Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| |

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2016

or

|

| |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No.: 001-33710

CLEAN DIESEL TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

| |

Delaware State or other jurisdiction of incorporation or organization | 06-1393453 (I.R.S. Employer Identification No.) |

1621 Fiske Place

Oxnard, CA 93033

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (805) 639-9458

Securities registered pursuant to Section 12(b):

|

| | |

Title of each class | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g): None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | | |

Large Accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of the common equity held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant's most recently completed second fiscal quarter, June 30, 2016, was $6,460,563 This calculation does not reflect a determination that persons are affiliates for any other purposes. The registrant does not have non-voting common stock outstanding.

As of March 31, 2017, the registrant had 15,703,301 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the registrant’s 2017 Annual Meeting of Stockholders are incorporated by reference in Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of December 31, 2016, the last day of the fiscal year covered by this Annual Report on Form 10-K.

CLEAN DIESEL TECHNOLOGIES, INC.

Annual Report on Form 10-K

For the Year Ended December 31, 2016

Table of Contents

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, adopted pursuant to the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties, as well as assumptions that could cause our results to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements generally are identified by the words “may,” “will,” “project,” “might,” “expects,” “anticipates,” “believes,” “intends,” “estimates,” “should,” “could,” “would,” “strategy,” “plan,” “continue,” “pursue,” or the negative of these words or other words or expressions of similar meaning. All statements, other than statements of historical fact, are statements that could be deemed forward-looking statements. These forward-looking statements are based on information available to us, are current only as of the date on which the statements are made, and are subject to numerous risks and uncertainties that could cause our actual results, performance, prospects or opportunities to differ materially from those expressed in, or implied by, the forward-looking statements. For a discussion of such risks and uncertainties, please see the discussion under the caption “Risk Factors” contained in this Annual Report on Form 10-K and in other information contained in this annual report and our publicly available filings with the Securities and Exchange Commission. You should not place undue reliance on any forward-looking statements. Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

You should read this Annual Report on Form 10-K and the documents that we reference in this Annual Report on Form 10-K and have filed with the Securities and Exchange Commission as exhibits thereto with the understanding that our actual future results and circumstances may be materially different from what we expect.

EXPLANATORY NOTE

The terms “CDTi” or the “Company” or “we,” “our” and “us” means Clean Diesel Technologies, Inc. and its consolidated subsidiaries as of the date of this Annual Report on Form 10-K. References to “Notes” are notes included in the consolidated financial statements included in this Annual Report on Form 10-K.

TRADEMARKS

The Clean Diesel Technologies name with logo, CDT logo, CDTi name with logo, CSI®, CATALYTIC SOLUTIONS®, CSI logo, ARIS®, BARETRAP®, BMARS™, CATTRAP®, COMBICLEAN®, COMBIFILTER®, DESIGNED TO FIT. BUILT TO LAST.™, DURAFIT™, DURAFIT OEM REPLACEMENT EMISSION TECHNOLOGIES™, MPC®, P2C™, PATFLUID®, PLATINUM PLUS®, PURIFIER and design, PURIFILTER®, PURIMUFFLER®, SPGM™, SPINEL™, THREE-WAY ZPGM™, TWO-WAY ZPGM™, ZPGM™, ZPGM TWC™, TERMINOX® and UNIKAT®, among others, are registered or unregistered trademarks of Clean Diesel Technologies, Inc. (including its subsidiaries).

PART I

ITEM 1. BUSINESS

Company Overview

Clean Diesel Technologies, Inc. is a leading provider of technology and solutions to the automotive emissions control markets. We possess market leading expertise in emissions catalyst design and engineering for automotive and off-road applications. In particular, we have a proven ability to develop proprietary materials incorporating various base metals that replace costly platinum group metals ("PGM") and rare earth metals in coatings on vehicle catalytic converters. Our business is driven by increasingly stringent global emission standards for internal combustion engines, which are major sources of a variety of harmful pollutants.

We deliver our catalyst technology through the supply of materials and technology used in the catalyst coating process as well as finished products such as coated substrates and emission control systems. We supply our proprietary catalyst technologies to major automakers, heavy duty truck manufacturers, catalyst manufacturers, distributors, integrators and retrofitters.

We produce coated substrates at our ISO Technical Specifications certified manufacturing facility in Oxnard, California. In some instances, the coated substrates we produce are integrated into exhaust systems by third-party manufacturers before being shipped to our end customer. We also supply coated substrates directly to exhaust systems manufacturers for incorporation in their own products.

Over the past decade, we have developed several generations of high performance catalysts, including our low-PGM mixed phase catalysts, or MPC® that are used on certain new Honda vehicles. During the same period we have developed the ability to deliver our catalyst technology to other catalyst manufacturers in the form of functional powders or material systems. Recently, we have expanded our offering of material systems beyond MPC® to include new synergized-PGM diesel oxidation catalysts, or SPGM™ DOCs, base-metal activated rhodium support, or BMARS™, and Spinel™ technologies. Most catalytic systems require significant amounts of costly PGMs to operate effectively. Our family of unique high-performance material systems, featuring inexpensive base-metals with low PGM content will enable further advances in catalyst performance. We are marketing these new catalyst technologies to other catalyst manufacturers in a proprietary powder form, which will allow them to capture the benefits of our advanced catalyst technology in their own manufacturing operations and will provide a new source of revenue for the Company.

Strategy

Over more than twenty years, we have developed the emissions control technology and manufacturing know-how to allow us to progress to delivering enabling technology for manufacturers serving the emissions catalyst market. The ability to deliver our advanced materials to other catalyst producers as functional powders allows us to achieve greater scale and higher return on our technology investment than would be possible as a manufacturer of emission control systems. The strategy to provide our technology to other manufacturers has significantly increased the size of our addressable market and provides access to markets that would not be achievable as a catalyst producer. In the short term, we are focusing our efforts and resources by pursuing opportunities in fast growing markets in China and India, as well as North America, where we believe that we can serve profitably with our technology provider business model.

The Chinese market offers significant opportunity as the world’s single largest automotive market with over 24 million vehicles produced in 2016. There is an extensive emission control systems supply chain serving domestic and international automobile manufacturers in China. Somewhat unique to China, there are many domestic catalyst manufacturers serving the automotive market in competition with the large global catalyst producers. This segment of the market requires technology and know-how to adhere to increasingly stringent emissions standards and to deliver competitively priced catalysts. In addition, there is significant pressure for the Chinese automotive market to address increasing air pollution, an issue that has escalated to become a matter of public policy. We believe these factors provide a highly favorable environment for our products and technology.

Air quality is also an important market driver in India where annual vehicle production was over 4 million in 2016. India has a number of domestic vehicle manufacturers that are served by both global and local catalyst manufacturers. There is significant opportunity to provide enabling technology to domestic catalyst producers with the appropriate manufacturing expertise.

North America continues to be a leading global automotive market with over 18 million vehicles produced in 2016. We have focused our resources in North America on developing the growing original equipment manufacturer ("OEM") diesel particulate filter ("DPF") and diesel oxidation catalysts ("DOC") replacement market. We currently serve that market directly with our DuraFit™ product line and through the supply of technology and products to other manufacturers and distributors for sale under their own brand. We believe that our technology has the potential to become the market standard in the OEM DPF and DOC replacement market.

In support of this strategy, we have filed approximately 215 patents that underpin next-generation technology for our advanced zero-PGM or ZPGM and low-PGM catalysts, and during 2015 and 2016, we completed an initial series of vehicle tests to validate our next-generation technologies. Based on the success of these tests, we are beginning to make our new catalyst technologies available to OEMs, catalyst coaters and other participants in the emission reduction supply chain for use in proprietary powder form, and we foresee multiple paths to market our new technologies.

Emissions Control Industry Overview

Regulatory standards have been adopted worldwide to control the exhaust emissions from on- and off-road engines. These emissions typically include nitrogen oxides, hydrocarbons, particulate matter, carbon monoxide and more recently greenhouse gases such as carbon dioxide. Emission regulations for mobile sources have tightened and expanded over the years due to an increased understanding of the impacts of these emissions on human health and the environment, which is highlighted by the following:

| |

• | According to a March 2014 EPA report, over 149 million Americans today still experience unhealthy levels of air pollution which are linked to adverse health impacts such as hospital admissions, emergency room visits and premature mortality. |

| |

• | In a 2014 State of the Air report prepared by the American Lung Association, it was documented that air pollution hovers at unhealthy levels in almost every major city, placing lives at risk. The same report indicated that cleaner diesel engines helped cut year-round particle pollution in many areas. |

| |

• | According to a 2013 report published by the World Health Organization, exposure to particulate matter less than 2.5 micrometers in diameter (PM2.5) reduces the life expectancy of each person in Europe by an average of 8.6 months. |

| |

• | A comprehensive 2016 study led by Tsinghua University and the Health Effects Institute found that, with continued actions to control air pollution, levels will decline substantially by the year 2030, and 275,000 premature deaths will be avoided in the People’s Republic of China. |

Because standards put in place by the United States Environmental Protection Agency, or EPA, the California Air Resources or CARB, the European Union, the Chinese Ministry of Environmental Protection and other international regulators continue to become more restrictive, we view the market opportunities for our products as continually expanding. Our light duty vehicle catalyst products and heavy duty diesel emission control systems are designed specifically to deal with emissions from gasoline, diesel and a variety of alternative fuel powered engines.

Light Duty Vehicles

Key milestones in the evolution of light duty vehicle emissions control in the U.S. are summarized in the table below:

|

| |

1970 | Congress passed the Clean Air Act, which required a 90% reduction in emissions from new automobiles by 1975, and resulted in the introduction of the first generation two-way catalytic converter to remove carbon monoxide and hydrocarbon emissions. |

1977 | Congress amended the Clean Air Act in order to further reduce the limits for nitrogen oxide emissions which resulted in the introduction of the three-way catalytic converter in 1981. |

1990 | Amendments were made to the Clean Air Act to further reduce nitrogen oxide emission limits by another 40% beginning in 1994. These "Tier 1" standards also resulted in standards for certain trucks. |

1998 | The Clinton Administration, auto industry and Northeast States came to a voluntary agreement to implement the National Low Emissions Vehicles, or NLEV, which was fully implemented across the U.S. by 2001. Additionally, CARB adopted the Low Emission Vehicle II, or LEV II, program which was a predecessor to the EPA's "Tier 2" standards set in 1999, which took effect in 2004. |

2014 | The EPA announced their finalized "Tier 3" standards, which are to be phased in between 2017 and 2025. These standards further reduce emissions from light duty vehicles by approximately 70% to 80% and are closely coordinated with the CARB LEV III standards. Of particular note, particulate matter standards are being further tightened to ensure that new advanced combustion strategies such as gasoline direct injection and diesel fueled vehicles do not pose additional new sources of pollution. |

Light Duty Vehicles—International Markets

Europe implemented similar regulations as those noted above under Euro III (effective 2000), Euro IV (effective 2005), Euro V (effective 2009) and Euro VI (effective 2016).

In India the current emission standard is at BSIII going to BSIV nationwide (similar to Euro-IV) with discussions still on-going concerning timing to implement BSV and BSV1.

China has the world's largest passenger car market and is transitioning to China V (equivalent to Euro-V) in 2016 and 2017, with a complex set of regional deadlines. China VI (with an accelerated timetable for Beijing called "Beijing 6") is set to be implemented in 2019. China VI is equivalent to Euro-VI.

Heavy Duty Diesel Engines

Key milestones in the evolution of heavy duty diesel engine emissions control in the U.S. are summarized in the table below.

|

| |

1985 | The EPA first mandated emission standards for diesel-fueled trucks and buses. |

1991 - 2006 | Emissions standards were largely met with advanced engine technologies. In approximately 375 engine certifications between 1994 and 2006, diesel oxidation catalysts were also used to help engines comply with particulate matter standards. |

2007 | The EPA and CARB standards further reduced particulate matter emissions limits for heavy duty engines by an additional 90% which led to the introduction of catalyzed diesel particulate filters, or CDPF. |

2010 | EPA 2010 significantly lowers the tailpipe emissions of nitrogen oxides, or NOx compared to the 2007 standard. 2010 tailpipe standards in US have led to the use of selective catalytic reduction, or SCR in addition to DOC and filters commonplace in EPA 2007 systems. |

Off-road compression ignition emissions standards (non-road Tier 1) were first set in 1996 and consistently phased in and further tightened by off-road Tier 2 and Tier 3 emissions limits. Tier 4 emissions limits which have been phased in between 2011 and 2014 saw the first introduction of various exhaust emissions controls including diesel oxidation catalysts, diesel particulate filters and selective catalytic reduction catalysts. Given the global nature of the off-road diesel powered equipment market, common EPA and European Union standards have typically been enacted at comparable times.

Emerging Replacement Market in North America

According to market analysis firm Power System Research, manufacturers in North America have produced on average of 250,000 heavy duty on-road diesel vehicles equipped with a diesel particulate filter each year since 2007 to comply with EPA requirements. The typical OEM warranty on diesel particulate filters is five years and has expired for many of these vehicles with more continuing to expire in the coming years. As 2007 and newer diesel particulate filters from OEMs fail and require replacement, non-OEM diesel particulate filters will be needed as replacements. According to a 2012 industry report, the market for medium and heavy duty vehicle after-treatment maintenance and repair is projected to grow from $0.5 billion in 2010 to $3.0 billion by 2017. In the third quarter of 2014, we introduced the CDTi manufactured DuraFit™ OEM replacement diesel particulate filters through our channel of distributors to provide an alternative to OEM manufactured parts. We expect to leverage our existing technology and know-how to serve this emerging market.

Heavy Duty Diesel Engines—International Markets

Europe has adopted the stringent Euro-VI standard for heavy-duty vehicles which has led to systems using DOC, particulate filters and SCR. China is following the European standards and is currently implementing Euro-V with Euro-VI set to begin in 2010 with an accelerated version in Beijing. India is currently at BSIV (similar to Euro-IV) and is discussing the timetable for BSV and BSVI implementation.

Technology

In addition to our traditional catalyst products (TWC, DOC, CDPF and SCR), we have succeeded in developing a broad technology portfolio of new materials and catalysts to meet and exceed regulatory emission standards around the globe. We have focused on the two products, Three-Way Catalysts (TWC) and Diesel Oxidation Catalysts (DOC), that currently utilize a significant amount of PGMs. In particular, our BMARS™, Spinel™ and MPC® powder materials and catalyst products

developed from these technologies: SPGM™ DOC, SPGM™ TWC and TWC using BMARS™ and MPC®, are at the core of our business.

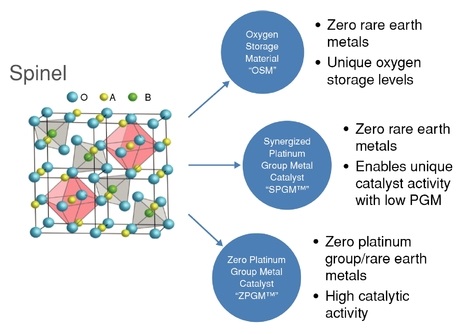

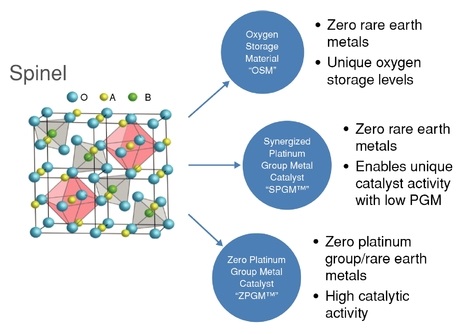

| |

• | Spinel™. Our Spinel™ technology is a unique clean emissions exhaust technology which we believe will dramatically reduce the cost of attaining more stringent clean air standards. Spinel was the name initially given to naturally-occurring magnesium aluminate (MgAI2O4) and is now used to describe any composition with the same structure. Our Spinel™ technology can employ numerous low-cost metals in the spinel structure enabling use in a wide range of engine and vehicle applications, both gasoline and diesel, as well as other potential vertical markets. Our unique Spinel™ technology utilizes various base metals, which when combined together in a common structure, achieve |

unusual and very effective catalytic conversion activity. Spinel™ technology is ideal for the coating of catalytic converters, an alternative to those utilizing costly PGMs and rare earth materials. The base metals we use are common and inexpensive compared to PGMs, such as platinum, palladium and rhodium, and rare earth metals, such as cerium, lanthanum and neodymium. We believe Spinel™ technology will provide significant cost savings over conventional coating formulations. In addition, the Spinel™ technology structure is extremely versatile and stable. The versatility is critical for optimizing future generations of products to meet changing catalytic conversion needs for rapidly evolving engine technologies and increasingly stringent clean air standards. The stability of Spinel™ is critical to provide superior catalytic performance over time and at extreme temperatures for lifetime durability. In addition to SPGM™ and ZPGM™catalysts, we currently have oxygen storage material, or OSM, under development, which synergizes PGM function and drives the critical vehicle on-board diagnostic system. Our newest family of advanced low-PGM and ZPGM™ oxide compounds based upon our Spinel™ technology is summarized below:

To date, we have filed numerous patents on our Spinel™ technology and two were issued in late 2014.

| |

• | BMARS™. We have developed and patented intellectual property rights to a novel technology for enhancing the catalytic activity of rhodium known as base-metal activated rhodium on Support (BMARS™). This technology is in the form of a nano-scale powder that can be used by catalyst manufacturing partners in the production of TWC. The products made from these novel materials exhibit superior NOx performance at reduced rhodium loading. |

| |

• | MPC®. We have developed and patented intellectual property rights to a novel technology for creating and manufacturing catalysts known as mixed phase catalysts (MPC®). This technology involves the self-assembly of a ceramic oxide matrix with catalytic metals precisely positioned within three-dimensional structures. The MPC® design gives our catalyst products two critical attributes that we believe differentiate them from competing offerings: superior stability that allows heat resistance and high performance with very low levels of precious metals; and base metal activation that allows base metals to be used instead of costly PGMs without compromising catalytic performance. |

| |

• | SPGM™ DOC. We have developed powder materials that can be used to produce SPGM™DOC, synergized PGM diesel oxidation catalyst. The unique materials developed enable a low PGM and high performance DOC for use in a range of applications, including systems utilizing particulate filters and SCR for advanced emission standards. |

| |

• | Platinum Plus®. We have developed and patented our Platinum Plus® fuel-borne catalyst as a diesel fuel soluble additive, which contains minute amounts of organo-metallic platinum and cerium catalysts. Platinum Plus® enables rapid conversion of particulate matter from diesel engines when coupled with a diesel particulate filter. It also improves combustion, which acts to reduce engine-out emissions. Platinum Plus® fuel-borne catalyst lends itself to a wide range of enabling solutions including diesel particulate filtration, low emission biodiesel, carbon reduction and exhaust emission reduction. |

| |

• | ARIS®. We have developed technology for selective catalytic reduction using urea, which is a highly effective method of reducing oxides of nitrogen. ARIS® technology forms a key part of the selective catalytic reduction system and is an advanced, computer-controlled, reagent injection system. |

We protect our proprietary technologies, along with our other intellectual property, through the use of patents, trade secrets and registered and common law trademarks. For additional information, refer to the "Intellectual Property" discussion below.

Competitive Advantages

Through a focused technology development campaign, we have developed a full suite of materials for gasoline and diesel engines with an associated broad portfolio of emission control catalysts. We believe that our technologies and products represent a fundamentally different solution, and the following competitive strengths position us as a leading provider of emission control products and systems.

| |

• | Superior Catalyst Performance. Our proprietary technology enables us to produce catalytic coatings capable of significantly better catalytic performance than those previously available. We have achieved this demonstrated performance advantage by creating catalysts using unique nanostructures with superior stability under prolonged exposure to high temperatures. As a result, in heavy duty diesel and automotive applications, our catalyst formulations are able to maintain high levels of performance over time using substantially lower, or zero, PGMs than products previously available. |

| |

• | Catalyst Cost Advantage—Addressing Global PGM Supply and Demand. Expensive PGMs, which include palladium, platinum and rhodium, and rare earth metals such as cerium, neodymium and lanthanum, are used in the manufacture of emission control catalysts, with palladium being the primary component used in catalysts serving the global light duty vehicle market. According to Johnson Matthey PLC's "Platinum 2013 Interim Review", in 2013, over 70% of all primary platinum and 80% of all primary rhodium produced originated in South Africa. Russia and South Africa combined supplied over 75% of palladium. We believe that the continued growth in supply of these metals from the mines in South Africa and Russia will be critical in order to meet the increasingly stringent global emission control standards. According to the same report, it is estimated that more than $6 billion is spent annually by OEMs on PGM purchases for catalysts. The global auto industry is expected to produce over 100 million vehicles by 2018, according to IHS Automotive. These production levels are expected to result in a continued increase in PGM demand for the foreseeable future. In addition, continued tightening of emission standards by regulators globally will require increased loading of PGM in emission catalysts. The new materials developed at CDTI enable OEMs and their suppliers to drastically reduce the PGM loadings in the DOC and TWC products that currently require the high cost of elevated PGM usage. |

| |

• | Highly Customizable Catalyst Formulations. Our proprietary MPC® technology is a design approach, as opposed to a single chemical formulation. We have developed this technology since inception as a platform that can be tailored for a range of different catalyst applications. Specifically, our formulations can be tailored in two distinct ways. First, the oxide compounds used in our formulations can be adapted for specific applications by adding to them, or doping them with, a wide range of chemical elements. Second, we are able to vary the mixtures of our compounds to create customized solutions for specific applications for different vehicle platforms within the auto industry, complex heavy duty diesel equipment for OEMs, aftermarket and retrofit markets, and for different applications in the energy sector, such as selective catalytic reduction nitrogen oxide control for industrial and utility boilers, process heaters, gas turbines and generator sets. These could also include applications in the fuel cell, petrochemical and refinery, and thermoelectric industries. |

| |

• | Proven Durability. Our products and systems have undergone substantial laboratory and field testing by our existing and prospective customers and have demonstrated their durability and reliability in a wide range of applications in actual use for many years. In addition, our products and systems have achieved numerous certifications and meet or exceed industry standards. |

| |

• | Broad Portfolio of Verified Heavy Duty Diesel Systems. We believe we offer one of the industry's most comprehensive portfolios of system products that have been evaluated and verified (approved) by the EPA and CARB, as well as regulators in several European countries, for use in engine retrofit programs and in the aftermarket segment. Additionally, we have a thorough understanding of the verification process and the demonstrated ability to obtain broad verifications of products for use in the retrofit market. |

| |

• | Compatibility with Existing Manufacturing Infrastructure and Operating Specifications. Catalytic converters using our catalyst products are compatible with existing automotive manufacturing processes as well as specific vehicle operating specifications. Our customers generally do not need to change their manufacturing operations, processes, or how their products operate in order to utilize our proprietary technology. Our heavy duty diesel emission control |

products and solutions are engineered to each customer's specific application and designed to deliver custom and industry-leading solutions that meet or exceed environmental mandates.

Products

We categorize our products as follows:

|

| |

Gasoline Engines | We offer a range of advanced powder materials for use in catalyst products for emission control from gasoline engines: MPC®, BMARS™ and Spinel™. In addition we provide the catalyst products themselves in high-value applications where necessary. We believe catalytic converters using our technology have superior catalytic performance, can cost substantially less as a result of significantly reduced PGM loadings, have comparable or better durability and are physically and operationally compatible with all existing manufacturing processes and operating requirements. Our solution is based on industry-leading, patent-protected technology and a scalable manufacturing business model. |

Diesel Engines | We offer proven and robust catalyst products for emissions control from diesel engine applications: catalyzed particulate filters and diesel oxidation catalysts. Current techniques for diesel engines to meet emissions standards require the use of several methods, including diesel oxidation catalysts, catalyzed diesel particulate filters and selective catalytic reduction systems. We offer a full range of catalyst products for the control of carbon monoxide, hydrocarbons, particulate matter and nitrogen oxide in light and heavy duty applications. A new generation of materials is now available that enable catalyst manufacturing partners to commercialize SPGM™ DOC products for improved performance and low PGM usage. |

Energy Applications | We have developed and can manufacture catalysts for use in selective catalytic reduction and carbon monoxide reduction systems, which are used to reduce nitrogen oxide and carbon monoxide emissions from natural gas and petroleum gas burning utility plants, industrial process plants, OEMs, refineries, food processors, product manufacturers and universities. |

Advanced Catalytic Materials | We have developed a complete suite of high performance and cost efficient technologies that can be offered in powder form to catalyst suppliers for inclusion in their manufacturing processes to address global demand by OEMs. |

Sales and Marketing

We deliver our catalyst technology to customers as finished products such as coated substrates and emissions control systems as well as through the supply of materials and technology used in the catalyst coating process.

We supply our proprietary catalyst technologies to the OEM segment including automakers, heavy duty truck manufacturers, catalyst manufacturers, and aftermarket participants including distributors, integrators and retrofitters.

In the OEM segment, we utilize a business development team, with technical backgrounds, to pursue customers that can benefit from the use of our technology in the manufacture of their own catalysts. The catalyst industry is mainly comprised of a few suppliers serving large, sophisticated customers such as automobile manufacturers. Extensive interaction is required between catalyst manufacturers and the auto maker in the course of developing an effective, reliable catalyst for a particular application. We produce coated catalysts and continue to be an approved supplier of catalysts for major automotive manufacturers. Our ability to deliver our technology in powder form to catalyst manufacturers has enhanced our ability to market our products globally and to other catalyst manufacturers.

In the aftermarket segment, we sell emissions control products to automotive aftermarket suppliers and distributors for the OEM DPF and DOC replacement market. OEM replacement products are sold through the OEMs proprietary service network or through independent distributors and retailers. We are present in the OEM replacement market with Durafit™ brand of OEM replacement diesel particulate filters and diesel oxidation catalysts as well as through the sale of products to other manufacturers. Retrofit applications generally involve funded projects that use "approved systems" that are one-off in nature. Typical retrofit end-user customers include school districts, municipalities and other fleet operators, and the market for our heavy duty diesel systems products is heavily influenced by government funding of emissions control projects.

Competition

The automotive emissions control industry is highly concentrated with a few major competitors as a result of continuing consolidation through acquisitions. The major competitors are diversified enterprises with catalysts representing one of several lines of business. Globally, we and our catalyst manufacturer customers compete directly against BASF GmbH, Johnson Matthey PLC and Umicore Limited Liability Company. In the North America heavy-duty diesel market, competitors also include, Donaldson Company, Inc., ESW, Inc., Hug Filtersystems, and DCL International, Inc.

In the worldwide market the key competitive factors are:

| |

• | Ability to provide a solution that satisfies emission reduction regulations; |

| |

• | Total cost of product (inclusive of PGM); |

| |

• | Ability to transition new products from development to production; |

| |

• | Quality control that guarantees 100% compliance with specifications; |

| |

• | On-time delivery to support customer production requirements; and |

| |

• | Financial stability and global reach. |

Our strategy of transitioning to an advanced materials company is intended to enable broad commercialization of our technology without the need for a global manufacturing footprint. In particular, our ability to provide enabling technology to domestic catalyst manufacturers in key growth markets will allow our customers to defend and grow their market share.

Research and Development

Our research and development in catalyst technology is our core strength and has resulted in a broad array of products for the light duty vehicle and heavy duty diesel markets. We believe that the technical sophistication and cost-to-performance ratio of our products truly distinguishes our company. Product development for TWC and DOC has resulted in a broad family of verified products and systems. We credit our accomplishments to date to innovation, technology differentiation, application engineering expertise, highly targeted product development efforts and solid experience in the verification and approval process.

Intellectual Property

Our intellectual property includes patent rights, trade secrets and registered and common law trademarks. Historically, we have primarily protected our intellectual property, particularly in the area of three-way catalysts (and particularly in the automotive area) by maintaining our innovative technology as trade secrets. We believe that the protection provided by trade secrets for our intellectual property was the most suitable protection available for the automotive industry where our business initially started and in which we currently sell our commercial products. Our automotive competitors largely rely on trade secret protection for their innovative technology.

In order to more broadly commercialize our technology in new business models, we have sought patent protection in relation to any new industries and new countries in which we expect to do business. We currently have approximately 111 issued patents and approximately 177 pending applications covering the following main technologies: fundamental catalyst formulations based on perovskite mixed metal oxides applicable to all catalyst markets, Spinel™ technology, Mixed Phase Catalyst (MPC®) technology, PGM-free catalyzed diesel particulate filter, selective catalytic reduction, diesel oxidation catalyst, ZPGM™ three-way catalyst formulations, ZPGM™ diesel oxidation catalyst, palladium three-way catalyst formulations, fuel-borne catalysts, optimization and stabilization of oxygen storage materials without rare earth materials, exhaust gas recirculation with selective catalytic reduction and exhaust systems for diesel engines incorporating particulate filters. Currently, our patents have expiration dates ranging from 2017 through 2033.

We have conducted an analysis of our technologies and intellectual property and have decided to aggressively patent our important technologies going forward. While we continue to rely on a combination of trade secrets, know-how, trademark registrations, confidentiality and other agreements with employees, customers, partners and others, we intend to strengthen our position through the prosecution of patents to protect our intellectual property rights pertaining to our products and technology.

We currently have registered and unregistered trademarks for the Clean Diesel Technologies name with logo, CDT logo, CDTi name with logo, CSI®, CATALYTIC SOLUTIONS®, CSI logo, ARIS®, BARETRAP®, BMARS™, CATTRAP®, COMBICLEAN®, COMBIFILTER®, DESIGNED TO FIT. BUILT TO LAST.™, DURAFIT™, DURAFIT OEM REPLACEMENT EMISSION TECHNOLOGIES™, MPC®, P2C™, PATFLUID®, PLATINUM PLUS®, PURIFIER and design, PURIFILTER®, PURIMUFFLER®, SPGM™, SPINEL™, THREE-WAY ZPGM™, TWO-WAY ZPGM™, ZPGM™, ZPGM TWC™, TERMINOX® and UNIKAT®.

Manufacturing Operations

We have developed innovative and sophisticated manufacturing processes for coating substrates using our proprietary catalytic coatings. The manufacturing process consists of preparing coatings direct or in powder form via controlled mixing and calcination, then coating and further calcining (one or multiple times) the coated substrates. The process of mixing and applying the various types of coatings onto high cell density substrates is complex and requires sophisticated manufacturing technology. We have been manufacturing automotive catalysts in house since 1999 perfecting those technologies. Our manufacturing processes are designed to provide a high level of quality control at every step of our unique manufacturing

process. We coat our proprietary catalyst products at our Oxnard, California manufacturing facility as well as support our downstream partners in deploying coating processes in their global facilities to enable them to correctly apply our unique products.

For our complete turnkey DuraFit™, Purifilter™, and private label family emissions products we outsource the manufacture of the metal enclosures, accessories and hardware which complete the unit sold to the end customer. We maintain ISO 9001:2008, ISO/TS 16949:2009 and ISO 14001:2004 certifications for our facilities.

Our raw material requirements include significant purchases of ceramic substrates filters that we coat with specialty formulated catalytic materials comprised of platinum group metals (PGMs) and various chemicals. PGMs and substrates are either provided on a consignment basis by the customers or are purchased by us on behalf of the customer. The availability of raw materials is generally dictated by global market supply of key materials. Delivery of key materials such as rare earth metals and PGMs have been at times constricted due to global supply constraints. The ceramic substrates and filters that we buy can generally be purchased from more than one source, limiting our risk of supply. Changing suppliers for some raw materials may require regulatory or customer approval. For further discussion of risk of supply, refer to "Item 1.A. Risk Factors”.

Regulations

We are committed to complying with all federal, state and international environmental laws governing production, use, transport and disposal of substances and control of emissions. In addition to governing our manufacturing and other operations, these laws often impact the development of our emissions control products, including, but not limited to, required compliance with emissions standards applicable to new product diesel, gasoline and alternative fuel engines. These regulations include those developed in Japan, in the United States by the EPA and CARB and in the E.U. by the European Environment Agency, including standards from the Verification of Emission Reduction Technologies, or VERT, Association.

Many of our products must receive regulatory approval prior to sale. In the United States, regulatory approval is obtained from the EPA or CARB through a verification process. The verification process includes a thorough review of the technology as well as tightly controlled testing to quantify statistically significant levels of emission reductions. For example, the EPA verification process begins with a verification application and a test plan. Once this is completed, the testing phase begins and is then followed by a data analysis to determine if the technology qualifies for verification. Once a technology is placed on the verified technologies list and 500 units are sold, the manufacturer is responsible for conducting in-use testing and reporting of results to the EPA. Where we own the verification, primarily in retrofit, we are responsible for this testing. Similar product approval schemes exist in other countries around the world.

Company History

We are a Delaware corporation formed in 1994 as a wholly-owned subsidiary of Fuel Tech, Inc., a Delaware corporation (formerly known as Fuel-Tech N.V., a Netherlands Antilles limited liability company) ("Fuel Tech"), and were spun off by Fuel Tech in a rights offering in December 1995 on the NASDAQ Stock Market (Symbol CDTI). On October 15, 2010, we completed a business combination with Catalytic Solutions, Inc. ("CSI"), a California corporation formed in 1996, when our wholly-owned subsidiary, CDTI Merger Sub, Inc., merged with and into CSI. We refer to this transaction as the "Merger." The Merger was accounted for as a reverse acquisition and, as a result, our Company's (the legal acquirer) consolidated financial statements are now those of CSI (the accounting acquirer), with the assets, liabilities, revenues and expenses of CDTI being included effective from October 15, 2010, the closing date of the Merger. From November 22, 2006 through the closing date of the Merger, CSI's common stock was listed on the AIM of the London Stock Exchange (AIM: CTS and CTSU).

Employees

As of December 31, 2016, we had 97 full time employees and 2 part time employees. None of our employees is a party to a collective bargaining agreement. We also retain outside consultants and sales and marketing consultants and agents.

ITEM 1A. RISK FACTORS

We are subject to risks and uncertainties that may affect our future financial performance and our stock price. Some of the risks and uncertainties that may cause our financial performance to vary or that may materially or adversely affect our financial performance or stock price are discussed below. Any of these risks, as well as other risks and uncertainties not known to us or that we believe to be immaterial, could harm our financial condition, results of operations or cash flows. You should carefully consider the risks described below in addition to the cautionary statements and risk factors described elsewhere and the other information contained in this Annual report on Form 10-K and in our other filings with the SEC, including subsequent reports on Forms 10-K, 10-Q and 8-K, before deciding to purchase, hold, or sell our stock.

Risks Related to Our Financial Condition

We have limited cash and experience negative cash flows from operations, and may need to raise additional capital to sustain our operations. If we are unable to raise additional capital when needed, we may be forced to seek to reorganize under bankruptcy laws or liquidate. As a result, our independent registered public accounting firm has expressed substantial doubt about our ability to continue as a going concern.

As of December 31, 2016, we had cash of $7.8 million, and indebtedness of $3.3 million. Additionally, we have historically operated with negative cash flows from operations and had operating cash flow deficits of $7.0 million and $11.6 million for the years ended December 31, 2016 and 2015, respectively. Due to these conditions, substantial doubt exists as to our ability to continue as a going concern. If necessary, we will seek to raise additional capital from the sale of equity securities or the incurrence of indebtedness to allow us to continue operations. There can be no assurance that additional financing will be available to us on acceptable terms, or at all. Our inability to raise capital when needed may cause us to reorganize our balance sheet and operations, or liquidate, under the protection of the U.S. Bankruptcy Code, which could result in a loss of your entire investment. Consistent with the foregoing, our auditors have rendered a going concern opinion in respect of our financial statements.

We may require additional working capital to maintain our operations in the form of funding from outside sources which may be limited, difficult to obtain, or unavailable on acceptable terms or not available at all, or in the case of an offering of common stock or securities convertible into or exercisable for common stock, may result in dilution to our existing stockholders.

We have historically relied on outside sources of funding in the form of debt or equity. Although we have a demand credit facility backed by our receivables and inventory, there is no guarantee that we will be able to borrow to the full limit of $7.5 million if the lender chooses not to finance a portion of our receivables or inventory. Additionally, the lender may terminate the facility at any time. We were successful in raising net proceeds of approximately $10.2 million and $7.1 million through private and public offerings of shares during the years ended December 31, 2016 and 2015, respectively, but there is no guarantee that should the need arise, we will be able to do so again.

Any required additional funding may be in the form of debt financing or a private or public offering of equity securities. We believe that debt financing would be difficult to obtain because of our limited assets and cash flows as well as current general economic conditions. Any additional offering of shares of our common stock or of securities exercisable for or convertible into shares of our common stock may result in further dilution to our existing stockholders. Our ability to consummate a financing will depend not only on our ability to achieve positive operating results, but also on conditions then prevailing in the relevant capital markets. There can be no assurance that such funding will be available if needed, or on acceptable terms. In the event that we are unable to raise such funds, we may be required to delay, reduce or severely curtail or cease our operations or the implementation of our business strategies or otherwise impede our on-going business efforts and/or seek reorganization under the U.S. Bankruptcy Code, any of which could have a material adverse effect on our business, operating results, financial condition and long-term prospects.

Future growth of our business depends, in part, on the general availability of funding for emissions control programs, enforcement of existing emissions-related environmental regulations, further tightening of emission standards worldwide, market acceptance of our catalyst products, and successful product verifications.

Although retrofit is a declining part of our business, future growth of our business depends in part on the general availability of funding for emissions control programs, which can be affected by economic as well as political reasons. Additionally, funding for the EPA's Diesel Emissions Reductions Act, or DERA, for 2016 was substantially reduced from historic levels, and future funding remains uncertain as budget discussions continue to be debated in the U.S. Congress. Funding under the U.S. Congestion Mitigation and Air Quality program, or CMAQ, can be used by states for a variety of emission reduction programs including purchase of new vehicles, building high occupancy travel lanes (car-pool lanes) and retrofit programs. To the extent that these funds are not used for retrofit programs, it limits our sales opportunities. Funding for these types of emissions control projects drives demand for our products. If such funding is not available, it can negatively affect our future growth prospects. In addition to funding, we also expect that our future business growth will be driven, in part, by the enforcement of existing emissions-related environmental regulations, further tightening of emissions standards worldwide, market acceptance of our catalyst products and successful product verifications. If such standards do not continue to become stricter or are loosened or are not enforced by governmental authorities due to commercial and business pressure or otherwise, it could have a material adverse effect on our business, operating results, financial condition and long-term prospects.

The pursuit of opportunities relating to special government mandated retrofit programs requires cash investment in operating expenses and working capital such as inventory and receivables prior to the realization of profits and cash from sales and, if we are not successful in accessing cash resources to make these investments, we may miss out on these opportunities; further, if we are not successful in generating sufficient sales from these opportunities, we will not realize the benefits of the investments in inventory, which could have an adverse effect on our business, financial condition and results of operations.

Although retrofit is a declining part of our business, we are pursuing revenue generating opportunities relating to special government mandated retrofit programs such as those in California and potentially others in various jurisdictions in North America, Europe and Asia. Opportunities such as these require cash investment in operating expenses and working capital such as inventory and receivables prior to realizing profits and cash from sales. If we are not successful in accessing cash resources to make these investments, we may miss out on these opportunities. Further, if we are not successful in generating sufficient sales from these opportunities, we will not realize the benefits of the investments in inventory, which would have an adverse effect on our business, financial condition and results of operations.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results, which will likely result in significant legal and accounting expense and diversion of management resources, and current and potential stockholders may lose confidence in our financial reporting and the market price of our stock will likely decline.

We are required by the SEC to establish and maintain adequate internal control over financial reporting that provides reasonable assurance regarding the reliability of our financial reporting and the preparation of financial statements in accordance with generally accepted accounting principles. We are likewise required, on a quarterly basis, to evaluate the effectiveness of our disclosure controls and to disclose any changes and material weaknesses in those internal controls.

Any failure to maintain internal controls could adversely affect our ability to report our financial results on a timely and accurate basis. If our financial statements are not accurate, investors may not have a complete understanding of our operations. If we do not file our financial statements on a timely basis as required by the SEC and The NASDAQ Capital Market, we could face negative consequences from those authorities. In either case, there could be a material adverse effect on our business. Inferior internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of our common stock. We can give no assurance that material weaknesses or restatements of financial results will not arise in the future due to a failure to implement and maintain adequate internal control over financial reporting or circumvention of these controls. In addition, in the future our controls and procedures may no longer be adequate to prevent or identify irregularities or errors or to facilitate the fair presentation of our consolidated financial statements. Responding to inquiries from the SEC or The NASDAQ Capital Market, regardless of the outcome, is likely to consume a significant amount of our management resources and cause us to incur significant legal and accounting expense. Further, many companies that have restated their historical financial statements have experienced a decline in stock price and related stockholder lawsuits.

The debt conversion completed in the third quarter of 2016 adversely affects our ability to take advantage of significant U.S. federal tax loss carryforwards and accumulated tax credits.

In connection with the debt conversion, we performed a study to evaluate the status of net operating loss carryforwards. Because the debt conversion caused an "ownership change" (as defined for U.S. federal income tax purposes), our ability to use our net operating losses and credits in future tax years has been significantly limited. In addition, due to the "ownership change," our federal research and development credits have also been limited and, consequently, we do not anticipate being able to use any of these credits that existed as of the date of the debt conversion in future tax years. Our limited ability to use these net operating losses and tax credits, including as a result of equity offerings subsequent to the debt conversion, could have an adverse effect on our results of operations once we become profitable.

Foreign currency fluctuations could impact financial performance.

Because of our activities in the United Kingdom, Europe, Canada and Asia, we are exposed to fluctuations in foreign currency rates. We do not manage the risk to such exposure by entering into foreign currency futures and option contracts. Foreign currency fluctuations may have a significant effect on our operations in the future.

Risks Related to Our Business

We cannot assure you that we will be successful in completing our transition into an advanced materials supplier or that those efforts will have the intended effect of increasing profitability.

We are in the process of transitioning from being a niche manufacturer of emissions control solutions for the automotive and heavy duty diesel markets to becoming an advanced materials technology provider of proprietary powders for these markets. During the second quarter of 2016, we completed our operating strategy transition however we are still in process with our business strategy transition. We believe that the transition to a powder-to-coat business model will allow us to achieve greater scale and higher return on our technology investment than in the past. In the short term, we expect to focus our efforts and resources in pursuing opportunities in fast growing markets in China and India, as well as North America, which we believe that we can serve profitably with our powder-to-coat business model. However, we cannot assure you that these efforts will be successful and, if they are, that they will have the intended effect of increasing profitability.

We may not be able to successfully implement this strategy for a number of reasons, including, but not limited to:

| |

• | Unforeseen costs and delays; |

| |

• | Unexpected legal, regulatory, or administrative hurdles; |

| |

• | Our customers' unfamiliarity with this business model; |

| |

• | Restrictions on our technology; and |

| |

◦ | Obtain additional capital to pursue such strategies on favorable terms or at all; |

| |

◦ | Protect our intellectual property; |

| |

◦ | Develop products that meet or exceed the qualification standards of OEMs and partners and provide greater value than alternatives; |

| |

◦ | Persuade other catalyst manufacturers to incorporate our technology in their products; |

| |

◦ | Find suitable third parties with whom to enter into partnering arrangements or invest in our business; and |

| |

◦ | Compete successfully or enter new markets. |

We hired a new Chief Executive Officer in November 2015, and our Executive Team, with input from our Board of Directors, is in the process of accelerating the execution of our business strategy. However, we cannot assure you that we will successfully complete our transformation from serving as a manufacturer of emissions solutions to a developer and supplier of proprietary powders used by other catalyst manufacturers for supply to the global automotive industry or that those efforts will have the intended effect of increasing profitability.

Furthermore, in attempting to execute this strategy, we may harm our relationships with customers, suppliers, employees or other third parties, any of which could be significant. The process of exploring, financing, and realigning our strategic path may also be disruptive to our business. While we believe the pursuit of this strategy will have a positive effect on our profitability in the long-term, there is no assurance that this will be the case. If we are not successful in our efforts to carry out this strategy, our business, financial condition, and results of operation may be adversely affected.

Our sales of coated catalysts to Honda, which historically has represented a substantial portion of our revenues, will begin to significantly decline in the fourth quarter of 2017 and end in the first quarter of 2018, which will adversely affect our operations and financial results if we are unable to secure new sources of revenue.

Historically, we have derived a significant portion of our revenue from sales to Honda, which represented 96% and 99% of Catalyst division revenues for the years ended December 31, 2016 and 2015, respectively, and 59% and 57% of consolidated revenues for the years ended December 31, 2016 and 2015, respectively. While we continually seek to broaden our customer base, through 2017 we will remain dependent on Honda to represent a substantial portion of our revenue. Our supply of coated catalysts to Honda will begin to significantly decline in the fourth quarter of 2017 and end in the first quarter of 2018, as certain current vehicle models are phased out. Accordingly, it will be critical that our powder-to-coat business strategy produces revenues with new customers, which may include Honda, directly or indirectly, to replace revenues from our current core catalyst business with Honda.

Historically, we have been dependent on a few major customers for a significant portion of our revenue and our revenue would decline if we are unable to maintain those relationships, if customers reduce their orders for our products, or if we are unable to secure new customers.

We expect to continue to derive a significant portion of our revenue from a limited number of customers. If we are unable to maintain our relationships with customers, or if customers reduce their orders for our products, our revenues will decline.

In addition, manufacturers typically seek to have two or more sources of critical components; however, there can be no assurance that manufacturers for which we are a shared supplier will not sole source the products we supply. Once our product is designed into a vehicle model, we generally supply our component for the life of that model. There can be no assurance, however, that our customers will retain us for a full model term. In this regard, relationships with our customers are based on purchase orders rather than long-term formal supply agreements and customers can discontinue or materially reduce orders without warning or penalty. In addition, while new models tend to remain relatively stable for a few years, there can be no assurance that manufacturers will not change models more rapidly, or change the performance requirements of components used in those models, and use other suppliers for these new or revised models. Demand for our products is tied directly to demand for vehicles. Accordingly, factors that affect the truck and automobile markets have a direct effect on our business, including factors outside of our control, such as vehicle sales slowdowns due to economic concerns, or as a result of natural disasters, including earthquakes and/or tsunamis. The loss of one or more of our significant customers, or reduced demand from one or more of our significant customers, would have an adverse effect on our revenue, and could affect our ability to become profitable or continue our business operations.

We have an expired agreement with Honda that may limit our rights to commercialize certain technology within the scope of that agreement and adversely affect our technology licensing strategy.

In conjunction with our longstanding relationship with Honda, we entered into a joint research agreement with the motorcycle division of Honda regarding the development of ZPGM™ catalysts for motorcycles. The agreement was signed in 2010, extended in 2012 and expired in March 2014, although confidentiality provisions continue to survive. The agreement provides that technology within the scope of the agreement developed solely by one party is owned by that party, and that technology within the scope of the agreement that is jointly developed by both parties is jointly owned. While we believe that core technology within the scope of the agreement was developed solely by us, there can be no assurance that our belief will not be challenged or invalidated. To the extent that Honda is a joint owner of critical technology developed under the agreement, Honda (including its automotive division) might not be required to pay us a license or royalty fee for use of the jointly owned technology; Honda may be able to manufacture its own catalysts based on the jointly owned technology; and Honda may be able to license the jointly owned technology to others without our consent. In addition, under the terms of the agreement, we may not be able to license jointly owned technology to others without Honda’s consent. Our inability to license jointly owned technology to others could adversely affect the ability to license certain technology.

We may not be able to successfully market new products that are developed or obtain verification or approval of our new products.

Some of our catalyst products and heavy duty diesel systems are still in the development or testing stage with targeted customers. We are developing technologies in areas that are intended to have a commercial application; however, there is no guarantee that such technologies will actually result in any commercial applications. In addition, we plan to market other emissions reduction devices used in combination with our current products. There are numerous development and verification issues that may preclude the introduction of these products for commercial sale. These proposed operations are subject to all of the risks inherent in a developing business enterprise, including the likelihood of continued operating losses. If we are unable to demonstrate the feasibility of these proposed commercial applications and products or obtain verification or approval for the products from regulatory agencies, we may have to abandon the products or alter our business plan. Such modifications to our business plan will likely delay achievement of revenue milestones and profitability.

PGMs and rare earth metals price fluctuations could impact financial performance.

Because our catalysts contain platinum, palladium and rhodium, or platinum group metals (PGMs), and rare earth metals, fluctuations in prices could have an adverse impact on our profits as it may not be possible to recover price increases from customers. Additionally, increased prices could result in increased working capital requirements which we may not be able to finance. Conversely, reductions in PGM prices could reduce the competitive advantage our catalyst technologies have over conventional catalysts which rely on significantly higher PGM loadings to achieve emissions targets.

We depend on intellectual property and the failure to protect our intellectual property could adversely affect our future growth and success.

We rely on patent, trademark and copyright law, trade secret protection, and confidentiality and other agreements with employees, customers, partners and others to protect our intellectual property. In addition, some of our intellectual property is not protected by any patent or patent application. The lack of patent and trademark protection may be intentional as we may

lack sufficient resources to protect our intellectual property in every applicable jurisdiction. As a result, it may be possible for third parties to obtain and use our intellectual property without the need to obtain our authorization.

We do not know whether any patents will be issued from our pending or future patent applications or whether the scope of any issued patents is or will be sufficiently broad to protect our technologies. Moreover, patent applications and issued patents may be challenged or invalidated. We could incur substantial costs in prosecuting or defending patent infringement suits. In addition, the laws of some foreign countries may not protect or enforce intellectual property rights to the same extent as do the laws of the United States.

The patents protecting our proprietary technologies expire after a period of time. Currently, our patents have expiration dates ranging from 2017 through 2033. Although we have attempted to incorporate technology from our core patents into specific patented product applications, product designs and packaging, there can be no assurance that this building block approach will be successful in protecting our proprietary technology and products. If we are not successful in protecting our proprietary technology, it could have a material adverse effect on our business, financial condition and results of operations. Questions have arisen regarding our exclusive ownership and control of certain technologies, including by our principal customer, Honda, and a former employee, who claims ownership in a patent relating to ZPGM™. In addition, we have sold technology for exclusive use in Asia to another party. For additional information, refer to “--We have an expired agreement with Honda that may limit our rights to commercialize certain technology...” above and “--We are subject to restrictions and must pay a royalty on certain sales of our products and technology in specified countries in Asia” below. Past or future weaknesses in control of our intellectual property could render our current strategies unachievable, require that we change our strategies which could prove unsuccessful, result in litigation over ownership issues including the costs thereof and potential adverse findings, require that we pay to license back technology that we developed or co-developed, or otherwise material adversely affect us, our business and our financial performance.

As part of our confidentiality procedures, we generally have entered into nondisclosure agreements with employees, consultants and corporate partners. We also have attempted to control access to and distribution of our technologies, documentation and other proprietary information. We plan to continue these procedures. Despite these procedures, third parties could copy or otherwise obtain and make unauthorized use of our technologies or independently develop similar technologies. The steps that we have taken and that may occur in the future might not prevent misappropriation of our solutions or technologies, particularly in foreign countries where laws or law enforcement practices may not protect the proprietary rights as fully as in the United States.

There can be no assurance that we will be successful in enforcing our proprietary rights. For example, from time to time we have become aware of competing technologies employed by third parties who might be covered by one or more of our patents. In such situations, we may seek to grant licenses to such third parties or seek to stop the infringement, including through the threat of legal action. There is no assurance that we would be successful in negotiating a license agreement on favorable terms, if at all, or able to stop the infringement. Any infringement upon our intellectual property rights could have an adverse effect on our ability to develop and sell commercially competitive systems and components.

If we fail to obtain the right to use the intellectual property rights of others which are necessary to operate our business, our ability to succeed will be adversely affected.

From time to time, we may choose to or be required to license technology or intellectual property from third parties in connection with the development of our products. We cannot assure you that third-party licenses will be available to us on commercially reasonable terms, if at all. Generally, a license, if granted, would include payments of up-front fees, ongoing royalties or both. These payments or other terms could have an adverse impact on our results of operations. The inability to obtain a necessary third-party license required for our product offerings or to develop new products and product enhancements could require us to substitute technology of lower quality or performance standards, or of greater cost, either of which could adversely affect our business. If we are not able to obtain licenses from third parties, if necessary, then we may also be subject to litigation to defend against infringement claims from these third parties. Our competitors may be able to obtain licenses or cross-license their technology on better terms than we can, which could put us at a competitive disadvantage. If we are unable to obtain or maintain any third-party license required to develop new products and product enhancements, on favorable terms, our results of operations may be harmed.

If third parties claim that our products infringe upon their intellectual property rights, we may be forced to expend significant financial resources and management time litigating such claims and our operating results could suffer.

Third parties may claim that our products and systems infringe upon their patents and other intellectual property rights. Identifying third-party patent rights can be particularly difficult, notably because patent applications are generally not published until up to 18 months after their filing dates. If a competitor were to challenge our patents, or assert that our products or

processes infringe their patent or other intellectual property rights, we could incur substantial litigation costs, be forced to make expensive product modifications, pay substantial damages or even be forced to cease some operations. Third-party infringement claims, regardless of their outcome, would not only drain financial resources but also divert the time and effort of management and could result in customers or potential customers limiting or deferring their purchase or use of the affected products or services until resolution of the litigation.

We are subject to restrictions and must pay a royalty on certain sales of our products and technology in specified countries in Asia.

In February 2008, we established a joint venture in Japan called TC Catalyst, Inc., or TCC, with Tanaka Holdings Co., Ltd. (formerly Tanaka Holdings K.K.), a Japanese company, which, together with its subsidiary Tanaka Kikinzoku Kogyo K.K., is referred to herein as TKK. Initially, we and TKK each owned 50% of TCC, but since formation we have sold most of our stake in the venture to TKK and now own 5%. In connection with these transactions, we also sold to TKK certain proprietary technology for sale, licensing or use in various countries in Asia, which we refer to as the Territory. In general, the technology covers our catalyst formulations (including platinum and zero platinum) developed for heavy duty commercial vehicles and other applications through 2013, and for non-commercial light vehicles through 2012. In addition, TKK has a right to cause us to license heavy duty commercial technology to TKK or TCC in exchange for a royalty if TKK or TCC desire to sell related products or services outside the Territory to subsidiaries of OEM customers located within the Territory. We have also agreed not to compete in the Territory with TKK or TCC in connection with heavy duty commercial vehicles and applications and light duty vehicles.

Subsequent to these arrangements, we discovered that an exception allowing us to continue to supply catalysts in Japan to our largest customer, Honda, had been omitted in an amendment to the original transaction documents with TKK. We have shipped approximately $5.6 million of catalysts covered by the agreements since such amendment through December 31, 2014. In this regard, in December 2014 we made a good faith payment of $0.3 million to TKK with respect to such prior shipments.

In addition, on March 13, 2015, we further amended our agreements with TKK and TCC to, among other things, enable us to sell in the Territory (i) coated substrates or certain catalytic materials utilizing the technology we sold to TKK for a 4% royalty to TKK; (ii) coated substrates and certain catalytic materials utilizing solely new technology developed by us after we sold TKK the prior technology, as well as licenses of such technology related to catalysts for heavy-duty commercial vehicles and applications and light duty vehicles, for a 3% royalty to TKK; (iii) products used in vehicles without a royalty, provided that the ultimate user of the vehicle which contains the product purchases the vehicle outside the Territory; (iv) limited quantities of coated substrates or certain catalytic materials sold for the purpose of customer testing, evaluation and approval without a royalty; and (v) limited quantities of coated substrates sold during an extended period of time after mass production ends for a specified vehicle model year program without a royalty.

Pursuant to the terms of the amendment, once an aggregate amount of approximately $16.6 million in royalties has been paid by us to TKK, we may commercialize any technology without a royalty, including inside the Territory.

Consequently, if we or third parties desire to sell our products or otherwise commercialize certain of our technology in the Territory, we currently would have to pay a royalty to TKK in order to do so, which could adversely affect our ability to expand. In addition, although we believe that the amendment to the parties’ agreements will generally enable us to pursue our business strategies in the Territory and that, based on discussions with TKK, our non-binding, good faith payment relieves us from further obligations to TKK with respect to past shipments of catalysts covered by the agreements, there can be no assurance that TKK will not assert claims and pursue available remedies, any of which could have an adverse effect on our business.