Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

| | |

Filed by the Registrant ý |

Filed by a party other than the Registrant |

Check the appropriate box: |

o Preliminary Proxy Statement |

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý Definitive Proxy Statement |

o Definitive Additional Materials |

o Soliciting Material under §240.14A-12 |

|

|

|

|

CLEAN DIESEL TECHNOLOGIES, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| | |

| | |

Payment of Filing Fee (Check the appropriate box): |

ý No fee required. |

o Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

___________________________________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 25, 2017

____________________________________________________

Dear Stockholder of Clean Diesel Technologies, Inc.:

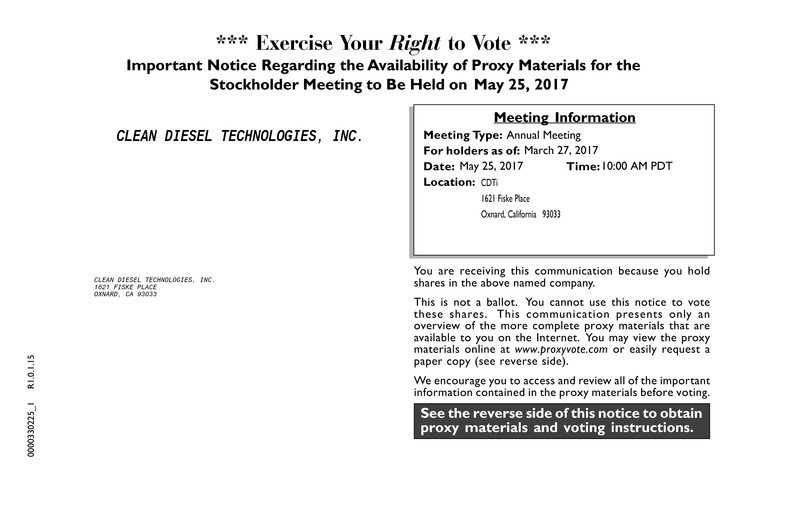

You are invited to attend the 2017 Annual Meeting (the “Annual Meeting”) of stockholders of Clean Diesel Technologies, Inc., a Delaware corporation (“CDTi”). The Annual Meeting will be held at 10:00 a.m. Pacific Time, Thursday, May 25, 2017, at CDTi’s corporate headquarters located at 1621 Fiske Place, Oxnard, California 93033, U.S.A. to consider and vote upon the following items:

| |

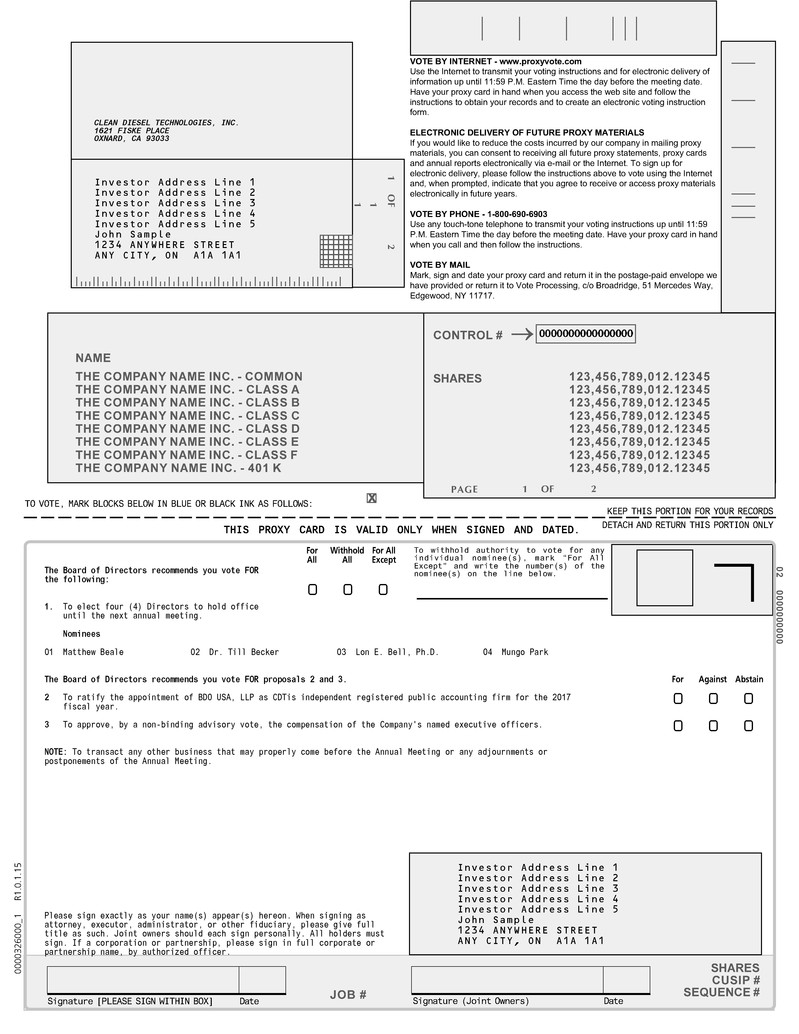

1. | To elect four (4) Directors to hold office until the next annual meeting and until their respective successors are elected and qualified; |

| |

2. | To ratify the appointment of BDO USA, LLP as CDTi’s independent registered public accounting firm for the 2017 fiscal year; |

| |

3. | To conduct a non-binding advisory vote to approve the compensation of our named executive officers; and |

| |

4. | To transact any other business that may properly come before the Annual Meeting or any adjournments or postponements of the Annual Meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

YOUR BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE FOR THE NOMINEES AND IN FAVOR OF THE OTHER PROPOSALS OUTLINED IN THE ACCOMPANYING PROXY STATEMENT.

The board of directors of CDTi has fixed the close of business on March 27, 2017 as the record date for the Annual Meeting. Only stockholders of record on the record date are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying Proxy Statement.

All stockholders are cordially invited to attend the meeting. This year, we have elected to use the Internet as our primary means of providing our proxy materials to stockholders. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to our stockholders a Notice of Internet Availability of Proxy Materials, which contains instructions on how to access our Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2016. The Notice of Internet Availability of Proxy Materials also includes instructions on how you can vote using the Internet or by telephone, and how you can request and receive, free of charge, a printed copy of our proxy materials. All stockholders who do not receive a Notice of Internet Availability of Proxy Materials will receive a paper copy of the proxy materials by mail.

Your vote is important. Whether or not you plan to attend the Annual Meeting, please vote by telephone or the Internet by following the voting procedures described in the proxy materials. If you received printed proxy materials and wish to vote by mail, promptly complete, date and sign the enclosed proxy card and return it in the accompanying envelope.

By order of the Board of Directors,

/s/ Tracy Kern

Tracy Kern

Chief Financial Officer and Corporate Secretary

Oxnard, California

April 10, 2017

Important Notice regarding the Availability of Proxy Materials for the

Stockholder Meeting to be Held on May 25, 2017.

The Proxy Statement, Annual Report to Stockholders and Directions to the Meeting

are available on the Internet at: www.cdti.com/proxy

CLEAN DIESEL TECHNOLOGIES, INC.

______________________________________

PROXY STATEMENT

FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

_______________________________________

Important Notice Regarding the Availability of Proxy Materials for the 2017 Annual Meeting

This proxy statement and the 2016 Annual Report are available for viewing, printing and downloading at www.proxyvote.com and on our website at www.cdti.com/proxy. Certain documents referenced in the proxy statement are available on our website. However, we are not including the information contained on our website, or any information that may be accessed by links on our website, as part of, or incorporating it by reference into, this proxy statement.

QUESTIONS AND ANSWERS ABOUT THIS PROXY STATEMENT AND VOTING

Why did I receive these proxy materials?

We are providing these proxy materials in connection with the solicitation by the Board of Directors of Clean Diesel Technologies, Inc., a Delaware corporation (sometimes referred to as “we,” “our,” “us,” the “Company,” the “Corporation” or “CDTi”), of proxies to be voted at our 2017 Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment or postponement thereof.

You are invited to attend the Annual Meeting, which will take place on May 25, 2017, beginning at 10:00 a.m., Pacific Time, at our corporate headquarters located at 1621 Fiske Place, Oxnard, California 93033, U.S.A. Directions to the Annual Meeting may be found at www.cdti.com/proxy. Stockholders will be admitted to the Annual Meeting beginning at 9:30 a.m., Pacific Time. Seating will be limited.

The Notice of Annual Meeting, proxy statement and proxy card and our Annual Report on Form 10-K for the year ended December 31, 2016 (the “2016 Annual Report”) are first being made available to our stockholders on or about April 12, 2017.

Who is entitled to attend the Annual Meeting?

Stockholders of record and beneficial owners as of March 27, 2017 are invited to attend the Annual Meeting. If your shares are held in the name of a broker, bank or other holder of record and you plan to attend the Annual Meeting, you must present proof of your ownership of CDTi stock, such as a bank or brokerage account statement, to be admitted to the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on March 27, 2017 (the “Record Date”), are entitled to vote at the Annual Meeting. On the Record Date, there were 15,703,371 shares of CDTi’s common stock outstanding and entitled to vote. Each share of common stock is entitled to one vote on each matter properly brought before the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If on March 27, 2017 your shares were registered directly in your name with CDTI’s transfer agent, American Stock Transfer & Trust Company, LLC, then you are the “stockholder of record.” Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card or vote via the Internet or by telephone to ensure your vote is counted.

If on March 27, 2017 your shares were held in a stock brokerage account or by a bank or other similar organization, then you are considered the “beneficial owner” of those shares. These proxy materials have been forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to direct your broker, bank or other agent how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

There are three matters scheduled for a vote:

| |

• | Election of Matthew Beale, Dr. Till Becker, Lon E. Bell, Ph.D., and Mungo Park as Directors to hold office for one-year terms; |

| |

• | Ratification of the appointment of BDO USA, LLP as CDTi’s independent registered public accounting firm for the 2017 fiscal year; and |

| |

• | Non-binding advisory vote to approve the compensation of our named executive officers. |

How do I vote?

Stockholders of record; Shares registered directly in your name.

If you are a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy using the enclosed proxy card, the Internet or telephone. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. Even if you have already voted by proxy, you may still attend the Annual Meeting and vote in person, if you choose.

| |

• | To vote in person, attend the Annual Meeting, and we will give you a ballot during the Annual Meeting. |

| |

• | To vote using the proxy card, please complete, sign and date the proxy card and return it in the prepaid envelope. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. If you do not have the prepaid envelope, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717, U.S.A. |

| |

• | To vote via the telephone, you can vote by calling the telephone number on your proxy card. Please have your proxy card handy when you call. Easy-to-follow voice prompts will allow you to vote your shares and confirm that your instructions have been properly recorded. |

| |

• | To vote via the Internet, please go to www.voteproxy.com and follow the instructions. Please have your proxy card handy when you go to the website. As with telephone voting, you can confirm that your instructions have been properly recorded. |

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day until 11:59 p.m. Eastern Time on May 24, 2017. After that, telephone and Internet voting will be closed, and if you want to vote your shares, you will either need to ensure that your proxy card is received by the Company before the date of the Annual Meeting or attend the Annual Meeting to vote your shares in person.

Beneficial owner; shares held in account at brokerage, bank or other organization.

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization rather than from CDTi. Simply complete and mail the proxy card as directed in those voting instructions to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank or other agent. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker, bank or other agent included by it with these proxy materials, or contact your broker, bank or other agent to request a proxy form.

What if I return a proxy card but do not make specific choices?

If your card does not indicate your voting preferences, the persons named in the proxy card will vote the shares represented by your proxy card as recommended by the Board of Directors. CDTi does not expect that any matters other than the election of Directors and the other proposals described herein will be brought before the Annual Meeting. If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your proxy card) will vote your shares using their best judgment.

What can I do if I change my mind after I vote?

If you are a stockholder of record, you can revoke your proxy at any time before the final vote at the Annual Meeting by:

| |

• | giving written notice that you are revoking your proxy to the Secretary, Clean Diesel Technologies, Inc., 1621 Fiske Place, Oxnard, California, 93033, U.S.A.; |

| |

• | delivering a properly completed proxy card with a later date, or vote by telephone or on the Internet at a later date (we will vote your shares as directed in the last instructions properly received from you prior to the Annual Meeting); or |

| |

• | attending and voting by ballot at the Annual Meeting (note, simply attending the Annual Meeting will not, by itself, revoke your proxy). |

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your broker, bank or other agent that is the holder of record and following its instructions.

Please note that to be effective, your new proxy card, Internet or telephonic voting instructions or written notice of revocation must be received by the Secretary prior to the Annual Meeting and, in the case of Internet or telephonic voting instructions, must be received before 11:59 p.m. Eastern Time on Tuesday, May 24, 2017.

What shares are included on the proxy card?

If you are a stockholder of record, you will receive only one proxy card for all the shares you hold of record in certificate and book-entry form.

If you are a beneficial owner, you will receive voting instructions from your broker, bank or other agent that is the holder of record.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the Annual Meeting for any purpose relevant to the Annual Meeting, by contacting the Secretary of CDTi.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count “For” and “Against” votes, and broker non-votes.

What is a broker non-vote?

If you are a beneficial owner whose shares are held of record by a broker, you must instruct the broker how to vote your shares. If you do not provide voting instructions, your shares will not be voted on any proposal on which the broker does not have discretionary authority to vote. This is called a “broker non-vote.” In these cases, the broker can register your shares as being present at the Annual Meeting for purposes of determining the presence of a quorum but will not be able to vote on those matters for which specific authorization is required.

If you are a beneficial owner whose shares are held of record by a broker, your broker has discretionary voting authority to vote your shares on Proposal No. 2, the ratification of BDO USA, LLP, even if the broker does not receive voting instructions from you. However, your broker does not have discretionary authority to vote on Proposal No. 1, the election of Directors, or Proposal No. 3, the non-binding advisory vote. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares.

What is the quorum requirement for the Annual Meeting?

A quorum of stockholders is necessary to hold a valid Annual Meeting. A quorum will be present if the holders of at least one-third (1/3) of the outstanding shares are represented by proxy or by stockholders present and entitled to vote at the Annual Meeting. On the Record Date, there were 15,703,371 shares outstanding and entitled to vote. Thus, 5,234,457 shares must be represented by proxy or by stockholders present and entitled to vote at the Annual Meeting. Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

If there is no quorum, the chairman or secretary of the Annual Meeting may adjourn the Annual Meeting to another time or date.

How many votes are required to approve each proposal?

|

| | |

Proposal | Vote Required | Broker Discretionary Voting Allowed? |

Proposal No. 1 -- Election of each director | Plurality of votes cast | No |

Proposal No. 2 -- Ratification of the appointment of BDO USA, LLP | Majority of votes cast | Yes |

Proposal No. 3 - Non-binding advisory vote on executive compensation | Majority of votes cast | No |

If you abstain from voting or there is a broker non-vote on any matter, your abstention or broker non-vote will not affect the outcome of such vote, because abstentions and broker non-votes are not considered votes cast under our By-laws or under the laws of Delaware (our state of incorporation).

Proposal No. 1-Election of Directors; plurality vote

Under our By-laws, Directors are elected by a plurality of votes cast. This means that Directors who receive the most “For” votes are elected. There is no “Against” option and votes that are “withheld” or not cast, including broker non-votes, are not counted as votes “For” or “Against.” If a Director nominee receives a plurality of votes but does not, however, receive a majority of votes, that fact will be considered by the Compensation and Nominating Committee of the Board in any future decision on Director Nominations.

Proposal No. 2-Ratification of BDO USA, LLP; majority vote

Under our By-laws, the votes cast “For” must exceed the votes cast “Against” to approve the ratification of BDO USA, LLP as our independent registered public accounting firm. Abstentions will not be counted as votes cast and accordingly, will not have an effect on this Proposal No. 2.

Proposal No. 3-Non-binding advisory vote to approve the compensation of our named executive officers; majority vote

Under our By-laws, the advisory vote will be approved if the votes cast “For” the proposal exceed the votes cast “Against” the proposal. While this advisory vote on executive compensation is non-binding, the Board of Directors and the Compensation and Nominating Committee will review the voting results and seek to determine the cause or causes of any significant negative voting result. Abstentions and broker non-votes will not be counted as votes cast and accordingly, will not have an effect on this Proposal No. 3.

How will my shares be voted at the Annual Meeting?

At the Meeting, the persons named in the proxy card will vote your shares as you instruct. If you sign your proxy card and return it without indicating how you would like to vote your shares, your proxy will be voted as the Board of Directors recommends, which is:

| |

• | FOR the election of each of the Director nominees named in this Proxy Statement; |

| |

• | FOR the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for the 2017 fiscal year; and |

| |

• | FOR the non-binding advisory vote to approve the compensation of our named executive officers. |

Do I have cumulative voting rights?

No, our Certificate of Incorporation does not provide for cumulative voting.

Am I entitled to dissenter rights or appraisal rights?

No, our stockholders are not entitled to dissenters’ rights or appraisal rights under the Delaware General Corporation Law for the matters being submitted to stockholders at the Annual Meeting.

Could other matters be decided at the Annual Meeting?

At the date of this Proxy Statement, we did not know of any matters to be considered at the Annual Meeting other than the items described in this Proxy Statement. If any other business is properly presented at the Annual Meeting, your proxy card grants authority to the proxy holders to vote on such matters in their discretion.

Can I access the Notice of Annual Meeting and Proxy Statement and the 2016 Annual Report on Form 10-K via the Internet?

This Notice of Annual Meeting and Proxy Statement and the 2016 Annual Report are available on our website at www.cdti.com/proxy. Instead of receiving future proxy statements and accompanying materials by mail, most stockholders can elect to receive an e-mail that will provide electronic links to them. Opting to receive your proxy materials online will save us the cost of producing documents and mailing them to your home or business, and also gives you an electronic link to the proxy voting site.

Stockholders of Record: You may enroll in the electronic proxy delivery service at any time by accessing your stockholder account at www.amstock.com and following the enrollment instructions.

Beneficial Owners: You also may be able to receive copies of these documents electronically. Please check the information provided in the proxy materials sent to you by your broker, bank or other holder of record regarding the availability of this service.

Who will pay for the cost of this proxy solicitation?

CDTi will pay the cost of soliciting proxies. Proxies may be solicited on our behalf by Directors, officers or employees in person or by telephone, electronic transmission and facsimile transmission or by other means of communication. Directors, officers or employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to the beneficial owners.

When are stockholder proposals or nominations due for next year’s annual meeting?

In accordance with CDTi’s By-laws, if you wish to submit a proposal for consideration at next year’s annual meeting but are not requesting that such proposal be included in next year’s proxy materials, or if you wish to nominate a person for election to the Board of Directors at next year’s annual meeting, your notice of such a proposal or nomination must be submitted in writing and delivered to, or mailed and received at, the principal executive offices of the Company not later than 90 days nor earlier than 150 days before the one year anniversary of the 2017 Annual Meeting of Stockholders. Accordingly, any such proposal or nomination must be received by the Secretary no later than February 24, 2018 (but no earlier than December 26, 2017), and should be delivered or mailed to the following address: Secretary, Clean Diesel Technologies, Inc., 1621 Fiske Place, Oxnard, California 93033, U.S.A.

In order to be properly submitted to the Secretary of the Company, a proposal or nomination by a CDTi stockholder must contain specific information as required under CDTi’s By-laws, including without limitation (i) the name and address of the stockholder making the proposal, (ii) the class and number of shares that are owned of record or beneficially owned by such stockholder, (iii) any material interest of such stockholder in the proposal, and (iv) certain information regarding the proposal or director nominee and such nominee’s relationship to the proposing stockholder. If you would like a copy of CDTI’s current By-laws, please write to the Secretary, Clean Diesel Technologies, Inc., 1621 Fiske Place, Oxnard, California 93033, U.S.A. CDTi’s current By-laws may also be found on the Company’s website at www.cdti.com.

To be considered for inclusion in CDTi’s proxy statement and form of proxy for the 2018 Annual Meeting of Stockholders, your stockholder proposal must be submitted in writing by December 13, 2017 to the Secretary, Clean Diesel Technologies, Inc., 1621 Fiske Place, Oxnard, California 93033, U.S.A.

Without limiting the advance notice provisions in the Company’s By-laws, which contain procedures that must be followed for a matter to be properly presented at an annual meeting, CDTi management who are proxy holders will have discretionary authority to vote all shares for which they hold proxies with respect to any stockholder proposal or nomination received after the deadline for such proposals or nominations set forth in the By-laws. Such discretionary authority may be exercised to oppose a proposal or nomination made by a stockholder.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. Final voting results will be reported in a Current Report on Form 8-K filed with the Securities and Exchange Commission.

DIRECTORS AND EXECUTIVE OFFICERS OF CDTi

The following table sets forth the name, age and positions with CDTi of individuals who are currently Directors and executive officers of CDTi. Following the table is a brief biography of each current Director and of each current executive officer of CDTi. To CDTi’s knowledge, there are no family relationships between any Director or executive officer and any other Director or executive officer of CDTi. Executive officers serve at the discretion of the Board of Directors. Additionally, executive officers may be elected to the Board of Directors.

|

| | | | |

Name | | Age | | Company Position |

Lon E. Bell, Ph.D. | | 76 | | Chairman of the Board of Directors |

Matthew Beale | | 50 | | President, Chief Executive Officer and Director |

Dr. Till Becker | | 59 | | Director |

Mungo Park | | 61 | | Director |

Peter J. Chase | | 49 | | Chief Operating Officer |

Stephen J. Golden | | 55 | | Chief Technology Officer and Vice President |

Tracy A. Kern | | 49 | | Chief Financial Officer and Corporate Secretary |

Current Directors

Lon E. Bell, Ph.D., Chairman of the Board. Dr. Bell joined the CDTi Board of Directors in June 2013, and was appointed Chairman of the Board in May 2016. He founded Gentherm Inc. (NASDAQ:THRM), formerly Amerigon Inc., a global developer and marketer of innovative thermal management technologies for a broad range of heating and cooling and temperature control applications, in 1991, and was a consultant to Gentherm from December 2010 to December 2012. Dr. Bell served many roles at Gentherm, including Chief Technology Officer until December 2010, Director of Technology until 2000, Chairman and Chief Executive Officer until 1999, and President until 1997. Dr. Bell served as the Chief Executive Officer and President of BSST LLC, a subsidiary of Gentherm, from September 2000 to December 2010. He served as a Director of Gentherm from 1991 to 2012. Previously, Dr. Bell co-founded Technar Incorporated, which developed and manufactured automotive components, and served as Technar’s Chairman and President until selling majority ownership to TRW Inc. in 1986. Dr. Bell continued managing Technar, then known as TRW Technar, as its President until 1991. Dr. Bell co-founded Mahindra REVA Electric Vehicle Pvt Ltd in 1994 and currently serves as a Director. He has served as a director for Ideal Power Converters, Inc. (NASDAQ:IPWR) since 2012 and ClearSign Combustion Corporation (NASDAQ:CLIR) since November 2011. From January 2012 to January 2014, Dr. Bell served as a Director of Aura Systems Inc. (OTC:AUSI) and through 2012, Dr. Bell was a director of the non-profit CALSTART. Dr. Bell received a BS degree in Mathematics, MS degree in Rocket Propulsion, and a Ph.D. in Mechanical Engineering from the California Institute of Technology.

Dr. Bell’s experience as a director of public companies, significant business acumen, technology and commercialization experience and first-hand understanding of the automotive industry led the Board to conclude that he should be nominated to continue to serve as a Director of CDTi.

Matthew Beale, President, Chief Executive Officer and Director. Mr. Beale was appointed Chief Executive Officer in October 2015 and President in December 2015. He joined the CDTi Board of Directors in September 2014. From May 2013 until September 2015, Mr. Beale served as Group Strategy Officer at Landi Renzo SpA (MIL:LR), a multinational engineering and manufacturing company based in Italy focused on alternative fuel systems and components for OEM and aftermarket automotive applications. From July 2012 to April 2013, Mr. Beale was a strategy consultant to the alternative fuel systems industry focused on business and capital markets strategies. Prior to that, he held several leadership positions at Fuel Systems Solutions, Inc. (NASDAQ:FSYS), a producer of fuel systems and components for automotive and industrial markets, including: Co-President and Head of IMPCO Operations from April 2011 to June 2012; Chief Financial Officer from May 2009 to March 2011; President and Secretary from May 2008 to March 2011; and Vice President of Business Development from February 2007 to April 2008. Previously, Mr. Beale held international corporate finance and banking positions with CVS Partners from 2005 to 2007; with Citigroup Inc. from 2000 to 2004; and with JP Morgan (NYSE:JPM) from 1994 to 2000. Mr. Beale received a BA in English Literature from the University of London, a Diploma in Accounting and Finance from the London School of Economics, and an MBA from IESE Business School.

Mr. Beale’s experience as an executive officer of public companies and his finance and operations leadership experience in the automotive industry provides him with the continued business experience and acumen to guide CDTi on its financial and strategic initiatives and led the Board to conclude that he should be nominated to continue to serve as a Director of CDTi.

Dr. Till Becker, Director. Dr. Becker joined the CDTi Board of Directors in February 2015. Dr. Becker has over 25 years of international experience in the automotive, consumer goods and energy industries, including 19 years in leadership roles at Daimler AG, and an extensive background in corporate restructuring and M&A transactions. Dr. Becker currently serves as a Senior Advisor at Global Board Room Advisors, an Asia-focused M&A consulting firm which he co-founded in 2011. Additionally, he has served as Senior Advisor to Holland Private Equity Growth Capital, an investment firm focused on growth-stage investments in small to mid-market technology companies in the Benelux and Germany, since 2014 and Senior Consultant to Artris Management Ltd., a European M&A and consulting company, since 2010. In 2013, Dr. Becker served as CEO of Hess AG, a provider of world-class lighting systems, where he implemented a successful restructuring plan that led to the company’s sale. From 2010 to 2011, he served as interim CEO of MPS Micropaint Holding AS, an international distributor of premium spot repair systems for small paint damages and as an advisor to RealEyes GmbH, a three-dimensional display imaging firm. From 2008 to 2010, Dr. Becker served as an advisor to Capital Dynamics Ltd., an independent, global asset management firm that invests in private equity and clean energy infrastructure. From 1987 to 2006, Dr. Becker served in numerous roles at Daimler AG, including Chairman and CEO of Daimler Northeast Asia, Mercedes-Benz Türk A.S., Istanbul, Mercedes-Benz India Pvt. Ltd. And Mercedes-Benz Portugal SA as well as Executive Vice President of the parent company. In addition to CDTi, Dr. Becker currently serves as chairman of the board of Armonic AudioMotive Limited and MPS Micropaint Holding AS and as director of Automotive Business Consulting AG and Equity Gate Advisors GmbH. He previously served as chairman the board of PAS Management Holding GmbH (2008 to 2010) and Lombardium Hamburg GmbH & Co KG (2009 to 2011). Dr. Becker received a law degree from the University of Münster.

Dr. Becker’s experience as a director and extensive international leadership experience, technology and commercialization experience and first-hand understanding of the automotive industry led the Board to conclude that he should be nominated to continue to serve as a Director of CDTi.

Mungo Park, Director. Mr. Park has been a Director of CDTi since September 2009 and served as Chairman from September 2009 to October 2010. Mr. Park is the Chairman and Founder of Innovator Capital Limited, a financial services company of London, England established in 2003. He has over 30 years of investment banking experience, focusing primarily on the technology, industrial technology and the biomedical industries.

Mr. Park’s fundraising experience and experience in advising “Greentech” companies on financial matters led the Board to conclude that he should be nominated to continue to serve as a Director of CDTi.

Executive Officers

Biographical information for Mr. Beale is included above under “-Current Directors.”

Peter J. Chase, Chief Operating Officer. Mr. Chase joined CDTi as Chief Operating Officer in January 2017. Mr. Chase has more than 25 years of experience in the automotive and industrial engine industries. Since 2005, he has served in key positions at IMPCO Technologies, Inc., now a division of Nasdaq-listed Westport Fuel Systems, including Director of Engineering, COO, Executive Vice President, Operations and Strategy, and most recently as General Manager. From 2004 to 2005, Mr. Chase was a Senior Engineer (Automotive) at Cummins Engine Company Australia, and from 2002 to 2004 he was Specialist Engineer at General Motors Holden, Australia. From 1999 to 2002, he was the Director of Engineering - GFP Division, at IMPCO Technologies, Inc. in the US and from 1997 to 1999, Technical Services Manager at IMPCO Technologies (Australia) Pty. Ltd. He served as Product Manager, Business/Product Planning at Perkins Engines (Peterborough) Ltd. in the United Kingdom from 1995 to 1997; as Project Manager at the Gas and Fuel Corporation of Victoria in Australia from 1992 to 1995; and as Research and Development Engineer at NGV Australia from 1990 to 1992. Mr. Chase holds a degree in Mechanical Engineering from the University of Melbourne, Australia.

Stephen J. Golden, Ph.D., Chief Technology Officer and Vice President. Dr. Golden has served as Chief Technology Officer and Vice President-Business Development and Strategy since April 2012. Dr. Golden joined CDTi as Chief Technical Officer in October 2010, immediately following the business combination of CDTi and Catalytic Solutions, Inc. Dr. Golden is one of the founders of Catalytic Solutions, Inc. and the developer of its technology and had served as the Chief Technical Officer and Director of Catalytic Solutions, Inc. since 1996. From 1994 to late 1995, Dr. Golden was the Research Director for Dreisbach Electromotive Incorporated, a developer of advanced batteries based in Santa Barbara, California. Dr. Golden received his doctorate in Material Science at Imperial College of Science and Technology in London, England. Dr. Golden did extensive post-doctoral work at the University of California, Santa Barbara, and the University of Queensland, Australia in ceramic oxide and mixed metal oxide materials.

Tracy A. Kern, Chief Financial Officer and Corporate Secretary. Ms. Kern joined CDTi as Chief Financial Officer and Corporate Secretary in June 2016. Ms. Kern has over 15 years of business experience in public accounting. Ms. Kern most recently served as Chief Financial Officer of Interlink Electronics, Inc. (NASDAQ: LINK), a provider of force-sensing

technologies, from June 2015 to May 27, 2016. From July 2008 until April 2015, Ms. Kern was Corporate Controller of Vitesse Semiconductor Corporation (NASDAQ:VTSS), a global provider of high performance integrated circuit solutions for carrier, enterprise and internet-of-things networks. Prior to Vitesse, from January 2003 to June 2008, Ms. Kern was the Chief Financial Officer for Chad Therapeutics, a publicly traded medical device manufacturing company headquartered in Chatsworth, California. Ms. Kern also was a manager at the public accounting firm KPMG, and is a Certified Public Accountant. She holds a Bachelor of Science degree in Accounting from California Lutheran University.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

The Nominees

We are asking you to vote for the election of four (4) nominees as Directors of CDTi. Each of the nominees is currently a Director of CDTi and was selected by the Board of Directors upon the recommendation of the Compensation and Nominating Committee of the Board. The term of office of each Director is until the 2018 annual meeting or until a successor is duly elected or, if before then, a Director resigns, retires or is removed by the stockholders.

The following table sets forth certain information with respect to each person nominated and recommended to be elected as a Director of CDTi.

|

| | | | |

Name | | Age | | Director Since |

Matthew Beale | | 50 | | 2014 |

Dr. Till Becker | | 59 | | 2015 |

Lon E. Bell, Ph.D. | | 76 | | 2013 |

Mungo Park | | 61 | | 2009 |

Biographical information for each nominee, including the reasons that we believe they should continue to serve as Directors, is included under “Directors and Executive Officers of CDTi-Current Directors”. Details concerning Directors’ compensation for the year ended December 31, 2016 are included under “Director Compensation”.

Availability

The nominees have all consented to stand for election and to serve. If one or more of the above nominees becomes unavailable or declines to accept election as a Director, votes will be cast for a substitute nominee, if any, designated by the Board on recommendation of the Compensation and Nominating Committee. If no substitute nominee is designated prior to the election, the individuals named as proxies on the enclosed proxy card will exercise their judgment in voting the shares that they represent, unless the Board reduces the number of Directors and eliminates the vacancy.

Plurality Voting

Under Delaware law and CDTi’s By-laws, a vote by a plurality of the shares voting is required for the election of Directors. Under plurality voting, Directors who receive the most “For” votes are elected; there is no “Against” option and votes that are “withheld” or not cast are disregarded in the count. If a nominee receives a plurality of votes but does not, however, receive a majority of votes, that fact will be considered by the Compensation and Nominating Committee in any future decision on nominations.

YOUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE ELECTION OF EACH OF THESE NOMINEES AS DIRECTORS.

ROLE AND COMPOSITION OF THE BOARD OF DIRECTORS

The Board of Directors, which is elected by the stockholders, is the ultimate decision-making body of the Company, except with respect to those matters reserved to the stockholders. It selects the Chief Executive Officer, or person or persons performing similar functions, and other members of the senior management team, and provides an oversight function for the Chief Executive Officer’s execution of overall business strategy and objectives. The Board acts as an advisor and counselor to senior management and validates business strategy and direction. The Board’s primary function is to monitor the performance of senior management and facilitate growth and success by providing mentoring and actionable business advice honed by substantial substantive knowledge of the Company’s business and history tempered with significant outside business experience.

Our By-laws state that the number of Directors shall be determined from time to time by the Board of Directors or by the stockholders.

Each Director shall be elected for a term of one year and until a successor is duly elected or until the Director shall sooner resign, retire, become deceased or be removed by the stockholders. Any Director may be removed by the stockholders with or without cause at any time. Any Director may resign at any time by submitting an electronic transmission or by delivering a written notice of resignation, signed by such Director to the Chairman, the Chief Executive Officer or the Secretary. Unless otherwise specified therein, such resignation shall take effect upon delivery. Vacancies in the Board may be filled by a majority of the Directors then in office (although less than a quorum), by the sole remaining Director, or by the stockholders. Any decrease in the authorized number of Directors shall not become effective until the expiration of the term of the Directors then in office unless, at the time of such decrease, there shall be vacancies on the Board that are being eliminated by the decrease. The Board is currently comprised of a Non-Executive Chairman, two Non-Executive Directors and our Chief Executive Officer.

Director Independence

The Board of Directors has affirmatively determined that each of Dr. Till Becker, Lon E. Bell, Ph.D., and Mungo Park is “independent” under the NASDAQ listing standards. In addition, the Board of Directors has determined that each of Dr. Becker, Dr. Bell and Mr. Park are “independent” under the heightened independence standards applicable to members of CDTi’s Audit Committee and Compensation and Nominating Committee under applicable NASDAQ listing standards and SEC rules.

2016 Meetings and Attendance

During 2016, the Board held 20 meetings. All Directors attended at least 75% or more of the aggregate number of meetings of the Board and Board Committees on which they served. All Directors standing for re-election attended the 2016 annual meeting of CDTI held on May 25, 2016. CDTi has a formal policy mandating Director Attendance at annual meetings.

Executive Sessions

In 2016, the Non-Executive Directors met in executive session of the Board on 1 occasions; the members of the Audit Committee met in executive session on 2 occasions; and the Compensation and Nominating Committee met in executive session on zero occasions. The policy of the Board is to hold at least two executive sessions of the Board annually and executive sessions of committees when needed.

Board Leadership Structure

The CDTi Board is led by a Chairman who is a Non-Executive Director selected by the full Board on nomination of the Compensation and Nominating Committee. The Board believes that the Chairman is responsible for Board leadership and the Chief Executive Officer is responsible for leading the management, employees and operations of CDTi and that these are two distinct and separate responsibilities. The Board believes this leadership structure is efficient and promotes good corporate governance. However, the Board continues to evaluate its leadership structure and may change it, if, in the opinion of the Board, a change is required by the needs of CDTi’s business and operations.

Risk Oversight

The Board of Directors exercises ultimate risk oversight responsibility for CDTi directly and through its committees. The direct role for the Board is to assist management in identifying risk, to evaluate management’s performance in managing risk, and, when appropriate, to request information and data to assist in that process. The Board believes that its leadership structure of a separate Chairman and Chief Executive Officer enhances the Board’s assessment of risk. The Audit Committee assists the

Board of Directors in its oversight of risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements. The Compensation and Nominating Committee oversees risks relating to CDTi’s compensation policies and practices. Each Committee reports its activities and recommendations to the Board, including assessment of risk, when appropriate.

COMMITTEES OF THE BOARD

The standing Committees of the Board of Directors are an Audit Committee, Compensation and Nominating Committee and Technology Committee. Special committees may be formed from time to time as determined by the Board of Directors. The Charters of the Audit Committee and Compensation and Nominating Committee are available on CDTi’s website at www.cdti.com under “Investor Relations”. The following table sets out the current membership of the standing Committees of our Board of Directors and the number of Committee meetings held in 2016:

|

| | | | | | |

Name | | Audit | | Compensation and Nominating | | Technology |

Dr. Till Becker | | X | | X | | X |

Lon E. Bell, Ph.D. | | X | | Chairman | | Chairman |

Mungo Park | | Chairman | | -- | | X |

Number of Meetings in 2016 | | 9 | | 5 | | 4 |

Audit Committee

The Audit Committee is responsible for oversight of accounting and financial reporting processes, audits of the financial statements, internal control and audit functions, and compliance with legal and regulatory requirements and ethical standards adopted by the Company. For audit services, the Audit Committee is responsible for the engagement and compensation of independent auditors, oversight of their activities and evaluation of their independence. The Audit Committee has instituted procedures for receiving reports of improper record keeping, accounting or disclosure. The Audit Committee is also responsible for reviewing transactions with related parties, regardless of the amount of such transaction. The Board has also constituted the Audit Committee as a qualified legal compliance committee in accordance with SEC regulations.

In the opinion of the Board, each of the members of the Audit Committee has both business experience and an understanding of generally accepted accounting principles and financial statements enabling them to effectively discharge their responsibilities as members of that Committee.

Audit Committee Financial Expert

The Board has determined that Mungo Park is an audit committee financial expert within the meaning of SEC regulations. In making this determination the Board considered Mr. Park’s formal training, extensive experience in accounting and finance and his prior service with other reporting companies under the Securities Exchange Act of 1934. The Board has also determined that Mr. Park is “independent,” as independence for audit committee members is defined in the NASDAQ listing standards.

Compensation and Nominating Committee

Compensation

The Compensation and Nominating Committee is responsible for the oversight and determination of executive compensation. For outside adviser services, the Compensation and Nominating Committee is responsible for the engagement and compensation of independent compensation consultants, legal advisors and other advisers, and the oversight of their activities and evaluation of their independence. Among other things, the Committee reviews, recommends and approves salaries and other compensation of the Company’s eligible employees, administers the Company’s Management Short Term Incentive Plan and the Company’s long-term incentives under the Company’s stock incentive plans (including reviewing, recommending and approving equity grants to eligible employees).

Executive compensation awards are approved by the Compensation and Nominating Committee on recommendation of the Chief Executive Officer, except that the compensation of the Chief Executive Officer is determined by the Committee itself. Compensation of executives is considered for final approval by the Board of Directors upon the recommendation of the Compensation and Nominating Committee.

In determining executive compensation, the Committee considers:

| |

• | the executive’s performance in light of Company goals and objectives; |

| |

• | competitive market data at comparable companies; |

| |

• | our overall budget for base salary increases; and |

| |

• | such other factors as it shall deem relevant. |

The Compensation and Nominating Committee is authorized to engage and retain independent third party compensation and legal advisors to obtain advice and assistance on all matters related to executive compensation and benefit plans, as well as external consultants to provide independent verification of market position and consider the appropriateness of executive compensation.

Nominating

The Compensation and Nominating Committee also identifies Director Nominees for election to fill vacancies on CDTi’s Board. Nominees are considered for approval by the Board on recommendation of the Committee. In evaluating nominees, the Committee seeks candidates of high ethical character with significant business experience at the senior management level who have the time and energy to attend to Board responsibilities. Candidates should also satisfy such other particular requirements that the Committee may consider important to CDTI’s business at the time. When a vacancy occurs on the Board, the Committee will consider nominees from all sources, including stockholders, nominees recommended by other parties, and candidates known to the Directors or CDTi’s management. The Committee may, if appropriate, make use of a search firm and pay a fee for services in identifying candidates. The best candidate from all evaluated will be recommended to the Board to consider for nomination.

The Compensation and Nominating Committee does not have a formal affirmative diversity policy for identifying nominees for the Board of Directors. When evaluating nominees, however, the Committee considers itself diversity neutral and examines a candidate’s background, experience, education, skills and individual qualities that could contribute to heterogeneity and perspective in Board deliberations.

Stockholders who wish to recommend candidates for consideration as nominees should furnish in writing detailed biographical information concerning the candidate to the Committee addressed to the Secretary of CDTi at 1621 Fiske Place, Oxnard, California, 93033, U.S.A. No material changes have been made to the procedures by which security holders may recommend nominees to CDTi’s Board of Directors.

Technology Committee

The Technology Committee’s responsibility is to represent and assist the Board of Directors in its review and oversight of the Company’s technology strategy and investment in research and development and technological and scientific initiatives and to review and identify specific technology, science and innovation matters that could have a significant impact on Company operations.

CORPORATE GOVERNANCE

The Board is committed to sound and effective corporate governance principles and practices. The role of our Board of Directors is to effectively govern the affairs of our Company for the benefit of our stockholders. Our Board of Directors strives to ensure the success and continuity of our Company and its mission through the election and appointment of qualified management. It is also responsible for ensuring that CDTi’s activities are conducted in a responsible and ethical matter.

Code of Business Ethics and Conduct

The Board has adopted a Code of Ethics and Business Conduct (the “Code”) that applies to all employees, executive officers and Directors. A copy of the Code is available free of charge on written or telephone request to Secretary, CDTi, 1621 Fiske Place, Oxnard, California 93033, U.S.A., or +1 805-639-9458. The Code is also available on CDTi’s website at www.cdti.com under “Investor Relations”. Changes to the Code or waivers granted under the Code will be posted on CDTi’s website at www.cdti.com under “Investor Relations”.

Communicating with the Board of Directors

Stockholders and other interested parties may contact any of CDTi’s Directors, including the Chairman or the Non-Executive Directors as a group, by writing a letter to the CDTi Director(s) c/o Secretary, CDTi, 1621 Fiske Place, Oxnard, California 93033, U.S.A. Communications will be forwarded directly to the Chairman, unless a different Director is specified.

Corporate Governance Materials

Materials relating to corporate governance at CDTi are published on our website at www.cdti.com under “Investor Relations”.

| |

• | Board of Directors-Background and Experience |

| |

• | Compensation and Nominating Committee Charter |

| |

• | Code of Ethics and Business Conduct |

| |

• | By-laws of Clean Diesel Technologies, Inc. |

| |

• | Restated Certificate of Incorporation of Clean Diesel Technologies, Inc., as amended |

Transactions with Related Parties

Since January 1, 2015, aside from those transactions listed below and compensation and other arrangements described elsewhere in this Proxy Statement or included in the Annual Report on Form 10-K for the year ended December 31, 2016, there has not been nor is there currently proposed any transaction or series of similar transactions to which the Company was or is to be a party in which the amount involved exceeds $120,000 or one percent of the Company’s average total assets at yearend for the last two completed fiscal years and in which any of the Company’s Directors, executive officer, persons who we know hold more than five percent of our common stock, or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest.

Kanis S.A.

We have entered into certain transactions involving the issuance of indebtedness by us to Kanis S.A., which has been from time to time and currently is the holder of more than five percent of our outstanding shares of common stock. For more information, see Note 10 to the Company's consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2016 filed with the Securities and Exchange Commission on April 7, 2017.

In connection with our loan transactions with Kanis S.A., we have issued equity securities to Kanis S.A. in consideration of the agreement to loan funds to us or to amend related debt instruments and/or agreements, including the issuance on: (i) December 30, 2010 of warrants to acquire up to 5,000 shares of common stock at $52.00 per share (the “December Warrants”) in connection with the entry into a loan commitment letter on such date providing for a loan by Kanis S.A. to us of $1.5 million; (ii) July 3, 2013 of 37,600 shares of common stock and warrants to acquire up to 18,800 shares of common stock at $6.25 per share in satisfaction of a $100,000 payment premium due June 30, 2013 and $135,000 of accrued interest as of June 30, 2013 relating to an 8% promissory note due 2016 in the aggregate principal amount of $1.5 million; (iii) on February 16, 2012 of warrants to acquire up to 1,000 shares of common stock at $19.00 per share (the “February Warrants”) in connection with an amendment to our 8% subordinated convertible note due 2016 issued pursuant to a subordinated notes commitment letter dated April 11, 2011; (iv) on July 27, 2012 of warrants to acquire up to 9,000 shares of common stock at $10.45 per share (the “July Warrants”) in connection with a 8% promissory note in the principal amount of in the initial aggregate principal amount of $3.0 million; and (v) on November 11, 2014 of warrants to acquire up to 16,000 shares of common stock at $8.75 per share in connection with the entry into a letter agreement amending the terms of various loans made by Kanis S.A. to us.

On October 7, 2015, we entered into a letter agreement with Kanis S.A., whereby Kanis S.A. agreed to amend the terms of the outstanding loans made to CDTi, such that (i) the maturity date and payment premium on the outstanding 8% shareholder note due on October 1, 2016 in the aggregate principal amount of $1,500,000 was extended to October 1, 2018; (ii) the maturity date on the outstanding 8% subordinated convertible note due on October 1, 2016 in the aggregate principal amount of $3,000,000 was extended to October 1, 2018; and (iii) the maturity date on the outstanding 8% shareholder note due on October 1, 2016 in the aggregate principal amount of $3,000,000 was extended to October 1, 2018. Pursuant to the terms of the agreement, we agreed to amend the terms of certain outstanding warrants issued to Kanis S.A. in order to (i) extend the expiration date until November 11, 2019 and (ii) with respect to the December Warrants, February Warrants and July Warrants, representing the right to purchase up to 15,000 shares of our common stock, reduce the exercise price to $8.75 per share.

On April 1, 2016, we borrowed $2.0 million from Kanis S.A. pursuant to an 8% promissory note due September 30, 2017 (the “April 2016 Note”) and, in connection therewith, entered into an amendment to loan agreement (the “April 2016 Agreement”) with Kanis S.A. Pursuant to the April 2016 Agreement, CDTi and Kanis S.A. agreed to amend an aggregate of $7,500,000 in principal amount of promissory notes and other indebtedness (collectively, the “Kanis Notes”), such that (i) Kanis S.A. had the right to convert the principal balance of the Kanis Notes and any accrued interest thereon into our common stock at a conversion price equal to the lower of the closing price of CDTI on the date before the date of the April 2016 Agreement or as of the date when Kanis S.A. exercised its conversion right; and (ii) we had the right to mandatorily convert the principal balance of the Kanis Notes and any accrued interest thereon into our common stock on the earlier of the maturity date thereof

or upon the occurrence of a “Liquidity Event” at a conversion price equal to the lower of the closing price of our common stock as of the date immediately before the date of the April 2016 Agreement or at a 25% discount to the Liquidity Event price. A Liquidity Event was defined as a strategic investment in CDTI or a public stock offering by CDTI.

On June 30, 2016, we entered into a letter agreement (the “Kanis Exchange Agreement”) with Kanis S.A. pursuant to which we agreed to an exchange with Kanis S.A. of the Kanis Notes for a number of shares of our common stock equal to (a) the principal amount of the Kanis Notes plus the accrued but unpaid interest thereon through and including the date of the settlement of the exchange contemplated by the Kanis Exchange Agreement, divided by (b) $1.6215. The transactions contemplated by the Kanis Exchange Agreement were subject to the approval of our stockholders. At a special meeting of stockholders held on August 25, 2016, our stockholders approved the transactions contemplated by the Kanis Exchange Agreement, which approval was a condition precedent to the issuance of our common stock in exchange for the Kanis Notes. On August 30, 2016, we consummated the Kanis Exchange Agreement transactions, pursuant to which we issued to Kanis S.A. an aggregate of 4,872,032 shares of common stock in exchange for the delivery to us of the Kanis Notes and the extinguishment of $7,900,000 of indebtedness.

On January 10, 2017, we repaid in full to Kanis S.A. the principal balance of the April 2016 Note and all accrued interest thereon.

Lon E. Bell, Ph.D.

On April 11, 2016, we borrowed $500,000 from Lon E. Bell, Ph.D., a director of CDTi, pursuant to an 8% convertible promissory note (the “Bell Note”). The Bell Note was convertible into our common stock at a conversion price equal to the lower of the closing price of our common stock on the date before the date of the Note or as of the date when Dr. Bell exercised his conversion right. The Company shall have the right to mandatorily convert the principal balance of the Note and any accrued interest into the common stock of Company upon the Maturity Date at a conversion price equal to the lower of the closing price of CDTI on the date before the date of the Note or the Maturity Date. We had the right to mandatorily convert the Bell Note concurrently with the closing of a Liquidity Event at a conversion price equal to the lower of the closing price of our common stock as of the date immediately before the date of the Bell Note or at a 25% discount to the Liquidity Event price. A Liquidity Event was defined as a strategic investment in CDTI or a public stock offering by CDTI.

Effective May 12, 2016, CDTi and Dr. Bell amended and restated the Bell Note to amend the conversion features contained therein. Following the amendment, Dr. Bell had the right to convert the Bell Note into our common stock at a fixed conversion price of $3.55 per share, and we had the right to mandatorily convert the Bell Note into our common stock at a fixed conversion price of $3.55 per share upon the earlier of the maturity date of the Bell Note and the closing of a Liquidity Event if, and only if, the $3.55 conversion price was less than the average closing price of our common stock for the five consecutive trading days ending on the trading day immediately preceding the date we exercise our conversion rights.

On June 30, 2016, we entered into a letter agreement (the “Bell Exchange Agreement”) with Dr. Bell pursuant to which we agreed to an exchange with Dr. Bell of the Bell Note for a number of shares of our common stock equal to (a) the principal amount of the Bell Note plus the accrued but unpaid interest thereon through and including the date of the settlement of the exchange contemplated by the Bell Exchange Agreement, divided by (b) $1.6215. The transactions contemplated by the Bell Exchange Agreement were subject to the approval of our stockholders. At a special meeting of stockholders held on August 25, 2016, our stockholders approved the transactions contemplated by the Bell Exchange Agreement, which approval was a condition precedent to the issuance of our common stock in exchange for the Bell Note. On August 30, 2016, we consummated the Bell Exchange Agreement transactions, pursuant to which we issued to Dr. Bell an aggregate of 317,950 shares of common stock in exchange for the delivery to us of the Bell Note and the extinguishment of $515,556 of indebtedness.

On December 16, 2016, we sold 250,000 shares of our common stock to Dr. Bell at a purchase price of $2.00 per share. The sale of shares to Dr. Bell was made pursuant to a securities purchase agreement (the “Purchase Agreement”) that we entered into on November 3, 2016 with Dr. Bell and 95 other investors, pursuant to which we sold an aggregate of 5,172,250 shares of our common stock for gross proceeds of $10,344,500. The sale of these securities was approved on October 24, 2016 by Kanis S.A., the holder of a majority of our outstanding shares of common stock as of such date. Dr. Bell purchased shares in the offering on the same terms as all other investors. At the initial closing of the offering, we entered into a registration rights agreement, dated November 4, 2016, with the investors, including Dr. Bell, pursuant to which we agreed to register for resale by the investors the shares of common stock purchased pursuant to the Purchase Agreement. We completed the registration of these shares in January 2017.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s Directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Officers, Directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company, all Section 16(a) filing requirements applicable to CDTi’s executive officers, Directors and greater than ten percent beneficial owners during the year ended December 31, 2016 were complied with, except as follows: Stephen Golden, our Chief Technology Officer, reported late on Form 5 his receipt in December 2016 of an aggregate of 2,806 shares of our common stock upon the vesting of restricted stock units and Tracy Kern, our Chief Financial Officer, did not report on Form 4 her receipt of June 16, 2016 of an option to purchase 10,000 shares of our common stock.

DIRECTOR COMPENSATION

Summary Director Compensation Table

The following table details the total compensation earned by our current non-employee directors in fiscal year 2016:

|

| | | | | | | | | | | |

Name | | Fees Earned or Paid in Cash | | All Other Compensation | | Total |

Lon E. Bell, Ph.D.(1) | | $ | 75,708 |

| | — |

| | $ | 75,708 |

|

Dr. Till Becker(2) | | $ | 42,833 |

| | — |

| | $ | 42,833 |

|

Mungo Park(3) | | $ | 47,333 |

| | — |

| | $ | 47,333 |

|

________________

| |

(1) | During 2016, Dr. Bell served on the Compensation and Nominating Committee and as Chairman of the Technology Committee. Dr. Bell also commenced service on the Audit Committee and as Chairman of the Board in May 2016 immediately following the 2016 annual meeting of stockholders. |

| |

(2) | During 2016, Dr. Becker served on the Technology Committee. Dr. Becker also commenced service on the Audit Committee and the Compensation and Nominating Committee in May 2016 immediately following the 2016 annual meeting of stockholders. |

| |

(3) | During 2016, Mr. Park served on the Audit Committee and the Technology Committee. Mr. Park also commenced service as Chairman of the Audit Committee in May 2016 immediately following the 2016 annual meeting of stockholders. |

As of December 31, 2016, none of our non-employee directors held options or stock awards for shares of our common stock except for Mr. Park, who held options to purchase an aggregate of 3,000 shares of our common stock.

Narrative to Director Compensation Table

During 2016, CDTi’s Non-Executive Directors were compensated based on the following fee schedule:

|

| | | |

| Description | | Compensation |

Board Member -- Retainers: | | |

. | Chairman (in addition to Member Retainer) | | $35,000 per year |

. |

Board Member Includes four in-person meetings Includes four telephonic meetings | | $25,000 per year, plus an annual award of restricted stock units valued at $30,000, with timing and vesting to be at the discretion of the Board on the recommendation of the Compensation and Nominating Committee |

| | | |

Board Member - Additional Compensation: | | |

. | Additional in-person meetings | | $1,500 each meeting |

. | Additional telephonic meetings | | $500 each meeting |

| | | |

Audit Committee -- Retainers: | | |

. | Chairman (in addition to Member Retainer) | | $10,000 per year |

. | Committee Member | | $5,000 per year |

| Includes four in-person meetings | | |

| Includes four telephonic meetings | | |

| | | |

Audit Committee -- Additional Compensation: | | |

. | Additional in-person meetings | | $1,500 each meeting |

. | Additional telephonic meetings | | $500 each meeting |

| | | |

Comp. and Nom. Committee -- Retainers: | | |

. | Chairman (in addition to Member Retainer) | | $7,500 per year |

. | Committee Member | | $5,000 per year |

| Includes four in-person meetings | | |

| Includes four telephonic meetings | | |

| | | |

Comp. and Nom. Committee -- Additional Compensation: | | |

. | Additional in-person meetings | | $1,500 each meeting |

. | Telephonic meetings | | $500 each meeting |

| | | |

Technology Committee -- Retainers: | | |

. | Chairman (in addition to Member Retainer) | | $7,500 per year |

. | Committee Member | | $5,000 per year |

| Includes four in-person meetings | | |

| Includes four telephonic meetings | | |

| | | |

Technology Committee -- Additional Compensation: | | |

. | Additional in-person meetings | | $1,500 each meeting |

. | Additional telephonic meetings | | $500 each meeting |

Fees earned by the Non-Executive Directors are generally paid in cash quarterly during the period earned. Restricted stock unit awards to Non-Executive Directors will be, under the current policy of the Board, granted pursuant to our stock incentive plan and vest over time.

During 2016, no awards of restricted stock units were made to our current Non-Executive Directors due to the limited availability of shares under our stock incentive plan.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information known to us regarding the beneficial ownership of common stock as of March 15, 2017 by: 1) each person known to CDTi to beneficially own more than five percent of its outstanding shares of common stock; 2) each of the Directors (including all nominees for Director); 3) CDTi’s “Named Executive Officers” as set forth in the Summary Compensation Table included under “Executive Compensation”; and 4) all current Directors and executive officers as a group at such date.

Unless otherwise noted below, the address of each beneficial owner listed in the table is in care of CDTi, 1621 Fiske Place, Oxnard, California, 93033.

|

| | | | | | | |

Name of Beneficial Owner | | Number of Shares Beneficially Owned(1) | | Percentage of Shares Outstanding(2) |

| | | | |

Directors, Named Executive Officers and all Directors and Executive Officers as a Group: | | | | |

Lon E. Bell, Ph.D., Chairman of the Board (3) | | 598,494 |

| | 3.8 | % |

Dr. Till Becker, Director | | 3,849 |

| | | * |

Mungo Park, Director(4) | | 9,544 |

| | | * |

Matthew Beale, President, Chief Executive Officer and Director(5) | | 287,437 |

| | 1.8 | * |

Stephen J. Golden, Ph.D., Chief Technology Officer and Vice President(6) | | 70,231 |

| |

| * |

Tracy A. Kern, Chief Financial Officer and Corporate Secretary(7) | | 40,000 |

| |

| * |

Directors and executive officers as a group (6 persons)(8) | | 1,009,555 |

| | 6.3 | % |

| | | | | |

Greater than 5% Stockholders: | | | | | |

Kanis S.A.(9) | | 5,012,708 |

| | 31.8 | % |

| | | | | | |

*Less than 1%

| |

(1) | To our knowledge, unless otherwise indicated in the footnotes to this table, we believe that each of the persons named in the table has sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to community property laws where applicable (or other beneficial ownership shared with a spouse) and the information contained in this table and these notes. |

Beneficial ownership has been determined in accordance with Securities and Exchange Commission (“SEC”) rules, which generally attribute beneficial ownership of securities to each person who possesses, either solely or shared with others, the power to vote or dispose of those securities. These rules also treat as beneficially owned all shares that a person would receive upon 1) exercise of stock options or warrants held by that person that are immediately exercisable or exercisable within 60 days of the determination date; and 2) vesting of restricted stock units held by that person that vest within 60 days of the determination date, which is March 15, 2017 for this purpose. Such shares are deemed to be outstanding for the purpose of computing the number of shares beneficially owned and the percentage ownership of the person holding such options, warrants or restricted stock units, but these shares are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

| |

(2) | The percent of CDTi beneficially owned is based on 15,703,371 shares of Common Stock issued and outstanding on March 15, 2017, together with the applicable stock options, restricted stock units and warrants for that stockholder or group of stockholders calculated in accordance with SEC rules. |

| |

(3) | For Dr. Bell, includes a warrant to acquire 8,000 shares. 16,000 shares and the warrant are held in the Bell Family Trust for which Dr. Bell serves as Trustee and has sole voting and investment control over such securities. |

| |

(4) | For Mr. Park, includes 3,000 shares subject to options currently exercisable. |

| |

(5) | For Mr. Beale, includes 260,000 shares subject to options exercisable within 60 days. |

| |

(6) | For Dr. Golden, includes 62,086 shares subject to options currently exercisable and 1,106 shares subject to restricted stock units issuable within 60 days. 1,711 shares are held in the Golden Family Trust for which Dr. Golden serves as Trustee and has sole voting and investment control over such securities. |

| |

(7) | For Ms. Kern, includes 30,000 shares subject to options exercisable within 60 days. |

| |

(8) | Includes warrants to acquire 8,000 shares, 355,086 shares subject to options currently exercisable and 1,106 shares subject to restricted stock units issuable within 60 days. |

| |

(9) | Kanis S.A.’s mailing address is c/o 235 Old Marylebone Road, London NW1 5QT, England. Includes warrants to purchase 49,800 shares that currently are exercisable. Derek Gray, Chief Financial Officer of Kanis S.A., exercises voting and investment power over the shares held by Kanis S.A. but disclaims beneficial ownership of such shares except to the extent of his pecuniary interest therein. |

Change of Control

On June 30, 2016, we entered into a Letter Agreement (the “Kanis Exchange Agreement”) with Kanis S.A. (“Kanis”) pursuant to which we agreed to an exchange with Kanis of an aggregate of $7,500,000 in principal amount of promissory notes and other indebtedness (collectively, the “Kanis Notes”) held by Kanis, plus accrued but unpaid interest, for a number of shares of Common Stock equal to (a) the principal amount of the Kanis Notes plus the accrued but unpaid interest thereon through and including the date of the settlement of the exchange contemplated by the Kanis Exchange Agreement, divided by (b) $1.6215.

At a special meeting of stockholders held on August 25, 2016, our stockholders approved the transactions contemplated by the Kanis Exchange Agreement, which approval was a condition precedent to the issuance of Common Stock in exchange for the Kanis Notes.

On August 30, 2016, we consummated the Kanis Exchange Agreement transaction, pursuant to which we issued to Kanis an aggregate of 4,872,032 shares of Common Stock in exchange for the delivery to us of the Kanis Notes and the extinguishment of $7,900,000 of indebtedness.

On August 30, 2016, after giving effect to the issuance to Kanis of 4,872,032 shares of Common Stock pursuant to the Kanis Exchange Agreement transaction, Kanis beneficially owned 5,012,707 shares of Common Stock, which included 49,800 shares that can be acquired by Kanis upon the exercise of outstanding warrants, and which represented approximately 52.6% of our outstanding Common Stock. As a result, immediately following consummation of the Kanis Exchange Transaction, Kanis controlled a majority of our total voting securities, and had the ability to control the outcome of matters submitted to our stockholders for approval, including the election of directors, the issuance of securities and any merger, consolidation, or sale of all or substantially all of our assets. This concentration of ownership may also have the effect of deterring, delaying or preventing a subsequent change of control of our company, could deprive our stockholders of an opportunity to receive a premium for their common stock as part of a sale of our company, and might ultimately affect the market price of our Common Stock.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table provides information regarding the compensation of our named executive officers during 2015 and 2016. As a “smaller reporting company,” as such term is defined in the rules promulgated under the Securities Act of 1933, as amended, or the Securities Act, we are required to provide compensation disclosure for our principal executive officer and the two most highly compensated executive officers other than our principal executive officer. Throughout this proxy statement, these three officers are referred to as our “Named Executive Officers.”

|

| | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position |

| Year |

| Salary

($)(1) |

| Bonus

($)(2) |

| Stock

Awards

($)(3)(4) |

| Option

Awards

($)(3) |

| Non‑Equity

Incentive Plan

Compensation

($)(5) |

| All Other

Compensation

($)(6) |

| Total

($) |

Matthew Beale(7) |

| 2016 |

| 270,192 |

|

| 37,500 |

|

| — |

|

| 1,019,324 |

|

| — |

|

| 33,392 |

|

| 1,360,408 |

|

President, Chief Executive Officer and Director |

| 2015 |

| 52,500 |

|

| — |

|

| 829,097 |

|

| — |

|

| 19,909 |

|

| 49,007 |

|

| 950,513 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen J. Golden, Ph.D. |

| 2016 |

| 245,192 |

|

| 37,500 |

|

| — |

|

| 254,830 |

|

| — |

|

| 392 |

|

| 537,914 |

|

Chief Technology Officer and Vice President |

| 2015 |

| 300,000 |

|

| 18,000 |

|

| 185,704 |

|

| — |

|

| 55,272 |

|

| 690 |

|

| 559,666 |

|

|

|

|

|

|

|

|

|

|

|