shall, notwithstanding any rights, voting or otherwise, which it may have as a quota holder of the Company, at all times vote and take all other necessary or desirable actions within such Party’s control (including, without limitation, attending meetings for purposes of obtaining a quorum, executing written consents in lieu of meetings, and electing and removing Directors), and otherwise procure that the Company take all necessary or desirable actions within its control, so as to cause the Company to comply fully and timely with the provisions of this Agreement.

ARTICLE IV

BUSINESS PLAN AND FINANCING

4.1

Business Plan. The Business of the Company shall be conducted in accordance with a comprehensive three-year business plan highlighting the business objectives and the envisaged economic and commercial results of the Company, which shall be approved by the Parties and reviewed on an annual basis (the “Business Plan”). The initial Business Plan is attached to this Agreement as Exhibit F.

4.2

Financial Policy. The overall financial policy of the Company shall be based on a definitive budget, which shall be approved by the Parties on an annual basis (the “Budget”). The initial Budget is attached to this Agreement as Exhibit G. In accordance with the Budget, the activities and any expansion of the Company shall be financed from its own resources and, if required, from additional equity funding or shareholders loans made by the Parties, which the Parties agree to provide to the Company from time to time as necessary. The Parties undertake to provide a shareholders loan for an amount of € [*] per each Party within one month from the establishment of the Company.

4.3

Dividend Policy. As soon as reasonably practicable after the end of each Financial Year, the Board shall determine the available distributable profits of the Company for that period. The Board shall, in making that determination, take into account the reasonable financial requirements of the Company for the following twelve (12) months.

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

5

ARTICLE V

CONSTITUTION AND MEETINGS OF THE BOARD

5.1

Election of Directors. Unless the Parties agree otherwise, the number of Directors shall be three (3), one (1) of which shall elected according to the binding nomination by Pirelli and one (1) of which shall be elected according to the binding nomination by CDTI (any Director so nominated by Pirelli, a “Pirelli Director”, and any Director so nominated by CDTI, an “CDTI Director”) and one (1) shall be elected in agreement between the Parties. The Directors so nominated shall be elected by the Parties for a term of three (3) years, except that each of the Parties may at any time elect to remove and replace any Director nominated by such Party pursuant to this Section . The Parties agree to exercise their voting rights in the Quota Holders’ Meeting such that each person nominated by the other Party is appointed, removed and replaced as provided in this Section .

5.2

Resignation of Nominated Directors. If either Party ceases to be a shareholder of the Company, it shall first procure the resignation of each Director which has been appointed on such Party’s nomination. The relevant Party shall procure that each resigning Director delivers to the Company a letter acknowledging that he or she has no claim of any kind against the Company. If the resigning Director is also an employee of the Company, the resigning Director shall also acknowledge in such letter that he or she has no claim for compensation for wrongful dismissal or unfair dismissal, no entitlement to any payment for redundancy and no claim in respect of any other moneys or benefits due to him or her from the Company, arising out of his or her employment or termination.

5.3

Chairman. The Board shall elect, for a term of one (1) year, one of the Directors to serve as the Chairman, who will preside at the meetings of the Board. The initial Chairman shall be Pirelli’s elected Director. Each Chairman shall serve a term of one (1) year, and the position of Chairman shall rotate on an annual basis between the Parties.

5.4

Notice of Board Meetings. In addition to the powers of the Board to call meetings as set out in the Articles, a Board meeting may be convened by either Party at any time. Unless otherwise agreed by all of the Directors, at least five (5) Business Days prior notice of any meeting of the Board shall be given to each Director at his or her last known address. The notice shall contain a short agenda of the business to be conducted at the meeting. No business which is not referred to in the notice may be conducted at any Board meeting without the consent of all Directors.

5.5

Frequency and Location of Board Meetings. Unless otherwise agreed by the Parties, the Board shall meet at intervals of not more than three (3) months. All Board meetings shall take place at the registered office of the Company or such other place as the Board may determine.

5.6

Quorum for Board Meetings. The quorum necessary for a meeting (including, without limitation, any adjourned meeting) of the Board shall be three (3) Directors.

6

5.7

Votes at Board Meetings. At meetings of the Board each Director present shall have one vote. The Chairman shall not have a second or casting vote. All decisions or resolutions of the Board shall be valid only if supported by a unanimous vote of all elected Directors.

5.8

Attendance at Board Meetings. Each Party shall use its reasonable endeavours to ensure its nominee Director attends and remains in attendance throughout each Board meeting for which proper notice is given. Meetings of the Board may be attended by the Directors in person, by telephone or video conference or other electronic means whereby each Director may hear all other Directors, and any Director so participating shall be considered present.

5.9 Resolutions in writing. The Board of Directors may also pass legal and binding resolutions in writing without convening a meeting of the Board of Directors, provided that all members of the Board of Directors have been previously notified in writing regarding the proposed resolution and all the members of the Board of Directors have unanimously approved the proposed resolution in writing. Resolution of the Board of Directors adopted in such manner shall be considered equally as valid as resolutions adopted at a meeting of the Board of Directors.

5.10 Directors Compensation. Directors shall not be compensated for services to the Company in their capacities as members of the Board.

ARTICLE VI

QUOTA HOLDERS’ MEETINGS

6.1

Notice and Location of Quota Holders’ Meetings. A Quota Holders’ Meeting may be called by the Board or by any Party at any time. Except as provided below, no less than ten (10) days’ notice of any Quota Holders’ Meeting must be given to each Party. Such notice shall specify the date, time and place of the meeting and the business to be transacted at it. No business may be conducted at a meeting which is not referred to in the notice, except with the consent of all Parties.

6.2

Quorum for Quota Holders’ Meetings.The quorum for a Quota Holders’ Meeting (including, without limitation, any adjourned meeting) shall be Quota Holders representing 100% of the capital. If a quorum is not constituted at a Quota Holders’ Meeting within one-half hour from the time appointed for the meeting (or such longer time as the persons present may agree to wait), then the meeting shall be adjourned pending subsequent reconvening under this Section . A meeting adjourned under this Section shall be reconvened not more than five (5) Business Days after the date of the original meeting. Notice of the time date and place for such reconvening of the adjourned meeting shall be provided to all Parties at least three (3) Business Days prior to the reconvening. At such reconvened meeting, a quorum shall be constituted by any Party who is present or duly represented. The adjourned meeting may then proceed with the business of the agenda for that meeting.

6.3

Chairman of Quota Holders’ Meetings. The Chairman shall also serve as the chairman of any Quota Holders’ Meetings. If the Chairman is absent from any Quota Holders’ Meeting, the Quota Holders present at the meeting shall nominate an individual to act as chairman of the meeting in question.

7

6.4

Voting at Quota Holders’ Meetings. At all Quota Holders’ Meetings, (i) each Share present or duly represented has one vote and (ii) the chairman of the meeting shall not have a vote (apart from the Quotas he or she represents, if applicable).

6.5

Attendance at Quota Holders’ Meetings. Each Party shall use its reasonable endeavours to ensure that its representative attends and remains in attendance throughout each Quota Holders’ Meeting for which proper notice is given. Meetings may be attended by the Parties’ representatives in person, by telephone or video conference or other electronic means whereby each Party’s representative may hear each other representative and the relevant Party will be considered present by its representative so participating.

6.6 Resolutions in writing. Quota Holders may also adopt valid and binding decisions without convening a Quota Holders’ Meeting, provided that the subject matter of the resolution or proposal, formally identified as such, has been sent in writing to all of the Quota Holders and each of the Quota Holders has approved the resolution or proposal by giving a signed written consent. Resolutions of Quota Holders of the Company adopted in such manner shall be considered equally as valid as resolutions adopted at a Quota Holders’ Meeting.

ARTICLE VII

MANAGEMENT OF THE COMPANY - PERSONNEL

7.1

Managing Director. The Board shall appoint a Managing Director of the Company. The initial Managing Director will be Attila Kiss. The Managing Director will have authority to make all decisions and approvals necessary for the day-to-day management of the business of the Company in the ordinary course, in a manner consistent with the approved Business Plan, Budget, by-laws and policies of the Company and subject to the supervision and authority of the Board.

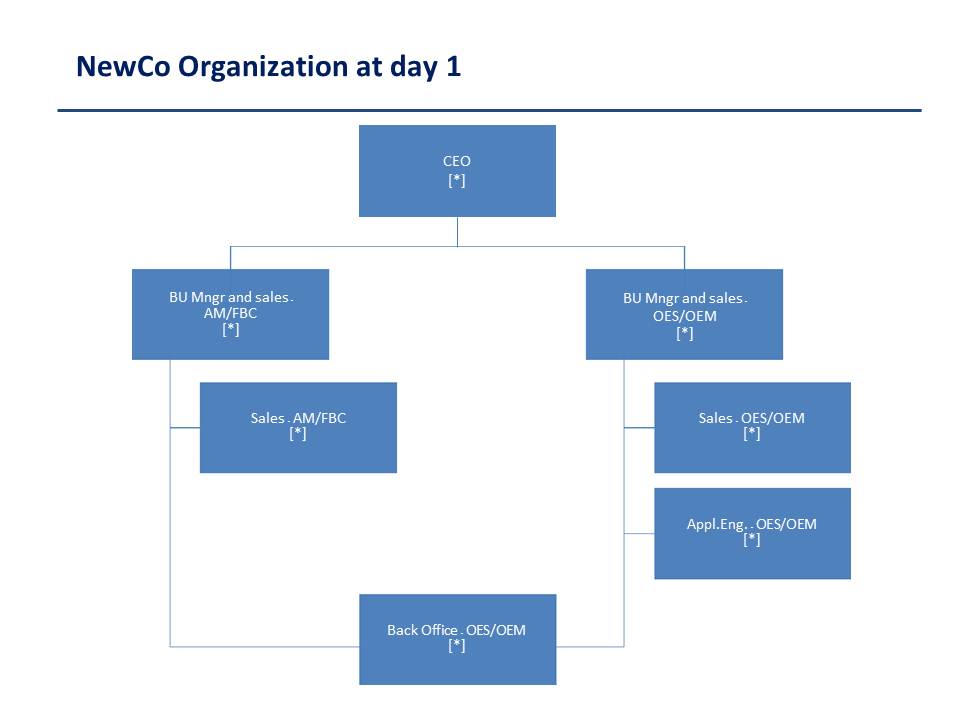

7.2

Organization structure. The organization structure of the Company is described in Exhibit H hereto, which also indicates the individuals taking the different positions indicated in such Exhibit.

ARTICLE VIII

AUDITORS AND INFORMATION

8.1

Statutory Auditors. The Parties agree that the Quota Holders’ Meeting shall appoint a statutory auditor of the Company which shall consist of one (1) effective member who shall serve for three years and shall be designated by the parties on a rotating bases. The first statutory auditor shall be designated by Pirelli.

8.2

Auditors. The annual accounts of the Company will be audited by Reconta Ernst & Young.

8

8.3

Dissemination of Information. The General Manager will be responsible for the preparation and dissemination to all Directors of the following financial and other management information compliant with the requirements of the Accounting Principles:

(a)

Within five (5) Business Days after the end of each month, for preliminary (sales, contribution margin and PBIT) management accounts of the Company and within ten (10) Business Days for detailed profit and loss management accounts.

(b)

Within thirty (30) Business Days after the end of every quarter, financial statements (balance sheet, earnings and cash flow) of the Company (on a consolidated basis), with all necessary schedules and supporting information.

(c)

Within ninety (90) days before the end of every Financial Year, the Budget for the following Financial Year.

(d)

Within the 25th February of each financial Year or within the different term that shall be agreed between the Parties also considering CDTI's reporting requirements to SEC, audited financial statements for the Company, prepared in according to the Accounting Principles for the preceding Financial Year.

8.4

Right of Inspection. Each Party will have the right to inspect and audit the books and records of the Company by its authorized representatives on ten (10) Business Days previous notice, during normal business hours and (at its own expense) to take away copies of or extracts from those books and records.

ARTICLE IX

PARTIES’ UNDERTAKINGS

9.1

Further Assurances. Each of the Parties undertakes to the other Party to do, execute and perform (and to procure that each of its Affiliates do, execute and perform) all such further deeds, documents, acts, assurances and things as may reasonably be required to carry out the provisions and intent of this Agreement and of the Articles.

9.2

9.3

Exclusivity and Promotion of the Business. Except for items expressly and mutually agreed upon between the Parties at any time, from the date hereof until the termination of this Agreement (i) all operations of Pirelli and its respective Affiliates in the business of the Pirelli Products within the Territory shall be pursued exclusively through the Company pursuant to, and as provided in, this Agreement and (ii) all operations of CDTI and its respective Affiliates in the

9

Business within the Territory shall be pursued exclusively through the Company pursuant to, and as provided in, this Agreement.

9.4

e³ trademark. As soon as practicable Pirelli or its Affiliate owning the trademark “e³” shall sell the trademark to the Company at a price equivalent to registration expenses, plus V.A.T.

ARTICLE X

RESTRICTIONS ON SHARE TRANSFERS

10.1

Permitted Transfers. A Party shall be permitted to Transfer all (and not some only) of the Quotas held by it (a “Permitted Transfer”) either (a) with the prior written consent of the other Party, subject to any conditions contained in that consent, or (b) to an Affiliate, provided that (i) such Transfer shall have effect only for so long as the Affiliate remains an Affiliate of the transferring Party Group and that immediately before ceasing to be such an Affiliate the transferee shall Transfer the Quotas back to the transferring Party or to any of its Affiliates, (ii) the transferring Party shall have guaranteed the obligations of such Affiliate on terms and conditions reasonably satisfactory to the other Party, and (iii) the transferee Affiliate shall have agreed in writing to be bound by the relevant terms and provisions of this Agreement as if an original signatory hereto.

10.2

Lock-up. Each of the Parties undertakes to the other that it shall not, other than in a Permitted Transfer, (i) Transfer, directly or indirectly, any of its Quotas in the Company, (ii) enter into any agreement or instrument granting the right to acquire any such Quotas or interest or (iii) enter into any agreement or undertaking to do any of the foregoing.

ARTICLE XI

DEADLOCK

11.1

Deadlock Occurrence. In the event that the Board or the Parties are unable to reach agreement on a Board or a Shareholder resolution, respectively, or on any other material issue that affects the Business or operations of the Company (hereinafter referred to as a “Deadlock”), then any Party may by notice in writing served on the other Party, giving reasonably full details thereof, declare that a Deadlock situation has arisen (a “Deadlock Notice”).

11.2

Resolution of Deadlock by Negotiation. Within fifteen (15) days after receipt of the Deadlock Notice or such longer period as the Parties may agree in writing (such period, as extended if applicable, the “Deadlock Resolution Period”), each Party shall designate a representative to represent it in negotiations with respect to the Deadlock, and such representatives shall meet and negotiate to resolve the Deadlock. If the Deadlock is not resolved during the Deadlock Resolution Period, within an additional five (5) days thereafter, either Party may (but it is not required to), notify the other Party that it elects to activate a new resolution procedure, pursuant to which the Parties shall jointly appoint an independent advisor to prepare and deliver to the Parties, within thirty (30) days of its appointment, a memorandum setting out its opinion on the proper resolution of the

10

Deadlock, which shall be considered in good faith by the Parties (but will not be binding on them).

11.3

Winding-up. If a resolution of the Deadlock is not agreed in accordance with the provisions of Section within sixty (60) days from receipt of the Deadlock Notice sent by any Party, then any Party may request that the Company be wound-up, whereupon all Parties shall procure that a resolution is passed to commence such wind-up proceedings as soon as practicable. The Parties shall procure that, during the liquidation period, the Company exerts its best efforts to facilitate the establishment or re-establishment of direct commercial relationships between each Party and the Company’s customers with respect to the Products manufactured or sold by such Party and to collect all receivables outstanding in due time with the support of the Party which in the meantime would have taken direct commercial relationship with the customers to which such receivables were issued to. The title to the Company’s trade names and trademarks will not be transferred to third parties unless previously offered to the Parties and the Parties having refused to purchase. In case both Parties will be interested to purchase such title, it will be assigned to the Party offering the highest consideration.

ARTICLE XII

REPRESENTATIONS AND WARRANTIES

Each Party represents and warrants to the other Party that:

(a)

it is duly formed and is organized and existing under the laws of its place of incorporation as stated above;

(b)

it has full power to enter into and perform its obligations under this Agreement and has taken all necessary corporate and other action to approve and authorize the transactions contemplated by this Agreement;

(c)

this Agreement constitutes its valid and binding obligations enforceable in accordance with the terms of this Agreement, subject to general principles of equity and laws affecting creditors’ rights generally; and

(d)

all relevant consents (if any) to its entering into this Agreement have been obtained and neither the entering into nor the performance by it of its obligations under this Agreement will constitute or result in any breach of any contractual or legal restriction binding on itself or its assets or undertaking.

ARTICLE XIII

TERMINATION

13.1

Termination. This Agreement shall continue in full force and effect from the date of this Agreement until the earliest of (i) the date on which all the Parties agree in writing to its termination, (ii) the fifth (5th) anniversary of the date hereof provided that it shall be deemed to be automatically renewed for a further five (5) year period unless any Party notifies in writing the other Party its contrary intention by giving a notice twelve (12) months prior to the date of the renewal, (iii) the date on which all the Quotas become beneficially owned by one Party,

11

subject to written confirmation thereof by that Party , (iv) the date of dissolution of the Company as a result of its liquidation, whether voluntary or compulsory (other than for the purpose of an amalgamation or reconstruction approved by all the Parties) or (v) upon the election of the other Party, in case a Party ceases to be an Affiliate of such Party’s Group. Upon termination of this Agreement under (ii) and (v) above, any Party may request that the Company be wound-up, whereupon all Parties shall procure that a resolution is passed to commence such wind-up proceedings as soon as practicable and the provisions of Section 11.3 shall apply.

13.2

Continuing Obligations after Termination. Termination of this Agreement, with respect to any and all the Parties, shall be without prejudice to any rights accrued prior to that termination and any provision which is expressly stated not to be affected by, or to continue after, such termination.

ARTICLE XIV

ANNOUNCEMENTS AND CONFIDENTIALITY

14.1

Prior Approval of Announcements. No press or public announcements, circulars or communications relating to this Agreement or the subject matter of it shall be made or sent by any of the Parties without the prior written approval of the other Party, such approval not to be unreasonably withheld or delayed.

14.2

Consultation prior to Announcements. Any Party may make press or public announcements or issue a circular or communication concerning this Agreement or the subject matter of it if required by Law or by any securities exchange or regulatory or governmental body to which that Party is subject, provided that the Party making it shall use all reasonable endeavours to consult with the other Party prior to its making or dispatch and shall, so far as may be reasonable, take account of the comments of the other Party with respect to its content and the timing and manner of its making or dispatch.

14.3

Confidentiality. Subject to Section , each of the Parties shall treat as strictly confidential all information received or obtained as a result of entering into or performing this Agreement which relates to (i) the provisions of this Agreement, or any document or agreement entered into pursuant to this Agreement, (ii) the negotiations relating to this Agreement, (iii) the other Party, (iv) the Company, or (v) the Business.

14.4

Exceptions. Any of the Parties may disclose information referred to in Section which would otherwise be confidential if and to the extent the disclosure is (i) required by the Law of any jurisdiction applicable to that Party, (ii) required by any securities exchange or regulatory or governmental body to which that Party is subject, (iii) required to vest in that Party the full benefit of this Agreement, (iv) disclosed to the professional advisers, experts, auditors or bankers of that Party, (v) disclosed to the officers or employees of that Party or an Affiliate of it who need to know the information for the purposes of the transactions contemplated by this Agreement, (vi) of information that has already come into the public domain through no fault of that Party or breach by that Party of this Agreement, (vii) of information which is already lawfully in the possession of that Party as evidenced by its or its professional advisers’ written records and which

12

was not acquired directly or indirectly from the other Party to whom it relates, or (viii) approved by the other Party in writing in advance, such approval not to be unreasonably withheld or delayed, provided that any information disclosed pursuant to (i) or above may be disclosed only after notice to the other Party, and the disclosing Party shall take all reasonable steps to co-operate with the other Party regarding the manner of that disclosure or any action which any of them may reasonably elect to take to challenge legally the validity of that requirement.

14.5

Time Limit. The restrictions contained in this shall continue to apply for a period of three (3) years after the rescission or termination of this Agreement.

ARTICLE XV

NOTICES

15.1

Form of Notices. All notices and other communications relating to this Agreement shall be in English and in writing and shall be given or made (and shall be deemed to have been duly given or made upon receipt) by delivery in person, by overnight courier service, by facsimile with receipt confirmed (followed by delivery of an original via overnight courier service) to the respective Parties at the relevant address or number, as appropriate, and marked for the attention of the relevant person indicated in Section , subject to such amendments as may be notified from time to time in accordance with this by the relevant Party to the other Party.

15.2

Initial Notice Details of the Parties.

The initial details for the purposes of Section are:

Pirelli

Address: Piero e Alberto Pirelli, 25 – 20126 Milano

Facsimile No: +39026440-3652 and +39026442-3329

Marked for the Attention of: Giorgio Bruno and Roberto Burini

CDTI

Address: 4567 Telephone Road, Suite 100; Ventura, California 93003

Facsimile No: (805) 639-9466

Marked for the Attention of: R. Craig Breese

ARTICLE XVI

MISCELLANEOUS

16.1

Parties’ Costs. Each Party will be responsible for all costs and expenses incurred by it in connection with and incidental to the preparation and completion of this Agreement or any document or agreement entered into pursuant to this Agreement.

16.2

Non-assignment. Save as provided in , no Party may assign any of its rights under this Agreement without the prior written consent of the other Party.

13

16.3

Entire Agreement. This Agreement and its Exhibits together represent the whole and only agreements between the Parties in relation to the subject matter of this Agreement and supersede any previous agreement, whether written or oral, between the Parties in relation to that subject matter. Accordingly, all other conditions, representations and warranties which would otherwise be implied (by Law or otherwise) shall not form part of this Agreement.

16.4

No Reliance. Each Party acknowledges that in entering into this Agreement it places no reliance on any representation, warranty or other statement relating to the subject matter of this Agreement other than as set out herein.

16.5

Amendments. No amendment or variation of this Agreement, including its Exhibits, shall be effective unless it is made or confirmed in a written document signed by all of the Parties.

16.6

Waivers. No delay in exercising or non-exercise by any Party of any right, power or remedy provided by Law or under or in connection with this Agreement shall impair, or otherwise operate as a waiver or release of, that right, power or remedy. Any waiver or release must be specifically granted in writing signed by the Party granting it and shall (i) be confined to the specific circumstances in which it is given, (ii) not affect any other enforcement of the same or any other right, and (iii) (unless it is expressed to be irrevocable) be revocable at any time in writing. Any single or partial exercise of any right, power or remedy provided by Law or under this Agreement shall not preclude any other or further exercise thereof or the exercise of any other right, power or remedy.

16.7

Rights and Remedies Not Exclusive. The rights, powers and remedies of each Party under this Agreement are cumulative and not exclusive of any other rights or remedies of that Party under any applicable Law. Each Party may exercise each of its rights as often as it shall think necessary.

16.8

Invalidity. If at any time any provision of this Agreement is or becomes illegal, invalid or unenforceable in any respect under the law of any jurisdiction that shall not affect or impair (i) the legality, validity or enforceability in that jurisdiction of any other provision of this Agreement, or (ii) the legality, validity or enforceability under the Law of any other jurisdiction of that or any other provision of this Agreement.

16.9

Governing Law and Jurisdiction. This Agreement shall be governed by and construed in accordance with Italian law.

16.10

Arbitration. All disputes arising in connection with this Agreement, unless amicably settled, shall be finally settled under the Rules of Conciliation and Arbitration of the International Chamber of Commerce by one arbitrator appointed in accordance with said Rules. Milan will be the place of arbitration.

IN WITNESS WHEREOF, this Agreement has been executed on the date first above written.

14

PIRELLI & C. AMBIENTE S.P.A.

CLEAN DIESEL TECHNOLOGIES INC.

/s/ Giorgio Bruno

/s/ R. Craig Breese

Giorgio Bruno

R. Craig Breese

15

LIST OF EXHIBITS

EXHIBIT A

Pirelli LTSA

EXHIBIT B

CDTI LTSA

EXHIBIT C

Services Agreement

EXHIBIT D

Articles of Association

EXHIBIT E

Products – Pirelli Products and CDTI Products

EXHIBIT F

Business Plan

EXHIBIT G

Budget 2013

EXHIBIT H

Organization Structure

16

1

Exhibit A

Agreement

between

Pirelli & C. Eco Technology RO SRL. (“PIRELLI”)

and

Eco Emission Enterprise srl (“Re-seller”)

and

together called “Parties”

Whereas

·

PIRELLI develops, sells and manufactures diesel particulate filters (DPF) substrates for a multitude of applications for emission reductions from internal combustion engines.

·

Re-seller is a Joint Venture Company, in which PIRELLI’s parent owns 50% of the share capital, whose scope of business is the marketing and sale, inter alia, of diesel particulate filters (DPF) substrates.

·

Pirelli and Re-seller desire to pursue an agreement related to the sale by Re-seller of PIRELLI’s diesel particulate filters substrates in Europe and in the CIS countries (“Territory”).

the Parties agree as follows

1.

Scope and Product Specifications

Re-seller hereby undertakes to promote the sale of the Products (as defined below) in the Territory and to buy the Products from PIRELLI, who undertakes to sell, according to the terms and conditions set forth in this agreement.

Appendix A hereto contains the list of the products of the Diesel Particulate Filter for automotive aftermarket (“Products”), and which are the subject of this agreement. Appendix A contain also the minimum selling price to be applied to re seller customers and shall be valid until 31 December 2013. Each 12 months the parties shall renegotiate in good faith the prices to be applied during the subsequent 12 months. Invoices shall be issued in Euro. The Products will be produced according to the specification included in Appendix A (“Specifications”). Products shall be sold to final customers only for the applications described in Appendix A and the customers shall be informed in writing about the specific application of the Product. Re-seller will provide warranties on the Products that are exact replicas of the warranties offered by Pirelli on the Products. Re-seller shall not offer to its customers warranties on the Products broader or more favourable for the customer than those offered to Re-seller by PIRELLI. Any deviation of warranty terms must be agreed to by Pirelli in writing before it can be offered to the customer, and re-seller accepts all risk of liability stemming from any warranty that exceeds the terms of Pirelli standard warranty. PIRELLI will indemnify and keep Re-seller free from any cost and damage deriving from claims raised by Re-seller customers for proven Products’ non conformity to the Specifications provided that (i) the claimed defect is not due to use of the product for applications different from the approved one (ii) such claims are raised within twelve (12) months from delivery of the Products to Re-seller and (ii) PIRELLI is duly informed about the claim and is given the possibility to take the defence.

2.

Pricing

2

The price of the Products is equal to the net invoice price applied the Re-seller to the customer less the percentage as indicated in appendix B (percentage),hereto and shall be valid until 31 December 2013; each 12 months the parties shall renegotiate in good faith the prices to be applied during the subsequent 12 months. Invoices shall be issued in Euro.

The Parties may agree to determine an adjustment of the originally agreed mark up applied, in case the margin of the Re-seller will not be anymore within the range of third parties margin benchmarked, in an ordinary course of business.

Generally, invoices shall be issued in Euro. For those customer contracts where invoicing is not in Euro, Pirelli will invoice Re-seller in the same European currency of such contracts.

3.

Forecasts, Volumes and Minimum Order Sizes

Re-seller shall provide a 12 months non-binding purchasing forecast (to be delivered to PIRELLI 30 days before the beginning of each 12 months period) indicating the quantity and Product specification of Products to be purchased during the following 12 months, together with a plan containing monthly expected calls. Re-seller will communicate to Pirelli its update of such forecast each MONTH of validity of this agreement.

Purchase orders shall be placed by telefax or electronic mail.

Re-seller commits to provide a [*] minimum order of any Product specification of Products.

PIRELLI will not sell Products directly to any third party in the Territory and will not appoint any re-seller, distributor or agent for the sale of the Products in the Territory.

4.

Deliveries

Products will be delivered to Re-seller ex-works Pirelli’s Bumbesti–Jiu, Romania as per Incoterms 2010. Delivery arrangements may be amended from time to time as required, upon the written agreement of both Parties. If the end user is paying for freight, the Re-seller will invoice the freight costs to the end user and Pirelli will invoice the Re-seller. Thus, freight costs will be a pass through item without recharge. When the Re- seller is contractually responsible for freight costs, the cost will be paid by Pirelli (to be agreed in advance). Any claim for lack of quantity of each delivery or for patent defects may be raised by Re-seller within 15 days from delivery. Delivery will be normally made within the number of days (calculated from orders acceptance) indicated in Annex A for each Product specification provided that Pirelli shall do its best in order to meet possible shorter terms requested by Re-seller.

5.

Payment Terms

Payments shall be made within 75 days from the invoicing day.

6.

Bank Information

Pirelli Bank information:

[*]

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

3

[*]

7.

Packaging Specifications

The Packaging of Orders will be conducted pursuant to the specifications denoted in Appendix C, which may be amended from time to time as required, upon the written agreement of both Parties.

8.

Term

This agreement shall come into force on the signing date indicated below and shall remain in force for the following three (3) years. It shall be considered renewed for subsequent 12 months periods unless it is terminated by a Party by written notice sent to the other at least 30 days before each termination date.

9.

Miscellaneous

(a)

No Assignment: The provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns. Except for assignment to companies controlled by the assigning party, no Party may assign or otherwise transfer any of its rights under this Agreement without the prior written consent of the other Party, which shall not be unreasonably withheld and any assignment or transfer made in violation thereof shall be void.

(b)

Arbitration: Any dispute arising in connection with this agreement, unless amicably settled, shall be finally settled under the Rules of Conciliation and Arbitration of the International Chamber of Commerce by one arbitrator appointed in accordance with such Rules. Geneva will be the place of arbitration. English shall be the language of the arbitration.

(c)

Controlling Law: This Agreement shall be construed, governed, interpreted, and applied in accordance with the laws of Switzerland.

(d)

Limitation of Liability: In no event will Pirelli, its subsidiaries, its subcontractors, or Re-seller, its subsidiaries or its subcontractors be liable for consequential, incidental, indirect, punitive or special damages, or loss of profits, data, business or goodwill, regardless of whether such liability is based on breach of contract, tort, strict liability, breach of warranties, failure of essential purpose, or otherwise, and even if advised of the likelihood of such damages.

(e)

Integration: This document represents the full and final agreement between the Parties. Neither Party is relying upon a representation, promise, or discussion that is not contained within this Agreement, and any prior discussions, documents, or agreements are specifically disclaimed. The Agreement can only be amended by a written document signed by both parties.

(f)

Title to the Products shall pass to Re-seller upon payment of the relevant price.

The Parties agree to the above as of ______, 2013

______________________

_________________________

Giorgio Bruno

President and Chief Executive Officer

For Pirelli & C. Eco Technology RO srl

For Eco Emission Enterprise srl

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

4

APPENDIX A

Pirelli Products

See Exhibit E to JVA signed on February, 19th 2013

5

APPENDIX B

Percentage

[*]

* The contents of this document have been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

6

APPENDIX C

Packing Specifications

[*]

* The contents of this document have been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

1

Exhibit B

Agreement

between

Clean Diesel Technologies, Inc., a Delaware corporation, and its subsidiaries and affiliates,, together called “CDTI”

and

Eco Emission Enterprise srl (“Re-seller”)

CDTI and Re-seller collectively called “Parties”

Whereas

·

CDTI develops, manufactures tests and sells exhaust aftertreatment technologies for onroad and offroad applications. CDTI manufactures and markets a line of catalytic emission control products and catalytic conversion technologies.

·

Re-seller is a Joint Venture Company, in which CDTI’s parent company owns 50% of the share capital, whose scope of business is the marketing and sale, inter alia, of catalytic emission control products.

·

CDTI and Re-seller desire to pursue an agreement related to the sale by Re-seller of CDTI’s catalytic after treatment system in Europe and in the CIS countries (“Territory”).

the Parties agree as follows

1.

Scope and Product Specifications

Re-seller hereby undertakes to promote the sale of the Products (as defined below) in the Territory and to buy the Products from CDTI, who undertakes to sell, according to the terms and conditions set forth in this agreement.

Appendix A hereto contains the list of the products (“Products”) which are the subject of this agreement. Appendix A contain also the minimum selling price to be applied to Re-seller customers and shall be valid until 31 December 2013; each 12 months the parties shall renegotiate in good faith the prices to be applied during the subsequent 12 months. The Products will be produced according to the specification sheets included in Appendix A (“Specifications”). Products shall be sold to final customers only for the applications described in Appendix A and the customers shall be informed in writing about the specific application of the Product.

Together with each purchase order CDTI will deliver to Re-seller the installation manual when applicable to the specific product.

Re-seller will provide warranties on the Products that are exact replicas of the warranties offered by CDTI on the Products. Re-seller shall not offer to its customers warranties on the Products broader or more favourable for the customer than those offered to Re-seller by CDTI. Any deviation of warranty terms must be agreed to by CDTI in writing before it can be offered to the customer, and Re-seller accepts all risk of liability stemming from any warranty that exceeds the terms of the CDTI standard warranty. CDTI will indemnify and keep Re-seller free from any cost and damage deriving from claims raised by Re-seller customers for proven Products’ non conformity to the Specifications provided that (i) the claimed defect is not due to use of the product for applications different from the approved one and/or to installation not compliant with the installation manual (ii) such claims are raised within twelve (12) months from delivery of the Products to Re-seller and (ii) CDTI is duly informed about the claim and is given the possibility to investigate and if appropriate, defend it.

2

2.

Pricing

The price of the Products is equal to the net invoice price applied the Re-seller to the customer less the percentage as indicated in appendix C (percentage) hereto and shall be valid until 31 December 2013 ; each 12 months the parties shall renegotiate in good faith the prices to be applied during the subsequent 12 months. Invoices shall be issued in Euro.

The Parties may agree to determine an adjustment of the originally agreed mark up applied, in case the margin of the Re-seller will not be anymore within the range of third parties margin benchmarked, in an ordinary course of business.

Invoices shall be issued by an European Affiliate of CDTI.

Generally, invoices shall be issued in Euro. For those customer contracts where invoicing is not in Euro, CDTI will invoice Re-seller in the same European currency of such contracts.

3.

Forecasts, Volumes and Minimum Order Sizes

Re-seller shall provide a 12 months non-binding purchasing forecast (to be delivered to CDTI 30 days before the beginning of each 12 months period) indicating the quantity and Product specification of Products to be purchased during the following 12 months, together with a plan containing monthly expected calls. Re-seller will communicate to CDTI its update of such forecast each month of validity of this agreement. Purchase orders shall be placed by telefax or electronic mail. Forecasts shall become binding thirty (30) days before order shipment.

CDTI will not sell Products directly to any third party in the Territory and will not appoint any re-seller, distributor or agent for the sale of the Products in the Territory.

4.

Deliveries

If no other contractual freight arrangements apply, products will be delivered to Re-seller ex-works CDTI premises in UK – Sweden Delivery arrangements may be may be amended from time to time as required, upon the written agreement of both Parties. If the end user is paying for freight, the Re-seller will invoice the freight costs to the end user customer and CDTI will invoice the Re-seller. Thus, freight costs will be a pass through item without recharge. When the Re-seller is contractually responsible for freight costs, the cost will be paid by CDTI (to be agreed in advance). Any claim for lack of quantity of each delivery or for patent defects may be raised by Re-seller within 15 days from delivery. Delivery will be normally made within the number of days (calculated from orders acceptance) indicated in Annex A for each Product specification provided that CDTI shall do its best in order to meet possible shorter terms requested by Re-seller.

5.

Payment Terms

Payments shall be made within thirty 75 days from the end invoicing day.

6.

Bank Information

[*]

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

3

[*]

7.

Packaging Specifications

The Packaging of Orders will be conducted pursuant to the specifications denoted in Appendix C, which may be amended from time to time as required, upon the written agreement of both Parties.

8.

Term

This agreement shall come into force on the signing date indicated below and shall remain in force for the following three (3) years. It shall be considered renewed for subsequent 12 months periods unless it is terminated by a Party by written notice sent to the other at least 30 days before each termination date.

9.

Miscellaneous

(a)

No Assignment: The provisions of this Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns. Except for assignment to companies controlled by the assigning party, no Party may assign or otherwise transfer any of its rights under this Agreement without the prior written consent of the other Party, which shall not be unreasonably withheld and any assignment or transfer made in violation thereof shall be void.

(b)

Arbitration: Any dispute arising in connection with this agreement, unless amicably settled, shall be finally settled under the Rules of Conciliation and Arbitration of the International Chamber of Commerce by one arbitrator appointed in accordance with such Rules. Geneva will be the place of arbitration. English shall be the language of the arbitration.

(c)

Controlling Law: This Agreement shall be construed, governed, interpreted, and applied in accordance with the laws of Switzerland.

(d)

Limitation of Liability: In no event will Re-seller, its subsidiaries, its subcontractors, or CDTI, its subsidiaries or its subcontractors be liable for consequential, incidental, indirect, punitive or special damages, or loss of profits, data, business or goodwill, regardless of whether such liability is based on breach of contract, tort, strict liability, breach of warranties, failure of essential purpose, or otherwise, and even if advised of the likelihood of such damages.

(e)

Integration: This document represents the full and final agreement between the Parties. Neither Party is relying upon a representation, promise, or discussion that is not contained within this Agreement, and any prior discussions, documents, or agreements are specifically disclaimed. The Agreement can only be amended by a written document signed by both parties.

(f)

Title to the Products shall pass to Re-seller upon payment of the relevant price.

The Parties agree to the above as of ___, 2013

______________________

For Eco Emission Enterprise srl R. Craig Breese

Clean Diesel Technologies Inc.

President and CEO

and on behalf of

Clean Diesel Technologies Sweden and

Clean Diesel Technologies UK

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

4

Appendix A

CDTI Products

See Exhibit E to JVA signed on February, 19th 2013

5

Appendix C

(due to numbering error, there is no Appendix B)

Percentage

Pricing of the products is the net invoice price from the Re-seller to the customer, less the following percentages:

Material Handling Products: [*]%

All other product lines: [*]%

The above percentages will be revisited and renegotiated between the parties periodically as they deem necessary.

Packaging Specifications

Packaging specifications vary by product and will be provided at the time of order.

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

Exhibit C

SERVICES AGREEMENT

This agreement (“Agreement”) dated as of 19 February 2013 by and between

Pirelli & C. Ambiente S.p.A., a company organized and existing under the laws of the Republic of Italy (“Pirelli”),

Clean Diesel Technologies, Inc. a corporation incorporated under the laws of Delaware, USA (“CDTI”)

and

Eco Emission Enterprise S.r.L., a company organized and existing under the laws of the Republic of Italy (“EEE”)

WHEREAS

·

EEE has decided to outsource some of the services necessary for running its operations;

·

Pirelli and CDTI are shareholders of EEE and are interested in providing some of the services required by EEE;

·

Pirelli and CDTI are interested in receiving certain services from EEE and EE is willing to provide such services

·

In consideration of the above, Providers accept to provide or cause its relevant Affiliates to provide, and the Receiver accepts to receive, such services, all under the terms and conditions set forth herein.

NOW THEREFORE the parties hereto agree as follows:

1. Definitions

The following terms in this Agreement shall have the meanings specified below.

“Affiliate” means, in respect of any party, any other person that, directly or indirectly, controls, is controlled by or is under common control with that party.

“Confidential Information” means any and all commercial, technical, business and other information furnished by and/or on behalf of a party, and/or its Affiliates, to the other party, and/or its Affiliates, for any purpose in connection with this Agreement either in writing or other tangible form.

“Effective Date” means March 1, 2013

“Services” means the Services described in the Schedules hereto.

“Providers” are the providers and or their Affiliates which provide the Services and indicated as Providers in the Schedules hereto.

“Receivers” are the receivers and which receive the Services and indicated as Receivers in the Schedules hereto.

- 2 -

2. Services

With respect to the Services described in Schedules 1/6 Pirelli shall supply or shall cause each other Provider and/or other sub-contractors or consultants to supply the Services to the Receiver as indicated in such Schedules in accordance with the terms and conditions set forth herein.

With respect to the Services described in Schedules 7 CDTI shall supply or shall cause each other Provider and/or other sub-contractors or consultants to supply the Services to the Receiver as indicated in such Schedules in accordance with the terms and conditions set forth herein.

With respect to the Services described in Schedules 8/9 EEE shall supply the Services to the Receiver as indicated in such Schedules in accordance with the terms and conditions set forth herein.

The Providers undertake to provide the Services in a timely manner with appropriate skill and care for the relevant Service. CDTI and Pirelli remain jointly and severally liable with each of its Affiliates which are indicated as Providers, for the timely fulfillment of the obligations arising out of this Agreement.

3. Confidentiality

Providers shall and shall cause their sub-contractors to treat confidentially and not to disclose to any third party any Confidential Information of Receiver or of any other Party, and to use such Confidential Information solely for the scope of the performance of this Agreement.

4. Cost of Services and payments

The Receiver shall pay to the relevant Provider the amount set forth in each Schedule as consideration for the Services provided.

Each relevant Provider shall issue and deliver invoices detailing services provided to the relevant Receiver for the amounts indicated in each Schedule the 31th March, 30th June, 30th September and 31th December of each year with respect to the Services provided during such periods.

All payments made under this Agreement shall be by wire transfer to the Providers’ account identified in writing by such Providers. All such payments shall be made thirty (30) days from the end of month of invoicing.

5. Limitation of liability

It is agreed that, except in case of gross negligence or willful misconduct, (i) the Receiver will indemnify the Providers of any claim raised against them and of any damage suffered by them as a consequence of the performance of the Services and (ii) the Providers shall not be liable to the Receiver for any damage of any kind whatsoever suffered by the Receiver

- 3 -

arising out or as a result of the performance or the failure to perform the Services. Without prejudice to the above the Providers shall not be liable to the Receiver for any amount exceeding the aggregate amount invoiced and paid by the Receiver under this Agreement during the 12 months preceding the date when the Providers’ or Provider’s liability has arisen.

6. Term

The term of this Agreement shall commence on the Effective Date and shall continue until February 28, 2014, unless extended by mutual written agreement of the parties hereto.

7. Force Majeure

If the performance of the Services or of any obligation hereunder is prevented, restricted or interfered with by reason of any act of God, civil disorder, strike, governmental act, war or, without limiting the foregoing, by any other cause not within the control of a Party hereto, then the Party so affected, upon giving prompt notice to the other Party, shall be excused from such performance to the extent of such prevention, restriction or interference; provided that the party so affected shall use its reasonable best efforts to avoid or remove such causes for non performance and shall continue performance hereunder with the utmost dispatch whenever such cases are removed.

8. Miscellaneous.

This Agreement and any rights or obligations hereunder shall not be assigned by either party without the prior written consent of the other party, provided that Providers may freely assign or transfer to its Affiliates, in whole or in part, this Agreement upon written notice to Receiver.

If any provision of this Agreement shall be held void, invalid, illegal or unenforceable, that provision shall be modified or eliminated to the minimum extent necessary that will achieve, to the extent possible, the purpose of such provision and the Agreement shall otherwise remain in full force and effect and enforceable.

No agreements amending or supplementing the terms hereof shall be effective except by means of a written document duly executed by the duly authorized representatives of the parties.

9. Language - Governing Law and disputes.

This Agreement has been negotiated, written and signed in the English language.

This Agreement shall be governed by and construed in accordance with the Italian law.

All disputes arising out of or in connection with this Agreement shall be finally settled in accordance with the Rules of the International Chamber of Commerce by one arbitrator appointed in accordance with such Rules. The arbitration shall be conducted in the English

- 4 -

language and the place and seat of arbitration shall be Milan. The award or the awards of such arbitration shall be binding upon the Parties hereto and may be enforced by any court having jurisdiction thereof.

IN WITNESS WHEREOF, the parties have caused their duly authorized representatives to execute this Agreement as of the Effective Date first set forth above.

| Pirelli By: __________________________ Name: Title: EEE By: __________________________ Name: Title: | CDTI By: __________________________ Name: Title: |

SCHEDULE 1

Services:

In-house legal services

Provider:

Pirelli Tyre SPA

Consideration:

Euro/year [*], Excluding V.A.T.

Receiver: Eco Emission Enterprise srl

Term: until 28 February 2014

Scope of the Service

Assistance on legal matters related to customers’ claims, contracts drafting and general legal advice on commercial matters.

Corporate secretariat activities, such as GSM and BOD meetings and relevant formalities.

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

|

|

| Last update |

|

Pirelli Sistemi Informativi | on: 07.02.2013 | |

| Version: 1.4 | ||

| Page 1 | ||

| C o n f i d e n t i a l |

Schedule 2

Services:

IT Service Management

Provider:

Pirelli Sistemi Informativi Srl

Consideration:

Euro/year [*]excluding V.A.T.)

Receiver:

Eco Emission Enterprise srl

Term:

until 28 February 2014

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

Last update Pirelli Sistemi Informativi on: 07.02.2013 Version: 1.4 Page 2 C o n f i d e n t i a l

[*]

.

* The contents of this document have been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 3

Services: Management Accounts

Provider: Pirelli & C. Ambiente S.p.A.

Receiver: Eco Emission Enterprise srl

Consideration: Euro/Year [*] (Excluding V.A.T.)

Term: until 28 February 2014

Scope of the Service

• Preparation of the annual budget and periodic review

• Monthly Budget compared with the same period, composed approximately by:

• Scheme of Profit & Loss synthetic

• Retail sales and margins by segment

• Detail of overhead costs

• Performance of NFP

• Cost control and collection of invoices received and approval of payments

• Regular monitoring (monthly) payments to suppliers and collections from customers

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 4

Services: Tax and Fiscal Services

Provider: Pirelli & C. Ambiente S.p.A.

Receiver: Eco Emission Enterprise srl

Consideration: Euro/Year [*] (Excluding V.A.T.)

Term: until 28 February 2014

Scope of the Service

Tax activity in favor of E-Cube SRL:

- Support for communications to the competent Tax Authority relating to the modifications in terms of Boards Members, place of business etc;

- Preparation and eventual submission of Tax Return and VAT Return;

- Propedeutical job and preparation of the VAT Communication (Comunicazione Dati Iva);

- Preparation of the Form 770 semplificato autonomi;

- Tax clauses analysis in agreements and contracts;

- General tax advice upon request.

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 5

Services:

Accounting/Bookkeeping

Provider:

Pirelli Servizi Amministrazione e Tesoreria S.p.A.

Receiver:

Eco Emission Enterprise S.r.l.

Consideration:

Euro/year: [*] (excluding V.A.T.)

Term: Until 28 February 2014

Scope of services:

·

Invoicing to customers

·

Receipt and filing (posting) of supplier invoices

·

Accounts receivable accounting

·

Accounts payable accounting

·

Processing and execution of payments to satisfy the following expenses:

-

Suppliers

-

Employee compensation and benefit (pay roll, pension, social security etc.) and travel expenses

-

Government and local authority tax, V.A.T., custom and excise

·

Bank and financial accounts accounting

·

General accounting

·

Financial Statements preparation (yearly and quarterly)

·

Preparation of the documentation for statutory auditors visits

·

Auditing firm management

·

Advise on accounting and treasury issues

·

Filing of tax returns (income tax, VAT, etc)

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 6

Services:

Personnel Administration, Employees Payroll, Time Management,

Compensation & Benefits Administration

Provider: Pirelli Servizi Amministrativi e Tesoreria S.r.l.

Receiver: Eco Emission Enterprise srl.

Consideration: Euro/Year [*] (excluding V.A.T.)*

Term: until 28 February 2014

Scope of the Service

The scope of the Services and the way they will be delivered will remain consistent with the practice in place before the closing. The detailed services included are described in the table below.

In general terms, these services cover but are not limited to:

••·

"Payroll Services — to be provided by Payroll Department Personnel through existing service provider, including the provision of monthly payroll checks in a manner consistent with prior practice or the effecting of direct deposits to employee accounts, management of tax and deduction allocation, provision of monthly and annual wage reporting and invoicing to the Companies. This service specifically excludes the management of bonus and commission incentives. However, bonus payments will continue to be processed through the payroll services described in this schedule.

·

Administration of pension plan — to be provided by Pirelli personnel in charge of Benefits Administration

·

Administration of employees' compensation — to be provided by Pirelli personnel in charge of Compensation

·

Preparation of Tax "730" Model

·

Time Management Administration

·

Payroll helpdesk to all Employees through dedicated email inbox

·

Employee Self-Service and on-line platforms (Design, realization, and release management of the HR Solutions is covered in schedule 1)"

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

[*]

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 7

Services:

Sales Support Services

Provider:

CDTI Sweden

Consideration:

Euro [*] per Quarter,

plus an annual bonus Fee equal to € [*]based on achievement of targets to be agreed upon between the Parties

plus reimbursement of travel expenses up to a maximum of €[*]per year and upon evidence of relevant receipt

all the above excluding VAT

Receiver: Eco Emission Enterprise srl

Term: until 28 February 2014

Scope of the Service

| Sales Support Services in the Scandinavian countries’ markets |

|

|

|

|

|

|

|

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 8

Services:

Consulting

Provider:

Eco Emission Enterprise srl

Consideration:

Euro per Quarter [*], excluding V.A.T.

Receiver: CDTI

Term: until 28 February 2014

Scope of the Service

1.

Consulting on Fuel Bourne Catalyst Supply Chain and Formulations

2.

[*]

3.

Consulting on a United Kingdom regulatory or fiscal filings.

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

SCHEDULE 9

Services:

Sales Support Services

Provider:

Eco Emission Enterprise srl

Consideration:

[*] Euro per Quarter, excluding V.A.T.

Receiver: Pirelli & C. Eco Technology S.p.A.

Term: until 28 February 2014

Scope of the Service

| Sales Support and development for Retrofit business |

| Support to develop European sales; Identification of potential customers also in relation to EEE contacts and new customers; Support on the business plan |

* Certain information on this page has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to the omitted portions.

Exhibit D

(unofficial translation)

Bylaws

Title I

NAME – PURPOSE – REGISTERED OFFICE – DURATION – SHAREHOLDERS’ DOMICILE

Article 1 – Name

A “società a responsabilità limitata” (limited liability company) is incorporated with the company name

"Eco Emission Enterprise S.R.L."

Article 2 – Purpose

The purpose of the company is: the purchase, sale, marketing, promotion and general marketing of filter products and additives as necessary to use those products.

The company may also:

execute all commercial, industrial, movable property, real estate and financial transactions on a supporting basis, including the issuance of guarantees on behalf of third parties and guarantees that it deems necessary or useful for realising the corporate purpose, with the exception of raising funds from the public and the activities reserved by law to specific classes of professionals.

Article 3 – Registered office

The registered office of the company is in Milan (MI).

The company may establish and abolish secondary establishments, branches, offices, affiliates, depots, warehouses and representative offices both inside and outside Italy.

Article 4 – Duration

The company will expire on 31 December 2050, and this date may be extended or the company may be prematurely dissolved on resolution by the shareholders’ meeting.

Article 5 – Register of shareholders

The company, in the person of its directors, shall keep the register of shareholders in accordance with the same provisions of law applicable to the other company books, and in which must be indicated the shareholders’ name and domicile, the equity investment owned by each one, the payments made for their equity investments, changes in the shareholders and, if notice has been given, their fax and electronic mail addresses for the purposes set out in these bylaws.

Title II

SHARE CAPITAL – CAPITAL SHARES – SHAREHOLDER PAYMENTS

Article 6 – Share capital

The share capital totals euro 1,00, divided into capital shares as provided by law. Within the limits and conditions imposed by law, the share capital may also be increased, with non-cash contributions, including contributions of work or services.

1

As applicable, the provisions of law and, in absence of these, the corresponding statutory provisions that govern opting out from “società per azioni” (joint-stock companies), shall govern the terms and conditions of the right to opt out. Said right shall exist only in the cases envisaged by law.

Article 7 – Capital shares

The capital shares, which are divisible, and the right to subscribe capital increases are not transferable to third parties for five years after the company formation date.

Article 8 – Shareholder payments

The company may receive advances on capital contributions and non-refundable grants or, without prejudice to the provisions of Article 2467 Italian Civil Code and the laws and regulations applicable at the time to the raising of funds from shareholders, interest-bearing and non-interesting loans.

Title III

SHAREHOLDER DECISIONS – SHAREHOLDERS’ MEETING

Article 9 – Shareholder decisions

The shareholders shall decide on the matters restricted to their purview under the law, as well as on those matters that one or more directors or as many shareholders as represent at least one third of the share capital submit for their approval.

The shareholder decisions are adopted in the form of a shareholders’ meeting resolution or outside of a shareholders’ meeting, i.e. by means of written consultation or on the basis of specific written consent.

Shareholder decisions, whether or not they are taken by the shareholders’ meeting, are adopted with the favourable vote of the entire share capital, unless otherwise envisaged by a mandatory provision of law.

Article 10 – Decisions adopted outside the shareholders’ meeting